Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Great Lakes Dredge & Dock CORP | d49050d8k.htm |

INVESTOR PRESENTATION GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS 2015 | Q2 INFO@GLDD.COM | GLDD.COM Exhibit 99.1 |

SAFE

HARBOR GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM This presentation includes “forward-looking” statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, the Private

Securities Litigation Reform Act of 1995 or in releases made by the SEC,

all as may be amended from time to time. Such statements include

declarations regarding the intent, belief, or current expectation of the Company and its management. The Company cautions that any such forward-looking statements are not

guarantees of future performance, and involve a number of risks, assumptions and

uncertainties that could cause actual results of the Company and its

subsidiaries, or industry results, to differ materially from those

expressed or implied by any forward-looking statements contained herein, including, but not limited to, as a result of the factors, risks and uncertainties described in other securities filings of the

Company made with the SEC, such as the Company’s most recent Report on Form

10-K. You should not place undue reliance upon these

forward-looking statements. Forward-looking statements provided herein are made only as of the date hereof or as a specified date herein and the Company does not

have or undertake any obligation to update or revise them, unless required by

law. 2 |

PRESENTERS GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM Chief Executive Officer, Director > JONATHAN BERGER > Board member since December 2006 > Former Managing Director and Co-head of Corporate Finance for Navigant Consulting, Inc. > Former partner at KPMG, LLP and past National Partner in charge of Corporate Finance at KPMG 3 Senior Vice President & Chief Financial Officer > MARK MARINKO > Elected Senior Vice President & Chief Financial Officer in June 2014 > Most recently served as President of

the Consumer Services Division at

TransUnion, after serving as Controller

and Vice President of Finance at

TransUnion since 1996 > Has over 30 years of financial leadership practice, specializing in accounting, finance, sales, systems and business operations Investor Relations > MARY MORRISSEY > Joined Great Lakes’ Corporate Development team in August 2012 > Assumed Investor Relations position June 2014 > Has a management consulting and commercial banking background |

01 ABOUT US GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM 4 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM > WHO IS GREAT LAKES DREDGE & DOCK CORPORATION? ABOUT US 5 > TTM Revenue $861 million > TTM EBITDA* $83 million > Company Backlog at 6/30/2015 $752 million Incident- and Injury-Free (IIF) Company *Adjusted EBITDA from continuing operations > Domestic Dredging > International Dredging > Environmental & Remediation Services > Geotechnical Services Marine & Environmental Infrastructure Contractor 01 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM PROTECTED DOMESTIC DREGING MARKET & PROVEN RECORD > “Dredging Act” and “Jones Act” effectively serve as barriers to entry for non-U.S.-owned dredging companies > Only U.S. dredging operator with significant international presence > Portfolio of flexible fleet enables repositioning of vessels as necessary > Demonstrated record of successful project completion having never failed to complete a marine project over 125-year history > Added sediment & soil remediation capabilities with 2012 Terra Contracting acquisition > Magnus acquisition in 2014 added geotechnical capabilities and diversifies geographic footprint across the U.S. > Rivers & lakes’ inland dredging fleet enables Company to pursue work that has a water-based component to it ENVIRONMENTAL & GEOTECHNICAL CAPABILITIES ABOUT US 6 6/30/2015 YTD TOTAL CONSOLIDATED COMPANY REVENUE – $359 MILLION 2014 TOTAL CONSOLIDATED COMPANY REVENUE – $806 MILLION 01 89% 11% Dredging Environmental & Remediation 86% 14% Dredging Environmental & Remediation |

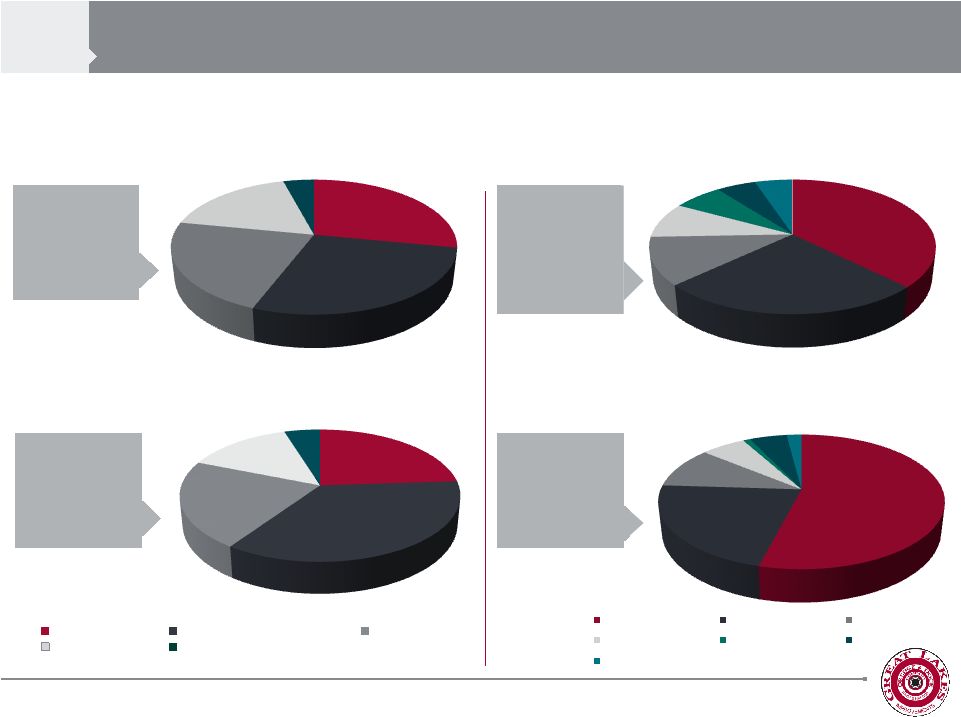

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM 38% 26% 11% 9% 7% 5% 5% 28% 28% 22% 18% 4% ABOUT US > LARGEST PROVIDER OF DREDGING 2013 DREDGING REVENUE BY WORK TYPE $643 MILLION 2014 DREDGING REVENUE BY WORK TYPE $698 MILLION 2013 DOMESTIC DREDGING BID MARKET SHARE DOM. BID MARKET: $1,276 MILLION 2014 DOMESTIC DREDGING BID MARKET SHARE DOM. BID MAKET: $1,520 MILLION 24% 36% 22% 14% 5% CAPITAL COASTAL PROTECTION RIVERS & LAKES FOREIGN MAINTENANCE 7 01 54% 22% 10% 6% 1% 5% 2% GREAT LAKES WEEKS MANSON OTHER ORION DUTRA NORFOLK |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM ABOUT US CAPITAL COASTAL PROTECTION MAINTENANCE INTERNATIONAL RIVERS & LAKES Deepening ports, coastal restoration, land reclamation, and excavation of underwater trenches Bid Market Share* 46% Creating and rebuilding beaches Bid Market Share* 58% Maintaining depth of shipping channels Bid Market Share* 33% International land reclamations, channel deepening and port infrastructure development 3-year Average Revenue $135M Inland maintenance and lake dredging, Environmental and habitat restoration Bid Market Share* 50% *The Company’s dredging bid market is defined as the aggregate dollar value of domestic projects on which the Company bid or could have

bid if not for capacity constraints. Bid market share represents bid market average

over the prior three years. 8

01 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM > 19 Vessels*: 16 U.S., 4 Middle East

(All U.S. flagged) > Including the only two large electric cutterhead dredges available in the U.S. for environmentally sensitive regions requiring lower emissions > 7 Vessels: 4 U.S., 3 Middle East,

(4 U.S. flagged) > Highly mobile, able to operate in rough waters > Little interference with other ship traffic > 5 Vessels: 4 U.S., 1 International, (All U.S. flagged) > Operates one of two environmentally friendly electric clamshell dredges in the U.S. > Maneuverability in tight areas such as docks and terminals HYDRAULIC HOPPER MECHANICAL ABOUT US *Note: Nine vessels are hydraulic but have less capacity, ideal for rivers and environmental dredging.

+ Over 140 Material Transportation Barge and Other Specialized Support

Vessels > LARGE & FLEXIBLE FLEET FOR DREDGING, U.S. &

INTERNATIONAL MARKETS

9 01 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM ABOUT US 01 $140 million Suez Canal deepening project $77 million Shell Island West project $200+ million Hurricane Sandy- related New Jersey shore protection projects > DREDGING WORLDWIDE WHERE WE HAVE WORKED COUNTRIES WHERE WE SEE OPPORTUNITIES 10 CURRENT PROJECTS / RECENT AWARDS $135 million Savannah Harbor deepening project $206 million PortMiami deepening project |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM ABOUT US 01 11 > WIDE RANGE OF ENVIRONMENTAL & GEOTECHNICAL SERVICES EXPECTED TO DIVERSIFY BEYOND CORE DREDGING SITE PREPARATION & DEVELOPMENT TBD > Excavation and management of contaminated soils > Stabilize sludge ponds and construct and close waste repositories > Mine reclamation > Wetlands construction > Hazardous waste remediation and removal > Landfill closure and capping > Slurry cutoff walls > Custom designed slurry backfills > Deep soil-mixed cutoff walls > Permeable reactive barriers > Biopolymer collection trenches > Soil stabilization & ground improvement ENVIRONMENTAL REMEDIATION GEOTECHNICAL SERVICES SEDIMENTS & WETLANDS > Design and construction of man-made wetlands > Contouring/shaping > Contaminated sediment excavation > Stream channel construction and restoration > Hazardous waste remediation > Water management > Site restoration |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM $6.4 $6.3 $5.4 $3.6 $3.1 $2.7 Conservation & Development Construction Site Remediation Building Remediation Emergency Response Special / Haz. Waste Other Rem. & Env. Clean-Up ABOUT US 01 12 $27.5 BILLION* > Highly fragmented – ~5,000 small, local and regional service providers with few large, public companies > Lower level of capital intensity compared to dredging > Drivers include: > Aging U.S. infrastructure – estimated $3.6 trillion investment needed for U.S. infrastructure by 2020 > Expansion and improvement of midstream assets and refining capacity: over $250 billion estimated spend in the next 25 years in natural gas, natural gas liquids and oil transmission infrastructure > Government oversight of environmental practices with tightened mandates and increased legislation > Superfund sites in the Northeast are now obtaining funding for environmental clean-up and remediation to develop brownfields > Natural disasters 2014 ENV. REMEDIATION & GEOTECHNICAL SERVICES – $27.5B > MARKET FOR ENVIRONMENTAL REMEDIATION EXPECTED TO GROW, PRIMARILY DRIVEN BY THE PRIVATE SECTOR MARKET OVERVIEW & DRIVERS Great Lakes was ranked #45 on Engineering News-Record’s “2014 Top 200 Environmental Firms List,” the Company’s inaugural year on the list Source: IBISworld, American Society of Civil Engineering and GLDD internal estimates |

02 FUTURE GROWTH GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM 13 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM DIVERSIFY CAPITALIZE OPTIMIZE ENHANCE BUILD Build upon Great Lakes’ preeminent position in the U.S. dredging market Enhance the Company’s operating capabilities via prudent and cost-effective investments and asset management Optimize the Company’s presence in foreign markets Capitalize on adjacent market opportunities in the Company’s domestic markets Pursue growth through diversification in the environmental & remediation segment FUTURE GROWTH 02 > GREAT LAKES INTENDS TO GROW THE BUSINESS BY CONTINUING TO EXECUTE THE FOLLOWING STRATEGIES: 14 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH 15 > BUILD UPON GREAT LAKES’ PREEMINENT POSITION IN THE U.S. DREDGING MARKET 43% 26% 10% 5% 4% 4% 2% 7% Great Lakes Weeks Manson Dutra Norfolk Orion Cashman Other 3 YR. AVG. DOMESTIC DREDGING BID MARKET SHARE (DOMESTIC BID MARKET: $3,736 MILLION) Great Lakes is the largest provider of dredging services in the United States ATTRACTIVE NEAR & LONG-TERM CATALYSTS IN U.S. DREDGING MARKET > Deepening of U.S. Ports Post-Panama Canal Deepening Growing use of “post-Panamax” vessels is expected, requiring the deepening of

many ports along the East Coast in order to accommodate the vessels

> Sandy Supplemental Appropriations Bill Provides an additional $800 million for dredging beyond the Corps’ annual budget;

increased attention on coastal restoration anticipated to result in increased

sustainable funding in future years

Provides a very high level of attention and funding for coastal protection work that

is anticipated to result in increased sustainable funding in future

years >

Gulf Coast Restoration

RESTORE Act requires 80% of penalties associated with Deepwater Horizon oil

spill to be deposited into a coastal restoration works fund, a portion of

which will be allocated to dredging

BP agreed to $18B settlement in July 2015

> Water Resources Reform & Development Act (WRRDA) & Harbor Maintenance Trust Fund (HMTF) First water legislation to be signed into law since 2007; authorizes dozens of large-scale water infrastructure projects Calls for HMTF monies (~$1.5 billion / year) to be fully allocated to harbor maintenance by 2025 02 Sources: Congressional Research Service, RESTORE Act, WRRDA |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM DELAWARE 40’ NEW YORK 50’ BOSTON 40’ CHARLESTON 45’ SAVANNAH 42’ JACKSONVILLE 40’ PORT EVERGLADES 42’ MIAMI 42’ MOBILE 45’ NEW ORLEANS 45’ HOUSTON 45’ SAN DIEGO 35’ PORTS WITH DEEPENING EXPEDITED BY OBAMA ADMINISTRATION PORTS WITH PLANS FOR EXPANSION > PORTS WITH PLANS FOR EXPANSION* International trade, particularly in the intermodal container shipping business, is undergoing significant change as a

result of the Panama Canal expansion. Many shipping lines have announced plans to

deploy larger ships which, due to channel dimension requirements,

currently cannot use many U.S. East and Gulf Coast ports. FUTURE

GROWTH 02

*GLDD recently completed the PortMiami deepening project, is deepening a portion of the Port of NY/ NJ and recently began the first phase of the Savannah deepening 16 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH 17 02 > Investment Overview Total estimated investment of $140M Invested to date as of 6/30/2015 of $68M > Financial Benefits Provides access to an unencumbered asset on our balance sheet to finance a potential future addition to the dredging fleet Five year accelerated depreciation for tax purposes is expected to create a tax shield Expected potential annual EBITDA of $20M – $30M > Timeline Executed contract with shipyard January 2014 Construction began September 2015 Expected completion is 4Q 2016 > ENHANCE OPERATING CAPABILITIES VIA PRUDENT AND COST- EFFECTIVE INVESTMENTS & ASSET MANAGEMENT Building the new hopper dredge represents a strategic investment by the Company in providing the most productive, efficient and capable dredging equipment in the domestic industry. > Performance Advantages 15,000 cubic yards capacity is significantly higher than a traditional self-propelled hopper dredge enabling the ATB to be the low cost producer Required crew complement is significantly reduced Construction cost is less than a traditional self-propelled hopper dredge Reduced insurance premiums Improved fuel efficiency Improved operating margins BUILDING ARTICULATED TUG & BARGE (ATB) HOPPER DREDGE |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH 18 02 > HISTORICALLY, DOMESTIC HOPPER MARKET HAS BEEN STRONG, AND THERE ARE ATTRACTIVE FUTURE OPPORTUNITIES ATB Build Progress – Barge “Ellis Island” > Historical hopper markets The ATB will be effective in all major hopper markets, including coastal protection, capital and maintenance projects It will be capable of competing in non-traditional hopper markets: mechanical and hydraulic maintenance projects, as well as hydraulic coastal projection projects > New opportunities for ATB Gulf Coast restoration – funded primarily by the BP settlement HMTF – incremental maintenance dredging each year until 2025 Superstorm Sandy coastal protection projects South Florida beaches – offshore borrow areas near depletion; sand source >100NM away being considered |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH 19 FUTURE GROWTH > OPTIMIZE PRESENCE IN ATTRACTIVE FOREIGN MARKETS 02 Great Lakes is the only U.S. dredging contractor with significant international presence

> Three-year average annual revenue of $135M > Work includes land reclamations, channel deepening and port infrastructure development > Over the last ten years, GLDD has performed dredging work in the Middle East, Africa, India, Australia, the Caribbean and Central and South America > Recently completed $140M contract to deepen and widen a portion of the Suez Canal in October 2014 OVERVIEW Great Lakes’ international strategy is to work in the most attractive markets that enable consistent utilization and optimization of the international fleet Oresund Fixed Link Durrat Al Bahrain Saipem Do Brasil |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH 20 > CAPITALIZE ON ADJACENT MARKET OPPORTUNITIES IN THE COMPANY’S DOMESTIC MARKETS 02 > $89M contract awarded 2/2014 > Rivers & lakes division is dredging nearly 11 million cubic yards of material from Basins 1-4 of Lake Decatur > Environmental & remediation segment is responsible for rehabilitation of Oakley Sediment Basin > Estimated completion in 2019 Strategy includes pursuing environmental projects with a water component

ACTIVE PROJECT EXAMPLES OF FUTURE POTENTIAL OPPORTUNITIES > EPA approved clean-up plan for Gowanus Canal Superfund site in September 2013 > Clean-up is expected to cost ~$500M and will be spread among more than three dozen entities > Should be completed by 2022 > Plan entails removing contaminated sediment from the bottom of canal by dredging, capping the dredged areas and implementing controls on combined sewer overflows to prevent future contamination Decatur Lake Project Passaic River Superfund > EPA finalizing a plan for the Passaic River Superfund – options range from removing 1M cubic yards (CY) of toxic sediment from the river bottom to just under 10M CY > Cost is expected to range from $500M to $1.7B > Several companies are responsible for the cleanup; one responsible party, Occidental Chemical, reached a $190M settlement with EPA in September 2014 Gowanus Canal Superfund Site Sources: EPA, Bloomberg |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM FUTURE GROWTH > Leverage our core competencies and strengths to capture market share in the environmental services market 21 02 > Strong reputation > Accurate estimating > Project mobilization and execution > Creativity > Engineering innovation > Commitment to safety > Stringent controls > Capitalize on GLDD’s scale and expanded capabilities to bid on larger, more complex projects > Establish new customers and focus on deepening existing relationships with customers in high potential end markets, e.g. Oil and Gas, Mining and Utilities > Target end-users directly to capture more value > Expand footprint geographically to smooth out seasonality STRATEGY |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM > PURSUE ATTRACTIVE END MARKETS TO GROW ENVIRONMENTAL BUSINESS 02 22 Sources: EPA, American Society of Civil Engineering, USACE National Levee Database and Earthworks, IHS Economic Consulting

FUTURE GROWTH Utilities > Coal combustion residuals (CCRs), commonly known as coal ash, are one of the largest industrial waste streams generated in the U.S. > CCR disposal occurs at more than 310 active on-site landfills and at more than 735 active on-site surface impoundments > EPA Final Rule regulating CCRs goes into effect October 2015 Levee & Dam Maintenance > Most common type of flood defense and mitigation > Approximately 100,000 miles of levees exist in the U.S. > Average age is 54 years > 500,000+ abandoned and inactive hardrock mines in the U.S. > $50B estimated clean-up > HR 963, the Hardrock Mining Reform and Reclamation Act of 2015, currently in subcommittee, would charge the mining industry a reclamation fee that would generate $200 million per year to fund abandoned mine restoration Mine Reclamation Oil & Gas > Driven by the shale and natural gas growth in the United States, significant investment has been made in midstream and downstream oil and gas infrastructure > Between 2014 and 2020, $80 billion is projected to be invested annually in U.S. midstream and downstream petroleum infrastructure |

03 INVESTMENT HIGHLIGHTS GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM 23 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM INVESTMENT HIGHLIGHTS > BACKLOG BY WORK TYPE | $ IN MILLIONS 24 03 *Includes low bids and options pending award as of 6/31/2015. $420.3 $543.4 $669.5 $752.0 $795.6 10% 32% 20% 34% 32% 19% 26% 32% 24% 28% 6% 5% 14% 11% 11% 52% 18% 20% 7% 7% 13% 4% 4% 4% 7% 5% 11% 20% 19% $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 12/31/2012 12/31/2013 12/31/2014 6/30/2015 06/30/2015* CAPITAL COASTAL PROTECTION RIVERS & LAKES FOREIGN MAINTENANCE ENVIRONMENTAL & REMEDIATION 5% |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2011 2012 2013 2014 YTD 6/30/2014 YTD 6/30/2015 CAPITAL MAINTENANCE COASTAL PROTECTION FOREIGN RIVERS & LAKES ENVIRONMENTAL & REMEDIATION 17.3% 12.7% 13.5% 9.6% 8.9% 9.1% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% $0 $20 $40 $60 $80 $100 $120 2011 2012 2013 2014 YTD 6/30/2014 YTD 6/30/2015 $90.1 > ANNUAL REVENUE > ANNUAL ADJUSTED EBITDA* 25 03 > ANNUAL ADJUSTED EBITDA* $588.4 *Adjusted EBITDA from continuing operations represents net income (loss), adjusted for net interest expense, income taxes, depreciation

and amortization expense, accelerated maintenance expense, goodwill

impairment, debt restructuring expense and gains on bargain purchase

acquisitions. INVESTMENT HIGHLIGHTS

$731.4 $806.8 $359.1 $413.4 $74.7 $98.1 $77.1 $31.8 $37.7 $520.1 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM > CAPEX $ IN MILLIONS > LEVERAGE 26 03 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2011 2012 2013 2014 YTD 6/30/2015 GROWTH MAINTENANCE $30.6 (D) $76.3 (A)

$62.1

(B) $103.7 (C)

0 1 2 3 4 5 2011 2012 2013 2014 6/30/2015 NET DEBT / EBITDA 3.5x 3.5x 4.4x (A) Includes $13.7 related to the Empire Pipeline, $3.6 related to the ATB Hopper Dredge, $6.8 related to two new scows and $11.7

related to the Terra Contracting

acquisition. (B) Includes $17.1 related to the ATB Hopper Dredge. (C) Includes $33.8 related to the ATB Hopper Dredge, $4.0 million related to the Team acquisition for which GLDD recognized a $2.2 million gain

on bargain purchase and $11.6 million related to the Magnus

acquisition. (D)

Includes $12.1 million related to the ATB Hopper Dredge and excludes $16.0 million for

the purchase of the Terrapin Island dredge that was previously on an

operating lease. INVESTMENT HIGHLIGHTS 3.7x $22.9 1.6x |

APPENDIX GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM 27 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM APPENDIX > RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA 28 06 FISCAL YEAR ENDING DECEMBER 31, SIX MONTHS ENDED JUNE 30, ($ IN MILLIONS) 2011 2012 2013 2014 2014 2015 NET INCOME (LOSS) $16.5 $(2.7) $(34.4) $10.3 $(6.6) $(5.7) INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF INCOME TAXES 0.9 (9.6) (54.9) $(10.4) (8.1) - NET INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTEREST (0.7) 0.6 0.6 - - - INCOME (LOSS) FROM CONTINUING OPERATIONS $16.3 $6.3 $19.9 $20.7 1.4 (5.7) ADJUSTED FOR: ACCELERATED MAINTENANCE EXPENSES - 4.7 - - - - LOSS ON EXTINGUISHMENT OF DEBT 5.1 - - - - - INTEREST EXPENSE – NET 21.4 20.9 21.9 20.0 10.0 11.2 INCOME TAX PROVISION (BENEFIT) 9.9 5.4 10.5 (11.5) 0.6 (3.6) DEPRECIATION AND AMORTIZATION 37.3 37.4 46.6 50.1 21.9 33.0 IMPAIRMENT OF GOODWILL - - - - 2.8 GAIN ON BARGAIN PURCHASE ACQUISITION - - - (2.2) (2.2) - ADJUSTED EBITDA FROM CONTINUING OPERATIONS $90.1 $74.7 $98.9 $77.1 $31.8 $37.7 |

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS INFO@GLDD.COM | GLDD.COM APPENDIX > STOCK PERFORMANCE INITIAL INVESTMENT $100 Note: Great Lakes went public in December 2006 29 06 12.31.06 12.31.07 12.31.08 12.31.09 12.31.10 12.31.11 12.31.12 12.31.13 12.31.14 6.30.15 GLDD 100.0% 135.2% 64.3% 100.5% 114.3% 86.2% 138.4% 142.6% 132.7% 92.4% PEERS 100.0% 132.6% 89.3% 96.6% 96.8% 79.3% 96.3% 141.7% 123.3% 124.9% RUSSELL 2K 100.0% 97.3% 63.4% 79.4% 99.5% 94.1% 107.8% 147.7% 152.9% 159.2% NASDAQ 100.0% 109.8% 65.3% 93.9% 109.8% 107.9% 125.0% 172.9% 196.1% 206.5% 50% 70% 90% 110% 130% 150% 170% 190% 210% 230% 12/31/2006 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 12/31/2014 6/30/2015 GLDD Peers Russell 2K NASDAQ |