Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IMAX CORP | d53948d8k.htm |

Table of Contents

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and the Securities and Futures Commission take no responsibility for the contents of this PHIP, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this PHIP.

Post Hearing Information Pack (“PHIP”) of

IMAX CHINA HOLDING, INC.

(Incorporated in the Cayman Islands with limited liability)

WARNING

The publication of this PHIP is required by The Stock Exchange of Hong Kong Limited (the “Exchange”) and the Securities and Futures Commission (the “Commission”) solely for the purpose of providing information to the public in Hong Kong.

This PHIP is in draft form. The information contained in it is incomplete and is subject to change which can be material. By viewing this document, you acknowledge, accept and agree with IMAX China Holding, Inc. (the “Company”), its sponsor, advisers and all members of the underwriting syndicate that:

| (a) | this document is only for the purpose of providing information to the public in Hong Kong and not for any other purposes. No investment decision should be based on the information contained in this document; |

| (b) | the publication of this document or supplemental, revised or replacement pages on the Exchange’s website does not give rise to any obligation of the Company, its sponsor, advisers or members of the underwriting syndicate to proceed with an offering in Hong Kong or any other jurisdiction. There is no assurance that the Company will proceed with the offering; |

| (c) | the contents of this document or supplemental, revised or replacement pages may or may not be replicated in full or in part in the actual final listing document; |

| (d) | the PHIP is not the final listing document and may be updated or revised by the Company from time to time in accordance with the Listing Rules; |

| (e) | this document does not constitute a prospectus, offering circular, notice, circular, brochure or advertisement offering to sell any securities to the public in any jurisdiction, nor is it an invitation to the public to make offers to subscribe for or purchase any securities, nor is it calculated to invite offers by the public to subscribe for or purchase any securities; |

| (f) | this document must not be regarded as an inducement to subscribe for or purchase any securities, and no such inducement is intended; |

| (g) | neither the Company nor any of its affiliates, advisers or underwriters is offering, or is soliciting offers to buy, any securities in any jurisdiction through the publication of this document; |

| (h) | no application for the securities mentioned in this document should be made by any person nor would such application be accepted; |

| (i) | the Company has not and will not register the securities referred to in this document under the United States Securities Act of 1933, as amended, or any state securities laws of the United States; |

| (j) | as there may be legal restrictions on the distribution of this document or dissemination of any information contained in this document, you agree to inform yourself about and observe any such restrictions applicable to you; |

| (k) | the application to which this document relates has not been approved for listing and the Exchange and the Commission may accept, return or reject the application for the subject public offering and/ or listing; and |

| (l) | you confirm that you are accessing this PHIP from outside the United States. |

THIS PHIP IS NOT FOR PUBLICATION OR DISTRIBUTION TO PERSONS IN THE UNITED STATES. ANY SECURITIES REFERRED TO HEREIN HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES WITHOUT REGISTRATION THEREUNDER OR PURSUANT TO AN AVAILABLE EXEMPTION THEREFROM. NO PUBLIC OFFERING OF THE SECURITIES WILL BE MADE IN THE UNITED STATES.

NEITHER THIS PHIP NOR ANY INFORMATION CONTAINED HEREIN CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN THE UNITED STATES OR IN ANY OTHER JURISDICTION WHERE SUCH OFFER OR SALE IS NOT PERMITTED. THIS PHIP IS NOT BEING MADE AVAILABLE IN, AND MAY NOT BE DISTRIBUTED OR SENT TO THE UNITED STATES OR ANY JURISDICTION WHERE SUCH DISTRIBUTION OR DELIVERY MAY BREACH LOCAL SECURITIES LAW.

No offer or invitation will be made to the public in Hong Kong until after a prospectus of the Company has been registered with the Registrar of Companies in Hong Kong in accordance with the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). If an offer or an invitation is made to the public in Hong Kong in due course, prospective investors are reminded to make their investment decisions solely based on a prospectus of the Company registered with the Registrar of Companies in Hong Kong, copies of which will be distributed to the public during the offer period.

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

IMPORTANT

| If you are in any doubt about any of the contents of this [REDACTED], you should obtain independent professional advice. |

IMAX CHINA HOLDING, INC.

(Incorporated in the Cayman Islands with limited liability)

[REDACTED]

| Number of [REDACTED] under the [REDACTED] |

: | [REDACTED] | ||

| Number of [REDACTED] |

: | [REDACTED] | ||

| Number of [REDACTED] |

: | [REDACTED] | ||

| [REDACTED] |

: | HK$[REDACTED] per [REDACTED] plus brokerage of 1.0%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund) | ||

| Nominal value |

: | US$0.0001 per [REDACTED] | ||

| Stock Code |

: | [REDACTED] | ||

[REDACTED] and Sole Sponsor

[REDACTED]

Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this [REDACTED], make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this [REDACTED].

A copy of this [REDACTED], having attached thereto the documents specified in “Appendix VII—Documents Delivered to the Registrar of Companies in Hong Kong and Available for Inspection”, has been registered by the Registrar of Companies in Hong Kong as required by Section 342C of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). The Securities and Futures Commission and the Registrar of Companies in Hong Kong take no responsibility as to the contents of this [REDACTED] or any other documents referred to above.

The [REDACTED] is expected to be determined by agreement between the Sole Global Coordinator (on behalf of the Underwriters) and the Company on the Price Determination Date, which is expected to be on or about [REDACTED] and, in any event, not later than [REDACTED]. The [REDACTED] will not be more than HK$[REDACTED] per [REDACTED] and is expected to be not less than HK$[REDACTED] per [REDACTED], unless otherwise announced.

[REDACTED]

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

IMPORTANT

[REDACTED]

— i —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

[REDACTED]

— ii —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

You should rely only on the information contained in this [REDACTED] and the Application Forms to make your investment decision. Neither the Company nor any of the Relevant Persons has authorised anyone to provide you with any information or to make any representation that is different from what is contained in this [REDACTED].

| Page | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 56 | ||||

| 70 | ||||

| 103 | ||||

| 151 | ||||

| 153 | ||||

| 154 | ||||

| 166 | ||||

| 191 | ||||

| 202 | ||||

| 204 | ||||

| 209 | ||||

| 218 | ||||

| 227 | ||||

| — |

Accountant’s Report |

I-1 | ||||||

| — |

Unaudited Pro Forma Financial Information |

II-1 | ||||||

| — |

Regulatory Overview |

III-1 | ||||||

| — |

Summary of the Constitution of the Company and Cayman Islands Company Law |

IV-1 | ||||||

| — |

Taxation |

V-1 | ||||||

| — |

Statutory and General Information |

VI-1 | ||||||

| — |

Documents Delivered to the Registrar of Companies in Hong Kong and Available for Inspection |

VII-1 | ||||||

| — |

Definitions and Glossary |

VIII-1 | ||||||

— iii —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

| This summary is intended to give you an overview of the information contained in this [REDACTED]. Since it is a summary, it does not contain all the information that may be important to you. You should read this [REDACTED] in its entirety [REDACTED]. Some of the particular risks of [REDACTED] are set out in “Risk Factors” and you should read that section carefully [REDACTED]. |

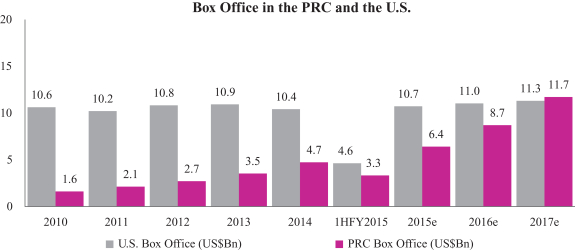

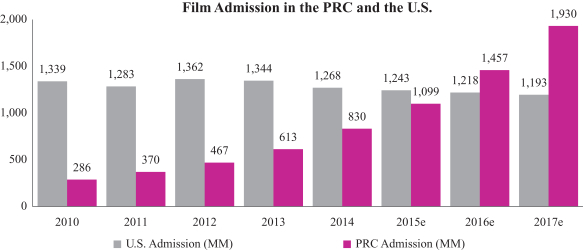

Introduction

We are a leading cinematic technology provider, the exclusive licensee of the IMAX brand in the theatre and films business and the sole commercial platform for the release of IMAX format films in Greater China. Standing for the highest quality and most immersive motion picture entertainment experience, the IMAX brand is one of the strongest entertainment brands in Greater China(1), having had a presence in the PRC for nearly 15 years. We believe that we are a key participant in the Greater China film industry with wide-spread recognition and consumer loyalty through our early entry and historical successes, including Avatar in 2010, Transformers: Age of Extinction in 2014 and Furious 7 in 2015. A significant majority of our revenue is generated in the PRC, and we expect the PRC to be the principal source of our growth in the future. Our goal is to deliver the IMAX experience to an even wider audience in both the PRC and Greater China as a whole, being the second largest and the fastest growing major cinema market in the world by total box office revenue.

We have two principal business segments, namely the theatre business and the films business.

Theatre Business

Our theatre business involves the design, procurement and provision of premium digital theatre systems at our exhibitor partners’ movie theatres, as well as the provision of related project management and ongoing maintenance services. In FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015, our theatre business accounted for 80.0%, 75.9%, 76.2%, 70.3% and 65.4% of our total revenue, respectively, and 84.6%, 74.4%, 74.4%, 73.0% and 61.9% of our total gross profit, respectively. In FY2014, 93.5% of our theatre business revenue was generated in the PRC, and we expect the PRC to generate a rising proportion of our revenue in the future.

We generate revenue by charging fees to exhibitors for the IMAX theatre system and associated services, brand and technology licensing and maintenance services. All the theatres using the IMAX theatre system are owned and operated by our exhibitor partners. This enables us to limit our exposure to financial, operational and regulatory risks associated with building and operating a movie theatre.

Films Business

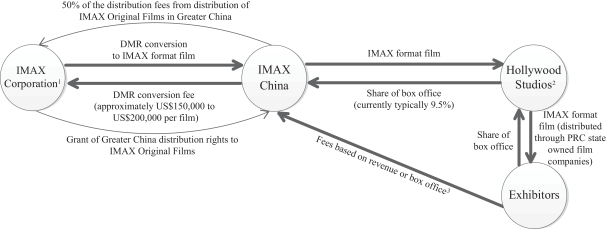

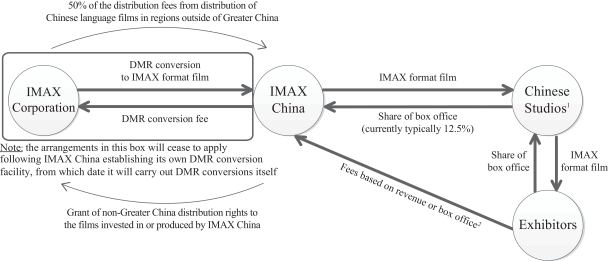

Our films business involves the digital re-mastering of Hollywood and Chinese language films into the IMAX format through a proprietary DMR conversion process and the exhibition of these films on the IMAX theatre network in Greater China. In FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015, our films business accounted for 20.0%, 24.1%, 23.8%, 29.7% and 34.6% of our total revenue, respectively, and 15.4%, 25.6%, 25.6%, 27.0% and 38.1% of our total gross profit, respectively. In FY2014, 86.0% of our films business revenue was generated in the PRC, and we expect the PRC to generate a rising proportion of our revenue in the future.

| (1) | According to a survey conducted by Millward Brown Research for a one week period in June 2014 involving over 300 participants. |

— 1 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

We generate revenue by sharing a fixed percentage in our studio partners’ box office generated from IMAX format films. This arrangement enables us to share in the box office success of a film while limiting our exposure to the significant capital investment required in making a film and the regulatory requirements governing the production and distribution of films in Greater China.

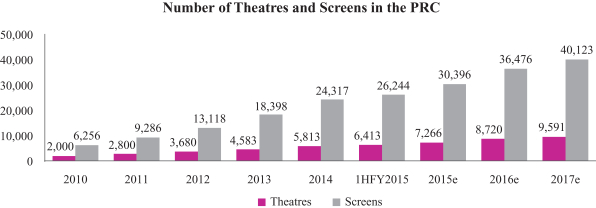

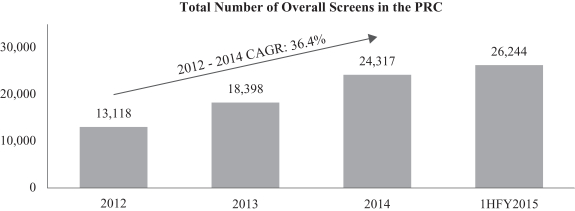

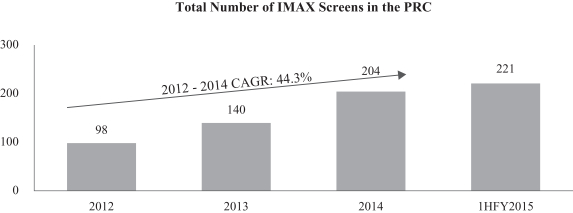

IMAX Theatre Network

The number of IMAX theatres in Greater China has grown rapidly, with 128, 173, 234 and 251 IMAX theatre systems operating in Greater China as at 31 December 2012, 2013 and 2014 and 30 June 2015, respectively, representing a CAGR of 30.9% for the periods 2012 through 30 June 2015. As at 30 June 2015, we had 221 commercial IMAX theatres in operation in the PRC, representing 88.0% of our total number of IMAX theatres in operation in Greater China.

As at 30 June 2015, we had a further 217 IMAX theatre systems in our backlog, representing contractual commitments entered into between us and our exhibitor partners which, along with future system signings, we believe will underpin our continued growth. In the ordinary course of business, we continue to seek new exhibitor partners and expand existing exhibitor partnerships to increase the size of the IMAX theatre network. The following table shows our backlog as at 30 June 2015 by business arrangement. The majority of the theatres in our backlog are commercial theatres, and 97.2% of them are to be located in the PRC.

| Number of systems | ||||

| Sales |

66 | |||

| Full revenue sharing |

86 | |||

| Hybrid revenue sharing |

65 | |||

|

|

|

|||

| Total |

217 | (1) | ||

|

|

|

|||

Note:

| (1) | Of the total number of systems in our backlog, three of them are digital upgrades. |

The carrying value of our backlog was US$127.6 million as at 30 June 2015. Revenue from our backlog is recognised following the installation of the relevant IMAX theatre systems and not at the time of signing customer contracts. 174 theatres in our backlog are due to be installed from 2015 to 2018, and 43 theatres in our backlog are due to be installed from 2019 to 2021. See “Business—Our Business Operations—The IMAX theatre network—Our backlog” and “Financial Information—Significant Factors Affecting Our Financial Condition and Results of Operations—Expansion of the IMAX Theatre Network in Greater China—Backlog”.

Our Partnerships

We have strong and successful partnerships with a number of key players across the Greater China film industry. These include over 30 exhibitors, including the largest exhibitor in the world, Wanda Cinema, as well as other established market players such as CJ CGV and Shanghai United Cinema. We also work with leading producers, directors and studios in Greater China, such as Huayi Brothers, Bona, Wanda Media and Filmko Holdings, to convert Chinese language films into the IMAX format for release on the IMAX theatre network. These films include Journey to the West: Conquering the Demons, Flying Swords of the Dragon Gate, Police Story, The Monkey King and Dragon Blade. In addition, we work with large commercial real estate developers, such as Wanda Plaza, China Resources and Longfor, to identify new IMAX theatre locations.

— 2 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

IMAX Films

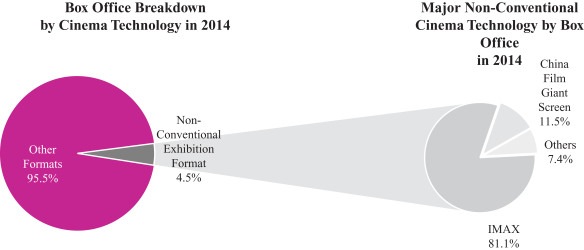

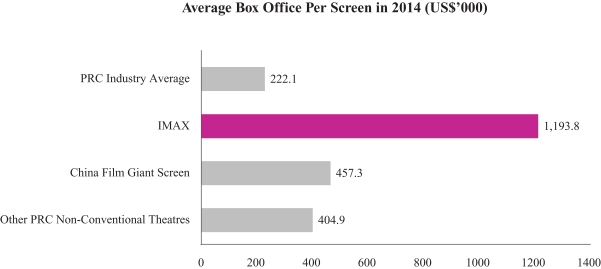

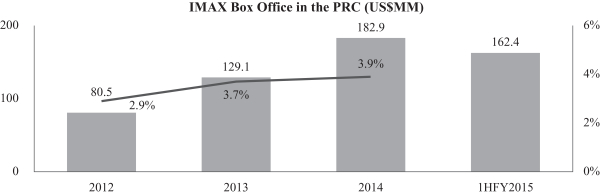

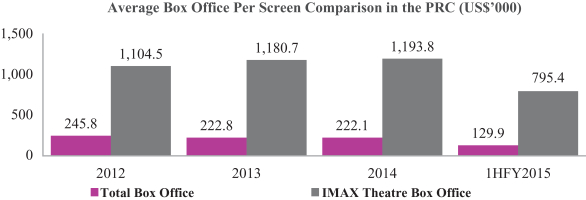

The theatre networks in the PRC have historically been under-developed and less well equipped than in the United States and other developed economies. We believe that our leading technology and theatre systems have allowed us to enhance the audience experience and satisfy growing consumer demand for the highest quality and most immersive motion picture entertainment that the IMAX brand stands for. In FY2014, only 4.5% of the total PRC box office was generated from non-conventional format films such as IMAX, of which 81.1% was generated by IMAX format films. However, we have achieved significant penetration within the top films released in the PRC - four out of the top five highest grossing films in FY2014 in the PRC were released in the IMAX format (the top five highest grossing films accounting for 19.3% of the total PRC box office in FY2014), and eight of the top 10 highest grossing films ever in the PRC were released in the IMAX format.

Over the last five years, the Chinese language film box office in the PRC has grown at a CAGR of 38.1%, and in FY2014, it represented 55.0% of the total box office in the PRC. This presented a unique opportunity for us as in FY2014 and 1HFY2015, Greater China box office from IMAX format Chinese language films as a percentage of the total Greater China box office from IMAX format films was only 15.2% and 8.4%, respectively. We are in the process of establishing a DMR conversion facility and screening room in the PRC, which will give us the ability to digitally remaster Chinese language films to IMAX format ourselves. This facility is expected to be fully operational by the end of 2015, and we believe that it will be highly attractive to filmmakers in the PRC and strengthen our partnerships with them. We expect that, following its establishment, our own DMR conversion facility will be able to meet our foreseeable needs in respect of the digital re-mastering of Chinese language films to IMAX format films. However, the DMR Services Agreements will remain in place to provide us with back-up and overflow capacity if needed.

IMAX Technology

IMAX theatre systems bring together IMAX DMR conversion technology, advanced projection systems, curved screens and proprietary theatre geometry as well as specialised sound systems to create a more intense, immersive and exciting experience than a traditional movie theatre. They are the product of over 40 years of research and development by IMAX Corporation, our Controlling Shareholder. As the exclusive licensee of the IMAX brand and technology in Greater China, we have full access to the most advanced IMAX theatre systems based on proprietary technology produced by IMAX Corporation.

OUR COMPETITIVE STRENGTHS

We believe that our success to date and potential for future growth are attributable to the following competitive strengths:

| · | A strong entertainment brand in the large and fast-growing Greater China market |

| · | Strong slate of Hollywood films(1) complemented by a growing portfolio of Chinese language films |

| · | Unparalleled network supported by strong exhibitor partnerships |

| · | Leading IMAX theatre system and technology delivering a unique cinematic experience |

| (1) | Hollywood films include all imported films subject to the annual quota imposed by the PRC government. |

— 3 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

| · | Significant value creation across the film industry for exhibitors, studios, filmmakers and commercial real estate developers |

| · | Experienced management team supported by prominent shareholders |

OUR BUSINESS STRATEGIES

Our goal is to deliver the unique IMAX experience to an even wider audience in both the PRC and Greater China as a whole through the following strategies:

| · | Expanding the IMAX theatre network in the PRC |

| · | Increasing the number of revenue sharing arrangements with our exhibitor partners |

| · | Strengthening our cooperation with PRC studios and filmmakers |

| · | Maintaining our position as a provider of leading cinema technology |

| · | Continuing to invest in the IMAX brand in Greater China |

| · | Leveraging the IMAX brand to develop and invest in complementary businesses |

Risk Factors

Our business is subject to numerous risks and there are risks relating to [REDACTED]. As different investors may have different interpretations and criteria when determining the significance of a risk, you should read “Risk Factors” in its entirety [REDACTED]. The risks we primarily face include the following:

| · | We depend principally on the orders from commercial film exhibitors for IMAX theatre systems, to generate box office revenue under revenue sharing arrangements and to supply venues in which to exhibit IMAX format films. However, we cannot assure you that exhibitors will continue to do any of these things. |

| · | The success of the IMAX theatre network is directly related to the availability and performance of IMAX format films. However, we cannot assure you that such films will continue to be available or successful. |

| · | We currently rely significantly on IMAX Corporation in many aspects of our businesses, including the provision of IMAX theatre system equipment and technical support, the provision of DMR conversion services, the licensing of IP rights and the remittance of fees from Hollywood studios. |

| · | A deterioration in our relationship with Wanda Cinema, or any of our leading exhibitor partners, could materially and adversely affect our business, results of operation and financial condition. |

| · | PRC government regulations applicable to any of our industry segments, including the entertainment industry, could severely impair our ability to operate our business. |

Relationship with IMAX Corporation, our Controlling Shareholder

Our ultimate controlling shareholder is IMAX Corporation. [REDACTED] Immediately following the

— 4 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

completion of the [REDACTED], IMAX Corporation will own approximately 69.8% of our issued share capital (assuming that the Over-allotment Option is not exercised). Following listing, IMAX Corporation will operate a theatre equipment and films business in regions outside of Greater China.

Competition

Our Directors believe that it is unlikely that the businesses of IMAX Corporation and us will compete in any material respect with each other, directly or indirectly, since they operate in distinct geographical areas. IMAX Corporation has granted us an exclusive right to use the IMAX brand and technology in Greater China for its theatre and films businesses under the Trademark License Agreements and the Technology License Agreements. These exclusive licences prevent IMAX Corporation from using the IMAX trademark or IMAX technology in Greater China to compete against our businesses.

Long-Term Agreements

We have entered into a series of long-term agreements with IMAX Corporation for the licensing of IMAX trademarks and technology, the procurement of theatre systems and equipment, ongoing maintenance of installed theatre systems and equipment and other services, including DMR conversions, and the procurement of films for distribution in Greater China.

The long-term agreements are designed to ensure that we have long-term security and stability of supply of the products and services necessary for us and our exhibitor partners to operate our respective businesses. Each of the long-term agreements are for a renewable term of 25 years or have no fixed term and are terminable only in limited circumstances. The key terms of these agreements are summarised in the table below:

| Agreement |

Subject Matter |

Term |

Fees |

Annual caps | ||||

| Exempt Continuing Connected Transactions | ||||||||

| Services Agreements |

Provision of certain elective services, including theatre design | Indefinite | Cost plus 10% or fixed fees for particular services | N/A | ||||

| DMR Software License Agreement |

Grant of a non-exclusive licence to IMAX Shanghai Multimedia for it to use IMAX DMR software in the DMR conversion facility to be established by the Group | 21 years (1) (renewable for an additional 25 years) | Annual fee of 5% of box office revenue from converted films |

N/A | ||||

| IMAX Shanghai Services Agreement |

Provision of maintenance services by IMAX Shanghai Services to IMAX Corporation for its theatre operations in regions outside of Greater China | Two years (renewable for successive one year periods unless terminated) | Cost plus 10% | N/A | ||||

| Tool and Equipment Supply Contract |

Provision of certain maintenance repair tools and equipment by IMAX Corporation to IMAX Shanghai Services | Indefinite | Purchase price of equipment quoted by IMAX Corporation | N/A | ||||

— 5 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

| Agreement |

Subject Matter |

Term |

Fees |

Annual caps | ||||

| Non-exempt Continuing Connected Transactions | ||||||||

| Personnel Secondment Agreement |

Secondment of certain employees of IMAX Corporation to IMAX Shanghai Multimedia | 25 years | Cost based | US$4 million, US$5 million and US$6 million for FY2015, FY2016 and FY2017, respectively | ||||

| Trademark License Agreements |

Grant of an exclusive right to use certain IMAX trademarks | 25 years (renewable for an additional 25 years) (2) | Annual fee of 2% of gross revenues of the Company | Determined by reference to the formulae for determining the royalties under the agreements | ||||

| Technology License Agreements |

Grant of an exclusive right to use certain IMAX technology | 25 years (renewable for an additional 25 years) (2) | Annual fee of 3% gross revenues of the Company | Determined by reference to the formulae for determining the royalties under the agreements | ||||

| DMR Services Agreement |

Provision of digital re-mastering services for Chinese language films and the distribution of such films by IMAX Corporation outside of Greater China | 25 years (renewable for an additional 25 years) (2) |

Conversion fees of cost plus 10%

50% of the distribution fees from distribution of Chinese language films in regions outside of Greater China payable by IMAX Corporation to the Group |

Determined by reference to the formulae for determining the fees | ||||

| Equipment Supply Agreements |

Supply of IMAX equipment to us for us to provide to customers | 25 years (renewable for an additional 25 years) (2) | Cost plus 10% | Determined by reference to the formulae for determining the purchase price | ||||

| Master Distribution Agreements |

Exclusive platform for the exhibition of Hollywood films in Greater China | 25 years (renewable for an additional 25 years) (2) |

Conversion fees of US$150,000 for most 2D films and US$200,000 for most 3D films (fees increase for films longer than 2.5 hours)

50% of the distribution fees from distribution of IMAX Original Films in Greater China |

Determined by reference to the formulae for determining the fees | ||||

— 6 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

Notes:

| (1) | The DMR Software License Agreement has an initial term of 21 years such that it is co-terminous with the other continuing connected transactions of the Company which have a 25-year term. |

| (2) | The renewal of these agreements upon the expiry of the initial 25-year term is subject to any applicable reporting, announcement and/or independent shareholders’ approval requirements under Chapter 14A of the Listing Rules. |

The agreements listed in the table above are described further in “Connected Transactions”.

The Stock Exchange has granted a waiver from the announcement and, where applicable, the approval of independent shareholders requirements of the Listing Rules in respect of each of the above transactions where this would otherwise be necessary for the entire duration of those transactions. In addition, with the exception of the Personnel Secondment Agreement, the Stock Exchange has granted a waiver from the requirement to set a monetary cap for the fees payable under these agreements and the requirement for each of these agreements to be of a term not exceeding three years in duration. See “Connected Transactions” for further details.

Contingency Agreements

In order to guard against any failure of supply by IMAX Corporation for any reason, the Contingency Agreements have been put in place to ensure that we could continue to provide IMAX digital xenon projection systems and IMAX laser-based digital projection systems to our exhibitor partners and to convert conventional films into IMAX format films. The Contingency Agreements operate as follows:

| · | Prior to Listing, IMAX Corporation will deposit the Escrow Documents, which will contain the design plans, specifications and know-how necessary to enable us to manufacture and fully assemble IMAX digital xenon projection systems, IMAX laser-based digital projection systems and nXos2 audio systems and to convert conventional films into IMAX format films with an independent third party escrow agent appointed jointly by us and IMAX Corporation (the “Agent”). |

| · | If IMAX Corporation has, in breach of the Equipment Supply Agreements, failed to supply us with IMAX equipment of an aggregate purchase cost of at least US$8.0 million (representing the purchase cost of approximately 20 IMAX theatre systems or the purchase cost of 30% of our total anticipated IMAX theatre system installations for 2015) for a period of at least nine months (other than force majeure type events that would restrict us from manufacturing or assembling those systems ourselves were the Escrow Documents released), we will be entitled to issue a release notice and the Agent will, subject to a dispute resolution mechanism, release the Escrow Documents to us within 30 days. |

| · | If the Escrow Documents are released to us, under the Trademark License Agreements, Technology License Agreements and DMR Software Licence we will automatically be granted an exclusive trademark and technology licence of the IMAX brand and technology, and a non-exclusive licence in the PRC to use the IMAX DMR software in the Group’s DMR conversion facility that will enable us to manufacture and assemble IMAX digital xenon projection systems, IMAX laser-based digital projection systems and nXos2 audio systems ourselves, or subcontract the manufacturing and assembly works to third party manufacturers, and to convert conventional films into IMAX format films, for a 12-year period following such release. |

— 7 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

We estimate that it would take around four months for us to establish our own manufacturing and assembly operations using the Escrow Documents. It may be possible to restore supply more quickly if we decided to subcontract the manufacturing and assembly operations. We plan to retain a sufficient inventory of equipment to mitigate the impact of an interruption of supply of theatre systems on our delivery obligations to exhibitors.

The Directors are of the view that the US$8.0 million aggregate purchase cost threshold for release of the Escrow Documents is sufficient such that any failure by IMAX Corporation to supply theatre systems to the Company without triggering the release of the Escrow Documents would not affect the Company’s sustainability. This is on the basis of our planned level of inventory and our ability to manage installation dates to mitigate the impact of a short term failure of supply.

Taking into account the above, the Directors believe that we would be able to carry on our theatre business even if IMAX Corporation were not able to supply the Group with IMAX theatre system components.

Competition

Over the last few years, a number of commercial exhibitors have introduced their own non-conventional theatres in the PRC including 73 from China Giant Screen, 32 from Wanda X-Land and 28 from CJ CGV. In FY2014, the IMAX theatre network in the PRC was the largest non-conventional theatre network and had the highest average box office per screen. In addition, based on a survey conducted by EntGroup, we are the most well-known non-conventional cinema technology brand in the PRC, being acknowledged by 100% of the surveyed audience, compared to 65.3% for Wanda X-Land. See “Industry Overview” for further information concerning the PRC film industry and the competitive landscape in which we operate.

Major Shareholders

The interests of our major Shareholders as at the Latest Practicable Date and immediately following completion of the [REDACTED] are set out below.

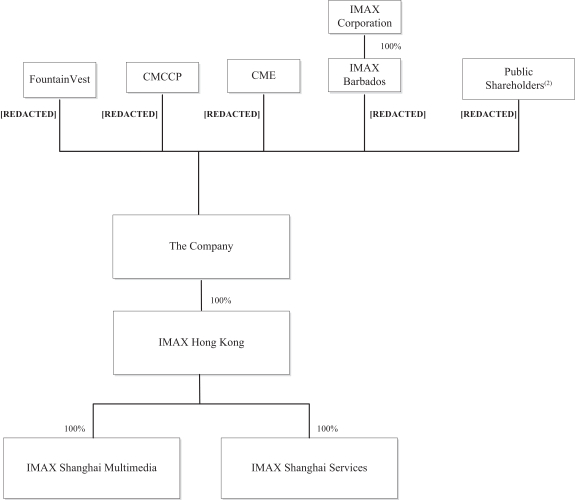

| As at the Latest Practicable Date |

Immediately following completion of the [REDACTED](1) |

|||||||||||||||||

| Name of Shareholder |

Capacity |

Number of Shares held or interested(2) |

Approximate Percentage of interest (%) |

Number of [REDACTED] held or interested |

Approximate Percentage of interest (%) |

|||||||||||||

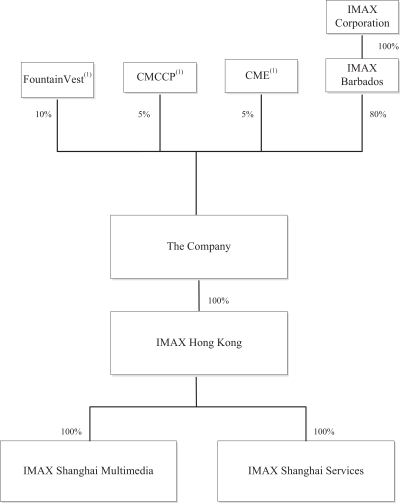

| IMAX Corporation |

Interest in controlled entity(3) | 270,000,000 | 80% | [REDACTED] | [REDACTED] | |||||||||||||

| IMAX Barbados |

Beneficial interest | 270,000,000 | 80% | [REDACTED] | [REDACTED] | |||||||||||||

| FountainVest |

Beneficial interest | 33,750,000 | 10% | [REDACTED] | [REDACTED] | |||||||||||||

| CMCCP |

Beneficial interest | 16,875,000 | 5% | [REDACTED] | [REDACTED] | |||||||||||||

| CME |

Beneficial interest | 16,875,000 | 5% | [REDACTED] | [REDACTED] | |||||||||||||

Notes:

| (1) | Assuming that the Over-allotment Option is not exercised. |

| (2) | Represents share numbers assuming the Share Subdivision had been completed. |

| (3) | 270,000,000 Shares are directly held by IMAX Barbados, which is a wholly-owned subsidiary of IMAX Corporation. |

— 8 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

Major Customers and Suppliers

Our largest supplier is IMAX Corporation. The percentage of our costs attributable to our largest supplier for FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015 was 82.7%, 84.2%, 82.8%, 86.9% and 81.8%, respectively.

The table below sets out our five largest customers for 1HFY2015, as well as their respective business activities:

| Our Five Largest Customers |

Business Activities | |

| Wanda Cinema |

Exhibitor | |

| IMAX Corporation |

Cinematic technology provider | |

| Jinyi Cinemas |

Exhibitor | |

| Shanghai Film Group |

Exhibitor | |

| CJ CGV |

Exhibitor |

The percentage of revenue attributable to our largest customer for FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015 was 21.9%, 24.1%, 23.1%, 31.9% and 32.3%, respectively. The percentage of revenue attributable to our five largest customers in aggregate for FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015 was 60.7%, 58.4%, 60.9%, 73.3% and 79.7%, respectively.

None of the Directors, their associates or any other Shareholder which (to the knowledge of the Directors) owns more than 5% of the Company’s share capital as at the Latest Practicable Date (other than IMAX Corporation) had any interest in any of our five largest suppliers or five largest customers.

Arrangements with Customers in our Theatre Business

We enter into two types of arrangements with our theatre business customers. Under sales arrangements, we typically charge a significant upfront fee and smaller ongoing fees (which are the greater of an annual minimum payment or a small percentage of the theatre’s box office), as well as an annual maintenance fee. Under revenue sharing arrangements, we provide IMAX theatre systems to our exhibitor partners in return for ongoing fees spread out over the 10 to 12 year term of the agreement which are principally based on a percentage of the box office our exhibitor partners generate from IMAX format films with no or a relatively smaller upfront payment.

Going forward, we intend to expand the proportion of IMAX theatres with revenue sharing arrangements, which may have an impact on our earnings and profitability. As the amount of revenue we are able to generate under revenue sharing arrangements is dependent upon the box office performance of the films exhibited, poor box office performance of any film will negatively affect the amount of the box office revenue we receive and reduce our earnings. In addition, the proportion of IMAX theatre systems we install under hybrid revenue sharing arrangements will have an effect on our gross profit and gross profit margin, because we record minimal gross profit and gross profit margin during the period of system installation and record substantially higher gross profit and gross profit margin in subsequent periods under hybrid revenue sharing arrangements. For further information, see “Financial Information—Significant Factors Affecting Our Financial Condition and Results of Operations—Proportion of revenue sharing arrangements”.

As we do not charge an upfront payment to our exhibitor partners under full revenue sharing arrangements, we may require increased working capital to continue to fund the purchase and

— 9 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

installation of such IMAX theatre systems provided to our exhibitor partners. See “Risk Factors—Risks Relating to Our Business and Industry—Our working capital requirements may increase as we enter into additional revenue sharing arrangements”.

A summary of the accounting treatment of each type of business arrangement is set out below.

| Revenue Recognition |

Ownership of IMAX Theatre Systems | |||

| Sales Arrangement |

Initial payments made for the IMAX theatre system plus present value of future ongoing payments all recognised upon installation | Title passes to the exhibitor at system installation or when certain milestone payments are received | ||

| Revenue Sharing Arrangement | ||||

| Full Revenue Sharing |

Ongoing payments from exhibitors based on share of box office recognised periodically throughout the term of the arrangement. | Title remains with us | ||

| Hybrid Revenue Sharing |

Initial payments made for the IMAX theatre system recognised upon installation | Title remains with us | ||

| Ongoing payments from exhibitors based on share of box office recognised periodically throughout the term of the arrangement. | ||||

Financial Information

Selected combined statements of comprehensive income data

| FY2012 | FY2013 | FY2014 | 1HFY2014 | 1HFY2015 | ||||||||||||||||||||||||||||||||||||

| US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | |||||||||||||||||||||||||||||||

| Revenues |

46,639 | 100.0 | % | 55,949 | 100.0 | % | 78,218 | 100.0 | % | 27,901 | 100.0 | % | 43,913 | 100.0 | % | |||||||||||||||||||||||||

| Cost of sales |

(22,294 | ) | (47.8 | )% | (23,701 | ) | (42.4 | )% | (31,758 | ) | (40.6 | )% | (10,822 | ) | (38.8 | )% | (13,349 | ) | (30.4 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Gross profit |

24,345 | 52.2 | % | 32,248 | 57.6 | % | 46,460 | 59.4 | % | 17,079 | 61.2 | % | 30,564 | 69.6 | % | |||||||||||||||||||||||||

| Selling, general and administrative expenses |

(7,947 | ) | (17.0 | )% | (8,867 | ) | (15.8 | )% | (11,251 | ) | (14.4 | )% | (5,563 | ) | (19.9 | )% | (11,847 | ) | (27.0 | )% | ||||||||||||||||||||

| Other expenses |

(1,019 | ) | (2.2 | )% | (2,445 | ) | (4.4 | )% | (4,045 | ) | (5.2 | )% | (1,425 | ) | (5.1 | )% | (2,453 | ) | (5.6 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Operating profit |

15,379 | 33.0 | % | 20,936 | 37.4 | % | 31,164 | 39.8 | % | 10,091 | 36.2 | % | 16,264 | 37.0 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Profit (loss) before income tax |

15,390 | 33.0 | % | 20,950 | 37.4 | % | 29,066 | 37.2 | % | 7,489 | 26.8 | % | (63,342 | ) | (144.2 | )% | ||||||||||||||||||||||||

| Income tax expense |

(2,523 | ) | (5.4 | )% | (3,495 | ) | (6.2 | )% | (6,285 | ) | (8.0 | )% | (1,947 | ) | (7.0 | )% | (4,605 | ) | (10.5 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Profit (loss) for the year/period |

12,867 | 27.6 | % | 17,455 | 31.2 | % | 22,781 | 29.1 | % | 5,542 | 19.9 | % | (67,947 | ) | (154.7 | )% | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total comprehensive income (loss) |

12,867 | 27.6 | % | 17,366 | 31.0 | % | 22,582 | 28.9 | % | 5,404 | 19.4 | % | (68,079 | ) | (155.0 | )% | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

— 10 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

Adjusted profit (loss) for the year/period

| FY2012 | FY2013 | FY2014 | 1HFY2014 | 1HFY2015 | ||||||||||||||||

| US$’000 | US$’000 | US$’000 | US$’000 | US$’000 | ||||||||||||||||

| Profit (loss) for the period |

12,867 | 17,455 | 22,781 | 5,542 | (67,947 | ) | ||||||||||||||

| Adjustments: |

||||||||||||||||||||

| Share-based compensation |

384 | 973 | 1,149 | 601 | 1,223 | |||||||||||||||

| Accretion of amortised cost of financial instrument |

— | — | 1,732 | 498 | 2,247 | |||||||||||||||

| Fair value adjustment of conversion option |

— | — | 577 | 2,110 | 77,568 | |||||||||||||||

| REDACTED costs |

— | — | — | — | 5,506 | |||||||||||||||

| Tax impact on items listed above |

(87 | ) | (221 | ) | (261 | ) | (116 | ) | (269 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted profit(1) |

13,164 | 18,207 | 25,978 | 8,635 | 18,328 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Note:

| (1) | Adjusted profit is not a measure of performance under IFRS. This measure does not represent and should not be used as a substitute for, gross profit or profit for the year as determined in accordance with IFRS. This measure is not necessarily an indication of whether cash flow will be sufficient to fund our cash requirements or whether our business will be profitable. In addition, our definition of adjusted profit may not be comparable to other similarly titled measures used by other companies. |

In 1HFY2015, we recorded a loss for the period of US$67.9 million, which was primarily due to a fair value adjustment of the bifurcated conversion option amounting to US$77.6 million associated with our Redeemable Class C Shares and [REDACTED] costs of US$5.5 million recorded in our selling, general and administrative expenses. Without considering the impact of these items, we would have recorded a profit for the period of US$18.3 million. See “Financial Information” for further information.

Revenue by business segment

| FY2012 | FY2013 | FY2014 | 1HFY2014 | 1HFY2015 | ||||||||||||||||||||||||||||||||||||

| US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | |||||||||||||||||||||||||||||||

| Theatre Business |

||||||||||||||||||||||||||||||||||||||||

| Sales |

25,341 | 54.3 | % | 21,387 | 38.2 | % | 28,662 | 36.6 | % | 6,624 | 23.7 | % | 7,932 | 18.1 | % | |||||||||||||||||||||||||

| Revenue Sharing Arrangements |

7,290 | 15.6 | % | 14,152 | 25.3 | % | 22,755 | 29.1 | % | 9,300 | 33.3 | % | 15,996 | 36.4 | % | |||||||||||||||||||||||||

| Theatre System Maintenance |

4,326 | 9.3 | % | 6,019 | 10.8 | % | 7,214 | 9.2 | % | 3,384 | 12.1 | % | 4,435 | 10.1 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Sub-total(1) |

37,321 | 80.0 | % | 42,459 | 75.9 | % | 59,627 | 76.2 | % | 19,615 | 70.3 | % | 28,739 | 65.4 | % | |||||||||||||||||||||||||

| Films Business |

9,318 | 20.0 | % | 13,490 | 24.1 | % | 18,591 | 23.8 | % | 8,286 | 29.7 | % | 15,174 | 34.6 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

46,639 | 100.0 | % | 55,949 | 100.0 | % | 78,218 | 100.0 | % | 27,901 | 100.0 | % | 43,913 | 100.0 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Note:

| (1) | Theatre business also includes other revenue of US$0.4 million, US$0.9 million, US$1.0 million, US$0.3 million and US$0.4 million in FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015, respectively. |

Gross profit and gross profit margin by business segment

| FY2012 | FY2013 | FY2014 | 1HFY2014 | 1HFY2015 | ||||||||||||||||||||||||||||||||||||

| US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | US$’000 | % | |||||||||||||||||||||||||||||||

| Theatre Business |

||||||||||||||||||||||||||||||||||||||||

| Sales |

16,301 | 64.3 | % | 14,065 | 65.8 | % | 19,519 | 68.1 | % | 4,912 | 74.2 | % | 5,749 | 72.5 | % | |||||||||||||||||||||||||

| Revenue Sharing Arrangements |

2,052 | 28.1 | % | 5,920 | 41.8 | % | 10,658 | 46.8 | % | 5,593 | 60.1 | % | 10,574 | 66.1 | % | |||||||||||||||||||||||||

| Theatre System Maintenance |

2,099 | 48.5 | % | 3,486 | 57.9 | % | 3,969 | 55.0 | % | 1,831 | 54.1 | % | 2,482 | 56.0 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Sub-total(1) |

20,599 | 55.2 | % | 23,999 | 56.5 | % | 34,556 | 58.0 | % | 12,463 | 63.5 | % | 18,928 | 65.9 | % | |||||||||||||||||||||||||

| Films Business |

3,746 | 40.2 | % | 8,249 | 61.1 | % | 11,904 | 64.0 | % | 4,616 | 55.7 | % | 11,636 | 76.7 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

24,345 | 52.2 | % | 32,248 | 57.6 | % | 46,460 | 59.4 | % | 17,079 | 61.2 | % | 30,564 | 69.6 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

— 11 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

Note:

| (1) | Theatre business also includes gross profit in respect of other revenue of US$0.1 million, US$0.5 million, US$0.4 million, US$0.1 million and US$0.1 million in FY2012, FY2013, FY2014, 1HFY2014 and 1HFY2015, respectively. |

Selected combined statements of financial position data

| As at 31 December | As at 30 June 2015 |

|||||||||||||||

| 2012 | 2013 | 2014 | ||||||||||||||

| US$’000 | US$’000 | US$’000 | US$’000 | |||||||||||||

| Current assets |

12,388 | 31,897 | 83,293 | 130,106 | ||||||||||||

| Current liabilities |

38,986 | 61,385 | 62,624 | 59,612 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net current assets/(liabilities) |

(26,598 | ) | (29,488 | ) | 20,669 | 70,494 | ||||||||||

| Non-current assets |

42,186 | 53,441 | 67,883 | 73,484 | ||||||||||||

| Non-current liabilities |

15,472 | 20,810 | 62,244 | 186,372 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total (deficit) equity |

116 | 3,143 | 26,308 | (42,394 | ) | |||||||||||

Selected consolidated statements of cash flow data

| FY2012 | FY2013 | FY2014 | 1HFY2014 | 1HFY2015 | ||||||||||||||||

| US$’000 | US$’000 | US$’000 | US$’000 | US$’000 | ||||||||||||||||

| Net cash provided by operating activities |

1,321 | 20,414 | 28,220 | 8,210 | 547 | |||||||||||||||

| Net cash used in investing activities |

(60 | ) | (12,118 | ) | (27,515 | ) | (22,317 | ) | (6,955 | ) | ||||||||||

| Net cash provided by financing activities |

— | — | 37,418 | 37,418 | 38,000 | |||||||||||||||

| Effects of exchange rate changes on cash |

(1 | ) | (7 | ) | (17 | ) | (9 | ) | (12 | ) | ||||||||||

| Increase in cash and cash equivalents during year/period |

1,260 | 8,289 | 38,106 | 23,302 | 31,580 | |||||||||||||||

| Cash and cash equivalents, beginning of year/period |

665 | 1,925 | 10,214 | 10,214 | 48,320 | |||||||||||||||

| Cash and cash equivalents, end of year/period |

1,925 | 10,214 | 48,320 | 33,516 | 79,900 | |||||||||||||||

Key Financial Ratios

The following table lays out certain financial ratios as at the dates and for the periods indicated. We have presented adjusted return on equity, adjusted return on total assets and adjusted profit margin because we believe they present a more meaningful picture of our financial performance than unadjusted numbers as they exclude the impact from share-based compensation, accretion of amortised cost of Redeemable Class C Shares, fair value adjustments and the related tax impact.

| For the year ended and as at 31 December |

For the six months ended and as at 30 June 2015 |

|||||||||||||||

| 2012 | 2013 | 2014 | ||||||||||||||

| Current ratio(1) |

31.8 | % | 52.0 | % | 133.0 | % | 218.3 | % | ||||||||

| Adjusted gearing ratio(2) |

— | — | 99.6 | % | 151.6 | % | ||||||||||

| Adjusted return on equity(3) |

124.2 | % | 63.4 | % | 47.7 | % | 50.4 | % | ||||||||

| Adjusted return on total assets(4) |

24.1 | % | 21.3 | % | 17.2 | % | 18.0 | % | ||||||||

| Adjusted profit margin(5) |

28.2 | % | 32.5 | % | 33.2 | % | 41.7 | % | ||||||||

Notes:

| (1) | Current ratio is calculated by dividing total current assets by total current liabilities and multiplying the result by 100. |

| (2) | Gearing ratio is calculated by dividing total debt by total equity and multiplying the result by 100. Total debt as at 31 December 2014 represents the Redeemable Class C Shares of US$26.8 million but without taking into account the value of the bifurcated conversion option of US$12.9 million as at 31 December 2014. Total debt as at 30 June 2015 represents the Redeemable Class C Shares of US$54.2 million but without taking into account the value of the bifurcated conversion option of US$103.4 million as at 30 June 2015. Total equity as at both 31 December 2014 and 30 June 2015 were adjusted to exclude the impact of the revaluation of the bifurcated conversion option associated with the Redeemable Class C Shares. |

— 12 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

| (3) | Adjusted return on equity is calculated by dividing adjusted profit for the year/period by total equity less combined equity, then multiplying the result by 100. Adjusted profit for the year/period means profit for the year/period adjusted for share-based compensation, accretion of amortised cost of Redeemable Class C Shares, fair value adjustment of conversion option, [REDACTED] costs, and the related tax impact. Total equity as at both 31 December 2014 and 30 June 2015 were adjusted to exclude the impact of the revaluation of the bifurcated conversion option associated with the Redeemable Class C Shares. Our adjusted return on equity as at 1HFY2015 has been annualised by multiplying the adjusted profit by 2. |

| (4) | Adjusted return on total assets is calculated by dividing adjusted profit for the year/period by total assets and multiplying the result by 100. Our adjusted return on total assets as at 1HFY2015 has been annualised by multiplying the adjusted profit by 2. |

| (5) | Adjusted profit margin is calculated by dividing adjusted profit for the year/period by revenue and multiplying the result by 100. |

Unaudited Pro Forma Financial Information

[REDACTED]

Recent Developments

Pursuant to the Shareholders’ Agreement, the Board resolved to declare and pay a special dividend of US$47.6 million to the Pre-IPO Shareholders, conditional on Listing and payable after Listing. For further information, see “History and Reorganisation—Reorganisation Steps for the Offshore Reorganisation—3. Declaration of Pre-IPO dividend by the Company to the Existing Shareholders”.

Upon completion of the [REDACTED], we expect to record a loss as a result of a non-cash charge to the income statement arising from the fair value adjustment of a bifurcated conversion option associated with the Redeemable Class C Shares. The amount of such loss can only be measured once the valuation of the adjustment is determined. This is a non-cash adjustment, so it will not affect our operating cash flow, but it will have a significant negative impact on our profit for FY2015.

Monster Hunt, a Chinese language film released in July 2015 and shown on 216 IMAX screens across the PRC became the highest grossing IMAX film in the PRC of all time, surpassing The Monkey King, which was released in FY2014.

The Directors confirm that, having performed reasonable due diligence on the Group, other than the increase in fair value adjustment of the bifurcated conversion option and the related non-cash charge (see above), there has been no material adverse change in the Group’s financial or trading position or prospects since 30 June 2015, which is the end of the period covered by the Accountant’s Report as set out in “Appendix I—Accountant’s Report”, up to the date of this [REDACTED].

Listing Expenses

Total expenses (including underwriting commissions) expected to be incurred by the Company in relation to the Listing are approximately US$12.9 million, of which US$7.0 million has been incurred during the Track Record Period. US$5.5 million was charged to profit or loss in 1HFY2015.

— 13 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

The remaining US$1.5 million that is incremental and directly attributable to the issue of [REDACTED] has been deferred and is included within “Other assets” on the statement of financial position as at 30 June 2015 and will be deducted from equity when [REDACTED] are issued.

Dividend Policy

After completion of the [REDACTED], our Shareholders will be entitled to receive dividends declared by us. The proposal of payment and the amount of our dividends will be made at the discretion of our Board and will depend on our general business condition and strategies, cash flows, financial results and capital requirements, the interests of our Shareholders, taxation conditions, statutory and regulatory restrictions and other factors that our Board deems relevant. Any dividend distribution shall also be subject to the approval of our Shareholders in a Shareholders’ meeting. We do not presently intend to declare any dividends following Listing. See “Financial Information—Dividend Policy and Distributable Reserves”.

Use of Proceeds

[REDACTED]

— 14 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

SUMMARY

Offering Statistics

[REDACTED]

— 15 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

| [REDACTED] |

— 16 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

DIRECTORS’ RESPONSIBILITY FOR THE CONTENTS OF THIS [REDACTED]

[REDACTED]

INFORMATION AND REPRESENTATION

You should only rely on the information contained in this [REDACTED] and the Application Forms to make your investment decision. Neither the Company nor any of the Relevant Persons has authorised anyone to provide you with any information or to make any representation that is different from what is contained in this [REDACTED]. No representation is made that there has been no change or development reasonably likely to involve a change in the Group’s affairs since the date of this [REDACTED] or that the information contained in this [REDACTED] is correct as at any date subsequent to its date.

EXCHANGE RATE CONVERSION

Solely for your convenience, this [REDACTED] contains translations of certain Renminbi amounts into Hong Kong dollars, of Renminbi amounts into U.S. dollars and of Hong Kong dollars into U.S. dollars at specified rates.

Unless we indicate otherwise, the translation of Renminbi into Hong Kong dollars, of Renminbi into U.S. dollars and of Hong Kong dollars into U.S. dollars, and vice versa, in this [REDACTED] was made at the following rate:

RMB6.3607 to US$1.00 (being the prevailing exchange rate on the Latest Practicable Date set by the People’s Bank of China)

HK$7.7505 to US$1.00 (being the prevailing exchange rate on the Latest Practicable Date set by the Hong Kong Monetary Authority)

No representation is made that any amounts in Renminbi, Hong Kong dollars or U.S. dollars can be or could have been at the relevant dates converted at the above rates or any other rates or at all.

ROUNDING

Unless otherwise stated, all the numerical figures are rounded to one decimal place. Any discrepancies in any table or chart between totals and sums of amounts listed therein are due to rounding.

— 17 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

FORWARD LOOKING STATEMENTS

This [REDACTED] contains forward-looking statements. All statements other than statements of historical fact contained in this [REDACTED], including, without limitation:

| (a) | the discussions of our business strategies, objectives and expectations regarding our future operations, margins, profitability, liquidity and capital resources; |

| (b) | the future development of, and trends and conditions in, the movie theatre industry and the general economy of the countries in which we operate or plan to operate; |

| (c) | our ability to control costs; |

| (d) | the nature of, and potential for, the future development of our business; and |

| (e) | any statements preceded by, followed by or that include words and expressions such as “expect”, “believe”, “plan”, “intend”, “estimate”, “forecast”, “project”, “anticipate”, “seek”, “may”, “will”, “ought to”, “would”, “should” and “could” or similar words or statements, |

as they relate to the Group or our management, are intended to identify forward-looking statements.

These statements are based on assumptions regarding our present and future business, our business strategies and the environment in which we will operate. These forward-looking statements reflect our current views as to future events and are not a guarantee of our future performance. Forward-looking statements are subject to certain known and unknown risks, uncertainties and assumptions, including the risk factors described in “Risk Factors”, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Subject to the requirements of applicable laws, rules and regulations, we do not have any obligation, and undertake no obligation, to update or otherwise revise the forward-looking statements in this [REDACTED], whether as a result of new information, future events or developments or otherwise. As a result of these and other risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this [REDACTED] might not occur in the way we expect or at all. Accordingly, you should not place undue reliance on any forward-looking information. All forward-looking statements contained in this [REDACTED] are qualified by reference to the cautionary statements set out in this section.

In this [REDACTED], statements of or references to our intentions or that of any of the Directors are made as at the date of this [REDACTED]. Any of these intentions may change in light of future developments.

— 18 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

| [REDACTED]

The occurrence of any of the following events could harm us materially and adversely affect our business, financial condition, results of operations or prospects. If any of these events occur, the trading price of the Shares could decline and you may lose all or part of your investment. You should seek professional advice from your relevant advisers regarding your prospective investment in the context of your particular circumstances. |

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

We depend principally on the orders from commercial film exhibitors for IMAX theatre systems, to generate box office revenue under revenue sharing arrangements and to supply venues in which to exhibit IMAX format films. However, we cannot assure you that exhibitors will continue to do any of these things.

Our primary customers are commercial film exhibitors, and we depend on such exhibitors to acquire IMAX theatre systems to generate revenue for us. We are unable to predict if, or when, exhibitors will acquire IMAX theatre systems or enter into revenue sharing arrangements with us, or whether any of our existing exhibitor partners will continue to so. If box office and concession revenues should decline, exhibitors may be less willing to invest capital in IMAX theatres. If exhibitors choose to reduce their levels of expansion or decide not to acquire IMAX theatre systems or enter into revenue sharing arrangements with us in the future, our revenues and the IMAX theatre network may not increase and motion picture studios may be less willing to convert their films into the IMAX format for exhibition in commercial IMAX theatres, which would adversely affect our films business. As a result, our future revenues and cash flows could be adversely affected, which may have a material and adverse effect on our business, results of operations and financial condition.

The success of the IMAX theatre network is directly related to the availability and performance of IMAX format films. However, we cannot assure you that such films will continue to be available or successful.

An important factor affecting the growth and success of the IMAX theatre network is the availability of films for IMAX theatres and the box office performance of such films. We currently rely entirely on films produced by third party filmmakers and studios which are converted by our Controlling Shareholder into the IMAX format using IMAX DMR conversion technology. In FY2014, 35 IMAX format films were released by studios to the IMAX theatre network in Greater China. We cannot assure you that filmmakers and studios, including Chinese filmmakers and studios, will continue to produce or convert films for exhibition in IMAX theatres, or that the films they produce will be commercially successful.

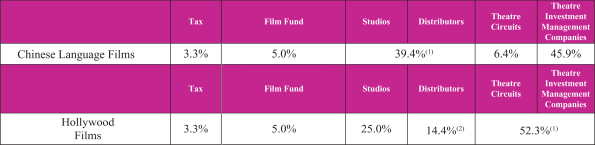

The availability and successful box office performance of IMAX format films have become increasingly important to our financial performance as the number of full revenue sharing and hybrid revenue sharing arrangements with our exhibitor partners has grown considerably over the Track Record Period. We are also directly impacted by box office results for the films released to the IMAX theatre network as we indirectly receive a percentage of the box office revenue from studios releasing IMAX format films. During the Track Record Period, we indirectly received an average 9.5% and 12.5% of the total box office generated by Hollywood films(1) and Chinese language films,

| (1) | Hollywood films include all imported films subject to the annual quota imposed by the PRC government. |

— 19 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

RISK FACTORS

respectively. Should studios seek to reduce the percentage of box office we are entitled to receive, which are contractual arrangements and are not regulated by PRC laws, we may not be able to generate the same level of revenue we have in the past.

In addition, our continued ability to find suitable partners to acquire IMAX theatre systems depends on the number and commercial success of films released to the IMAX theatre network. The commercial success of films released to IMAX theatres depends on a number of factors outside of our control, including general political, social and economic conditions, whether the film receives critical acclaim, the timing of its release, the success of the marketing efforts of the studio releasing the film and consumer preferences, including the demand for entertainment and leisure products and services in the PRC and consumers’ disposable income levels and willingness to purchase tickets for IMAX format films. Moreover, films can be subject to delays in production or changes in release schedule, which can negatively impact the number, timing and quality of IMAX format films released to the IMAX theatre network. If the number of films released to the IMAX theatre network decreases, if these films are not as commercially successful as anticipated, or if a decline in spending by consumers on discretionary items such as entertainment occurs, our revenue and profitability could suffer and our business, results of operations and financial condition could in turn be materially and adversely affected.

We currently rely significantly on IMAX Corporation in many aspects of our businesses, including the provision of IMAX theatre system equipment and technical support, the provision of DMR conversion services, the licensing of IP rights and the remittance of fees from Hollywood studios.

As the exclusive licensee of the IMAX brand in the theatre and films business and the sole commercial platform for IMAX format films in Greater China, we rely on IMAX Corporation to provide us with the right to use the IMAX brand and technology and to supply us with many of the products and services which are core to our business activities. The products and services provided by IMAX Corporation include IMAX theatre system equipment, theatre design services, technical support and DMR conversion services.

In order to procure such equipment, services and intellectual property, we have entered into a series of agreements with IMAX Corporation. See “Connected Transactions” for further information. These agreements have a renewable term of 25 years. We cannot assure you that the agreements will be renewed upon expiry on terms acceptable to us or at all. In addition, each of these agreements is terminable by the Controlling Shareholder before the expiry of their term in certain circumstances, including material breach by us. If such agreements are terminated or are not renewed, or if the agreements are renewed on terms which are less favourable to us, it may be more difficult for us to obtain the necessary technology and materials to conduct our business operations or to do so profitably, which could have a material and adverse effect on our business, results of operations and financial condition.

IMAX Corporation is required under the terms of the Master Distribution Agreement to pay us all revenue remitted to it by Hollywood studios in respect of the Greater China box office for IMAX format Hollywood films. See “Business–Our Business Operations–Our Business Arrangements–Studio and Film Arrangements” and “Connected Transactions–Non-Exempt Connected Transactions–Continuing Connected Transactions Subject to Reporting, Announcement and Independent Shareholders’ Approval Requirements Subject to Waivers Granted–2. Master Distribution Agreements”. While we will become a direct contracting party to the global agreements with

— 20 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

RISK FACTORS

Hollywood studios alongside IMAX Corporation where possible in the future, for IMAX format films subject to existing contracts and any new contracts to which we are not a party, we are dependent on IMAX Corporation to pay us such fees remitted to it. Should IMAX Corporation fail to fulfil its contractual payment obligations, our future revenues and cash flows could be adversely affected, which would in turn materially and adversely affect our results of operations and financial condition.

The contingency arrangements we have put in place to maintain supply if IMAX Corporation is unable or unwilling to provide IMAX theatre system equipment to us may not be effective and may result in us incurring significant additional costs.

We have entered into contingency arrangements with IMAX Corporation and an independent third party escrow agent, under which IMAX Corporation will deposit the Escrow Documents with the escrow agent. The escrow agent has agreed to release such Escrow Documents to us, subject to certain conditions, if IMAX Corporation fails to supply us with IMAX equipment with an aggregate purchase price of at least US$8.0 million for a nine month period in breach of the Equipment Supply Agreements. See “Relationship with the Controlling Shareholder–Contingency Arrangements” for further information.

IMAX Corporation is entitled to dispute the release of the Escrow Documents if they consider that the requirement for them to have failed to supply us with IMAX equipment for the requisite period and value has not been met. Such a dispute may ultimately be referred to an independent expert for determination, over whom we will have no control, who may rule against us. In addition, any dispute between us and IMAX Corporation regarding the release of the Escrow Documents could, even if IMAX Corporation is ultimately not successful, divert our management’s attention and delay or limit our ability to use the Escrow Documents.

If the Escrow Documents are released to us, we estimate that it would take us around four months from the date of such release to establish our own manufacturing and assembly operations. However, this timing is subject to a number of factors, including availability of alternative facilities, tools and factory equipment, the appointment of technical staff and potential regulatory approval, all of which could impact our ability to manufacture and fully assemble IMAX theatre systems ourselves. These risks may be exacerbated by our lack of experience in establishing and operating manufacturing and assembly operations.

If we are delayed in obtaining the Escrow Documents, or if it takes us longer than anticipated to obtain the Escrow Documents, this may impair our ability to maintain a sufficient supply of IMAX theatre systems to provide to our exhibitor customers since we only intend to retain an inventory of systems sufficient to meet these obligations based on our estimate of how long it would take us to establish our own manufacturing and assembly operations in a base case scenario without taking into account possible delays. In addition, we may need to incur significant costs to establish our own manufacturing and assembly operations. These factors could have a material adverse effect on our business, results of operations and financial condition.

IMAX Corporation will not be under any obligation to deposit materials relating to any new products that it develops with the Escrow Agent. Accordingly, if IMAX Corporation develops any new products in the future, we will not be able to rely on the contingency arrangements to obtain those products if IMAX Corporation is unable or unwilling to provide them to us. An inability to obtain a supply of products containing the latest technology could adversely affect our competitive position compared to other providers of non-conventional cinema technology in Greater China. This could materially and adversely affect our business, results of operations and financial condition.

— 21 —

Table of Contents

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT.

RISK FACTORS

In addition, upon release of the Escrow Documents to us, we will be entitled to manufacture and assemble, or subcontract the manufacturing and assembly of, IMAX digital xenon projection systems, IMAX laser-based digital projection systems and nXos2 audio systems, and to convert conventional films into IMAX format films, for a 12-year period. If we are unable to develop our own alternative theatre and film technology, or obtain suitable theatre and film technology from third parties, to replace IMAX Corporation theatre and film technology, before the expiry of that 12-year period, our business, results of operations and financial condition would be materially and adversely affected.

A deterioration in our relationship with Wanda Cinema, or any of our leading exhibitor partners, could materially and adversely affect our business, results of operation and financial condition.