Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Party City Holdco Inc. | d29155d8k.htm |

September 9, 2015 Goldman Sachs Global Retailing Conference Exhibit 99.1 |

Disclaimer 1 Forward Looking Statements Certain statements herein are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements contained herein that are not clearly historical in nature are forward-looking. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential” or the negative of these terms or other comparable terminology. These forward-looking statements speak only as of the date hereof and are based on the Company’s current plans and expectations and are subject to a number of known and unknown uncertainties and risks, many of which are beyond the Company’s control. As a consequence, current plans, anticipated actions and future financial position and

results of operations may differ significantly from those expressed in

any forward-looking statements in the presentation. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented and we do not intend to update any of these forward-looking statements.

Non-GAAP Financial Measures

This presentation includes unaudited non-GAAP financial measures, including

Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow. We present non-GAAP measures when our management believes that the additional information provides useful information about our operating performance. Non-GAAP financial

measures do not have any standardized meaning and are therefore unlikely

to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP.

See our SEC filings for a reconciliation of the non-GAAP financial

measures to the comparable GAAP measures. Industry Data

This presentation also contains industry data, forecasts and other information that we

obtained from industry publications and surveys, public filings and internal company sources. Statements as to our ranking, market position and market estimates are based on independent industry publications, third-party forecasts and

management’s estimates and assumptions about our markets and our

internal research. While we are not aware of any misstatements regarding our market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors. We have not independently verified third-party

information nor have we ascertained the underlying economic assumptions

relied upon in those sources, and we cannot assure you of the accuracy or completeness of such information contained in this presentation. |

Agenda 2 3 10 25 Business Update Historical Financial Performance 7 Company Overview Key Investment Highlights |

Business Update |

Business

Update 4

Solid YTD performance:

— Adjusted EBITDA growth of 9% 1 — Net wholesale revenues up 4% 1 (10% ex currency and USB acquisition 2 ) — YTD brand comps 3.1% Progress in strengthening our vertical model with ACIM acquisition — Gross margin expansion by turning “doubles” into “triples” Debt refinance results in $24 million annual cash savings Per 2Q earnings release guidance: — Reaffirmed revenues of $2.25-$2.35 billion — Raised adjusted net income to $112-$122 million — FY’15 brand comps in the range of 3% — 30 3 new PC corporate stores, ~325 Halloween City stores International expansion with Mexico franchise agreement 1 YTD 6/30/15 vs. YTD 6/30/14 2 USB acquisition results in loss of $6 million of third party wholesale sales 3 19 net of 11 closures |

Illustration: Power of the Vertical Model

5 Breakdown of Retail Sales 1 For ease of illustration purposes, a static individual margin used. Actual results depend on range of individual margins by product

line. 2

Assumes 100% share of shelf

Singles: Product that PRTY buys from a third party and sells at Party City corporate stores.

Earns retail margin only.

- Examples: candy, greeting cards, helium, foil serving pans Doubles: Product that PRTY’s wholesale division buys from a third party and sells at Party City corporate stores. Earns wholesale+retail margin. - Examples: party favors, costumes and other wearables, table covers, cutlery Triples: Product that PRTY’s wholesale division manufactures+distributes+sells at Party City corporate stores. Earns manufacturing+wholesale+retail margin. - Examples: paper plates, bowls, cups & napkins, plastic cups, metallic and latex balloons, piñatas

70% share of shelf 80% share of shelf PRTY Nickname Hypothetical example Individual 1 Cumulative "Single" 1.00 $ Retail sales price 0.50 product cost 0.50 product profit 0.20 occupancy 0.30 $ net gross margin 30% 30% "Double" 0.50 $ WS sales price 0.25 product cost 0.25 product profit 0.10 freight/distribution 0.15 $ net gross margin 30% 45% "Triple" 0.25 $ Mfg sales price 0.21 cost 0.04 $ profit 15% 49% Gross Margin 2 20% 50% 50% 30% 30% 20% Today Goal Triples Doubles Singles |

Recent

Developments: Acquisitions 6

U.S. Balloon Acquisition In October 2014, Party City acquired U.S. Balloon Manufacturing Co., Inc. (“U.S. Balloon”), a

distributor of metallic balloons, for approximately $11 million

Allowed Party City to capture the full manufacturing-to-retail margin on

balloons that it manufactures and sells at company-owned Party City

stores U.S. Balloon was previously a wholesale customer of Anagram that

sold balloons to Party City retail stores

Mexico Master Franchise Agreement In April 2015, entered into an agreement with a subsidiary of Grupo Oprimax to franchise the Party City concept in Mexico Under the terms of the agreement, Grupo Oprimax will open at least 80 stores by the end of 2024 Expected to open 3 stores within the next twelve months Travis Designs Acquisition In March 2015, acquired U.K. based Travis Designs for approximately $12 million

Travis designs, sources and distributes high-end costumes

Will provide significant sourcing and vertical integration synergies, as well as

access to a higher- end costume customer

Potential Acquisitions: the Company would also consider acquiring franchisees and

costume manufacturing capabilities ACIM

Acquisition In August 2015, acquired assets of a custom injection molded plastics manufacturer for $5.2

million, plus land and a manufacturing facility in New Mexico for approximately $6

million Will provide Company over time the opportunity to earn full

manufacturing to retail margin on plastic products including drinkware,

serveware, and cutlery |

Company Overview |

8 Company Overview: Nobody Has More Party For Less! Manufacturing Largest global designer, manufacturer, and distributor of decorated party supplies and costumes Largest vertically integrated supplier and retailer of decorated party goods globally

$2.3 billion in worldwide sales

1,2 $372 million in Adjusted EBITDA 1,3 / 16.2% Adjusted EBITDA margin 1 1 Reflects LTM June 30, 2015 numbers. 2 Includes franchise royalties and locations. 3 See SEC filings for reconciliation of Adjusted EBITDA to Net Income. Retail Wholesale / Distribution #1 party goods retailer in North America ~900 locations across North America 2 ~70% of products are sourced through wholesale business The largest manufacturer of metallic balloons in the world >40,000 SKUS 40,000 Retail Outlets 41 5 Puerto Rico Hawaii Canada One stop shop for all party needs Grocery Stores Dollar Stores Mass Merchant Party City Independent Party Stores |

9 Timeline: A History of Party City’s Vertical Integration Evolution of the Business – Key Events Amscan founded Acquired Anagram Acquired M&D Balloons Acquired Party City Acquired Party America Acquired Gags and Games, Factory Card and Party Outlet & 85% of Party City Franchise Group Acquired remaining interest in Party City Franchise Group Acquired Christy’s Costumes and Christy Garments and Accessories Acquired party goods division of American Greetings Acquired Riethmuller, Latex Balloon Manufacturing in Malaysia, and Party Packagers in Canada Acquired iParty and Party Delights (online retailer) Acquired U.S. Balloon (Balloon distributor to Party City) 1989 1986 2003 2002 2001 2008 2007 2006 2005 1998 1997 1947 2010 2011 2013 2014 Established as a Wholesaler / Manufacturer, Party City has developed into a fully Integrated Wholesaler

with an Omni-Channel Retail Presence

Built a new distribution facility Hong Kong showroom opened 2015 Acquired Travis Designs (designs, sources and distributes high- end costumes) Acquired ACIM (custom injection molded plastics manufacturer) Became a vertically integrated manufacturer The Party Superstore Channel evolves |

Key Investment Highlights |

Investment Highlights 11 Unique Vertically Integrated Operating Model with Controlled Distribution Channels Leading Market Position in a Growing Category Combination of wholesale and retail enhances profitability through greater margin capture for majority of goods Amscan has approximately 70% share of shelf at Party City Global sourcing model assures lowest cost manufacturing for all products Rapid response to changing consumer trends Leading party goods supplier in the growing $10 billion party goods industry Leading global designer, manufacturer and distributor of decorated party supplies and costumes #1 party goods retailer in North America with over 900 superstore locations Broad and Innovative Product Offering Strong Financial Performance And Free Cash Flow Generation Unmatched product breadth with over 25,000 SKUs in-store and 35,000 SKUs online Best-in-class design capabilities and innovation track record creating new opportunities Brand portfolio of licenses supported by market position at wholesale and retail Sales of party goods have been resilient in all economic cycles Repeat-purchase model, consumable nature of products and predictable selling patterns Consistent margin expansion and top- line growth; superior to peers Exceptional free cash flow generation Multiple Levers for Disciplined Growth World-Class Management Team And Experienced Sponsor Ownership Seasoned management team with experience across wholesale and retail businesses and international and e- commerce platforms Track record of strong performance operating with leverage Majority sponsor has a long history of success in C&R investments Meaningful whitespace: 400+ new stores 1 Strong e-commerce growth through enhanced omni-channel initiatives Grow wholesale business through increased share of shelf and alternative markets Select geographic and channel expansion opportunities Expertise in tuck-in acquisitions 1 2 3 4 5 6 1 Includes franchise stores in Mexico |

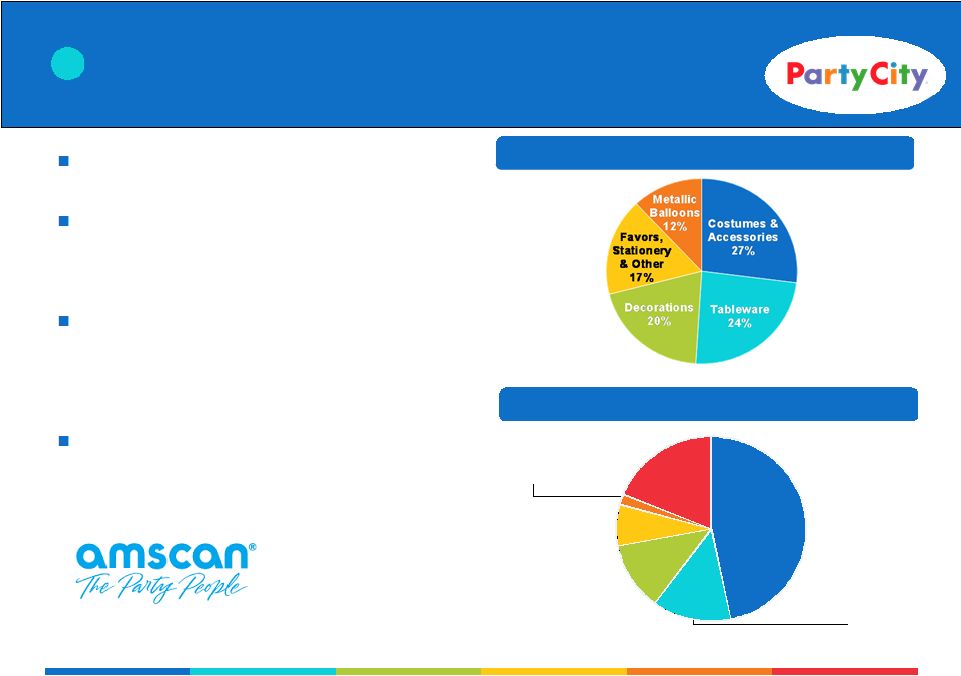

One of

the largest manufacturers, designers and distributors of decorated party

supplies in the world Product sold in over 40,000 retail outlets in 100+

countries

— 61% U.S. and 39% International 1 Deep assortment with over 40,000 SKUs across 5 product categories — 400+ party goods ensembles, which contain 5 to 50 design-coordinated items Balanced, multi-channel customer base – no single customer represents more than 10% of third party sales at wholesale Leading Wholesale Business Wholesale Revenue by Product Category 1 Wholesale Sales by Channel 1 12 1 Reflects December 31, 2014 numbers. Based on total wholesale sales including intercompany sales to retail operations. 2014 total wholesale sales were $1,213 million and intercompany sales were $567 million. 2 Includes sales to Party City Canada and Party Delights. 1 Owned Stores & e- commerce 47% 2 Party City Franchised Stores 13% Other Domestic Retailers 12% Domestic Balloon Distributors/ Retailers 7% International Balloon Distributions 2% Other International 19% |

Category

Defining Omni-Channel Retail Concept 13

Retail Stores e-Commerce Nobody Has More Party for Less! Largest retail network of decorated party supplies in North America — 697 company- owned Party City superstores including 43 locations in Canada and 205 franchise locations A leading operator of temporary Halloween stores in North America — Used to test locations for year round Party City stores Significant e-Commerce platform with ~$160 million of revenue for 2014 1 — B2B capabilities — Average basket 3x retail U.K. acquisition expanded platform into Europe Rolling out additional country specific sites across Europe and beyond (including Germany, France, and the Netherlands) ~900 Party Superstores Over 300 Temporary Stores e-Commerce currently ~9% 2 of Retail Sales 1 Includes Party Delights and $19 million of wholesale e-commerce. 2 Reflects June 30, 2015 numbers. We believe we are the leading integrated wholesale business is the largest global designer, manufacturer and distributor of party goods by revenue — Over 40,000 SKUs in over 40,000 retail outlets worldwide Third-Party Retail 1 |

Category

Leadership Like No Other 14

Party Goods Vitamin & Supplements Crafts Pet Supplies Sporting Goods Home Improvement Industry Leader Sales ($mm) 1,6191 $1,934 1 $4,764 $7,112 $6,941 $84,380 Stores 6931 3,516 1 1,295 1,404 701 2,270 #2 Player NM Sales ($mm) — $1,242 2 2 2 $56,949 Stores — 725 ~600 ~1,300 ~185 1,843 Source: Company filings and websites 1 Excludes franchise revenue and locations. 2 Private company; data not available 1 |

Unique

Vertically-Integrated Operating Model Vertical model and significant

scale provide unique competitive advantages Enhanced profitability by

capturing the full manufacturing-to-retail margin on a significant portion of the products sold in our retail stores Maintain greater control of every step from design and production through the sale of our products across channels

Approximately one third 5 of the total $257 million LTM June 2015 Income from Operations is earned outside of the vertical model, leveraging our infrastructure and scale Third-Party Wholesale Revenue $658 Million 1,2,3 Retail Revenue $1.6 Billion 2 ~70% Share of Shelf Manufacturing 31% 4 of Wholesale Products 1 Third-Party Wholesale Revenue net of intercompany sales. 2 Reflects LTM June 30, 2015 numbers. 3 Includes sales to Party City franchisees. 4 Reflects December 31, 2014 numbers. 5 $71.6 million Income from Operations earned from Wholesale. 15 Cost competitive sourcing Global scale Enhanced control of inflation pressures Ensures best products and inventory Design and innovation capabilities Global opportunities (retail + wholesale) Rapid response to changes in consumer preferences 2 |

Highly

Efficient Manufacturing, Sourcing And Distribution Capabilities on a Global

Footprint Sourcing

Distribution Manufacturing 16 In-house manufacturing focused on high-volume party essentials that can be manufactured through highly automated processes — Examples: Paper and plastic tableware products and metallic balloons Capabilities are cost-competitive and provide rapid turnaround times on key product categories Labor intensive products, such as banners, favors and centerpieces, are principally sourced from Asia 20+ year relationships with many of our vendors Sourcing, quality control and testing offices throughout Asia Warehousing and distribution facilities around the world Wholesale Sourcing Mix 1 1 Reflects December 31, 2014 numbers. Based on total wholesale sales including intercompany sales to retail operations. 2014 total wholesale sales

were $1,213 million and intercompany sales were $567 million.

Manchester UK Headquarters Manufacturing / Distribution Elmsford (NY) Louisville (KY) Anagram Eden Prairie (MN) Ampro Tijuana (Mexico) Everts Malaysia Melaka (Malaysia) Harriman (NY) Newburgh (NY) Chester (NY) Edina (MN) Amscan Asia Pacific Baulkham Hills (Australia) Amscan UK Milton Keynes, (England) Manufacturing / Distribution Manufacturing Manufacturing / Distribution Manufacturing Distribution Amscan Europe Kircheim unter Teck (Germany) Distribution Distribution Distribution Manufacturing Amscan De Mexico Guadalajara (Mexico) Manufacturing / Distribution Amscan Asia Hong Kong (China) Distribution Distribution / Sourcing 6 Sourcing Facilities East Providence (RI) Manufacturing / Distribution Distribution Naperville (IL) Distribution Distribution Brooklyn (NY) 2 |

110

person in-house design team —

Creative staff is constantly in the market identifying trends

and new product concepts

Vertical integration allows development team to test new

products and rapidly respond to changes in consumer

preferences Proprietary designs and licenses help differentiate products from those of competitors Introduce approximately 7,000 new products and 50 new party goods ensembles annually Best-In-Class Innovation Capabilities And Broad Product Offering 17 Selected Merchandise Ensembles License Portfolio Innovation Product Offering Broadest assortment of merchandise — Organized by events and themes Deep merchandise selection — Wide assortment including invitations, thank you cards, tableware, hats, horns, banners, cascades, balloons, novelty gifts, piñatas, favors and candy 3 |

One

stop shop for all party needs —

Powerful combination of physical and online stores

Broad assortment of merchandise

— Greater assortment of products than our national competitors, including mass merchants Deep merchandise selection — High in stock positions of core items Compelling Value — “Nobody has More Party for Less” pricing strategy Differentiated and Fun Retail Experience Party Goods SKU Count Comparison 1 18 1 Party City management estimates. Creating an Innovative and Fun Approach to Shopping Sports City Candy City Custom Invitations Favor City 3 |

Sales

of party goods have been resilient in all economic cycles Strong Financial

Performance and Free Cash Flow Generation

19 Rolling LTM Gross Wholesale Sales ($ in millions) 4 |

Strong

Financial Performance and Free Cash Flow Generation

20 4 Adj. EBITDA ($mm) Free Cash Flow ($mm) Adj. EBITDA Margin FCF Conversion 1 Free Cash Flow defined as Adjusted EBITDA less CapEx. 2 Free Cash Flow Conversion defined as (Adjusted EBITDA – CapEx) / Adjusted EBITDA. 3 See SEC filings for reconciliation of Adjusted EBITDA to Net Income 3 1 2 14.4% 14.7% 15.3% 15.7% 15.9% 16.1% 2010A 2011A 2012A 2013A 2014A LTM 6/30/15A $181 $231 $247 $260 $284 $295 2010A 2011A 2012A 2013A 2014A LTM 6/30/15A $231 $275 $292 $321 $362 $372 2010A 2011A 2012A 2013A 2014A LTM 6/30/15A 78.4% 84.0% 84.6% 81.0% 78.5% 79.2% 2010A 2011A 2012A 2013A 2014A LTM 6/30/15A |

Multiple

Levers for Disciplined Growth 21

5 Grow Wholesale Business Increase share of shelf at company-owned and third-party stores Drive continued product innovation through new licenses and integration of new manufacturing acquisitions

Expand into adjacent business-to-business channel

Grow Our Global Digital Platform Enhance customer experience through integrated omni-channel strategy Further develop international capabilities through country specific sites Currently represents only approximately 9% of retail sales Drive Additional Growth and Productivity From Existing Stores Continue to improve brand image and awareness Pursue merchandising initiatives to drive increased units per transaction Convert existing stores to new, more customer interactive format Increase International Presence Drive international growth through customization of products to local tastes and holidays

Expand retail presence through store-within-a-store concept with select

international retailers Represents ~15% of revenues in 2014

Expand Our Retail Store Base Plan to open ~30 stores per year representing ~4% annual square footage growth New stores generate a ~3 year payback and 50% ROIC in year 3 Pursue Accretive Acquisitions Completed numerous successful acquisitions over the past 16 years Emphasis on smaller, bolt-on acquisitions that add scale and/or unique capabilities

Significant synergy potential through leveraging existing distribution, production and

marketing capabilities |

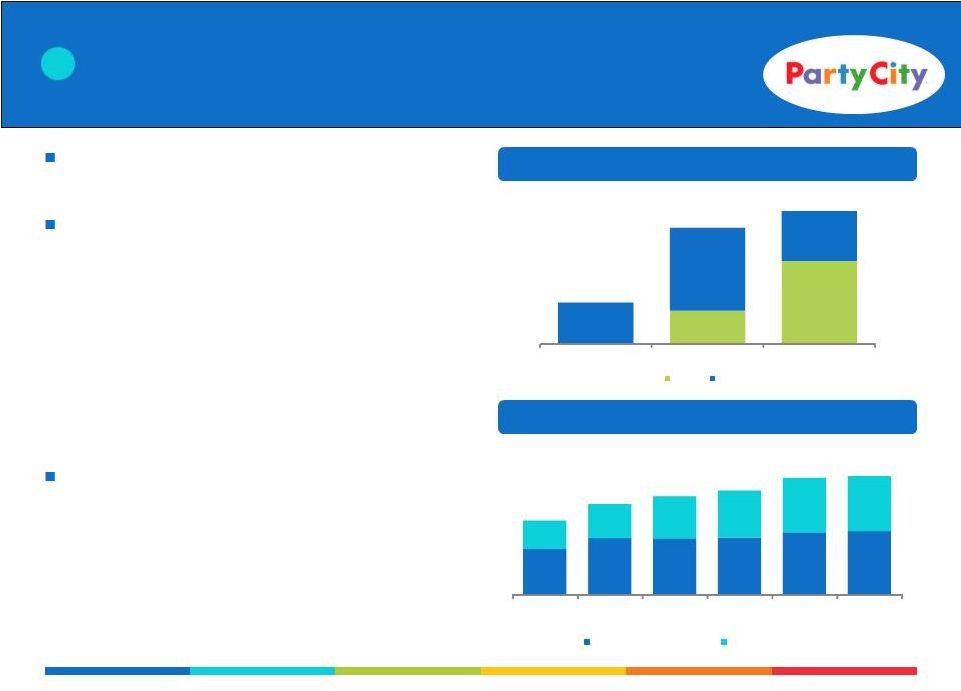

4 22 Expand Our Retail Store Base Current retail network includes approximately 900 party superstores, including: Approximately 650 company-owned stores in the U.S. and approximately 40 stores in Canada Approximately 200 franchised locations Acquired stores have been rebranded Opportunity to add over 400 2 additional Party City stores in the U.S., Canada and Mexico 23 new stores opened in FY 2014 (19 net, including acquired and closed stores) Consistent Company-Owned Store Growth 1 Stores added in 2013 include all 54 stores that were acquired from iParty and converted to the

Party City banner. 2 Includes franchise stores in Mexico New Stores Opened: 24 25 23 Target New Store Economics with Vertically- Integrated Model Sales at Maturity ~$2 million Initial Sales Growth 8 – 10% over 3 – 4 years Year 3 EBITDA Margins ~18-20% Average Total Net Investment $765k Pre-Tax Cash-on-Cash Returns ~50% by Year 3 Payback Period ~3 Years Through our vertical model, we are able to enhance our total profitability by capturing

the manufacturing-to-retail margin on a significant portion of our retail sales

and by leveraging our access to multiple channels. In this way, we

are like no other retailer. 5

1 600 674 693 1,000+ 2012 2013 2014 Potential |

4 23 Drive Additional Growth And Productivity From Existing Stores Increase share of shelf of vertical products in redesigned party stores Convert existing stores to new, more customer interactive format Broadening products within existing license arrangements Adding color coordinated dress-up and candy products Expect to have all 200 remaining stores converted by 2018 Remodeled stores expected to generate sales growth 5-6% higher than non-remodeled in the first year New store management model increases employee engagement and improves customer service Pursue merchandising initiatives to drive increased units per transaction Continue to improve brand image and awareness Strong emphasis on price- value proposition – “Nobody Has More Party For Less” Continual use of Party City website and social marketing to communicate products, party ideas, assortment, and value 5 |

4 24 Grow Wholesale Business Wholesale growth driven by our leading scale, vertical operating model and strong innovation Product portfolio initiatives include: — Building out wearable / costume business to capitalize on recent acquisitions — Acquisition of new licenses and expansion into new categories under existing

licenses –

Partnerships with MLB, NBA, NFL, and NHL

teams Expansion into adjacent business-to-business channel — Targeting under-served consumer segments Wholesale Share of Shelf 1 Gross Wholesale Sales 1 Based on product COGS. 5 ~25% ~70% ~75-80% 20% 50% 50% 30% 2005 2014 Long-term goal Triples Doubles $471 $585 $583 $593 $646 $658 $298 $355 $440 $488 $567 $572 $769 $940 $1,023 $1,081 $1,213 $1,230 2010 2011 2012 2013 2014 LTM 06/30/15A 3rd Party Wholesale Intercompany Sales |

Historical Financial Performance |

Superior

Financial Performance 26

Total Revenues ($mm) Same Store Sales Growth 1 New Store Openings 1 Same store sales growth is brand comp (includes e-commerce sales and all stores converted to the Party City banner). 2011 comps driven by

strong growth in e-commerce operations started in 2009. 2014

comps partially driven by rebranding 54 stores acquired from

iParty 2 2011 includes 26 stores acquired from Party Packagers and 2013 store growth includes 54 stores acquired from iParty.

$1,015 $1,247 $1,560 $1,487 $1,599 $1,872 $1,914 $2,045 $2,271 $2,304 2006A 2007A 2008A 2009A 2010A 2011A 2012A 2013A 2014A LTM 06/30/15 Net Openings : 17 43 25 74 19 20 2 Brand Comp Sales affected by Superstorm Sandy and the timing of New Year’s 3.6% 9.5% 2.9% 5.8% 3.1% 2010A 2011A 2012A 2013A 2014A H1 2015 3.1% 13 16 24 25 23 27 2010A 2011A 2012A 2013A 2014A LTM 6/30/15 |

4.2x 3.5x 6.3x 6.7x 5.8x 4.9x 5.1x 2010A 2011A 2012A 2013A 2014A LTM 6/30/15A LTM 6/30/15 PF for Refi Target Acquisition by THL Historical Net Debt / Adj. EBITDA 2 Strong Balance Sheet and Liquidity 27 Majority of primary proceeds from IPO used to reduce existing indebtedness Solid free cash flow generation with ability to self-fund organic growth and opportunistic acquisitions

Ample liquidity going forward supported by new revolver of $640 million 1 Target gross leverage: 3.0x - 3.5x 1 ABL revolver comprised of $500 million facility, $40 million FILO tranche, and $100 million seasonal facility increase.

2 See SEC filings for reconciliation of Adjusted EBITDA to Net Income. 3 Leverage as of fiscal year end. 4 Including Holdco Notes. 3,4 3,4 4 Dividend Payment 3 3.0 - 3.5x |

Recent

Results: Second Quarter 2015 28

Q2 2015 Total Revenues increased 0.8% vs. Q2 2014 primarily due to:

SSS growth of 1.2%, partially impacted by the shift of the Easter selling season to

the first quarter (+1.5%) The addition of 20 net new stores vs. Q2

2014 Wholesale sales (ex currency and USB impact) were fueled by contract

manufacturing sales and higher international sales Total gross profit

margin increased 80 basis points to 38.3% of net sales compared to 37.5% of net sales in the second quarter of fiscal 2014, primarily due to lower purchase accounting adjustments, higher share of shelf, favorable product mix and fewer

markdowns Adjusted EBITDA margin increased 100 basis points primarily due to the impact of leverage

1 Reflects negative impact from the Easter timing shift. SSS were 2.7% excluding the shift. PY SSS benefited from rebranding acquired iParty stores and Easter shift 1 Q2 2015 Summary Results Three Months Ended, Y-o-Y ($ in millions) 6/30/2014 6/30/2015 $ % Total Revenues $492 $496 $4 0.8% SSS 4.7% 1.2% Gross Profit $183 $188 $5 2.7% % margin 37.5% 38.3% Adj. EBITDA $69 $75 $6 8.7% % margin 14.1% 15.1% Capital Expenditures $19 $19 $0 0.0% % margin 3.9% 3.8% |