Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Quanex Building Products CORP | d61044d8k.htm |

| EX-2.1 - EX-2.1 - Quanex Building Products CORP | d61044dex21.htm |

| EX-10.1 - EX-10.1 - Quanex Building Products CORP | d61044dex101.htm |

| EX-99.1 - EX-99.1 - Quanex Building Products CORP | d61044dex991.htm |

Quanex

Building Products Acquisition of Woodcraft Industries

August 31, 2015 Exhibit 99.2 |

Safe Harbor

1 Forward Looking Statements Statements made during this presentation that use the words "estimated," "expect," "could," "should,"

"believe," "will," "might," or similar words

reflecting future expectations or beliefs are forward-looking statements. The forward-looking statements include, but are not limited to, the expected timing of the completion of the acquisition, the entry of the proposed debt

agreements as contemplated and the availability of funds under those agreements, and

continued success of the operations of Woodcraft. The statements set

forth in this presentation are based on current expectations. Actual results or events may differ materially from this presentation.

Factors that could impact future results may include, without

limitation, the risk that the parties may be unable to obtain

governmental and regulatory approvals required for the transaction, or required

governmental and regulatory approvals may delay the transaction or result

in the imposition of conditions that are not favorable to Quanex or that could cause the parties to abandon the transaction; the risk that a condition to closing of the transaction may not be satisfied; the occurrence of any

event, change, or other circumstances that could give rise to the termination of the

Merger Agreement; the timing to consummate the transactions; the risk

that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transactions may not be fully realized or may take longer to realize than expected; the effect

of the announcement of the transaction on the retention of customers, employees, or

suppliers; the diversion of management time on merger-related issues;

general worldwide economic conditions and related uncertainties, including in the credit markets; increasing competition in the building materials industry; the complex and uncertain regulatory environment in which

the parties operate; and other risks, uncertainties, and factors discussed or referred

to in the “Risk Factors” section of Quanex’s most recent

Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on December 12, 2014, or in Quanex’s subsequent filings with the SEC, which filings are available online at www.sec.gov,

www.quanex.com or on request to Quanex. Any forward-looking statements in this

Current Report are made as of its filing date, and Quanex undertakes no

obligation to update or revise any forward-looking statements to reflect new information or events.

Any forward-looking statements in this presentation are made

as of the date hereof, and Quanex undertakes no obligation to update or

revise any forward- looking statements to reflect new information or events. Any guidance provided in this presentation sets forth management’s best estimate

based on current and anticipated market conditions and other

factors. While management believes that these estimates and assumptions are reasonable, they are inherently uncertain and are subject to, among other things, significant business, economic, regulatory, environmental and

competitive risks and uncertainties that could cause actual results to differ

materially from those that we anticipate, as set forth above. |

2 Transaction Overview Quanex is acquiring Woodcraft Industries for $248.5M, or ~8x LTM EBITDA A complementary strategic fit, adding: • Identical business model – just in time component supplier to OEMs • Clear market leader – almost twice as large as nearest competitor • In an attractive end market – attractive margins and ~75% exposure to R&R • At a good time – cabinet market poised for high single digit annual growth Expected to be accretive to EPS, EBITDA margins and ROIC • 2016 EPS accretion estimated to be approximately $0.11 per share excluding transaction expenses and any impact from purchase accounting step up of inventory • Attractive current (13%) and mid-cycle (>15%) EBITDA margins • Expected to deliver IRR in excess of WACC Adds $45M-$50M to mid-cycle EBITDA guidance To be funded with cash, new ABL revolving credit facility and new Term Loan B Expect approximately 3.2x pro forma debt / EBITDA at close Targeted to close in 4 th calendar quarter of 2015 Note on Non-GAAP Financial Measures: EBITDA (defined as net income or

loss before interest, taxes, depreciation and amortization and other, net, as described in Quanex’s filings with the Securities and Exchange Commission) is a non-GAAP financial measure that Quanex's management uses to measure its operational performance and

assist with financial decision-making. EBITDA is a key metric used by

management in determining the value of annual incentive awards for its employees. Quanex believes this non-GAAP measure provides a consistent basis for comparison between periods, and will assist investors in understanding our financial performance when comparing our results to other investment

opportunities. EBITDA may not be the same as that used by other

companies. While the Company considers EBITDA to be an important measure of operating performance, the company does not intend for this information to be considered in isolation or as a

substitute for net income or other measures prepared in accordance with US GAAP.

Due to the high variability and difficulty in predicting certain items that affect GAAP net income (including in respect of the impact of Woodcraft Industries), information reconciling forward-looking EBITDA as presented to GAAP financial measures is

unavailable to Quanex without unreasonable effort. ROIC (or Return on

Invested Capital), a financial measure used to quantify the returns Quanex earns on its invested capital, and IRR (or Internal Rate of Return), a metric that measures the net present value of all cash flows from a capital project or investment (both capital deployed and after tax cash flows received), are also non-GAAP

financial measures. Quanex believes ROIC and IRR are meaningful

indicators of performance and useful metrics for investors and financial analysts. Quanex’s calculations of ROIC and IRR may not be comparable to similarly titled definitions used by other

companies and are not substitutes for financial information prepared in accordance with

GAAP. |

3 Attractive Opportunity Consistent with Strategy Woodcraft acquisition is consistent with Quanex’s strategic objectives of pursuing M&A opportunities that provide market leadership, superior technology and attractive financial returns

Attractive adjacency given its complementary OEM service model and

products Clear market leader aligned with top cabinet OEMs

Cabinet industry is more profitable than window industry

Positive impact on seasonality

Accretive to EPS, FCF per share, and margins

Well positioned to gain share within the cabinet market, which is forecasted to grow

high single digits annually over next few years

Best-in-class quality, lead times and service levels with unmatched product

breadth Experienced management team and employee base

Margin enhancement through automation and operational improvements

Strong, stand-alone platform requiring minimal operational integration

|

4 Woodcraft Industries Company Overview Leading door and component supplier to the Kitchen and Bath Cabinet Industry Market leader with ~15% share of total domestic cabinet doors & components and ~27% share of outsourced market ¹ Headquartered in St. Cloud, MN Employees: ~1,500 13 manufacturing facilities and 4 distribution centers across U.S., Canada, and Mexico Critical supplier and partner to cabinet OEMs Experienced management team (average 20+ years with business) with proven capabilities through all phases of industry cycle Outstanding, stand-alone platform ¹ Source: Management estimates 2014 Revenue by Product Over one million SKUs across the entire product spectrum Hardwood Doors 41% Hardwood Components 35% Engineered Wood Products 17% Imported Products 7% |

5 Woodcraft Industries Product Overview Breadth of products unmatched by competition – over one million SKUs across entire product spectrum Hardwood Components 35% of sales Engineered Wood 17% of sales Imported Products 7% of sales Hardwood Doors 41% of sales Products that Woodcraft imports include drawer components, Lazy Susan trays, certain entry level doors, and face frame assemblies Woodcraft’s engineered wood products include veneer raised panels (“VRPs”), veneer slab doors (“VSDs”), rigid thermofoil

products (“RTF”), and profile wrapped components

(“Wrap”) Products include moldings, face frames, drawer fronts,

stiles and rails, panels, and other kitchen cabinet

accessories Few competitors are capable of supplying components to large

cabinet OEMs given the variation in products and volumes

Woodcraft manufactures a variety of door styles, including flat

panel, solid raised panel, applied molding, arch, miter, and mullion

|

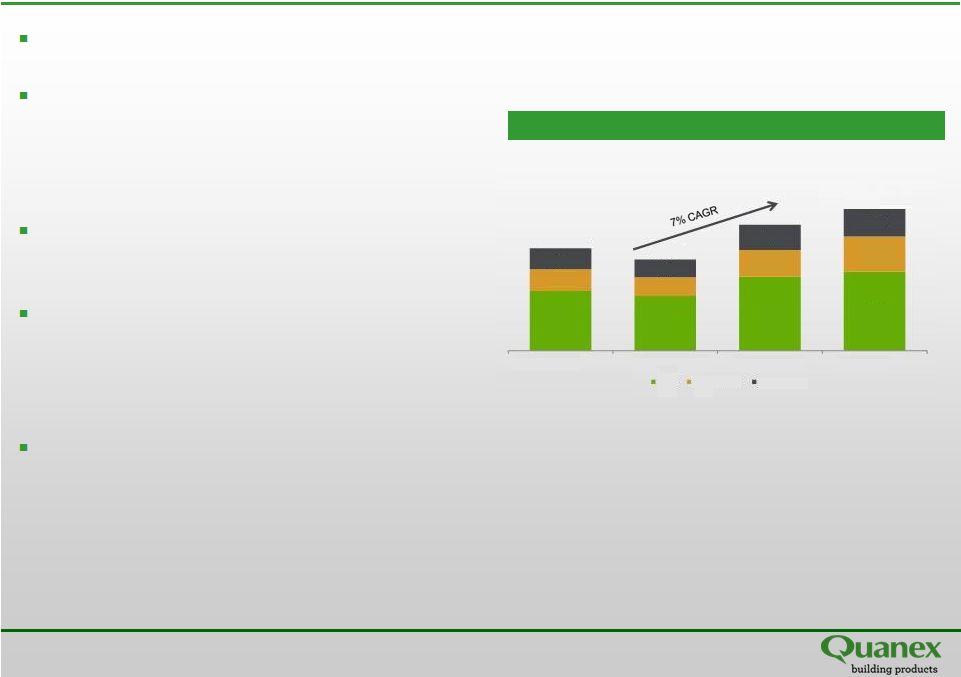

6 U.S. Kitchen & Bath Cabinet Market Overview Market is expected to grow 7% per year Woodcraft primarily serves the stock & semi- custom segments, which together comprise ~80% of the total kitchen & bath cabinet market Repair & Remodel drives demand, comprising ~75% of the market As cabinet market grows, cabinet OEMs are expected to outsource an increasing share of door & component production driving outsourced growth Cabinet market expected to grow faster than window market and cabinet OEMs realize higher margins than window OEMs U.S. Kitchen & Bath Cabinet Market Size ($ in Billions) Source: The Freedonia Group $7.6 $7.0 $9.4 $10.0 $2.7 $2.4 $3.4 $4.5 $2.7 $2.3 $3.2 $3.5 $13.0 $11.6 $16.0 $18.0 2008 2013 2018P 2023P Stock Semi-Custom Custom |

7 Thank you |