Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Northfield Bancorp, Inc. | nfbk2015825hopewellvalleym.htm |

| EX-99.2 - EXHIBIT 99.2 - Northfield Bancorp, Inc. | exhibit992cover.htm |

| EX-2.1 - EXHIBIT 2.1 - Northfield Bancorp, Inc. | exhibit21.htm |

| EX-99.1 - EXHIBIT 99.1 - Northfield Bancorp, Inc. | exhibit991pressrelease.htm |

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 Acquisition of Hopewell Valley Community Bank August 26, 2015

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -1- Forward-looking Statements and Associated Risk Factors; Additional Information This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Northfield and Hopewell Valley, including future financial and operating results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Northfield’s and Hopewell Valley’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Northfield’s and Hopewell Valley’s management and are subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward- looking statements: (1) the businesses of Northfield and Hopewell Valley may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of Hopewell Valley may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) difficulties associated with achieving expected future financial results; (10) competition from other financial services companies in Northfield’s and Hopewell Valley’s markets; (11) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Northfield’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC's Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Northfield or Hopewell Valley or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Northfield and Hopewell Valley do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Northfield Bancorp, Inc. will be filing a registration statement on Form S-4 containing a proxy statement/prospectus and other documents regarding the proposed transaction with the SEC. Hopewell Valley Community Bank stockholders and investors are urged to read the proxy statement/prospectus when it becomes available, because it will contain important information about Northfield Bancorp, Inc. and Hopewell Valley Community Bank and the proposed transaction. When available, copies of the proxy statement/prospectus will be mailed to Hopewell Valley Community Bank stockholders. Copies of the proxy statement/prospectus also may be obtained free of charge at the SEC’s web site at http://www.sec.gov, or by directing a request to Northfield Bancorp, Inc., Attention: Corporate Secretary, 581 Main Street, Suite 810, Woodbridge, NJ 07095, or on its website at www.eNorthfield.com. Copies of other documents filed by Northfield Bancorp, Inc. with the SEC may also be obtained free of charge at the SEC’s website or by directing a request to Northfield Bancorp, Inc. at the address provided above. This presentation does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities.

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -2- Transaction Overview Consideration • $14.32 per share; $54.9 million in aggregate1 • 75% Stock/25% Cash • 0.9592 shares of Northfield stock (fixed exchange ratio) or $14.50 cash • Hopewell Valley’s SBLF preferred redeemed at closing Market Continuity • Hopewell Valley’s Chairman to join Northfield Bancorp and Northfield Bank boards • Hopewell Valley’s CEO to join Northfield Bank to assist in transition Due Diligence • Comprehensive on and off-site due diligence completed • In-depth loan review conducted Expected Closing • First Quarter 2016 Required Approvals • Hopewell Valley’s stockholders • Customary regulatory approvals, including U.S. Treasury 1- Based on NFBK closing stock price of $14.87 on August 25, 2015. Transaction value includes cash payment for outstanding HVCB options.

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -3- Strategic Rationale Franchise Growth • Northfield expands into New Jersey counties of Mercer, Hunterdon and Somerset • Deposit franchise supports continued loan growth • Hopewell Valley’s commercial focus augments Northfield’s lending initiatives Financially Attractive • Earnings per share accretion approximately 14% • Tangible book value dilution approximately 3% • Earn back period under 5 years • Internal rate of return greater than 15% • Strong pro forma capital with tangible common equity-to-tangible assets of 15.2% Strong HVCB Fundamentals1 • Net interest margin of 3.52% • Cost of funds of 0.45% • Loan-to-deposit ratio of 80% • ROATCE of 6.7% 1- Source: SNL Financial. Data at or for the twelve months ended June 30, 2015.

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -4- Balance Sheet Assets $495 Gross Loans $357 Depos its $445 Tangible Common Equity1 $35 Loans / Depos its 80% Depos its / Funding 100% Profitability NIM 3.52% Cost of Funds 0.45% Efficiency Ratio 76.4% ROAA 0.50% ROATCE 6.7% Asset Quality NPAs / Assets 2 0.96% NCOs / Avg. Loans 0.04% Company Overview ◦ New Jersey state-chartered commercial bank with $495 million in assets and $445 million in deposits ◦ Ten banking offices serving Mercer (6), Hunterdon (3) and Somerset (1) counties in New Jersey ◦ Predominant focus on small and middle market businesses and professionals Financial Highlights Branch Network Source: SNL Financial. Financial data at or for the twelve months ended June 30, 2015. 1- Adjusted for conversion of $869,490 Convertible Series A preferred stock into common stock in connection with the transaction. 2- Excludes restructured loans. Hunterdon Mercer Somerset ($Millions) Overview of Hopewell Valley Community Bank

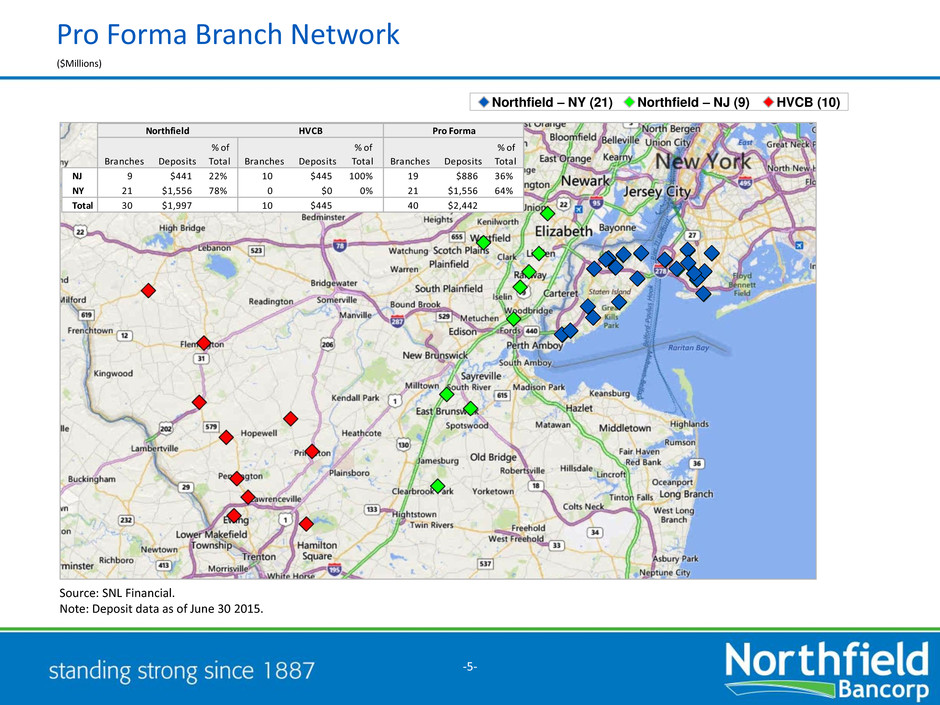

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -5- HVCB (10) Northfield – NJ (9) Source: SNL Financial. Note: Deposit data as of June 30 2015. ($Millions) Northfield – NY (21) Pro Forma Branch Network Northfield HVCB Pro Forma Branches Deposits % of Total Branches Deposits % of Total Branches Deposits % of Total NJ 9 $441 22% 10 $445 100% 19 $886 36% NY 21 $1,556 78% 0 $0 0% 21 $1,556 64% Total 30 $1,997 10 $445 40 $2,442

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -6- Residential 19.5% Multifamily 56.1% CRE 18.3% Construction & Land 0.7% C&I 0.8% Other 2.0% Home Equity 2.6% NFBK Total Loans: $2,204 million Loan Yield: 4.11% Loans / Deposits: 111% Residential 15.1% Multifamily 1.3% CRE 57.4% Construction & Land 10.3% C&I 6.3% Other 0.2% Home Equity 9.4% HVCB Total Loans: $357 million Loan Yield: 4.68% Loans / Deposits: 80% Residential 18.9% Multifamily 48.4% CRE 23.7% Construction & Land 2.1% C&I 1.5% Other 1.8% Home Equity 3.6% Pro Forma Total Loans: $2,561 million Loan Yield: 4.19% Loans / Deposits: 106% Pro Forma Loan Composition Source: SNL Financial and company filings. Note: Financial data as of or for the quarter ended June 30, 2015. Excludes purchase accounting adjustments.

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -7- Source: SNL Financial and company filings. Note: Financial data as of or for the quarter ended June 30, 2015. Excludes purchase accounting adjustments. Jumbo Time 14.4% Retail Time 14.7% Noninterest- Bearing 19.0% Other Transaction MMDA & Savings 52.0% HVCB Total Deposits: $445 million Cost of Deposits: 0.43% Deposits / Funding: 100% Jumbo Time 9.1% Retail Time 19.9% Noninterest- Bearing 14.3% Other Transaction MMDA & Savings 56.7% Pro Forma Total Deposits: $2,425 million Cost of Deposits: 0.50% Deposits / Funding: 81% Jumbo Time 8.0% Retail Time 21.1% Noninterest- Bearing 13.2% Other Transaction MMDA & Savings 57.7% Total Deposits: $1,980 million Cost of Deposits: 0.52% Deposits / Funding: 77% NFBK Pro Forma Deposit Composition

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -8- Key Modeling Assumptions • Cost savings: 30% of Hopewell Valley’s operating expense base • Credit mark: 2.4% of gross loans • Core deposit intangible: 1% of core deposits amortized over 10 years on sum-of- years’ digits basis • Restructuring charge: $3.4 million, after tax • Revenue synergies identified but excluded from financial analysis Pricing Metrics • Price to tangible book value: 1.47x • Core deposit premium: 4.4% • Price to last twelve months net income: 24.9x • Price to last twelve months net income (adjusted for cost savings): 11.2x Financial Impact • Earnings per share accretion approximately 14% • Tangible book value dilution approximately 3% • Earn back period under 5 years • Internal rate of return greater than 15% • Strong pro forma capital with tangible common equity-to-tangible assets of 15.2% Financial Impact

51 204 51 0 90 187 185 205 229 255 255 0 112 48 160 -9- 581 Main Street Suite 810 Woodbridge, NJ 07095 (732) 499-7200 www.eNorthfield.com John W. Alexander Chairman and CEO William R. Jacobs Senior Vice President, Chief Financial Officer Steven M. Klein President, Chief Operating Officer Kenneth, J. Doherty Executive Vice President, Chief Lending Officer Michael J. Widmer Executive Vice President, Operations