Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Penumbra Inc | d923792dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 14, 2015

Registration No. 333-206412

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Penumbra, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3841 | 05-0605598 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

One Penumbra Place

1351 Harbor Bay Parkway

Alameda, California 94502

(510) 748-3200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Adam Elsesser

Chairman, Chief Executive Officer and President

Penumbra, Inc.

One Penumbra Place

1351 Harbor Bay Parkway

Alameda, California 94502

(510) 748-3200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Alan F. Denenberg Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Robert D. Evans Executive Vice President and General Counsel Penumbra, Inc. One Penumbra Place 1351 Harbor Bay Parkway Alameda, California 94502 (510) 748-3200 |

Rezwan D. Pavri Richard A. Kline Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 (650) 752-3100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 14, 2015

Preliminary Prospectus

3,800,000 Shares

Common Stock

This is the initial public offering of common stock of Penumbra, Inc.

We are offering 3,800,000 shares of our common stock. Prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price will be between $25.00 and $28.00 per share.

Our common stock has been approved for listing on the New York Stock Exchange under the symbol “PEN.”

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Penumbra before expenses(1) |

$ | $ | ||||||

| (1) | See the section titled “Underwriting” for additional disclosure regarding underwriter compensation and offering expenses. |

We have granted the underwriters the right to purchase an additional 570,000 shares of common stock from us.

We are an “emerging growth company” as defined under the federal securities laws, and as such, we have elected to comply with reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2015.

| J.P. Morgan | BofA Merrill Lynch | |

| Wells Fargo Securities | Canaccord Genuity | |

, 2015

Table of Contents

In this prospectus, “Penumbra,” “Penumbra, Inc.,” the “Company,” “we,” “us” and “our” refer to Penumbra, Inc. and its consolidated subsidiaries. We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

This prospectus includes industry and market data that we obtained from industry publications, internal estimates and other third-party sources. These sources may include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

We also refer to certain studies in this prospectus. In certain cases, we may sponsor, fund and/or control the conduct of these studies, or may have other relationships with certain of the authors of such studies. Specifically, we sponsored, funded and controlled the THERAPY and Penumbra Pivotal studies, and provided a modest grant, together with a number of other industry participants, relating to the MR CLEAN study, but did not control such study. We may also have or have had consulting relationships with or have provided grants to physicians who authored or co-authored some of such studies for matters unrelated to such studies, including the MR CLEAN, ESCAPE, SWIFT PRIME, REVASCAT, Kass-Hout T, et al., Turk Comparison, Humphries W, et al., ADAPT FAST, Mascitelli, Patel, et al. and Milburn, et al. studies cited in this prospectus.

i

Table of Contents

Through and including , 2015 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes to those statements contained elsewhere in this prospectus.

Overview

Penumbra is a global interventional therapies company that designs, develops, manufactures and markets innovative medical devices. We have a broad portfolio of products that addresses challenging medical conditions and significant clinical needs across two major markets, neuro and peripheral vascular. The conditions that our products address include, among others, ischemic stroke and hemorrhagic stroke, which involve blockage or rupture of blood vessels in the brain, and various peripheral vascular conditions that can be treated through thrombectomy and embolization procedures, which involve the use of medical devices to remove or treat blockages or ruptures of blood vessels.

We are an established company focused on the neuro market, and we recently expanded our business to include the peripheral vascular market. We sell our products to hospitals, primarily through our salesforce, as well as through distributors in select international markets. We focus on developing, manufacturing and marketing products for use by specialist physicians, including interventional neuroradiologists, neurosurgeons, interventional neurologists, interventional radiologists and vascular surgeons. We design our products to provide these specialist physicians with a means to drive improved clinical outcomes through faster and safer procedures.

We attribute our success to our culture built on cooperation, our highly efficient product innovation process, our disciplined approach to product and commercial development, our deep understanding of our target end markets and our relationships with specialist physicians. We believe these factors have enabled us to rapidly innovate in a highly capital-efficient manner.

Since our founding in 2004, we have had a strong track record of organic product development and commercial expansion that has established the foundation of our global organization. Some of our key accomplishments include:

| • | launching our first product, for neurovascular access, in the United States in 2007; |

| • | establishing our direct neuro salesforce in the United States and Europe in 2008; |

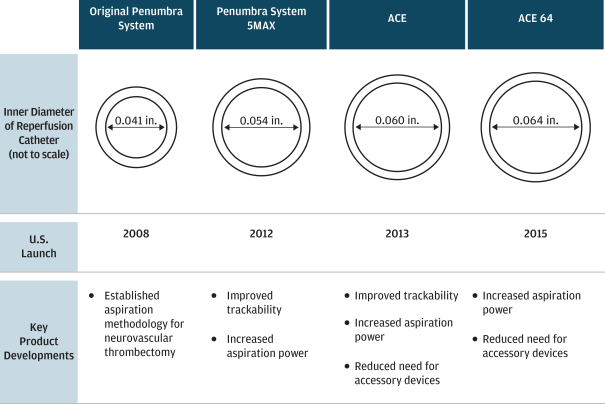

| • | launching the first 510(k)-cleared, aspiration-based product for the treatment of ischemic stroke patients in 2008, and launching four subsequent generations of that product; |

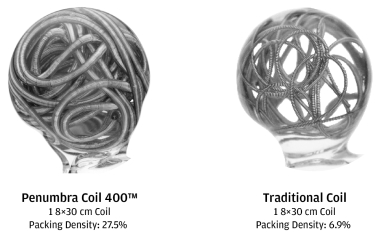

| • | launching our first neurovascular coil for the treatment of brain aneurysms in 2011; |

| • | launching our first peripheral vascular product in 2013; and |

| • | establishing our direct peripheral vascular salesforce in the United States and Europe in 2014. |

As of June 30, 2015, we had approximately 1,000 employees worldwide. We sell our products to hospitals primarily through our direct sales organization in the United States, most of Europe, Canada and Australia, as well as through distributors in select international markets. For the year ended December 31, 2014, we generated revenue of $125.5 million, which represents a 41.3% increase over 2013, and $3.0 million in operating income as compared to an operating loss of $1.1 million in 2013. For the six months ended June 30, 2015, we generated revenue of $81.3 million, which represents a 41.0% increase over the six months ended June 30, 2014, and $0.2 million in operating income as compared to operating income of $2.4 million for the six months ended June 30, 2014.

1

Table of Contents

Market Opportunity

We estimate that the market for our current neuro and peripheral vascular products in the United States and Europe combined was approximately $1.3 billion in 2014, which we estimate represents growth of approximately 3.2% per year from 2012. While reliable third-party data is not available for markets outside the United States and Europe, we believe that there is a substantial additional market for our neuro and peripheral vascular products in the rest of the world.

According to the American Heart Association (AHA), the worldwide incidence of all forms of stroke was 33 million in 2010. Furthermore, according to a paper published in the journal The Lancet, 202 million people globally were living with peripheral artery disease in 2010.

We believe the market for our products remains substantially under-penetrated today, and that this market will experience significant growth as we and our competitors:

| • | generate additional clinical evidence supporting endovascular treatment of vascular disease; |

| • | improve existing technologies to enable physicians to treat vascular disease faster and more safely than previously possible; |

| • | support and educate the growing number of specialist physicians who treat vascular disease in the use of endovascular treatment; |

| • | grow the number of hospitals where endovascular treatment of vascular disease is available; and |

| • | raise patient awareness of endovascular treatment of vascular disease. |

Industry Background

Vascular disease refers to any condition that affects the circulatory system and typically manifests as a blockage or rupture of an artery or a vein. It may occur in any part of the body, and is a condition that leads most often to blood vessel narrowing and obstruction, but can also lead to expansion of the blood vessel wall and blood vessel wall weakening and rupture. Vascular disease can cause a range of conditions, from pain to functional impairment, and it can require the amputation of a limb or result in death.

When the treatment for vascular disease is performed from within a vessel, it is referred to as an endovascular procedure. Endovascular device markets are conventionally classified according to the anatomic location of the disorder. We currently focus our efforts on the neuro and peripheral vascular markets.

| • | Neuro products. Our neuro products are used to treat patients with vascular disease and disorders in the brain, including patients with strokes caused by either vascular occlusion or rupture or weakening of the vessel walls. Our neuro products are generally catheter-based technologies that are administered by an interventional neuroradiologist, a neurosurgeon or an interventional neurologist. |

| • | Peripheral products. Our peripheral products are used to treat patients with vascular disease in all vasculature other than that which exists in the brain or the heart, including the upper and lower extremities, kidneys, neck and lungs. Our products that address peripheral vascular disorders are catheter-based technologies that are typically administered by an interventional radiologist or a vascular surgeon. |

Our Strengths

As we have grown as an organization, we have been able to scale our business from development stage in 2004 to a company with approximately 1,000 employees focused on multiple product categories in two target end markets. We believe the following strengths have enabled us to develop our broad and differentiated product portfolio and have been, and will continue to be, significant factors in our continued success and growth:

| • | our culture built on cooperation, which we have institutionalized through our unique organizational structure; |

2

Table of Contents

| • | our highly efficient product innovation process; |

| • | our disciplined approach to clinical and commercial development; |

| • | our deep understanding of our target end markets; and |

| • | our relationships with specialist physicians. |

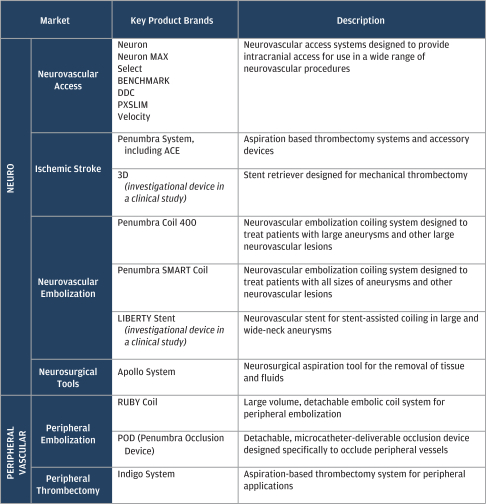

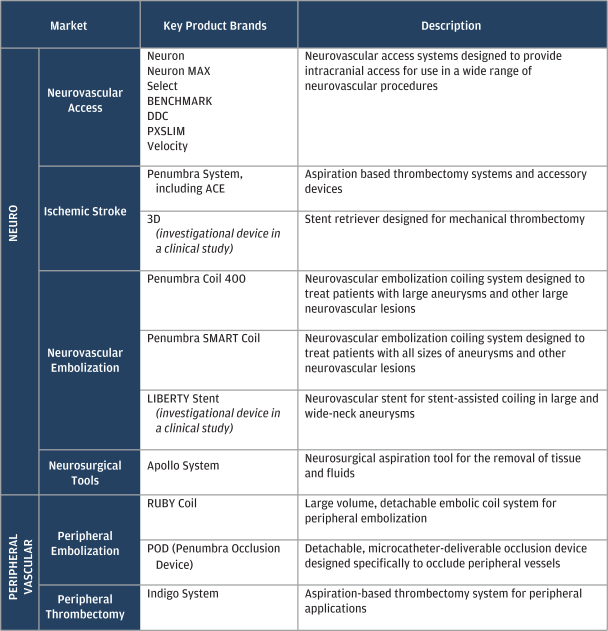

Our Products

Since our founding in 2004, we have invested in expanding our product development and marketing capabilities. These investments have included engineering and materials science capabilities, pre-clinical and bench-testing infrastructure and in-house clinical and regulatory infrastructure. Our fully-integrated organization has enabled us to launch 14 product brands for access, thrombectomy and embolization since 2007 to service our two target end markets.

The following table summarizes our product offerings in each of our target end markets:

3

Table of Contents

Our Growth Strategies

We believe the following strategies will continue to play a critical role in our future growth:

| • | expanding the penetration of our products in our target end markets; |

| • | growing the acceptance of our innovative products as the standard of care in their targeted clinical applications; |

| • | continuing to leverage our development capabilities to drive efficient, rapid product development; and |

| • | scaling our organizational culture of cooperative product development and commercial execution. |

Risks Associated With Our Business

Our business is subject to numerous risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

| • | we have a limited operating history and may not be able to sustain or grow our profitability or generate positive cash flows from operations; |

| • | our existing products may be rendered obsolete and we may be unable to effectively introduce and market new products or may fail to keep pace with advances in technology; |

| • | delays in product introductions could adversely affect our business, results of operations, financial condition or cash flows; |

| • | we face significant competition, and if we are unable to compete effectively, we may not be able to achieve or maintain significant market penetration or improve our results of operations; |

| • | our future growth depends, in part, on our ability to further penetrate our current customer base and increase the frequency of use of our products by our customers; |

| • | our future growth depends, in part, on significantly expanding our user base to include additional specialist physicians in both our existing and future target end markets; |

| • | the marketing and sales of our products require a significant amount of time and expense and we may not have the resources to successfully market and sell our products; |

| • | third-party reimbursement may not be available or adequate for the procedures in which our products are used; |

| • | we are subject to stringent domestic and foreign medical device regulation, which may impede the approval or clearance process for our products, hinder our development activities and manufacturing processes and, in some cases, result in the recall or seizure of previously approved or cleared products; |

| • | we rely on a variety of intellectual property rights, and if we are unable to maintain or protect our intellectual property, our business and results of operations will be harmed; and |

| • | we may become involved in lawsuits or other proceedings to protect or enforce our patents or other intellectual property rights or to defend against accusations of infringement, which could be expensive, time consuming and unsuccessful. |

Corporate Information

We were incorporated in 2004 as a Delaware corporation under the name Penumbra, Inc. Our principal executive offices are located at One Penumbra Place, 1351 Harbor Bay Parkway, Alameda, California 94502, and our telephone number is (510) 748-3200. Our website address is www.penumbrainc.com. The information on, or that can be accessed through, our website is not part of this prospectus. We have included our website address as an inactive textual reference only.

4

Table of Contents

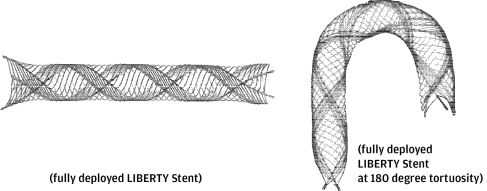

We use “Penumbra System®,” “ACE™,” “Penumbra Coil 400™,” “Penumbra SMART COIL™,” “LIBERTY™ Stent,” “Apollo™ System,” “Ruby® Coil,” “Indigo® System” and other marks as trademarks in the United States and other countries. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) December 31, 2020 (the last day of the fiscal year following the fifth anniversary of our initial public offering), (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, (3) the last day of the fiscal year in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates is equal to or exceeds $700 million as of the prior June 30th, and (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and any reference herein to “emerging growth company” has the meaning ascribed to it in the JOBS Act.

An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the U.S. Securities and Exchange Commission (the SEC). As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act also provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

5

Table of Contents

THE OFFERING

| Common stock offered by us |

3,800,000 shares |

| Common stock to be outstanding after this offering |

29,838,637 shares |

| Option to purchase additional shares of our common stock from us |

570,000 shares |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $90.2 million, or approximately $104.2 million if the underwriters exercise their option to purchase additional shares in full, assuming an initial public offering price of $26.50 per share (which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our common stock and enable access to the public equity markets for us and our stockholders. We intend to use the net proceeds from this offering for product development, including research and development and clinical trials, expansion of our salesforce and working capital and general corporate purposes. From time to time, we may consider the acquisition of complementary technologies or businesses, though we have no agreements or understandings with respect to any such acquisitions at this time. Pending the use of the net proceeds from this offering, we intend to invest the net proceeds in investment grade, interest bearing securities. See the section titled “Use of Proceeds” for additional information. |

| NYSE stock symbol |

“PEN” |

The number of shares of common stock to be outstanding after this offering is based upon 26,038,637 shares outstanding (including preferred stock on an as-converted basis) as of June 30, 2015, and excludes:

| • | 2,460,574 shares of common stock issuable upon the exercise of options to purchase shares of our common stock outstanding as of June 30, 2015, at a weighted average exercise price of $5.27 per share; |

| • | 1,713,634 shares of common stock reserved for future grant or issuance under our 2014 Equity Incentive Plan as of June 30, 2015; |

| • | 871,250 shares of common stock issuable upon the exercise of options to purchase shares of our common stock at an exercise price of $22.04 per share and 11,000 shares of restricted stock, which were granted in August 2015; |

| • | 450,000 shares of common stock issuable upon the exercise of options to purchase shares of our common stock to be granted to our Chief Executive Officer at an exercise price equal to our initial public offering price, which options will vest over a period of four years from the date of this prospectus; |

| • | 3,000,000 shares of common stock initially reserved for future issuance under our Amended and Restated 2014 Equity Incentive Plan, which will become effective immediately prior to the completion of this offering, as well as any automatic increases in the number of shares of our common stock reserved for future issuance pursuant to this plan; and |

6

Table of Contents

| • | 600,000 shares of common stock initially reserved for issuance under our 2015 Employee Stock Purchase Plan, or our ESPP, as well as any automatic increases in the number of shares of our common stock reserved for future issuance pursuant to this plan. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | outstanding shares include 24,818 shares of common stock issued upon early exercise of stock options and subject to repurchase; |

| • | outstanding shares include 755,771 shares of unvested restricted stock; |

| • | no exercise of options outstanding as of June 30, 2015, or subsequently issued; |

| • | the automatic conversion of all of our outstanding shares of preferred stock into an aggregate of 19,510,410 shares of common stock immediately upon the completion of this offering, assuming a one-to-one conversion ratio of our outstanding shares of preferred stock into common stock; |

| • | no exercise by the underwriters of their option to purchase up to 570,000 additional shares of our common stock from us; and |

| • | the filing and effectiveness of our amended and restated certificate of incorporation in Delaware and the adoption and effectiveness of our amended and restated bylaws immediately upon the completion of this offering. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data. We have derived the summary consolidated statement of operations data for the years ended December 31, 2013 and 2014, from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statement of operations data for the year ended December 31, 2012, from our audited consolidated financial statements not included in this prospectus. We have derived the summary consolidated statement of operations data for the six months ended June 30, 2014 and 2015, and our balance sheet data as of June 30, 2015, from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and reflect, in our opinion, all adjustments of a normal, recurring nature that are necessary for a fair statement of the unaudited interim consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future and the results for the six months ended June 30, 2015 are not necessarily indicative of results to be expected for the full year or any other period. The following summary consolidated financial data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2012 | 2013 | 2014 | 2014 | 2015 | ||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | 73,141 | $ | 88,848 | $ | 125,510 | $ | 57,643 | $ | 81,263 | ||||||||||

| Cost of revenue |

24,178 | 30,972 | 42,668 | 19,489 | 27,160 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

48,963 | 57,876 | 82,842 | 38,154 | 54,103 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

12,548 | 14,084 | 15,575 | 7,538 | 7,983 | |||||||||||||||

| Selling, general and administrative |

32,987 | 44,918 | 64,258 | 28,240 | 45,943 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

45,535 | 59,002 | 79,833 | 35,778 | 53,926 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

3,428 | (1,126 | ) | 3,009 | 2,376 | 177 | ||||||||||||||

| Interest income (expense), net |

244 | 345 | 439 | 39 | 385 | |||||||||||||||

| Other income (expense), net |

220 | (474 | ) | (309 | ) | (92 | ) | (498 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before provision for (benefit from) income taxes |

3,892 | (1,255 | ) | 3,139 | 2,323 | 64 | ||||||||||||||

| Provision for (benefit from) income taxes |

1,934 | (5,354 | ) | 894 | 666 | 233 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 1,958 | $ | 4,099 | $ | 2,245 | $ | 1,657 | $ | (169 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to common stockholders |

$ | 412 | $ | 887 | $ | (833 | ) | $ | 355 | $ | (34 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders |

||||||||||||||||||||

| Basic |

$ | 0.10 | $ | 0.21 | $ | (0.18 | ) | $ | 0.08 | $ | (0.01 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | 0.07 | $ | 0.14 | $ | (0.18 | ) | $ | 0.05 | $ | (0.01 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares used to compute net income (loss) per share attributable to common stockholders |

||||||||||||||||||||

| Basic |

4,153,121 | 4,304,396 | 4,609,375 | 4,520,898 | 5,000,375 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

5,886,126 | 6,500,835 | 4,609,375 | 6,743,140 | 5,000,375 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net income (loss) per share — Basic |

$ | 0.10 | $ | (0.01 | ) | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma net income (loss) per share — Diluted |

$ | 0.09 | $ | (0.01 | ) | |||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted average shares used to compute the pro forma net income (loss) per share |

||||||||||||||||||||

| —Basic (unaudited) |

22,680,810 | 24,510,785 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| —Diluted (unaudited) |

25,037,541 | 24,510,785 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

8

Table of Contents

| As of June 30, 2015 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 36,764 | $ | 36,764 | $ | 126,944 | ||||||

| Total assets |

$ | 129,070 | $ | 129,070 | $ | 219,250 | ||||||

| Long-term debt |

$ | — | $ | — | $ | — | ||||||

| Working capital |

$ | 91,298 | $ | 91,298 | $ | 181,478 | ||||||

| Preferred stock |

$ | 111,467 | $ | — | $ | — | ||||||

| Total stockholders’ equity (deficit) |

$ | (11,099 | ) | $ | 100,368 | $ | 190,548 | |||||

| (1) | The pro forma column reflects (i) the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 19,510,410 shares of our common stock, which conversion will occur immediately upon the completion of this offering, as if such conversion had occurred on June 30, 2015, and (ii) the filing and effectiveness of our amended and restated certificate of incorporation and the retirement of our authorized preferred stock that will convert to common stock as set forth in clause (i). |

| (2) | The pro forma as adjusted column gives effect to (a) the pro forma adjustments set forth in (1) above and (b) the sale and issuance by us of 3,800,000 shares of our common stock in this offering, assuming an initial public offering price of $26.50 per share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $26.50 per share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, the amount of our cash and cash equivalents, total assets, working capital and stockholders’ equity by $3.5 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting underwriting discounts and commissions payable by us. An increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease, as applicable, the amount of our cash and cash equivalents, total assets, working capital and stockholders’ equity by $24.6 million, assuming an initial public offering price of $26.50 per share, which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions payable by us. |

9

Table of Contents

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing these risks, you should also refer to the other information contained in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making a decision to invest in our common stock.

Business Risks

We have a limited operating history and may not be able to sustain or grow our profitability or generate positive cash flows from operations.

We were founded in 2004 and did not generate any revenue until 2007. Moreover, while we have successfully developed, obtained regulatory clearance or approval for, and introduced a number of products in the neuro market since 2007, we first introduced products in the peripheral vascular and neurosurgical markets in 2013 and 2014, respectively. Accordingly, we only have a limited operating history upon which investors can evaluate our business and prospects, and this limited operating history may not be indicative of our future results. Since 2009, we have been generally profitable on an annual basis; however, we incurred operating losses in 2013, and we are not currently cash-flow positive. We can give no assurance that we will be profitable or cash-flow positive in the future.

We expect that our general and administrative and sales and marketing expenses will increase to support our anticipated growth as well as the additional operational and reporting costs associated with being a public company. We have also expended significant amounts on research and development to develop and fund clinical testing of our products, and we expect to continue to do so. We also expend significant amounts on maintaining inventory levels of raw materials, components and finished products to meet anticipated customer demand. In addition, our coil products are sold on a consignment basis, which requires us to expend significant amounts on inventory that is placed at many customer locations. Our ability to sustain our growth and profitability and become cash-flow positive may be influenced by many factors, including:

| • | our ability to achieve and maintain market acceptance of our products; |

| • | unanticipated problems and additional costs relating to the development and testing of new products; |

| • | our ability to introduce, manufacture at scale and commercialize new products; |

| • | our ability to produce sufficient quantities of our products to meet demand and to smoothly transition to new products; |

| • | the impact of competition; |

| • | the timing and impact of market and regulatory developments; |

| • | our ability to expand into new markets; |

| • | pricing pressure from competitors; |

| • | the availability and adequacy of third-party reimbursement for procedures in which our products are used; and |

| • | our ability to obtain and maintain adequate intellectual property protection for our products and technologies. |

If we encounter difficulties with any of the foregoing or unexpected expenses, it could materially adversely affect our business, results of operations, financial condition or cash flows.

10

Table of Contents

Our existing products may be rendered obsolete and we may be unable to effectively introduce and market new products or may fail to keep pace with advances in technology.

The medical device market is characterized by rapidly advancing technology. Our success depends, in part, on our ability to anticipate technological advancements and competitive innovations and introduce new products to adapt to these advancements and innovations. To compete in the marketplace, we have made, and we must continue to make, substantial investments in new product development, whether internally through research and development or externally through licensing or acquisitions. We can give no assurance that we will be successful in identifying, developing or acquiring, and marketing new products or enhancing our existing products. In addition, we can give no assurance that new products or alternative treatment techniques developed by competitors will not render our current or future products obsolete or inferior, technologically or economically.

The success of any new products that we develop or acquire depends on achieving and maintaining market acceptance. Market acceptance for our current and new products could be affected by a number of factors, including:

| • | our ability to market and distribute our products effectively; |

| • | the availability, perceived efficacy and pricing of alternative products from our competitors; |

| • | the development of new products or alternative treatments by others that render our products and technologies obsolete; |

| • | the price, quality, effectiveness and reliability of our products; |

| • | our customer service and reputation; |

| • | our ability to convince specialist physicians to use our products on their patients; and |

| • | the timing of market entry of new products or alternative treatments. |

Our competition may respond more quickly to new or emerging technologies or a changing clinical landscape, undertake more extensive marketing campaigns, have greater financial, marketing and other resources than us or be more successful in attracting potential customers and strategic partners. Given these factors, we cannot assure you that we will be able to continue or increase our level of success. Our failure to introduce new and innovative products in a timely manner, and our inability to maintain or grow the market acceptance of our existing products, could result in permanent write-downs or write-offs of our inventory and otherwise have a material and adverse effect on our business, results of operations, financial condition or cash flows.

Delays in product introductions could adversely affect our business, results of operations, financial condition or cash flows.

The medical device market is highly competitive and designs change often to adjust to shifting market preferences and other factors. Therefore, product life cycles are relatively short. As a result, any delays in our product launches may significantly impede our ability to enter or compete in a given market and may reduce the sales that we are able to generate from these products. We may experience delays in any phase of a product launch, including during research and development, clinical trials, regulatory review, manufacturing and marketing. Delays in product introductions could materially adversely affect our business, results of operations, financial condition or cash flows.

We face significant competition, and if we are unable to compete effectively, we may not be able to achieve or maintain significant market penetration or improve our results of operations.

The medical device industry is intensely competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants. We compete with a number of manufacturers and distributors of neuro and peripheral vascular devices. Our most notable competitors are Boston Scientific, Johnson & Johnson, Medtronic, Stryker and Terumo. All of these competitors are large, well-capitalized companies with longer operating histories and significantly greater resources than us. We also

11

Table of Contents

compete with a number of smaller medical device companies that have a single product or a limited range of products. Our competitors may be able to spend more on product development, marketing, sales and other product initiatives, or be more focused in their spending and activities, than we can. Some of our competitors have:

| • | significantly greater name recognition; |

| • | broader or deeper relations with healthcare professionals, customers and third-party payors; |

| • | more established distribution networks; |

| • | additional lines of products and the ability to offer rebates or bundle products to offer greater discounts or other incentives to gain a competitive advantage; |

| • | greater experience in conducting research and development, manufacturing, clinical trials, marketing and obtaining regulatory clearance or approval for products; and |

| • | greater financial and human resources for product development, sales and marketing and patent litigation. |

We compete primarily on the basis that our products are able to treat patients with neurovascular and peripheral vascular diseases and disorders safely and effectively. Our continued success depends on our ability to:

| • | develop innovative, proprietary products that can cost-effectively address significant clinical needs; |

| • | continue to innovate and develop scientifically advanced technology; |

| • | obtain and maintain regulatory clearances or approvals; |

| • | demonstrate efficacy in Penumbra-sponsored and third-party clinical trials and studies; |

| • | apply technology across product lines and markets; |

| • | attract and retain skilled research and development and sales personnel; and |

| • | cost-effectively manufacture and successfully market and sell products. |

We cannot assure you that we will be able to compete effectively on the basis of these factors. Additionally, our competitors with greater financial resources could acquire or develop new technologies or products that effectively compete with our existing or future products. If we are unable to effectively compete, it would materially adversely affect our business, results of operations, financial condition and cash flows.

Our future growth depends, in part, on our ability to further penetrate our current customer base and increase the frequency of use of our products by our customers.

We will need to continue to make specialist physicians and other hospital staff aware of the benefits of our products to generate increased demand and frequency of use, and thus increase sales to our hospital customers. Although we are attempting to increase the number of patients treated with procedures that use our products through our established relationships and focused sales efforts, we cannot provide assurance that our efforts will increase the use of our products. If we are unable to increase the frequency of use of our products by specialist physicians, this could materially adversely affect our business, results of operations, financial condition or cash flows.

Our future growth depends, in part, on significantly expanding our user base to include additional specialist physicians in both our existing and future target end markets.

Currently, the primary users of our neuro products are neuro interventionalists who perform endovascular neuro interventions. We also began selling in the peripheral vascular market in 2013 with the introduction of our Ruby Coil and the neurosurgery market in 2014 with the introduction of our Apollo System, and we may enter new target end markets in the future. Our revenue growth will depend in part on our ability to convince

12

Table of Contents

specialist physicians in our existing and future target end markets of our products’ efficacy, to educate them in the proper use of our products and to sell our products to their affiliated hospitals. Convincing specialist physicians to use new products and to dedicate the time and energy necessary for adequate education in the use of our products is challenging, especially in new markets where treatments using our products are not established. Expanding our customer base in existing or new target end markets may require, among other things, additional clinical evidence supporting patient benefits, training in a manner to which we are not accustomed, or other resources that we do not readily have available or are not cost effective for us to provide. If we are unable to convert specialist physicians in existing or new target end markets to the use of our products, our sales growth will be limited, which could materially adversely affect our business, results of operations, financial condition or cash flows.

The marketing and sales of our products require a significant amount of time and expense and we may not have the resources to successfully market and sell our products, which would adversely affect our business and results of operations.

The marketing and sales of our products requires us to invest in training and education and employ a salesforce that is large enough to interact with the specialist physicians who use our products. Entering new markets also requires a significant amount of time and expense in order to identify and establish relationships with key opinion leaders among the specialist physicians who may use our products in those markets. We may not have adequate resources to market and sell our products successfully against larger competitors. For example, when we began selling in the peripheral vascular market in 2013, we did not have a dedicated direct peripheral vascular sales team and our neuro sales team was required to dedicate a portion of its efforts to the sales of our peripheral vascular products. We subsequently expended significant sums to develop a direct salesforce focused on peripheral vascular product sales. If we do not have adequate resources to market and sell our products effectively, or cannot otherwise market and sell our products successfully, it could materially adversely affect our business, results of operations, financial condition or cash flows.

Third-party reimbursement may not be available or adequate for the procedures in which our products are used.

Our ability to commercialize new products successfully in both the United States and international markets depends in part on the availability of, and hospitals’ ability to obtain, adequate levels of third-party reimbursement for the procedures in which our products are used. In the United States, the cost of medical care is funded, in substantial part, by government insurance programs, such as Medicare and Medicaid, and private and corporate health insurance plans. Third-party payors may deny reimbursement if they determine that a device used in a procedure has not received appropriate FDA or other governmental regulatory clearances or approvals, is not used in accordance with cost-effective treatment methods as determined by the payor, or is experimental, unnecessary or inappropriate. Our ability to commercialize our products successfully will depend, in large part, on the extent to which adequate reimbursement levels for the cost of their use are obtained from government authorities, private health insurers and other organizations, such as health maintenance organizations. Further, healthcare in the United States and international markets is also being affected by economic pressure to contain reimbursement levels and costs. Changing reimbursement models could materially adversely affect our business, results of operations, financial condition or cash flows.

We have generated a significant portion of our revenue from products that are used in connection with the treatment of neurovascular diseases, and our revenue and business prospects would be adversely affected if our neuro product sales were to decline.

We have generated most of our revenue from our neurovascular products, including our Penumbra System, Penumbra Coil 400 and Neuron products. If any one or more of these products, or any successor products, were no longer available for sale in any key market because of regulatory, third-party reimbursement or intellectual property issues or any other reason, or if one of our competitors introduced one or more products that specialist physicians believe are superior to our products, our revenue from these products would

13

Table of Contents

decline. A significant decline in our sales of neurovascular products could also negatively impact our financial condition and our ability to conduct product development activities, and therefore negatively impact our business prospects.

We must maintain and further develop relationships with specialist physicians. If specialist physicians do not recommend and endorse, or use, our products or if our relationships with specialist physicians deteriorate, our products may not be accepted or maintain acceptance in the marketplace, which would adversely affect our business and results of operations.

Our products are sold to hospitals for use by specialist physicians practicing at their facilities. In order for us to sell our products, specialist physicians must recommend and endorse them for the hospital to purchase them, and must use them in treating their patients to generate follow-on sales. We may not obtain the necessary recommendations or endorsements for new products from specialist physicians, nor may we be able to maintain the current or future level of acceptance and usage of our products. Acceptance of our products depends on educating the medical community as to the distinctive characteristics, perceived benefits, safety, clinical efficacy and cost-effectiveness of our products compared to products of our competitors or treatments that do not use our products, and on training specialist physicians in the proper application and use of our products. We invest in significant training and education of our sales representatives and specialist physicians to achieve market acceptance of our products, with no assurance of success. If we are not successful in obtaining and maintaining the recommendations or endorsements of specialist physicians for our products, if specialist physicians prefer our competitors’ products or other alternative treatments that do not use our products, or if our products otherwise do not gain or maintain market acceptance, our business could be adversely affected.

In addition, the research, development, marketing and sales of our products are dependent, in part, upon our working relationships with specialist physicians. We rely on them to provide us with knowledge and feedback regarding our products and the marketing of our products. If we are unable to develop or maintain strong relationships with specialist physicians and receive their advice and input, the development and marketing of our products could suffer, which could materially adversely affect our business, results of operations, financial condition or cash flows.

We may not be able to achieve or maintain satisfactory pricing and margins for our products.

Manufacturers of medical devices have a history of price competition, and we can give no assurance that we will be able to achieve satisfactory prices for our products or maintain prices at the levels we have historically achieved. If we are unable to achieve or maintain our prices, or if our costs increase and we are unable to offset such increase with an increase in our prices, our margins could erode and we may be unable to maintain profitable operations.

We cannot be certain that we will be able to manufacture our products in high volumes at commercially reasonable costs.

We currently maintain our manufacturing operations in buildings located at our campus in Alameda, California. We currently produce substantially all of our products at this facility, and we do not have redundant facilities. We may need to expend significant capital resources and increase the size of our manufacturing capabilities as we grow our business. We could, however, encounter problems related to:

| • | capacity constraints; |

| • | production yields; |

| • | quality control; |

| • | equipment availability; and |

| • | shortages of qualified personnel. |

14

Table of Contents

Our continuous product innovation limits our ability to identify and implement manufacturing efficiencies. Failure to do so may reduce our ability to manufacture our products at commercially reasonable costs. If we are unable to manufacture our products in high volumes at commercially reasonable costs, it could materially affect our ability to adequately increase production of our products and fulfill customer orders on a timely basis, which could have a material adverse effect on our business, results of operations, financial condition or cash flows.

We are required to maintain high levels of inventory, which consume a significant amount of our working capital and could lead to permanent write-downs or write-offs of our inventory.

We maintain a significant inventory of raw materials, components and finished goods, which subjects us to a number of risks and challenges. Our hospital customers typically maintain only small quantities of our products at their facilities, so as products are used, they order replacements that typically require prompt delivery. As a result, we must maintain sufficient levels of finished goods to permit rapid shipment of products following receipt of a customer order. In turn, we must also maintain a sufficient supply of raw materials and components inventory to permit rapid manufacturing and re-stocking of finished goods. Furthermore, our coil inventory is supplied to hospital customers on a consignment basis, which means that it is classified as part of our inventory for financial reporting purposes but is maintained at the hospital location until it is used.

Maintaining a significant inventory of raw materials, components and finished goods consumes a significant amount of our working capital. This working capital could be used for other purposes, such as research and development or sales and marketing activities. As we grow our business, we may need substantial additional capital to fund higher levels of inventory, which may materially adversely affect our liquidity or result in dilution to our stockholders if we sell additional equity securities or leverage if we raise debt capital to finance our working capital requirements.

Maintaining a significant inventory of raw materials, components and finished goods also subjects us to the risk of inventory excess and obsolescence, which may lead to a permanent write-down or write-off of our inventory. While in inventory, our components and finished goods may become obsolete, and we may over-estimate the amount of inventory needed, which may lead to excessive inventory. In these circumstances, we would write-down or write-off our inventory, and we may be required to expend additional resources or be constrained in the amount of end product that we can produce. Furthermore, our products have a limited shelf life due to sterilization requirements, and part or all of a given product or component may expire, resulting in a decrease in value and potentially a permanent write-down of our inventory. For example, we recorded write downs of $0.9 million and $1.9 million for excess and obsolete inventory in 2013 and 2014, respectively. In the event that a substantial portion of our inventory becomes excess or obsolete, it could materially adversely affect our results of operations.

Defects or failures, or alleged defects or failures, associated with our products could lead to recalls, safety alerts or litigation, as well as significant costs and negative publicity.

Manufacturing flaws, component failures, design defects, off-label uses or inadequate disclosure of product-related information could result in an unsafe condition or the injury or death of a patient. These problems could lead to a recall of, or issuance of a safety alert relating to, our products and result in significant costs, negative publicity and adverse competitive pressure. While we have had product recalls, they have all been voluntary, based on our own internal safety and quality monitoring and testing data, and none of our past product recalls has been material. The circumstances giving rise to recalls are, however, unpredictable, and any future recalls of existing or future products could materially adversely affect our business, results of operations, financial condition or cash flows.

The medical device industry has historically been subject to extensive litigation over product liability claims. There are high rates of mortality and other complications associated with some of the medical conditions suffered by the patients whom specialist physicians use our devices to treat, and we may be subject to product liability claims if our products cause, or merely appear to have caused, an injury or death. For

15

Table of Contents

example, we were made aware of potential product liability claimants who allegedly suffered injuries as a result of aneurysm procedures performed in the United States and the United Kingdom in which the Penumbra Coil 400 was used. We have not been served with formal complaints; however, the attorney for the purported U.S. claimant has indicated that a civil suit will be brought against us shortly. While specific damages have not been asserted, counsel for the purported claimant indicated that he expects that a jury could award $35 million in damages were this matter to go to trial. This amount is substantially in excess of our insurance coverage. The attorney for the potential claimant in the United Kingdom has not specified any damage amount. As no litigation has been instituted in either of these cases, and therefore neither we nor the potential claimants have engaged in discovery, we are unable to assess the merits of the claims. We expect to vigorously defend any litigation that might be brought, as we believe there would be substantial questions regarding causation, liability and damages.

In addition, an injury or death that is caused by the activities of our suppliers, such as those that provide us with components and raw materials, or by an aspect of a treatment used in combination with our products, such as a complementary drug or anesthesia, may be the basis for a claim against us by patients, hospitals, health-care providers or others purchasing or using our products, even if our products were not the actual cause of such injury or death. An adverse outcome involving one of our products could result in reduced market acceptance and demand for all of our products, and could harm our reputation and our ability to market our products in the future. In some circumstances, adverse events arising from or associated with the design, manufacture or marketing of our products could result in the suspension or delay of regulatory reviews of our premarket notifications or applications for marketing. Any of the foregoing problems could disrupt our business and have a material adverse effect on our business, results of operation, financial condition or cash flows.

Although we carry product liability insurance in the United States and in other countries in which we conduct business, including for clinical trials and product marketing, we can give no assurance that such coverage will be available or adequate to satisfy any claims. Product liability insurance is expensive, subject to significant deductibles and exclusions, and may not be available on acceptable terms, if at all. If we are unable to obtain or maintain insurance at an acceptable cost or on acceptable terms with adequate coverage or otherwise protect against potential product liability claims, we could be exposed to significant liabilities. A product liability claim, recall or other claim with respect to uninsured liabilities or for amounts in excess of insured liabilities could materially adversely affect our business, financial condition and results of operations. Defending a suit, regardless of its merit or eventual outcome, could be costly, could divert management’s attention from our business and might result in adverse publicity, which could result in reduced acceptance of our products in the market, product recalls or market withdrawals.

Our products are continually the subject of clinical trials conducted by us, our competitors, or other third parties, the results of which may be unfavorable, or perceived as unfavorable, and which could materially adversely affect our business, financial condition and results of operations.

As a part of the regulatory process of obtaining marketing clearance or approval for new products and new indications for existing products, as well as to provide specialist physicians with ongoing information regarding the efficacy of our products, we conduct and participate in numerous clinical trials with a variety of study designs, patient populations and trial endpoints. Our competitors and third parties also conduct clinical trials of our products without our participation. Unfavorable or inconsistent clinical data from existing or future clinical trials conducted by us, our competitors or third parties, or the market’s or regulators’ perception of clinical data, could materially adversely affect our business, results of operations, financial condition or cash flows.

Our future success depends in part upon establishing an interventional stroke care pathway in the United States that integrates the use of endovascular thrombectomy into the treatment of ischemic stroke.

The stroke care pathway in the United States generally begins with emergency responders who are responsible for transporting the patient to a hospital facility. With a small number of exceptions (such as for trauma), emergency responders in the United States generally operate under a protocol that transports

16

Table of Contents

patients to the nearest hospital, which decreases the likelihood that the patient will be transported to a stroke center that has a developed stroke team and an interventional approach to the treatment of stroke. Further, there is no agreed upon standard of care among physicians or hospitals regarding the treatment of ischemic stroke patients, and treatment protocols vary according to the particular hospital, often resulting in significant delays and gaps in patients being assessed for and receiving interventional treatment. The absence of a uniform protocol among hospitals and among physicians within the same hospital means that we have to educate each hospital and stroke center about protocols that integrate our products for the treatment of stroke.

We believe that the stroke care system in the United States has not been historically geared towards interventional treatment of stroke due to the absence of clinical evidence that interventional techniques were effective. Our and our competitors’ ability to alter the existing stroke care pathway may depend on whether we and our competitors are successful in using recent positive clinical studies to convince specialist physicians that intervention yields superior clinical results relative to cases where intervention is not used.

Establishing an interventional stroke pathway that integrates the use of interventional treatments, including our products, will depend upon many factors, including:

| • | continuing to educate hospitals and specialist physicians about the clinical evidence supporting intervention, as well as the use, benefits and cost-effectiveness of our products; |

| • | improving the speed with which patients are assessed for and receive interventional treatments; and |

| • | increasing the likelihood that patients are transported to a hospital or stroke center where interventional treatments are available. |

Even if these efforts are successful, it may be years before existing systems and care pathways are changed. These factors may make it difficult to grow our business.

Any data that is gathered in the course of clinical trials may be significantly more favorable than the typical results achieved by practicing specialist physicians, which could negatively impact rates of adoption of our products.

Even if the data collected from clinical trials indicates positive results, each specialist physician’s actual experience with our products will vary. Clinical trials often involve procedures performed by specialist physicians who are technically proficient and high volume users. Consequently, the results reported in clinical trials may be significantly more favorable than typical results of other users. If specialist physicians’ experiences indicate, or they otherwise believe, that our products are not as safe or effective as other treatment options with which they are more familiar, or clinical trial data indicates the same, adoption of our products may suffer, which could materially adversely affect our business, results of operations, financial condition or cash flows.

Negative publicity regarding our products or marketing tactics by competitors could reduce demand for our products, which would adversely affect sales and our financial performance.

We may experience, from time to time, negative exposure in clinical publications or in marketing campaigns of our competitors. Such publications or campaigns may present negative individual physician experience regarding the safety or effectiveness of our products or may suggest our competitors’ products are superior to ours, based on studies or clinical trials conducted or funded by competitors or that involved competitive products.

Our reputation and competitive position may also be harmed by other publicly available information suggesting that our products are not safe. For example, we file adverse event reports under Medical Device Reporting, or MDR, obligations with the FDA that are publicly available on the FDA’s website. We are required to file MDRs if our products may have caused or contributed to a serious injury or death or malfunctioned in a way that could likely cause or contribute to a serious injury or death if it were to recur. Any such MDR that reports a significant adverse event could result in negative publicity and could harm our reputation and future sales.

17

Table of Contents

Our dependence on key suppliers puts us at risk of interruptions in the availability of our products, which could reduce our revenue and adversely affect our results of operations. In addition, increases in prices for raw materials and components used in our products could adversely affect our results of operations.

We require the timely delivery of sufficient amounts of components and materials to manufacture our products. For reasons of quality assurance, cost effectiveness or availability, we procure certain raw materials and components from a single or limited number of suppliers. We generally acquire such raw materials and components through purchase orders placed in the ordinary course of business, and as a result we may not have a significant inventory of these materials and components and generally do not have any guaranteed or contractual supply arrangements with many of these suppliers. Our reliance on these suppliers subjects us to risks that could harm our business, including, but not limited to, difficulty locating and qualifying alternative suppliers.

Our dependence on third-party suppliers involves several other risks, including limited control over pricing, availability, quality and delivery schedules. Suppliers of raw materials and components may decide, or be required, for reasons beyond our control, to cease supplying raw materials and components to us or to raise their prices. Shortages of raw materials, quality control problems, production capacity constraints or delays by our suppliers could negatively affect our ability to meet our production requirements and result in increased prices for affected materials or components. We may also face delays, yield issues and quality control problems if we are required to locate and secure new sources of supply. While we have not experienced any to date, any material shortage, constraint or delay may result in delays in shipments of our products, which could materially adversely affect our results of operations. Increases in prices for raw materials and components used in our products could also materially adversely affect our results of operations.

In addition, the FDA and regulators outside of the United States may require additional testing of any raw materials or components from new suppliers prior to our use of these materials or components. In the case of a device with clearance under section 510(k) of the U.S. Federal Food, Drug, and Cosmetic Act, referred to as a 510(k), we may be required to submit a new 510(k) if a change in a raw material or component supplier results in a change in a material or component supplied that is not within the 510(k) cleared device specifications. If we need to establish additional or replacement suppliers for some of these materials or components, our access to the materials or components might be delayed while we qualify such suppliers and obtain any necessary FDA approvals or clearances. Our suppliers may also be subject to regulatory inspection and scrutiny. Any adverse regulatory finding or action against those suppliers could impact their ability to supply us with raw materials and components for our products.

Our corporate culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the innovative approach, creativity, and teamwork fostered by our culture, and our business may be harmed.

We believe that a critical contributor to our success has been our corporate culture, which we believe fosters innovation, teamwork, and a focus on execution, as well as facilitating critical knowledge transfer and knowledge sharing. As we grow, we may find it difficult to maintain these important aspects of our corporate culture, which could limit our ability to innovate and operate effectively. Any failure to preserve our culture could also negatively affect our ability to retain and recruit personnel or execute on our business strategy.

If our facilities were to become inoperable, we would be unable to continue to develop and manufacture our products until we were able to restore full research, manufacturing and administrative capabilities at our facilities or secure a new facility, and as a result, our business would be harmed.

We currently maintain our research and development, manufacturing and administrative operations in buildings located at our campus in Alameda, California, and we do not have redundant facilities. Alameda is situated on or near earthquake fault lines, and our facilities are built on filled land, which could be prone to liquefaction in a major earthquake. Should one or more of our buildings be significantly damaged or destroyed by natural or man-made disasters, such as earthquakes, fires or other events, it could take months to relocate

18

Table of Contents

or rebuild, during which time our employees may seek other positions, our research, development and manufacturing would cease or be delayed and our products may be unavailable. Moreover, because of the time required to approve and license a manufacturing facility under FDA and non-U.S. regulatory requirements, we may not be able to resume production on a timely basis even if we are able to replace production capacity in the event we lose manufacturing capacity. While we maintain property and business interruption insurance, such insurance has limits and would only cover the cost of rebuilding and relocating and lost profits, but not losses we may suffer due to our products being replaced by competitors’ products. The inability to perform our research, development and manufacturing activities, combined with our limited inventory of raw materials and components and manufactured products, may cause specialist physicians to discontinue using our products or harm our reputation, and we may be unable to reestablish relationships with those specialist physicians in the future. Consequently, a catastrophic event at our facility could materially adversely affect our business, results of operations, financial condition or cash flows.

To successfully market and sell our products internationally, we must address a number of unique challenges applicable to international markets.

For 2014 and the six months ended June 30, 2015, we derived 34% and 34%, respectively, of our revenue from international sales. International sales are subject to a number of risks and challenges, including:

| • | reliance on distributors; |

| • | varying coverage and reimbursement policies, processes and procedures; |