Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - MISONIX INC | v418437_ex21.htm |

| EX-23 - EXHIBIT 23 - MISONIX INC | v418437_ex23.htm |

| EX-31.2 - EXHIBIT 31.2 - MISONIX INC | v418437_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - MISONIX INC | v418437_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - MISONIX INC | v418437_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - MISONIX INC | v418437_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number: 1-10986

| MISONIX, INC. |

(Exact name of registrant as specified in its charter)

| New York | 11-2148932 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1938 New Highway, Farmingdale, New York | 11735 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (631) 694-9555

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $.01 par value | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes þ No

The aggregate market value of the voting stock held by non-affiliates of the registrant on December 31, 2014 (computed by reference to the closing price of such stock on such date) was approximately $81,749,310.

There were 7,744,113 shares of Common Stock outstanding at August 20, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None

With the exception of historical information contained in this Form 10-K, content herein may contain "forward looking statements" that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. MISONIX, INC. (the “Company”) cannot guarantee that any forward looking statements will be accurate, although the Company believes that is has been reasonable in its expectations and assumptions. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. These factors include general economic conditions, delays and risks associated with the performance of contracts, risks associated with international sales and currency fluctuations, uncertainties as a result of research and development, acceptable results from clinical studies, including publication of results and patient/procedure data with varying levels of statistical relevance, risks involved in introducing and marketing new products, potential acquisitions, consumer and industry acceptance, litigation and/or contemplated 510(k) filings, the ability to achieve and maintain profitability in the Company's business lines, and other factors discussed in this Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company disclaims any obligation to update its forward-looking statements.

TABLE OF CONTENTS

| 2 |

Overview

MISONIX, INC. (“Misonix” or the “Company”) is a New York corporation which, through its predecessors, was first organized in 1959. The Company designs, manufactures, develops and markets minimally invasive ultrasonic surgical device products. These products include the BoneScalpel® surgical system (“BoneScalpel”) which is used, among other things, for surgical procedures of the spine and in Maxillofacial procedures, the SonaStar® Surgical Aspirator (“SonaStar”) which is used to emulsify and remove soft and hard tumors and the SonicOne® Wound Cleansing and Debridement System (“SonicOne”) which offers tissue specific debridement and cleansing of wounds and burns for effective removal of devitalized tissue and fibrin deposits while sparing viable cells.

The Company continues to develop its portfolio of therapeutic ultrasonic surgical devices aimed at expanding the base of clinical users. Current applications include the ability to transect or shape bone, ablate and aspirate both soft and hard tissue, cleanse and debride advanced wounds and remove unwanted body fat. Among clinical specialties served are: Spine Surgery, Skull-Based Surgery (i.e., Cranio-Maxillo-Facial), Neurosurgery, Orthopedic Surgery, Plastic Surgery, Wound, Burn and Vascular Surgery.

In the United States, a nationwide ‘hybrid’ sales organization, which includes contracted, commissioned, independent sales representatives, managed by Company personnel and supported by Company application specialists, markets our neuro/spine/skull-based products to our surgical customers. Products in this category are our BoneScalpel and SonaStar Systems.

In the United States, a second nationwide ‘hybrid’ sales organization, which includes contracted, commissioned, independent sales representatives managed by Company personnel and supported by Company specialists, markets our wound and burn care product portfolio to our acute, in patient and clinical customer base. Products in this category are SonicOne and SonicOne O.R.

Outside the United States, our BoneScalpel, SonaStar and SonicOne product platforms are marketed by specialty distributors who purchase products from the Company and resell products to their clinical customer bases. Representation for the BoneScalpel and SonaStar is worldwide with a strong presence in all major markets in the Americas, Europe, the Middle East, Asia, Australia and New Zealand. With regard to the SonicOne, representation is in a few countries at the present time.

The BoneScalpel is a unique, state of the art, ultrasonic bone cutting system capable of making precise cuts with minimal necrosis, minimal burn artifact, minimal inflammation and minimal bone loss. The device is also capable of preserving surrounding soft tissue structures. This device can make precise linear or curved cuts, on any plane, with precision not normally associated with power instrumentation. The BoneScalpel offers the speed and convenience of a power instrument without the dangers associated with conventional rotary devices. The effect on surrounding soft tissue is minimal due to the elastic and flexible structure of healthy tissue. This is a significant advantage in anatomical regions like the spine where patient safety is of primary concern. In addition, the linear motion of the blunt, tissue-impacting tips avoids accidental ‘trapping’ of soft tissue while largely eliminating the high speed spinning and tearing associated with rotary power instruments. The BoneScalpel allows surgeons to improve on existing surgical techniques by creating new approaches to osteotomies and bone removal, leading to substantial time savings and increased operation efficiencies.

Following its original market introduction in Europe almost four years ago, the BoneScalpel has attracted a steadily growing following in the surgical community, which led to significant sales growth in fiscal year 2015. The expandable BoneScalpel product platform will create entry into dynamic market segments like spine surgery and selected skull-based surgeries, i.e. Maxillo-Facial/Reconstructive procedures. In the future, additional market niche opportunities may exist in small bone surgery of the hand, foot or ankle, and additional skull-based procedures, i.e. ENT surgery.

The SonaStar System provides powerful precise aspiration following the ultrasonic ablation of hard or soft tissue. The SonaStar has been used for a wide variety of surgical procedures using both open and minimally invasive approaches, including neurosurgery and liver surgery. An additional option for the SonaStar is the use of OsteoSculpt® probe tips, which allows for the precise shaping or shaving of bony structures that prevent open access to partially or completely hidden soft tissue masses.

The SonicOne Ultrasonic Cleansing and Debridement System is a highly innovative, tissue specific approach for the effective removal of devitalized or necrotic tissue and fibrin deposits while sparing viable, surrounding cellular structures. The tissue specific capability is, in part, due to the fact that healthy and viable tissue structures have a higher elasticity and flexibility than necrotic tissue and are more resistant to destruction from the impact effects of ultrasound. The ultrasonic debridement process separates devitalized tissue from viable tissue layers, allowing for a more defined treatment and, usually, a reduced pain sensation. SonicOne establishes a new standard in wound and burn bed preparation, which is the essential first step in the healing process, while speeding the progression toward full patient healing.

| 3 |

The Company has an agreement with Covidien Plc (“Covidien”), now Medtronic plc, that expires in October 2016 which represents the development of the AutoSonix product and as a result of that joint development; patents are co-owned by Misonix and Covidien which results in Covidien paying Misonix a 5% royalty on end user sales. The royalty is recorded as “other income” in the Company’s financial statements and amounted to $4,162,000 in fiscal 2015.

On February 1, 2015, the Company entered into an agreement with Aesculap, Inc. (“Aesculap”) to buy back certain accounts that were protected under the termination agreement entered into by Misonix and Aesculap on December 31, 2012 (the “Termination Agreement”). The Termination Agreement allowed Aesculap to continue to sell and service key accounts which were defined as accounts maintaining a specified revenue level on average over a three year term which was due to expire on December 31, 2015. The buy back amount total is $328,136 and one half was paid on February 1, 2015 and the balance was paid on March 1, 2015. The total buy back amount includes $28,867 worth of units that will be for customer use and is expected to be fully utilized. The buy back has been recorded as reacquired contractual rights in intangible and other assets and will be amortized over the period through December 31, 2015.

| 4 |

Discontinued Operations

High Intensity Focused Ultrasound Technology

In consideration for the May 2010 sale of its rights to the high intensity focused ultrasound technology to USHIFU LLC, now SonaCare, Misonix will receive up to approximately $5.8 million, paid out of an earn-out of 7% of gross revenues received from SonaCare’s sales of the (i) prostate product in Europe and (ii) kidney and liver products around the world related to the business being sold up to the time the Company has received the first $3 million and thereafter 5% of the gross revenues up to $5.8 million. Commencing 90 days after each December 31st and beginning December 31, 2011 the payments will be the greater of (a) $250,000 or (b) 7% of gross revenues received up to the time the Company has received the first $3 million and thereafter 5% of gross revenues up to the $5.8 million. Cumulative payments through June 30, 2015 were $1,004,788.

| 5 |

Medical Devices

In October 1996, the Company entered into a twenty-year license agreement with Covidien. The Covidien license covers the further development of the Company's medical technology relating to laparoscopic products, which uses high frequency sound waves to coagulate and divide tissue for both open and laparoscopic surgery. The Covidien license gives Covidien exclusive worldwide marketing and sales rights for this technology and device. Total sales by Misonix of this device to Covidien were approximately $3,820, $5,226 and $110,437 for the fiscal years ended June 30, 2015, 2014 and 2013, respectively. Total royalties from sales of this device worldwide were approximately $4,162,000, $3,619,000 and $2,369,000 for the fiscal years ended June 30, 2015, 2014 and 2013, respectively.

The Company’s distribution agreement with Mentor Corporation, a subsidiary of Johnson & Johnson, for the sale, marketing and distribution of the Lysonix soft tissue aspirator used for cosmetic surgery has terminated. Sales continue on a limited non-contractual purchase order basis. Total sales of this device were approximately $264,000, $267,000 and $382,000 for the fiscal years ended June 30, 2015, 2014 and 2013, respectively.

| 6 |

The Company’s revenues are generated from various regions throughout the world. Sales by the Company outside the United States are made through distributors. Sales made in the United States are made primarily through representative agents. The following is an analysis of net sales from continuing operations by geographic region:

| For the years ended ended June 30, | ||||||||

| 2015 | 2014 | |||||||

| United States | $ | 10,797,920 | $ | 8,185,468 | ||||

| Australia | 364,156 | 120,118 | ||||||

| Europe | 3,385,603 | 2,387,376 | ||||||

| Asia | 4,125,662 | 3,572,056 | ||||||

| Canada and Mexico | 836,188 | 779,833 | ||||||

| South America | 911,711 | 1,165,124 | ||||||

| South Africa | 540,185 | 378,287 | ||||||

| Middle East | 1,243,153 | 472,173 | ||||||

| $ | 22,204,578 | $ | 17,060,435 | |||||

| For the years ended June 30, | ||||||||

| 2014 | 2013 | |||||||

| United States | $ | 8,185,468 | $ | 7,649,041 | ||||

| Australia | 120,118 | 358,509 | ||||||

| Europe | 2,387,376 | 3,062,307 | ||||||

| Asia | 3,572,056 | 1,619,255 | ||||||

| Canada and Mexico | 779,833 | 516,088 | ||||||

| South America | 1,165,124 | 735,060 | ||||||

| South Africa | 378,287 | 489,756 | ||||||

| Middle East | 472,173 | 397,210 | ||||||

| $ | 17,060,435 | $ | 14,827,226 | |||||

| 7 |

Market and Customers

The Company’s products are sold worldwide and has many customers and distributors. The Company’s largest customer is our Chinese distributor. Sales to Cicel (Beijing) Science and Tech Co. Ltd. (“Cicel”) were $2,974,086 (13.4% of total sales) for the fiscal year ended June 30, 2015. The Company also receives royalties from Covidien, which was our non-exclusive BoneScalpel distributor in the United States, for patents it co-owns on the AutoSonic product. Total royalties from Covidien related to their sales of the Company’s ultrasonic cutting products, which use high frequency sound waves to coagulate and divide tissue for both open and laparoscopic surgery, were $4,162,000, $3,619,000 and $2,369,000 for the fiscal years ended June 30, 2015, 2014 and 2013, respectively. Net income/(loss) for the years ended June 30, 2015, 2014 and 2013 was $5,571,171, $1,393,299 and ($2,670,000), respectively, of which $4,162,000, $3,619,000 and $2,369,000, respectively, was from royalty income from Covidien. Accounts receivable from Covidien were approximately $1,012,000 and $892,000, which includes $1,012,000 and $892,000 of royalty income receivable, at June 30, 2015 and 2014, respectively. Accounts receivable from Aesculap were approximately $1,000 and $121,000 at June 30, 2015 and 2014, respectively. At June 30, 2015 and 2014, the Company’s accounts receivable with customers outside the United States were approximately $1,805,000 and $1,332,000, respectively. Accounts receivable from Cicel were approximately $586,000 and $606,000 at June 30, 2015 and 2014, respectively. The Company sells the BoneScalpel, SonaStar and SonicOne Wound Cleansing and Debridement System through direct sales persons and sales agents in the United States and through distributors outside the United States.

The Company continues its strategy to consign units, primarily the BoneScalpel and SonicOne OR, in the United States in an effort to increase the installed base of units in the market. This strategy has the effect of increasing Property, Plant and Equipment and we do not receive revenues for these units, as the Company continues to own the units and depreciates them over time. This strategy offers the Company wider acceptance of the product and ultimately increases our revenues through the sale of disposables used with the BoneScalpel and SonicOne OR. The practice of placing systems with hospitals has the effect of accelerating hospital acceptance during a time of budget constraints.

Manufacturing and Supply

The Company manufactures and assembles its medical device products at its production facility located in Farmingdale, New York. The Company's products include components manufactured by other companies in the United States. The Company is not dependent upon any single source of supply and has no long-term supply agreements. The Company believes that it will not encounter difficulty in obtaining materials, supplies and components adequate for its anticipated short-term needs.

Competition

Competition in the medical device products industry is rigorous with many companies having significant capital resources, large research laboratories and extensive distribution systems greater than the Company's. Some of the Company's major competitors are Medtronic, Anspach, Synthes (a division of Johnson and Johnson), Integra Life Sciences, Inc., Sööring, Stryker Corporation and Smith and Nephew.

| 8 |

Regulatory Requirements

The Company's medical device products are subject to the regulatory requirements of the U.S. Food and Drug Administration (“FDA”). A medical device, as defined by the FDA, is an instrument, apparatus, implement, machine, contrivance, implant, in vitro reagent, or other similar or related article, including a component, part, or accessory which is recognized in the official National Formulary or the United States Pharmacopoeia, or any supplement to such listings, intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment or prevention of disease, in man or animals, or intended to affect the structure or any function of the body of man or animals, and which does not achieve any of its primary intended purposes through chemical action within or on the body of man or animals and which is not dependent upon being metabolized for the achievement of any of its primary intended purposes (a "medical device"). The Company's products that are subject to FDA regulations for product labeling and promotion comply with all applicable regulations. The Company is listed with the FDA as a medical device manufacturer and has the appropriate FDA Establishment Numbers in place. The Company has a post-market monitoring system in place such as Complaint Handling and Medical Device Reporting procedures. All current devices manufactured and sold by the Company have all the necessary regulatory approvals. The Company is not aware of any situations which would be materially adverse at this time and neither has the FDA sought legal remedies available, nor have there been any material violations of its regulations alleged, against the Company at present.

Patents, Trademarks, Trade Secrets and Licenses

The following is a list of the U.S. patents which have been issued to the Company:

| Number | Description | Issue Date | Expiration Date | |||

| D478165 | Cannula for ultrasonic probe | 08/05/2003 | 08/05/2017 | |||

| 5,769,211 | Autoclavable switch - relating to a medical handpiece with autoclavable rotary switch to be used in medical procedures | 06/23/1998 | 01/21/2017 | |||

| 6,033,375 | Ultrasonic probe with isolated and teflon coated outer cannula | 03/07/2000 | 12/23/2017 | |||

| 6,270,471 | Ultrasonic probe with isolated outer cannula | 08/07/2001 | 12/23/2017 | |||

| 6,443,969 | Ultrasonic blade with cooling | 09/03/2002 | 08/15/2020 | |||

| 6,379,371 | Ultrasonic blade with cooling | 04/30/2002 | 11/15/2019 | |||

| 6,375,648 | Infiltration cannula with teflon coated outer surface | 04/23/2002 | 10/02/2018 | |||

| 6,063,050 | Ultrasonic dissection and coagulation system | 05/16/2000 | 10/16/2017 | |||

| 6,036,667 | Ultrasonic dissection and coagulation system | 03/14/2000 | 08/14/2017 | |||

| 6,582,440 | Non-clogging catheter for lithotripsy | 06/24/2003 | 12/26/2016 | |||

| 6,454,730 | Thermal film ultrasonic dose indicator | 09/24/2002 | 04/02/2019 |

| 9 |

| 6,613,056 | Ultrasonic probe with low-friction bushings | 09/02/2003 | 02/17/2019 | |||

| 6,648,839 | Ultrasonic medical treatment device for RF cauterization and related method | 11/18/2003 | 05/08/2022 | |||

| 6,736,814 | Ultrasonic medical treatment device for bipolar RF cauterization and related method | 05/18/2004 | 02/28/2022 | |||

| 6,799,729 | Ultrasonic cleaning and atomizing probe | 10/05/2004 | 10/05/2021 | |||

| 6,869,439 | Ultrasonic dissector | 03/22/2005 | 03/22/2022 | |||

| 6,902,536 | RF cauterization and ultrasonic ablation | 06/07/2005 | 06/07/2022 | |||

| 7,442,168 | High efficiency medical transducer with ergonomic shape and method manufacture | 10/28/2008 | 04/01/2023 | |||

| 7,223,267 | Ultrasonic probe with detachable slidable cauterization forceps | 02/06/2004 | 02/06/2024 | |||

| 7,717,913 | Cauterization and ultrasonic ablation instrument with multi hole collar and electrode MTG sleeve | 05/18/2010 | 11/04/2024 | |||

| 7,776,027 | Medical handpiece with automatic power switching means | 08/17/2010 | 07/11/2022 | |||

| 6,492,762 | Ultrasonic transducer, transducer array, and fabrication method | 12/10/2002 | 03/22/2020 | |||

| 6,787,974 | Ultrasound transducer unit and planar ultrasound lens | 09/07/2004 | 11/21/2021 | |||

| 6,461,314 | Intrabody HIFU applicator | 10/08/2002 | 02/2/2020 | |||

| D627,463 | Ultrasonic wound treatment probe | 01/27/2010 | 11/24/2024 | |||

| 7,931,611 | Ultrasonic wound debrider probe and method of use | 03/23/2005 | 10/15/2027 | |||

| D627,463 | Ultrasonic wound treatment probe | 08/30/2011 | 08/30/2025 | |||

| 8,025,672 | Ultrasonic wound treatment method and apparatus | 09/27/2011 | 08/29/2026 | |||

| 8,109,925 | Treatment of breast disease with vibrating device | 02/07/2012 | 05/25/2027 | |||

| D667,117 | Ultrasonic bone cutting blade | 09/11/2012 | 09/11/2026 | |||

| 8,343,178 | Method for ultrasonic tissue excision with tissue selectivity | 01/01/2013 | 12/30/2031 | |||

| 8,353,912 | Ultrasonic spinal surgery method | 01/15/2013 | 08/12/2030 | |||

| D680,218 | Ultrasonic bone cutting blade | 04/16/2013 | 04/16/2027 | |||

| 8,430,897 | Ultrasonic wound debrider probe and method of use | 04/30/2013 | 03/11/2028 | |||

| 8,444,629 | Medical handpiece with automatic power switching means | 05/21/2013 | 01/12/2031 |

| 10 |

| D683,087 | Surgical instrument sleeve | 06/25/2013 | 06/25/2027 | |||

| D699,839 | Surgical shield | 02/18/2014 | 02/18/2028 | |||

| D700,327 | Ultrasonic osteotome tip | 02/25/2014 | 02/25/2028 | |||

| 8,659,208 | Waveform generator for driving electromechanical device | 02/25/2014 | 07/26/2032 | |||

| 8,690,783 | Ultrasonic transducer assembly | 04/08/2014 | 05/20/2031 | |||

| 8,698,377 | Dual-mode piezocomposite ultrasonic transducer | 04/15/2014 | 05/20/2031 | |||

| 8,814,870 | Hook blade for bone cutting | 08/26/2014 | 06/14/2026 | |||

| 8,894,673 | Guarded osteotome | 11/25/2014 | 10/07/2031 | |||

| 9,070,856 | Digital waveform generator | 06/30/2015 | 06/12/2028 | |||

| D715,434 | Osteotome blades-design | 10/14/2014 | 10/14/2028 | |||

| D715,936 | Osteotome blades | 10/21/2014 | 10/21/2028 | |||

| D715,435 | Osteotome blades-design | 10/14/2014 | 10/14/2028 | |||

| D715,436 | Osteotome blades-design | 10/14/2014 | 10/14/2028 | |||

| 152,513* | Serrated hook blade | 08/01/2014 | 08/01/2024 |

The Company regularly has patents that have been applied for but have not received approval; to date the Company has thirty (30) pending U.S. patent applications and thirty five (35) pending international applications.

| * | Patent valid in Canada. |

| 11 |

The following is a list of the U.S. trademarks which have been issued to the Company:

| Registration | Registration | ||||||

| Number | Date | Mark | Goods | ||||

| 2,812,718 | 02/10/2004 | Misonix | Ultrasonic medical devices, namely ultrasonic surgical aspirators, ultrasonic lithotripters and ultrasonic phacoemulsifiers | ||||

| 3,373,435 | 01/22/2008 | SonicOne | Ultrasonic surgical systems | ||||

| 3,583,091 | 03/03/2009 | Osteosculpt | Surgical devices, and instruments, namely, ultrasonic cutters and ablators | ||||

| 3,775,329 | 04/13/2010 | Sonastar | Ultrasonic medical devices namely ultrasonic surgical aspirators, ultrasonic scalpels and ultrasonic bone shavers | ||||

| 3,637,456 | 06/16/2009 | Misonix | Ultrasonic cleaning units and ultrasonic liquid processors for industrial, domestic and/or laboratory use | ||||

| 4,506,761 | 04/01/2014 | SonicOne Plus | Ultrasonic surgical system | ||||

| 3,882,225 | 11/30/2010 | Misonix | Laboratory equipment | ||||

| 4,715,865 | 04/07/2015 | BoneScalpel | Surgical devices and instruments, and surgical and medical kits for ultrasonic surgical procedures comprised of ultrasonic cutting blades, ultrasonic bone cutting blades, osteotomes, ultrasonic osteotomes; ultrasonic ablating tools, namely, ultrasonic cutting blades, ultrasonic osteotomes; ultrasonic bone ablating tools, namely, ultrasonic bone cutting blades, ultrasonic bone shavers, ultrasonic osteotomes; incising tools, namely, cutting instruments, osteotomes and ultrasonic incising tools, namely, ultrasonic cutting blades, ultrasonic osteotomes; and ancillary ultrasonic surgical equipment, namely, ultrasonic signal generators, ultrasonic waveform generators, ultrasonic controllers, cables, hand-pieces with electro-mechanical transducers |

| 12 |

Backlog

As of June 30, 2015, the Company's backlog (firm orders that have not yet been shipped) was $33,238, as compared to $357,645 as of June 30, 2014. The Company’s method of business has changed with the shift from major distributors in 2012. As a result, we no longer have large recurring orders but ship on a just in time basis.

Employees

As of June 30, 2015, the Company employed a total of 80 full-time employees, including 30 in management and supervisory positions. The Company considers its relationship with its employees to be good.

Website Access Disclosure

The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K are available free of charge on the Company's website at www.misonix.com as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). Copies of the Company's Annual Report will be made available to shareholders, free of charge, upon written request.

| 13 |

In addition to the other information contained in this Annual Report on Form 10-K and the exhibits hereto, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition and/or results of operations could be materially adversely affected by any of these risks. This section contains forward-looking statements. You should refer to the explanation of the qualifications and limitations on forward-looking statements set forth immediately prior to the beginning of Item 1 of this Annual Report on Form 10-K. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business, financial condition and/or results of operations. The following list sets forth many, but not all, of the factors that could impact the Company’s ability to achieve results discussed in any forward-looking statement. Investors should understand that it is not possible to predict or identify all such factors and should not consider this list to be a complete statement of all potential risks and uncertainties.

Risks Related to Our Business

We are subject to extensive medical device regulation which may impede or hinder the approval process for our products and, in some cases, may not ultimately result in approval or may result in the recall or seizure of previously approved products.

Our products, development activities and manufacturing processes are subject to extensive and rigorous regulation by the FDA pursuant to the Federal Food, Drug, and Cosmetic Act (the "FDC Act"), by comparable agencies in foreign countries, and by other regulatory agencies and governing bodies. Under the FDC Act, medical devices must receive FDA clearance or approval before they can be commercially marketed in the U.S. In addition, most major markets for medical devices outside the U.S. require clearance, approval or compliance with certain standards before a product can be commercially marketed. The process of obtaining marketing approval or clearance from the FDA for new products, or with respect to enhancements or modifications to existing products, could:

| • | take a significant period of time; |

| • | require the expenditure of substantial resources; |

| • | involve rigorous pre-clinical and clinical testing; |

| • | require changes to the products; and |

| • | result in limitations on the indicated uses of the products. |

Even after products have received marketing approval or clearance, product approvals and clearances by the FDA can be withdrawn due to failure to comply with regulatory standards or the occurrence of unforeseen problems following initial approval. There can be no assurance that we will receive the required clearances from the FDA for new products or modifications to existing products on a timely basis or that any FDA approval will not be subsequently withdrawn. Later discovery of previously unknown problems with a product or manufacturer could result in fines, delays or suspensions of regulatory clearances, seizures or recalls of products, operating restrictions and/or criminal prosecution. The failure to receive product approval clearance on a timely basis, suspensions of regulatory clearances, seizures or recalls of products or the withdrawal of product approval by the FDA could have a material adverse effect on our business, financial condition or results of operations.

We may not meet regulatory quality standards applicable to our manufacturing and quality processes and registrations of products outside the United States.

As a medical device manufacturer, we are required to register with the FDA and are subject to periodic inspection by the FDA for compliance with the FDA's Quality System Regulation requirements, which require manufacturers of medical devices to adhere to certain regulations, including testing, quality control and documentation procedures. In addition, the Federal Medical Device Reporting regulations require us to provide information to the FDA whenever there is evidence that reasonably suggests that a medical device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. Compliance with applicable regulatory requirements is subject to continual review and is rigorously monitored through periodic inspections by the FDA. In the European Community and China, we are required to maintain certain ISO certifications in order to sell our products and must undergo periodic inspections by notified bodies to obtain and maintain these certifications. Failure to meet regulatory quality standards could have a material adverse effect on our business, financial condition or results of operations.

| 14 |

Future intellectual property litigation could be costly and disruptive to us.

We operate in an industry that is susceptible to significant intellectual property litigation and, in recent years, it has been common for companies in the medical device field to aggressively challenge the patent rights of other companies in order to prevent the marketing of new devices. Intellectual property litigation is expensive, complex and lengthy and its outcome is difficult to predict. Future patent litigation may result in significant royalty or other payments or injunctions that can prevent the sale of products and may significantly divert the attention of our technical and management personnel. In the event that our right to market any of our products is successfully challenged, and if we fail to obtain a required license or are unable to design around a patent, our business, financial condition or results of operations could be materially adversely affected.

We may not be able to effectively protect our intellectual property rights.

Patents and other proprietary rights are and will be essential to our business and our ability to compete effectively with other companies will be dependent upon the proprietary nature of our technologies. We also rely upon trade secrets, know-how, continuing technological innovations, strategic alliances and licensing opportunities to develop, maintain and strengthen our competitive position. We pursue a policy of generally obtaining patent protection in both the U.S. and abroad for patentable subject matter in our proprietary devices and also attempt to review third-party patents and patent applications to the extent publicly available to develop an effective patent strategy, avoid infringement of third-party patents, identify licensing opportunities and monitor the patent claims of others. We currently own numerous U.S. and foreign patents. We also are party to various license agreements pursuant to which patent rights have been obtained or granted in consideration for cash or royalty payments. No assurance can be made that any pending or future patent applications will result in issued patents, that any current or future patents issued to, or licensed by, us will not be challenged or circumvented by our competitors, or that our patents will not be found invalid.

In addition, we may have to take legal action in the future to protect our patents, trade secrets or know-how or to assert our intellectual property rights against claimed infringement by others. Any legal action of that type could be costly and time consuming to us and no assurances can be made that any lawsuit will be successful.

The invalidation of key patents or proprietary rights that we own, or an unsuccessful outcome in lawsuits to protect our intellectual property, could have a material adverse effect on our business, financial condition or results of operations.

Future product liability claims and other litigation, including private securities litigation and shareholder derivative suits, may adversely affect our business, reputation and ability to attract and retain customers.

The design, manufacture and marketing of medical device products of the types that we produce entail an inherent risk of product liability claims. A number of factors could result in an unsafe condition or injury to, or death of, a patient with respect to these or other products that we manufacture or sell, including component failures, manufacturing flaws, design defects or inadequate disclosure of product-related risks or product-related information. These factors could result in product liability claims, a recall of one or more of our products or a safety alert relating to one or more of our products. Product liability claims may be brought by individuals or by groups seeking to represent a class.

Anyone or any company can bring an action against Misonix.

Our judicial system allows anyone to bring a claim against the Company and force the Company to defend itself even if the claim is baseless. The defense may or may not be covered by the Company’s insurance, the result of which could ultimately create a burden on the Company dependent upon the outcome.

Our future growth is dependent upon the development of new products and line extensions, which requires significant research and development, clinical trials and regulatory approvals, all of which are very expensive and time-consuming and may not result in a commercially viable product.

In order to develop new products and improve current product offerings, we focus our research and development programs largely on the development of next-generation and novel technology offerings across multiple programs and opportunities.

As a part of the regulatory process of obtaining marketing clearance from the FDA for new products, we conduct and participate in numerous clinical trials with a variety of study designs, patient populations and trial endpoints. Unfavorable or inconsistent clinical data from existing or future clinical trials conducted by us, by our competitors or by third parties, or the market's perception of this clinical data, may adversely impact our ability to obtain product approvals from the FDA, our position in, and share of, the markets in which we participate and our business, financial condition, results of operations or future prospects.

| 15 |

New products may not be accepted in the market.

We are now, and will continue to be, developing new products and introducing them into the market. There can be no assurance that any new product will be accepted by the market. New products are sometimes introduced into the market in a prototype format and may need later revisions or design changes before they operate in a manner to be accepted in the market. As a result of the introduction of new products, there is some risk that revenue expectations may not be met and in some cases the product may not achieve market acceptance.

We face intense competition and may not be able to keep pace with the rapid technological changes in the medical device industry.

The medical device product market is highly competitive. We encounter significant competition across our product lines and in each market in which our products are sold from various medical device companies, some of which have greater financial and marketing resources than we do.

Additionally, the medical device product market is characterized by extensive research and development and rapid technological change. Developments by other companies of new or improved products, processes or technology may make our products or proposed products obsolete or less competitive and may negatively impact our revenues. In some cases foreign companies may attempt to copy our designs illegally. We are required to devote continued efforts and financial resources to develop or acquire scientifically advanced technologies and products, apply our technologies cost-effectively across product lines and markets, attract and retain skilled development personnel, obtain patent and other protection for our technology and products, obtain required regulatory and reimbursement approvals and successfully manufacture and market our products. Failure to develop new products or enhance existing products could have a material adverse effect on our business, financial condition or results of operations.

Consolidation in the healthcare industry could lead to demands for price concessions or the exclusion of some suppliers from certain of our significant market segments.

The cost of healthcare has risen significantly over the past decade and numerous initiatives and reforms initiated by legislators, regulators and third-party payers to curb these costs have resulted in a consolidation trend in the healthcare industry, including hospitals. This in turn has resulted in greater pricing pressures and the exclusion of certain suppliers from important market segments as group purchasing organizations, independent delivery networks and large single accounts continue to consolidate purchasing decisions for some of our hospital customers. We expect that market demand, government regulation, third-party reimbursement policies and societal pressures will continue to change the worldwide healthcare industry, resulting in further business consolidations and alliances among our customers and competitors, which may reduce competition, exert further downward pressure on the prices of our products and may adversely impact our business, financial condition or results of operations.

We may experience disruption in supply due to our dependence on our suppliers to continue to ship product requirements and our inability to obtain suppliers of certain components for our products.

Our suppliers may encounter problems during manufacturing due to a variety of reasons, including failure to follow specific protocols and procedures, failure to comply with applicable regulations, equipment malfunctions, labor shortages or environmental factors. In addition, we purchase both raw materials used in our products and finished goods from various suppliers and may have to rely on a single source supplier for certain components of our products where there are no alternatives are available. Although we anticipate that we have adequate sources of supply and/or inventory of these components to handle our production needs for the foreseeable future, if we are unable to secure on a timely basis sufficient quantities of the materials we depend on to manufacture our products, if we encounter delays or contractual or other difficulties in our relationships with these suppliers, or if we cannot find suppliers at an acceptable cost, then the manufacture of our products may be disrupted, which could increase our costs and have a material adverse effect on our business.

If we fail to manage any expansion or acquisition, our business could be impaired.

We may in the future acquire one or more technologies, products or companies that complement our business. We may not be able to effectively integrate these into our business and any such acquisition could bring additional risks, exposures and challenges to the Company. In addition, acquisitions may dilute our earnings per share, disrupt our ongoing business, distract our management and employees, increase our expenses, subject us to liabilities and increase our risk of litigation, all of which could harm our business. If we use cash to acquire technologies, products, or companies, such use may divert resources otherwise available for other purposes. If we use our common stock to acquire technologies, products, or companies, our shareholders may experience substantial dilution. If we fail to manage any expansions or acquisition, our business could be impaired.

| 16 |

Our agreements and contracts entered into with partners and other third parties may not be successful.

We signed in the past and may pursue in the future agreements and contracts with third parties to assist in our marketing, manufacturing, selling and distribution efforts. We cannot assure you that any agreements or contracts entered into will be successful.

The current disruptions in the financial markets could affect our ability to obtain debt financing on favorable terms (or at all) and have other adverse effects on us.

The United States credit markets have recently experienced historic dislocations and liquidity disruptions which have caused financing to be unavailable in many cases and even if available caused spreads on prospective debt financings to widen considerably. These circumstances have materially impacted liquidity in the debt markets, making financing terms for borrowers able to find financing less attractive, and in many cases have resulted in the unavailability of certain types of debt financing. Continued uncertainty in the credit markets may negatively impact our ability to access debt financing on favorable terms or at all. In addition, Federal legislation to deal with the current disruptions in the financial markets could have an adverse effect on our financial condition and results of operations.

The fluctuation of our quarterly results may adversely affect the trading price of our common stock.

Our revenues and results of operations have in the past and will likely vary in the future from quarter to quarter due to a number of factors, many of which are outside of our control and any of which may cause our stock price to fluctuate. You should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance. It is likely that in some future quarters, our results of operations may be below the expectations of public market analysts and investors. In this event, the price of our common stock may fall.

We may not be able to attract and retain additional key management, sales and marketing and technical personnel, or we may lose existing key management, sales and marketing or technical personnel, which may delay our development and marketing efforts.

We depend on a number of key management, sales and marketing and technical personnel. The loss of the services of one or more key employees could delay the achievement of our development and marketing objectives. Our success will also depend on our ability to attract and retain additional highly qualified management, sales and marketing and technical personnel to meet our growth goals. We face intense competition for qualified personnel, many of whom are often subject to competing employment offers, and we do not know whether we will be able to attract and retain such personnel.

Future changes in financial accounting standards or practices or existing taxation rules or practices may cause adverse or unexpected revenue fluctuations and affect our reported results of operations.

A change in accounting standards or practices or a change in existing taxation rules or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. New accounting pronouncements and taxation rules and varying interpretations of accounting pronouncements and taxation practice have occurred and may occur in the future. Changes to existing rules or the questioning of current practices may adversely affect our reported financial results or the way we conduct our business.

Adverse litigation results could affect our business.

Litigation can be lengthy, expensive and disruptive to our operations, and results cannot be predicted with certainty. An adverse decision could result in monetary damages or injunctive relief that could affect our financial condition or results of operations.

The Affordable Healthcare for America Act includes provisions that may adversely affect our business and results of operations, including an excise tax on the sales of most medical devices.

On March 21, 2010, the House of Representatives passed the Affordable Health Care for America Act, which President Obama signed into law on March 23, 2010. While the current evaluation for this legislation is not material, its potential impact on the Company may adversely affect our business and results of operations. The medical device tax has been established, but in the future the government may decide to increase the tax rate.

| 17 |

We are subject to extensive anti-corruption laws and regulations.

Our international operations must comply with U.S. law, including the U.S. Foreign Corrupt Practices Act (“FCPA”). The FCPA and similar foreign anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence foreign government officials for the purpose of obtaining or retaining business regardless of whether those practices are legal or culturally expected in the foreign jurisdiction. Recently, there has been a substantial increase in the global enforcement of anti-corruption laws. Although we are not aware of any incidents, we could be the subject of claims that may adversely impact our business, results of operations, financial condition or reputation. Violations of these laws could result in criminal or civil sanctions.

We are experiencing greater scrutiny and regulation by governmental authorities, which may lead to greater regulation in the future.

Our medical devices and our business activities are subject to rigorous regulation, including by the FDA, U.S. Department of Justice, and numerous other federal, state and foreign governmental authorities. These authorities and members of Congress have been increasing their scrutiny of our industry. Certain state governments and the federal government have enacted legislation aimed at increasing transparency of our interactions with health care providers. As a result, we are required by law to disclose payments and other transfers of value to health care providers licensed by certain states and, starting with payments or other transfers of value made on or after August 1, 2013, to all U.S. physicians and U.S. teaching hospitals at the federal level. Any failure to comply with these legal and regulatory requirements could impact our business. In addition, we may continue to devote substantial additional time and financial resources to further develop and implement policies, systems, and processes to comply with enhanced legal and regulatory requirements, which may also impact our business. We anticipate that governmental authorities will continue to scrutinize our industry closely, and that additional regulation may increase compliance and legal costs, exposure to litigation, and other adverse effects on our operations.

Risk of reprocessing disposables.

In some jurisdictions around the world culture and practice encourages reuse when the product is clearly labeled for single use.

Item 1B. Unresolved Staff Comments.

None.

The Company occupies approximately 34,400 square feet at 1938 New Highway, Farmingdale, New York pursuant to a lease expiring on June 30, 2018. The Company pays rent of approximately $26,000 a month, which includes a pro rata share of real estate taxes, water, sewer and other charges which are assessed on the leased premises or the land upon which the leased premises are situated. The Company believes that the leased facilities are adequate for its present needs.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

| 18 |

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

| (a) | The Company's common stock, $.01 par value ("Common Stock"), is listed on the Nasdaq Global Market ("Nasdaq") under the symbol "MSON". |

The following table sets forth the high and low sales prices for the Common Stock during the periods indicated as reported by Nasdaq:

| High | Low | |||||||

| Fiscal 2015: | ||||||||

| First Quarter | $ | 13.49 | $ | 6.01 | ||||

| Second Quarter | 14.90 | 8.89 | ||||||

| Third Quarter | 14.50 | 10.78 | ||||||

| Fourth Quarter | 13.90 | 9.50 | ||||||

| High | Low | |||||||

| Fiscal 2014: | ||||||||

| First Quarter | $ | 5.50 | $ | 3.92 | ||||

| Second Quarter | 6.03 | 3.86 | ||||||

| Third Quarter | 7.17 | 4.85 | ||||||

| Fourth Quarter | 6.88 | 5.57 | ||||||

| High | Low | |||||||

| Fiscal 2013: | ||||||||

| First Quarter | $ | 4.38 | $ | 2.15 | ||||

| Second Quarter | 9.13 | 4.01 | ||||||

| Third Quarter | 8.55 | 2.98 | ||||||

| Fourth Quarter | 6.91 | 5.00 | ||||||

| (b) | As of August 12, 2015, the Company had 7,744,113 shares of Common Stock outstanding and 66 shareholders of record. This does not take into account shareholders whose shares are held in "street name" by brokerage houses. |

| (c) | The Company has not paid any cash dividends since its inception. The Company does not intend to pay any cash dividends in the foreseeable future, but intends to retain all earnings, if any, for use in its business operations. |

| 19 |

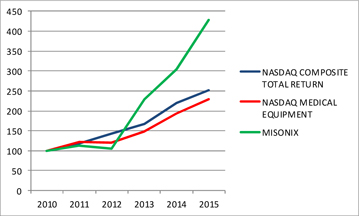

Share Performance Graph

The following graph compares the cumulative total return on the Company’s Common Stock during the last five fiscal years with the NASDAQ Total U.S. and Foreign Return Index and the NASDAQ Medical Devices, Instruments and Supplies Index during the same period. The graph shows the value, at the end of each of the last five fiscal years, of $100 invested in the Common Stock or the indices on June 30, 2010. The graph depicts the change in value of the Company’s Common Stock relative to the noted indices as of the end of each fiscal year and not for any interim period. Historical stock price performance is not necessarily indicative of future stock price performance.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||

| MISONIX, INC. | 100 | 113 | 105 | 230 | 304 | 428 | ||||||||||||||||||

| NASDAQ Composite Total Return | 100 | 119 | 142 | 167 | 219 | 251 | ||||||||||||||||||

| NASDAQ Medical Equipment Index | 100 | 122 | 120 | 149 | 194 | 224 | ||||||||||||||||||

| 20 |

Equity Compensation Plan Information:

| Number of | ||||||||||||

| securities | ||||||||||||

| remaining | ||||||||||||

| available for | ||||||||||||

| Number of | Weighted | future | ||||||||||

| securities to | -average | issuance | ||||||||||

| be | exercise | under equity | ||||||||||

| issued upon | price of | compensation | ||||||||||

| exercise of | outstanding | plans | ||||||||||

| outstanding | options, | (excluding | ||||||||||

| options, | warrants | securities | ||||||||||

| warrants | and | reflected in | ||||||||||

| Plan category | and rights | rights | column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | ||||||||||||

| I. 1996 Directors Plan | 15,000 | $ | 7.60 | - | ||||||||

| II. 1996 Plan | 1,000 | 7.60 | - | |||||||||

| III.1998 Plan | 6,000 | 7.60 | - | |||||||||

| IV.2001 Plan | 9,968 | 2.80 | - | |||||||||

| V. 2005 Plan | 223,725 | 2.19 | 625 | |||||||||

| VI. 2005 Directors Plan | 120,000 | 3.63 | 12,500 | |||||||||

| VII. 2009 Plan | 345,423 | 2.91 | 21,100 | |||||||||

| VIII. 2009 Directors Plan | 138,750 | 5.68 | 35,000 | |||||||||

| IX. 2012 Plan | 442,750 | 6.59 | 48,500 | |||||||||

| X. 2012 Directors Plan | 75,000 | 13.20 | 125,000 | |||||||||

| XI. 2014 Plan | 180,000 | 12.28 | 570,000 | |||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | 1,557,616 | $ | 5.80 | 812,725 | ||||||||

| 21 |

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes appearing in Item 8 “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K.

The consolidated statements of income data for the years ended June 30, 2013, 2014 and 2015 and the consolidated balance sheet data as of June 30, 2014 and 2015 are derived from our audited consolidated financial statements appearing in Item 8 of this Annual Report on Form 10-K. The consolidated statements of income data for the years ended June 30, 2011 and 2012 and the consolidated balance sheets data as of June 30, 2011, 2012 and 2013 are derived from our audited consolidated financial statements that are not included in this Annual Report on Form 10-K. The historical results are not necessarily indicative of the results to be expected in any future period.

Selected income statement data:

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net sales | $ | 22,204,578 | $ | 17,060,435 | $ | 14,827,226 | $ | 15,678,000 | $ | 12,373,029 | ||||||||||

| Net income (loss) from continuing operations | 5,571,171 | 1,393,299 | (2,670,965 | ) | 366,325 | (3,534,246 | ) | |||||||||||||

| Net Income/(loss) per share from continuing operations - Basic | $ | 0.70 | $ | 0.15 | $ | (0.40 | ) | $ | (0.09 | ) | $ | (0.30 | ) | |||||||

| Net Income/(loss) per share from continuing operations - Diluted | $ | 0.66 | $ | 0.15 | $ | (0.40 | ) | $ | (0.09 | ) | $ | (0.30 | ) | |||||||

Selected balance sheet data:

| June 30, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Total assets | $ | 26,454,248 | $ | 19,527,869 | $ | 17,359,927 | $ | 18,312,837 | $ | 18,358,322 | ||||||||||

| Total long term liabilities | 20,395 | 67,932 | 96,745 | 140,143 | 175,403 | |||||||||||||||

| Total stockholders' equity | 23,754,345 | 16,352,364 | 13,777,220 | 15,590,067 | 14,877,283 | |||||||||||||||

| 22 |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following table sets forth, for the three most recent fiscal years, the percentage relationship to net sales of principal items in the Company's Consolidated Statements of Operations:

| Fiscal years ended | ||||||||||||

| June 30, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of goods sold | 32.8 | 34.8 | 50.1 | |||||||||

| Gross profit | 67.2 | 65.2 | 49.9 | |||||||||

| Selling expenses | 40.8 | 42.6 | 45.7 | |||||||||

| General and administrative expenses | 26.9 | 27.5 | 30.0 | |||||||||

| Research and development expenses | 7.2 | 10.0 | 10.1 | |||||||||

| Total operating expenses | 74.9 | 80.2 | 85.8 | |||||||||

| Loss from operations | (7.7 | ) | (14.9 | ) | (35.9 | ) | ||||||

| Other income | 19.1 | 21.7 | 16.2 | |||||||||

| Income/(loss) before provision for income taxes | 11.3 | 6.8 | (19.7 | ) | ||||||||

| Income tax (benefit)/expense | (12.5 | ) | 0.2 | (0.5 | ) | |||||||

| Net income/(loss) from continuing operations | 23.9 | 6.6 | (19.2 | ) | ||||||||

| Income from discontinued operations (net of income tax) | 1.2 | 1.6 | 1.2 | |||||||||

| Net income/(loss) | 25.1 | % | 8.2 | % | (18.0 | )% | ||||||

| 23 |

Results of Operations:

The following discussion and analysis provides information which the Company's management believes is relevant to an assessment and understanding of the Company's results of operations and financial condition. This discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere herein. Unless otherwise specified, this discussion relates solely to the Company's continuing operations.

All of the Company's sales have been derived from the sale of medical device products, which include manufacture and distribution of ultrasonic medical device products.

Fiscal years ended June 30, 2015 and 2014:

Net sales:

Net sales increased $5,144,143 to $22,204,578 in fiscal 2015 from $17,060,435 in fiscal 2014. The increase is due to higher BoneScalpel revenue of $3,400,398, higher SonicOne revenue of $1,045,786 and higher SonaStar revenue of $861,224, partially offset by lower Lithotripsy revenue of $81,666, lower service revenue of $51,295 and lower other revenue of $30,304. There were 83 BoneScalpel units consigned in the United States in fiscal 2015 as compared to 59 consigned BoneScalpel units in fiscal 2014.

Set forth below are tables showing the Company’s net sales by (i) product category and (ii) geographic region for the years ended June 30, 2015 and 2014:

| For the years ended ended June 30, | ||||||||||||

| 2015 | 2014 | Variance | ||||||||||

| BoneScalpel | $ | 11,084,084 | $ | 7,683,686 | $ | 3,400,398 | ||||||

| SonicOne | 3,272,826 | 2,227,040 | 1,045,786 | |||||||||

| SonaStar | 7,209,299 | 6,348,075 | 861,224 | |||||||||

| Other | 638,369 | 801,634 | (163,265 | ) | ||||||||

| $ | 22,204,578 | $ | 17,060,435 | $ | 5,144,143 | |||||||

| For the years ended ended June 30, | ||||||||

| 2015 | 2014 | |||||||

| United States | $ | 10,797,920 | $ | 8,185,468 | ||||

| Australia | 364,156 | 120,118 | ||||||

| Europe | 3,385,603 | 2,387,376 | ||||||

| Asia | 4,125,662 | 3,572,056 | ||||||

| Canada and Mexico | 836,188 | 779,833 | ||||||

| South America | 911,711 | 1,165,124 | ||||||

| South Africa | 540,185 | 378,287 | ||||||

| Middle East | 1,243,153 | 472,173 | ||||||

| $ | 22,204,578 | $ | 17,060,435 | |||||

| 24 |

Net sales increased $1,171,289 to $6,749,436 for the three month period ended June 30, 2015 from $5,578,147 for the three month period ended June 30, 2014. The increase is due to higher BoneScalpel revenue of $1,198,526 and higher SonicOne revenue of $490,809, partially offset by lower SonaStar revenue of $505,317 and lower other revenue of $12,729. There were 19 BoneScalpel units consigned in the United States for the three months ended June 30, 2015 as compared to 15 consigned units for the same period in fiscal 2014.

Set forth below are tables showing the Company’s net sales by (i) product category and (ii) geographic region for the three months ended June 30, 2015 and 2014:

| Three months ended June 30, | ||||||||||||

| 2015 | 2014 | Variance | ||||||||||

| BoneScalpel | $ | 3,685,901 | $ | 2,487,375 | $ | 1,198,526 | ||||||

| SonicOne | 984,610 | 493,801 | 490,809 | |||||||||

| SonaStar | 1,940,193 | 2,445,510 | (505,317 | ) | ||||||||

| Other | 138,732 | 151,461 | (12,729 | ) | ||||||||

| $ | 6,749,436 | $ | 5,578,147 | $ | 1,171,289 | |||||||

| Three months ended June 30, | ||||||||

| 2015 | 2014 | |||||||

| United States | $ | 3,088,818 | $ | 2,518,285 | ||||

| Australia | 50,935 | 3,960 | ||||||

| Europe | 794,987 | 799,891 | ||||||

| Asia | 1,366,541 | 1,546,564 | ||||||

| Canada and Mexico | 322,272 | 163,660 | ||||||

| South America | 296,416 | 354,147 | ||||||

| South Africa | 295,034 | 56,190 | ||||||

| Middle East | 534,433 | 135,450 | ||||||

| $ | 6,749,436 | $ | 5,578,147 | |||||

Gross profit:

Gross profit increased to 67.2% in fiscal 2015 from 65.2% in fiscal 2014. The increase is primarily related to higher sales volume as well as a favorable product mix of higher margin product deliveries in fiscal 2105. The higher sales volume resulted in higher coverage of fixed expenses resulting in higher margins.

Gross profit increased to 66.6% for the three months ended June 30, 2015 from 65.4% for the three months ended June 30, 2014. The increase is due to higher sales volume as well as a favorable product mix of higher margin product deliveries for the three months ended June 30, 2015. The higher sales volume resulted in higher coverage of fixed expenses resulting in higher margins.

Selling expenses:

Selling expenses increased $1,789,969 to $9,062,695 in fiscal 2015 from $7,272,726 in fiscal 2014. The increase is related to higher sales commissions of $560,371, higher salary expenses of $484,083 due to increased head count, higher depreciation expense of $233,833 due the increase in the number of demo units used for consignments in the field, higher travel expense of $218,143, higher employee welfare and office expense of $92,426 and higher other expenses of $12,638.

Selling expenses increased $646,030 to $2,492,432 for the three months ended June 30, 2015 from $1,846,402 for the three months ended June 30, 2014. The increase is due to higher salary and benefit expenses of $290,165 due to increased headcount, higher travel expenses of $134,718, higher sales commissions of $108,156, higher depreciation expense of $70,768 and higher consulting and advertising expenses of $44,261, partially offset by lower other expenses of $2,038.

| 25 |

General and administrative expenses:

General and administrative expenses increased $1,292,568 to $5,983,623 in fiscal 2015 from $4,691,055 in fiscal 2014. The increase is due to higher consulting expenses of $616,541 mainly as a result of a onetime expense related to the upgrade of the Company’s information and technology systems, higher non-cash compensation from the issuance of stock options of $410,365, higher stockholder relation expenses of $67,105, higher office expenses of $57,952, higher insurance expenses of $45,964, higher bonus and bank fee expenses of $55,264, higher employment fees of $35,163 and higher other expenses of $4,484.

General and administrative expenses increased $446,595 to $1,619,362 for the three months ended June 30, 2015 from $1,172,767 for the three months ended June 30, 2014. The increase is due to higher non-cash compensation due to the issuance of stock options of $156,940, higher consulting expenses of $102,006 due to one-time expenses related to the upgrade of the Company’s information and technology systems, higher insurance expenses of $60,108, higher bad debt reserve and employee expenses of $78,597, higher office and depreciation expenses of $35,993 and higher other expenses of $12,951.

Research and development expenses:

Research and development expenses decreased $118,828 to $1,592,923 for fiscal 2015 from $1,711,751 for fiscal 2014. The decrease is due to lower product development material expenses of $70,035, lower consulting expenses of $48,151 and lower other expenses of $642.

Research and development expenses increased $25,880 to $423,258 for the three months ended June 30, 2015 from $397,378 for the three months ended June 30 2014. The increase is due to higher temporary help of $13,411, higher employee benefits of $9,172 and higher other expenses of $3,297.

Other income:

Other income increased $528,189 to $4,234,363 in fiscal 2015 from $3,706,174 in fiscal 2104. The increase is related to higher royalty income from Covidien.

Other income decreased $143,550 to $1,026,366 for the three months ended June 30, 2015 from $1,169,916 for the three months ended June 30, 2014. The decrease is due to lower royalty income from Covidien.

Income taxes: In fiscal 2015 and 2014 the income tax benefit for continuing operations had an effective tax rate of (110.5%) as compared to income tax expense with an effective rate of .2% in fiscal 2014. Prior to June 30, 2014 and through March 31, 2015, the Company had a full valuation allowance recorded against deferred tax assets. As of the year ended June 30, 2015, the Company reduced the valuation allowance by $5,503,417. The change in the valuation allowance includes a $1,499,297 write-off of deferred tax assets against its corresponding valuation allowance. The write-off primarily pertains to a loss in tax benefit for net operating losses subject to limitation under federal tax law that preclude its utilization. In addition, during the fourth quarter of fiscal 2015, based on our consideration of all available positive and negative evidence including achieving cumulative profitable operating performance over the past three years and our positive outlook for taxable income in the future, the Company reevaluated its deferred tax asset. Based upon the guidance under ASC 740, we concluded that it was more likely than not that the Company would realize the benefit of such deferred tax assets. The portion of the valuation allowance release attributable to income in future years resulted in the recognition of a tax benefit of $2,892,000 in continuing operations in the fourth quarter of fiscal 2015. The deferred tax asset will be realized against future income tax expense that would be payable in the absence of the net operating loss carryforwards. The Company still maintains a full valuation allowance on foreign net operating losses.

Fiscal years ended June 30, 2014 and 2013:

Net sales:

Net sales increased $2,233,209 to $17,060,435 in fiscal 2014 from $14,827,226 in fiscal 2013. The increase is due to higher BoneScalpel revenue of $1,340,540, higher SonaStar revenue of $1,037,032 and higher SonicOne revenue of $369,644, partially offset by lower service revenue of $385,202, lower Lysonix revenue of $114,679 and lower other revenue of $14,126.

| 26 |

Set forth below are tables showing the Company’s net sales by (i) product category and (ii) geographic region for the years ended June 30, 2014 and 2013:

| For the years ended June 30, | ||||||||||||

| 2014 | 2013 | Variance | ||||||||||

| BoneScalpel | $ | 7,683,686 | $ | 6,343,146 | $ | 1,340,540 | ||||||

| SonicOne | 2,227,040 | 1,857,396 | 369,644 | |||||||||

| SonaStar | 6,348,075 | 5,311,043 | 1,037,032 | |||||||||

| Other | 801,634 | 1,315,641 | (514,007 | ) | ||||||||

| $ | 17,060,435 | $ | 14,827,226 | $ | 2,233,209 | |||||||

| For the years ended June 30, | ||||||||

| 2014 | 2013 | |||||||

| United States | $ | 8,185,468 | $ | 7,649,041 | ||||

| Australia | 120,118 | 358,509 | ||||||

| Europe | 2,387,376 | 3,062,307 | ||||||

| Asia | 3,572,056 | 1,619,255 | ||||||

| Canada and Mexico | 779,833 | 516,088 | ||||||

| South America | 1,165,124 | 735,060 | ||||||

| South Africa | 378,287 | 489,756 | ||||||

| Middle East | 472,173 | 397,210 | ||||||

| $ | 17,060,435 | $ | 14,827,226 | |||||

Net sales for the three months ended June 30, 2014 were $5,578,147, an increase of $1,819,164 from $3,758,983 for the three months ended June 30, 2013. The increase is due to higher SonaStar revenue of $1,047,342, higher BoneScalpel revenue of $975,434, higher SonicOne revenue of $63,614 and higher other revenue of $1,521, partially offset by lower Lysonix revenue of $168,386 and lower service revenue of $100,361.

Set forth below are tables showing the Company’s net sales by (i) product category and (ii) geographic region for the three months ended June 30, 2014 and 2013:

| Three months ended June 30, | ||||||||||||

| 2014 | 2013 | Variance | ||||||||||

| BoneScalpel | $ | 2,487,375 | $ | 1,511,941 | $ | 975,434 | ||||||

| SonicOne | 493,801 | 430,187 | 63,614 | |||||||||

| SonaStar | 2,445,510 | 1,398,168 | 1,047,342 | |||||||||

| Other | 151,461 | 418,687 | (267,226 | ) | ||||||||

| $ | 5,578,147 | $ | 3,758,983 | $ | 1,819,164 | |||||||

| Three months ended June 30, | ||||||||

| 2014 | 2013 | |||||||

| United States | $ | 2,518,285 | $ | 1,996,969 | ||||

| Australia | 3,960 | 37,135 | ||||||

| Europe | 799,891 | 762,499 | ||||||

| Asia | 1,546,564 | 525,776 | ||||||

| Canada and Mexico | 163,660 | 79,350 | ||||||

| South America | 354,147 | 156,680 | ||||||

| South Africa | 56,190 | 126,327 | ||||||

| Middle East | 135,450 | 74,247 | ||||||

| $ | 5,578,147 | $ | 3,758,983 | |||||

| 27 |

Gross profit:

Gross profit increased to 65.2% in fiscal 2014 from 49.9% in fiscal 2013. The increase is primarily due to the reversal of $438,509 of Soma related costs previously accrued in fiscal 2013 in accordance with the PuriCore Settlement Agreement (see Note 8 to Consolidated Financial Statements included in this Annual Report) in addition to $638,000 of Soma-related costs booked in fiscal 2013, in addition to inventory reserves booked in the fourth quarter 2013.

Gross profit increased to 65.4% for the three months ended June 30, 2014 from 34.2% for the three months ended June 30, 2013. The increase is primarily related to Soma-related costs of approximately $189,000 and inventory reserves of approximately $610,000 booked against the Soma and Anika inventory in fiscal 2013.

Selling expenses:

Selling expenses increased $496,522 to $7,272,726 (42% of sales) in fiscal 2014 from $6,776,204 (46% of sales) in fiscal 2013. The increase is due to higher sales commissions of $765,711, higher depreciation expense of $176,598 (due to the increase in number of demonstration units placed in the field) and higher other expenses of $3,779, partially offset by lower personnel expenses of $221,248 and lower travel expenses of $228,318.

Selling expenses for the three months ended June 30, 2014 decreased $160,935 to $1,846,402 (33% of sales) from $2,007,337 (53% of sales) for the three months ended June 30, 2013. The decrease is due to lower personnel costs of $167,154, lower travel expenses of $144,452 and lower advertising expenses of $69,751, partially offset by higher sales commission expenses of $215,479 and higher other expenses of $4,943.

General and administrative expenses:

General and administrative expenses increased $244,566 to $4,691,055 in fiscal 2014 from $4,446,489 in fiscal 2013. The increase is related to higher non-cash compensation expenses from the issuance of stock options of $208,413, higher legal expenses of $45,167 and higher accounting and travel expenses of $42,132, partially offset by lower bad debt expense of $50,000 and other lower expenses of $1,145.

For the three months ended June 30, 2014, general and administrative expenses increased $16,949 to $1,172,767 from $1,155,818 for the three months ended June 30, 2013. The increase is primarily related to higher non-cash compensation expenses from the issuance of stock options of $55,468 and other higher expenses of $6,428, partially offset by lower consulting expenses of $44,947.

Research and development expenses:

Research and development expenses increased $215,693 to $1,711,751 in fiscal 2014 from $1,496,058 in fiscal 2013. The increase in research and development expenses is due to higher product development material costs of $75,625, higher temporary help expenses of $57,592, higher legal expenses of $34,246, higher amortization expense of $24,099 and other higher expenses of $24,131.

For the three months ended June 30, 2014, research and development expenses increased $44,609 to $397,378 from $352,769 for the three months ended June 30, 2013. The increase is due to higher product development labor expenses of $21,331, higher legal expenses of $18,849 and higher other expenses of $4,429.

Other income:

Other income increased $1,309,345 to $3,706,174 in fiscal 2014 from $2,396,829 in fiscal 2013. The increase in other income is related to higher royalty income from Covidien of $1,213,781.

Other income increased $486,502 to $1,169,916 for the three months ended June 30, 2014 from $683,414 for the three months ended June 30, 2013. The increase is due to higher royalty income from Covidien of $431,110.

Income taxes: In fiscal 2014 and 2013 the income tax benefit for continuing operations had an effective tax rate of .2%. Overall, when considering discontinued operations, the Company had minimal income tax expense. In prior years the Company established a valuation allowance against deferred tax assets due to the net loss from operations over the past 5 years which caused management to conclude that it is more likely than not that its deferred tax assets may not be fully realized.

| 28 |

Discontinued operations:

The following represents the results of the Laboratory and Forensic Safety Products business along with legal and other expenses associated with Labcaire Systems Limited and Misonix HIFU Technologies Limited which are included in discontinued operations:

| For the years ended | ||||||||||||

| June 30, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Revenues | $ | 18,242 | $ | 19,901 | $ | 19,901 | ||||||

| Income from discontinued operations, before tax | $ | 18,242 | $ | 19,901 | $ | 5,449 | ||||||

| Gain on sale of discontinued operations | 250,000 | 250,000 | 250,000 | |||||||||

| Income tax expense | (1,127 | ) | (3,182 | ) | (79,667 | ) | ||||||

| Net income from discontinued operations, net of tax | $ | 267,115 | $ | 266,719 | $ | 175,782 | ||||||

See Note 1 of the Notes to Consolidated Financial Statements included in Item 8 of this Annual Report for further discussion of the nature of discontinued operations.

Liquidity and Capital Resources:

Working capital at June 30, 2015 and 2014 was $18,289,000 and $12,277,000, respectively. For the fiscal year ended June 30, 2015, cash provided by operations totaled $2,371,339, mainly due to higher net income, partially offset by higher inventory and accounts receivable. For the fiscal year ended June 30, 2015, cash used in investing activities totaled $778,203, primarily consisting of the purchase of property, plant and equipment along with filing for additional patents. For the fiscal year ended June 30, 2015, cash provided by financing activities was $723,560. Cash provided by discontinued operations was $267,115.