Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EUROSITE POWER INC. | eusp201509038-k.htm |

INVESTOR PRESENTATION TICKER: EUSP Menzies Hotels - Welcombe Hotel & Spa, Stratford upon Avon POWER TO PROFIT Menzies Hotels - Welcombe Hotel & Spa, Stratford upon Avon

DR. JOHN N. HATSOPOULOS Chairman of the Board 2 Rodman & Renshaw 17th Annual Global Investor Conference September 2015

Confidential and proprietary information. FORWARD LOOKING STATEMENTS 3 We have made statements in this presentation that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investments objectives, plans and current expectations. Any statements in this presentation that are not statements of historical fact are forward-looking statements (including, but not limited to, statements regarding our future financial performance, our estimated 2013 revenue, statements concerning scaling our business, expected revenue leverage, the characteristics and growth of markets and customers, our objectives and plans for future operations, technology developments and products and our expected liquidity and capital resources). We have based these forward-looking statements on our current expectations and projections about future events at the time of such statements. Although we believe that the expectations underlying our forward- looking statements are reasonable, these expectations may prove to be incorrect, and all of these statements are subject to risks and uncertainties. Therefore, you should not place undue reliance on our forward-looking statements. You should pay particular attention to the risk factors that are included in our SEC filings. We believe these risks and uncertainties could cause actual results or events to differ materially from the forward- looking statements that we make. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections or expectations prove incorrect, actual results, performance or financial condition may vary materially and adversely from those anticipated, estimated or expected. Our forward- looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. Except as required by law, we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Confidential and proprietary information. EUROSITE POWER AT A GLANCE 4 EuroSite Power (OTCQB:EUSP) owns and operates clean, on-site energy systems that produce electricity, hot water, heat and cooling. UK based subsidiary mirroring parent company’s successful US operation These systems save commercial building operators money on their energy, heating and cooling needs. The Company’s business model (“On-Site Utility™”) is to own and install the equipment and sell the energy produced to customers on a long-term contract. On-Site Utility™ - eliminates commercial buildings’ expenditures to operate or replace their energy, heating, or cooling equipment. EUSP assumes responsibility for operating energy systems onsite. Target customers include health care facilities, hotels, leisure & sports facilities, multi-family housing and education.

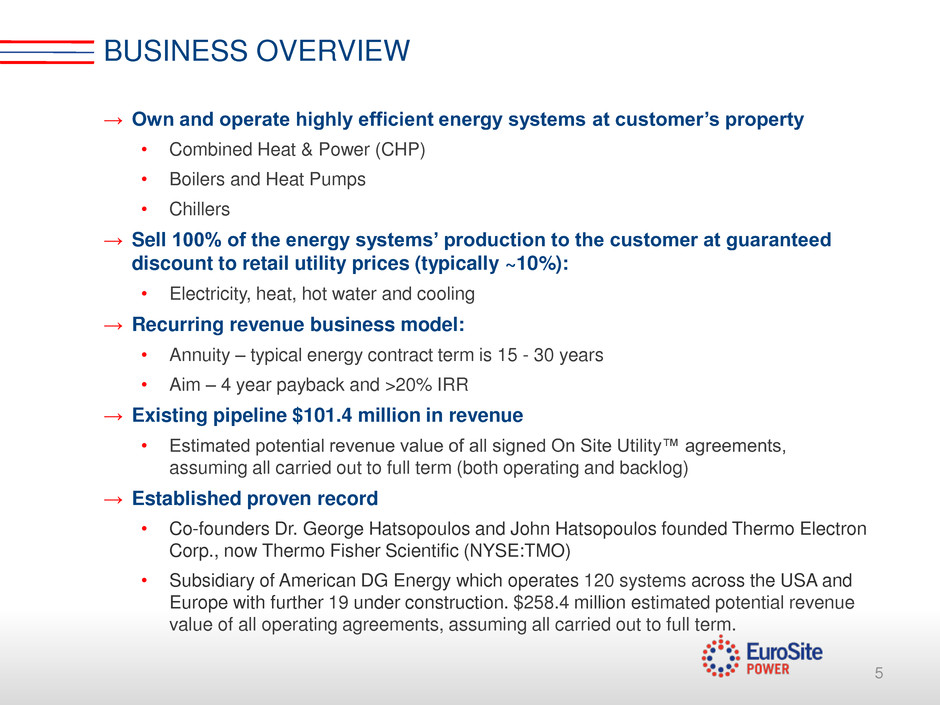

Confidential and proprietary information. BUSINESS OVERVIEW 5 → Own and operate highly efficient energy systems at customer’s property • Combined Heat & Power (CHP) • Boilers and Heat Pumps • Chillers → Sell 100% of the energy systems’ production to the customer at guaranteed discount to retail utility prices (typically ~10%): • Electricity, heat, hot water and cooling → Recurring revenue business model: • Annuity – typical energy contract term is 15 - 30 years • Aim – 4 year payback and >20% IRR → Existing pipeline $101.4 million in revenue • Estimated potential revenue value of all signed On Site Utility™ agreements, assuming all carried out to full term (both operating and backlog) → Established proven record • Co-founders Dr. George Hatsopoulos and John Hatsopoulos founded Thermo Electron Corp., now Thermo Fisher Scientific (NYSE:TMO) • Subsidiary of American DG Energy which operates 120 systems across the USA and Europe with further 19 under construction. $258.4 million estimated potential revenue value of all operating agreements, assuming all carried out to full term.

Confidential and proprietary information. 19 x Hospitality 1,915kWe 1 x Healthcare – 100kWe 16 x Leisure & Sports – 1,745kWe EUROSITE POWER IN ACTION 6

Confidential and proprietary information. Operating 28 Under construction 8 Total 36 CONTRACTED ENERGY SYSTEMS 7 UK Operation

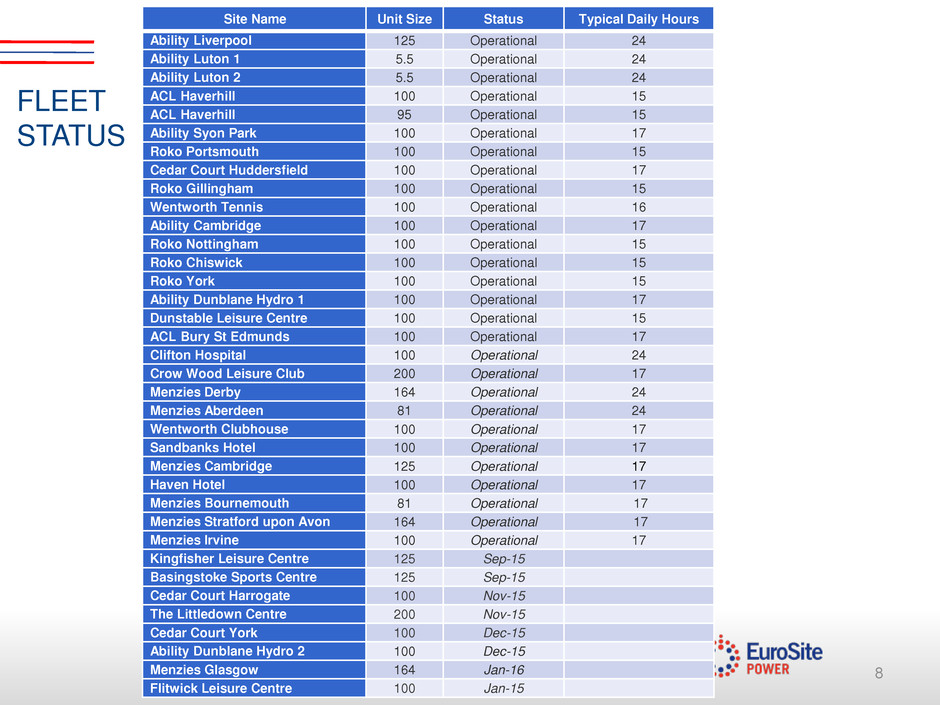

Confidential and proprietary information. 8 FLEET STATUS Site Name Unit Size Status Typical Daily Hours Ability Liverpool 125 Operational 24 Ability Luton 1 5.5 Operational 24 Ability Luton 2 5.5 Operational 24 ACL Haverhill 100 Operational 15 ACL Haverhill 95 Operational 15 Ability Syon Park 100 Operational 17 Roko Portsmouth 100 Operational 15 Cedar Court Huddersfield 100 Operational 17 Roko Gillingham 100 Operational 15 Wentworth Tennis 100 Operational 16 Ability Cambridge 100 Operational 17 Roko Nottingham 100 Operational 15 Roko Chiswick 100 Operational 15 Roko York 100 Operational 15 Ability Dunblane Hydro 1 100 Operational 17 Dunstable Leisure Centre 100 Operational 15 ACL Bury St Edmunds 100 Operational 17 Clifton Hospital 100 Operational 24 Crow Wood Leisure Club 200 Operational 17 Menzies Derby 164 Operational 24 Menzies Aberdeen 81 Operational 24 Wentworth Clubhouse 100 Operational 17 Sandbanks Hotel 100 Operational 17 Menzies Cambridge 125 Operational 17 Haven Hotel 100 Operational 17 Menzies Bournemouth 81 Operational 17 Menzies Stratford upon Avon 164 Operational 17 Menzies Irvine 100 Operational 17 Kingfisher Leisure Centre 125 Sep-15 Basingstoke Sports Centre 125 Sep-15 Cedar Court Harrogate 100 Nov-15 The Littledown Centre 200 Nov-15 Cedar Court York 100 Dec-15 Ability Dunblane Hydro 2 100 Dec-15 Menzies Glasgow 164 Jan-16 Flitwick Leisure Centre 100 Jan-15

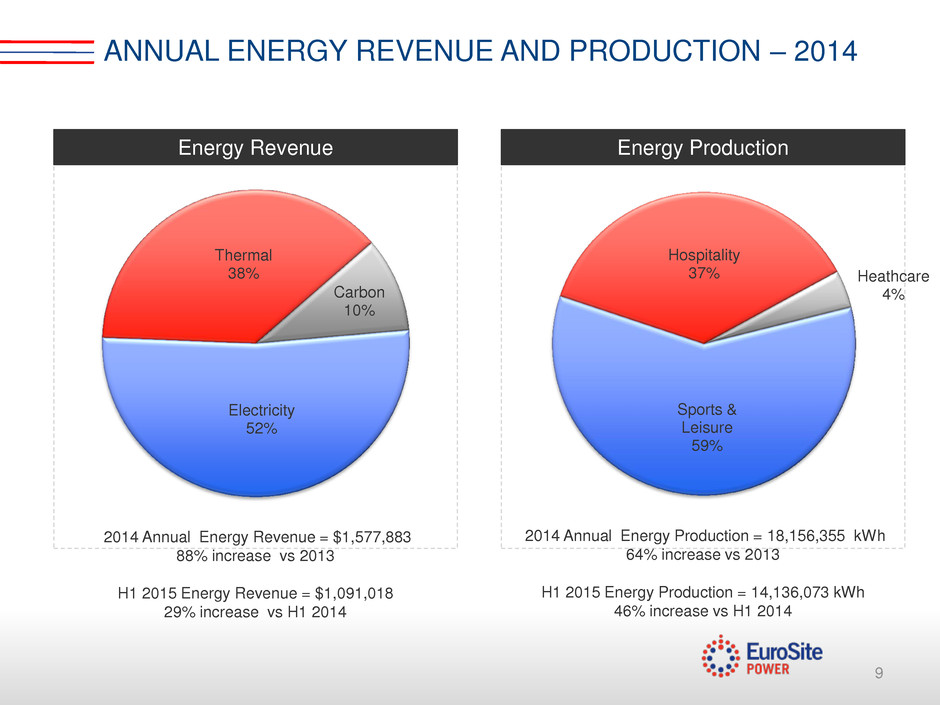

Confidential and proprietary information. ANNUAL ENERGY REVENUE AND PRODUCTION – 2014 9 Sports & Leisure 59% Hospitality 37% Heathcare 4% Energy Revenue Energy Production TO BE INSERTED 2014 Annual Energy Production = 18,156,355 kWh 64% increase vs 2013 H1 2015 Energy Production = 14,136,073 kWh 46% increase vs H1 2014 Electricity 52% Thermal 38% Carbon 10% 2014 Annual Energy Revenue = $1,577,883 88% increase vs 2013 H1 2015 Energy Revenue = $1,091,018 29% increase vs H1 2014

Confidential and proprietary information. COMPELLING CUSTOMER VALUE PROPOSITION 10 → Guaranteed lower energy costs – typically 10% discount to utility rates → Immediate positive cash flow and increased net income → No cost alternative to purchasing energy equipment → No capital, budget or financing required → No operating costs; pay only for energy used → No maintenance, staffing, or other operational responsibilities → Low carbon technology delivers green, sustainable solutions → Back-up power for blackouts and energy shortages → Extended boiler/mechanical plant life and lower maintenance costs

Confidential and proprietary information. COMPETITIVE ADVANTAGES 11 → Not a manufacturer but a utility provider Customer and EuroSite Power objectives aligned Ensures we always use the right technology applied correctly Access to the best technology Exclusive agreement for Tecogen technology → Guaranteed energy discount rates Discounts locked into contract Customer saves irrespective of how much energy is produced → Rebalances risk for the customer EuroSite Power pays for the fuel/power used by its solution Maintenance and repair costs EuroSite Power responsibility Customer pays only for the energy produced, no minimum payment → Maximum use of incentives Uniquely allows benefits under CRC Energy Efficiency Scheme Removes burden of complex CCL administration

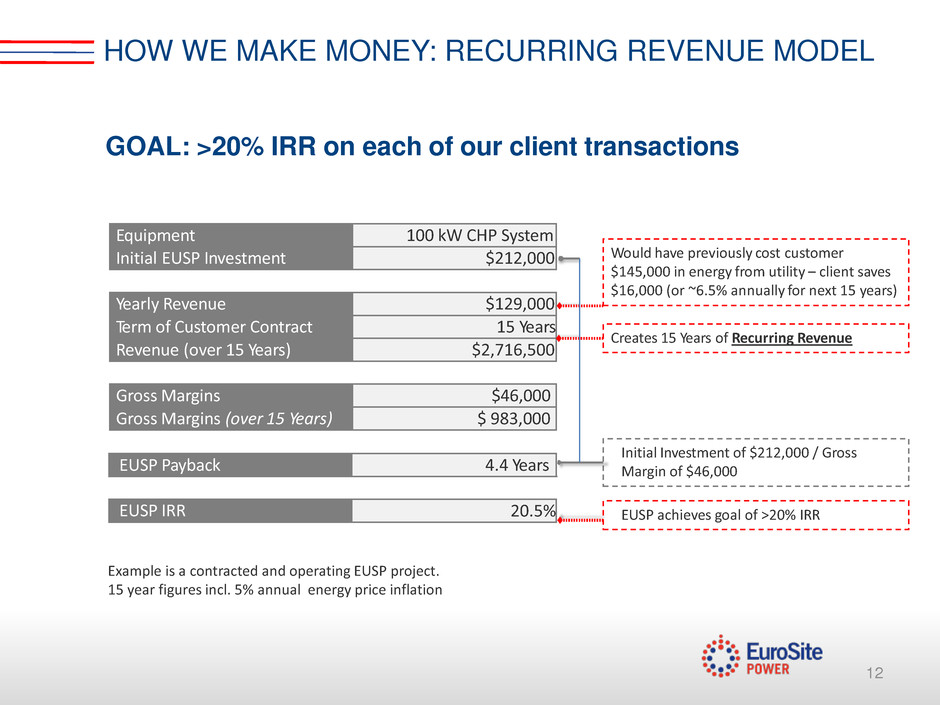

Confidential and proprietary information. Equipment 100 kW CHP System Initial EUSP Investment $212,000 Yearly Revenue $129,000 Term of Customer Contract 15 Years Revenue (over 15 Years) $2,716,500 12 HOW WE MAKE MONEY: RECURRING REVENUE MODEL GOAL: >20% IRR on each of our client transactions EUSP Payback EUSP IRR 4.4 Years 20.5% Would have previously cost customer $145,000 in energy from utility – client saves $16,000 (or ~6.5% annually for next 15 years) Creates 15 Years of Recurring Revenue Initial Investment of $212,000 / Gross Margin of $46,000 EUSP achieves goal of >20% IRR Gross Margins $46,000 Gross Margins (over 15 Years) $ 983,000 Example is a contracted and operating EUSP project. 15 year figures incl. 5% annual energy price inflation

Confidential and proprietary information. TECHNOLOGY RANGE 13 The Company’s product offerings include an array of efficient and innovative energy, heating and cooling systems. Combined Heat and Power (CHP) Generates electricity, heat and hot water Standby power Low emissions and low carbon 15kW – 500kW Chillers Generates chilled water for air conditioning and process needs Electric & Gas 200kW – 1,400kW Hot Water & Heat Heat pumps Highly efficient boilers Conversions from LPG, oil & steam

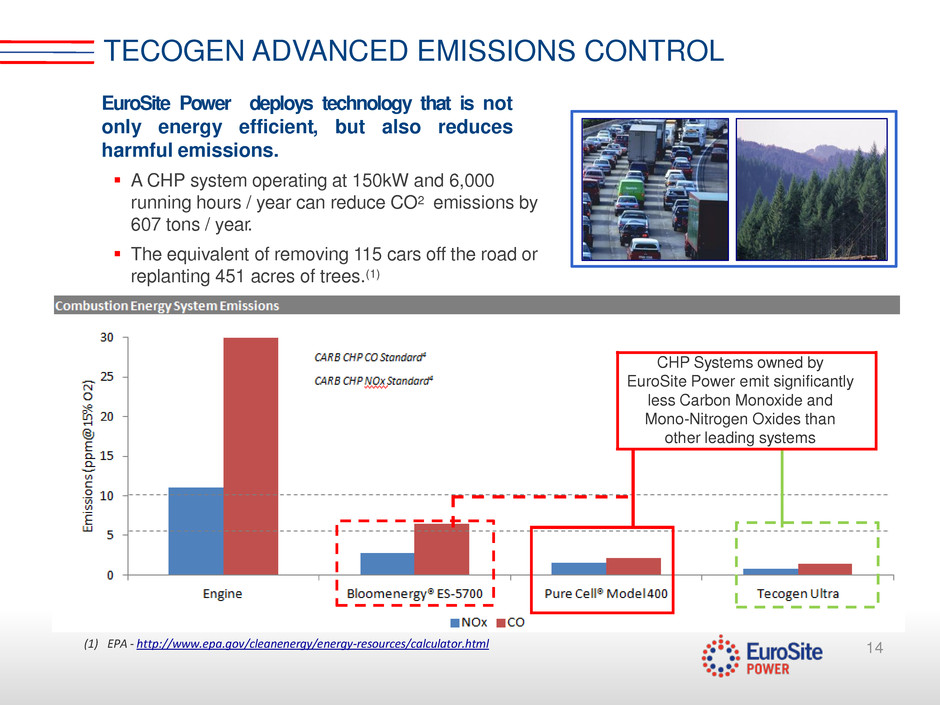

Confidential and proprietary information. TECOGEN ADVANCED EMISSIONS CONTROL 14 EuroSite Power deploys technology that is not only energy efficient, but also reduces harmful emissions. A CHP system operating at 150kW and 6,000 running hours / year can reduce CO2 emissions by 607 tons / year. The equivalent of removing 115 cars off the road or replanting 451 acres of trees.(1) (1) EPA - http://www.epa.gov/cleanenergy/energy-resources/calculator.html CHP Systems owned by EuroSite Power emit significantly less Carbon Monoxide and Mono-Nitrogen Oxides than other leading systems

Confidential and proprietary information. EuroSite Power owns and operates CHP systems that are significantly more efficient than other methods of energy production – including the traditional electric grid and boilers. Electric Grid (32% Efficient) EUSP CHP Systems 88% Efficient Traditional Energy & Hot Water Set Up (Commercial) EUSP Energy & Hot Water Set-Up (Commercial) Cleaner High-efficiency Cost effective Independent grid and energy security Commercial Customer HIGH EFFICIENCY: CHP VERSUS UTILITY + BOILER 15 Boiler (65% Efficient)

Confidential and proprietary information. Fuel (natural gas) Combined heat and power generation (“CHP”) systems are highly efficient units that provide lower electricity and heating expenditures for customers from the production of electricity and simultaneous output of hot water and heat. A single energy source (natural gas) is used to run an engine that creates electricity + heat ₋ Heat is harnessed and processed to deliver hot water + space heat Typically provides 40-50% of electricity needs of a building – (site continues to be able to access electricity from the grid) Typically provides 70-80% of thermal needs of a building – (hot water, space heating, laundry, pool heating) Input Outputs Heat Hot Water Electricity HOW DOES CHP WORK? 16

Confidential and proprietary information. EUSP SALES PIPELINE – “HOT” 17 Type Properties kW Tons Therms Annual Revenue Potential Village Hotels Hotel 25 2,940 $3,822,000 DeVere Hotels Hotel 4 600 $780,000 Shiva Hotels Hotel 3 600 $780,000 1Life - additional sites Athletic 2 200 $260,000 Jupiter Hotels Hotel 3 500 $650,000 The Grove Hotel 1 400 $520,000 Freedom Active Athletic 1 300 $390,000 SLM Athletic 3 300 $390,000 Sheffield International Venues Athletic 2 300 $390,000 Topland Group - Hallmark Hotels Hotel 5 400 $520,000 Royal Household Other 2 240 $312,000 St Georges Hospital, Morpeth Healthcare 1 200 $260,000 David Lloyd Leisure Athletic 2 200 $260,000 Greenwich Leisure Athletic 5 500 6 $725,000 Rafayel Hotel Hotel 1 100 $130,000 Celtic Manor Hotel Hotel 1 120 $156,000 Ability Group - additional sites Hotel 2 150 $195,000 Swan Housing Association Housing 1 400 $520,000 Virgin Active - initial sites Athletic 2 200 $260,000 Sunderland Leisure Centre Athletic 1 140 $182,000 Addlestone DH Athletic 1 100 $130,000 Total 68 8,890 0 6 $11,632,000

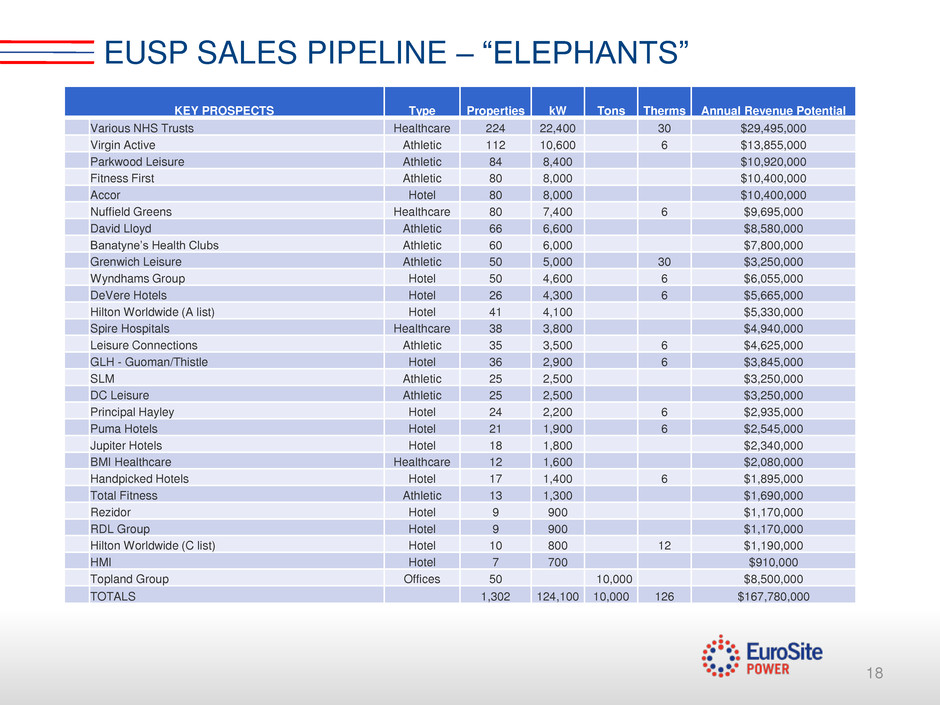

Confidential and proprietary information. EUSP SALES PIPELINE – “ELEPHANTS” 18 KEY PROSPECTS Type Properties kW Tons Therms Annual Revenue Potential Various NHS Trusts Healthcare 224 22,400 30 $29,495,000 Virgin Active Athletic 112 10,600 6 $13,855,000 Parkwood Leisure Athletic 84 8,400 $10,920,000 Fitness First Athletic 80 8,000 $10,400,000 Accor Hotel 80 8,000 $10,400,000 Nuffield Greens Healthcare 80 7,400 6 $9,695,000 David Lloyd Athletic 66 6,600 $8,580,000 Banatyne’s Health Clubs Athletic 60 6,000 $7,800,000 Grenwich Leisure Athletic 50 5,000 30 $3,250,000 Wyndhams Group Hotel 50 4,600 6 $6,055,000 DeVere Hotels Hotel 26 4,300 6 $5,665,000 Hilton Worldwide (A list) Hotel 41 4,100 $5,330,000 Spire Hospitals Healthcare 38 3,800 $4,940,000 Leisure Connections Athletic 35 3,500 6 $4,625,000 GLH - Guoman/Thistle Hotel 36 2,900 6 $3,845,000 SLM Athletic 25 2,500 $3,250,000 DC Leisure Athletic 25 2,500 $3,250,000 Principal Hayley Hotel 24 2,200 6 $2,935,000 Puma Hotels Hotel 21 1,900 6 $2,545,000 Jupiter Hotels Hotel 18 1,800 $2,340,000 BMI Healthcare Healthcare 12 1,600 $2,080,000 Handpicked Hotels Hotel 17 1,400 6 $1,895,000 Total Fitness Athletic 13 1,300 $1,690,000 Rezidor Hotel 9 900 $1,170,000 RDL Group Hotel 9 900 $1,170,000 Hilton Worldwide (C list) Hotel 10 800 12 $1,190,000 HMI Hotel 7 700 $910,000 Topland Group Offices 50 10,000 $8,500,000 TOTALS 1,302 124,100 10,000 126 $167,780,000

Confidential and proprietary information. TARGET MARKETS AND DRIVERS 19 Geographic Focus • United Kingdom • Broader European market • $1.5 billion annual market potential: $900 million electricity, $600 million heat Target Sectors • Hotels • NHS Hospitals & nursing homes • Leisure & Sports facilities • Multi-family residential • Manufacturing Key Drivers • Rising energy prices • Increased carbon taxes • Regulation and policy • Fears over security of supply • Need to be green Incentives • Climate Change Levy exemption • CRC Energy Efficiency Scheme • Renewables – RHI, FiT & RO • Enhanced Capital Allowances Sales Strategy • Property owners and “C” level • Direct sales • Strategic partnerships e.g. Dong Energy

Confidential and proprietary information. TECHNOLOGY DRIVERS 20 European Emissions Legislation • Increasing focus on air quality • Directive on industrial emissions 2010/75/EU – January 2014 • Directive on Large Combustion Plants – January 2016 • TA Luft 2002 – widely adopted across Europe (not UK) UK Emissions Regulations • Largely driven by European Directives • Environmental Permitting (England and Wales) Regulations 2010 • The Air Quality Regulations 2000 • Air Quality Management Areas Network Interface • Premium quality wave form, voltage and power factor for special applications • Exceed harmonic noise requirements • Streamlined G59/2 process due to unique inverter technology Building Regulations • Part L - Consideration of high-efficiency alternative systems for new buildings and refurbishments – specifically incudes CHP and heat pumps

Confidential and proprietary information. WHY EUROSITE POWER: MARKET OPPORTUNITY → Proven business model • Existing EUSP pipeline $101.4M in revenue from agreements already closed • Long term annuity style power purchase agreements • Operating fleet with blue chip customer base • Established delivery infrastructure → European market advantages • High energy prices, which are likely to increase further in the near future • Urban markets with high densities of buildings suitable for CHP systems • Additional income stream from selling carbon • Regulatory framework and government incentives favorable to CHP • Few competitors: Competition is focused on larger systems (>1 MW) • InVerde 100kW system is only inverter-based system on the market →Near-term target markets • 13,700 potential sites in the UK, Spain, and Belgium • $1.5 billion annual market potential: $900 million electricity, $600 million heat and hot water 21

Confidential and proprietary information. TOP 10 EUROPEAN TARGETS 22 €/kWh Incentives/Support Rank Country Spark Spred Electricity Rate Gas Rate Feed-in Tariff Certificate Scheme Capital Grants Energy Tax Exemption ECA Business Tax Exemption 1 Romania 3.53 0.075 0.021 2 Latvia 2.71 0.090 0.033 3 Estonia 2.34 0.079 0.034 4 Lithuania 2.31 0.096 0.041 5 Poland 2.10 0.078 0.037 6 Germany 2.07 0.084 0.041 7 Ireland 3.46 0.130 0.038 8 Italy 3.13 0.108 0.034 9 Slovakia 3.10 0.111 0.036 10 Turkey 3.05 0.072 0.024

Confidential and proprietary information. CONTACT INFORMATION 23 Principal Executive Offices: 45 First Avenue Waltham, MA 02451 United States P: 781-522-6000 F: 781-522-6050 European Headquarters: 54 Clarendon Road Watford WD17 1DU United Kingdom P: 0844-693-2848 info@eurositepower.co.uk www.eurositepower.com https://twitter.com/EurositePwr