Attached files

| file | filename |

|---|---|

| EX-3.4 - EX-3.4 - Pure Storage, Inc. | d895532dex34.htm |

| EX-3.1 - EX-3.1 - Pure Storage, Inc. | d895532dex31.htm |

| EX-3.2 - EX-3.2 - Pure Storage, Inc. | d895532dex32.htm |

| EX-4.1 - EX-4.1 - Pure Storage, Inc. | d895532dex41.htm |

| EX-1.1 - EX-1.1 - Pure Storage, Inc. | d895532dex11.htm |

| EX-10.4 - EX-10.4 - Pure Storage, Inc. | d895532dex104.htm |

| EX-10.7 - EX-10.7 - Pure Storage, Inc. | d895532dex107.htm |

| EX-10.6 - EX-10.6 - Pure Storage, Inc. | d895532dex106.htm |

| EX-23.2 - EX-23.2 - Pure Storage, Inc. | d895532dex232.htm |

Table of Contents

As filed with the U.S. Securities and Exchange Commission on September 9, 2015

Registration No. 333-206312

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PURE STORAGE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3572 | 27-1069557 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

650 Castro Street, Suite 400

Mountain View, California 94041

(800) 379-7873

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Scott Dietzen

Chief Executive Officer

Pure Storage, Inc.

650 Castro Street, Suite 400

Mountain View, California 94041

(800) 379-7873

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mark P. Tanoury John T. McKenna Seth J. Gottlieb Cooley LLP 3175 Hanover Street Palo Alto, California 94304 (650) 843-5000 |

Joseph FitzGerald Vice President & General Counsel Todd Wheeler Pure Storage, Inc. 650 Castro Street, Suite 400 Mountain View, California 94041 (800) 379-7873 |

Alan F. Denenberg Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued September 9, 2015

Shares

CLASS A COMMON STOCK

Pure Storage, Inc. is offering shares of its Class A common stock. This is our initial public offering and no public market currently exists for our shares of Class A common stock. We anticipate that the initial public offering price will be between $ and $ per share.

We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to ten votes and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately % of the voting power of our outstanding capital stock immediately following this offering, with our directors, executive officers and principal stockholders representing approximately % of such voting power.

Our Class A common stock has been approved for listing on the New York Stock Exchange under the trading symbol “PSTG.”

We are an “emerging growth company” as defined under the federal securities laws. Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 10.

PRICE $ A SHARE

| Price to Public |

Underwriting |

Proceeds to |

||||||||||

| Per share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters the right to purchase up to an additional shares of Class A common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2015.

| MORGAN STANLEY | GOLDMAN, SACHS & CO. | BARCLAYS | ALLEN & COMPANY LLC |

| BofA MERRILL LYNCH | ||||||

| PACIFIC CREST SECURITIES | STIFEL | RAYMOND JAMES | EVERCORE ISI | |||

| a division of KeyBanc Capital Markets | ||||||

, 2015

Table of Contents

In a world that runs on flash

What was complex,

now is simple

What filled data center racks,

now fits in a box

What took days, now takes hours

What became outdated, now is evergreen

Table of Contents

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since that date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Until , 2015 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade shares of our Class A common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, especially the risks of investing in our Class A common stock discussed under the heading “Risk Factors,” and our consolidated financial statements and related notes included elsewhere in this prospectus before making an investment decision. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Pure Storage,” “Pure,” “the company,” “we,” “us” and “our” refer to Pure Storage, Inc. and its wholly-owned subsidiaries.

PURE STORAGE, INC.

Overview

Our mission is to deliver data storage that transforms business through a dramatic increase in performance and reduction in complexity and costs. Our innovative technology replaces storage systems designed for mechanical disk with all-flash systems optimized end-to-end for solid-state memory. At the same time, our innovative business model replaces the traditional forklift upgrade cycle with an evergreen storage model of hardware and software upgrades and maintenance.

Our next-generation storage platform and business model are the result of our team’s substantial experience in enterprise storage and web-scale infrastructure, as well as frustration with the industry’s status quo. This deep industry understanding led to the development of our three-part integrated platform: the Purity Operating Environment, our flash-optimized software, FlashArray, our modular and scalable all-flash array hardware, and Pure1, our cloud-based management and support. Our platform can deliver a 10X acceleration in business applications over legacy disk-based storage. It is also designed to be compatible with existing infrastructure, substantially more reliable and power and space efficient.

Our business model builds on our technology innovations to reverse the traditional storage business model. Instead of moving data between old and new systems via forklift upgrades, we keep business data and applications in place and upgrade technology around it. Our platform and business model are designed to add value to customers for a decade or more, reducing total cost of storage ownership while increasing loyalty.

Our innovations help rebalance the datacenter by closing the performance gap between legacy storage technology and servers and networks. But it is the simplicity of our platform and business model that is revolutionizing the enterprise storage experience. Together, our innovations have helped our customers realize the promise of the cloud model for IT and the benefits of Moore’s Law. This has yielded industry-leading Net Promoter scores, based on the results of customer satisfaction surveys we conducted.

Since launching FlashArray in May 2012, our customer base has grown to over 1,100 customers. Our customers include large and mid-size organizations across a diverse set of industry verticals, including cloud-based software and service providers, consumer web, education, energy, financial services, governments, healthcare, manufacturing, media, retail and telecommunications. Our platform is used for a broad set of storage use cases, including database applications, private and public cloud infrastructure, virtual server infrastructure and virtual desktop infrastructure. Our platform helps customers increase employee productivity, improve operational efficiency, make better decisions through faster, more accurate analytics and deliver more compelling user experiences to their customers and partners.

We sell our platform predominantly through a high touch, channel-fulfilled model. Our sales force works collaboratively with our global network of distribution and channel partners, which provides us broad sales reach while maintaining direct customer engagement.

1

Table of Contents

Pure Storage serves the market for enterprise storage and related storage software. According to IDC, the combined worldwide spend by enterprises on external storage hardware priced at more than $50,000 per array and storage and device management, storage infrastructure and storage replication software is estimated to grow from approximately $24.2 billion in 2014 to $27.0 billion in 2018. We believe the benefits of next-generation flash storage will drive flash to ultimately become the predominant form of primary enterprise storage and present a broad market opportunity.

This market opportunity is reflected in our rapid growth. Our revenue increased from $6.1 million for the fiscal year ended January 31, 2013 to $42.7 million for the fiscal year ended January 31, 2014 and to $174.5 million for the fiscal year ended January 31, 2015, representing year-over-year revenue growth of 603% and 308% for our two most recent fiscal years. Our revenue increased from $59.4 million for the six months ended July 31, 2014 to $158.7 million for the six months ended July 31, 2015, representing period-over-period growth of 167% for our most recent interim period. Our net loss was $23.4 million, $78.6 million, and $183.2 million for the fiscal years ended January 31, 2013, 2014 and 2015, respectively and $95.2 million and $113.0 million for the six months ended July 31, 2014 and 2015, respectively. For the fiscal year ended January 31, 2015 and the six months ended July 31, 2015, 77% and 78% of our revenue was from the United States and 23% and 22% from the rest of the world, respectively.

Industry Background

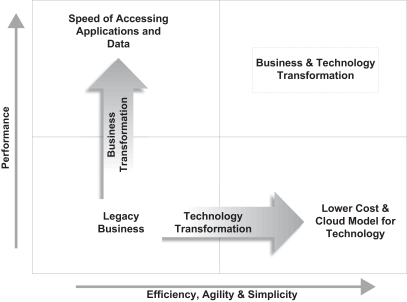

Technology continues to transform business—redefining how products and services are built, how customers and partners are served and how organizations innovate. As a result, organizations face the urgent need to operate with greater speed and to leverage technology to be smarter and more innovative. Indeed, the speed, agility and efficiency of an organization’s information systems contribute to and in many cases define competitive advantage.

Organizations must make technology investments that improve IT performance and in parallel reduce the cost and complexity of their operations. Technology that can quickly adapt to ever-changing requirements and drive these dual and seemingly opposed requirements of improving both performance and efficiency is essential.

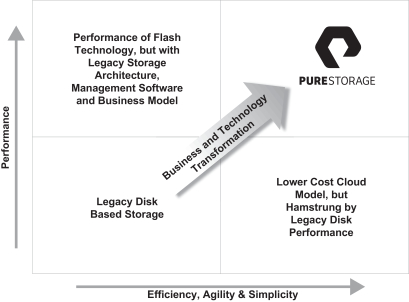

Business Transformation through Improved Performance. The speed of servers and networks has dramatically improved over the past several decades, but the performance of disk-based storage has not kept up. Disk-based storage is now an obstacle to application performance.

Flash memory is a solid-state storage technology that can eliminate the storage bottleneck, while providing better performance, greater storage density and improved power efficiency as compared to disk. Flash memory has transformed today’s consumer technology experience—it is the storage media inside smartphones—and it is now time for business to enjoy those same benefits. The price performance of flash technology also has improved dramatically in recent years. Already, leading web-scale companies such as Apple, Facebook and Google are utilizing flash-based storage in their datacenters.

Even when retrofitted with flash, legacy approaches to storage generally fall short. Too often, they rely on legacy storage software, which was optimized for the serial and sequential read and write patterns of disk. They do not take full advantage of the parallelizable and random access nature of flash. Even modern hybrid storage approaches—those that pair flash and disk designs—are inadequate, as they suffer from the speed of the far slower disk operations.

IT Transformation through Reduced Costs and Complexity. Cloud computing has been one of the more compelling IT advances in years. Today, organizations use shared resources in the cloud, significantly reducing the cost and complexity of operations and datacenters. Organizations around the world are now adopting many of the core tenets of this cloud model to transform their own operations and datacenters.

2

Table of Contents

Legacy disk-based storage is generally inconsistent with the design tenets of the cloud. It does not scale easily, and is complex and costly to manage, often requiring expert consultants for routine operations. Most legacy disk-based storage requires organizations to replace their storage systems every 3 to 5 years. This is expensive and worrisome for customers, who must juggle upgrades and downtime during the data migration period. The result is an endless and time-consuming cycle of procurement, provisioning and troubleshooting of data storage.

Next-Generation Storage. With the increased demands of a complex and changing business environment, we believe organizations not only desire but also require a new storage platform that combines the following:

| • | Dramatically improved performance to keep up with the demands of the business; |

| • | Reliability, security and data management services for operating in mission critical environments; |

| • | Seamless interoperability for compatibility with existing IT infrastructure investments; |

| • | Simplicity, agility, easy automation and elasticity to enable the cloud model of IT; and |

| • | Greater price performance and reduced total cost of ownership. |

Our Solution

Pure Storage is defining the next generation of enterprise data storage. We have pioneered the all-flash array category and have coupled that with our customer-centric business model. We believe that our approach is having a profound impact both on our customers and the data storage industry as a whole:

| • | Business Transformation. With Pure Storage, customers’ business applications run faster—helping them to improve yields, employee productivity and customer and partner experiences, allowing them to make smarter decisions, and enabling them to increase innovation across their organizations. |

| • | Technology Transformation. Our platform increases the efficiency, agility and simplicity of IT infrastructure, enabling our customers to reduce the cost and complexity of operations and implement the cloud model. |

The following differentiates our storage platform:

| • | High Performance. Our FlashArray and Purity Operating Environment software were specifically architected for the fast parallelizable and random access of flash. The result is that customers can eliminate more than one year of cumulative application latency every month as compared to legacy disk-based storage in typical deployments. |

| • | Enterprise Resiliency. Our platform, through the Purity Operating Environment, enables customers to maintain continuous access to their data without a loss in performance, even in the event of hardware or software component failures or during upgrades. |

| • | Simplicity. Our platform is simple to deploy, manage and upgrade for a wide variety of customer use cases—the basic operating commands fit on a single, folding business card. Our platform is designed to seamlessly integrate with existing investments in server and application infrastructure. |

| • | Agile Management. Through Pure1, we deliver an integrated cloud-based management and support experience. We originate most of the support interactions we have with our customers, consistent with our proactive focus on helping our customers quickly respond to issues and stay ahead of changes to their storage requirements. |

| • | Evergreen Storage. Our platform is designed to support customer deployments for a decade or more. Through our innovative business model, we provide software updates, any needed hardware replacements, and a controller refresh every three years so the customer can run the latest Purity Operating Environment for predictable maintenance fees. |

3

Table of Contents

| • | Compelling Economics. Our FlashReduce software, combined with consumer-grade flash memory, allows customers to achieve price-performance levels that enable our platform to be deployed across a wide range of use cases. |

| • | Lower Total Cost of Ownership. Our platform reduces the space, power, cooling, management overhead and other associated expenses as compared to disk-based storage. |

Growth Strategies

Key elements of our growth strategy include:

| • | Relentlessly Innovate and Maintain Technology Leadership. We will continue to invest in product innovation and technology leadership and plan to enhance our flash-optimized software, modular and scalable hardware and cloud-based management and support. |

| • | Continue to Drive Large Customer Adoption. We intend to grow our base of customers, including large customers, by promoting our platform, increasing our investment in sales and marketing and leveraging our network of channel partners. |

| • | Further Leverage our Channel Ecosystem. We intend to continue investing in training, demand generation and partner programs. We also believe we can enable many of our partners to independently identify, qualify, sell and upgrade customers, with limited involvement from us. |

| • | Drive Greater Penetration into our Existing Customer Base. We believe our over 1,100 customers represent a significant opportunity for us to realize incremental sales. We sell additional products and services to our customers as the data within their existing application deployments naturally grows and as customers migrate additional applications to our platform. |

| • | Cultivate our Inspirational Culture. We believe our culture is a critical part of our success. We strive to maintain an exciting and supportive atmosphere that attracts great talent and inspires our employees to excel and deliver a differentiated experience for our customers. |

| • | Leverage our Technology Ecosystem. We will continue to develop strategic relationships with technology vendors to allow integration of our platform with their offerings, enabling a streamlined experience for our customers. |

Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| • | We have experienced rapid growth in recent periods, and we may not be able to sustain or manage future growth effectively. |

| • | We intend to continue focusing on revenue growth and increasing our market penetration and international presence at the expense of near-term profitability by investing heavily in our business. |

| • | We have a limited operating history, which makes our future operating results difficult to predict. |

| • | The market for all-flash storage products is rapidly evolving, which makes it difficult to forecast customer adoption rates and demand for our products. |

| • | We face intense competition from a number of established companies and new entrants. |

| • | Many of our established competitors have long-standing relationships with key decision makers at many of our current and prospective customers, which may inhibit our ability to compete effectively and maintain or increase our market share. |

4

Table of Contents

| • | Our ability to increase our revenue will substantially depend on our ability to attract, motivate and retain sales, engineering and other key personnel, including our management team, and any failure to attract, motivate and retain these employees could harm our business, operating results and financial condition. |

| • | If we fail to adequately expand our sales force, our growth will be impeded. |

| • | The success of our business depends in part on our ability to protect and enforce our intellectual property rights. |

If we are unable to adequately address these and other risks we face, our business, financial condition, operating results and prospects may be adversely affected.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012, and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. We may take advantage of these exemptions for up to five years or until we are no longer an “emerging growth company,” whichever is earlier.

Corporate Information

We were incorporated in Delaware in October 2009 as OS76, Inc. In January 2010, we changed our name to Pure Storage, Inc. Our principal executive offices are located at 650 Castro Street, Suite 400, Mountain View, California 94041, and our telephone number is (800) 379-7873. Our website address is www.purestorage.com. Information contained on or accessible through our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

Pure Storage, the “P” logo, Purity Operating Environment, FlashArray, Pure1 and other trade names, trademarks or service marks of Pure Storage appearing in this prospectus are the property of Pure Storage. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders.

5

Table of Contents

THE OFFERING

| Class A common stock offered |

shares | |

| Class A common stock to be outstanding after this offering |

shares | |

| Class B common stock to be outstanding after this offering |

shares | |

| Total Class A and Class B common stock to be outstanding after this offering |

shares | |

| Over-allotment option of Class A common stock offered |

shares | |

| Voting rights |

We have two classes of authorized common stock: Class A common stock and Class B common stock. The rights of the holders of Class A and Class B common stock are identical, except with respect to voting and conversion rights. The holders of Class A common stock are entitled to one vote per share, and the holders of Class B common stock are entitled to ten votes per share, on all matters that are subject to stockholder vote. Following this offering, each share of Class B common stock may be converted into one share of Class A common stock at the option of the holder thereof, and will be converted into one share of Class A common stock upon transfer thereof, subject to certain exceptions. See “Description of Capital Stock” for additional information. | |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering primarily for general corporate purposes, including expansion of our product development and sales and marketing organizations. We may also use a portion of the net proceeds from this offering for acquisitions of, or investments in, technologies, solutions or businesses that complement our business, although we have no commitments or agreements to enter into such acquisitions or investments. See “Use of Proceeds” for additional information. | |

| New York Stock Exchange symbol |

“PSTG” | |

6

Table of Contents

The number of shares of Class A and Class B common stock to be outstanding after this offering is based on no shares of our Class A common stock and 160,056,764 shares of our Class B common stock outstanding as of July 31, 2015, and excludes:

| • | 59,928,620 shares of Class B common stock issuable upon the exercise of outstanding stock options as of July 31, 2015 under our 2009 Equity Incentive Plan with weighted-average exercise price of $4.53 per share; |

| • | 15,102,581 shares of Class B common stock reserved for future issuance under our 2009 Equity Incentive Plan, which shares will cease to be available for issuance at the time our 2015 Equity Incentive Plan becomes effective in connection with this offering; |

| • | 700,000 shares of Class B common stock that we issued in September 2015 to the Pure Good Foundation; |

| • | 27,000,000 shares of Class A common stock reserved for future issuance under our 2015 Equity Incentive Plan, as well as any automatic increases in the number of shares of Class A common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement for this offering; and |

| • | 3,500,000 shares of Class A common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, as well as any automatic increases in the number of shares of Class A common stock reserved for future issuance under this plan, which will become effective upon the execution of the underwriting agreement for this offering. |

In addition, unless we specifically state otherwise, all information in this prospectus assumes:

| • | that our amended and restated certificate of incorporation, which we will file in connection with the closing of this offering, and our amended and restated bylaws adopted in connection with this offering are effective; |

| • | the conversion of all outstanding shares of our preferred stock into an aggregate of 122,280,679 shares of Class B common stock immediately upon the closing of this offering; |

| • | no exercise of outstanding options; and |

| • | no exercise by the underwriters of their right to purchase up to an additional shares of Class A common stock to cover over-allotments. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data. We have derived the consolidated statements of operations data for the fiscal years ended January 31, 2014 and 2015 from our audited financial statements included elsewhere in this prospectus. The selected consolidated statements of operations data for the fiscal year ended January 31, 2013 are derived from our unaudited consolidated financial statements not included in this prospectus. We have derived the selected consolidated financial statements of operations data for the six months ended July 31, 2014 and 2015 and consolidated balance sheet data as of July 31, 2015 from our unaudited consolidated financial statements included elsewhere in the prospectus. The unaudited consolidated financial statements were prepared on a basis consistent with our audited financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future and our results for the six months ended July 31, 2015 are not necessarily indicative of the results that may be expected for the full fiscal year.

You should read this data together with our consolidated financial statements and related notes appearing elsewhere in this prospectus and the sections titled “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Fiscal Year Ended January 31, |

Six Months Ended July 31, |

|||||||||||||||||||

| 2013 | 2014 | 2015 | 2014 | 2015 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Product |

$ | 5,474 | $ | 39,228 | $ | 154,836 | $ | 53,253 | $ | 134,810 | ||||||||||

| Support |

603 | 3,505 | 19,615 | 6,159 | 23,928 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

6,077 | 42,733 | 174,451 | 59,412 | 158,738 | |||||||||||||||

| Cost of revenue: |

||||||||||||||||||||

| Product(1) |

3,605 | 19,974 | 63,425 | 22,608 | 50,353 | |||||||||||||||

| Support(1) |

709 | 4,155 | 14,127 | 4,924 | 14,421 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenue |

4,314 | 24,129 | 77,552 | 27,532 | 64,774 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

1,763 | 18,604 | 96,899 | 31,880 | 93,964 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development(1) |

12,383 | 36,081 | 92,707 | 40,533 | 69,870 | |||||||||||||||

| Sales and marketing(1) |

10,727 | 54,750 | 152,320 | 71,563 | 107,844 | |||||||||||||||

| General and administrative(1) |

2,017 | 5,902 | 32,354 | 14,419 | 27,919 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

25,127 | 96,733 | 277,381 | 126,515 | 205,633 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(23,364 | ) | (78,129 | ) | (180,482 | ) | (94,635 | ) | (111,669 | ) | ||||||||||

| Other income (expense), net |

(6 | ) | (141 | ) | (1,412 | ) | (307 | ) | (1,074 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before provision for income taxes |

(23,370 | ) | (78,270 | ) | (181,894 | ) | (94,942 | ) | (112,743 | ) | ||||||||||

| Provision for income taxes |

2 | 291 | 1,337 | 257 | 214 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ (23,372 | ) | $ | (78,561 | ) | $ | (183,231 | ) | $ | (95,199 | ) | $ | (112,957 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to common stockholders, basic and diluted(2) |

$ | (1.28 | ) | $ | (3.24 | ) | $ | (6.56 | ) | $ | (3.66 | ) | $ | (3.41 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted(2) |

18,239 | 24,237 | 27,925 | 25,976 | 33,154 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per share attributable to common stockholders, basic and diluted(2) |

$ | (1.26 | ) | $ | (0.73 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted-average shares used in computing pro forma net loss per share attributable to common stockholders, basic and diluted(2) |

145,719 | 155,435 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

8

Table of Contents

| (1) | Includes stock-based compensation expense as follows: |

| Fiscal Year Ended January 31, |

Six Months Ended July 31, |

|||||||||||||||||||

| 2013 | 2014 | 2015 | 2014 | 2015 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cost of revenue—product |

$ | 66 | $ | 253 | $ | 303 | $ | 229 | $ | 96 | ||||||||||

| Cost of revenue—support |

— | 316 | 1,273 | 898 | 854 | |||||||||||||||

| Research and development |

752 | 11,477 | 22,512 | 15,147 | 10,429 | |||||||||||||||

| Sales and marketing |

342 | 9,014 | 22,466 | 17,361 | 5,980 | |||||||||||||||

| General and administrative |

256 | 506 | 6,479 | 4,508 | 3,300 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stock-based compensation expense |

$ | 1,416 | $ | 21,566 | $ | 53,033 | $ | 38,143 | $ | 20,659 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Stock-based compensation expense for the fiscal years ended January 31, 2014 and 2015 and the six months ended July 31, 2014 included $13.3 million, $27.6 million, and $27.6 million, respectively, of cash paid for the repurchase of common stock in excess of fair value. See Note 9 to our consolidated financial statements for additional information.

| (2) | See Note 10 to our consolidated financial statements for an explanation of the method used to calculate our actual and pro forma basic and diluted net loss per share attributable to common stockholders and the weighted-average number of shares used in the computation of the per share amounts. |

| As of July 31, 2015 | ||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(2)(3) | ||||||||

| (unaudited) | ||||||||||

| (in thousands) | ||||||||||

| Consolidated Balance Sheet Data: |

||||||||||

| Cash and cash equivalents |

$ | 128,282 | $ | 128,282 | ||||||

| Working capital |

147,554 | 147,554 | ||||||||

| Total assets |

336,563 | 336,563 | ||||||||

| Deferred revenue, current and noncurrent portion |

123,482 | 123,482 | ||||||||

| Convertible preferred stock |

543,940 | — | ||||||||

| Total stockholders’ (deficit) equity |

$ | (388,028 | ) | $ | 155,912 | |||||

| (1) | The pro forma column reflects the conversion of all outstanding shares of convertible preferred stock into 122,280,679 shares of Class B common stock immediately upon the closing of this offering. |

| (2) | The pro forma as adjusted column further reflects the receipt of $ million in net proceeds from our sale of shares of Class A common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share would increase or decrease, respectively, the amount of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase or decrease of 1,000,000 in the number of shares we are offering would increase or decrease, respectively, the amount of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $ million, assuming the assumed initial public offering price per share, as set forth on the cover page of this prospectus, remains the same after deducting underwriting discounts and commissions. The pro forma as adjusted information is illustrative only, and we will adjust this information based on the actual initial public offering price and other terms of this offering determined at pricing. |

9

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our Class A common stock. If any of the following risks actually occur, it could harm our business, prospects, operating results and financial condition. In such event, the trading price of our Class A common stock could decline and you might lose all or part of your investment.

Risks Related to Our Business and Industry

We have experienced rapid growth in recent periods, and we may not be able to sustain or manage future growth effectively.

We have significantly expanded our overall business, customer base, headcount, channel partner relationships and operations in recent periods, and we anticipate that we will continue to expand and may experience rapid growth in future periods. For example, from January 31, 2014 to January 31, 2015, our headcount increased from over 350 to over 800 employees, and to over 1,100 employees as of July 31, 2015. Our future operating results will depend to a large extent on our ability to successfully manage our anticipated expansion and growth. To manage our growth successfully, we believe that we must, among other things, effectively:

| • | maintain and extend our product leadership; |

| • | recruit, hire, train and manage additional personnel; |

| • | maintain and further develop our channel partner relationships; |

| • | enhance and expand our distribution and supply chain infrastructure; |

| • | expand our support capabilities; |

| • | forecast and control expenses; |

| • | enhance and expand our international operations; and |

| • | implement, improve and maintain our internal systems, procedures and controls. |

We expect that our future growth will continue to place a significant strain on our managerial, administrative, operational, financial and other resources. We will incur costs associated with this future growth prior to realizing the anticipated benefits, and the return on these investments may be lower, may develop more slowly than we expect or may never materialize. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new products or enhancements to existing products in a timely manner, and we may fail to satisfy customers’ expectations, maintain product quality, execute on our business plan or adequately respond to competitive pressures, each of which could adversely affect our business and operating results.

We intend to continue focusing on revenue growth and increasing our market penetration and international presence at the expense of near-term profitability by investing heavily in our business.

Our strategy is to increase our investments in marketing, sales, support and research and development at the expense of near-term profitability. We believe our decision to continue investing heavily in our business will be critical to our future success. We anticipate that our operating costs and expenses will increase substantially for the foreseeable future. In addition, we expect to incur significant legal, accounting and other expenses that we did not incur as a private company. Even if we achieve significant revenue growth, we may continue to experience losses, similar or greater than to those we have incurred historically.

10

Table of Contents

We have not achieved profitability for any fiscal year since our inception. We incurred a net loss of approximately $183.2 million for the fiscal year ended January 31, 2015 and $113.0 million for the six months ended July 31, 2015, and we had an accumulated deficit of $341.6 million and $454.5 million as of January 31, 2015 and July 31, 2015, respectively. Our operating expenses largely are based on anticipated revenue, and a high percentage of our expenses are, and will continue to be, fixed in the short term. If we fail to adequately increase revenue and manage costs, we may not achieve or maintain profitability in the future. As a result, our business could be harmed and our operating results could suffer.

We have a limited operating history, which makes our future operating results difficult to predict.

We were founded in October 2009, but have generated substantially all of our revenue since February 1, 2013. We have a limited operating history in an industry characterized by rapid technological change, changing customer needs, evolving industry standards and frequent introductions of new products and services. Our limited operating history makes it difficult to evaluate our current business and our future prospects, including our ability to plan for and model future growth. All of these factors make our future operating results difficult to predict, which may impair our ability to manage our business and reduce your ability to assess our prospects.

You should not consider our revenue growth in prior quarterly or annual periods as indicative of our future performance. In future periods, we do not expect to achieve similar percentage revenue growth rates as we have achieved in some past periods. If we are unable to maintain adequate revenue or revenue growth, our stock price could be volatile, and it may be difficult to achieve and maintain profitability.

The market for all-flash storage products is rapidly evolving, which makes it difficult to forecast customer adoption rates and demand for our products.

The market for all-flash storage products is rapidly evolving. As a result, our future financial performance will depend on the continued growth of this market and on our ability to adapt to emerging customer demands and trends. Sales of our products are currently focused on use cases that require performance storage products such as virtualization and transaction processing. Many of our target customers have never purchased all-flash storage products and may not have the desire or available budget to invest in a new technology such as ours. It is difficult to predict with any precision customer adoption rates, customer demand for our products or the future growth rate and size of our market. Our products may never reach mass adoption, and changes or advances in alternative technologies or adoption of cloud storage offerings not utilizing our storage platform could adversely affect the demand for our products. Further, although flash storage has a number of advantages as compared to other data storage alternatives, such as hard disk drives, flash storage has certain limitations as well, including a higher price per gigabyte of raw storage, more limited methods for data recovery and reduced performance gains for certain uses, including sequential input/output, or I/O, transactions. A slowing in or reduced demand for all-flash storage products caused by lack of customer acceptance, technological challenges, alternative technologies and products or otherwise would result in a lower revenue growth rate or decreased revenue, either of which would negatively impact our business and operating results.

We face intense competition from a number of established companies and new entrants.

We face intense competition from a number of established companies that sell competitive storage products. These competitors include Cisco, Dell, EMC, HP, Hitachi Data Systems, IBM, Lenovo and NetApp. These competitors, as well as other potential competitors, may have:

| • | greater name recognition and longer operating histories; |

| • | larger sales and marketing and customer support budgets and resources; |

| • | broader distribution and established relationships with distribution partners and customers; |

| • | the ability to bundle storage products with other products and services to address customers’ requirements; |

| • | greater resources to make acquisitions; |

11

Table of Contents

| • | larger and more mature intellectual property portfolios; and |

| • | substantially greater financial, technical and other resources. |

We also face competition from a number of other companies, one or more of which may become significant competitors in the future. New competitors could emerge and acquire significant market share. All of our competitors may utilize a broad range of competitive strategies. For example, some of our competitors have offered bundled products and services in order to reduce the initial cost of their storage products. Our competitors may also choose to adopt more aggressive pricing policies than we choose to adopt. Some of our competitors have offered their products either at significant discounts or even for free in response to our efforts to market the overall benefits and technological merits of our products.

Many competitors have developed competing all-flash or hybrid storage technologies. For example, some of our competitors have developed all-flash storage products with data reduction technologies that directly compete with our products. We expect our competitors to continue to improve the performance of their products, reduce their prices and introduce new services and technologies that may, or that they may claim to, offer greater performance and improved total cost of ownership as compared to our products. In addition, our competitors may develop enhancements to, or future generations of, competitive products that may render our products or technologies obsolete or less competitive. These and other competitive pressures may prevent us from competing successfully against current or future competitors.

Many of our established competitors have long-standing relationships with key decision makers at many of our current and prospective customers, which may inhibit our ability to compete effectively and maintain or increase our market share.

Many of our competitors benefit from established brand awareness and long-standing relationships with key decision makers at many of our current and prospective customers. We expect that our competitors will seek to leverage these existing relationships to discourage customers from purchasing our products. In particular, when competing against us, we expect our competitors to emphasize the perceived risks of relying on products from a company with a shorter operating history. Additionally, most of our prospective customers have existing storage systems manufactured by our competitors. This gives an incumbent competitor an advantage in retaining the customer because the incumbent competitor already understands the customer’s network infrastructure, user demands and IT needs. In the event that we are unable to successfully sell our products to new customers or persuade our customers from continuing to purchase our products, we may not be able to maintain or increase our market share and revenue, which could adversely affect our business and operating results.

Our ability to increase our revenue will substantially depend on our ability to attract, motivate and retain sales, engineering and other key personnel, including our management team, and any failure to attract, motivate and retain these employees could harm our business, operating results and financial condition.

Our ability to increase our revenue will substantially depend on our ability to attract and retain qualified sales, engineering and other key employees, including our management. These positions may require candidates with specific backgrounds in software and the storage industry, and competition for employees with such expertise is intense. Our ability to attract, motivate or retain employees may be reduced as we become a public company, as the value of our stock fluctuates and as our employees have the opportunity to sell their equity after this offering. We may not be successful in attracting, motivating and retaining qualified personnel. We have from time to time experienced, and we expect to continue to experience, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. To the extent that we are successful in hiring to fill these positions, we need a significant amount of time to train the new employees before they can become effective and efficient in performing their jobs. From time to time, there may be changes in our management team resulting from the hiring or departure of those individuals. Members of our management team, including our executive officers, are generally employed on an at-will basis, which means that they could terminate their employment with us at any time. If we are unable to attract, motivate and retain qualified sales, engineering and other key employees, including our management, our business and operating results could suffer.

12

Table of Contents

If we fail to adequately expand our sales force our growth will be impeded.

We will need to continue to expand and optimize our sales infrastructure in order to grow our customer base and our business. We plan to continue to expand our sales force, both domestically and internationally. Identifying, recruiting and training qualified sales personnel require significant time, expense and attention. It can take time before our sales representatives are fully trained and productive. Our business may be adversely affected if our efforts to expand and train our sales force do not generate a corresponding increase in revenue. In particular, if we are unable to hire, develop and retain qualified sales personnel or if new sales personnel are unable to achieve desired productivity levels in a reasonable period of time, we may not be able to realize the expected benefits of this investment or increase our revenue.

If we fail to develop and introduce new or enhanced products on a timely basis, our ability to attract and retain customers could be impaired and our competitive position could be harmed.

We operate in a dynamic environment characterized by rapidly changing technologies and industry standards and technological obsolescence. To compete successfully, we must design, develop, market and sell new or enhanced products that provide increasingly higher levels of performance, capacity and reliability and that meet the cost expectations of our customers, which is a complex and uncertain process. The introduction of new products by our competitors, the market acceptance of products based on new or alternative technologies or the emergence of new industry standards could render our existing or future products obsolete or less competitive. As we introduce new or enhanced products, we must successfully manage product launches and transitions to the next generations of our products. For example, in June 2015, we announced our new FlashArray//m product. If we are not able to successfully manage the transition from our FlashArray 400-Series product to our FlashArray//m product, our business, operating results and financial condition could be harmed. Similarly, if we fail to introduce new or enhanced products that meet the needs of our customers in a timely or cost-effective fashion, we will lose market share and our operating results will be adversely affected.

Our research and development efforts may not produce successful products that result in significant revenue in the near future, if at all.

Developing new products and related enhancements is expensive and time intensive. Our investments in research and development may result in products that may not achieve market adoption, are more expensive to develop than anticipated, may take longer to generate revenue or may generate less revenue than we anticipate. Our future plans include significant investments in research and development for new products and related opportunities. We believe that we must continue to dedicate significant resources to our research and development efforts to maintain or expand our competitive position. However, these efforts may not result in significant revenue in the near future, if at all, which could adversely affect our business and operating results.

If we fail to successfully maintain or grow our relationships with channel partners, our business, operating results and financial condition could be harmed.

Our future success is highly dependent upon our ability to establish and maintain successful relationships with a variety of channel partners in markets where we do not have a large direct sales force or direct customer support personnel. In addition to selling our products, our partners may offer installation, post-sale service and support on our behalf in their local markets. In markets where we rely on partners more heavily, we have less contact with our customers and less control over the sales process and the quality and responsiveness of our partners. As a result, it may be more difficult for us to ensure the proper delivery and installation of our products or the quality or responsiveness of the support and services being offered. Any failure on our part to effectively identify, train and manage our channel partners and to monitor their sales activity, as well as the customer support and services being provided to our customers in their local markets, could harm our business, operating results and financial condition.

13

Table of Contents

Our channel partners may choose to discontinue offering our products and services or may not devote sufficient attention and resources toward selling our products and services. We typically enter into non-exclusive, written agreements with our channel partners. These agreements generally have a one-year, self-renewing term, have no minimum sales commitment and do not prohibit our channel partners from offering products and services that compete with ours. Accordingly, our channel partners may choose to discontinue offering our products and services or may not devote sufficient attention and resources toward selling our products and services. Additionally, our competitors may provide incentives to our existing and potential channel partners to use, purchase or offer their products and services or to prevent or reduce sales of our products and services. The occurrence of any of these events could harm our business, operating results and financial condition.

Our gross margins are impacted by a variety of factors, are subject to variation from period to period and are difficult to predict.

Our gross margins fluctuate from period to period due primarily to product costs, customer mix and product mix. Over the fiscal year ended January 31, 2015, and the six months ended July 31, 2015, our quarterly gross margins ranged from 53% to 60%. Our gross margins are likely to continue to fluctuate and may be affected by a variety of factors, including:

| • | demand for our products; |

| • | sales and marketing initiatives, discount levels, rebates and competitive pricing; |

| • | changes in customer, geographic or product mix, including mix of configurations within products; |

| • | the cost of components and freight; |

| • | new product introductions and enhancements, potentially with initial sales at relatively small volumes and higher product costs; |

| • | the timing and amount of revenue recognized and deferred; |

| • | excess inventory levels or purchase commitments as a result of changes in demand forecasts or product transitions; |

| • | an increase in product returns, order rescheduling and cancellations; |

| • | the timing of technical support service contracts and contract renewals; |

| • | inventory stocking requirements to mitigate supply constraints, accommodate unforeseen demand or support new product introductions; and |

| • | product quality and serviceability issues. |

Due to such factors, gross margins are subject to variation from period to period and are difficult to predict. If we are unable to manage these factors effectively, our gross margins may decline, and fluctuations in gross margins may make it difficult to manage our business and achieve or maintain profitability, which could materially harm our business, operating results and financial condition.

Our operating results may fluctuate significantly, which could make our future results difficult to predict and could cause our operating results to fall below expectations.

Our operating results may fluctuate due to a variety of factors, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of our future performance. If our revenue or operating results fall below the expectations of investors or any securities analysts that follow our company, the price of our Class A common stock would likely decline.

14

Table of Contents

Factors that are difficult to predict and that could cause our operating results to fluctuate include:

| • | the timing and magnitude of orders, shipments and acceptance of our products in any quarter, including product returns, order rescheduling and cancellations by our customers; |

| • | fluctuations in demand and prices for our products; |

| • | potential seasonality in the markets we serve; |

| • | our ability to control the costs of the components we use in our hardware products; |

| • | our ability to timely adopt subsequent generations of components into our hardware products; |

| • | disruption in our supply chains, component availability and related procurement costs; |

| • | reductions in customers’ budgets for IT purchases; |

| • | changes in industry standards in the data storage industry; |

| • | our ability to develop, introduce and ship in a timely manner new products and product enhancements that meet customer requirements; |

| • | our ability to effectively manage product transitions as we introduce new products; |

| • | any change in the competitive dynamics of our markets, including new entrants or discounting of product prices; |

| • | our ability to control costs, including our operating expenses; and |

| • | future accounting pronouncements and changes in accounting policies. |

The occurrence of any one of these risks could negatively affect our operating results in any particular quarter, which could cause the price of our Class A common stock to decline.

Our sales cycles can be long and unpredictable, particularly with respect to large orders, and our sales efforts require considerable time and expense. As a result, it can be difficult for us to predict when, if ever, a particular customer will choose to purchase our products, which may cause our operating results to fluctuate.

Our sales efforts involve educating our customers about the use and benefits of our products, including their technical capabilities and cost saving potential. Larger customers often undertake an evaluation and testing process that can result in a lengthy sales cycle. We spend substantial time and resources on our sales efforts without any assurance that our efforts will produce any sales. In addition, product purchases are frequently subject to budget constraints, multiple approvals and unplanned administrative, processing and other delays. A substantial portion of our quarterly sales typically occurs during the last several weeks of the quarter, which we believe largely reflects customer buying patterns of products similar to ours and other products in the technology industry generally. Since we do not recognize revenue from a sale until title is transferred for the product, if we have a substantial portion of our sales at the end of a quarter, we may be unable to transfer title and recognize the associated revenue in that quarter. Furthermore, our products come with a 30-day money back guarantee, allowing a customer to return a FlashArray product within 30 days of receipt if the customer is not satisfied with its purchase for any reason. In addition, a portion of our sales in any quarter is generated by sales activity initiated during the quarter. These factors, among others, make it difficult for us to predict when customers may purchase our products. We may expend significant resources on an opportunity without ever achieving a sale, which may adversely affect our operating results and cause our operating results to fluctuate. In addition, if sales expected from a specific customer for a particular quarter are not realized in that quarter or at all, our operating results may suffer.

15

Table of Contents

Our company culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the innovation, creativity and teamwork fostered by our culture, and our business may be harmed.

We believe that a critical contributor to our success has been our company culture, which we believe fosters innovation, creativity, teamwork, passion for customers and focus on execution, as well as facilitating critical knowledge transfer and knowledge sharing. As we grow and change, we may find it difficult to maintain these important aspects of our company culture, which could limit our ability to innovate and operate effectively. Any failure to preserve our culture could also negatively affect our ability to retain and recruit personnel, continue to perform at current levels or execute on our business strategy.

Because our long-term success depends, in part, on our ability to expand the sales of our products to customers located outside of the United States, our business is susceptible to risks associated with international operations.

We maintain operations outside of the United States. We have been expanding and intend to continue to expand these operations in the future. We have limited experience operating in foreign jurisdictions. Our inexperience in operating our business outside of the United States increases the risk that our international expansion efforts may not be successful. In addition, conducting and expanding international operations subjects us to new risks that we have not generally faced in the United States. These include:

| • | exposure to foreign currency exchange rate risk; |

| • | difficulties in collecting payments internationally, and managing and staffing international operations; |

| • | establishing relationships with channel partners in international locations; |

| • | the increased travel, infrastructure and legal compliance costs associated with international locations; |

| • | the burdens of complying with a wide variety of laws associated with international operations, including taxes and customs; |

| • | significant fines, penalties and collateral consequences if we fail to comply with anti-bribery laws; |

| • | heightened risk of improper, unfair or corrupt business practices in certain geographies; |

| • | potentially adverse tax consequences, including repatriation of earnings; |

| • | increased financial accounting and reporting burdens and complexities; |

| • | political, social and economic instability abroad, terrorist attacks and security concerns in general; and |

| • | reduced or varied protection for intellectual property rights in some countries. |

The occurrence of any one of these risks could negatively affect our international operations and, consequently, our business, operating results and financial condition generally.

The sales prices of our products and services may decrease, which may reduce our gross profits and adversely impact our financial results.

The sales prices for our products and services may decline for a variety of reasons, including competitive pricing pressures, discounts, a change in our mix of products and services, the introduction of competing products or services or promotional programs. Competition continues to increase in the markets in which we participate, and we expect competition to further increase in the future, thereby leading to increased pricing pressures. Larger competitors with more diverse product and service offerings may reduce the price of products or services that compete with ours or may bundle them with other products and services. Additionally, although we price our products and services predominantly in U.S. dollars, currency fluctuations in certain countries and regions may negatively impact actual prices that partners and customers are willing to pay in those countries and regions. Furthermore, we anticipate that the sales prices for our products will decrease over product life cycles.

16

Table of Contents

We cannot assure you that we will be successful in developing and introducing new offerings with enhanced functionality on a timely basis, or that our new product and services offerings, if introduced, will enable us to maintain or improve our gross margins and achieve profitability.

We derive substantially all of our revenue from a single family of products, and a decline in demand for these products would cause our revenue to grow more slowly or to decline.

Our FlashArray family of products accounts for all of our revenue and will continue to comprise a significant portion of our revenue for the foreseeable future. As a result, our revenue could be reduced by:

| • | the failure of our current products to achieve broad market acceptance; |

| • | any decline or fluctuation in demand for our products, whether as a result of product obsolescence, technological change, customer budgetary constraints or other factors; |

| • | the introduction of competing products and technologies that replace or substitute, or represent an improvement over, our products; and |

| • | our inability to release enhanced versions of our products, including any related software, on a timely basis. |

If the market for all-flash storage products grows more slowly than anticipated or if demand for our products declines, we may not be able to increase our revenue or achieve and maintain profitability.

Our products are highly technical and may contain undetected defects, which could cause data unavailability, loss or corruption that might, in turn, result in liability to our customers and harm to our reputation and business.

Our products are highly technical and complex and are often used to store information critical to our customers’ business operations. Our products may contain undetected errors, defects or security vulnerabilities that could result in data unavailability, loss, corruption or other harm to our customers. Some errors in our products may only be discovered after they have been installed and used by customers. Any errors, defects or security vulnerabilities discovered in our products after commercial release could result in a loss of revenue or delay in revenue recognition, injury to our reputation, a loss of customers or increased service and warranty costs, any of which could adversely affect our business and operating results. In addition, errors or failures in the products of third-party technology vendors may be attributed to us and may harm our reputation.

We could face claims for product liability, tort or breach of warranty. Many of our contracts with customers contain provisions relating to warranty disclaimers and liability limitations, which may be difficult to enforce. Defending a lawsuit, regardless of its merit, would be costly and might divert management’s attention and adversely affect the market’s perception of us and our products. Our business liability insurance coverage could prove inadequate with respect to a claim and future coverage may be unavailable on acceptable terms or at all. These product-related issues could result in claims against us, and our business, operating results and financial condition could be harmed.

Our brand name and our business may be harmed by the marketing strategies of our competitors.

Because of the early stage of our business, we believe that building and maintaining brand recognition and customer goodwill is critical to our success. Our efforts in this area have, on occasion, been hampered by the marketing efforts of our competitors, which have included statements about us and our products. If we are unable to effectively respond to the marketing efforts of our competitors and protect our brand and customer goodwill now or in the future, our business will be adversely affected.

17

Table of Contents

Our products must interoperate with third party operating systems, software applications and hardware, and if we are unable to devote the necessary resources to ensure that our products interoperate with such software and hardware, we may lose or fail to increase our market share and may experience reduced demand for our products.

Our products must interoperate with our customers’ existing infrastructure, specifically their networks, servers, software and operating systems, which may be manufactured by a wide variety of vendors. When new or updated versions of these software operating systems or applications are introduced, we must sometimes develop updated versions of our software so that our products will interoperate properly. For example, our Pure1 cloud-based management and support includes connectors to virtualization platforms, allowing our customers to manage the FlashArray from within the native management tools, including for VMware and OpenStack. We may not deliver or maintain interoperability quickly, cost-effectively or at all. These efforts require capital investment and engineering resources. If we fail to maintain compatibility of our products with these infrastructure components, our customers may not be able to fully utilize our products, and we may, among other consequences, lose or fail to increase our market share and experience reduced demand for our products, which may harm our business, operating results and financial condition.

Our products must conform to industry standards in order to be accepted by customers in our markets.

Generally, our products comprise only a part of a datacenter. The servers, network, software and other components and systems of a datacenter must comply with established industry standards in order to interoperate and function efficiently together. We depend on companies that provide other systems in a datacenter to conform to prevailing industry standards. Often, these companies are significantly larger and more influential in driving industry standards than we are. Some industry standards may not be widely adopted or implemented uniformly, and competing standards may emerge that may be preferred by our customers. If larger companies do not conform to the same industry standards that we do, or if competing standards emerge, market acceptance of our products could be adversely affected, which may harm our business.

Our ability to successfully market and sell our products is dependent in part on ease of use and the quality of our support offerings, and any failure to offer high-quality installation and technical support could harm our business.

Once our products are deployed within our customers’ datacenters, customers depend on our support organization to resolve technical issues relating to our products. Our ability to provide effective support is largely dependent on our ability to attract, train and retain qualified personnel, as well as to engage with qualified support partners that provide a similar level of customer support. In addition, our sales process is highly dependent on our product and business reputation and on recommendations from our existing customers. Although our products are designed to be interoperable with existing servers and systems, we may need to provide customized installation and configuration support to our customers before our products become fully operational in their environments. Any failure to maintain, or a market perception that we do not maintain, high-quality installation and technical support could harm our reputation, our ability to sell our products to existing and prospective customers and our business.

We rely on contract manufacturers to manufacture our products, and if we fail to manage our relationship with our contract manufacturers successfully, our business could be negatively impacted.

We rely on a limited number of contract manufacturers to manufacture our products. Our reliance on contract manufacturers reduces our control over the assembly process, and exposes us to risks, such as reduced control over quality assurance, costs and product supply. If we fail to manage our relationships with these contract manufacturers effectively, or if these contract manufacturers experience delays, disruptions, capacity constraints or quality control problems, our ability to timely ship products to our customers could be impaired and our competitive position and reputation could be harmed. If we are required to change contract manufacturers or assume internal manufacturing operations, we may lose revenue, incur increased costs and damage our customer relationships. Qualifying a new contract manufacturer and commencing production is

18

Table of Contents

expensive and time-consuming. We may need to increase our component purchases, contract manufacturing capacity and internal test and quality functions if we experience increased demand. The inability of our contract manufacturers to provide us with adequate supplies of high-quality products could cause a delay in our order fulfillment, and our business, operating results and financial condition may be harmed.

We rely on a limited number of suppliers, and in some cases single-source suppliers, and any disruption or termination of these supply arrangements could delay shipments of our products and could harm our relationships with current and prospective customers.