Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION SEPTEMBER 28 AND 29 2015 - GREAT PLAINS ENERGY INC | a9252015investorpresentati.htm |

September 28 & 29, 2015 Investor Presentation Exhibit 99.1

Forward-Looking Statement Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of capital projects and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business strategy, operations or development plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts, including but not limited to cyber terrorism; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather- related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of generation, transmission, distribution or other projects; Great Plains Energy’s ability to successfully manage transmission joint venture; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; and other risks and uncertainties. This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. 2 September 28 & 29, 2015 Investor Presentation

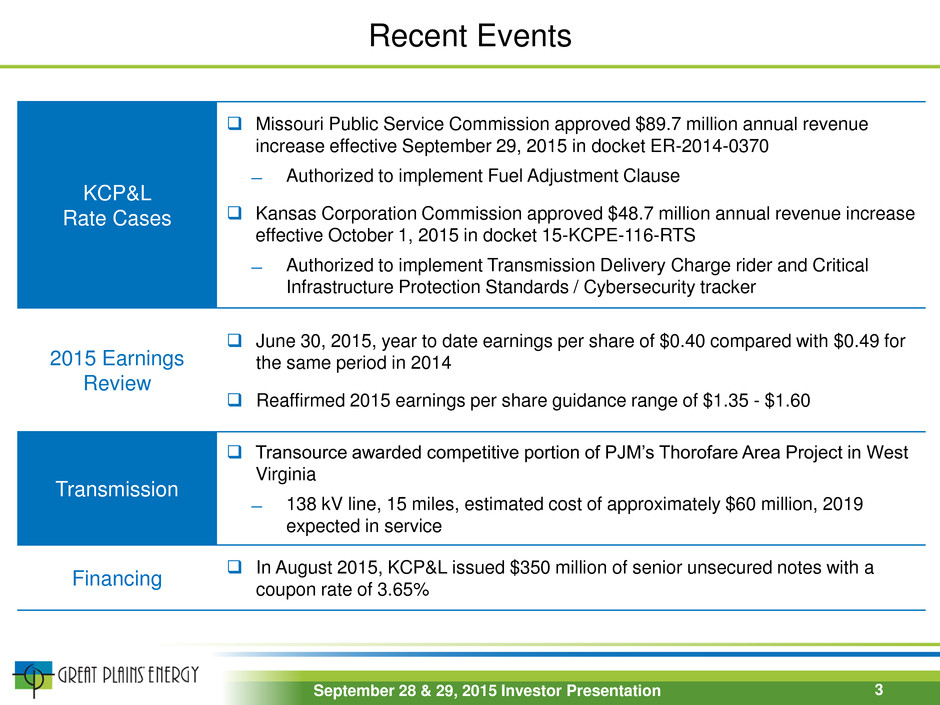

Recent Events KCP&L Rate Cases Missouri Public Service Commission approved $89.7 million annual revenue increase effective September 29, 2015 in docket ER-2014-0370 ̶ Authorized to implement Fuel Adjustment Clause Kansas Corporation Commission approved $48.7 million annual revenue increase effective October 1, 2015 in docket 15-KCPE-116-RTS ̶ Authorized to implement Transmission Delivery Charge rider and Critical Infrastructure Protection Standards / Cybersecurity tracker 2015 Earnings Review June 30, 2015, year to date earnings per share of $0.40 compared with $0.49 for the same period in 2014 Reaffirmed 2015 earnings per share guidance range of $1.35 - $1.60 Transmission Transource awarded competitive portion of PJM’s Thorofare Area Project in West Virginia ̶ 138 kV line, 15 miles, estimated cost of approximately $60 million, 2019 expected in service Financing In August 2015, KCP&L issued $350 million of senior unsecured notes with a coupon rate of 3.65% 3 September 28 & 29, 2015 Investor Presentation

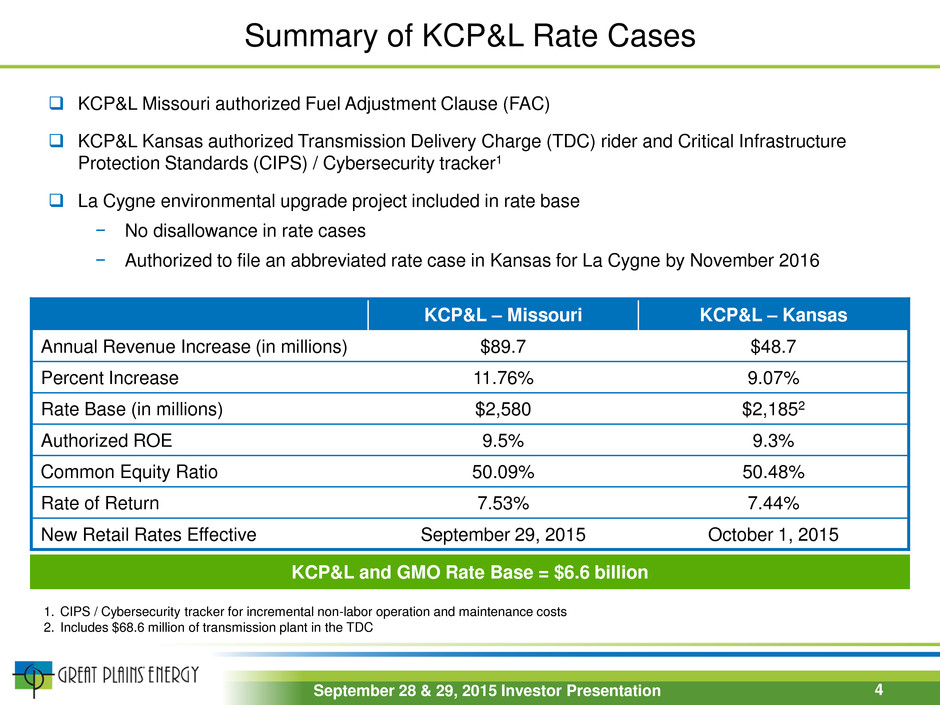

Summary of KCP&L Rate Cases KCP&L – Missouri KCP&L – Kansas Annual Revenue Increase (in millions) $89.7 $48.7 Percent Increase 11.76% 9.07% Rate Base (in millions) $2,580 $2,1852 Authorized ROE 9.5% 9.3% Common Equity Ratio 50.09% 50.48% Rate of Return 7.53% 7.44% New Retail Rates Effective September 29, 2015 October 1, 2015 KCP&L Missouri authorized Fuel Adjustment Clause (FAC) KCP&L Kansas authorized Transmission Delivery Charge (TDC) rider and Critical Infrastructure Protection Standards (CIPS) / Cybersecurity tracker1 La Cygne environmental upgrade project included in rate base − No disallowance in rate cases − Authorized to file an abbreviated rate case in Kansas for La Cygne by November 2016 1. CIPS / Cybersecurity tracker for incremental non-labor operation and maintenance costs 2. Includes $68.6 million of transmission plant in the TDC KCP&L and GMO Rate Base = $6.6 billion September 28 & 29, 2015 Investor Presentation 4

Solid Vertically Integrated Midwest Utilities Solid Midwest fully regulated electric utility operating under the KCP&L brand Company attributes – Regulated operations in Kansas and Missouri – ~842,700 customers / ~3,000 employees – ~6,600 MW of primarily low-cost coal baseload generation – ~3,600 circuit miles of transmission lines; ~22,500 circuit miles of distribution lines – ~$10.5 billion in assets at 2014YE – ~$6.6 billion in rate base 1. In thousands 2014 Retail MWh Sold by Customer Type 2014 Retail MWh Sales by Jurisdiction 2014 MWh Generated by Fuel Type Service Territories: KCP&L and GMO Business Highlights 5 Total: ~ 23,115 MWhs1 Total: ~ 23,115 MWhs1 September 28 & 29, 2015 Investor Presentation

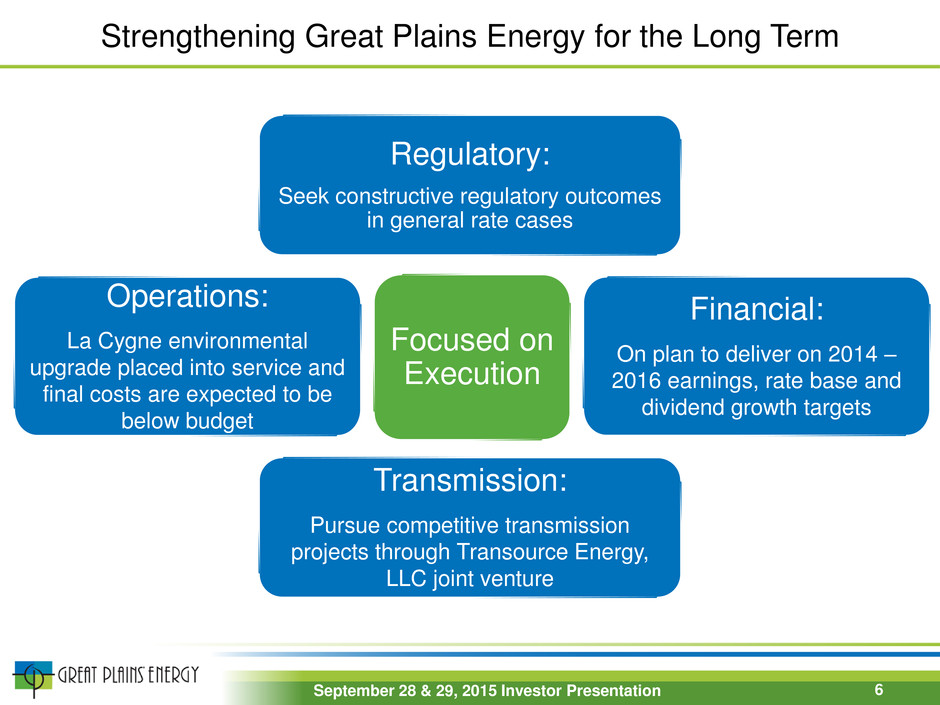

Strengthening Great Plains Energy for the Long Term Focused on Execution Regulatory: Seek constructive regulatory outcomes in general rate cases Financial: On plan to deliver on 2014 – 2016 earnings, rate base and dividend growth targets Transmission: Pursue competitive transmission projects through Transource Energy, LLC joint venture Operations: La Cygne environmental upgrade placed into service and final costs are expected to be below budget 6 September 28 & 29, 2015 Investor Presentation

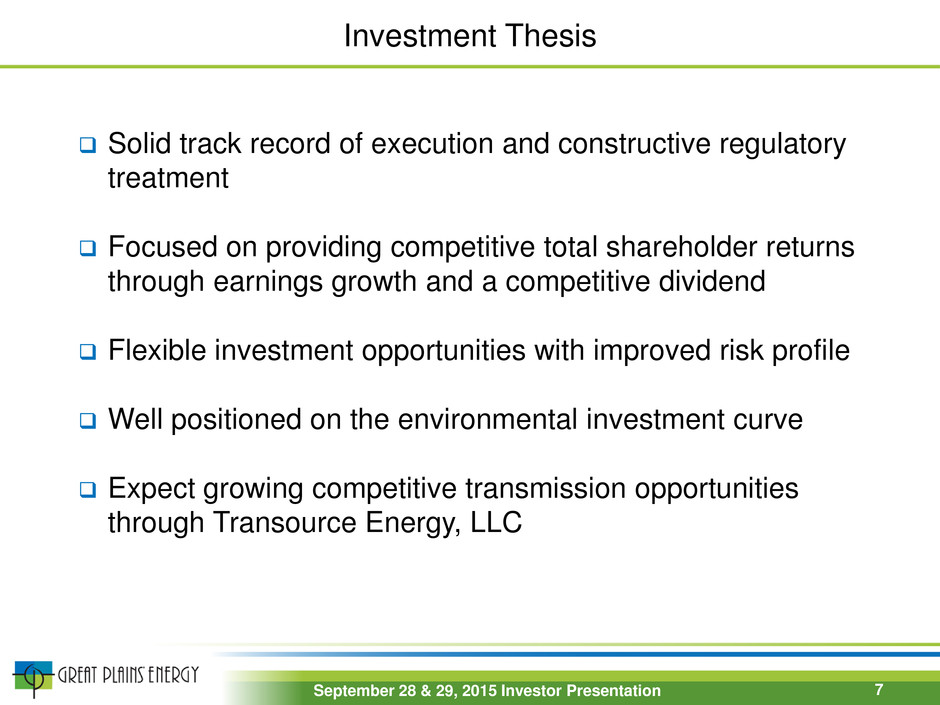

Investment Thesis Solid track record of execution and constructive regulatory treatment Focused on providing competitive total shareholder returns through earnings growth and a competitive dividend Flexible investment opportunities with improved risk profile Well positioned on the environmental investment curve Expect growing competitive transmission opportunities through Transource Energy, LLC 7 September 28 & 29, 2015 Investor Presentation

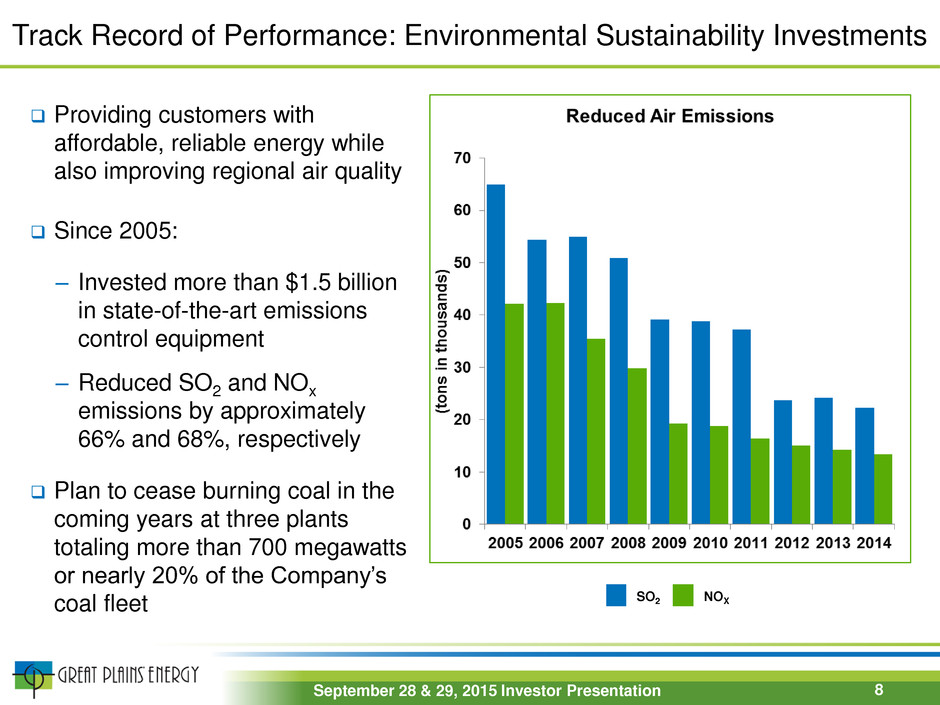

Track Record of Performance: Environmental Sustainability Investments Providing customers with affordable, reliable energy while also improving regional air quality Since 2005: – Invested more than $1.5 billion in state-of-the-art emissions control equipment – Reduced SO2 and NOx emissions by approximately 66% and 68%, respectively Plan to cease burning coal in the coming years at three plants totaling more than 700 megawatts or nearly 20% of the Company’s coal fleet SO2 NOX 8 September 28 & 29, 2015 Investor Presentation

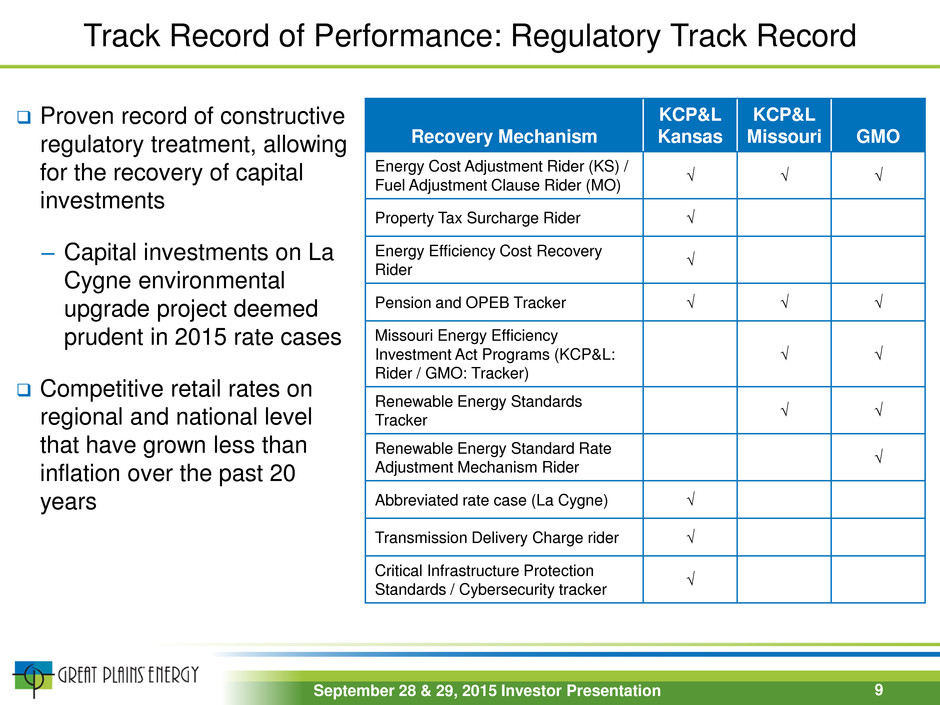

Track Record of Performance: Regulatory Track Record Proven record of constructive regulatory treatment, allowing for the recovery of capital investments – Capital investments on La Cygne environmental upgrade project deemed prudent in 2015 rate cases Competitive retail rates on regional and national level that have grown less than inflation over the past 20 years Recovery Mechanism KCP&L Kansas KCP&L Missouri GMO Energy Cost Adjustment Rider (KS) / Fuel Adjustment Clause Rider (MO) √ √ √ Property Tax Surcharge Rider √ Energy Efficiency Cost Recovery Rider √ Pension and OPEB Tracker √ √ √ Missouri Energy Efficiency Investment Act Programs (KCP&L: Rider / GMO: Tracker) √ √ Renewable Energy Standards Tracker √ √ Renewable Energy Standard Rate Adjustment Mechanism Rider √ Abbreviated rate case (La Cygne) √ Transmission Delivery Charge rider √ Critical Infrastructure Protection Standards / Cybersecurity tracker √ 9 September 28 & 29, 2015 Investor Presentation

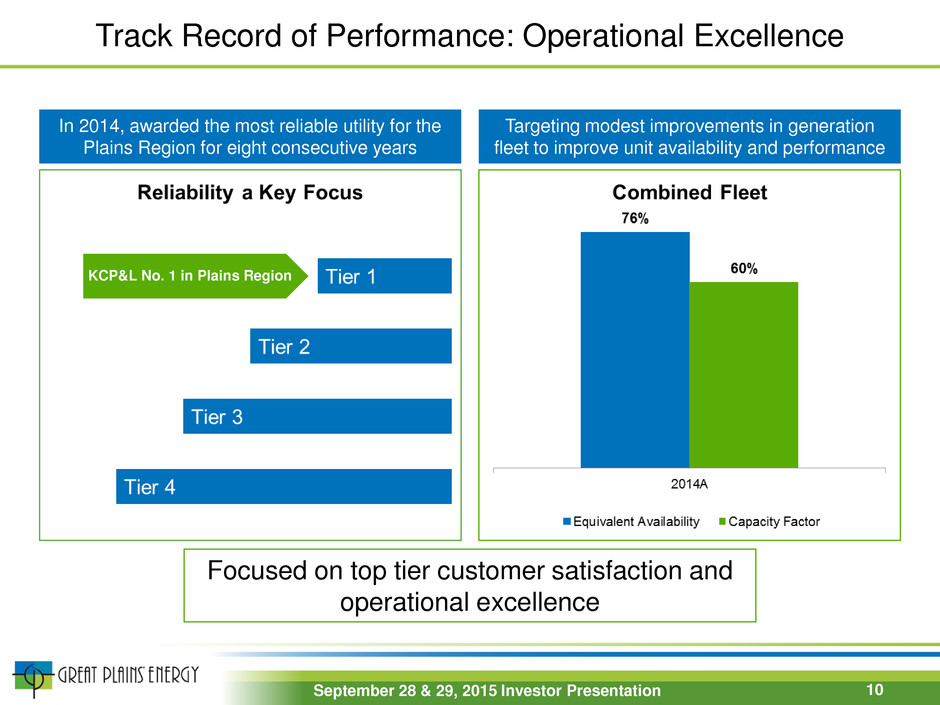

Track Record of Performance: Operational Excellence Focused on top tier customer satisfaction and operational excellence In 2014, awarded the most reliable utility for the Plains Region for eight consecutive years Targeting modest improvements in generation fleet to improve unit availability and performance 10 KCP&L No. 1 in Plains Region September 28 & 29, 2015 Investor Presentation

Track Record of Performance: Financial Profile Total shareholder return of 21% in 2014 Received credit rating upgrades by Standard and Poor’s and Moody’s Investor Service in 2014 Increased common stock dividend for fourth consecutive year General rate cases outcomes expected to support targeted annualized earnings growth of 4% - 6% from 2014 - 20161 Continued focus on diligent cost management Reducing regulatory lag through cost recovery mechanisms 1. Off initial 2014 earnings per share guidance range of $1.60 - $1.75 11 September 28 & 29, 2015 Investor Presentation

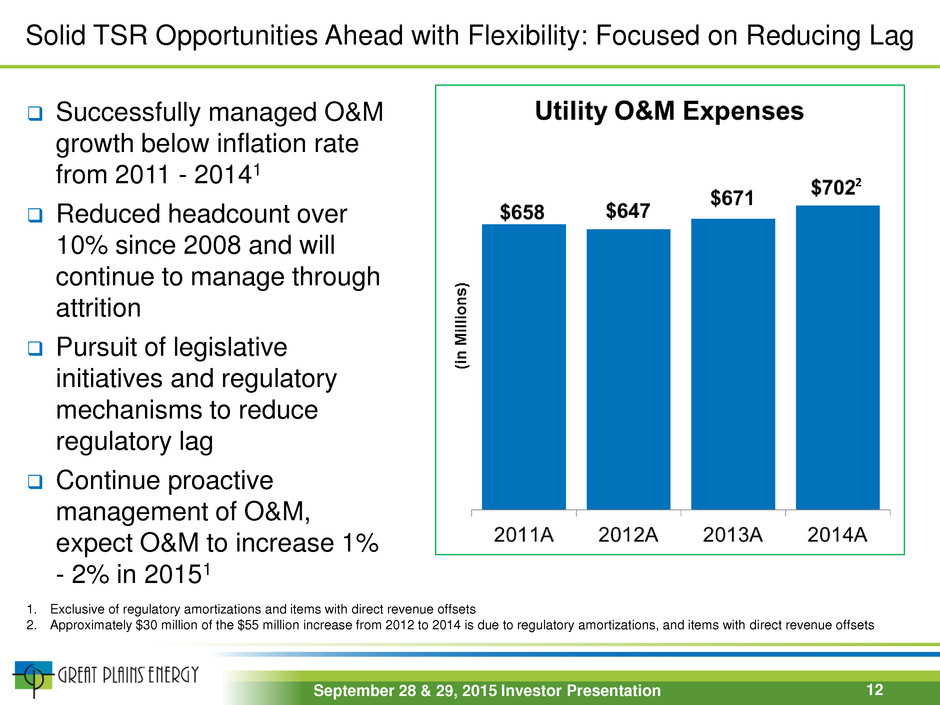

Solid TSR Opportunities Ahead with Flexibility: Focused on Reducing Lag Successfully managed O&M growth below inflation rate from 2011 - 20141 Reduced headcount over 10% since 2008 and will continue to manage through attrition Pursuit of legislative initiatives and regulatory mechanisms to reduce regulatory lag Continue proactive management of O&M, expect O&M to increase 1% - 2% in 20151 1. Exclusive of regulatory amortizations and items with direct revenue offsets 2. Approximately $30 million of the $55 million increase from 2012 to 2014 is due to regulatory amortizations, and items with direct revenue offsets 12 2 September 28 & 29, 2015 Investor Presentation

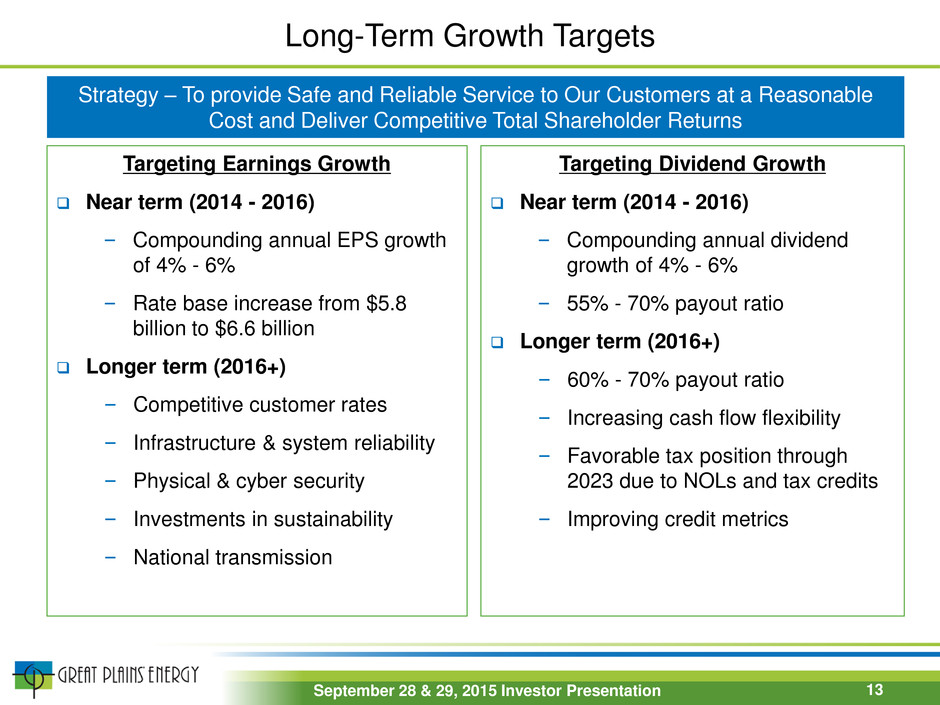

Long-Term Growth Targets Targeting Earnings Growth Near term (2014 - 2016) ‒ Compounding annual EPS growth of 4% - 6% ‒ Rate base increase from $5.8 billion to $6.6 billion Longer term (2016+) ‒ Competitive customer rates ‒ Infrastructure & system reliability ‒ Physical & cyber security ‒ Investments in sustainability ‒ National transmission Strategy – To provide Safe and Reliable Service to Our Customers at a Reasonable Cost and Deliver Competitive Total Shareholder Returns Targeting Dividend Growth Near term (2014 - 2016) ‒ Compounding annual dividend growth of 4% - 6% ‒ 55% - 70% payout ratio Longer term (2016+) ‒ 60% - 70% payout ratio ‒ Increasing cash flow flexibility ‒ Favorable tax position through 2023 due to NOLs and tax credits ‒ Improving credit metrics 13 September 28 & 29, 2015 Investor Presentation

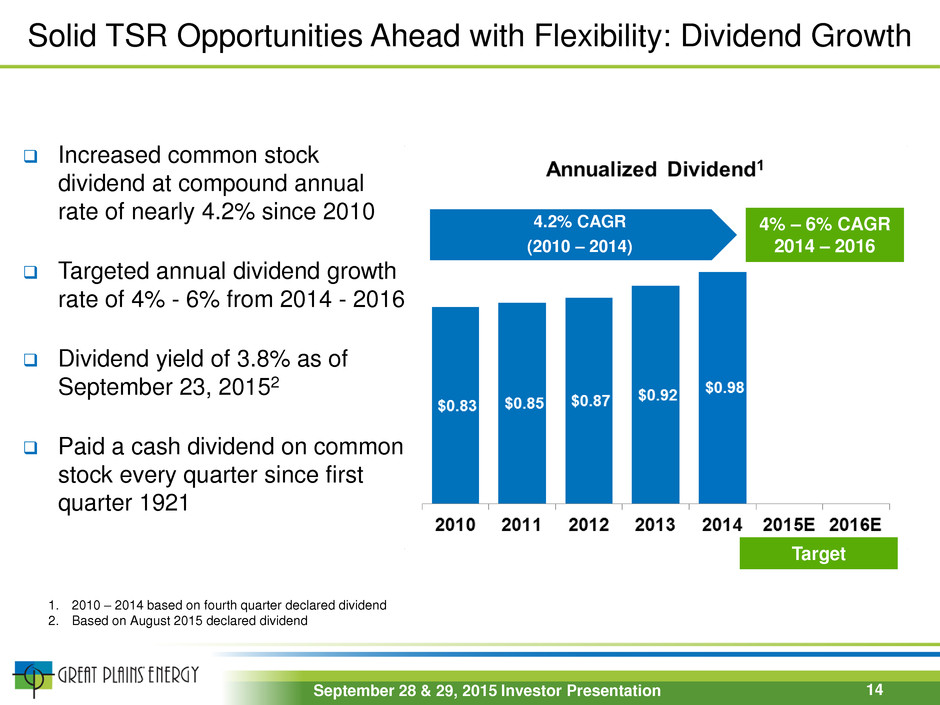

Solid TSR Opportunities Ahead with Flexibility: Dividend Growth 1. 2010 – 2014 based on fourth quarter declared dividend 2. Based on August 2015 declared dividend Increased common stock dividend at compound annual rate of nearly 4.2% since 2010 Targeted annual dividend growth rate of 4% - 6% from 2014 - 2016 Dividend yield of 3.8% as of September 23, 20152 Paid a cash dividend on common stock every quarter since first quarter 1921 4% – 6% CAGR 2014 – 2016 Target 4.2% CAGR (2010 – 2014) 14 September 28 & 29, 2015 Investor Presentation

GXP – Attractive Platform for Shareholders Focused on Shareholder Value Creation Target significant reduction in regulatory lag Seek to deliver earnings growth and increasing and sustainable dividends as a key component of total shareholder return Improvement in / stability of key credit metrics is a priority Flexible Investment Opportunities Environmental – approximately $540 million of capital projects over the next five years, does not include potential impact of Clean Power Plan finalized in August 2015 Transmission – formed Transource Energy, LLC joint venture to pursue competitive transmission projects Renewables – driven by Missouri and Kansas Renewable Portfolio Standards Other Growth Opportunities – selective future initiatives that will leverage our core strengths Diligent Regulatory Approach Proven track record of constructive regulatory treatment Credibility with regulators in terms of planning and execution of large, complex projects Competitive retail rates on a regional and national level supportive of potential future investment Excellent Relationships with Key Stakeholders Customers – focused on top tier customer satisfaction Suppliers – strategic supplier alliances focused on long-term supply chain value Employees – strong relations between management and labor (3 IBEW locals) Communities – leadership, volunteerism and high engagement in the areas we serve 15 September 28 & 29, 2015 Investor Presentation

• NYSE: GXP • www.greatplainsenergy.com • Company Contacts: Lori Wright Vice President – Investor Relations and Treasurer (816) 556-2506 lori.wright@kcpl.com Calvin Girard Senior Manager, Investor Relations (816) 654-1777 calvin.girard@kcpl.com Investor Relations Information 16 September 28 & 29, 2015 Investor Presentation

Appendix Pages Operations Overview 18 – 26 2015 Earnings Guidance and Projected Drivers and Assumptions 27 – 29 2016 and 2017 Considerations and Projected Capital Expenditures Plan 30 – 31 Second Quarter and Year-to-Date June 30, 2015 Update 32 – 37 17 September 28 & 29, 2015 Investor Presentation

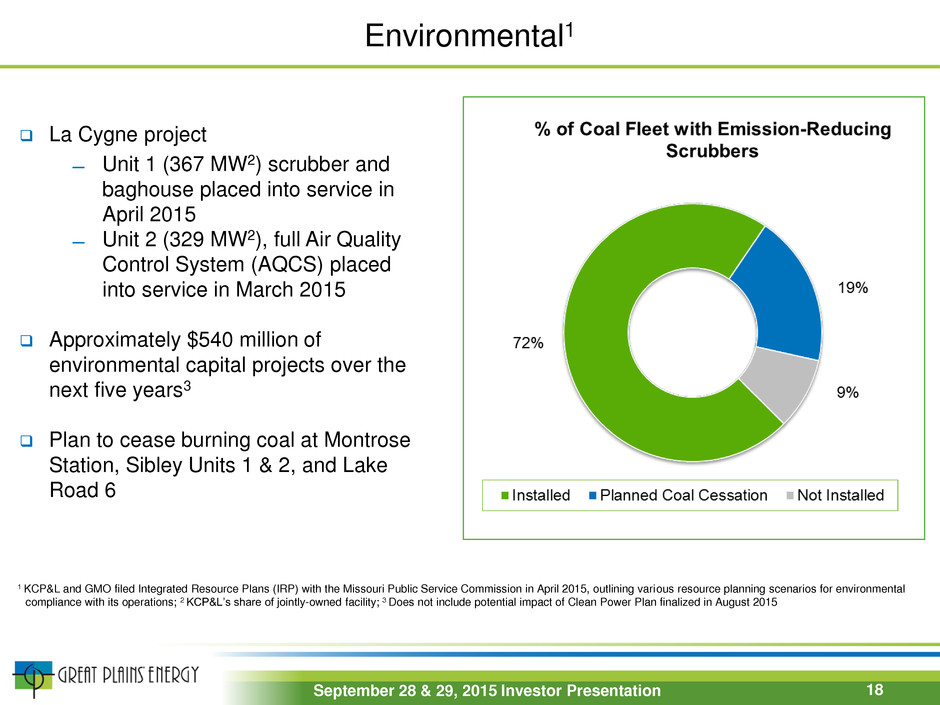

Environmental1 La Cygne project ̶ Unit 1 (367 MW2) scrubber and baghouse placed into service in April 2015 ̶ Unit 2 (329 MW2), full Air Quality Control System (AQCS) placed into service in March 2015 Approximately $540 million of environmental capital projects over the next five years3 Plan to cease burning coal at Montrose Station, Sibley Units 1 & 2, and Lake Road 6 1 KCP&L and GMO filed Integrated Resource Plans (IRP) with the Missouri Public Service Commission in April 2015, outlining various resource planning scenarios for environmental compliance with its operations; 2 KCP&L’s share of jointly-owned facility; 3 Does not include potential impact of Clean Power Plan finalized in August 2015 18 September 28 & 29, 2015 Investor Presentation

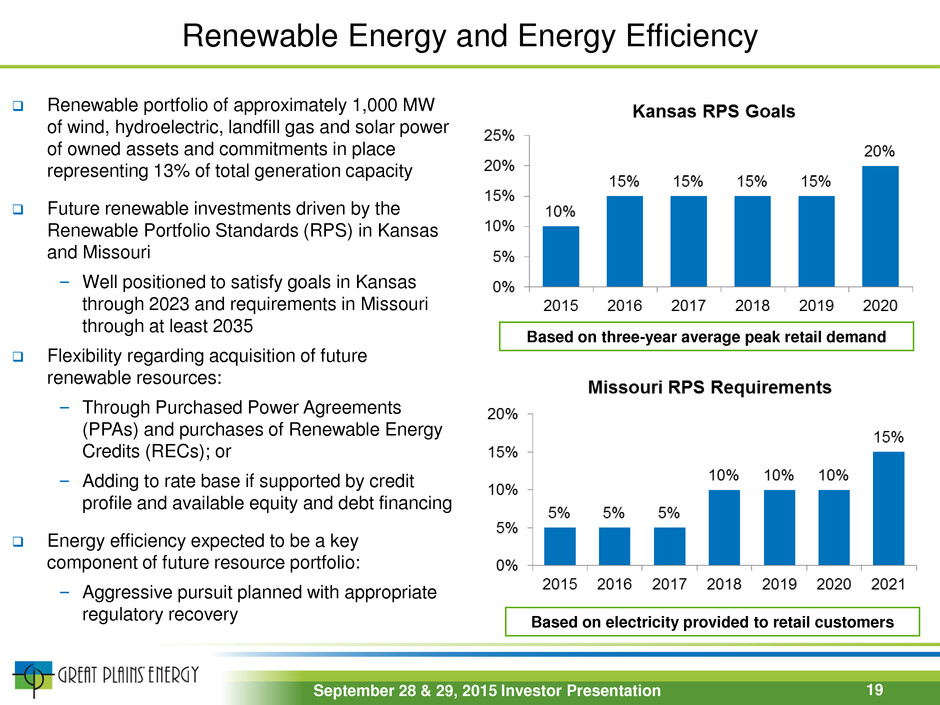

Renewable Energy and Energy Efficiency Renewable portfolio of approximately 1,000 MW of wind, hydroelectric, landfill gas and solar power of owned assets and commitments in place representing 13% of total generation capacity Future renewable investments driven by the Renewable Portfolio Standards (RPS) in Kansas and Missouri – Well positioned to satisfy goals in Kansas through 2023 and requirements in Missouri through at least 2035 Flexibility regarding acquisition of future renewable resources: – Through Purchased Power Agreements (PPAs) and purchases of Renewable Energy Credits (RECs); or – Adding to rate base if supported by credit profile and available equity and debt financing Energy efficiency expected to be a key component of future resource portfolio: – Aggressive pursuit planned with appropriate regulatory recovery Based on three-year average peak retail demand Based on electricity provided to retail customers 19 September 28 & 29, 2015 Investor Presentation

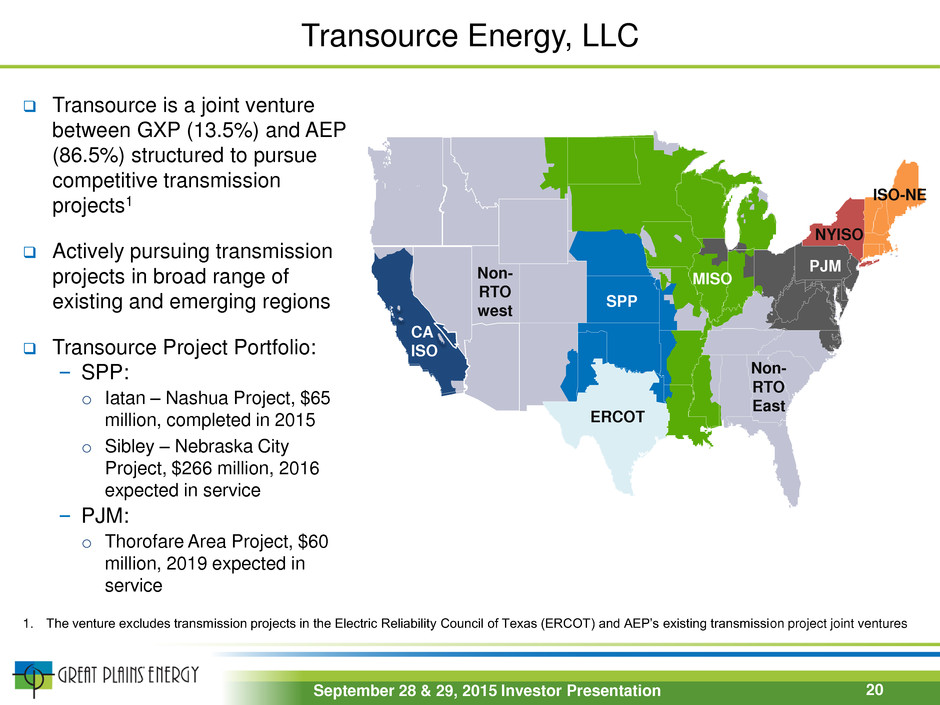

Transource Energy, LLC SPP ERCOT CA ISO Non- RTO west Non- RTO East MISO PJM NYISO ISO-NE Transource is a joint venture between GXP (13.5%) and AEP (86.5%) structured to pursue competitive transmission projects1 Actively pursuing transmission projects in broad range of existing and emerging regions Transource Project Portfolio: – SPP: o Iatan – Nashua Project, $65 million, completed in 2015 o Sibley – Nebraska City Project, $266 million, 2016 expected in service – PJM: o Thorofare Area Project, $60 million, 2019 expected in service 1. The venture excludes transmission projects in the Electric Reliability Council of Texas (ERCOT) and AEP’s existing transmission project joint ventures 20 September 28 & 29, 2015 Investor Presentation

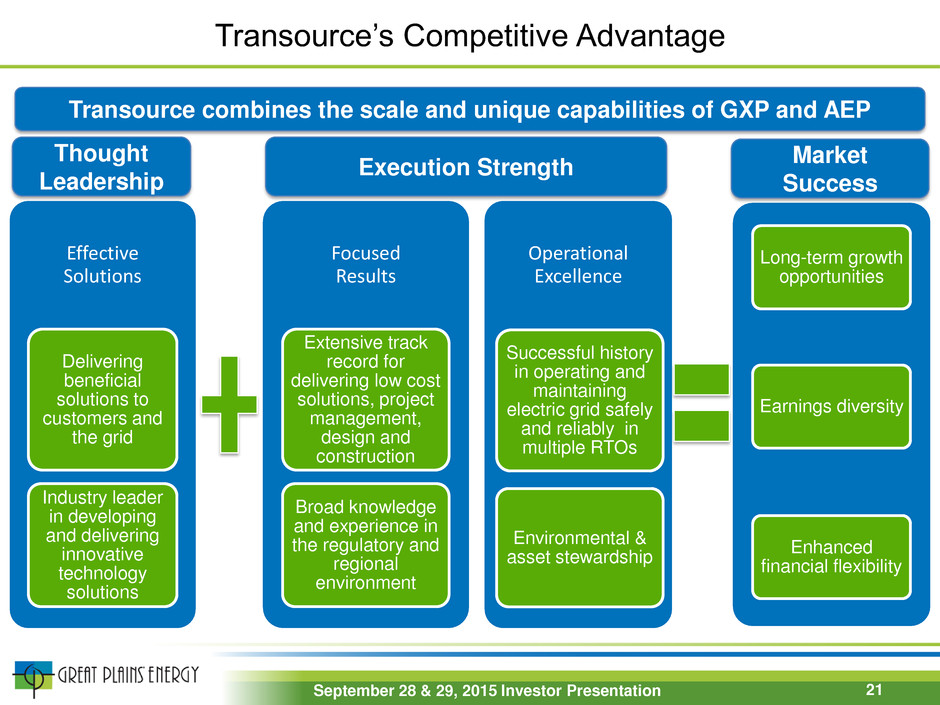

Transource’s Competitive Advantage Transource combines the scale and unique capabilities of GXP and AEP Operational Excellence Successful history in operating and maintaining electric grid safely and reliably in multiple RTOs Environmental & asset stewardship Focused Results Extensive track record for delivering low cost solutions, project management, design and construction Broad knowledge and experience in the regulatory and regional environment Long-term growth opportunities Earnings diversity Enhanced financial flexibility Thought Leadership Execution Strength Effective Solutions Delivering beneficial solutions to customers and the grid Industry leader in developing and delivering innovative technology solutions Market Success 21 September 28 & 29, 2015 Investor Presentation

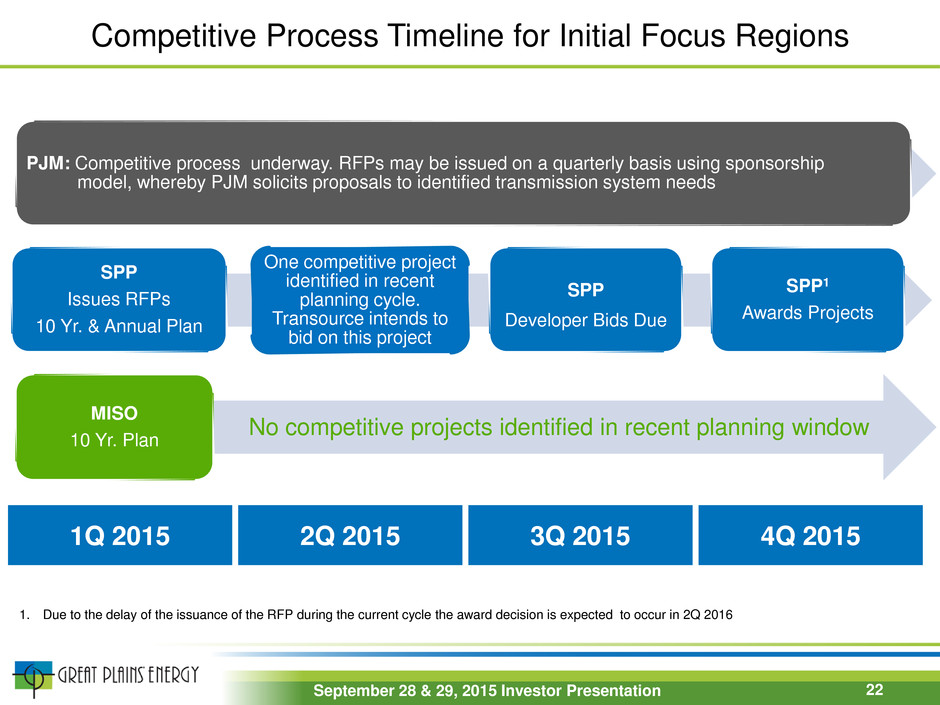

Competitive Process Timeline for Initial Focus Regions 1Q 2015 2Q 2015 3Q 2015 4Q 2015 SPP Issues RFPs 10 Yr. & Annual Plan One competitive project identified in recent planning cycle. Transource intends to bid on this project SPP Developer Bids Due SPP1 Awards Projects PJM: Competitive process underway. RFPs may be issued on a quarterly basis using sponsorship model, whereby PJM solicits proposals to identified transmission system needs 22 MISO 10 Yr. Plan No competitive projects identified in recent planning window 1. Due to the delay of the issuance of the RFP during the current cycle the award decision is expected to occur in 2Q 2016 September 28 & 29, 2015 Investor Presentation

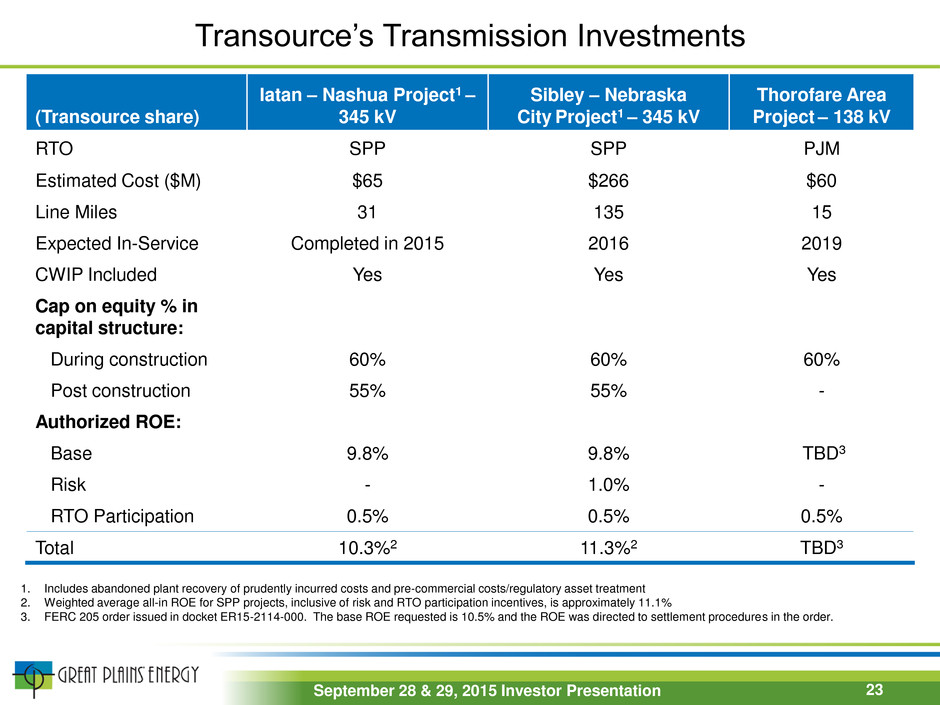

Transource’s Transmission Investments 23 (Transource share) Iatan – Nashua Project1 – 345 kV Sibley – Nebraska City Project1 – 345 kV Thorofare Area Project – 138 kV RTO SPP SPP PJM Estimated Cost ($M) $65 $266 $60 Line Miles 31 135 15 Expected In-Service Completed in 2015 2016 2019 CWIP Included Yes Yes Yes Cap on equity % in capital structure: During construction 60% 60% 60% Post construction 55% 55% - Authorized ROE: Base 9.8% 9.8% TBD3 Risk - 1.0% - RTO Participation 0.5% 0.5% 0.5% Total 10.3%2 11.3%2 TBD3 1. Includes abandoned plant recovery of prudently incurred costs and pre-commercial costs/regulatory asset treatment 2. Weighted average all-in ROE for SPP projects, inclusive of risk and RTO participation incentives, is approximately 11.1% 3. FERC 205 order issued in docket ER15-2114-000. The base ROE requested is 10.5% and the ROE was directed to settlement procedures in the order. September 28 & 29, 2015 Investor Presentation

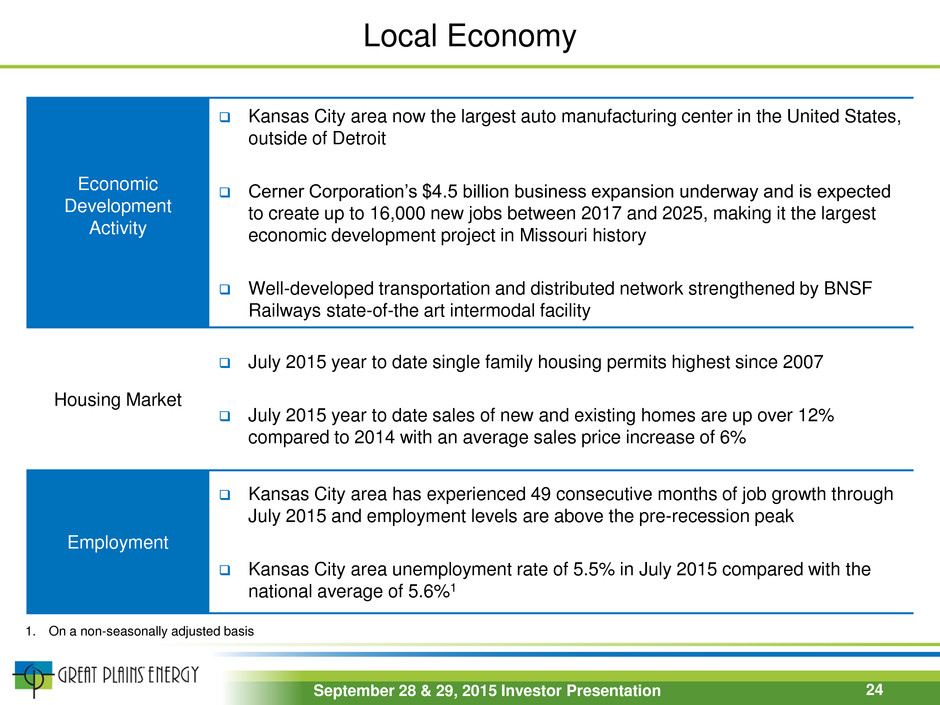

Local Economy Economic Development Activity Kansas City area now the largest auto manufacturing center in the United States, outside of Detroit Cerner Corporation’s $4.5 billion business expansion underway and is expected to create up to 16,000 new jobs between 2017 and 2025, making it the largest economic development project in Missouri history Well-developed transportation and distributed network strengthened by BNSF Railways state-of-the art intermodal facility Housing Market July 2015 year to date single family housing permits highest since 2007 July 2015 year to date sales of new and existing homes are up over 12% compared to 2014 with an average sales price increase of 6% Employment Kansas City area has experienced 49 consecutive months of job growth through July 2015 and employment levels are above the pre-recession peak Kansas City area unemployment rate of 5.5% in July 2015 compared with the national average of 5.6%1 1. On a non-seasonally adjusted basis 24 September 28 & 29, 2015 Investor Presentation

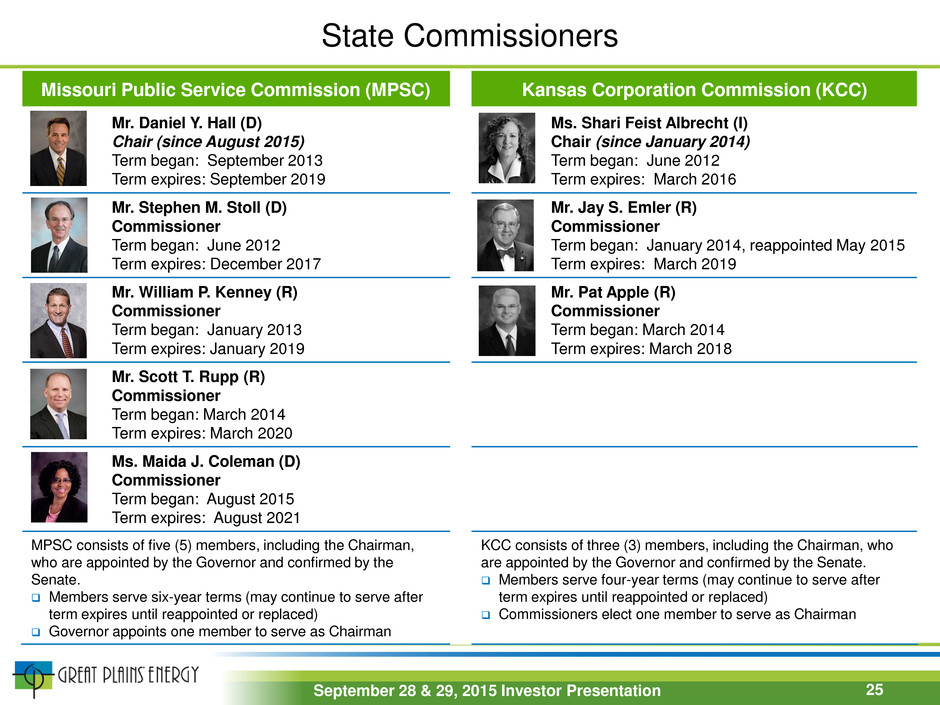

State Commissioners Missouri Public Service Commission (MPSC) Kansas Corporation Commission (KCC) Mr. Daniel Y. Hall (D) Chair (since August 2015) Term began: September 2013 Term expires: September 2019 Ms. Shari Feist Albrecht (I) Chair (since January 2014) Term began: June 2012 Term expires: March 2016 Mr. Stephen M. Stoll (D) Commissioner Term began: June 2012 Term expires: December 2017 Mr. Jay S. Emler (R) Commissioner Term began: January 2014, reappointed May 2015 Term expires: March 2019 Mr. William P. Kenney (R) Commissioner Term began: January 2013 Term expires: January 2019 Mr. Pat Apple (R) Commissioner Term began: March 2014 Term expires: March 2018 Mr. Scott T. Rupp (R) Commissioner Term began: March 2014 Term expires: March 2020 Ms. Maida J. Coleman (D) Commissioner Term began: August 2015 Term expires: August 2021 MPSC consists of five (5) members, including the Chairman, who are appointed by the Governor and confirmed by the Senate. Members serve six-year terms (may continue to serve after term expires until reappointed or replaced) Governor appoints one member to serve as Chairman KCC consists of three (3) members, including the Chairman, who are appointed by the Governor and confirmed by the Senate. Members serve four-year terms (may continue to serve after term expires until reappointed or replaced) Commissioners elect one member to serve as Chairman 25 September 28 & 29, 2015 Investor Presentation

Key Elements of 2006 - 2013 Rate Cases Rate Case Outcomes ($millions) Rate Jurisdiction Date Filed Effective Date Rate Base Rate-making Equity Ratio Return on Equity Rate Increase Approved ($) Rate Increase Approved (%) KCP&L – Missouri 2/1/2006 1/1/2007 $1,270 53.69% 11.25% $50.6 10.5% KCP&L – Missouri 2/1/2007 1/1/2008 $1,298 57.62% 10.75% $35.3 6.5% KCP&L – Missouri 9/5/2008 9/1/2009 $1,4961 46.63% n/a2 $95.0 16.16% KCP&L – Missouri 6/4/2010 5/4/2011 $2,036 46.30% 10.00% $34.8 5.25% KCP&L – Missouri 2/27/2012 1/26/2013 $2,052 52.25%3 9.7% $67.4 9.6% KCP&L – Kansas 1/30/2006 1/1/2007 $1,0001 n/a n/a2 $29.0 7.4% KCP&L – Kansas 2/28/2007 1/1/2008 $1,1001 n/a n/a2 $28.0 6.5% KCP&L – Kansas 9/5/2008 8/1/2009 $1,2701 50.75% n/a2 $59.0 14.4% KCP&L – Kansas 12/17/2009 12/1/2010 $1,781 49.66% 10.00% $22.0 4.6% KCP&L – Kansas 4/20/2012 1/1/2013 $1,798 51.82% 9.5% $33.2 6.7% KCP&L – Kansas 12/9/2013 7/25/2014 $1,916 51.82%9 9.5%9 $11.5 2.2% GMO - Missouri 7/3/2006 5/31/2007 $1,104 48.17% 10.25% $58.8 Refer to fn. 4 GMO - Missouri 9/5/2008 9/1/2009 $1,4741 45.95% n/a2 $63.0 Refer to fn. 5 GMO - Missouri 6/4/2010 6/25/2011 $1,758 46.58% 10.00% $65.5 Refer to fn. 6 GMO – Missouri 2/27/2012 1/26/2013 $1,830 52.25%3 9.7% $47.97 Refer to fn. 8 GMO (Steam) –Missouri 9/5/2008 7/1/2009 $14 n/a n/a2 $1.0 2.3% 1 Rate Base amounts are approximate amounts since the cases were black box settlements; 2 Not available due to black box settlement; 3 MPSC authorized an equity ratio of approximately 52.6% or approximately 52.3% after including other comprehensive income; 4 MPS 11.6%, L&P 12.8%; 5 MPS 10.5%, L&P 11.9%; 6 MPS 7.2%, L&P 21.3%; 7 L&P $21.7 million - includes full impact of phase in from rate case ER-2010-0356; 8 MPS 4.9%, L&P 12.7% - includes full impact of phase in from rate case ER-2010-0356; 9Abbreviated rate case to include La Cygne CWIP; maintain previously authorized Kansas jurisdictional rate-making equity ratio and return on equity based on its 2012 order. 26 September 28 & 29, 2015 Investor Presentation

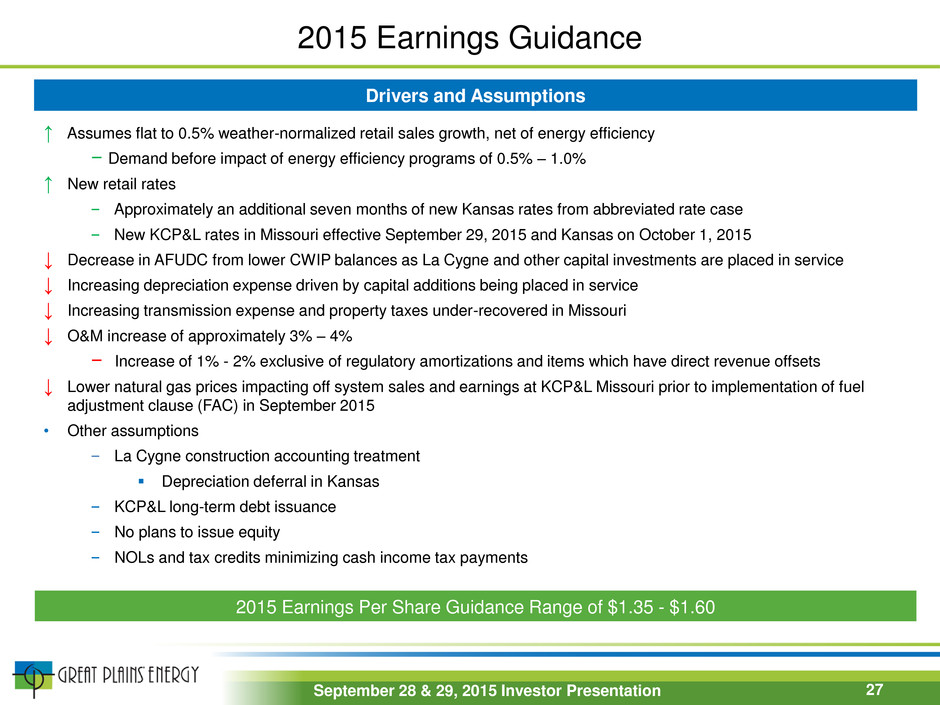

2015 Earnings Guidance 27 Drivers and Assumptions ↑ Assumes flat to 0.5% weather-normalized retail sales growth, net of energy efficiency ‒ Demand before impact of energy efficiency programs of 0.5% – 1.0% ↑ New retail rates ‒ Approximately an additional seven months of new Kansas rates from abbreviated rate case ‒ New KCP&L rates in Missouri effective September 29, 2015 and Kansas on October 1, 2015 ↓ Decrease in AFUDC from lower CWIP balances as La Cygne and other capital investments are placed in service ↓ Increasing depreciation expense driven by capital additions being placed in service ↓ Increasing transmission expense and property taxes under-recovered in Missouri ↓ O&M increase of approximately 3% – 4% ‒ Increase of 1% - 2% exclusive of regulatory amortizations and items which have direct revenue offsets ↓ Lower natural gas prices impacting off system sales and earnings at KCP&L Missouri prior to implementation of fuel adjustment clause (FAC) in September 2015 • Other assumptions ‒ La Cygne construction accounting treatment Depreciation deferral in Kansas ‒ KCP&L long-term debt issuance ‒ No plans to issue equity ‒ NOLs and tax credits minimizing cash income tax payments 2015 Earnings Per Share Guidance Range of $1.35 - $1.60 September 28 & 29, 2015 Investor Presentation

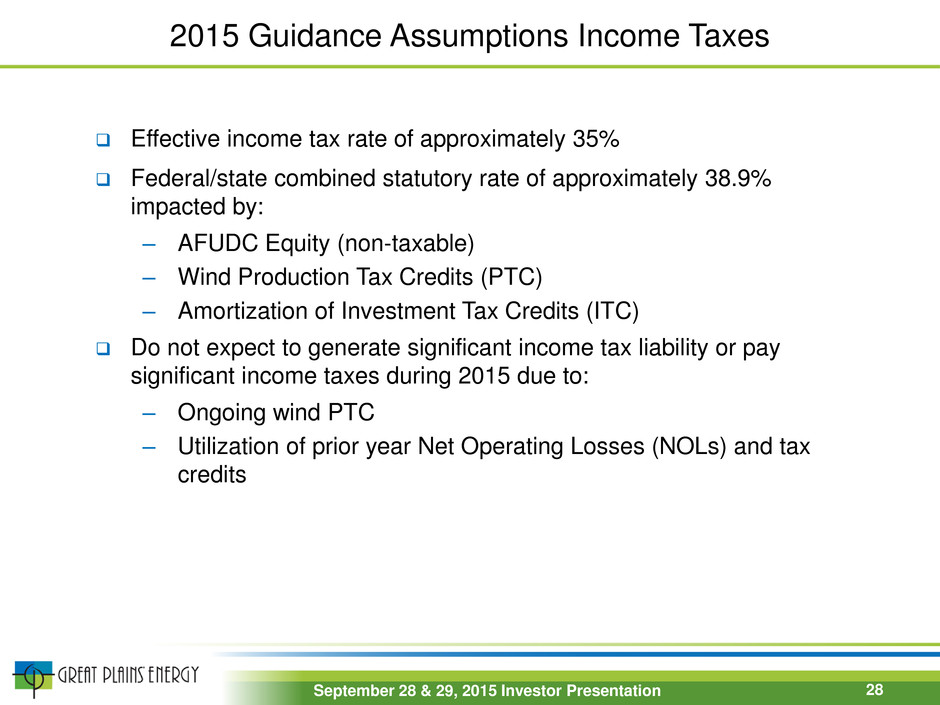

2015 Guidance Assumptions Income Taxes Effective income tax rate of approximately 35% Federal/state combined statutory rate of approximately 38.9% impacted by: – AFUDC Equity (non-taxable) – Wind Production Tax Credits (PTC) – Amortization of Investment Tax Credits (ITC) Do not expect to generate significant income tax liability or pay significant income taxes during 2015 due to: – Ongoing wind PTC – Utilization of prior year Net Operating Losses (NOLs) and tax credits 28 September 28 & 29, 2015 Investor Presentation

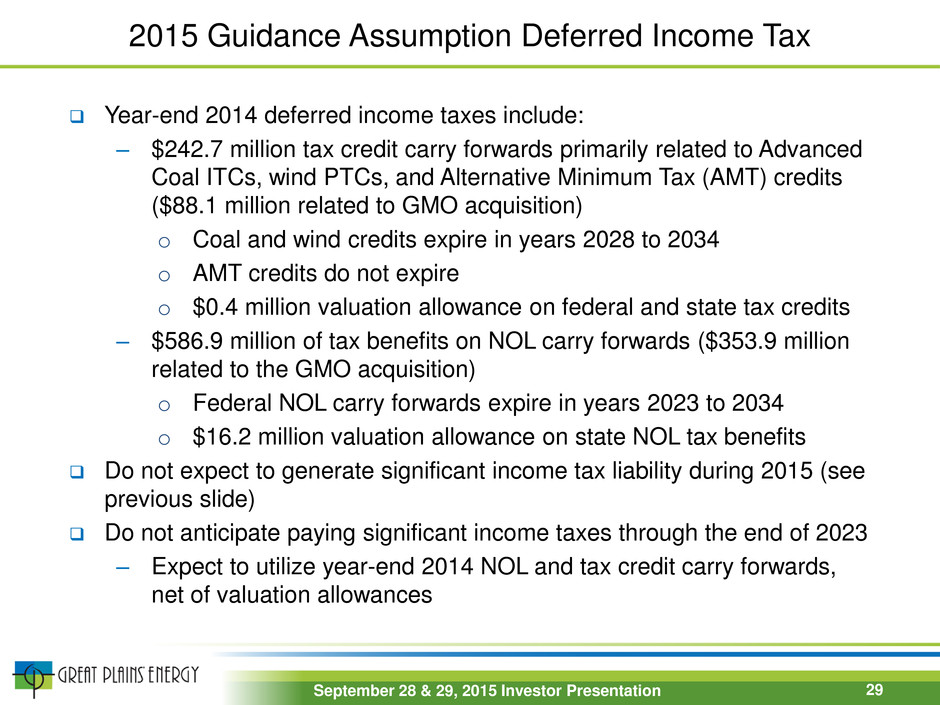

2015 Guidance Assumption Deferred Income Tax 29 Year-end 2014 deferred income taxes include: – $242.7 million tax credit carry forwards primarily related to Advanced Coal ITCs, wind PTCs, and Alternative Minimum Tax (AMT) credits ($88.1 million related to GMO acquisition) o Coal and wind credits expire in years 2028 to 2034 o AMT credits do not expire o $0.4 million valuation allowance on federal and state tax credits – $586.9 million of tax benefits on NOL carry forwards ($353.9 million related to the GMO acquisition) o Federal NOL carry forwards expire in years 2023 to 2034 o $16.2 million valuation allowance on state NOL tax benefits Do not expect to generate significant income tax liability during 2015 (see previous slide) Do not anticipate paying significant income taxes through the end of 2023 – Expect to utilize year-end 2014 NOL and tax credit carry forwards, net of valuation allowances September 28 & 29, 2015 Investor Presentation

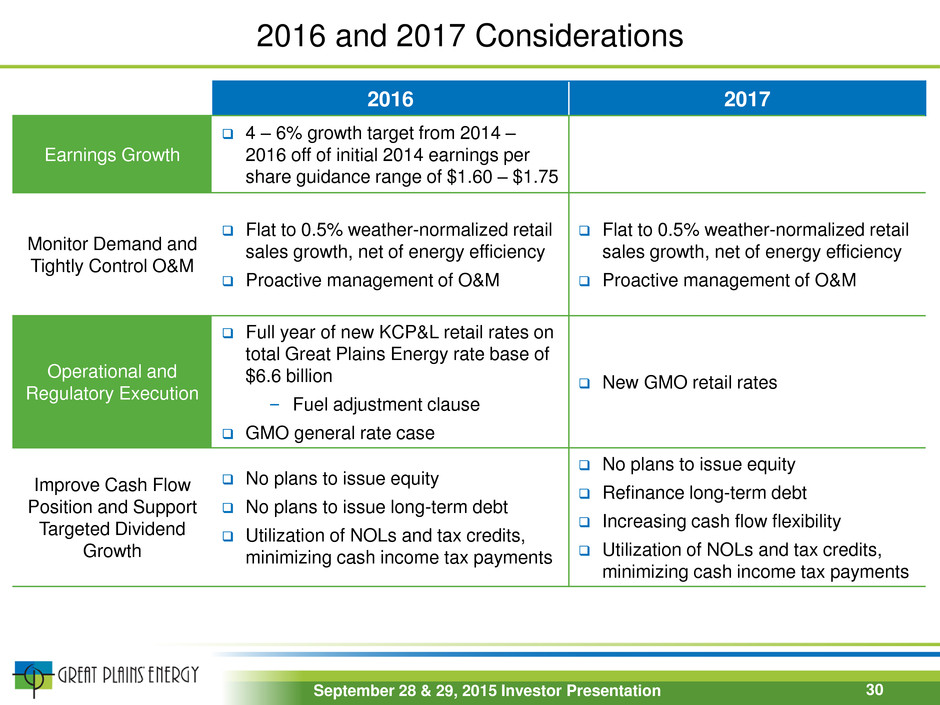

2016 and 2017 Considerations 2016 2017 Earnings Growth 4 – 6% growth target from 2014 – 2016 off of initial 2014 earnings per share guidance range of $1.60 – $1.75 Monitor Demand and Tightly Control O&M Flat to 0.5% weather-normalized retail sales growth, net of energy efficiency Proactive management of O&M Flat to 0.5% weather-normalized retail sales growth, net of energy efficiency Proactive management of O&M Operational and Regulatory Execution Full year of new KCP&L retail rates on total Great Plains Energy rate base of $6.6 billion ‒ Fuel adjustment clause GMO general rate case New GMO retail rates Improve Cash Flow Position and Support Targeted Dividend Growth No plans to issue equity No plans to issue long-term debt Utilization of NOLs and tax credits, minimizing cash income tax payments No plans to issue equity Refinance long-term debt Increasing cash flow flexibility Utilization of NOLs and tax credits, minimizing cash income tax payments 30 September 28 & 29, 2015 Investor Presentation

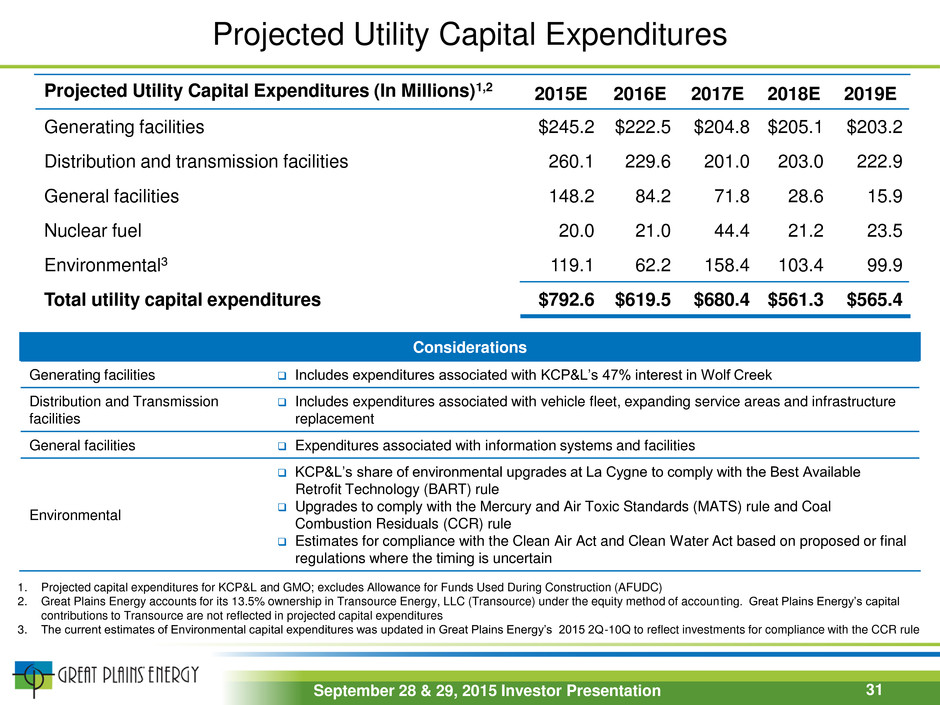

Projected Utility Capital Expenditures Considerations Generating facilities Includes expenditures associated with KCP&L’s 47% interest in Wolf Creek Distribution and Transmission facilities Includes expenditures associated with vehicle fleet, expanding service areas and infrastructure replacement General facilities Expenditures associated with information systems and facilities Environmental KCP&L’s share of environmental upgrades at La Cygne to comply with the Best Available Retrofit Technology (BART) rule Upgrades to comply with the Mercury and Air Toxic Standards (MATS) rule and Coal Combustion Residuals (CCR) rule Estimates for compliance with the Clean Air Act and Clean Water Act based on proposed or final regulations where the timing is uncertain 31 1. Projected capital expenditures for KCP&L and GMO; excludes Allowance for Funds Used During Construction (AFUDC) 2. Great Plains Energy accounts for its 13.5% ownership in Transource Energy, LLC (Transource) under the equity method of accounting. Great Plains Energy’s capital contributions to Transource are not reflected in projected capital expenditures 3. The current estimates of Environmental capital expenditures was updated in Great Plains Energy’s 2015 2Q-10Q to reflect investments for compliance with the CCR rule Projected Utility Capital Expenditures (In Millions)1,2 2015E 2016E 2017E 2018E 2019E Generating facilities $245.2 $222.5 $204.8 $205.1 $203.2 Distribution and transmission facilities 260.1 229.6 201.0 203.0 222.9 General facilities 148.2 84.2 71.8 28.6 15.9 Nuclear fuel 20.0 21.0 44.4 21.2 23.5 Environmental3 119.1 62.2 158.4 103.4 99.9 Total utility capital expenditures $792.6 $619.5 $680.4 $561.3 $565.4 September 28 & 29, 2015 Investor Presentation

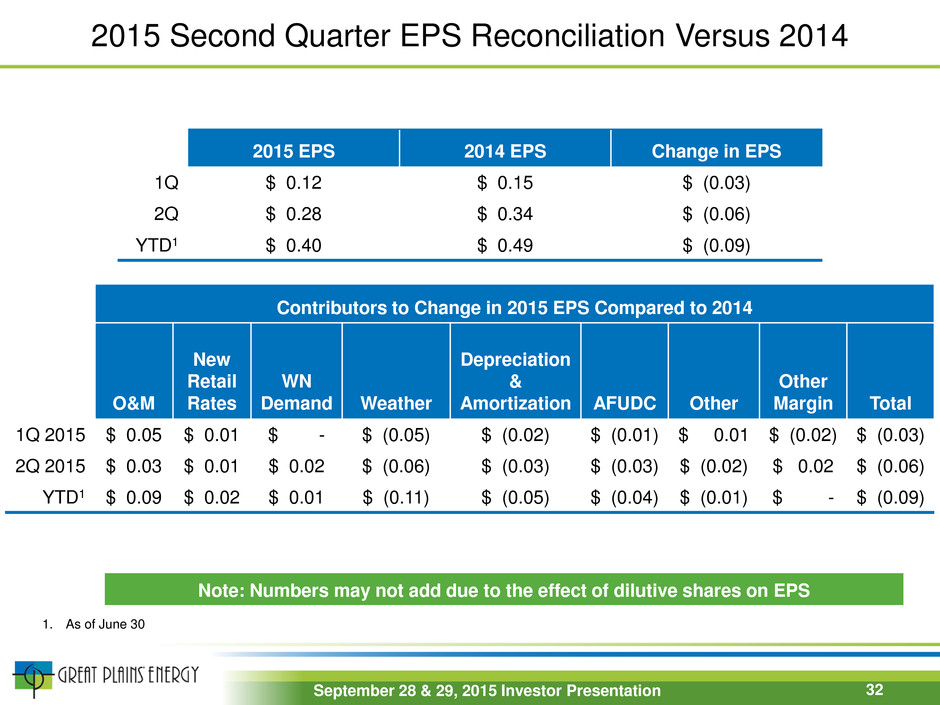

2015 Second Quarter EPS Reconciliation Versus 2014 Contributors to Change in 2015 EPS Compared to 2014 O&M New Retail Rates WN Demand Weather Depreciation & Amortization AFUDC Other Other Margin Total 1Q 2015 $ 0.05 $ 0.01 $ - $ (0.05) $ (0.02) $ (0.01) $ 0.01 $ (0.02) $ (0.03) 2Q 2015 $ 0.03 $ 0.01 $ 0.02 $ (0.06) $ (0.03) $ (0.03) $ (0.02) $ 0.02 $ (0.06) YTD1 $ 0.09 $ 0.02 $ 0.01 $ (0.11) $ (0.05) $ (0.04) $ (0.01) $ - $ (0.09) 2015 EPS 2014 EPS Change in EPS 1Q $ 0.12 $ 0.15 $ (0.03) 2Q $ 0.28 $ 0.34 $ (0.06) YTD1 $ 0.40 $ 0.49 $ (0.09) Note: Numbers may not add due to the effect of dilutive shares on EPS 1. As of June 30 32 September 28 & 29, 2015 Investor Presentation

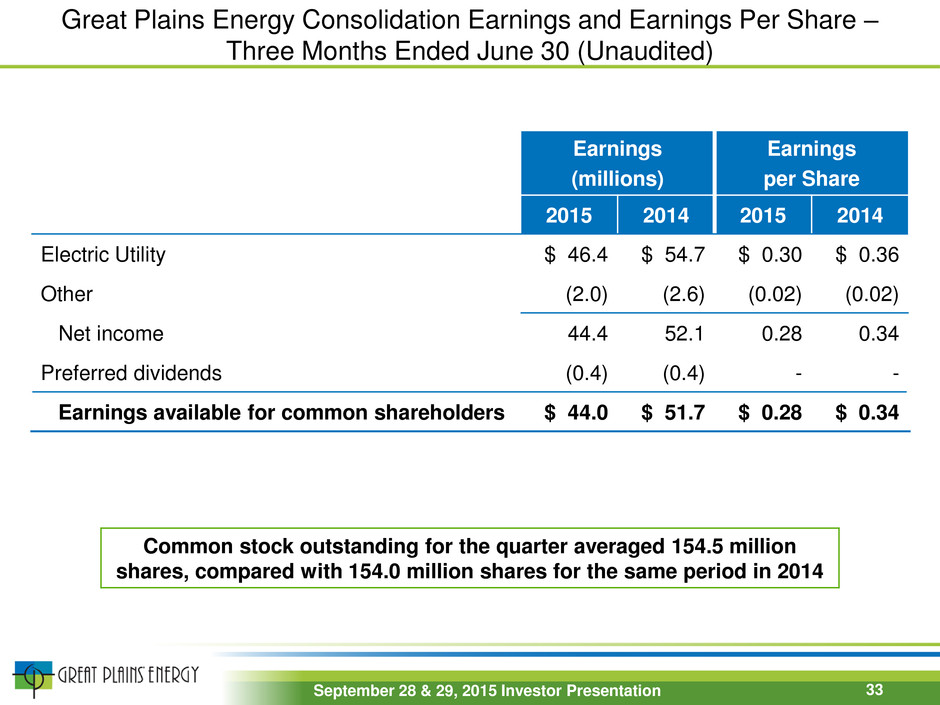

Great Plains Energy Consolidation Earnings and Earnings Per Share – Three Months Ended June 30 (Unaudited) Common stock outstanding for the quarter averaged 154.5 million shares, compared with 154.0 million shares for the same period in 2014 Earnings (millions) Earnings per Share 2015 2014 2015 2014 Electric Utility $ 46.4 $ 54.7 $ 0.30 $ 0.36 Other (2.0) (2.6) (0.02) (0.02) Net income 44.4 52.1 0.28 0.34 Preferred dividends (0.4) (0.4) - - Earnings available for common shareholders $ 44.0 $ 51.7 $ 0.28 $ 0.34 33 September 28 & 29, 2015 Investor Presentation

Great Plains Energy Consolidation Earnings and Earnings Per Share – Year to Date June 30 (Unaudited) Common stock outstanding for the quarter averaged 154.5 million shares, compared with 154.0 million shares for the same period in 2014 Earnings (millions) Earnings per Share 2015 2014 2015 2014 Electric Utility $ 67.3 $ 80.8 $ 0.43 $ 0.52 Other (4.0) (4.9) (0.03) (0.03) Net income 63.3 75.9 0.40 0.49 Preferred dividends (0.8) (0.8) - - Earnings available for common shareholders $ 62.5 $ 75.1 $ 0.40 $ 0.49 34 September 28 & 29, 2015 Investor Presentation

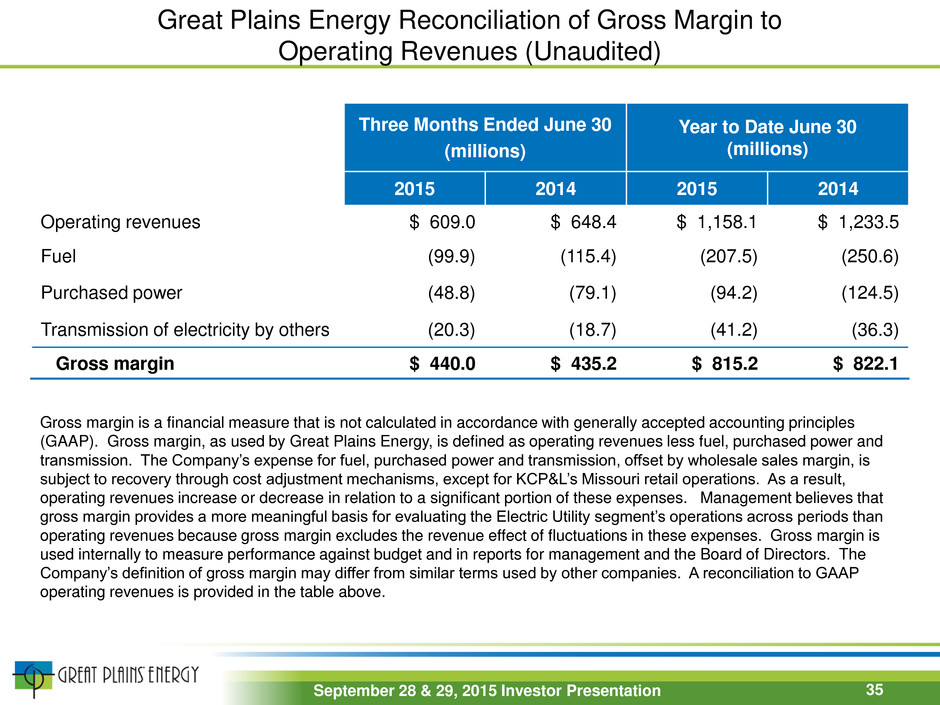

Great Plains Energy Reconciliation of Gross Margin to Operating Revenues (Unaudited) Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting principles (GAAP). Gross margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission. The Company’s expense for fuel, purchased power and transmission, offset by wholesale sales margin, is subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by other companies. A reconciliation to GAAP operating revenues is provided in the table above. Three Months Ended June 30 (millions) Year to Date June 30 (millions) 2015 2014 2015 2014 Operating revenues $ 609.0 $ 648.4 $ 1,158.1 $ 1,233.5 Fuel (99.9) (115.4) (207.5) (250.6) Purchased power (48.8) (79.1) (94.2) (124.5) Transmission of electricity by others (20.3) (18.7) (41.2) (36.3) Gross margin $ 440.0 $ 435.2 $ 815.2 $ 822.1 35 September 28 & 29, 2015 Investor Presentation

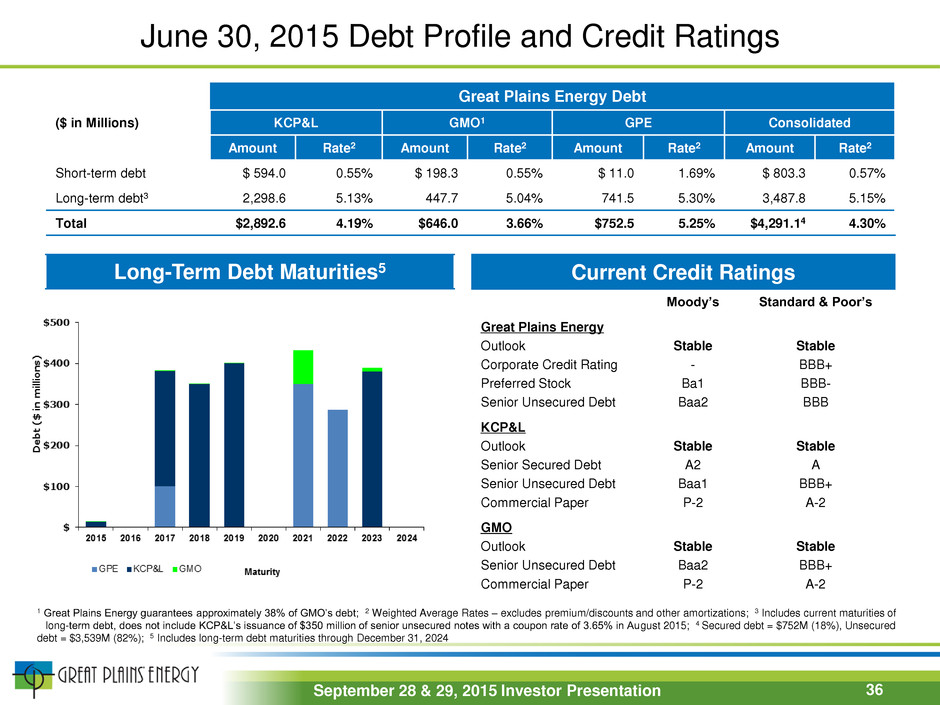

June 30, 2015 Debt Profile and Credit Ratings Great Plains Energy Debt ($ in Millions) KCP&L GMO1 GPE Consolidated Amount Rate2 Amount Rate2 Amount Rate2 Amount Rate2 Short-term debt $ 594.0 0.55% $ 198.3 0.55% $ 11.0 1.69% $ 803.3 0.57% Long-term debt3 2,298.6 5.13% 447.7 5.04% 741.5 5.30% 3,487.8 5.15% Total $2,892.6 4.19% $646.0 3.66% $752.5 5.25% $4,291.14 4.30% Current Credit Ratings Moody’s Standard & Poor’s Great Plains Energy Outlook Corporate Credit Rating Preferred Stock Senior Unsecured Debt Stable - Ba1 Baa2 Stable BBB+ BBB- BBB KCP&L Outlook Senior Secured Debt Senior Unsecured Debt Commercial Paper Stable A2 Baa1 P-2 Stable A BBB+ A-2 GMO Outlook Senior Unsecured Debt Commercial Paper Stable Baa2 P-2 Stable BBB+ A-2 1 Great Plains Energy guarantees approximately 38% of GMO’s debt; 2 Weighted Average Rates – excludes premium/discounts and other amortizations; 3 Includes current maturities of long-term debt, does not include KCP&L’s issuance of $350 million of senior unsecured notes with a coupon rate of 3.65% in August 2015; 4 Secured debt = $752M (18%), Unsecured debt = $3,539M (82%); 5 Includes long-term debt maturities through December 31, 2024 Long-Term Debt Maturities5 36 September 28 & 29, 2015 Investor Presentation

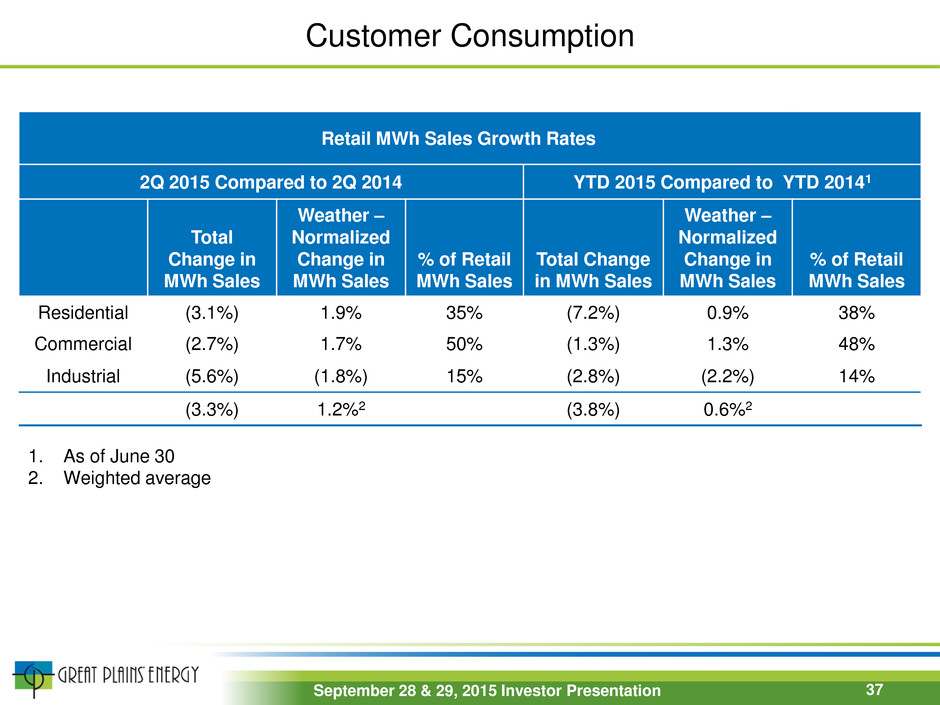

Customer Consumption 37 1. As of June 30 2. Weighted average Retail MWh Sales Growth Rates 2Q 2015 Compared to 2Q 2014 YTD 2015 Compared to YTD 20141 Total Change in MWh Sales Weather – Normalized Change in MWh Sales % of Retail MWh Sales Total Change in MWh Sales Weather – Normalized Change in MWh Sales % of Retail MWh Sales Residential (3.1%) 1.9% 35% (7.2%) 0.9% 38% Commercial (2.7%) 1.7% 50% (1.3%) 1.3% 48% Industrial (5.6%) (1.8%) 15% (2.8%) (2.2%) 14% (3.3%) 1.2%2 (3.8%) 0.6%2 September 28 & 29, 2015 Investor Presentation