Attached files

| file | filename |

|---|---|

| EX-3.1 - CERTIFICATE OF INCORPORATION - LM FUNDING AMERICA, INC. | d917042dex31.htm |

| EX-23.1 - CONSENT - LM FUNDING AMERICA, INC. | d917042dex231.htm |

| EX-23.2 - CONSENT - LM FUNDING AMERICA, INC. | d917042dex232.htm |

| EX-4.2 - FORM OF STOCK CERTIFICATE - LM FUNDING AMERICA, INC. | d917042dex42.htm |

| EX-5.1 - OPINION - LM FUNDING AMERICA, INC. | d917042dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 27, 2015

Registration No. 333-205232

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LM FUNDING AMERICA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 6199 | 47-3844457 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

302 Knights Run Avenue, Suite 1000

Tampa, Florida 33602

Telephone No.: (813) 222-8996

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Stephen Weclew

Chief Financial Officer

302 Knights Run Avenue, Suite 1000

Tampa, Florida 33602

Telephone No.: (813) 222-8996

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Martin A. Traber, Esq. Curt P. Creely, Esq. Foley & Lardner LLP 100 North Tampa Street, Suite 2700 Tampa, Florida 33602 Telephone No.: (813) 229-2300 Facsimile No.: (813) 221-4210 |

Michael T. Cronin Johnson Pope Bokor Ruppel & Burns, LLP 911 Chestnut Street Clearwater, Florida 33756 Telephone No.: (727) 461-1818 Facsimile No.: (727) 462-0365 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered(3) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Units, each unit consisting of: |

$20,000,000.00 | $2,324.00 | ||

| One share of common stock, par value $0.001 per share |

— | (2) | ||

| One warrant to purchase one share of common stock |

— | (2) | ||

| Common stock, issuable upon exercise of common stock warrants |

$20,000,000.00 | $2,324.00 | ||

| Total |

$40,000,000.00 | $4,648.00(4) | ||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Section 6(b) and Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | No fee pursuant to Rule 457(g). |

| (3) | Pursuant to Rule 416, this registration statement also covers such number of additional shares of common stock to prevent dilution resulting from stock splits, stock dividends and similar transactions pursuant to the terms of the warrants referenced above. |

| (4) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED AUGUST 27, 2015

Maximum of 2,000,000 Units

Minimum of 1,200,000 Units

Each Unit Consisting of One Share of Common Stock and One Warrant

LM Funding America, Inc. is offering for sale up to 2,000,000 units, with each unit consisting of one share of our common stock, par value $0.001 per share, and one warrant. This is our initial public offering, and prior to this offering, there has been no public market for our units, shares of common stock, or warrants. We anticipate that the initial public offering price will be $10.00 per unit.

Each warrant may be exercised to acquire one share of common stock at an exercise price equal to $12.50 per share (which is 125% of the public offering price). The warrants may be exercised at any time after the closing of this offering until the five-year anniversary of the closing of this offering. We may cancel the warrants, in whole or in part, and if in part, by lot, at any time following the six-month anniversary of the closing of this offering if the closing price per share of our common stock exceeds $15.00 (which is 150% of the public offering price) for at least ten trading days within any period of twenty consecutive trading days.

Our placement agent, International Assets Advisory, LLC (the “Placement Agent”), is selling the units on a minimum/maximum “best efforts” basis. The Placement Agent is not required to sell any specific dollar amount of securities but will use its best efforts to sell the securities offered. Our Placement Agent will receive a fee with respect to such sales. Funds for the units will be deposited into escrow with SunTrust Bank, N.A. until a minimum of 1,200,000 units have been sold. In the event we do not sell a minimum of 1,200,000 units by November 13, 2015, escrowed funds will be promptly returned to investors without interest or deduction. In the event that a minimum of 1,200,000 units are sold by November 13, 2015, we will close on those funds received and promptly issue the units.

Our units, shares of common stock, and warrants have been approved for listing on The NASDAQ Capital Market under the symbols “LMFAU,” “LMFA” and “LMFAW,” respectively. We expect that the shares of common stock and warrants comprising the units will begin separate trading, and that the units will cease trading, on or about the 45th day following the date of this prospectus.

We are an “emerging growth company” under federal securities laws and will be subject to reduced public reporting requirements. Investing in our securities involves a high degree of risk. See “Risk Factors” on page 12.

| Price to Public | Placement Agent Fees(1) |

Proceeds, Before Expenses, to LM Funding America, Inc.(2) |

||||||||||

| Per unit |

$ | 10.00 | $ | 0.75 | $ | 9.25 | ||||||

| Total if minimum sold |

$ | 12,000,000.00 | $ | 900,000.00 | $ | 11,100,000.00 | ||||||

| Total if maximum sold |

$ | 20,000,000.00 | $ | 1,500,000.00 | $ | 18,500,000.00 | ||||||

| (1) | The terms of our arrangements with the Placement Agent are described under the caption “Plan of Distribution” beginning on page 94. |

| (2) | We expect total cash expenses for this offering to be approximately $1,259,479, which includes an estimated $200,000 of an accountable expense allowance of one percent (1%) of the amount of this offering payable to the Placement Agent. |

We expect all units purchased in this offering to be delivered to the purchasers on or about , 2015.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

International Assets Advisory, LLC

The date of this prospectus is , 2015.

Table of Contents

| 1 | ||||

| 12 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

39 | |||

| 51 | ||||

| 68 | ||||

| 74 | ||||

| 81 | ||||

| 83 | ||||

| 85 | ||||

| 89 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF SECURITIES |

91 | |||

| 94 | ||||

| 98 | ||||

| 98 | ||||

| 98 | ||||

| 98 | ||||

| F-1 |

You should rely only on the information contained in this prospectus. We have not, and the Placement Agent has not, authorized any other person to provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We and the Placement Agent are offering to sell and seeking offers to buy these securities only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we nor the Placement Agent have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Table of Contents

This summary highlights information that we present more fully in the rest of this prospectus and does not contain all of the information you should consider before investing in our securities. You should read the entire prospectus carefully, including the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Statements” and our consolidated financial statements and the related notes elsewhere in this prospectus before making an investment decision.

Except as otherwise indicated, the market data and industry statistics in this prospectus are based upon independent industry publications and other publicly available information. All dollar amounts referred to in this prospectus are in U.S. dollars unless otherwise indicated. We own the trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the TM, SM and ® symbols, but we will assert, to the fullest extent under applicable law, our applicable rights, if any, in these trademarks, service marks and trade names. All other trademarks are the property of their respective owners.

As used in this prospectus, unless context requires otherwise, references to “LMF,” “LM Funding,” “we,” “us,” “our,” “the Company,” “our company,” and similar references refer to (i) following the date of the Corporate Reorganization discussed under the heading “Corporate Reorganization,” LM Funding America, Inc., a Delaware corporation, and its consolidated subsidiaries, and (ii) prior to the date of the Corporate Reorganization, LM Funding, LLC, a Florida limited liability company, and its consolidated subsidiaries.

Unless otherwise indicated, the financial information in this prospectus represents the historical financial information of LM Funding, LLC and its consolidated subsidiaries. The financial results of LM Funding, LLC and its consolidated subsidiaries will be consolidated in our financial statements after this offering.

LM Funding America, Inc.

Company Overview

We are a specialty finance company that provides funding to nonprofit community associations primarily located in the state of Florida and, to a lesser extent, nonprofit community associations in the states of Washington and Colorado. We offer incorporated nonprofit community associations, which we refer to as “Associations,” a variety of financial products customized to each Association’s financial needs. Our original product offering consists of providing funding to Associations by purchasing their rights under delinquent accounts that are selected by the Associations arising from unpaid Association assessments. We provide funding against such delinquent accounts, which we refer to as “Accounts,” in exchange for a portion of the proceeds collected by the Associations from the account debtors on the Accounts. More recently, we have started to engage in the business of purchasing Accounts on varying terms tailored to suit each Association’s financial needs, including under our New Neighbor GuarantyTM program. We believe that revenues from the New Neighbor Guaranty program, as well as other similar products we may develop in the future, including products developed in response to the laws and regulations governing Association Accounts in various states in which we intend to expand, will comprise an increasingly larger piece of our business during the next few years, and we intend to seek to leverage these products to expand our business activities and growth both within and outside of Florida.

Under our original business, we purchase an Association’s right to receive a portion of the Association’s collected proceeds from owners that are not paying their assessments. After taking assignment of an

1

Table of Contents

Association’s right to receive a portion of the Association’s proceeds from the collection of delinquent assessments, we engage law firms to perform collection work on a deferred billing basis on behalf of Associations wherein the law firms receive payment upon collection from the account debtors or a predetermined contracted amount if payment from account debtors is less than legal fees and costs owed. Under this business model, we typically fund an amount equal to or less than the statutory minimum an Association could recover on a delinquent account for each Account, which we refer to as the “Super Lien Amount”. Upon collection of an Account, the law firm working on the Account, on behalf of the Association, generally distributes to us the funded amount, interest otherwise payable to the Association, and administrative late fees otherwise payable to the Association, with the law firm retaining legal fees and costs collected, and the Association retaining the balance of the collection. In connection with this business, we have developed proprietary software for servicing Accounts, which we believe enables law firms to service Accounts efficiently and profitably.

Under the New Neighbor Guaranty program, an Association will generally assign substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payment by us of monthly dues on each delinquent unit. This simultaneously eliminates a substantial portion of the Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed monthly payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the program enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables. We intend to leverage our proprietary software platform, as well as our industry experience and knowledge gained from our original business, to expand the New Neighbor Guaranty program and to potentially develop other new products in the future.

Because we acquire and collect on the delinquent receivables of Associations, the Account debtors are third parties that we have little or no information about. Therefore, we cannot predict when any given Account will be paid off or how much it will yield. In assessing the risk of purchasing Accounts, we review the property values of the underlying units, the governing documents of the relevant Association, and the total number of delinquent receivables held by the Association.

As of June 30, 2015, we have, since our inception, purchased an aggregate of approximately $274 million in Association receivables by funding a total of approximately $11 million with respect to 11,000 units across nearly 500 Associations in Florida, Washington and Colorado. Through June 30, 2015, we have, since our inception, received just over $102 million from approximately $192 million in purchased Accounts. From these purchased Accounts, we have recovered almost all of our principal investment of $8 million and earned about $29 million in revenues. Per our contracts, we have paid or recovered $10 million in legal fees and returned $55 million to our funded Associations.

Our Products

Original Product

Our original product relies upon Florida statutory provisions that effectively protect the principal amount invested by us in each Account. In particular, Section 718.116(1), Florida Statutes, makes purchasers and sellers of a unit in an Association jointly and severally liable for all past due assessments, interest, late fees, legal fees, and costs payable to the Association. In addition, the statute grants to Associations a so-called “super lien”, which is a category of lien that is given a statutorily higher priority than all other types of liens other than property tax liens. Under the Florida statute, a Florida Association’s super lien has higher priority than all other lien holders, except in the case of property tax liens. The amount of the Association’s priority over a first mortgage holder that takes title to a property through foreclosure (or deed in lieu), referred to as the Super Lien Amount, is limited to twelve months’ past due assessments or, if less, one percent (1.0%) of the original mortgage amount. Under our contracts with Associations for our original product, we pay Associations an amount up to the Super Lien Amount for the right to receive the funded Super Lien Amount and all collected interest and late fees on Accounts purchased from the Associations. To protect any amount invested by us in

2

Table of Contents

excess of the Super Lien Amount, we purchase insurance from an affiliate of AmTrust North America, or AmTrust, covering all assessments lost during the term of coverage due to a first mortgage foreclosure resulting in a Super Lien Amount payoff less a deductible equal to six months of assessments.

In other states in which we offer our original product, which are currently only Washington and Colorado, we rely on statutes that we believe are similar to the above-described Florida statutes in relevant respects. A total of approximately 21 U.S. states and the District of Columbia have super lien statutes that give Association assessments super lien status under some circumstances, and of these states, we believe that all of these jurisdictions other than Alaska have a regulatory and business environment that would enable us to offer our original product to Associations in those states on materially the same basis. With respect to our original product, for the year ended December 31, 2014, we acquired 496 Accounts for $359,200, compared to 1,097 Accounts for $940,097 for the year ended December 31, 2013. We believe the decline in purchased Accounts acquired in 2014 as compared to 2013 was a result of a decline in our available capital in 2014.

New Neighbor Guaranty

In 2012, we began development of a new product, the New Neighbor Guaranty, wherein an Association assigns substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payments in an amount equal to the regular ongoing monthly or quarterly assessments for delinquent units when those amounts would be due to the Association. We assume both the payment and collection obligations for these assigned Accounts under this product. This simultaneously eliminates an Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed assessment payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the product enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables.

Before we implement the New Neighbor Guaranty program, an Association typically asks us to conduct a review of its accounts receivable. After we have conducted the review, we inform the Association of which Accounts we are willing to purchase and the terms of such purchase. Once we implement the New Neighbor Guaranty program, we begin making scheduled payments to the Association on the Accounts as if the Association had non-delinquent residents occupying the units underlying the Accounts. Our obligation to pay monthly assessments under the New Neighbor Guaranty is limited to 48 months or a lesser amount of months capped by the $17,000 per Account limit contained in our AmTrust insurance policy. Our obligation to pay monthly assessments on any unit ends upon full collection of all amounts owed on the Account and return of the Account to the Association. Our New Neighbor Guaranty contracts typically allow us to retain all collection proceeds on each Account other than special assessments and accelerated assessment balances. Thus, the Association foregoes the potential benefit of a larger future collection in exchange for the certainty of a steady stream of immediate payments on the Account.

As a result of the availability of our insurance coverage from AmTrust, unlike our original product, which relies on the existence of certain types of super lien statutes to protect our principal investment, we believe we can offer the New Neighbor Guaranty program in the majority of U.S. states with similar limited risk. The only portion of our principal investment at risk in Accounts in states without super lien statutes is the portion comprising six months’ worth of past due assessments. Our AmTrust insurance policy covers all assessments during the coverage term that go unpaid as a result of a first mortgage foreclosure. Therefore, for each month we fund a delinquent Account under the New Neighbor Guaranty, the AmTrust insurance policy will reimburse us for the funded amount, but not our profits or costs.

The New Neighbor Guaranty program represented approximately six percent (6%) of our overall revenue in 2014. That is in comparison to our original product, which accounted for approximately eighty-nine percent (89%) of our overall revenue in the same period. The balance of our revenue from the period was from Accounts that are hybrids of the original product with varying splits and from income on real estate owned, or REO, units. As we continue to develop our New Neighbor Guaranty product, we expect it to make up continually larger portions of our total revenue.

3

Table of Contents

As of June 30, 2015, our average investment per unit for currently active Accounts under our original product was approximately $699, and we expect that this average investment size will not materially change for the foreseeable future. Current investment for active New Neighbor Guaranty Accounts as of June 30, 2015 averaged approximately $5,217 per unit, although this average will vary in the future depending on how quickly we add new Accounts and how quickly we are able to resolve those Accounts. The average continued payment to Associations that have the New Neighbor Guaranty program in place is $280 per month for each active Account as of June 30, 2015.

As of June 30, 2015, we have historically recovered approximately $3,450 per Account in interest and late fee revenue for Accounts collected under our original product. Accounts under our New Neighbor Guaranty program are producing revenue to us of, on average, approximately $7,600 per Account as of June 30, 2015 after the recovery of our purchase price or investment basis. The average total recovery under our New Neighbor Guaranty program at final settlement is approximately $11,000 per Account, and is expected to continue to increase.

Future Products

We are also developing other variations of our contracts with Associations in various states that we may introduce to the market in the future. For example, under one product under development, at the request of an Association lender we may contract with an Association to provide that the Association will have revenues equal to or more than 90% of budget or any other percentage the lender requests. If an Association is at 80% of budget and a lender requires it to maintain revenues of 90% of budget, this product would provide upfront capital to bring the Association to the 90% threshold and then make continuing payments to keep it there through the term of the loan. This minimizes the lender’s risk of delinquencies adversely affecting the loan’s repayment. Also, this would enable lenders to do business with more Associations than their previous underwriting guidelines would permit if Associations contract with us as part of the loan package. This product, along with other variations on our contracts with Associations in various states, remains under development, however, and there is no assurance that we will ultimately launch this product or any other variation on our contracts with Associations in any state.

Industry Overview

According to the Community Association Institute (“CAI”), as of January 2014, 65 million people lived in 328,500 Associations in the United States. As a percentage, homeowners associations account for between 51-55% of the total and condominium associations make up between 42-45% of the total, with cooperatives comprising the balance. Florida has nearly eight million residents living in more than 47,000 community associations. Assuming the national distribution of property types exists in Florida, Florida has approximately 24,000 homeowners associations and 20,000 condominium associations. As of June 15, 2015, we have contracted with approximately 450 community associations. We believe opportunity remains abundant in our other geographic markets. As of December 31, 2014, the state of Washington had more than 10,000 community associations and the state of Colorado had more than 9,000.

Associations typically address delinquencies by paying lawyers or collection agencies to recover amounts owed. While Associations seek recovery of delinquent amounts, budgets go underfunded causing the need to cut services or raise assessments further. The real estate downturn in 2008 made delinquency issues an acute problem for a large number of Associations. We were organized in 2008 to immediately address the financial problems faced by Associations as a result of delinquent unit owners.

4

Table of Contents

According to the CAI, in Florida, where we have primarily operated, Associations annually assess their residents $9 billion and nationwide, annual assessments by Associations are $65 billion. We believe we are the largest purchaser of delinquent Accounts in Florida, with total purchases of approximately $274 million over a seven-year period. The balance of delinquent Accounts are serviced by lawyers, collection companies, or a handful of small competitors of us, or not serviced at all. We believe we offer Associations a better financial solution to Account delinquencies and that Associations will increasingly turn to us and our products as a solution to handle Account delinquencies.

Our Strategy

Our primary objective is to utilize our competitive strengths, including our proprietary technology and our management’s experience and expertise in buying and collecting Association Accounts, to grow our business in Florida and in other states by identifying, evaluating, pricing, and acquiring Association Accounts and maximizing collections of such Accounts in a cost-efficient manner. The principal elements of our strategy are comprised of the following:

| • | Capitalizing on our brand and existing strategic relationships to identify and acquire Association Accounts. We market our “We Buy Problems” and “You Are Always Better off with LM Funding” brands primarily through trade shows throughout Florida and, to a lesser extent, at national events. Participation in these shows and events has enabled us to form strategic relationships throughout the Association services industry and has served to provide a positive reputation in the industry. We leverage our brand and strategic relationships with law firms and Associations to identify and purchase Accounts. |

| • | Partnering with Associations’ advisors such as law firms, management companies, accountants, Association lenders, and others to efficiently identify and acquire Accounts on a national basis. The point of purchase for Accounts is at the individual Association board of directors level; therefore, establishing and maintaining relationships with the advisors of those boards is important to our business strategy. Our strategic relationships with Association boards’ advisors provide us with opportunities to meet with Association boards on favorable terms and help us to gain their trust and confidence. |

| • | Providing our proprietary software to our partner law firms in order to cost effectively track, control, and collect purchased Accounts and maintain low fixed overhead. We believe our proprietary software enables an attorney to efficiently handle approximately 1,000 accounts at a time with a high degree of uniformity and accuracy based upon our experience with the historical caseload per lawyer of Business Law Group, P.A. This enables our law firms to operate more efficiently and profitably, while simultaneously enabling us to cost effectively track and control our Accounts on a real-time basis. |

| • | Leveraging our insurance arrangement with AmTrust to develop new products and markets and control risk. We build our products with a low-risk, high-reward outlook. Initially, we controlled risk by funding the almost always recoverable Super Lien Amount. Now, our insurance arrangement with AmTrust allows us to develop new products such as the New Neighbor Guaranty and operate in states without a statute giving Association assessments super lien status with low risk to our principal investment while pursuing the high rewards of full lien payoffs. |

| • | Utilizing increased access to capital and lines of credit to expand our product offerings nationally. As a specialty finance company, capital is our inventory. Access to capital has always determined the speed of our growth and the amount of upfront funding we can provide with our products. We believe that increased access to capital will enable us to pursue more opportunities to buy Accounts and to develop a wider array of specialty finance products. |

5

Table of Contents

| • | Extending secured commercial loans as a means to acquiring large blocks of Accounts. We intend to pursue the extension of secured loans to commercial partners who, as a condition of such loans, would be required to drive large blocks of accounts to us. Banks, management companies, law firms, and large Associations control large blocks of Accounts that we may be able to acquire if we help meet their capital needs. |

| • | Pursuing acquisitions of legacy providers in the Association Account servicing industry. A number of smaller collection companies continue to operate in the community association market. Some have funded Accounts that we can acquire. Others have customer relationships which can serve as a valuable platform for selling our products. Although we have not historically pursued any acquisitions and have not had acquisition discussions with any potential targets, in part due to insufficient capital, we believe the opportunity to make acquisitions could be an important part of our growth strategy going forward. |

Risks Relating to Our Business and This Offering

The implementation of our business strategy and our future results of operations and financial condition are subject to a number of risks and uncertainties. We discuss in detail factors that could adversely affect our actual results and performance, as well as the successful implementation of our business strategy, under the heading “Risk Factors” beginning on page 12. Before you invest in our securities, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors,” including:

| • | we may not be able to continue to purchase Association Accounts at favorable prices, or on sufficiently favorable terms, or at all; |

| • | since debtors under Accounts are third parties that we have little or no information about, we cannot predict when any given Account will pay off or how much such payoff will yield; |

| • | we may not be able to recover sufficient amounts on our Accounts to cover our costs; |

| • | we face intense competition from lawyers, collection agencies, and other direct and indirect competitors; |

| • | we are dependent upon third-party law firms to service our Accounts; |

| • | we may not be successful at acquiring and collecting Accounts in other states profitably; |

| • | the Rodgers family will effectively control our company by beneficially owning more than 50% of our outstanding common stock; and |

| • | government regulation, current laws, and new laws may limit our ability to recover and enforce the collection of our Accounts. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related disclosure in our “Management’s Discussion and Analysis of Financial Condition and Results of Operations;” |

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

6

Table of Contents

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; |

| • | we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” and |

| • | we may elect to use an extended transition period for complying with new or revised accounting standards. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company if we have more than $1 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some or all of these reduced burdens.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

Corporate Information

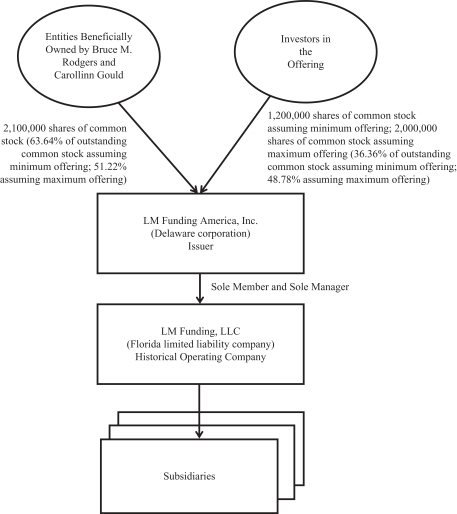

We began operations in 2008, and historically, our business was operated through LM Funding, LLC, a limited liability company organized in the state of Florida on January 14, 2008. LM Funding America, Inc. was incorporated in the state of Delaware on April 20, 2015 for the purpose of this offering and has engaged to date only in activities in contemplation of this offering. Upon completion of the offering, LM Funding America, Inc. will be a holding company the principal asset of which will be its interest in LM Funding, LLC. We expect that substantially all of our business will be conducted through LM Funding, LLC, and the financial results of LM Funding, LLC and its consolidated subsidiaries will be consolidated in our financial statements. LM Funding America, Inc. will be the sole managing member of LM Funding, LLC and will therefore have 100% of the voting rights and control of LM Funding, LLC. See “Corporate Reorganization.”

After completion of this offering, LM Funding America, Inc. will be a “controlled company” under the listing rules of The NASDAQ Capital Market.

Our principal executive offices are located at 302 Knights Run Avenue, Suite 1000, Tampa, Florida 33602, and our telephone number is (813) 222-8996. Our website is www.lmfunding.com. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

7

Table of Contents

The Offering

| Issuer |

LM Funding America, Inc. |

| Securities offered |

A minimum of 1,200,000 and a maximum of 2,000,000 units. Each unit consists of one share of common stock, $0.001 par value, and one warrant. |

| Warrant terms |

The warrants included in the units will be exercisable any time following the completion of the offering, and will expire on the final day of the 60th month following the date of the closing of this offering. Each warrant may be exercised to purchase one share of common stock at an exercise price equal to 125% of the public offering price ($12.50 per share assuming the expected public offering price). |

| We may cancel the warrants, in whole or in part, and if in part, by lot, at any time following the six-month anniversary of the closing of this offering if the closing price per share of common stock exceeds $15.00 (which is 150% of the public offering price) for at least ten trading days within any period of twenty consecutive trading days. |

| Shares of common stock outstanding after the closing of the offering |

Assuming that we sell the minimum number of units, we will have 3,300,000 shares of common stock outstanding and assuming that we sell the maximum number of units, we will have 4,100,000 shares of common stock outstanding (not including the shares of common stock underlying the warrants offered hereby). |

| NASDAQ Capital Market symbols |

“LMFAU” for our units, “LMFA” for our shares of common stock, and “LMFAW” for our warrants. |

| Use of Proceeds |

We estimate the net proceeds to us from this offering to be approximately $9,920,521 if we achieve the minimum offering and $17,240,521 if we achieve the maximum offering, based on an assumed initial offering price of $10.00 per unit. We intend to use the estimated net proceeds from this offering for general corporate purposes and growth capital, including working capital and capital for acquisitions to allow us to grow in Florida and nationally. |

| Proposed Transfer Agent |

American Stock Transfer & Trust Company, LLC. |

| Risk Factors |

Investing in our securities involves a high degree of risk and as an investor, you should be prepared to bear a complete loss of your investment. See the heading “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

8

Table of Contents

| Conditions to Closing |

We will not close the offering if we do not receive subscriptions to purchase at least the minimum offering amount. |

| Escrow Period |

Funds will be held in escrow until the earlier of our receipt of commitments to purchase units or November 13, 2015. |

| Escrow Agent |

SunTrust Bank, N.A. will serve as escrow agent for the subscription funds pending the closing of the offering. |

| Plan of Distribution |

The Placement Agent intends to market the securities on a “best efforts” agency basis. |

Unless otherwise indicated, all information in this prospectus assumes the sale of 1,600,000 units (the midpoint of the minimum and maximum offering set forth on the cover page of this prospectus) at an assumed initial public offering price of $10.00 per unit.

9

Table of Contents

Summary Historical and Pro Forma Consolidated Financial Data

The following tables set forth, for the periods and at the dates indicated, the summary historical and pro forma consolidated financial and operational data for LM Funding, LLC and Subsidiaries and LM Funding America, Inc. The summary historical financial data as of and for the six months ended June 30, 2015 and June 30, 2014, and as of and for the years ended December 31, 2014 and 2013 has been derived from the consolidated financial statements of LM Funding, LLC and Subsidiaries contained herein. Historical results are not indicative of the results to be expected in the future. You should read the following information together with the more detailed information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Statements” and our consolidated financial statements and the accompanying notes thereto appearing elsewhere in this prospectus.

The summary unaudited pro forma consolidated financial data of LM Funding America, Inc. presented below as of and for the six months ended June 30, 2015 and for the year ended December 31, 2014 has been prepared to give pro forma effect to all of the transactions described under the heading “Unaudited Pro Forma Financial Statements” as if they had been completed as of January 1st of each year, with respect to the unaudited pro forma condensed consolidated statements of income, and as of June 30, 2015 with respect to the unaudited pro forma condensed consolidated balance sheet. This pro forma financial data is subject and gives effect to the assumptions and adjustments described in the notes accompanying the unaudited pro forma financial statements included elsewhere in this prospectus. The summary unaudited pro forma financial data is presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the transactions been consummated on the dates indicated, and does not purport to be indicative of statements of financial condition data or results of operations as of any future date or for any future period.

| LM Funding America, Inc. |

Historical LM Funding, LLC and Subsidiaries | |||||||||||||||||||

| Pro Forma Results (Unaudited) |

||||||||||||||||||||

| 6 Months Ended |

(Unaudited) 6 Months Ended |

Fiscal Year Ended | ||||||||||||||||||

| Consolidated Balance Sheet Data | June 30, 2015 |

June 30, 2015 |

June 30, 2014 |

December 31, 2014 |

December 31, 2013 |

|||||||||||||||

| ASSETS |

||||||||||||||||||||

| Cash |

$ | 13,580,521 | $ | 2,429,982 | $ | 1,127,314 | $ | 2,027,694 | $ | 764,850 | ||||||||||

| Finance receivables |

2,849,754 | 2,849,754 | 4,036,107 | 3,473,261 | 4,727,332 | |||||||||||||||

| Due from related party |

12,851 | 12,851 | 534,973 | 463,900 | 484,990 | |||||||||||||||

| Other assets |

707,841 | 707,841 | 335,094 | 806,503 | 330,642 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 17,150,967 | $ | 6,000,428 | $ | 6,033,488 | $ | 6,771,358 | $ | 6,307,814 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND MEMBERS’ EQUITY (DEFICIT) |

||||||||||||||||||||

| Liabilities |

$ | 348,700 | $ | 348,700 | $ | 549,248 | $ | 472,597 | $ | 600,762 | ||||||||||

| Bank indebtedness |

7,042,975 | 7,042,975 | 7,278,495 | 7,431,938 | — | |||||||||||||||

| Other indebtedness |

1,777,778 | 1,777,778 | — | — | 8,252,849 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 9,169,453 | 9,169,453 | 7,827,743 | 7,904,535 | 8,853,611 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Members’ equity (deficit) |

7,921,211 | (3,229,328 | ) | (1,821,167 | ) | (1,144,212 | ) | (2,547,513 | ) | |||||||||||

| Non-controlling interest |

60,303 | 60,303 | 26,912 | 11,035 | 1,716 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 7,981,514 | (3,169,025 | ) | (1,794,255 | ) | (1,133,177 | ) | (2,545,797 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 17,150,967 | $ | 6,000,428 | $ | 6,033,488 | $ | 6,771,358 | $ | 6,307,814 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10

Table of Contents

| LM Funding America, Inc. | Historical LM Funding, LLC and Subsidiaries | |||||||||||||||||||||||

| Pro Forma Results (Unaudited) |

||||||||||||||||||||||||

| 6 Months Ended |

Fiscal Year Ended |

(Unaudited) 6 Months Ended |

Fiscal Year Ended | |||||||||||||||||||||

| Consolidated Statements of Income Data |

June 30, 2015 |

December 31, 2014 |

June 30, 2015 |

June 30, 2014 |

December 31, 2014 |

December 31, 2013 |

||||||||||||||||||

| Revenues |

$ | 3,603,736 | $ | 7,649,389 | $ | 3,603,736 | $ | 4,001,127 | $ | 7,649,389 | $ | 6,895,487 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Staff costs and payroll |

864,005 | 1,806,137 | 611,505 | 654,255 | 1,301,137 | 1,461,431 | ||||||||||||||||||

| Collection costs |

27,100 | — | 27,100 | 332,896 | 715,547 | 564,818 | ||||||||||||||||||

| Professional fees |

487,510 | 765,537 | 387,510 | 390,816 | 565,537 | 267,554 | ||||||||||||||||||

| Settlement costs with associations |

256,913 | 373,422 | 256,913 | 226,527 | 373,422 | 364,490 | ||||||||||||||||||

| Other expenses |

584,247 | 1,162,390 | 584,247 | 689,206 | 1,162,390 | 1,167,592 | ||||||||||||||||||

| Interest expense |

338,825 | 641,023 | 402,825 | 519,694 | 985,023 | 1,213,422 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before taxes |

1,045,136 | 2,900,880 | 1,333,636 | 1,187,733 | 2,546,333 | 1,856,180 | ||||||||||||||||||

| Provision for income taxes |

(397,200 | ) | (1,102,300 | ) | — | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (1) |

$ | 647,936 | $ | 1,798,580 | $ | 1,333,636 | $ | 1,187,733 | $ | 2,546,333 | $ | 1,856,180 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | includes income attributable to non-controlling interest |

11

Table of Contents

An investment in our securities involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below together with the other information included in this prospectus before purchasing our securities in this offering. If any of the possibilities described as risks below actually occur, our business, financial condition and results of operations would likely suffer and the trading price of our securities could fall, causing you to lose some or all of your investment in the securities we are offering. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Risks Relating to Our Business

We may not be able to purchase Accounts at favorable prices, or on sufficiently favorable terms, or at all.

Our success depends upon the continued availability of Association Accounts. The availability of Accounts at favorable prices and on terms acceptable to us depends on a number of factors outside our control, including:

| (i) | the status of the economy and real estate market in markets which we have operations may become so strong that delinquent Accounts do not occur in sufficient quantities to efficiently acquire them; |

| (ii) | the perceived need of Associations to sell their Accounts to us as opposed to taking other measures to solve budget problems such as increasing assessments; and |

| (iii) | competitive pressures from law firms, collections agencies, and others to produce more revenue for Associations than we can provide through the purchase of Accounts. |

In addition, our ability to purchase Accounts, in particular with respect to our original product, is reliant on state statutes allowing for a Super Lien Amount to protect our principal investment; any change of those statutes and elimination of the priority of the Super Lien Amount, particularly in Florida, could have an adverse effect on our ability to purchase Accounts. If we were unable to purchase Accounts at favorable prices or on terms acceptable to us, or at all, it would likely have a material adverse effect on our financial condition and results of operations.

Our quarterly operating results may fluctuate and cause our stock price to decline.

Because of the nature of our business, our quarterly operating results may fluctuate, which may adversely affect the market price of our common stock. Our results may fluctuate as a result of the following factors:

| (i) | the timing and amount of collections on our Account portfolio; |

| (ii) | our inability to identify and acquire additional Accounts; |

| (iii) | a decline in the value of our Account portfolio recoveries; |

| (iv) | increases in operating expenses associated with the growth of our operations; and |

| (v) | general, economic and real estate market conditions. |

We may not be able to recover sufficient amounts on our Accounts to recover charges to the Accounts for interest and late fees necessary to fund our operations.

We acquire and collect on the delinquent receivables of Associations. Since Account debtors are third parties that we have little to no information about, we cannot predict when any given Account will pay off or how much it will yield. In order to operate profitably over the long term, we must continually purchase and collect on a sufficient volume of Accounts to generate revenue that exceeds our costs.

12

Table of Contents

We are subject to intense competition seeking to provide a collection solution to Associations for delinquent Accounts.

Lawyers, collection agencies, and other direct and indirect competitors vying to collect on Accounts all propose to solve the problem delinquent Accounts pose to Associations. Additionally, Associations and their management companies sometimes try to solve their delinquent Account problems in house, without the assistance of third-party collection agencies. An Account that an Association attempts to collect through any of these other options is an Account we cannot purchase and collect. We compete on the basis of reputation, industry experience, performance and financing dollars. Some of these competitors have greater contacts with Associations, greater financial resources and access to capital, more personnel, wider geographic presence and other resources than we have. In addition, we expect the entry of new competitors in the future given the relatively new nature of the market in which we operate. Aggressive pricing by our competitors could raise the price of acquiring and purchasing Accounts above levels that we are willing to pay, which could reduce the number of Accounts suitable for us to purchase or if purchased by us, reduce the profits, if any, generated by such Accounts. If we are unable to purchase Accounts at favorable prices or at all, the revenues generated by us and our earnings could be materially reduced.

We are dependent upon third-party law firms to service our Accounts.

Although we utilize our proprietary software and in-house staff to track, monitor, and direct the collection of our Accounts, we depend upon third-party law firms to perform the collection work. As a result, we are dependent upon the efforts of our third-party law firms, particularly Business Law Group, P.A. (“BLG”) to service and collect our Accounts. BLG presently services approximately 98% of our Accounts. Our revenues and profitability could be materially affected if:

| (i) | our agreements with the third-party law firms we use are terminated and we are not able to secure replacement law firms or direct payments from account debtors to our replacement law firms; |

| (ii) | our relationships with our law firms adversely change; |

| (iii) | our law firms fail to adequately perform their obligations; or |

| (iv) | internal changes at such law firms occur, such as loss of staff who service us. |

We are dependent upon AmTrust for insuring some of our purchased Accounts.

When the purchase price of an Account exceeds the amount protected by the Super Lien Amount, or if we purchase an Account in a jurisdiction without a super lien statute, we purchase insurance from AmTrust. This insurance covers all principal assessments owed less the six month past-due assessment deductible for the term of the coverage. AmTrust is the only provider of such coverage, and it is not clear that any other insurance agency would be willing or able to provide such coverage at comparable rates to those offered by AmTrust. Therefore, we are dependent upon AmTrust to provide us with this insurance coverage. Our revenues and profitability could be materially adversely affected if AmTrust were to materially raise the price of this coverage or decline to continue offering this coverage and we were unable to secure replacement coverage at a comparable price.

Our AmTrust insurance policy operates on a claims-made basis with no guarantees of renewability and remains in effect until canceled, with no specified ending coverage date. Premiums are paid on an annual basis. We fully expect the continued renewal or non-cancelation of the policy, as AmTrust continues to express desire to expand into specialty markets. Approximately fourteen percent (14%) of our currently active portfolio is insured by this product. We are currently in negotiations with AmTrust and its representative broker to extend coverage for additional policy periods. If we are unable to reach an agreement, we will pursue coverage from other carriers. Our business operations could be affected by any impairment in cash flows that would otherwise be smoothed by insurance payments if we are unable to find comparable coverage on a commercially reasonable basis.

If we are unable to access external sources of financing, we may not be able to fund and grow our operations.

We depend upon on loans from external sources from time to time to fund and expand our operations. Our ability to grow our business is dependent on our access to additional financing and capital resources. The failure to obtain financing and capital as needed would limit our ability to purchase Accounts and achieve our growth plans.

13

Table of Contents

In addition, some of our financing sources impose certain restrictive covenants, including financial covenants. Failure to satisfy any of these covenants could:

| (i) | cause our indebtedness to become immediately payable; |

| (ii) | preclude us from further borrowings from these existing sources; and |

| (iii) | prevent us from securing alternative sources of financing on favorable terms, if at all, necessary to purchase Accounts and operate our business. |

We may not be successful at acquiring and collecting Accounts in other states profitably.

Our business strategy is dependent upon expanding our operations into other states and we have purchased and intend continue to purchase Accounts in states in which we have little or no operating history. We may not be successful in acquiring any Accounts in these new markets and our limited experience in these markets may impair our ability to profitably or successfully collect the Accounts. This may cause us to overpay for these Accounts and consequently, fail to generate a profit from these Accounts. Our inability to acquire or profitably collect on Accounts in these states could have a material adverse effect on our financial condition and results of operations as we expand our business operations.

We may not be successful at acquiring and collecting New Neighbor Guaranty Accounts in other states profitably.

Our business strategy is dependent upon expanding our operations in other states with our New Neighbor Guaranty product. We may not be successful in acquiring any New Neighbor Guaranty Accounts in these new markets and our limited experience in these markets may impair our ability to profitably or successfully collect New Neighbor Guaranty Accounts. Specifically, the time required to complete a lien foreclosure directly affects the profitability of New Neighbor Guaranty Accounts. In judicial foreclosure states such as Florida where judges and the courts are heavily involved in completing a foreclosure, completing a foreclosure takes longer. With New Neighbor Guaranty Accounts, longer times to complete foreclosures may cause us to overpay for New Neighbor Guaranty Accounts and consequently, we may fail to generate a profit from these New Neighbor Guaranty Accounts. Our inability to acquire or profitably collect on New Neighbor Guaranty Accounts in other states could have a material adverse effect on our financial condition and results of operations as we expand the use of our New Neighbor Guaranty product in Florida and other states.

The Rodgers family will effectively control our company, substantially reducing the influence of our other stockholders.

Immediately following the consummation of this offering, Bruce M. Rodgers, our Chairman and Chief Executive Officer and his family, including trusts or custodial accounts of minor children of each of Mr. Rodgers and his wife Carollinn Gould, will beneficially own in the aggregate more than 51% of our outstanding shares of common stock. As a result, the Rodgers family will be able to significantly influence the actions that require stockholder approval, including the election of a majority of our directors and the approval of mergers, sales of assets or other corporate transactions or matters submitted for stockholder approval. As a result, our other stockholders may have little or no influence over matters submitted for stockholder approval. In addition, the Rodgers family’s influence could deter or preclude any unsolicited acquisition of us and consequently materially adversely affect the price of our common stock.

We have experienced and expect to continue to experience significant growth and we may encounter difficulties managing our growth, which could disrupt our operations.

We have experienced significant growth since our inception, which has placed additional demands on our resources, and we expect to continue to experience significant growth. There can be no assurance that we will be

14

Table of Contents

able to manage our expanding operations effectively or that we will be able to maintain or accelerate our growth, and any failure to do so could adversely affect our ability to generate revenues and control expenses. Future growth will depend upon a number of factors, including:

| (i) | the effective and timely initiation and development of relationships with law firms, management companies, accounting firms and other trusted advisors of Associations willing to sell Accounts; |

| (ii) | our ability to continue to develop our proprietary software for use in other markets and with different products; |

| (iii) | our ability to maintain the collection of Accounts efficiently; |

| (iv) | the recruitment, motivation and retention of qualified personnel both in our principal office and in new markets; |

| (v) | our ability to successfully implement our business strategy in states outside of the state of Florida; and |

| (vi) | our successful implementation of enhancements to our operational and financial systems. |

Due to our limited financial resources and the limited experience of our management team, we may not be able to effectively manage the growth of our business. Our expected growth may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business strategy or disrupt our operations.

Government regulations may limit our ability to recover and enforce the collection of our Accounts.

Federal, state and municipal laws, rules, rules, regulations and ordinances may limit our ability to recover and enforce our rights with respect to the Accounts acquired by us. These laws include, but are not limited to, the following federal statutes and regulations promulgated thereunder and comparable statutes in states where account debtors reside and/or located:

| (i) | the Fair Debt Collection Practices Act; |

| (ii) | the Federal Trade Commission Act; |

| (iii) | the Truth-In-Lending Act; |

| (iv) | the Fair Credit Billing Act; |

| (v) | the Dodd-Frank Act; |

| (vi) | the Equal Credit Opportunity Act; and |

| (vii) | the Fair Credit Reporting Act. |

We may be precluded from collecting Accounts we purchase where the Association or its prior legal counsel, management company, or collection agency failed to comply with applicable laws in charging the account debtor or prosecuting the collection of the Account. Laws relating to the collection of consumer debt also directly apply to our business. Our failure to comply with any laws applicable to us, including state licensing laws, could limit our ability to recover our Accounts and could subject us to fines and penalties, which could reduce our revenues. Presently, we are being audited by the Florida Office of Financial Regulation for compliance with its registration requirements. We do not know what, if any, consequences this audit will produce. In addition, our third-party law firms may be subject to these and other laws and their failure to comply with such laws could also materially adversely affect our revenues and earnings.

We may become regulated under the Bureau of Consumer Financial Protection, or CFPB, and have not developed compliance standards for such oversight.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (2010), or Dodd-Frank Act, represents a comprehensive overhaul of the financial services industry within the U.S. The Dodd-Frank Act allows consumers

15

Table of Contents

free access to their credit score if their score negatively affects them in a financial transaction or a hiring decision, and also gives consumers access to credit score disclosures as part of an adverse action and risk-based pricing notice. Title X of the Dodd-Frank Act establishes the Bureau of Consumer Financial Protection, or CFPB, within the Federal Reserve Board, and requires the CFPB and other federal agencies to implement many new and significant rules and regulations. Significant portions of the Dodd-Frank Act related to the CFPB became effective on July 21, 2011. The CFPB has broad powers to promulgate, administer and enforce consumer financial regulations, including those applicable to us and possibly our funded Associations. Under the Dodd-Frank Act, the CFPB is the principal supervisor and enforcer of federal consumer financial protection laws with respect to nondepository institutions, or “nonbanks”, including, without limitation, any “covered person” who is a “larger participant” in a market for other consumer financial products or services. We do not know if our unique business model makes us a covered person.

The CFPB has started to exercise authority to define unfair, deceptive or abusive acts and practices and to require reports and conduct examinations of these entities for purposes of (i) assessing compliance with federal consumer financial protections laws; (ii) obtaining information about the activities and compliance systems or procedures of such entities; and (iii) detecting and assessing risks to consumers and to markets for consumer financial products and services. The exercise of this supervisory authority must be risk-based, meaning that the CFPB will identify nonbanks for examination based on the risk they pose to consumers, including consideration of the entity’s asset size, transaction volume, risk to consumers, existing oversight by state authorities and any other factors that the CFPB determines to be relevant. When a nonbank is in violation of federal consumer financial protection laws, including the CFPB’s own rules, the CFPB may pursue administrative proceedings or litigation to enforce those laws and rules. In these proceedings, the CFPB can obtain cease and desist orders, which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief, and monetary penalties ranging from $5,000 per day for ordinary violations of federal consumer financial protection laws to $25,000 per day for reckless violations and $1 million per day for knowing violations. Also, where a company has violated Title X of the Dodd-Frank Act or CFPB regulations under Title X, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB (but not for civil penalties). If the CFPB or one or more state officials believe that we have committed a violation of the foregoing laws, they could exercise their enforcement powers in a manner that could have a material adverse effect on us.

At this time, we cannot predict the extent to which the Dodd-Frank Act or the resulting rules and regulations, including those of the CFPB, will impact the U.S. economy and our products and services. Compliance with these new laws and regulations may require changes in the way we conduct our business and could result in additional compliance costs, which could be significant and could adversely impact our results of operations, financial condition or liquidity.

Current and new laws may adversely affect our ability to collect our Accounts, which could adversely affect our revenues and earnings.

Because our Accounts are generally originated and collected pursuant to a variety of federal and state laws by a variety of third parties and may involve consumers in all 50 states, the District of Columbia and Puerto Rico, there can be no assurance that all Associations and their management companies, legal counsel, collections agencies and others have at all times been in compliance with all applicable laws relating to the collection of Accounts. Additionally, there can be no assurance that we or our law firms have been or will continue to be at all times in compliance with all applicable laws. Failure to comply with applicable laws could materially adversely affect our ability to collect our Accounts and could subject us to increased costs, fines, and penalties. Furthermore, changes in state law regarding the lien priority status of delinquent Association assessments could materially and adversely affect our business.

16

Table of Contents

We may incur substantial debt from time to time in connection with the purchase of Accounts which may increase our vulnerability to economic or business downturns.

We may incur substantial indebtedness from time to time in connection with the purchase of Accounts and could be subject to risks associated with incurring such indebtedness, including:

| (i) | we could be required to dedicate a portion of our cash flows from operations to pay debt service costs and, as a result, we would have less funds available for operations, future acquisitions of Accounts, and other purposes; |

| (ii) | it may be more difficult and expensive to obtain additional funds through financings, if such funds are available at all; |

| (iii) | we could be more vulnerable to economic downturns and fluctuations in interest rates, less able to withstand competitive pressures and less flexible in reacting to changes in our industry and general economic conditions; and |

| (iv) | if we default under any of our existing credit facilities or if our creditors demand payment of a portion or all of our indebtedness, we may not have sufficient funds to make such payments. |

We have pledged substantially all of our assets to secure our borrowings.

Our existing indebtedness is, and any future indebtedness we incur may be, secured by substantially all of our assets. If we default under the indebtedness secured by our assets, the secured creditor could declare all of the indebtedness then outstanding to be immediately due and payable. If we were unable to pay such amounts, our assets would be available to the secured creditor to satisfy our obligations to the secured creditor.

We are subject to loan covenants that may restrict our ability to operate our business.

Our credit facilities impose certain restrictive covenants, including financial covenants, that restrict our ability to operate our business. Our credit facilities restrict us from undertaking additional indebtedness, a sale of substantially all of our assets, a merger, or other type of business consolidation. Failure to satisfy any of these covenants could result in all or any of the following:

| (i) | acceleration of the payment of our outstanding indebtedness; |

| (ii) | cross defaults to and acceleration of the payment under other financing arrangements; |

| (iii) | our inability to borrow additional amounts under our existing financing arrangements; and |

| (iv) | our inability to secure financing on favorable terms or at all from alternative sources. |

Class action suits and other litigation in our industry could divert our management’s attention from operating our business and increase our expenses.

Certain originators and servicers involved in consumer credit collection have been subject to class actions and other litigation. Claims include failure to comply with applicable laws and regulations such as usury and improper or deceptive origination and collection practices. If we become a party to such class action suits or other litigation, our management’s attention may be diverted from our everyday business activities and implementing our business strategy, and our results of operations and financial condition could be materially adversely affected.

Any future acquisitions that we make may prove unsuccessful or strain or divert our resources.

We may seek to grow through acquisitions of related businesses. Such acquisitions present risks that could materially adversely affect our business and financial performance, including:

| (i) | the diversion of our management’s attention from our everyday business activities; |

| (ii) | the assimilation of the operations and personnel of the acquired business; |

17

Table of Contents

| (iii) | the contingent and latent risks associated with the past operations of, and other unanticipated problems arising in, the acquired business; and |

| (iv) | the need to expand our management, administration and operational systems to accommodate such acquired business. |

If we make such acquisitions we cannot predict whether:

| (i) | we will be able to successfully integrate the operations of any new businesses into our business; |

| (ii) | we will realize any anticipated benefits of completed acquisitions; or |

| (iii) | there will be substantial unanticipated costs associated with such acquisitions. |

In addition, future acquisitions by us may result in potentially dilutive issuances of our equity securities, the incurrence of additional debt, and the recognition of significant charges for depreciation and amortization related to goodwill and other intangible assets.

Although we have no present plans or intentions to make acquisitions of related businesses, we continuously evaluate such potential acquisitions. However, we have not reached any agreement or arrangement with respect to any particular acquisition and we may not be able to complete any acquisitions on favorable terms or at all.

Our investments in other businesses and entry into new business ventures may adversely affect our operations.

We have made and may continue to make investments in companies or commence operations in businesses and industries that are not identical to those with which we have historically been successful. If these investments or arrangements are not successful, our earnings could be materially adversely affected by increased expenses and decreased revenues.

If our technology and software systems are not operational, our operations could be disrupted and our ability to successfully acquire and collect Accounts could be adversely affected.

Our success depends in part on our proprietary software. We must record and process significant amounts of data quickly and accurately to properly track, monitor and collect our Accounts. Any failure of our information systems and their backup systems would interrupt our operations. We may not have adequate backup arrangements for all of our operations and we may incur significant losses if an outage occurs. In addition, we rely on third-party law firms who also may be adversely affected in the event of an outage in which the third-party servicer does not have adequate backup arrangements. Any interruption in our operations or our third-party law firms’ operations could have an adverse effect on our results of operations and financial condition.

Our organizational documents and Delaware law may make it harder for us to be acquired without the consent and cooperation of our Board of Directors and management.

Certain provisions of our organizational documents and Delaware law may deter or prevent a takeover attempt, including a takeover attempt in which the potential purchaser offers to pay a per share price greater than the current market price of our common stock. Under the terms of our certificate of incorporation, our Board of Directors has the authority, without further action by our stockholders, to issue shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. In addition, our directors serve staggered terms of one to three years each and, as such, at any given annual meeting of our stockholders, only a portion of our Board of Directors may be considered for election, which may prevent our stockholders from replacing a majority of our Board of Directors at certain annual meetings and may entrench our management and discourage unsolicited stockholder proposals. The ability to issue shares of preferred stock could tend to discourage takeover or acquisition proposals not supported by our current Board of Directors.

18

Table of Contents

Future sales of our common stock may depress our stock price.