Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ATMEL CORP | t1502204_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - ATMEL CORP | t1502204_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - ATMEL CORP | t1502204_ex99-1.htm |

| EX-3.1 - EXHIBIT 3.1 - ATMEL CORP | t1502204_ex3-1.htm |

| EX-99.4 - EXHIBIT 99.4 - ATMEL CORP | t1502204_ex99-4.htm |

| EX-2.1 - EXHIBIT 2.1 - ATMEL CORP | t1502204_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - ATMEL CORP | t1502204_ex99-2.htm |

Exhibit 99.5

… personal … portable … connected Investor Presentation September 21, 2015 Dialog’s Acquisition of Atmel A Global Leader in Mobile Power and IoT

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Safe Harbor This presentation is not a prospectus. It does not constitute or form part of an offer to sell or any invitation to purchase or subscribe for any securities or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities or the solicitation of any vote or approval in any jurisdiction pu rsu ant to the proposed merger of Dialog Semiconductor plc (“Dialog”) and Atmel Corporation (“Atmel”) announced on September 20, 2015 (the “Merger”) or otherwise. Any acceptance or response to the Merger should be made only on the basis of the information ref err ed to, in respect of shareholders of Dialog, a shareholder circular seeking the approval of Dialog shareholders for the Merger and issuance of ADS s t o Atmel shareholders (the “Circular”) or, in respect of shareholders of Atmel, the proxy statement and US prospectus which will form part of the Form F - 4 Registration Statement (the “Proxy Statement/Prospectus”) that will be filed in connection with the Merger in due course. This communication may be deemed to be solicitation material in respect of the proposed Merger involving Dialog and Atmel. In co nnection with the proposed Merger, Dialog intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 containing the Proxy Statement/Prospectus fo r the stockholders of Atmel and each of Dialog and Atmel plan to file other documents with the SEC regarding the proposed merger. The definitive proxy statement/prospectus will be mailed to shareholder s o f Atmel. Shareholders of Dialog and Atmel are advised to read carefully the formal documentation in relation to the Merger once it has been dispatched. The proposals for the Merger will, in respect of sha reholders of Dialog, be made solely through the Circular, and, in respect of shareholders of Atmel, be made solely through the Proxy Statement/Prospectus. Both the Circular and the Proxy Statement/Prosp ect us will contain the full terms and conditions of the way in which the Merger will be implemented, including details of how to vote with respect to the implementation of the Merger. Any acceptance or oth er response to the proposals should be made only on the basis of the information in respect of shareholders of Dialog, in the Circular, or, in respect of shareholders of Atmel, in the Proxy Statement/Prospectu s. This communication comprises an advertisement for the purposes of paragraph 3.3R of the Prospectus Rules made under Part VI of the FSMA and not a prospectus. Any prospectus in connection with the admission of ordinary shares of Dialog to listing on the Frankfurt Stock Exchange will be published at a later date. Copies o f t he prospectus will, following publication, be available from the website of the National Storage Mechanism at www.hemscott.com / nsm.do and available for inspection by Dialog shareholders at Dialog’s registered office. BEFORE MAKING AN INVESTMENT OR VOTING DECISION, WE URGE INVESTORS OF DIALOG AND ATMEL TO READ CAREFULLY THE CIRCULAR, UK PROS PEC TUS, PROXY STATEMENT AND F - 4 REGISTRATION STATEMENT AND US PROSPECTUS (INCLUDING ANY SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT DIALOG OR ATMEL WILL FILE WITH THE UKLA OR SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Forward - looking statements This presentation contains, or may contain, forward - looking statements concerning Dialog and Atmel (together such companies and their subsidiaries being the “Merged Company”) that are subject to risks and uncertainties. Generally, the words “will”, “may”, “should”, “continue‟, “believes”, “targets”, “plans”, “expects”, “estimate s”, “aims”, “intends”, “anticipates” or similar expressions or negatives thereof identify forward - looking statements. Forward - looking statements include statements relating to the following: (i) the expected benefits o f the Merger, the expected accretive effect of the Merger on the Merged Company’s financial results, expected cost, revenue, technology and other synergies, the expected impact for customers and en d - u sers, future capital expenditures, expenses, revenues, earnings, synergies, economic performance, financial condition, losses and future prospects; (ii) business and management strategies and the expan sio n and growth of Dialog’s or Atmel’s operations and potential synergies resulting from the Merger; (iii) the effects of government regulation on Dialog’s, Atmel’s or the Merged Company’s business; (iv) the a nti cipated timing of regulatory approvals; and (v) the anticipated timing of shareholder meetings and completion of the Merger. These forward - looking statements are based upon the current beliefs and expectations of the management of Dialog and involve ris ks and uncertainties that could cause actual results to differ materially from those expressed in the forward - looking statements. Many of these risks and uncertainties relate to factors that are beyond Dialo g’s and Atmel’s ability to control or estimate precisely and include, without limitation: the ability to obtain governmental approvals of the Merger or to satisfy other conditions to the Merger on the pr opo sed terms and timeframe; the possibility that the Merger does not close when expected or at all, or that the companies may be required to modify aspects of the Merger to achieve regulatory approval; the ab ility to realize the expected synergies from the Merger in the amounts or in the timeframe anticipated; the potential harm to customer, supplier, employee and other relationships caused by the announcement or closing of the Merger; the ability to integrate Atmel’s businesses into those of Dialog's in a timely and cost - efficient manner; the development of the markets for Dialog's and Atmel's products; the Merged Com pany’s ability to develop and market products containing the respective technologies of Dialog and Atmel in a timely and cost - effective manner; economic conditions and the difficulty in predicting sal es, even in the short - term; factors affecting the quarterly results of Dialog, Atmel and the Merged Company; sales cycles; price reductions; dependence on and qualification of foundries to manufacture the produ cts of Dialog, Atmel and the Merged Company; production capacity; the ability to adequately forecast demand; customer relationships; the ability of Dialog, Atmel and the Merged Company to compete success ful ly; product warranties; the impact of legal proceedings; the impact of intellectual property indemnification practices; and other risks and uncertainties, including those detailed from time to tim e i n Dialog’s and Atmel’s periodic reports (whether under the caption Risk Factors or Forward Looking Statements or elsewhere). Neither Dialog nor Atmel can give any assurance that such forward - looking statements w ill prove to have been correct. The reader is cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date of this presentation. Neither Dialog nor Atmel nor any other person undertakes any obligation to update or revise publicly any of the forward - looking statements set out herein, whether as a result of new information, future events or otherwise, except to the ext ent legally required. Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of Dialog, Atmel, or the Merged Company, following the implementat ion of the Merger or otherwise. No statement in this presentation should be interpreted to mean that the earnings per share, profits, margins or cash flows of Dialog for the current or future financial ye ars would necessarily match or exceed the historical published figures. Overseas jurisdictions The release, publication or distribution of this presentation in jurisdictions other than the United Kingdom may be restricte d b y the laws of those jurisdictions and therefore persons into whose possession this presentation comes should inform themselves about and observe any such restrictions. Failure to comply with any such restrict ion s may constitute a violation of the securities laws of any such jurisdiction. 2

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Important Information, Where to Find It In connection with the proposed transaction, Dialog will file with the SEC a Registration Statement on Form F - 4, which will cont ain a Proxy Statement for the Atmel stockholder meeting to adopt the merger agreement (the “Proxy Statement and F - 4 Registration Statement”).WE URGE INVESTORS TO READ THE PROXY STATEMENT AND F - 4 REGISTRATION STATEMENT (INCLUDING ANY SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT DIALOG OR ATMEL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain, free of charge, copies of the Proxy Statement and F - 4 Registration Statement and any other documents filed by Dialog or Atmel with the SEC in connection with the proposed transaction at the SEC’s website at http://www.sec.gov. Important Additional Information Dialog, Atmel and their directors and certain executive officers may be deemed to be participants in the solicitation of prox ies from stockholders in connection with the approval of the proposed transaction. Dialog plans to file the Proxy Statement and F - 4 Regis tration Statement with the SEC in connection with the solicitation of proxies to approve the proposed transaction. Information about Dia log’s directors and executive officers is set forth in Dialog’s Annual report and accounts 2014. Information regarding the names of Atmel’s directors and executive officers and their respective interests in Atmel by security holdings or otherwise is set forth in At mel ’s proxy statement relating to the 2015 annual meeting of stockholders, which may be obtained free of charge at the SEC’s website at http://www.sec.gov. Additional information regarding the interests of such potential participants will be included in the Pro xy Statement and F - 4 Registration Statement and other relevant documents to be filed with the SEC in connection with the solicitation of prox ies to approve the proposed transaction . 3

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Acquisition Announcement DIALOG is acquiring ATMEL in a cash and stock transaction worth ~$ 4.6Bn 1 Combined company will be fast - growing and diversified with ~$ 2.7Bn (1 ) of revenues 2 Strong pipeline of leading products, customers, and design wins 4 Complementary product portfolios, targeting three attractive segments : – Mobile Power – IoT – Automotive 3 Annual cost synergies of $150MM expected to be achievable within two years 5 Accretive to underlying EPS in 2017, the first full year following closing 6 4 Note 1. Last twelve months ( LTM )

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Dialog and Atmel at a Glance 5 Company Highlights Company Highlights • #1 market share in power management ( PMICs ) for smartphones and tablets • Best - in - class dedicated power management team with broad IP portfolio • Leading portfolio of PMIC , power conversion (AC/DC), LED lighting, Bluetooth ® smart and audio products • Large custom mixed - signal design team, established strategic relationships with top - tier OEMs • Track record of solid execution with strong revenue growth and strong cash generation • Exploiting China smartphone and IoT opportunity • A leading supplier of ARM ® and proprietary microcontrollers ( MCUs ) • Large MCU business with 35,000+ customers and broad ecosystem support • Differentiated technology for IoT Security, Automotive Touch, and Low - Power Wireless • Established and proven global channel distribution network • New product design win activity supporting expected growth and margin expansion

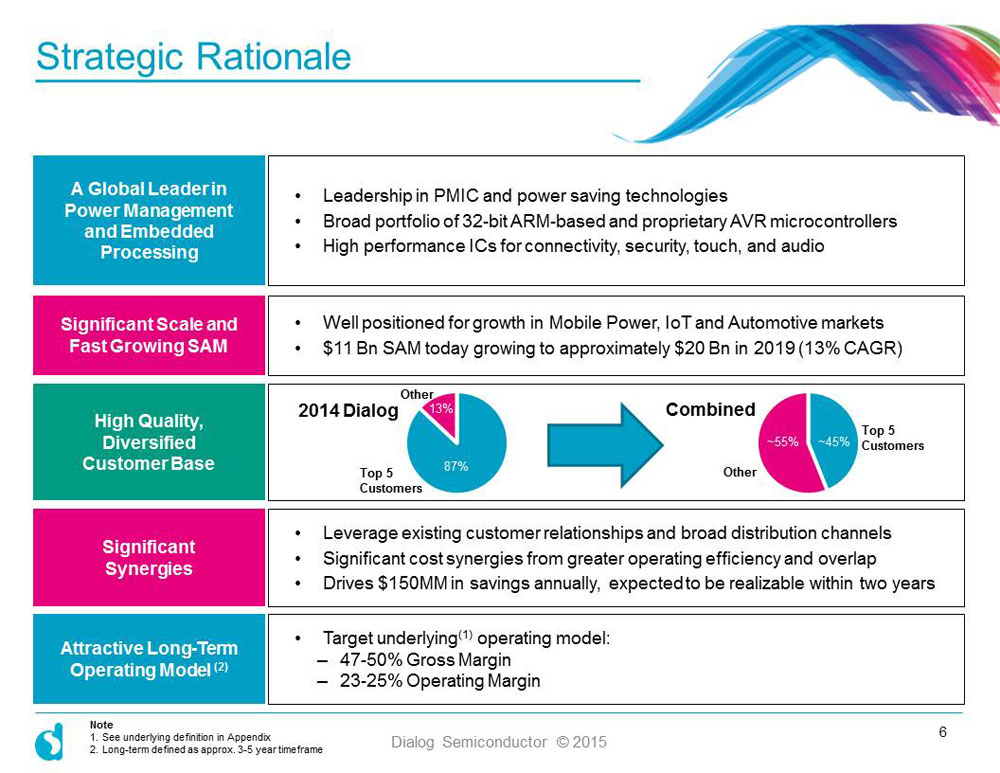

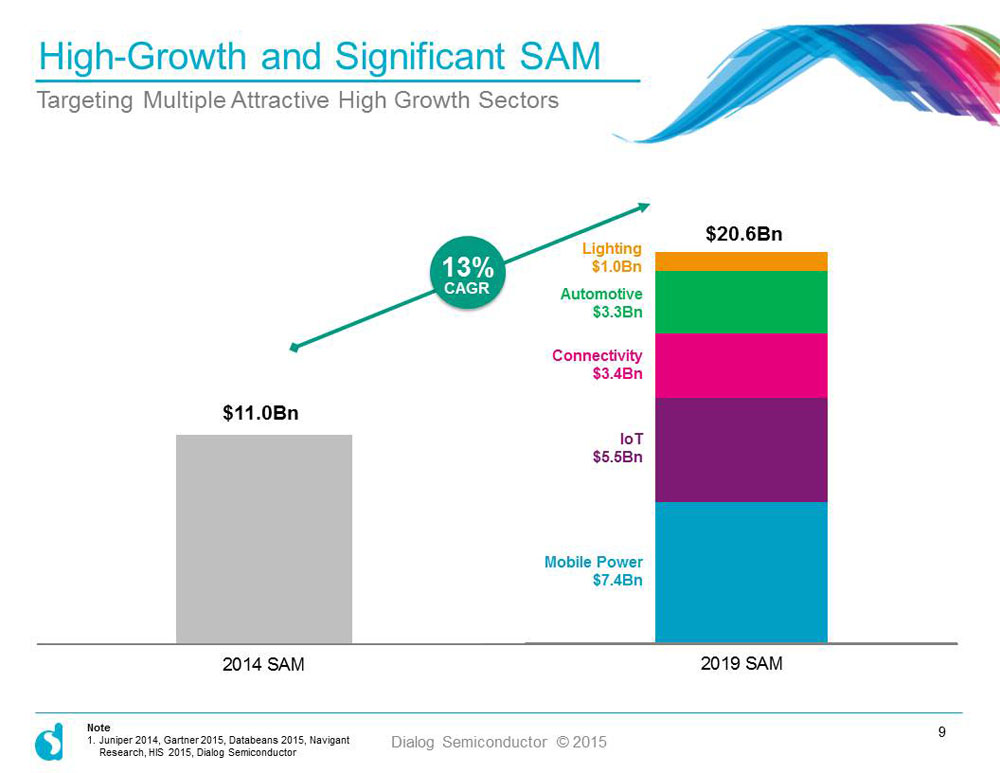

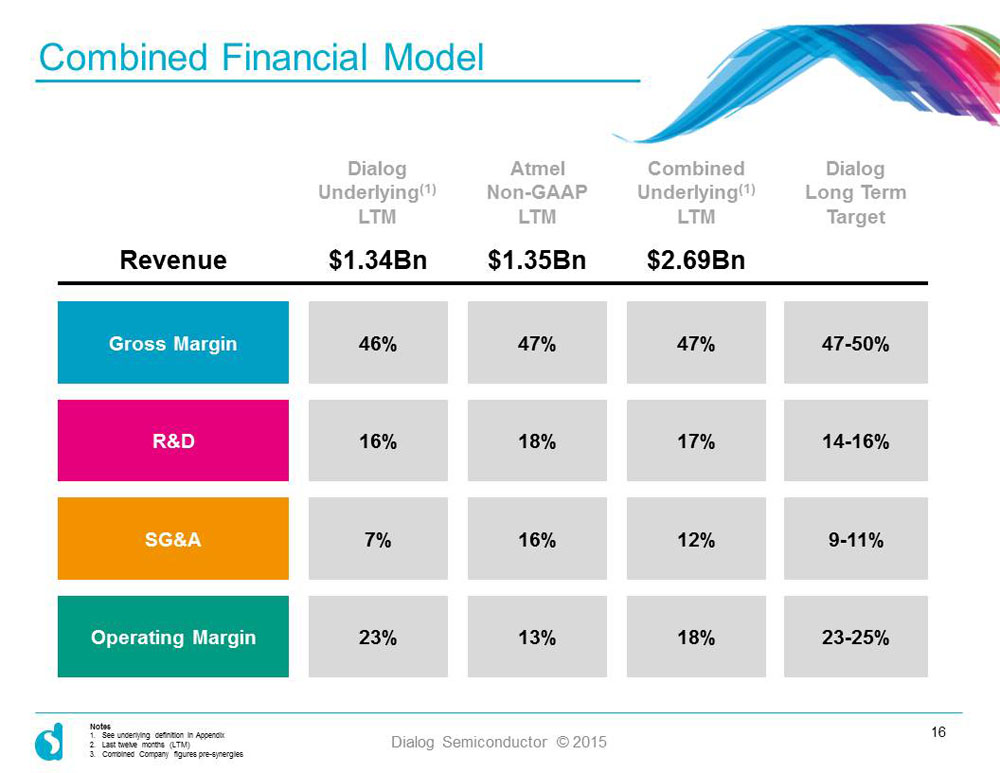

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Strategic Rationale 6 A Global Leader in Power Management and Embedded Processing High Q uality , Diversified Customer Base Significant Synergies Significant Scale and Fast Growing S AM Attractive Long - Term Operating Model (2) • Leadership in PMIC and power saving technologies • Broad portfolio of 32 - bit ARM - based and proprietary AVR microcontrollers • High performance ICs for connectivity , security, touch, and audio • Leverage existing customer relationships and broad distribution channels • Significant cost synergies from greater operating efficiency and overlap • Drives $150MM in savings annually, expected to be realizable within two years • Well positioned for growth in Mobile Power, IoT and Automotive markets • $11 Bn SAM today growing to approximately $20 Bn in 2019 (13% CAGR ) • Target underlying (1) operating model: – 47 - 50% Gross Margin – 23 - 25% Operating Margin 2014 Dialog Top 5 Customers Top 5 Customers Other Other 87% ~45% 13% ~55% Combined Note 1. See underlying definition in Appendix 2. Long - term defined as approx. 3 - 5 year timeframe

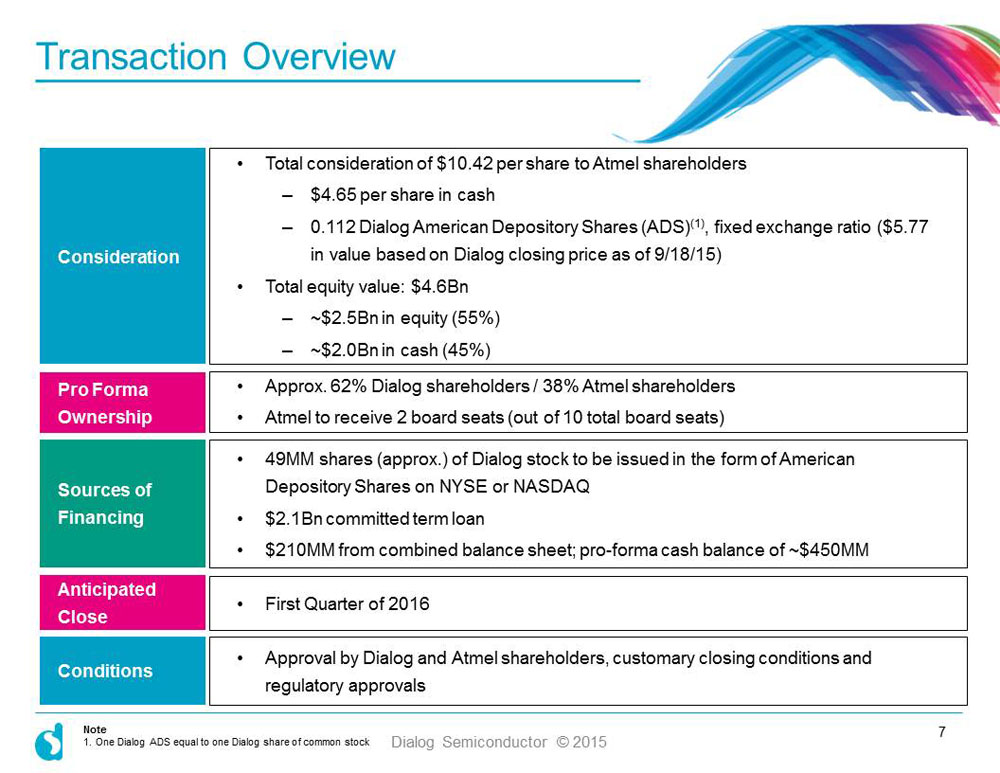

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Transaction Overview 7 Consideration Pro Forma Ownership Anticipated Close Conditions Sources of Financing • Total consideration of $10.42 per share to Atmel shareholders – $4.65 per share in cash – 0.112 Dialog American Depository Shares (ADS) (1) , fixed exchange ratio ($5.77 in value based on Dialog closing price as of 9/18/15) • Total equity value: $4.6Bn – ~$2.5Bn in equity (55%) – ~$2.0Bn in cash (45%) • Approx. 62% Dialog shareholders / 38% Atmel shareholders • Atmel to receive 2 board seats (out of 10 total board seats) • First Quarter of 2016 • Approval by Dialog and Atmel shareholders, customary closing conditions and regulatory approvals • 49MM shares (approx.) of Dialog stock to be issued in the form of American Depository Shares on NYSE or NASDAQ • $2.1Bn committed term loan • $210MM from combined balance sheet; pro - forma cash balance of ~$450MM Note 1. One Dialog ADS equal to one Dialog share of common stock

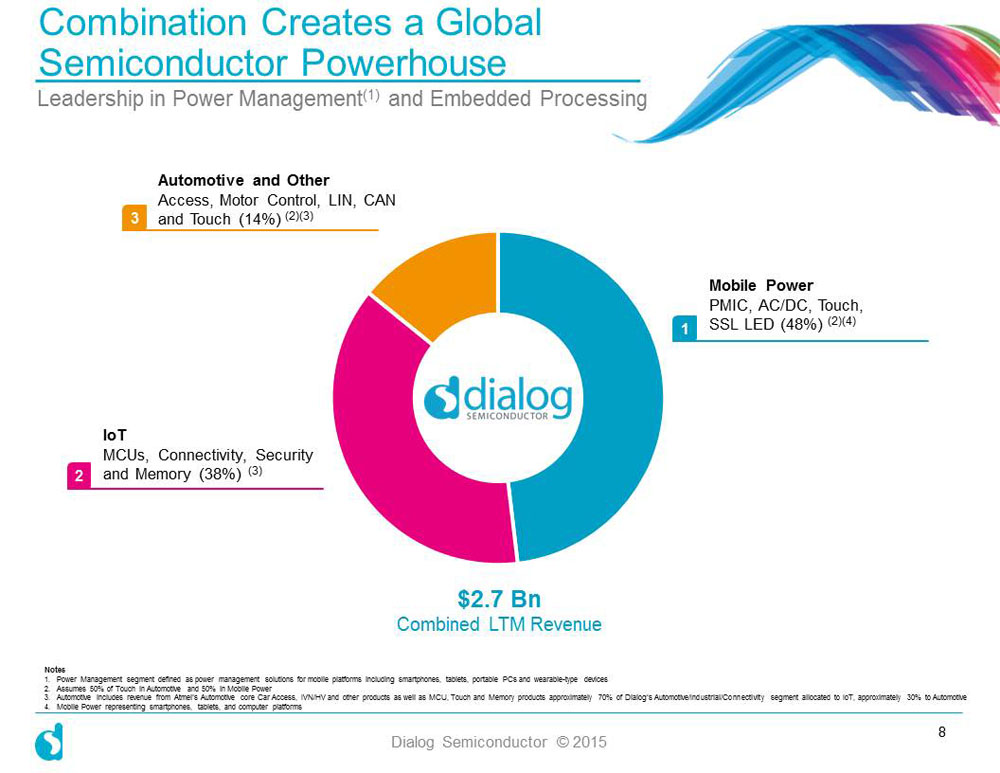

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 8 1 Mobile Power PMIC , AC/DC, Touch, SSL LED (48%) ( 2 )( 4 ) 2 IoT MCUs , Connectivity, Security and Memory (38%) (3) 3 Automotive and Other Access, Motor Control , LIN, CAN and Touch (14%) (2)(3) $2.7 Bn Combined LTM Revenue Notes 1. Power Management segment defined as power management solutions for mobile platforms including smartphones, tablets, portable PCs and wearable - type devices 2. Assumes 50% of Touch in Automotive and 50% in Mobile Power 3. Automotive includes revenue from Atmel‘s Automotive core Car Access, IVN / HV and other products as well as MCU , Touch and Memory products approximately 70% of Dialog’s Automotive/Industrial/Connectivity segment allocated to IoT , approximately 30% to Automotive 4. Mobile Power representing smartphones, tablets, and computer platforms Combination Creates a Global Semiconductor Powerhouse Leadership in Power Management (1) and Embedded Processing

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 High - Growth and Significant SAM Targeting Multiple Attractive High Growth Sectors 2019 SAM $ 20.6Bn Automotive $ 3.3Bn Connectivity $ 3.4Bn 9 Lighting $1.0Bn $11.0Bn 13% CAGR Mobile Power $7.4Bn IoT $5.5Bn 2014 SAM Note 1. Juniper 2014, Gartner 2015, Databeans 2015, Navigant Research, HIS 2015, Dialog Semiconductor

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 • Highly integrated and increasingly complex Power Management IC IP to Exploit Mobile Power • End - to - end solution leading in Rapid Charge ™ rollout Wearable, hybrid devices Sensors, camera, GPS, audio Always - on sensing USB - C. wireless, energy harvesting Single or multiple (series/parallel) New customer applications Increased context awareness Expanding use cases New charging scenarios Different battery configs AC - DC ICs for mobile chargers 10 PMIC , AC/DC, Touch

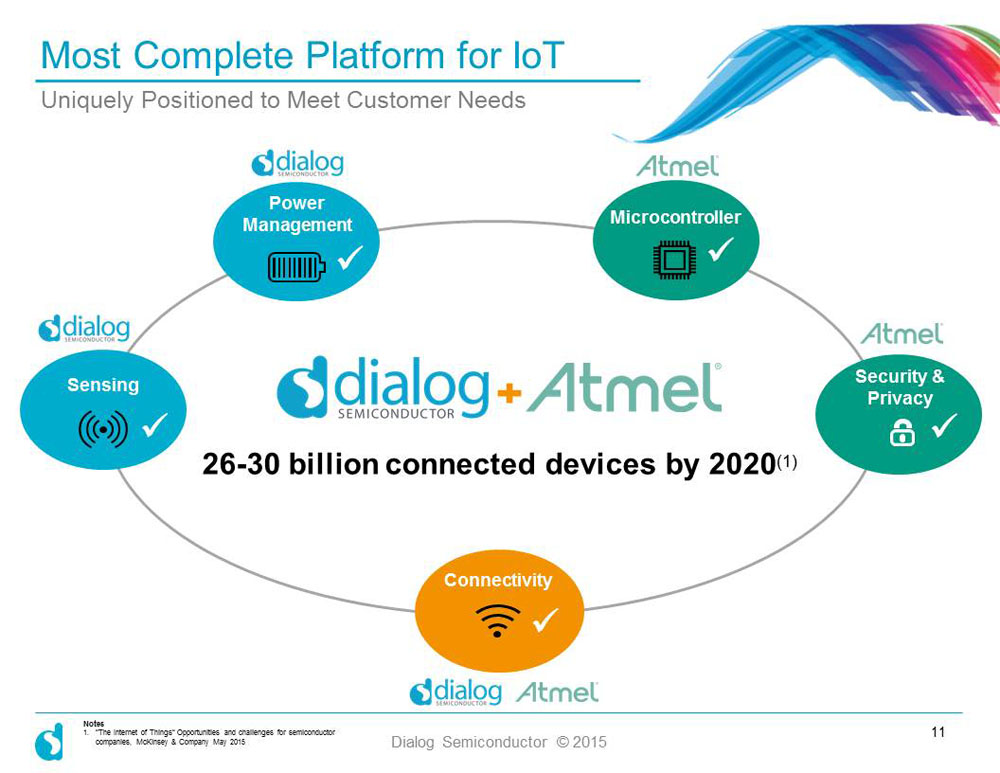

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Most Complete Platform for IoT 11 Security & Privacy 26 - 30 billion connected devices by 2020 (1) Microcontroller x x Connectivity x Sensing x Power Management x Uniquely Positioned to Meet Customer Needs Notes 1. “The Internet of Things” Opportunities and challenges for semiconductor companies, McKinsey & Company May 2015

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Growing Automotive Market Opportunity 12 • Access, Safety, Security and Touch • Networking LIN/CAN • Wiper Motor Control Car Access Key Fob Door Car Receiver Infotainment Internet Access Audio System Rear - Seat Display Central Information Display Instrument Cluster Engine Product Legend IVN MCU Security Touch RF Body Electronics & Chassis Entry Power Steering Doors Braking System Lights Windows Seats Mirror Broad Product Portfolio – Differentiated User Experience Notes 1. Local Interconnect Network (LIN) 2. Controller Area Network (CAN) 3. In - Vehicle Networking ( IVN ) x x x

Dialog Semiconductor © 2015 0 157 197 230 0 126 243 146 0 0 153 130 126 25 116 0 138 171 Diversified Top Tier Customers Selected Customers IoT ( MCUs , Connectivity, Security and Memory) Mobile Power ( PMIC , AC/DC, Touch, SSL LED) Automotive (Access , Motor Control, LIN, CAN and Touch) Key Pillars 1 2 3 13 Top and Emerging Smartphone OEMs and Partners

Dialog Semiconductor © 2015 Four Pillars of Our Strategy More products in higher growth segments Dialog Semiconductor ©2015 Leverage broad product portfolio and customer base • Combine power management, MCUs , connectivity and security functionality to innovate and drive growth across mobile power, IoT and automotive applications Broader and deeper at our customer base • Leverage proven and established global distribution channels Continuous innovation • Investments in power management, 32 - bit ARM microcontrollers, rapid charging technologies as well as leading IoT connectivity (Bluetooth ® Smart, WiFi ) Strategic focus on fast growing China consumer electronics market • Direct, distribution and innovative partnerships with key players in China Dialog Semiconductor ©2015 high low low high Profitability Growth More products in higher growth segments 14 2 3 4 1

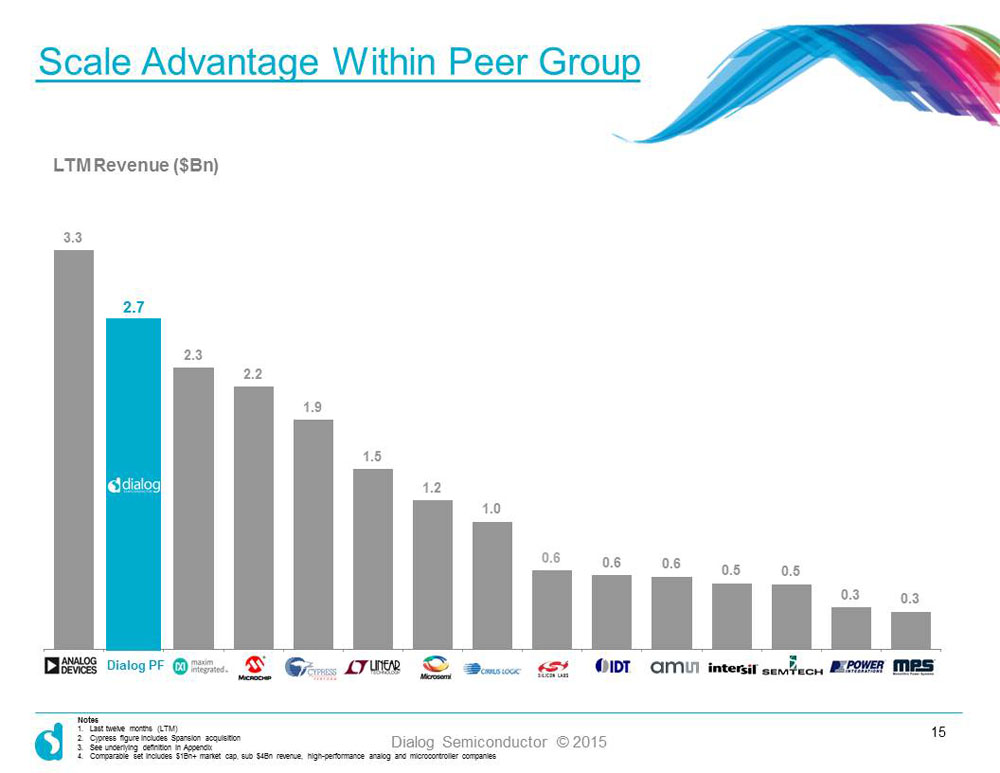

Dialog Semiconductor © 2015 3.3 2.7 2.3 2.2 1.9 1.5 1.2 1.0 0.6 0.6 0.6 0.5 0.5 0.3 0.3 Analog Devices Dialog PF Maxim Microchip Cypress Linear Microsemi Cirrus Silicon Labs IDT AMS Intersil Semtech Power Integrations Monolithic Power Dialog PF LTM Revenue ($ Bn ) 15 Scale Advantage Within Peer Group Notes 1. Last twelve months ( LTM ) 2. Cypress figure includes Spansion acquisition 3. See underlying definition in Appendix 4. Comparable set includes $1Bn+ market cap, sub $4Bn revenue, high - performance analog and microcontroller companies

Dialog Semiconductor © 2015 Combined Financial Model 16 Gross Margin Operating Margin 46% R&D SG&A 47% 47% 47 - 50% 16% 18% 17% 14 - 16% 7% 16% 12% 9 - 11% 23% 13% 18% 23 - 25% Dialog Underlying (1) LTM Atmel Non - GAAP LTM Combined Underlying (1) LTM Dialog Long Term Target Revenue $1.34Bn $1.35Bn $2.69Bn Notes 1. See underlying definition in Appendix 2. Last twelve months ( LTM ) 3. Combined Company figures pre - synergies

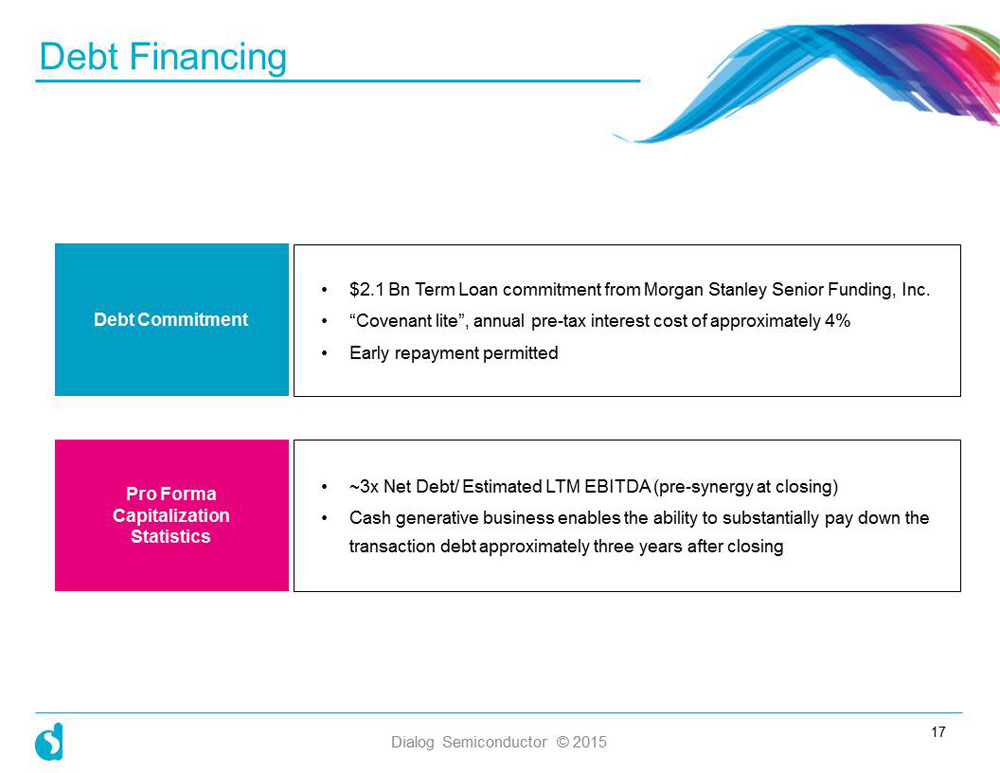

Dialog Semiconductor © 2015 Debt Financing 17 Debt Commitment Pro Forma Capitalization Statistics • $2.1 Bn Term Loan commitment from Morgan Stanley Senior Funding, Inc. • “Covenant lite”, annual pre - tax interest cost of approximately 4% • Early repayment permitted • ~3x Net Debt/ E stimated LTM EBITDA (pre - synergy at closing) • Cash generative business enables the ability to substantially pay down the transaction debt approximately three years after closing

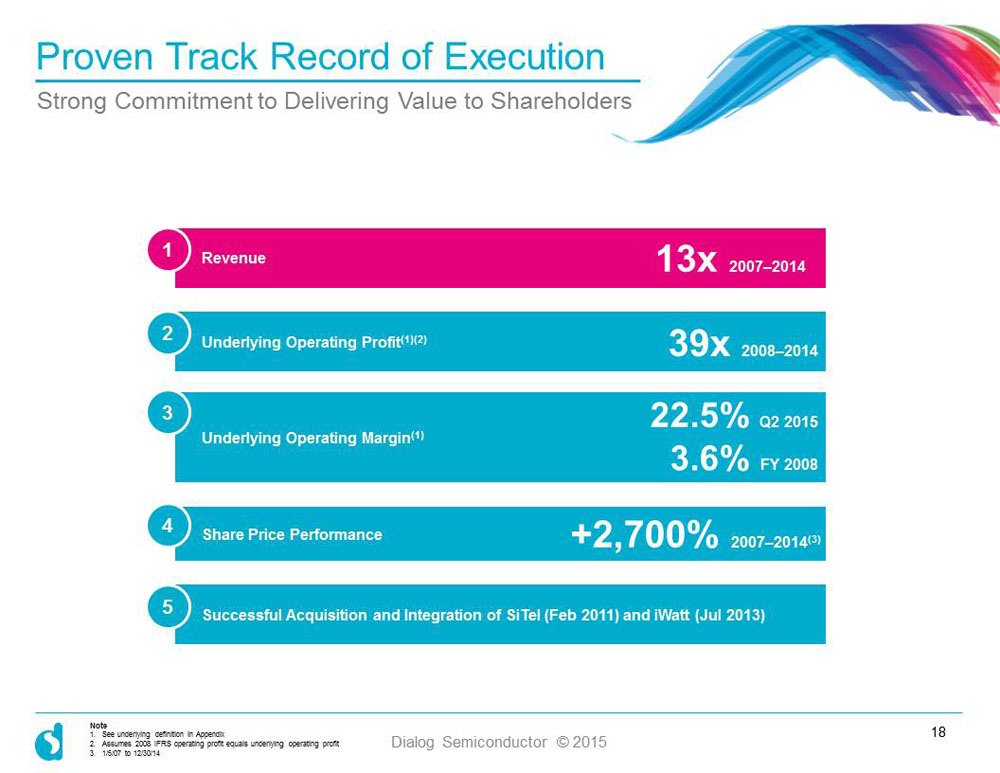

Dialog Semiconductor © 2015 Strong Commitment to Delivering Value to Shareholders Successful Acquisition and Integration of SiTel (Feb 2011) and iWatt (Jul 2013) Revenue 13x 2007 – 2014 Underlying Operating Profit (1 )(2) 39x 2008 – 2014 Share Price Performance +2,700 % 2007 – 2014 (3) Underlying Operating Margin (1) 22.5% Q2 2015 3.6% FY 2008 Proven Track Record of Execution 18 1 2 3 4 5 Note 1. See underlying definition in Appendix 2. Assumes 2008 IFRS operating profit equals underlying operating profit 3. 1/5/07 to 12/30/14

… personal … portable … connected Dialog Semiconductor © 2015 The Power To Be . . . 19 Contact: Jose Cano Head of Investor Relations jose.cano@diasemi.com +44 (0)1793 756 961 Mark Tyndall SVP , Corporate Development & Strategy mark.tyndall@diasemi.com +1 408 - 621 - 6749

Dialog Semiconductor © 2015 Appendix Underlying Results The term “underlying” is not defined in IFRS and therefore may not be comparable with similarly titled measures reported by other companies. Underlying measures are not intended as a substitute for, or a superior measure to, IFRS measures. Underlying results (net of tax) have been fully reconciled to IFRS results (net of tax) above. All other underlying measures disclosed within this report are a component of this measure and adjustments between IFRS and underlying measures for each of these measures are a component of those disclosed above . Underlying results are based on IFRS , adjusted to exclude share - based compensation charges and amortization of intangibles associated with acquisitions and certain other non - recurring items. Non - GAAP Metrics Non - GAAP net income excludes share - based compensation expense, acquisition - related charges, restructuring charges (credits), operating results of the exited XSense business for 2015, loss from manufacturing facility damage and shutdown, French building underutilization and other (credits), loss (gain) related to foundry arrangements, gain on sale of assets and investments, non - GAAP tax adjustments, as well as net (loss) income attributable to noncontrolling interest. 20