Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VIDLER WATER RESOURCES, INC. | a8-kforcorporatepresentati.htm |

1 Photo by Jean-Pierre Lavoie CORPORATE PRESENTATION SEPTEMBER 2015 NASDAQ:PICO

2 2 SAFE HARBOR STATEMENT This presentation contains forward-looking statements made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements often address current expected future business and financial performance, and may contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates”, “seeks,” or “will.” All forward-looking statements included in this presentation are based on information available to PICO as of the date hereof, and PICO assumes no obligation to update any such forward-looking statements. Actual results could differ materially from those described in the forward-looking statements. Forward-looking statements involve risks and uncertainties, including, but not limited to, economic, competitive, and governmental factors outside of our control, that may cause our business, industry, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in detail under the heading “Risk Factors” in PICO’s periodic reports filed with the U.S. Securities and Exchange Commission.

3 3 WHO WE ARE A diversified holding company founded over two decades ago that seeks to identify and invest in unique, undervalued assets at opportunistic prices Value-based managers with a portfolio consisting of controlling ownership stakes in water resource and real estate businesses Diligent, long-term oriented investors with a focus on: • Purchasing ownership stakes in companies with competitive advantages and real assets • Acquiring assets where we can isolate compelling value-creation opportunities with the opportunity to apply our experience and expertise to drive meaningful upside • Generating returns by partnering actively with boards and management, providing expertise in strategic investment direction, operations and financing Listed on NASDAQ (ticker symbol: PICO)

4 4 TIMELINE OF TRANSACTIONS December 1993 & June 1994: Current President & CEO, John Hart, and former Chairman Ron Langley structure two separate capital infusions in to Physicians Insurance Company of Ohio at $3.50 per share for a controlling 40% interest. John Hart and Ron Langley become the new management team that directs Physician’s investment portfolio and oversees the insurance operations. August 1995: Physicians acquires Sequoia Insurance Company, a California property & casualty insurer. September 1995: Physicians acquires controlling stake (38%) of The Ondaatje Corporation (TOC), a Canadian public company listed on the Toronto Stock Exchange. John Hart and Ron Langley take over the management of TOC and use TOC as a vehicle to acquire water resources and real estate. TOC is renamed Global Equity Corporation (GEC). November 1995: GEC acquires Vidler Water Company. Since this acquisition to date Vidler has acquired, developed and monetized several water resource and water storage assets throughout the Southwest United States. November 1996: Citation Insurance Group (CIG), a public holding company trading on NASDAQ, is acquired by Physicians in a 5:1 reverse merger transaction. CIG is renamed PICO Holdings, Inc, effects a 1:5 reverse stock split, and starts trading on the NASDAQ as PICO. The transaction results in Physicians and Citation Insurance Company becoming wholly-owned subsidiaries of PICO. Both Physicians and Citation are placed into “run-off” on their existing policy liabilities. 1996 through 2002: GEC acquires approximately 23% stake in Jungfraubahn Holding AG a public company trading on the Swiss stock exchange that operates several railways in the Bernese Oberland region of Switzerland. Also during this period, PICO acquires several other minority interests in Swiss public companies. April 1997: PICO and GEC acquire Nevada Land & Resource Company (NLRC), the owner of 1.35 million acres of undeveloped land in northern Nevada. August 1997: PICO acquires additional shares in GEC and increases its interest in GEC to 51%.

5 5 December 1998: PICO acquires the balance of GEC it does not already own and through this acquisition, acquires a 100% interest in Vidler and NLRC. 1999 through 2002: PICO acquires 20% stake in Australian Oil & Gas Company (AOG), an Australian oil rig operator trading on the Australian Stock Exchange. July 2002: PICO sells its stake in AOG. March 2003: PICO sells Sequoia Insurance Company. January 2008: PICO acquires UCP as a vehicle to acquire and improve single-family residential lots. April 2008: PICO sells its interest in Jungfraubahn Holding AG. 2010: UCP forms Benchmark Communities to design, construct and sell single-family homes. 2010 through 2012: PICO acquires an 88% interest in a new subsidiary, Northstar Agribusiness, and constructs a canola seed crushing facility in Hallock, Minnesota. The plant becomes operational in August 2012 and commences production of canola oil and meal. December 2011: PICO sells NLRC. At the time of sale NLRC had only 480,000 acres remaining from its original 1.35 million acre land portfolio. December 2012: PICO sells its insurance in run-off operations (Physicians Insurance Company of Ohio and Citation Insurance Company). 2012 through 2014: PICO sells its portfolio of Swiss equities. July 2013: UCP completes a $116 million IPO on the NYSE and starts trading under the symbol UCP. PICO retains a controlling interest of approximately 58%. July 2015: PICO sells its interest in Northstar Agribusiness. TIMELINE OF TRANSACTIONS

6 6 STRATEGIC ASSETS & FINANCIAL HIGHLIGHTS Water Resources & Real Estate • Focus on unique, strategic assets with long-term value potential • Current holdings: water & real estate assets with strong potential for growth through Vidler Water Company, Inc. and UCP, Inc. • Vidler and UCP represent over 90% of PICO shareholders’ equity at June 30, 2015 Water Resources Development • Vidler is the leader in water resource development in the Southwest U.S. • Water is a limiting factor in population/economic growth in the Southwest U.S. • Vidler seeks to develop long-term sustainable and reliable water supplies and has accumulated a broad portfolio of Water Rights and Water Storage Credits located in some of the fastest growing communities in the Southwest U.S. Real Estate • UCP acquires and develops residential lots in select markets in the Western U.S. • Since 2008 UCP has acquired over 9,800 residential lots and started its own home builder- Benchmark Communities • UCP completed an IPO in July 2013; listed on the NYSE; PICO owns 57.2% of UCP

7 7 VALUATION & FINANCIAL APPROACH Attractive Valuation And Capital Structure • Currently trading at a meaningful discount to book value and book value is estimated to be understated » Price to Book: 0.8 (as of September 2015); 20% discount • Allocate capital to existing and new assets based on risk/reward » Conservative capital structure with relatively low leverage ratios » Proven ability to find interesting and unique investments (out – of - favor, undiscovered or misunderstood assets or situations that require a catalyst) » Potential return of capital to shareholders through share repurchases, using disconnect between book value of assets and share price as litmus test

8 VIDLER WATER COMPANY

9 9 VIDLER: LEADER IN WATER RESOURCE DEVELOPMENT Proven strategy focused on acquiring and developing underappreciated water assets • Purchase farms and ranches with significant, undervalued water assets • Develop storage infrastructure to “bank” water for future use • Unlock new sources of water not previously appropriated • Customers: developers, municipalities, utilities, public agencies and agricultural Currently manage over a dozen water resource projects with an aggregate book value of $186 million as of June 30, 2015: • Fish Springs Ranch water credits and pipeline rights (Reno, Nevada) • Carson / Lyon water rights (Northern Nevada) • Water storage credits in Arizona Major growth catalysts include: • Population/economic trends in Southwest U.S. (esp. Northern Nevada and Arizona) • Limited available water supply in many of the southwestern states; prolonged drought

10 10 VIDLER: POTENTIAL WATER SUPPLY CRISIS BY 2025 • Areas where water supplies may not be adequate to meet water demands in 2025 for people, for farms, and for the environment

11 11 Southwestern U.S. Water Supply Forecast in 2025 VIDLER: WATER ASSETS IN AREAS OF GREATEST NEED 7 6 9 10 8 1 2 3 4 5 Sacramento amentSacramento Carson City Phoenix Las Vegas Salt Lake City Denver Austin usti Santa Fe Boise Albuquerque Conflict potential – Moderate Conflict potential – Substantial Conflict potential – Highly likely Major Highways Vidler Water Company Significant Current Projects 1) Underground Storage Facility 2) Phoenix AMA Storage Credits 3) Colorado Water Rights 4) Fish Springs Ranch Project 5) Carson-Lyon Intertie 6) Tule Desert 7) Toquop Energy Site 8) Kane Springs-Coyote Springs 9) Middle Rio Grande Water Rights 10) Lower Rio Grande Water Rights Source: Department of Interior and Vidler Water Company

12 12 SIGNIFICANT GROWTH PROJECTED FOR NORTHERN NEVADA REGION • Projected Job Growth Includes –Tesla Primary & Induced –Historical Growth –Economic Development Authority of Western Nevada (EDAWN) Projected Growth 150,000 170,000 190,000 210,000 230,000 250,000 270,000 Reno-Sparks MSA Projected Employment Growth: 2015-2019 Sources: Bureau of Labor Statistics, EDAWN 1.2% Growth/Year 4.7% Growth/Year

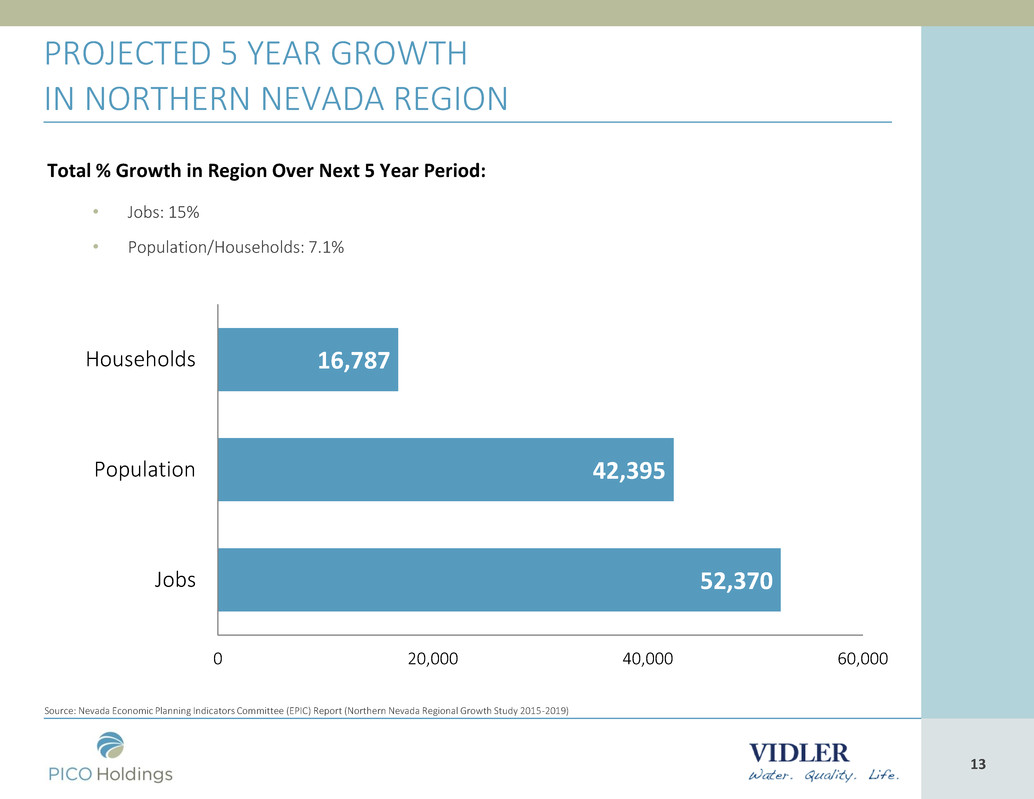

13 13 16,787 42,395 52,370 0 20,000 40,000 60,000 Households Population Jobs Source: Nevada Economic Planning Indicators Committee (EPIC) Report (Northern Nevada Regional Growth Study 2015-2019) Total % Growth in Region Over Next 5 Year Period: • Jobs: 15% • Population/Households: 7.1% PROJECTED 5 YEAR GROWTH IN NORTHERN NEVADA REGION

14 14 Source: Center for Regional Studies – UNR. Me d ia n Pric e H o m e Sal e s $260,000 $240,000 $220,000 $200,000 $180,000 $160,000 $140,000 Reno-Sparks MSA Home Prices: Jan-10 to Jan-15 40% 30% 20% 10% 0% -10% -20% -30% -40% R-S Median Home Price Growth Rate Jan-15: $247,517 Jan-15: 14.6% HOME PRICE GROWTH

15 15 VIDLER: PREVIOUS TRANSACTIONS • Vidler Water Company acquired in 1995: Only asset at acquisition was a collection of water rights and associated infrastructure in Colorado • Late 1990s / early 2000s spent identifying, acquiring and developing water resource and water storage assets in California, Nevada, Arizona and Colorado • From 2002 through 2009 Vidler monetized several water projects for proceeds of approximately $180 million generating a weighted average project IRR of approximately 45% * * Includes one project that Vidler management transacted through another PICO subsidiary, Nevada Land & Resource Company

16 UCP, INC. NYSE:UCP

17 17 (1) Includes General & Administrative and Sales & Marketing (2) Owned and controlled as of March 31,2015. Includes 354 homes under construction COMPANY SNAPSHOT Company Highlights • Homebuilder and land developer focused on high growth markets » Founded in 2004 by CEO Dustin Bogue » Headquartered in San Jose, California » 191 employees as of March 31, 2015(1) • Acquired by PICO Holdings in 2008 to capitalize on dislocation in the housing market » Over $200mm of capital deployed » IPO in July 2013 raised $116mm » Debt offering in 2014 raised $75mm • Significant land position of 7,240 lots(2) » Over 55% acquired prior to 2012 » 113 lots acquired in the Southeast, with control of an addition 476, through the Citizens Homes transaction in March 2014 • Future earnings growth trajectory to come from: » Build-out of current inventory » Organic growth in existing footprint » Adjacent market expansion

18 18 COMPANY SNAPSHOT Central Valley 23% Bay Area 28% Pacific Northwest 13% Southern California 6% Southeast 30% Lots By Market(1) 2015, 11% 2008- 2010, 39% 2011- 2013, 17% 2014, 33% Lots By Vintage Attractive Land Position High Growth Market Focus SF Bay Area Pacific Northwest Southeast Central Valley Southern California (1) Owned and controlled as of March 31,2015. Includes 354 homes under construction Two-thirds of lots acquired in 2014 -2015 YTD were a result of Southeast Expansion

19 19 33 41 196 432 502 2011 2012 2013 2014 LTM Q1 15 Homebuilding Deliveries STRONG HISTORICAL GROWTH TRAJECTORY • UCP has effectively deployed approximately $535mm in capital since 2008, amassing an attractive portfolio of well-located lots in high growth markets and significantly ramping up its homebuilding activities (1) As of March 31, 2015. Includes 354 homes under construction. (2) Active communities consist of those developments with which UCP has more than 15 homes remaining to sell. 2) IPO and Growth (2013+) • Opened 20 communities since IPO • 7,240 lots owned and controlled (1) • Sufficient to supply 3-4 years of rapid growth in core markets • Opened operations in both Southern California and the Southeast • 27 active communities at 03/31/2015 (2) 1) PICO Acquisition (2008-2012) • Opportunistically deployed $219mm to acquire over 6,000 lots • Strategic expansion into Pacific Northwest • Formed Benchmark Communities (2010)

20 20 INVESTMENT HIGHLIGHTS Exposure to high growth markets Long, high quality land position to fuel growth trajectory Significant runway to accelerate homebuilding community count Building backlog to support growth objectives Strong 1st move-up buyer focus with wide range of product capabilities Proven land acquisition, entitlement and development platform Opportunity to enhance profitability through scale, efficiencies, and land sales

21 21 Name Position Years with PICO John Hart President & CEO 22 Max Webb EVP & CFO 20 Dorothy Timian- Palmer President and COO, Vidler Water 17 Dustin Bogue President & CEO, UCP, Inc. 8 MANAGEMENT & OPERATING TEAM

22 22 PICO INVESTMENT HIGHLIGHTS • Opportunity to own a potentially undervalued security that is supported by hard assets » Provides significant downside protection at current price » Holding company structure offers access to ownership of water resource assets generally unavailable to most investors • Stock currently trading at discount to book value and book value is estimated to be understated • Conservative approach to capital allocation » Low leverage ratios and sufficient liquidity to weather difficult macroeconomic conditions » Potential return of capital through share repurchases

23 APPENDIX

24 24 PRIOR REPRESENTATIVE INVESTMENTS • Active Investor Working with Board & Management to Assist with Strategic Investment Direction or Financing » Physicians Insurance Company of Ohio » Structured capital infusion to struggling medical malpractice insurer: $8 million for 40% interest in 1993 / 1994 » Took control of investment portfolio and redirected investments to value style equities » Put the insurance operations into “run – off” » Sold Physicians in 2012: total sale proceeds and dividends over the ownership period equated to approximately 24% IRR

25 25 PRIOR REPRESENTATIVE INVESTMENTS • Bottoms up, Value Investor » Jungfraubahn Holding AG » Swiss company screened from a detailed analysis of Swiss stocks: Jungfraubahn identified due to low multiples of Price to Book and Price to Cash Flows and high dividend yield » Assets identified as unique (certain Swiss cogwheel railways) with strong recurring cash flow providing large amount of downside risk protection » Obtained one seat on the Board; worked behind the scenes to help improve free cash flow » Initial investment commenced in 1996 and sold in 2008 for approximately 20% IRR

26 26 PRIOR REPRESENTATIVE INVESTMENTS • Opportunities Among the Out – of – Favor, Undiscovered or Misunderstood » Nevada Land & Resource Company, LLC » Owner of 1.35 million acres of checker - boarded land sections in Northern Nevada » Asset was considered non – core by seller (Santa Fe Railroad) and purchased at approximately $36 per acre » Ownership over 14.5 years generated $137 million in revenues from land sales and leases producing approximately 9% IRR over the entire period (1997 to 2011)

27 27 PRIOR REPRESENTATIVE INVESTMENTS • Active Investor Working with Board & Management to Assist with Strategic Investment Direction or Financing » Australian Oil & Gas Company » Accumulated 20% shareholding in AOG – underlying rig assets identified as undervalued in low O&G price environment » Made bridge loan and underwrote rights offering so AOG could purchase new rigs to fulfil several lucrative contracts » Exited on buy–out of the company for approximately 22% IRR over course of entire investment (1998 to 2002)