Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Sientra, Inc. | a2225896zex-23_2.htm |

| EX-16.1 - EX-16.1 - Sientra, Inc. | a2225896zex-16_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on September 3, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sientra, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3842 (Primary Standard Industrial Classification Code Number) |

20-5551000 (I.R.S. Employer Identification Number) |

420 South Fairview Avenue, Suite 200

Santa Barbara, CA 93117

(805) 562-3500

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Hani Zeini

Founder, President and Chief Executive Officer

Sientra, Inc.

420 South Fairview Avenue, Suite 200

Santa Barbara, CA 93117

(805) 562-3500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| C. Thomas Hopkins, Esq. Charles J. Bair, Esq. Cooley LLP 1333 2nd Street, Suite 400 Santa Monica, CA 90401 (310) 883-6400 |

Matthew Pigeon Chief Financial Officer and Treasurer Joel Smith, Esq. General Counsel, Secretary and Chief Compliance Officer Sientra, Inc. 420 South Fairview Avenue, Suite 200 Santa Barbara, CA 93117 (805) 562-3500 |

Charles K. Ruck, Esq. Shayne Kennedy, Esq. Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, CA 92626 (714) 540-1235 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee |

||

|---|---|---|---|---|

Common Stock, $0.01 par value per share |

$86,250,000 | $10,023 | ||

|

||||

- (1)

- Includes

the additional shares that may be purchased by the underwriters pursuant to an option to purchase additional shares.

- (2)

- Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated September 3, 2015

Shares

| SIENTRA, INC. |

|

Common Stock

$ per share

- •

- Sientra, Inc. is offering shares of its common stock.

- •

- Trading symbol: The NASDAQ Global Select Market — SIEN.

- •

- The last reported sale price of our common stock on , 2015 was $ per share.

This investment involves risk. See "Risk Factors" beginning on page 13.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

|

|||||||||

Per Share |

Total |

||||||||

|---|---|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||||

Underwriting discounts and commissions(1) |

$ | $ | |||||||

Proceeds to Sientra, Inc., before expenses |

$ | $ | |||||||

|

|

|||||||||

(1) |

See "Underwriting" for additional information regarding underwriting compensation. |

||||||||

|

|||||||||

We have granted the underwriters an option to purchase up to additional shares of our common stock for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2015.

| Piper Jaffray | Stifel | |

Leerink Partners |

William Blair |

The date of this prospectus is , 2015.

You should rely only on the information contained in this prospectus or any related free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with different information. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus or incorporated herein by reference, is only accurate as of the date of this prospectus or the date of the document incorporated by reference, as applicable, regardless of the time of delivery of this prospectus and the sale of our common stock.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant made to you or for your benefit. Moreover, such representations, warranties or covenants were accurate only as of the date they were made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

i

Our trademark portfolio contains five registered U.S. trademarks, including Sientra®, Simplicity is Beauty®, Sientra Simplicity is Beauty®, Anatomical Controlled® and ACX®, and six Canadian trademark applications. This prospectus contains additional trademarks and trade names of others, which are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus or any document incorporated herein by reference are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that we will not assert, to the fullest extent under applicable law, our rights thereto.

Investors Outside of the United States

Neither we nor any of the underwriters have taken any action that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of our common stock and the distribution of this prospectus outside of the United States.

Market and Industry Data and Forecasts

Certain market and industry data and forecasts included or incorporated by reference in this prospectus were obtained from independent market research, industry publications and surveys, governmental agencies, publicly available information and Realself, Inc. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe the data from such third-party sources that is included in the prospectus or incorporated herein by reference to be reliable. However, we have not independently verified any of such data and cannot guarantee its accuracy or completeness and cannot assure you that the trends reflected in this data will continue. Similarly, internal market research and industry forecasts, which we believe to be reliable based upon our management's knowledge of the market and the industry, have not been verified by any independent sources. While we are not aware of any misstatements regarding the market or industry data presented herein or incorporated herein by reference, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2014 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, which are incorporated herein by reference, and "Special Note Regarding Forward-Looking Statements" in this prospectus.

On November 3, 2014, the Company completed an initial public offering, or IPO, whereby it sold a total of 5,750,000 shares of common stock at $15.00 per share inclusive of 750,000 shares sold to underwriters pursuant to the exercise in full of their option to purchase additional shares. The Company received net proceeds from the IPO of approximately $77.0 million, after deducting underwriting discounts and commissions and offering expenses of approximately $9.2 million. In connection with our IPO, our board of directors and stockholders approved an amendment to the Company's certificate of incorporation, which effected a 1 for 2.75 reverse stock split of the Company's issued and outstanding shares of common stock. All issued and outstanding shares of common stock, stock options and warrants and the related per share amounts were adjusted to reflect this reverse stock split for all periods presented. The outstanding shares of convertible preferred stock were converted on a 2.75-to-1 basis into shares of common stock concurrent with the closing of the IPO. All of the outstanding shares of Series A, Series B and Series C preferred stock converted into 8,942,925 shares of common stock. Following the closing of the IPO, there were no shares of preferred stock outstanding.

ii

This summary highlights information contained in other parts of this prospectus or incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2014, our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, and our other filings with the Securities and Exchange Commission listed in the section of the prospectus entitled "Incorporation of Certain Information by Reference." This summary does not contain all of the information you should consider in making your investment decision. Before deciding to invest in shares of our common stock, you should read the entire prospectus, the registration statement of which this prospectus is a part, and the information incorporated by reference herein in their entirety. You should carefully consider, among other things, the matters discussed in the sections entitled "Risk Factors" and "Selected Financial Data" included elsewhere in this prospectus and incorporated herein by reference and the matters discussed in our financial statements and the accompanying notes and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," in each case, incorporated by reference into this prospectus. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See "Special Note Regarding Forward-Looking Statements." Unless otherwise stated in this prospectus, references to "Sientra," "we," "us," "our" or "the Company" refer to Sientra, Inc.

Overview

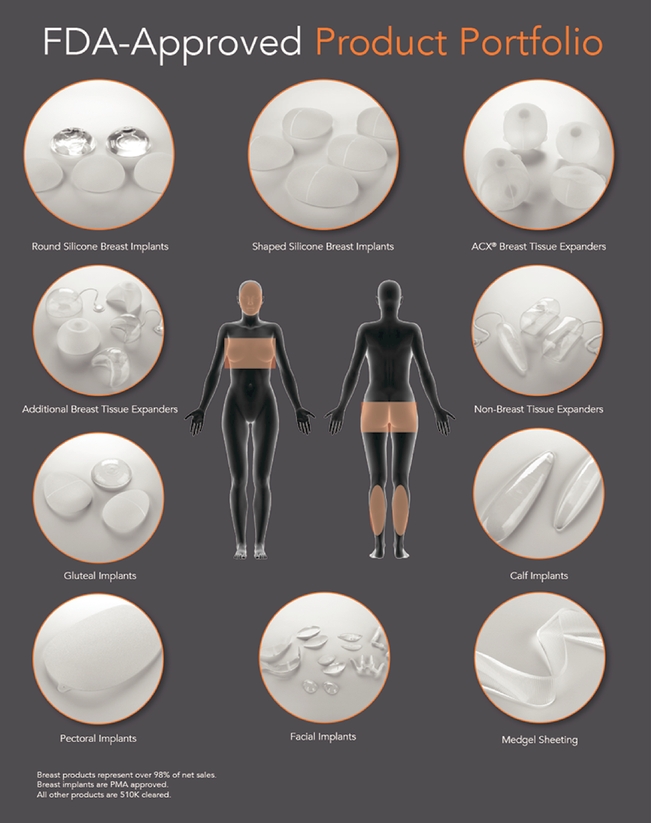

We are a medical aesthetics company committed to making a difference in patients' lives by enhancing their body image, growing their self-esteem and restoring their confidence. We were founded to provide greater choice to board-certified plastic surgeons and patients in need of medical aesthetics products. We have developed a broad portfolio of products with technologically differentiated characteristics, supported by independent laboratory testing and strong clinical trial outcomes. We sell our breast implants and breast tissue expanders, or Breast Products, exclusively to board-certified and board-admissible plastic surgeons and tailor our customer service offerings to their specific needs, which we believe helps secure their loyalty and confidence. These advantages have allowed us to increase our market share each year since we entered the market in 2012.

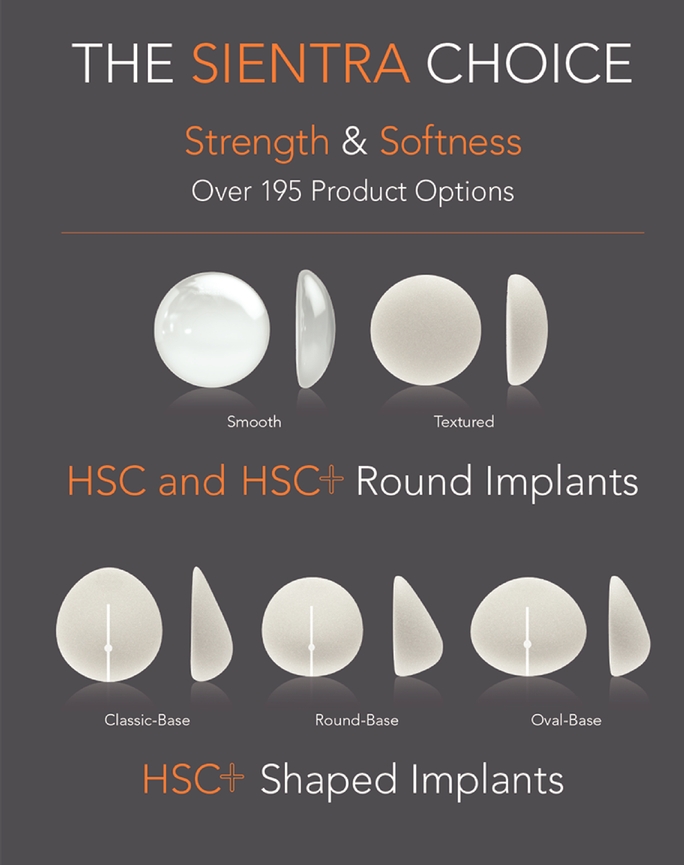

Our primary products are silicone gel breast implants for use in breast augmentation and breast reconstruction procedures, which we offer in over 195 variations of shapes, sizes, fill volumes, and textures. Our breast implants are primarily used in elective procedures which are generally performed on a cash-pay basis. Many of our breast implants incorporate one or more differentiated technologies, including a proprietary high-strength, cohesive silicone gel and proprietary texturing branded TRUE Texture. Our breast implants offer a desired balance between strength, shape retention and softness due to the high-strength, cohesive silicone gel used in our manufacturing process. TRUE Texture provides texturing on the implant shell that is designed to reduce the incidence of malposition, rotation and capsular contracture. We also offer breast tissue expanders and a range of other aesthetic and specialty products. We do not have any patents or patent applications, but rely on trade secrets, proprietary know-how and regulatory barriers to protect our products and technologies.

Our breast implants were approved by the U.S. Food and Drug Administration, or FDA, in 2012, based on data we collected from our ongoing, long-term clinical trial of our breast implants in 1,788 women across 36 investigational sites in the United States, which included 3,506 implants (approximately 53% of which were smooth and 47% of which were textured). Our clinical trial is the largest prospective, long-term safety and effectiveness pivotal study of breast implant patients in the United States and included the largest magnetic resonance imaging, or MRI, cohort with 571 patients. The clinical data we collected over an eight-year follow-up period demonstrated rupture rates, capsular contracture rates and reoperation rates that were comparable to or better than those of our competitors, at similar time points. In addition to our pivotal study, our clinical data is supported by

1

our Continued Access Study of 2,497 women in the United States. We have also commissioned a number of bench trials run by independent laboratories that we believe further demonstrate the advantages of our breast implants over those of our competitors.

We sell our Breast Products exclusively to board-certified and board-admissible plastic surgeons, as determined by the American Board of Plastic Surgery, who we refer to as Plastic Surgeons. These surgeons have completed the extensive multi-year plastic surgery residency training required by the American Board of Plastic Surgery. While aesthetic procedures are performed by a wide range of medical professionals, including dermatologists, otolaryngologists, obstetricians, gynecologists, dentists and other specialists, the majority of aesthetic surgical procedures are performed by Plastic Surgeons. Plastic Surgeons are thought leaders in the medical aesthetics industry. According to the American Society of Plastic Surgeons, or ASPS, there are approximately 6,400 board-certified plastic surgeons in the United States. We seek to provide Plastic Surgeons with differentiated services, including enhanced customer service offerings, a ten-year limited warranty that is the best-in-the-industry based on providing patients with the largest cash reimbursement for certain out-of-pocket costs related to revision surgeries in a covered event; a lifetime no-charge implant replacement program for covered ruptures; and our industry-first CapCon Care Program, or C3 Program, through which we offer no-charge replacement implants to breast augmentation patients who experience capsular contracture within the first five years after implantation with our smooth or textured breast implants.

We commenced sales of our breast implants in the United States in the second quarter of 2012. Our net sales were $44.7 million, $35.2 million and $10.4 million for the years ended December 31, 2014, 2013 and 2012, respectively. Our net sales were $26.6 million and $21.9 million for the six months ended June 30, 2015 and 2014, respectively. Our net loss was $5.8 million, $19.1 million and $23.4 million for the years ended December 31, 2014, 2013 and 2012, respectively. Our net loss was $6.4 million and $1.2 million for the six months ended June 30, 2015 and 2014, respectively.

Our Market

The overall market for medical aesthetic procedures is significant, and awareness and acceptance of these procedures is growing in the United States. According to ASAPS, in 2014, consumers in the United States spent approximately $12.4 billion on aesthetic procedures overall, including both surgical and non-invasive cosmetic treatments. Of this amount, more than $7.5 billion was spent on aesthetic surgical procedures.

Breast augmentation surgery remains the leading aesthetic surgical procedure by dollars and number of procedures in the United States. According to ASAPS, over 287,000 primary breast augmentation procedures and 72,000 revision augmentation procedures were performed in the United States in 2014. These procedures provide cosmetic solutions generally to enhance breast size and shape, correct breast asymmetries or help restore fullness after breastfeeding. For breast reconstruction, ASPS estimates that approximately 102,000 procedures were performed in the United States in 2014. These procedures are a surgical solution generally used to restore a breast to near normal shape and appearance following a mastectomy and typically utilize a breast tissue expander prior to implantation of a breast implant. Based on the number of procedures reported by ASAPS and by ASPS, and our estimates of average selling price, implant mix and implants per procedure, we estimate that the U.S. market for breast implants and breast tissue expanders exceeded $630 million in 2014.

Our Opportunity

We believe a significant opportunity exists in the U.S. marketplace due to the high barriers to entry in the U.S. breast implant market and the historical lack of product and service innovation for Plastic Surgeons.

2

For more than 20 years prior to the FDA approval of our breast implants in 2012, only two companies manufactured and distributed breast implants in the United States. We believe that this market concentration is largely a result of the considerable costs and risks associated with the lengthy regulatory approval process required by the FDA, which has created a significant barrier to entry in the U.S. breast implant market. All new breast implants require pre-market approval, or PMA, from the FDA before they may be marketed in the United States. The PMA application process is lengthy and uncertain, and the PMA application must be supported by valid scientific evidence, which typically requires long-term follow-up of a large number of enrolled patients, as well as extensive technical, pre-clinical, clinical and manufacturing data to demonstrate safety and effectiveness. At present, we are not aware of any ongoing clinical studies in the United States for silicone breast implants other than those post-approval studies being performed by us and our two U.S. competitors. We believe that in the near term, it is likely that the companies currently providing silicone breast implants in the United States will continue to be the only companies servicing the U.S. silicone breast implant market.

We believe the rigorous FDA approval process and the existence of only two competitors in the U.S. market have historically contributed to a lack of technological innovation in the U.S. breast implant industry resulting in limited product choices. Until the FDA approval of our breast implants in 2012, surgeons in the United States were only able to purchase basic round breast implants from our two U.S. competitors, while surgeons outside of the United States were able to purchase technologically-advanced round and anatomically-shaped breast implants.

Our Competitive Strengths

We believe that we are well positioned to take advantage of opportunities afforded by current market dynamics. By focusing on products with technologically differentiated characteristics, demonstrating strong clinical data, offering more product choice and providing services tailored specifically to the needs of Plastic Surgeons, we believe we can continue to enhance our position in the breast implant market. Our competitive strengths include:

Differentiated silicone gel and texturing technologies. We incorporate differentiated technologies into our breast implants, including a proprietary high-strength, cohesive silicone gel and proprietary texturing branded TRUE Texture. Our breast implants offer a desired balance between strength, shape retention and softness due to the high-strength, cohesive silicone gel used in our manufacturing process. In addition, TRUE Texture technology provides texturing on the implant shell that is designed to reduce the incidence of malposition, rotation and capsular contracture. We do not have any patents or patent applications, but rely on trade secrets, proprietary know-how and regulatory barriers to protect our products and technologies.

Strong clinical trial outcomes. Our clinical trial results demonstrate the safety and effectiveness of our breast implants. Our breast implants were approved by the FDA based on data we collected from our ongoing, long-term clinical trial of our breast implants in 1,788 women across 36 investigational sites in the United States. The clinical data we collected over an eight-year follow-up period demonstrated rupture rates, capsular contracture rates and reoperation rates that were comparable to or better than those of our competitors, based on our competitors' published eight-year data.

Innovative services that deliver an improved customer experience. Our customer service offerings are intended to accommodate and anticipate the needs of Plastic Surgeons so that they can focus on providing better services to their patients. We provide a ten-year limited warranty that is the best-in-the-industry based on providing patients with the largest cash reimbursement for certain out-of-pocket costs related to revision surgeries in a covered event; a lifetime no-charge implant replacement program for covered ruptures; and our industry-first C3 Program through which we offer

3

no-charge replacement implants to breast augmentation patients who experience capsular contracture within the first five years after implantation with our smooth or textured breast implants. We also offer specialized educational initiatives and a streamlined ordering, shipping and billing process.

Board-certified plastic surgeon focus. We sell our Breast Products exclusively to board-certified and board-admissible plastic surgeons who are thought leaders in the medical aesthetics industry. We address the specific needs of Plastic Surgeons through continued product innovation, expansion of our product portfolio and enhanced customer service offerings. We believe that securing the loyalty and confidence of Plastic Surgeons is essential to our success and that our association with Plastic Surgeons enhances our credibility and aligns with our focus on making a difference in patients' lives.

Proven and experienced leadership team. We have a highly experienced management team at both the corporate and operational levels with significant experience in the medical aesthetics industry. Members of our senior management team collectively have more than 135 years of medical aesthetics industry experience.

Our Strategy

Our objective is to become a leading global provider of differentiated medical aesthetic products and services tailored to meet the needs of Plastic Surgeons, allowing us to deliver on our commitment to enhance and make a difference in patients' lives. We are currently focused on growing the breast implant and breast tissue expander markets and our share of them in the United States, and intend to leverage our capabilities into new or complementary aesthetic products or technologies and new geographic markets or market segments. To achieve our objective, we are pursuing the following business strategies:

Create awareness of our differentiated technologies, products and services with Plastic Surgeons and consumers. Since we commenced commercial operations, we have focused our marketing efforts on Plastic Surgeons to promote and create awareness of the benefits of our products. Among other marketing programs targeted at Plastic Surgeons, we offer educational initiatives exclusively to Plastic Surgeons through our Sientra Education Forums. Recently, we have increased our consumer-directed efforts including an expanded exclusive relationship with Realself.com. We believe that continuing to invest in expanding marketing initiatives will have a positive impact on our business.

Expand to new markets. We are pursuing regulatory approval for our breast implants in Canada and intend to expand into the Canadian market upon receipt of such approval. We regularly evaluate additional expansion opportunities and in the future may also expand our business to cover new markets and geographic territories.

Selectively pursue acquisitions. We may selectively pursue domestic and international acquisitions of businesses or technologies that may allow us to leverage our relationships with Plastic Surgeons and our existing commercial infrastructure to provide us with new or complementary products or technologies, and allow us to compete in new geographic markets or market segments or to increase our market share.

Broaden our product portfolio and launch new products and services. We plan to continue to develop products that address the unmet needs of Plastic Surgeons and patients by leveraging our innovative technologies in combination with our regulatory and product development expertise. We have a number of new Breast Products under development with different characteristics and configurations. We believe these expanded product choices will allow Plastic Surgeons to potentially achieve better outcomes for their patients.

4

Enhance our sales capabilities and marketing programs to drive adoption of our products. We intend to increase our direct sales capabilities through the hiring of additional, experienced sales representatives and support staff. We believe that continued expansion of our sales team will allow us to broaden our market reach and educate a broader group of Plastic Surgeons on the benefits of our products.

Invest in clinical studies and peer reviewed articles with key opinion leaders. We intend to continue to invest in clinical studies in order to provide published peer reviewed articles that support the clinical benefits of our products and technologies over those of our competitors. We believe our relationship with Plastic Surgeons and our continued focus on providing differentiated products and services will allow us to leverage our existing capabilities to increase our share of the breast implant market specifically and the medical aesthetics market generally.

Recent Developments

Following is a summary of selected recent developments affecting our business:

Launch of new style and configuration of Silicone Gel Breast Implants. In late August 2015, we introduced a new round breast implant featuring our unique high-strength HSC+ silicone gel which was previously available only in our anatomically shaped breast implants. We believe our new HSC+ round breast implants allow surgeons and patients to benefit from the highly cohesive gel in the form of a more traditional round implant. We believe that prior to this introduction by us, such benefits were only accessible to surgeons in the form of shaped implants. In addition, in the fourth quarter of 2014, we launched a line extension to our line of smooth round silicone gel breast implants that provides a higher fill ratio that we believe is desired by some surgeons. We also recently added 16 additional sizes and configurations of our moderate-plus and high projection round implants. This makes a total of over 195 available shapes, sizes and configurations of our silicone gel breast implants.

Direct-to-Consumer Marketing through Exclusive Campaign with Realself.com. We have expanded our exclusive relationship with Realself.com, or Realself. Realself is one of the world's largest online communities for learning and sharing information about cosmetic procedures with nearly 1.5 million unique users a month specifically interested in breast augmentation. For the first six months of 2015, we saw a strong engagement with the Sientra brand and its value proposition where the Sientra brand held a commanding 56% share of all branded breast implant traffic on Realself. We have also experienced substantial growth in the number of Sientra pages viewed on Realself, which we primarily attribute to the launch of our branded Sientra webpages on Realself in May 2014. From 2013 to 2014, the number of Sientra pages viewed on Realself increased by over 50-fold to over 1.2 million in 2014, approximately 1.0 million of which occurred in the last six months of the year. More recently, as our exclusive relationship with Realself has deepened, the number of Sientra pages viewed on Realself has increased. During the first six months of 2015, the number of Sientra pages viewed on Realself increased to approximately 2.9 million views an approximately 20-fold increase when compared to the first six months of 2014.

In August 2015, we launched our "Orange Dot" campaign with Realself in which all plastic surgeons who are Sientra customers are identified with an orange dot on their profile. Simultaneously, Sientra has advertisements on Realself that explain that the easiest way to identify a board-certified or board-admissible plastic surgeon is by looking for the orange dot because Sientra sells only to board-certified and board-admissible plastic surgeons.

In addition, we achieved a very high 97% worth it approval rating, a metric that is highly relevant to the site and its members as it indicates their approval, the relevance of the material and their decision

5

making. We believe that such targeted efforts utilizing online communities are important elements of our brand expansion and that further targeting such direct-to-consumer marketing will help build consumer engagement with the Sientra brand and create value for our surgeons for the long-term.

Increased Sales Organization to a total of 46 Plastic Surgery Consultants. During the first half of 2015, we increased the number of plastic surgery consultants, or PSCs, by 7 from 39 to 46, and we plan to continue adding more PSCs in order to obtain broader coverage and deeper account penetration in certain geographic markets.

Our Eight-Year Follow-Up Data from the pivotal trial that was the basis of PMA Approval in the United States. In May 2015, an update on the eight-year follow-up data from Sientra's ongoing PMA Study of our gel breast implant, authored by Stevens, Harrington, Alizadeh, et al, was published in the peer-reviewed Aesthetic Surgery Journal. Among the significant statistics reported were data on key complications measured among the 1,116 women in the primary-augmentation cohort of Sientra's Core Study, an ongoing 10-year open label, prospective, multicenter clinical study, including:

| |

Sientra 8-Year | |||

|---|---|---|---|---|

Rupture (overall) |

4.9 | % | ||

(MRI cohort) |

7.2 | % | ||

(non-MRI cohort) |

1.5 | % | ||

Capsular Contracture (III/IV) |

11.2 | % | ||

Reoperation |

20.7 | % | ||

This newly released 8-year follow-up data allows the following summary of Sientra's key clinical data over various follow-up periods:

| |

3-Year | 5-Year | 6-Year | 8-Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Kaplan-Meier % (KM%) |

||||||||||||

Rupture (overall) |

0.7 | 2.0 | 3.2 | 4.9 | |||||||||

Rupture (MRI cohort) |

2.5 | 4.2 | 5.4 | 7.2 | |||||||||

Rupture (non-MRI cohort) |

0.0 | 0.6 | 1.7 | 1.5 | |||||||||

Capsular Contracture |

6.0 | 8.8 | 10.0 | 11.2 | |||||||||

Reoperation |

12.6 | 16.6 | 18.7 | 20.7 | |||||||||

Our clinical study was not designed to facilitate head-to-head comparisons with our competitors. However, our clinical data and our competitors' clinical data are publicly available to both surgeons and patients who are able to use such data to compare and contrast competing implants. For example, comparisons of the eight-year follow-up data from our pivotal study to the eight-year follow-up data from our competitors' pivotal studies are shown below:

| |

Sientra Pivotal Study |

Mentor Pivotal Study |

Allergan Pivotal Study |

|||

|---|---|---|---|---|---|---|

Augmentation |

(N=1,116) | (N=552) | (N=455) | |||

Rupture (overall) |

4.9% | NR | 5.8% | |||

Rupture (MRI) |

7.2% | 10.6% (24.2% at 10 years) | 7.7% (8.8% at 10 years) | |||

Capsular Contracture |

11.2% | 10.9% | 16.8% | |||

Reoperation |

20.7% | 20.1% | 32.1% |

N = Number of patients

NR = Not reported

Key complications by Kaplan-Meier rate (KM%)

6

As shown above, Sientra's clinical rupture data at 8 years of follow-up compares favorably to both of our competitors' rupture data at eight years. In addition, in 2015, a rupture trending analysis of data from Sientra's Core Study was published. This study evaluated 1,792 implants (approximately 52% of which were smooth and 48% of which were textured) in 935 patients (implanted at 31 sites with an average follow-up of 6.6 years — range 147 days to 10.6 years) of which 43 implants were ruptured. The study showed that, in each of the first two years following implantation there were 2 or fewer ruptures and, following that, in each of years 3-10, there was a single-digit number of ruptures each year, with no real pattern from year-to-year. The most significant finding of the study was the observation that approximately half of the ruptures originated from three particular surgeons which suggests that surgical technique is a significant factor in rupture rates.

Selected Risks Related to Our Business and Our Industry

Our business is subject to numerous risks and uncertainties of which you should be aware before you decide to invest in our common stock. These risks may prevent us from achieving our business objectives, and may adversely affect our business, financial condition, results of operations and prospects. These risks are discussed in greater detail under "Risk Factors" contained in our Annual Report on Form 10-K for the year ended December 31, 2014 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015 that are incorporated by reference into this prospectus and in the section entitled "Risk Factors" beginning on page 13 of this prospectus. These risks include, but are not limited to the following:

- •

- we have incurred significant net operating losses since inception and cannot assure you that we will achieve profitability;

- •

- our future profitability depends on the success of our Breast Products;

- •

- we rely on a foreign, sole source, third-party to manufacture and supply our silicone gel breast implants, tissue expanders and other

products;

- •

- there are inherent risks in contracting with manufacturers located outside of the United States such as in Brazil;

- •

- various factors outside our direct control may adversely affect manufacturing and supply of our breast implants, tissue expanders and

other products;

- •

- we have a limited operating history and may face difficulties encountered by companies early in their commercialization in competitive

and rapidly evolving markets;

- •

- if we fail to compete effectively against our competitors, both of which have significantly greater resources than we have, our net

sales and operating results may be negatively affected;

- •

- pricing pressure from customers and our competitors may impact our ability to sell our products at prices necessary to support our

current business strategies;

- •

- the long-term (defined as 10 years or more) safety of our products has not fully been established and our breast implants are

currently under study in our PMA and post-approval studies, which could reveal unanticipated complications;

- •

- we are subject to extensive federal and state regulation, and if we fail to comply with applicable regulations, we could suffer severe

criminal or civil sanctions or be required to restructure our operations, any of which could adversely affect our business, financial condition and operating results;

- •

- if our intellectual property rights do not adequately protect our products or technologies, others could compete against us more directly, which would hurt our profitability; and

7

- •

- any negative publicity concerning our products could harm our business and reputation and negatively impact our financial results.

Corporate Information

We incorporated in Delaware on August 29, 2003 under the name Juliet Medical, Inc. and subsequently changed our name to Sientra, Inc. in April 2007. Our principal executive offices are located at 420 South Fairview Avenue, Suite 200, Santa Barbara, California 93117, and our telephone number is (805) 562-3500. Our website address is www.sientra.com. The information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

- •

- we are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control

over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

- •

- we are permitted to provide less extensive disclosure about our executive compensation arrangements in our periodic reports, proxy

statements and registration statements; and

- •

- we are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of these provisions until December 31, 2019. However, if certain events occur prior to December 31, 2019, including if we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, our annual gross revenue equals or exceeds $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to December 31, 2019.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

8

Shares of common stock offered by us |

shares. | |

Shares of common stock to be outstanding immediately after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

|

Option to purchase additional shares |

We have granted the underwriters an option to purchase up to additional shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

We currently anticipate that we will use the net proceeds received by us from this offering for the following purposes: (i) we may acquire or invest in complementary products, technologies, businesses or international expansion opportunities; however, we currently have no agreements or commitments to complete any such transaction, and (ii) for working capital and other general corporate purposes. We may also use a portion of the net proceeds to repay a portion of our long-term debt. For additional information, see "Use of Proceeds." |

|

Risk factors |

You should read the "Risk Factors" section of this prospectus, our Annual Report on Form 10-K for the year ended December 31, 2014 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, incorporated by reference herein, for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

The NASDAQ Global Select Market symbol |

"SIEN." |

The number of shares of our common stock to be outstanding immediately after this offering is based on 14,942,696 shares of common stock outstanding as of June 30, 2015, and excludes:

- •

- 47,710 shares of common stock issuable upon exercise of outstanding warrants as of June 30, 2015, at an exercise price of

$14.671 per share;

- •

- 2,231,748 shares of common stock issuable upon exercise of outstanding options to purchase shares of common stock under our 2007

Equity Incentive Plan, or the 2007 Plan, and our 2014 Equity Incentive Plan, or the 2014 Plan, as of June 30, 2015, at a weighted average exercise price of $7.58 per share;

- •

- 668,112 shares of common stock reserved for future grant or issuance under the 2014 Plan, as of June 30, 2015;

- •

- 404,629 shares of common stock reserved for future grant or issuance under the 2014 Employee Stock Purchase Plan, or ESPP, as of June 30, 2015; and

9

- •

- 44,250 shares of common stock issued on July 20, 2015 under the ESPP.

Except as otherwise indicated or the context otherwise requires, the information in this prospectus assumes:

- •

- no exercise of the underwriters' option to purchase additional shares; and

- •

- no exercise of the outstanding warrants or options described above subsequent to June 30, 2015.

10

The following table set forth our summary financial data for the periods and as of the dates indicated. We derived the summary statement of operations data for the years ended December 31, 2012, 2013 and 2014 from our audited financial statements incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2014. The summary statement of operations data for the six months ended June 30, 2014 and 2015, and the summary balance sheet data as of June 30, 2015 were derived from our unaudited financial statements incorporated by reference into this prospectus from our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015. In the opinion of management, the unaudited financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of our results for those periods. Our historical results are not necessarily indicative of future operating results and our interim results are not necessarily indicative of results for a full year or any future period.

The summary financial data should be read together with our financial statements and related notes, "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus or incorporated herein by reference.

| |

Year Ended December 31, |

Six Months Ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 | 2013 | 2014 | 2014 | 2015 | |||||||||||

| |

|

|

|

(Unaudited) |

||||||||||||

| |

(In thousands, except per share and share amounts) |

|||||||||||||||

Statement of operations data: |

||||||||||||||||

Net sales |

$ | 10,447 | $ | 35,171 | $ | 44,733 | $ | 21,947 | $ | 26,640 | ||||||

Cost of goods sold |

2,352 | 8,592 | 11,500 | 5,455 | 7,174 | |||||||||||

| | | | | | | | | | | | | | | | | |

Gross profit |

8,095 | 26,579 | 33,233 | 16,492 | 19,466 | |||||||||||

| | | | | | | | | | | | | | | | | |

Operating expenses: |

||||||||||||||||

Sales and marketing |

17,919 | 22,229 | 23,599 | 11,863 | 13,805 | |||||||||||

Research and development |

3,670 | 4,479 | 4,707 | 2,305 | 2,753 | |||||||||||

General and administrative |

9,938 | 18,078 | 10,712 | 4,908 | 7,664 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total operating expenses |

31,527 | 44,786 | 39,018 | 19,076 | 24,222 | |||||||||||

| | | | | | | | | | | | | | | | | |

Loss from operations |

(23,432 | ) | (18,207 | ) | (5,785 | ) | (2,584 | ) | (4,756 | ) | ||||||

Other (expense) income, net: |

||||||||||||||||

Interest income |

— | — | — | — | 7 | |||||||||||

Interest expense |

— | (872 | ) | (2,172 | ) | (842 | ) | (1,339 | ) | |||||||

Other (expense) income, net |

(1 | ) | (46 | ) | 2,146 | 2,264 | (288 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Total other (expense) income, net |

(1 | ) | (918 | ) | (26 | ) | 1,422 | (1,620 | ) | |||||||

| | | | | | | | | | | | | | | | | |

Loss before income taxes |

(23,433 | ) | (19,125 | ) | (5,811 | ) | (1,162 | ) | (6,376 | ) | ||||||

Income taxes |

— | — | — | — | — | |||||||||||

| | | | | | | | | | | | | | | | | |

Net loss |

(23,433 | ) | $ | (19,125 | ) | $ | (5,811 | ) | $ | (1,162 | ) | $ | (6,376 | ) | ||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Per share data: |

||||||||||||||||

Basic and diluted net loss per share attributable to common stockholders(1) |

$ | (85.01 | ) | $ | (82.25 | ) | $ | (2.28 | ) | $ | (5.58 | ) | $ | (0.43 | ) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average outstanding common shares used for net loss per share attributable to common stockholders: |

||||||||||||||||

Basic and diluted(1) |

275,642 | 232,512 | 2,545,371 | 208,294 | 14,927,558 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (1)

- For an explanation of the calculations of our basic and diluted net loss per share, see (a) Note 2 to our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014, incorporated herein by reference, and (b) Note 6 to our unaudited financial statements included in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, incorporated herein by reference.

11

| |

As of June 30, 2015 (Unaudited) (In thousands) |

||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1)(2) | |||||

Balance sheet data (at end of period): |

|||||||

Cash and cash equivalents |

$ | 89,659 | $ | ||||

Working capital |

93,439 | ||||||

Total assets |

134,413 | ||||||

Long-term debt |

25,686 | ||||||

Total stockholders' equity |

90,437 | ||||||

- (1)

- The

as adjusted column reflects the receipt of the net proceeds from the sale of shares of

our common stock at an assumed public offering

price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market

on , 2015, and after deducting the estimated underwriting

discounts and commissions and estimated offering expenses payable by us.

- (2)

- A $1.00 increase (decrease) in the assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $ million, assuming the number of shares offered by us as stated on the cover of this prospectus remains unchanged and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, a 1,000,000 share increase (decrease) in the number of shares offered by us, as set forth on the cover of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $ million, at the assumed public offering price of $ per share, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of our public offering determined at pricing.

12

Investing in our common stock involves a high degree of risk. Before investing in our common stock, you should consider carefully the risks described below, together with the other information contained in this prospectus or incorporated by reference in this prospectus, including the risks and uncertainties discussed under "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2014 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, which are incorporated herein by reference in their entirety. The risks and uncertainties described below and incorporated herein by reference are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. If any of the following or other risks actually occur, our business, financial condition, results of operations and future prospects could be materially and adversely affected. In that event, the market price of our stock could decline, and you could lose part or all of your investment.

Risks Relating to this Offering

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

Investors purchasing shares of common stock in this offering will pay a price per share that substantially exceeds the as adjusted net tangible book value per share. As a result, investors purchasing shares of common stock in this offering will incur immediate dilution of approximately $ per share, based on an assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, and our as adjusted net tangible book value as of June 30, 2015, after giving effect to this offering. As a result of the dilution to investors purchasing shares in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of our liquidation. For more information on the dilution you will experience immediately after this offering, see "Dilution."

Sales of a substantial number of shares of our common stock in the public market could cause our stock price to decline.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that our officers, directors or the holders of a large number of shares of common stock intend to sell shares, could reduce the market price of our common stock. Based on the number of shares of common stock outstanding as of June 30, 2015, and an assumed offering price per share of $ as of , 2015, upon the closing of this offering, we will have outstanding a total of approximately shares of common stock. Of these shares, the shares of our common stock sold in our initial public offering, which was completed on November 3, 2014, are currently freely tradable, and the shares to be sold in this offering, plus any shares sold upon exercise of the underwriters' option to purchase additional shares, will be freely tradable, without restriction, in the public market immediately following this offering.

Each of our directors and officers and substantially all of our stockholders, optionholders and warrantholders entered into lock-up agreements with the underwriters in connection with our initial public offering. The lock-up agreements expired on April 27, 2015, and based on shares outstanding as of August 7, 2015, up to an additional 9,127,824 shares of common stock became eligible for sale in the public market, approximately 105,735 of which are held by our executive officers and directors and approximately 8,115,083 of which are held by our affiliates (including stockholders affiliated with our directors) and subject to volume limitations under Rule 144 under the Securities Act. Each of our directors and officers and certain of our stockholders entered into lock-up agreements with the underwriters in connection with this offering which will expire 90 days from the date of this

13

prospectus, following which approximately shares of common stock will be eligible for sale in the public market, approximately of which are held by our executive officers and directors and approximately of which are held by our affiliates (including stockholders affiliated with our directors) and subject to volume limitations under Rule 144 under the Securities Act.

Holders of an aggregate of approximately 7,620,083 shares of our common stock have rights, subject to some conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders.

In addition, as of August 7, 2015, options to purchase an aggregate of 2,237,248 shares of our common stock were outstanding under our 2007 Plan and our 2014 Plan, which have been registered on a Registration Statement on Form S-8. In addition, 662,612 shares of common stock that are reserved for issuance under our 2014 Plan are registered on the Registration Statement on Form S-8. These shares can be freely sold in the public market upon issuance and once vested.

We cannot predict what effect, if any, sales of our shares in the public market or the availability of shares for sale will have on the market price of our common stock. Future sales of substantial amounts of our common stock in the public market, including shares issued upon exercise of outstanding options or warrants, or the perception that such sales may occur, however, could adversely affect the market price of our common stock and also could adversely affect our future ability to raise capital through the sale of our common stock or other equity-related securities of ours at times and prices we believe appropriate.

Our management team may invest or spend the proceeds from this offering in ways with which you may not agree or in ways which may not yield a return.

Our management has considerable discretion in the application of the net proceeds from this offering, and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment. We currently anticipate that we will use the net proceeds from this offering for the following purposes: (i) we may acquire or invest in complementary products, technologies, businesses or international expansion opportunities; however, we currently have no agreements or commitments to complete any such transaction, and (ii) for working capital and other general corporate purposes. We may also use a portion of the net proceeds to repay a portion of our long-term debt. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in high-quality, short-term interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

14

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, or incorporates by reference, estimates, projections and other forward-looking statements including in the sections entitled "Prospectus Summary," "Risk Factors," "Use of Proceeds," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business". Our estimates, projections and other forward-looking statements are based on our management's current assumptions and expectations of future events and trends, which affect or may affect our business, strategy, operations or financial performance. Although we believe that these estimates, projections and other forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of information currently available to us. Many important factors, in addition to the factors described in this prospectus, or incorporated herein by reference, may adversely and materially affect our results as indicated in forward-looking statements. You should read this prospectus, the documents incorporated herein by reference and the documents that we have filed as exhibits, or incorporated by reference, to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from those anticipated or implied in the forward-looking statements.

All statements other than statements of historical fact are forward-looking statements. The words "believe," "may," "might," "could," "will," "aim," "estimate," "continue," "anticipate," "intend," "expect," "plan," or the negative of those terms, and similar expressions that convey uncertainly of future events or outcomes are intended to identify estimates, projections and other forward-looking statements.

Our estimates, projections and other forward-looking statements may be influenced by one or more of the factors set forth under "Risk Factors" above and incorporated herein by reference and one or more of the following factors:

- •

- our history of net operating losses and uncertainty regarding our ability to achieve profitability;

- •

- our dependence on sales of silicone gel breast implants to generate a significant amount of our net sales;

- •

- our reliance on a foreign, sole source, third-party to manufacture and supply our silicone gel breast implants, tissue expanders and

other products;

- •

- our limited operating history and any difficulties encountered by us as a result of being a company early in its commercialization;

- •

- our ability to successfully commercialize our products;

- •

- our inability to operate in a competitive industry and compete successfully against competitors that have greater resources than we

do;

- •

- pricing pressure from customers and our competitors;

- •

- concern about the safety and efficacy of our products, which is based on limited long-term clinical data;

- •

- the failure of our products to achieve and maintain market acceptance;

- •

- our inability to expand our sales force and marketing programs;

- •

- the productivity of our sales representatives and ability to achieve expected growth;

- •

- our inability to retain a high percentage of our customer base;

15

- •

- any inaccuracies in our assumptions about the breast implant market;

- •

- our inability to protect our intellectual property;

- •

- our failure to comply with the applicable governmental regulations to which our products and operations are subject;

- •

- the accuracy of our estimates regarding expenses, net sales, capital requirements and needs for additional financing;

- •

- our expectations regarding the period during which we qualify as an emerging growth company under the JOBS Act; and

- •

- our use of the proceeds from this offering.

Other sections of this prospectus, and incorporated herein by reference, include additional factors that could adversely impact our business, strategy, operations or financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

Estimates, projections and other forward-looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or review any estimate, projection or forward-looking statement because of new information, future events or other factors. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC, after the date of this prospectus. See the information included under the heading "Where You Can Find More Information." Estimates, projections and other forward-looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described above, the estimates, projections and other forward-looking statements discussed in this prospectus, or incorporated herein by reference, might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, but not limited to, the factors mentioned above. Because of these uncertainties, you should not place undue reliance on these forward-looking statements when making an investment decision.

16

We estimate that the net proceeds from our issuance and sale of shares of our common stock in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, assuming a public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed public offering price of $ per share would increase (decrease) our expected net proceeds from this offering by approximately $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Similarly, a 1,000,000 share increase (decrease) in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the net proceeds to us by approximately $ million, at the assumed public offering price of $ per share, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We currently anticipate that we will use the net proceeds received by us for the following purposes: (i) we may acquire or invest in complementary products, technologies, businesses or international expansion opportunities; however, we currently have no agreements or commitments to complete any such transaction, and (ii) for working capital and other general corporate purposes. We may also use a portion of the net proceeds to repay a portion of our long-term debt. As of June 30, 2015, we had $25.7 million outstanding on our long-term debt term loans which bear interest at a rate equal to 8.4% per annum. The long-term loan facility consists of (i) a $7.5 million tranche A term loan, (ii) a $2.5 million tranche B term loan and (iii) a $5.0 million tranche C term loan, maturing on February 1, 2017, and (iv) a $10.0 million tranche D term loan maturing on January 1, 2019.

Our expected use of the net proceeds from this offering is based upon our present plans and business condition. As of the date of this prospectus, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of proceeds will vary depending on numerous factors, including the factors described under the heading "Risk Factors" beginning on page 13 of this prospectus, or incorporated herein by reference. As a result, management will retain broad discretion over the allocation of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds.

Pending the use of the net proceeds of this offering, we intend to invest the net proceeds in high-quality, short-term interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

17

Our common stock has been listed on The NASDAQ Global Select Market under the symbol "SIEN" since October 29, 2014. Prior to that date, there was no public trading market for our common stock. Our common stock priced at $15.00 per share in our initial public offering on October 28, 2014. The following table sets forth for the periods indicated the high and low intra-day sales prices per share of our common stock as reported on The NASDAQ Global Select Market:

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

2015 |

|||||||

Third quarter (through ) |

$ | $ | |||||

Second quarter |

$ | 26.67 | $ | 15.93 | |||

First quarter |

$ | 20.93 | $ | 14.02 | |||

2014 |

|||||||

Fourth quarter (from October 29, 2014) |

$ | 19.99 | $ | 12.53 | |||

On , 2015, the last reported sale price of our common stock on The NASDAQ Global Select Market was $ per share. As of August 7, 2015, there were 14,986,946 shares of our common stock outstanding and we had 104 holders of record of our common stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

18

We have never declared or paid any cash dividends on our capital stock. At the present time, we have no plans to declare or pay any cash dividends and intend to retain all of our future earnings, if any, generated by our operations for the development and growth of our business. Any future determination related to our dividend policy will be made by our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual restrictions, business prospects and other factors that our board of directors may deem relevant. Investors should not purchase our common stock with the expectation of receiving cash dividends. In addition, the terms of our term loan agreement restrict our ability to pay dividends. See the "Management's Discussion and Analysis of Financial Condition and Results of Operations — Indebtedness" section of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, incorporated herein by reference, for a description of the restrictions on our ability to pay dividends.

19

The following table sets forth our capitalization as of June 30, 2015:

- •

- on an actual basis; and

- •

- on an as adjusted basis to reflect the issuance and sale by us of shares of our common stock in this offering at an assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, after deducting the estimated underwriting discounts and estimated offering expenses payable by us.

You should read this table in conjunction with the information included under the heading "Use of Proceeds" included elsewhere in this prospectus, and under the headings "Selected Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus or incorporated herein by reference.

| |

As of June 30, 2015 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||

| |

(Unaudited) |

||||||

| |

(In thousands, except share amounts) |

||||||

Long-term debt |

$ | 25,686 | |||||

| | | | | | | | |

Stockholders' equity: |

|||||||

Preferred stock, $0.01 par value; authorized 10,000,000 shares, none issued or outstanding actual and as adjusted |

— | — | |||||

Common stock, $0.01 par value; 200,000,000 shares authorized, 15,015,423 shares issued and 14,942,696 shares outstanding, actual; 200,000,000 shares authorized; shares issued and shares outstanding, as adjusted |

150 | ||||||

Additional paid-in capital |

230,969 | ||||||

Treasury stock, at cost (72,727 shares) |

(260 | ) | |||||

Accumulated deficit |

(140,422 | ) | |||||

| | | | | | | | |

Total stockholders' equity |

90,437 | ||||||

| | | | | | | | |

Total capitalization |

$ | 116,123 | $ | ||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

A $1.00 increase (decrease) in the assumed public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, would increase (decrease) our as adjusted additional paid-in capital, total stockholders' equity and total capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, a 1,000,000 share increase (decrease) in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) our as adjusted additional paid-in capital, total stockholders' equity and total capitalization by approximately $ million, at the assumed public offering price of $ per share, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

20

The information set forth above is based on 14,942,696 shares of our common stock outstanding as of June 30, 2015, and excludes:

- •

- 47,710 shares of common stock issuable upon exercise of outstanding warrants as of June 30, 2015, at an exercise price of

$14.671 per share;

- •

- 2,231,748 shares of common stock issuable upon exercise of outstanding options to purchase shares of common stock under our 2007 Plan

and our 2014 Plan, as of June 30, 2015, at a weighted average exercise price of $7.58 per share;

- •

- 668,112 shares of common stock reserved for future grant or issuance under the 2014 Plan, as of June 30, 2015;

- •

- 404,629 shares of common stock reserved for future grant or issuance under the ESPP, as of June 30, 2015; and

- •

- 44,250 shares of common stock issued on July 20, 2015 under the ESPP.

21

If you invest in our common stock in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per share of our common stock and the net tangible book value per share of our common stock upon completion of this offering.

Net tangible book value per share is determined by dividing our total tangible assets (total assets less intangible assets) less our total liabilities by the number of shares of common stock outstanding. Our historical net tangible book value at June 30, 2015, was 76.1 million, or $5.09 per share of our common stock.

After giving effect to the sale of shares of our common stock in this offering, assuming a public offering price of $ per share, the last reported sale price of our common stock on The NASDAQ Global Select Market on , 2015, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2015, would have been approximately $ million, or $ per share of our common stock. This represents an immediate increase in net tangible book value of approximately $ per share to existing stockholders, and an immediate dilution of approximately $ per share to new investors purchasing our common stock in this offering.

The following table illustrates this per share dilution:

Assumed public offering price per share |

$ | ||||||

Historical net tangible book value per share as of June 30, 2015 |

$ | 5.09 | |||||

Increase in net tangible book value per share attributable to new investors purchasing shares in this offering |

$ | ||||||

As adjusted net tangible book value per share after giving effect to this offering |

$ | ||||||

| | | | | | | | |

Dilution per share to new investors participating in this offering |

$ | ||||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |