Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CINCINNATI FINANCIAL CORP | v419936_ex99-1.htm |

| 8-K - 8-K - CINCINNATI FINANCIAL CORP | v419936_8k.htm |

Exhibit 99.2

Cincinnati Financial Corporation Investor Handout September 2015

Nasdaq : CINF ► This presentation contains forward - looking statements that involve risks and uncertainties. Please refer to our various filings with the U.S. Securities and Exchange Commission for factors that could cause results to materially differ from those discussed. ► The forward - looking information in this presentation has been publicly disclosed, most recently on July 28, 2015, and should be considered to be effective only as of that date. Its inclusion in this document is not intended to be an update or reaffirmation of the forward - looking information as of any later date. ► Reconciliations of non - GAAP measures are in our most recent quarterly earnings news release, which is available on the Investors page of our website cinfin.com .

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 1 |

Strategy Overview ► Competitive advantages: • Relationships leading to agents’ best accounts • Financial strength for stability and confidence • Local decision making and claims excellence ► Other distinguishing factors: • 54 years of shareholder dividend increases • Common stocks for more than 30% of investments • 26 years of favorable reserve development

Performance Targets & Trends ► 12.6% value creation ratio for full - year 2014 within target: 10% to 13% annual average for 2013 through 2017 – 11.7% five - year average as of 12 - 31 - 14 ► Related performance drivers were on track for 1H15: – 4 % premium growth essentially matched estimated industry average – 94.9% combined ratio was better than 95% to 100% long - term target – Eight consecutive quarters of investment income growth ► Ranked #1 or #2 in ~75% of agencies appointed 5 + years ► Improving through strategic profitability & growth initiatives

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 2 |

Cincinnati Financial at a Glance ► Top 25 U.S. P/C insurer ► A.M. Best rating: A+ Superior ► $4.2 billion 2014 premiums: 67% C ommercial 25 % Personal 5 % L ife 3 % Excess & surplus ► Competitive advantages: – Relationships leading to agents’ best accounts – Financial strength for stability and confidence – Local decision making and claims excellence ► 54 consecutive years of shareholder dividend increases – Only eight U.S. public companies can match this record – 6 % increase in full - year 2014 dividends paid over 2013 – Yield is attractive, 3.3% in early - August 2015

Second - Quarter 2015 Highlights ► EPS of $1.06 per share vs . 51 cents in 2Q14 – Operating earnings rose $63 million, or 84%, compared with second - quarter 2014, including after - tax losses from natural catastrophes that decreased by $23 million ► Investment income rose 3% – Dividend income was up 3%, interest income was up 3% ► Property casualty net written premiums grew 6% – Higher average renewal pricing: commercial lines rose low - single - digits, personal lines and excess and surplus lines rose mid - single - digits ► Combined ratio of 92.4% improved 8.5 points – 3.9 points of improvement from natural catastrophe losses – 1.4 points of improvement in noncatastrophe weather

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 3 |

Long - Term Value Creation ► Targeting annual rate of growth in book value plus the percentage of dividends to beginning book value to average 10% to 13% from 2013 through 2017 – Value creation ratio (VCR) for 2010 through 2014 averaged 11.7% – 12.6% VCR for 2014 was down 3.5 points from 2013 • Realized plus unrealized capital gain component was 0.9 points lower • Operating earnings component was 1.3 points lower ► Three performance drivers: – Premium growth above industry average – Combined ratio consistently within the range of 95% to 100% – Investment contribution • Investment income growth • Compound annual total return for equity portfolio over five - year period exceeding return for S&P 500 Index

Increase Value for Shareholders Measured by Value Creation Ratio Target for the period 2013 - 2017: Annual VCR averaging 10% to 13 % -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% -6% -4% -2% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 2010 2011 2012 2013 2014 VCR - Investment Income & Other VCR - P&C Underwriting VCR - Bond Portfolio Gains VCR - Equity Portfolio Gains Total Shareholder Return (TSR) Actual VCR: 11.1% 6.0% 12.6% 16.1% 12.6% Value Creation Ratio Total Shareholder Return

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 4 |

Outperforming the Industry 65% 70% 75% 80% 85% 90% 95% 100% 105% 2010 2011 2012 2013 2014 Cincinnati – excl. cat. losses Est. Industry (A.M. Best) – excl. cat. Losses Cincinnati – incl. cat. losses Est. Industry (A.M. Best) – incl. cat. Losses Statutory combined ratio Industry data excludes mortgage and financial guaranty Cincinnati’s historical catastrophe loss annual averages as of 12 - 31 - 14: 5 - year = 7.4%, 10 - year = 6.0%

Strategies for Long - Term Success ► Financial strength for consistent support to agencies – Diversified fixed - maturity portfolio, laddered maturity structure • No corporate exposure exceeded 0.6% of total bond portfolio at 06 - 30 - 15, no municipal exposure exceeded 0.3% – 31.1% of investment portfolio in common stocks to grow book value • No single security exceeded 3.9% of publicly traded common stock portfolio – Portfolio composition helps mitigate anticipated effects of inflation and a rise in interest rates – Low reliance on debt, with 11.4% debt - to - total - capital at 06 - 30 - 15 • Nonconvertible, noncallable debentures due in 2028 and 2034 – Capacity for growth with premiums - to - surplus at 1.0 - to - 1 ► Operating structure reflects agency - centered model – Field focus – staffed for local decision making , agency support – Superior claims service and broad insurance product offerings ► Profit improvement and premium growth initiatives

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 5 |

Improve Profitability ► Enhancing underwriting expertise and knowledge – Ongoing enhancement initiatives for predictive modeling tools and analytics to improve pricing precision and segmentation on an individual policy basis – Data management for better underwriting and more granular pricing decisions; long - term data warehouse project continues to be developed over time – Ongoing loss control and staff specialization aimed at lowering loss ratios ► I mproving efficiencies with technology – Streamlining processing for agencies and the company – Helps optimize personalized service ► Ongoing efforts for greater efficiency and effectiveness – Additional field positions staffed for better risk selection and specialized claims service – 3% increase in full - time - equivalent staff at year - end 2014 versus 2009 • 12% increase in field staff while headquarters staff decreased less than 1% • 40% or $1.2 bilion increase in property casualty direct written premiums

Drive Premium Growth ► New agency appointments bring potential for growth over time – Target for 2015: appoint approximately 100 agencies – 99 appointed in 2014, $ 2.7B aggregate premiums from all carriers – 53 appointed in 1H15, representing $1.7B in annual aggregate premiums ► Expanding marketing and service capabilities – Ongoing development of target market programs and cross - selling – Expansion of customer care center for small commercial policies – Enhanced marketing, products and services for high net worth clients of our agencies – Expanded use of assumed reinsurance to further deploy capital, diversify risk ► 6% growth in 2014 property casualty net written premiums – Commercial and personal lines each up 6 %, E&S up 20% – Commercial and personal lines low - single - digit average price increases – Term life insurance earned premiums up 7%

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 6 |

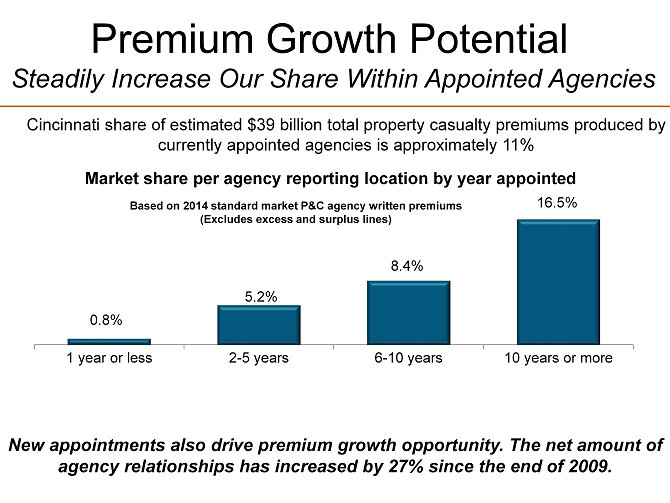

Premium Growth Potential ► Historically, we earn approximately 10% market share in new agencies within 10 years after appointment – demonstrated by: – 1 % share on average earned in 2014 for all agencies appointed in 2014, 5% for appointments during 2010 - 13, 8 % for appointments during 2005 - 09 ► Our agencies currently write significant amounts of business with other carriers, representing potential for us – Agencies appointed during 2011 - 14 place $ 11 billion in annual premiums for standard lines business with all carriers they represent – Excess and surplus lines for all of our agents – approximately $3 billion ► We help our agencies grow their businesses by attracting more clients in their communities through our unique service

Select Group of Agencies in 39 States P&C Market Share: 1,493 agency relationships with 1,913 locations Our Commercial Top Five = 39% Ohio, Illinois, Pennsylvania, Indiana, North Carolina Our Personal Top Five = 56% Ohio, Georgia, Indiana, Illinois , Michigan 1% and higher Less than 1% Inactive states Headquarters (no branches ) (as of June 30, 2015) Market Share Top Five Ohio: 4.7% Indiana: 2.8% Kentucky : 2 .4% Montana: 2.1% Alabama : 2.1% Based on 2014 data excluding A&H

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 7 |

APPENDIX Income, Dividend & Cash Flow Trends Underwriting Focus & Premium Growth Trends Business Mix & Premium Growth Potential Reserve Adequacy & Selected Paid Loss Trends Investment Portfolio Management & Performance Financial Strength Ratings & Valuation Comparison to Peers

Income and Shareholder Dividends $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 2011 2012 2013 2014 6 mos 14 6 mos 15 Operating Income Net Income Dividends declared Per share basis

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 8 |

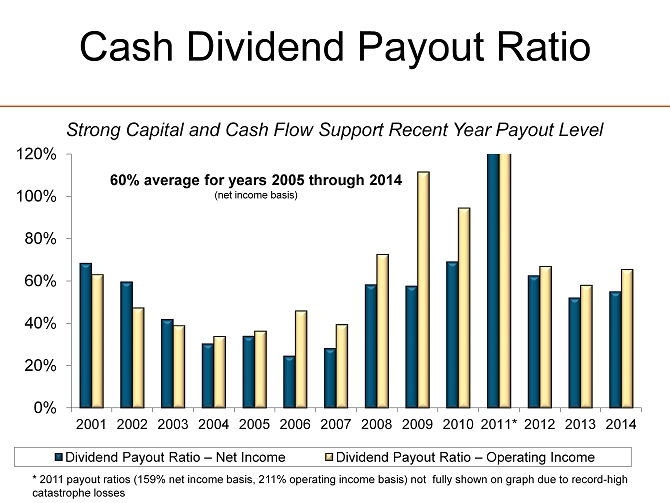

Cash Dividend Payout Ratio 0% 20% 40% 60% 80% 100% 120% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011* 2012 2013 2014 Dividend Payout Ratio – Net Income Dividend Payout Ratio – Operating Income 60% average for years 2005 through 2014 (net income basis) Strong Capital and Cash Flow Support Recent Year Payout Level * 2011 payout ratios (159% net income basis, 211% operating income basis) not fully shown on graph due to record - high catastrophe losses

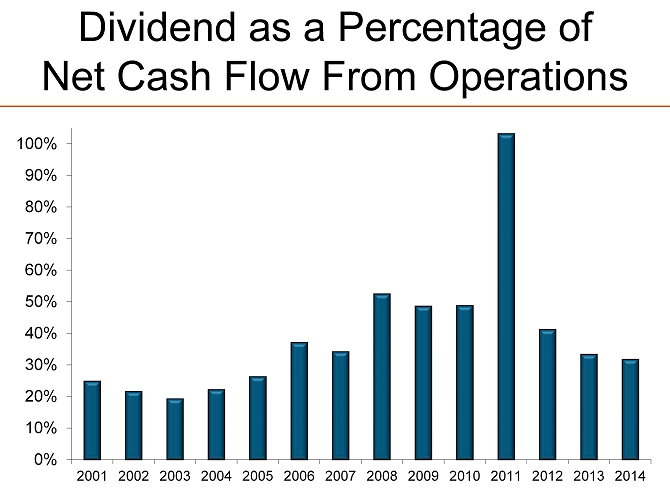

Dividend as a Percentage of Net Cash Flow From Operations 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 9 |

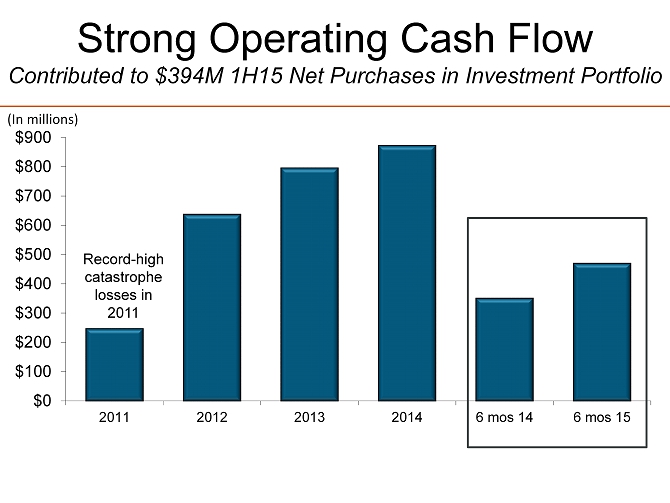

Strong Operating Cash Flow Contributed to $394M 1H15 Net P urchases in Investment P ortfolio $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2011 2012 2013 2014 6 mos 14 6 mos 15 Record - high catastrophe losses in 2011 (In millions)

Solid Reinsurance Program Balances Costs With Shareholders’ Equity Protection Major Treaties (Estimated 2015 ceded premiums) Coverage and Retention Summary at 01 - 01 - 15 Property catastrophe ($42 million) • Treaty has one reinstatement provision • $100 million additional coverage collateralized by catastrophe bond for severe convective storm or earthquake losses in certain geographic regions For a single event: • Retain 100% of first $100 million in losses • Retain 5.0% at $100 - 600 million • Max exposure for $600M event = $125 million Property per risk & $25 million property excess treaties ($25 million) For a single loss: • Retain 100% of first $10 million in losses • Retain 0% of losses $10 - 50 million • Facultative reinsurance for >$50 million Casualty per occurrence ($13 million) For a single loss: • Retain 100% of first $10 million in losses • Retain 0% of losses $10 - 25 million • Facultative reinsurance for >$25 million Casualty excess treaties ($3 million for two treaties combined) Workers’ comp, extra - contractual & clash coverage: • $25 million excess of $25 million (first excess treaty) • $20 million excess of $50 million (second treaty) Primary reinsurers are Swiss Re, Munich Re, Hannover Re, Partner Re and Lloyds of London

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 10 |

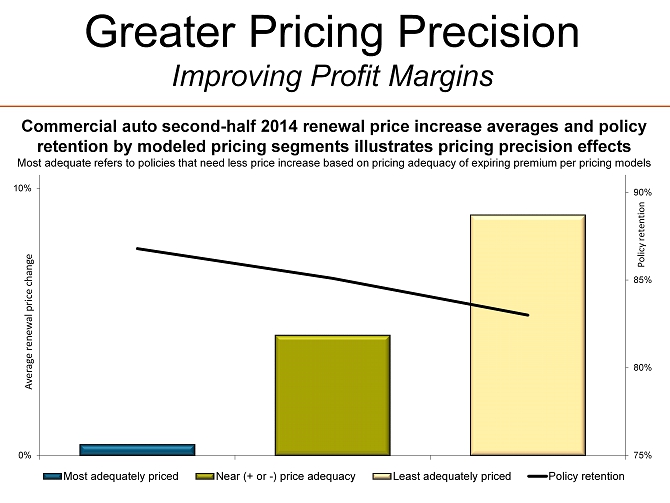

Greater Pricing Precision Improving Profit Margins Commercial auto second - half 2014 renewal price increase averages and policy retention by modeled pricing segments illustrates pricing precision effects Most adequate refers to policies that need less price increase based on pricing adequacy of expiring premium per pricing mode ls 75% 80% 85% 90% 0% 10% Most adequately priced Near (+ or -) price adequacy Least adequately priced Policy retention Average renewal price change Policy retention

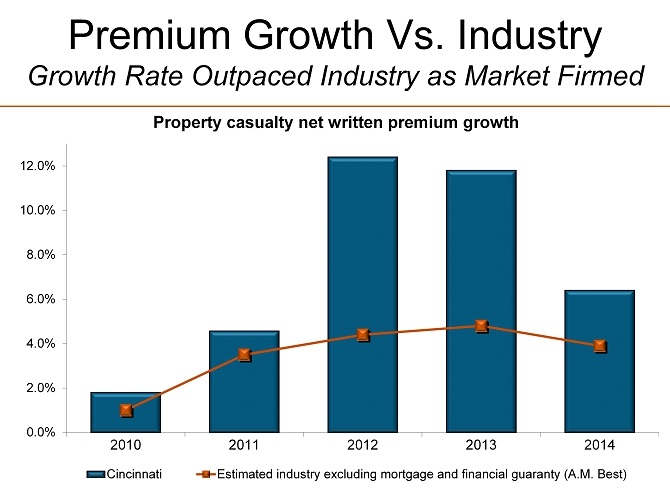

Premium Growth Vs. Industry Growth Rate Outpaced Industry as Market Firmed 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2010 2011 2012 2013 2014 Cincinnati Estimated industry excluding mortgage and financial guaranty (A.M. Best) Property casualty net written premium growth

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 11 |

Market for 75% of Agency’s Typical Risks 2014 Net Earned Premiums Commercial Property 18% Commercial Casualty 23% Commercial Auto 13% Workers' Compensation 9% Other Commercial 7% Excess & Surplus 4% Homeowner 11% Personal Auto 12% Other Personal 3% E&S Lines 3% Commercial Lines 67% Personal Lines 25% Life 5% Consolidated $4.243 Billion Property Casualty $4.045 Billion

Premium Growth Potential Steadily Increase Our Share Within Appointed Agencies 0.8% 5.2% 8.4% 16.5% 1 year or less 2-5 years 6-10 years 10 years or more Cincinnati share of estimated $39 billion total property casualty premiums produced by currently appointed agencies is approximately 11% Market share per agency reporting location by year appointed Based on 2014 standard market P&C agency written premiums (Excludes excess and surplus lines) New appointments also drive premium growth opportunity. The net amount of agency relationships has increased by 27 % since the end of 2009.

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 12 |

Property Casualty Reserves Favorable Development for 26 Consecutive Years $3,811 $3,905 $3,813 $3,942 $4,156 2010 2011 2012 2013 2014 Reserve range at 12 - 31 - 14 Low end $ 3,922 High end $4,296 Carried at 63 rd percentile Values shown are carried loss and loss expense reserves net of reinsurance Vertical bar represents reasonably likely range Calendar year development (Favorable) ($ 304) ($ 285) ($ 396) ($ 147 ) ($98) In millions

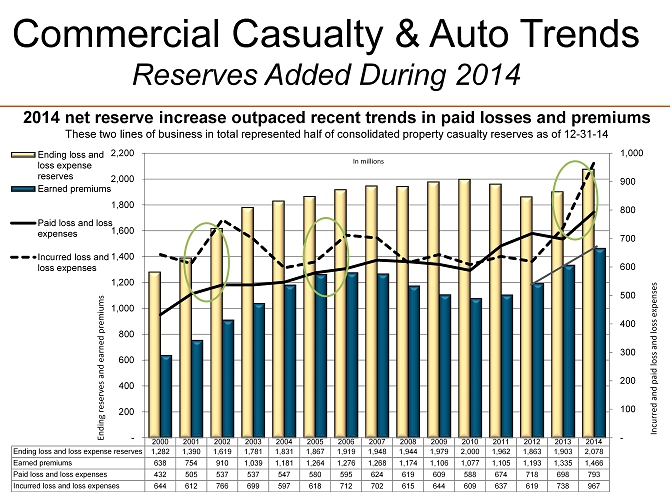

Commercial Casualty & Auto Trends Reserves Added During 2014 2014 net reserve increase outpaced recent trends in paid losses and premiums These two lines of business in total represented half of consolidated property casualty reserves as of 12 - 31 - 14 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Ending loss and loss expense reserves 1,282 1,390 1,619 1,781 1,831 1,867 1,919 1,948 1,944 1,979 2,000 1,962 1,863 1,903 2,078 Earned premiums 638 754 910 1,039 1,181 1,264 1,276 1,268 1,174 1,106 1,077 1,105 1,193 1,335 1,466 Paid loss and loss expenses 432 505 537 537 547 580 595 624 619 609 588 674 718 698 793 Incurred loss and loss expenses 644 612 766 699 597 618 712 702 615 644 609 637 619 738 967 - 100 200 300 400 500 600 700 800 900 1,000 - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 Ending loss and loss expense reserves Earned premiums Paid loss and loss expenses Incurred loss and loss expenses Ending reserves and earned premiums Incurred and paid loss and loss expenses In millions

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 13 |

Investment Income 3 % Growth in 2Q15: Dividends up 3%, Interest up 3% (pretax) $400 $425 $450 $475 $500 $525 $550 2010 2011 2012 2013 2014 Pretax bond yield: 5.49% 5.31% 5.15% 4.90% 4.76% (Bonds at amortized cost) Pretax book yield for bonds acquired in 2014: 3.88% Pretax book yield as of 12 - 31 - 14 for bonds maturing in 2015=4.37%, 2016=4.44%, 2017=4.89% Portion of bond portfolio maturing: 9.2% in 2015, 7.0% in 2016, 7.7% in 2017, 19.9% in 2018 - 19

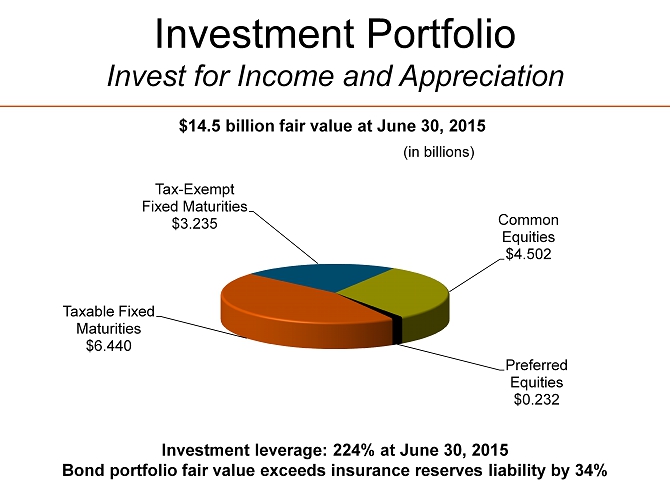

Investment Portfolio Invest for Income and Appreciation Taxable Fixed Maturities $6.440 Tax - Exempt Fixed Maturities $3.235 Common Equities $4.502 Preferred Equities $0.232 $ 14.5 billion fair value at June 30, 2015 Investment leverage: 224% at June 30, 2015 Bond portfolio fair value exceeds insurance reserves liability by 34% (in billions)

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 14 |

Diversified Equity Portfolio * Balances Income Stability & Capital Appreciation Potential June 30, 2015 Sector CFC S&P 500 Weightings Information technology 18.6% 19.6% Industrials 14.7 10.1 Financial 14.6 16.6 Healthcare 11.1 15.4 Consumer staples 10.7 9.4 Energy 10.1 7.9 Consumer discretionary 9.0 12.8 Materials 5.5 3.1 Utilities 3.2 2.8 Telecomm services 2.5 2.3 * Publicly traded common stock core portfolio, approximately 50 holdings (excludes energy MLP’s, one private equity) Portfolio Highlights at 6 - 30 - 15 • Apple - largest holding • 3.9% of publicly traded common stock portfolio • 1.2% of total investment portfolio • 3% increase in 2 Q15 dividend income • 48 of 48 companies in core portfolio increased their annual regular dividend (over the past 12 months) • Unrealized gains totaled $1.9 billion (pretax) • Seven largest contributors represent 31%: ExxonMobil, Honeywell, Apple, BlackRock, P&G, RPM International, and JP Morgan Chase • Annual portfolio returns: (2014 & 2013) 12.3% & 31.7% ( S&P 500: 13.7% & 32.4%)

Bond Portfolio Risk Profile $9.675 Billion at June 30, 2015 ► Credit risk – A2/A average rating – 59% rated >=A, 33% rated BBB, 4 % rated <=BB, 4 % unrated – No European sovereign debt – Euro - based securities are 4% of bond portfolio (mostly corporate bonds) ► Interest rate risk – 4.8 years effective duration, 6.8 years weighted average maturity – Generally laddered maturity structure • 24% of year - end 2014 portfolio matures by the end of 2017, 44% by 2019, 81% by 2024 – With 31.1% of the investment portfolio invested in common stocks at 06 - 30 - 15, we estimated shareholders’ equity would decline 4.6% if interest rates were to rise by 100 basis points ► Bond portfolio is well - diversified – Largest issuer (corporate bond) = 0.6% of total bond portfolio – Municipal bond portfolio (more than 1,500 issues ) • Over 43% insured at 12 - 31 - 14, 98% with underlying rating >=A3/A - • Texas issuers=12.5%, Indiana=7.1%, Ohio=6.3%, 12 other states each 2.1% to 5.2% • 64% locally issued general obligations, 36% special revenue bonds

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 15 |

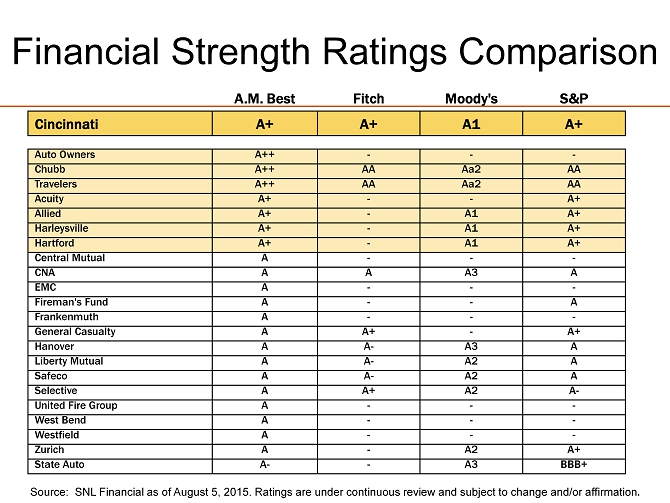

Source: SNL Financial as of August 5, 2015. Ratings are under continuous review and subject to change and/or affirmation . A.M. Best Fitch Moody's S&P Cincinnati A+ A+ A1 A+ Auto Owners A++ - - - Chubb A++ AA Aa2 AA Travelers A++ AA Aa2 AA Acuity A+ - - A+ Allied A+ - A1 A+ Harleysville A+ - A1 A+ Hartford A+ - A1 A+ Central Mutual A - - - CNA A A A3 A EMC A - - - Fireman's Fund A - - A Frankenmuth A - - - General Casualty A A+ - A+ Hanover A A - A3 A Liberty Mutual A A - A2 A Safeco A A - A2 A Selective A A+ A2 A - United Fire Group A - - - West Bend A - - - Westfield A - - - Zurich A - A2 A+ State Auto A - - A3 BBB+ Financial Strength Ratings Comparison

Valuation Comparison to Peers 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 Ratio of closing price on 09 - 2 - 15 to latest reported tangible book value

| Copyright © 2015 Cincinnati Financial Corporation. All rights reserved. Do not reproduce or post online, in whole or in part, without written permission. | 16 |