Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99.1 - EliteSoft Global Inc. | ex991.htm |

| EX-10 - EXHIBIT 10.2 - EliteSoft Global Inc. | ex102.htm |

| EX-10 - EXHIBIT 10.1 - EliteSoft Global Inc. | ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

September 4, 2015

(DATE OF REPORT)

EliteSoft Global Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| Delaware | 000-55240 | 47-1208256 | ||

|

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) |

(COMMISSION FILE NO.) | (IRS EMPLOYEE IDENTIFICATION NO.) |

18582 NW Holly

Street, Unit 202

Beaverton, OR 97006-7014

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(503) 830 2918

(ISSUER TELEPHONE NUMBER)

Unit A-9-4, Northpoint Office Suite, Mid Valley City

No. 1, Medan Syed Putra Utara, Kuala Lumpur, Malaysia 59200

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting Material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| 1 |

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Factors that might cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” contained in this report. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by law, we expressly disclaim any obligation to update publicly any forward-looking statements for any reason after the date of this report, to conform these statements to actual results, or to changes in our expectations. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this report.

EliteSoft Global Inc.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

Assignment Assumption Agreement with EliteSoft Asia SdnBhd

On June 1, 2015, EliteSoft Global Inc. (the "Company"), entered into an agreement accepting the assignment assumption of the NZ Financial Limited Technology Services Agreement.

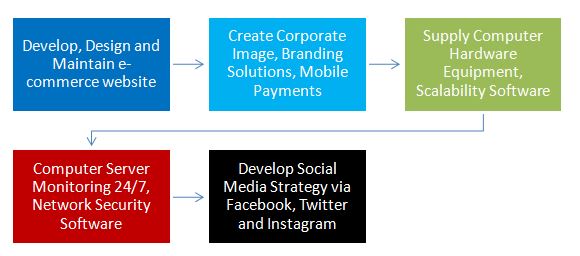

The Company executed an assignment assumption agreement (the “Assignment and Assumption Agreement”) with EliteSoft Asia Sdn Bhd. (“ESA”), a Malaysian-based technical software and services corporation. Pursuant to the Agreement, the Company shall provide performance on its agreement by providing professional services related to the items as outlined in the Assignment and Assumption Agreement as illustrated directly below and also filed as exhibit 10.1 on our Form 8-K filed June 2, 2015.

Pursuant to the Agreement, the Company is compensated $2,000 per month during the term of the Agreement by NZ Financial Limited. Furthermore, the parties also agreed that the consideration to be paid for the Assignment will be 2,000,000 shares of the Company’s restricted common stock to ESA.

Technology Services Agreement with YouthliteSdnBhd

| 2 |

In addition, on May 28, 2015, the Company entered into a two year Technology Services Agreement with YouthliteSdnBhd, ("Youthlite") a natural skin care and cosmetics company based in Malaysia to be effective on June 1, 2015. The total value of the Technology Services Agreement is$95,131, of which $3,963 is paid monthly to the Company.

Pursuant to the Technology Services Agreement, the Company provides Youthlite with the following services:

(a) Creation and design of corporate images and materials, (b) Design and development of the Youthlite website, (c) Development of e-commerce software for sales transactions, (d) Provide required computer hardware to operate its online business, (e) 24/7 server monitoring, (f) Create social media strategy via Facebook, Twitter, Instagram, (g) Provide video production services for infomercials.

ITEM 2.01 COMPLETION OF DISPOSITION OR ACQUISITION OF ASSETS.

As described above under Item 1.01, the Company entered into an agreement with NZ Financial Limited by way of its Assignment and Assumption from EliteSoft Asia Sdn Bhd. Additionally, the Company entered into a two year Technology Services Agreement with YouthliteSdn Bhd. Pursuant to both Agreements, the Company began operations to provide technology services to fulfill its performance per the agreements. Pursuant to Item 2.01(f) of Form 8-K, the information that would be required if we were filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) upon consummation of the transaction follows. The information below corresponds to the item numbers of Form 10 under the Exchange Act.

ITEM 1. DESCRIPTION OF BUSINESS

(a) Business of Issuer

EliteSoft Global Inc., ( the "Company", or "EliteSoft Global") was incorporated as ANDES 3Inc in the State of Delaware on June 23, 2014, and is a development stage company with minimal revenues. We were formerly known as ANDES 3 Inc and on March 16, 2015, the Company filed a Certificate of Amendment to the Articles of Incorporation with the Secretary of State of the State of Delaware to change the name of the Registrant to EliteSoft Global Inc. the amendment was effectively completed and the Registrant informed on March 23, 2015.

EliteSoft Global is a smaller reporting company under SEC Rule 405 because it is currently not trading, has a public float of zero and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available. As a smaller reporting company, pursuant to Rule 8-01 of Regulation S-X, the Company is only required to produce financial statements as follows: (a) audited balance sheet as of the end of each of the most recent two fiscal years, or as of a date within 135 days if the issuer has existed for a period of less than one fiscal year, (b) audited statements of income, cash flows and changes in stockholders' equity for each of the two fiscal years preceding the date of the most recent audited balance sheet (or such shorter period as the registrant has been in business), and (c) interim reviewed financial statements for the current period if the filing is more than 135 days after the end of your fiscal year. Any and all amendments shall include updated interim or audited financial statements if the financial statements in the prior filing are more than 135 days old.

We are an information technology (IT) web, systems integration and applications solutions company. We combine leading technology and draw upon our experience as professional IT specialists to create, design, develop and maintain corporate websites, e-commerce, social media strategies, server monitoring and supply computer hardware equipment on a global basis. We work to achieve this mission by using technology that is scalable, off-the-shelf, customizable, and communicates a clear message to our clients target market.We market third-party vendor software, IT services, and hardware that deliver new opportunities, greater convenience, and enhanced value to our client's business. We have also established our in-house research and development (R&D) team to focus on e-commerce solutions, mobile payment, and financial services as an increasing effort for our company to provide full life cycle solutions to clients. The company maintains an office in Beaverton, Oregon as its headquarters, and an office in Kuala Lumpur, Malaysia, as its location servicing clients within the Asia-Pacific region.

| 3 |

We currently generate revenue by providing web and IT services to two clients. We entered into an Assignment Assumption Agreement with ESA for which we acquired the NZ Financial Limited Technology Services Agreement whereby we support their initiatives with developing, designing, and maintaining their e-commerce website, create their corporate image, supply necessary computer hardware equipment, monitor their server, and develop their social media strategies. Our agreement generates approximately $2,000 per month with NZ Financial Limited. We generate $3,963 per month through our Technology Services Agreement with YouthliteSdnBhd, a company incorporated under the laws of Malaysia. Under this agreement, we are responsible for the following: (a) Creation and design of corporate images and materials, (b) Design and development of the Youthlite website, (c) Development of e-commerce software for sales transactions, (d) Provide required computer hardware to operate its online business, (e) 24/7 server monitoring, (f) Create social media strategy via Facebook, Twitter, Instagram, (g) Provide video production services for infomercials.

Our market opportunity is in Asia and in particular, countries such as Singapore, Thailand, Indonesia, Japan, Hong Kong, Korea, and China. We also find that markets in New Zealand and Australia are favorable to our industry as well.

Our primary goals are to become the leading IT services company in Asia with a strong focus on the financial sector, e-commerce, business-web-based training and certification.

The EliteSoft Global Relationship Solutions

|

· Create IT solutions for customers with real time analytics · Drive and coordinate both strategic and operational responses to feedback · Build long term customer loyalty | ||

| · Increase customer value | ||

| · Enhance and grow recurring revenues and profits |

ESG Primary Services

| · | Software services and integration |

ESG integrates customer backend software development with CRM tools to enhance its overall experience with e-commerce and customer database solutions. Allowing ESG to manage backend software to handle internet traffic gives the enterprise a more robust, efficient operational platform that is also scalable and dynamic. Customer feedback is processed through integration of legacy data collection methods including phone, postal mail, OCR, and IVR. ESG aggregates these messages through a single, easily managed and secure solution to manage response action through an organization.

| · | E-commerce Hosting Solutions |

ESG develops corporate websites with e-commerce functionality through the deployment of complete end to end solutions. ESG's approach is to develop customizable websites that maintain a professional and effective retail presence with database driven storefronts that is enabled to handle large volumes of internet traffic, and ability to securely manage transactions. From backend, to frontend functionality, ESG develops the entire e-commerce experience in between, including product, payment, shipping and taxation functionality. ESG incorporates shopping cart solutions into its software to allow customers to sell practically anything they desire. Additionally, ESG features compatibility with all PHP 4 coding versions, object oriented languages, and multilingual language support.

| 4 |

| · | Multimedia Services |

ESG offers a comprehensive multimedia package solution. The integration of text, photos, animation, narration, music, and interactivity, we create presentations for clients for a memorable experience. Our designers have the ability to create a multimedia presentation on an interactive website, flash introductions, CD presentations, interactive tutorials, and/or, an e-brochure or e-catalog.

| · | Graphic Design/Branding |

As the most prominent visual element of a company's products, or services, branding communicates a message to potential customers. ESG has developed a branding department that is central of our customer's brand identity needs. ESG's graphic design team creates logos, images, and identity marks in print media or digital media for brand marketing purposes. ESG believes that brand marketing through corporate identity, logo design, print and digital media, and marketing brochures will enhance customer brand awareness.

Customers, Distribution and Marketing

Customers

We currently provide our IT web, systems integration and applications solutions to two companies, NZ Financial Limited and Youthlite Sdn Bhd. We seek to provide these services primarily to the Asia-Pacific region in particular, countries such as Singapore, Thailand, Indonesia, Japan, Hong Kong, Korea, and China. We also find that markets in New Zealand and Australia are favorable to our industry as well and have begun marketing our efforts in those markets.

Third Party Products

With the execution of our client agreements, we began integrating systems from Dell, Lenovo, Samsung, Apple, Acer and ASUS. Our business strategy is to implement and integrate third party products into our client's network.

Marketing Strategy

We plan on launching marketing in the Asia-Pacific region through an online advertising campaign leveraging our experience and utilizing our business contacts in the Asia-Pacific region.

Industry, Competition, and Future Operations

The IT web, System Integration and Application Solutions Industry

The

IT web, systems integration and applications solutions market is a highly fragmented industry. There are numerous companies that

have established businesses and command large market share, such as Accenture, BAE Systems, Cognizant Technology, Fujitsu, Hewlett-Packard,

IBM, Infosys, Lockheed Martin, Oracle, Tata Consultancy that we compete against. We also compete with Alibaba, eBay, Amazon, Rakuten,

Groupon, ASOS, Expedia and other e-commerce platform companies specifically in our e-commerce business in the Asia-Pacific region.

Additionally, many of the vendor companies that the industry purchases products from may compete against their clients by offering

full life cycle solutions and packages that support compatible software and hardware products, a role that IT web and system integrators

normally play, therefore, emerging companies in our industry have taken to a full solution approach that offers clients a robust,

'best of breed' and customized software programming with a higher emphasis on customer service relations. Additionally, in the

Asia-Pacific markets, companies offer other options such as managing payroll, and accounting as well as recruitment and human

resources on behalf of clients to further differentiate themselves from competitors. According to Transparency Market Research

in 2014, the firm believes that the global market for system integration services was valued at $191.36 billion in 2013, and is

expected to reach $377.59 billion by 2020, growing at a CAGR (compound annual growth rate) of 10.9% during the period. Their assessment

of the industry was that the Asia Pacific region was expected to be the fastest growing regional market for system integration,

during the forecasted period. The rapidly growing economies of the Asia-Pacific region and globalization of firms are key drivers

in propelling demand for the IT, system integration and services business.

| 5 |

Our company has developed a strategy that will encompass a broader approach to traditional IT web and system integration by focusing

efforts on the emerging mobile payment industry. Our approach is to offer our clients full mobile payment integration with their

IT strategy and developing a competitive mobile solution to their commerce needs.

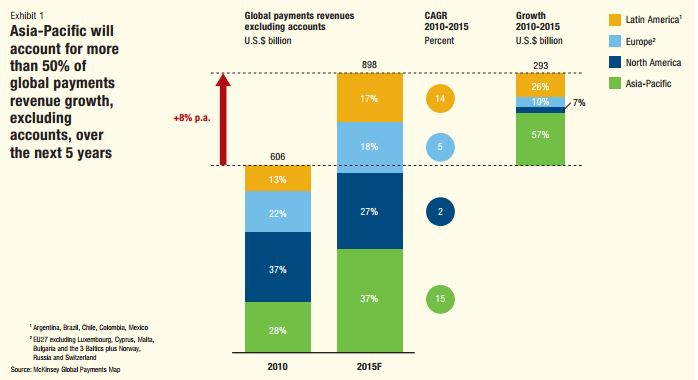

According to McKinsey, a global business consultancy firm, the Asia-Pacific region will account for more than 50% of the global payments growth over the next five years and cashless transactions will increase by more than 20% growth in countries such as Thailand, China, Indonesia and China.

Source: McKinsey Global

Competition

The mobile payments industry in the Asia-Pacific region is highly competitive. Given the outlook in the Asia-Pacific region, we believe that competition for revenues will intensify. In the mobile payments space, we compete with stand alone players such as PayPal, Netteller, China Union Pay, AliPay, and BitPay ,additionally, we compete with three categories of institutional players, Non-Bank payment companies, Asia-Pacific banks in home markets, and Banks in non-home markets.

Non-Bank payment companies are telecom or "telco" companies, that are seeking to expand their existing technologies by offering mobile payment solutions integrated into mobile phones and consumer machines such as ticketing services.

Asia-Pacific banks are banks in home markets in Asia such as HSBC, Citi, and Standard Chartered. These banking institutions seek to increase their footprint with clients by offering mobile bank payment solutions in order to capture more revenue.

Banks in non-home markets are banks outside the Asia-Pacific region that offer competitive services with the objective to increase

cash management services through either low cost fees or no fee accounts. These banks are generally the least sophisticated members

of the current competitive landscape based upon their inexperience in operating within the Asia-Pacific region, however, the amount

of financial resources these banks control are formidable.

Employees

As of September 3, 2015, EliteSoft Global Inc. employed a total of 10 people. A business development manager, administrative account manager, human resources executive, web specialist, one part time and one full time programmer, a dispatch officer and our officers and directors, Swee Seong "Eugene" Wong, Khoo Mae Ling, Cornelius Ee, and Finny Chu. The company considers its relationship with its employees to be stable, and anticipates growing its workforce.

| 6 |

Facilities and Logistics

EliteSoft Global Inc. was incorporated in the State of Delaware on June 23, 2014;the company maintains an office in Beaverton, Oregon as its headquarters, and an office in Kuala Lumpur, Malaysia, as its location servicing clients within the Asia-Pacific region. Our office in Beaverton is a 1,100square foot facility owned by our President, Chief Executive Officer, Chairman, and we have secured this space without cost. Our office in Kuala Lumpur is a 2,000 square foot leased facility under a two-year lease agreement at an expense of $2,500 per month. Our office currently maintains the following positions; business development manager, admin and accounts manager, human resources executive, web specialist, and full/part time programmers.

The following table lists our current location. The lease payment for our facility is approximately $2,500, paid monthly.

| Location | Address | Size |

|

Beaverton, OR

Kuala Lumpur, Malaysia |

18582 HW Holly Street, Unit 202

Unit A-9-4, Northpoint Office Suite, Mid Valley City No 1., Medan Syed Putra Utara Kuala Lumpur, Malaysia 59200 |

1,100, square feet

2,000 square feet |

RISK FACTORS

An investment in our Common Stock is highly speculative in nature, involves a high degree of risk, and is suitable only for persons who can afford to risk the loss of the entire amount invested. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the eventual trading price of our Common Stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We have a very short history of operations and have experienced losses since inception and we may not achieve or sustain profitability in the future.

We are a development stage company with minimal revenues. We were incorporated on June 23, 2014 in the State of Delaware as ANDES 3 Inc. We currently have two customers and we anticipate that our cost of revenues and operating expenses will increase substantially in the foreseeable future as we continue to grow our business by developing our new technology initiatives and securing, highly skilled computer programmers. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues sufficiently to offset these higher expenses. Many of our efforts to generate revenues from our business are challenging, and any failure to increase our revenues or generate revenues from our technological services and solutions could prevent us from attaining or increasing profitability. We do not expect to be profitable in the foreseeable future and we cannot be certain that we will be able to attain profitability on a quarterly or annual basis, or if we do, that we will sustain profitability.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We were incorporated in the State of Delaware on June 23, 2014. Our operations are minimal and we have minimal revenues as a development stage company. We will encounter risks and difficulties frequently experienced by growing companies in rapidly developing and changing industries, including challenges in forecasting accuracy, determining appropriate investments of our limited resources, market acceptance of our current and future solutions, competition from established companies with greater financial and technical resources, uncertainty in the Asia-Pacific region as conflicts may arise of which any outcome cannot be determined, retaining customers, managing customer deployments, hiring and retaining highly skilled computer programmers, and developing new solutions. Our current operations infrastructure may require changes in order for us to achieve profitability and scale our operations efficiently. If we fail to implement these changes on a timely basis or unable to implement them due to factors beyond our control, our business may suffer. We cannot assure you that we will be successful in addressing these and other challenges we may face in the future.

| 7 |

We operate in an intensely competitive market with established companies competing for market share.

Our competitors in our IT web and system integration business are companies with much greater financial resources than our company such as Accenture, BAE Systems, Cognizant Technology, Fujitsu, Hewlett-Packard, IBM, Infosys, Lockheed Martin, Oracle, Tata Consultancy. We compete against Alibaba, eBay, Amazon, Rakuten, Groupon, ASOS in our e-commerce platform business. We also compete against PayPal, Netteller, China Union Pay, AliPay, and BitPay, within the mobile payments business, however, we also compete with three categories of institutional players, Non-Bank payment companies, Asia-Pacific banks in home markets, and Banks in non-home markets. Non-Bank payment companies are telecom or "telco" companies, that are seeking to expand their existing technologies by offering mobile payment solutions integrated into mobile phones and consumer machines such as ticketing services. Asia-Pacific banks are banks in home markets in Asia such as HSBC, Citi, and Standard Chartered. These banking institutions seek to increase their footprint with clients by offering mobile bank payment solutions in order to capture more revenue. Banks in non-home markets are banks outside the Asia-Pacific region that offer competitive services with the objective to increase cash management services through either low cost fees or no fee accounts. These banks are generally the least sophisticated members of the current competitive landscape based upon their inexperience in operating within the Asia-Pacific region, however, the amount of financial resources these banks control are formidable. Due to the competitive landscape, in both IT web, system integration and mobile payments, we cannot assure you that we will succeed in our business plans or maintain our current level of operational activity.

We may not be able to compete successfully against current and future competitors.

The IT web, systems integration and applications solutions market is a highly fragmented industry with many large companies that command leading market share. Accenture, BAE Systems, Cognizant Technology, Fujitsu, Hewlett-Packard, IBM, Infosys, Lockheed Martin, Oracle, Tata Consultancy are companies within the IT web and systems integration industry we compete against. As a full life cycle solutions integrator, our business model includes e-commerce and mobile payments as additional functions and features we build for our clients. Alibaba, eBay, Amazon, Rakuten, Groupon, ASOS are our e-commerce platform competitors and we also compete against PayPal, Netteller, China Union Pay, AliPay, and BitPay, within the mobile payments business, additionally, we also compete with three categories of institutional players, Non-Bank payment companies, Asia-Pacific banks in home markets, and Banks in non-home markets.

| · | All of our current competitors have greater financial, marketing, and technical resources than we do, allowing them to leverage a larger installed customer base, adopt more aggressive pricing policies, and devote greater resources to the development, promotion and sale of their products and services than we can; and |

| · | Companies may enter our market by expanding their platforms or acquiring a competitor. |

If we are unable to maintain or expand our sales and marketing capabilities, and attract and retain skilled personnel, we may not be able to generate anticipated revenues.

Increasing our customer base and penetrating our target markets will depend to a significant extent on our ability to expand our sales and marketing operations and activities. We expect to be largely dependent on our sales force to obtain new customers. We also expect to be highly dependent on skilled computer programmers. Competition for both are intense, and we may not be able to attract, integrate sufficient highly qualified personnel.

| 8 |

Our failure to obtain capital may significantly restrict our proposed operations.

We will need to raise more capital to expand our business. Future sources of capital may not be available to us when we need it or may be available only on unacceptable terms.

We are subject to the risk that certain key personnel, including key employees named below, on whom we depend, in part, for our operations, will cease to be involved with us. The loss of any these individuals would adversely affect our financial condition and the results of our operations.

We are dependent on the experience, knowledge, skill and expertise of our CEO, President and Chairman, Swee Seong “Eugene” Wong. We are also in large part dependent on VP of Information Technology, Cornelius Ee. The loss of any of the key personnel listed above could materially and adversely affect our future business efforts. Our success depends in substantial part upon the services, efforts and abilities of Swee Seong “Eugene” Wong, our CEO, President and Chairman, due to his experience, history and knowledge of the IT industry and his overall insight into our business direction. The loss or our failure to retain Mr. Wong, or Mr. Ee, or to attract and retain additional qualified personnel, could adversely affect our operations. We do not currently carry key-man life insurance on any of our officers and have no present plans to obtain this insurance. See “Management.”

The lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our Chairman and CEO comes with some public company experience during his service as director of a public company in Malaysia, however, does not have public company experience with a U.S. public company and under the Federal securities laws of the United States and rules and regulations of the U.S. Securities and Exchange Commission, which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Regulations, including those contained in and issued under the Sarbanes-Oxley Act of 2002 (“SOX”) and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”), increase the cost of doing business and may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our Common Stock.

We are a public company. The current regulatory climate for public companies, even small and emerging growth companies such as ours, may make it difficult or prohibitively expensive to attract and retain qualified officers, directors and members of board committees required to provide for our effective management in compliance with the rules and regulations which govern publicly-held companies, including, but not limited to, certifications from executive officers and requirements for financial experts on boards of directors. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. For example, the enactment of the Sarbanes-Oxley Act of 2002 has resulted in the issuance of a series of new rules and regulations and the strengthening of existing rules and regulations by the SEC. Further, recent and proposed regulations under Dodd-Frank heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business could be adversely affected.

Our internal controls over financial reporting may not be effective, and our independent auditors may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business.

| 9 |

We are subject to various SEC reporting and other regulatory requirements. We have incurred and will continue to incur expenses and, to a lesser extent, diversion of our management’s time in our efforts to comply with SOX Section 404 regarding internal controls over financial reporting. Our management’s evaluation over our internal controls over financial reporting may determine that material weaknesses in our internal control exist. If, in the future, management identifies material weaknesses, or our external auditors are unable to attest that our management’s report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price, and subject us to sanctions or investigation by regulatory authorities.

Limitations on director and officer liability and our indemnification of our officers and directors may discourage stockholders from bringing suit against a director.

Our Certificate of Incorporation and By-Laws provide, with certain exceptions as permitted by Delaware corporation law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, our Certificate of Incorporation and By-Laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law.

We may incur a variety of costs to engage in future acquisitions of companies, products or technologies, to grow our business, to expand into new markets, or to provide new services. As such, the anticipated benefits of those acquisitions may never be realized.

It is management’s intention to acquire other businesses to grow our customer base, to expand into new markets, and to provide new product lines. We may make acquisitions of, or significant investments in, complementary companies, products or technologies, although no additional material acquisitions or investments are currently pending. Acquisitions may be accompanied by risks such as:

| · | difficulties in assimilating the operations and employees of acquired companies; |

| · | diversion of our management’s attention from ongoing business concerns; |

| · | our potential inability to maximize our financial and strategic position through the successful incorporation of acquired technology and rights into our products and services; |

| · | additional expense associated with amortization of acquired assets; |

| · | additional expense associated with understanding and development of acquired business; |

| · | maintenance and implementation of uniform standards, controls, procedures and policies; and |

| · | impairment of existing relationships with employees, suppliers and customers as a result of the integration of new management employees. |

Our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

There can be no assurance that we will be able to manage our expansion through acquisitions effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel in multiple geographic locations. We may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

The forecasts of market growth included in this Form 8-K may prove to be inaccurate, and even if the market in which we compete achieve the forecasted growth, we cannot assure you our business will grow at similar rates, if at all.

Growth forecasts are subject to significant uncertainty and are based on assumptions and estimates, which may not prove to be accurate. Forecasts relating to the expected growth in the information technology (IT) web, systems integration and applications solutions sector, including the forecasts or projections referenced in this Form 8-K, may prove to be inaccurate. Even if these markets experience the forecasted growth, we may not grow our business at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of market growth included in this prospectus should not be taken as indicative of our future growth.

| 10 |

We might require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to develop new features or enhance our existing products, improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we may need to engage in equity or debt financings to secure funds. If we raise funds through issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing secured by us in the future could involve restrictive covenants relating to our future capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. In addition, we may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired.

If we obtain financing, existing shareholder interests may be diluted.

If we raise additional funds by issuing equity or convertible debt securities, the percentage ownership of our shareholders will be diluted. In addition, any new securities could have rights, preferences and privileges senior to those of our common stock. Furthermore, we cannot assure you that additional financing will be available when and to the extent we require or that, if available, it will be on acceptable terms.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an “emerging growth company.”

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

As a public company, we are subject to the reporting requirements of the Exchange Act, and requirements of SOX. The cost of complying with these requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. SOX requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting. To maintain and improve the effectiveness of our disclosure controls and procedures, we must commit significant resources, may be required to hire additional staff and need to continue to provide effective management oversight.

We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join the Company and to maintain appropriate operational and financial systems to adequately support expansion.

These activities may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

As an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”) enacted on April 5, 2012, we may take advantage of certain temporary exemptions from various reporting requirements including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of SOX (and rules and regulations of the SEC thereunder, which we refer to as Section 404) and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements.

| 11 |

When these exemptions cease to apply, we expect to incur additional expenses and devote increased management effort toward ensuring

compliance with them. We will remain an “emerging growth company” for up to five years, although we may cease to be

an emerging growth company earlier under certain circumstances. See “Management’s Discussion and Analysis of Financial

Condition and Results of Operations –JOBS Act” for additional information on when we may cease to be deemed to be an

emerging growth company. We cannot predict or estimate the amount of additional costs we may incur as a result of becoming a public

company or the timing of such costs.

Our reported financial results may be adversely affected by changes in accounting principles generally accepted in the United States.

Generally accepted accounting principles in the United States are subject to interpretation by the Financial Accounting Standards Board (FASB), the SEC, and various bodies formed to promulgate and interpret appropriate accounting principles. A change in these principles or interpretations could have a significant effect on our reported financial results, and could affect the reporting of transactions completed before the announcement of a change.

Risks Related to Our Common Stock

Our stock price may be volatile or may decline regardless of our operating performance, and the price of our common stock may fluctuate significantly.

Once our shares begin trading, the market price for our common stock is likely to be volatile, in part because our shares have not been traded publicly. In addition, the market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

| · | competition from other IT web, system integration companies or related businesses; |

| · | changes in foreign government regulations, general economic or market conditions or trends in our industry or the economy as a whole and, in particular, in the IT web, system integration industry; |

| · | changes in key personnel; |

| · | entry into new geographic markets; |

| · | actions and announcements by us or our competitors or significant acquisitions, divestitures, strategic partnerships, joint ventures or capital commitments; |

| · | changes in operating performance and stock market valuations of other IT web, system integration and related companies; |

| · | investors’ perceptions of our prospects and the prospects of the IT web, system integration industry; |

| · | fluctuations in quarterly operating results, as well as differences between our actual financial and operating results and those expected by investors; |

| · | the public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC; |

| · | announcements relating to litigation; |

| · | financial guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance; |

| 12 |

| · | changes in financial estimates or ratings by any securities analysts who follow our common stock, our failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our common stock; |

| · | the development and sustainability of an active trading market for our common stock; |

| · | future sales of our common stock by our officers, directors and significant stockholders; and |

| · | changes in accounting principles affecting our financial reporting. |

These and other factors may lower the market price of our common stock, regardless of our actual operating performance.

The stock markets and trading facilities, including the OTC Bulletin Board, have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities in many companies. In the past, stockholders of some companies have instituted securities class action litigation following periods of market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources and the attention of management could be diverted from our business.

Our Common Stock is subject to risks arising from restrictions on reliance on Rule 144 by shell companies or former shell companies.

Under a regulation of the SEC known as “Rule 144,” a person who has beneficially owned restricted securities of an issuer and who is not an affiliate of that issuer may sell them without registration under the Securities Act provided that certain conditions have been met. One of these conditions is that such person has held the restricted securities for a prescribed period, which will be 6 months or 1 year, depending on various factors. The holding period for our common stock would be 1 year if our common stock could be sold under Rule 144. However, Rule 144 is unavailable for the resale of securities issued by an issuer that is a shell company (other than a business combination related shell company) or that has been at any time previously a shell company. The SEC defines a shell company as a company that has (a) no or nominal operations and (b) either (i) no or nominal assets, (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets. Until the merger, we were a shell company.

The SEC has provided an exception to this unavailability if and for as long as the following conditions are met:

| · | The issuer of the securities that was formerly a shell company has ceased to be a shell company, |

| · | The issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, |

| · | The issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and |

| · | At least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company known as “Form 10 Information.” |

The purpose of filing this Current Report on Form 8-K is to provide updated “Form 10 Information” about the plans of the Company going forward, stockholders who receive our restricted securities will be able to sell them pursuant to Rule 144 without registration for only as long as we continue to meet those requirements and are not a shell company. No assurance can be given that we will meet these requirements or that we will continue to do so, or that we will not again be a shell company. Furthermore, any non-registered securities we sell in the future or issue for acquisitions or to consultants or employees in consideration for services rendered, or for any other purpose will have limited or no liquidity until and unless such securities are registered with the SEC and/or until a year after we have complied with the requirements of Rule 144. As a result, it may be harder for us to fund our operations, to acquire assets and to pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the SEC, which could cause us to expend additional resources in the future. In addition, if we are unable to attract additional capital, it could have an adverse impact on our ability to implement our business plan and sustain our operations. Our status as a former “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions, which could cause the value of our securities, if any, to decline in value or become worthless.

| 13 |

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of our company, the trading price for our common stock would be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who cover us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our common stock could decrease, which could cause our stock price and trading volume to decline.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

As a public company, we will be required to evaluate our internal controls over financial reporting. Furthermore, at such time as we cease to be an “emerging growth company,” as more fully described in these Risk Factors, we shall also be required to comply with Section 404. At such time, we may identify material weaknesses that we may not be able to remediate in time to meet the applicable deadline imposed upon us for compliance with the requirements of Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. We cannot be certain as to the timing of completion of our evaluation, testing and any remediation actions or the impact of the same on our operations. If we are not able to implement the requirements of Section 404 in a timely manner or with adequate compliance, our independent registered public accounting firm may issue an adverse opinion due to ineffective internal controls over financial reporting and we may be subject to sanctions or investigation by regulatory authorities, such as the SEC. As a result, there could be a negative reaction in the financial markets due to a loss of confidence in the reliability of our financial statements. In addition, we may be required to incur costs in improving our internal control system and the hiring of additional personnel. Any such action could negatively affect our results of operations and cash flows.

We are an "emerging growth company" and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Stock less attractive to investors, potentially decreasing our stock price.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| 14 |

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| · | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we may choose “opt out” of such extended transition period, and as a result, we would then comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards would be irrevocable

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

When these exemptions cease to apply, we expect to incur additional expenses and devote increased management effort toward ensuring compliance with them. We may remain an “emerging growth company” for up to five years, although we may cease to be an emerging growth company earlier under certain circumstances. We cannot predict or estimate the amount of additional costs we may incur as a result of the change in our status under the JOBS Act or the timing of such costs.

The Company is an Emerging Growth Company under the JOBS Act of 2012, but the Company has irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(B) of the JOBS Act.

Our management and directors have significant control of our common stock and could control our actions in a manner that conflicts with the interests of other stockholders.

Our executive officers, directors and their affiliated entities together beneficially own approximately 83% of our common stock, representing approximately 83% of the voting power of our outstanding capital stock. As a result, these stockholders, acting together, will be able to exercise considerable influence over matters requiring approval by our stockholders, including the election of directors, and may not always act in the best interests of other stockholders. Such a concentration of ownership may have the effect of delaying or preventing a change in our control, including transactions in which our stockholders might otherwise receive a premium for their shares over then current market prices.

| 15 |

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and operating results. In addition, current and potential stockholders could lose confidence in our financial reporting, which could have an adverse effect on our stock price.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed.

Upon the effectiveness of the Company’s contemplated current report under the Securities Exchange Act of 1934, we will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments.

During the course of our testing, we may identify deficiencies which we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if we fail to maintain the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain an effective internal control environment could cause us to face regulatory action and also cause investors to lose confidence in our reported financial information, either of which could have an adverse effect on our stock price.

Investors should not anticipate receiving cash dividends on our common stock.

The continued operation and growth of our business will require substantial cash. Accordingly, we do not anticipate that we will pay any cash dividends on shares of our common stock for the foreseeable future. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend upon our results of operations, financial condition, contractual restrictions relating to indebtedness we may incur, restrictions imposed by applicable law and other factors our board of directors deems relevant. Accordingly, realization of a gain on your investment will depend on the appreciation of the price of our common stock, which may never occur. Investors seeking cash dividends in the foreseeable future should not purchase our common stock.

OTC Bulletin Board Qualification for Quotation

To have our shares of common stock on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. We have not engaged in any discussions with a FINRA Market Maker to file our application on Form 211 with FINRA, and no assurances can be made that we would be able to do so.

ITEM 2. FINANCIAL INFORMATION

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this Form 8-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those forward-looking statements below. Factors that could cause or contribute to those differences include, but are not limited to, those identified below and those discussed in the section entitled “Risk Factors” included elsewhere in this Form 8-K.

We were incorporated in Delaware as ANDES 3Inc on June 23, 2014, and on July 7, 2014, we filed a registration statement on Form 10 to register with the U.S. Securities and Exchange Commission as a public company. We were originally organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation.

| 16 |

On February 20, 2015, Richard Chiang, then our sole director and shareholder, entered into a Stock Purchase Agreement (the "SPA") whereby EliteSoft Asia Sdn Bhd.("ESA") purchased 10,000,000 shares of our common stock from Mr. Chiang, which constituted 100% of our issued and outstanding shares of common stock. Upon Mr. Chiang's resignation following the execution of the SPA, ESA elected Mr. Eugene Wong, as a Director of the Company. Immediately following the election of Mr. Wong as a Director to the Company’s Board of Directors, Mr. Wong, acting as the sole Director, to fill the vacancies created by Mr. Chiang’s resignations, appointed himself as Chairman of the Board of Directors, President, and Chief Executive Officer. Further, acting as the Board of Directors, he also appointed Khoo Mae Ling as Chief Financial Officer, and Secretary. Cornelius Ee as Vice President of Information Technology.

As previously disclosed on Form 8-K on April 14, 2015, the company on March 16, 2015 filed a Certificate of Amendment (the “Amendment”) to the Certificate of Incorporation with the Secretary of State of the State of Delaware to change the name of the Registrant to EliteSoft Global Inc.

We are currently a development stage company with minimal revenues and operations.

As we are commencing as a public company, we plan to raise capital by offering shares of our common stock to investors. During the next twelve months, we anticipate we will need to pursue capital of at least $1 million dollars to fund our operations. We believe we will be able to raise the necessary capital to carry out our business plans, but can make no assurance that we will be able to do so.

Overview

We are a development stage company with minimal revenues. We were formerly known as ANDES 3Inc and amended our name to reflect our operations. We are an information technology (IT) web, systems integration and applications solutions company. We combine leading technology and draw upon our experience as professional IT specialists to create, design, develop and maintain corporate websites, e-commerce, social media strategies, server monitoring and supply computer hardware equipment on a global basis. We work to achieve this mission by using technology that is scalable, off-the-shelf, customizable, and communicates a clear message to our clients target market. We market third-party vendor software, IT services, and hardware that deliver new opportunities, greater convenience, and enhanced value to our client's business. We have also established our in-house research and development (R&D) team to focus on e-commerce solutions, mobile payment, and financial services as an increasing effort for our company to provide full life cycle solutions to clients. The company maintains an office in Kuala Lumpur, Malaysia, as its primary business focus is obtaining and servicing clients within the Asia-Pacific region.

We currently generate revenue by providing web and IT services to two clients. We entered into an Assignment Assumption Agreement with ESA for which we acquired the NZ Financial Limited Technology Services Agreement whereby we support their initiatives with developing, designing, and maintaining their e-commerce website, create their corporate image, supply necessary computer hardware equipment, monitor their server, and develop their social media strategies. Our agreement generates approximately $2,000 per month with NZ Financial Limited. We generate $3,963 per month through our Technology Services Agreement with Youthlite Sdn Bhd, a company incorporated under the laws of Malaysia. Under this agreement, we are responsible for the following: (a) Creation and design of corporate images and materials, (b) Design and development of the Youthlite website, (c) Development of e-commerce software for sales transactions, (d) Provide required computer hardware to operate its online business, (e) 24/7 server monitoring, (f) Create social media strategy via Facebook, Twitter, Instagram, (g) Provide video production services for infomercials.

Our market opportunity is in Asia and in particular, countries such as Singapore, Thailand, Indonesia, Japan, Hong Kong, Korea, and China. We also find that markets in New Zealand and Australia are favorable to our industry as well. The company maintains an office in Kuala Lumpur, Malaysia, as its primary business focus is obtaining and servicing clients within the Asia-Pacific region.

| 17 |

Our primary goals are to become the leading IT services company in Asia with a strong focus on the financial sector, e-commerce, business-web-based training and certification. We currently generate revenue by customizing, integrating, delivering and supporting a range of IT web, systems integration, e-commerce and mobile payment platforms. We purchase software and hardware from vendors such as Dell, Lenovo, Samsung, Apple, Acer and ASUS which are delivered to us for integration at our 2,000 sqft office located in Kuala Lumpur, Malaysia.

Quantitative and Qualitative Disclosures about Market Risk.

We have not utilized any derivative financial instruments such as futures contracts, options and swaps, forward foreign exchange contracts or interest rate swaps and futures. We believe that adequate controls are in place to monitor any hedging activities. We do not have any borrowings and, consequently, we are not affected by changes in market interest rates. While all of our current sales are outside the United States, all of our current sales are settled with US currency, and while we own limited assets and operate facilities in countries outside the United States, we have not been affected by foreign currency fluctuations or exchange rate changes. Overall, we believe that our exposure to interest rate risk and foreign currency exchange rate changes is not material to our financial condition or results of operations.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ("US GAAP"). US GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expenses amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

We believe the following is among the most critical accounting policies that impact our consolidated financial statements. We suggest that our significant accounting policies, as described in our financial statements in the Summary of Significant Accounting Policies, be read in conjunction with this Management's Discussion and Analysis of Financial Condition and Results of Operations.

Income Taxes

The Company accounts for income taxes in accordance with ASC Topic 740, “Income Taxes.” ASC 740 requires a company to use the asset and liability method of accounting for income taxes, whereby deferred tax assets are recognized for deductible temporary differences, and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion, or all of, the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Under ASC 740, a tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s consolidated financial statements.

| 18 |

Recent Accounting Pronouncements

In April 2014, the FASB issued Accounting Standards Update No. 2014-08 (ASU 2014-08), Presentation of Financial Statements (Topic 205) and Property, Plant and Equipment (Topic 360). ASU 2014-08 amends the requirements for reporting discontinued operations and requires additional disclosures about discontinued operations. Under the new guidance, only disposals representing a strategic shift in operations or that have a major effect on the Company's operations and financial results should be presented as discontinued operations. This new accounting guidance is effective for annual periods beginning after December 15, 2014. The Company is currently evaluating the impact of adopting ASU 2014-08 on the Company's results of operations or financial condition.

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2014-09 (ASU 2014-09), Revenue from Contracts with Customers. ASU 2014-09 will eliminate transaction- and industry-specific revenue recognition guidance under current U.S. GAAP and replace it with a principle based approach for determining revenue recognition. ASU 2014-09 will require that companies recognize revenue based on the value of transferred goods or services as they occur in the contract. The ASU also will require additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. ASU 2014-09 is effective for reporting periods beginning after December 15, 2016, and early adoption is not permitted. Entities can transition to the standard either retrospectively or as a cumulative-effect adjustment as of the date of adoption. Management is currently assessing the impact the adoption of ASU 2014-09 and has not determined the effect of the standard on our ongoing financial reporting.

In August 2014, the FASB issued Accounting Standards Update No. 2014-15 (ASU 2014-15), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which provides guidance on determining when and how to disclose going-concern uncertainties in the financial statements. The new standard requires management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date the financial statements are issued. An entity must provide certain disclosures if conditions or events raise substantial doubt about the entity’s ability to continue as a going concern. The ASU applies to all entities and is effective for annual periods ending after December 15, 2016, and interim periods thereafter, with early adoption permitted. The Company is currently evaluating the impact the adoption of ASU 2014-15 on the Company’s financial statement presentation and disclosures.

In November 2014, the FASB issued Accounting Standards Update No. 2014-16 (ASU 2014-16), Determining Whether the Host Contract in a Hybrid Financial Instrument Issued in the Form of a Share Is More Akin to Debt or to Equity. The amendments in this ASU do not change the current criteria in U.S. GAAP for determining when separation of certain embedded derivative features in a hybrid financial instrument is required. The amendments clarify that an entity should consider all relevant terms and features, including the embedded derivative feature being evaluated for bifurcation, in evaluating the nature of the host contract. The ASU applies to all entities that are issuers of, or investors in, hybrid financial instruments that are issued in the form of a share and is effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted.

In January 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-01 (Subtopic 225-20) - Income Statement - Extraordinary and Unusual Items. ASU 2015-01 eliminates the concept of an extraordinary item from GAAP. As a result, an entity will no longer be required to segregate extraordinary items from the results of ordinary operations, to separately present an extraordinary item on its income statement, net of tax, after income from continuing operations or to disclose income taxes and earnings-per-share data applicable to an extraordinary item. However, ASU 2015-01 will still retain the presentation and disclosure guidance for items that are unusual in nature and occur infrequently. ASU 2015-01 is effective for periods beginning after December 15, 2015. The adoption of ASU 2015-01 is not expected to have a material effect on the Company’s consolidated financial statements. Early adoption is permitted.

In February, 2015, the FASB issued Accounting Standards Update (ASU) No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. ASU 2015-02 provides guidance on the consolidation evaluation for reporting organizations that are required to evaluate whether they should consolidate certain legal entities such as limited partnerships, limited liability corporations, and securitization structures (collateralized debt obligations, collateralized loan obligations, and mortgage-backed security transactions). ASU 2015-02 is effective for periods beginning after December 15, 2015. The adoption of ASU 2015-02 is not expected to have a material effect on the Company’s consolidated financial statements. Early adoption is permitted

| 19 |

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company's present or future financial statements.

Liquidity and Capital Resources

Since our inception we relied primarily from our former President, Chief Executive Officer and Chairman of the Board of Directors. Since February 20, 2015, we relied primarily on related party loans from Mr. Chang Ku Ee, a director of ESA. To date, he has extended $50,000 to the company. During the quarter ended June 30, 2015, Mr. Cornelius Ee, Vice President ,Information Technology and Director of the Company, advanced the Company $3,331 for general operating expenses. The advance is unsecured, non-interest bearing and has no specific terms of repayment. As of June 30, 2015, the Company owed $3,331 to Mr. Cornelius Ee.

ITEM 3. PROPERTIES.

The Company through a two year lease agreement occupies a 2,000 square foot facility in Kuala Lumpur, Malaysia for approximately $2,500 per month.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the date of this Report, there were 12,000,000 shares of common stock issued and outstanding. The following table sets forth certain information regarding the beneficial ownership of the outstanding shares as of the date of this Report, (i) each of our executive officers and directors; and (ii) all of our executive officers and directors as a group.

Except as otherwise indicated, each such person has investment and voting power with respect to such shares, subject to community property laws where applicable. The address of all individuals for whom an address is not otherwise indicated is 18582 NW Holly Street, Unit 202 Beaverton, OR 97006-7014.

| Name of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership |

Percent (%) of Common Stock | |||||

| Named Executive Officers | |||||||