Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARGOTEC ACQUISITION - SCHWEITZER MAUDUIT INTERNATIONAL INC | aceacquisitionpr8-k.htm |

| EX-2.1 - EXHIBIT 2.1 - ARGOTEC PURCHASE AGREEMENT - SCHWEITZER MAUDUIT INTERNATIONAL INC | ex21-argotecequityinterest.htm |

| EX-99.1 - EXHIBIT 99.1 - ARGOTEC ACQUISITION PRESS RELEASE - SCHWEITZER MAUDUIT INTERNATIONAL INC | ex991-pressreleasexargotec.htm |

© 2015 Schweitzer-Mauduit International, Inc. Confidential 1 Acquisition of Argotec September 22, 2015 Ex. 99.2

© 2015 Schweitzer-Mauduit International, Inc. Confidential This presentation may contain “forward-looking statements.” All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. Caution should be taken not to place undue reliance on any such forward-looking statements because actual results may differ materially from the results suggested by these statements. These forward-looking statements are made only as of the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” and elsewhere in our Annual Report on Form 10-K for the period ended December 31, 2014 and those described from time-to-time in our periodic and other reports filed with the Securities and Exchange Commission. Safe Harbor Statement 2

© 2015 Schweitzer-Mauduit International, Inc. Confidential 3 Argotec Overview Leading specialty producer of thermoplastic polyurethane (TPU) films for a range of applications and end segments with approximately $115 million of revenue and an EBITDA margin nearing 20% Highly engineered products with significant “dark IP” process knowledge, difficult to replicate Complementary to existing specialty films businesses acquired via DelStar and Gilberdyke (medical) with exposure to growing end segments, overall long-term growth expected in the 5% - 7% range Purchase Price $280 million transaction value, subject to customary closing adjustments Effective purchase price is approximately $215 million (under 10x EBITDA) given structure of deal and tax basis step-up; present value of tax benefit to SWM estimated at $65 million Financial Impact Expected 2016 Adjusted EPS accretion of approximately $0.20 High margin business with low capex requirements and significant free cash flow Commercial, geographic, and technical synergy opportunities Ongoing benefits to cash flow from tax step-up Financing 100% cash, financed partially with cash on hand (repatriated tax-efficiently) and either refinancing of current credit facility or exercise of accordion feature on current credit facility Realignment of long-term debt structure is underway and expected to provide strategic flexibility and meaningful dry powder for future acquisitions Pro Forma Net Debt / EBITDA at closing approximately 2.5x Timing Expected to close in Q4 2015 Subject to customary closing and regulatory conditions Transaction Overview Argotec is the next step in building our Advanced Materials and Structures segment (Filtration segment to be renamed), increasing the scale and breadth of our diversification initiatives 1 1 “Adjusted EPS” excludes restructuring and impairment expenses, non-cash amortization of intangible assets, and inventory step-up charges expenses related to purchase accounting,

© 2015 Schweitzer-Mauduit International, Inc. Confidential Company Description Diversified End Segment High Quality Products with Broad Applications Manufacturer of specialty TPU film and sheets with proprietary technologies and processes that has leading positions in growing end segments TPU Leader Strong position in flat-die TPU film extrusion Extrudes both aliphatic films (used in exterior applications due to strong UV characteristics) and aromatic films (less resistant to UV and used in dozens of applications where clarity is less important) Attractive End Segments Surface/paint protection, glass lamination/protection, industrial, medical, textile, graphics Industry-leading Quality 20 years meeting automotive QS, medical GMP, aerospace and ISO quality standards Strong Financial Profile Sales of approximately $115 million and an EBITDA margin nearing 20% Expected annual growth in the 5% - 7% range ARGOTHANE® Specialty Films ARGOGUARD® Paint & Surface Protection ARGOMED® Medical Films ARGOFLEX ® Textile Lamination ARGOGRAPH® Graphic Films ARGOBOND® Glass Lamination Argotec Overview A leading specialty producer of thermoplastic polyurethane (“TPU”) films for a diverse range of niche applications and end segments Sales by End Segment 4 Primary Product Types: Flat die extrusion (aliphatic / aromatic); blown film (aromatic) Surface Protection & Glass Lamination, 60% Industrial, 17% Medical, 10% Textile, 5% Other, 8%

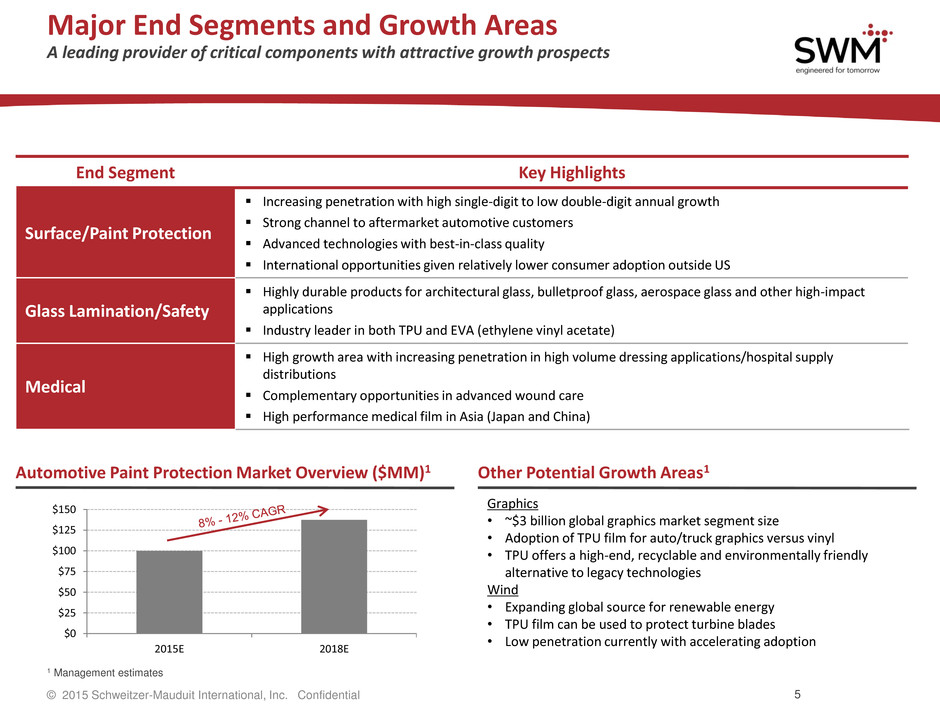

© 2015 Schweitzer-Mauduit International, Inc. Confidential $0 $25 $50 $75 $100 $125 $150 2015E 2018E Major End Segments and Growth Areas A leading provider of critical components with attractive growth prospects End Segment Key Highlights Surface/Paint Protection Increasing penetration with high single-digit to low double-digit annual growth Strong channel to aftermarket automotive customers Advanced technologies with best-in-class quality International opportunities given relatively lower consumer adoption outside US Glass Lamination/Safety Highly durable products for architectural glass, bulletproof glass, aerospace glass and other high-impact applications Industry leader in both TPU and EVA (ethylene vinyl acetate) Medical High growth area with increasing penetration in high volume dressing applications/hospital supply distributions Complementary opportunities in advanced wound care High performance medical film in Asia (Japan and China) Automotive Paint Protection Market Overview ($MM)1 Other Potential Growth Areas1 Graphics • ~$3 billion global graphics market segment size • Adoption of TPU film for auto/truck graphics versus vinyl • TPU offers a high-end, recyclable and environmentally friendly alternative to legacy technologies Wind • Expanding global source for renewable energy • TPU film can be used to protect turbine blades • Low penetration currently with accelerating adoption 1 Management estimates 5

© 2015 Schweitzer-Mauduit International, Inc. Confidential Leading technology poised to benefit from SWM’s global platform, Operational Excellence, and focus on growth investments Argotec only manufactures in the U.S. Benefit from SWM’s global operations and sales force, particularly in Europe and Asia SWM brings additional Operational Excellence experience SWM will remain an aggressive acquirer of complementary growth businesses; Argotec brings an attractive set of acquisition targets Entry / expansion into growth end segments Surface/Paint Protection Film (largely automotive) Medical Graphics Wind Additional opportunities in many sectors to replace coatings with films Complementary fit / synergies with other advanced materials businesses Increases scale and expands technology in advanced materials Increases capabilities in resin extrusion across the franchise Extends SWM’s technologies and products in medical end segment Opportunities to share best practices and optimize efficiency across multiple acquired businesses Argotec’s Strategic Fit with SWM Argotec is a growing, specialty business that is uniquely complementary to SWM’s Advanced Materials & Structures segment and stands to benefit from SWM’s core capabilities 6

© 2015 Schweitzer-Mauduit International, Inc. Confidential SWM Transformation Progress Argotec addition fits well with SWM’s strategy to acquire complementary companies with strong growth prospects, technology, and margins, and ability to leverage SWM core competencies 7 AMS portfolio consists of 4 complementary acquired businesses to be run as one segment to maximize growth opportunities, sales and cost synergies, sharing of best practices, R&D, and commercial alignment Non-Tobacco Net Sales (paper) ≈ $50 million DelStar generated $125+ million Net Sales Air Filtration and Medical Bolt-ons support growth With Argotec, AMS approaches $300 million in Net Sales (over $300 million including non- tobacco paper revenue) Advanced Materials and Structures Approximately 1/3rd of SWM annualized Net Sales Filtration (Water/Liquids/Air) Medical (Woundcare) Specialty Industrial (Automotive, Safety/Security, Energy) Res in -b as ed T ec h n o lo gi e s Nets Films Composites & Media Tubes Pronamic Gilberdyke 2013 2014 2015 Today