Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMMONWEALTH EDISON Co | d26890d8k.htm |

| Exhibit 99.1

|

Wolfe Research Power and Gas Leaders Conference

September 29, 2015

Joe Nigro

Executive Vice President, Exelon CEO, Constellation

|

|

Cautionary Statements Regarding Forward-Looking Information

This report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2014 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 22; (2) Exelon’s Second Quarter 2015 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 19; and (3) other factors discussed in filings with the SEC by Exelon and Generation. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this report. Exelon does not undertake any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this report.

1 Wolfe Conference

|

|

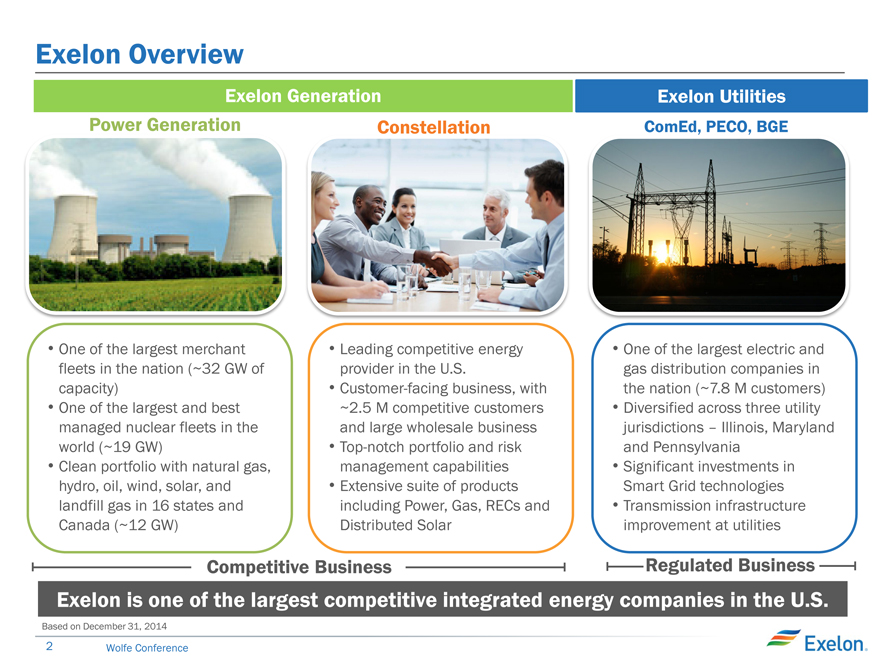

Exelon Overview

Exelon Generation

Power Generation Constellation

One of theGenerationlargest merchant LeadingRetail competitive & Wholesale energy

fleets in the nation (~32 GW of provider in the U.S.

capacity) • Customer-facing business, with

One of the largest and best ~2.5 M competitive customers

managed nuclear fleets in the and large wholesale business

world (~19 GW) • Top-notch portfolio and risk

Clean portfolio with natural gas, management capabilities

hydro, oil, wind, solar, and • Extensive suite of products

landfill gas in 16 states and including Power, Gas, RECs and

Canada (~12 GW) Distributed Solar

Exelon Utilities

ComEd, PECO, BGE

One of the largest electric and gas distribution companies in the nation (~7.8 M customers)

DiversifiedEacross three utility jurisdictionsx – Illinois, Maryland

e and Pennsylvania l Significanto investments in Smart Grid n technologies

Transmission infrastructure improvement at utilities

Competitive Business

Regulated Business

Exelon is one of the largest competitive integrated energy companies in the U.S.

Based on December 31, 2014

2 Wolfe Conference

|

|

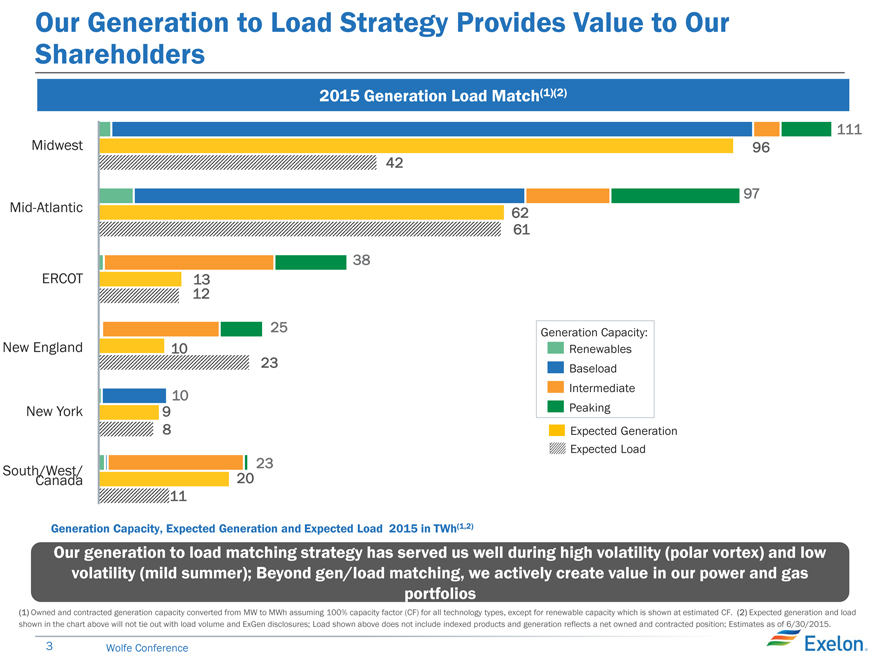

Our Generation to Load Strategy Provides Value to Our Shareholders

2015 Generation Load Match(1)(2)

111

Midwest 96

42

97

Mid-Atlantic 62

61

38

ERCOT 13

12

25 Generation Capacity:

New England 10 Renewables

23 Baseload

10 Intermediate

New York 9 Peaking

8 Expected Generation

Expected Load

South/West/ 23

Canada 20

11

Generation Capacity, Expected Generation and Expected Load 2015 in TWh(1,2)

Our generation to load matching strategy has served us well during high volatility (polar vortex) and low volatility (mild summer); Beyond gen/load matching, we actively create value in our power and gas portfolios

(1) Owned and contracted generation capacity converted from MW to MWh assuming 100% capacity factor (CF) for all technology types, except for renewable capacity which is shown at estimated CF. (2) Expected generation and load shown in the chart above will not tie out with load volume and ExGen disclosures; Load shown above does not include indexed products and generation reflects a net owned and contracted position; Estimates as of 6/30/2015.

3 Wolfe Conference

|

|

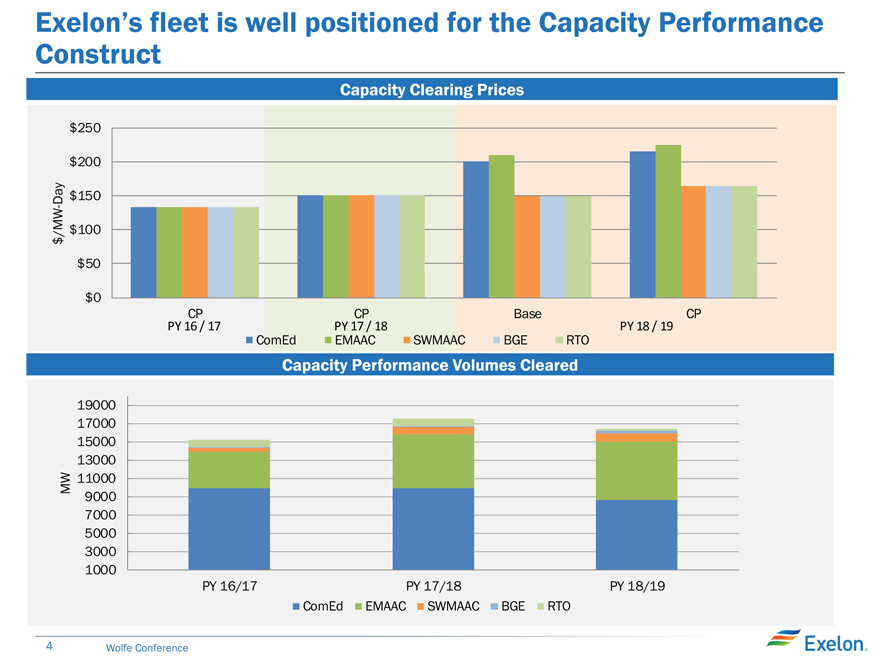

Exelon’s fleet is well positioned for the Capacity Performance Construct

Capacity Clearing Prices

$250

$200

Day $150

-

/MW $100

$

$50

$0

CP CP Base CP

PY 16 / 17 PY 17 / 18 PY 18 / 19

ComEd EMAAC SWMAAC BGE RTO

Capacity Performance Volumes Cleared

19000

17000

15000

13000

MW 11000

9000

7000

5000

3000

1000

PY 16/17 PY 17/18 PY 18/19 ComEd EMAAC SWMAAC BGE RTO

4 Wolfe Conference

|

|

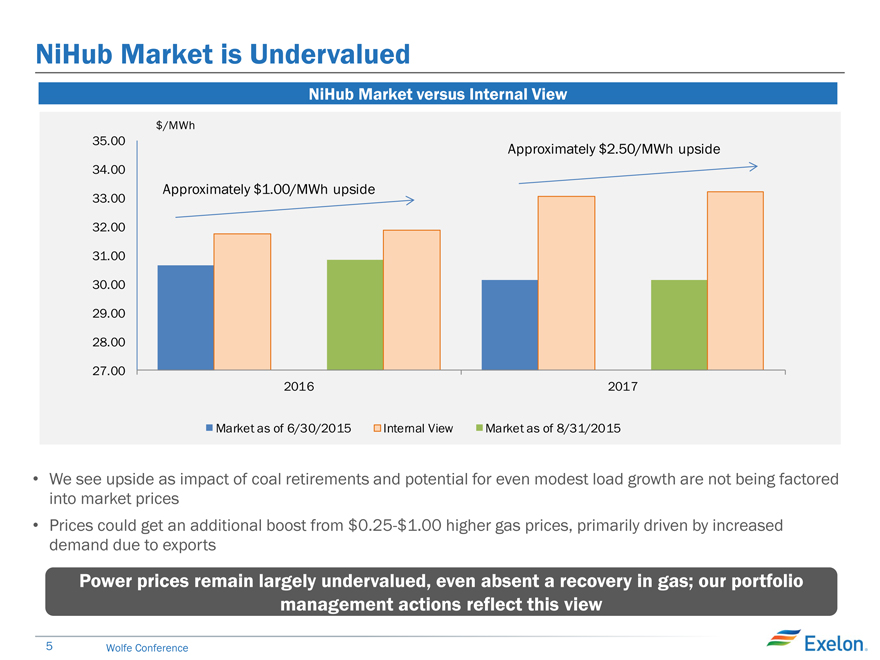

NiHub Market is Undervalued

NiHub Market versus Internal View

$/MWh

35.00 Approximately $2.50/MWh upside

34.00

33.00 Approximately $1.00/MWh upside

32.00

31.00

30.00

29.00

28.00

27.00

2016 2017

Market as of 6/30/2015 Internal View Market as of 8/31/2015

We see upside as impact of coal retirements and potential for even modest load growth are not being factored into market prices

Prices could get an additional boost from $0.25-$1.00 higher gas prices, primarily driven by increased demand due to exports

Power prices remain largely undervalued, even absent a recovery in gas; our portfolio management actions reflect this view

5 Wolfe Conference