Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CIM REAL ESTATE FINANCE TRUST, INC. | exhibit991ccptivvaluation.htm |

| 8-K - CCPT IV 8-K - CIM REAL ESTATE FINANCE TRUST, INC. | ccptiv8-kvaluation.htm |

| EX-99.3 - EXHIBIT 99.3 - CIM REAL ESTATE FINANCE TRUST, INC. | exhibit993ccptivvaluation.htm |

Cole Credit Property Trust IV, Inc. (“CCPT IV”) ESTIMATED VALUE OF SHARES $4.3 billion Purchase Price 828 Properties Across 45 States NCREIF regions by purchase price 22.3 million Square Feet Diversification by property type $339.9 million Distributions Declared 11.1 years Average Remaining Lease Term2 98.3% Occupancy 21.0% 33.5% 26 .1% 19.4% Multi-Tenant Retail 40.6% Single-Tenant Retail 56.5%1 Other 2.9% 503 Tenant Concepts Top Five Tenants (by Annualized Rental Revenue) 7.5% 5.2% 4.8% 4.0% 3.9% 53 Industry Sectors Top Five Industries (by Annualized Rental Revenue) Discount 14.6% Pharmacy 11.6% Home & Garden 8.9% Grocery/Supermarket 6.9% Gas/Convenience 6.8% All data as of 06/30/15, unless otherwise noted. Dollar amounts, square footage and percentages are approximate. Excludes unconsolidated joint ventures. 1. Includes restaurants. 2. Based on gross annualized rental revenue. FOR FINANCIAL ADVISOR USE ONLY. We are pleased to report that on September 27, 2015, the CCPT IV Board of Directors (the ”Board”) approved an estimated net asset value (“NAV”) per share of our common stock of $9.70 as of August 31, 2015. The Board determined an estimated per share NAV in order to assist those broker-dealers that participated in CCPT IV’s offering in meeting their customer account statement reporting obligations as required by FINRA. The Board engaged Duff & Phelps, LLC (“Duff & Phelps”), an independent global valuation advisory and cor porate finance counseling firm that specializes in providing real estate valuation services, to review CCPT IV’s portfolio as of August 31, 2015, and to provide the Board with an estimated NAV and a range of estimated values per share of CCPT IV’s common stock based upon the estimated market value of CCPT IV’s assets, less the estimated market value of CCPT IV’s liabilities, divided by the shares outstanding. Using the NAV methodology, Duff & Phelps arrived at an estimated NAV per share of $9.70 and a fair value range of $9.22 to $10.21 per share. The determination of the NAV per share was solely the decision of the Board. The Board approved $9.70 per share as the estimated share value of CCPT IV, which will replace the original public offering price of $10.00 on all customer account statements. It is important to keep in mind that large, well-constructed, high-quality REITs such as CCPT IV may trade at a premium to NAV when sold or listed on an open exchange. The estimated NAV does not reflect any “portfolio premium,” nor does it reflect an enterprise value for CCPT IV. CCPT IV broke escrow on April 13, 2012 and raised approximately $2.9 billion of equity through its initial public offering of common shares, not including shares sold pursuant to its distribution reinvestment plan (“DRIP”). CCPT IV stopped accepting subscription agreements as of February 25, 2014. For 41 consecutive months, it has paid an annualized distribution rate of 6.25% based on the $10.00 initial public offering price. Distributions continue to be fully covered by funds from operations. 2325 EAST CAMELBACK ROAD, STE 1100, PHOENIX, AZ 85016 | 866.341.2653 | WWW.COLECAPITAL.COM © 2015 COLE CAPITAL ADVISORS, INC. ALL RIGHTS RESERVED. FOR FINANCIAL ADVISOR USE ONLY. SECURITIES DISTRIBUTED BY AFFILIATE BROKER-DEALER: COLE CAPITAL CORPORATION, MEMBER FINRA/SIPC

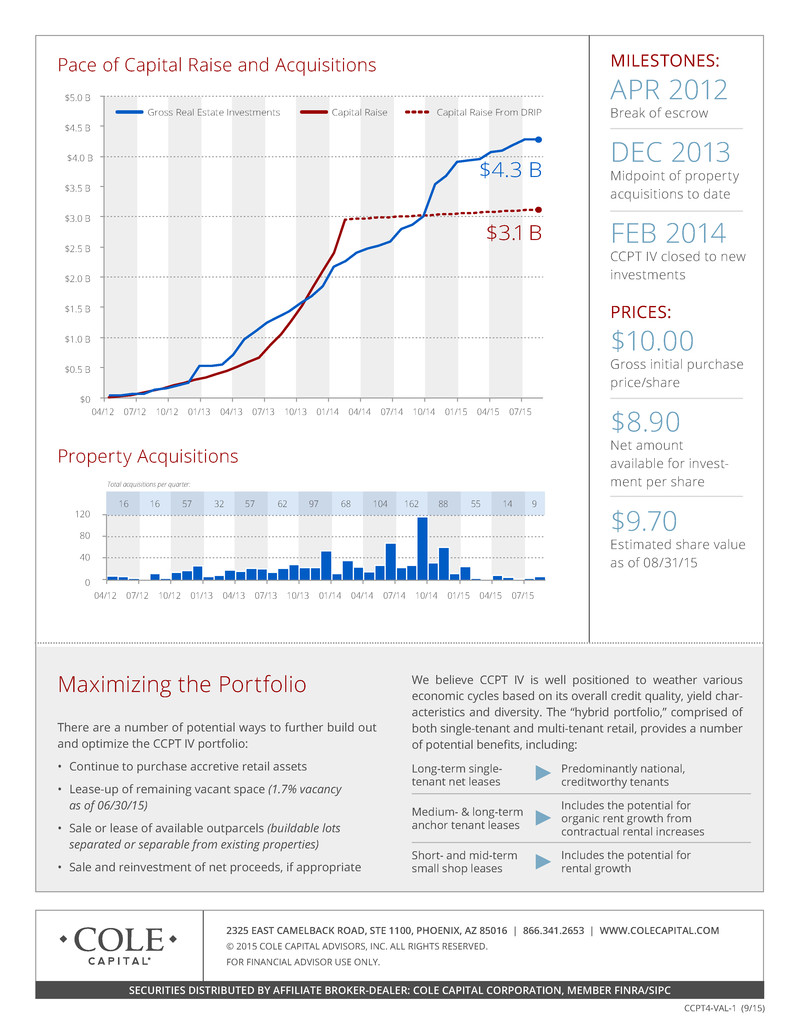

Pace of Capital Raise and Acquisitions Property Acquisitions # OF PROPERTIE S ACQUIRED B Y M ONT H 0 40 80 120 $0 $0.5 B $1.0 B $1.5 B $2.0 B $2.5 B $3.0 B $3.5 B $4.0 B $4.5 B $5.0 B 04/12 07/12 10/12 01/13 04/13 07/13 10/13 01/14 04/14 07/14 10/14 01/15 04/15 07/15 Gross Real Estate Investments CAPITAL RAISE COMPARED TO PURCHASE PRIC E Capital Raise Capital Raise From DRIP $3.1B $4.3 B 04/12 Total acquisitions per quarter: 07/12 10/12 01/13 04/13 07/13 10/13 01/14 04/14 07/14 10/14 01/15 04/15 07/15 16 16 57 32 57 62 97 68 104 162 88 55 14 9 # OF PROPERTIE S ACQUIRED B Y M ONT H 0 40 80 120 $0 $0.5 B $1.0 B $1.5 B $2.0 B $2.5 B $3.0 B $3.5 B $4.0 B $4.5 B $5.0 B 04/12 07/12 10/12 01/13 04/13 07/13 10/13 01/14 04/14 07/14 10/14 01/15 04/15 07/15 Gross Real Estate Investments CAPITAL RAISE COMPARED TO PURCHASE PRIC E Capital Raise Capital Raise From DRIP $3.1B $4.3 B 04/12 Total acquisitions per quarter: 07/12 10/12 01/13 04/13 07/13 10/13 01/14 04/14 07/14 10/14 01/15 04/15 07/15 16 16 57 32 57 62 97 68 104 162 88 55 14 9 MILESTONES: APR 2012 Break of escrow DEC 2013 Midpoint of property acquisitions to date FEB 2014 CCPT IV closed to new investments PRICES: $10.00 Gross initial purchase price/share $8.90 Net amount available for invest- ment per share $9.70 Estimated share value as of 08/31/15 CCPT4-VAL-1 (9/15) 2325 EAST CAMELBACK ROAD, STE 1100, PHOENIX, AZ 85016 | 866.341.2653 | WWW.COLECAPITAL.COM © 2015 COLE CAPITAL ADVISORS, INC. ALL RIGHTS RESERVED. FOR FINANCIAL ADVISOR USE ONLY. SECURITIES DISTRIBUTED BY AFFILIATE BROKER-DEALER: COLE CAPITAL CORPORATION, MEMBER FINRA/SIPC Maximizing the Portfolio There are a number of potential ways to further build out and optimize the CCPT IV portfolio: • Continue to purchase accretive retail assets • Lease-up of remaining vacant space (1.7% vacancy as of 06/30/15) • Sale or lease of available outparcels (buildable lots separated or separable from existing properties) • Sale and reinvestment of net proceeds, if appropriate We believe CCPT IV is well positioned to weather various economic cycles based on its overall credit quality, yield char- acteristics and diversity. The “hybrid portfolio,” comprised of both single-tenant and multi-tenant retail, provides a number of potential benefits, including: Long-term single- tenant net leases Predominantly national, creditworthy tenants Medium- & long-term anchor tenant leases Includes the potential for organic rent growth from contractual rental increases Short- and mid-term small shop leases Includes the potential for rental growth