Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | a8-kbody2015barclaysconfer.htm |

Barclays Global Financial Services Conference Aleem Gillani, Chief Financial Officer, SunTrust Banks, Inc. September 17, 2015

2 The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2014 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, the Company presents net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements regarding future levels of the efficiency ratio and capital returns are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “initiatives,” “opportunity,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could"; such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2014 and in other periodic reports that we file with the SEC. Those factors include: as one of the largest lenders in the Southeast and Mid-Atlantic U.S. and a provider of financial products and services to consumers and businesses across the U.S., our financial results have been, and may continue to be, materially affected by general economic conditions, and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; legislation and regulation, including the Dodd-Frank Act, as well as future legislation and/or regulation, could require us to change certain of our business practices, reduce our revenue, impose additional costs on us, or otherwise adversely affect our business operations and/or competitive position; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; loss of customer deposits and market illiquidity could increase our funding costs; we rely on the mortgage secondary market and GSEs for some of our liquidity; our framework for managing risks may not be effective in mitigating risk and loss to us; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; a downgrade in the U.S. government's sovereign credit rating, or in the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict; we are subject to certain risks related to originating and selling mortgages, and we may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain breaches of our servicing agreements, and this could harm our liquidity, results of operations, and financial condition; we face certain risks as a servicer of loans; we are subject to risks related to delays in the foreclosure process; our earnings may be affected by volatility in mortgage production and servicing revenues, and by changes in carrying values of our MSRs and mortgages held for sale due to changes in interest rates; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; negative public opinion could damage our reputation and adversely impact business and revenues; we rely on other companies to provide key components of our business infrastructure; we are at risk of increased losses from fraud; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber-attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we might not pay dividends on our common stock; our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations, and they require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries. Important Cautionary Statement

3 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Strong Capital Position Why invest in SunTrust?

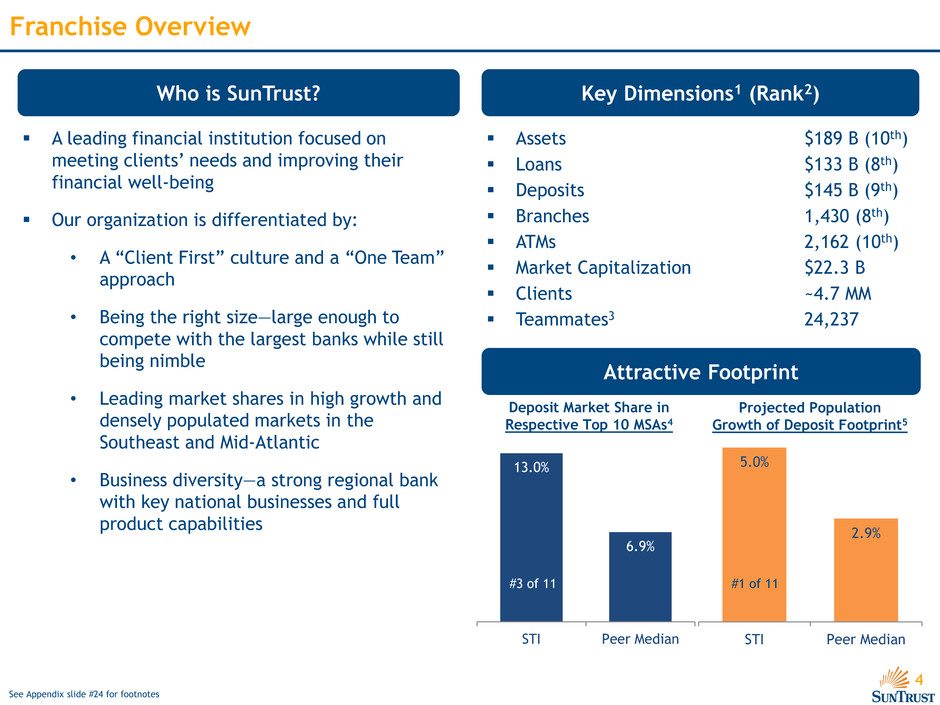

4 13.0% 6.9% STI Peer Median 5.0% 2.9% STI Peer Median Franchise Overview Who is SunTrust? Key Dimensions1 (Rank2) A leading financial institution focused on meeting clients’ needs and improving their financial well-being Our organization is differentiated by: • A “Client First” culture and a “One Team” approach • Being the right size—large enough to compete with the largest banks while still being nimble • Leading market shares in high growth and densely populated markets in the Southeast and Mid-Atlantic • Business diversity—a strong regional bank with key national businesses and full product capabilities Assets $189 B (10th) Loans $133 B (8th) Deposits $145 B (9th) Branches 1,430 (8th) ATMs 2,162 (10th) Market Capitalization $22.3 B Clients ~4.7 MM Teammates3 24,237 Attractive Footprint Deposit Market Share in Respective Top 10 MSAs4 Projected Population Growth of Deposit Footprint5 #1 of 11 #3 of 11 See Appendix slide #24 for footnotes

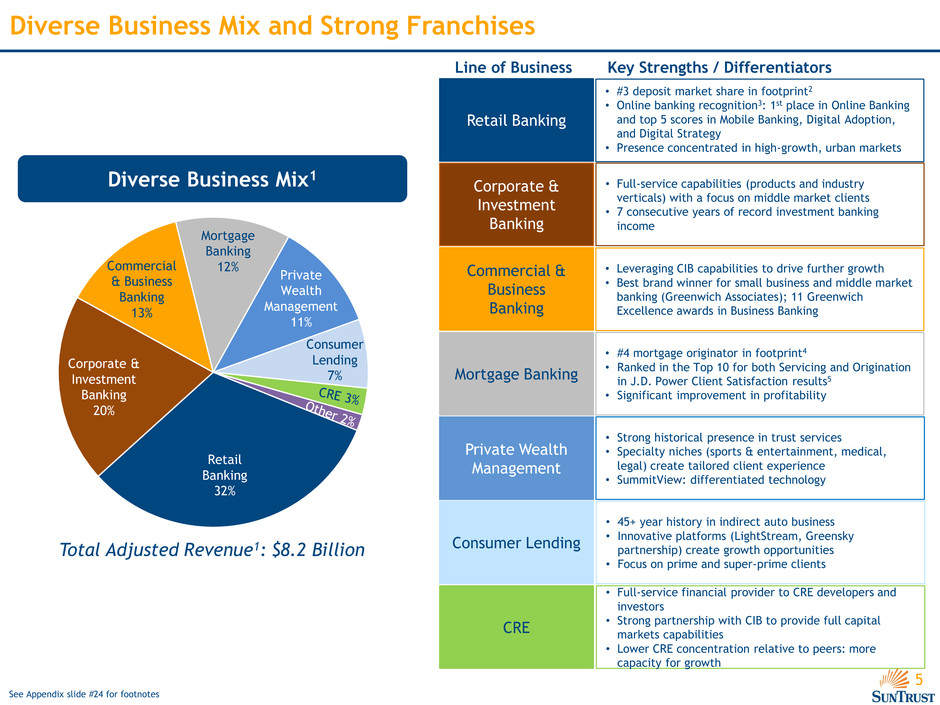

5 Diverse Business Mix and Strong Franchises Diverse Business Mix1 Total Adjusted Revenue1: $8.2 Billion Commercial & Business Banking 13% Private Wealth Management 11% Consumer Lending 7% Corporate & Investment Banking 20% Mortgage Banking 12% Retail Banking 32% Retail Banking Corporate & Investment Banking Commercial & Business Banking Mortgage Banking Private Wealth Management Consumer Lending CRE • #3 deposit market share in footprint2 • Online banking recognition3: 1st place in Online Banking and top 5 scores in Mobile Banking, Digital Adoption, and Digital Strategy • Presence concentrated in high-growth, urban markets • Full-service capabilities (products and industry verticals) with a focus on middle market clients • 7 consecutive years of record investment banking income • Leveraging CIB capabilities to drive further growth • Best brand winner for small business and middle market banking (Greenwich Associates); 11 Greenwich Excellence awards in Business Banking • #4 mortgage originator in footprint4 • Ranked in the Top 10 for both Servicing and Origination in J.D. Power Client Satisfaction results5 • Significant improvement in profitability • Strong historical presence in trust services • Specialty niches (sports & entertainment, medical, legal) create tailored client experience • SummitView: differentiated technology • 45+ year history in indirect auto business • Innovative platforms (LightStream, Greensky partnership) create growth opportunities • Focus on prime and super-prime clients • Full-service financial provider to CRE developers and investors • Strong partnership with CIB to provide full capital markets capabilities • Lower CRE concentration relative to peers: more capacity for growth See Appendix slide #24 for footnotes Line of Business Key Strengths / Differentiators

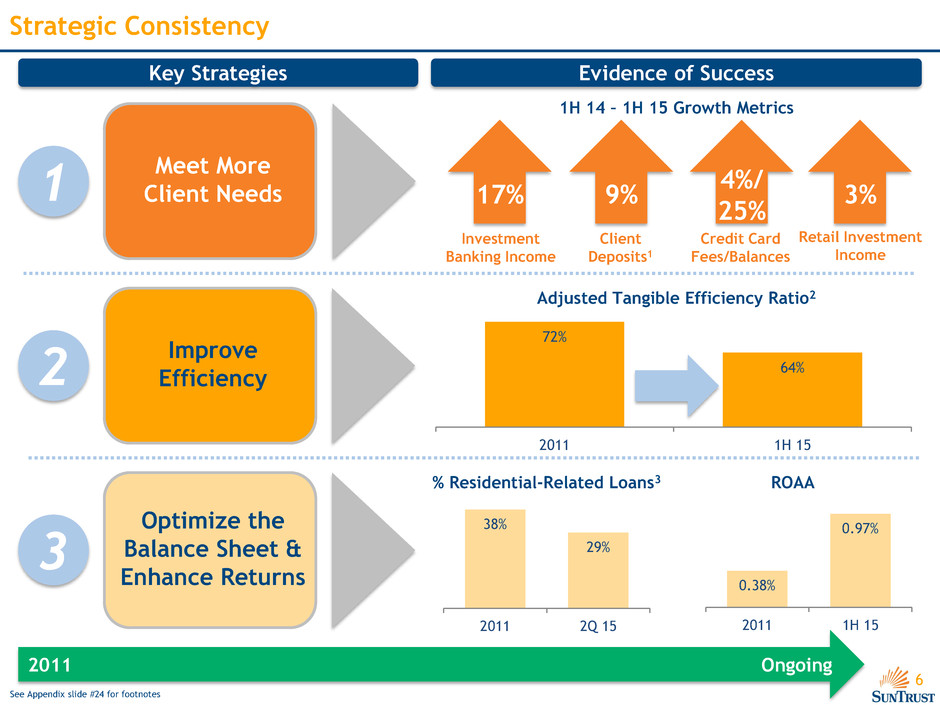

6 Strategic Consistency Key Strategies Evidence of Success 1H 14 – 1H 15 Growth Metrics Adjusted Tangible Efficiency Ratio2 Meet More Client Needs Improve Efficiency Optimize the Balance Sheet & Enhance Returns % Residential-Related Loans3 17% Investment Banking Income 4%/ 25% Credit Card Fees/Balances 9% Client Deposits1 ROAA 2011 Ongoing 3% Retail Investment Income 1 2 3 72% 64% 2011 1H 15 See Appendix slide #24 for footnotes 0.38% 0.97% 2011 1H 15 38% 29% 2011 2Q 15

7 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Strong Capital Position Why invest in SunTrust?

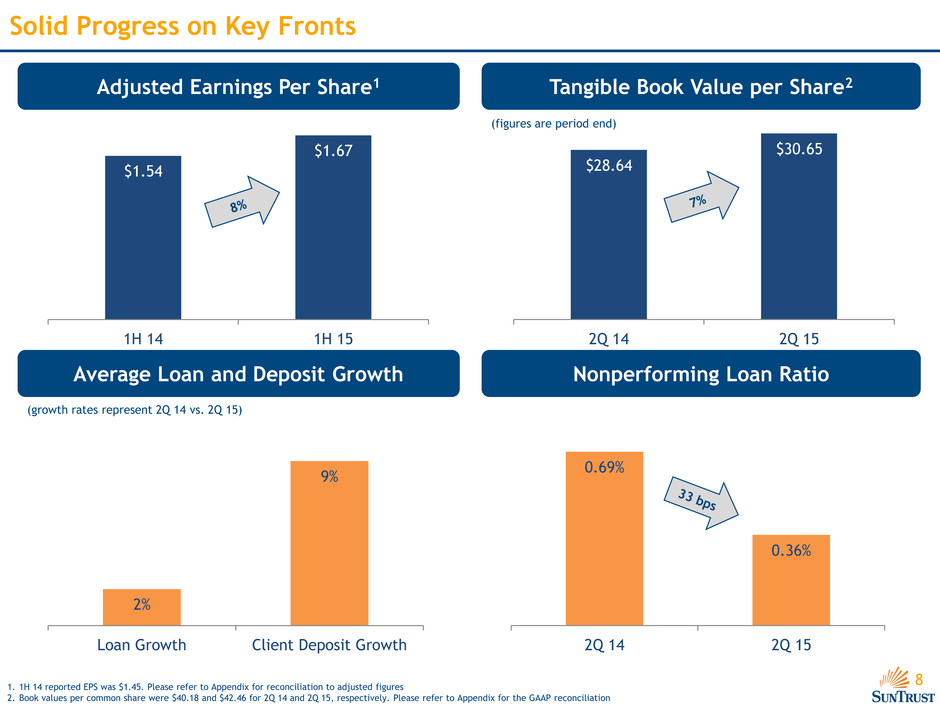

8 0.69% 0.36% 2Q 14 2Q 15 $1.54 $1.67 1H 14 1H 15 Solid Progress on Key Fronts Adjusted Earnings Per Share1 Nonperforming Loan Ratio Tangible Book Value per Share2 Average Loan and Deposit Growth (growth rates represent 2Q 14 vs. 2Q 15) 1. 1H 14 reported EPS was $1.45. Please refer to Appendix for reconciliation to adjusted figures 2. Book values per common share were $40.18 and $42.46 for 2Q 14 and 2Q 15, respectively. Please refer to Appendix for the GAAP reconciliation (figures are period end) $28.64 $30.65 2Q 14 2Q 15 2% 9% Loan Growth Client Deposit Growth

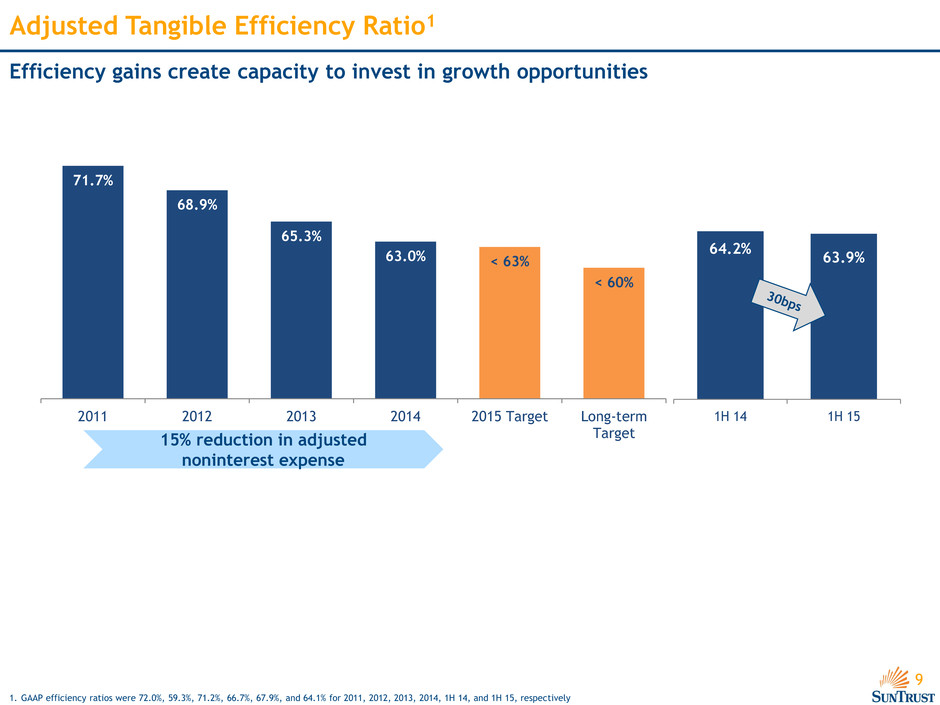

9 Adjusted Tangible Efficiency Ratio1 Efficiency gains create capacity to invest in growth opportunities 1H 14 1H 15 71.7% 68.9% 65.3% 63.0% < 63% < 60% 2011 20 2 2013 2014 2015 Target Long-term Target 64.2% 63.9% 15% reduction in adjusted noninterest expense 1. GAAP efficiency ratios were 72.0%, 59.3%, 71.2%, 66.7%, 67.9%, and 64.1% for 2011, 2012, 2013, 2014, 1H 14, and 1H 15, respectively

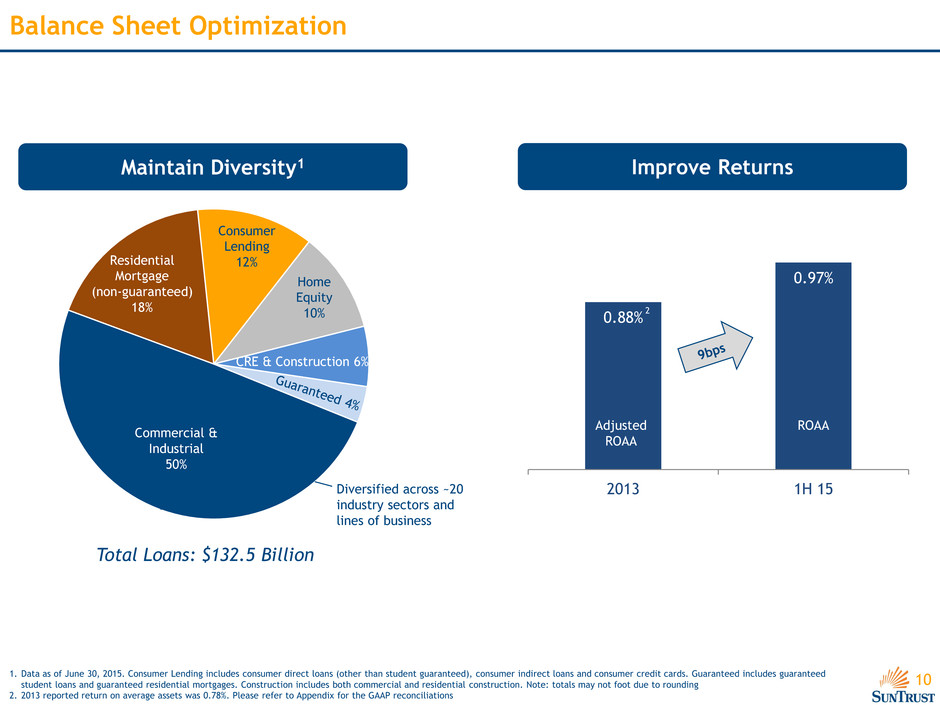

10 0.88% 0.97% 2013 1H 15 Balance Sheet Optimization 1. Data as of June 30, 2015. Consumer Lending includes consumer direct loans (other than student guaranteed), consumer indirect loans and consumer credit cards. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. Construction includes both commercial and residential construction. Note: totals may not foot due to rounding 2. 2013 reported return on average assets was 0.78%. Please refer to Appendix for the GAAP reconciliations Commercial & Industrial 50% Residential Mortgage (non-guaranteed) 18% Consumer Lending 12% Home Equity 10% Maintain Diversity1 CRE & Construction 6% Total Loans: $132.5 Billion Diversified across ~20 industry sectors and lines of business Improve Returns Adjusted ROAA 2 ROAA

11 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Strong Capital Position Why invest in SunTrust?

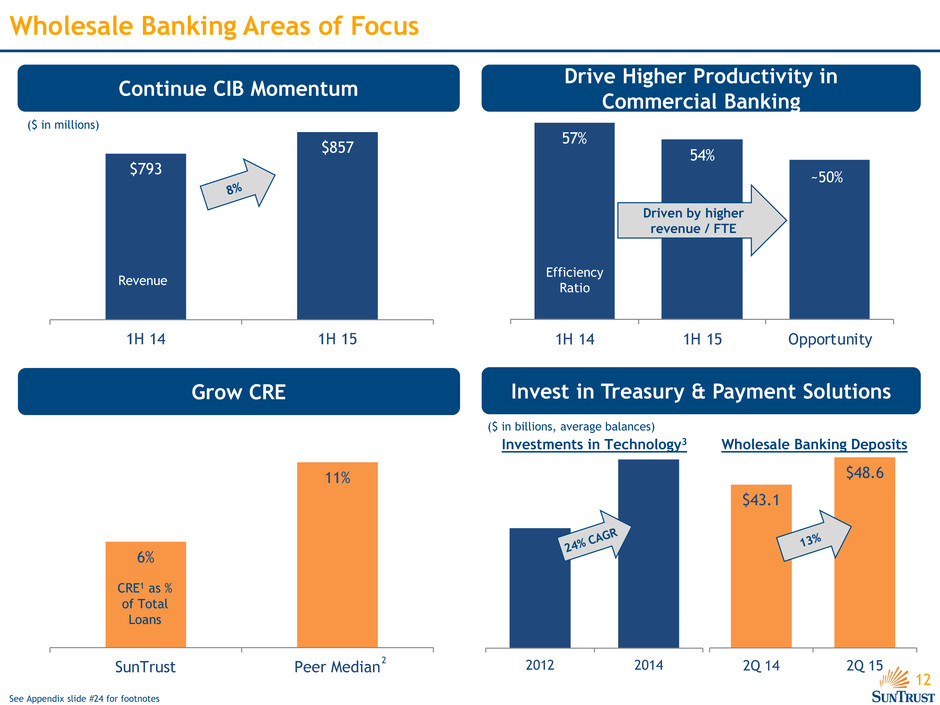

12 $793 $857 1H 14 1H 15 57% 54% 1H 14 1H 15 Opportunity 6% 11% SunTrust Peer Median $43.1 $48.6 2Q 14 2Q 15 Wholesale Banking Areas of Focus Grow CRE Continue CIB Momentum Drive Higher Productivity in Commercial Banking ($ in millions) Efficiency Ratio CRE1 as % of Total Loans 2 Driven by higher revenue / FTE Revenue 2012 2014 Invest in Treasury & Payment Solutions ($ in billions, average balances) Investments in Technology3 Wholesale Banking Deposits ~50% See Appendix slide #24 for footnotes

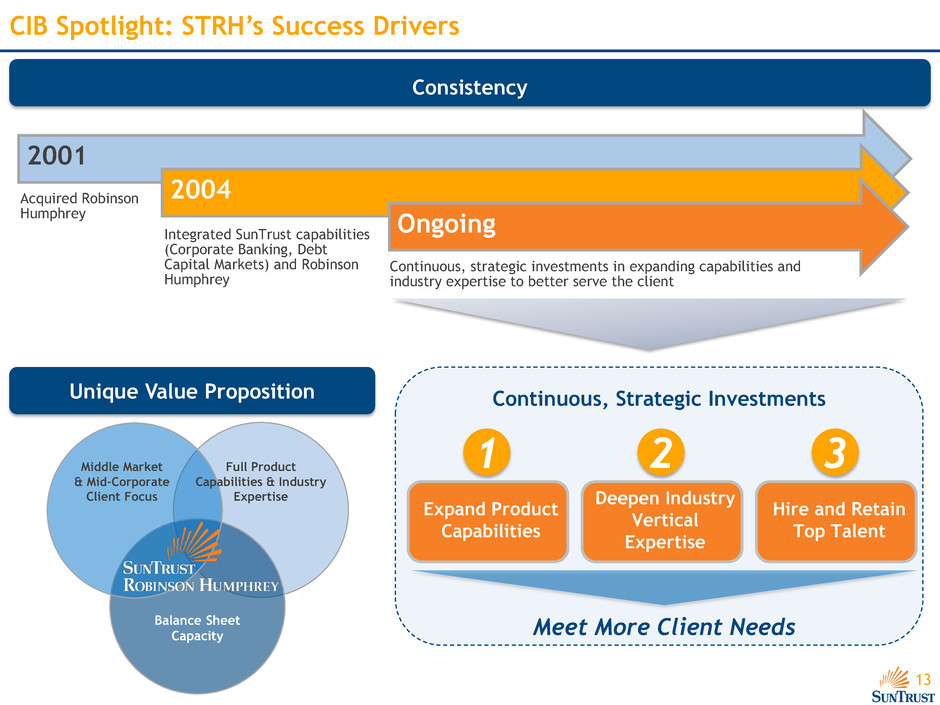

13 Continuous, Strategic Investments 2001 Acquired Robinson Humphrey 2004 Integrated SunTrust capabilities (Corporate Banking, Debt Capital Markets) and Robinson Humphrey Ongoing Continuous, strategic investments in expanding capabilities and industry expertise to better serve the client CIB Spotlight: STRH’s Success Drivers Consistency Unique Value Proposition Middle Market & Mid-Corporate Client Focus Balance Sheet Capacity Full Product Capabilities & Industry Expertise 1 2 3 Meet More Client Needs Expand Product Capabilities Deepen Industry Vertical Expertise Hire and Retain Top Talent

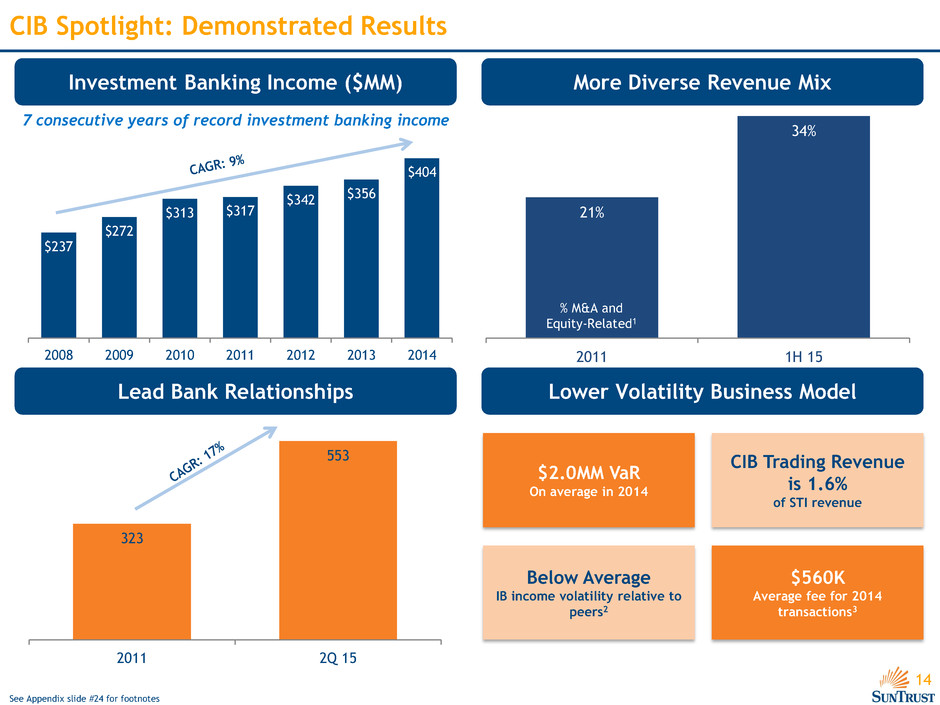

14 323 553 2011 2Q 15 $237 $272 $313 $317 $342 $356 $404 2008 2009 2010 2011 2012 2013 2014 21% 34% 2011 1H 15 CIB Spotlight: Demonstrated Results Investment Banking Income ($MM) More Diverse Revenue Mix Lead Bank Relationships Lower Volatility Business Model $2.0MM VaR On average in 2014 CIB Trading Revenue is 1.6% of STI revenue Below Average IB income volatility relative to peers2 $560K Average fee for 2014 transactions3 % M&A and Equity-Related1 7 consecutive years of record investment banking income See Appendix slide #24 for footnotes

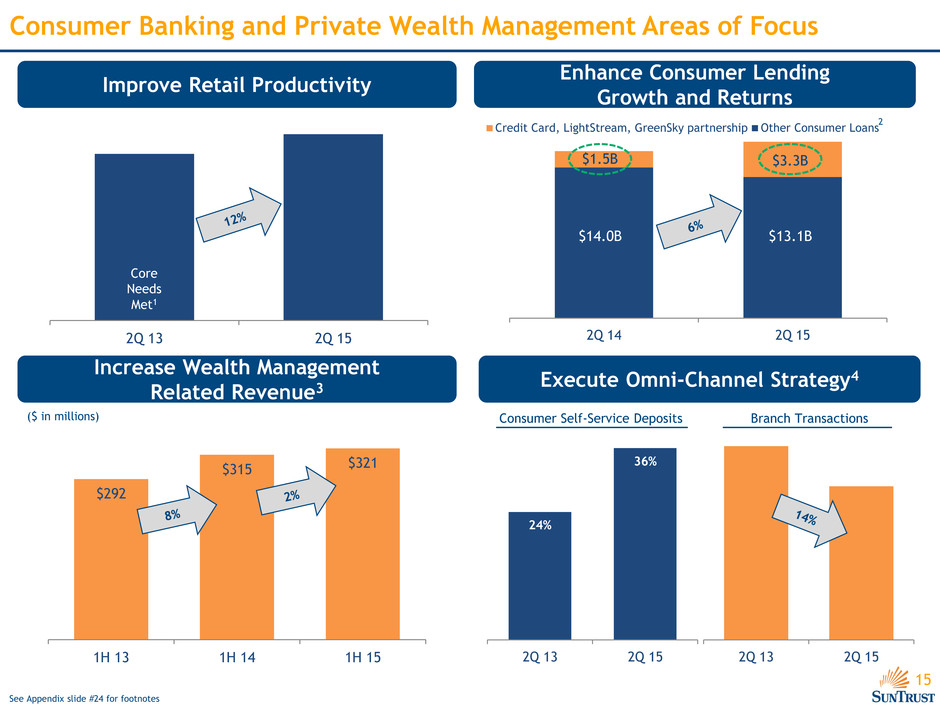

15 2Q 13 2Q 15 Increase Wealth Management Related Revenue3 $292 $315 $321 1H 13 1H 14 1H 15 2Q 14 2Q 15 Enhance Consumer Lending Growth and Returns 2Q 13 2Q 15 Consumer Banking and Private Wealth Management Areas of Focus See Appendix slide #24 for footnotes Improve Retail Productivity Core Needs Met1 ($ in millions) Execute Omni-Channel Strategy4 24% 36% 2Q 13 2Q 15 $13.1B $14.0B $1.5B $3.3B 2 2Q 14 2Q 15 Credit Card, LightStream, GreenSky partnership Other Consumer Loans Consumer Self-Service Deposits Branch Transactions

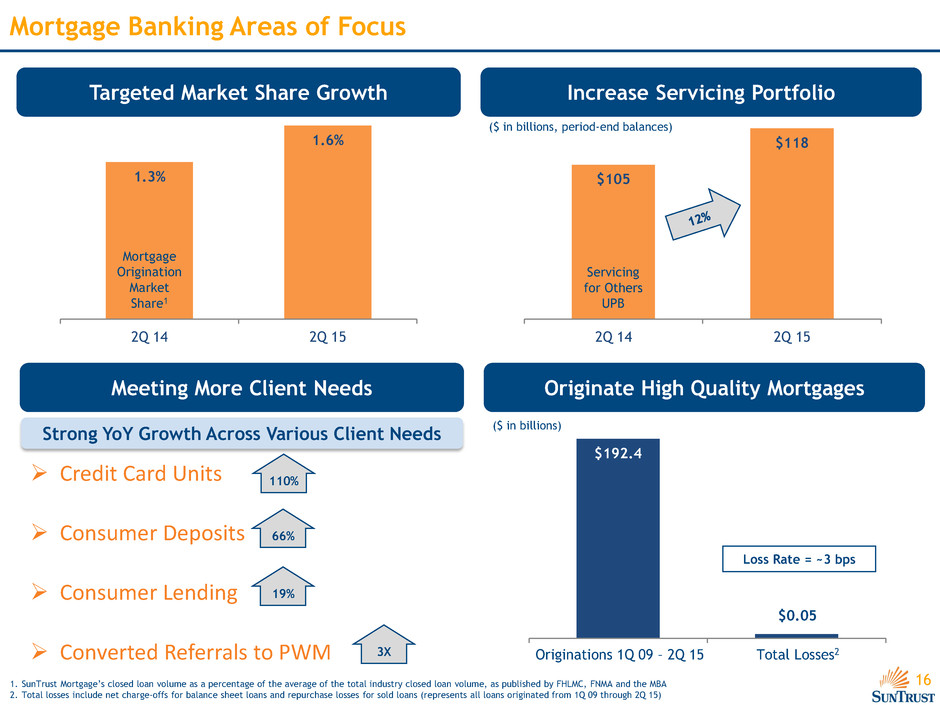

16 1.3% 1.6% 2Q 14 2Q 15 Targeted Market Share Growth $192.4 Mortgage Banking Areas of Focus $105 $118 2Q 14 2Q 15 Servicing for Others UPB ($ in billions, period-end balances) Increase Servicing Portfolio Mortgage Origination Market Share1 ($ in billions) Meeting More Client Needs Originate High Quality Mortgages Originations 1Q 09 – 2Q 15 Total Losses2 $0.05 Loss Rate = ~3 bps Credit Card Units Consumer Deposits Consumer Lending Converted Referrals to PWM Strong YoY Growth Across Various Client Needs 110% 66% 19% 3X 1. SunTrust Mortgage’s closed loan volume as a percentage of the average of the total industry closed loan volume, as published by FHLMC, FNMA and the MBA 2. Total losses include net charge-offs for balance sheet loans and repurchase losses for sold loans (represents all loans originated from 1Q 09 through 2Q 15)

17 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Strong Capital Position Why invest in SunTrust?

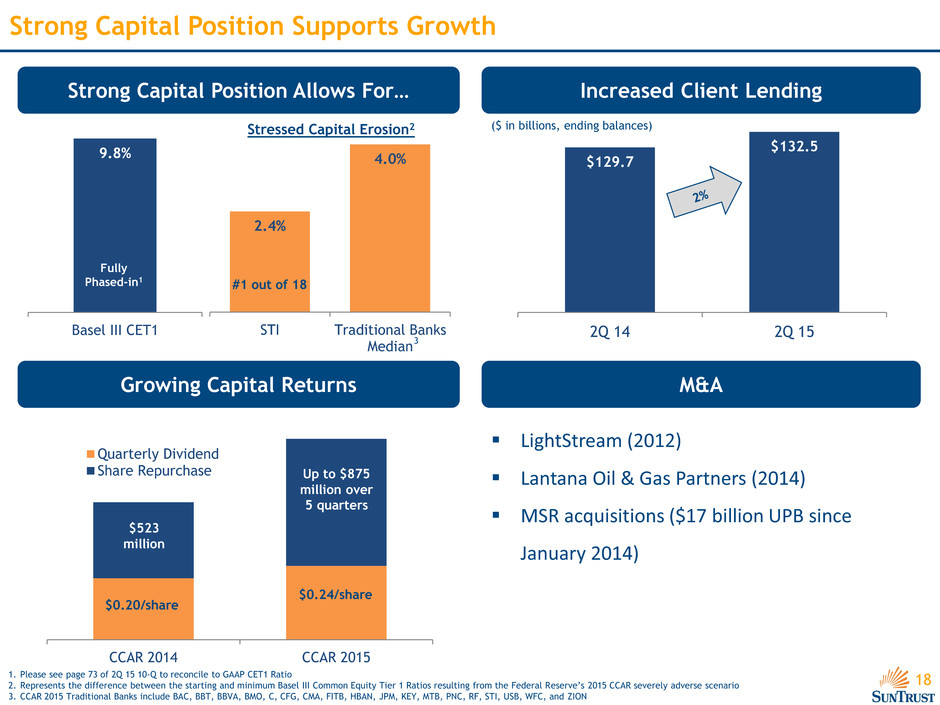

18 2.4% 4.0% STI Traditional Banks Median 9.8% Basel III CET1 $129.7 $132.5 2Q 14 2Q 15 CCAR 2014 CCAR 2015 Quarterly Dividend Share Repurchase Strong Capital Position Supports Growth Growing Capital Returns Strong Capital Position Allows For… Increased Client Lending M&A LightStream (2012) Lantana Oil & Gas Partners (2014) MSR acquisitions ($17 billion UPB since January 2014) ($ in billions, ending balances) Stressed Capital Erosion2 $0.20/share $0.24/share $523 million Up to $875 million over 5 quarters #1 out of 18 3 1. Please see page 73 of 2Q 15 10-Q to reconcile to GAAP CET1 Ratio 2. Represents the difference between the starting and minimum Basel III Common Equity Tier 1 Ratios resulting from the Federal Reserve’s 2015 CCAR severely adverse scenario 3. CCAR 2015 Traditional Banks include BAC, BBT, BBVA, BMO, C, CFG, CMA, FITB, HBAN, JPM, KEY, MTB, PNC, RF, STI, USB, WFC, and ZION Fully Phased-in1

19 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Strong Capital Position Why invest in SunTrust?

Appendix

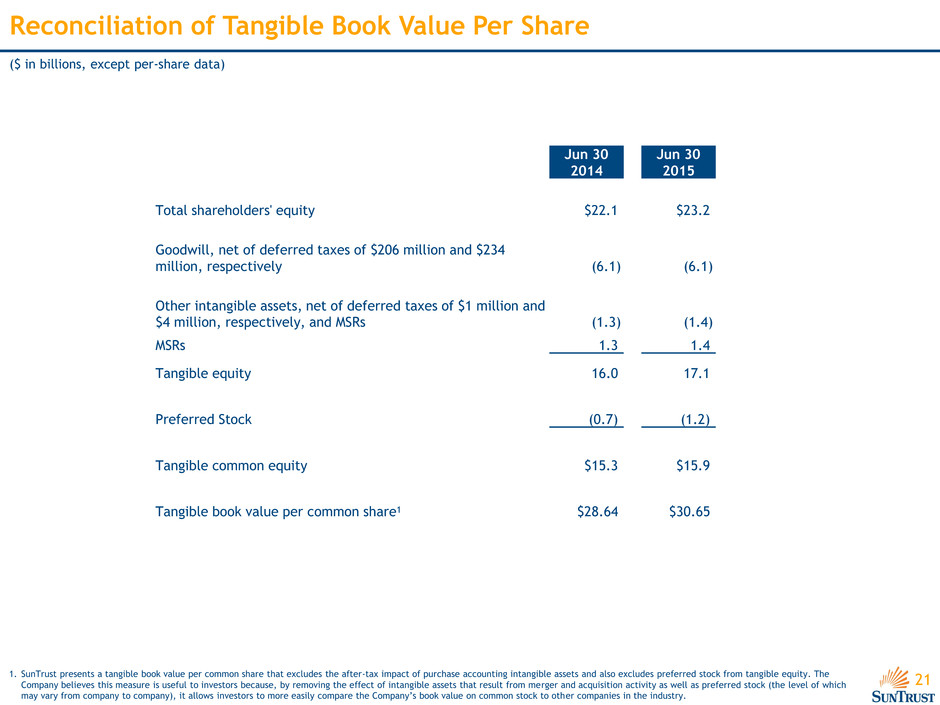

21 Reconciliation of Tangible Book Value Per Share ($ in billions, except per-share data) 1. SunTrust presents a tangible book value per common share that excludes the after-tax impact of purchase accounting intangible assets and also excludes preferred stock from tangible equity. The Company believes this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred stock (the level of which may vary from company to company), it allows investors to more easily compare the Company’s book value on common stock to other companies in the industry. Jun 30 Jun 30 2014 2015 Total shareholders' equity $22.1 $23.2 Goodwill, net of deferred taxes of $206 million and $234 million, respectively (6.1) (6.1) Other intangible assets, net of deferred taxes of $1 million and $4 million, respectively, and MSRs (1.3) (1.4) MSRs 1.3 1.4 Tangible equity 16.0 17.1 Preferred Stock (0.7) (1.2) Tangible common equity $15.3 $15.9 Tangible book value per common share1 $28.64 $30.65

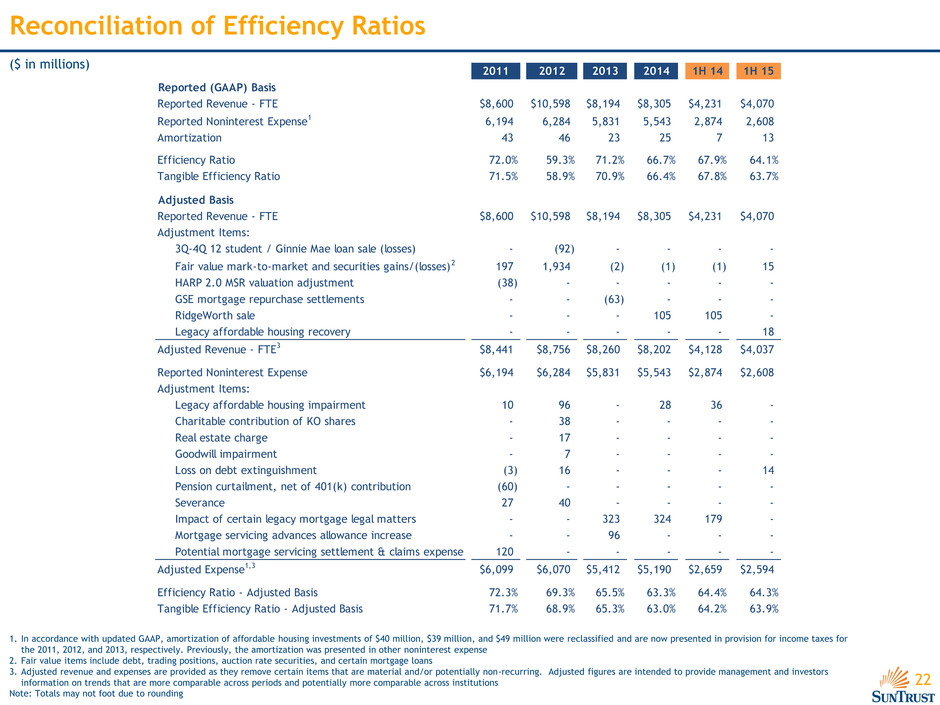

22 Reconciliation of Efficiency Ratios ($ in millions) 1. In accordance with updated GAAP, amortization of affordable housing investments of $40 million, $39 million, and $49 million were reclassified and are now presented in provision for income taxes for the 2011, 2012, and 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Fair value items include debt, trading positions, auction rate securities, and certain mortgage loans 3. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions Note: Totals may not foot due to rounding 2011 2012 2013 2014 1H 14 1H 15 Reported (GAAP) Basis Reported Revenue - FTE $8,600 $10,598 $8,194 $8,305 $4,231 $4,070 Reported Noninterest Expense1 6,194 6,284 5,831 5,543 2,874 2,608 Amortization 43 46 23 25 7 13 Efficiency Ratio 72.0% 59.3% 71.2% 66.7% 67.9% 64.1% Tangible Efficiency Ratio 71.5% 58.9% 70.9% 66.4% 67.8% 63.7% Adjusted Basis Reported Revenue - FTE $8,600 $10,598 $8,194 $8,305 $4,231 $4,070 Adjustment Items: 3Q-4Q 12 student / Ginnie Mae loan sale (losses) - (92) - - - - Fair value mark-to-market and securities gains/(losses)2 197 1,934 (2) (1) (1) 15 HARP 2.0 MSR valuation adjustment (38) - - - - - GSE mortgage repurchase settlements - - (63) - - - RidgeWorth sale - - - 105 105 - Legacy affordable housing recovery - - - - - 18 Adjusted Revenue - FTE3 $8,441 $8,756 $8,260 $8,202 $4,128 $4,037 Reported Noninterest Expense $6,194 $6,284 $5,831 $5,543 $2,874 $2,608 Adjustment Items: Legacy affordable housing impairment 10 96 - 28 36 - Charitable contribution of KO shares - 38 - - - - Real estate charge - 17 - - - - Goodwill impairment - 7 - - - - Loss on debt extinguishment (3) 16 - - - 14 Pension curtailment, net of 401(k) contribution (60) - - - - - Severance 27 40 - - - - Impact of certain legacy mortgage legal matters - - 323 324 179 - Mortgage servicing advances allowance increase - - 96 - - - Potential mortgage servicing settlement & claims expense 120 - - - - - Adjusted Expense1,3 $6,099 $6,070 $5,412 $5,190 $2,659 $2,594 Efficiency Ratio - Adjusted Basis 72.3% 69.3% 65.5% 63.3% 64.4% 64.3% Tangible Efficiency Ratio - Adjusted Basis 71.7% 68.9% 65.3% 63.0% 64.2% 63.9%

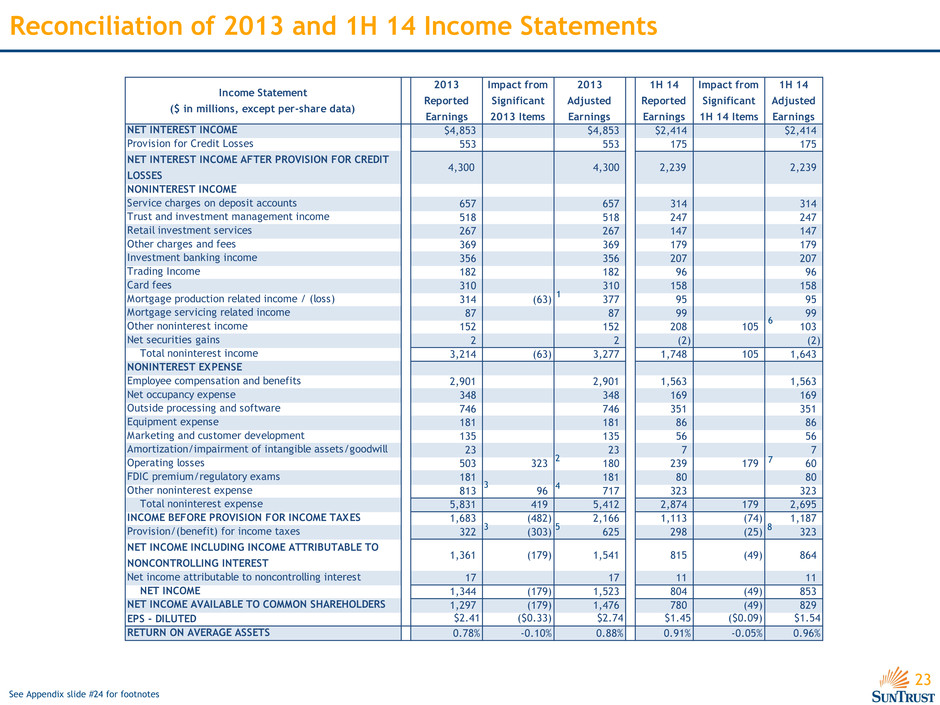

23 Income Statement ($ in millions, except per-share data) 2013 Reported Earnings Impact from Significant 2013 Items 2013 Adjusted Earnings 1H 14 Reported Earnings Impact from Significant 1H 14 Items 1H 14 Adjusted Earnings NET INTEREST INCOME $4,853 $4,853 $2,414 $2,414 Provision for Credit Losses 553 553 175 175 NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES 4,300 4,300 2,239 2,239 NONINTEREST INCOME Service charges on deposit accounts 657 657 314 314 Trust and investment management income 518 518 247 247 Retail investment services 267 267 147 147 Other charges and fees 369 369 179 179 Investment banking income 356 356 207 207 Trading Income 182 182 96 96 Card fees 310 310 158 158 Mortgage production related income / (loss) 314 (63) 377 95 95 Mortgage servicing related income 87 87 99 99 Other noninterest income 152 152 208 105 103 Net securities gains 2 2 (2) (2) Total noninterest income 3,214 (63) 3,277 1,748 105 1,643 NONINTEREST EXPENSE Employee compensation and benefits 2,901 2,901 1,563 1,563 Net occupancy expense 348 348 169 169 Outside processing and software 746 746 351 351 Equipment expense 181 181 86 86 Marketing and customer development 135 135 56 56 Amortization/impairment of intangible assets/goodwill 23 23 7 7 Operating losses 503 323 180 239 179 60 FDIC premium/regulatory exams 181 181 80 80 Other noninterest expense 813 96 717 323 323 Total noninterest expense 5,831 419 5,412 2,874 179 2,695 INCOME BEFORE PROVISION FOR INCOME TAXES 1,683 (482) 2,166 1,113 (74) 1,187 Provision/(benefit) for income taxes 322 (303) 625 298 (25) 323 NET INCOME INCLUDING INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST 1,361 (179) 1,541 815 (49) 864 Net income attributable to noncontrolling interest 17 17 11 11 NET INCOME 1,344 (179) 1,523 804 (49) 853 NET INCOME AVAILABLE TO COMMON SHAREHOLDERS 1,297 (179) 1,476 780 (49) 829 EPS - DILUTED $2.41 ($0.33) $2.74 $1.45 ($0.09) $1.54 RETURN ON AVERAGE ASSETS 0.78% -0.10% 0.88% 0.91% -0.05% 0.96% Reconciliation of 2013 and 1H 14 Income Statements See Appendix slide #24 for footnotes 1 2 3 3 4 5 6 7 8

24 Footnotes Slide #5: 1. Based on Adjusted 2014 FTE Revenue. Reported 2014 FTE Revenue was $8.3 billion. Corporate & Investment Banking excludes a $49 million lease impairment. Mortgage Banking excludes $41 million of gains related to loan sales. Other includes Corporate, RidgeWorth, certain Treasury & Payment Solutions standalone client sub-segments and legacy affordable housing business and excludes a $105 million pre-tax gain on sale of RidgeWorth. 2. Source: SNL Financial. In-footprint rank includes all banks with deposits in FL, GA, VA, TN, MD, NC, DC, SC, AL, WV, AR, and MS (as of June 30, 2014), per FDIC deposit market share data 3. Source: Javelin Strategy & Research 2014 Digital Banking Experience Leaders (July 2014) 4. Source: SNL Financial. Data represents 2013 originations 5. Source: JD Power 2014 U.S. Primary Mortgage Origination Satisfaction Study Slide # 15: 1. Total number of core product sales booked in traditional branches / number of sales FTEs / number of business days 2. Excludes residential mortgage, home equity, and guaranteed student loans. Other consumer loans primarily consist of indirect auto 3. Includes retail investment income and trust and investment management income. Excludes RidgeWorth revenue 4. Self-service consumer deposit transactions include Mobile, Tablet and ATM (excludes direct deposit) Slide #4: 1. Assets, Loans, Deposits, Branches, and ATM’s source: Y-9C Bank Holding Company data as of June 30, 2015 2. Rank amongst U.S. commercial banks, excluding non-traditional commercial banks, as of June 30, 2015 3. Represents full-time equivalent employees 4. Source: SNL Financial, as of June 30, 2014, based on top 10 MSAs (by deposits) for each institution. Numerator is company’s total deposits in its top 10 MSAs and denominator is total deposits in those 10 MSAs 5. Source: SNL Financial, as of August 14, 2015, based on five-year projected change (2015-2020). Weighted average by deposits in MSAs and counties not in any MSA Note: Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, and WFC Slide #23: 1. Reflects the pre-tax impact of mortgage repurchase settlements with Fannie Mae and Freddie Mac. 2. Reflects the pre-tax impact from the settlement of certain legal matters. 3. In accordance with updated GAAP, amortization of affordable housing investments of $49 million was reclassified and is now presented in provision for income taxes for 2013. Previously, the amortization was presented in other noninterest expense. 4. Reflects the pre-tax impact from the mortgage servicing advances allowance increase. 5. Reflects the income tax benefit related to footnotes #1, #2, and #3 ($190) and the other tax items ($113) referred to in the October 10, 2013, 8-K 6. Reflects the pre-tax gain associated with the RidgeWorth sale 7. Reflects the pre-tax impact from the settlement of certain legacy mortgage matters 8. Reflects the income tax benefit related to footnotes #7 and #8 Note: Totals may not foot due to rounding Slide # 6: 1. Based on six month average balances 2. Calculated on a tangible basis and excluding certain items that potentially are material and/or nonrecurring. Please refer to appendix slide #22 for the GAAP reconciliations 3. Includes guaranteed residential mortgages, non-guaranteed residential mortgages, home equity products, and residential construction loans Slide # 12: 1. Includes investor-owned commercial real estate, commercial construction and land development, and multifamily loans. Source: Y-9C Bank Holding Company data as of June 30, 2015 2. Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, and WFC 3. Represents growth in expenses associated with investments in technology (including marketing, training, and consulting) Slide #14: 1. Revenue as a percentage of investment banking income 2. Peers include BAC, JPM, WFC, GS, MS, KEY; based on standard deviation of investment banking income growth rates from 2009-2014 3. Excludes fees earned in Tax-Exempt and Financial Risk Management