Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STATE STREET CORP | barclayspresentation-septe.htm |

State Street Global Services Well positioned for secular growth trends Barclays Global Financial Services Conference Gunjan Kedia Executive Vice President Head of Investment Servicing, Americas September 17, 2015 STT: NYSE Exhibit 99.1

2 Forward-looking statements This presentation contains forward-looking statements within the meaning of U.S. securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, investment portfolio performance and strategies, financial portfolio performance, dividend and stock purchase programs, expected outcomes of legal proceedings, market growth, acquisitions, joint ventures and divestitures and new technologies, services and opportunities, as well as regarding industry, regulatory, economic and market trends, initiatives and developments, the business environment and other matters. Terminology such as “outlook,” “expect,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms, are intended to identify forward looking statements, although not all forward looking statements contain such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to September 17, 2015. Important factors that may also affect future results and outcomes include, but are not limited to: an adverse outcome in excess of the accrued reserve with respect to one or more claims relating to our indirect foreign exchange business could have a material adverse effect on our reputation, on our consolidated results of operations for the period in which the adverse outcome occurs (or an accrual is determined to be required), or on our consolidated financial condition; the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposure, including, for example, the direct and indirect effects on counterparties of the sovereign-debt risks in the U.S., Europe and other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates, the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit- agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to other-than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term funding, our ability to manage levels of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement changes to the regulatory framework applicable to our operations, including implementation of the Dodd-Frank Act, the Basel III final rule and European legislation (such as the Alternative Investment Fund Managers Directive and Undertakings for Collective Investment in Transferable Securities Directives); among other consequences, these regulatory changes impact the levels of regulatory capital we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, and restrictions on banking and financial activities. In addition, our regulatory posture and related expenses have been and will continue to be affected by changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, capital planning and compliance programs, and changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory ratios that we are required or will be required to meet, whether arising under the Dodd-Frank Act or the Basel III final rule, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital ratios that cause changes in those ratios as they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or programs, including acquisitions, dividends and stock purchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to the adequacy of our controls or compliance programs; financial market disruptions or economic recession, whether in the U.S., Europe, Asia or other regions; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations and those of our clients and our regulators; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or proceedings; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the liquidity or valuation of assets underlying those pools; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depository obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to State Street or regarding other industry participants or industry-wide factors, or other reputational harm; our ability to control operational risks, data security breach risks and outsourcing risks, our ability to protect our intellectual property rights, the possibility of errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems and their effective operation both independently and with external systems, and complexities and costs of protecting the security of our systems and data; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of State Street as a suitable service provider or counterparty; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; our ability to complete acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses and joint ventures will not achieve their anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced, that client and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced, and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging needs of our clients and to develop products that are responsive to such trends and profitable to us, the performance of and demand for the products and services we offer, and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to defer materially from those indicated by any forward-looking statements are set forth in our 2014 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation speak only as of the date hereof, September 17, 2015, and we do not undertake efforts to revise those forward-looking statements to reflect events after that date.

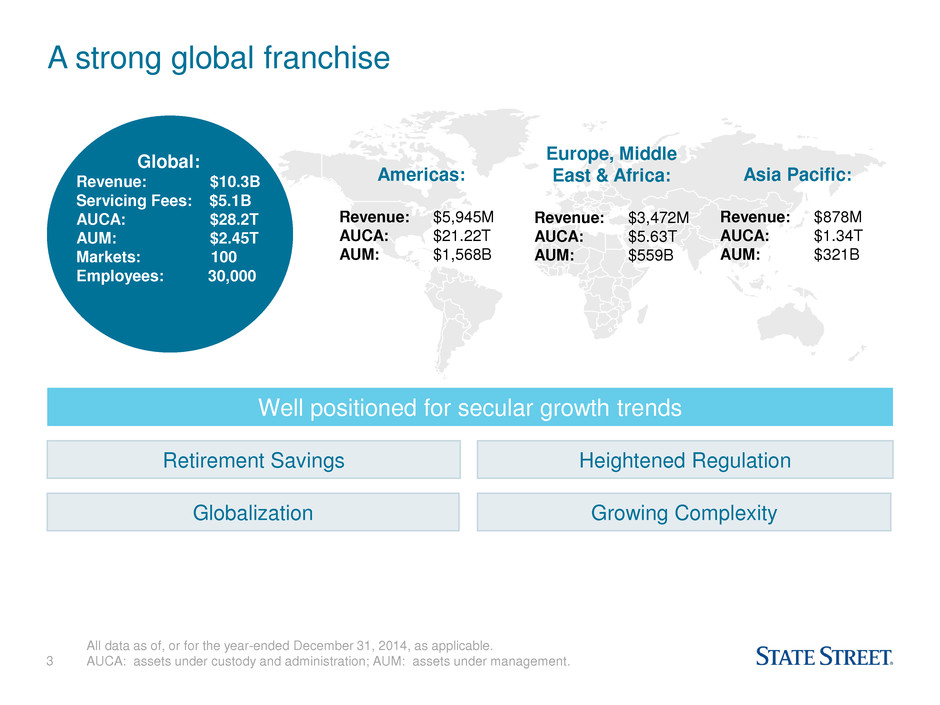

3 A strong global franchise Well positioned for secular growth trends All data as of, or for the year-ended December 31, 2014, as applicable. AUCA: assets under custody and administration; AUM: assets under management. Retirement Savings Globalization Growing Complexity Heightened Regulation Global: Revenue: $10.3B Servicing Fees: $5.1B AUCA: $28.2T AUM: $2.45T Markets: 100 Employees: 30,000 Americas: Revenue: $5,945M AUCA: $21.22T AUM: $1,568B Europe, Middle East & Africa: Revenue: $3,472M AUCA: $5.63T AUM: $559B Asia Pacific: Revenue: $878M AUCA: $1.34T AUM: $321B

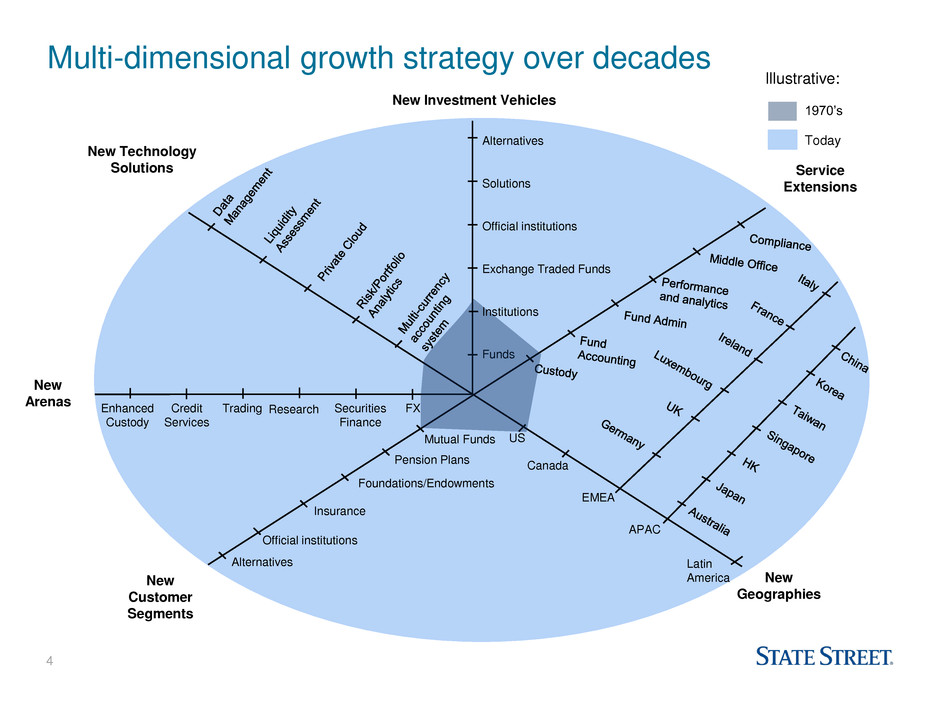

4 Multi-dimensional growth strategy over decades New Geographies New Customer Segments New Investment Vehicles New Technology Solutions Service Extensions Mutual Funds Pension Plans Foundations/Endowments Insurance US Official institutions Canada EMEA Solutions Official institutions Exchange Traded Funds Funds Alternatives APAC New Arenas Research FX Securities Finance 1970’s Today Alternatives Latin America Trading Credit Services Enhanced Custody Institutions Illustrative:

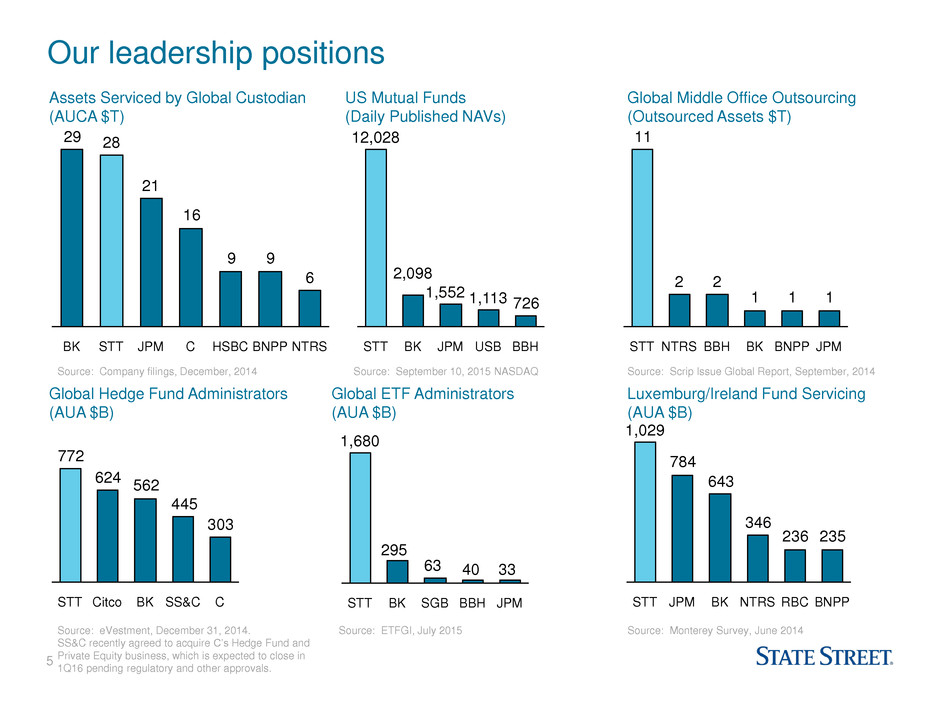

5 Assets Serviced by Global Custodian (AUCA $T) US Mutual Funds (Daily Published NAVs) Global Middle Office Outsourcing (Outsourced Assets $T) Global Hedge Fund Administrators (AUA $B) Global ETF Administrators (AUA $B) Luxemburg/Ireland Fund Servicing (AUA $B) Our leadership positions 6 99 16 2829 21 NTRS BNPP HSBC C JPM STT BK Source: Company filings, December, 2014 111 22 11 JPM BNPP BK BBH NTRS STT Source: Scrip Issue Global Report, September, 2014 303 445 562 624 772 C SS&C BK Citco STT Source: eVestment, December 31, 2014. SS&C recently agreed to acquire C’s Hedge Fund and Private Equity business, which is expected to close in 1Q16 pending regulatory and other approvals. 334063 295 JPM BBH SGB BK STT 1,680 Source: ETFGI, July 2015 235236 346 643 784 BNPP RBC NTRS BK JPM STT 1,029 Source: Monterey Survey, June 2014 Source: September 10, 2015 NASDAQ 726 JPM 1,552 BK 2,098 STT 12,028 BBH USB 1,113

6 1 As of December 31, 2014 Case Study: Global Asset Manager Growing with our clients Assets Under Custody & Administration at State Street ($B) Average Number of Products used by State Street Clients1 17 14 8 Top 25 Top 1000 Top 100 Middle Office Services Institutional Funds Servicing Private Equity administ ration Securities lending expansion FXConnect expansion Retail Funds Servicing Global Real Estate Fund- Admin Luxembourg fund servicing Investor AML ESP DataGX Client divests a business 324 284 267 196 269 6671 47 CAGR 31.8% 2014 2013 2012 2011 2010 2009 2008 2007

7 Our Foundation: • Client satisfaction • Service quality • Risk Excellence • Talent depth and knowledge • Efficiency and scalability of core operations Looking ahead: Global Services priorities Drive market share in high growth areas: Alternatives, ETFs, Offshore funds Innovate for consistent product leadership Expand presence in key emerging economies Digitize our enterprise

8 Key Initiatives: • Sector Solutions focus on five core client segments to drive business development • Thought leadership: − Center for Applied Research − Market Entry Solutions − State Street Associates − Agile IT Development • Product Excellence: − Proprietary global platforms (accounting, real estate, TotalETF) − Broad range of solutions and capabilities (e.g. transfer agency, data and analytics) − Consistent technology leadership • Deep talent and quality of service Driving market share in high growth areas ETF Assets3 (AUA $B) STT Industry Luxembourg/Dublin Assets2 (AUA $B) Alternative Investment Market Assets1 (AUA $B) 1 Hedge Fund Research, Towers Watson, Preqin. Includes hedge funds, private equity, real estate. 2 Offshore market information was from Monterey Insight. Ireland data is as of June 30 every year, and Luxembourg data is as of December 31 every year. 3 ETFGI, July 2015. 2008-2014 CAGR 11.6% 19.6% 8.7% 17.4% 23.8% 24.4% 2014 8,500 2013 7,700 2012 7,100 2011 6,300 2010 5,800 2009 5,000 2008 4,400 16% 2014 5,790 19% 2013 5,370 2012 4,600 2011 4,120 2010 3,790 2009 3,460 2008 3,510 2014 2,785 2009 1,158 2008 774 57% 2013 2,398 2012 1,949 2011 1,526 2010 1,478

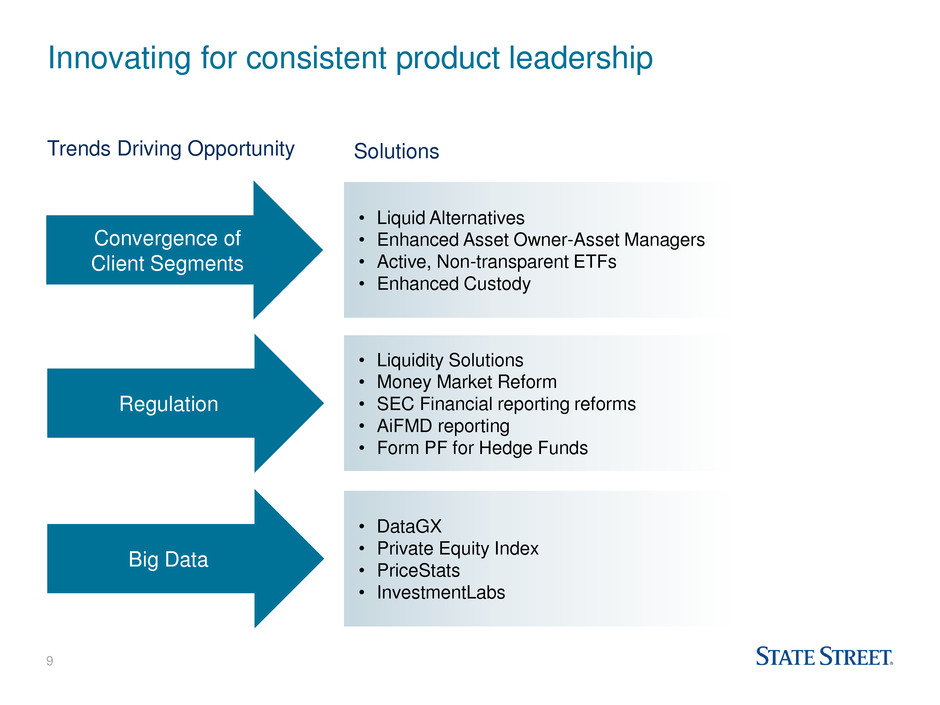

9 Innovating for consistent product leadership Convergence of Client Segments Regulation Big Data • Liquid Alternatives • Enhanced Asset Owner-Asset Managers • Active, Non-transparent ETFs • Enhanced Custody • Liquidity Solutions • Money Market Reform • SEC Financial reporting reforms • AiFMD reporting • Form PF for Hedge Funds • DataGX • Private Equity Index • PriceStats • InvestmentLabs Trends Driving Opportunity Solutions

10 Expanding presence in key emerging economies 1 In some markets, State Street has multiple operations centers and/or client management offices. All data as of August 31, 2015. 2 Refers to Investment Trust Management funds (a.k.a., the collective funds) in Japan. Australia and Japan: • Superannuation, Japan ITM2 funds • Asset owners’ increasing sophistication demand solutions such as alternatives servicing, data & analytics China and Hong Kong: • Mutual Fund Recognition and Stock Connect • China public pension fund reform Singapore and Southeast Asia: • Official Institutions expanding overseas investments • ASEAN Collectives Investment Scheme (CIS) passport Client Management Center Client Location Operations Center South Korea Taiwan Australia New Zealand Japan China Hong Kong Brunei Malaysia Singapore Indonesia India Philippines Vietnam Macau Thailand East Timor State Street’s Footprint in Asia Pacific Region1

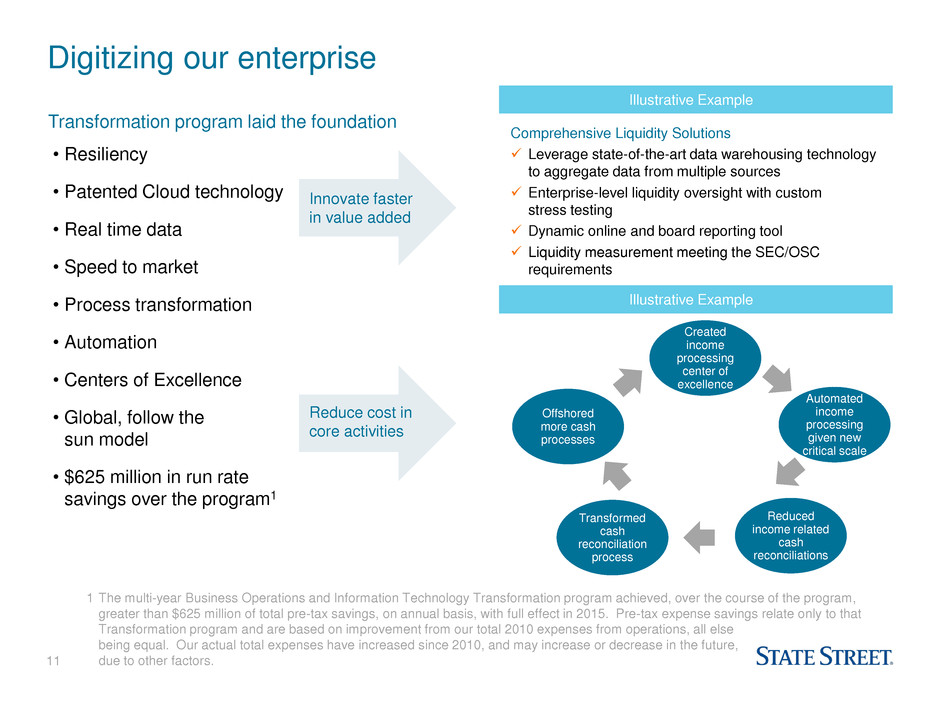

11 Digitizing our enterprise Illustrative Example • Resiliency • Patented Cloud technology • Real time data • Speed to market • Process transformation • Automation • Centers of Excellence • Global, follow the sun model • $625 million in run rate savings over the program1 1 The multi-year Business Operations and Information Technology Transformation program achieved, over the course of the program, greater than $625 million of total pre-tax savings, on annual basis, with full effect in 2015. Pre-tax expense savings relate only to that Transformation program and are based on improvement from our total 2010 expenses from operations, all else being equal. Our actual total expenses have increased since 2010, and may increase or decrease in the future, due to other factors. Innovate faster in value added Comprehensive Liquidity Solutions Leverage state-of-the-art data warehousing technology to aggregate data from multiple sources Enterprise-level liquidity oversight with custom stress testing Dynamic online and board reporting tool Liquidity measurement meeting the SEC/OSC requirements Reduce cost in core activities Created income processing center of excellence Offshored more cash processes Automated income processing given new critical scale Transformed cash reconciliation process Reduced income related cash reconciliations Illustrative Example Transformation program laid the foundation

12 State Street Global Services – Results built on… A strong franchise Well positioned for secular growth trends Focused strategy with four priorities • Deep global client relationships • Market leading product capabilities • Proprietary platforms • Global footprint • Globalization • Retirement savings • Heightened regulation • Growing complexity • Leadership in high- growth areas • Innovate for product leadership • Expand presence in key emerging markets • Digitize our enterprise

13 Q&A

14 Appendix This Appendix includes financial information presented on a GAAP basis as well as on a non-GAAP, or “operating basis,” in addition to other measures not presented in conformity with GAAP and used in the calculation of identified capital ratios. Management measures and compares certain financial information on an operating basis, as it believes that this presentation supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to State Street’s normal ongoing business operations. Management believes that operating-basis financial information, which reports revenue from non-taxable sources, such as interest revenue from tax-exempt investment securities and processing fees and other revenue associated with tax-advantaged investments, on a fully taxable-equivalent basis and excludes the impact of revenue and expenses outside of the normal course of business, facilitates an investor’s understanding and analysis of State Street’s underlying financial performance and trends in addition to financial information prepared and reported in conformity with GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP.

15 1 See slides 16-18 for 2015 outlook disclosed on January 23, 2015. Includes operating-basis financial information, a non-GAAP presentation. Operating-basis financial information and financial outlook is a non-GAAP presentation. Refer to slide 14 included with this presentation for explanations of our non-GAAP measures. Continue to expect full year 2015 results in line with expectations communicated on January 23, 20151 • Continue to expect operating-basis total fee revenue growth to be in the range of 4%-7% for 2015 compared to 2014: – Weaker Euro to USD exchange rate in 2015 placing downward pressures on fee growth • Continue to expect 2015 operating-basis total fee revenue growth to outpace operating-basis expense growth by at least 200bp relative to 2014: – Growth in regulatory compliance expenses continues to be a headwind, which we continue to partially offset with efficiency improvements • Continue to experience NIR headwinds relative to 2014: – Expect full year 2015 operating-basis NIR to be between $2.16B to $2.22B reflecting the following assumptions: – The Federal Reserve Board increases administrative rates in December 2015 – The Bank of England and European Central Bank do not change administrative rates in 2015 – Client cash deposits at State Street decline over the remainder of the year from their 2Q15 peak – If there are no rate increases in either US or Europe, expect full year 2015 operating-basis NIR to be near the lower end of the $2.16B to $2.22B range • Continue to expect an operating-basis effective tax rate of 30-32% for full year 2015: – Expect an operating-basis effective tax rate of 32-34% for second half of 2015

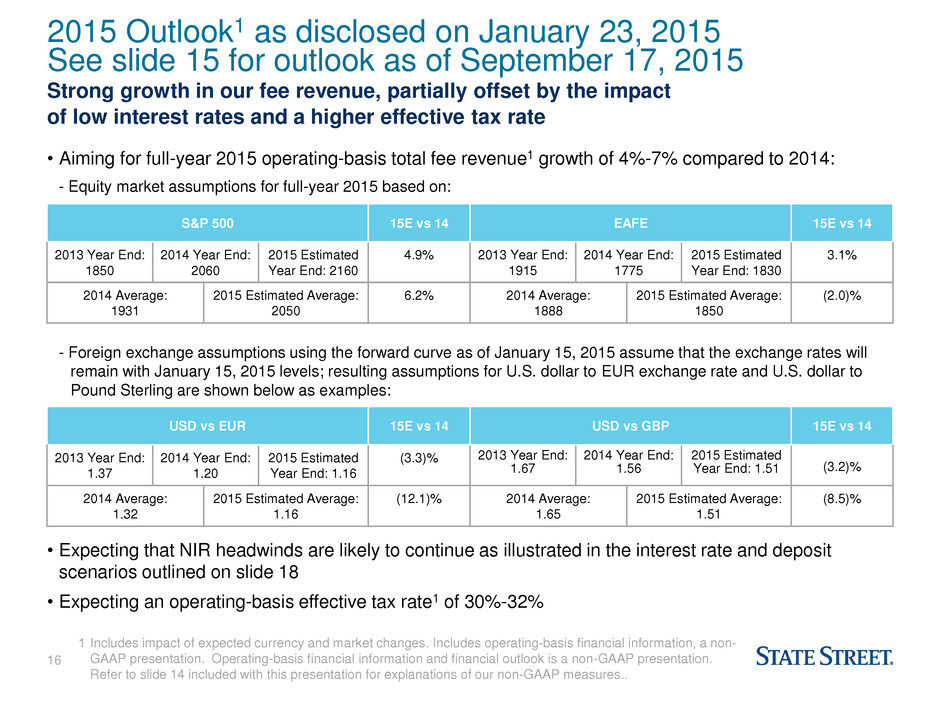

16 1 Includes impact of expected currency and market changes. Includes operating-basis financial information, a non- GAAP presentation. Operating-basis financial information and financial outlook is a non-GAAP presentation. Refer to slide 14 included with this presentation for explanations of our non-GAAP measures.. 2015 Outlook1 as disclosed on January 23, 2015 See slide 15 for outlook as of September 17, 2015 - Foreign exchange assumptions using the forward curve as of January 15, 2015 assume that the exchange rates will remain with January 15, 2015 levels; resulting assumptions for U.S. dollar to EUR exchange rate and U.S. dollar to Pound Sterling are shown below as examples: • Expecting that NIR headwinds are likely to continue as illustrated in the interest rate and deposit scenarios outlined on slide 18 • Expecting an operating-basis effective tax rate1 of 30%-32% S&P 500 15E vs 14 EAFE 15E vs 14 2013 Year End: 1850 2014 Year End: 2060 2015 Estimated Year End: 2160 4.9% 2013 Year End: 1915 2014 Year End: 1775 2015 Estimated Year End: 1830 3.1% 2014 Average: 1931 2015 Estimated Average: 2050 6.2% 2014 Average: 1888 2015 Estimated Average: 1850 (2.0)% USD vs EUR 15E vs 14 USD vs GBP 15E vs 14 2013 Year End: 1.37 2014 Year End: 1.20 2015 Estimated Year End: 1.16 (3.3)% 2013 Year End: 1.67 2014 Year End: 1.56 2015 Estimated Year End: 1.51 (3.2)% 2014 Average: 1.32 2015 Estimated Average: 1.16 (12.1)% 2014 Average: 1.65 2015 Estimated Average: 1.51 (8.5)% • Aiming for full-year 2015 operating-basis total fee revenue1 growth of 4%-7% compared to 2014: - Equity market assumptions for full-year 2015 based on: Strong growth in our fee revenue, partially offset by the impact of low interest rates and a higher effective tax rate

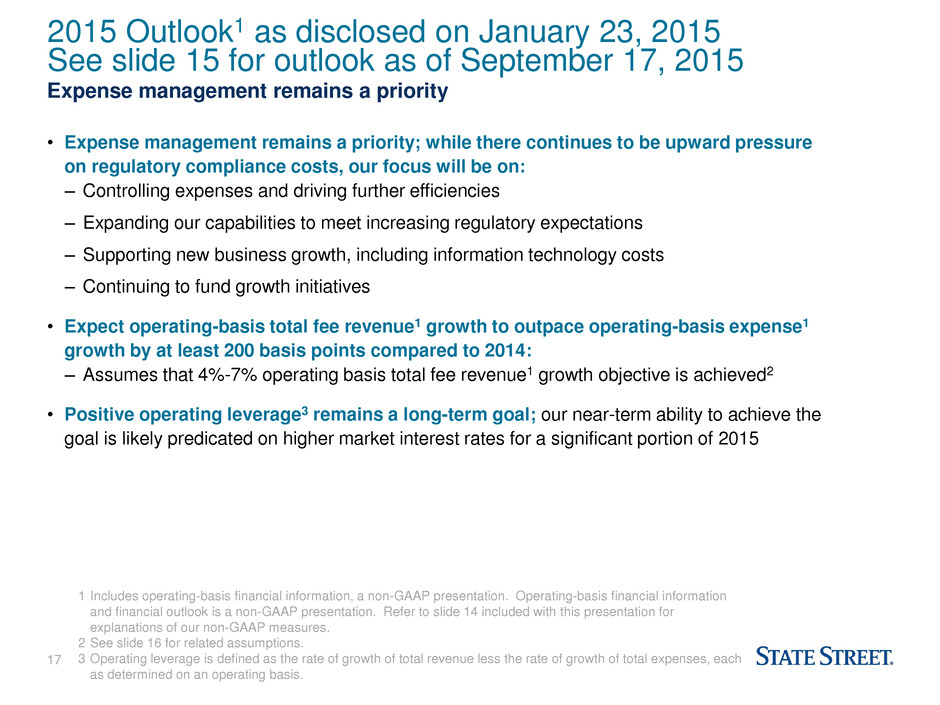

17 1 Includes operating-basis financial information, a non-GAAP presentation. Operating-basis financial information and financial outlook is a non-GAAP presentation. Refer to slide 14 included with this presentation for explanations of our non-GAAP measures. 2 See slide 16 for related assumptions. 3 Operating leverage is defined as the rate of growth of total revenue less the rate of growth of total expenses, each as determined on an operating basis. • Expense management remains a priority; while there continues to be upward pressure on regulatory compliance costs, our focus will be on: – Controlling expenses and driving further efficiencies – Expanding our capabilities to meet increasing regulatory expectations – Supporting new business growth, including information technology costs – Continuing to fund growth initiatives • Expect operating-basis total fee revenue1 growth to outpace operating-basis expense1 growth by at least 200 basis points compared to 2014: – Assumes that 4%-7% operating basis total fee revenue1 growth objective is achieved2 • Positive operating leverage3 remains a long-term goal; our near-term ability to achieve the goal is likely predicated on higher market interest rates for a significant portion of 2015 Expense management remains a priority 2015 Outlook1 as disclosed on January 23, 2015 See slide 15 for outlook as of September 17, 2015

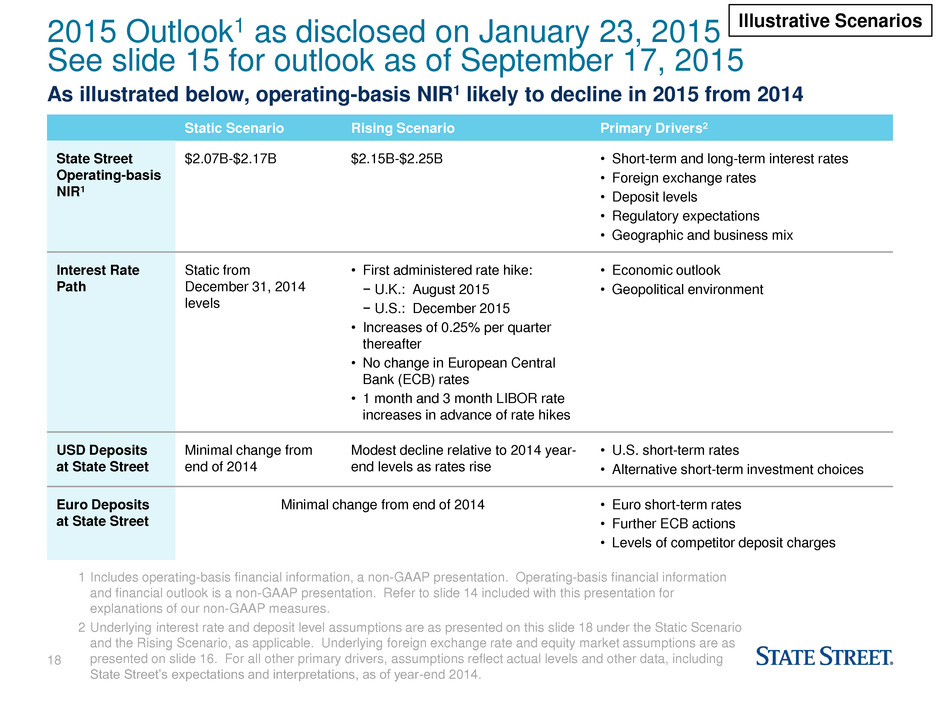

18 Static Scenario Rising Scenario Primary Drivers2 State Street Operating-basis NIR1 $2.07B-$2.17B $2.15B-$2.25B • Short-term and long-term interest rates • Foreign exchange rates • Deposit levels • Regulatory expectations • Geographic and business mix Interest Rate Path Static from December 31, 2014 levels • First administered rate hike: − U.K.: August 2015 − U.S.: December 2015 • Increases of 0.25% per quarter thereafter • No change in European Central Bank (ECB) rates • 1 month and 3 month LIBOR rate increases in advance of rate hikes • Economic outlook • Geopolitical environment USD Deposits at State Street Minimal change from end of 2014 Modest decline relative to 2014 year- end levels as rates rise • U.S. short-term rates • Alternative short-term investment choices Euro Deposits at State Street Minimal change from end of 2014 • Euro short-term rates • Further ECB actions • Levels of competitor deposit charges 1 Includes operating-basis financial information, a non-GAAP presentation. Operating-basis financial information and financial outlook is a non-GAAP presentation. Refer to slide 14 included with this presentation for explanations of our non-GAAP measures. 2 Underlying interest rate and deposit level assumptions are as presented on this slide 18 under the Static Scenario and the Rising Scenario, as applicable. Underlying foreign exchange rate and equity market assumptions are as presented on slide 16. For all other primary drivers, assumptions reflect actual levels and other data, including State Street’s expectations and interpretations, as of year-end 2014. Illustrative Scenarios As illustrated below, operating-basis NIR1 likely to decline in 2015 from 2014 2015 Outlook1 as disclosed on January 23, 2015 See slide 15 for outlook as of September 17, 2015