Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K INVESTOR PRESENTATION SEPTEMBER 2015 - SUN COMMUNITIES INC | form8-kinvestorpresentatio.htm |

FORWARD LOOKING STATEMENTS This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the "Company") and from third-party sources indicated herein. Such third-party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2014, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include: changes in general economic conditions, the real estate industry and the markets in which we operate; • difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; our liquidity and refinancing demands; our ability to obtain or refinance maturing debt; our ability to maintain compliance with covenants contained in our debt facilities; availability of capital; our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; increases in interest rates and operating costs, including insurance premiums and real property taxes; risks related to natural disasters; general volatility of the capital markets and the market price of shares of our capital stock; our failure to maintain our status as a REIT; changes in real estate and zoning laws and regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITs; litigation, judgments or settlements; our ability to maintain rental rates and occupancy levels; competitive market forces; and the ability of manufactured home buyers to obtain financing and the level of repossessions by manufactured home lenders. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements. 2

SUN COMMUNITIES, INC. (NYSE:SUI) Leading owner, operator and developer of manufactured housing (“MH”) and recreational vehicle (“RV”) communities Sun Communities’ current portfolio includes 251 communities consisting of 93,373 sites across 30 states □ 200 MH communities, 37 RV resorts, and 14 communities containing both MH and RV. □ 73,652 manufactured home sites □ 19,721 RV sites □ Annuals/Seasonals – 9,675 □ Transient – 10,046 Sell and lease new and pre-owned manufactured homes as an adjunct to our core business 3 As of September 2015

AFFORDABILITY Affordability Drives Manufactured Housing Manufactured Housing vs. Multi Family: Sun – Manufactured Homes • Average rent ≈ $845/month or $0.65/square foot • Average square footage ≈ 1,300 square feet Apartments • Average rent ≈ $1,050/month or $1.00/square foot* • Average square footage ≈ 1,050 square feet Source: Rent.com data *Represents average rent for a 2 bedroom apartment in major metropolitan areas Sun operates in as of August 2015.4 Comparing Sun manufactured homes to the multifamily average, a manufactured home provides approximately 24% more space at approximately 36% less cost per square foot.

The median income in the 30 states in which Sun operates is $59,000 and the average income in a MH community is roughly half the median income. The average single family home costs over 5x the price of a MH unit. * 2013 Average 2 person household income - 30 states in which SUI operates per US Census data. Housing data from 2014 MHI Quick Facts Manufactured Housing vs. Single Family • Average cost of Manufactured Housing ≈ $64,000 or roughly 1 years median income • Average cost of Single Family ≈ $324,500 or roughly 5 years median income 5 AFFORDABILITY Affordability Drives Manufactured Housing 63,100 62,800 60,500 62,200 64,000 $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 2009 2010 2011 2012 2013 Manufactured Housing 270,900 272,900 267,900 292,200 324,500 Single‐Family Portion of purchase price attributable to land Median Household Income*

76.0% 78.0% 80.0% 82.0% 84.0% 86.0% 88.0% 90.0% 92.0% 94.0% 96.0% ‐20.00% ‐15.00% ‐10.00% ‐5.00% 0.00% 5.00% 10.00% 15.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Mortgage Rates (% Change)** Mortgages (% change)** Sun Occupancy ***Data from IBISWorld is based on 30-year conventional mortgage rates and borrowing capacity advanced by a commercial bank to include industrial, real estate, and consumer loans. Sun's O ccupancy P e r c e n t a g e C h a n g e i n m o r t g a g e r a t e s & a c c e s s t o c r e d i t 6 Sun’s occupancy continues to grow through various changes in the single family market. Affordability Drives Manufactured HousingAFFORDABILITY

STABILITY OF REVENUE Stable and growing revenue due to: Low turnover of owner occupied sites due to high cost to move a home ($4,000- $10,000) Average tenure of our residents in our communities is 12 years Average term of home in our communities is approximately 45 years No loss in revenue as home stays in the community. 7 Move Outs and Re-Sales Stable and Growing Revenues 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD 2015 Resident Re‐Sales Home Move Outs

CAPITAL EXPENDITURES Manufactured housing is a low capex business relative to its peers as it is largely a land ownership business. Source: Company filings Data as of 12/31/2014 8 12.2% 8.8% 8.1% 4.7% 3.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Multi-family Student Housing Overall Average Self-Storage Manufactured Housing Capex as a % of Revenues

RECESSION RESISTANT Same Site NOI Growth Same Site OccupancySame Site Rent Growth Low annual resident turnover results in stability of income and occupancy Strong and consistent rental growth creating a stable revenue stream Occupancy gains are a function of Sun’s integrated platform, including leasing, sales, and financing 9 *Projection based on midpoint of 2015 guidance $393 $404 $413 $425 $437 $445 $456 $472 $370 $390 $410 $430 $450 $470 $490 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 * A v e r a g e M o n t h l y R e n t 82.1% 83.4% 84.3% 85.8% 86.7% 88.9% 93.2% 94.2% 80.0% 82.0% 84.0% 86.0% 88.0% 90.0% 92.0% 94.0% 96.0% 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 * 2.79% 0.70% 3.12% 3.58% 5.54% 5.87% 7.71% 9.60% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 *

SAME SITE NOI Source: Citi Investment research, August 2015. “REITs”- includes an index of REITs across a variety of asset classes including self storage, mixed office, regional malls, shopping centers, multifamily, student housing, manufactured homes and specialty Sun’s average same site NOI growth has exceeded the Industry Average by 160 bps and Apartment Average by 150 bps over a 16 year period. 10 ‐9.00% ‐8.00% ‐7.00% ‐6.00% ‐5.00% ‐4.00% ‐3.00% ‐2.00% ‐1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 1 Q 9 9 2 Q 9 9 3 Q 9 9 4 Q 9 9 1 Q 0 0 2 Q 0 0 3 Q 0 0 4 Q 0 0 1 Q 0 1 2 Q 0 1 3 Q 0 1 4 Q 0 1 1 Q 0 2 2 Q 0 2 3 Q 0 2 4 Q 0 2 1 Q 0 3 2 Q 0 3 3 Q 0 3 4 Q 0 3 1 Q 0 4 2 Q 0 4 3 Q 0 4 4 Q 0 4 1 Q 0 5 2 Q 0 5 3 Q 0 5 4 Q 0 5 1 Q 0 6 2 Q 0 6 3 Q 0 6 4 Q 0 6 1 Q 0 7 2 Q 0 7 3 Q 0 7 4 Q 0 7 1 Q 0 8 2 Q 0 8 3 Q 0 8 4 Q 0 8 1 Q 0 9 2 Q 0 9 3 Q 0 9 4 Q 0 9 1 Q 1 0 2 Q 1 0 3 Q 1 0 4 Q 1 0 1 Q 1 1 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 4 Q 1 4 1 Q 1 5 2 Q 1 5 Apartments Apartments Average (2.9%) SUI SUI Average (4.4%) Industry Average (2.8%)

SAME SITE INDEXED NOI GROWTH MH is the most recession resistant sector of the housing and commercial real estate sectors and has consistently outperformed multifamily in same site NOI growth since 2000. Source: SNL 11

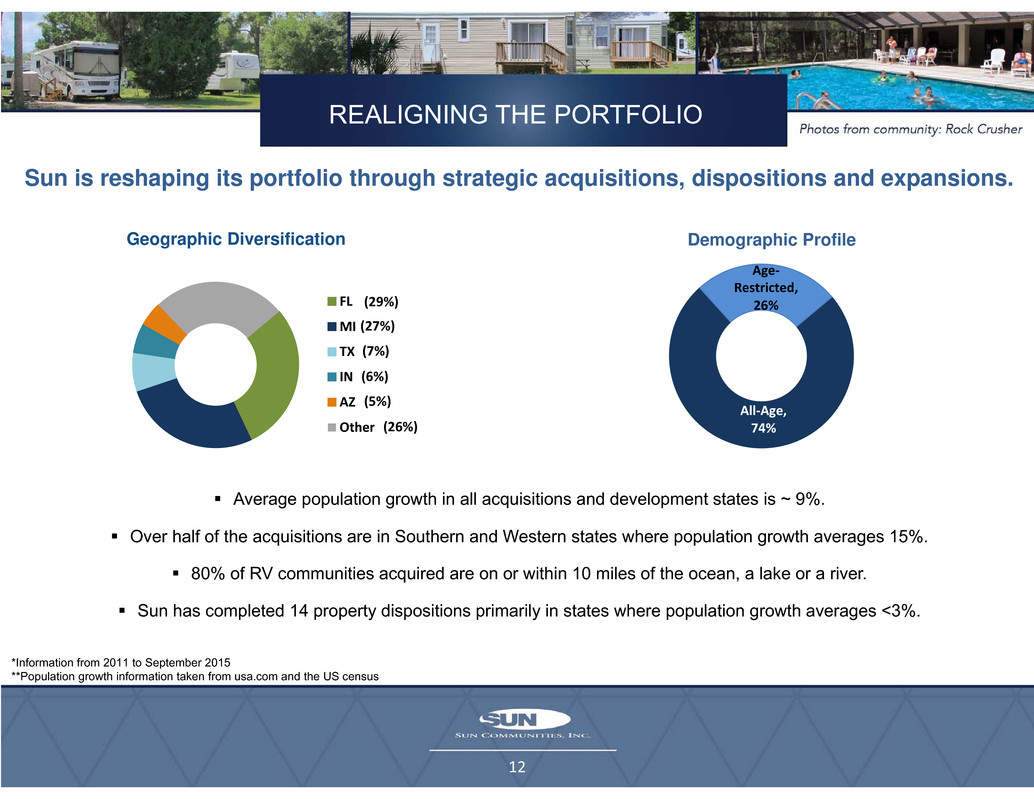

REALIGNING THE PORTFOLIO 12 *Information from 2011 to September 2015 **Population growth information taken from usa.com and the US census Sun is reshaping its portfolio through strategic acquisitions, dispositions and expansions. Average population growth in all acquisitions and development states is ~ 9%. Over half of the acquisitions are in Southern and Western states where population growth averages 15%. 80% of RV communities acquired are on or within 10 miles of the ocean, a lake or a river. Sun has completed 14 property dispositions primarily in states where population growth averages <3%. FL MI TX IN AZ Other (29%) (27%) (7%) (6%) (5%) (26%) Geographic Diversification All‐Age, 74% Age‐ Restricted, 26% Demographic Profile

TIMELINE : STRATEGIC ACQUISITIONS • 17 MH & 1 RV properties Kentland Acquisition growing the portfolio. 136 communities 54,811 sites Since May 2011, Sun has acquired over $2.5 billion of communities, increasing its number of sites and communities by 85% and 96%, respectively. 13 2011 173 communities 63,697 sites 2012 188 communities 69,789 sites 2013 217 communities 79,554 sites 2014 251 communities 93,373 sites 2015 • Further strengthened the MH portfolio with the 6 community Rudgate Acquisition. • Acquired Palm Creek, an irreplaceable age restricted asset. • Geographic & RV Diversification with 10 RV community Morgan acquisition entering 5 new states. • Closed 1st phase of “ALL” 59 high quality, age-restricted community acquisition, strengthening & diversifying the portfolio. • Final closing of “ALL” acquisition enhancing the portfolio by adding FL and 26 age- restricted communities. • Acquired 8 MH communities, adding 3 age-restricted communities and 4 RV Resorts.

GROWTH THROUGH ACCRETIVE ACQUISITIONS A Look at Acquisition Performance 2011 Acquisitions (26 Communities) 2012 Acquisitions (11 Communities)* 14 $13 $16 $19 $22 $25 $28 $31 $34 $37 $40 Year 1 Year 2 Year 3 Year 4 ( i n m i l l i o n s ) Revenues NOI 90.8% 92.5% 97.6% 98.5% 90% 92% 94% 96% 98% 100% Year 1 Year 2 Year 3 Year 4 Occupancy $20 $22 $24 $26 $28 $30 $32 $34 $36 $38 $40 Year 1 Year 2 Year 3* ( i n m i l l i o n s ) Revenues NOI 96.8% 97.1% 97.8% 96% 97% 98% 99% 100% Year 1 Year 2 Year 3* Occupancy *2012 Acquisitions Year 3 represents actuals through July 2015 plus projection for balance of 2015.

RV INDUSTRY : GROWTH CONTRIBUTORS Contributors In the 5 years to 2020, industry revenue is expected to increase at approximately 1.6% to $6 billion Shipments reached a 7 year high in 2014 and a 6.5% year-over-year increase is projected for 2015 Adults aged 50 and over accounted for more than 40% of total campers and this demographic has a high level of disposable income Growth in disposable income positively affects the industry and is expected to average 2.4% through 2020 Through 2020 domestic travel is forecast to increase at an average rate of 1.6% per year Through 2020 inbound travel is forecast to increase at 4.2% per year Sources: RVIA , GoRVing.com & IBISWorld *Recession period (credit and gas crunch). RV INDUSTRY: High Demand/ Steady Growth 15

SUN RV PORTFOLIO PERFORMANCE Strong RV Portfolio Performance **Based on 2015 guidance. Percentage of revenues from RV resorts increased from 10% in 2011 to an estimated 17% in 2015 NOI and Income Growth – 2013 Morgan acquisition (10 properties) 16 *Year 3 represents actuals through July 2015 plus projection for balance of 2015. *

GROWTH THROUGH EXPANSION OPPORTUNITIES Inventory of over 8,100 zoned and entitled sites available for expansion at 48 communities in 15 states Expanding in communities with strong demand evidenced by occupancy of ~95% Expansion lease-up is driven by sales, rental and relocation programs Approximately 700 sites expected to be developed at 5 communities in TX and CA by end of 2015 4,100 sites planned for development in the next 4 years Assuming a 100 site expansion at $45,000 per site, that is leased up in a year (8 sites/month), results in an unlevered return of 15%-17%* *assuming a 6% cap rate and exiting in 5 years 17 Strong Growth and Returns from Expansions

CONSERVATIVE BALANCE SHEET Net Debt / Enterprise Value EBITDA / Interest 18 *Calculated based on trailing 12 months ended June 30, 2015 which only includes a partial year of EBITDA for 2015 acquisitions. Net Debt / EBITDA Fixed Debt (%)

STAGGERED DEBT MATURITIES 19 *Data as of 6/30/2015, adjusted for line of credit refinance on 8/19/2015 Unsecured Line of Credit Refinanced Increased total potential capacity, inclusive of the accordion, from $600M to $750M Reduced spread to LIBOR by 10bps Added a Term loan component for $58M Improved covenants and lowered unused fees Extended the maturity date from 2018 to 2020 The company has a well laddered debt maturity schedule with only approximately 20% of debt coming due before 2019 $19 $221 $130 $83 $98 $92 $303 $1,170 $88 $58 $35 $392 $25 $235 $137 $90 $106 $158 $311 $1,292 1.1% 11.0% 16.8% 20.7% 25.2% 31.9% 45.1% 100.0% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2015 2016 2017 2018 2019 2020 2021 Thereafter Mortgage Debt Secured Borrowings Term Loan Capacity Series B-3 Preferred OP Units Revolver Capacity Cumulative % Total

20

PERFORMANCE VS. INDICES 21 Sun has outperformed all major REIT sector indices and many major market indices over the last five years. 5-year Total Returns by Index as of 6-30-2015 5-year Total Returns by REIT Sector as 6-30-2015 Source: SNL 326% 260% 233% 222% 220% 199% 195% 0% 50% 100% 150% 200% 250% 300% 350% SUI SNL US REIT Manufactured Homes S&P Small‐Cap S&P 500 Russell 2000 SNL US REIT Equity MSCI US REIT (RMS) 326% 278% 260% 238% 218% 210% 202% 197% 192% 172% 172% 0% 100% 200% 300% 400% SUI Self‐Storage Manufactured Housing Shopping Malls Retail Multifamily Industrial Strip Malls Hotel Healthcare Office