Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED SEPT 3, 2015 - VERIFONE SYSTEMS, INC. | ex991q32015pressrelease.htm |

| 8-K - 8-K - VERIFONE SYSTEMS, INC. | form8-kitems202901932015.htm |

FINANCIAL RESULTS For the Third Quarter Ended July 31, 2015 Exhibit 99.2

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Verifone’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Verifone’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K and quarterly reports on Form 10-Q. Verifone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. FORWARD-LOOKING STATEMENTS 2

NON-GAAP FINANCIAL MEASURES 3 With respect to any non-GAAP financial measures presented in the information, reconciliations of non-GAAP to GAAP financial measures may be found in Verifone’s quarterly earnings release as filed with the Securities and Exchange Commission as well as the Appendix to these slides. Management uses non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these Non-GAAP financial measures help it to evaluate Verifone’s performance and to compare Verifone’s current results with those for prior periods as well as with the results of peer companies. These non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP.

INTRODUCTION Paul Galant Chief Executive Officer

Q3 BUSINESS HIGHLIGHTS 5 Record revenue quarter; first $500M+ quarter in company history 18% EPS growth over Q3FY14 North America: 3rd consecutive record quarter of $209M (61% YOY growth) EMEA: 6 European markets with double-digit constant currency growth Latin America: Driving services growth; new global gateway in Mexico Asia: 11% sequential growth; new Asia Pacific, China leaders Year of Product: Progress on next generation terminals and services platforms

TRANSFORMATION PROGRESS – YEAR TO DATE 6 Key Initiatives Product Portfolio Management R&D Re-Engineering Cost Optimization • Driving Global Product Mgmt • Reduced SKUs ~60% • Reduced active platforms from 13 to 8 • Divested non-core businesses • Expanding product portfolio • Verifone Engage • Developing full China product suite • Complete mPOS and mobile product family • Established Global R&D infrastructure • Created 10 Centers of Excellence • Unifying development environment • Consolidated R&D sites from 75 to 60 • Consolidating to next-generation payment gateway • Implemented R&D planning and resource system • Initiated 100 cost-savings projects • Additional restructuring plans announced in Q3 15 • Consolidating distribution, repair & warehouse operations • Refinanced debt with $1.3B agreement • Consolidated 11 data centers • Closed 28 facilities • Liquidated 22 of 134 legal entities • 62% of entities covered by financial shared services

WHAT WILL DRIVE GROWTH IN FY16 AND BEYOND? 7 U.S. EMV migration 3-year upgrade cycle; ~3% North America revenue growth in FY16 U.S. Mid-Tier/SMB ~7M devices still need to be upgraded (~2M of which are greenfield) U.S. Hospitality ~1M additional greenfield opportunity U.S. Petro ~$50M incremental revenue in FY16 (at-pump, site controller, media) Verifone Engage New device platform for interactive commerce; available 1H16 Mobility e355 available Q415; ~$35M incremental revenue in FY16 Next Gen Gateways Successful launch in Mexico; rollout in U.S. next Estate Management VHQ scaling globally Secure Commerce Architecture Over 25 SCA deals in Q3; pipeline of 220k connected devices Visa CyberSource Formal joint marketing begins Q4; client onboarding early 1H16 App Marketplace App ecosystem to launch in early 2016

Q3 FINANCIAL RESULTS AND GUIDANCE Marc Rothman Chief Financial Officer

NON-GAAP KEY METRICS* 9 * Net Income = Net Income attributable to VeriFone Systems, Inc. stockholders * Operating Cash Flow = GAAP net cash provided by operating activities * A reconciliation of our GAAP to Non-GAAP financial measures, including Free Cash Flow, can be found in the appendix section Q315 Q314 Q215 Q315 % SEQ Inc(Dec) % YoY Inc(Dec) Net Revenues 476 490 510 4% 7% Gross Margin 198 210 213 1% 7% % of Revenue 41.6% 42.8% 41.7% (1.1)pts 0.1pts Operating Income 63 69 72 3% 14% % of Revenue 13.2% 14.1% 14.0% (0.1)pts 0.8pts Net Income* 45 51 54 7% 20% EPS 0.40 0.44 0.47 7% 18% Operating Cash Flow* 59 56 71 27% 21% Free Cash Flow* 38 27 42 55% 10% $ in millions, except EPS

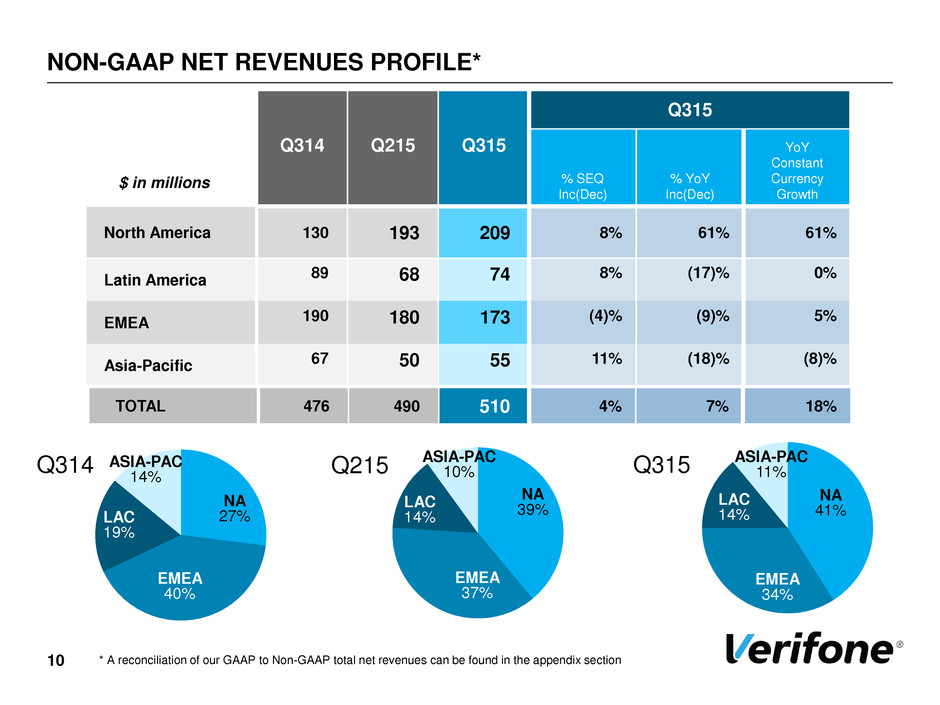

$ in millions NON-GAAP NET REVENUES PROFILE* Q315 Q314 Q215 Q315 % SEQ Inc(Dec) % YoY Inc(Dec) YoY Constant Currency Growth North America 130 193 209 8% 61% 61% Latin America 89 68 74 8% (17)% 0% EMEA 190 180 173 (4)% (9)% 5% Asia-Pacific 67 50 55 11% (18)% (8)% TOTAL 476 490 510 4% 7% 18% Q215 Q315 Q314 NA 27% ASIA-PAC 14% LAC 19% EMEA 40% NA 39% ASIA-PAC 10% LAC 14% EMEA 37% NA 41% ASIA-PAC 11% LAC 14% EMEA 34% 10 * A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section

NON-GAAP NET REVENUES AND GROSS MARGIN* $ in millions Q314 Q215 Q315 System Solutions 299 324 333 Services 177 166 177 Total Net Revenues 476 490 510 Services % of Total Net Revenues 37% 34% 35% $ in millions % of Revenue Q314 Q215 Q315 System Solutions 41.3% 43.1% 41.1% Services 42.1% 42.1% 42.9% Total Gross Margin % 41.6% 42.8% 41.7% 11 * A reconciliation of our GAAP to Non-GAAP Net revenues and gross margin can be found in the appendix section

NON-GAAP OPERATING EXPENSES* 12 * A reconciliation of our GAAP to Non-GAAP operating expenses can be found in the appendix section $ in millions Q314 Q215 Q315 Research and Development 46 46 49 % of Revenue 10% 9% 10% Sales and Marketing 47 51 50 % of Revenue 10% 10% 10% General and Administrative 42 43 42 % of Revenue 9% 9% 8% Total Operating Expenses 135 140 141 % of Revenue 28% 29% 28%

TOTAL CASH, GROSS DEBT AND NET DEBT Total Cash ($ in millions) 268 249 230 264 250 241 234 242 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Gross Debt ($ in millions) 1036 1001 940 924 883 863 843 814 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 814 As of July 31, 2015: $814M Outstanding Debt: – Short-term of $32M – Long-term of $782M Credit Ratings: – S&P . . . BB – Moody’s . . . Ba3 Net Debt ($ in millions) 768 752 710 660 633 622 609 572 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 13

Q314 Q215 Q315 $ Days $ Days $ Days Accounts Receivables, net 299 57 328 60 322 57 Inventories 113 37 129 43 122 38 Accounts Payable 143 46 171 55 150 45 Cash Conversion Cycle 47 48 49 $ in millions Notes: Accounts Receivable Days is calculated as Accounts Receivable, net divided by Non-GAAP Total Net Revenues * 90 days Inventory Days is calculated as Average Inventory divided by Non-GAAP Total Cost of Net Revenues * 90 days Accounts Payable Days is calculated as Accounts Payable divided by Non-GAAP Total Cost of Net Revenues * 90 days Cash Conversion Cycle is calculated as Accounts Receivable Days plus Inventory Days less Accounts Payable Days A reconciliation of our GAAP to Non-GAAP total net revenues and GAAP to Non-GAAP total cost of net revenues can be found in the appendix section BALANCE SHEET SELECT DATA 14

WORKING CAPITAL TREND Working Capital Performance* 17.7% 15.7% 14.3% 14.1% 13.7% 14.3% 14.6% 14.4% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Percent of S a le s Y/Y changes • AR increased $23M • Inventory increased $9M • AP increased $7M 15 * Working Capital Performance, as % of Non-GAAP Total Net Revenues = working capital / quarterly non-GAAP Total Net Revenues annualized • Working Capital = AR + Inventory – AP • A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section

55 32 57 59 52 41 56 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 CASH FLOW 71 38 11 36 38 29 22 27 42 Q413 Q114 Q214 Q314 Q414 Q115 Q215 Q315 Free Cash Flow* 42 ($ in millions) ($ in millions) Operating Cash Flow: $71M Free Cash Flow: $42M CapEx: ~$30M Operating Cash Flow* 16 * Operating Cash Flow = GAAP net cash provided by operating activities. Free Cash Flow is a non-GAAP financial measure * A reconciliation of our GAAP net cash provided by operating activities to Free Cash Flow can be found in the appendix section

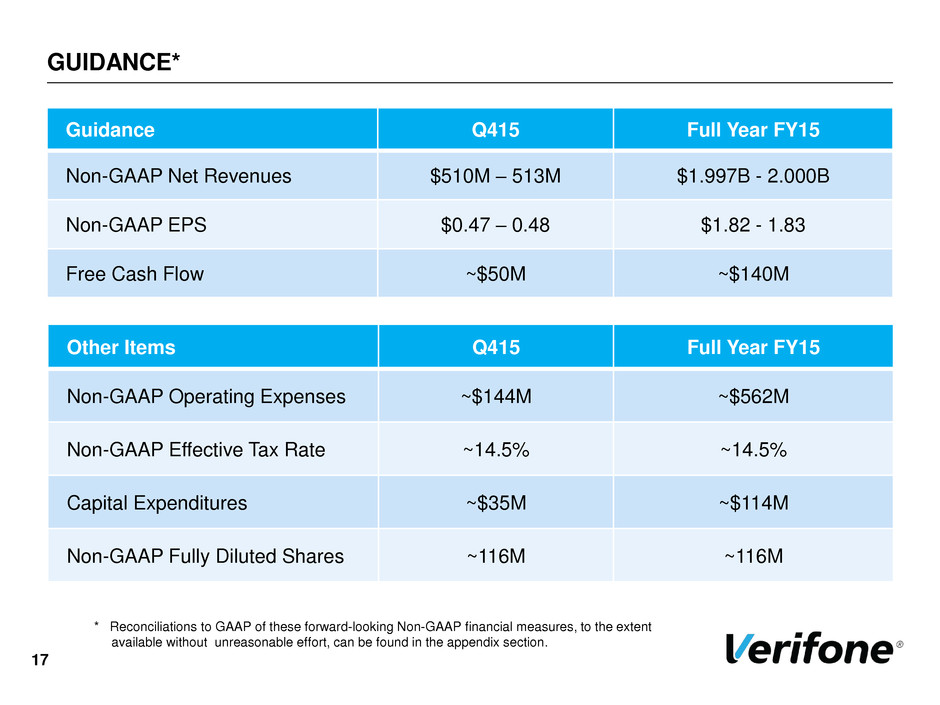

17 Guidance Q415 Full Year FY15 Non-GAAP Net Revenues $510M – 513M $1.997B - 2.000B Non-GAAP EPS $0.47 – 0.48 $1.82 - 1.83 Free Cash Flow ~$50M ~$140M Other Items Q415 Full Year FY15 Non-GAAP Operating Expenses ~$144M ~$562M Non-GAAP Effective Tax Rate ~14.5% ~14.5% Capital Expenditures ~$35M ~$114M Non-GAAP Fully Diluted Shares ~116M ~116M * Reconciliations to GAAP of these forward-looking Non-GAAP financial measures, to the extent available without unreasonable effort, can be found in the appendix section. GUIDANCE*

Q&A SESSION

APPENDIX

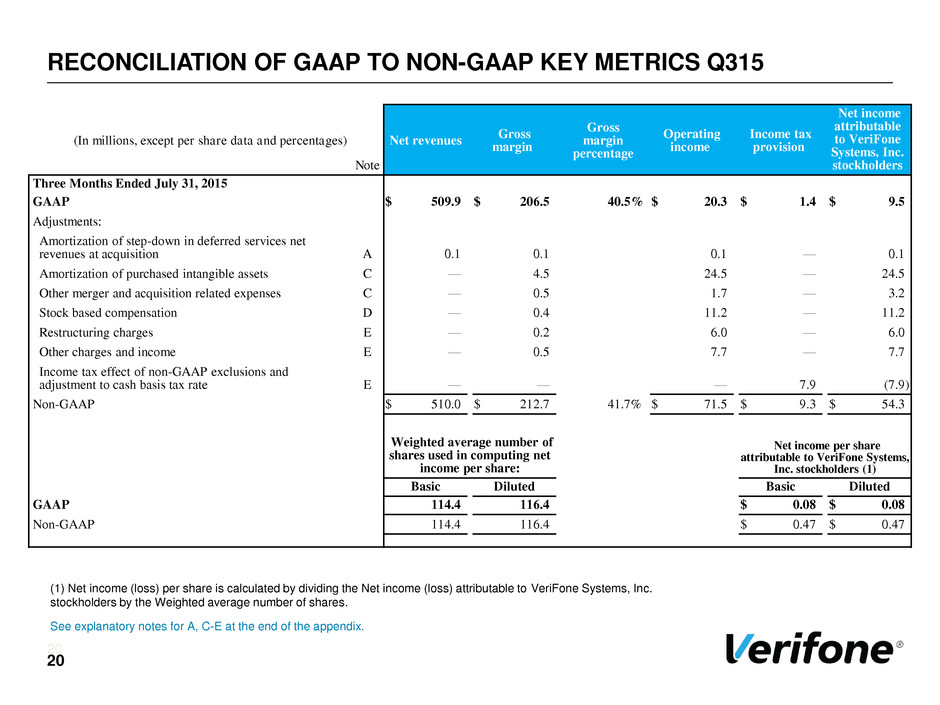

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q315 20 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-E at the end of the appendix. 20 (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income Income tax provision Net income attributable to VeriFone Systems, Inc. stockholders Three Months Ended July 31, 2015 GAAP $ 509.9 $ 206.5 40.5 % $ 20.3 $ 1.4 $ 9.5 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.1 0.1 0.1 — 0.1 Amortization of purchased intangible assets C — 4.5 24.5 — 24.5 Other merger and acquisition related expenses C — 0.5 1.7 — 3.2 Stock based compensation D — 0.4 11.2 — 11.2 Restructuring charges E — 0.2 6.0 — 6.0 Other charges and income E — 0.5 7.7 — 7.7 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 7.9 (7.9 ) Non-GAAP $ 510.0 $ 212.7 41.7 % $ 71.5 $ 9.3 $ 54.3 Weighted average number of shares used in computing net income per share: Net income per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 114.4 116.4 $ 0.08 $ 0.08 Non-GAAP 114.4 116.4 $ 0.47 $ 0.47

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q215 21 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-E at the end of the appendix. (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income Income tax provision Net income attributable to VeriFone Systems, Inc. stockholders Three Months Ended April 30, 2015 GAAP $ 490.1 $ 203.9 41.6 % $ 29.7 $ 1.4 $ 17.6 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.2 0.2 0.2 — 0.2 Amortization of purchased intangible assets C — 4.6 25.2 — 25.2 Other merger and acquisition related expenses C — 0.4 0.5 — 1.5 Stock based compensation D — 0.4 8.9 — 8.9 Restructuring charges E — — 0.2 — 0.2 Other charges and income E — 0.2 4.6 — 4.6 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 7.3 (7.3 ) Non-GAAP $ 490.3 $ 209.7 42.8 % $ 69.3 $ 8.7 $ 50.9 Weighted average number of shares used in computing net income per share: Net income per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 113.9 115.9 $ 0.15 $ 0.15 Non-GAAP 113.9 115.9 $ 0.45 $ 0.44

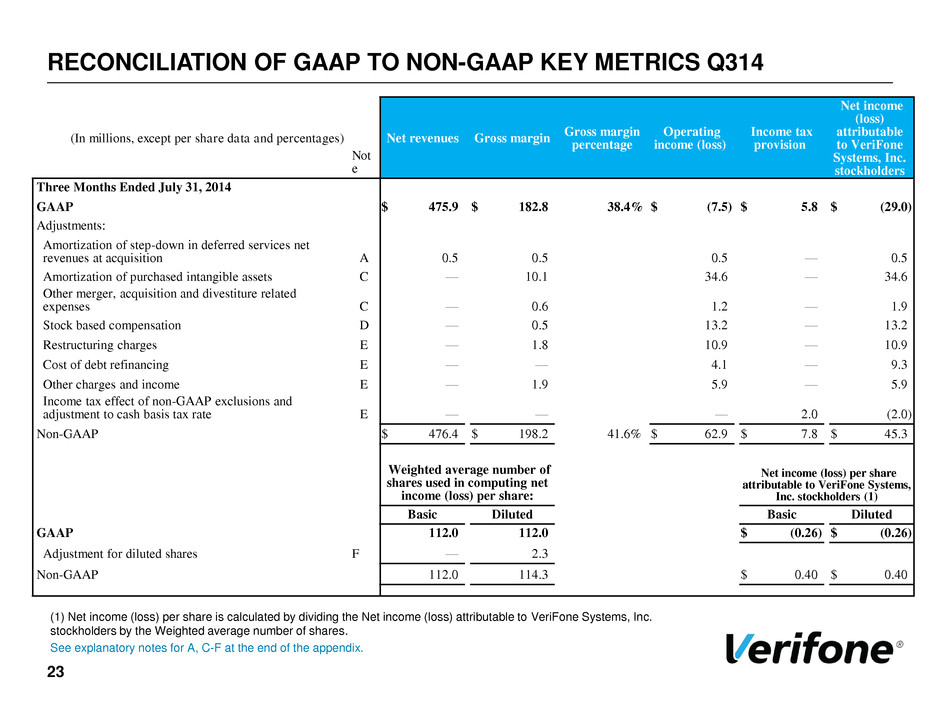

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q314 23 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, C-F at the end of the appendix. (In millions, except per share data and percentages) Not e Net revenues Gross margin Gross margin percentage Operating income (loss) Income tax provision Net income (loss) attributable to VeriFone Systems, Inc. stockholders Three Months Ended July 31, 2014 GAAP $ 475.9 $ 182.8 38.4 % $ (7.5 ) $ 5.8 $ (29.0 ) Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.5 0.5 0.5 — 0.5 Amortization of purchased intangible assets C — 10.1 34.6 — 34.6 Other merger, acquisition and divestiture related expenses C — 0.6 1.2 — 1.9 Stock based compensation D — 0.5 13.2 — 13.2 Restructuring charges E — 1.8 10.9 — 10.9 Cost of debt refinancing E — — 4.1 — 9.3 Other charges and income E — 1.9 5.9 — 5.9 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate E — — — 2.0 (2.0 ) Non-GAAP $ 476.4 $ 198.2 41.6 % $ 62.9 $ 7.8 $ 45.3 Weighted average number of shares used in computing net income (loss) per share: Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 112.0 112.0 $ (0.26 ) $ (0.26 ) Adjustment for diluted shares F — 2.3 Non-GAAP 112.0 114.3 $ 0.40 $ 0.40

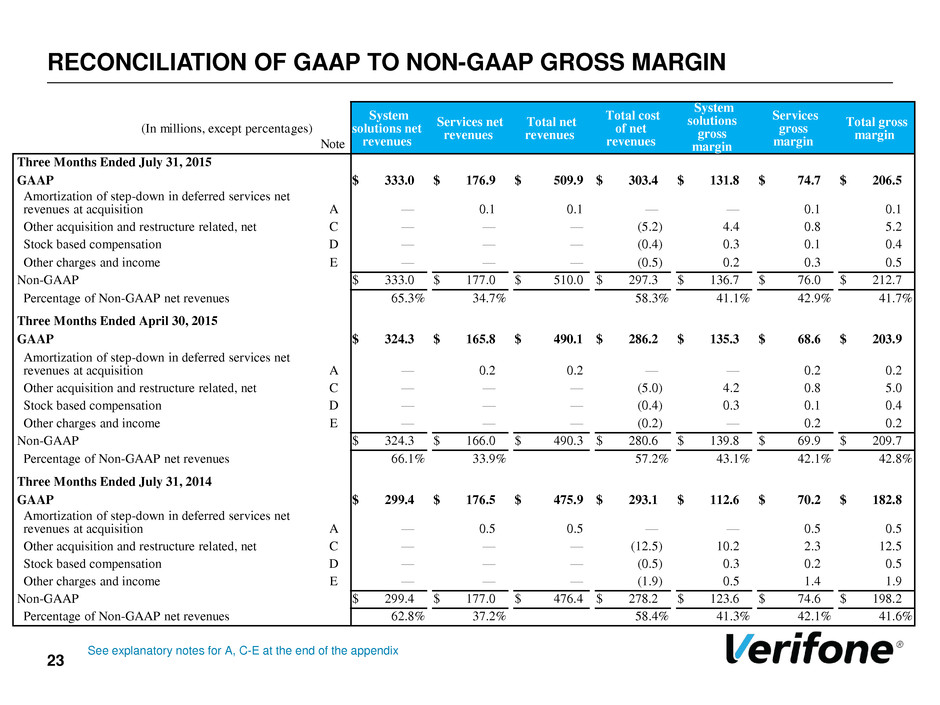

RECONCILIATION OF GAAP TO NON-GAAP GROSS MARGIN 23 See explanatory notes for A, C-E at the end of the appendix (In millions, except percentages) Note System solutions net revenues Services net revenues Total net revenues Total cost of net revenues System solutions gross margin Services gross margin Total gross margin Three Months Ended July 31, 2015 GAAP $ 333.0 $ 176.9 $ 509.9 $ 303.4 $ 131.8 $ 74.7 $ 206.5 Amortization of step-down in deferred services net revenues at acquisition A — 0.1 0.1 — — 0.1 0.1 Other acquisition and restructure related, net C — — — (5.2 ) 4.4 0.8 5.2 Stock based compensation D — — — (0.4 ) 0.3 0.1 0.4 Other charges and income E — — — (0.5 ) 0.2 0.3 0.5 Non-GAAP $ 333.0 $ 177.0 $ 510.0 $ 297.3 $ 136.7 $ 76.0 $ 212.7 Percentage of Non-GAAP net revenues 65.3 % 34.7 % 58.3 % 41.1 % 42.9 % 41.7 % Three Months Ended April 30, 2015 GAAP $ 324.3 $ 165.8 $ 490.1 $ 286.2 $ 135.3 $ 68.6 $ 203.9 Amortization of step-down in deferred services net revenues at acquisition A — 0.2 0.2 — — 0.2 0.2 Other acquisition and restructure related, net C — — — (5.0 ) 4.2 0.8 5.0 Stock based compensation D — — — (0.4 ) 0.3 0.1 0.4 Other charges and income E — — — (0.2 ) — 0.2 0.2 Non-GAAP $ 324.3 $ 166.0 $ 490.3 $ 280.6 $ 139.8 $ 69.9 $ 209.7 Percentage of Non-GAAP net revenues 66.1 % 33.9 % 57.2 % 43.1 % 42.1 % 42.8 % Three Months Ended July 31, 2014 GAAP $ 299.4 $ 176.5 $ 475.9 $ 293.1 $ 112.6 $ 70.2 $ 182.8 Amortization of step-down in deferred services net revenues at acquisition A — 0.5 0.5 — — 0.5 0.5 Other acquisition and restructure related, net C — — — (12.5 ) 10.2 2.3 12.5 Stock based compensation D — — — (0.5 ) 0.3 0.2 0.5 Other charges and income E — — — (1.9 ) 0.5 1.4 1.9 Non-GAAP $ 299.4 $ 177.0 $ 476.4 $ 278.2 $ 123.6 $ 74.6 $ 198.2 Percentage of Non-GAAP net revenues 62.8 % 37.2 % 58.4 % 41.3 % 42.1 % 41.6 %

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES 24 See explanatory notes for C-E at the end of the appendix (In millions, except percentages) Note Research and development Sales and marketing General and administrative Total Three Months Ended July 31, 2015 GAAP $ 54.2 $ 56.6 $ 55.4 $ 166.2 Other acquisition and restructure related, net C, E (3.4 ) (1.1 ) (2.6 ) (7.1 ) Stock based compensation D (1.7 ) (4.7 ) (4.4 ) (10.8 ) Other charges and income E — (0.9 ) (6.3 ) (7.2 ) Non-GAAP $ 49.1 $ 49.9 $ 42.1 $ 141.1 As a percentage of total Non-GAAP net revenues 10 % 10 % 8 % 28 % Three Months Ended April 30, 2015 GAAP $ 47.6 $ 55.3 $ 49.5 $ 152.4 Other acquisition and restructure related, net C, E — (0.1 ) (0.2 ) (0.3 ) Stock based compensation D (1.2 ) (3.5 ) (3.8 ) (8.5 ) Other charges and income E (0.1 ) (0.3 ) (2.9 ) (3.3 ) Non-GAAP $ 46.3 $ 51.4 $ 42.6 $ 140.3 As a percentage of total Non-GAAP net revenues 9 % 10 % 9 % 29 % Three Months Ended July 31, 2014 GAAP $ 53.2 $ 54.1 $ 58.5 $ 165.8 Other acquisition and restructure related, net C, E (4.8 ) (2.0 ) (2.7 ) (9.5 ) Stock based compensation D (2.1 ) (5.6 ) (5.0 ) (12.7 ) Cost of debt refinancing E — — (4.1 ) (4.1 ) Other charges and income E — 0.7 (4.9 ) (4.2 ) Non-GAAP $ 46.3 $ 47.2 $ 41.8 $ 135.3 As a percentage of total Non-GAAP net revenues 10 % 10 % 9 % 28 %

RECONCILIATION OF GAAP TO NON-GAAP NET REVENUES 25 See explanatory notes for A-B at the end of the appendix. $ in millions GAAP net revenues Amortization of step-down in deferred revenue at acquisition Non-GAAP net revenues Constant currency adjustment Non-GAAP net revenues at constant currency Note (A) (A) (B) (B) Three Months Ended July 31, 2015 North America $ 208.6 $ — $ 208.6 $ 1.2 $ 209.8 Latin America 73.7 — 73.7 15.1 88.8 EMEA 172.6 0.1 172.7 27.2 199.9 Asia-Pacific 55.0 — 55.0 6.5 61.5 Total $ 509.9 $ 0.1 $ 510.0 $ 50.0 $ 560.0 Three Months Ended April 30, 2015 North America $ 193.0 $ — $ 193.0 Latin America 68.1 — 68.1 EMEA 179.4 0.2 179.6 Asia-Pacific 49.6 — 49.6 Total $ 490.1 $ 0.2 $ 490.3 Three Months Ended July 31, 2014 North America $ 129.8 $ — $ 129.8 Latin America 89.2 — 89.2 EMEA 190.0 0.2 190.2 Asia-Pacific 66.9 0.3 67.2 Total $ 475.9 $ 0.5 $ 476.4

RECONCILIATION OF OPERATING CASH FLOW TO FREE CASH FLOW 26 See explanatory notes for G at the end of the appendix. Three Months Ended $ in millions Note July 31, 2015 April 30, 2015 January 31, 2015 October 31, 2014 Free Cash Flow GAAP net cash provided by operating activities G $ 71.4 $ 56.3 $ 41.1 $ 51.6 Less: GAAP capital expenditures G (29.6 ) (29.3 ) (19.6 ) (22.2 ) Free cash flow G $ 41.8 $ 27.0 $ 21.5 $ 29.4 Three Months Ended July 31, 2014 April 30, 2014 January 31, 2014 October 31, 2013 Free Cash Flow GAAP net cash provided by operating activities G $ 58.9 $ 56.5 $ 31.9 $ 54.9 Less: GAAP capital expenditures G (20.9 ) (21.0 ) (20.9 ) (17.2 ) Free cash flow G $ 38.0 $ 35.5 $ 11.0 $ 37.7

RECONCILIATION OF NET REVENUES GUIDANCE 27 See explanatory notes for A at the end of the appendix. Three Months Ending October 31, 2015 Year Ending October 31, 2015 Range of Guidance Range of Guidance GAAP net revenues $ 510 $ 513 $ 1,996 $ 1,999 Adjustments to net revenues A — — 1 1 Non-GAAP net revenues $ 510 $ 513 $ 1,997 $ 2,000

EXPLANATORY NOTES TO RECONCILIATIONS OF GAAP TO NON-GAAP ITEMS 28 Note A: Non-GAAP net revenues. Non-GAAP net revenues exclude the fair value decrease (step-down) in deferred revenue at acquisition. Note B: Non-GAAP net revenues at constant currency. Verifone determines non-GAAP net revenues at constant currency by recomputing non-GAAP net revenues denominated in currencies other than U.S. Dollars in the current fiscal period using average exchange rates for that particular currency during the corresponding financial period of the prior year. Verifone uses this non-GAAP measure to evaluate performance on a comparable basis excluding the impact of foreign currency fluctuations. Note C: Merger and Acquisition Related. Verifone adjusts certain revenues and expenses for items that are the result of merger and acquisitions. Acquisition related adjustments include the amortization of intangible assets, fixed asset fair value adjustments, contingent consideration adjustments, incremental costs associated with acquisitions, acquisition integration expenses and changes in estimate on contingencies that existed at the time of acquisition. Note D: Stock-Based Compensation. Our non-GAAP financial measures eliminate the effect of expense for stock-based compensation. Note E: Other Charges and Income. Verifone excludes certain revenue, expenses and other income (expense) that are the result of unique or unplanned events, such as litigation settlement and loss contingency expense, certain costs incurred in connection with senior executive management changes, certain personnel and outside professional service fees incurred on initiatives to transform, streamline and centralize our global operations, and restructure and impairment charges related to certain exit activities initiated as part of our global transformation initiatives and gain or loss on financial transactions, such as the accelerated amortization of capitalized debt issuance costs due to the early repayment of debt. In addition, income taxes are adjusted for the tax effect of the adjusting items related to our non-GAAP financial measures and to reflect our estimate of cash taxes on a non-GAAP basis. Under GAAP our Income tax provision (benefit) as a percentage of Income (loss) before income taxes was 12.6% for the fiscal quarter ended July 31, 2015, 7.6% for the fiscal quarter ended April 30, 2015, (25.5)% for the fiscal quarter ended July 31, 2014, 9.3% for the nine months ended July 31, 2015 and 2.7% for the nine months ended July 31, 2014. For non-GAAP purposes, we used a 14.5% rate for the fiscal quarters ended July 31, 2015, April 30, 2015 and July 31, 2014 and the nine months ended July 31, 2015 and 2014. Note F: Non-GAAP diluted shares. Diluted non-GAAP weighted average shares include additional shares that are dilutive for non-GAAP computations of earnings per share in periods when we have a non-GAAP net income and a GAAP basis net loss. Note G: Free Cash Flow. Verifone determines free cash flow as net cash provided by operating activities less capital expenditures.