Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For fiscal year ended May 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-36506

PERFORMANCE SPORTS GROUP LTD.

(Exact name of registrant as specified in its charter)

British Columbia, Canada | Not applicable. | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

100 Domain Drive Exeter, New Hampshire | 03883 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (603) 610-5802

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on which Registered | |||||

Common Shares, no par value | New York Stock Exchange | |||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company o | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of November 28, 2014, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was $764.8 million, based on the closing sales price per share as reported by the New York Stock Exchange on such date.

As of the close of business on August 25, 2015, there were 45,552,180 shares of the registrant's Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to registrant’s 2015 annual and special meeting of shareholders (the “Proxy Statement”) are incorporated by reference in Part III hereof.

TABLE OF CONTENTS

Page | |||

PART I. | |||

Item 1. | Business | ||

Item 1A. | Risk Factors | ||

Item IB. | Unresolved Staff Comments | ||

Item 2. | Properties | ||

Item 3. | Legal Proceedings | ||

Item 4 | Mine Safety Disclosures | ||

PART II. | |||

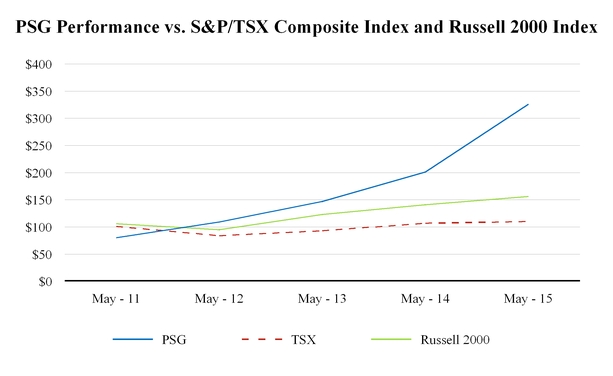

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities | ||

Item 6. | Selected Financial Data | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||

Item 8. | Financial Statements and Supplementary Data | ||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | ||

Item 9A. | Controls and Procedures | ||

Item 9B. | Other Information | ||

PART III. | |||

Item 10. | Directors, Executive Officers and Corporate Governance | ||

Item 11. | Executive Compensation | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | ||

Item 14. | Principal Accounting Fees and Services | ||

PART IV. | |||

Item 15. | Exhibits and Financial Statement Schedules | ||

SIGNATURES | |||

EXHIBIT INDEX | |||

3

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this annual report on Form 10-K about our current and future plans, expectations and intentions, results, levels of activity, performance, goals or achievements or any other future events or developments constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995 and within the meaning of applicable Canadian securities laws (collectively, “forward-looking statements”). Such statements often include words such as “may,” “will,” “would,” “should,” “could,” “expects,” “plans,” “intends,” “trends,” “indicates,” “anticipates,” “believes,” “estimates,” “predicts,” “likely,” or “potential” or the negative or other variations of these words or other comparable words or phrases.

Discussions containing forward-looking statements may be found, among other places, under “General Development of the Business,” “Industry Overview,” “Business of the Company,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements are based on estimates and assumptions made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we believe are appropriate and reasonable under the circumstances, but there can be no assurance that such estimates and assumptions will prove to be correct. Certain assumptions with respect to the determination of acquisition accounting, valuation of derivatives, share-based payments, claim liabilities, employee future benefits, income taxes, the impairment of assets, and goodwill and intangibles are material factors made in preparing forward-looking information and management’s expectations.

Many factors could cause our actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the following factors, which are discussed in greater detail in the “Risk Factors” section of this annual report on Form 10-K: inability to maintain and enhance brands, inability to introduce new and innovative products, intense competition in the sporting equipment and apparel industries, inability to own, enforce, defend and protect intellectual property rights worldwide, costs associated with potential lawsuits to enforce, defend or protect intellectual property rights, inability to protect our known brands and rights to use such brands, infringement of intellectual property rights of others, inability to translate booking orders into realized sales, including risks associated with changes in the mix or timing of orders placed by customers, seasonal fluctuations in our operating results and the trading price of our Common Shares, decrease in popularity of ice hockey, baseball and softball, roller hockey or lacrosse, reduced popularity of the National Hockey League, Major League Baseball or other professional or amateur leagues in sports in which our products are used, adverse publicity of athletes who use our products or the sports in which our products are used, inability to ensure third-party suppliers will meet quality and regulatory standards, reliance on third-party suppliers and manufacturers, disruption of distribution systems, loss of significant customers or suppliers, loss of key customers’ business due to customer consolidation, change in the sales mix towards larger customers, cost of raw materials, shipping costs and other cost pressures, risks associated with doing business abroad, inability to expand into international market segments, inability to accurately forecast demand for products, inventory shrinkage, excess inventory due to inaccurate demand forecasts, product liability, warranty and recall claims, inability to successfully design products that satisfy testing protocols and standards established by testing and athletic governing bodies, inability to successfully open and operate Own The Moment Hockey Experience retail stores, inability to successfully implement our strategic initiatives on anticipated timelines, including our profitability improvement initiative, risks associated with our third-party suppliers and manufacturers failing to manufacture products that comply with all applicable laws and regulations, inability to source merchandise profitably in the event new trade restrictions are imposed or existing trade restrictions become more burdensome, departure of senior executives or other key personnel with specialized market knowledge and technical skills, litigation, including certain class action lawsuits, employment or union-related disputes, disruption of information technology systems, including damages from computer viruses, unauthorized access, cyberattack and other security vulnerabilities, potential environmental liabilities, restrictive covenants in our credit facilities, increasing levels of indebtedness, inability to generate sufficient cash to fund operations or service the Company’s indebtedness failure to make, integrate, and maintain new acquisitions, inability to realize growth opportunities or cost synergies that are anticipated to result from new acquisitions such as Easton Baseball/Softball, undisclosed liabilities acquired pursuant to recent acquisitions, volatility in the market price for Common Shares, possibility that we will need additional capital in the future, incurrence of additional expenses as a result of the loss of our foreign private issuer status, assertion that the acquisition of the Bauer Hockey Business at the time of the Canadian IPO was an inversion transaction, our current intention not to pay cash dividends, dependence on the performance of subsidiaries given the our status as a holding company, potential inability of investors to enforce judgments against the Company and its directors, fluctuations in the value of certain foreign currencies, including the Canadian dollar, in relation to the U.S. dollar, and other world currencies, general adverse economic and market conditions, changes government regulations, including tax laws and unanticipated tax liabilities and natural disasters and geo-political events. These factors are not intended to represent a complete list of the factors that could affect us; however, these factors should be considered carefully.

The purpose of the forward-looking statements in this annual report on Form 10-K is to provide the reader with a description of management’s expectations regarding the Company’s financial performance and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking statements made herein. Unless otherwise stated, the

4

forward-looking statements contained in this annual report on Form10-K are made as of the date of this annual report on 10-K, and we have no intention and undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The forward-looking statements contained in this annual report on Form 10-K are expressly qualified by this cautionary statement.

5

Part I

Unless otherwise noted or the context requires otherwise, “Performance Sports Group,” “PSG,” the “Company,” “we,” “us” and “our” refer to Performance Sports Group Ltd. and its direct and indirect subsidiary entities and predecessors. The Company’s fiscal year ends May 31st. Any reference to a fiscal year is to May 31 of the year then ended. All references to “$”, “US$”, “dollars” or “U.S. dollars” are to United States dollars and references to “Cdn$” and “Canadian dollars” are to Canadian dollars. Amounts are stated in U.S. dollars unless otherwise indicated.

Item 1. | BUSINESS |

Our Company

CORPORATE STRUCTURE

Incorporation and Office

The Company was incorporated under the British Columbia Business Corporations Act (“BCBCA”) on December 2, 2010, and its corporate name was changed shortly thereafter to Bauer Performance Sports Ltd. On June 17, 2014, the Company changed its corporate name from Bauer Performance Sports Ltd. to Performance Sports Group Ltd. The renaming of the Company was undertaken to better reflect the growth of the Company in connection with its strategic acquisitions and potential expansion into new high performance sports.

The Company’s registered office is located at 666 Burrard Street, Suite 1700, Vancouver, British Columbia, V6C 2X8. The Company’s headquarters and executive offices are currently located at 100 Domain Drive, Exeter, New Hampshire 03833, United States.

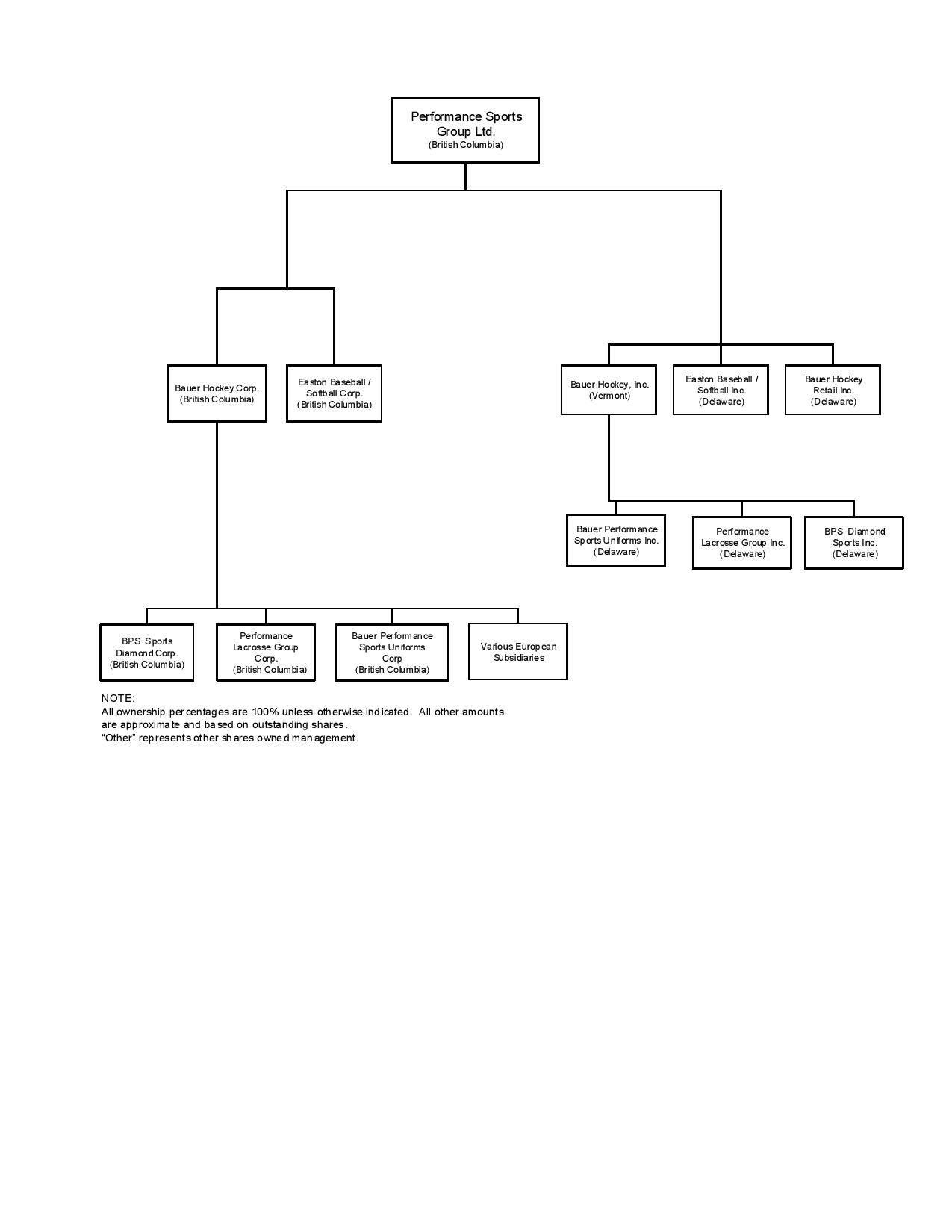

Intercorporate Relationships

The organization chart below describes the intercorporate relationships of our Company and our wholly owned material operating and certain other subsidiaries, together with the jurisdiction of incorporation or constitution of each such subsidiary.

6

7

GENERAL DEVELOPMENT OF THE BUSINESS

History

Headquartered in Exeter, New Hampshire, we are a leading designer, developer and manufacturer of high performance sports equipment and related apparel. Our mission is to elevate performance and protection for athletes at all levels through a combination of athlete insights and superior innovation.

As part of our growth strategy, we have acquired, integrated and significantly accelerated the growth of seven businesses since 2008, completing our most recent acquisition, Easton Baseball/Softball (as defined below), in April 2014. Highlights of our strategic acquisitions since 2012 are described below.

The Easton Baseball/Softball Acquisition

On April 15, 2014, we completed the acquisition of the Easton baseball and softball business and the assets formerly used in Easton-Bell Sports, Inc.’s lacrosse business (“Easton Baseball/Softball”) from Easton-Bell Sports, Inc., now named BRG Sports, Inc. (“BRG Sports”), for $330 million in cash, plus a net working capital adjustment of $21.7 million (the “Easton Baseball/Softball Acquisition”).

EASTON is one of the world’s leading and most iconic diamond sports (baseball and softball) brands with authentic brand equity accumulated over 40 years of designing and manufacturing high performance diamond sports products. Building upon its heritage in bats, EASTON has developed into one of the strongest and most innovative brands in baseball and softball, and holds the No. 1 position in diamond sports in North America with an approximate 27% market share and strong positions in multiple product categories. Easton Baseball/Softball has gained market share through innovative and higher-priced new product lines, an effective go-to-market strategy and significant brand investment.

We acquired Easton Baseball/Softball as part of an ongoing strategy to utilize our proven acquisition platform to expand our business into complementary categories and sports. The acquisition has greatly enhanced our brand portfolio, offers us another significant lever for growth, has added valuable intellectual property (including 130 patents and patents pending) and provides a significant counter-seasonal business to our existing revenue stream and working capital needs. Additionally, our R&D-focused platform allows for cross-pollination of technologies between EASTON and COMBAT, as well as our other sports, and provides the necessary infrastructure to grow the EASTON brand.

The acquisition has provided numerous financial benefits including being accretive to Adjusted EPS within the first year of ownership and generating significant cash flow to support our growth. The spring/summer season of baseball and softball is highly complementary to the fall/winter season of hockey, and our quarterly sources of revenue and profitability are more balanced throughout the year as a result. The more evenly distributed seasonality of the combined business provides more consistent working capital levels and allows us to improve our efficiency in our manufacturing, distribution and other efforts.

As a result of the Easton Baseball/Softball Acquisition, we acquired the EASTON and MAKO brands and trademarks and entered into an intellectual property agreement to license back the use of these trademarks to BRG Sports (and their permitted successors and assigns) for use in their hockey and cycling businesses on an exclusive, perpetual, royalty-free basis. Since our acquisition of Easton Baseball/Softball, BRG Sports sold the Easton Hockey business to private investment firm Chartwell Investments and its cycling business to Chris Tutton, the owner of Race Face Performance Products Inc.

The Company initially financed the Easton Baseball/Softball Acquisition, as well as refinanced certain existing indebtedness, with a $200 million secured asset-based revolving credit facility (the “ABL Facility”) and a $450 million secured term loan credit facility (the “New Term Loan Facility” and, together with the “New ABL Facility”, collectively, the “Credit Facilities”). On June 25, 2014, the Company completed an underwritten initial public offering on the New York Stock Exchange (“NYSE”) and a new issue of common shares of the Company (“Common Shares”) in Canada for net proceeds of approximately $119.5 million (the “U.S. IPO”), including the exercise in full of the over-allotment option. The Company used the net proceeds of the U.S. IPO to reduce leverage and repay approximately $119.5 million of the Company’s New Term Loan Facility.

The Combat Acquisition

On May 6, 2013, we completed the acquisition of substantially all of the assets of Combat Sports (“Combat Sports” and, such acquisition, the “Combat Acquisition”) for an aggregate purchase price of approximately Cdn$4 million in cash. The acquisition of Combat Sports was funded from cash on hand.

8

From 1998 through its acquisition by the Company, Combat Sports had been supplying composite and hybrid composite products for both its own COMBAT brand as well as for high-end brand name companies in the baseball and softball bat, hockey stick and lacrosse shaft markets. Since the acquisition, Combat Sports has focused solely upon the baseball and softball bat market, as well as related apparel. The business has developed a reputation for its premier and innovative composite technology, with the latest composite advancements in performance and durability serving players from the grassroots level to the elite professional levels. Combat Sports and several of its key employees have a long history of expertise in composite materials, including developing innovative products for NASA, the U.S. military and several leading manufacturers. By continuing to focus resources in the areas of Combat Sports’ success - baseball, softball and advanced composite technologies - we expect to further strengthen the COMBAT brand and grow our overall portfolio of high-performing products.

The Inaria Acquisition

On October 16, 2012, we completed the acquisition of Inaria International Inc. (“Inaria” and, such acquisition, the “Inaria Acquisition”). The Company entered into a purchase agreement with Inaria and its shareholders, pursuant to which we purchased substantially all of the assets of Inaria for an aggregate purchase price of approximately Cdn$7 million in cash. The Company used its former credit facility to fund the Inaria Acquisition.

Inaria, a Toronto-based company named after the Italian soccer phrase “in the area”, was founded in 1999 and began its business with a focus on soccer uniforms and products. INARIA has since become a growing brand in the team sports and active wear industry, providing a full-line of team apparel products, including pro-style jerseys, practice jerseys, socks, warm-up suits and training apparel for both youth sports programs and the most elite-level teams.

The company’s expertise in developing quality products with competitive pricing and rapid turnaround time quickly propelled INARIA into ice hockey and other sports. The Inaria Acquisition strengthened our position in team apparel, establishing Performance Sports Group as a reliable and competitive supplier in this growing segment of the market.

The Cascade Acquisition

On June 29, 2012, we completed the acquisition of Cascade Helmets Holdings, Inc. (“Cascade” and, such acquisition, the “Cascade Acquisition”). The Company entered into a purchase agreement with Cascade and its shareholders, pursuant to which we purchased all of the outstanding shares of Cascade for an aggregate purchase price of $64 million in cash subject to adjustment.

In order to fund the Cascade Acquisition, the Company (i) completed a public offering of 3,691,500 Common Shares at a price of Cdn$7.80 per share, including the exercise in full of the over-allotment option, for gross proceeds of approximately Cdn$28.7 million; (ii) completed a concurrent private placement of the equivalent of 642,000 Common Shares at the same price as those sold under the public offering, for gross and net proceeds of approximately Cdn$5.0 million; and (iii) entered into amendments to its former credit facilities.

The Cascade Acquisition significantly expanded our presence in the growing lacrosse market, through the addition of an industry-leading brand whose helmet and headgear products have been complementary to our existing offering of lacrosse equipment products under the MAVERIK brand.

INDUSTRY OVERVIEW

Sporting Goods Industries

We design, develop, manufacture and sell performance sports equipment and related apparel for ice hockey and roller hockey, baseball and softball, lacrosse and soccer.

We operate in the global sporting goods industry with a primary focus on North America and Europe. We believe this global industry is growing, including in the United States where, from 2009 to 2014, manufacturers’ wholesale sales of sporting goods increased from $48.3 billion in 2009 to $56.9 billion in 2014, representing a compound annual growth rate of 2.8%.

A Large and Growing Addressable Market

Within the sporting goods industry, we currently target an approximately $3.3 billion directly addressable market with attractive growth rates across multiple team sports, consisting of approximately $2 billion in equipment wholesale sales and approximately $1.2 billion in apparel wholesale sales. The growing size of team sports and the improving U.S. macroeconomic

9

outlook serve as a strong tailwind for our growth. The anticipated annual percentage growth in each of our sports categories is as follows:

Sport/Category | Anticipated Annual Percentage Growth of Industry | |

Hockey equipment (Global) | Low-Single-Digit to Mid-Single Digit | |

Hockey apparel (Global) | Mid-Single-Digit to High-Single-Digit | |

Baseball/Softball equipment (Global) | Low-Single-Digit | |

Baseball/Softball apparel (Global) | Low-Single-Digit | |

Lacrosse equipment (U.S., Canada) | Mid-Single-Digit to High-Single-Digit | |

Lacrosse apparel (U.S., Canada) | Mid-Single-Digit to High-Single-Digit | |

Soccer team apparel (U.S., Canada) | Low-Single-Digit to Mid-Single Digit | |

Source: Management estimates.

Our addressable market features attractive category fundamentals, including frequent replacement cycles and innovation-driven rising average selling prices.

Ice Hockey

Ice Hockey Participation Rates and Demographics

Ice hockey is a team sport played in over 80 countries by more than an estimated six million people. While ice hockey is played around the world, the largest and most significant markets for ice hockey are Canada, the United States and a number of European countries, including the Nordic countries (principally, Sweden and Finland), Central European countries (principally, the Czech Republic, Germany, Switzerland, Austria and Slovakia) and Eastern European countries (principally, Russia).

According to the International Ice Hockey Federation’s ("IIHF") 2014 survey of players, there are approximately 1.8 million registered players in the world, up from 1.6 million registered players in 2013, an increase of 12.5%. According to the IIHF, in the past five years, registered players have grown 20%, from 1.5 million players in 2010 to 1.8 million in 2014. In addition to registered players, management estimates another 4 million unregistered players globally, creating a total of approximately 6 million hockey players.

There are 533,172 registered players in the United States, according to USA Hockey’s 2014-15 Season Report, up from 519,417 in 2014, a 2.6% increase. In the past five years, registered players in the U.S. have increased 6.5% (500,579 in 2011 to 533,172 in 2015).

In Canada, there were 634,892 registered players in 2014, according to Hockey Canada’s 2014 Annual Report, representing a 1.6% increase from 625,152 players in 2013. In the past five years, registered players in Canada have increased 10.0% (577,077 in 2010 to 634,892 in 2014).

According to IIHF membership data, 63% of hockey players globally are under the age of 20. Due to this younger demographic, there is a need to purchase new equipment more frequently as these young participants grow.

Ice Hockey Equipment and Related Apparel Industry

Management estimates that the global ice hockey wholesale equipment market is approximately $670 million and the global ice hockey apparel market (including licensed apparel) is approximately $390 million.

The global ice hockey equipment and related apparel industry has significant barriers to entry and is stable in certain regions and growing in others, such as the United States and Eastern Europe. Russia had experienced significant growth prior to calendar 2015 but has entered a period of instability due to macroeconomic conditions in the region. Ice hockey equipment and related apparel sales are driven primarily by global ice hockey participation rates (registered and unregistered). Other drivers of equipment sales include demand creation efforts, the introduction of innovative products, a shorter product replacement cycle,

10

general macroeconomic conditions and the level of consumer discretionary spending. Skates and sticks are the largest contributors to equipment sales, accounting for an estimated 60% of industry sales in calendar 2014, according to management estimates.

Management estimates that 90% of the ice hockey equipment market is attributable to three major competitors: Bauer Hockey, Reebok International Ltd. (“Reebok”), a subsidiary of adidas AG, which owns both the REEBOK and CCM brands, and Easton Hockey (which is owned by private investment firm Chartwell Investments and utilizes the EASTON brand under a trademark license from the Company), each of whom offers consumers a full range of products (skates, sticks and full protective equipment). The remaining equipment market is highly fragmented among many smaller equipment manufacturers that offer specific products, catering to niche segments within the broader market.

The following table shows our estimated ranking of the three major competitors referenced above, in total and by major product category:

Company | Total Market | Skates | Sticks | Helmets | Protective | Goalie | ||||||

BAUER | #1 | #1 | #1 | #1 | #1 | #2 | ||||||

REEBOK/CCM | #2 | #2 | #2 | #2 | #2 | #1 | ||||||

EASTON | #3 | #3 | #3 | #3 | #3 | n/a | ||||||

Licensed apparel is included in the ice hockey-related apparel market and represents approximately one-third of the market. The related apparel market is more fragmented than the equipment market and includes a variety of larger and smaller participants. We expect consolidation in this market to occur in the coming years, in a manner similar to what has occurred in the ice hockey equipment industry.

Roller Hockey

Roller Hockey Participation Rates and Demographics

Roller hockey is a team sport played principally in the United States, particularly in warmer regions such as California. According to a 2015 Sports and Fitness Industry Association (“SFIA”) report, total U.S. participation in roller hockey was approximately 1.8 million in 2014, up 33.3% over 1.3 million players in 2013. In the past five years, roller hockey has grown 26.3%, from 1.4 million participants in 2010 to 1.8 million in 2014.

Roller Hockey Equipment and Related Apparel Industry

The roller hockey equipment and related apparel industry shares similar characteristics to the ice hockey equipment and related apparel industry given the similarity of the sports. Management estimates that the wholesale roller hockey equipment market generated approximately $20 million in sales in calendar 2014. Through our Company’s MISSION and BAUER brands, we hold the No. 1 and No. 2 market share positions in the roller hockey equipment market, respectively, and have a substantial lead over our primary competitors, including Reebok, Tour and a few competitors in niche categories, such as wheels and accessories.

Street Hockey

Street Hockey Participation Rates and Demographics

Street hockey is a team sport played throughout the world, primarily in the largest ice hockey markets. According to management estimates and industry sources, there are approximately 93,000 registered players in Canada, approximately 48,000 registered players in the United States, and approximately 50,000 registered players in the rest of the world. Youth players represent approximately 50% of the registered participants. Management believes that registered participation represents only a small portion of the overall consumer base for street hockey products and that unregistered participants far exceed registered participants in number.

Street Hockey Equipment Industry

The street hockey equipment industry shares similar characteristics to the ice hockey equipment and related apparel industry given the similarity of the sports. Management estimates that the wholesale street hockey equipment market generated

11

approximately $25 million in sales in calendar 2014. The Company entered the street hockey market with a full line of street hockey equipment and accessories in April 2015 under the BAUER brand.

Baseball and Softball

Baseball and Softball Participation Rates and Demographics

Baseball and softball are team sports played principally in the United States, Japan, certain other Asian countries (such as South Korea), and Latin America. Global baseball/softball participation is estimated to be approximately 65 million, according to the World Baseball Softball Confederation. Baseball remains one of the most popular team sports by participation in the United States, second only to basketball, according to SFIA.

According to SFIA, total baseball and softball (fast pitch and slow pitch) participation in the U.S was 22.7 million in 2014, equal to the overall participation rate in 2013. In the past five years, overall participation in baseball and softball has decreased by a total of 9.9%, from 25.2 million participants in 2010 to 22.7 million in 2014.

While participation for baseball and softball in the United States has remained flat or decreased, the market continues to grow as innovation, particularly in bats, has driven rising prices.

Baseball and Softball Equipment and Related Apparel Industry

Management estimates that, in calendar 2014, the global baseball and softball wholesale equipment market was approximately $1.2 billion, while the global baseball and softball wholesale apparel market (excluding footwear) was estimated to be approximately $560 million. North America provides the largest portion of the global wholesale market, with an estimated $700 million equipment market and a $430 million apparel market (not including footwear).

With approximately 65 million participants globally, we believe the enthusiast base in these sports will experience continued growth, driven by the increasing popularity of travel ball, club baseball and softball, and more frequent play.

The baseball and softball equipment market is fragmented and is currently led by five major brands: our EASTON brand, MIZUNO, Jarden-owned RAWLINGS, and Amer Sports-owned WILSON and LOUISVILLE SLUGGER. Similar to Easton Baseball/Softball, our major competitors offer a full line of baseball and softball products and varying degrees of related apparel. In total, we compete with over a dozen brands in the baseball and softball equipment market, including, in addition to those above, Amer Sports-owned DEMARINI, MARUCCI, Jarden-owned MIKEN and WORTH, NOKONA, ZETT and SSK. In addition, NIKE and UNDER ARMOUR also are competitive brands in specific categories such as batting gloves.

The following table shows our estimated ranking in North America of the five major brands referenced above, in total and by major product category:

Company | Total Market | Bats | Batting Helmets | Catcher Protective | Equipment Bags | Batting Gloves | Apparel w/o Uniform | Accessories | Ball Gloves | |||||||||

EASTON | #1 | #1 | #1 | #2 | #1 | #3 | #4 | #3 | #6 | |||||||||

WILSON/ DEMARINI | #2 | #2 | n/a | #6 | #5 | n/a | #7 | n/a | #2 | |||||||||

RAWLINGS/ WORTH | #3 | #3 | #2 | #3 | #6 | #6 | #2 | #5 | #1 | |||||||||

MIZUNO | #4 | n/a | #4 | #4 | n/a | #5 | #5 | n/a | #3 | |||||||||

LOUISVILLE SLUGGER | #5 | #4 | n/a | n/a | #4 | n/a | n/a | n/a | #4 | |||||||||

Lacrosse

Lacrosse Participation Rates and Demographics

Lacrosse is a team sport played principally in the United States and Canada. Management estimates that the total global participation is approximately 900,000. According to U.S. Lacrosse, there were 772,772 registered players in the United States in

12

2014, up 3.5% from 2013 (746,859). In the past five years, registered players in the U.S. grew 23.7%, from 624,593 players in 2010 to 772,772 in 2014. In Canada, we estimate that there are approximately 100,000 participants.

The drivers of this growth included: (i) the establishment and popularity of the National Lacrosse League and Major League Lacrosse, (ii) the rapid expansion of high school and youth programs, (iii) emerging growth outside of key lacrosse markets in the Mid-Atlantic and Northeastern United States, (iv) enhanced funding and popularity of the National Collegiate Athletic Association (the “NCAA”) lacrosse programs, and (v) increased visibility of the sport in media and advertising.

Approximately 93% of lacrosse participants in the United States are under the age of 20, with 55% of participants in the youth (15 and under) category and 38% of participants in the high school category. Similar to ice hockey, the high representation of youth in the sport provides the industry with a more frequent product replacement cycle, as these young players outgrow their equipment.

Lacrosse Equipment and Related Apparel Industry

Management estimates that, in calendar 2014, the global lacrosse equipment market was approximately $120 million, with the United States accounting for approximately $110 million while the Canadian market was estimated to be approximately $10 million in size. Management estimates that the wholesale market for lacrosse apparel (including team) is approximately $40 million in size.

Management estimates that the lacrosse market will continue to grow in the range of mid-single digits to high-single digits for the next several years. The lacrosse equipment market is made up of four primary equipment categories: sticks (shafts and heads), gloves, helmets and protective equipment. Sticks currently make up the largest segment of the lacrosse equipment market, representing approximately 35% of calendar 2014 industry-wide United States sales. Helmets currently make up approximately 20% of calendar 2014 industry-wide United States sales.

The North American lacrosse equipment and related apparel market is a high growth, emerging sports equipment market underpinned by strong growth in participation rates. The lacrosse equipment market is currently led by six major brands: New Balance-owned WARRIOR and BRINE, our MAVERIK and CASCADE brands, STX, and Jarden-owned DEBEER (women’s only). The Company’s three major competitors all offer full lines of lacrosse equipment products, while Cascade’s product offering is primarily focused on helmets.

The following table shows our estimated ranking in North America of our four major competitor brands, in total sales:

WARRIOR / | MAVERIK / | STX | DEBEER LACROSSE | ||||

BRINE | CASCADE | ||||||

Market Position | #1 | #2 | #3 | #4 | |||

Team Apparel Industry

Team apparel and uniforms make up a large and growing market characterized by high fragmentation and competition, which provides significant competitive advantages to companies that can offer a one-stop shopping experience for high-quality products and a unified look (equipment and apparel) under authentic brands.

Management estimates that the overall non-footwear apparel market (including team, performance and lifestyle) in the sports markets we address is approximately $1.2 billion in size (Hockey - $390 million, Baseball/Softball - $560 million, Lacrosse - $40 million, Soccer - $300 million (team uniforms in Canada and the United States)).

BUSINESS OF THE COMPANY

Our Company

Headquartered in Exeter, New Hampshire, we are a leading designer, developer and manufacturer of high performance sports equipment and related apparel. Our mission is to elevate performance and protection for athletes at all levels through a combination of athlete insights and superior innovation. Our model is simple. We combine authentic brands and sport-specific employee expertise with our platform strengths, particularly our high performing R&D and game changing product creation processes, to annually grow our overall revenue, market share and profitability. On a constant currency basis, we strive to grow our revenues each year faster than the total market for each of our sports and to grow our profitability faster than revenues, both

13

as measured excluding the year-over-year impact of foreign exchange.

Our products are marketed under the BAUER (ice and roller hockey), MISSION (roller hockey), MAVERIK (lacrosse), CASCADE (lacrosse), INARIA (soccer apparel), EASTON (baseball and softball) and COMBAT (baseball and softball) brand names and are sold by sales representatives and independent distributors throughout the world. Our brands have a rich history of innovation, authenticity and market leadership, with the BAUER and EASTON brands dating back to 1927 and 1922, respectively.

In recent years, we have experienced strong revenue and profit growth through innovation, product development, marketing and acquisitions that have driven market share gains in all of our sports. Our scale, strong distribution and manufacturing relationships, disciplined cost management and sourcing strategies have enabled us to maintain consistent and attractive Adjusted EBITDA margins and to compete successfully. Our annual revenues have grown from $219.5 million in Fiscal 2008 to $654.7 million in Fiscal 2015, representing a compound annual growth rate of 16.9%; Adjusted EBITDA has grown from $22.9 million in Fiscal 2008 to $98.3 million in Fiscal 2015, representing a compound annual growth rate of 23.1%; and Adjusted EPS has grown from $0.15 in Fiscal 2010 to $1.02 in Fiscal 2015, representing a compound annual growth rate of 45.5% (we did not report Adjusted EPS prior to Fiscal 2010). Our Adjusted EBITDA, together with our relatively low level of capital expenditures and certain tax attributes, allow us to generate predictable and significant cash flows to invest in R&D, pursue acquisitions and other growth initiatives, and reduce our indebtedness.

As part of our growth strategy, we have acquired, integrated and significantly accelerated the growth of seven businesses since 2008, completing our most recent acquisition, Easton Baseball/Softball, in April 2014.

Our Core Businesses

We have the most recognized and strongest brands in ice hockey, roller hockey, baseball and softball, and hold top market share positions in these sports, with an expanding presence in the fast-growing lacrosse market. Our mission is to elevate player performance and protection at all levels through a combination of athlete insights and superior innovation.

Hockey and Related Apparel

We offer a complete line of head-to-toe performance-driven equipment under the BAUER and MISSION brands for players in every major ice and roller hockey market in the world. Our equipment offerings include skates, sticks, protective equipment, helmets and goalie equipment for ice hockey, roller hockey and street hockey.

We drive market share growth by introducing new products with performance improvements each year in most of our equipment categories, alternating three sub-brands of products for ice hockey, the VAPOR, SUPREME and NEXUS lines. Through this strategy, we have grown sales by creating excitement and dialogue at the retail level with retailers and consumers and maintaining a significant advantage over competitors who introduce new products less frequently.

In addition to equipment, we offer a full assortment of hockey apparel, including team apparel and uniforms, performance apparel and lifestyle apparel. While the hockey apparel industry is highly fragmented with several niche brands, our ability to offer a reliable and competitive apparel experience combined with access to our leading equipment creates a unique opportunity for team business.

BAUER holds the No. 1 market share position in ice hockey equipment with approximately 56% overall market share. MISSION and BAUER combined have the No. 1 market share position in roller hockey equipment at approximately 70%.

Baseball/Softball and Related Apparel

With the EASTON and COMBAT brands, we offer a broad line of baseball and softball equipment for all ages and levels of play. Our equipment and accessories (bats, gloves, protective equipment and apparel) for athletes and enthusiasts serve the professional, inter-scholastic, and recreational levels of the diamond sports market across a variety of price points.

EASTON is one of the world’s leading and most iconic diamond sports brands with authentic brand equity accumulated over 40 years of designing and manufacturing high performance diamond sports products. Building upon its heritage in bats, EASTON has developed into one of the strongest and most innovative brands in baseball and softball, and holds the No. 1 position in diamond sports in North America, with an approximately 27% market share and strong positions in multiple product categories.

As we have done with prior acquisitions, we have utilized our platform to accelerate Easton Baseball/Softball’s growth and look to increase market share in every category of baseball and softball equipment both domestically and internationally, and

14

to expand EASTON’s presence in apparel.

COMBAT’s proprietary bat manufacturing process has created a unique bat technology that has a loyal following. COMBAT’s patented technology, combined with its unique connection to the sport and its emphasis on grassroots marketing has elevated the COMBAT brand at all levels.

Both EASTON and COMBAT offer a wide variety of baseball/softball specific apparel and we expect to expand both brands’ apparel offering to include uniforms.

Lacrosse and Related Apparel

With our MAVERIK and CASCADE brands, we offer a comprehensive line of lacrosse equipment for all skill levels and hold approximately a 28% market share.

Through the MAVERIK brand, we offer a full line of gloves, heads, shafts and protective equipment, as well as a women’s specific line of product, for players of all ages. MAVERIK, founded in 2005 and acquired by the Company in 2010, continues to expand its brand presence, with five MAVERIK teams participating in the 16-team 2015 NCAA Division I tournament, including No. 1 overall seed Notre Dame.

CASCADE has been a pioneer in head protection since 1986 and is the No. 1 brand in lacrosse head protection with 90% market share. Since 1995, 16 NCAA champions have worn CASCADE helmets. CASCADE provides a wide variety of helmets for all ages, as well as several options for eye protection for the female player. In addition, CASCADE offers a 48-hour turnaround time for customer helmets.

In addition to equipment, CASCADE and MAVERIK design and manufacture accessories and related apparel, including performance apparel and lifestyle apparel.

Soccer Apparel

INARIA designs and manufactures a full-line of soccer apparel, including pro-style jerseys, practice jerseys, socks, warm-up suits and training apparel. The company offers full finishing, embellishment and unique customization services at its Canadian headquarters.

INARIA has recently elevated its brand at the youth, college and professional soccer levels through a variety of sponsorships and partnerships. INARIA is a sponsor of Schwan’s USA Cup, one of the world’s largest youth soccer tournaments, and recently signed professional team Minnesota United FC as the team’s official uniform provider. In addition, INARIA has also signed several NCAA Division I programs, including Cornell University and Colgate University.

Our Core Strengths

We believe the following strengths are integral to enhancing our leadership position and market share in all product categories in all our sports:

Strong and Authentic Brands in Attractive Markets

We have the No. 1 brands in the ice hockey, roller hockey and North American diamond sports (baseball and softball) equipment industries through the BAUER, MISSION and EASTON brands, respectively. BAUER is the most recognized and strongest brand in ice hockey with an estimated 56% overall worldwide market share. MISSION and BAUER combined are the leading brands in roller hockey with an estimated 70% market share. EASTON is one of the most iconic diamond sports brand with the No. 1 market share in North America, estimated at 27%. Easton Baseball/Softball has an opportunity to meaningfully increase its market share by growing its core bats category and expanding its position in several other large and profitable diamond sports categories where it is underpenetrated today. In the lacrosse category, our MAVERIK and CASCADE brands combined have an estimated 28% market share, with our CASCADE brand continuing to be the leading helmet provider with an estimated 90% market share. Through continued rapid growth of our CASCADE and MAVERIK brands, we aim to become the market leader in the lacrosse market by 2016. Our market leadership within each sport extends across multiple product categories through a full product suite that addresses our consumers’ needs for high performance equipment and apparel for players of all ages.

We believe the strong brand recognition and consumer loyalty for our brands is the result of regularly bringing to market innovative, top quality equipment with superior performance, our “true to the game” authenticity, and consistent and effective

15

brand communication. Our brand recognition in every sport creates significant barriers to entry in our markets, as many consumers believe that brands with heritage and authenticity will provide the best products to improve their game. This belief is reinforced by the numerous professional and elite-level athletes who utilize our products and who thereby create a halo effect that influences our broader group of consumers. These elite athletes include the 75% of National Hockey League (“NHL”) players who wore BAUER skates last season, 40 of the last 48 NCAA Division I lacrosse national championship finalist teams who wore CASCADE helmets, and 17 EASTON teams competing in the 2015 College World Series.

Our brands and their broad product offerings address an attractive, highly popular team sports market that is estimated at approximately $3.3 billion. Despite modest participation growth in these sports, these markets exhibit strong dollar value growth due to positive underlying fundamentals. There are attractive purchasing patterns in the markets we service. A short replacement cycle is driven by our core youth consumers regularly outgrowing their equipment and parents wanting to provide their children with the highest performing products. Additionally, we deliver products to market using short innovation-led product cycles that ensure a relentless flow of the latest technologies are available for consumers. Consistent innovation that improves the quality and performance of our products also allows us to raise average selling prices, further underpinning growth in the size of our markets.

Integrated Performance Sports Platform

We have achieved our leadership position and growth by leveraging our world-class performance sports products platform. Customer-facing, consumer-facing and product development functions are managed individually by sport and by category within each sport. Back-end functions and certain R&D activities are shared across sports to drive operational synergies and efficiency. This integrated platform is supported by authentic brands, deep consumer insights, significant R&D investments, and strong intellectual property. We originally developed this organizational structure to promote and support the rapid growth of our ice hockey equipment business but have also used it to successfully integrate and significantly grow the new performance equipment and apparel categories and sports markets we have entered through our recent acquisitions.

Each of our businesses maintains dedicated management, sales, marketing, product development and R&D teams, while leveraging highly scalable and shared resources such as sourcing & manufacturing, distribution & logistics, advanced R&D, information technology, human resources, finance and legal. These distinct units within each business often collaborate with their counterparts across the Company. This approach ensures we benefit from our scale and capitalize on opportunities to apply key advances across our platform without compromising the functions that support our strong consumer connections, “true to the game” authenticity, high performance products and well-established retailer relationships.

Our category management structure allows us to drive growth opportunities in every sport by deploying a multi-disciplinary approach to product development. We have a strong product development process that allows us to share best practices and innovation across the Company. These resources are both scalable and shareable across sports and categories. We believe this collaborative approach to product development yields superior results and products.

Industry-Leading R&D and Innovation

We believe our development capabilities and intellectual property portfolio provide us with a strategic competitive advantage by allowing us to create advanced products, drive new purchases and create barriers to entry. Our intellectual property portfolio includes 638 patents (including design patents and patents pending).

Our mission is to elevate player performance and protection at all levels by combining athlete insights with superior innovation. To achieve this we have consistently invested in R&D, spending on average, from Fiscal 2009 to Fiscal 2015, approximately 4.0% of our annual revenues on R&D ($24.2 million in Fiscal 2015, $18.5 million in Fiscal 2014 and $16.1 million in Fiscal 2013). Few of our competitors can match this level of investment due to their lack of scale or their concentration on a single sport. We employ a passionate and committed team of more than 75 designers, developers, engineers and technicians, who work closely with our scientific and research partners, including McGill University, the University of Pittsburgh Medical Center, the Composites Innovation Center and the University of Bath. This team has a world-class reputation and leads the sporting goods industry by continuously bringing to market innovative, often revolutionary, top-quality equipment with superior performance that is trusted by players of all skill levels.

We have a disciplined, rolling, multi-year product development program through which we bring hundreds of new products to market across all of our sports in an organized and efficient manner every year. We introduce new products on a regular basis, with the timing of new product launches typically driven by one- to five-year product life cycles, depending on the sport and the product category.

16

Diversified and Balanced Business Model

We have built a balanced business model that provides a consistent flow of revenue across several product categories, sports seasons, and geographies. Hockey represents approximately 60% of our sales, with baseball and softball accounting for approximately 30% of sales and other sports contributing the remainder. Within each sport, we maintain a broad product offering across all major equipment categories, with an increasing team and related-apparel offering.

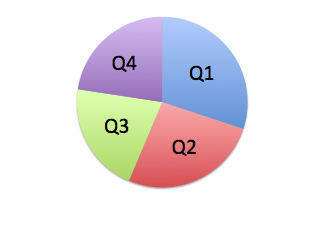

As illustrated below, the majority of sales for the spring/summer season of baseball and softball are shipped December through March, a perfect complement to ice hockey, where the majority of sales are shipped May through October. We believe this diversified model generates more consistent cash flow to allow us to invest in other growth opportunities and/or pay down our debt more evenly each year. The complementary seasonality of ice hockey and diamond sports offers us incremental benefits in physical distribution, raw material purchasing and internal manufacturing, and allows for the most efficient utilization of our third-party manufacturing partners’ annual production capacity.

Fiscal 2015 Revenue by Quarter

Source: Management estimates.

The Company has a global sales and distribution network in over 60 countries to service a broad and diverse customer base. We sell to more than 5,000 retailers in Canada, the United States, Scandinavia and Finland, and more than 60 distributors in other international markets. The majority of our sales are to independent or specialty retailers, such as Pure Hockey, Monkey Sports, Pro Hockey Life, Total Hockey, and Lacrosse Unlimited. As a result we have relatively low customer concentration, as evidenced by the fact that our largest customer, Canadian Tire Corporation, Limited, represents only approximately 10% of the Company’s sales. The specialty channel offers us numerous attractive qualities, including higher margins, a focus on higher performance products, superior levels of customer service that drive customer engagement with our brand, a more diversified customer base and higher barriers to entry for new brands due to the fragmented nature of the channel and the associated investment to properly service it.

Our sales are diversified geographically, with increased geographic sales concentration in the United States as a result of our acquisition of Easton Baseball/Softball. In Fiscal 2015, approximately 42% of our total sales were in the United States, approximately 33% were in Canada, and approximately 25% were in the rest of the world.

Proven Acquisition Platform

We have a proven capability to identify, acquire, integrate and rapidly grow complementary businesses. We believe that our integrated performance sports platform and scale enable us to materially enhance the synergy potential and success of an acquisition by leveraging our industry-leading R&D expertise, customer relationships, marketing resources and low-cost manufacturing.

Since September 2008, as part of our growth strategy, we have acquired, integrated and significantly accelerated the growth of seven businesses, completing our latest Easton Baseball/Softball in April 2014. Building upon our base with Bauer Hockey, we acquired Mission-ITECH Hockey Inc. (“MISSION”) in September 2008, the leader in roller hockey and at the time the fourth largest ice hockey company; entered the performance apparel market through the acquisition of certain intellectual property assets from Jock Plus Hockey Inc. in November 2009; secured a lacrosse platform brand with our acquisition of Maverik Lacrosse LLC (“Maverik” and, such acquisition the “Maverik Acquisition”) in June 2010; complemented Maverik with the

17

acquisition of Cascade, the industry-leader in lacrosse helmets, in June 2012; acquired Inaria in October 2012 to provide the capability to support all of our existing sports with team and performance apparel and enter the youth soccer apparel market; entered the diamond sports market through the acquisition of specialty bat manufacturer Combat Sports in May 2013; and gained the market-leading position in the North American baseball and softball market through the Easton Baseball/Softball Acquisition in April 2014.

As we expand our performance sports platform, we remain focused on valuation, maintaining prudent debt levels and acquiring only those brands and businesses that allow us to drive significant organic revenue, market share and earnings growth. We also maintain the discipline to forgo other acquisition opportunities that do not meet our criteria.

Seasoned Management Team

We are led by an experienced and committed management team with a successful track record of developing and marketing innovative products, integrating strategic acquisitions, and implementing successful growth strategies that continually outperform the respective market in which we compete. Under their leadership, we have expanded our market share in hockey, sourced and integrated seven acquisitions since September 2008, and dramatically increased sales and earnings.

Led by Kevin Davis, Chief Executive Officer (“CEO”), who has been with the Company for more than 13 years and Amir Rosenthal, President, PSG Brands, and Chief Financial Officer (“CFO”) who has been with the Company for more than seven years, the senior management team has an average of more than 20 years’ experience in the sporting goods and consumer product industries, including with Nike, Procter & Gamble, Newell Rubbermaid, Unilever, Cleveland Golf and the Boston Bruins. On a company-wide basis, our dedicated and passionate employees have been with the Company for an average of more than eight years, which we believe represents a strong commitment to the Company and an enthusiasm for our sports categories.

Growth Strategies

Significantly Grow Market Share in Baseball and Softball

The Easton Baseball/Softball business provides us with significant opportunities to build on the brand’s strong foundation to further drive revenue growth opportunities in the United States and internationally. We believe EASTON’s brand equity well positions us to expand in other diamond sports equipment categories that have historically been less of a focus for the business, such as ball gloves, accessories, batting gloves and apparel. We expect to increase Easton Baseball/Softball’s market share in diamond sports equipment by accelerating investment in product development, instilling category management resources and enhancing already strong connections with consumers. We also believe we can leverage our team apparel capabilities to add uniforms to Easton Baseball/Softball’s apparel business, further increasing its revenue growth potential. Another area of revenue growth opportunity is the expansion of EASTON’s presence internationally, particularly in Japan, the second largest baseball market globally.

We also intend to use the COMBAT brand, its dedicated and passionate team and its intellectual property assets to grow our diamond sports business. We believe COMBAT will continue its rapid growth in bats through an expansion of marketing and grass roots initiatives and by leveraging our unique and proprietary technologies. COMBAT has significant experience embodied in trade secrets and know how related to prototyping and manufacturing advanced composite sporting goods and other products using proprietary software, formulations, seamless construction and precision molding processes. This knowledge enables advanced composite products to be manufactured with greater quality and efficiency, and provides a significant competitive advantage over existing and potential competitors.

Continue to Grow in Hockey

BAUER is the most recognized brand in ice hockey equipment and has been synonymous with the sport itself for more than 85 years. We believe that this strong brand recognition is the result of consistent brand communication, our “true to the game” authenticity, and regularly delivering to market innovative top-quality equipment with superior performance. We have the leading market share in the overall ice hockey equipment market, with an estimated 56% market share in Fiscal 2015.

As the result of our continued focus on category management, product development and consistent innovation, we have increased our ice hockey market share substantially from approximately 35% in 2007 and hold the No. 1 market share position in each of our ice and roller hockey equipment categories, with the exception of goalie equipment for which we now hold the No. 2 market share position. For Fiscal 2015, we estimate that we had more than a 70% market share in ice hockey skates, 65% in helmets and protective, 45% in sticks and 35% in goalie.

18

While we are already the leading player in ice hockey, we believe there is still a substantial opportunity to increase our market share. We intend to expand our market share in all categories, and are particularly focused on categories where we have a leading but less than 65% market share, such as sticks, the largest ice hockey product category. Historically, we have driven market share growth by introducing new products with performance improvements each year, and we intend to continue leveraging our world-class R&D and product development platform to develop high performance and innovative products that advance player performance and protection and distinguish us from our competitors.

In addition, we are utilizing Bauer Hockey’s unique position in the market to develop partnerships and initiatives to drive hockey participation growth across the world. In October 2012, Bauer Hockey, in partnership with the Canadian Hockey Association (“Hockey Canada”), launched “Grow the Game”, a multi-faceted global initiative to add one million new players globally to the game of hockey by 2022 (double the recent industry growth rate) and increase player safety. The first round of pilot programs for the “First Shift” program launched in Canada in 2014 and included innovations such as reducing the length of seasons, parent outreach and education, and cost reduction initiatives. In the past year, we have expanded the program across Canada and are working with USA Hockey, Inc. (“USA Hockey”) to launch a similar program in the United States. Based on our success in hockey, we see an additional opportunity to launch similar initiatives in other sports.

Bauer Hockey also opened its first ever Own The Moment Hockey Experience in the Boston suburb of Burlington, Massachusetts and plans to open a total of 8-10 retail stores in key North American hockey markets, including Bloomington, Minnesota in the Fall of calendar year 2015. A transformative and historic initiative for Bauer Hockey, these premium retail experiences are expected to elevate the BAUER brand, deliver an unmatched consumer educational experience and serve as the ultimate BAUER brand and product showcase.

Built to inform and inspire hockey players, each Own The Moment Hockey Experience will have expertly trained associates to guide each consumer through a “fit, learn and experience” process. The process includes understanding the player’s needs, a customized fit based on the athlete’s style of play and the opportunity to try-before-you-buy on an indoor ice rink that will be housed inside the Own The Moment Hockey Experience. The in-store fitting protocol and experience will be personalized for the entire hockey community, including players of all ages and abilities. Every Own The Moment Hockey Experience will have dedicated areas for each product category as well as specific areas to easily educate new-to-hockey families and welcome them to the sport.

Equipped with advanced fitting protocols and unique in-store educational tools, the Company plans to continually test various retail strategies and share the findings with its authorized retail partners throughout the world to improve the consumer experience at every retail destination and further elevate the BAUER brand. In addition to sharing overall strategies, each Own The Moment Hockey Experience will serve as a training site for local retailer staff to learn the latest information about BAUER equipment.

The Company expects its retail operations to grow its overall business and be profitable in the next 12 to 16 months.

Grow Apparel Across All Sports

Our ice hockey, roller hockey, lacrosse and diamond sports authentic brands and product offerings provide us with an opportunity to develop and sell a comprehensive line of related apparel and accessories, including team performance and lifestyle apparel. Drawing on our experience in ice hockey, where we have successfully grown our apparel revenues at a 33% compound annual growth rate from Fiscal 2009 to Fiscal 2015, we believe we can also grow our share in each of these apparel categories in other sports.

We deliver convenience and consistent branding to a traditionally fragmented team apparel market, thus helping our retail partners to provide a fully customized service to their customers. We are expanding our team apparel offering across our high performance sports platform, including building on our iconic EASTON and cutting-edge MAVERIK brands in the diamond sports and lacrosse apparel markets, respectively, while focusing the INARIA brand on the soccer apparel market. The expansion of our team apparel capabilities in hockey under the BAUER brand has provided another lever of growth to our hockey business by combining team apparel offerings with customized equipment such as helmets and pants.

In addition to team apparel, we believe there is a significant opportunity to leverage our strong brand names to increase our presence and product offering in performance and lifestyle apparel. We have made significant R&D investments in apparel as well as in our equipment categories. Recent examples of products developed from these efforts include our training and base layer products for hockey utilizing the 37.5™ moisture management system and our new line of protective hockey apparel utilizing Poron®XRD™, a proprietary foam exclusively available to us for use in hockey and lacrosse. Our performance apparel business has seen the benefit of this investment and grown at a 51% compound annual growth rate from Fiscal 2009 to Fiscal 2015.

19

Continue Our Rapid Growth in Lacrosse

Through our CASCADE and MAVERIK brands, we estimate our lacrosse market share to be 28%, including a 90% market share in helmets. We believe our intellectual property assets, authentic lacrosse brand names, and strong R&D and product development platform position us well to achieve overall market leadership by 2016.

We intend to continue to focus and drive growth amongst core youth (15 and under) and high school markets, which represent 38% and 55% of lacrosse participants in the United States, respectively. Similar to ice hockey and baseball, the high representation of youth in the sport provides the industry with a more frequent product replacement cycle as players grow out of their equipment.

With our CASCADE brand, we are the leading manufacturer and distributor of men’s and youth lacrosse helmets in North America. CASCADE has been able to develop its leading market position, long-term relationships with retailers and strong industry-wide brand recognition due to an efficient manufacturing process and supply chain that allows it to manufacture and ship customized products within 48 hours of order. Cascade has been the helmet sponsor of Major League Lacrosse since 1999, with 85% of the league wearing CASCADE helmets. In addition, 40 of the last 48 NCAA Division I lacrosse national championship finalist teams have exclusively worn CASCADE helmets. We are the exclusive helmet provider for approximately 72% of all NCAA Division I collegiate lacrosse teams, and 48 of the top 50 high school teams in the United States.

Our lacrosse business operates a 72,000 square-foot manufacturing facility in Liverpool, New York with multiple production lines, as well as operations in New York City and Exeter, New Hampshire. As most of our lacrosse business’ component suppliers and vendors have facilities located within 300 miles of the Liverpool facility, we are able to manufacture and ship individualized products within a 48-hour turnaround time from order confirmation. We intend to maintain our factory custom competitive advantage while ensuring our lacrosse business continues to provide its specialty dealers and retailers with strong customer service and product customization capabilities, which are particularly important for the many school and travel lacrosse teams that customize the color schemes of their helmets as part of the team uniforms. These unique attributes have enabled our lacrosse business to develop long-term relationships with its retailers while also building strong industry-wide brand recognition. We manufacture and deliver all of our lacrosse helmet products to retailers and other distributors through our facility in Liverpool, New York and our other lacrosse equipment products through our third-party facility in Aurora, Illinois.

Beyond increasing market share in our current men’s lacrosse categories, we see substantial opportunity to expand our presence in women’s lacrosse and in lacrosse team apparel by leveraging the combined product innovation and research capabilities of the Company. We are well positioned to deliver advancements in women’s head protection as a result of CASCADE’s leadership position in helmets and recently launched MAVERIK branded lacrosse uniforms through a targeted strategy incorporating our team apparel capabilities and Cascade’s strong customization-based customer relationships.

Continue to Pursue Strategic Acquisitions

We have repeatedly used our world-class performance sports product platform to grow our business into new performance equipment and apparel categories and sports markets. Our successful acquisition and integration of seven businesses since 2008 has demonstrated our ability to identify targets and integrate acquired businesses. We are continuing to explore a number of potential near-term opportunities to complement our organic growth. When evaluating potential targets, we look for the ability to leverage our world-class performance sports platform, existing or potential market leaders, authentic brand equity and heritage and sports that demand high quality, innovative performance products. We are disciplined in our approach and have foregone many acquisition opportunities that did not satisfy our criteria.

Operating Segments

The Company has four operating segments: (i) Hockey, (ii) Baseball/Softball, (iii) Lacrosse and (iv) Soccer. Hockey and Baseball/Softball are reportable operating segments, and the remaining operating segments do not meet the criteria for a reportable segment and are included in Other Sports. The Hockey segment includes the BAUER and MISSION brands. The Baseball/Softball segment includes the EASTON and COMBAT brands. Other Sports includes the Lacrosse and Soccer operating segments, which includes the MAVERIK, CASCADE, and INARIA brands.

For operating segments data and geographic segments data, see “Segment Results” and refer to Note 17 of the Notes to Consolidated Financial Statements.

20

Customers

Our customer base spans over 5,000 retailers in Canada, the United States, the Nordic countries and more than 60 distributors. We sell our products through diverse channels of distribution including: (i) specialty retailers that cater to sports enthusiasts who typically seek premium products at the highest performance levels, (ii) national and regional full-line sporting goods retailers and distributors (“big box”), (iii) institutional buyers such as educational institutions and athletic leagues, and (iv) mass retailers that offer a focused selection of products at entry-level and mid-level price points.

In Fiscal 2015, approximately 58% of our total sales were in the United States, approximately 24% were in Canada, and approximately 18% were in the rest of the world. By channel, 27% of our sales were to big box accounts and 73% was to sport-specific specialty accounts (including larger, multi-door accounts).

Our ten largest customers together accounted for approximately 37% of the Company’s sales in Fiscal 2015, with our top customer, Canadian Tire Corporation, Limited, accounting for approximately 10% of our sales.

Bauer Hockey sells directly to our customers in Canada, the United States, and the Nordic countries. In Fiscal 2015, approximately 83% of our ice hockey equipment sales were to these markets. By channel, 18% of Bauer Hockey sales were to large big box accounts and 82% were to hockey specialty accounts (including larger, multi-door accounts). In these jurisdictions, our customers are typically independently-owned specialty hockey retail stores and large sporting goods retailers. Bauer Hockey sells through distributors outside North America and the Nordic countries. In Fiscal 2015, approximately 17% of our ice hockey equipment sales were to distributors representing over 1,000 retail outlets globally, providing us access to the world’s largest hockey markets outside North America and the Nordic countries. We believe that larger, more established equipment manufacturers like Bauer Hockey are able to more effectively serve the spectrum of retail channels globally, through established relationships and developed distribution capabilities.

Our lacrosse business exclusively sells its products through dealers and retailers, with minimal direct sales to end-consumers. In Fiscal 2015, approximately 89% of our lacrosse revenues were generated from lacrosse specialty and independent dealers, who then sell through to individuals, teams and institutions. The remaining 11% of our lacrosse revenues were from big box retailers and sporting goods retail chains, primarily on an exclusive basis. Through our grassroots and product-focused marketing approach, we have developed a diverse lacrosse customer base, with no customer representing more than 16% of total Fiscal 2015 sales.

COMBAT’s sales and distribution network focuses primarily on North America. COMBAT’s customers are made up of online stores, big box retailers, sporting goods chains and baseball specialty dealers. By channel, 3% of COMBAT sales were to big box and sporting goods chains and 97% were to baseball specialty accounts (including larger, multi-door accounts). COMBAT’s revenues are also generated via direct sales to end-consumers through team buy-in programs. COMBAT’s products are geared towards the high-end baseball and softball market which is currently served by the various retailers described above. This range allows for a wide variety of customers.

Easton Baseball/Softball’s sales and distribution network focuses primarily on North America. Easton Baseball/Softball’s customers are made up of online stores, big box retailers, sporting goods chains and baseball specialty dealers. By channel, 51% of Easton Baseball/Softball sales were to big box and sporting goods chains and 49% were to baseball specialty accounts (including larger, multi-door accounts). Easton Baseball/Softball’s products are geared towards the high-end baseball and softball market which is currently served by the various retailers described above. This range allows for a wide variety of customers.

Inaria predominantly sells its products directly to teams and associations. In Fiscal 2015, approximately 66% of revenues were generated in Canada. The primary soccer product being sold is a “player kit” that includes a jersey, shorts and matching socks for each member of the team or association. Each player kit is sized and personalized with team identifiers and numbering. Revenue is also generated from supplemental products such as off-field apparel, balls, bags and coaching accessories.

Research and Development

We have a disciplined, rolling, multi-year product development program through which we bring hundreds of new products to market annually across all of our sports. To support the successful execution of our new product launches, we (i) fully integrate our manufacturing partners into our R&D program, (ii) incorporate advanced materials into our product design to create lighter, more durable products, (iii) maintain a strong focus and discipline on cost management, and (iv) heavily test prototypes throughout the development phase, including utilization lab tests and on-ice/on-field trials by elite and high level players. We believe that this collaborative process yields superior equipment and performance apparel.

21