Attached files

| file | filename |

|---|---|

| EX-31.02 - EXHIBIT 31.02 - HWN, INC. | exhibit31-2.htm |

| EX-31.01 - EXHIBIT 31.01 - HWN, INC. | exhibit31-1.htm |

| EX-32.01 - EXHIBIT 32.01 - HWN, INC. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended May 31, 2015

Commission File Number 000-53461

MANTRA VENTURE GROUP LTD.

(Exact name of registrant as specified in its charter)

| British Columbia | 26-0592672 | |

| (State or other jurisdiction of incorporation | (IRS Employer Identification No.) | |

| or organization) | ||

| #562 – 800 15355 24th Avenue | ||

| Surrey, British Columbia, Canada | V4A 2H9 | (604) 560-1503 |

| (Address of principal executive office) | (Zip Code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The aggregate market value of the voting common equity held by non-affiliates as of November 30, 2014, based on the closing sales price of the Common Stock as quoted on the OTCQB was $14,416,955. For purposes of this computation, all officers, directors, and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5 percent beneficial owners are, in fact, affiliates of the registrant.

As of September 16, 2015, there were 72,383,203 shares of registrant’s common stock outstanding.

1

TABLE OF CONTENTS

2

PART I

ITEM 1 - BUSINESS

This Annual Report on Form 10-K (including the section regarding Management's Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our Management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Factors” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

This Annual Report on Form 10-K includes the accounts of Mantra Venture Group Ltd., a Nevada corporation (“Mantra”), together with its subsidiaries, as follows, collectively referred to as “we”, “us” or the “Company”: Mantra Energy Alternatives Ltd., a British Columbia corporation, Mantra Hong Kong Ltd., a Hong Kong corporation, Mantra NextGen Power Inc., a British Columbia corporation, Mantra Energy Alternatives UK Ltd.., a United Kingdom corporation, and Climate ESCO Ltd., A British Columbia corporation. All the subsidiaries are direct subsidiaries of Mantra and are wholly-owned with the exception of Climate ESCO Ltd., which is 65% owned and Mantra Energy Alternatives Ltd., which is 88% owned.

Description of Business

We were incorporated in Nevada on January 22, 2007. On December 8, 2008 we continued our corporate jurisdiction out of the state of Nevada and into the Province of British Columbia, Canada. Our principal offices are located at 1562 128th Street, Surrey, British Columbia, Canada, V4A 3T7. Our telephone number is (604) 560-1503. Our fiscal year end is May 31.

We are building a portfolio of companies and technologies that mitigate negative environmental and health consequences that arise from the production of energy and the consumption of resources.

Our mission is to develop and commercialize alternative energy technologies and services to enable the sustainable consumption, production and management of resources on residential, commercial and industrial scales. To carry out our business strategy we have acquired or licensed from third parties technologies that require further development before they can be brought to market. We are also developing such technologies ourselves, and we anticipate that to complete commercialization of some technologies we will enter into joint ventures, partnerships, or other strategic relationships with third parties who have expertise that we may require. We have also entered into formal relationships with consultants, contractors, retailers and manufacturers who specialize in the areas of environmental sustainability in order to carry out our business strategy.

We have acquired and own a process for the electro-reduction of carbon dioxide (“ERC”) and have the exclusive world license for a mixed-reactant fuel cell (“MRFC”). We are developing these technologies toward commercial applications.

In the past we have contracted out our development work to various laboratories. As of July 1, 2014, we have been carrying out research and development on these technologies in our own internal laboratory with our own staff in Vancouver, BC. These activities include: experimentation to improve the process performance; process and economic modeling to optimize the costs of a commercial system; design and simulation of pilot systems for technology demonstration and validation; business development activities such as the establishment of strategic and technology development partners; and the design and fabrication of laboratory prototypes, among others.

We currently carry on our business through our subsidiary, Mantra Energy Alternatives Ltd. (“MEA”), through which we identify, acquire, develop and market technologies related to alternative energy production and reduction of greenhouse gas emissions and resource consumption. We also have a number of inactive subsidiaries, which we plan to engage in various businesses in the future.

3

Since our inception, we have incurred operational losses and we have completed several rounds of financing to fund our operations.

On May 25, 2015, the company released a demonstration video of its MRFC technology. This video showcased the fuel cell powering an electric scooter, and was designed to demonstrate the capabilities of the technology to strategic partners and investors.

Collaboration with Alstom (Switzerland) Ltd.

On June 24, 2013, we entered into an agreement with Alstom (Switzerland) Ltd. concerning the joint research and development projects relating to (1) a pilot plant for the conversion of carbon dioxide to formate at a Lafarge cement plant (the “Lafarge pilot project”); and (2) the development of processes for the conversion of carbon dioxide to other valuable chemicals.

Pursuant to the agreement with Alstom, MEA and Alstom will co-operate in one or more research and development projects related to MEA’s ERC technology. Prospective projects will be associated with the development of technologies and processes for the conversion of CO2 to chemical products and the investigation of the feasibility of scale-up and commercialization of these processes. Prior to undertaking any research and development project under the agreement, MEA and Alstom will mutually agree to special terms and conditions governing the purpose, aims and objectives of any such project, including technical descriptions, the designation of work phases and project managers, and the allocation of responsibilities and costs between the parties. The commencement of any work phase for any project will be at the sole discretion of Alstom.

Intellectual Property Management

MEA and Alstom also will establish an intellectual property committee to oversee and manage all intellectual property issues and activities resulting from the agreement, including the protection of any new intellectual property. Each party will have exclusive right and discretion to prosecute all patents and patent applications resulting from its work on any project. The parties will jointly prosecute any intellectual property in jointly-owned results. Alstom will have the additional option under the agreement to acquire an exclusive license to intellectual property created by MEA under the agreement, and to a license to MEA’s ERC technology as may be reasonably required to exploit intellectual property assumed by Alstom. The agreement does not affect ownership of any underlying intellectual property of either party.

Lafarge Pilot Project and Carbon Dioxide to Alternative Products

The agreement with Alstom will remain valid for five years or the completion of the last active project, whichever last occurs, and may be extended at any time by the written agreement of both parties. The first joint research and development project under the agreement is the Lafarge pilot project, which plans for the design, construction, and installation of a pilot plant for the conversion of 100 kg/day carbon dioxide to formate, followed by a commercialization scale-up study. Alstom’s contribution to the Lafarge pilot plant project will be approximately CDN$250,000 for in-kind services.

A second integrated research and development project will study carbon dioxide conversion to alternative chemical products by electrochemical reduction, with a focus on catalyst materials and lifetime. Through this project, we deriveour only current source of revenue. From Phases 1 and 2, we received approximately CDN$435,563. In November 2014,the project was approved for advance to the subsequent phase (to Phase 3 from Phase 2). The budget for Phase 3, which began in January 2015, is CDN$180,375 and it was projected to last eight months. Phase 3 will be completed at the end of September 2015. The work that has been done during this phase includes further improvements to the reactor design and operating conditions, scale-up of the reactor, development of a reactor simulation model, and further development and analysis of the process economic model. Mantra and Alstom are also actively seeking external funding to support the execution of the projects.

Electro Reduction of Carbon Dioxide (“ERC”)

We previously acquired 100% ownership in and to a certain chemical process for the electro-reduction of carbon dioxide. The reactor at the core of the chemical process, referred to as the electrochemical reduction of carbon dioxide (CO2), or “ERC”, has been proven functional through small-scale prototype trials and limited scale-up trials. ERC offers a possible solution to reduce the impact of CO2 emissions on Earth’s environment by converting CO2 into chemicals with a broad range of commercial applications, including a fuel for a next generation of fuel cells. Powered by electricity, the ERC process combines captured carbon dioxide with water to produce materials, such as formic acid, formate salts, oxalic acid and methanol, that are conventionally obtained from the thermo-chemical processing of fossil fuels. However, while thermo-chemical reactions must be driven at relatively high temperatures that are normally obtained by burning fossil fuels, ERC operates at near ambient conditions and is driven by electric energy that can be taken from an electric power grid supplied by hydro, wind, solar or nuclear energy.

ERC has been shown to produce a range of compounds, including formic acid, formate salts, oxalic acid, and methanol. The efficiency for generation of each compound depends on the experimental conditions, most importantly the material of the cathode, which catalyzes the electrochemical reactions.

4

Until appropriate cathodes are found some products of CO2 reduction (methanol, for instance) are obtained at efficiencies too low for practical use. Other products can be generated on known cathodes with high current yields that could support valuable practical processes. For example, formic acid and its salts have been obtained on tin cathodes with current efficiencies above 80%, at industrially relevant conditions.

ERC Development to Date

In October of 2008, we completed our first ERC prototype reactor capable of processing 1 kilogram of CO2 per day. We anticipate that commercialization of ERC will require us to develop reactors capable of processing not less than 100 tons of CO2 per day; however, there is no guarantee that we will successfully produce reactors of that size. Production of commercially viable ERC reactors will depend on continued research and development, successful testing of small-scale ERC reactors, and securing of additional financing. This testing is underway in our research facilities, and is complemented by the parallel engineering of a scaled-up demonstration plant by BC Research Inc.

Pictured Above, Design for Bench Scale ERC Reactor

Established and Emerging Market for ERC and its Chemical Products

The technology behind ERC can be applied to any scale commercial venture which outputs CO2 into the atmosphere, though it is expected to be most effective when applied to large scale stationary sources. We anticipate that, once fully commercialized, we will be able to offer ERC as a CO2 management system to various industry including steel, cement, fermentation processes, power generation and pulp and paper.

As described, the ERC process can be used to produce a variety of different chemical products from CO2. The first products that Mantra are targeting are formic acid and its salts. These products have existing markets as commodity chemicals and sell for between $1,000 and $1,500 per tonne, with global consumption being in excess of 600,000 tonnes per year. Formic acid and its salts are used in a variety of industrial applications, including silage preservation, leather tanning, textiles production, oil well drilling, and de-icing, and show enormous potential for market expansion through their use in chemical energy storage.

However, if the ERC process reaches market acceptance as a way to deal with CO2 emissions from industry facilities, it will likely lead to supply of formic acid in excess of current market demand. We have identified several potential future applications for formic acid, which may lead to an expansion in current market demand. The application we have identified and are currently focusing on is energy storage.

5

Mixed-Reactant Fuel Cell (MRFC)

We retain the exclusive worldwide license for the MRFC technology. The MRFC is a novel fuel cell architecture that utilizes a mixture of the fuel and oxidant, and as a result, does not need a membrane. Conventional fuel cells (typically powered by hydrogen or methanol) must keep the fuel and oxidant separate, leading to several complications: a costly, failure-prone ion-selective membrane must be used to separate but ionically connect the cathode and anode chambers; complex reactant distribution and manifolding; and heavy, thick bipolar plates for separating cells. By contract, the MRFC has no membrane, has a simple reactant distribution mechanism, and contains no bipolar plates; as a result, the system is projected to be cheaper, lighter, and more robust than conventional fuel cells.

The MRFC thus offers the potential to provide distributed or grid-connected clean, affordable heat and power. Being very versatile due to its simplicity, the MRFC can address several markets, including emergency backup power, stationary combined heat and power, industrial vehicles such as forklifts, and transportation. The first target market for this technology is distributed emergency backup power for telecommunications.

The MRFC was invented and developed at the University of British Columbia by Professor Emeritus Colin Oloman and his team. In July 2014, we brought the technology into our internal lab for development, which culminated in May 2015 in a video we released showcasing an electric scooter powered exclusively by our MRFC technology. This video was intended to promote the technology to strategic partners and investors. Much of our research budget and activity over the period of January to May 2015 was dedicated to the design and construction of this scooter and the subsequent production of the demonstration video.We are currently exploring possibilities for joint development of the fuel cell with strategic partners.

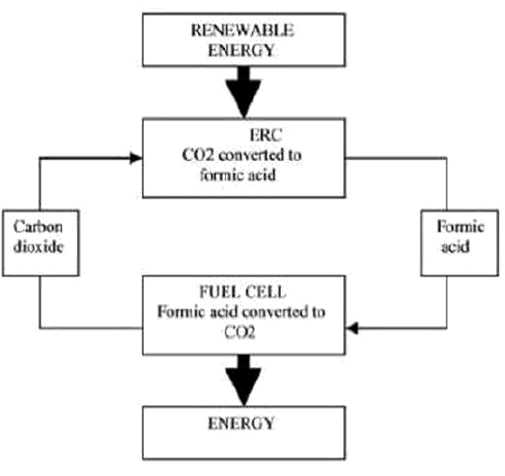

Energy Storage

Formate salts and formic acid, which can be produced from CO2 via ERC, are excellent energy carriers and effective fuels for the MRFC. Thus, the integration of ERC and MRFC represents an energy storage solution whereby intermittent renewable electricity can be stored as formate/formic acid when it is available, and liberated when it is needed. The availability of energy storage is widely recognized as the next most critical factor for increased renewables penetration.

6

Competition

There are several existing alternative methods to ERC which convert CO2 into useful products. Other methods include, for example:

- Thermo-chemical reactions to produce carbon monoxide, formic acid, methane or methanol;

- Bio-chemical reactions to produce methane;

- Photo-chemical reactions to produce carbon monoxide, formaldehyde or formic acid; and

- Photo-electro-chemical reaction to produce carbon monoxide and possibly methane & methanol.

Some thermo-chemical methods are established commercial industrial processes (e.g. production of methanol from CO2) however, like ERC, most of these alternative methods of CO2 conversion are still at the level of laboratory research and development projects. These alternative methods typically suffer from the following problems:

- Low reaction rate and low CO2 space velocity make it too costly and time consuming to process industrial quantities of CO2 ;

- Low selectivity for specified product(s) makes it harder to control product yield;

- High operating temperature and pressure requires large quantities of fossil fuels to power reaction; and

- Highly expensive and cumbersome hydrogen (H2) is required as a feed reactant.

Based on scholarship and test results to date, we believe that, compared with alternative methods of CO2 conversion, ERC, when converting CO2 to formate or formic acid, has several notable advantages including the following:

- Medium reaction rate allows for commercially viable CO2 processing times;

- Medium CO2 space velocity gives the ability to treat comparatively large volumes of CO2 ;

- High product selectivity for formate and formic acid;

- Low operating temperature and pressure make it possible to rely on renewable sources of electricity instead of fossil fuels; and

- Hydrogen (H2) is not required as feed reactant.

In addition to these advantages, we consider most developers of CO2 utilization technologies to not be directly competitive with Mantra. This is because a) the supply of CO2from industrial sources is very large, allowing for multiple technologies to be successful commercially, and b) most technologies generate different products from CO2 than those produced by Mantra, and thus will not be competitors in the sale of chemical products.

However, because ERC has not yet been tested at a commercially viable scale, there is no guarantee that any of the advantages cited by us will translate into actual competitive advantages for ERC over competing methods for CO2 conversion at an industrial scale. Also, like other competing methods, ERC suffers from fast cathode deterioration, and we must successfully isolate or develop a better ERC cathode in order to gain a competitive advantage in this regard. We have had success developing methods for improving the activity and extending the lifetime of the cathode at the bench scale and expect these methods to translate into significant process improvements as ERC is scaled up.

Our competition consists of a number of small companies capable of competing effectively in the alternative energy market as well as several large companies that possess substantially greater financial and other resources than we do. Many of these competitors are substantially larger and better funded than us, and have significantly longer histories of research, operation and development. Our competitors include technology providers or energy producers using biomass combustion, biomass anaerobic digestion, geothermal, solar, wind, new hydro and other renewable energy sources. In addition, we will face well-established competition from electric utilities and other energy companies in the traditional energy industry who have substantially greater financial resources than we do.

Our competitors may be able to offer more competitively priced and more widely available energy products than ours and they also may have greater resources than us to create or develop new technologies and products.

Therefore, there is no assurance that we will be successful in competing with existing and emerging competitors in the alternative energy industry or traditional energy industry.

We plan to identify business opportunities with interested parties and potential customers by networking and participating in conferences and exhibitions related to greenhouse gas emissions reduction and alternative energy sources and technologies. The strategic and geographic focus of our business is currently the North American market. We believe that one of our competitive advantages is our online carbon reduction marketplace which brings energy/carbon reduction products and service providers into direct contact with consumers and enables the facilitation of business contacts. The focus of our online carbon reduction marketplace is not on business-to-business carbon trading, as is the case with many of our competitors.

While our competitors may be operating similar business models, we plan to build our competitive position in the industry by:

- filling our Scientific Advisory Board with skilled and proficient professionals;

- developing and acquiring technologies to establish sustainable fuel supply chains;

7

- providing a comprehensive range of services; and

- providing marketing and promotion services to generate public awareness and enhance the reputation of sustainability initiatives.

However, since we are still a young company, we face the same problems as other start-up companies in other industries. Our competitors may develop similar technologies to ours and use the same methods as we do, and they may generally be able to respond more quickly to new or emerging technologies and changes in legislation and industry regulation. Additionally, our competitors may devote greater resources to the development, promotion and sale of their technologies or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Government Regulations

Some aspects of our intended operations, upon commercial deployment of our technologies, will be subject to a variety of federal, provincial, state and local laws, rules and regulations in North America and worldwide relating to, among other things, worker safety and the use, storage, discharge and disposal of environmentally sensitive materials. For example, we are subject to the Resource Conservation Recovery Act (“RCRA”), the principal federal legislation regulating hazardous waste generation, management and disposal.At this time, our small-scale laboratory operations are in compliance with, but are not significantly impacted by, waste disposal regulations.

Under some of the laws regulating the use, storage, discharge and disposal of environmentally sensitive materials, an owner or lessee of real estate may be liable for the costs of removing or remediating certain hazardous or toxic substances located on or in, or emanating from, such property, as well as related costs of investigation and property damage. Laws of this nature often impose liability without regard to whether the owner or lessee knew of, or was responsible for, the presence of the hazardous or toxic substances. These laws and regulations may require the removal or remediation of pollutants and may impose civil and criminal penalties for violations. Some of the laws and regulations authorize the recovery of natural resource damages by the government, injunctive relief and the imposition of stop, control, remediation and abandonment orders. The costs arising from compliance with environmental and natural resource laws and regulations may increase operating costs for both us and our potential customers. We are also subject to safety policies of jurisdictional-specific Workers Compensation Boards and similar agencies regulating the health and safety of workers.

In addition to the forgoing, in the future our U.S., Canadian and global operations may be affected by regulatory and political developments at the federal, state, provincial and local levels including, but not limited to, restrictions on offset credit trading, the verification of offset projects and related offset credits, price controls, tax increases, the expropriation of property, the modification or cancellation of contract rights, and controls on joint ventures or other strategic alliances.

We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our intended business. At this time, we do not anticipate any material capital expenditures to comply with environmental or various regulations and requirements.

While our intended projects or business activities have been designed to produce environmentally friendly green energy or other alternative products for which no specific regulatory barriers exist, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs and decreasing potential demand for our technologies, products or services, which could have a material adverse effect on our results of operations.

Research and Development Expenditures

During the year ended May 31, 2015, we spent $698,567 on research and development. For the last two fiscal years, we have spent $1,094,845 on research and development. We anticipate that we will incur $4,200,000 in expenses on research and development (including wages and commercialization efforts) for ERC and MRFC,as well as other technologies we may acquire over the next 12 months.We believe that we may receive public funding and/or the award of further contract research and development projects during the 2016 fiscal year, which will help meet the financing necessary to carry out these activities.

Employees

As of September 16, 2015, we had eight full-time employees, including three in management, one in administrative duties and four in research and development. Additionally, we have retained a number of consultants for legal, accounting and investor relations services.None of our employees are represented by a collective bargaining agreement, and we believe that our relations with our employees are good.

Intellectual Property

We previously acquired the process for the “Continuous Co-Current Electrochemical Reduction of Carbon Dioxide”, or the ERC technology, on November 2, 2007 as embodied by and described in the following Patent Cooperation Treaty application:

8

| Country |

Application

Number |

File Date |

Status |

| Patent Cooperation Treaty (PCT) | W02207 | 10/13/2006 | PCT(1) |

| (1) |

The Patent Cooperation Treaty, an international patent law treaty, provides a unified procedure for filing patent applications to protect inventions in each of its contracting states. |

The Patent Cooperation Treaty filing was made with a Receiving Office in 2006 and a written opinion was issued by International Searching Authority regarding the patentability of the invention which is the subject of the application. Finally, the examination and grant procedures will be handled by the relevant national or regional authorities. On March 31, 2008 we initiated the national patent process. The national patent process has been initiated in in Europe, the U.S., Canada, Australia, India, and China.

As of the date of this annual report, we have been awarded the following patents:

| Country | Patent Number | Patent Date | Name of Patent |

| India | 251493 | March 20, 2012 | “An Electrochemical Process for Reducing of Carbon Dioxide” |

| China | ZL 2006 8 0037810.8 |

May 8, 2013 | “Continuous Co- Current Electrochemical Reduction of Carbon Dioxide” |

| Australia | 2012202601 | May 1, 2014 | “Continuous Co- Current Electrochemical Reduction of Carbon Dioxide” |

| Canada | CA2625656 C | December 19, 2014 | “Continuous electro-chemical reduction of carbon dioxide” |

We have not filed for protection of our trademark. We own the copyright of our logo and all of the contents of our website, www.mantraenergy.com.

ITEM 1A - RISK FACTORS

Not required under Regulation S-K for “smaller reporting companies.”

ITEM 1B – UNRESOLVED STAFF COMMENTS

Not required under Regulation S-K for “smaller reporting companies.”

ITEM 2 – PROPERTIES

Our principal executive offices are located at 1562 128th Street, Surrey, British Columbia, Canada V4A 3T7. Our telephone number is (604) 560-1503. The office is approximately 1,200 square feet in size and is leased for a term of 24 months. The lease began on June 1, 2014 and will end in June 2016. Currently we pay approximately $1,300 per month for our office space in Surrey.

Our research facilities are located at 202-3590 West 41st Avenue, Vancouver, British Columbia, Canada, V6N 3E6. The telephone number is (604) 267-4005. The facility is approximately 1,400 square feet in size and is leased for a term of two years beginning on July 1, 2014. Currently we pay approximately $3,600 per month in rent.

We believe that our existing facilities are suitable and adequate to meet our current business requirements. We maintain a website at www.mantraenergy.com and the information contained on that website is not deemed to be a part of this annual report.

9

ITEM 3 - LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

ITEM 4 – MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock

Our common stock is currently available for quotation on the OTCQB market under the symbol “MVTG.” Previously, our common stock was available for quotation on the Over-the-Counter Bulletin Board under the symbol “MVTG.”

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

| Fiscal Year 2014 | ||

| High | Low | |

| First Quarter | $0.19 | $0.10 |

| Second Quarter | $0.15 | $0.072 |

| Third Quarter | $0.18 | $0.0471 |

| Fourth Quarter | $0.744 | $0.18 |

| Fiscal Year 2015 | ||

| High | Low | |

| First Quarter | $0.645 | $0.45 |

| Second Quarter | $0.67 | $0.30 |

| Third Quarter | $0.37 | $0.23 |

| Fourth Quarter | $0.29 | $0.115 |

On September 15, 2015, the closing sale price of our common stock, as reported by the OTC Markets, was $0.08 per share. On September 16, 2015, there were 422 holders of record of our common stock. Because many of our shares of common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividend Policy

We have never paid any cash dividends on our capital stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. We intend to retain future earnings to fund ongoing operations and future capital requirements of our business. Any future determination to pay cash dividends will be at the discretion of the Board and will be dependent upon our financial condition, results of operations, capital requirements and such other factors as the Board deems relevant.

Recent Sales of Unregistered Securities

During the quarter ended May 31, 2015, we sold 138,889 shares of common stock for $25,000.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our registered securities during the period covered by this Annual Report.

ITEM 6 – SELECTED FINANCIAL DATA

Not required under Regulation S-K for “smaller reporting companies.”

10

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management's Discussion and Analysis of Financial Condition and Results of Operations includes a number of forward-looking statements that reflect Management's current views with respect to future events and financial performance. You can identify these statements by forward-looking words such as “may” “will,” “expect,” “anticipate,” “believe,” “estimate” and “continue,” or similar words. Those statements include statements regarding the intent, belief or current expectations of us and members of its management team as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risk and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission. Important factors known to us could cause actual results to differ materially from those in forward-looking statements. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in the future operating results over time. We believe that its assumptions are based upon reasonable data derived from and known about our business and operations and the business and operations of the Company. No assurances are made that actual results of operations or the results of our future activities will not differ materially from its assumptions. Factors that could cause differences include, but are not limited to, expected market demand for the Company’s services, fluctuations in pricing for materials, and competition.

Business Overview

We are building a portfolio of companies and technologies that mitigate negative environmental and health consequences that arise from the production of energy and the consumption of resources.

Our mission is to develop and commercialize alternative energy technologies and services to enable the sustainable consumption, production and management of resources on residential, commercial and industrial scales. To carry out our business strategy, we have acquired or licensed technologies from third parties that require further development before they can be brought to market. We are also developing such technologies ourselves, and we anticipate that to complete commercialization of some technologies, we will enter into joint ventures, partnerships, or other strategic relationships with third parties who have expertise that we may require. We have also entered into formal relationships with consultants, contractors, retailers and manufacturers who specialize in the areas of environmental sustainability in order to carry out our business strategy.

We have acquired and own a process for the electro-reduction of carbon dioxide (“ERC”) and have the exclusive world license for a mixed-reactant fuel cell (“MRFC”). We are developing these technologies toward commercial applications.

In the past, we contracted out our development work to various laboratories. As of July 1, 2014, we have been carrying out research and development on these technologies in our own internal laboratory with our own staff in Vancouver, BC. These activities include: experimentation to improve the process performance; process and economic modeling to optimize the costs of a commercial system; design and simulation of pilot systems for technology demonstration and validation; business development activities such as the establishment of strategic and technology development partners; and the design and fabrication of laboratory prototypes, among others.

Current trends are positive for the company, as government regulation, public sentiment and industrial players increasingly support technological solutions with reduced environmental impacts. Specifically, regulations on carbon emissions (such as the BC carbon tax or the US EPA’s recently announced Clean Power Plan) are placing costs or limitations on the amount of CO2 that emitters can release into the atmosphere. The two technologies that currently make up our portfolio both directly address CO2 emissions and contribute to their reduction.

Results of Operations

Fiscal year Ended May 31, 2015 Compared to Fiscal year Ended May 31, 2014

The following summary of our results of operations should be read in conjunction with our audited financial statements for the years ended May 31, 2015 and 2014.

Our operating results for the years ended May 31, 2015 and 2014 are summarized as follows:

| Year Ended | ||||||

| May 31, | ||||||

| 2015 | 2014 | |||||

| Revenue | $ | 198,908 | $ | 274,584 | ||

| Operating Expenses | $ | (2,110,013 | ) | $ | (1,568,122 | ) |

| Other Income (Expense) | $ | (378,926 | ) | $ | (59,222 | ) |

| Net Loss | $ | (2,215,621 | ) | $ | (1,352,760 | ) |

11

Revenue

Our revenue for the year ended May 31, 2015 was $198,908, compared to our revenue for the year ended May 31, 2014, which was $274,584, representing approximately a 28% decrease. During the year ended May 31, 2015, revenue decreased because the contracted research project that we are conducting for our client Alstom advanced into a new phase (from Phase 2 to Phase 3). Phase 3 of this project has a smaller budget than Phase 2 due to reduced research activities, and as such, our revenue derived from this project has reduced accordingly.

Operating Expenses

Our operating expenses for the years ended May 31, 2015 and May 31, 2014 are outlined in the table below:

| Year Ended | ||||||

| May 31, | ||||||

| 2015 | 2014 | |||||

| Business development | $ | 23,683 | $ | 40,300 | ||

| Consulting and advisory | $ | 442,408 | $ | 342,307 | ||

| Depreciation and amortization | $ | 40,769 | $ | 25,771 | ||

| Foreign exchange loss (gain) | $ | (46,123 | ) | $ | (88,728 | ) |

| General and administrative | $ | 137,494 | $ | 132,674 | ||

| License fees | $ | 45,941 | $ | 40,000 | ||

| Management fees | $ | 280,950 | $ | 184,463 | ||

| Professional fees | $ | 133,836 | $ | 168,354 | ||

| Public listing costs | $ | 39,651 | $ | 24,405 | ||

| Rent | $ | 64,196 | $ | 57,853 | ||

| Research and development | $ | 698,567 | $ | 396,278 | ||

| Shareholder communications and awareness | $ | 26,931 | $ | 7,382 | ||

| Travel and promotion | $ | 178,442 | $ | 199,327 | ||

| Wages and benefits | $ | 43,268 | $ | 37,736 | ||

| TOTAL | $ | 2,110,013 | $ | 1,568,122 | ||

The increase in operating expenses for the year ended May 31, 2015, compared to the same period in fiscal 2014, was mainly due to increases in research and development, consulting and advisory fees and management fees. The increase in research and development were mainly the result of an increase in stock-based compensation and research and development activities. The increase in consulting and advisory and management fees was mainly the result of increased stock-based compensation. We also had increases in deprecation due to increased capital assets subject to amortization in the current year compared to the prior year, in shareholder communications and awareness from increased efforts and expenditures to improve our visibility to investors in new regions, such as Europe, Japan and the U.S., including travel to and within these regions and exhibiting and attending corresponding conferences.

Slightly offsetting those increases were decreases in business development as we had an ongoing research and development contract, and our focus was on executing this contract as opposed to further expanding business activities, professional fees because of changes to our auditing firm and legal firm that resulted in reduced costs, as well as a reduced number of patent applications being filed, travel and promotion as a result of a decrease in travel during the current year compared to the prior year and a decrease in foreign exchange gain as a result of the relative increase in the value during fiscal 2015 of the U.S. Dollar against the Canadian Dollar. Our revenues are largely in Canadian Dollars and a substantial amount of our expenses are paid in Canadian Dollars.

Our general and administrative expenses consist of office occupation expenses, communication expenses (cellular, internet, fax and telephone), bank charges, foreign exchange, courier, postage costs and office supplies. Our professional fees include legal, accounting, and auditing fees. Business development, consulting and advisory costs include fees paid, shares issued and options granted to contractors and advisory board members.

Liquidity and Financial Condition

As of May 31, 2015, our total current assets were $166,204 and our total current liabilities were $1,524,500, resulting in a working capital deficit of $1,358,296 compared to working capital of $348,045 as at May 31, 2014.

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have historically raised additional capital through equity offerings and loan transactions.

12

Cash Flows

| Year Ended | Year Ended | |||||

| May 31, | May 31, | |||||

| 2015 | 2014 | |||||

| Net Cash Used in Operating Activities | $ | (1,192,006 | ) | $ | (1,302,235 | ) |

| Net Cash Used In Investing Activities | $ | (61,773 | ) | $ | (78,808 | ) |

| Net Cash Provided by Financing Activities | $ | 329,339 | $ | 2,287,542 | ||

| Cash (decrease) increase during the year | $ | (924,440 | ) | $ | 906,499 |

The decrease in cash that we experienced during fiscal 2015 as compared to an increase of cash during fiscal 2014 was primarily due to the decrease during fiscal 2015 of cash received from the sale of our common stock, as we only raised $329,339 from financing activities during fiscal 2015, compared to $2,287,542 in the prior year. We expect that our total expenses will increase over the next year as we increase our business operations, which is subject to raising additional funds, for which we currently have no commitments. We have not been able to reach the break-even point since our inception and have had to rely on outside capital resources. We do not anticipate making significant revenues for the next year. Over the next 12 months, subject to raising additional funds, we plan to primarily concentrate on commercializing our ERC technology and associated projects.

| Description |

Estimated expenses ($) |

| Research and Development | 500,000 |

| Consulting Fees | 250,000 |

| Commercialization of ERC | 3,000,000 |

| Shareholder communication and awareness | 200,000 |

| Professional Fees | 300,000 |

| Wages and Benefits | 200,000 |

| Management Fees | 150,000 |

| Total | 4,600,000 |

In order to fully carry out our business plan, we need additional financing of approximately $5,100,000 for the next 12 months. In order to improve our liquidity, we intend to pursue additional equity financing from private placement sales of our equity securities or shareholders’ loans. We do not presently have sufficient financing to undertake our planned business activities. Issuances of additional shares will result in dilution to our existing shareholders.

We currently do not have any arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available to us.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenue and operating results has not been significant.

Critical Accounting Policies

Our consolidated financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in note 2 of the notes to our financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Basis of Presentation/Principles of Consolidation

13

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. These consolidated financial statements include the accounts of our company and our subsidiaries, Carbon Commodity Corporation, Climate ESCO Ltd., Mantra Energy Alternatives Ltd., Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc. All the subsidiaries are wholly-owned with the exception of Climate ESCO Ltd., which is 64.55% owned and Mantra Energy Alternatives Ltd., which is 88.21% owned. All inter-company balances and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to allowance for doubtful accounts, the estimated useful lives and recoverability of long-lived assets, valuation of inventory, equity component of convertible debt, stock-based compensation, and deferred income tax asset valuation allowances. Our company bases our estimates and assumptions on current facts, historical experience and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Accounts Receivable

Our company recognizes allowances for doubtful accounts to ensure accounts receivable are not overstated due to the inability or unwillingness of its customers to make required payments. The allowance is based on historical bad debt expense, the age of receivable and the specific identification of receivables our company considers at risk.

14

Intangible Assets

Intangible assets consist of patents and are stated at cost and have a definite life. Intangible assets are amortized over their estimated useful lives. Our company periodically evaluates the reasonableness of the useful lives of these assets. Once these assets are fully amortized, they are removed from the accounts. These assets are reviewed for impairment or obsolescence when events or changes in circumstances indicate that the carrying amount may not be recoverable. If impaired, intangible assets are written down to fair value based on discounted cash flows or other valuation techniques. Our company has no intangibles with indefinite lives.

Long-lived Assets

In accordance with ASC 360, “Property, Plant and Equipment”, our company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value, which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

Technology Development Revenue Recognition

Our company performs research and development services. Our company recognizes revenue under research contracts when a contract has been executed, the contract price is fixed and determinable, delivery of services or products has occurred, and collectability of the contract price is considered reasonably assured and can be reasonably estimated. Revenue is based on direct labor hours expended at contract billing rates plus other billable direct costs.

Research and Development Costs

Research and development costs are expensed as incurred.

Stock-based Compensation

Our company records stock-based compensation in accordance with ASC 718, “Compensation – Stock Compensation”, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

Our company uses the Black-Scholes option pricing model to calculate the fair value of stock-based awards. This model is affected by our company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to our company’s expected stock price volatility over the term of the awards, and actual and projected employee stock option exercise behaviors. The value of the portion of the award that is ultimately expected to vest is recognized as an expense in the consolidated statement of operations over the requisite service period.

Recent Accounting Pronouncements

We do not expect the adoption of any recently issued accounting pronouncements to have a significant impact on our results of operations, financial position or cash flow.

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required under Regulation S-K for “smaller reporting companies.”

15

ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

MANTRA VENTURE GROUP LTD.

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Mantra Venture Group Ltd.

We have audited the accompanying balance sheets of Mantra Venture Group Ltd. as of May 31, 2015 and 2014, and the related statements of operations, stockholders’ equity (deficit), and cash flows each of the two years in the period ended May 31, 2015. Mantra Venture Group Ltd.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Mantra Venture Group Ltd. as of May 31, 2015 and 2014, and the results of its operations and its cash flows for each of two years in the period ended May 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements the Company has an accumulated deficit of $11,529,916 and a working capital deficit of $1,358,296 as of May 31, 2015 which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Sadler, Gibb & Associates, LLC

Salt Lake City, UT

September 18, 2015

F-2

MANTRA VENTURE GROUP LTD.

Consolidated balance

sheets

(Expressed in U.S. dollars)

| May 31, | May 31, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash | 7,446 | 931,886 | ||||

| Accounts receivable | 25,527 | 163,591 | ||||

| Deferred finance costs | 7,085 | – | ||||

| Prepaid expenses and deposits | 126,146 | 504,697 | ||||

| Total current assets | 166,204 | 1,600,174 | ||||

| Deposit | 8,000 | – | ||||

| Restricted cash | 20,734 | 27,374 | ||||

| Property and equipment, net | 90,205 | 94,231 | ||||

| Intangible assets, net | 54,577 | 29,547 | ||||

| Total assets | 339,720 | 1,751,326 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 613,875 | 715,053 | ||||

| Due to related parties | 112,193 | 159,994 | ||||

| Loans payable | 190,106 | 204,176 | ||||

| Obligations under capital lease | 17,325 | 8,246 | ||||

| Convertible debentures (net of discount of $189,520) | 237,333 | 164,660 | ||||

| Derivative liability | 353,668 | – | ||||

| Total current liabilities | 1,524,500 | 1,252,129 | ||||

| Obligations under capital lease | – | 19,856 | ||||

| Convertible debentures (net of discount of $nil) | – | 16,640 | ||||

| Total liabilities | 1,524,500 | 1,288,625 | ||||

| Stockholders’ equity (deficit) | ||||||

| Mantra Venture Group Ltd. stockholders’ equity (deficit) | ||||||

| Preferred

stock Authorized: 20,000,000 shares, par value $0.00001 Issued and outstanding: Nil shares |

– | – | ||||

| Common

stock Authorized: 100,000,000 shares, par value $0.00001 Issued and outstanding: 71,516,581 (May 31, 2014 – 69,157,322) shares |

715 | 692 | ||||

| Additional paid-in capital | 10,462,265 | 9,679,880 | ||||

| Subscriptions receivable | – | (1,791 | ) | |||

| Common stock subscribed | 74,742 | 216,391 | ||||

| Accumulated deficit | (11,529,916 | ) | (9,314,295 | ) | ||

| Total Mantra Venture Group Ltd. stockholders’ equity (deficit) | (992,194 | ) | 580,877 | |||

| Non-controlling interest | (192,586 | ) | (118,176 | ) | ||

| Total stockholders’ equity (deficit) | (1,184,780 | ) | 462,701 | |||

| Total liabilities and stockholders’ equity (deficit) | 339,720 | 1,751,326 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-3

MANTRA VENTURE GROUP LTD.

Consolidated statements of

operations

(Expressed in U.S. dollars)

| Year Ended | Year Ended | |||||

| May 31, | May 31, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| Revenue | 198,908 | 274,584 | ||||

| Cost of goods sold | – | – | ||||

| Gross profit | 198,908 | 274,584 | ||||

| Operating expenses | ||||||

| Business development | 23,683 | 40,300 | ||||

| Consulting and advisory | 442,408 | 342,307 | ||||

| Depreciation and amortization | 40,769 | 25,772 | ||||

| Foreign exchange loss (gain) | (46,123 | ) | (88,728 | ) | ||

| General and administrative | 137,494 | 132,673 | ||||

| License fees | 45,941 | 40,000 | ||||

| Management fees | 280,950 | 184,463 | ||||

| Professional fees | 133,836 | 168,354 | ||||

| Public listing costs | 39,651 | 24,405 | ||||

| Rent | 64,196 | 57,853 | ||||

| Research and development | 698,567 | 396,278 | ||||

| Shareholder communications and awareness | 26,931 | 7,382 | ||||

| Travel and promotion | 178,442 | 199,327 | ||||

| Wages and benefits | 43,268 | 37,736 | ||||

| Total operating expenses | 2,110,013 | 1,568,122 | ||||

| Loss before other income (expense) | (1,911,105 | ) | (1,293,538 | ) | ||

| Other income (expense) | ||||||

| Accretion of discounts on convertible debentures | (110,842 | ) | (26,557 | ) | ||

| Gain on settlement of debt | 1,759 | 11,503 | ||||

| Loss on change in fair value of derivatives | (228,668 | ) | – | |||

| Interest expense | (41,175 | ) | (44,168 | ) | ||

| Total other income (expense) | (378,926 | ) | (59,222 | ) | ||

| Net loss for the period | (2,290,031 | ) | (1,352,760 | ) | ||

| Less: net loss attributable to the non-controlling interest | 74,410 | 62,104 | ||||

| Net loss attributable to Mantra Venture Group Ltd. | (2,215,621 | ) | (1,290,656 | ) | ||

| Net loss per share attributable to Mantra Venture Group

Ltd. common shareholders, basic and diluted |

(0.03 | ) | (0.02 | ) | ||

| Weighted average number of shares outstanding used in the

calculation of net loss attributable to Mantra Venture Group Ltd. per common share |

70,847,805 | 59,096,396 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-4

MANTRA VENTURE GROUP LTD.

Consolidated statements of stockholder’s equity (deficit)

For the

Years Ended May 31, 2015 and 2014

| Common Stock | Additional | Common | Common stock | Total | ||||||||||||||||||||

| paid-in | stock | subscriptions | Accumulated | Non-controlling | stockholders’ | |||||||||||||||||||

| Amount | capital | subscribed | receivable | Deficit | interest | equity (deficit) | ||||||||||||||||||

| Number | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| Balance, May 31, 2013 | 55,226,276 | 552 | 6,875,939 | 115,662 | – | (8,023,639 | ) | (56,072 | ) | (1,087,558 | ) | |||||||||||||

| Stock Issued for Cash | ||||||||||||||||||||||||

| Stock issued at $0.15 per share pursuant to the exercise of warrants | 1,093,000 | 11 | 163,939 | – | – | – | – | 163,950 | ||||||||||||||||

| Stock issued at $0.20 per share pursuant to the exercise of warrants | 3,094,958 | 31 | 618,961 | – | – | – | – | 618,992 | ||||||||||||||||

| Stock issued at $0.12 per share pursuant to the exercise of stock options | 100,000 | 1 | 11,999 | – | – | – | – | 12,000 | ||||||||||||||||

| Units issued at $0.08 per share | 3,678,088 | 37 | 294,207 | (43,000 | ) | (1,791 | ) | – | – | 249,453 | ||||||||||||||

| Units issued at $0.10 per share | 400,000 | 4 | 39,996 | – | – | – | 40,000 | |||||||||||||||||

| Units issued at $0.12 per share | 140,000 | 1 | 16,799 | – | – | – | – | 16,800 | ||||||||||||||||

| Units issued at $0.17 per share | 100,000 | 1 | 16,999 | – | – | – | – | 17,000 | ||||||||||||||||

| Units issued at $0.20 per share | 4,760,000 | 48 | 951,952 | – | – | – | – | 952,000 | ||||||||||||||||

| Shares issued for services | 565,000 | 6 | 394,089 | 5 | – | – | – | 394,100 | ||||||||||||||||

| Subscriptions received | – | – | – | 134,705 | – | – | – | 134,705 | ||||||||||||||||

| Shares issuable for conversion of debt | – | – | – | 9,019 | – | – | – | 9,019 | ||||||||||||||||

| Beneficial conversion features | 192,000 | 192,000 | ||||||||||||||||||||||

| Fair value of stock options granted | – | – | 103,000 | – | – | – | – | 103,000 | ||||||||||||||||

| Net loss for the year | – | – | – | – | – | (1,290,656 | ) | (62,104 | ) | (1,352,760 | ) | |||||||||||||

| Balance, May 31, 2014 | 69,157,322 | 692 | 9,679,880 | 216,391 | (1,791 | ) | (9,314,295 | ) | (118,176 | ) | 462,701 | |||||||||||||

(The accompanying notes are an integral part of these consolidated financial statements)

F-5

MANTRA VENTURE GROUP LTD.

Consolidated statements of stockholder’s equity (deficit)

For the

Years Ended May 31, 2015 and 2014

| Common Stock | Additional | Common | Common stock | Total | ||||||||||||||||||||

| paid-in | stock | subscriptions | Accumulated | Non-controlling | stockholders’ | |||||||||||||||||||

| Amount | capital | subscribed | receivable | Deficit | interest | equity (deficit) | ||||||||||||||||||

| Number | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| Balance, May 31, 2014 | 69,157,322 | 692 | 9,679,880 | 216,391 | (1,791 | ) | (9,314,295 | ) | (118,176 | ) | 462,701 | |||||||||||||

| Stock Issued for Cash | ||||||||||||||||||||||||

| Stock issued at $0.25 per share pursuant to the exercise of warrants | 240,000 | 2 | 61,623 | (32,625 | ) | (19,000 | ) | – | – | 10,000 | ||||||||||||||

| Stock issued at $0.25 per share pursuant to the exercise of options | 150,000 | 1 | 2,999 | – | (3,000 | ) | – | – | – | |||||||||||||||

| Units issued at $0.30 per share | 533,333 | 5 | 159,995 | (100,000 | ) | – | – | – | 60,000 | |||||||||||||||

| Units issued at $0.20 per share | 500,000 | 5 | 99,995 | – | – | – | – | 100,000 | ||||||||||||||||

| Units issued at $0.40 per share | 150,000 | 2 | 59,998 | – | – | – | – | 60,000 | ||||||||||||||||

| Stock issued at $0.18 per share | 138,889 | 1 | 24,999 | – | – | – | – | 25,000 | ||||||||||||||||

| Shares issued for services | 587,000 | 6 | 41,753 | (5 | ) | – | – | – | 41,754 | |||||||||||||||

| Subscriptions received | – | – | – | – | 23,791 | – | – | 23,791 | ||||||||||||||||

| Shares issuable for conversion of debt | 60,037 | 1 | 9,018 | (9,019 | ) | – | – | – | – | |||||||||||||||

| Fair value of stock options granted | – | – | 322,005 | – | – | – | – | 322,005 | ||||||||||||||||

| Net loss for the year | – | – | – | – | – | (2,215,621 | ) | (74,410 | ) | (2,290,031 | ) | |||||||||||||

| Balance, May 31, 2015 | 71,516,581 | 715 | 10,462,265 | 74,742 | – | (11,529,916 | ) | (192,586 | ) | (1,184,780 | ) | |||||||||||||

(The accompanying notes are an integral part of these consolidated financial statements)

F-6

MANTRA VENTURE GROUP LTD.

Consolidated statements of

cash flows

(Expressed in U.S. dollars)

| Year Ended | Year Ended | |||||

| May 31, | May 31, | |||||

| 2015 | 2014 | |||||

| $ | $ | |||||

| Operating activities | ||||||

| Net loss | (2,290,031 | ) | (1,352,760 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Loss in fair value of derivative liability | 193,424 | – | ||||

| Amortization of finance costs | 2,415 | – | ||||

| Accretion of discounts on convertible debentures | 110,842 | 26,557 | ||||

| Depreciation and amortization | 40,769 | 25,772 | ||||

| Foreign exchange loss (gain) | (8,062 | ) | (7,424 | ) | ||

| Gain on settlement of debt | (1,759 | ) | (11,503 | ) | ||

| Initial derivative expenses | 35,244 | – | ||||

| Shares issued for services | 41,754 | 94,703 | ||||

| Stock-based compensation on options and warrants | 322,005 | 103,000 | ||||

| Changes in operating assets and liabilities: | ||||||

| Amounts receivable | 138,064 | (143,676 | ) | |||

| Prepaid expenses and deposits | 370,551 | (170,772 | ) | |||

| Accounts payable and accrued liabilities | (99,421 | ) | 147,298 | |||

| Due to related parties | (47,801 | ) | (13,430 | ) | ||

| Net cash used in operating activities | (1,192,006 | ) | (1,302,235 | ) | ||

| Investing activities | ||||||

| Purchase of property and equipment | (28,295 | ) | (48,475 | ) | ||

| Investment in intangible assets | (33,478 | ) | (30,333 | ) | ||

| Net cash used in investing activities | (61,773 | ) | (78,808 | ) | ||

| Financing activities | ||||||

| Repayment of capital lease obligations | (10,145 | ) | (7,542 | ) | ||

| Repayment of loan payable | (54,807 | ) | (101,809 | ) | ||

| Proceeds from issuance of convertible debentures | 125,000 | 192,000 | ||||

| Proceeds from stock subscribed | 23,791 | – | ||||

| Finance costs | (9,500 | ) | – | |||

| Proceeds from the issuance of options and warrants | 10,000 | |||||

| Proceeds from issuance of common stock and subscriptions received | 245,000 | 2,204,893 | ||||

| Net cash provided by financing activities | 329,339 | 2,287,542 | ||||

| Change in cash | (924,440 | ) | 906,499 | |||

| Cash, beginning of period | 931,886 | 25,387 | ||||

| Cash, end of period | 7,446 | 931,886 | ||||

| Non-cash investing and financing activities: | ||||||

| Common stock issued to relieve common stock subscribed | 100,0000 | 43,000 | ||||

| Common stock issued to settle debt | 9,019 | – | ||||

| Loan payable settled through shares issuable | – | 9,019 | ||||

| Common stock issued for pre-paid asset | – | 360,000 | ||||

| Debt discount on beneficial conversion feature | – | 192,000 | ||||

| Original debt discount against derivative liability | 125,000 | – | ||||

| Common stock issued on exercise of options | 3,001 | – | ||||

| Warrants exercised for common stock and subscriptions receivable | 51,625 | – | ||||

| Common stock issued for common stock receivable | 2,998 | – | ||||

| Supplemental disclosures: | ||||||

| Interest paid | 8,668 | 9,098 | ||||

| Income taxes paid | – | – |

(The accompanying notes are an integral part of these consolidated financial statements)

F-7

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

May 31, 2015

(Expressed

in U.S. dollars)

| 1. |

Basis of Presentation |

|

Mantra Venture Group Ltd. (the “Company”) was incorporated in the State of Nevada on January 22, 2007 to acquire and commercially exploit various new energy related technologies through licenses and purchases. On December 8, 2008, the Company continued its corporate jurisdiction out of the State of Nevada and into the province of British Columbia, Canada. The Company is in the business of developing and providing energy alternatives. The Company also provides marketing and graphic design services to help companies optimize their environmental awareness presence through the eyes of government, industry and the general public. | |

|

These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has yet to acquire commercially exploitable energy related technology, and is unlikely to generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of management to raise additional equity capital through private and public offerings of its common stock, and the attainment of profitable operations. As at May 31, 2015, the Company has accumulated losses of $11,529,916 and a working capital deficit of $1,358,296. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. | |

|

Management requires additional funds over the next twelve months to fully implement its business plan. Management is currently seeking additional financing through the sale of equity and from borrowings from private lenders to cover its operating expenditures. There can be no certainty that these sources will provide the additional funds required for the next twelve months. | |

| 2. |

Significant Accounting Policies |

| (a) |

Basis of Presentation/Principles of Consolidation | |

|

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. These consolidated financial statements include the accounts of the Company and its subsidiaries, Carbon Commodity Corporation, Climate ESCO Ltd., Mantra Energy Alternatives Ltd., Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc. All the subsidiaries are wholly-owned with the exception of Climate ESCO Ltd., which is 64.55% owned and Mantra Energy Alternatives Ltd., which is 88.21% owned. All inter- company balances and transactions have been eliminated. | ||

| (b) |

Use of Estimates | |

|

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to allowance for doubtful accounts, the estimated useful lives and recoverability of long-lived assets, valuation of inventory, equity component of convertible debt, stock-based compensation, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. | ||

| (c) |

Cash and Cash Equivalents | |

|

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. | ||

| (d) |

Accounts Receivable | |

|

The Company recognizes allowances for doubtful accounts to ensure accounts receivable are not overstated due to the inability or unwillingness of its customers to make required payments. The allowance is based on historical bad debt expense, the age of receivable and the specific identification of receivables the Company considers at risk. The Company had no allowance for doubtful accounts as of May 31, 2015 and 2014. |

F-8

MANTRA VENTURE GROUP LTD.

Notes to the

consolidated financial statements

May 31, 2015

(Expressed

in U.S. dollars)

| (e) |

Property and Equipment | |

|

Property and equipment are stated at cost. The Company depreciates the cost of property and equipment over their estimated useful lives at the following annual rates: |

| Automotive | 3 years straight-line basis |

| Computer equipment | 3 years straight-line basis |

| Leasehold improvements | 5 years straight-line basis |

| Office equipment and furniture | 5 years straight-line basis |

| Research equipment | 5 years straight-line basis |

| (f) |

Intangible Assets | |

|