Attached files

| file | filename |

|---|---|

| EX-23.1 - Prosper Funding LLC | e00345_ex23-1.htm |

As filed with the Securities and Exchange Commission on September 18, 2015

Registration Nos. 333-204880 and 333-204880-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Prosper Funding LLC | Prosper Marketplace, Inc. | |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| 45-4526070 | 73-1733867 | |

| (I.R.S. Employer Identification Number) | (I.R.S. Employer Identification Number) |

Delaware

(State or other jurisdiction of incorporation or organization)

6199

(Primary Standard Industrial Classification Code Number)

221 Main Street, 3rd Floor

San Francisco, CA 94105

(415) 593-5400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sachin Adarkar, Esq.

Secretary

221 Main Street, 3rd Floor

San Francisco, CA 94105

(415) 593-5400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Keir D. Gumbs, Esq.

Covington & Burling LLP

One CityCenter, 850 Tenth Street, NW

Washington, DC 20001-4956

(202) 662-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 under the Securities Exchange Act of 1934. (Check one):

| Large Accelerated Filer o | Accelerated Filer o | Non-accelerated Filer o | Smaller Reporting Company x |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Aggregate Offering Price per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

||||||||||||

| Borrower Payment Dependent Notes | $ | 1,500,000,000 | 100 | % | $ | 1,500,000,000 | (1) | $ | 174,300 | |||||||

| PMI Management Rights (2) | N/A | (2) | N/A | (2) | N/A | (2) | N/A | (2) | ||||||||

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the rules and regulations under the Securities Act of 1933, as amended.

(2) Each Borrower Payment Dependent Note will be issued with a PMI Management Right that is attached to and will not be separable from the Borrower Payment Dependent Note. No separate consideration is being paid for or value assigned to the PMI Management Rights and accordingly, no additional registration fee is being paid herewith.

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Prosper Funding LLC and Prosper Marketplace, Inc. may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 18, 2015

PROSPER FUNDING LLC

$1,500,000,000 Borrower Payment Dependent Notes

PROSPER MARKETPLACE, INC.

PMI Management Rights

This is a public offering to investor members of Prosper Funding LLC of up to $1,500,000,000 in principal amount of Borrower Payment Dependent Notes, or “Notes.” Each Note will come attached with a PMI Management Right issued by Prosper Marketplace, Inc. Prosper Funding LLC will be the sole issuer of the Notes and Prosper Marketplace, Inc. will be the sole issuer of the PMI Management Rights. For the purposes of this prospectus, the Notes and the PMI Management Rights will be collectively referred to as “the Securities.”

Except as the context requires otherwise, as used in this prospectus, “we,” “us,” “our,” and “Registrants” refer to Prosper Marketplace, Inc. (“PMI”), a Delaware corporation, and its wholly owned subsidiary, Prosper Funding LLC (“PFL”), a Delaware limited liability company; and “Prosper” refers to PMI and its wholly owned subsidiaries, PFL and Prosper Healthcare Lending LLC on a consolidated basis. In addition, the unsecured, consumer loans originated through our marketplace are referred to as “Borrower Loans.”

Payments for each series of Notes will be dependent on payments PFL receives on a specific Borrower Loan described in a listing posted to our marketplace. All listings on our marketplace are posted by individual consumer borrower members of PFL requesting individual consumer loans. In addition, each listing will be described in a prospectus supplement.

Important terms of the Notes include the following, each of which is described in detail in this prospectus:

| · | The Notes are special, limited obligations of PFL only and are not obligations of its parent company, PMI or of the borrowers under the corresponding Borrower Loans. |

| · | PFL’s obligation to make payments on a Note will be limited to an amount equal to the Note holder’s pro rata share of amounts PFL receives with respect to the corresponding borrower loan, net of any servicing fees. Neither Prosper Funding LLC nor Prosper Marketplace, Inc. guarantees payment of the Notes or the corresponding Borrower Loans. |

| · | The Notes will bear interest from the date of issuance, have a fixed rate, be payable monthly and have an initial maturity of three or five years from issuance. PFL may add additional Note terms from time to time. |

| · | A Note holder’s recourse will be extremely limited in the event that borrower information is inaccurate for any reason. |

Important terms of the PMI Management Rights include the following, each of which is described in detail in this prospectus:

| · | The PMI Management Rights will not be separable from the Notes offered on the marketplace and will not be assigned a value separate from the Notes. |

| · | The PMI Management Rights are “investment contracts” issued by PMI directly to Note holders. The phrase “investment contract” is a concept under federal securities law that refers to an arrangement where investors invest money in a common enterprise with the expectation of profits, primarily from the efforts of others. Here, the “investment contracts” that PMI is registering as PMI Management Rights arise from the services that PMI has provided and will provide, as described in the Administration Agreement, the Indenture, the Investor Registration Agreement, and in this prospectus, which services include, but are not limited to: |

| · | the existence and operation of the marketplace; | |

| · | verification of borrower information; | |

| · | evaluation and validation of the Prosper Score and Prosper Rating; | |

| · | remitting borrower payments; and | |

| · | collecting on delinquent accounts. |

| · | Investors who purchase PMI Management Rights will have rights under the federal securities laws as a purchaser of a registered security. Investors will have limited contractual rights, collectively through the indenture trustee, to enforce PMI’s contractual obligations under the Administration Agreement. Such contractual rights exist under state law and will not, in any way, affect the rights of investors under the federal securities laws. |

| · | PMI’s obligations to provide services under the Administration Agreement may be terminated by PMI or by PFL under certain circumstances described in this prospectus. For more information, see “Summary of Indenture, Form of Notes, PMI Management Rights and Administration Agreement-Administration Agreement-Indenture Trustee as Third-Party Beneficiary.” Termination of the Administration Agreement would not affect the rights of holders of previously-issued PMI Management Rights under the federal securities laws. |

PFL will offer the Notes to its lender members at 100% of their principal amount.

The Notes and PMI Management Rights will be issued in electronic form only and will not be listed on any securities exchange. The Notes and PMI Management Rights will not be transferable except through the Folio Investing Note Trader platform, or the “Note Trader platform,” operated and maintained by FOLIOfn Investments, Inc., a registered broker-dealer. There can be no assurance, however, that a market for Notes will develop on the Note Trader platform. Therefore, note purchasers must be prepared to hold their Notes and PMI Management Rights to maturity.

This offering is highly speculative and the Notes involve a high degree of risk. Investing in the Notes should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” for more information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2015

TABLE OF CONTENTS

PART II

| i |

This prospectus describes Prosper Funding LLC’s offering of Borrower Payment Dependent Notes, or “Notes.” In addition, a PMI Management Right issued by Prosper Marketplace, Inc. is attached to each Note issued by Prosper Funding LLC. Such PMI Management Right will not be separable from the Note to which it is attached and will not be assigned any value separate from such Note. This prospectus is part of a registration statement filed with the Securities and Exchange Commission, which is referred to herein as the “SEC.” This prospectus, and the registration statement of which it forms a part, speak only as of the date of this prospectus. Prosper Funding LLC and Prosper Marketplace, Inc. will supplement this prospectus from time to time as described below.

The offering described in this prospectus is a continuous offering pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Securities are offered continuously and sales of the Securities through the marketplace occur on a daily basis. When PFL posts a loan request on the marketplace, that posting constitutes an offer by PFL to sell the series of Notes corresponding to that request. As used in this prospectus, a “loan listing” or a “listing” shall refer to a posted loan request. PFL may allocate some of its loan requests to other investor funding channels, including, for example, loans that it sells privately to certain investor members. If it does so, it will allocate loan requests among its various investor channels automatically, based upon a random allocation methodology determined by PFL or PMI. Some loan listings may have been allocated to one of the other investor funding channels first. All such loan listings will be identified for investor members. PFL and PMI prepare regular supplements to this prospectus, which are called “listing reports.” In each listing report, PFL and PMI provide information about the most recent loan listings posted on the marketplace and the series of Notes that correspond to those listings. PFL and PMI will also regularly file prospectus supplements that are called “sales reports,” describing funding, interest rate and maturity date for each series of Notes sold through the marketplace. These prospectus supplements will provide information about the Notes that will correspond to the information contained in the corresponding borrower listings. These listing and sales reports will also be posted on PFL’s website.

PFL and PMI will prepare prospectus supplements to update this prospectus for other purposes, such as to disclose changes to the terms of the offering of the Notes, provide quarterly updates of financial and other information included in this prospectus and disclose other material developments. These prospectus supplements will be filed with the SEC pursuant to Rule 424(b) and will be posted on PFL’s website. When required by SEC rules, such as when there is a “fundamental change” in the offering or the information contained in this prospectus, or when an annual update of financial information is required by the Securities Act or SEC rules, PFL and PMI will file post-effective amendments to the registration statement of which this prospectus forms a part, which will include either a prospectus supplement or an entirely new prospectus to replace this prospectus. PFL and PMI currently anticipate that post- effective amendments will be required, among other times, when there are changes to the material terms of the Notes.

The Securities are not available for offer and sale to residents of every state. PFL’s website indicates the states where residents may purchase the Securities. PFL posts on its website any special suitability standards or other conditions applicable to purchases of the Securities in certain states that are not otherwise set forth in this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

PFL and PMI have filed a registration statement on Form S-1 with the SEC in connection with this offering. In addition, PFL and PMI are required to file annual, quarterly and current reports and other information with the SEC. You may read and copy the registration statement and any other documents PFL or PMI has filed at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. PFL and PMI’s SEC filings are also available to the public at the SEC’s Internet site at http://www.sec.gov.

This prospectus is part of the registration statement and does not contain all of the information included in the registration statement and the exhibits, schedules and amendments to the registration statement. Some items are omitted in accordance with the rules and regulations of the SEC. For further information with respect to PFL, PMI and the Securities, please refer to the registration statement and to the exhibits and schedules to the registration statement filed as part of the registration statement. Whenever a reference is made in this prospectus to any of PFL or PMI’s contracts or other documents, the reference may not be complete and, for a copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

PFL and PMI “incorporate” into this prospectus information filed with the SEC in their Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (“Annual Report”) filed on April 6, 2015, their Quarterly Reports on Form 10-Q for the period ended March 31, 2015 filed on May 20, 2015 and for the period ended June 30, 2015 filed on August 10, 2015 (“Quarterly Reports”), and their Current Reports on Form 8-K filed on January 20, 2015, January 27, 2015, April 10, 2015, and July 14, 2015 (“Current Reports”). This means that PFL and PMI disclose important information to you by referring you to their Quarterly and Annual Reports and their Current Reports, all of which are available at www.prosper.com. The information incorporated by reference is considered to be part of this prospectus. Information contained in this prospectus automatically updates and supersedes previously filed information.

You may request a copy of PFL and PMI’s Annual Report, Quarterly Reports and their Current Reports, which will be provided to you at no cost, by writing, telephoning or emailing PFL or PMI. Requests should be directed to Customer Support, 221 Main Street, 3rd Floor, San Francisco, CA 94105; telephone number (415) 593-5400; or emailed to support@prosper.com. In addition, PFL and PMI’s Annual Reports, Quarterly Reports and Current Reports are available at www.prosper.com.

| 1 |

This summary highlights information contained elsewhere in this prospectus. You should read the following summary together with the more detailed information appearing in this prospectus, including the financial statements and related notes, and the risk factors, before deciding whether to purchase the Notes.

PFL operates a peer-to-peer online credit marketplace, which this prospectus refers to as the “marketplace,” that enables PFL’s borrower members to borrow money and its investor members to purchase Borrower Payment Dependent Notes, or Notes, issued by PFL, the proceeds of which facilitate the funding of the Borrower Loans made to borrower members. The peer-to-peer lending industry is a very innovative and unique industry, and the application of federal and state laws in areas such as securities and consumer finance to PFL’s business is still evolving. PFL is a wholly-owned subsidiary of PMI.

About the Marketplace

PMI developed the marketplace and owned the proprietary technology that makes operation of the marketplace possible. In connection with this offering, PMI transferred ownership of the marketplace, including all of the rights related to the operation of the marketplace, to PFL.

PMI and WebBank entered into a Loan Account Program Agreement, pursuant to which PMI, as agent of WebBank, manages the operation of the marketplace in connection with the submission of loan applications by potential borrowers, the making of related loans by WebBank and the funding of such loans by WebBank. In the future, PMI and/or PFL may enter into agreements with other banks that would act in addition to, or in lieu of, WebBank, in connection with making Borrower Loans through the marketplace. PFL and PMI entered into an Administration Agreement, pursuant to which PMI has agreed to manage all other aspects of the marketplace on behalf of PFL. Prior to the commencement of this offering, PMI operated the marketplace, facilitated the origination of loans by WebBank through the marketplace and issued and sold notes corresponding to those loans. Notes issued and sold through the marketplace prior to the commencement of this offering are referred to as “PMI Notes”. The PMI Notes are not offered pursuant to this prospectus.

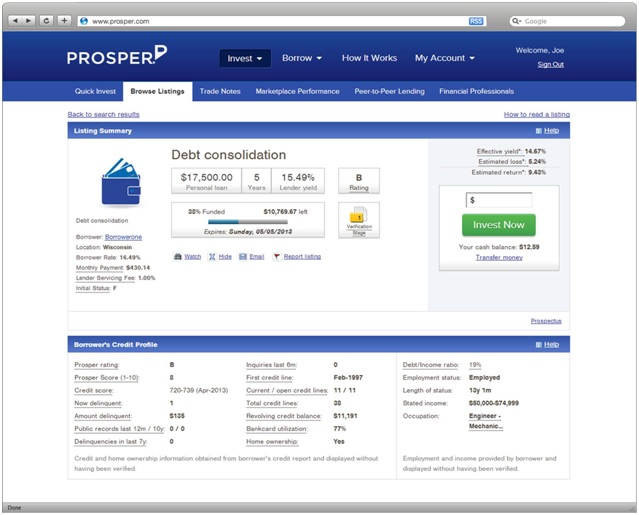

Loan Listings. A loan listing, or a listing, is a request by a PFL borrower member for a Borrower Loan in a specified amount that is posted on the marketplace by the borrower member. A borrower member who posts a loan listing on the marketplace is referred to as an “applicant” and an applicant who obtains a loan through the marketplace as a “borrower.” PMI adds to each listing additional information, including the desired loan amount, interest rate and corresponding yield percentage, the minimum amount of total bids required for the loan to fund, the Prosper Rating and estimated loss rate for the listing, the applicant’s debt-to-income ratio, certain credit information from the applicant’s credit report, the applicant’s numerical credit score range, and the applicant’s self-reported annual income range, occupation and employment status. Neither PFL nor PMI guarantees payment of the Notes or the corresponding Borrower Loans.

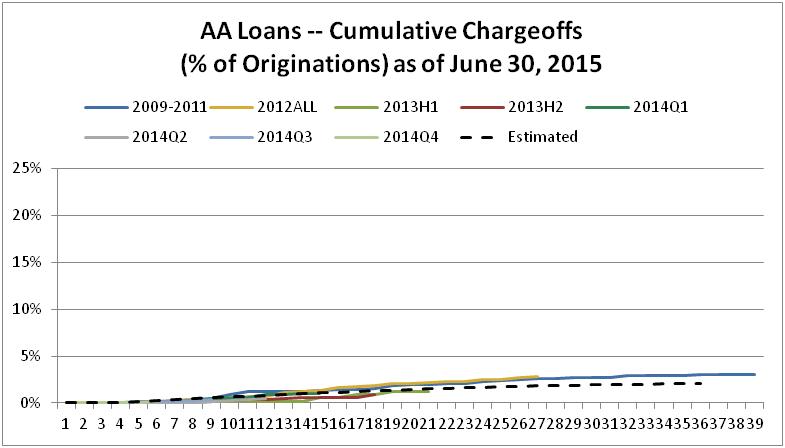

The Prosper Rating is a proprietary credit rating that we assign to each listing. The Prosper Rating is a letter that indicates the level of risk associated with a listing and corresponds to an estimated average annualized loss rate range for the listing. There are currently seven Prosper Ratings, represented by seven letter scores, but this, as well as the loss ranges associated with each, may change over time as the marketplace dictates. The estimated loss rate for each listing is based on two scores: a consumer reporting agency score and an in-house custom score calculated using the historical performance of previous Borrower Loans with similar characteristics. We will use these two scores to determine an estimated loss rate for each listing, which correlates to a Prosper Rating. This rating system allows for consistency when assigning ratings to listings. See “About the Marketplace - Risk Management” for more information.

Bidding on Listings. A bid on a listing is an investor member’s commitment to purchase a Note in the principal amount of the investor member’s bid that will be dependent for payment on the payments PFL receives on the Borrower Loan described in the listing. After a listing is posted, investor members can place bids on that listing until the listing has received bids totaling the requested loan amount. The minimum amount an investor member may bid is $25. Bids made through Quick Invest or Auto Quick Invest, our automated bidding tools for the Note Channel, or through Premier, our order execution service for the Note Channel, may be for up to 100% of the requested loan amount. For all other bids, the maximum bid amount is 10% of the requested loan amount during the first 24 hours after the loan listing is posted, and 100% of the requested loan amount after that. An investor member who wishes to bid on a listing must have funds in the amount of the bid in his investor member account at the time the bid is made. Once a bid is placed, it is irrevocable, and the amount of the bid may not be withdrawn from the investor member’s account, unless the bidding period expires without the listing having received enough bids to be funded. Once the listing has received bids totaling the requested loan amount, no further bids can be placed. The maximum length of the bidding period is 14 days. If the listing does not receive bids equal to or exceeding the minimum amount required for the listing to fund by the close of the fourteenth day after the listing is posted, the listing will terminate and the requested loan will not be funded.

Borrower Loans. If at the end of the bidding period the listing has received bids equal to or exceeding the minimum amount required to fund, a loan will be made to the applicant in an amount equal to the total amount of all winning bids. All Borrower Loans are unsecured obligations of individual borrower members with a fixed interest rate set by us and a loan term currently set at three or five years, although we may expand the range of available loan terms in the future to between three months and seven years. The minimum and maximum principal amounts for Borrower Loans are currently $2,000 and $35,000, respectively, but in the future we may permit borrowers to request loans in principal amounts between $500 and $35,000. All Borrower Loans are originated by WebBank, a Federal Deposit Insurance Corporation (“FDIC”) insured, Utah-chartered industrial bank. After originating a Borrower Loan, WebBank sells and assigns such Borrower Loans to PFL, without recourse to WebBank, in exchange for the principal amount of the Borrower Loan. WebBank has no obligation to Note holders.

| 2 |

For all Borrower Loans, we verify the applicant’s identity against data from consumer reporting agencies and other identity and anti-fraud verification databases. Loan listings can be posted without either of us obtaining any documentation of the applicant’s ability to afford the loan. In some instances, we verify the income or employment information provided by applicants in listings. This verification is normally done after the listing has been created but before the loan is funded, and therefore the results of the verification process are not reflected in the loan listings. If we are unable to verify material information with respect to an applicant or listing, we will cancel or refuse to post the listing or cancel any or all commitments against the listing. we may also delay funding of a Borrower Loan in order to verify the accuracy of information provided by an applicant in connection with the listing, or to determine whether there are any irregularities with respect to the listing. If we identify material misstatements or inaccuracies in the listing or in other information provided by the applicant, we will cancel the listing or related loan. See “About the Marketplace-Borrower Identity and Financial Information Verification.”

The Notes. PFL generally issues and sells a series of Notes for each Borrower Loan that is funded on the marketplace. The Notes are sold to the investor members who successfully bid on the corresponding Borrower Loan listing in the principal amounts of their respective bids. Each series of Notes is dependent for payment on payments PFL receives on the corresponding Borrower Loan. PFL uses the proceeds of each series of Notes to purchase the corresponding Borrower Loan from WebBank.

PFL will pay each Note holder principal and interest on the Note in an amount equal to each such Note’s pro rata portion of the principal and interest payments, if any, that PFL receives on the corresponding Borrower Loan, net of PFL’s servicing fee, which is currently set at 1% per annum of the outstanding principal balance of the corresponding Borrower Loan prior to applying the current payment. PFL may in the future increase the servicing fee to a percentage that is greater than 1% but less than or equal to 3% per annum. Any change to PFL’s servicing fee will only apply to Notes offered and sold after the date of the change. PFL will pay Note holders any other amounts it receives on the corresponding Borrower Loans, including late fees and prepayments, subject to its servicing fee, except that it will not pay Note holders any non-sufficient funds fees for failed borrower payments that it receives. In addition, the funds available for payment on the Notes will be reduced by the amount of any attorneys’ fees or collection fees PFL, a third- party servicer or a collection agency imposes in connection with collection efforts related to the corresponding borrower loan. Notwithstanding the foregoing, no payments will be made on any Note after its final maturity date. See “The Offering-Final maturity date/Extension of maturity date.”

Under the Indenture, if a “Repurchase Event” occurs with respect to a Note, PFL will, at its sole option, either repurchase the Note from the holder or indemnify the holder of the Note for any losses resulting from nonpayment of the Note or from any claim, demand or defense arising as a result of such Repurchase Event. A “Repurchase Event” occurs with respect to a Note if (i) a Prosper Rating different from the Prosper Rating actually calculated by PFL was included in the listing for the corresponding Borrower Loan and the interest of the holder in the Note is materially and adversely affected, (ii) a Prosper Rating different from the Prosper Rating that should have appeared was included in the listing for the corresponding Borrower Loan because either PFL inaccurately input data into, or inaccurately applied, the formula for determining the Prosper Rating and, as a result, the interest of the holder in the Note is materially and adversely affected, or (iii) the corresponding Borrower Loan was obtained as a result of verifiable identify theft on the part of the purported borrower member and a material payment default under the corresponding Borrower Loan has occurred.

Under PFL’s investor member registration agreement, PFL represents and warrants that (i) if an investor member uses an automated bidding tool or order execution service offered by PFL, such as Quick Invest, Auto Quick Invest or Premier, to identify Notes for purchase, each Note purchased will conform to the investment criteria provided by the investor member through such tool or service, and (b) each Note that an investor member purchases from PFL will be in the principal amount of the bid such investor member placed and will correspond to the Borrower Loan on which such investor member bid. If PFL breaches either of these representations and warranties and, as a result, the Note sold to an investor member is materially different from the Note that would have been sold had the breach not occurred or if the investor member would not have purchased the Note at all absent such breach, PFL will, at its sole option, either indemnify the investor member from any losses resulting from such breach, repurchase the Note or cure the breach, if the breach is susceptible to cure. If PFL breaches any of its other representations and warranties in the investor member registration agreement and such breach materially and adversely affects an investor member’s interest in a Note, PFL will, at its sole option, either indemnify the investor member, repurchase the affected Note from such investor member or cure the breach. If PFL repurchases any Notes, PMI will concurrently repurchase the related PMI Management Right for zero consideration. For more information about PFL’s repurchase and indemnification obligations under the indenture and the investor member registration agreements, see “About the Marketplace-Note Repurchase and Indemnification Obligations.”

PMI Management Rights. The PMI Management Rights are “investment contracts” issued by PMI directly to Note holders. The phrase “investment contract” is a concept under federal securities law that refers to an arrangement where investors invest money in a common enterprise with the expectation of profits, primarily from the efforts of others. Here, the “investment contracts” that PMI is registering as PMI Management Rights arise from the services that PMI has provided and will provide, as described in the Administration Agreement, the Indenture, the Lender Registration Agreement, and in this prospectus, which services include, but are not limited to:

| · | the existence and operation of the marketplace; | |

| · | verification of borrower information; | |

| · | evaluation and validation of the Prosper Score and Prosper Rating; | |

| · | remitting borrower payments; and | |

| · | collecting on delinquent accounts. |

Investors who purchase PMI Management Rights will have rights under the federal securities laws as a purchaser of a registered security. Investors will have limited contractual rights, collectively through the indenture trustee, to enforce PMI’s contractual obligations under the Administration Agreement. Such contractual rights exist under state law and will not, in any way, affect the rights of investors under the federal securities laws.

| 3 |

The PMI Management Rights arise from the services that PMI will provide to PFL under the Administration Agreement as described in this prospectus. Pursuant to the Administration Agreement, PMI will provide three kinds of services to PFL: (i) PMI will manage the operation of the marketplace itself (credit policy revisions, systems maintenance, etc.) (the “Loan Marketplace Administration Services”); (ii) PMI will provide back-office services to PFL (maintaining books and records, making periodic regulatory filings, performing limited cash management functions, etc.) (the “Corporate Administration Services”); and (iii) PMI will service the Borrower Loans and Notes originated through the marketplace (the “Loan and Note Servicing Services”). Holders of PMI Management Rights will have a limited contractual ability, collectively through the indenture trustee, to enforce PMI’s obligations under the Administration Agreement. However, holders of PMI Management Rights also have rights under the federal securities laws that are not limited, contractually or otherwise. PMI’s obligations to provide services under the Administration Agreement may be terminated by PMI or by PFL under certain circumstances described in this prospectus. For more information, see “Summary of Indenture, Form of Notes, PMI Management Rights and Administration Agreement-PMI Management Rights.”

Termination of the Administration Agreement would not affect the rights of holders of previously issued PMI Management Rights under the federal securities laws. If PFL or PMI were to terminate PMI’s obligations to provide services under the Administration Agreement, PMI would cease to issue new PMI Management Rights. PFL has entered into a back-up servicing agreement with a loan servicing company who is willing and able to transition loan and Note servicing responsibilities from PMI, but it is unlikely that the back-up servicer would be able to perform functions other than servicing the outstanding Borrower Loans and Notes. Therefore, PFL might have to suspend the facilitation of new Borrower Loans and the issuance of new Notes until it could find another party or parties that could perform the services PMI had been performing under the Administration Agreement. PFL believes it could find another party or parties to perform such services, but the search could take time. For more information, see “Risk Factors-Risks Related to PFL and PMI, Our Marketplace and Our Ability to Service the Notes.”

The PMI Management Rights will be attached to the Notes, will not be separable from the Notes and will not be assigned a value separate from the Notes.

Servicing and Loan Marketplace Administration. PFL is responsible for servicing the Borrower Loans and Notes. Following its purchase of Borrower Loans and sale of Notes corresponding to the Borrower Loans, PFL begins servicing the Borrower Loans and Notes. If a Borrower Loan becomes one or more days past due, PFL may collect on it directly or refer it to a third party servicer or collection agency for collection. See “About the Marketplace- Loan Servicing and Collection.”

PFL has entered into an Administration Agreement with PMI, pursuant to which PFL has engaged PMI to assist it in servicing the Borrower Loans, managing the marketplace, and in performing other duties. Pursuant to the Administration Agreement, PMI will provide a variety of administrative and management services, including, but not limited to, supervision of:

| · | the management, maintenance and operation of the marketplace; |

| · | the issuance, sale and payment of the Notes; |

| · | PFL’s purchase of Borrower Loans; |

| · | the operation of www.prosper.com; |

| · | PFL’s compliance with applicable federal and state laws (including consumer protection laws, state lender licensing requirements and securities registration requirements); |

| · | the applicant verification and eligibility processes; |

| · | the posting of listings on the marketplace; and |

| · | the assignment of a Prosper Rating and an interest rate to each listing. |

See “About the Marketplace,” “Summary of Indenture, Form of Notes and Administration Agreement-Administration Agreement” and “Information About Prosper Marketplace, Inc.” for more information.

Quick Invest. The marketplace includes a loan search tool, Quick Invest, that makes it easier for investor members to identify Notes that meet their investment criteria. An investor member using Quick Invest is asked to indicate (i) the Prosper Rating or Ratings she wishes to use as search criteria, (ii) the total amount she wishes to invest and (iii) the amount she wishes to invest per Note. If she wishes to search for Notes using criteria other than, or in addition to, Prosper Rating, she can use one or more of several dozen additional search criteria, such as loan amount, debt-to-income ratio and credit score. The only criteria an investor member cannot specify in Quick Invest are the monthly payment amount. Quick Invest then compiles a basket of Notes for her consideration that meet her search criteria. If the pool of Notes that meet her criteria exceeds the total amount she wishes to invest, Quick Invest selects Notes from the pool based on how far the listings corresponding to the Notes have progressed through the loan verification process, i.e., Notes from the pool that correspond to listings for which we have completed the verification process will be selected first. If the pool of Notes that meet the investor member’s specified criteria and for which we have completed verification still exceeds the amount she wishes to invest, Quick Invest selects Notes from that pool based on the principle of first in, first out, i.e., the Notes from the pool with the corresponding listings that were posted earliest will be selected first. If the pool of Notes that meet the investor member’s criteria exceeds the amount she wishes to invest, but the subset of that pool for which we have completed loan verification does not equal the amount she wishes to invest, Quick Invest selects all of the Notes that correspond to listings for which we have completed loan verification and makes up the difference by selecting Notes from the remaining pool on a first in, first out basis. If the investor member’s search criteria include multiple Prosper Ratings, Quick Invest divides the investor’s basket into equal portions, one portion representing each Prosper Rating selected. To the extent available Notes with these Prosper Ratings are insufficient to fill the investor member’s order, the investor member is advised of this shortfall and given an opportunity either to reduce the size of her order or to modify her search criteria to make her search more expansive. The Auto Quick Invest feature allows investor members (i) to have Quick Invest searches run on their designated criteria automatically each time new listings are posted on the marketplace, and (ii) to have bids placed automatically on any Notes identified by each such search. See “About the Marketplace-How to Bid to Purchase Notes-Quick Invest.”

| 4 |

Corporate Information

Prosper Marketplace, Inc. PMI was incorporated in the State of Delaware in March 2005. Its principal executive offices are located at 221 Main Street, 3rd Floor, San Francisco, California 94105. Its telephone number at this location is (415) 593-5400.

Prosper Funding LLC. PMI formed Prosper Funding LLC in the State of Delaware in February 2012. PFL’s principal executive offices are located at 221 Main Street, 3rd Floor, San Francisco, California 94105. Its telephone number at this location is (415) 593-5400. Its website address is www.prosper.com. The information contained on its website is not incorporated by reference into this prospectus.

PFL has been organized and is operated in a manner that is intended (i) to minimize the likelihood that it will become subject to bankruptcy proceedings, and (ii) to minimize the likelihood that it would be substantively consolidated with PMI, and thus have its assets subject to claims by PMI’s creditors, if PMI files for bankruptcy. This is achieved by placing certain restrictions on PFL’s activities, including its transactions with PMI, and implementing certain formalities designed to expressly reinforce PFL’s status as a distinct corporate entity from PMI. See “Information About Prosper Funding LLC.”

| 5 |

Borrower Payment Dependent Notes

| Issuer | Prosper Funding LLC | |

| Securities offered | Borrower Payment Dependent Notes, or “Notes,” issued in series, with each series dependent for payment on payments PFL receives on a specific corresponding Borrower Loan. | |

| Offering price | 100% of the principal amount of each Note. | |

| Initial maturity date | Maturities are for three or five years and match the maturity date of the corresponding Borrower Loan. PFL may in the future extend the range of available loan terms to between three months and seven years, at which time the Notes will have terms between three months and seven years. | |

| Final maturity date / Extension of maturity date | The final maturity date of each Note is the date that is one year after the initial maturity date. Each Note matures on the initial maturity date, unless any principal or interest payments in respect of the correspond Borrower Loan remain due and payable to PFL upon the initial maturity date, in which case maturity of the Note will be automatically extended to the final maturity date. Each Note will mature on final maturity date, even if principal or interest payments in respect of the corresponding Borrower Loan remain due and payable. PFL will have no further obligation to make payments on the Note after the final maturity date even if it receives payments on the corresponding Borrower Loan after such date. | |

| Interest rate | Each series of Notes will have a stated, fixed interest rate equal to the loan yield percentage specified in related loan listing as determined by PFL, which is the interest rate for the corresponding Borrower Loan, net of servicing fees. | |

| Setting interest rate for Notes | Interest rates vary among the Notes, but each series of Notes will have the same interest rate. We set the interest rates for Borrower Loans based on Prosper Ratings, as well as additional factors such as Borrower Loan terms, the economic environment and competitive conditions. The interest rate on each Note is equal to the interest rate on the corresponding Borrower Loan, net of service fees. See “About the Marketplace-Setting Interest Rates. | |

| Payments on the Notes | PFL will pay principal and interest on any Note an investor member purchases in an amount equal to the investor member’s pro rata portion of the principal and interest payments, if any, PFL receives on the corresponding Borrower Loan, net of servicing fees and other charges. See “Offering-Servicing Fees and Other Charges.” Each Note will provide for monthly payments over a term equal to the corresponding Borrower Loan. The payment dates for the Notes will fall on the sixth business day after the due date for each installment of principal and interest on the corresponding Borrower Loan although interest will be deemed to accrue thereon only through each corresponding loan payment date. See “Summary of Indenture, Form of Notes and Administration Agreement-Indenture and Form of Notes” more information. | |

|

Investor members will designate PFL to apply the proceeds from the sale of each series of Notes to the purchase of the corresponding Borrower Loan from WebBank. Each Borrower Loan is a fully amortizing consumer loan made by WebBank to an individual borrower member. Borrower Loans currently have a term of three or five years, but PFL may in the future extend the range of available loan terms to between three months and seven years. Borrower members may request Borrower Loans within specified minimum and maximum principal amounts (currently between $2,000 and $35,000, but which may increase to between $500 and $35,000), which are subject to change from time to time. WebBank subsequently sells and assigns the Borrower Loans to PFL without recourse in exchange for the principal amount of the Borrower Loan. Borrower Loans provide for monthly payments over the term equal thereof and are unsecured and unsubordinated. Borrower Loans may be repaid at any time by the borrowers without prepayment penalty. PMI verifies each applicant’s identity against data from consumer reporting agencies and other identity and anti-fraud verification databases. Loan listings can be posted without either of us obtaining any documentation of the applicant’s ability to afford the loan. We sometimes verify the income or employment information provided by applicants. This verification is normally done after the listing has been created but before the loan has funded, and therefore the results of the verification are not reflected in the listings. See “About the Marketplace-Borrower Identity and Financial Information Verification” for more information.

|

| 6 |

| Borrower members are able to use the loan proceeds for any purpose other than (i) buying, carrying or trading in securities or buying or carrying any part of an investment contract security or (ii) paying for postsecondary educational expenses (i.e., tuition, fees, required equipment or supplies, or room and board) at a college/university/vocational school, as the term “postsecondary educational expenses is defined in Bureau of Consumer Finance Protection Regulation Z, 12 C.F.R. § 1026.46(b)(3), and they warrant and represent that they will not use the proceeds for any such purposes. | ||

| The Notes will not be contractually senior or contractually subordinated to other indebtedness, if any, that PFL incurs. All Notes will be special, limited obligations of PFL. PFL was formed by PMI so that, in the event of PMI’s bankruptcy, the Borrower Loans that PFL owns should be shielded from claims by PMI’s creditors, thereby protecting the interests of Note holders in those Borrower Loans and the proceeds thereof. This is achieved by placing certain restrictions on PFL’s activities, including restrictions in PFL’s organizational documents on its ability to incur additional indebtedness, and by implementing certain formalities designed to expressly reinforce its status as a distinct corporate entity from PMI. Nevertheless, the Notes themselves do not restrict PFL’s incurrence of other indebtedness or the grant or imposition of liens or security interests on PFL’s assets, and holders of the Notes do not themselves have a direct security interest in the corresponding Borrower Loan or the proceeds of that loan. Accordingly, in the event of a bankruptcy or similar proceeding of PFL, the relative rights of a holder of a Note may be uncertain. To further limit the risk of PFL’s insolvency, PFL has therefore granted the indenture trustee, for the benefit of the Note holders, a security interest in the Borrower Loans corresponding to the Notes, the payments and proceeds that PFL receives on such Borrower Loans, the bank account in which the Borrower Loan payments are deposited and the FBO account. The indenture trustee may exercise its legal rights to the collateral only if an event of default has occurred under the Amended and Restated Borrower Payment Dependent Notes Indenture for the Notes (the “indenture”), which would include PFL’s becoming subject to a bankruptcy or similar proceeding. Only the indenture trustee, not the holders of the Notes, has a security interest in the above collateral. If the indenture trustee were to exercise its legal rights to the collateral, the indenture provides that amounts collected on a particular Borrower Loan (minus allowable fees and expenses) are to be applied to amounts due and owing on the corresponding Note. There can be no assurance, however, that the indenture trustee, or ultimately the Note holders, would realize any amounts from the collateral. See “Risk Factors- Risks Related to PFL and PMI, Our Marketplace and Our Ability to Service the Notes” for more information. |

| Servicing fees and other charges | PFL subtracts a servicing fee from every loan payment it receives. The amount of the servicing fee deducted from a particular payment is equal to (a) the product obtained by multiplying the applicable annual servicing fee rate by a fraction, the numerator of which is equal to the number of days since the borrower’s last payment (or, if applicable, since the date on which the relevant loan was funded) and the denominator of which is 365, multiplied by (b) the outstanding principal balance of the loan prior to applying the current payment. The servicing fee rate is currently set at 1% per annum of the outstanding principal balance of the corresponding loan prior to applying the current payment, but PFL may increase that in the future to a rate greater than 1% but less than or equal to 3% per annum. Any change to the servicing fee will only apply to Notes offered and sold after the date of the change. Listings set forth the applicable servicing fee. Because servicing fees reduce the effective yield to investors, the yield percentage displayed in each listing is net of servicing fees. | |

| PFL will retain any non-sufficient funds fees charged to a borrower’s account to cover its administrative expenses. If a Borrower Loan enters collection, either of us, a third party servicer or a collection agency may charge a collection fee of up to 40% of any amounts that are obtained, in addition to any legal fees and transaction fees associated with accepting payments incurred in the collection effort. The collection fee will vary depending on whether we use our in-house collections department, a third party servicer’s in-house collections department or a collection agency. If a third party servicer or a collection agency is used, the fee will also vary depending on the third party servicer or collection agency used. These fees will correspondingly reduce the amounts of any payments that Note holders receive on the corresponding Notes and are not reflected in the yield percentage displayed in listings. | ||

| PFL will pay investor members any late fees it receives on Borrower Loans. | ||

| Use of proceeds | PFL will use the proceeds of each series of Notes to purchase the corresponding Borrower Loan. |

| Electronic form and transferability | The Notes will be issued in electronic form only and will not be listed on any securities exchange. The Notes will not be transferable except through the Folio Investing Note Trader platform operated and maintained by FOLIOfn Investments, Inc., a registered broker-dealer. There can be no assurance that a market for the Notes will develop on the Note Trader platform and, therefore, investor members must be prepared to hold their Notes to maturity. See “About the Marketplace-Note Trader Platform” for more information. | |

| U.S. federal income tax consequences | Although the matter is not free from doubt, PFL will treat the Notes as its debt instruments that have original issue discount (“OID”) for U.S. federal income tax purposes. Accordingly, if you hold a Note, you will be required to include OID currently as ordinary interest income for U.S. federal income tax purposes (which may be in advance of interest payments on the Note) if the Note has a maturity date of more than one year, regardless of your regular method of tax accounting. You should consult your own tax advisor regarding the U.S. federal, state, local and non-U.S. tax consequences of the purchase, ownership, and disposition of the Notes (including any possible differing treatments of the Notes). See “Material U.S. Federal Income Tax Considerations” for more information. |

| 7 |

| Financial suitability | Investor members that are residents of Alaska, Idaho, Missouri, Nevada, New Hampshire, Virginia or Washington must meet one or more of the following suitability requirements:

| |

| a. | (i) You must have an annual gross income of at least $70,000; (ii) your net worth must be at least $70,000 (exclusive of home, home furnishings and automobiles); and (iii) the total amount of Securities you purchase cannot exceed 10% of your net worth (exclusive of home, home furnishings and automobiles); or | |

| b. | (i) Your net worth must be at least $250,000 (exclusive of home, home furnishings and automobiles); and (ii) the total amount of Securities you purchase cannot exceed 10% of your net worth (exclusive of home, home furnishings and automobiles). | |

| Investor members that are residents of California must meet one or more of the following suitability requirements: | ||

| a. | (i) You must have had an annual gross income of at least $85,000 during the last tax year; (ii) you must have a good faith belief that your annual gross income for the current tax year will be at least $85,000; and (iii) the total amount of Securities you purchase cannot exceed 10% of your net worth; or | |

| b. | (i) Your net worth must be at least $200,000; and (ii) the total amount of Securities you purchase cannot exceed 10% of your net worth; or | |

| c. | (i) Your net investment in Securities cannot exceed $2,500; and (ii) the total amount of Securities you purchase cannot exceed 10% of your net worth. | |

| The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar offerings not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. | ||

| For purposes of these suitability requirements, you and your spouse are considered to be a single person. In addition, the following definitions apply: | ||

| “annual gross income” means the total amount of money you earn each year, before deducting any amounts for taxes, insurance, retirement contributions or any other payments or expenses; | ||

| “net worth” means the total value of all your assets, minus the total value of all your liabilities. The value of an asset is equal to the price at which you could reasonably expect to sell it. In calculating your net worth, you should only include assets that are liquid, meaning assets that consist of cash or something that could be quickly and easily converted into cash, such as a publicly-traded stock. You shouldn’t include any illiquid assets, such as homes, home furnishings or cars; | ||

| “net investment” means the principal amount of Securities purchased, minus principal payments received on the Securities. | ||

| Investor members should be aware that PFL may apply more restrictive financial suitability standards or maximum investment limits to residents of certain states. If established, before making commitments to purchase Notes each investor member will be required to represent and warrant that he or she meets these minimum financial suitability standards and maximum investment limits. See “Financial Suitability Requirements” for more information. | ||

PMI Management Rights

| Issuer | Prosper Marketplace, Inc. | ||

|

Securities offered |

PMI Management Rights issued by PMI and attached to the Notes offered on the marketplace. The PMI Management Rights are “investment contracts” issued by PMI directly to Note holders. The phrase “investment contract” is a concept under federal securities law that refers to an arrangement where investors invest money in a common enterprise with the expectation of profits, primarily from the efforts of others. Here, the “investment contracts” that PMI is registering as PMI Management Rights arise from the services that PMI has provided and will provide, as described in the Administration Agreement, the Indenture, the Investor Registration Agreement, and in this prospectus, which services include, but are not limited to: | ||

| · | the existence and operation of the marketplace; | ||

| · | verification of borrower information; | ||

| · | evaluation and validation of the Prosper Score and Prosper Rating; | ||

| · | remitting borrower payments; and | ||

| · | collecting on delinquent accounts. | ||

| 8 |

| Offering price | No separate consideration will be paid for the PMI Management Rights and such securities will not be separable from the Notes |

| Use of proceeds | PMI will not receive any proceeds from the issuance of the PMI Management Rights. |

| Electronic form and transferability | The PMI Management Rights will be issued in electronic form only. |

| Enforceability | Investors who purchase PMI Management Rights will have rights under the federal securities laws as a purchaser of a registered security. Investors will have limited contractual rights, collectively through the indenture trustee, to enforce PMI’s contractual obligations under the Administration Agreement. Such contractual rights exist under state law and will not, in any way, affect the rights of investors under the federal securities laws. PMI’s obligations to provide services under the Administration Agreement may be terminated by PMI or by PFL under certain circumstances described in this prospectus. For more information, see “Summary of Indenture, Form of Notes, PMI Management Rights and Administration Agreement-Administration Agreement-Indenture Trustee as Third-Party Beneficiary.” |

| U.S. federal income tax consequences | PMI expects that the purchase, sale and holding of the PMI Management Rights will not have any U.S. federal income tax consequences |

| Financial suitability | See “The Offering-Borrower Payment Dependent Notes-Financial Suitability.” |

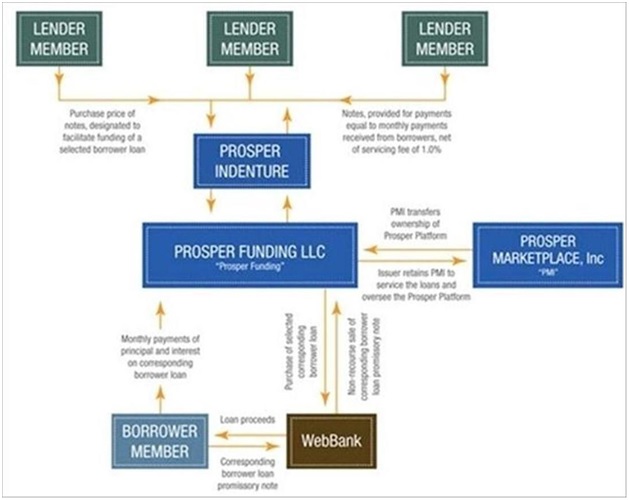

The following diagram illustrates the basic structure of the marketplace for a single series of Notes. This graphic does not demonstrate many details of the marketplace, including the effect of prepayments, late payments, late fees or collection fees. See “About the Marketplace” for more information.

| 9 |

This prospectus includes forward-looking statements. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by the use of words such as “may,” “believe,” “expect,” “project,” “estimate,” “intend,” “anticipate,” “plan,” “continue” or similar expressions. In particular, information appearing under “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus, as well as the information appearing under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in PFL and PMI’s Annual Report for the fiscal year ended December 31, 2014, pages 64 to 73, which are incorporated by reference in this prospectus, includes forward-looking statements. Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Where, in any forward-looking statement, PFL or PMI expresses an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our respective managements, expressed in good faith and is believed to have a reasonable basis. Nevertheless, there can be no assurance that the expectation or belief will result or be achieved or accomplished.

The following include some but not all of the factors that could cause actual results or events to differ materially from those anticipated:

| · | the performance of the Notes, which, in addition to being speculative investments, are special, limited obligations that are not guaranteed or insured; |

| · | PFL’s ability to make payments on the Notes, including in the event that borrowers fail to make payments on the corresponding Borrower Loans; |

| · | our ability to attract potential borrowers to our marketplace |

| · | the reliability of the information about borrowers that is supplied by borrowers including actions by some borrowers to defraud investor members; |

| · | our ability to service the Borrower Loans, and our ability or the ability of a third party debt collector to pursue collection against any borrower, including in the event of fraud or identity theft; |

| · | credit risks posed by the creditworthiness of borrowers and the effectiveness of the credit rating systems; |

| · | our limited operational history and lack of significant historical performance data about borrower performance; |

| · | the impact of current economic conditions on the performance of the Notes and loss rates of the Notes; |

| · | our compliance with applicable local, state and federal law, including the Investment Advisers Act of 1940, the Investment Company Act of 1940 and other laws; |

| · | potential efforts by state regulators or litigants to characterize PFL or PMI, rather than WebBank, as the lender of the Borrower Loans originated through the marketplace; |

| · | the application of federal and state bankruptcy and insolvency laws to borrowers, PFL and PMI; |

| · | the impact of borrower delinquencies, defaults and prepayments on the returns on the Notes; |

| · | the lack of a public trading market for the Notes and any inability to resell the Notes on the Note Trader platform; |

| · | the federal income tax treatment of an investment in the Notes and the PMI Management Rights; |

| · | our ability to prevent security breaches, disruptions in service, and comparable events that could compromise the personal and confidential information held on our data systems, reduce the attractiveness of the marketplace or adversely impact our ability to service Borrower Loans; and |

There may be other factors that may cause actual results to differ materially from the forward-looking statements. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them does occur, what impact they will have on either of our results of operations and financial conditions. You should carefully read the factors described in the “Risk Factors” section of this prospectus for a description of certain risks that could, among other things, cause our actual results to differ from these forward-looking statements.

All forward-looking statements speak only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

| 10 |

The Notes and PMI Management Rights involve a high degree of risk. You should carefully consider the risks described below before making a decision to invest in the Notes and PMI Management Rights. If any of the following risks actually occurs, you might lose all or part of your investment in the Notes and PMI Management Rights. In addition to the disclosures below, please read carefully the sections entitled “Item 1A. Risk Factors” beginning on page 41 of PFL and PMI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 previously filed with the SEC and incorporated by reference into this prospectus, and the sections entitled “Item 1A. Risk Factors” included in any subsequent Annual or Quarterly Report that may be incorporated by reference into this prospectus. Before making an investment decision, you should carefully consider these risks. While we believe the risks and uncertainties described below include all material risks currently known by us, it is possible that these may not be the only ones we face. If any of the risks actually occur, our business, financial condition, operating results and prospects could be materially and adversely affected.

| 11 |

RISKS RELATED TO BORROWER DEFAULT

The Notes are risky and speculative investments for suitable investors only.

Investors should be aware that the Notes offered through our marketplace are risky and speculative investments. The Notes are special, limited obligations of PFL and depend entirely for payment on PFL’s receipt of payments under the corresponding Borrower Loans. Notes are suitable only for investors of adequate financial means. If an investor cannot afford to lose the entire amount of such investor’s investment in the Notes, the investor should not invest in the Notes.

Payments on the Notes depend entirely on payments PFL receives on corresponding Borrower Loans. If a borrower fails to make any payments on the corresponding Borrower Loan related to a Note, payments on such Note will be correspondingly reduced.

PFL will only make payments pro rata on a series of Notes after it receives a borrower’s payment on the corresponding Borrower Loan, net of servicing fees. PFL also will retain from the funds received from the relevant borrower and otherwise available for payment on the Notes any non-sufficient funds fees and the amounts of any attorneys’ fees or collection fees our in-house collections department, a third-party servicer or collection agency imposes in connection with collection efforts. Under the terms of the Notes, if PFL does not receive any or all payments on the corresponding Borrower Loan, payments on the Note will be correspondingly reduced in whole or in part. If the relevant borrower does not make a payment on a specific monthly loan payment date, no payment will be made on the Note on the corresponding succeeding Note payment date.

Information supplied by applicants may be inaccurate or intentionally false. Information regarding income and employment is not verified in many cases.

Applicants supply a variety of information regarding the purpose of the loan, income, occupation, and employment status that is included in borrower listings. We do not verify the majority of this information, which may be incomplete, inaccurate or intentionally false. Applicants may misrepresent their intentions for the use of Borrower Loan proceeds. Neither we nor WebBank verifies any statements by applicants as to how loan proceeds are to be used nor do we or WebBank confirm after loan funding how loan proceeds were used. All listings are posted to our marketplace without our verifying the information provided by the applicant, including the borrower’s stated income, employment status or occupation. Investor members should not rely on an applicant’s self-reported information such as income, employment status, or occupation in making investment decisions. In the cases in which we select applicants for income and employment verification, the verification is normally done after the listing has been created but prior to the time the Borrower Loan is funded. For the period from July 13, 2009 to June 30, 2015, we verified employment and/or income on approximately 58% of the Borrower Loans originated through our marketplace on a unit basis (177,698 out of 308,652) and approximately 72% of originations on a dollar basis ($2,717 million out of $3,778 million). Of these loans, we cancelled 40,643 or 14% of the loan listings for which we verified employment and/or income information because the listings contained inaccurate or insufficient employment or income information. We selected these listings based on a combination of factors, including amount of loan requested, Prosper Rating, debt-to-income ratio and stated income. Listings do not disclose the identity of applicants, and investors have no ability to obtain or verify applicant information either before or after they purchase a Note. If an applicant supplies false, misleading or inaccurate information, an investor may lose part or all of the purchase price paid for a Note. Under PFL’s Administration Agreement with PMI, PMI is required to perform borrower identity and financial information verification services for PFL. See “About the Marketplace-Borrower Identity and Financial Information Verification” for more information. The number or percentage of applicants whose income and employment information is verified in relation to future listings may differ from the historical information supplied above. No assurance is made that such information will be verified with respect to any particular applicant or borrower. Neither the indenture trustee nor holders of any Notes will have any contractual or other relationship with any borrower that would enable the indenture trustee or such holder to make any claim against such borrower for fraud or breach of any representation or warranty in relation to any false, incomplete or misleading information supplied by such borrower in relation to the relevant Borrower Loan or Note.

The Borrower Loans are not secured by any collateral or guaranteed or insured by any third party, and investors must rely on us or a third-party collection agency to pursue collection against any borrower.

Borrower Loans are unsecured obligations of borrower members. They are not secured by any collateral, and they are not guaranteed or insured by PFL, PMI or any third party or backed by any governmental authority in any way. We and our third-party collection agencies will, therefore, be limited in our ability to collect on Borrower Loans. Moreover, Borrower Loans are obligations of borrowers to PFL as successor to WebBank, not obligations to the holders of Notes. Holders of the Notes will have no recourse to the borrowers and no ability to pursue borrowers to collect payments under Borrower Loans. Holders of the Notes may look only to PFL for payment of the Notes. Furthermore, if a borrower fails to make any payments on the Borrower Loan, the holders of the Notes corresponding to that Borrower Loan will not receive any payments on their Notes. The holders of such Notes will not be able to pursue collection against the borrower and will not be able to obtain the identity of the borrower in order to contact the borrower about the defaulted Borrower Loan.

| 12 |

The maximum debt-to-income ratio for applicants is 50%.

Debt-to-income (“DTI”) is a measurement of a borrower’s ability to take on additional debt. While there is an upper limit of 50% on the DTI ratio for eligible borrowers in our marketplace, borrowers with higher DTI ratios may represent a greater risk of default than borrowers with lower DTI ratios. Note that the measure of DTI for eligibility decisions does not include the amount of the requested Borrower Loan, whereas the measure of DTI presented in a listing includes the amount of the requested Borrower Loan.

The credit information of an applicant may be inaccurate or may not accurately reflect the applicant’s creditworthiness, which may cause an investor to lose all or part of the price paid for a Note.

We obtain applicant credit information from consumer reporting agencies, and assign Prosper Ratings to listings based in part on the applicant’s credit score. A credit score that forms a part of the Prosper Rating assigned to a listing may not reflect the applicant’s actual creditworthiness because the credit score may be based on outdated, incomplete or inaccurate consumer reporting data. Similarly, the credit data taken from the applicant’s credit report and displayed in listings may also be based on outdated, incomplete or inaccurate consumer reporting data. We do not verify the information obtained from the applicant’s credit report. Moreover, investor members do not, and will not, have access to financial statements of applicants or to other detailed financial information about applicants.

The Prosper Rating may not accurately set forth the risks of investing in the Notes and no assurances can be provided that actual loss rates for the Notes will come within the estimated loss rates indicated by the Prosper Rating.

If we include in a listing a Prosper Rating that is different from the Prosper Rating calculated by us or calculate the Prosper Rating for a listing incorrectly, and such error materially and adversely affects a holder’s interest in the related Note, PFL will indemnify the holder or repurchase the Note. PFL will not, however, have any indemnity or repurchase obligation under the Amended and Restated Indenture, the Notes, the investor agreement or any other agreement associated with the Note Channel as a result of any other inaccuracy with respect to a listing’s Prosper Score or Prosper Rating. For example, the Prosper Rating for a listing could be inaccurate because the applicant’s credit report contained incorrect information. Similarly, the Prosper Rating does not reflect the substantial risk associated with the facts that (i) we do not verify much of the applicant information on which the Prosper Rating is based and (ii) much of such information is provided directly by the applicants themselves, who remain anonymous to potential Note purchasers. In addition, the Prosper Rating does not reflect PFL’s credit risk as a debtor (such credit risk exists even though, as the debtor on the Notes, PFL’s only obligation is to pay to the Note holders their pro rata shares of collections received on the related Borrower Loans net of applicable fees). If PFL repurchases any Notes, PMI will concurrently repurchase the related PMI Management Right for zero consideration. PFL’s repurchase obligations under the Amended and Restated Indenture, the Notes, the investor agreement or any other agreement associated with the Note Channel, and PMI’s concurrent repurchase of the related PMI Management Rights, do not affect a Note holder’s rights under federal or state securities laws. A Prosper Rating is not a recommendation by us to buy, sell or hold a Note. In addition, no assurances can be provided that actual loss rates for the Notes will fall within the expected loss rates indicated by the Prosper Rating. The interest rates on the Notes might not adequately compensate Note purchasers for these additional risks. See “About the Marketplace-Note Repurchase and Indemnification Obligations” for more information.

Investor members who use the Quick Invest tool may face additional risk of funding Borrower Loans that have been erroneously selected by Quick Invest.

Since it was first implemented in July 2011 through June 30, 2015, the Quick Invest tool has experienced programming errors that affected 8,630 Notes and PMI Notes out of the 4,592,900 Notes and PMI Notes purchased. The Quick Invest Tool has not experienced any errors since April 2013.

In the event of any errors in Quick Invest that cause an investor to purchase a Note from PFL that such investor would not otherwise have purchased or that differs materially from the Note such investor would have purchased had there been no error, PFL will either repurchase the Note, indemnify the investor against losses suffered on that Note or cure such error. See “Risk Factors-Risks Related to PFL and PMI Our Marketplace and Our Ability to Service the Notes” for more information.

Some borrowers may use our marketplace to defraud investors, which could adversely affect investors’ ability to recoup their investment.

We use identity and fraud checks with external databases to authenticate each borrower’s identity. There is a risk, however, that these checks could fail and fraud may occur. In addition, applicants may misrepresent their intentions regarding loan purpose or other information contained in listings, and we do not verify the majority of this information. While PFL will indemnify an investor or repurchase Notes in limited circumstances (including, e.g., a material payment default on the Borrower Loan resulting from verifiable identity theft), it is not obligated to indemnify an investor or repurchase a Note from an investor if the investment is not realized in whole or in part due to fraud (other than verifiable identity theft) in connection with a loan listing, or due to false or inaccurate statements or omissions of fact in a listing, whether in credit data, a borrower member’s representations, similar indicia of borrower intent and ability to repay the Borrower Loan. For the period from July 13, 2009 to June 30, 2015, we verified employment and/or income on approximately 58% of the Borrower Loans originated through our marketplace on a unit basis (177,698 out of 308,652) and approximately 72% of originations on a dollar basis ($2,717 million out of $3,778 million). Of these Borrower Loans, we cancelled 40,643 or 14% of the loan listings for which we verified employment and/or income information because the listings contained inaccurate or insufficient employment or income information. If PFL repurchases a Note, the repurchase price will be equal to the Note’s outstanding principal balance and will not include accrued interest. If PFL repurchases any Notes, PMI will concurrently repurchase the related PMI Management Rights for zero consideration. See “About the Marketplace-Note Repurchase and Indemnification Obligations” for more information.

| 13 |

The fact that we have the exclusive right and ability to investigate claims of identity theft in the origination of Borrower Loans creates a significant conflict of interest between us and the investors.

We have the exclusive right to investigate claims of identity theft and determine, in our sole discretion, whether verifiable identity theft has occurred. Verifiable identity theft triggers an obligation by PFL to either repurchase the related Notes or indemnify the applicable Note holders. As we are the sole entities with the ability to investigate and determine verifiable identity theft, which triggers PFL’s repurchase or indemnification obligation, a conflict of interest exists. Investors rely solely on us to investigate incidents that might require PFL to indemnify the applicable Note holders or repurchase the related Notes. The denial of a claim under PFL’s identity theft guarantee would save PFL from its indemnification or repurchase obligation.

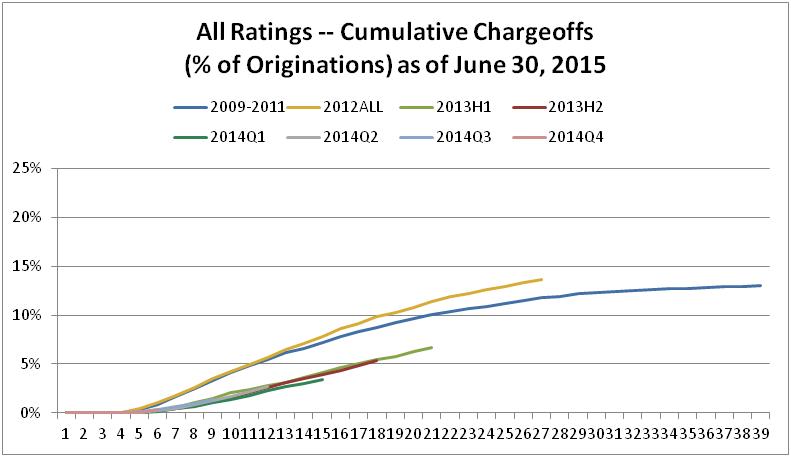

PFL does not have significant historical performance data about performance on the Borrower Loans. Loss rates on the Borrower Loans may increase and prior to investing investors should consider the risk of non-payment and default.

Borrower Loans were first offered through our marketplace in February 2006. The estimated loss rates displayed on listings and used to determine the Prosper Rating have been developed from the loss histories of all Borrower Loans originated through our marketplace. However, future Borrower Loans originated through our marketplace may default more often than similar Borrower Loans have defaulted in the past, which increases the risk of investing in the Notes.

If payments on the Borrower Loan corresponding to an investor’s Note become more than 30 days overdue, such investor will be unlikely to receive the full principal and interest payments that were expected on the Note, and such investor may not recover the original purchase price on the Note.