Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SoulCycle Inc. | d844646dex991.htm |

| EX-23.1 - EX-23.1 - SoulCycle Inc. | d844646dex231.htm |

| EX-99.4 - EX-99.4 - SoulCycle Inc. | d844646dex994.htm |

| EX-99.6 - EX-99.6 - SoulCycle Inc. | d844646dex996.htm |

| EX-99.5 - EX-99.5 - SoulCycle Inc. | d844646dex995.htm |

| EX-99.2 - EX-99.2 - SoulCycle Inc. | d844646dex992.htm |

| EX-99.3 - EX-99.3 - SoulCycle Inc. | d844646dex993.htm |

| EX-21.1 - EX-21.1 - SoulCycle Inc. | d844646dex211.htm |

| EX-10.22 - EX-10.22 - SoulCycle Inc. | d844646dex1022.htm |

| EX-10.21 - EX-10.21 - SoulCycle Inc. | d844646dex1021.htm |

Table of Contents

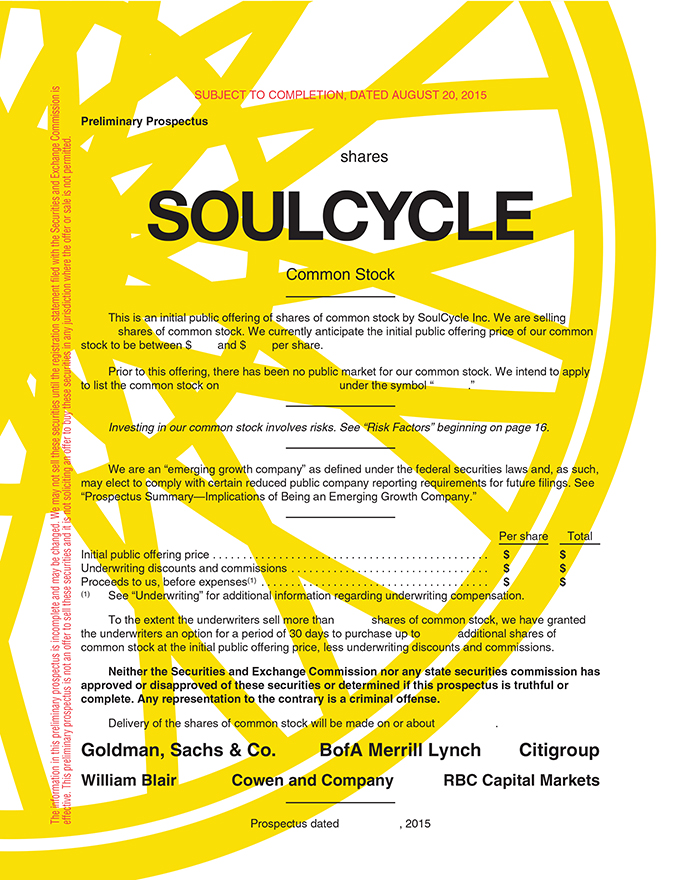

As filed with the Securities and Exchange Commission on August 20, 2015

Registration Statement No. 333-205951

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SoulCycle Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7997 | 47-4018466 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

609 Greenwich Street

New York, NY 10014

(212) 787-7685

(Address, including zip code, and telephone number, including area code, of Registrants’ principal executive offices)

Melanie Whelan

Chief Executive Officer

SoulCycle Inc.

609 Greenwich Street

New York, NY 10014

(212) 787-7685

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael L. Zuppone, Esq. Paul Hastings LLP 75 East 55th Street New York, NY 10022 (212) 318-6000 Facsimile: (212) 319-4090 |

Robert E. Buckholz, Esq. Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 (212) 558-4000 Facsimile: (212) 558-3588 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b- 2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer ¨ | ||||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| 1 | ||||

| 16 | ||||

| 33 | ||||

| 35 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 | |||

| 68 | ||||

| 77 | ||||

| 82 | ||||

| 90 | ||||

| 97 | ||||

| 100 | ||||

| 105 | ||||

| Certain Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

108 | |||

| 112 | ||||

| 115 | ||||

| 118 | ||||

| 118 | ||||

| 118 | ||||

| F-1 |

We have not authorized anyone to provide you with information different from that contained in this prospectus or in any free writing prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Persons who come into possession of this prospectus and any such free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

SoulCycle, the SoulCycle Wheel and our respective designs, logos and phrases, among others, are our trademarks and/or registered trademarks under applicable intellectual property laws. Solely for convenience, we refer to our trademarks in this prospectus without the ™ and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Unless otherwise indicated, all other trademarks and trade names appearing in this prospectus are the property of their respective owners. It should be noted that we have registered our marks domestically and abroad as provided herein (with other various applications pending); and we vigilantly protect and defend our intellectual property rights domestically and abroad.

i

Table of Contents

Note Regarding Formation Transactions and Basis of Presentation

We previously effected, and prior to the completion of this offering we will have effected, certain transactions which are referred to in this prospectus as the Formation Transactions. See “The Formation Transactions.” Unless otherwise stated, or the context otherwise requires, all information in this prospectus reflects the consummation of the Formation Transactions and the completion of this offering. As part of the Formation Transactions:

| • | On May 15, 2015, our predecessor, SoulCycle Holdings, LLC redeemed common units representing 25% of the then outstanding interests in our predecessor, and our predecessor converted into a corporation named SoulCycle Inc. As a result, Equinox Holdings, Inc., which we refer to in this prospectus as Equinox or EHI, correspondingly increased its ownership of SoulCycle Inc., as the successor upon the conversion, to 97% of the outstanding shares of our common stock, which it held through a wholly owned subsidiary, SoulCycle Intermediate Holdings LLC, or SIH, newly formed in connection with the transaction. |

| • | Prior to the completion of this offering, our amended and restated certificate of incorporation will become effective and will effect a recapitalization of our common stock into a single class of common stock and a for stock split. |

In addition, prior to the completion of this offering, EHI and its direct and indirect parents will effect successive distributions in kind of 100% of the membership interests in SIH to the indirect owners of EHI in order to spin off and separate SoulCycle Inc. from EHI.

SoulCycle Holdings, LLC and its consolidated subsidiaries, or SCH, is the predecessor of the issuer, SoulCycle Inc. and its consolidated subsidiaries, or SCI, for financial reporting purposes. From the date of the conversion, May 15, 2015, forward, SCI is the financial reporting entity. Accordingly, the historical consolidated financial information included in this prospectus is that of SCH for the periods ended December 31, 2014, 2013 and 2012. For the period ended June 30, 2015, the financial information combines the results of SCH for the 135 day period ended May 15, 2015 and the results of SCI for the 46 day period from inception through June 30, 2015.

See “The Formation Transactions” and “Certain Relationships and Related Party Transactions” for a description of the foregoing transactions.

ii

Table of Contents

DEFINITIONS

| • | Classes: classes include each completed class held at a studio in any period. |

| • | Existing studios: existing studios are studios that have been open for more than 12 months for any period. |

| • | New studios: new studios are studios that have been open for 12 months or less for any period. |

| • | Payback period: payback period is calculated as a proxy for the length of time required to recover the initial investment in a studio and is calculated by dividing the total cost to open a new studio by its cumulative Studio Contribution. |

| • | Rides: rides include each rider’s attendance at a class for which a studio fee was paid in any period. |

| • | Rides per day: rides per day is calculated by dividing the total number of paying rides by calendar days in the time period. This metric is used to analyze studio growth more accurately when comparing to timeframes that include more or fewer days. |

| • | Same studio sales: same studio sales is defined as, for any reporting period, sales for the comparable studio base, which we define as the number of studios opened longer than 12 months. Our same studio sales calculation excludes any studios closed for renovations, breakage revenue, our online retail sales and our one-time promotional warehouse sale in 2014. |

NON-GAAP FINANCIAL MEASURES

Certain financial measures used in this prospectus, such as EBITDA, Adjusted EBITDA and Studio Contribution, are not recognized under generally accepted accounting principles or “GAAP.” We define those and other non-GAAP terms as follows:

| • | “Free Cash Flows” is defined as cash generated from operating cash flows less capital expenditures. |

| • | “EBITDA” is defined as net income before depreciation and amortization, interest expense and provision for (benefit from) income taxes. |

| • | “Adjusted EBITDA” and “Adjusted EBITDA Margin” are supplemental measures of our performance and are also the basis for performance evaluation under our executive compensation programs. Adjusted EBITDA is defined as net income before depreciation and amortization, interest expense and provision for (benefit from) income taxes, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include, among other things, share-based compensation expense and non-cash deferred rent charges, excluding amortization of landlord contributions. “Adjusted EBITDA Margin” is defined as, for any period, the Adjusted EBITDA for that period divided by the revenue for that period. We believe that Adjusted EBITDA and Adjusted EBITDA Margin are appropriate measures of operating performance because they eliminate the impact of expenses that do not relate to business performance. |

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are included in this prospectus because they are key metrics used by management and our board of directors to assess our financial performance. EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are frequently used by analysts, investors and other interested parties to evaluate companies in our industry.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not GAAP measures of our financial performance or liquidity and should not be considered as alternatives to net income as measures of financial performance, or cash flows from operations as measures of liquidity or any other performance measure derived in accordance with GAAP. Adjusted EBITDA and Adjusted EBITDA Margin should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do

iii

Table of Contents

not reflect tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future, including, among other things, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as supplemental measures. Our measures of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation.

| • | “Studio Contribution” is defined as, Adjusted EBITDA, less corporate expenses in Adjusted EBITDA, including compensation for corporate employees, rent and occupancy for corporate headquarters and general and administrative expenses related to our corporate overhead. “Studio Contribution Margin” is defined as, for any period, the Studio Contribution for that period, divided by the total revenue for that period. Studio Contribution and Studio Contribution Margin are supplemental measures of operating performance of our studios and our calculations thereof may not be comparable to similar measures reported by other companies. Studio Contribution and Studio Contribution Margin have limitations as analytical tools and should not be considered as substitutes for analysis of our results as reported under GAAP. We believe that Studio Contribution and Studio Contribution Margin are important measures to evaluate the performance and profitability of each studio, individually and in the aggregate. We also use Studio Contribution and Studio Contribution Margin information to benchmark our performance versus competitors. |

For a reconciliation of net income and income from operations to EBITDA, Adjusted EBITDA and Studio Contribution, each non-GAAP measures, see “Selected Consolidated Financial Data” in this prospectus.

iv

Table of Contents

This summary highlights certain significant information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus, including the section entitled “Risk Factors” and our consolidated financial statements and related notes, before you decide whether to invest in our common stock. If you invest in our common stock, you are assuming a high degree of risk. See the section entitled “Risk Factors.” References to “we,” “our,” “our company,” “us,” “the company” and “SoulCycle,” refer to SoulCycle Holdings, LLC and its consolidated subsidiaries with respect to periods prior to completion of the conversion transaction described herein and SoulCycle Inc. and its consolidated subsidiaries with respect to the period following completion of the conversion into a corporation on May 15, 2015.

Our Company

SoulCycle is a rapidly growing lifestyle brand that strives to empower our riders in an immersive fitness experience. Our founders, Elizabeth Cutler and Julie Rice, were introduced at a lunch ten years ago and quickly realized they shared a similar vision about the changing role of fitness in our society of over-programmed, always-connected consumers. Traditionally, exercise was viewed as a chore, a box that needed to be checked. We believe that fitness should be joyful, inspiring and help people connect with their true and best selves.

What started as a single, 31-bike indoor cycling studio on the Upper West Side of New York City has transformed into a high growth lifestyle brand that, as of June 30, 2015, comprised a community of over 324,000 unique riders in 44 studios across the United States and with social media followers around the world. We believe SoulCycle is leading the global trend towards healthy living and a lifelong quest for meaning, wellness and personal growth.

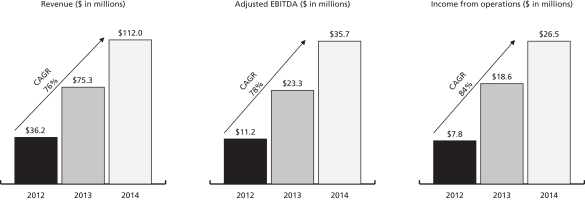

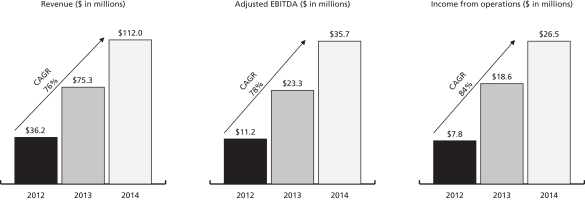

Our community’s passion for our brand has helped us to deliver strong financial and operating performance, as illustrated by the following:

| • | Expanded studio count from 12 studios in 2012 to 36 studios in 2014, representing a compounded annual growth rate “CAGR” of 73%; |

| • | Increased classes conducted and rides from approximately 25,000 and 969,000 in 2012 to over 81,000 classes and 2.9 million rides in 2014; |

| • | Expanded total revenue from $36.2 million in 2012 to $112.0 million in 2014, representing a CAGR of 76%; |

| • | Increased Adjusted EBITDA from $11.2 million in 2012 to $35.7 million in 2014, representing a CAGR of 78% and an Adjusted EBITDA Margin of 32% in 2014; and |

| • | Increased income from operations from $7.8 million in 2012 to $26.5 million in 2014. |

1

Table of Contents

For a reconciliation of income from operations to Adjusted EBITDA, a non-GAAP measure, see “Selected Consolidated Financial Data” in this prospectus.

Our Soul

We Aspire to Inspire. Our mission is to bring Soul to the people. SoulCycle instructors guide riders through an inspirational, meditative fitness experience designed to benefit the body, mind and soul. Set in a dark, candlelit room to high-energy music, our riders move in unison as a pack to the beat, and follow the cues and choreography of the instructor. The experience is tribal. It is primal. And it is fun.

Our classes follow a signature format, yet every SoulCycle experience is unique. Produced to engage every single rider, each carefully curated “cardio party” is fueled by the personalities of our instructors, their uniquely crafted musical playlists and the energy of the room. The signature class includes approximately 35–40 minutes of riding, a five to eight minute upper-body strength series using hand weights and a three minute cool-down stretch. During the class, the instructor leads the rider on an emotional journey that runs parallel to the physical workout. We believe the combination of the physical, musical and emotional aspects of the ride leaves riders inspired and connected to both the brand and the community. Based on the impact we’ve had on our riders’ physical and mental well-being, we believe SoulCycle is more than a business, it’s a movement.

Your Soul Matters. We are a “culture of yes.” Our core values are service and hospitality. We believe every ride matters; every rider matters. All of our employees complete initial, as well as ongoing, hospitality training at our “Soul University” to ensure exceptional service across the organization. We empower our managers to treat their studio as their own business and believe this helps foster the entrepreneurial culture upon which we were founded. We care, we work hard and we work together as a team. We encourage our teams to ride as much as they can, as we believe that motivated, engaged and well-trained employees are the key to cultivating our rider communities. We invest considerably in celebrating our teams through programs (such as weekly “SOULccolade”) that reward hard work, creativity, resourcefulness and actions that embody the culture and spirit of our brand.

Pack. Tribe. Community. At SoulCycle, our riders feed off the group’s shared energy and motivation to push themselves to their greatest potential. In becoming part of our community, our riders are instilled with greater awareness of not only their bodies but also their emotions. We believe this awareness leads to healthier decisions, relationships and lives. We are not a business that values only transactions, rather we create a community that cultivates and sustains relationships. Our immersive culture of inspiration and empowerment contributes to the engaged and connected rider base in each of our studios.

2

Table of Contents

What Sets SoulCycle Apart

We believe the following strengths define our lifestyle brand positioning and are key drivers of our success:

Our SOUL: An aspirational lifestyle brand. Great brands often begin with an authentic and powerful origin story, and at SoulCycle, we created a radically innovative business that has resonated with consumers and the press since day one. We believe SoulCycle ignited the boutique fitness category and remains the industry’s defining brand as demonstrated by the number of rides and our riders’ engagement with our brand.

From the beginning, SoulCycle has attracted a following that includes business leaders, social influencers and celebrities who were drawn to the idea of an elevated, meditative fitness experience. The explosive growth of our brand is fueled by an ever-expanding core of passionate fans who develop a powerful, emotional connection to SoulCycle and are proud to act as Soul evangelists spreading the word to friends, family and followers. We believe the distinctive SoulCycle experience creates passion and loyalty and generates tremendous word-of-mouth brand awareness, fueling our growth.

Our riders arrive early and stay after class to socialize with their fellow riders, the studio teams and instructors. Riders voraciously consume, comment on and share content from our blog and social media channels. SoulCycle apparel has become the uniform of choice both inside and outside the studios. Our silver retail bags can be seen in airports, on street corners and in households across the country. We do not have a target demographic because at SoulCycle, ANYONE can be an Athlete, a Legend, a Warrior, a Renegade or a Rockstar. It is the place people come, regardless of their age, athletic ability, size, shape, profession or personality, to connect with their best selves.

In 2014, SoulCycle had over 10,000 unsolicited print and online press placements across local and national news outlets, including publications ranging from The New York Times and The Wall Street Journal to current events and fashion periodicals such as Vanity Fair and Vogue. Furthermore, SoulCycle was included in television programs covering topics ranging from news to pop culture with features in The Colbert Report, The Tonight Show Starring Jimmy Fallon and the prime time show NCIS.

We have been recognized as being an innovative force both within our industry and beyond, including our being voted one of the World’s Top 10 Most Innovative Companies in Fitness by Fast Company in 2013, and rated the sixth most influential brand on Twitter at the most recent Consumer Electronics Show.

We believe our riders’ engagement with our brand will continue to attract new riders and allow us to maintain what we believe to be our leading, industry-defining position based on the number of rides and the popularity of our brand.

What we provide: A one-of-a-kind fitness experience that inspires and delights. Our focus is to change people’s relationship with exercise by creating a workout that doesn’t feel like WORK. We have accomplished this by consistently delivering an elevated fitness experience that is physically efficient and challenging, spiritually uplifting and above all else, FUN, paired with our focus on offering welcoming and personal service at every touchpoint.

SoulCycle is carefully curated to be different from a gym or a typical fitness experience. Visitors are greeted with a smile by our studio front desk staff, inspired to open themselves to the possibility of change by our instructors and embraced and encouraged by our community of riders. After the 45-minute journey, riders stay connected to the brand through conversations on our digital and mobile platforms. For many of our riders, SoulCycle is not about how much weight they can lose, rather, it’s about letting go, turning inward and finding the strength to meet life’s daily challenges, overcome

3

Table of Contents

obstacles and break through. SoulCycle isn’t in the business of changing bodies: it’s in the business of changing lives.

Our pioneering pay-per-class model is a key motivating factor: every time our customers step into one of our studios, they are making a choice to be there. We therefore consider ourselves obligated to ensure that riders enjoy and find value in each and every studio visit and interaction with our brand. Our studios currently average 72,000 rides per week and 30% of our weekly rides are reserved within the first 15 minutes of availability in the frenzied “Monday at noon” experience when riders can select classes for the upcoming week.

What we create: A community for our riders. SoulCycle is a business built on relationships. It starts with our leadership and extends through our studio teams, instructors and corporate employees.

We build our rider communities by developing relationships with our riders and encouraging them to develop relationships with each other every day. The concept of community and mutual support is reinforced in every single SoulCycle class. We ride to the rhythm of the music, moving on the bikes together as a pack. We are accountable to one another during class, and we celebrate our journey together when class comes to a close. We believe the SoulCycle experience fosters loyal communities of riders whose relationships extend well beyond the doors of our studios.

Our physical studio communities are complemented by rapidly growing digital communities that include SoulCycle riders and those who have never ridden in our studios but connect with the SoulCycle lifestyle. As of December 31, 2014, SoulCycle’s social media presence included over 70,000 Instagram followers, 53,000 Facebook fans, 36,000 Twitter followers and 18,000 Spotify followers, driven by the approximately 235,000 unique riders who experienced SoulCycle in 2014.

We believe the community we create is essential to the inspiration of the brand and our engagement with our riders.

How we do it: Invest in scaling our empowered instructor and studio teams. We are truly in the people business and place our instructors and studio teams at the core of our culture. We are intentional about hiring people who genuinely care about others, and who show the capacity to cultivate and sustain meaningful relationships. In hiring our studio teams, we value positivity and problem solving. Our instructor scouting team is always identifying and recruiting charismatic fitness professionals to audition for our eight-week proprietary training program.

At SoulCycle, we have created full-time careers for our instructors, which we believe is unique in the fitness industry. Our instructors teach indoor cycling only at SoulCycle and receive an attractive compensation and benefits package. We want our instructors to feel like they have a real career path at SoulCycle and believe this is a key differentiator versus competitors in the fitness industry.

Our overall training philosophy provides “freedom within a framework” to create structure, but not limit creativity and entrepreneurialism, as we believe empowered employees are the most engaged. In addition to our eight-week instructor training program, we have created “Soul University” with over 45 proprietary training programs to scale the distinctive culture and service of our studio operation.

We believe our instructors and studio teams are not only integral to the class experience, but also core to our brand’s culture and community.

4

Table of Contents

What the numbers say: Highly attractive financial profile and unit economic returns. We believe SoulCycle is portable across markets, as demonstrated by our national presence. The size and layout of our studios are also flexible, as our studios generally range between 2,000 and 5,500 square feet. On average, in 2014, our studios opened prior to 2014 generated annual studio revenue of $4 million and a Studio Contribution Margin of 55%. In addition, we believe we have highly attractive new studio economics and target payback periods of approximately two years for new urban studios and three years for new suburban studios. Our compelling unit economics, combined with our focus on profitable growth, help drive an Adjusted EBITDA Margin greater than 30%. We also generate strong Free Cash Flows.

Who we are: An inspired and passionate management team. Our company is led by our chief executive officer, Melanie Whelan. Drawing from her prior management experience with Equinox, the Virgin Group and Starwood Hotels & Resorts, Ms. Whelan has helped lead SoulCycle’s growth since 2012 by managing and scaling the 44-studio field operation as well as overseeing all corporate functions. Our founders, Elizabeth Cutler and Julie Rice, who serve as our co-chief creative officers, have been recognized by multiple third parties as leading innovators and as the creators of one of the most influential brands. Our chief financial officer, Larry M. Segall, a member of SCH’s board of managers since 2011, recently joined us from Equinox, having served as its chief financial officer over the past 10 years, a position where he was directly responsible for the oversight of all aspects of our financial, accounting and administrative functions.

SoulCycle’s Growth Strategy

Key elements to our growth strategy are:

Expanding our studio base. We believe that new studio openings present one of the greatest opportunities to continue to drive growth. Since opening our first studio in 2006, we have expanded significantly and as of June 30, 2015, operate 44 studios across eight metropolitan areas. We believe there is significant whitespace to continue expanding in both existing and new U.S. markets, with both urban and suburban locations and a long-term opportunity to grow our current SoulCycle domestic footprint to at least 250 studios. We have a disciplined site selection process and employ rigorous analytics to identify new studio locations in attractive markets. We opened 11 new studios in 2014 and 13 studios in 2013. Over the past several years, we have invested in our infrastructure and personnel and believe that our company is well-positioned to open at least 10 to 15 new studios per year for the next several years. In addition, we believe that the SoulCycle brand can be successfully transported abroad, as demonstrated by international recognition and social media followers, which would represent growth incremental to our planned domestic footprint.

Optimizing our market presence. Given the passion and loyalty within our current community and growing brand awareness in circles outside our footprint, we believe there is an opportunity to optimize our market presence as measured by rides per day. We have several initiatives underway to both attract new riders and increase the frequency of rides by our existing community. Such initiatives include “clustering” of new studios in existing markets to further increase brand awareness, increasing engagement through targeted messaging and our website and enhancing the in-studio experience through amenity and technology-based service programs. The SoulCycle community is committed, engaged and outsized given our current 44 studio footprint as of June 30, 2015.

Growing the SoulCycle community. We continue to grow the SoulCycle community through our grassroots marketing initiatives, our digital and social customer engagement programs and our corporate social responsibility activities. This strong engagement with our community elicits inspiring rider testimonials, which are published on our website and attracted approximately 11.0 million visits in 2014. As part of our hospitality-focused culture, we maintain continual dialogue with our riders through

5

Table of Contents

our “Your Soul Matters” team, responding to 50,000 rider emails annually, and our Twitter feed, which primarily consists of conversations: riders actively reaching out and receiving an immediate response in real-time. We will continue to increase our social media presence through Instagram, Facebook, Twitter and Spotify as part of our relentless commitment to customer service. We welcome the opportunity to give back to our communities by creating impactful experiences for their charitable organizations. The meaningful community interactions across our digital platforms and our corporate social responsibility initiatives nurture the continued growth of our brand.

Brand extension opportunities. We believe we can continue to extend and monetize the SoulCycle brand beyond the walls of our studios primarily in the areas of retail and digital content.

Retail

Our branded retail line of apparel, sourced from a selective assortment of premium brands, strengthens rider engagement and allows us to garner a larger share of riders’ spend. We unveil a new, limited production, retail collection every month to generate excitement about the latest product as well as an urgency to purchase these latest offerings given their limited availability. Our line was recently featured in Women’s Wear Daily, Self and LuckyShops. We believe there is a considerable opportunity to expand our retail brand going forward.

Digital

We believe a clear opportunity exists to expand our digital platform with content created or curated by our world-renowned instructor talent. Additionally, we believe there is also an opportunity to expand SoulCycle class content to an “at-home” audience. We intend to explore these brand extension opportunities going forward.

Corporate Information

SoulCycle Inc. was incorporated as a Delaware corporation on May 15, 2015. Our predecessor, SoulCycle Holdings, LLC, was organized as a Delaware limited liability company on March 25, 2011 as the successor to a business founded by our founders in 2006. We currently conduct all operations through our wholly-owned subsidiaries. We are headquartered in New York, New York. Our principal executive and administrative offices are located at 609 Greenwich Street, New York, New York 10014, and our telephone number at this location is (212) 787-7685. Our corporate website address is www.soul-cycle.com. Information included or referred to on, or otherwise accessible through, our website is not deemed to form a part of, or be incorporated by reference into, this prospectus.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business goals and objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider the risks discussed in the section entitled “Risk Factors,” including the following risks, before investing in our common stock:

| • | our success depends on our ability to maintain the value and reputation of our brand; |

| • | we may be unable to attract and retain riders, which could have a negative effect on our business and rate of growth; |

| • | our business is geographically concentrated, and a failure to gain acceptance in new markets may have an adverse effect on our business and rate of growth; |

6

Table of Contents

| • | the level of competition we face could negatively impact our revenue growth and profitability; and |

| • | we may not be able to successfully execute our growth strategy or effectively manage our growth. |

Summary of Formation Transactions

Prior to the consummation of the Redemption-Related and Separation-Related Transactions described below (which we refer to as the Formation Transactions), EHI, our founders, Elizabeth P. Cutler and Julie J. Rice and trusts for the benefit of their respective families and an employee-owned entity comprised the only members holding membership interests in SCH.

The Redemption-Related Transactions

The Redemption-Related Transactions were consummated on May 15, 2015. In connection with these transactions:

| • | EHI contributed its membership interests representing a 72% interest in SCH to SIH; |

| • | SCH borrowed $167.1 million, net of original issue discount, under a credit agreement SCH entered into on that date and obtained equity contributions of $12.7 million from EHI to redeem membership interests representing a 25% interest in SIH out of the 27% interest in SCH then owned by our founders and their family trusts in exchange for a payment to each founder and her respective family trust of $89.9 million, including reimbursement of expenses; |

| • | The employee-owned entity retained its membership interests representing a 1% interest in SCH; and |

| • | SCH converted from a limited liability company into a corporation named SoulCycle Inc., resulting in an ownership structure pursuant to which, by agreement among the parties: |

| • | SIH held 970,000 shares of our class B common stock (representing 97% of the common stock then outstanding); |

| • | Our founders and their family trusts held 20,000 shares of our class A common stock (representing 2% of the common stock then outstanding). Our founders also held unvested options to purchase 33,334 shares of our class A common stock (representing 3% of the common stock then outstanding on a fully diluted basis); and |

| • | The employee-owned entity held 10,000 restricted shares of our class B common stock (representing 1% of the common stock then outstanding), which were subsequently distributed to certain employees who were its owners upon the liquidation of the entity. |

The shares of class A and class B common stock described above do not reflect the recapitalization of our common stock into a single class of common stock and for stock split, as described below, that will occur prior to the completion of this offering. Our class A common stock possesses certain major decision approval and governance-related rights that will be eliminated as a result of our planned recapitalization discussed under “—The Offering,” below.

The Separation-Related Transactions

The Separation-Related Transactions will be consummated prior to the completion of this offering in order to spin off and separate SIH and SoulCycle Inc. from EHI. EHI and its direct and indirect

7

Table of Contents

parents will effect a series of successive distributions in kind of 100% of the membership interests in SIH to the direct and indirect members of Related Equinox Holdings II, L.L.C., or REH II, who are the ultimate indirect owners of EHI. SIH intends to distribute, tax-free, shares of our common stock to its equity owners beginning on the 18-month anniversary of the separation, such that all of the shares are distributed by the 27-month anniversary of the separation or upon the earlier vote of the holders of a majority of SIH’s membership interests. In connection with the separation:

| • | We will grant to REH II option-holders options to purchase a corresponding number of shares of our common stock, in aggregate shares of common stock (representing % of the common stock then outstanding on a fully diluted basis). These options upon exercise will not dilute other stockholders as a result of SIH’s share delivery obligation, described below. |

| • | We will enter into an agreement with SIH which obligates it to deliver to us, at our direction, a number of the outstanding shares of common stock owned by it sufficient to satisfy our obligations to deliver shares upon the exercise of such options. |

| • | Prior to the separation, REH II will issue REH II class S preferred units to current and former EHI employees who hold REH II restricted stock units. In connection with the separation, these current and former EHI employees will be able to elect a complete redemption of their REH II class S preferred shares in exchange for SIH membership interests from REH II. These SIH membership interests will represent a right to receive up to an aggregate of shares of common stock (representing % of the common stock then outstanding on a fully diluted basis). SIH will be obligated to distribute to these SIH members the underlying shares of our common stock no earlier than 18 months thereafter or upon the earlier vote of the holders of a majority of SIH’s membership interests. |

See “The Formation Transactions” and “Certain Relationships and Related Party Transactions” for a description of the foregoing transactions.

Recapitalization

Prior to the completion of this offering, our amended and restated certificate of incorporation will become effective. Our amended and restated certificate of incorporation will effect a recapitalization of our class A common stock and class B common stock into a single class of common stock and a for stock split.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as modified by the Jumpstart Our Business Startups Act of 2012, referred to as the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies that are not emerging growth companies. We may take advantage of the following provisions:

| • | reduced disclosure about our executive compensation arrangements; |

| • | no non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

8

Table of Contents

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (i) the end of the fiscal year following the fifth anniversary of the IPO; (ii) the first fiscal year after our annual gross revenues are $1.0 billion or more; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or (iv) the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

We have taken advantage of reduced disclosure regarding executive compensation arrangements in this prospectus, and we may choose to take advantage of some, but not all, of these reduced disclosure obligations in future filings while we remain an emerging growth company. If we do, the information that we provide to stockholders may be different than the information that other public companies provide to stockholders.

The JOBS Act permits an emerging growth company, such as us, to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have chosen to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

9

Table of Contents

The Offering

| Common stock offered |

shares |

| Underwriters’ option to purchase additional shares |

shares |

| Common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We estimate the net proceeds from this offering to us will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, based on an initial public offering price of $ per share after deducting estimated offering expenses payable by us and underwriting discounts and commissions. |

We intend to use the net proceeds to repay debt and pay EHI’s deferred tax distribution claim. The remaining net proceeds will be used for capital expenditures, working capital and other general corporate purposes. See the section entitled “Use of Proceeds.”

| Conflicts of interest |

Because affiliates of Goldman, Sachs & Co., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Citigroup Global Markets Inc. are lenders under our credit agreement, each of Goldman, Sachs & Co., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Citigroup Global Markets Inc. is deemed to have a conflict of interest under Rule 5121 of the Financial Industry Regulatory Authority, which we refer to as Rule 5121. Accordingly, this offering will be conducted in accordance with Rule 5121. See “Underwriting—Conflicts of Interest.” |

| Directed share program |

The underwriters have reserved, at the initial public offering price, up to approximately shares of our common stock being offered for sale to our directors, officers and certain employees and other parties related to the company. The number of shares available for sale to the general public in this offering will be reduced to the extent these persons purchase reserved shares. Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares. |

|

Proposed symbol |

“ ” |

10

Table of Contents

The number of shares of our common stock to be outstanding immediately after this offering is based on the number of shares to be outstanding after giving effect to the Formation Transactions, and excludes:

| • | shares of common stock reserved for issuance under our 2015 Omnibus Incentive Plan consisting of (i) shares of common stock issuable upon the exercise of options previously granted to certain employees, including executive officers, and (ii) additional shares of common stock reserved for future issuance; and |

| • | shares of common stock issuable upon the exercise of the options granted to our founders in connection with the Redemption-Related Transactions. |

Except as otherwise indicated, all information contained in this prospectus assumes:

| • | an offering price of $ per share of common stock, which is the mid-point of the range set forth on the cover of this prospectus; |

| • | the underwriters do not exercise their option to purchase up to additional shares of our common stock; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws prior to the completion of this offering; |

| • | the completion of a recapitalization resulting in a single class of authorized and outstanding common stock upon the filing of our amended and restated certificate of incorporation; |

| • | the completion of a for split of our common stock upon the filing of our amended and restated certificate of incorporation; and |

| • | our issuance of shares of common stock in this offering. |

11

Table of Contents

Summary Historical and Pro Forma Consolidated Financial and Other Data

Pro Forma

The following tables present the summary historical and pro forma consolidated financial and other data for SoulCycle Inc. and its consolidated subsidiaries, or SCI, the successor to SoulCycle Holdings, LLC and its consolidated subsidiaries, or SCH. SCH is the predecessor of the issuer, SCI, for financial reporting purposes and accordingly this prospectus contains the historical financial statements of SCH. The summary consolidated statement of operations data for each of the years ended December 31, 2014, 2013 and 2012 and the summary consolidated balance sheet data as of December 31, 2014 and 2013 are derived from the audited consolidated financial statements of SCH contained herein. The summary consolidated statement of operations data for the six months ended June 30, 2015 and 2014 and the summary consolidated balance sheet data as of June 30, 2015 are derived from the unaudited consolidated financial statements of SCI included in this prospectus. For the period ended June 30, 2015, the financial information combines the results of SCH and its subsidiaries for the 135 day period ended May 15, 2015 and the results of SCI for the 46 day period from inception through June 30, 2015. In the opinion of our management, such unaudited financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results for those periods.

The results of operations for the periods presented below are not necessarily indicative of the results to be expected for any future period and the results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year. The information set forth below should be read together with the “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus.

The summary unaudited pro forma financial data for the year ended December 31, 2014 and as of and for the six months ended June 30, 2015 give effect to the Redemption-Related Transactions, as described in “The Formation Transactions—The Redemption–Related Transactions,” the subsequent grant of options to purchase our common stock to certain of our employees following the Redemption-Related Transactions, the completion of the planned recapitalization of our common stock into a single class of common stock and for stock split and the completion of this offering, including the repayment of $ of outstanding indebtedness under our credit agreement and the payment to EHI of approximately $17.0 million to satisfy the deferred tax distribution claim, as described in “Use of Proceeds,” as if all such transactions had occurred on January 1, 2014, in the case of the summary unaudited pro forma consolidated statement of operations data, and as of June 30, 2015, in the case of the summary unaudited pro forma consolidated balance sheet data. The unaudited pro forma financial information includes various estimates which are subject to material change and may not be indicative of what our operations or financial position would have been had this offering and related transactions taken place on the dates indicated, or that may be expected to occur in the future. See “Unaudited Pro Forma Consolidated Financial Information” for a complete description of the adjustments and assumptions underlying the summary unaudited pro forma consolidated financial data.

12

Table of Contents

| Historical SoulCycle Inc. and SoulCycle Holdings, LLC(1) |

Pro Forma SoulCycle Inc.(1)(2) | |||||||||||||||||||||||

| For the six months ended June 30, |

For the year ended December 31, |

For the six months ended June 30, |

For the year ended December 31, | |||||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | 2015 | 2014 | ||||||||||||||||||

| ($000’s, except for share and per share data) |

(unaudited) | (unaudited) | ||||||||||||||||||||||

| Consolidated Statement of Operations Data |

||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||

| Studio fees |

$ | 63,145 | $ | 41,432 | $ | 93,776 | $ | 62,740 | $ | 30,812 | ||||||||||||||

| Other revenue |

11,212 | 8,331 | 18,175 | 12,568 | 5,358 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Total revenue |

74,357 | 49,763 | 111,951 | 75,308 | 36,170 | |||||||||||||||||||

| Expenses: |

||||||||||||||||||||||||

| Compensation and related |

28,796 | 18,509 | 42,200 | 28,227 | 14,979 | |||||||||||||||||||

| General and administrative |

13,605 | 8,534 | 20,814 | 14,972 | 7,392 | |||||||||||||||||||

| Rent and occupancy |

7,071 | 3,788 | 9,053 | 6,053 | 2,829 | |||||||||||||||||||

| Depreciation and amortization |

5,214 | 2,969 | 6,905 | 3,334 | 1,150 | |||||||||||||||||||

| Retail cost of sales |

3,798 | 2,967 | 6,440 | 4,145 | 1,975 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Total operating expenses, net |

58,484 | 36,767 | 85,412 | 56,731 | 28,325 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Income from operations |

15,873 | 12,996 | 26,539 | 18,577 | 7,845 | |||||||||||||||||||

| Interest expense, net |

1,518 | 146 | 302 | 148 | 8 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Income before income taxes |

14,355 | 12,850 | 26,237 | 18,429 | 7,837 | |||||||||||||||||||

| Provision for (benefit from) income taxes |

(72,953 | ) | 396 | 908 | 632 | 214 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Net income |

$ | 87,308 | $ | 12,454 | $ | 25,329 | $ | 17,797 | $ | 7,623 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Supplemental pro forma net income per share data(2): |

||||||||||||||||||||||||

| Pro forma weighted average shares outstanding: |

||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||

| Pro forma net income available per share: |

||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||

| Diluted |

||||||||||||||||||||||||

13

Table of Contents

| Pro forma SoulCycle Inc.(2) |

Historical SoulCycle Inc. |

Historical SoulCycle Holdings, LLC |

||||||||||||

| June 30, 2015 |

June 30, 2015 |

December 31, 2014 |

December 31, 2013 |

|||||||||||

| ($000’s) | (unaudited) |

|||||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||||

| Cash and cash equivalents |

$ | 3,829 | $ | 5,762 | $ | 4,657 | ||||||||

| Total assets |

183,739 | 85,601 | 54,430 | |||||||||||

| Total debt |

172,417 | 3,806 | 3,836 | |||||||||||

| Stockholders’/members’ equity |

(49,249 | ) | 49,747 | 28,112 | ||||||||||

| (1) | From the date of the conversion, May 15, 2015, forward, SCI is the financial reporting entity. Accordingly, the historical consolidated financial information included in this prospectus is that of SCH for the periods ended December 31, 2014, 2013 and 2012. For the period ended June 30, 2015, the financial information combines the results of SCH for the 135 day period ended May 15, 2015 and the results of SCI for the 46 day period from inception through June 30, 2015. |

| (2) | Pro forma and supplemental pro forma net income per share figures give effect to the Redemption-Related Transactions, the subsequent grant of options to purchase our common stock to certain of our employees, the recapitalization and stock split and the completion of this offering, including the repayment of outstanding indebtedness under our credit agreement and the payment of EHI’s deferred tax distribution claim. See “Unaudited Pro Forma Consolidated Financial Information” for a detailed presentation of the unaudited pro forma financial information. |

| For the six months ended June 30, |

For the year ended December 31, |

|||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| Other Financial and Operating Data: |

||||||||||||||||||||

| Studios open at beginning of period |

36 | 25 | 25 | 12 | 7 | |||||||||||||||

| Studios open at end of period |

44 | 29 | 36 | 25 | 12 | |||||||||||||||

| Classes |

54,564 | 37,067 | 81,317 | 52,766 | 25,126 | |||||||||||||||

| Rides |

1,976,544 | 1,317,025 | 2,889,159 | 1,970,899 | 969,104 | |||||||||||||||

| Rides per day |

10,920 | 7,276 | 7,916 | 5,400 | 2,648 | |||||||||||||||

| Capital expenditures ($000’s) |

(26,669 | ) | (15,075 | ) | (34,911 | ) | (26,408 | ) | (13,234 | ) | ||||||||||

| Adjusted EBITDA ($000’s) |

25,690 | 16,527 | 35,687 | 23,304 | 11,212 | |||||||||||||||

| Adjusted EBITDA Margin |

34.5 | % | 33.2 | % | 31.9 | % | 30.9 | % | 31.0 | % | ||||||||||

| Studio Contribution ($000’s) |

40,365 | 26,288 | 59,193 | 41,750 | 19,446 | |||||||||||||||

| Studio Contribution Margin |

54.3 | % | 52.8 | % | 52.9 | % | 55.4 | % | 53.8 | % | ||||||||||

| Same Studio Sales (%) |

11 | % | 2 | % | 5 | % | 22 | % | 68 | % | ||||||||||

14

Table of Contents

| For the six months ended June 30, |

For the year ended December 31, |

|||||||||||||||||||

| 2015 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||

| ($000’s) | (unaudited) | (unaudited) | ||||||||||||||||||

| EBITDA Reconciliation: |

||||||||||||||||||||

| Net income |

$ | 87,308 | $ | 12,454 | $ | 25,329 | $ | 17,797 | $ | 7,623 | ||||||||||

| Provision for (benefit from) income taxes |

(72,953 | ) | 396 | 908 | 632 | 214 | ||||||||||||||

| Interest expense, net |

1,518 | 146 | 302 | 148 | 8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

15,873 | 12,996 | 26,539 | 18,577 | 7,845 | |||||||||||||||

| Depreciation and amortization |

5,214 | 2,969 | 6,905 | 3,334 | 1,150 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

21,087 | 15,965 | 33,444 | 21,911 | 8,995 | |||||||||||||||

| Components of Adjusted EBITDA: |

||||||||||||||||||||

| Amortization of deferred rent(a) |

1,927 | 555 | 1,832 | 1,320 | 669 | |||||||||||||||

| Other expense(b) |

2,676 | 7 | 411 | 73 | 1,548 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

25,690 | 16,527 | 35,687 | 23,304 | 11,212 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Corporate expenses(c) |

14,675 | 9,761 | 23,506 | 18,446 | 8,234 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Studio Contribution |

$ | 40,365 | $ | 26,288 | $ | 59,193 | $ | 41,750 | $ | 19,446 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Reflects the extent to which our GAAP rent expense for the period, excluding amortization of landlord contributions, has been above or below our cash rent payments. |

| (b) | Other expense is comprised of the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include, among other things, share-based compensation expense and loss on disposal of assets. |

| (c) | Corporate expenses are comprised of compensation for corporate employees, rent and occupancy for corporate headquarters and general and administrative expenses related to our corporate overhead. |

15

Table of Contents

An investment in our common stock involves a high degree of risk. In deciding whether to invest, you should carefully consider the following risk factors, as well as the financial and other information contained in this prospectus, including our consolidated financial statements and related notes. Any of the following risks could have a material adverse effect on our business, financial condition, results of operations or prospects and cause the value of our stock to decline, which could cause you to lose all or part of your investment. Additional risks and uncertainties of which we are unaware, or that we currently deem immaterial also may become important factors that affect us.

Risks Related to Our Business and Industry

Our success depends on our ability to maintain the value and reputation of our brand.

Our success depends on the value and reputation of the SoulCycle brand. The SoulCycle name is integral to our business as well as to the implementation of our strategies for expanding our business. Maintaining, promoting and positioning our brand will depend largely on the success of our ability to provide a consistent, high quality rider experience and our marketing, merchandising and community-building efforts. We rely on social media, as one of our marketing strategies, to have a positive impact on both our brand value and reputation. Our brand could be adversely affected if we fail to achieve these objectives or if our public image or reputation were to be tarnished by negative publicity. We have also benefited in the past from favorable publicity related to celebrities riding in our studios. If in the future we lose such celebrity ridership, this could have a negative effect on our business. Additionally, while we devote considerable efforts and resources to protecting our intellectual property, if these efforts are not successful, the value of our brand may be harmed. Our failure to maintain the value and reputation of our brand could have a material adverse effect on our financial condition and growth rate.

We may be unable to attract and retain riders, which could have a negative effect on our business and rate of growth.

The performance of our studios is dependent on our ability to continuously attract and retain riders, and we cannot be sure that we will be successful in these efforts, or that rider levels at our studios will not materially decline. There are numerous factors that could lead to a decline in ridership levels at established studios or that could prevent us from increasing our ridership levels at newer studios, including harm to our reputation, a decline in our ability to deliver quality service at a competitive cost, the opening of new studios that may have the potential to cannibalize store sales in existing areas, the heightened presence of direct and indirect competition in the areas in which the studios are located, the decline in the public’s interest in fitness through cycling, a deterioration of general economic conditions and a change in consumer spending preferences or buying trends. As a result of these factors, we cannot be sure that our ridership levels will be adequate to maintain or permit the expansion of our operations. A decline in ridership levels may have a material adverse effect on our financial condition and results of operations and growth rate.

Our business is geographically concentrated, and a failure to gain acceptance in new markets may have an adverse effect on our business and rate of growth.

As of June 30, 2015, we operate in eight metropolitan areas, the majority of which are located in the coastal areas of the United States, and our studios in the New York metropolitan area and in and around Los Angeles and San Francisco generated approximately 87% of our revenues for the six months ended June 30, 2015. We may not find as much demand in other markets and our brand may not gain the same acceptance. A failure to gain acceptance in new markets may have a material

16

Table of Contents

adverse effect on our financial condition and results of operations and growth rate. The benefits of our brand may also be diluted by the presence of multiple locations in the same market.

In addition, due to our geographic concentration, adverse weather conditions, such as regional winter storms, could cause temporary or prolonged closures of our studios and decreased rider attendance. Adverse economic conditions or increased competition in those areas, especially in New York City, could have a disproportionate adverse effect on our financial condition, results of operations and growth rate.

The level of competition we face could negatively impact our revenue growth and profitability.

The level of competition we face is high and continues to increase. In each of the markets in which we operate, we compete with other cycling oriented competitors, general health and fitness clubs, private studios, amenity and condominium clubs and, to a certain extent, the home-use fitness equipment industry that offer or make available cycling alternatives. We also compete with other cycling oriented competitors, other entertainment and retail businesses for the discretionary income of our target demographics. We might not be able to compete effectively in the future in the markets in which we operate. We may face new competitors that enter our market with greater resources than us and such competition may be detrimental to our business. These competitive conditions may limit our ability to increase fees without a material loss in ridership, attract new riders and attract and retain qualified personnel.

The number of competitor studios and other venues such as fitness clubs that offer lower pricing for a cycling experience and a lower level of service continues to grow in our markets. These studios and other venues have attracted, and may continue to attract, riders away from our studios. In addition, large competitors could enter the urban markets in which we operate to open a chain of studios in these markets through one or a series of acquisitions.

The market for technical athletic apparel is highly competitive. Competition may result in pricing pressures, reduced profit margins or lost market share or a failure to grow our market share, any of which could substantially harm our business and results of operations. We compete against direct retailers of athletic apparel, including large, diversified apparel companies with substantial market share and established companies expanding their production and marketing of technical athletic apparel, as well as against retailers specifically focused on women’s athletic apparel.

We may not be able to successfully execute our growth strategy or effectively manage our growth.

Our growth strategy contemplates a significant expansion in the number of studios we operate. Successful implementation of our growth strategy will require significant expenditures before any substantial associated revenue is generated. Many of our existing studios are still relatively new. We cannot assure you that our recently opened or future studios will generate revenue and cash flow comparable with those generated by our existing mature studios. Furthermore, we cannot assure you that our new studios, on average, will continue to mature at the same rate as our existing studios, especially if economic conditions deteriorate.

We rely on a limited number of vendors for our retail product offerings and a single supplier and single producer for development, manufacturing and shipping of our bikes. A loss of any of our vendors or our bike producer could negatively effect our business.

Three of our vendors accounted for 63% of our retail sales for the six months ended June 30, 2015. Our ability to offer retail collections and our retail sales could be substantially curtailed if one or

17

Table of Contents

more of these vendors were to cease, decrease or delay supply of our products, whether for voluntary or involuntary reasons, or if the retail products they supply have quality issues.

We currently rely on one supplier and one producer for our bikes. Our reliance on a sole producer for our bikes increases our risks since we do not currently have an alternative or replacement manufacturer. In the event of interruption from our producer we may not be able to develop alternate or secondary sources without incurring material additional costs and substantial delays.

We have grown rapidly in recent years and have limited operating experience at our current scale of operations. If we are unable to manage our operations at our current size or are unable to manage any future growth effectively, our brand image and financial performance may suffer.

We have expanded our operations rapidly and have limited operating experience at our current size. If our operations continue to grow, we will be required to continue to expand our studio development and sales and marketing, to upgrade our management information systems and other processes and to obtain more space for our expanding administrative support and other headquarters personnel. Our continued growth could strain our existing resources, and we could experience ongoing operating difficulties in managing a greater number of geographically dispersed studios. These difficulties could result in the erosion of our brand image and could have a material adverse effect on the growth rate of our business and our financial condition and operating results.

Our newly opened studios may negatively impact our financial results in the short-term, and may not achieve sales and operating levels consistent with our more mature studios on a timely basis or at all.

We have actively pursued new studio growth and plan to continue doing so in the future. We cannot assure you that our new studio openings will be successful or reach the sales and profitability levels of our mature studios. Our studios typically reach maturity in the second year of continuous operation. New studio openings may negatively impact our financial results in the short-term due to the effect of studio opening costs, lower ridership sales and contribution on overall profitability during the initial period following opening. New studios build their sales volume and their rider base over time and, as a result, generally have lower margins and higher operating expenses, as a percentage of revenue, than our more mature studios. New studios may not achieve sustained ridership sales and operating levels consistent with our more mature studio base on a timely basis, or at all. This may have an adverse effect on our financial condition, operating results and growth rate.

If we are unable to identify and acquire suitable sites for new studios, our revenue growth rate and profits may be negatively impacted.

Our continued growth depends, in large part, on our ability to open new studios and to operate those studios successfully. We must identify and acquire sites that meet the site selection criteria we have established. If we are unable to identify and acquire desirable sites for new studios, our revenue growth rate and profits may be negatively impacted. Additionally, if our analysis of the suitability of a site is incorrect, we may not be able to recover our capital investment in developing and building the new studio.

Our growth and profitability could be negatively impacted if we are unable to renew or replace our current studio leases on favorable terms, or at all, and we cannot find suitable alternate locations.

We currently lease substantially all of our studio locations pursuant to long-term non-cancelable leases (generally 5 to 20 years, including option periods). During the next 20 years, we have leases for

18

Table of Contents

three studio locations that are due to expire without any renewal options between the years 2023 and 2028 and 49 studio locations that are due to expire with renewal options. For leases with renewal options, 31 of them provide for our unilateral option to renew for additional rental periods at specific rental rates (for example, based on the consumer price index or stated renewal terms already set in the leases) or based on the fair market rate at the location. Our ability to negotiate favorable terms on an expiring lease or to negotiate favorable terms on leases with renewal options, or conversely for a suitable alternate location, could depend on conditions in the real estate market, competition for desirable properties and our relationships with current and prospective landlords or may depend on other factors that are not within our control. Any or all of these factors and conditions could negatively impact our revenue, growth and profitability.

If we do not retain key management personnel and/or fail to attract and retain highly qualified studio personnel, including instructors, our business will suffer.

The success of our business depends on our ability to attract and retain key management personnel. If any of these persons were to leave, it might be difficult to replace them, and our business could be harmed. See “Management.” In addition, the quality of our studio operations personnel, particularly our instructors, is central to the success of our business. We cannot assure you that we can attract, train and retain sufficient qualified personnel to meet our business needs, particularly the instructors at our studios, who are critically important to our studio performance. If we are unable to attract, train and retain key instructors, this may have a material adverse effect on our business.

Our growth could place strains on our management, employees, information systems and internal controls, which may adversely impact our business.

Our expansion will also place significant demands on our management resources. We will be required to identify attractive studio locations, negotiate favorable rental terms and open new studios on a timely and cost-effective basis while maintaining a high level of quality, efficiency and performance at both mature and newly opened studios. Moreover, we plan to expand into markets where we have little or no direct prior experience, and we could encounter unanticipated problems, cost overruns or delays in opening studios in new markets or in the market acceptance for our studios. In addition, we will need to continue to implement management information systems and improve our operating, administrative, financial and accounting systems and controls. We will also need to recruit, train and retain new instructors and other employees and maintain close coordination among our executive, accounting, finance, marketing, sales and operations functions.

These processes are time-consuming and expensive and may divert management’s attention. We may not be able to effectively manage this expansion, and any failure to do so could have a material adverse effect on our rate of growth, business, financial condition and results of operations.

In addition, our transition to a public company that will be subject to regulatory oversight and reporting obligations under the federal securities laws will require significant attention from our senior management and could divert their attention away from the day-to-day management of our business. This could adversely affect our business, financial condition and operating results.

We expect to make capital expenditures necessary to pursue our expansion strategy. Any required outlays may from time to time be significant and when incurred may adversely impact our cash flow.

Our expansion strategy contemplates the opening of multiple new studios. We also periodically undertake renovations to upgrade existing studios. We revitalize our studios with capital improvements on a quarterly basis and perform full-scale renovation work on our existing studios approximately every

19

Table of Contents

four years. Required outlays for such capital expenditures may at times be significant and may adversely impact cash flows during the periods when incurred. Our capital expenditures totaled $34.9 million, $26.4 million and $13.2 million, for the years ended December 31, 2014, 2013 and 2012, respectively, representing 31.2%, 35.1% and 36.6% of total revenue for the years ended December 31, 2014, 2013 and 2012, respectively. In addition, we may need to finance such expenditures with indebtedness which would increase our financing costs and may adversely impact our results of operations.

An economic downturn or economic uncertainty in our key markets may adversely affect discretionary spending and demand for our services.

Our premium cycling offerings may be considered discretionary items for our riders. Factors affecting the level of spending for such discretionary items include general economic conditions and other factors such as consumer confidence in future economic conditions, fears of recession, the availability of consumer credit, levels of unemployment, tax rates and the cost of consumer credit. As global economic conditions continue to be volatile or economic uncertainty remains, trends in consumer discretionary spending also remain unpredictable and subject to reductions due to credit constraints and uncertainties about the future. Unfavorable economic conditions may lead consumers to reduce or forgo use of our services. Our sensitivity to economic cycles and any related fluctuation in discretionary purchases may have a material adverse effect on our financial condition.

We could be subject to personal injury claims related to the use of our studios.

Riders could assert claims of personal injury in connection with their use of our services and facilities. If we cannot successfully defend any large claim or maintain our general liability insurance on acceptable terms or maintain adequate coverage against potential claims, our financial results could be adversely affected. Depending upon the outcome, these matters may have a material effect on our consolidated financial position, results of operations and cash flows.

We are subject to government regulation. Changes in these regulations or a failure to comply with them could have a negative effect on our financial condition.