Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Mobiquity Technologies, Inc. | mobiquity_ex2301.htm |

| EX-23.2 - CONSENT - Mobiquity Technologies, Inc. | mobiquity_ex2302.htm |

As filed with the Securities and Exchange Commission on August 25, 2015

Registration No. 333-201340

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MOBIQUITY TECHNOLOGIES, INC.

(Name of registrant as specified in its charter)

| New York | 7310 | 11-3427886 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

|

600 Old Country Road, Suite 541 Garden City, NY 11530 (516) 256-7766 |

|

(Address, including zip code, and telephone number, including area code, or registrant’s principal executive offices) |

|

Dean L Julia, Co-Chief Executive Officer 600 Old Country Road, Suite 541 Garden City, NY 11530 (516) 256-7766 |

|

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

|

Steven Morse, Esq. Morse & Morse, PLLC 1400 Old Country Road, Suite 302 Westbury, New York 11590 Tel: (516) 487-1446 Fax: (516) 487-1452 |

Ralph V. DeMartino, Esq. Schiff Hardin LLP 901 K Street, Suite 700 Washington, DC 20001 Tel: (202) 724-6848 Fax: (202) 778-6460 |

Cavas Pavri, Esq. Schiff Hardin LLP 100 North 18th Street, Suite 300 Philadelphia, Pennsylvania 19103 Tel: (202) 724-6847 Fax: (202)778-6460 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | o | Non-accelerated filer | o | |

| Accelerated filer | o | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee (1) (2) (9) | ||||||

| Units each consisting of one

share of Common Stock, par value $0.0001 per share, One-half share of Series AA Convertible Preferred Stock, par value $0.0001 per share, and four Series 1 Warrants, each to purchase one share of Common Stock (3) | $ | 14,950,000.00 | $ | 1,737.19 | ||||

| Shares of Common Stock, par value $0.0001 per share (4)(5) | – | – | ||||||

| Series AA Convertible Preferred Stock, par value $0.0001 per share (4) | – | – | ||||||

| Shares of Common Stock underlying the Series AA Convertible Preferred Stock (4)(5) | – | – | ||||||

| Series 1 Warrants, each to purchase one share of Common Stock (6) | – | – | ||||||

| Shares of Common Stock underlying the Series 1 Warrants (3)(7) | $ | 30,360,000.00 | $ | 3,527.83 | ||||

| Representative’s Unit Purchase Option to purchase Units (6) | $ | 100.00 | $ | 0.02 | ||||

| Units underlying the Unit Purchase Option | $ | 934,375.00 | $ | 108.57 | ||||

| Shares of Common Stock underlying Units in Unit Purchase Option | – | – | ||||||

| Series AA Convertible Preferred Stock underlying Units underlying the Unit Purchase Option (4)(5) | – | – | ||||||

| Shares of Common Stock underlying the Series AA Convertible Preferred Stock underlying Units underlying the Unit Purchase Option (4)(5) | – | – | ||||||

| Series 1 Warrants underlying Units underlying the Unit Purchase Option (6) | – | – | ||||||

| Shares of Common Stock underlying the Series 1 Warrants underlying Units underlying the Unit Purchase Option (3)(7) | $ | 1,518,000.00 | $ | 176.39 | ||||

| Total Registration Fee (8) | $ | 47,462,475.00 | $ | 5,500.01 | ||||

______________

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant. |

| (3) | Estimated solely for purpose of calculating the registration fee pursuant to Rule 457(i) under the Securities Act. |

| (4) | No registration fee required pursuant to Rule 457(i) under the Securities Act. |

| (5) | Pursuant to Rule 416, under the Securities Act the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (6) | No registration fee required pursuant to Rule 457(g) under the Securities Act. |

| (7) | There will be issued a warrant to purchase one share of common stock for every one share offered. The warrants are exercisable at a per share price equal to 125% of the common stock public offering price. |

| (8) | Of the total registration fee of $5,501.01, $1,389.77 was paid previously. |

| (9) | Based upon a fee of $.0001162 per dollar. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting and offer to buy these securities in any jurisdiction where the offer of sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST __, 2015 |

Units – Each Unit Consisting of One Share of Common Stock, One-Half Share of Series AA Convertible Preferred Stock and Four Series 1 Warrants

We are offering by this prospectus units (the “Units”) in a “firm commitment” underwritten offering. Each Unit consists of one share of our common stock, one-half share of our Series AA Convertible Preferred Stock and four Series 1 Warrants. Each one-half share of Series AA Convertible Preferred Stock is convertible at the option of the holder into one share of our common stock. Each Series 1 Warrant is exercisable into one share of our common stock at an exercise price of $ per share. The Units are being offered at a price of $ per Unit.

Each share of our common stock, each one-half share of Series AA Convertible Preferred Stock and each Series 1 Warrant that comprise the Units will automatically separate on the six month anniversary of the date that the Units are originally issued (the “Issuance Date”). However, each share of our common stock, each one-half share of the Series AA Convertible Preferred Stock and each Series 1 Warrant will become separable prior to the expiration of the six-month period if at any time after 30 days from the Issuance Date either (i) the closing price of our common stock on the NYSE MKT is greater than 200% of the Series 1 Warrants exercise price for a period of 20 consecutive trading days (the “Trading Separation Trigger”), (ii) all the Series 1 Warrants in a given Unit are exercised for cash (solely with respect to the Units that include the exercised Series 1 Warrants) (a “Warrant Cash Exercise Trigger”) or (iii) the Units are delisted (the “Delisting Trigger”) from the NYSE MKT for any reason (any such event, a “Separation Trigger Event”). Upon the occurrence of a Separation Trigger Event, the Units will separate: (i) 15 days after the date of the Trading Separation Trigger, (ii) on the date of any Warrant Cash Exercise Trigger (solely with respect to the Units that include the exercised Series 1 Warrants) or (iii) the date of the Delisting Trigger, as the case may be. We refer to the separation of the Units prior to the end of the six-month period after the Issuance Date as an Early Separation.

Each one-half share of Series AA Convertible Preferred Stock will become convertible into common stock on the six month anniversary of the Issuance Date or on the date of such Early Separation. The Series AA Convertible Preferred Stock shall not become convertible upon separation solely as a result of a Warrant Cash Exercise Trigger. In addition, the Series AA Preferred Stock will automatically convert into shares of common stock upon the occurrence of a Fundamental Transaction (as defined herein). The Series 1 Warrants are exercisable upon the separation of the Units, provided that all the Series 1 Warrants in a given Unit may be exercised for cash at any time commencing 30 days after the Issuance Date.

This prospectus also covers the Units and underlying securities issuable upon exercise of the unit purchase option to be issued to the underwriter.

Our securities are not listed on any national securities exchange and there is currently no market for the Units, the Series AA Convertible Preferred Stock or the Series 1 Warrants. Our common stock is currently quoted on the OTCQB marketplace under the symbol “MOBQ.QB.” The last reported per share price for our common stock was $_______, as quoted by the OTCQB marketplace on _______, 2015 after giving retroactive effect to a presumed 1-for-20 reverse stock split to be completed prior to the effectiveness of the registration statement of which this prospectus is a part. We have applied to list the Units and our common stock on the NYSE MKT under the symbol “MOBQU” and “MOBQ”, respectively. No assurance can be given that our application will be approved. We do not intend to list the Series AA Convertible Preferred Stock or the Series 1 Warrants on the NYSE MKT, any other national securities exchange or any other nationally recognized trading system.

INVESTING IN THE UNITS AND THE UNDERLYING SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE __ OF THIS PROSPECTUS FOR A DISCUSSION OF INFORMATION THAT SHOULD BE CONSIDERED IN CONNECTION WITH AN INVESTMENT IN THE UNITS AND THE UNDERLYING SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE UNITS OR THE UNDERLYING SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Unit | Total | |||||||

| Public offering price | $ | $ | 13,000,000 | |||||

| Underwriting discount (1) | $ | $ | 1,040,000 | |||||

| Offering proceeds to us, before expenses | $ | $ | 11,960,000 | |||||

———————

| (1) | The underwriter will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 90 of this prospectus for a description of compensation payable to the underwriter. |

We expect to deliver the Units to investors on or about , 2015. We have granted the underwriter an option for a period of 45 days to purchase up to an additional Units. If the underwriter exercises the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before expenses, will be $ .

Dawson James Securities, Inc.

The date of this prospectus is , 2015

![]()

TABLE OF CONTENTS

| Page | ||||

| PROSPECTUS SUMMARY | 1 | |||

RISK FACTORS |

9 | |||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 19 | |||

| USE OF PROCEEDS | 20 | |||

| MARKET PRICE OF COMMON STOCK | 21 | |||

| DIVIDEND POLICY | 21 | |||

| CAPITALIZATION | 22 | |||

| DILUTION | 23 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 24 | |||

| BUSINESS | 30 | |||

| MANAGEMENT | 36 | |||

| EXECUTIVE AND DIRECTOR COMPENSATION | 42 | |||

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 50 | |||

| PRINCIPAL STOCKHOLDERS | 52 | |||

| DESCRIPTION OF CAPITAL STOCK | 53 | |||

| SHARES ELIGIBLE FOR FUTURE SALE | 55 | |||

| UNDERWRITING | 56 | |||

| LEGAL MATTERS | 60 | |||

| EXPERTS | 60 | |||

| WHERE YOU CAN FIND MORE INFORMATION | 60 | |||

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | F-1 | |||

For investors outside the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

We have not, and the underwriter has not, authorized any other person to provide you with different information than that contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources and on our knowledge of the markets for our services. These data involve a number of assumptions and limitations. We have not independently verified the accuracy of any third party information. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

PROSPECTUS SUMMARY

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. You should carefully read this prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under “Risk Factors” beginning on page 9 and our consolidated financial statements and notes thereto that appear elsewhere in this prospectus.

On November 17, 2014, we held a special meeting of our stockholders to approve authorizing our board of directors to effectuate a reverse stock split in its sole discretion of not less than 1-for-5 and not greater and 1-for-20 for the purpose of attempting to obtain a listing of our common stock on the NYSE MKT. Such approval was obtained, and this prospectus assumes the completion of a reverse stock split in a ratio of 1-for-20 effective , 2015. Unless otherwise indicated, all share and per share amounts in this prospectus including market information, except for the historical consolidated financial statements and notes thereto have been retroactively adjusted to reflect such 1-for-20 reverse stock split.

As used in this prospectus, the terms “we,” “our,” “us,” “Mobiquity Technologies,” or “the company” refer to Mobiquity Technologies, Inc. and its subsidiaries, taken as a whole, unless the context otherwise requires it.

Overview

We own and operate a national location-based mobile advertising network and have developed a consumer-focused proximity network which we believe is unlike any other in the United States. Our integrated suite of proprietary location based mobile advertising technologies allows clients to execute more personalized and contextually relevant experiences, driving brand awareness and incremental revenue in real-time.

Leveraging our agreements with Simon Property Group, Inc. (which we refer to herein as Simon or Simon Property), and Macerich Partnership, L.P. (which we refer to as “Macerich”), the number one and number three mall operators, respectively, in the U.S. in terms of number of Class A properties, we have installed our location-based mobile advertising solutions in the common areas of approximately 295 retail destinations across the U.S. to create “smart malls” using Bluetooth-enabled iBeacon compatible technology. As part of our plan to expand our mall footprint into the common areas of other malls, we recently have also added 27 malls operated by Preit Services, LLC, which we will refer to as “PREIT.” We plan to further expand our mall footprint into the common areas of other malls and outside of malls with additional synergistic venues that will allow for cross marketing opportunities, including venues such as stadiums, arenas, additional college campuses, airports and retail chains. For example, we have entered into an agreement with the New York State University at Stony Brook to deploy a mobile advertising network in their new arena. This type of installation will enable fan engagement, cross-marketing opportunities, sponsorship activation and create interactive event experiences. This will be our first installation in the university market.

We operate through our wholly-owned subsidiaries, Ace Marketing & Promotions, Inc. and Mobiquity Networks, Inc. Ace Marketing is our legacy marketing and promotions business which provides integrated marketing services to our commercial customers. While Ace Marketing currently represents substantially all of our revenue, we anticipate that activity from Ace Marketing will represent a diminishing portion of corporate revenue as our attention is now principally focused on developing and executing on opportunities in our Mobiquity Networks business.

We believe that our Mobiquity Networks business represents our greatest growth opportunity going forward. We believe this business unit is well positioned as a result of our early mover status, exclusive agreements, and novel technology integration to address a rapidly growing segment of the digital advertising market – location based mobile marketing. We expect that Mobiquity Networks will generate the majority of our revenue by the end of 2016 through our MOBI-Beacons Solutions described below, although no assurances can be given in this regard.

Mobiquity Hardware Solutions

Our Mobiquity hardware solutions are currently deployed in retail locations (and in the future may be deployed at other venues such as stadiums, arenas, college campuses and airports) to create the Mobiquity network. Our hardware solutions include Mobi-Units, Mobi-Beacons and Mobi-Tags, which can be used in different combinations as the setting requires.

Mobi-Units utilize both Bluetooth and Wi-Fi to communicate with all mobile devices, including smart phones and feature phones. When our Mobi-Units are in use, consumers have the choice through an opt-in process to receive only desired content and offers. Additionally, through the use of Wi-Fi, consumers can connect to view content and receive special offers.

1

Mobi-Beacons , which utilize Bluetooth LE 4.0 technology, can dramatically enhance the in-app experience through the use of hyper accurate location event data. Our Mobi-Beacons have been developed to meet or exceed all iBeacon standards. Importantly, we have also developed a proprietary method for encrypting and decrypting our beacon signals on a rolling basis to ensure that our beacon network remains fully secure, and exclusively for the beneficial use of our clients.

Mobi-Tags interact with smart phones utilizing quick response codes and near field communication and can promote app downloads, social media engagement and database building.

Although we offer three types of hardware solutions, namely, Mobi-Units, Mobi-Beacons and Mobi-Tags as described above, the most current technology are our Mobi-Beacons and this is the hardware solution that we have deployed throughout the mall network and this is the hardware solution that we intend to recommend to expand to other venues.

Our Single Integrated Platform

Our Mobiquity Platform employs a number of core mobile solutions such as; Bluetooth, Wi-Fi, Near Field Communication and Quick Response Codes in order to engage with nearly 100% of mobile device types. The platform also allows for plug-in solutions to be added to increase our service offerings and add complementary revenue streams. For example, in addition to our advertising network, numerous plug-ins can be added for services such as loyalty programs, indoor mapping and mobile payments. We have developed an online software platform that integrates the hardware and facilitates campaign management and reporting across the installed network. Our clients can use our network to deploy mobile ad campaigns simultaneously across multiple delivery methods, paying a fee per campaign delivered. Alternatively, clients can subscribe to our Location Signal Service to access real-time contextual beacon signals to drive localized in-app user activity. Management believes that no other competitive solution offers a platform that integrates the depth and range of mobile advertising tools combined with a nationally deployed hardware network.

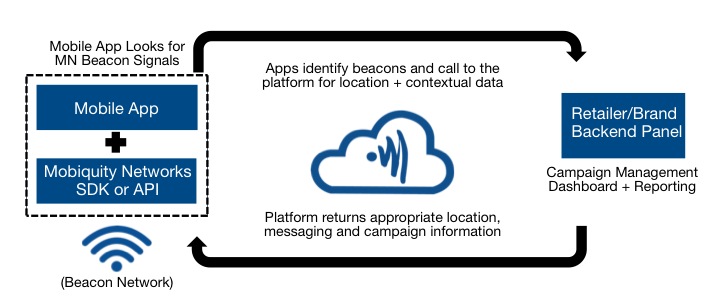

A diagram of our basic network architecture is as follows:

2

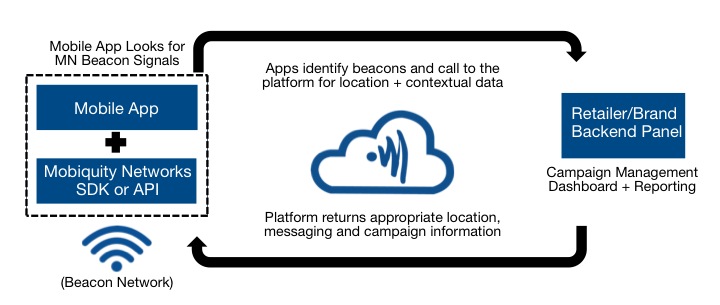

The following graphic depicts a typical mall-shopper engagement from our customers’ viewpoint:

Our Mobiquity Networks business monetizes its network by providing clients with access to our exclusive common-area beacon signals. By incorporating our software development kit (or SDK), the client app (or campaign-specific third party app) can access the beacon signals provided by our network, and leverage those signals plus the associated contextual information provided by our platform to trigger location-based campaign messaging. We plan to generate revenue several ways including by collecting a fee based on the delivery of our customer advertising campaigns, and licensing our location signals.

In order to expand our customer reach and potential app engagement, we have entered into agreements with numerous third party app publishers, including Moviefone, Retale.com, Relevant Solutions and ShopAdvisor, among others. In November 2014, we entered into a partnership agreement with Mobile Roadie, one of the largest mobile app and marketing platforms with clients in over 70 countries. By integrating the Mobiquity Networks SDK with the Mobile Roadie platform, Mobile Roadie clients will have the ability to add beacon campaigns to their existing mobile marketing applications, and will be able to leverage our public beacon network. Mobile Roadie has powered thousands of apps in the Apple App Store and Google Android Market. Mobile Roadie clients will be able to use their platform and our Mobi-Beacons to power the clients’ own private networks in their respective locations. Our relationship with Mobile Roadie and its client base potentially brings significant additional reach to our advertisers. Additionally, the context provided by our network gives shoppers more value as their app experiences are made more expansive and relevant as they shop. Each Mobile Roadie app can potentially be an advertiser or publisher on our network. We are in discussions with numerous other third party app developers, including social media apps, retailer apps, entertainment apps, gaming apps and shopping apps. We will continue to attempt to enter into agreements with other app publishers, as the more apps containing our SDK integration, the greater chance of triggering a beacon engagement for which we get compensated by the advertiser.

Our Agreements with Mall Property Owners/Managers and IBM

Simon Properties

We entered into an initial agreement with Simon Property in April 2011. This agreement was amended in September 2013 and July 2014 to, among other things, expand the number of Simon mall properties covered by the agreement. Pursuant to our agreement with Simon, we have the right, on an exclusive basis, to install Bluetooth proximity marketing equipment to send information across the air space of the common areas of our Simon mall network, which includes approximately 240 malls across the United States. Under a master agreement and related agreements between us and Simon covering approximately 240 Simon malls, Simon is entitled to receive fees from us equal to a minimum fee plus the greater of a pre-set, per mall fee or a percentage of revenues derived from within the Simon mall network as well as certain commission fees based on revenues generated through Simon’s sales efforts. We believe that the revenue share in which Simon participates will exceed the minimum annual mall fees when revenues exceed approximately $14 million dollars. The agreement also provides for Simon to adjust the number of malls subject to the agreement from time to time based upon changes in its beneficial ownership interest in the malls. Our agreement with Simon expires on December 31, 2017. Our agreement with Simon is subject to earlier termination by either us or Simon only following a notice and cure period in the event of a material breach of the agreement.

3

Macerich

In April 2015, we entered into a license agreement with Macerich. Pursuant to our agreement with Macerich, we have the right to install Mobi-Beacons to send information across the air space of the common areas of our Macerich mall network, which will include approximately 55 malls across the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive. Under a license agreement between us and Macerich currently covering 55 malls, Macerich is entitled to receive fees from us equal to a minimum fee plus the greater of a pre-set per mall fee or a percentage of revenues derived from within the Macerich mall network as well as certain commission fees based on revenues generated through Macerich’s sales efforts. We believe that the revenue share in which Macerich participates will exceed the minimum annual mall fees if we generate revenues within the Macerich network of approximately $3 million or more in a calendar year.. The agreement also provides for Macerich to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls. Our agreement with Macerich has a term of three years but is subject to earlier termination (i) with cause following a notice and cure period in the event of material breach of the agreement or (ii) without cause by Macerich after one year on 90 days’ prior written notice to us. In the event of termination of the agreement without cause, Macerich will reimburse us for certain out-of-pocket expenses.

IBM

In April 2015, we entered into a Joint Initiative Agreement with IBM and enrolled as an IBM Business Partner through IBM's PartnerWorld program. We are teaming with IBM to deliver jointly developed solutions for mall-based tenants, including retail clients. These solutions leverage the Mobiquity Networks beacon platform deployed exclusively in the common areas of our mall footprint across the United States, as well as our SDK which can be embedded within mall clients' mobile apps, to deliver relevant content in real time to shoppers' smart phones as they visit these malls. IBM has agreed to work with these clients to provide the analytics solutions needed to deliver personalized, one-on-one content to shoppers through our platform, and to help clients obtain insights from shopper transactions to drive improved customer experience and business performance. IBM services will also provide the integration capabilities needed to combine the Mobiquity Network platform in the mall common areas with the in-store server and network infrastructure, to optimize delivery of context-relevant content for the shopper. Together, our Joint Initiative Agreement with IBM can help their mall clients provide enhanced omni-channel marketing solutions and optimize business results. The agreement has an initial terms of two years and may be extended by agreement of the parties.

PREIT

Pursuant to a master agreement effective August, 2015, we entered into an agreement with PREIT pursuant to which we have the right to install our Mobi-Beacons and to send information across the air space of the common areas of our PREIT mall network, which will include approximately 27 malls in select states in the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive. Under our agreement between us and PREIT, PREIT is entitled to an agreed upon revenue share over the four year term of the agreement. In the event the net revenue share as defined in the agreement is not attained for any measurement period, also as defined in the agreement, either party may terminate the agreement upon 90 days prior written notice. PREIT may also terminate the agreement if it determines that Mobiquity’s installed equipment is not adequate and/or provides a negative user experience for the visitors to the PREIT malls. The agreement also provides for PREIT to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls.

The Mall Network

Through our agreements with Simon, Macerich and PREIT, we have installed or will install our Mobi-Beacons in about 322 shopping malls across the United States. Our agreements with Simon, Macerich and PREIT provide exclusive Bluetooth advertising rights in the common areas of each such malls. Our hardware solutions mesh together to create our network, which according to Simon, provides advertisers the opportunity to reach approximately 2.6 billion annual mall visits with mobile content and offers when they are most receptive to spending, while located in the Simon malls. The 2014 annual report for the International Council of Shopping Centers (ICSC) indicates that shoppers spend on average over $97 per shopping mall visit in 2013, which represents over $250 billion of annual spending. We believe our network provides advertisers the ability to influence a portion of these shoppers who carry smartphones.

3

Mobiquity Advantages

We believe our agreements with Simon, Macerich and PREIT potentially provide us with an advantage over our competitors as it gives us a national network. Our technology allows us the opportunity to reach nearly 100% of mobile device types by utilizing our Mobi-Beacons integrated into a single platform. Our platform monitors and reports hardware activity in real time, manages campaigns, delivers highly targeted content and provides third party access to our Mobiquity network through licensing of our SDK, and the integration of an application program interface. Specifically as it relates to our lead service offering – Location Signals and Campaign Management via Beacons – campaigns require an app that has integrated our SDK in order to engage with our network. The more apps that have integrated the Mobiquity SDK, the more opportunities to engage with mall shoppers in our network. We are carefully selecting app partners that have a relevance to the mall shopping experience and to the mall shopper demographic. For example, the apps of retailers and brands are obvious partners. Additionally, we intend to partner with shopping apps such as coupon distribution platforms, and apps targeting mall-related audiences in fashion and entertainment. Our SDK is currently installed in various mobile retail related apps. We are in various stages of SDK integration with dozens of additional mobile app properties that represent tens of millions of active app users, and we are in negotiations with various venues in regard to network expansion. Management believes that our ability to deliver a significant national audience via a single network is a significant advantage when creating app relationships.

4

Favorable Industry Trends

We believe the demand for location based mobile marketing services represents a large and growing market opportunity. Consumers are increasingly using smartphones and, according to a December 2014 report by IAB Mobile Marketing Center of Excellence, 88% of consumer mobile internet time is spent in apps where we expect to derive the majority of our revenue. According to the blog Asymco, a comScore survey on smartphones shows that the smartphone penetration rate in the U.S. at the end of 2013 was approximately 62.5%, representing 149 million users and is expected to grow to 90% penetration or approximately 230 million users by December 2016.

Importantly, according to eMarketer, mobile ad spending grew 83% from 2013 to 2014 and the trend is expected to continue as the share of advertising spend on mobile is still disproportionately small relative to the amount of time spent by consumers on their mobile devices. A 2014 report by leading venture capital firm Kleiner Perkins reported that 20% of media time is spent on mobile however mobile represented only 4% of total advertising spending share.

Despite the growth in e-commerce, 90% of all purchases are still made in traditional brick and mortar stores according to A.T. Kearney and 75% of Americans visit a mall at least once a month according to JCDecaux. Smartphone devices were estimated to influence $593 billion or 19% of in-store sales in 2013 and are expected to influence $4.5 trillion or 81% of in-store sales by 2018 according to a survey commissioned by Deloitte Consulting LLP. According to a 2014 Holiday Shopping Recap by Adobe Digital Index, 54% of marketers currently use or plan to use beacons in the next 12 to deliver location based content. Finally, BI Intelligence estimates that beacon triggered messages will influence $4.1 billion in store sales by the end of 2015, growing to $44.4 billion by the end of 2016.

We believe these trends will help drive demand for our Mobiquity Networks business as consumers increasingly engage with advertising content on their mobile devices and marketers seek to increase both the share of advertising dollars spent on mobile as well as the use of location technologies to personalize content delivered to consumers.

Our Strategy

Our goal is to enhance the shopper experience with retail customers by providing valuable and relevant content in real-time based on location. We achieve this goal by providing our customers (such as retailers, brands, and the entertainment industry) with a highly targeted form of mobile marketing engagement. Our platform enables interaction and advertising based on time, location and personalization to create the most effective campaigns and experiences possible, in a way that is not possible without our network. We connect customers to brands in the retail space by increasing individual retail location app usage and driving foot traffic to such individual retail locations. We have deployed our Mobi-Beacons in approximately 240 Simon malls and 55 Macerich malls and intend to install our Mobi-Beacons in 27 PREIT malls, in each case in malls across the United States. We intend to utilize the proceeds of this offering to expand our sales and marketing human resource capability to focus on generating revenue over our network. Our sales and marketing team will be seeking to generate revenue over our network through five primary verticals:

| · | Retailers, Brands and Apps relevant to the shopping experience. |

| · | Shopping/Coupon related Apps with relevant offers. |

| · | Entertainment Apps relevant to the shopper demographic. |

| · | Advertising Networks and Exchanges serving location relevant ads. |

| · | Data Analytic and Social Media Apps requesting real-time location based signal. |

We plan to expand on our current footprint into the common areas of other mall operations as well as outside of the malls with additional synergistic venues that will allow for cross marketing opportunities. Such venues include but are not limited to: stadiums, arenas, college campuses, airports and retail chains. The purpose of this type of expansion will be to create a unified network that will allow relevant beacon companies the opportunity to become part of our Mobiquity network. They may find it advantageous to become part of our network, so they will have the ability to drive traffic into their stores. In the future, we may also build a private advertising exchange system that would allow for programmatic buying where advertisers will be given permission to engage with shoppers through our Mobiquity network. Additionally, we plan to add other mobile services and plug-ins such as; loyalty programs, attribution, indoor mapping, security and mobile payments.

5

Sales and Marketing

We have allocated approximately $1.5 million of the net proceeds of this offering to hire additional qualified sales and marketing personnel to generate revenue on our proximity mall network and to hire additional engineers, developers, computer and technology support personnel.

The key elements of our distribution and marketing strategy are as follows:

| · | Direct Sales. Our internal salesforce will call on retailers, brands and relevant advertisers to advertise on the network. |

| · | Resellers. We intend to engage with third parties, such as advertising agencies and out-of-home companies to sell advertising on the network. |

| · | Publishers. We intend to engage with app developers, ad networks, ad exchanges and other companies that have existing relationships with access to a large number of apps to increase our reach and provide an alternative to advertisers with limited app downloads or no app. |

| · | Data Signals. We intend to engage with social media companies, ad networks and ad exchanges to provide real-time location-based data to increase the relevance and value of their in-app ad serving. |

| · | Data Platforms. We intend to engage with data management companies to provide historical location-based data which will enable personalized online, offline and mobile campaigns to targeted audiences. |

Our Proprietary Technology

In March 2013, we formed Mobiquity Networks and Mobiquity Wireless, SLU (or Mobiquity Wireless) in Spain. Mobiquity Wireless then acquired our proximity marketing assets from FuturLink, a Spanish company who had been licensing such assets to us. These assets include, without limitation, the FuturLink technology which consists of patent applications, source codes and trademark(s). The patent applications acquired related to the hardware and associated process for identifying and acquiring connections to mobile devices and the process for delivering select content to users on an opt-in basis. Additionally, significant “know how” was acquired with respect to managing remote hardware across a large physical network. As the technology owner, we will leverage the hardware and software included in our purchase to expand our mall-based footprint in the United States. We believe our acquisition of FuturLink’s technology and corresponding patent applications provided us with the flexibility and autonomy to improve, upgrade and integrate new ideas and cutting edge technologies into our existing platform. This will allow us to evolve as new technologies emerge. To date, none of the patent applications that we have acquired have resulted in the issuance of any patents.

We believe that our intellectual property is a valuable asset to us as we move forward with our technology platform. Since we acquired this technology, we have further developed our ability to manage large networks of hardware to include beacon technology. Additionally, we have expanded campaign management tools to optimize them to meet the demands of our customers. Also, and importantly, we have developed a proprietary method for encrypting and decrypting the beacon signals on a rolling basis to attempt to ensure that our beacon network remains fully secure and exclusively for the beneficial use of our clients.

We believe our intellectual property gives us a lead in the industry with respect to the sophisticated management of large-scale network deployments and campaign management. Most beacon providers focus on single-store applications and we believe such providers are not capable of managing beacons across multiple locations, much less manage a public network that will be accessed by multiple advertisers versus a single retailer. Our network-focused platform approach is a key selling tool when presenting our capabilities to property owners, such as mall developers, who understand the challenges associated with managing a large number of hardware solutions across hundreds of properties.

6

Risks Associated with Our Business

Our business is subject to numerous risks, which are highlighted in the section entitled “Risk Factors” immediately following this prospectus summary. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks are as follows:

| · | we have a history of operating losses and an accumulated deficit of approximately $35.5 million at June 30, 2015 and our auditors have expressed a substantial doubt about our ability to continue as a going concern; | |

| · | our business prospects and future growth could become dependent upon our rights licensing agreement with Simon, our rights agreement with Macerich and our rights agreement with PREIT, each a top mall developer, to create exclusively in the common areas a location-based marketing network called Mobiquity Networks in about 322 malls across the United States. We can provide no assurance that we will be able to comply with all the requirements of either agreement or extend the terms of either agreement. In the event that we lose our rights under either agreement, our business could be materially and adversely harmed. We intend to attempt to expand our mall network footprint into other malls and non-mall venues. We can provide no assurances that we will be able implement our expansion plans; | |

| · | the location-based mobile marketing industry is relatively new and unproven. We will attempt to capitalize on our location-based mobile mall network footprint. We can provide no assurances that we will be able to generate substantial revenues to support our operations or to successfully compete against large, medium and small competitors that are in (or may enter) the proximity marketing industry with substantially larger resources and management experience; | |

| ||

| · | our operations will require substantial additional financing to expand our mall footprint in other malls and in additional synergistic venues and to generally support our operations. The raise of additional required capital following this offering will likely involve substantial dilution to our stockholders. We can also provide no assurances that additional financing will be available to us on favorable terms, if at all; | |

| · | our location-based mobile marketing technology is based upon intellectual property which we originally licensed from an unrelated company and subsequently purchased. Our success will depend upon our ability to have patents issued from patent applications filed in connection with such intellectual property and also to defend our intellectual property rights from challenges or circumvention of our intellectual property rights by third parties. To date, none of the patent applications that we have acquired have resulted in the issuance of any patents; | |

| · | our future performance is materially dependent upon our management (in particular, Dean Julia and Michael Trepeta) and their ability to manage our growth as well as our ability to retain their services. The loss of our key management personnel could have a material adverse effect on our business. If we are unable to manage our expansion successfully and obtain substantial revenues for our location-based mobile mall network and outside of malls in other synergistic venues, the failure to do so could have a material adverse effect on our business, results of operations and financial condition; and | |

| · | substantially all of our revenues to date have been generated by our integrated marketing subsidiary Ace Marketing. This subsidiary faces extensive competition with no company dominating the market in which this subsidiary operates. |

Corporate Information

We were incorporated in New York in March 1998 originally under the name Ace Marketing & Promotions, Inc. and changed our name to Mobiquity Technologies, Inc. in September 2014. At that time, we changed the name of our subsidiary from Ace Marketing, Inc. to Ace Marketing & Promotions, Inc. Our principal executive offices are located at 600 Old Country Road, Ste. 541, Garden City, NY 11530. Our telephone number is (516) 256-7766. Our website address is http://www.mobiquitytechnologies.com. Information contained on our website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus. You should not rely on our website or any such information in making your decision whether or not to purchase our common stock.

“Mobiquity,” “Mobiquity Networks, Inc.,” “Mobiquity Technologies,” “Mobi-Beacons,” “Mobi-Units,” “Mobi-Tags,” “Mobi Rewards,” “Mobi Offers” and “Connecting Fans and Brands” are registered trademarks of Mobiquity Technologies. These service marks, trademarks, and tradenames referred to in this prospectus are the property of their respective owners. Except as set forth above and solely for convenience, the trademarks and tradenames in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

7

THE OFFERING

| Price per Unit | $ per Unit |

Securities offered by us |

Units. Each Unit consists of one share of our common stock, one-half share of our Series AA preferred stock, each convertible into one share of common stock and four Series 1 warrants, each exercisable for one share of common stock. |

Separation of common stock, Series AA Convertible preferred stock and Series 1 Warrants

|

The shares of common stock, the shares of Series AA convertible preferred stock and the Series 1 warrants that comprise the units offered hereby and will trade together as units until the six month anniversary of the Issuance Date at which point they will automatically separate. However the shares of common stock, the shares of AA convertible preferred stock and the Series 1 warrants will become separable prior to the expiration of the six month anniversary if at any time after 30 days from the Issuance Date any of the following separation trigger events occurs.

· The closing price of our common stock on the NYSE MKT is greater than 10% of the Series 1 warrants exercise price for a period of 20 consecutive trading days (the “trading separation trigger”), · All Series 1 warrants in a given Unit are exercised for cash (solely with respect to the Units that include the exercised Series 1 warrants) (a “Warrant Cash Exercise Trigger”) or · The Units are delisted from the NYSE MKT for any reason (the “Listing Trigger”).

Upon the occurrence of a Separation Trigger Event, the shares of common stock, the shares of Series AA convertible preferred stock and the Series 1 Warrants comprising the Units will separate: (i) in the case of the Trading Separation Trigger, on the 15th day after the date of the Trading Separation Trigger; (ii) in the case of a Warrant Cash Exercise Trigger, on the date such Warrant Cash Exercise Trigger if effected, but solely with respect to the Units that include the exercised Series 1 Warrants; and (iii) in the case of the Delisting Trigger, on the date thereof. |

8

| Series AA Convertible Preferred Stock | Each one-half share of Series AA Convertible Preferred Stock will become convertible into one share of common stock on the six month anniversary of the Issuance Date or, on the date of an Early Separation. In addition, the Series AA Preferred Stock will automatically convert into shares of common stock upon the occurrence of a Fundamental Transaction (as defined herein). For additional information, see “Description of Securities.” |

Series 1 Warrants |

Each Series 1 Warrant is exercisable for one share of common stock at an initial cash exercise price of $ per share. In lieu of paying the exercise price in cash, holders may elect a cashless exercise whereby the holder would receive a number of shares of common stock equal to the Black Scholes Value (as defined herein). The Series 1 Warrants are exercisable upon the separation of the Units, provided that all Series 1 Warrants in a given Unit may be exercised for cash at any time commencing 30 days after the Issuance Date. The Series 1 Warrants will expire on the fifth anniversary of the Issuance Date. For additional information, see “Description of Securities.” |

Common Stock to be outstanding before this offering |

3,769,778 shares. |

Securities to be outstanding after this |

shares of common stock, shares of Series AA convertible preferred stock and _________ Series 1 warrants. If the over-allotment option is exercised in full to purchase Units over a period of 45 days, the total number of securities outstanding immediately after the offering would be shares of common stock, shares of Series AA convertible preferred stock and Series 1 warrants. |

| Use of proceeds | Although we will have broad discretion in how we allocate the proceeds of this offering, we intend to use the net proceeds from this offering to make payment of fees to secure and maintain our existing mall rights, to hire additional personnel for sales and marketing and human resources, to repay certain indebtedness, and for working capital and other general corporate purposes. See “Use of Proceeds.” |

| Risk factors | See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in shares of our common stock. |

|

Lock-up provisions |

We and our directors, executive officers and certain stockholders have agreed with the underwriter, subject to specific exceptions, not to sell or transfer any common shares or securities convertible into or exercisable for common shares for a period of up to three months after the date of the prospectus. See “Underwriting.” |

| Proposed Symbol and Listing | We have applied to list our common stock and Units on the NYSE MKT, subject to notice of issuance, and such listing is expected to commence following the effectiveness of the registration statement of which this prospectus forms a part. We do not intend to list the Series AA convertible preferred stock of the Series 1 Warrants on the NYSE MKT, any other national securities exchange or any other nationally recognized trading system. |

9

Unless we indicate otherwise, all information in this prospectus, except for the consolidated financial statements and notes thereto and selected financial data extracted therefrom:

| · | reflects a 1-for-20 reverse stock split of our common shares effective ___________, 2015 and the corresponding adjustment of all share prices, all stock option and warrant exercise price per common share and all convertible note conversion prices per share; | |

| · | is based on 3,769,778 common shares issued and outstanding as of the date of this prospectus; | |

| · | excludes up to ____________ shares of common stock underlying the shares of Series AA Convertible Preferred Stock and the Series 1 Warrants comprising the Units offered hereby (assuming the Series 1 Warrants are exercised for cash); | |

| · | excludes up to __________ shares of common stock underlying the ____________ Units included in the unit purchase option to be issued to the representative of the underwriters in connection with this offering (assuming the underlying shares of Series AA Convertible Preferred Stock are converted and the Series 1 Warrants included in such Units are exercised for cash); | |

| · | excludes 1,672,279 common shares issuable upon exercise of outstanding warrants to purchase our common shares with a weighted average exercise price of approximately ______ per share as of the date of this prospectus; | |

| · | excludes 942,000 common shares issuable upon exercise of outstanding options to purchase our common shares with a weighted average exercise price of approximately $8.00 per share as of the date of this prospectus; | |

| · | excludes 25,000 common shares issuable upon conversion of outstanding convertible notes at a minimum of $10.00 per share, 53,667 shares issuable upon conversion of notes at $6.00 per share and 450,000 shares issuable upon conversion of $2.7 million of letters of credit provided on our behalf by third parties, convertible at $6.00 per share; | |

| · | excludes up to 8,334 shares of common stock and warrants to purchase up to 2,500 shares of common stock at an exercise price of $10 per share pursuant to the terms of a $50,000 convertible note issued on December 29, 2014, noting that the foregoing amounts do not include the possible issuance of shares upon conversion of accrued interest due and payable on said note; | |

| · | excludes up to 558,334 shares of common stock and warrants to purchase up to 167,500 shares of common stock at $10 per share issuable upon conversion of notes in the principal amount of $3,350,000 at $6 per share, noting the foregoing amounts do not include the possible issuance of additional shares upon conversion of accrued interest due and payable on said notes; | |

| · | excludes up to 100,834 shares of common stock issuable upon conversion of debt in the principal amount of $605,000, noting the foregoing amounts do not include the possible issuance of additional shares upon conversion of accrued interest due and payable on said notes or the possible conversion of the $605,000 into securities on the same terms as those securities sold in this offering; and | |

| · | assumes no exercise by the underwriter of its option to purchase up to an additional Units to cover over-allotments, if any. |

10

SUMMARY CONSOLIDATED FINANCIAL DATA

The consolidated statements of operations data for the quarter ended June 30, 2015 and 2014 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future. You should read this information together with our financial statements and related notes appearing elsewhere in this prospectus and the information under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Three Months Ended June 30, | Six Months Ended June 30 | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| In thousands except share and per share amounts | In thousands except share and per share amounts | |||||||||||||||

| Consolidated Statements of Operations Data: | ||||||||||||||||

| Revenues, net | $ | 572 | $ | 929 | $ | 1,087 | $ | 1,559 | ||||||||

| Cost of revenues | 431 | 743 | 868 | 1,249 | ||||||||||||

| Gross Profit | 141 | 185 | 219 | 310 | ||||||||||||

| Operating Expenses | 2,984 | 2,090 | 5,563 | 4,553 | ||||||||||||

| Loss from operations | (2,843 | ) | (1,905 | ) | (5,344 | ) | (4,243 | ) | ||||||||

| Total Other income (expense) | (98 | ) | (13 | ) | (177 | ) | (23 | ) | ||||||||

| Net loss | (2,942 | ) | (1,918 | ) | (5,521 | ) | (4,267 | ) | ||||||||

| Other Comprehensive Income (Loss) | (6 | ) | 5 | (6 | ) | (1 | ) | |||||||||

| Net Comprehensive Loss | (2,948 | ) | (1,914 | ) | (5,527 | ) | (4,268 | ) | ||||||||

Please refer to Notes to our consolidated financial statements for an explanation of the method used to calculate the historical net loss per share attributable to common stockholders and the number of shares used in the computation of the per share amounts.

| As of June 30, 2015 | ||||||||

| Actual | As Adjusted(1) | |||||||

| (In thousands) | ||||||||

| Consolidated Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 1,446 | $ | |||||

| Working capital | ||||||||

| Total assets | 2,357 | |||||||

| Long-term liabilities | 3,934 | |||||||

| Accumulated deficit | (35,533 | ) | ||||||

| Total stockholders’ equity (deficit) | (2,661 | ) | ||||||

________________

| (1) | The as adjusted consolidated balance sheet data in the table above gives effect to the post June 30, 2015 receipt of net proceeds of $___________ based upon sale by us of Units offered by this prospectus at a public offering price of $ per Unit and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The table also assumes that the underwriter’s over-allotment option is not exercised and it does not give effect to the application of the net proceeds of the offering. This column gives effect to the sale after June 30, 2015 of $_________ in net proceeds from the sale of promissory notes in the principal amount of $__________ in August 2015. |

11

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding to invest in our company or deciding to maintain or increase your investment, you should consider carefully the risks and uncertainties described below, together with all information in this prospectus, including our consolidated financial statements and related notes. If one or more of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price for our Units or common stock could decline and you may lose your investment.

Risks Relating To Our Business

We have a history of operating losses and may not in the future generate consistent revenues or profits. Since our inception, we have experienced a continued history of operating losses and an accumulated deficit of $35,532,738 as of June 30, 2015 and an accumulated deficit of $30,011,866 as of December 31, 2014. For the six months ended June 30, 2015 and for the years ended December 31, 2014 and 2013, we incurred a net loss of $5,520,872, $10,506,099 and $6,088,733, respectively. Our operating losses for the past several years are primarily attributable to the transformation of our company into an advertising technology corporation. Our Mobiquity Network subsidiary has no revenues from its operations in the sixth months ended June 30, 2015. We can provide no assurances that our operations will generate consistent or predictable revenue or be profitable in the future. This is particularly the case as we are shifting our business emphasis to focus on our Proximity Marketing business.

We are shifting our business from our legacy marketing and promotion business to our Mobiquity Networks integrated suite of proprietary location-based mobile advertising technologies, the success of which cannot be assured. Further, our Mobiquity Networks’ business may be subject to quarterly fluctuations in its operating results due to the seasonality of mall-based business. We operate through our wholly-owned subsidiaries, Ace Marketing & Promotions, Inc. and Mobiquity Networks, Inc. Ace Marketing is our legacy marketing and promotions business which provides integrated marketing services to our commercial customers. While Ace Marketing currently represents substantially all of our revenue, we anticipate that activity from Ace Marketing will represent a diminishing portion of corporate revenue as our attention is now principally focused on developing and executing on opportunities in our Mobiquity Networks business. We believe that our Mobiquity Networks business represents our growth opportunity going forward and that this business unit is positioned as a result of our early mover status and novel technology integration to address a growing segment of the digital advertising market – location based mobile marketing. We expect that Mobiquity Networks will generate the majority of our revenue by the end of 2016, although no assurances can be given in this regard. Further, we can provide no assurances that the implementation of our Mobiquity Networks’ business will meet our expectations in terms of generating a certain amount of revenue by a certain year. Also, the operating results of our Mobiquity Networks’ business may fluctuate quarterly due to the seasonality of mall-based businesses.

We cannot accurately predict the volume or timing of any future revenues. We may be unable to capture revenue from our new Mobiquity business in the manner in which we anticipate and we may incur substantial expenses and devote significant management effort and expense in developing customer adoption of our Mobiquity solution, which may not result in revenue generation. As such, we cannot accurately predict the volume or timing of any future revenues.

Our auditors have expressed a substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming our company will continue as a going concern. Our continued existence is dependent upon our ability to obtain additional debt and/or equity financing to advance its new technology revenue stream. We have incurred net losses for the six months ended June 30, 2015 and for the years ending December 31, 2014 and 2013 of $5,520,872, $10,506,099 and $6,088,733, respectively. As of June 30, 2015 and December 31, 2014, we had an accumulated deficit of $35,532,738 and $30,011,866. We have had negative cash flows from operating activities of $4,269,034, $5,878,741 and $3,693,898 for the six months ended June 30, 2015 and for the years ending December 31, 2014 and 2013, respectively. These factors raise substantial doubt concerning our ability to continue as a going concern.

Our business may become dependent on our agreement with Simon Property, which agreement expires on December 31, 2017. In April 2011, we entered into our agreement with Simon Property, a leading mall developer, which agreement was amended first in September 2013 and secondly in July 2014. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with Simon Property to execute on the development of our Proximity Marketing business and to attempt to achieve profitable operations. We have signed an agreement with Simon Property to create Mobiquity Networks in about 240 of their malls. This agreement expires on December 31, 2017. There is a risk that our agreement with Simon Property will not be extended beyond its original terms by Simon Property or that our operations will not be profitable. Also, our agreement with Simon Property requires us to maintain for each calendar year under said agreement the minimum amount of fees under irrevocable standby letters of credit. For 2015, a non-affiliated stockholder and Thomas Arnost, our Executive Chairman, each provided the necessary letters of credit totaling $2,700,000 with one-half coming from each party. Also, each person who issued the letter of credit is receiving quarterly, while the letters of credit are outstanding, options to purchase 6,250 shares of our common stock, exercisable at the prevailing market price per share on the date of grant and interest at the rate of 8% per annum on the monies that they have had to set aside in their bank accounts and are unable to have access as a result of the letters of credit. In the event Simon Property finds it necessary to draw down on the letter(s) of credit, we have 30 days to obtain satisfactory replacement letters of credit. We can provide no assurance that we will be able to maintain the necessary letters of credit as required by the agreement. In the event of a default under our agreement with Simon Property, which is not cured within 30 days of notice of such breach, Simon Property may commence an action for damages or other appropriate relief and/or terminate the agreement. If we were to lose our agreement with Simon Property for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

| 12 |

Our business may also become dependent upon our agreement with Macerich, which agreement expires in April 2018. In April 2015, we entered into an agreement with Macerich, a leading mall developer. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with Macerich to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with Macerich to create Mobiquity Networks in about 55 of their malls. There is a risk that our agreement with Macerich will not be extended beyond its original terms by Macerich or that our operations will not be profitable. Our agreement with Macerich has a term of three years expiring in April 2018, but is subject to earlier termination (i) with cause following a notice and cure period in the event of material breach of the agreement, (ii) in the event the Macerich mall properties are sold, or (iii) without cause by Macerich after one year. If we were to lose our agreement with Macerich, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

Our business may also become dependent upon our agreement with PREIT, which agreement expires in 2019. In 2015, we entered into an agreement with PREIT, a leading mall developer. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with PREIT to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with PREIT to create Mobiquity Networks in about 27 of their malls. There is a risk that our agreement with PREIT will not be extended beyond its original terms by PREIT or that our operations will not be profitable. Our agreement with PREIT has a term of four years expiring in 2019, but is subject to earlier termination in the event of (i) a material breach of the agreement, (ii) in the event certain net revenue thresholds are not met for any measurement period, in each case as defined in the agreement, (iii) in the event of a sale of the mall premises, or (iv) if PREIT determines that our Mobi-Beacons or app is not adequate and/or otherwise provides a negative user experience for the visitors to the PREIT malls. If we were to lose our agreement with PREIT, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

We may be unable to realize the benefits of our agreement with IBM. In April 2015, we entered into a Joint Initiative Agreement with IBM and enrolled as an IBM Business Partner through IBM's PartnerWorld program. We are teaming with IBM to deliver jointly developed solutions for mall-based tenants, including retail clients. These solutions leverage the Mobiquity Networks beacon platform deployed exclusively in the common areas of our mall footprint across the United States, as well as our SDK which can be embedded within mall clients' mobile apps, to deliver relevant content in real time to shoppers' smart phones as they visit these malls. IBM has agreed to work with these clients to provide the analytics solutions needed to deliver personalized, one-on-one content to shoppers through Mobiquity's platform, and to help clients obtain insights from shopper transactions to drive improved customer experience and business performance. IBM services will also provide the integration capabilities needed to combine the Mobiquity Network platform in the mall common areas with the in-store server and network infrastructure, to optimize delivery of context-relevant content for the shopper. However, there is a risk that we may be unable to realize the benefits of this agreement, and a further risk that our agreement with IBM may not result in revenue generating or profitable operations of our company.

The reach of our Mobi-Beacons is dependent upon our successful integration of our SDK into various mobile applications (or apps) to allow us to communicate with our targeted audience. For us to create substantial revenues from our Mobi-Beacons, we are dependent upon entering into agreements with mobile application publishers to expand our targeted audience similar to the agreements described under “Business – Our Single Integrated Platform,” Our Mobi-Beacons communicate with our SDK which will be embedded into apps pursuant to agreements we negotiate with app publishers. The greater the number of publisher apps into which our SDK is embedded, the greater the chance of triggering a beacon engagement for which we get compensated by advertisers. We currently have entered into agreements with a limited number of third party app publishers. There is a risk that we will be unable to expand our third party publisher network on terms satisfactory to us, or at all, and if we are unable to do so, our results of operations and overall business prospects would suffer.

The location-based mobile marketing industry is relatively new and our competition may become extensive. In 2008, we became an authorized distributor, provider and reseller in the United States of mobile advertising solutions, in the location-based mobile advertising industry. In March 2013, we purchased the mobile advertising technology from our licensor. In 2011, we started transforming our company into a location-based mobile mall marketing enterprise with the formation of our Mobiquity Networks subsidiary. Currently, we have not generated significant revenue from this new and unproven segment of our business as our proximity marketing revenues totaled $-0-, $149,500 and $162,500 for the six months ended June 30, 2015 and for the years ended December 31, 2014 and 2013, respectively. While we intend to market our Mobiquity devices as a differentiated and advantageous mobile technology to attempt to capitalize on our location-based mobile mall network footprint, there is a risk that we will be unable to expand this business or generate substantial advertising revenues to support operations. Moreover, there is a risk that our location-based mobile mall network will be unable to compete with large, medium and small competitors that are in (or may enter) the proximity marketing industry with substantially larger resources and management experience. If our Mobiquity technology is unsuccessful for any reason in the marketplace, our business would be substantially harmed.

| 13 |

We expect to derive substantially all of our future revenues from our principal technology, which leaves us subject to the risk of reliance on such technology. Further, our principal technology is subject to pending patent applications which could be rejected by the United States Patent and Trademark Office. We expect to derive substantially all of our future revenues from our Mobiquity location-based mobile advertising technology. As such, any factor adversely affecting our ability to offer and implement our solution to new customers, including regulatory issues, market acceptance, competition, performance and reliability, reputation, price competition and economic and market conditions, would likely harm our operating results. Also, we may be unable to develop our principal technology, which would also harm our operating results. Moreover, in spite of our efforts related to the registration of our technology with the United States Patent and Trademark Office, if patent protection is not available for our principal technology because of rejection of our patent applications, the viability of our Mobiquity offering would likely be adversely impacted to a significant degree, which would materially impair our business prospects and results of operations.

If our Mobiquity technology fails to satisfy current or future customer requirements, we may be required to make significant expenditures to redesign the technology, and we may have insufficient resources to do so. Our Mobiquity technology is designed to address an evolving marketplace and must comply with current and evolving customer requirements in order to gain market acceptance. There is a risk that we will not meet anticipated customer requirements or desires, including those of our key property licensor, Simon Property Group. If we are required to redesign our technologies to address customer demands or otherwise modify our business model, we may incur significant unanticipated expenses and losses, and we may be left with insufficient resources to engage in such activities. If we are unable to redesign our technology, develop new technology or modify our business model to meet customer desires or any other customer requirements that may emerge, our operating results would be materially and adversely affected.

If we fail to respond quickly to technological developments, our service may become uncompetitive and obsolete. The location-based mobile advertising market in which we plan to compete are expected to experience rapid technology developments, changes in industry standards, changes in customer requirements and frequent new improvements. If we are unable to respond quickly to these developments, we may lose competitive position, and our technologies may become uncompetitive or obsolete, causing revenues and operating results to suffer. In order to compete, we may be required to develop or acquire new technology and improve our existing technology and processes on a schedule that keeps pace with technological developments. We must also be able to support a range of changing customer preferences. For instance, our shopping mall customers may have different requirements from universities or other users of our technology and solution, and thus we may be required to adopt our platform to accommodate the different customers. We cannot guarantee that we will be successful in any manner in these efforts.

We cannot predict our future capital needs and we may not be able to secure additional financing. Between January 2013 and August 2015, we raised over $15 million in private equity and debt financing to support our transformation from an integrated marketing company to an advertising technology company. Since we might be unable to generate recurring or predictable revenue or cash flow to fund our operations, we will likely need to seek additional (perhaps substantial) equity or debt financing even following this offering to provide the capital required to maintain or expand our operations. We may also need additional funding for developing products and services, increasing our sales and marketing capabilities, promoting brand identity, and acquiring complementary companies, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. We cannot predict our future capital needs with precision, and we may not be able to secure additional financing on terms satisfactory to us, if at all, which could lead to termination of our business.

When we elect to raise additional funds or additional funds are required, we may raise such funds from time to time through public or private equity offerings, debt financings or other financing alternatives, as well as through sales of common stock to Aspire Capital under the purchase agreement which we intend to terminate upon the completion of this offering. Additional equity or debt financing may not be available on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing operational development and commercialization efforts and our ability to generate revenues and achieve or sustain profitability will be substantially harmed.