Attached files

Exhibit 10.3

AGREEMENT OF LEASE

FOR

1-95 COMMERCE CENTER

THIS LEASE is made as of the 5th day of December, 2005 between Simone Holdings Inc., a Florida corporation and Signature Structures, Inc., a Florida corporation, d/b/a Simone Structures, J.V., with its offices at 6761 W. Indiantown Road Suite 29, Jupiter, Florida 33458, as Landlord or Lessor, and SANCILIO & COMPANY, a Florida Corporation, with its-offices at 1001 No. US Hwy One Suite 409, Jupiter Florida 33477 as Tenant or Lessee.

SUMMARY

Certain provisions of the Lease attached hereto are presented in this Summary to facilitate convenient reference by the parties hereto; the listing of these provisions in summary form shall not be deemed to alter the fact that they are in an integral part of the Lease.

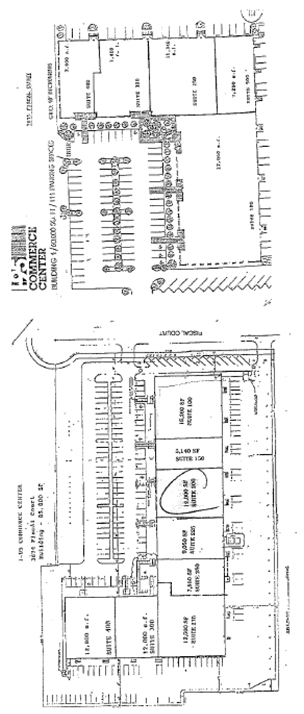

| 1. | Lessee’s Building Address: | Suite #200 3874 Fiscal Court, Riviera Beach, FL 33404 (As more fully described in Exhibit “B”) | ||

| 2. | Original Term: | Sixty-two Months | ||

| Commencement: | January 1, 2006 | |||

| Expiration Date: | 62 months, zero days from Commencement Date. | |||

| 3. | Purposes: | All lawful purposes in full accordance with the then applicable zoning code. | ||

| 4. | Initial Fixed Rent: | Annually: $ 78,000.00 Monthly: $ 6,500.00 | ||

| Adjustments: | Annual Base Rent Years: Year 1 = 78,000.00 Year 1 plus CPI Increase = Year 2 Year 2 plus CPI Increase = Year 3 Year 3 plus CPI Increase = Year 4 Year 4 plus CPI Increase = Year 5 Year 5 plus CPI Increase = Year 6 CPI Increase are (outlined in Paragraph 2C attached hereto, and subject to a minimum of three (3%) percent and five (5%) percent maximum. | |||

| 5. | Rentable Square Feet: | 12,000 (premises) | ||

| 6. | Rent Abatement | Two Months Rent including additional rent with a rental commencement date of March 1, 2006 | ||

1

| 7. | Month 1 & Last Month’s Base Rent | First and last month base rent shall be pro-rated based on the actual number of days Lessee is obligated to the building under this Lease. First month’s rent is due upon occupancy. | ||

| 8. | First Month Rent: | $ 9,744.75 due upon execution of this Lease by Lessee. | ||

| 9. | Security Deposit: | $ 9,744.75 due upon execution of this Lease by Lessee. | ||

| 10. | Pro Rata Operating Expenses: | Shall be due Month 1 through Month 62 (Current expenses are estimated at $2.65 per square foot which adjusts annually.) | ||

| 11. | Percentage of Operating Expenses: | 8.2305 % of the Building Projects’ Expenses. | ||

| 12. | Broker’s Name and Address: | Robert Smith CR Richard Ellis 5355 Town Center Road, Suite 701 Boca Raton, FL 33486 | ||

| 13. | Bank Letter of Credit: | Deutsche Bank Trust Company Americas 280 Park Ave New York, NY 10017 | ||

| 14. | Options: | Tenant will have one (1) option to renew the lease for an additional five (5) year period upon one hundred eighty days (180) written notice. | ||

2

WITNESSETH:

Lessor hereby leases to Lessee and Lessee hereby hires from the Lessor the space described in Paragraph 1 of the Summary (the “Summary”) attached hereto and made a part hereof (said space is hereinafter called the “premises” or the “demised premises”) in a Building located on a portion of Lots 8 through 13 excluding Lots 9, 10, and 11 of Plat No. 2, Central Industrial Park North, a P.I.D., in Riviera Beach, Florida (hereinafter called the “Building”), for the term described in Paragraph 2 of the summary, to commence on the “Commencement Date”, and to expire on the Expiration Date as described in Paragraph 2 of the Summary, unless sooner ended pursuant to the terms hereof. The fact that “punch list” or similar type items remain to be performed in the premises or Building on the Commencement Date shall not delay the commencement of the term of this Lease as aforesaid.

Lessor and Lessee covenant and agree:

1. PURPOSES: Lessee shall use and occupy the premises only for the purposes described in Paragraph 3 of the Summary, and for no other purpose.

2. ANNUAL BASE RENT:

A. Beginning with the Commencement Date and continuing throughout the term of this Lease, Lessee shall pay to Lessor in lawful United States currency, the fixed annual rent described in Paragraph 4 of the Summary (the “Fixed Annual Rent”), payable in the equal monthly installments described in Paragraph 4 of the Summary (the “Base Monthly Rent”), together with any and all sales and use taxes levied upon the use and occupancy of the premises as set forth in Article 4 hereof. Payment shall be in advance on the first day of each month. Lessee’s rent in the first month of the term and the last month of terra shall be pro-rated based on the number of days the Lessee is obligated and bound by this Lease. All rent shall be paid to Lessor without demand, setoff or deduction whatsoever, c/o Simone Structures, J.V., 6761 West Indiantown Road, #29, Jupiter, Florida 33458 or at such other place as lessor shall designate in writing to Lessee.

B. In the event that any payment herein provided for by Lessee to Lessor shall become overdue for a period in excess often (10) days, then, at Lessor’s option, a “late charge” of one and one-half percent (1.5%) of such payment as additional rent may be charged.

C. The base rent shall be increased to compensate for changes in the cost of living as computed by reference to the Consumer Price Index for all Urban Consumers, U.S. City Average, all items (1982-84 = 100) published by Bureau of Labor Statistics of the U.S. Department of Labor with a minimum of three (3%) percent and a maximum of five (5%) percent. Adjustments to the base rent shall be computed annually commencing on the first (1st) anniversary of the commencement date and on each annual anniversary of the commencement date. The amount of adjustment shall be arrived for succeeding years of the lease term by dividing the most recent CPI by the preceding year’s CPI and multiplying the monthly rent by the result. Because actual CPI figures are not published until sometime after the month for which they are collected and therefore not available at the time an increase should become effected, a CPI figure from two months prior to the increase month shall be used; however, under

3

no circumstances shall the Tenant pay an annual rent of less than the amount of Base Rent paid in the year before. In the event this price index is discontinued or changed in any way, at the election of the Lessor the parties herein shall accept comparable statistics on the Cost of Living as computed and published by an agency of the United States Government or by a responsible financial periodical of recognized authority to be selected by the Lessor.

3. ANNUAL EXPENSES:

A. Expenses: Lessee shall pay to Lessor, monthly, as additional rent, an amount representing Lessee’s pro-rata share of Lessor’s expenses associated with operating the Building Project, as defined and computed in the manner set forth in this Article 3A.

(1) For the purposes of this Lease, the following definitions shall apply:

(a) The term “Building Project” shall mean all of the land, together with the improvements thereon, located in Lots 8 through 13, excluding Lots 9, 10, and 11 of Plat No. 2; Central Industrial Park North, a P.I.D., in Riviera Beach, Florida, unless modified by the sale or transfer of any portion of the land and improvements hereof (which sale or transfer shall be documented by a written addendum to this Lease, whereby the percentage of Operating Expenses, described Paragraph 11 of the Summary, will be recalculated in accordance with the then current Building Project).

(b) The term “Operation Year” shall mean the period from the first day of March through the last day of February, inclusive, during any calendar year in which the term of this Lease commences and each subsequent period with the same beginning and ending dates in which occurs any part of the term of this Lease.

(c) The term “The Percentage” shall mean the Percentage of Operating Expenses described in Paragraph 11 of the Summary. The Percentage has been computed on the basis of a fraction, the numerator of which is the approximate rentable square foot area of the premises and the denominator of which is the approximate total rentable square foot area of all space in the Building Project, both as described in Paragraph 5 of the Summary.

(d) The term “Expenses” shall mean the sum of “Taxes” and “Operating Expenses”, as hereinafter defined:

(i) The term “Taxes” shall mean the total of all real estate taxes and special or other assessments levied, assessed or imposed at any time by any governmental authority upon or against the Building Project to the extent it relates to the premises. If due to a future change in the method of taxation or in the taxing authority, or for any other reason, a franchise, income, transit, profit, or other tax or governmental imposition, however designated, shall be levied against Lessor in substitution is whole or in part for the real estate taxes, or in lieu of additions to or increases of said real estate taxes, then such franchise, income, transit, profit, or other tax or governmental imposition shall be deemed to be included within the definition of “taxes” for the purposes of this Article 3A. As to special assessments which are payable over a period of time extending beyond the term of this Lease unexpired at the time of the imposition of such assessment, shall be included in “taxes” for the purposes of this Article 3A; and

4

(ii) The term “Operating Expenses” shall mean the total of all the costs and expenses incurred, borne or accrued, borne or accrued by Lessor with respect to the operation and maintenance of the Building Project and the repair and/or replacement of equipment used therein or thereon, which, in accordance with sound accounting and management principles generally accepted with respect to the operation of first class warehouse and/or industrial park building, would be construed as an operating expense (but specifically excluding structural repairs to the exterior block walls, the foundation, footing, steel beams and other structural support members, the repair of which are the sole responsibility of Lessor); and

(e) The term “Expense Statement” shall mean a statement in writing, signed by or on behalf of Lessor, setting forth the amount payable by Lessee for a specified Operation year pursuant to this Article 3A.

(2) The additional rent pursuant to the provisions of this Article 3A shall be paid by Lessee to Lessor as follows:

(a) A projected Expense Statement for the remaining portion of the Operation Year which falls within the first year of the term of this Lease shall be furnished by Lessor to Lessee upon the execution of this Lease. Lessee shall thereupon pay to Lessor, together with the first installment of base monthly rent, a sum equal to one-twelfth (1/12) of the Percentage times the Expenses specified on the projected Expense Statement for such Operation Year, which sum shall be designated as the “Expense Payment” for the Operation year. On the first day of the following month and on the first day of each succeeding month thereafter, until readjusted pursuant to the terms of this Article 3, the monthly rent payable under this Lease shall be increased by an amount equal to the Expense Payment for that Operation Year.

(b) A projected Expense Statement for each operation Year after the first shall be furnished by Lessor to Lessee during the month of February prior to each such succeeding Operation Year. On the first day of March of each succeeding year thereafter, until readjusted pursuant to the terms of this Article 3, the monthly rent payable under this Lease shall be adjusted by a sum equal to one-twelfth (1/12) of the Percentage times the Expenses specified on the projected Expense Statement for such Operation Year, which sum shall be designated as the “Expense Payment” for that Operation Year.

(c) An actual Expense Statement for each preceding Operation Year shall be furnished by Lessor to Lessee prior to the first day of April of Each Operation Year after the first. If the actual amount of the sum of the Expense Payments for the previous Operation Year pursuant to the actual Expense Statement shall be less or greater than the sum of the Expense Payments for that Operation year which were actually paid by Lessee to Lessor, there shall be paid by Lessee to Lessor within ten (10) days of receipt of such actual Expense Statement, or credited by Lessor to Lessee against the rent next due hereunder after receipt of such actual expense statement, as the case may be, an amount equal to the difference between the sum of the Expense Payments for that Operation Year which were actually paid by Lessee to Lessor.

5

B. Lessor shall cause Expense Statements to be prepared in reasonable detail and delivered to Lessee on a timely basis. The Expense Statements shall be deemed to constitute a final determination as between Lessor and Lessee of the matters therein for the periods represented thereby, unless Lessee, within ten (10) days after any such Statement is furnished, gives written notice to Lessor that it disputes its accuracy or its appropriateness and specifies the particular respects in which such Statement is considered to be inaccurate or inappropriate. If Lessee shall so dispute any such Statement, then pending the resolution of such dispute, either by mutual agreement between the parties hereto or by employing an independent auditor to audit such statements, the cost of which to be paid for by the non-prevailing party. Lessee shall nevertheless pay to Lessor the Fixed Annual Rent and additional rent in accordance with the Statement, and any amount determined to be excessive shall be credited to the payments of base monthly rent due from Lessee in the month immediately following such determination.

C. Any delay or failure of Lessor in computing or billing for any additional rent hereunder shall not constitute a waiver of, or in any way impair, the continuing obligation of Lessee to pay such additional rent or Fixed Annual Rent

D. Notwithstanding any expiration of this Lease or termination of this Lease prior to its expiration date (except in the case of a cancellation by mutual agreement or by cancellation by Lessee as a result of Lessor’s breach of this lease), and notwithstanding that an Expense Statement may be furnished to Lessee after the expiration or termination of this Lease, Lessee’s obligation to pay Fixed Annual Rent or additional rent as adjusted under this Article 3 shall continue and shall cover all periods up to the expiration day of this Lease and shall survive any sooner expiration or termination of this Lease. Any obligation on Lessor’s part to credit any amount to Lessee pursuant to this Article 3 shall, upon the termination of this Lease for a reason other than Lessee’s default hereunder, be converted to an obligation on Lessor’s part to pay such amount to Lessee within forty-five (45) days of the date such credit was to have been made.

E. Notwithstanding anything to the contrary above, if such charges (or portion thereof) as set forth in this Paragraph 3 are directly related to Tenant’s occupancy of the Premises, then Tenant shall be fully responsible for the same to the extent of said-direct relationship.

4. SALES AND USE TAX: Lessee hereby covenants and agrees to pay monthly to Lessor, as additional rent, any sales, use or other tax to the extent it relates to the Building Project, excluding state and federal income tax or personal property tax now or hereafter imposed upon rents by the United States of America., the State of Florida or any political subdivision thereof; and any interest or penalties assessed in connection therewith by reason of Lessor’s actions or inaction’s in connection with their remittance of such tax to the proper governing body, providing Lessee renders timely payments, notwithstanding the fact that the statute, ordinance or enactment imposing the same may endeavor to impose the tax on Lessor.

5. ASSIGNMENT OR SUBLETTING:

A. Lessee shall not assign the right of occupancy under this Lease or any other interest herein, or sublet the premises, or any portion thereof, without the prior written consent of Lessor, which shall not be unreasonably withheld. Lessee absolutely shall have no right of

6

assignment or subletting if it is in default of this Lease. Should Lessor elect to grant its written consent to any proposed assignment or sublease, Lessee agrees to pay Lessor an administrative fee in a reasonable amount (but not less than $150.00), to process and approve such assignment or sublease and Lessor shall prescribe the substance and forma of such assignment or sublease.

B. Notwithstanding any assignment of this Lease, or the subletting of the premises or any portion thereof; Lessee shall continue to be liable for the performance of the terms, conditions and covenants of this Lease, including, but not limited to, the payment of rent and additional rent. Consent by Lessor to an assignment or subletting shall not operate as a waiver of Lessor’s right to withhold consent as to any subsequent assignment and subletting. Lessor shall have the sole option, which shall be exercised by providing Lessee with written notice thereof terminating Lessee’s rights and obligations under this Lease rather than permitting any assignment or subletting by Lessee.

C. Should Lessor Permit any assignment or subletting by Lessee and should the monies received by Lessee as a result of such assignment or subletting minus an amount reasonably assessed by Lessee for services it provides for any assignee or sublessee and any other costs Lessee incurs pursuant to any assignment or subletting be greater than the amount due to Lessor under this Lease, then, at Lessor’s election, the excess shall be payable by Lessee to Lessor, it being the parties’ intention that Lessor, and not Lessee, shall be the party to receive any profit from any assignment or subletting. Any and all of Lessee’s options to lease additional space in the Building to be exercised subsequent to the date if such assignment or subletting are absolutely waived and terminated at Lessor’s sole option.

D. Any breach of this Article 5 by the Lessee will constitute a default under the terms of this Lease.

6. DEFAULT:

A. Lessor may terminate this Lease on five (5) days notice: (i) if rent or additional rent is not paid within ten (10) days after written notice from Lessor; or (ii) if Lessee shall have failed to cure a default in the performance of any covenant of this Lease (except the payment of rent), or any rule or regulation hereinafter set forth within five (5) days after written notice thereof or, if such default is incapable of cure within said five (5) day period, if Lessee shall not promptly proceed to cure such default within said five (5) days, or shall not thereafter complete the curing of such default with due diligence; or (iii) if a petition in bankruptcy shall be filed by or against Lessee or if Lessee shall make a general assignment for the benefit of creditors, or receive the benefit of any insolvency or reorganization act; or (iv) if a receiver or trustee is appointed for any portion of Lessee’s property and such appointment is not vacated within thirty (30) days; or (v) if any execution or attachment shall be issued under which the premises shall be taken or occupied or attempted to be taken or occupied by anyone other than Lessee; or (vi) if the premises become and remain vacant or deserted for a period of twenty (20) days; or (vii) if the premises are used for some purpose other than the purpose in Article 1 hereof; or (viii) if this lease is mortgaged or assigned without the prior written consent of Lessor; or (ix) if any portion of the premises is sublet without the prior written consent of Lessor; or (x) if Lessee shall default beyond any grace period under any other Lease between Lessee and Lessor; or (xi) if Lessee shall fail to move into or take possession of the premises within fifteen (15) days after commencement of the term of this Lease.

B. At the expiration of the five (5) day notice period, this Lease any rights of renewal or extension thereof shall terminate as completely as if that were the date originally fixed for the expiration of the term of this Lease, but Lessee shall remain liable as hereinafter provided.

7

7. REMEDIES: Upon Lessor’s termination of the lease in connection with Article 6 above:

A. (1) Lessor may re-enter the premises by summary proceedings or otherwise and re-let the premises, or any part thereof, as Lessee’s agent, in the name of Lessor, or otherwise, for a term shorter or longer than the balance of the term of this Lease, and may grant reasonable concessions of free rent and/or reasonable tenant improvements, and may grant any other reasonable concessions in connection therewith as are necessary to re-let the premises. Lessee shall pay Lessor any deficiency between the rent hereby reserved and the net amount of any rents collected by Lessor for the remaining term of this Lease through such re-letting. Such deficiency shall become due and payable monthly, as it is determined. Unless Lessee is notified by Lessor in writing to the contrary, any such re-entry or re-letting shall be deemed to be only for the account of Lessee. Lessor shall have no obligation to re-let the premises, and its failure or refusal to do so, or failure to collect rent on re-letting, shall not affect Lessee’s liability hereunder. In computing the net amount of rents collected through such re-letting Lessor may deduct all expenses incurred in obtaining possession or re-letting the premises, including rent concessions, reasonable attorneys’ fees and costs (at trial and appellate levels, including bankruptcy court proceedings), brokerage fees, the cost of restoring the premises. In no event shall lessee be entitled to a credit or repayment for re-rental income which exceeds the sums payable by Lessee hereunder or which covers a period after the original term of this Lease. Lessee hereby expressly waives any right of redemption granted by any present or future laws. “Re-Enter” and “re-entry”, as used herein, are not restricted to their technical meaning:

(2) Lessor may retake possession of the premises, or any part thereof, on its own behalf, and, upon notice to Lessee in writing to that effect, may treat this Lease as terminated;

(3) Lessor may accelerate and claim and demand immediate payment of the Fixed Annual Rent and all forms of additional rent (as reasonable estimated) due for the remainder of the term of this Lease and any extensions thereof which may have been exercised;

(4) Lessor may pursue any other remedy available to it at law or in equity; and

(5) In the event of a breach or threatened breach of any of the covenants or provisions hereof, Lessor shall have the further right to seek an injunction.

B. Mention herein of any particular remedy shall not preclude Lessor from any other available remedy or remedies at law or in equity, all of which are cumulative.

8

C. If Lessor’s re-entry is the result of Lessee’s bankruptcy, insolvency, or reorganization, Lessor shall recover as liquidated damages, in addition to accrued rent and other charges, the Full rental for the maximum period allowed by any act relating to bankruptcy, insolvency or reorganization.

D. If Lessor re-enters the premises for any cause or if Lessee abandons or vacates the premises, any property left in the premises shall be deemed to have been abandoned by Lessee, and Lessor shall have the right to retain or dispose of such property in any manner without any obligation to account therefore to Lessee. This provision shall survive any termination of this Lease.

8. LESSOR MAY CURE DEFAULTS: If Lessee shall default in performing any covenant or condition or condition of this Lease, Lessor may perform the same for the account of Lessee, and Lessee shall reimburse Lessor for any expense incurred therefore.

9. ALTERATIONS: Lessee shall make no decoration, alteration, addition or improvement in or to the premises without the prior written consent of Lessor, and then only by contractors or mechanics and in such manner and time, and with such materials as may be approved by Lessor, not to be unreasonably withheld. All alterations, additions or improvements to the premises, including air-conditioning equipment and duct work, except movable office furniture and equipment installed at the expense of Lessee, shall, unless Lessor elects or otherwise agrees in writing, become the property of Lessor upon the installation thereof, and shall be surrendered with the premises at the expiration of this Lease; provided, however, any such alterations, additions, and improvements which Lessor designates in writing at least thirty (30) days prior to the expiration of the lease shall be removed by Lessee at or before the expiration or sooner termination of this Lease and any damage caused thereby shall be repaired at Lessee’s expense. Lessor shall not unreasonably withhold or delay its consent to non-structural alterations.

10. LIENS: The interest of Lessor in the Building and/or Building Project shall not be subject to a lien for any improvements to the premises made by Lessee. Lessee shall permit no lien to be filed against any portion of the building or Building Project for work or materials claimed to have been furnished to Lessee, and, if any such lien shall be filed, Lessee shall, at its expense, cause any such lien to be discharged of record within ten (10) days after notice thereof. Lessor may record a Memorandum of Lease prohibiting the attachment of any contractor’s liens to Lessor’s interest in the premises.

11. REPAIRS: Lessee shall, at its expense, take good care of the premises, which includes, but is not limited to, all electrical, plumbing, heating, air conditioning and other mechanical or machinery installations therein; all doors, as well as all plate glass doors and windows, fixtures and appurtenances therein, and shall make all repairs, alterations, replacements and modifications necessary to keep them in as good working order and condition, using material and labor of a kind and quality equal to the original work, as they were upon commencement of this Lease, including structural repairs when those are necessitated by the act, omission or negligence of Lessee or its agents, employees or invitees. The exterior walls of the Building, the windows and the portions of all window sills outside same are not part of the premises demised by this Lease, and Lessor hereby reserves all rights to such parts of the Building.

9

Tenant shall not abandon or vacate the Demised Premises, shall not permit, license or suffer the occupancy of any other party in the Demised Premises and shall keep the Demised Premises and sidewalks, service-ways and loading areas adjacent to the Demised Premises neat, clean and free from dirt, rubbish, insects and pests at all times and store all trash and garbage within the Demised Premises, arranging for a regular pick up of such garbage and trash at Tenant’s expense. Tenant shall store all trash and garbage within the area designated by Landlord for such trash pick up and removal and only the receptacles of the size, design and color from time to time prescribed by Landlord. Tenant shall not operate an incinerator or burn trash or garbage within the Center.

Tenant agrees, at Tenant’s sole cost and expense (i) to comply promptly and fully with all present and future governmental laws, ordinances, orders, rules and regulations affecting the Premises and/or Tenant’s use thereof, including without limitation, the Americans with Disabilities Act, 42, U.S.C. Section 12111, et. Seq., as amended, and/or the cleanliness, safety, occupancy and use of the same; and (ii) be and remain authorized to do business in the state in which the Center is located.

Tenant shall make no alternations or additions to the Premises or erect any exterior signs other than a building standard Tenant sign (if any) provided by Landlord or as may be made with Landlord’s prior written consent which consent shall not be unreasonably withheld. All alterations or additions made with such consent shall be part of the Premises and the property of Landlord, subject to the terms of this Lease unless otherwise provided by the instrument of consent. Tenant’s trade fixtures, equipment or other personal property placed on the Premises may be removed by Tenant at any time during the Rental Term; but if installation of any of same in or on the Premises or the removal therefrom of any thereof could deface structurally alter the Premises, Landlord’s written consent to installation must first be procured and, upon removal, all any damage to the Premises caused thereby shall be fully repaired promptly by Tenant at Tenant’s expense. There shall be no outside storage of any kind whatsoever. Notwithstanding anything to the contrary contained herein, Tenant shall not be responsible for roof or structural maintenance except to the extent the same may be occasioned by Tenant’s negligence.

12. COMPLIANCE:

A. Lessee shall, at its expense, comply with all laws, orders and regulations of any governmental authority having or asserting jurisdiction over the premises or the use or occupancy thereof, including, but not limited to, any and all federal, state and local laws, ordinances, regulations and other requirements regarding hazardous or toxic wastes or materials, radioactive materials asbestos or other contaminating wastes or pollutants (collectively, “Hazardous Materials”).

B. Lessee shall, at its expense, comply with all requirements of the Board of Fire Underwriters, or any other similar body affecting the premises. Lessee shall not use the premises nor store or use hazardous or flammable materials on the premises in a manner which shall increase the cost of fire insurance or other insurance of Lessor or of any other tenant over that in effect prior to the Lease. If Lessee’s such use of the premises directly causes increases in any such costs, Lessee shall promptly and fully reimburse the party paying such increased cost. The fact that the premises are being used for the purpose set forth in Article 1 hereof shall not relieve Lessee from the foregoing duties, obligations and expenses.

10

C. Lessee shall, at its expense, observe faithfully and comply strictly with all Rules and Regulations which may from time to time be adopted with respect to the Building and/or Building Project.

D. Lessee shall at no time use or occupy the premises in violation of the certificate of occupancy issued for the Building or the premises, a copy of which shall be provided to Lessee upon delivery from the county via Certified Mail, which shall then be attached as Exhibit B hereto. Lessee shall not use the premises in any way which may constitute a nuisance to the neighborhood by reason of odors, fumes, dust, smoke, noise or pollution, or in any way which may be hazardous by reason of danger of fire, explosion or pollution. The statement of the permitted use of the premises in Article 1 hereof shall not constitute a warranty or representation by Lessor that such use is permitted by local building, zoning, or land use codes or ordinances and Lessee shall comply with all such codes and ordinances throughout the term of this Lease. Lessee shall procure any and all governmental licenses, permits and other approvals from time to time required for the uses permitted under this Lease. Lessee shall be solely responsible for ascertaining whether Lessee’s proposed use of the premises complies with local zoning and other laws, ordinances and regulations. At no time shall retail sales be conducted from the premises.

E. (1) Lessee shall not use, maintain, generate or bring on or into the premises, the Building or the Building Project, or transport or dispose of on or from the premises, the Building or the Building Project (whether through the sewer or septic system or into the ground by removal off-site or otherwise) any Hazardous Materials. Lessee shall immediately deliver to Lessor copies of any and all letters, notices, complaints and any other written communication received by Lessee, and shall immediately deliver written notice to Lessor of any oral communication received by Lessee, which related to Lessee’s compliance or non-compliance with any federal, state or local laws, ordinances, regulations or other requirements regarding hazardous Materials. In no event shall Lessee’s use or occupancy of the premises the Building or the Building Project pose any substantial present or potential hazard to the health, safety or welfare of the occupants of the premises, the Building or the Building Project, or pose any substantial present or potential risk of damage to the premises, the Building or the Building Project.

(2) If Lessor has reason to believe that there exists any Hazardous Materials in or on the premises, the Building or the Building Project caused or permitted by Lessee, then Lessor shall have the right to obtain, at Lessee’s expense, if such report confirms the presence of such Hazardous Materials, and environmental audit report from a qualified environmental engineer or testing service selected by Lessor. If the presence of any Hazardous Materials in or on the premises, the Building or the building Project caused or permitted by Lessee results in contamination, or if contamination by Hazardous Materials otherwise occurs for which Lessee is liable to Lessor for damages resulting therefrom, Lessee shall indemnify, defend and hold harmless Lessor and Lessor’s successors, assigns, grantees and mortgagees from and against any and all claims, judgments, damages, penalties, fines, assessments, liens, costs, liabilities and losses (inducing without limitation, and diminution in value of the premises, the Building or the Building Project, damages for the loss of restriction on use of rentable or usable space or of any

11

amenity of the premises, the Building or the Building Project, damages arising from any adverse impact on marketing space in the Building or the building Project, and any sums paid in settlement of any claims, attorney’s fees and costs, consultation fees and expert fees, including any such fees and costs in bankruptcy and through and including all post-judgment and appellate proceedings) which may arise during or after the term of this Lease as a result of such contamination. The foregoing indemnification of Lessor by Lessee includes, without limitation, and any and all costs incurred in connection with any investigation of the site conditions or any clean-up, the handling and disposal of any Hazardous Materials, and any other remedial, removal or restoration work required by a federal, state or local governmental agency or political subdivision because of Hazardous Materials present in the soil or ground water on or under the building or the Building Project. Notwithstanding the foregoing, if the presence of any Hazardous Materials caused or permitted by Lessee results in any contamination of any part of the Building Project, Lessee shall promptly take any and all actions, at Lessee’s expense, and subject to Lessor’s prior written consent thereto, as may be necessary or appropriate to restore and repair the Building Project to the condition existing immediately prior to the introduction of any such hazardous Materials.

(3) Lessor and Lessee acknowledge that Lessor may become legally liable for the costs of complying with laws relating to hazardous Materials which are the responsibility of Lessee and accordingly, Lessor and Lessee agree that the costs of complying with laws relating to Hazardous Materials in or on the Building Project caused or permitted by Lessee, for which Lessor may be legally liable, and which are paid or incurred by Lessor, shall be fully reimbursed to Lessor by Lessee within ten (10) days after Lessee receives a statement of charges therefore from Lessor.

(4) The provisions of this Article 12E shall survive the expiration or sooner termination of this Lease.

13. SERVICES: Lessor shall be obligated only to furnish landscape, maintenance and lighting services for the parking facilities and green areas adjacent to the Building and the cost of such items shall be included within the term Operating Expenses for the purposes of Article 3A hereof.

14. UTILITIES: Tenant shall pay, when due, all charges by public authority or private utility for any and all water, sewer, electric, gas, dumpster and trash removal, and other utility service to the Premises during the Rental Term, not payable in the first instance by Landlord, and if such charges are payable by Landlord in the first instance, Tenant shall reimburse Landlord for Tenant’s pro rata share of such charges, as determined by Landlord, within fifteen (15) days of Landlord notifying Tenant of the amount of said charges.

A. Lessee shall obtain and pay for Lessee’s entire separate supply of electric current, including all electricity used by the air conditioning and ventilating equipment servicing the premise, by direct application to and arrangement with the public utility company servicing the Building. Lessor will permit its electric feeders, risers and wiring serving the premises to be used by Lessee to the extent available and safely capable of being used for such purposes.

12

B. Lessor shall not be liable to Lessee for any cost, loss, damage or expense which Lessee may sustain or incur if either the quantity or character of electric service is changed or is no longer available or suitable for Lessee’s requirements.

C. Lessee covenants and agrees that at all times its use of electric current shall never exceed the capacity of the existing feeders to the Building or the risers or wiring installation.

15. INTERRUPTION OF SERVICES, ETC: Lessor reserves the right from time to time, to install, use, maintain, repair, replace and relocate for service to the premises and other parts of the Building, or either, pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the premises or the Building. Interruption of curtailment of any service maintained in the Building if caused by strikes, mechanical difficulties, or any cause beyond Lessor’s control, whether similar or dissimilar to those enumerated, shall not entitle Lessee to any claim against Lessor or to any abatement in rent, nor shall the same constitute a constructive or partial eviction. Lessor shall not be liable to lessee for any injury or damage resulting from defects in the plumbing, heating or electrical systems in the building or for any damage resulting from water leakage into the Building other than injury or damage that could have been prevented by Lessor as a result of Lessor arranging for the prompt repair of any such defect or leakage Lessor had notice or actual knowledge of or of any act or failure to act by any other tenant at the Building or for any damage resulting from windstorm, hurricane or rainstorm or any other cause beyond Lessor’s control.

16. ABANDONMENT OF PREMISES: Lessee covenants and agrees that it shall occupy the entire premises, shall conduct its business thereon in the regular and usual manner, throughout the term of this Lease, and that these covenants are a material element of consideration inducing Lessor to execute this Lease. Lessee further agrees that if at any time during the term of this Lease, it is dispossessed by process of law or otherwise, or if Lessee fails to so conduct its business therein, then all Fixed Annual Rent and additional rent reserved in this Lease shall, at the option of Lessor, immediately become due and payable.

17. NON-WAIVER: No waiver of any covenant or condition of this Lease by either party shall be deemed to imply or constitute a further waiver of the same covenant or condition or any other covenant or condition of this Lease. Any such waiver must be in writing and signed by the party granting the waiver. No act or omission of Lessor or its agents shall constitute an actual or constructive eviction unless Lessor shall have first received written notice of Lessee’s claim and shall have had a reasonable opportunity to respond to such claim.

18. SUBORDINATION AND ESTOPPEL:

A. This Lease shall be subordinate to any mortgage heretofore or hereafter placed upon the Building and/or the Building Project and any renewal, modification, replacement or extension of such mortgage, and to any and all advances made or to be made thereunder. Further, if requested by Lessor or any existing or prospective mortgagee of the Building and/or Building Project, Lessee agrees to execute a Subordination and Attornment Agreement. Any such mortgage to which this Lease shall be subordinated may contain such other terms, provisions and conditions as such mortgagee deems usual or customary. Lessee agrees to execute and deliver any instruments necessary or reasonable to implement the provisions of this

13

Article, including any reasonable, non-material modification to this Lease requested by any existing or prospective mortgagee of the Building and/or the Building Project. Lessee hereby irrevocable appoints Lessor and any successor or assign of Lessor as its attorney-in-fact (which appointment is coupled with an interest and is irrevocable) to execute and deliver any such instrument of subordination for and on behalf of Lessee and its permitted successors and assigns.

B. Lessee shall, from time to time, upon request, execute and deliver to the party requesting the same (i) an “Estoppel Letter”, so-called, in form satisfactory to such party stating, if true, that this Lease is in full force and effect and that no defaults exist hereunder on the part of Lessor and stating the current status of rent paid to Lessor and security deposits held by Lessor, and any other reasonable information relating to the Lease, (ii) a copy of every notice of default delivered by Lessee to Lessor at the same time and in the manner as to Lessor, and/or (iii) and agreement acknowledging an assignment of this Lease and consenting to the payment of rent in accordance with the terms of such assignment.

C. For the purposes hereof, the term “mortgage” shall include real estate mortgages, deeds of trust, security agreements, ground leases, or any other form of indenture affecting the Building or the Building Project; the term “mortgagee” shall mean the holder of any mortgage, security agreement or indenture or any existing or future ground lessor, trustee of a deed, or trust.

19. DAMAGE OR DESTRUCTION:

A. If the premises shall be partially damaged by fire or other casualty, and in Lessor’s opinion (which shall be given within ten (10) days after the occurrence of such fire or other casualty or if, in good faith, such opinion cannot be made within ten (10) days then within a reasonable amount of time not to exceed twenty (20) days), the damage can be repaired within ninety (90) days, excluding the time required to obtain permits, then the damage shall be repaired by and at the expense of Lessor, this Lease shall continue in effect, and all forms of rent due hereunder shall abate in proportion to the portion of the premises deemed by both parties to be unusable by Lessee, commencing with the date of such fire or other casualty. If in Lessor’s opinion, the damage cannot be repaired within such ninety (90) days, then Lessor shall provide written notice to Lessee of Lessor’s opinion, and Lessee may at its option, terminate this Lease within ten (10) days thereof. If Lessee elects not to terminate this Lease, Lessor may, at its option, either terminate this lease or repair such damage within a reasonable time and, in such event, this lease shall continue in effect and the rent shall abate as aforesaid. Lessor’s election shall be evidenced by written notice given to lessee.

B. If the premises shall be totally damaged by fire or other casualty and in Lessor’s opinion (which shall be given within ten (10) days after the occurrence of such fire or other casualty or if, in good faith, such opinion cannot be made within ten (10) days then within a reasonable amount of time, not to exceed twenty (20) days), repair or restoration is economically justified and such repair or restoration can be completed within ninety (90) days, excluding the time required to obtain permits, then the premises shall be restored by and at the expense of Lessor, with all forms of rent abating in toto, commencing with the date of such fire or other casualty. If Lessor shall decide not to restore the premises, then Lessor shall give written notice to Lessee of such decision, the term of this Lease shall automatically expire on the third (3rd) day after such notice is given, and all forms of rent due hereunder shall abate in toto, commencing with the date of such fire or other casualty.

14

C. If the premises are damaged as a result of a wrongful or negligent act of Lessee or any of its guests, invitees, customers or agents on the premises with Lessee’s express or implied consent, then there shall be no abatement of rent, regardless of the period for which the premises are unusable, and any such damage shall be repaired promptly at Lessee’s sole cost and expense in accordance with Paragraph 11 hereof. In no event shall Lessor be liable to Lessee for any delay in restoring the premises. Lessor shall not be responsible for any damage to or destruction of Lessee’s interior tenant improvements, movable trade fixtures, display devices, supplies, equipment or similar tangible personal property.

D. Notwithstanding the foregoing, each party shall look first to any insurance in its favor before making any claim against the other party for recovery for loss or damage resulting from fire or other casualty to the extent that such insurance is in force and collectible and to the extent permitted by law. Lessor and Lessee hereby release and waive all right of recovery against the other or any one claiming through or under each of them by way of subrogation or otherwise. However, the foregoing release and waiver shall be in force only if both releasor’s insurance policies contain a clause providing that such a release or waiver shall not invalidate such insurance. Lessee hereby expressly agrees that the foregoing provisions shall govern and control in lieu of any law contrary to the provisions of this paragraph.

20. CONDEMNATION: If the whole or any substantial part of the premises shall be condemned by eminent domain, or acquired by private purchase in lieu thereof for any public or quasi-public purpose, this Lease shall, at the option of Lessor, terminate on the date of the vesting of title through such proceeding or purchase and Lessee shall have no claim against Lessor for the value of any of any unexpired portion of the term of this Lease, nor shall Lessee be entitled to any part of the condemnation award or private purchase price awarded to Lessor, nor shall Lessor be entitled to any condemnation award, awarded to Lessee. If less than a substantial part of the premises is taken by condemnation, and as a result the Lessee’s use of the Premises is not interfered with, this Lease shall not terminate, but all forms of rent due hereunder shall abate in proportion to the portion of the premises so taken. In no event shall Lessor be liable to Lessee for any business interruption, diminution in use or for the value of any unexpired term of this Lease.

21. RIGHT OF ENTRY: Lessee shall permit Lessor to erect and maintain pipes and conduits in and through the premise. Lessor and its agents shall have the right to enter or pass through the premises at all times upon giving reasonable notice to Lessee by master key and, in an emergency, by reasonable force or otherwise, to examine the same, and to make such repairs, alterations or additions as it may deem necessary or desirable to the premises or the Building, and to take all material into and upon the premises that may be required therefor. Such entry and work shall not constitute an eviction of Lessee in whole or in part, providing such entry and work does not materially interfere with Lessee’s use of the premises, and shall impose no liability on Lessor by reason of inconvenience or injury to Lessee’s business. Lessor shall have the right at any time, without the same constituting an actual or constructive eviction, and without incurring any liability to Lessee, to (i) remove or change the arrangement and/or location of entrances, corridors (if any), stairs, toilets and/or other public parts of the Building, (ii) change the name or

15

number by which the Building is known, (iii) alter the number of and/or relocate parking areas for the Building, (iv) alter the location of walkways, driveways, and green areas with respect to the Building and/or Building Project, and/or (v) make additions to the Building and/or Building Project. At any time during the term of this Lease, Lessor may exhibit the premises to prospective purchasers or mortgagees of Lessor’s interest therein, and may place upon the premises the usual “For Sale” notices. During the last year of the term of this Lease, Lessor may exhibit the premises to prospective tenants and may place and keep upon the premises the usual “To Let” notices.

22. RELOCATION: [INTENTIONALLY DELETED]

23. END OF TERM: Lessee shall surrender the premises to Lessor at the expiration of this Lease with premised in as good order and condition as they were delivered to Lessee at the commencement of this Lease, except for reasonable wear and tear and damage by fire or other casualty in accordance with paragraph 11 of this Lease. Any defects in the premises discovered by Lessee within thirty (30) days of the Commencement Date shall be listed on an exhibit by Lessee, acknowledged by Lessor and attached hereto. Lessee shall also (except as otherwise provided herein) remove all of its personal property from the premises at the expiration of the term of this Lease and restore the premises to their original condition, except for reasonable wear and tear and damage by fire and other casualty. Lessee acknowledges that possession of the premises must be surrendered to Lessor at the expiration or sooner termination of the term of this Lease. Lessee agrees it shall indemnify and save Lessor harmless against all cost, claims, loss or liability resulting from delay by Lessee in so surrendering the premises, including without limitation, any claims made by any succeeding tenant founded on such delay. The parties recognize and agree that the damage to Lessor resulting from any failure by Lessee to timely surrender possession of the premises as aforesaid will be substantial, will exceed the amount of monthly rent therefore payable hereunder, and accurate measurement will be impossible. Lessee therefore agrees that if possession of the premises is not surrendered to Lessor on the date of the expiration or sooner termination of this Lease, then Lessee agrees to pay Lessor as liquidated damages for each month, and for each portion of any month pro-rated on a daily basis, during which Lessee holds over in the premises after the expiration or termination of the term of this Lease, as sum equal to two (2) times the average rent and additional rent which was payable per month under this Lease during the last six months of the term thereof.

24. POSSESSION: If Lessor shall be unable to give possession of the premises upon obtaining the Certificate of Occupancy for any reason, Lessor shall not be subject to any liability for such failure. In such event, this Lease shall stay in full force and effect, without extension of its term, provided Lessor gives possession within twenty (20) days from obtaining the Certificate of Occupancy, otherwise this Lease shall terminate and Lessee shall have no further liability to Lessor pursuant to this Lease; however, in the event the reason for the delay in possession was caused by change orders by Lessee to the attached Lessee Interior Improvement Plan, then the twenty day time period shall extend by the number of days required to facilitate such change orders. The rent hereunder shall not commence until the premises are available for occupancy by Lessee.

25. QUIET ENJOYMENT: Lessor covenants that if Lessee pays the rent and performs all of Lessee’s other obligations under this Lease, Lessee may peaceably and quietly enjoy the demised premises, subject to the terms, covenants and conditions of this Lease and the ground Lease, underlying lease and/or mortgages herein before mentioned.

16

26. INDEMNITY: Lessee shall indemnify, defend and save Lessor harmless from and against any liability or expense, including reasonable attorney’s fees through all appellate levels, arising from the use or occupation of the premises by Lessee, or any of its guests, invitees, customers or agents on the premises with Lessee’s express or implied consent.

27. CONDITION OF PREMISES: Lessee acknowledges that Lessor has made no representations or promises with respect to the condition of the premises, except as herein expressly set forth. Lessee agrees to accept the premises “as is”, except for any work which lessor has expressly agreed in writing to perform, and any repairs necessary pursuant to Lessee’s inspection of the premises upon commencement of this Lease.

28. JURY WAIVER: To the extent permitted by law, Lessor and Lessee hereby waive trial by jury in any action, proceeding or counterclaim involving any matter whatsoever arising out or in any way connected with this Lease, the relationship of Landlord and tenant, Lessee’s use or occupancy of the premises (except for personal injury or property damage) or involving the right to any statutory relief or remedy. Neither party will interpose any counterclaim of any nature in any summary proceeding.

29. NOTICES: Any bill, notice or demand from Lessor to Lessee may be delivered personally at the premises or sent by registered or certified mail to Lessee at the premises. Such bill, notice or demand shall be deemed to have been given at the time of such delivery or mailing. Any notice from Lessee to Lessor must be sent by registered or certified mail to the address set forth for Lessor at the beginning of this Lease. Notice shall be deemed given three (3) days after same shall have been deposited in an official United States Post Office, postage prepaid, or when hand-delivered, as the case may be. Either party may specify a different address for notice purposes by giving written notice thereof to the other party in accordance with the provisions of this Article.

A. If the holder of record of a mortgage or a ground lessor covering the Demised Premises should have given prior notice to Tenant that it is the holder of such mortgage or is a ground lessor and such notice includes the address to which notices are to be sent, Tenant shall give to said party notice simultaneously with any notice given to Landlord to correct any alleged default of Landlord hereunder. Said party shall have the right, within thirty (30) days after receipt of said notice, to correct or remedy such default before Tenant may take no action under the Lease by reason of such default if such party shall have commenced, during said thirty-day period, to remedy the alleged default and continues thereafter to use its diligence to remedy the alleged default. Any notice of default given to Landlord shall be null and void unless simultaneous notice has been given to said mortgagee or ground lessor.

30. SECURITY DEPOSIT: Lessee has deposited with Lessor the sum described in Paragraph 9 of the summary as security for the performance by Lessee of the terms of this Lease. Lessor may use any part of the security to satisfy any default of Lessee and any expenses arising from such default, including but not limited to any damages or rent deficiency before or after re-entry by Lessor. Lessee shall, upon demand, deposit with Lessor the full amount so used, in

17

order that Lessor shall have the full security deposit on hand at all times during the term of this Lease. If Lessee shall comply fully with terms of this Lease, the security deposit shall be returned to Lessee upon the expiration or earlier termination of this Lease.

31. FINANCIAL STATEMENTS: Upon request from Lessor, Lessee shall deliver to Lessor its regularly prepared annual financial statements for each fiscal year of Lessee which concludes during any portion of the term of this Lease such statements shall be (i) prepared in accordance with generally accepted accounting principles, (ii) certified by the independent certified public accountant preparing the same, if so prepared, or by the chief executive officer of the Lessee, if prepared internally, and (iii) delivered to Lessor within twenty (20) days after completion of the same or ninety (90) days after the conclusion of such fiscal year, whichever is earlier.

32. EFFECT OF CONVEYANCE OR LEASE: If the Building or Building Project shall be sold, transferred, or Leased, or the Lease thereof transferred or sold, Lessor shall be relieved of all future obligations and liabilities hereunder providing the security deposit has been properly transferred to Lessor’s successor in interest and the purchaser or transferee of the Building or Building Projects, as the case may be, shall be deemed to have assumed and agreed to perform all such obligations and liabilities of Lessor hereunder. In the event of such sale, transfer or Lease, Lessor shall also be relieved of all existing obligations and liabilities hereunder, provided that the purchaser, transferee or Lessee of the Building or Building Project, as the case may be, assumes in writing such obligations and liabilities (a copy of such assumption will be provided to Lessee).

33. RIGHTS OF SUCCESSORS AND ASSIGNS: This Lease shall bind and inure to the benefit of the heirs, executors, administrators, personal representatives, successors and, except as otherwise provided herein, the assigns of the parties hereto.

34. BROKER: Both parties represent and warrant that they neither consulted nor negotiated with any Broker or finder with respect to the demised premises other than the Broker described in paragraph 12 of the Summary (hereinafter referred to as the Broker). Both parties agree to indemnify, defend and save the other party harmless from and against any claims for fees or commissions from anyone other than Broker, with whom either party has dealt in connection with the demised premises of this Lease. Lessor agrees to pay any commission or fee owing to Broker.

35. INSURANCE: Lessee shall, at its own expense, carry throughout the term of this Lease, public liability insurance with limits of One Million Dollars ($1,000,000.00) with respect to injuries or death to one person and Two Million Dollars ($2,000,000.00) with respect to injuries or death to more than one person per occurrence and property damage insurance with limits of Seven Hundred Fifty Thousand Dollars ($750,000.00) with respect to damage to property in or about the premises (or such higher amounts as Lessor or Lessor’s mortgagee may hereafter reasonably require). Lessee shall also carry at its own expense window, door and plate glass insurance for the demised premises. Said insurance shall be written by companies satisfactory to Lessor. Lessee shall deliver to Lessor, prior to taking occupancy of the premises and annually thereafter, satisfactory evidence of such coverage. All insurance policies required by this Article shall (i) contain a provision prohibiting cancellation without first giving thirty (30) days written

18

notice to Lessor and any mortgagee with respect to the Building or Building Project, (ii) shall name Lessor and any other party designated by Lessor as additional insured thereunder, and (iii) shall contain a waiver of subrogation against Lessor.

36. INTEREST ON PAST DUE OBLIGATIONS: In the event that any payment required of Lessee hereunder (including, but not limited to, any form of rent or additional rent due hereunder and any late charge for such rent) shall not have been received by Lessor within thirty (30) days of the date such payment is due, then the amount of such payment shall bear interest from and after the expiration of such thirty (30) day period at the rate of the lesser of the highest rate permitted by law and eighteen percent (18%) per annum. The payment of such interest shall not excuse or cure any default by Lessee under this Lease.

37. SIGNAGE: Lessee shall not display any sign (except for a sign identifying tenant to be located on the front of the building) visible from the exterior of the premises without Lessor’s prior written consent, which consent shall not unreasonably be withheld provided that the proposed sign complies with the sign criteria established by Lessor for the Building and complies with all applicable sign ordinances (which compliance and investigations of regulations shall be Lessee’s sole responsibility).

Lessor reserves the right, but not the obligation, to pay for and install signage with Lessee’s name above said space, in the event Lessee elects not to take on the responsibility. Both parties acknowledge that the attached specifications referenced in Paragraph 46 of this Lease do not include the cost of the exterior signage. The electricity cost to illuminate the sign shall be the Lessee’s sole responsibility and shall be at the Lessee’s sole choice to illuminate the sign.

38. CAPTIONS, ETC: The captions herein are inserted only for convenience, and are in no way to be construed as a part of this Lease or as a limitation of the scope of any provision of this Lease. This Lease is submitted to Lessee for signature with the understanding that it shall not bind Lessor or Lessee unless and until it is duly executed by both Lessee and Lessor and an executed copy delivered to Lessee.

39. ATTORNEY’S FEES: In the event that Lessor should bring suit for the possession of the premises, for the recovery of any payment herein provided for, for a breach of any provision of this Lease, or for any other relief against Lessee hereunder, or in the event that Lessee shall bring any action for any relief against Lessor arising out of this Lease, then all costs and expenses thereof, including reasonable attorney’s fees and costs (at trial and appellate levels including bankruptcy court proceedings), incurred by the prevailing party therein shall be paid by the other party, which obligation on the part of such other party shall be deemed to have accrued on the date of the commencement of such action and shall be enforceable whether or not the action is prosecuted to judgment. This right, other than the right to collect reasonable attorney fees and any other right duplicated in Article 7, is in addition to the right given Lessor to collect from Lessee all damages, costs and expenses incurred by Lessor as a result of a default by Lessee as set forth in Article 7 hereof; it being understood no damages or costs are to be duplicated.

40. SEPARABILITY: If any term of this Lease, or the application thereof to any person or circumstances, shall to any extent be invalid or unenforceable, the remainder of this Lease, or the

19

application of such term to persons or circumstances other than those as to which it is invalid or unenforceable, shall not be affected thereby, and this Lease shall be valid and enforceable to the fullest extent permitted by law.

41. ACCORD AND SATISFACTION: No payment by Lessee or receipt by Lessor of a lesser amount than that stipulated herein for Fixed annual Rent, additional rent or any other charge shall be deemed to be other than on account of the Fixed Annual Rent, additional rent or other charge then due in accordance herewith, nor shall any endorsement or statement on a check or letter accompanying any check or payment be deemed an accord and satisfaction unless otherwise agreed to in writing by the parties hereto. Lessor may accept any such check or payment without prejudice to Lessor’s right to recover the balance of such Fixed Annual rent, additional rent or other charge and may pursue any other remedy in this Lease, at law or in equity.

42. MODIFICATION: This Lease may not be changed, waived, discharged or terminated orally, but only by an instrument or instruments in writing signed by the party against which enforcement of this change, waiver, discharge or termination is asserted.

43. COUNTERPARTS: This Lease may be executed in any number of counterparts, each of which shall be an original but all of which together shall constitute one and the same instrument.

44. APPLICABLE LAW: This Lease shall be governed by and construed according to the laws of the State of Florida.

45. NO RECORDATION: Except with the prior express written consent of Lessor, this Lease shall not be recorded.

46. CONSTRUCTION: See Addendum C attached hereto and incorporated herein.

47. EARLY OCCUPANCY: Lessor hereby agrees to permit Lessee use of the premises during the construction time period, however, Lessee shall obtain their own occupancy license, liability insurance for their employees and shall indemnify and hold harmless the Lessor and Lessor’s agent, in the event of any injury to any employee, agent or guest while occupying said space during this time period. Lessee shall use their best efforts not to hinder, in any way, the general contractor or subcontractors conduction the tenant improvements.

48. PARKING SPACES: Lessor agrees to allocate to Lessee the non-exclusive use of the parking spaces at the Leased premises.

49. LIMITATION OF LESSOR’S LIABILITY: The obligations of Lessor under this Lease do not constitute personal obligations of the individual partners, shareholders, directors, officers, employees or agents of Lessor, and Lessee shall look solely to Lessor for satisfaction of any liability in respect of this Lease, and will not seek recourse against the individual partners, shareholders, directors, officers, employees or agents of Lessor or any of their personal assets for such satisfaction. Lessees sole rights and remedy in any actions or proceeding concerning Lessors reasonableness (where the same is required under this Lease) shall be an action for either declaratory judgment or specific performance.

20

50. RECORDING/MEMORANDUM OF LEASE: At Lessor’s request, at any time during the Term, Lessee agrees to immediately join in a Memorandum of Lease in form and content reasonably satisfactory to Lessee, which Memorandum, at Lessor’s sole discretion, may be recorded in the Public Records of Palm Beach County, Florida. In no event shall this Lease or any Memorandum of this Lease be recorded by Lessee.

51. INTERPRETATION: Should any of the provisions of this Lease require judicial interpretation, it is agreed by the parties hereto that the court interpreting or construing the same shall not apply a presumption that the terms of any such provision shall be more strictly construed against the party who itself or through its agent prepared the same, as all parties have participated in the preparation of the provision of this Lease and that all terms were negotiable.

52. LESSOR’S LIEN: TO SECURE THE PAYMENT OF ALL RENT AND OTHER SUMS OF MONEY DUE AND TO BECOME DUE AND THE FAITHFUL PERFORMANCE OF THE LEASE BY TENANT, TENANT HEREBY GRANTS TO LANDLORD AN EXPRESS FIRST AND PRIOR LIEN AND SECURITY INTEREST ON ALL PROPERTY (INCLUDING IN THE DEMISED PREMISES, AND ALSO UPON ALL PROCEEDS OF ANY INSURANCE WHICH MAY ACCRUE TO TENANT BY REASON OF DESTRUCTION OR OF DAMAGE TO ANY SUCH PROPERTY. SUCH PROPERTY SHALL NOT BE REMOVED THEREFROM WITHOUT THE WRITTEN CONSENT OF LANDLORD UNTIL ALL ARREARAGES IN RENT AND OTHER SUMS OF MONEY THEN DUE TO LANDLORD HEREUNDER SHALL FIRST HAVE BEEN PAID. THIS LIEN AND SECURITY INTEREST IS GIVEN IN ADDITION TO THE LANDLORD’S STATUTORY LIEN AND SHALL BE CUMULATIVE THERETO. CONCURRENTLY WITH THE EXECUTION OF THE LEASE (OR LATER, IF REQUIRED BY LANDLORD, UNIFORM COMMERCIAL CODE FINANCING STATEMENTS IN SUFFICIENT FORM SO THAT WHEN PROPERLY FILED, THE SECURITY INTEREST HEREBY GIVEN SHALL BE PERFECTED. THE LIEN AND SECURITY INTEREST CREATED HEREBY SHALL BE TERMINATED WHEN ALL OF THE RENT AND OTHER SUMS OF MONEY BECOMING DUE DURING THE LEASE TERM SHALL HAVE BEEN PAID IN FULL.

53. MISCELLANEOUS:

A. Any approval by Landlord or Landlord’s architects and/or engineers of any of Tenant’s drawings, plans and specifications which are prepared in connection with any construction of improvements in the Premises shall not in any way be construed or operate to bind Landlord or to constitute a representation or warranty of Landlord as to the adequacy or sufficiency of such drawings, plans and specifications, or the improvements to which they relate, for any use, purpose, or condition, but such approval shall merely be the consent of Owner as may be required hereunder in connection with construction of Tenant’s improvements in the leased Premises in accordance with such drawings, plans and specifications.

B. There shall be no merger of this Lease or of the leasehold estate hereby created with the fee estate in the leased Premises or any part thereof by reason of the fact that the same

21

person may acquire or hold, directly or indirectly, this Lease of the leasehold estate hereby created or any interest in this Lease or in such leasehold estate as well as the fee estate in the leasehold Premises or any interest in such fee estate.

C. Neither Landlord nor Landlord’s agents or brokers have made any representations or promises with respect to the Premises, the Building or the Land except as herein expressly set forth and no rights, easements or licenses are acquired by Tenant by implication or otherwise except as expressly set forth in the provisions of this Lease.

D. The submission of this Lease to Tenant shall not be construed as an offer, nor shall Tenant have any rights with respect thereto unless and until Landlord shall, or shall cause its managing agent to execute a copy of this Lease and deliver the same to Tenant.

E. If Tenant signs as a corporation, (each of) the person(s) executing this Lease on behalf of Tenant does hereby covenant and warrant that Tenant is a duly authorized and existing corporation, qualified to do business in the State of Florida, that the corporation has the full right and authority to enter into this Lease, and that (each and both of) the person(s) signing on behalf of the corporation is (are) authorized to do so.

F. Tenant shall not record the Lease without Landlord’s prior written consent, and any such recordation shall, at the option of Landlord, constitute a non-curable default of Tenant; provided, however, Tenant shall, within ten (10) days after request by Landlord, execute and deliver to Landlord a memorandum of the Lease for the purpose of recordation in a form prescribed by Landlord.

G. Time is of the essence.

H. Whenever a period of time is prescribed for action to be taken by Landlord, Landlord shall not be liable or responsible for and there shall be excluded from the computation of any such period of time, any delays due to strikes, riots, acts of god, shortages of labor or materials, war, governmental laws, regulations or restrictions or any other causes of any kind whatsoever which are beyond the reasonable control of Landlord.

I. Each provision performable by Tenant shall be deemed both a covenant and a condition. The Lease contains all agreements of the parties with respect to any matter mentioned herein. No prior agreement or understanding pertaining to any such matter shall be effective. The Lease may be modified in writing only, signed by the parties in interest at the time of modification.

J. Subject to the provisions hereof restricting assignment or subletting by Tenant and regarding Landlord’s liability, this Lease shall bind the parties, their personal representatives, successors and assigns. The Lease shall be governed by the laws of the State of Florida.

K. In computing the square footage of the Demised Premises and all premises in that Center, Landlord includes a proportionate factor of all meter rooms and other utility closets as may be required and interior corridors to which Tenant has access. All dimensions are measured from the center line of interior walls and from the exterior face of exterior walls.

22

L. The terms “Landlord” and “Tenant”, as used herein, denote both singular and plural and all genders. Where “Tenant” consists of more than one person, whether natural or artificial, all the persons constituting “Tenant” shall be jointly and severally liable for all obligations to be performed by Tenant herein. If Tenant is a corporation or other entity, Tenant shall furnish to Landlord such evidence as Landlord may reasonably require in order to evidence the authority of Tenant to execute and deliver the Lease and to perform its obligations hereunder.

M. The Effective Date of the Lease shall be the date last executed by the parties without amendment or deletion to the Lease and its Exhibits.

N. All terms, covenants and conditions herein contained to be performed by Tenant shall be performed at its sole cost and expense, and if Landlord shall pay any sum of money or do any act which requires the payment of money, by reason of the failure, neglect or refusal of Lessee to perform such term, covenant or condition, the sum of money so paid by Landlord shall be deemed additional rent and shall be payable by Tenant to Landlord within ten (10) days after demand therefore.

O. Any amount due to Landlord not paid when due shall bear interest at the maximum rate allowable by law accruing from the date due. Payment of such interest shall not excuse or cure any default by Tenant under the Lease.

P. Provisions herein to the contrary notwithstanding, there shall be absolutely no personal liability on the part of Landlord, its directors, officers or shareholders, or any of its partners, their directors, officers or shareholders, with respect to any of the terms, conditions and covenants of the Lease; and Tenant shall look solely to the interest of Landlord in the Center for the satisfaction of each and every remedy of Tenant.

Q. The submission of the Lease for examination by Tenant does not constitute an offer or an option to lease the Demised Premises, nor is it intended as a reservation of the Demised Premises for the benefit of Tenant, nor shall the Lease have any force or validity until and unless a copy of it is returned by Tenant duly executed by Landlord.

R. All obligations of Tenant to pay rent or to perform any act after the termination of the Lease shall survive such termination.

54. LESSOR’S RIGHT TO CURE DEFAULT: If Lessee shall fail to pay any sum of money, other than Rent, or shall fail to perform any other act on its part to be performed hereunder, Lessor may, but shall not be obligated to, and without waiving or releasing Lessee from any obligations of Lessee, make any such payment or perform any such act on Lessee’s part to be made or performed as in this Lease provided, all sums to be paid by Lessor and all of Lessor’s incidental costs shall be deemed Additional Rent hereunder and shall be payable to Lessor upon demand.

23

55. RADON GAS: Radon is a naturally occurring radioactive gas that, when it has accumulated in a building in sufficient quantities, may present health risks to persons who are exposed to it overtime. Levels of radon that exceed federal and state guidelines have been found in Florida. Additional information regarding radon and radon testing may be obtained from your county public health unit.

56. ENVIRONMENTAL: Lessee does not and will not engage in any activity which would involve the use of the Premises for the storage, use, treatment, transportation or disposal of any chemical, material, or substance which is regulated as toxic or hazardous or exposure to which is prohibited, limited, or regulated by any federal, state, county, regional, local, or other governmental authority or which, even if not so regulated, may or could pose a hazard to the health and safety of the other tenants and occupants of Lessor’s property.

57. NON-DISCLOSURE: Tenant hereby agrees not to discuss, communicate or otherwise disclose in any fashion whatsoever anything contained in this Lease Agreement to any other tenant of Shopping Center, prospective tenant or third party without the express written permission of the Landlord.

58. COMPLY WITH LAWS: Tenant shall at all times during the Term of this Lease, at Tenant’s sole cost and expense, perform and comply with laws, rules, orders, ordinances, acts, regulations and requirements now or hereafter enacted or promulgated by applicable governmental entities which are applicable to the Premises and the business of Tenant conducted with respect thereto. If, during the term of this Lease, any law, regulation or rule requires that any alteration, additions or other change be made to the demised premises, they shall be at the sole cost and expense of Tenant. Tenant agrees, at Tenant’s sole cost and expense (i) to comply promptly and fully with all present and future governmental laws, ordinances, rules and regulations affecting the Premises and/or Tenant’s use thereof, including without limitation, the Americans with Disabilities Act, 42 U.S.C. Section 12111, et. Seq. as amended and/or the cleanliness, safety, occupancy and use of the same; and (ii) be and remain authorized to do business in the state in which the Premises are located.

59. INCREASE IN INSURANCE PREMIUMS: Tenant shall not stock, use or sell any article or do anything in or about the demised premises which may be prohibited by Landlord’s insurance policies or any endorsement or forms attached thereto, or which will increase any insurance rates and premiums on the demised premises, the building of which they are a part, and all other buildings in the Shopping Center. Tenant shall pay on demand any increase in premiums for Landlord’s insurance that may be charged on such insurance carried by Landlord resulting from Tenant’s use and occupancy of the demised premises of the Shopping Center, whether or not Landlord has consented to the same.

60. FORCE MAJEURE: Landlord shall be excused for the period of any delay in the performance of any obligations hereunder when prevented from so doing by cause or causes beyond Landlord’s control which shall include, without limitation, all labor disputes, civil commotion, war, warlike operations, invasions, rebellion, hostilities, military or usurped power, sabotage, governmental regulations or control, fires or other casualty, inability to obligation, any materials, services or financing or through acts of God.

24

[SIGNATURE PAGE FOLLOWS.]

25