Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - OLIN Corp | form8-k.htm |

Exhibit 99.1

Olin & DCPMerger UpdateSeptember 28, 2015

Forward-Looking Statements This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which Olin Corporation (“Olin”) and The Dow Chemical Company’s (“TDCC”) chlorine products business operate. These statements may include statements regarding the proposed combination of TDCC’s chlorine products business with Olin in a “Reverse Morris Trust” transaction, the expected timetable for completing the transaction, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Olin’s and TDCC’s chlorine products businesses’ future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies and competition. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties. We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “plan,” “estimate,” “will,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: factors relating to the satisfaction of the conditions to the proposed transaction, including regulatory approvals; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the possibility that Olin may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all; the integration of the TDCC’s chlorine products business being more difficult, time-consuming or costly than expected; the effect of any changes resulting from the proposed transaction in customer, supplier and other business relationships; general market perception of the proposed transaction; exposure to lawsuits and contingencies associated with TDCC’s chlorine products business; the ability to attract and retain key personnel; prevailing market conditions; changes in economic and financial conditions of Olin and TDCC’s chlorine products business; uncertainties and matters beyond the control of management; and the other risks detailed in Olin’s Form 10-K for the fiscal year ended December 31, 2014 and Olin’s Form 10-Q for the fiscal quarter ended June 30, 2015. These risks, as well as other risks associated with Olin, TDCC’s chlorine products business and the proposed transaction are also more fully discussed in the prospectus included in the registration statement on Form S-4 filed with the Securities and Exchange Commission (the “SEC”) by Olin, and declared effective by the SEC, on September 2, 2015. The forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to Olin or that Olin considers immaterial could affect the accuracy of our forward-looking statements. The reader is cautioned not to rely unduly on these forward-looking statements. Olin and TDCC undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. 2

SEC Disclosure Rules Important Notices and Additional InformationIn connection with the proposed combination of Olin with the chlorine products business of The Dow Chemical Company (“TDCC”), Blue Cube Spinco Inc. (“Splitco”) has filed with the Securities and Exchange Commission (the “SEC”), and the SEC declared effective on September 2, 2015, a registration statement on Form S-4 and Form S-1 containing a prospectus and Olin has filed with the SEC, and the SEC declared effective on September 2, 2015, a registration statement on Form S-4 containing a prospectus. INVESTORS AND SECURITYHOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENTS/PROSPECTUSES AS WELL AS ANY OTHER RELEVANT DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT OLIN, TDCC, SPLITCO AND THE PROPOSED TRANSACTION. Investors and securityholders may obtain a free copy of the registration statements/prospectuses and other documents filed by Olin, TDCC and Splitco with the SEC at the SEC’s website at http://www.sec.gov. Free copies of these documents and each of the companies’ other filings with the SEC, may also be obtained from the respective companies by directing a request to Olin at Olin Corporation, ATTN: Investor Relations, 190 Carondelet Plaza, Suite 1530, Clayton, Missouri 63105 or TDCC or Splitco at The Dow Chemical Company, 2030 Dow Center, Midland, Michigan 48674, ATTN: Investor Relations, as applicable. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 3

Dow – Olin Transaction Closing TimetableDeal is on track to close no later than October 5, 2015 4 Completed Expected onOctober 5th Completed Completed Completed Completed Completed Completed

‘New Olin’ EBITDA 5 Pro forma 2014 EBITDA bridge Costs Retained by Dow New Contract Terms & Services As Dow AnticipatedSynergies $6183 $2351 $ in millions 1 Based on audited financials as published in S4 filing2 Estimated annual cost savings as published in S4 filing3 Separated basis Existing Olin $962 $1,200 - $1,300 ‘New Olin’ $3441 $2502 $1331 At Least$200 Cost + $100 New Sales

Ethylene Summary Olin has access to cost-based ethylene for 100% of its acquired vinyls capacityOlin receives immediate ethylene integration without start up or operating risk 6

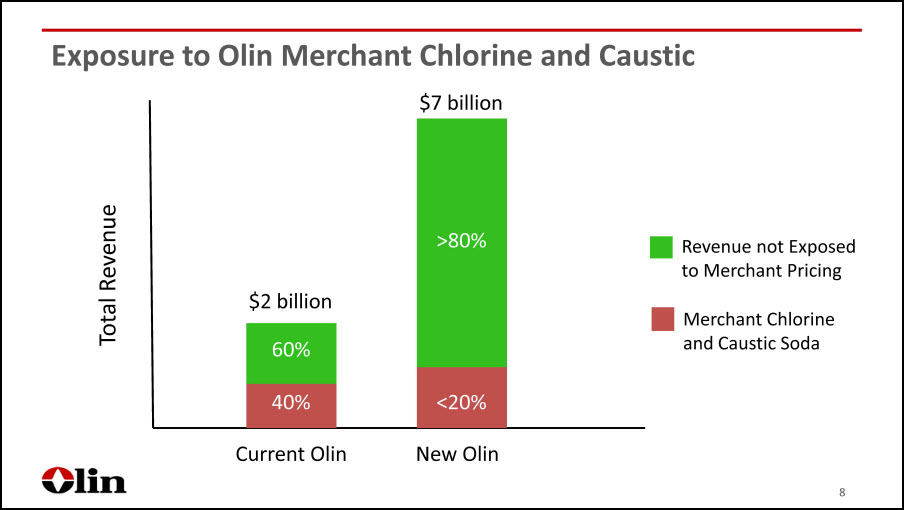

Stable Cash Flow From Product Diversity Long-term contracts with Dow provide stable cash flowsWinchester provides stable and predictable cash flowsIndustrial bleach provides non-cyclical cash flowsChlorinated Organics uses by-product streams to serve non-cyclical demandOlin exposure to merchant chlorine and merchant caustic soda pricing reduced to less than 20% of revenue 7

Exposure to Olin Merchant Chlorine and Caustic 8 Current Olin New Olin <20% 40% Total Revenue Merchant Chlorine and Caustic Soda Revenue not Exposed to Merchant Pricing >80% 60% $2 billion $7 billion

9 Significant Upside From SynergiesDetailed planning continues; expect to realize savings by end of third year 9 Cost synergies breakdown Expected Annual Value Logistics & procurement Increased procurement efficienciesElimination of duplicate terminals and optimization of freight to terminalsReduction of net acquisition cost of purchased causticSavings from trucking and rail fleet optimizationCOGS reduction opportunities $50MM Operationalefficiencies SG&ACost optimizationEnergy utilization $70MM Assetoptimization Consolidation of select operations and facilities across businessInstallation of new capacityRelocation of select manufacturing processes $80MM Total annualized cost synergies expected to be achieved by end of third year $200MM Accessing new segments and customers Increased sales to new third-party customersAccess to new product markets Potential upside to $300MM

Synergy Update Highly confident of achieving at least $200 million of annual cost synergiesFirst joint Olin-DCP synergy meeting held week of September 20 identified additional synergy upsideLogistics synergies available for realization DAY ONEEstimated access to new segments and customer synergies of an additional $100 millionBleach capability at Freeport expected to be operational in 9-12 months 10

Balance Sheet Considerations Debt ProfileEfficient Transaction StructurePro Forma Free Cash FlowUses of Cash 11

Debt Profile$ in millions Current Olin Notes $ 367Current Olin Recovery Zone Bonds 153New Term Loans 2,150New Bonds 1,220 Gross Debt $ 3,890Pro Forma weighted average interest rate is less than 5%All term loans are pre-payable without penaltyNear term debt maturities are $160 in 2016 and $38 in 2017Olin has access to a $500 million undrawn revolving credit facility 12

Efficient Transaction Structure Transaction is a clean “Our watch – your watch” allocation for legacy environmental and litigation liabilitiesOlin agreed to assume up to $400 million of domestic defined benefit pension liabilityFor funding purposes Olin domestic defined benefit pension plan is overfundedAssumption of the Dow liability not expected to create a funding requirementAssumption of the Dow liability is expected to reduce Olin’s non-cash pension income by approximately $15 million per yearExact amount of transfer to be determined post-closing 13

Strong Pro Forma Free Cash Flow $ in millions 14 pro formaAdjustedEBITDA pro formaCash Flow pro formaInterest Dividend pro formaFreeCash Flow pro formaTaxes CapitalSpending $962 $280 $599 ($250) ($113) ($133) ($186) 1 2 3 4 5 Source: Dow, DCP Management, Olin Management(1) Company Adjusted EBITDA for the year ended December 31, 2014. Remaining cash flow figures estimated as if the Company operated FY 2014 with pro forma capital structure and current capital spending targets. Refer to Disclaimer section for further information regarding forward looking statements. (2) Estimated using a blended global statutory rate of 37%. (3) Represents the mid-point of management’s annual maintenance capital spending estimate range of $225 to $275 million. (4) Calculated based upon the Company’s pro forma capital structure following the consummation of the Transactions. (5) Calculated based on 166.1 million shares outstanding and an annual dividend rate of $0.80 per share. $200 ($74) $126 $126 Cost Synergies From Operations $1,162 $406 $725

Uses of Cash Annual maintenance capital spending estimated at $250 millionAnnual dividend $133 millionFree Cash flow focus on:Funding of synergy capital - $200 million over three yearsRepayment of debt 15

Summary of Bond Offering Bonds are required to be issued to Dow to complete the tax free bond exchangeTo qualify for tax free treatment, bonds required a minimum term of 8 years with a 5 year non-call featureTotal issuance:$720 million of 8 year notes, 100% par value at 9.75%$500 million of 10 year notes, 100% par value at 10.0% Weighted average interest rate of 9.85% 16