Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d75910d8k.htm |

Sealed

Air Company Overview As of September 18, 2015

Contact: Lori Chaitman, VP, Investor Relations

Email: lori.chaitman@sealedair.com

Exhibit 99.1 |

Safe

Harbor and Regulation G Statement This

presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition and results of operations. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this press release regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding expected future operating results, expectations regarding the results of restructuring and other programs, anticipated levels of capital expenditures and expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings. The following are important factors that we believe could cause actual results to differ materially from those in our forward-looking statements: the cash tax benefits associated with the Settlement agreement (as defined in our 2014 Annual Report on Form 10-K), global economic and political conditions, changes in our credit ratings, changes in raw material pricing and availability, changes in energy costs, competitive conditions, success of our restructuring activities, currency translation and devaluation effects, the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and productivity efforts, the effects of animal and food-related health issues, pandemics, consumer preferences, environmental matters, regulatory actions and legal matters, and the other information referenced in the “Risk Factors” section appearing in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance, which exclude items we consider unusual or special items. We believe the use of such financial measures and information may be useful to investors. We believe that the use of non-U.S. GAAP measures helps investors to gain a better understanding of core operating results and future prospects, consistent with how management measures and forecasts the Company's performance, especially when comparing such results to previous periods or forecasts. Please see Sealed Air’s July 30, 2015 earnings press release for important information about the use of non-U.S. GAAP financial measures relevant to this presentation, including applicable reconciliations to U.S. GAAP financial measures. Information reconciling forward-looking non-U.S. GAAP measures to U.S. GAAP measures is not available without unreasonable effort. Website Information We routinely post important information for investors on our website, www.sealedair.com, in the "Investor Relations" section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document. 2 |

3 2013 2020 VISION To create a better way for life MISSION We Re-imagine™ the industries we serve to create a world that feels, tastes and works better. |

4 • Focus on innovation to accelerate core growth and enter adjacent markets • Introduce new business models and share in the value

created

• Technology-driven R&D investments dedicated to remote monitoring, data gathering, and tracking and analytics • Create ONE company culture • Improve productivity with focus on support expense ratio • End market focus vs.

product focus

• Value-added selling approach |

5 Total Sales Adj. EBITDA Free Cash Flow Adj. EBITDA Margin Improvement Cumulative FCF Generation, 2012 - 2014 Organic Growth Organic Growth 2014 HIGHLIGHTS* * 2014 Sales & Adj. EBITDA includes financial results from the Food Care’s NA Trays and Absorbent Pads Business,

which accounted for approx. $200M in Sales and $40M in Adj. EBITDA. This business was

divested on April 2, 2015. |

6 Total Sales Adj. EBITDA Free Cash Flow Adj. EBITDA Margin Improvement Improvement Organic Growth Organic Growth H1 2015 HIGHLIGHTS* * Q1 2015 Sales & Adj. EBITDA includes financial results from the Food Care’s NA Trays and Absorbent Pads Business,

which accounted for approx. $50M in Sales and $10M in Adj. EBITDA. This business was

divested on April 2, 2015. |

Sealed

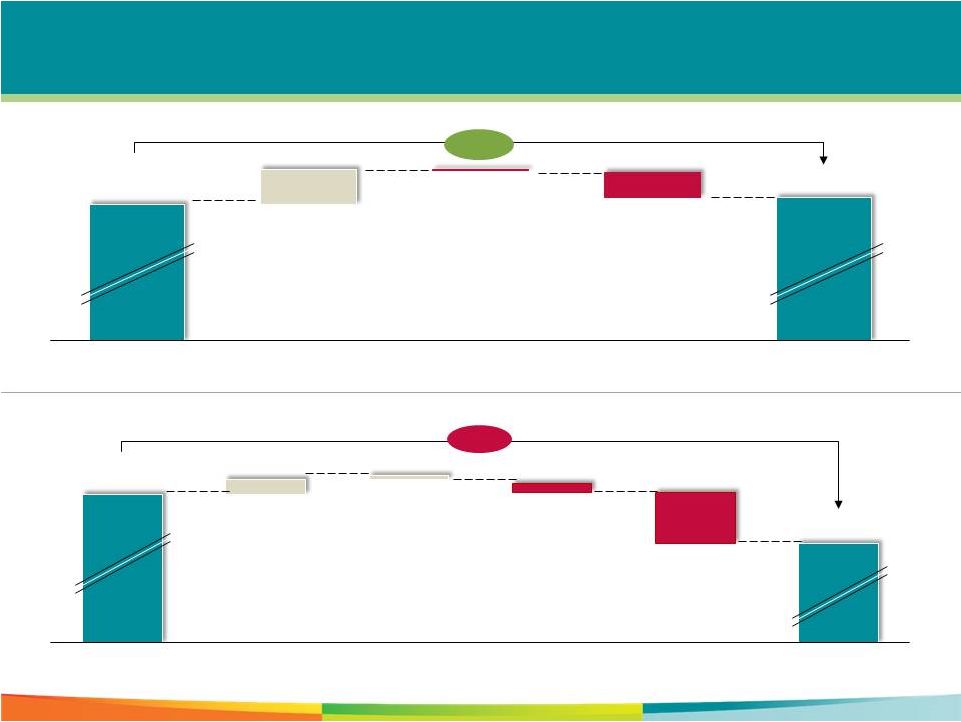

Air: H1 2015 Organic Sales Growth 3.4% 7

2014 Net Sales ($M) H1 2015 Net Sales ($M) H1 2015 Net Sales Divestiture -55 -7.1% Foreign Exchange -345 Volume Price/Mix H1 2014 Net Sales Constant Dollar Sales Growth: 2.0% Organic Sales Growth: 3.4% 2014 Net Sales +0.8% Foreign Exchange -183 Volume Price/Mix 2013 Net Sales Constant Dollar Sales Growth: 3.2% Organic Growth: 3.2% -6 7,691 7,751 3,801 3,531 29 249 101 |

Price/Mix

& Volume Trends 8

* Food Care & North America Q2 2015 results reflect organic growth trends, which

exclude the impact of currency translation and NA Trays and Absorbent

Pads Business divestiture. Product Price/Mix

(% Change) By Division Q1 2015 Q2 2015 Food Care 3.3% 2.7% Diversey Care 1.7% 2.2% Product Care 3.5% 1.3% Sealed Air 2.9% 2.4% By Region Q1 2015 Q2 2015 North America 2.5% 1.3% EMEA 1.8% 1.5% Latin America 11.4% 11.9% AsiaPac 0.7% 1.3% Sealed Air 2.9% 2.4% Volume (% Change) By Division Q1 2015 Q2 2015 Food Care 2.5% 1.5% Diversey Care (0.2%) 1.6% Product Care (2.4%) (1.6%) Sealed Air 0.6% 0.9% By Region Q1 2015 Q2 2015 North America 0.6% 1.1% EMEA 1.2% 1.4% Latin America (4.8%) (3.2%) AsiaPac 2.8% 2.3% Sealed Air 0.6% 0.9% (% Change) By Division Q1 2015 Q2 2015 Food Care 5.8% 4.2%* Diversey Care 1.5% 3.8% Product Care 1.1% (0.3%) Sealed Air 3.5% 3.3%* By Region Q1 2015 Q2 2015 North America 3.2% 2.3%* EMEA 3.1% 2.9% Latin America 6.6% 8.7% AsiaPac 3.5% 3.6% Sealed Air 3.5% 3.3%* Constant Dollars Sales Growth* |

Sealed

Air: H1 2015 Adj. EBITDA Margin 16.8% 9

H1 2015 Adj. EBITDA ($M) H1 2014 Adj. EBITDA Volume -27 Mix & Price/ Cost Spread Cost Synergies 10.7% SG&A/ Other H1 2015 Adj. EBITDA Foreign Exchange -56 Divestiture -12 Margin: 14.1% Margin: 16.8% Constant Dollar Adj. EDITDA Growth: 21.3% Organic Adj. EBITDA Growth: 23.4% 2014 Adj. EBITDA ($M) 2013 Volume -127 Mix & Price/ Cost Spread Cost Synergies 7.5% SG&A/ Other 2014 Foreign Exchange -30 Constant Dollar Adj. EDITDA Growth: 10.4% Organic Adj. EBITDA Growth: 12.0% 1,118 1,041 150 97 114 5 33 -12 535 592 |

Cleaning & Hygiene

Solutions Integrating of technology- enabled connected services & systems Increasing productivity, food safety & infection prevention General & Performance Packaging Solutions Leveraging data & technology to minimize damage, optimize cube, increase fulfillment velocity & improve customer experience Packaging & Hygiene Solutions Full Range of Equipment/Systems Engineering Plant Designs Lowering total costs & reducing waste How We Deliver Value 2014 Sales 2014 Adj. EBITDA 2014 Sales 2014 Adj. EBITDA Margin 2014 Sales 2014 Adj. EBITDA Margin 10 |

Food

Care Business Snapshot 2014* SALES: $3.6B

11 2014 Percent of Sales By Region TOP 20 CUSTOMERS GENERATE

~25% OF

SALES 2014 Net Sales

By End Market Who We Serve GLOBAL ADDRESSABLE MARKET: $38B | ESTIMATED GLOBAL MARKET SHARE 10% Source: Sealed Air estimates *Note: As reported, excluding the North American Trays and Absorbents, divested in 2015

37% 15% 32% North America Latin America EMEA Asia Pacific 30% 15% Fresh Red Meat Smoked & Processed Meat Poultry Dairy Solids Beverages Other 20% 13% 11% 11% 16% |

Food

Care End Market Drivers 12

• Economy impacting market • Large herd with low productivity • Bags per head: 14 • Growing penetration and bags per head • Penetration of boxed beef, case ready and export for fresh beef BRAZIL: #1 POSITION • Stable herd • Driving growth through case ready innovations in Western Europe • Market position in Russia • Technologies that drive demand EUROPE: #1 POSITION • Strong performance • Non-sustainable slaughter • Bag per head: 25 • Strong export market performance • Automation, case ready penetration • Features that add value are driving demand AUSTRALIA: #1 POSITION • Herd rebuilding • Largest bag per head: 35+ • Automation • Case ready penetration • Features that add value and drive demand NA: #1 POSITION GLOBAL BEEF MARKET WE CONSISTENTLY OUTPACE GLOBAL COMPETITORS FOOD WASTE REDUCTION 25% - 40% OF FOOD GROWN, PROCESSED & TRANSPORTED IN U.S. WILL NEVER BE CONSUMED INNOVATIONS TO REDUCE FOOD WASTE Cold Chain Monitoring Moisture Barrier Film Smart(er) Labeling Sanitation & Hygiene Vacuum Skin Packaging Re- closability Transport Protection Active Packaging Meal Portioning Moving Product Through the Supply Chain Packaging Technologies that Extend Freshness Consumer- Centric Packaging Designs |

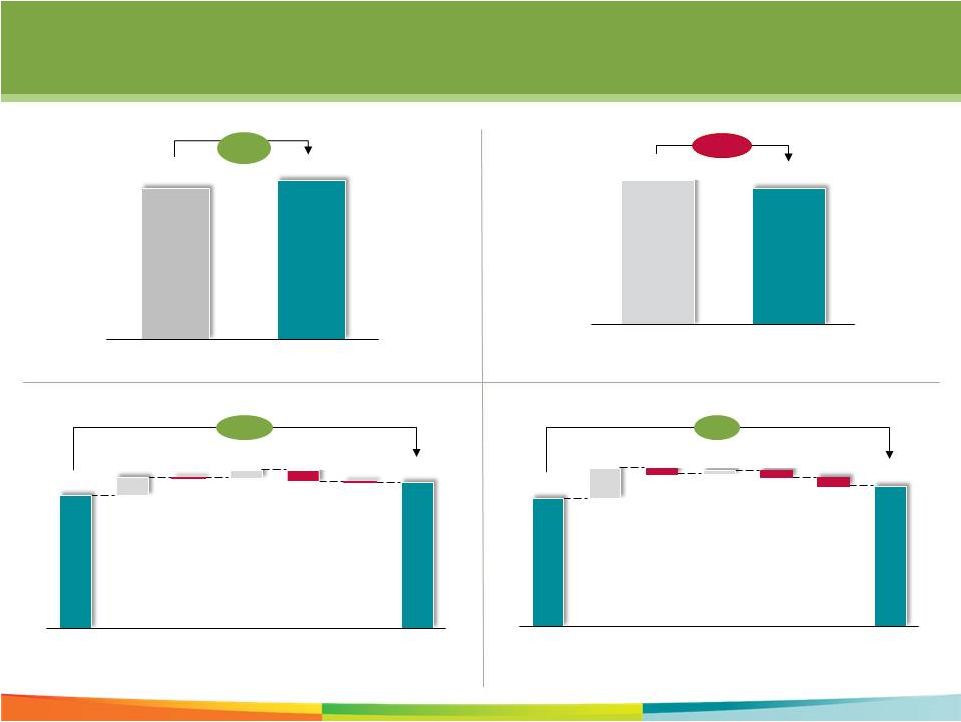

Models

that leverage our

deep segment and operational expertise with knowledge management Technologies that can be extended to adjacent markets with higher growth rates Food Care: Innovation & Operating Disciplines Drive Performance Volume fueled by core growth opportunities and adoption of Change the Game initiatives, offset by continued rationalization Price/Mix driven by new product acceptance and ongoing pricing disciplines EBITDA margin expansion opportunities as a result of increased volume, favorable mix and price cost spread, and disciplined cost management 13 NEW MARKET SEGMENTS INNOVATION- ENABLED NEW BUSINESS MODELS Technologies that enhance our position in core, mature segments GAME CHANGING SOLUTIONS FINANCIAL DRIVERS |

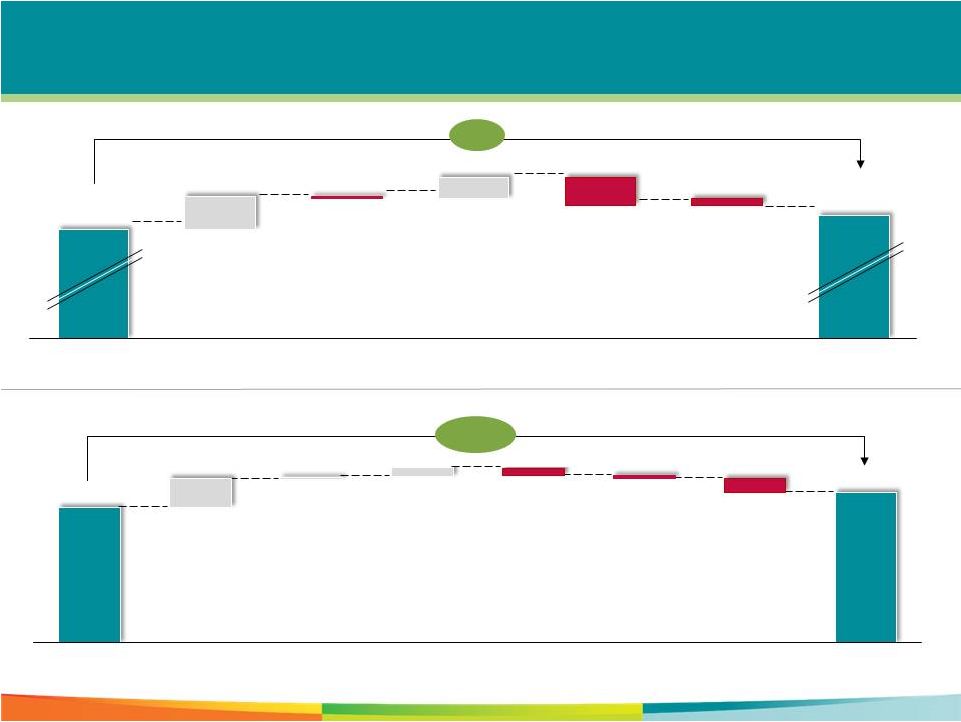

Constant

Dollar Net Sales Growth: 3.6% H1 2015 Net Sales ($M)

Food Care: H1 2015 Adjusted EBITDA Margin 21.1%

14 2014 Adjusted EBITDA ($M) H1 2015 Adjusted EBITDA ($M) 15.0% H2 2015 Foreign Exchange -29 SG&A/ Other -5 Cost Synergies -12 Volume Mix & Price/Cost Spread H1 2014 Divest- titure 2014 Net Sales ($M) Adj. EBITDA Margin: H1 2015: 21.1% H1 2014: 17.0% Organic* Net Sales Growth: 5.0% H1 2015 -7.5% H1 2014 2013 2014 +0.6% 2013 2014 -12 +9.0% -20 Foreign Exchange Volume SG&A/ Other -51 Mix & Price/Cost Spread Cost Synergies Adj. EBITDA Margin: 2014: 17.5% 2013: 16.1% Organic* Adj. EBITDA Growth: 27.9% * Organic growth excludes currency translation and Food Care’s NA Trays and Absorbent Pads Business divestiture.

Constant Dollar Adj. EBITDA Growth: 12.2%

317 68 10 15 364 3,814 3,835 615 87 51 670 1,866 1,726 |

Diversey

Care Business Snapshot 2014 AS REPORTED SALES: $2.2B

15 2014 Percent of Sales By Region TOP 20 CUSTOMERS GENERATE

~20% OF

SALES 2014 Net Sales

By End Market Who We Serve GLOBAL ADDRESSABLE MARKET: $27B | ESTIMATED GLOBAL MARKET SHARE 8% Source: Sealed Air estimates North America Latin America EMEA Asia Pacific Building Service Contractors Food Service Food Retail Hospitality Healthcare Distribution Other 27% 8% 52% 13% 12% 13% 12% 13% 10% 31% 9% |

Diversey

Care End Market Drivers 16

THE CHANGING WORLD IS IMPACTING OUR INDUSTRY

Hygiene Standards…

Food Safety... Sustainability Standards… Labor Scarcity… Healthcare Compliance… Increased hygiene standards $226B cost of

absenteeism

Increased food safety

1 in 6 food-poisoned in US Increased healthcare compliance

$40B Hospital Acquired Infection (HAI) in US Increased labor scarcity & Illiteracy Up to 70%

turnover in BSC

The Opportunity of Clean

“The Value of Clean” ISSA Survey

Reduced probability of catching cold or influenza

80% Surfaces contaminated with viruses reduced 62% Reduced absenteeism 46% Productivity gain in a 100 employee office with an average salary of $25k will lead to $125k in savings 2% - 8% Customers avoid a store if restrooms are not clean. 35% of those customers will not return. 50% |

Diversey

Care: Innovation & Operating Disciplines Drive

Performance Volume driven by new

customer wins, bolt-on

acquisitions and ramp of

Change the Game initiatives,

offset by purposeful

rationalization of low-margin

business Price/Mix dependent on ongoing pricing disciplines and customer mix EBITDA margin expansion opportunities as a result of disciplined cost management, elimination of low margin business and higher mix of innovative platform sales 17 GAME CHANGING SOLUTIONS FINANCIAL DRIVERS ROBOTICS INTERNET OF CLEAN™ SUSTAINABILITY Smartly connect facilities and equipment Enable customers’ operational excellence and smart cleaning services Better and more efficient service Next generation of cleaning machines based on Artificial Intelligence Dramatic increase in user safety Simplification of customer process Reduced environmental impact Reduced use of resources & utilities |

H1 2015

Net Sales ($M) Diversey Care: H1 2015 Adjusted EBITDA 11.0%

18 2014 Adjusted EBITDA ($M) H1 2015 Adjusted EBITDA ($M) H2 2015 -5.7% Mix & Price/Cost Spread H1 2014 Foreign Exchange -18 SG&A/ Other -8 Cost Synergies Volume 2014 Net Sales ($M) Adj. EBITDA Margin: H1 2015: 11.0% H1 2014: 10.8% Constant Dollar Net Sales Growth: 2.7% H1 2015 -7.7% H1 2014 -40 SG&A/ Other Cost Synergies -10 Foreign Exchange 2014 +3.2% Volume Mix & Price/Cost Spread 2013 Adj. EBITDA Margin: 2014: 11.3% 2013: 11.0% Constant Dollar Net Sales Growth: 3.0% +0.6% Constant Dollar Adj. EBITDA Growth: 7.5% Constant Dollar Adj. EBITDA Growth: 9.7% 117 7 2 10 110 1,086 1,003 237 26 9 23 245 2,161 2,173 2013 2014 |

Product

Care Business Snapshot 2014 AS REPORTED SALES: $1.7B

19 2014 Percent of Sales By Region CHANNEL PARTNERS 2014 Net Sales By End Market Who We Serve GLOBAL ADDRESSABLE MARKET: $6.5B | ESTIMATED GLOBAL MARKET SHARE 25% Source: Sealed Air estimates North America Latin America EMEA Asia Pacific E-Commerce 3PL Fulfillment Consumer Applications General Manufacturing Transportation Electronics 59% 4% 25% 12% 18% 7% 19% 38% 6% 12% |

Product

Care End Market Drivers 20

A recent consumer study conducted by the Harris Poll

Trends High Growth Market Sectors e-Commerce Third-Party Logistics (3PL) Cold Chain Construction Electronics Transportation INCREASES IN FREIGHT COSTS OMNI-CHANNEL FULFILLMENT CHANGING CUSTOMER EXPECTATIONS dimensional weight pricing reduce pack size without sacrificing production freight carriers non-professional packers space limited environments material storage constraints Next day / same day delivery speeds More conscious of packaging in general Expect packages to reflect how much a brand values their $ |

Product

Care: Innovation & Operating Disciplines Drives

Performance Volume driven by core growth

and Change the Game

initiatives, offset by product

rationalization Price/Mix dependent on ability to maintain pricing disciplines and ensure capture of differentiated value proposition EBITDA margin expansion opportunities as a result of the adoption of performance- based packaging and Change the Game Initiatives, re- allocation of resources into high growth areas and disciplined cost management 21 GAME CHANGING SOLUTIONS FINANCIAL DRIVERS Catalyzing the advancement and growth of strategic partners through automation and a system solution approach FULFILLMENT VELOCITY Enabling value added differentiation and customized solutions to further enhance their customer’s experience upon delivery CUSTOMER EXPERIENCE Reducing damage with a total solution approach through: Application knowledge Advanced design tools State of the art testing Virtual simulation DAMAGE REDUCTION Creating the “perfect optimized package” resulting in: Minimized material waste Reduced freight costs Reduced use of natural resources CUBE OPTIMIZATION |

H1 2015

Net Sales ($M) Product Care: H1 2015 Adjusted EBITDA 20.4%

22 H1 2015 Adjusted EBITDA ($M) 141 34 4 155 H2 2015 Foreign Exchange 9.6% SG&A/ Other -10 Cost Synergies -7 Mix & Price/Cost Spread Volume -8 H1 2014 Adj. EBITDA Margin: H1 2015: 20.4% H1 2014: 17.6% Constant Dollar Net Sales Growth: 0.4% 803 758 -5.5% H1 2014 H1 2015 2014 Net Sales ($M) 2014 Adjusted EBITDA ($M) 1,610 1,655 2013 2014 Constant Dollar Net Sales Growth: 3.7% +2.8% 266 37 17 293 2013 Mix & Price/Cost Spread -2 +9.9% 2014 Foreign Exchange -2 SG&A/ Other -24 Cost Synergies Volume Adj. EBITDA Margin: 2014: 17.7% 2013: 16.5% Constant Dollar Adj. EBITDA Growth: 16.6% Constant Dollar Adj. EBITDA Growth: 10.5% |

GET FIT Driving Results: Adjusted EBITDA of 20% by 2020 23 Adjusted EBITDA, 2013 – 2020E +20 % ~ 18% 13.5% 14.4% 16.3% - 16.5% 2013 2014 2015 Outlook 2018 Outlook 2020 Target |

46

321 71 936 94 425 425 425 425 400 450 450 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2033 Credit Facility ST Borrowings & Current Portion of LT Debt Senior Notes 6.5% 5.25% 6.875% 4.875% 5.125% 5.5% €4.5% ($ millions) Appropriate and Manageable Debt 24 |

Capital

Expenditures Maintenance + Growth Capex Range:

~$180M - $220M Support core growth opportunities and Change the Game initiatives Disciplined Approach to Capital Allocation 25 Debt Optimal Net Debt/EBITDA Ratio: 3.5x - 4x Attractive debt maturity profile provides flexibility Solid cash flows and sources of liquidity Share Repurchase / Dividend As of Sept. 11, 2015, repurchased 9.5M shares inclusive of ASR program currently underway Approx. $1.1 billion available under repurchase program Assess dividend payout ratio annually M&A Strategy Targeted bolt-on technology based acquisitions (i.e. Intellibot, B+) |

Sealed

Air: Continuing to Change the Game or

in all markets we serve

Solid Global & -focused Strong EBITDA to shareholders 26 |