Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUNE ENERGY INC | d44010d8k.htm |

| EX-99.1 - EX-99.1 - DUNE ENERGY INC | d44010dex991.htm |

Exhibit 99.2

UNITED STATES BANKRUPTCY COURT

WESTERN DISTRICT OF TEXAS

AUSTIN DIVISION

| In re: | ) | Chapter 11 | ||

| ) | ||||

| DUNE ENERGY, INC. | ) | Case No. 15-10336 | ||

| DUNE OPERATING COMPANY | ) | Case No. 15-10337 | ||

| DUNE PROPERTIES, INC. | ) | Case No. 15-10338 | ||

| ) | ||||

| ) | (Jointly Administered) | |||

| Debtors. | ) |

DISCLOSURE STATEMENT UNDER 11 U.S.C. § 1125 IN

SUPPORT OF THE CHAPTER 11 PLAN OF THE DEBTORS

| HAYNES AND BOONE, LLP 1221 McKinney, Suite 2100 Houston, Texas 77010 Telephone: (713) 547-2000 Facsimile: (713) 236-5490 | ||||

| ATTORNEYS FOR DEBTORS | ||||

1

TABLE OF CONTENTS

| ARTICLE I. INTRODUCTION |

1 | |||||

| A. |

Summary of Plan |

1 | ||||

| B. |

Filing of the Debtors’ Bankruptcy Cases |

5 | ||||

| C. |

Purpose of Disclosure Statement |

5 | ||||

| D. |

Combined Hearing on Approval of the Disclosure Statement and Confirmation of the Plan |

5 | ||||

| E. |

Disclaimers |

5 | ||||

| ARTICLE II. EXPLANATION OF CHAPTER 11 |

6 | |||||

| A. |

Overview of Chapter 11 | 6 | ||||

| B. |

Chapter 11 Plan | 7 | ||||

| ARTICLE III. VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS |

7 | |||||

| A. |

Ballots and Voting Deadline | 7 | ||||

| B. |

Holders of Claims or Equity Interests Entitled to Vote | 8 | ||||

| C. |

Bar Date for Filing Proofs of Claim | 8 | ||||

| D. |

Definition of Impairment | 9 | ||||

| E. |

Classes Impaired Under the Plan | 9 | ||||

| F. |

Vote Required for Class Acceptance | 9 | ||||

| G. |

Information on Voting and Ballots | 10 | ||||

| 1. Transmission of Ballots to Holders of Claims and Equity Interests | 10 | |||||

| 2. Ballot Tabulation Procedures | 10 | |||||

| 3. Execution of Ballots by Representatives | 12 | |||||

| 4. Waivers of Defects and Other Irregularities Regarding Ballots | 12 | |||||

| 5. Withdrawal of Ballots and Revocation | 12 | |||||

| H. |

Confirmation of Plan | 12 | ||||

| 1. Solicitation of Acceptances | 12 | |||||

| 2. Requirements for Confirmation of the Plan | 13 | |||||

| 3. Acceptances Necessary to Confirm the Plan | 14 | |||||

| 4. Cramdown |

14 | |||||

| ARTICLE IV. BACKGROUND OF THE DEBTORS |

15 | |||||

| A. |

Description of Debtors’ Businesses | 15 | ||||

| B. |

Corporate Information and Debtors’ Relationship to Subsidiaries | 16 | ||||

| 1. Corporate Structure | 16 | |||||

| 2. Current Officers and Directors of Dune Energy | 16 | |||||

| C. |

Events Leading to the Bankruptcy Cases | 17 | ||||

| D. |

Prepetition DIP Financing Negotiations, Restructuring Initiatives and Sale Efforts | 18 | ||||

| ARTICLE V. DEBTOR’S ASSETS AND LIABILITIES |

19 | |||||

| A. |

Prepetition Financing Arrangements | 19 | ||||

| B. |

Schedules of Assets and Liabilities | 20 | ||||

| 1. Assets |

20 | |||||

| (a) |

Office Lease and Office Equipment |

21 | ||||

i

| (b) |

Boats and Vehicles |

21 | ||||

| (c) |

Bank Accounts and Deposits |

21 | ||||

| (d) |

Insurance Policies |

21 | ||||

| (e) |

Accounts Receivable |

21 | ||||

| (f) |

Other Personal Property |

21 | ||||

| 2. |

Liabilities |

22 | ||||

| (a) |

Secured Claims |

22 | ||||

| (b) |

Unsecured Priority Claims |

22 | ||||

| (c) |

General Unsecured Claims |

22 | ||||

| C. |

Summary of Proofs of Claim | 22 | ||||

| ARTICLE VI. LEGAL PROCEEDINGS |

23 | |||||

| A. |

Garden Island Bay Intermittent Release | |

23 |

| ||

| B. |

D&D Cajun Ventures, LLC, et al. v. Atlantic Richfield Company, et al. | |

23 |

| ||

| C. |

Emerald Land Corporation v. Dune Properties, Inc. | 23 | ||||

| D. |

Collins, et al. v. Atinum Operating Inc., et al. | 23 | ||||

| E. |

Broussard, et al. v. Martin Operating Partnership, LP, et al. | 23 | ||||

| F. |

Casey, et al. v. Atinum Operating, Inc., et al. | 24 | ||||

| G. |

Parish of Plaquemines v. Apache Oil Corporation, et al. | 24 | ||||

| H. |

State of Louisiana ex rel. St. Mary Parish School Board v. Dune Energy, Inc., et al. | 24 | ||||

| I. |

Bridges v. Dune Operating Company | 24 | ||||

| J. |

Daigle v. Texaco, Inc., et al. | 25 | ||||

| K. |

D&O Rights of Action | 25 | ||||

| L. |

Eos Merger Termination Fee | 25 | ||||

| M. |

Well Blowout Litigation | 25 | ||||

| N. |

Recovery on Preference Actions and Other Avoidance Actions | 26 | ||||

| O. |

Other Claims and Causes of Action Belonging to the Debtors’ Estates | 27 | ||||

| ARTICLE VII. POST-BANKRUPTCY CASE ADMINISTRATION |

28 | |||||

| A. |

First and Second Day Motions | 28 | ||||

| B. |

Meeting of Creditors | 28 | ||||

| C. |

Official Committee of Unsecured Creditors | 28 | ||||

| D. |

The DIP Facility and Use of Cash Collateral | 29 | ||||

| E. |

Committee’s Lien Challenge | 30 | ||||

| F. |

The Post-Petition Sale Process, The Sale of the Debtors’ Businesses and Assets and Creditor Recovery | 30 | ||||

| G. |

Professionals | 32 | ||||

| 1. Professionals Employed by the Debtors |

32 | |||||

| 2. Professionals Employed by the Committee |

32 | |||||

| H. |

Rejection of Executory Contracts | 33 | ||||

| ARTICLE VIII. THE COMPROMISE | 33 | |||||

| A. |

Introduction | 33 | ||||

| B. |

The Compromise | 33 | ||||

ii

| C. |

The Lien Challenge Claims |

36 | ||||

| ARTICLE IX. EXAMPLE DISTRIBUTIONS TO CREDITORS |

37 | |||||

| A. |

Estimate of Administrative, Priority and General Unsecured Claims |

37 | ||||

| 1. Allowed Administrative Claims |

37 | |||||

| 2. Allowed Priority Unsecured Tax Claims |

37 | |||||

| 3. Allowed Priority Employee Claims |

37 | |||||

| 4. Allowed Priority Unsecured (Non-Tax) Claims |

37 | |||||

| 5. Allowed General Unsecured Claims |

38 | |||||

| B. |

Distribution Example |

38 | ||||

| 1. Assumptions Used for Distribution Example in Exhibit 2 |

39 | |||||

| ARTICLE X. DESCRIPTION OF THE PLAN |

40 | |||||

| A. |

Introduction |

40 | ||||

| B. |

Substantive Consolidation |

40 | ||||

| C. |

Designation of Claims and Equity Interests/Impairment |

40 | ||||

| D. |

Allowance and Treatment of Unclassified Claims and Equity Interests |

41 | ||||

| E. |

Allowance and Treatment of Classified Claims and Equity Interests |

42 | ||||

| 1. General |

42 | |||||

| 2. Allowance and Treatment of Allowed Priority Employee Claims (Class - 1.1) |

42 | |||||

| 3. Allowance and Treatment of Allowed Priority Unsecured Non-Tax Claims (Class - 1.2) |

42 | |||||

| 4. Allowance and Treatment of Allowed Secured Tax Claims (Class - 2) |

42 | |||||

| 5. Allowance and Treatment of Allowed First Lien Lender Claims (Class - 3.1) |

43 | |||||

| 6. Allowance and Treatment of Allowed Other Secured Claims (Class - 3.2) |

43 | |||||

| 7. Allowance and Treatment of Allowed Second Lien Loan Claims (Class - 3.3) |

44 | |||||

| 8. Allowance and Treatment of Allowed General Unsecured Claims (Class - 4) |

45 | |||||

| 9. Allowance and Treatment of Allowed Subordinated Claims (Class - 5) |

45 | |||||

| 10. Allowance and Treatment of Allowed Equity Interests (Class - 6) |

45 | |||||

| F. |

Resolution of Claims |

45 | ||||

| G. |

Assumption and Rejection of Executory Contracts Under the Plan |

46 | ||||

| ARTICLE XI. MEANS FOR EXECUTION AND IMPLEMENTATION OF THE PLAN |

47 | |||||

| A. |

Introduction |

47 | ||||

| B. |

The Plan Trust |

48 | ||||

| C. |

Tax Treatment of the Plan Trust |

49 | ||||

| D. |

Issuance of New Equity Interest and Existence of Reorganized Debtors |

49 | ||||

| E. |

Selection of Plan Trustee and Formation of the Oversight Committee |

50 | ||||

| F. |

Beneficial Interests |

50 | ||||

| G. |

Distribution to Beneficiaries |

51 | ||||

| H. |

The Closing of the Effective Date Transactions |

51 | ||||

| I. |

Bankruptcy Code Section 1145 Determination |

52 | ||||

iii

| J. |

Termination of the Committee |

52 | ||||

| K. |

Preservation of Rights of Action |

52 | ||||

| L. |

Abandonment of Remaining Assets. |

52 | ||||

| M. |

Agreement Regarding Professional Compensation Claim of Haynes and Boone, LLP. |

52 | ||||

| N. |

Release of the Debtors |

52 | ||||

| O. |

Injunction |

53 | ||||

| P. |

Exculpation |

54 | ||||

| Q. |

Retention of Jurisdiction |

55 | ||||

| R. |

Defects, Omissions and Amendment of the Plan |

56 | ||||

| ARTICLE XII. ALTERNATIVES TO THE PLAN |

57 | |||||

| A. |

Chapter 7 Liquidation |

57 | ||||

| B. |

Dismissal |

57 | ||||

| C. |

Exclusivity and Alternative Plan Potential |

58 | ||||

| ARTICLE XIII. FEASIBILITY AND CERTAIN FACTORS TO BE CONSIDERED |

58 | |||||

| A. |

Feasibility |

58 | ||||

| B. |

Certain Factors to be Considered |

58 | ||||

| 1. Failure to Confirm or Consummate the Plan |

58 | |||||

| 2. Claim Estimates May Be Incorrect |

59 | |||||

| 3. Estimate of Preference Recoveries May Be Incorrect |

59 | |||||

| ARTICLE XIV. CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN |

59 | |||||

| A. |

United States Federal Income Tax Consequences to the Debtors |

60 | ||||

| B. |

United States Federal Income Tax Consequences to Holders of Claims Against the Debtors |

60 | ||||

| 1. Gain or Loss Recognition on the Satisfaction of Claims |

60 | |||||

| 2. Character of Gain or Loss |

60 | |||||

| 3. Amounts in Respect of Interest |

60 | |||||

| 4. Information Reporting and Backup Withholding |

61 | |||||

| C. |

United States Federal Income Tax Consequences With Respect to the Plan Trust |

61 | ||||

| D. |

Importance of Obtaining Professional Tax Assistance |

61 | ||||

| ARTICLE XV. CONCLUSION |

62 | |||||

iv

EXHIBITS TO THE DISCLOSURE STATEMENT

| Exhibit 1 |

Chapter 11 Plan | |

| Exhibit 2 |

Distribution Example | |

| Exhibit 3 |

Liquidation Analysis and Notes |

v

ARTICLE I.

INTRODUCTION

Dune Energy, Dune Operating, and Dune Properties (i.e., the Debtors)1 submit this Disclosure Statement for use in the solicitation of votes on the Debtors’ Chapter 11 Plan. The Plan is annexed as Exhibit 1 to this Disclosure Statement.

This Disclosure Statement sets forth certain relevant information regarding the Debtors’ prepetition operations and financial history, the need to seek chapter 11 protection, significant events that have occurred during the Bankruptcy Cases, including the Sale of the Sale Assets to the Buyers and the resultant analysis of the expected return to the Debtors’ Creditors. This Disclosure Statement also describes terms and provisions of the Plan, including certain alternatives to the Plan, certain effects of confirmation of the Plan, certain risk factors associated with the Plan, and the manner in which Distributions will be made under the Plan. Additionally, this Disclosure Statement discusses the confirmation process and the voting procedures that holders of Claims and Equity Interests must follow for their votes to be counted.

All descriptions of the Plan set forth in this Disclosure Statement are for summary purposes only. To the extent of any inconsistency between this Disclosure Statement and the Plan, the Plan shall control. You are encouraged to review the Plan in full.

YOU ARE BEING SENT THIS DISCLOSURE STATEMENT BECAUSE YOU ARE A CREDITOR OR OTHER PARTY IN INTEREST OF THE DEBTORS. THIS DOCUMENT DESCRIBES A CHAPTER 11 PLAN WHICH, WHEN CONFIRMED BY THE BANKRUPTCY COURT, WILL GOVERN HOW YOUR CLAIM OR EQUITY INTEREST WILL BE TREATED. THE DEBTORS URGE YOU TO REVIEW THE DISCLOSURE STATEMENT AND THE PLAN CAREFULLY. ALL HOLDERS OF GENERAL UNSECURED CLAIMS ARE URGED TO REVIEW THE RECOMMENDATION SET OUT IN THE SOLICITATION LETTERS INCLUDED WITH THIS DISCLOSURE STATEMENT. THE DEBTORS BELIEVE THAT ALL CREDITORS SHOULD VOTE IN FAVOR OF THE PLAN.

| A. | Summary of Plan |

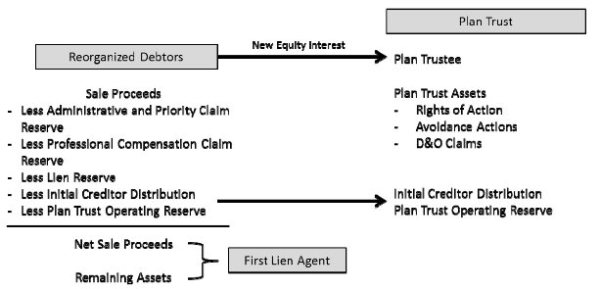

The Plan provides for the resolution of Claims against and Equity Interests in the Debtors and implements a Distribution scheme derived from the effectuated Sale of the Debtors’ Asset to the Buyer. In concert with the First Lien Agent and the Committee, the Debtors have designed a structure whereby Administrative Claims and Priority Claims will be satisfied (as described herein), the First Lien Lenders will receive the Class 3.1 Recoveries, and the Plan Trust will be created to provide meaningful recoveries to the Debtors’ Creditors, all as described herein. Finally, the Plan provides for the wind down of the Debtors in an orderly and cost efficient manner.

Under the Plan, Claims and Equity Interests are classified and each class has its own treatment. The table below describes each class of Claims and Equity Interests, which holders of Claims and Equity Interests belong in each class, the treatment of each class of Claims or Equity Interests, and the expected recovery of each holder of Claims or Equity Interests in the respective class.

| 1 | Except as otherwise provided in this Disclosure Statement, capitalized terms herein have the meaning ascribed to them in the Plan. Any capitalized term used herein that is not defined in the Plan shall have the meaning ascribed to that term in the Bankruptcy Code or Bankruptcy Rules, whichever is applicable. |

Summary of Plan Treatment

| Class Description |

Treatment | |

| Class 1.1 – Allowed Priority Employee Claims |

To the extent an Allowed Priority Employee Claim has not already been satisfied, the Reorganized Debtors shall satisfy any Allowed Priority Employee Claim by the payment of Cash from the Administrative and Priority Claim Reserve to the holder of such Claim in the amount of its Allowed Priority Employee Claim, plus accrued interest after the Confirmation Date, such payment to be made on the later of (a) ten (10) days after the Effective Date or (b) ten (10) days after the date such Claim becomes Allowed.

The Debtors estimate Allowed Priority Employee Claims will be paid in full. | |

| Class 1.2 – Allowed Priority Unsecured Non-Tax Claims |

To the extent an Allowed Priority Unsecured Non-Tax Claim has not already been satisfied, and unless otherwise agreed, the Reorganized Debtors shall satisfy any Allowed Priority Unsecured Non-Tax Claim by the payment of Cash from the Administrative and Priority Claim Reserve to the holder of such Claim in the amount of its Allowed Priority Unsecured Non-Tax Claim, such payment to be made on the later of (a) the Effective Date or (b) ten (10) days after the date such Claim becomes Allowed.

The Debtors estimate that Allowed Priority Unsecured Non-Tax Claims will be paid in full. | |

| Class 2 – Allowed Secured Tax Claims |

Allowed Secured Tax Claims shall receive either (i) a Distribution equal to 100% of its Allowed Secured Tax Claim in cash on the Effective Date; (ii) conveyance of any Remaining Assets securing the Allowed Secured Tax Claim, (iii) such treatment that may be agreed to by the holder of such Allowed Secured Tax Claim and the Reorganized Debtors, or (iv) to the extent such Allowed Secured Tax Claim is secured by Liens against the Sale Proceeds pursuant to the Sale Order, such Allowed Secured Tax Claim shall be satisfied by payment of Cash from the Lien Reserve to the holder of such Claim in the amount of its Allowed Secured Tax Claim.

The Debtors estimate that the Allowed Secured Tax Claims will be paid in full. | |

| Class 3.1 – Allowed First Lien Lender Secured Claims |

The First Lien Lender Claims are Allowed as follows: (i) the First Lien Lender Secured Claim has been allowed pursuant to the DIP Financing Orders in the amount of $40,197,480.60; (ii) the First Lien Lender Adequate Protection Claim shall be Allowed in the amount of $7,842,028.97, and (iii) the First Lien Lender Deficiency Claim shall be Allowed in an amount of approximately $30 million, but will be more precisely determined at the Confirmation Hearing as the amount of the allowed First Lien Lender Secured Claim set forth above less the Net Sale Proceeds as shall be calculated on the Confirmation Date and shall be treated as an Allowed Class 4 Claim; provided, however, that in the event that holders of First Lien Lender | |

2

| Class Description |

Treatment | |

| Claims receive any subsequent Distributions on account of their First Lien Lender Secured Claim or First Lien Lender Adequate Protection Claim, the First Lien Lender Deficiency Claim shall be reduced dollar-for-dollar by any such Distribution to the First Lien Agent for purposes of any subsequent Distributions thereon.

The First Lien Agent, as agent for the First Lien Lenders, shall be allocated the Class 3.1 Beneficial Interest on account of the Allowed First Lien Lender Adequate Protection Claim and shall be allocated a Class 4 Beneficial Interest on account of the Allowed First Lien Lender Deficiency Claim in accordance with the Plan Trust Agreement.

The Allowed First Lien Lender Secured Claim shall be satisfied by payment to the First Lien Agent, for Distribution to the First Lien Lenders in accordance with the Prepetition First Lien Credit Agreement, of the Net Sale Proceeds, all Remaining Cash on Hand, and the net proceeds from the liquidation of the Remaining Assets to the First Lien Agent. On account of the Class 3.1 Beneficial Interest, holders of the Allowed First Lien Lender Adequate Protection Claim shall receive the Class 3.1 Avoidance Action Recoveries and the Class 3.1 Net Recoveries until the Allowed First Lien Lender Adequate Protection Claim is paid in full, and thereafter, any remaining Class 3.1 Avoidance Action Recoveries and Class 3.1 Net Recoveries shall become Class 4 Avoidance Action Recoveries and Class 4 Net Recoveries, respectively, for payment to the holders of Class 4 Beneficial Interests (including to the Allowed First Lien Lenders as holders of the First Lien Deficiency Claim). With respect to all Distributions that otherwise would have been made on account of the Allowed First Lien Lender Adequate Protection Claim, the First Lien Agent and First Lien Lenders have agreed pursuant to the Compromise that (A) thirty percent (30%) of such Distributions up to the first $4 million of distributions thereon, and fifty percent (50%) of subsequent Distributions thereon, shall be paid to holders of Allowed General Unsecured Claims (which amounts under such sharing arrangement shall not constitute an actual or implied distribution on account of such First Lien Lender Adequate Protection Claims or diminish the amount thereof); and (B) holders of Allowed Non-Deficiency General Unsecured Claims shall be entitled to their Pro Rata Share of the Class 3.1 Deficiency Carve-Out and the Initial Creditor Distribution. On account of the Class 4 Beneficial Interest, the holder of the Allowed First Lien Lender Deficiency Claim will receive its Pro Rata Share of Class 4 Net Recoveries and Class 4 Avoidance Action Recoveries, other than the Class 3.1 Deficiency Carve-Out. |

3

| Class Description |

Treatment | |

| Class 3.2 – Allowed Other Secured Claims | Allowed Other Secured Claims shall be satisfied in full, to the extent of the value of the collateral securing such Claims, by: (i) payment of Cash to the holder of such Claim in the amount of its Allowed Other Secured Claim; (ii) conveyance of the Remaining Assets securing such Allowed Other Secured Claim; (iii) such other treatment that may be agreed to by the holder of such Claim and the Reorganized Debtors; or (iv) to the extent such Allowed Other Secured Claim is secured by Liens against the Sale Proceeds pursuant to the Sale Order, such Allowed Other Secured Claim shall be satisfied by payment of Cash from the Lien Reserve to the holder of such Claim in the amount of its Allowed Other Secured Claim..

The Debtors estimate that Allowed Other Secured Claims will be satisfied in full. | |

| Class 3.3 – Allowed Second Lien Loan Claims | Allowed Second Lien Loan Claims shall be treated as General Unsecured Claims under the Plan. Holders of Allowed Second Lien Loan Claims shall be allocated a Class 4 Beneficial Interest. In accordance with the Plan Trust Agreement and on account of their Class 4 Beneficial Interest, holders of Allowed Second Lien Loan Claims shall receive a Pro Rata Share of the Class 4 Net Recoveries, unless such Class 4 Net Recoveries relate to allocations under the Compromise related to collateral of the First Lien Lenders that was the subject of the Lien Challenge Proceeding in which case those Class 4 Net Recoveries shall be treated as Shared Collateral (as defined in the Intercreditor Agreement) and such other applicable provisions thereof and those Class 4 Net Recoveries shall be turned over and distributed directly to the First Lien Agent pursuant to and consistent with Bankruptcy Code section 510(a). | |

| Class 4 – Allowed General Unsecured Claims | Each holder of an Allowed General Unsecured Claim shall be allocated a Class 4 Beneficial Interest. On account of such Class 4 Beneficial Interest, (i) holders of Allowed General Unsecured Claims shall receive a Pro Rata Share of the Class 4 Avoidance Action Recoveries and the Class 4 Net Recoveries, and (ii) holders of Allowed Non-Deficiency General Unsecured Claims shall receive a Pro Rata Share of the Initial Creditor Distribution and a Pro Rata Share of the Class 3.1 Deficiency Carve-Out. | |

| Class 5 – Allowed Subordinated Claims | On the Effective Date, all Allowed Subordinated Claims shall not be entitled to any Distribution under the Plan. | |

| Class 6 – Allowed Equity Interests | On the Effective Date, all existing Equity Interests shall be canceled and shall not be entitled to any Distribution under the Plan. | |

4

The foregoing analysis makes certain assumptions, including, without limitation, the amount of General Unsecured Claims ultimately Allowed, recoveries resulting from the liquidation of the Plan Trust Assets, and a number of other variables more fully discussed in Article XIII.B herein. The Debtors have prepared a Distribution Example which estimates recoveries to certain Creditors. The Distribution Example is discussed in Article IX.B herein.

| B. | Filing of the Debtors’ Bankruptcy Cases |

On March 8, 2015 (i.e., the Petition Date), the Debtors filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court for the Western District of Texas, Austin Division. The Debtors filed their Bankruptcy Cases to preserve the value of their assets and to restructure their financial affairs. To such end, the Debtors have continued to manage their properties and are operating and managing their businesses as debtors in possession in accordance with Bankruptcy Code sections 1107 and 1108. No trustee or examiner has been appointed in the Bankruptcy Cases.

| C. | Purpose of Disclosure Statement |

Bankruptcy Code section 1125 requires the Debtors to prepare and obtain court approval of a Disclosure Statement as a prerequisite to soliciting votes on the Plan. The purpose of the Disclosure Statement is to provide information to Creditors and Interestholders that will assist them in deciding how to vote on the Plan.

Approval of this Disclosure Statement does not constitute a judgment by the Bankruptcy Court as to the desirability of the Plan or as to the value or suitability of any consideration offered thereunder. The Bankruptcy Court’s approval does indicate, however, that the Bankruptcy Court has determined that the Disclosure Statement contains adequate information to permit you to make an informed judgment regarding acceptance or rejection of the Plan.

| D. | Combined Hearing on Approval of the Disclosure Statement and Confirmation of the Plan |

The Bankruptcy Court has set September 17, 2015 at 10:00 a.m. (Central Time) (the “Combined Hearing”), as the time and date for the hearing to consider approval of this Disclosure Statement and the Confirmation Hearing to determine whether the Plan has been accepted by the requisite number of holders of Claims, and whether the other standards for confirmation of the Plan have been satisfied. Once commenced, the Combined Hearing may be adjourned or continued by announcement in open court with no further notice.

| E. | Disclaimers |

THIS DISCLOSURE STATEMENT IS PROVIDED FOR USE SOLELY BY HOLDERS OF CLAIMS AND EQUITY INTERESTS AND THEIR ADVISERS IN CONNECTION WITH THEIR DETERMINATION TO ACCEPT OR REJECT THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS IMPORTANT INFORMATION THAT MAY BEAR ON YOUR DECISION REGARDING ACCEPTING THE PLAN. PLEASE READ THIS DOCUMENT WITH CARE.

FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS THE REPRESENTATION OF THE DEBTORS ONLY AND NOT OF THEIR ATTORNEYS, ACCOUNTANTS OR OTHER PROFESSIONALS. FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN SUBJECTED TO AN AUDIT BY AN INDEPENDENT CERTIFIED PUBLIC ACCOUNTANT. THE DEBTORS ARE NOT ABLE TO CONFIRM THAT THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT DOES NOT INCLUDE ANY INACCURACIES. HOWEVER, THE DEBTORS HAVE MADE THEIR BEST EFFORT TO PROVIDE ACCURATE INFORMATION AND ARE NOT AWARE OF ANY INACCURACY IN THIS DISCLOSURE STATEMENT.

5

THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN INDEPENDENTLY INVESTIGATED BY THE BANKRUPTCY COURT AND HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT. IN THE EVENT THIS DISCLOSURE STATEMENT IS APPROVED, SUCH APPROVAL DOES NOT CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT OF THE FAIRNESS OR MERITS OF THE PLAN OR OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT.

THE ONLY REPRESENTATIONS THAT ARE AUTHORIZED BY THE DEBTORS CONCERNING THE DEBTORS, THE VALUE OF THEIR ASSETS, THE EXTENT OF THEIR LIABILITIES, OR ANY OTHER FACTS MATERIAL TO THE PLAN ARE THE REPRESENTATIONS MADE IN THIS DISCLOSURE STATEMENT. REPRESENTATIONS CONCERNING THE PLAN OR THE DEBTORS OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT ARE NOT AUTHORIZED BY THE DEBTORS.

HOLDERS OF CLAIMS AND EQUITY INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND ALL SUCH HOLDERS OF CLAIMS AND EQUITY INTERESTS SHOULD CONSULT WITH THEIR OWN ADVISERS.

THE DEBTORS HAVE NO ARRANGEMENT OR UNDERSTANDING WITH ANY BROKER, SALESMAN, OR OTHER PERSON TO SOLICIT VOTES FOR THE PLAN. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE PLAN OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE DEBTORS. THE DELIVERY OF THIS DISCLOSURE STATEMENT SHALL NOT UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AS OF ANY TIME AFTER THE DATE HEREOF OR THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION SET FORTH HEREIN OR IN THE AFFAIRS OF THE DEBTORS SINCE THE DATE HEREOF. ANY ESTIMATES OF CLAIMS AND EQUITY INTERESTS SET FORTH IN THIS DISCLOSURE STATEMENT MAY VARY FROM THE FINAL AMOUNTS OF CLAIMS OR EQUITY INTERESTS ALLOWED BY THE BANKRUPTCY COURT. SIMILARLY, THE ANALYSIS OF ASSETS AND THE AMOUNT ULTIMATELY REALIZED FROM THEM MAY DIFFER MATERIALLY.

THE DESCRIPTION OF THE PLAN CONTAINED HEREIN IS INTENDED TO BRIEFLY SUMMARIZE THE MATERIAL PROVISIONS OF THE PLAN AND IS SUBJECT TO AND QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE PROVISIONS OF THE PLAN.

ARTICLE II.

EXPLANATION OF CHAPTER 11

| A. | Overview of Chapter 11 |

Chapter 11 is the principal reorganization chapter of the Bankruptcy Code. Under chapter 11, a debtor in possession may seek to reorganize its business or to sell the business for the benefit of the debtor’s creditors and other interested parties.

The commencement of a chapter 11 case creates an estate comprising all of the debtor’s legal and equitable interests in property as of the date the petition is filed. Unless the bankruptcy court orders the appointment of a trustee, a chapter 11 debtor may continue to manage and control the assets of its estate as a “debtor in possession,” as the Debtors have done in the Bankruptcy Cases since the Petition Date.

Formulation of a chapter 11 plan is the principal purpose of a chapter 11 case. Such plan sets forth the means for satisfying the claims of creditors against, and interests of equity security holders in, the debtor.

6

| B. | Chapter 11 Plan |

After a plan has been filed, the holders of claims against, or equity interests in, a debtor are permitted to vote on whether to accept or reject the plan. Chapter 11 does not require that each holder of a claim against, or equity interest in, a debtor vote in favor of a plan in order for the plan to be confirmed. At a minimum, however, a plan must be accepted by a majority in number and two-thirds in dollar amount of those claims actually voting from at least one class of claims impaired under the plan. The Bankruptcy Code also defines acceptance of a plan by a class of equity interests as acceptance by holders of two-thirds of the number of shares actually voted.

Classes of claims or equity interests that are not “impaired” under a chapter 11 plan are conclusively presumed to have accepted the plan, and therefore are not entitled to vote. A class is “impaired” if the plan modifies the legal, equitable, or contractual rights attaching to the claims or equity interests of that class. Modification for purposes of impairment does not include curing defaults and reinstating maturity or payment in full in cash. Conversely, classes of claims or equity interests that receive or retain no property under a plan of reorganization are conclusively presumed to have rejected the plan, and therefore are not entitled to vote.

Even if all classes of claims and equity interests accept a chapter 11 plan, the Bankruptcy Court may nonetheless deny confirmation. Bankruptcy Code section 1129 sets forth the requirements for confirmation and, among other things, requires that a plan be in the “best interest” of impaired and dissenting creditors and interestholders and that the plan be feasible. The “best interest” test generally requires that the value of the consideration to be distributed to impaired and dissenting creditors and interestholders under a plan may not be less than those parties would receive if the debtor were liquidated under a hypothetical liquidation occurring under chapter 7 of the Bankruptcy Code. A plan must also be determined to be “feasible,” which generally requires a finding that there is a reasonable probability that the debtor will be able to perform the obligations incurred under the plan and that the debtor will be able to continue operations without the need for further financial reorganization or liquidation.

The Bankruptcy Court may confirm a chapter 11 plan even though fewer than all of the classes of impaired claims and equity interests accept it. The Bankruptcy Court may do so under the “cramdown” provisions of Bankruptcy Code section 1129(b). In order for a plan to be confirmed under the cramdown provisions, despite the rejection of a class of impaired claims or interests, the proponent of the plan must show, among other things, that the plan does not discriminate unfairly and that it is fair and equitable with respect to each impaired class of claims or equity interests that has not accepted the plan.

The Bankruptcy Court must further find that the economic terms of the particular plan meet the specific requirements of Bankruptcy Code section 1129(b) with respect to the subject objecting class. If the proponent of the plan proposes to seek confirmation of the plan under the provisions of Bankruptcy Code section 1129(b), the proponent must also meet all applicable requirements of Bankruptcy Code section 1129(a) (except section 1129(a)(8)). Those requirements include the requirements that (i) the plan comply with applicable Bankruptcy Code provisions and other applicable law, (ii) that the plan be proposed in good faith, and (iii) that at least one impaired class of creditors or interestholders has voted to accept the plan.

ARTICLE III.

VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS

| A. | Ballots and Voting Deadline |

Holders of Claims entitled to vote on the Plan will receive instructions for submitting an electronic Ballot to vote to accept or reject the Plan. After carefully reviewing the Disclosure Statement, including all exhibits, each holder of a Claim (or its authorized representative) entitled to vote should follow the instructions to indicate its vote on the electronic Ballot. All holders of Claims (or their authorized representatives) entitled to vote must (i) carefully review the electronic Ballot and the instructions for completing it, (ii) complete all parts of the electronic Ballot, and (iii) submit the electronic Ballot by the deadline (i.e., the Voting Deadline) for the Ballot to be considered. Claimholders who wish to submit a paper Ballot may request a paper Ballot by contacting the Debtors’ voting agent (the “Voting Agent”) at the following address: Dune Energy, Inc. Ballot Processing, c/o Prime Clerk, LLC, 830 3rd Avenue, 3rd Floor, New York, NY 10022, by telephone at (855) 410-7360, or by email at duneenergyballots@primeclerk.com.

7

The Bankruptcy Court has directed that, in order to be counted for voting purposes, Ballots for the acceptance or rejection of the Plan must be submitted no later than September 10, 2015 at 4:00 p.m. prevailing Central Time, on the website for the Bankruptcy Cases: http://cases.primeclerk.com/duneenergy/.

BALLOTS MUST BE SUBMITTED ELECTRONICALLY ON THE ABOVE WEBSITE OR IN PAPER FORM, IF REQUESTED, SO AS TO BE ACTUALLY RECEIVED BY THE VOTING AGENT NO LATER THAN SEPTEMBER 10, 2015 AT 4:00 P.M. PREVAILING CENTRAL TIME. ANY BALLOTS SUBMITTED AFTER THAT DEADLINE WILL NOT BE COUNTED.

| B. | Holders of Claims or Equity Interests Entitled to Vote |

Any holder of a Claim or Equity Interest of the Debtors whose Claim or Equity Interest is impaired under the Plan is entitled to vote if either (i) the Claim or Equity Interest has been listed in the Schedules of Assets and Liabilities in an amount greater than zero or the Schedule of Equity Security Holders (and the Claim or Equity Interest is not scheduled as disputed, contingent, or unliquidated) or (ii) the holder of a Claim or Equity Interest has filed a proof of claim or proof of interest (that is not contingent or in an unknown amount) on or before any deadline set by the Bankruptcy Court for such filings.

Any holder of a Claim or Equity Interest as to which an objection has been filed (and such objection is still pending) is not entitled to vote, unless the Bankruptcy Court (on motion by a party whose Claim or Equity Interest is subject to an objection) temporarily allows the Claim or Equity Interest in an amount that it deems proper for the purpose of accepting or rejecting the Plan. Such motion must be heard and determined by the Bankruptcy Court on or before the first date set by the Bankruptcy Court for the Confirmation Hearing on the Plan.

In addition, a vote may be disregarded if the Bankruptcy Court determines that the acceptance or rejection was not solicited or procured in good faith or in accordance with the applicable provisions of the Bankruptcy Code.

| C. | Bar Date for Filing Proofs of Claim |

The Bankruptcy Court established (a) June 5, 2015 at 4:00 p.m. (Central Time) as the general deadline for filing proofs of claim in the Bankruptcy Case (i.e., the General Bar Date), including any Claims filed pursuant to Bankruptcy Code section 503(b)(9), and (b) September 4, 2015 at 4:00 p.m. (Central Time) as the deadline for filing a proof of claim by any governmental unit (as defined by section 101(27) of the Bankruptcy Code), with two (2) exceptions: (i) in the event that the Debtors amend their Schedules of Assets and Liabilities, the Debtors must give notice of such amendment to the holder of a Claim affected thereby, and the affected Claim holder shall have the later of the General Bar Date or thirty (30) days from the date on which notice of such amendment was given to file a proof of claim; and (ii) except as otherwise set forth in any order authorizing the rejection of an Executory Contract, in the event that a Claim arises with respect to a Debtor’s rejection of an Executory Contract, the Claim holder shall have the later of the General Bar Date or thirty (30) days after the date any order is entered authorizing the rejection of such Executory Contract. These deadlines along with procedures for filing proofs of claim are described in the Bar Date Order, which was approved by the Bankruptcy Court on April 13, 2015.

A copy of the Bar Date Order may be obtained from the website for the Bankruptcy Cases at https://cases.primeclerk.com/duneenergy/ or by contacting the Debtors’ Claims and Noticing Agent, Prime Clerk LLC (the “Claims Agent”) at the following address:

| Dune Energy, Inc. Claims Processing Center c/o Prime Clerk LLC 830 Third Avenue, 9th Floor New York, NY 10022 Telephone: (212) 257-5450 |

8

| D. | Definition of Impairment |

Under Bankruptcy Code section 1124, a class of claims or equity interests is impaired under a chapter 11 plan unless, with respect to each claim or equity interest of such class, the plan:

| (1) | leaves unaltered the legal, equitable, and contractual rights of the holder of such claim or equity interest; or |

| (2) | notwithstanding any contractual provision or applicable law that entitles the holder of a claim or equity interest to receive accelerated payment of such claim or equity interest after the occurrence of a default: |

| (a) | cures any such default that occurred before or after the commencement of the case under this title, other than a default of a kind specified in Bankruptcy Code section 365(b)(2) or of a kind that section 365(b)(2) expressly does not require to be cured; |

| (b) | reinstates the maturity of such claim or equity interest as it existed before the default; |

| (c) | compensates the holder of such claim or equity interest for damages incurred as a result of reasonable reliance on such contractual provision or applicable law; |

| (d) | if such claim or such equity interest arises from any failure to perform a nonmonetary obligation, other than a default arising from failure to operate a nonresidential real property lease subject to Bankruptcy Code section 365(b)(1)(A), compensates the holder of such claim or such equity interest (other than the debtor or an insider) for any actual pecuniary loss incurred by such holder as a result of such failure; and |

| (e) | does not otherwise alter the legal, equitable, or contractual rights to which such claim or equity interest entitles the holder of such claim or equity interest. |

| E. | Classes Impaired Under the Plan |

Other than the Unimpaired Classes (i.e., Classes 1.1 and 1.2) all classified Claims or Equity Interests are Impaired under the Plan. Therefore, holders of those Claims and Equity Interests are eligible, subject to the voting requirements described above, to vote to accept or reject the Plan.

Claims in Classes 1.1 and 1.2 are not Impaired under the Plan, and therefore holders of those Claims are conclusively presumed to have accepted the Plan pursuant to Bankruptcy Code section 1126(f). Accordingly, the Debtors will not be soliciting votes from Claim holders in these Classes.

| F. | Vote Required for Class Acceptance |

The Bankruptcy Code defines acceptance of a plan by a class of creditors as acceptance by holders of at least two-thirds in dollar amount and more than one-half in number of the Claims of that class that actually cast ballots for acceptance or rejection of the Plan; that is, acceptance by a class takes place only if creditors holding Claims in that class constituting at least two-thirds in amount of the total amount of Claims and more than one-half in number of the creditors actually voting cast their ballots in favor of acceptance.

The Bankruptcy Code defines acceptance of a plan by a class of equity interests as acceptance by holders of at least two-thirds in amount of the allowed equity interests of that class.

9

| G. | Information on Voting and Ballots |

| 1. | Transmission of Ballots to Holders of Claims and Equity Interests |

Instructions for completing and submitting electronic Ballots are being provided to all holders of Claims entitled to vote on the Plan in accordance with the Bankruptcy Rules. Those holders of Claims or Equity Interests whose Claims or Equity Interests are unimpaired under the Plan are conclusively presumed to have accepted the Plan under Bankruptcy Code section 1126(f), and therefore need not vote with regard to the Plan. Under Bankruptcy Code section 1126(g), holders of Claims or Equity Interests who do not either receive or retain any property under the Plan are deemed to have rejected the Plan. In the event a holder of a Claim or Equity Interest does not vote, the Bankruptcy Court may deem such holder of a Claim or Equity Interest to have accepted the Plan.

| 2. | Ballot Tabulation Procedures |

Solely for purposes of voting to accept or reject the Plan and not for the purpose of allowance of, or distribution on account of, any Claim, and without prejudice to the rights of the Debtors in any other context, each Claim within a Class of Claims entitled to vote to accept or reject the Plan is temporarily Allowed in an amount equal to the amount of such Claim as set forth in the Schedules of Assets and Liabilities, provided that:

| (a) | if a Claim is Allowed under the Plan or by order of the Bankruptcy Court, such Claim is Allowed for voting purposes in the Allowed amount set forth in the Plan or the order; |

| (b) | if a Claim for which a proof of claim has been timely filed is for unknown or undetermined amounts, or is wholly unliquidated or contingent (as determined on the face of the claim or after a reasonable review of the supporting documentation by the Voting Agent) and such Claim has not been Allowed, such Claim will be temporarily Allowed for voting purposes only, and not for purposes of allowance or distribution and accorded one vote and valued at an amount equal to one dollar ($1.00), unless such claim is disputed as set forth in paragraph (h) below; |

| (c) | if a Claim has been estimated or otherwise Allowed for voting purposes by order of the Bankruptcy Court, such Claim is temporarily Allowed in the amount so estimated or Allowed by the Bankruptcy Court for voting purposes only, and not for purposes of allowance or distribution; |

| (d) | if a proof of claim was timely filed in an amount that is liquidated and matured, such Claim is temporarily Allowed in the amount set forth on the proof of claim, unless such Claim is disputed as set forth in subparagraph (h) below; |

| (e) | if a Claim is listed in the Schedules of Assets and Liabilities as contingent, unliquidated, or disputed or for $0.00 and a proof of claim was not (i) filed by the applicable bar date for the filing of proofs of claims established by the Bankruptcy Court or (ii) deemed timely filed by an order of the Bankruptcy Court prior to the Voting Deadline, the Debtors propose that such Claim shall be disallowed for voting purposes and for purposes of allowance and distribution pursuant to Bankruptcy Rule 3003(c); |

| (f) | if a Claim is listed in the Schedules of Assets and Liabilities or on a timely filed proof of claim as contingent, unliquidated, or disputed in part, such Claim is temporarily Allowed in the amount that is liquidated, matured, and undisputed for voting purposes only, and not for purposes of allowance or distribution; |

| (g) | if a creditor has filed proofs of claim against multiple Debtors, such creditor’s Claim shall only be counted once for voting purposes; |

| (h) | if the Debtors have served an objection or request for estimation as to a Claim at least fourteen (14) calendar days before the Voting Deadline, such claim is temporarily disallowed |

10

| for voting purposes unless a motion for temporary allowance is filed and approved by the Bankruptcy Court; provided, however, that if such objection is an objection to reduce the amount of the Claim and no motion for temporary allowance is filed, the Claim shall be Allowed to be voted in the reduced amount; |

| (i) | Claims scheduled in the Debtors’ Schedules of Assets and Liabilities or filed in the amount of $0.00 are not entitled to vote; and |

| (j) | if a proof of claim has been amended by a later-filed proof of claim, the earlier-filed Claim will not be entitled to vote, regardless of whether the Debtors have objected to such earlier-filed Claim. |

The following procedures shall apply for tabulating votes:

| (a) | any Ballot that is otherwise timely completed, executed, and properly cast to the Voting Agent but does not indicate an acceptance or rejection of the Plan, or that indicates both an acceptance and rejection of the Plan, shall not be counted; if no votes to accept or reject the Plan are received with respect to a particular Class that is entitled to vote on the Plan, such Class shall be deemed to have voted to accept the Plan; |

| (b) | if a creditor casts more than one Ballot voting the same Claim before the Voting Deadline, the last properly cast Ballot received before the Voting Deadline shall be deemed to reflect the voter’s intent and thus supersede any prior Ballots; |

| (c) | creditors must vote all of their Claims within a particular Class to either accept or reject the Plan, and may not split their votes within a particular Class and thus a Ballot (or group of Ballots) within a particular Class that partially accepts and partially rejects the Plan shall not be counted; |

| (d) | a creditor who votes an amount related to a Claim that has been paid or otherwise satisfied in full or in part shall only be counted for the amount that remains unpaid or not satisfied, and if such Claim has been fully paid or otherwise satisfied, such vote will not be counted for purposes of amount or number; and |

| (e) | for purposes of determining whether the numerosity and amount requirements of sections 1126(c) and 1126(d) of the Bankruptcy Code have been satisfied, the Debtors will tabulate only those Ballots received by the Voting Deadline. For purposes of the numerosity requirement of section 1126(c) of the Bankruptcy Code, separate Claims held by a single creditor in a particular Class shall be aggregated as if such creditor held one Claim against the Debtors in such Class, and the votes related to such Claims shall be treated as a single vote to accept or reject the Plan. |

The following Ballots shall not be counted or considered for any purpose in determining whether the Plan has been accepted or rejected:

| (a) | any Ballot received after the Voting Deadline, unless the Debtors, in their discretion, grant an extension of the Voting Deadline with respect to such Ballot; |

| (b) | any Ballot that is illegible or contains insufficient information to permit identification of the voter; |

| (c) | any Ballot cast by a Person that does not hold a Claim or Equity Interest in a Class that is entitled to vote to accept or reject the Plan; |

| (d) | any unsigned Ballot or paper Ballot that does not contain an original signature; and |

11

| (e) | any Ballot transmitted to the Voting Agent by facsimile or electronic mail, unless the Debtors, in their discretion, consent to such delivery method. |

| 3. | Execution of Ballots by Representatives |

To the extent applicable, if a Ballot is submitted by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations, or others acting in a fiduciary or representative capacity, such Persons must indicate their capacity when submitting the Ballot and, at the Debtors’ request, must submit proper evidence satisfactory to the Debtors of their authority to so act. For purposes of voting tabulation, a Ballot submitted by a representative shall account for the total number of represented parties with respect to the numerosity requirement set forth in this Article.

| 4. | Waivers of Defects and Other Irregularities Regarding Ballots |

Unless otherwise directed by the Bankruptcy Court, all questions concerning the validity, form, eligibility (including time of receipt), acceptance, and revocation or withdrawal of Ballots will be determined by the Debtors in their sole discretion, whose determination will be final and binding. The Debtors reserve the right to reject any and all Ballots not in proper form, the acceptance of which would, in the opinion of the Debtors or their counsel, be unlawful. The Debtors further reserve the right to waive any defects or irregularities or conditions of delivery as to any particular Ballot. Unless waived, any defects or irregularities in connection with deliveries of Ballots must be cured within such time as the Debtors (or the Bankruptcy Court) determine. Neither the Debtors nor any other Person will be under any duty to provide notification of defects or irregularities with respect to deliveries of Ballots, nor will any of them incur any liability for failure to provide such notification; provided, however, that the Debtors will indicate on the ballot summary the Ballots, if any, that were not counted, and will provide copies of such Ballots with the ballot summary to be submitted at the Confirmation Hearing. Unless otherwise directed by the Bankruptcy Court, delivery of such Ballots will not be deemed to have been made until any irregularities have been cured or waived. Unless otherwise directed by the Bankruptcy Court, Ballots previously furnished, and as to which any irregularities have not subsequently been cured or waived, will be invalidated.

| 5. | Withdrawal of Ballots and Revocation |

The Debtors may allow any Claimant who submits a properly completed Ballot to supersede or withdraw such Ballot on or before the Voting Deadline. In the event the Debtors do permit such supersession or withdrawal, the claimant, for cause, may change or withdraw its acceptance or rejection of the Plan in accordance with Bankruptcy Rule 3018(a).

| H. | Confirmation of Plan |

| 1. | Solicitation of Acceptances |

The Debtors are soliciting your vote.

NO REPRESENTATIONS OR ASSURANCES, IF ANY, CONCERNING THE DEBTORS OR THE PLAN ARE AUTHORIZED BY THE DEBTORS, OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT. ANY REPRESENTATIONS OR INDUCEMENTS MADE BY ANY PERSON TO SECURE YOUR VOTE, OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT, SHOULD NOT BE RELIED ON BY YOU IN ARRIVING AT YOUR DECISION, AND SUCH ADDITIONAL REPRESENTATIONS OR INDUCEMENTS SHOULD BE REPORTED TO DEBTORS’ COUNSEL FOR APPROPRIATE ACTION.

THIS IS A SOLICITATION SOLELY BY THE DEBTORS, AND IS NOT A SOLICITATION BY ANY SHAREHOLDER, ATTORNEY, ACCOUNTANT, OR OTHER PROFESSIONAL FOR THE DEBTORS. THE REPRESENTATIONS, IF ANY, MADE IN THIS DISCLOSURE STATEMENT ARE THOSE OF THE DEBTORS AND NOT OF

12

SUCH SHAREHOLDERS, ATTORNEYS, ACCOUNTANTS, OR OTHER PROFESSIONALS, EXCEPT AS MAY BE OTHERWISE SPECIFICALLY AND EXPRESSLY INDICATED.

Pursuant to Bankruptcy Code section 105(d)(2)(B)(vi), the Bankruptcy Court may combine the hearing on approval of the Disclosure Statement with the hearing on confirmation of the Plan. The Bankruptcy Court has scheduled the Combined Hearing to consider approval of this Disclosure Statement and confirmation of the Plan. Accordingly, this Disclosure Statement has not yet been approved by the Bankruptcy Court, but the Bankruptcy Court has authorized the Debtors to provide this Disclosure Statement to holders of Claims and Equity Interests for the purpose of soliciting their votes to accept or reject the Plan.

| 2. | Requirements for Confirmation of the Plan |

At the Confirmation Hearing, the Bankruptcy Court shall determine whether the requirements of Bankruptcy Code section 1129 have been satisfied, in which event the Bankruptcy Court shall enter an Order confirming the Plan. The Debtors believe that the Plan satisfies all of the statutory requirements of the Bankruptcy Code for confirmation because, among other things:

| (a) | The Plan complies with the applicable provisions of the Bankruptcy Code; |

| (b) | The Debtors have complied with the applicable provisions of the Bankruptcy Code; |

| (c) | The Plan has been proposed in good faith and not by any means forbidden by law; |

| (d) | Any payment or distribution made or promised by the Debtors or by a Person issuing securities or acquiring property under the Plan for services or for costs and expenses in connection with the Plan has been disclosed to the Bankruptcy Court, and any such payment made before the confirmation of the Plan is reasonable, or if such payment is to be fixed after confirmation of the Plan, such payment is subject to the approval of the Bankruptcy Court as reasonable; |

| (e) | The Debtors have disclosed the identity and affiliation of any individual proposed to serve, after confirmation of the Plan, as a director, officer or voting trustee of the Debtors, an affiliate of the Debtors participating in a joint plan with the Debtors, or a successor to the Debtors under the Plan; the appointment to, or continuance in, such office of such individual is consistent with the interests of Creditors and Interestholders and with public policy; |

| (f) | Any government regulatory commission with jurisdiction (after confirmation of the Plan) over the rates of the Debtors has approved any rate change provided for in the Plan, or such rate change is expressly conditioned on such approval; |

| (g) | With respect to each impaired Class of Claims or Equity Interests, either each holder of a Claim or Equity Interest of the Class has accepted the Plan, or will receive or retain under the Plan on account of that Claim or Equity Interest, property of a value, as of the effective date of the Plan, that is not less than the amount that such holder would so receive or retain if the Debtors were liquidated on such date under chapter 7 of the Bankruptcy Code. If Bankruptcy Code section 1111(b)(2) applies to the Claims of a Class, each holder of a Claim of that Class will receive or retain under the Plan on account of that Claim property of a value, as of the Effective Date, that is not less than the value of that holder’s interest in the Debtors’ interest in the property that secures that claim; |

| (h) | Each Class of Claims or Equity Interests has either accepted the Plan or is not impaired under the Plan, subject to the Debtors’ right to seek cramdown of the Plan under section 1129(b) of the Bankruptcy Code; |

13

| (i) | Except to the extent that the holder of a particular Administrative Claim has agreed to a different treatment of its Claim, the Plan provides that Administrative Claims shall be paid in full on the Effective Date; |

| (j) | With respect to holders of Allowed Priority Employee Claims, the Plan provides that holders of such Claims shall receive Cash in the amount of their Allowed Priority Employee Claims, plus accrued interest after the Confirmation Date, such payment to be made on the later of (a) ten (10) days after the Effective Date or (b) ten (10) days after the date such Claim becomes Allowed; |

| (k) | With respect to holders of Priority Unsecured Non-Tax Claims, the Plan provides that, that absent agreement, holders of Allowed Priority Unsecured Non-Tax Claims shall receive Cash in the amount of their Priority Unsecured Non-Tax Claims on the later of (i) the Effective Date or (ii) ten (10) days after the Allowance Date in accordance with the Plan Trust Agreement; |

| (l) | With respect to a Secured Claim (including a Claim that that would otherwise be a Priority Unsecured Tax Claim, but for the secured status of the claim), the holder of that Claim will receive on account of such Claim either (i) a Distribution equal to 100% of its claim in cash on the Effective Date; (ii) conveyance of any collateral securing the Allowed Secured Claim, or (iii) such other treatment that may be agreed to by the holder of such Claim and the Plan Trustee; |

| (m) | If a Class of Claims or Equity Interests is Impaired under the Plan, at least one such Class of Claims or Equity Interests has accepted the Plan, determined without including any acceptance of the Plan by any insider holding a Claim or Equity Interest of that Class; |

| (n) | Confirmation of the Plan is not likely to be followed by the liquidation or the need for further financial reorganization of the Debtors or any successor to the Debtors under the Plan, unless such liquidation or reorganization is proposed in the Plan; |

| (o) | All court fees, as determined by the Bankruptcy Court at the Confirmation Hearing, have been paid or the Plan provides for the payment of such fees on the Effective Date; and |

| (p) | The Plan provides that all transfers of property shall be made in accordance with applicable provisions of nonbankruptcy law that govern the transfer of property by a corporation or trust that is not a moneyed, business, or commercial corporation or trust. |

The Debtors assert that they have proposed the Plan in good faith and they believe that they have complied, or will have complied, with all the requirements of the Bankruptcy Code governing confirmation of the Plan.

| 3. | Acceptances Necessary to Confirm the Plan |

Voting on the Plan by each holder of an Impaired Claim (or its authorized representative) is important. Chapter 11 of the Bankruptcy Code does not require that each holder of a Claim or Equity Interest vote in favor of the Plan in order for the Bankruptcy Court to confirm the Plan. Generally, under the acceptance provisions of Bankruptcy Code section 1126(a), each Class of Claims or Equity Interests has accepted the Plan if holders of at least two-thirds in dollar amount and more than one-half in number of the Allowed Claims of such Class actually voting in connection with the Plan vote to accept the Plan. With regard to a Class of Equity Interests, more than two-thirds of the shares actually voted must accept to bind that Class. Even if all Classes of Claims and Equity Interests accept the Plan, the Bankruptcy Court may refuse to confirm the Plan.

| 4. | Cramdown |

In the event that any impaired Class of Claims or Equity Interests does not accept the Plan, the Bankruptcy Court may still confirm the Plan at the request of the Debtors if, as to each Impaired Class that has not accepted the Plan, the Plan “does not discriminate unfairly” and is “fair and equitable.” A chapter 11 plan does not discriminate unfairly within the meaning of the Bankruptcy Code if no class receives more than it is legally entitled to receive for its claims or equity interests. “Fair and equitable” has different meanings for holders of secured and unsecured claims and equity interests.

14

With respect to a secured claim, “fair and equitable” means either (i) the Impaired secured creditor retains its liens to the extent of its allowed claim and receives deferred cash payments at least equal to the allowed amount of its claims with a present value as of the effective date of the plan at least equal to the value of such creditor’s interest in the property securing its liens; (ii) property subject to the lien of the Impaired secured creditor is sold free and clear of that lien, with that lien attaching to the proceeds of sale, and such lien proceeds must be treated in accordance with clauses (i) and (iii) hereof; or (iii) the Impaired secured creditor realizes the “indubitable equivalent” of its claim under the plan.

With respect to an unsecured claim, “fair and equitable” means either (i) each Impaired creditor receives or retains property of a value equal to the amount of its allowed claim or (ii) the holders of claims and equity interests that are junior to the claims of the dissenting class will not receive any property under the plan.

With respect to equity interests, “fair and equitable” means either (i) each Impaired equity interest receives or retains, on account of that equity interest, property of a value equal to the greater of the allowed amount of any fixed liquidation preference to which the holder is entitled, any fixed redemption price to which the holder is entitled, or the value of the equity interest, or (ii) the holder of any equity interest that is junior to the equity interest of that class will not receive or retain under the plan, on account of that junior equity interest, any property.

The Debtors believe that the Plan does not discriminate unfairly and is fair and equitable with respect to each impaired Class of Claims and Equity Interests. In the event at least one Class of Impaired Claims or Equity Interests rejects or is deemed to have rejected the Plan, the Bankruptcy Court will determine at the Confirmation Hearing whether the Plan is fair and equitable and does not discriminate unfairly against any rejecting Impaired Class of Claims or Equity Interests.

ARTICLE IV.

BACKGROUND OF THE DEBTORS

| A. | Description of Debtors’ Businesses |

Dune Energy is an independent energy company that was formed in 1998 and operates through two wholly owned subsidiaries, Dune Operating and Dune Properties. Since May 2004, the Debtors have been engaged in the exploration, development, acquisition and exploitation of crude oil and natural gas properties in Texas and Louisiana. The Debtors’ interests in their oil and gas properties are held by Dune Properties, and their oil and gas operations are conducted by Dune Operating. The Debtors sell their oil and gas production primarily to domestic pipelines and refineries.

As of the Petition Date, the Debtors had 32 full-time employees. The Debtors are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages. The Debtors utilize the services of independent contractors to perform various field and other services.

The Debtors’ primary focus has been development and exploration in their Gulf Coast properties to expand their reserve base through workovers and recompletions, field extensions, delineation of deeper formations within existing fields and exploratory drilling. The Debtors have also sought to grow their reserves through acquisitions of producing properties, leasehold acreage and drilling prospects in core operating areas that require minimal initial upfront capital. In evaluating acquisition opportunities, the Debtors have sought to acquire operational control of properties that they believe have a solid proved reserve base coupled with significant exploitation and exploration potential.

As of the Petition Date, the Debtors’ oil and gas properties covered over 74,000 gross acres across 15 producing oil and natural gas fields. The Debtors’ total proved reserves as of December 31, 2013 were 93.1 billion cubic feet of natural gas equivalent (“Bcfe”), consisting of 50.1 billion cubic feet of natural gas (“Bcf”) and 7.2 million barrels of crude oil (“Mmbbl”). At year-end 2013, the Debtors’ proved developed producing, or PDP,

15

reserves of 23.6 Bcfe were 25.3% of their 93.1 Bcfe of total proved oil and natural gas reserves, the Debtors’ proved developed non-producing, or PDNP, reserves of 25.5 Bcfe were 27.4% of their total proved oil and natural gas reserves, and the Debtors’ proved undeveloped, or PUD, reserves of 44.1 Bcfe were 47.3% of their total proved oil and natural gas reserves.

As of the Petition Date, approximately 58% of the Debtors’ total proved oil and gas reserves were located in three fields: Garden Island Bay, Leeville, and Bateman Lake. These fields have large acreage positions surrounding piercement salt domes. In the Garden Island Bay field, Dune controlled sixteen (16) prospects and approximately forty (40) separate well locations. Dune maintained a 100% working interest in these prospects. At the Leeville field, Dune participated with a 40% working interest as a non-operator in a shallow drilling program encompassing five (5) to ten (10) primarily PUD locations per year. As of the Petition Date, the Leeville field had twenty-eight producing wells, and Shoreline Energy is the operator and majority interest holder in the field. As of the Petition Date, the Bateman Lake field had eleven (11) producing wells. The reserves attributed to the Bateman Lake field are 90% natural gas. As a result of low gas prices, the Debtors have not recently conducted drilling in this field.

As of the Petition Date, the Chocolate Bayou, Comite, and Live Oak fields comprised the Debtors’ next three (3) largest properties and consisted of 26% of the Debtors’ total proved reserves. These assets are typically characterized as having fewer wellbores than the salt dome fields but present numerous opportunities for PUD drilling and fault blocks containing unproved reserves that have been identified with new 3-D seismic data. As of the Petition Date, the remaining fields contained approximately 16% of the Debtors’ total proved oil and gas reserves and were characterized by occasional new drilling wells and workovers.

As described in more detail in Article VII.F below, the Debtors sold their interests in the Garden Island Bay, Leeville, Bateman Lake, Chocolate Bayou, and Comite fields as part of their postpetition Sale process.

| B. | Corporate Information and Debtors’ Relationship to Subsidiaries |

| 1. | Corporate Structure |

Dune Energy was incorporated under the laws of the State of Delaware. Dune Operating and Dune Properties are wholly-owned subsidiaries of Dune Energy and were each incorporated under the laws of the State of Texas. The Debtors oversee their operations from their offices in Houston, Texas.

| 2. | Current Officers and Directors of Dune Energy |

As of the Petition Date, the following lists the individuals who served as officers and directors of Dune Energy and the capacities in which they served:

| Robert A. Schmitz | Chairman of the Board | |

| John R. Brecker | Director | |

| Michael R. Keener | Director | |

| Dr. Alexander A. Kulpecz, Jr. | Director | |

| James A. Watt | President, Chief Executive Officer and Director | |

| Hal Bettis | Executive Vice President, Business Development and Environmental Affairs | |

| Frank T. Smith, Jr. | Senior Vice President, Chief Financial Officer and Secretary | |

| Richard H. Mourglia | General Counsel and Senior Vice President – Land | |

| Donald R. Martin | Chief Restructuring Officer |

Following the closing of Trimont Sale and the White Marlin Sale (as described in further detail below), certain officers and directors of the Debtors resigned their positions. As of the date of this Disclosure Statement, Mr. Watt remains as President, Secretary and the sole Director of each of the Debtors, and Mr. Martin remains as Chief Restructuring Officer of each of the Debtors.

16

| C. | Events Leading to the Bankruptcy Cases |

As of September 30, 2014, Dune had outstanding Prepetition Debt Obligations of approximately $106.8 million. During 2014, as a result of a significant decline in oil prices, the Debtors’ revenues fell sharply. Although the Debtors were able to reduce expenses, the significant decline in revenue imposed a strain on the Debtors’ liquidity. Dune’s earnings before interest, taxes, depreciation, amortization and exploration expenses (“EBITDAX”) declined considerably from the prior year. For the twelve months ended December 31, 2014, Dune’s EBITDAX was $13.1 million, compared to EBITDAX of $20.6 million for the same time period in 2013. The reduction in Dune’s EBITDAX was primarily due to lower revenues. Revenues for the twelve months ended December 31, 2014 were approximately $43.0 million, compared to revenues of $55.5 million for the same time period in 2013. Although the Debtors’ $22.6 million in operating expenses for the twelve months ended December 31, 2014 were approximately $2.3 million (9.4%) less than the $24.9 million in operating expenses for the same time period in 2013, the decline in their revenues continued to outpace their cost savings efforts.

In spite of their declining revenues, the Debtors continued to service their debt, making all scheduled interest installment payments under the Prepetition Loan Documents. At the end of the second quarter of 2014, the Debtors were in default of the First Lien Credit Agreement due to the failure to meet certain covenant ratios in the First Lien Credit Agreement. In addition, on July 15, 2014, the First Lien Agent notified the Debtors that effective July 1, 2014, the Debtors’ borrowing base, which was $47.5 million at that time, would be reduced by $2.5 million and would be further reduced by $2.5 million each month until October 2014, resulting in a borrowing base of $37.5 million. The reduction in the borrowing base under the First Lien Credit Facility significantly restricted the Debtors’ liquidity.

To address the Debtors’ liquidity constraints and obtain additional working capital to further develop their oil and gas properties, the Debtors engaged in numerous exploratory discussions with independent exploration and production companies regarding potential joint ventures or other strategic transactions. Prior to the Petition Date, the Debtors contacted a total of forty-five (45) prospective strategic and financial buyers. Thirty (30) of the companies declined to consider an acquisition of or merger with the Debtors. Fifteen (15) of the companies expressed an interest in considering an acquisition and proceeded with non-disclosure/standstill agreements, one of which was Eos.

From May through July 2014, the Debtors received seven (7) indications of interest from potential buyers, including a non-binding indication of interest from Eos for the purchase of all of the Debtors’ outstanding shares of stock, with an estimation of the Debtors’ enterprise value at $140 million. After careful review of the indications of interest, the Debtors’ board of directors authorized the continued discussion and negotiation with Eos and one other prospective buyer in an effort to enter into a definitive agreement in connection with a merger transaction. As discussions continued, Eos lowered its offer price based on the Debtors’ enterprise value. The other interested party continued its due diligence review, but did not provide a formal offer.

On September 17, 2014, Dune Energy, Eos, and Eos Sub entered into a merger agreement (the “Merger Agreement”). The Merger Agreement provided for Eos Sub to commence a cash tender offer for all of the issued and outstanding shares of the Company’s common stock for $0.30 per share payable to the holder in cash, without interest and less any applicable withholding taxes, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated October 9, 2014 (as amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal,” which, together with the Offer to Purchase and any amendments or supplements from time to time thereto, constitute the “Offer”). In addition to the Offer Price, Eos agreed to provide Dune Energy with sufficient funds to pay in full and discharge all of Dune Energy’s outstanding indebtedness and assume liability for all of Dune Energy’s trade debt, as well as fees and expenses related to the Merger Agreement and the transactions contemplated therein. The Offer Price was based on an implied enterprise value of $135.9 million.

The Debtors also pursued alternative sources of financing to address their liquidity constraints. During the third quarter of 2014, the Debtors had executed non-disclosure agreements with five (5) potential financing sources and received four (4) term sheets from potential lenders for a new first lien debt facility that could replace the First Lien Credit Facility. In spite of this initial interest from potential financing sources, the Debtors’ negotiations with the potential financing sources proved unsuccessful.

17

During the third quarter of 2014, the Debtors also engaged in discussions with the First Lien Agent regarding the reduction of the borrowing base and the default that occurred in the second quarter of 2014. The Debtors also informed the First Lien Agent that they would be unable to comply with certain covenant ratios in the First Lien Credit Agreement for the third quarter of 2014. The First Lien Agent indicated a willingness to grant the Debtors a forbearance under the First Lien Credit Facility if the Debtors entered into a strategic transaction.

Following Dune Energy’s entry into the Merger Agreement with Eos, Dune Energy entered into the Forbearance Agreement and Fourth Amendment to Amended and Restated Credit Agreement (the “First Forbearance Agreement”) with the First Lien Agent and the First Lien Lenders. Under the First Forbearance Agreement, the First Lien Agent and First Lien Lenders agreed to a limited forbearance from exercising their rights and remedies with respect to the defaults under the First Lien Credit Agreement until December 31, 2014, unless earlier terminated in accordance with the terms of the First Forbearance Agreement. The First Lien Agent and First Lien Lenders also agreed to forego the October 1 reduction to the borrowing base and agreed to maintain the Debtors’ borrowing base at $40,000,000 until the next scheduled redetermination period.

Following entry into the Merger Agreement, Eos commenced the Offer on October 9, 2014. On November 5, 2014, Eos informed Dune Energy that Eos Sub would not be able to complete the financing and consequently, would not be prepared to consummate the Offer, by the original expiration date of 12:00 midnight, New York City time, on November 6, 2014. Dune Energy, Eos, and Eos Sub then entered into a series of amendments to the Merger Agreement to extend the Offer to allow Eos Sub to complete the financing in order to fund the Offer and merger.

On December 16, 2014, Eos informed Dune Energy that it could not complete the merger and Offer on the terms originally set forth in the Merger Agreement due to the recent severe decline in the price of oil. Due to such decline, Eos’ potential sources of financing for the merger and Offer were withdrawn. On December 22, 2014, Dune Energy, Eos, and Eos Sub agreed to extend the Offer’s expiration date to January 15, 2015 and the “End Date” set forth in the Merger Agreement to January 31, 2015 to allow the parties additional time to negotiate revised terms.

In light of ongoing negotiations related to the Merger Agreement, on January 2, 2015, Dune Energy, the First Lien Agent, and the First Lien Lenders entered into the Amended and Restated Forbearance Agreement and Fifth Amendment to the Amended and Restated Credit Agreement dated effective as of December 31, 2014 (the “Second Forbearance Agreement”). Under the terms of the Second Forbearance Agreement, the First Lien Agent and the First Lien Lenders agreed to extend the limited forbearance until January 31, 2015, unless earlier terminated in accordance with the terms of the Second Forbearance Agreement. In addition, the First Lien Agent and the First Lien Lenders agreed to maintain the Debtors’ borrowing base at $40,000,000 during the forbearance period. The Debtors agreed to begin making monthly, rather than quarterly, interest payments to the First Lien Agent. The Second Forbearance Agreement also provided that all commitments of the First Lien Lenders under the First Lien Credit Agreement would terminate on January 31, 2015 without further notice.

During January 2015, the Debtors continued to negotiate the revised terms of the Merger Agreement. Dune Energy, Eos, and Eos Sub entered into additional amendments to the Merger Agreement during this time to facilitate further negotiations. In addition, on January 30, 2015, the Debtors, the First Lien Agent, and the First Lien Lenders entered into the Second Amended and Restated Forbearance Agreement dated effective as of January 31, 2015 (the “Third Forbearance Agreement”). Under the terms of the Third Forbearance Agreement, the First Lien Agent and First Lien Lenders agreed to further extend the limited forbearance. The forbearance period under the Third Forbearance Agreement terminated on February 25, 2015.

Despite numerous extensions of the expiration of the Offer, Eos was unable to complete the financing and consummate the proposed transaction with the Debtors. Facing a liquidity crisis in February 2015, the Debtors were unable to agree to any further extensions of the Offer. On March 4, 2015, the Merger Agreement was terminated.

| D. | Prepetition DIP Financing Negotiations, Restructuring Initiatives and Sale Efforts |