Attached files

Registration No. ____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BREATHE ECIG CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1040

|

37-1640902

|

||

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

322 Nancy Lynn Lane, Suite 7

Knoxville, TN 37919

(865) 337-7549

(Address and telephone number of principal executive offices and principal place of business)

CRA of America, LLC

606 S. Ninth St.

Las Vegas, NV 89101

(Name, address and telephone number of agent for service)

Copies to:

Jeffrey M. Quick

Quick Law Group, P.C.

1035 Pearl Street, Suite 403

Boulder, CO 80302

Telephone: (720) 259-3393

Facsimile: (303) 845-7315

Approximate date of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company þ

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of

Securities to be registered |

Amount of Shares

to be

Registered

|

Proposed maximum

offering price

per share

|

Proposed

maximum aggregate

offering price

|

Amount of

Registration

Fee

|

||||||||||||||

|

Common Stock

|

12,000,000 | (1 | ) | $ | .045 | (3) | $ | 540,000 | $ | 62.75 | (3) | |||||||

|

Common Stock

|

8,000,000 | (2 | ) | .045 | (3) | 360,000 | 41.83 | (3) | ||||||||||

|

(1)

|

Represents shares issued and issuable pursuant to the Securities Purchase Agreement between the Company and FirstFire Global Opportunities Fund LLC, a Delaware limited lability company (“FirstFire”), dated July 2, 2015 (the “Purchase Agreement”).

|

|

(2)

|

Represents shares issuable under the Warrant issued by the Company to FirstFire on July 2, 2015 (the “Warrant”) pursuant to the terms of the Purchase Agreement.

|

|

(3)

|

Calculated in accordance with Rule 457(c) of the Securities Act, based upon the average high and low prices reported on the OTCQB on August 13, 2015.

|

We may hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until we shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement is filed with the Securities and Exchange Commission and becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 17, 2015

PRELIMINARY PROSPECTUS

20,000,000 SHARES OF COMMON STOCK

BREATHE ECIG CORP.

This prospectus relates to the resale of up to 20,000,000 shares of our common stock, which may be offered by the selling stockholder, FirstFire Global Opportunities Fund LLC, a Delaware limited liability company, or FirstFire. The shares of common stock being offered by the selling stockholder are comprised of the following: (i) 12,000,000 shares issued or issuable pursuant to the Securities Purchase Agreement between us and FirstFire on July 2, 2015 (the “Purchase Agreement”) and (ii) 8,000,000 shares issuable under the Warrant issued by the Company to FirstFire on July 2, 2015 (the “Warrant”) pursuant to the terms of the Purchase Agreement.

We are not selling any securities under this prospectus and will not receive any of the proceeds from the resale of shares of our common stock by the selling stockholder under this prospectus, however, we have received gross proceeds of $240,000 from the sale of the shares under the Purchase Agreement.

FirstFire may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. We provide more information about how FirstFire may sell its shares of common stock in the section titled “Plan of Distribution” on page 25. We will pay the expenses incurred in connection with the offering described in this prospectus, with the exception of brokerage expenses, fees, discounts and commissions, which will be paid by the selling stockholder. With respect to the shares of Common Stock that have been and may be issued pursuant to the Purchase Agreement, FirstFire is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act, and with respect to any other shares of common stock, FirstFire may be deemed to be an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Our common stock is quoted on the OTCBB Marketplace operated by FINRA, or the OTCQB, under the symbol “BVAP”. The last reported sale price of our common stock on the OTCBB on August 13, 2015 was $0.045 per share.

Investing in our common stock involves a high degree of risk. Please see the sections entitled “Risk Factors” on page 10 of this prospectus and “Part I—Item 1A Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [_________], 2015.

TABLE OF CONTENTS

|

Page

|

||||

|

PART I - INFORMATION REQUIRED IN PROSPECTUS

|

||||

|

1

|

||||

| SUMMARY OF FINANCIAL INFORMATION | 8 | |||

|

10

|

||||

|

10

|

||||

|

23

|

||||

|

23

|

||||

|

23

|

||||

|

25

|

||||

|

26

|

||||

|

27

|

||||

|

27

|

||||

|

36

|

||||

|

36

|

||||

|

37

|

||||

|

38

|

||||

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 41 | |||

|

41

|

||||

|

47

|

||||

|

49

|

||||

|

50

|

||||

|

II-1

|

||||

|

II-1

|

||||

|

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

|

||||

|

II-2

|

||||

|

II-2

|

||||

|

II-2

|

||||

|

II-3

|

||||

|

II-4

|

||||

|

II-6

|

||||

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted.

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information and the financial statements appearing elsewhere in this Prospectus. This Prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we,” “our,” “us,” the “Company,” or the “Registrant” refer to Breathe Ecig Corp., a Nevada corporation.

Our Business

Breathe, LLC was formed in October 2013 and Breathe eCigs. Corp. was formed on December 31, 2014. On December 31, 2014, Breathe, LLC entered into a Bill of Sale to transfer 100% of the assets to Breathe eCigsCorp.

Since formation, Breathe has operated as a development stage company, with the intentions of designing marketing and distributing electronic cigarettes (“E-cigarettes”), vaporizers, e-liquids (i.e., liquid nicotine) and related accessories. As of December 31, 2014 Breathe had no revenues and limited assets.

E-cigarettes and vaporizers are replacements for traditional cigarettes allowing smokers to reproduce the smoking experience. Although they do contain nicotine, E-cigarettes and vaporizers do not burn tobacco and are not smoking cessation devices.

Breathe’s initial line of products will focus on E-cigarettes. The present day E-Cigarette is a smokeless, battery-powered device that vaporizes liquid nicotine for delivery via inhalation by the user. The E-Cigarette does not contain tobacco, only nicotine derived from the tobacco plant and trace amounts of secondary chemical ingredients. The component parts of an E-Cigarette are the nicotine cartridge; the atomizer (which vaporizes the liquid nicotine); the rechargeable battery that powers it; and a light-emitting diode (LED) indicator at the end that is activated when the user draws in air (collectively referred to as the “Component Parts”). Breathe will partner with manufacturers in the United States who will be responsible for producing the liquid nicotine filling the nicotine cartridge with liquid nicotine; thereby ensuring a safe and high standard process for producing a consumer product.

Market Opportunity For E-Cigarettes

Breathe operates within the rapidly growing and global e-cigarette industry, an emerging product category that is taking market share from the $783 billion global tobacco industry. The American Cancer Society estimates that there are 1.3 billion tobacco smokers in the world, consuming approximately 6 trillion cigarettes per year, or 190 thousand cigarettes per second. Tobacco use is the leading cause of preventable illness and death, causing more than 5 million annual deaths across the globe according to the CDC. We believe e-cigarettes offer an alternative for current smokers of traditional cigarettes.

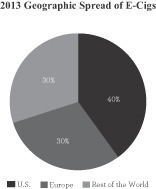

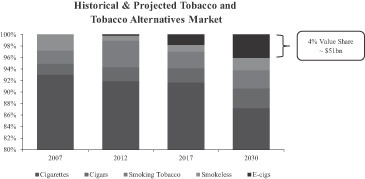

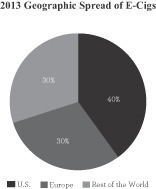

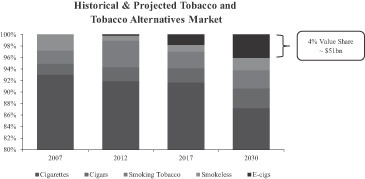

Still in the early stages of its market penetration, the e-cigarette industry is highly fragmented with approximately 250 brands worldwide according to the CDC. Primarily propelled by the cannibalization of the traditional tobacco industry, the global e-cigarette industry has recently experienced dramatic growth. According to Euromonitor, e-cigarettes accounted for approximately $3.5 billion in 2013 global retail sales, with approximately 40% of sales generated in the U.S., 30% of sales generated in Europe, and 30% of sales generated in the rest of the world. Euromonitor estimated that significant market growth was achieved from 2012 to 2013 with the U.S., Europe and the rest of the world generating growth rates of 180%, 160%, and 150%, respectively. Euromonitor also projects e-cigarette sales to represent approximately $51 billion, or 4% of the global tobacco and tobacco alternatives market by 2030. We believe that we are well positioned to benefit from, and take advantage of, these attractive market trends in the coming years.

|

|

Source: Euromonitor International 2013.

Below is a table presenting the market shares in the United States of various e-cigarette brands for the 52 weeks ended August 30, 2014:

BUSINESS STRATEGY

Breathe’s strategic goal is to profitably expand its operations. The business strategies employed by Breathe to achieve this goal are defined succinctly through the Company’s mission statement of creating Socially Responsible Innovation in the E-Cigarette and Vaporizer industries and by fulfilling the following objectives:

|

●

|

Building a strong brand through a concentration of operational focus on the design, market and distribution of exceptional quality electronic cigarettes and vaporizers;

|

|

●

|

Specializing in the development of great tasting proprietary organic and naturally flavored e-liquids with nicotine from Tennessee-sourced Tobacco plants;

|

|

|

●

|

Exceptional Packaging – The Company’s high-end products will comprise high quality packaging, unique and customizable labeling for specific customers and retailers;

|

|

●

|

Age Verification A commitment to verifying and ensuring that all Breathe customers are at least 21 years old, through specific product labeling and marketing efforts focused on the adult population age 21 and older;

|

|

●

|

Environmentally Conscious Production and Disposal Process A commitment to establishing an environmentally aware production and disposal process, which shall include a special recycling program for eligible retailers where (a) said retailers will be provided with a self-mailer option to ship expended lithium batteries and other recyclables to a designated facility and (b) where proceeds from these eligible recyclables will then be shared with the respective retailers;

|

|

●

|

Pursuing Growth Opportunities Focusing on pursuing growth opportunities after launching our current product offerings and seeking brands, other products, and partnerships to complement our high-end quality products;

|

|

●

|

Maximizing our financial performance Continuing to drive our business activities to deliver improved financial performance; and

|

|

●

|

Developing a global distribution platform with the emphasis of serving customers throughout the entire world.

|

License to Intellectual Property and Brand Portfolio

Breathe has the exclusive licensing rights to sell the following product lines:

|

●

|

Mini e-cigarette Pack – a standard e-cigarette pack designed for vending machines and convenience stores;

|

|

●

|

Original non CP – a standard rechargeable single unit without the child protective device;

|

|

●

|

Original with CP - a standard rechargeable single unit with the child protective device;

|

|

●

|

Smart e-cigarette PCC – Smart e-cigarette carrying case, 2 rechargeable mini-e-cigarettes with 5 cartridges and iPhone chargeable connections;

|

|

●

|

5 Pack mini Ref – 5 mini cartridges for the mini size e-cigarette; and

|

|

●

|

5 pack Standard Ref – 5 refillable cartridges for the mini-size e-cigarettes.

|

Pricing, Sales Model; e-Commerce and Retail

Breathe plans to offer its Products at prices, determined based on pricing strategies that are developed by the Company from time to time and which management believes to be best suited to achieve the Company’s goals at such time. These pricing strategies are expected to be developed based on a number of factors, including the needs and behaviors of customers, purchase volumes, market specific criteria, and the Company’s costs of goods.

The price of the brand portfolio of products are broken down as follows, with prices varying based on product type and distribution channel (e-commerce vs. retail):

|

Mini e-Cig

Pack

|

Original non

CP

|

Original with

CP

|

Smart E-Cig

PCC

|

5 Pack mini

Ref.

|

5 pack

Standard

Ref.

|

|||||||||||||||||||

|

E-Commerce Price

|

$ | 19.95 | $ | 19.95 | $ | 19.95 | $ | 38.00 | $ | 19.95 | $ | 19.95 | ||||||||||||

|

Retail Price

|

$ | 10.00 | $ | 10.00 | $ | 10.50 | $ | 25.00 | $ | 10.50 | $ | 10.50 | ||||||||||||

Management believes that the elegant design of the packaging, along with high quality products which feature excellent tasting, proprietary and handcrafted flavors justifies the costs and increases the margins.

Production and Supply for e-cigarette Lines

The launch of a new E-Cigarette line involves input from many different sources, from the manufacturer to the customer.

The stages of the development, manufacturing, production and distribution process of the E-cigarette can be summarized as follows:

|

●

|

Discussions with designers and creators (includes analysis and factory trends, target clientele and market communication);

|

|

●

|

Concept choice;

|

|

●

|

Produce mock-ups for final acceptance of unit device, packaging and flavoring;

|

|

●

|

Receive bids from component suppliers;

|

|

●

|

Choose suppliers;

|

|

●

|

Schedule production and packaging;

|

|

●

|

Issue component part purchase orders;

|

|

●

|

Follow quality control procedures for incoming components;

|

|

●

|

Follow packaging and inventory control procedures;

|

|

●

|

Engage U.S. based FDA certified e-liquid manufacturer to produce and fill nicotine cartridges after

receiving Component Parts; and

|

|

●

|

Production specialists who carry out packaging or logistics for storage, order preparation and shipment.

|

Procurement and Distribution

In launching E-Cigarette lines, the Company must be able to coordinate procuring the Component Parts, manufacturing the product, packaging the product, storage, distribution and order processing. The Company has been in discussions with a Canadian-based and Chinese based manufacturer who will produce the pen devices. The Company has been in discussions with a U.S. based manufacturer who will produce the e-liquids and who will also fill the cartridges with the e-liquids, which in turn will allow all of the Company’s consumables to be U.S. oriented. Therefore, after the pen devices are manufactured overseas, the e-liquid filled cartridges will be inserted in the U.S. and ready for distribution.

The Company has been in discussions with a distribution center and warehouse located in Knoxville, TN who will procure the component goods from the manufacturers and other suppliers, package the Company’s products for distribution, manage purchase orders and the electronic data interchange.

Additionally, the distribution partner, under the supervision of the Company’s leadership, will be responsible for negotiate pricing and payment terms with suppliers, manufacture and package the products and coordinate payment to the suppliers.

Finally, the Company’s experienced leadership team will be responsible for all component costs, transportation, assembly costs and a management fee paid to the Distribution and Manufacturer.

Market Opportunity

The e-cigarette industry is booming – approximately 3.5 million Americans regularly use e-cigarettes, according to a 2013 study done by Mary Diduch. The Centers for Disease Control show that e-cigarette use quadrupled in a single year from 2009 to 2010. Based on 2011 numbers alone, 21% of adult smokers in the United States have used e-cigarettes, 6% of all adults have tried e-cigarettes, and general awareness of e-cigarettes rose to 60% of all adults, up from 40% from 2010 according to a 2013 study published by the CDC. The co-founder of the Tobacco Vapor Electronic Cigarette Association stated in March 2012 that nearly 20 million e-cigarette cartridges are sold in the United States, per week.

Moreover, there is currently a favorable regulatory environment with certain federal, local and state regulation focused at advertising, age verification and use bans in public areas.

Marketing and Growth Strategies

In order to increase brand awareness, the Company began to focus its marketing initiatives and efforts through the development of a proprietary system that has accumulated over 20 million individuals that have the potential to see very advertisement and social media post produced by the Company. In addition to hosting a secure web portal, www.breathecig.com, that promotes the Company’s products and will handle orders, the Company has also been marketed on major social media platforms: LinkedIn, Facebook, Twitter, Instagram, Google and Pinterest. Because of this successful initial marketing effort:

|

●

|

The Company has already received hundreds of requests for more information on its products;

|

|

●

|

These initial efforts have been cost effective and have not involved a substantial drive to promote sales;

|

|

●

|

The Company’s website has received over 600,000 visitors during the last 18 months; and

|

|

●

|

The Company has received numerous requests from customers interested in purchasing Breathe’s products including but not limited to major retail groups, Hotel Chains, Restaurants and Club Owners.

|

Retail and Wholesale Distribution

The Company is developing unique and distinct brands for its E-cigarette Products for purposes of marketing and selling such branded E-cigarette Products, initially in North America, China, Africa, and Europe, through retail and wholesale distribution channels, including convenience stores, retail chains, wholesale trade, pharmacies, gas stations, hotels, industrial customers, clubs, casinos and duty free stores.

In addition, the Company intends to enter into exclusive agreements with various distributors providing them with exclusivity on certain brands of Product in defined territories and markets worldwide.

E-Commerce

The Company intends to distribute its branded Products through its website, www.breathecig.com, and other online sales platforms. Through its e-commerce sales initiatives, the Company hopes to generate recurring purchases of its exclusive brands of E-cigarettes from customers who are legally allowed to purchase cigarettes in the United States and other regions. Management expects that its marketing strategy will include various forms of social media as a key element in its marketing strategies and in further establishing and growing the Company’s business.

White Label/Private Brand Distribution

The Company is actively pursuing opportunities and relationships to develop and offer its Products on a “white label”, private branded basis. Management of the Company believes that there is an opportunity to supply Products on a custom branded basis to a variety of customers for purposes of resale. These potential customers may include wholesale and retail customers that have or wish to develop a private customizable label.

Subsequent Events

Securities Purchase Agreement and Warrant

On July 2, 2015 (the “Closing Date”), the Company, entered into a securities purchase agreement (the “Purchase Agreement”) with FirstFire Global Opportunities Fund LLC, a Delaware limited liability company (“FirstFire”). Pursuant to the terms of the Purchase Agreement, FirstFire purchased from the Company on the Closing Date (i) 4,000,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) and (ii) a warrant to acquire up 4,000,000 shares of the Company’s Common Stock at an exercise price $0.20 per share, subject to adjustment, for a period of five years from the Closing Date (the “Warrant”), for an total purchase price of $240,000 (the “First Tranche”).

Pursuant to the Purchase Agreement, FirstFire shall be required to purchase an additional (i) 3,333,333 shares of the Company’s Common Stock and (ii) a warrant to acquire up 3,333,333 shares of the Company’s Common Stock at an exercise price $0.20 per share for a period of five years from the date of issuance for an total purchase price of $200,000 (the “Second Tranche”). FirstFire shall be obligated to make the Second Tranche investment within five trading days of the effective date of the Registration Statement (as defined below) but only if the Company’s Common Stock has a closing price as of such date greater than $0.08 per share.

The shares of Common Stock issued to FirstFire under the First Tranche and, if applicable, the Second Tranche shall be subject to adjustment without any additional further consideration from FirstFire as set forth below:

First Adjustment. On the date six months from the Closing Date (the “First Adjustment Date”), the Company shall issue to FirstFire the number of shares of Common Stock (if positive) obtained by subtracting (i) 4,000,000 plus, if applicable, the Second Tranche shares from (ii) the quotient determined by dividing (A) $240,000 plus, if applicable, the Second Tranche investment amount by (B) the closing price of the Common Stock on the First Adjustment Date (the “Standard First Adjustment”). Additionally, if on the First Adjustment Date, the closing price of the Common Stock is (i) between $0.06 and $0.08, the Company shall issue to FirstFire an additional 10% of the number of shares of Common Stock issued as the Standard First Adjustment or (ii) below $0.06, the Company shall issue to FirstFire an additional 15% of the number of shares of Common Stock issued as the Standard First Adjustment (the “Bonus First Adjustment”). The shares of Common issued under the Standard First Adjustment and Bonus First Adjustment shall be referred to as the “First Adjustment Shares”.

Second Adjustment. On the date seven months from the Closing Date (the “Second Adjustment Date”), the Company shall issue to FirstFire the number of shares of Common Stock (if positive) obtained by subtracting (i) the number obtained by subtracting (A) the First Adjustment Shares, if any, from (B) 4,000,000 plus, if applicable, the Second Tranche shares from (ii) the quotient determined by dividing (A) $240,000 plus, if applicable, the Second Tranche investment amount by (B) the closing price of the Common Stock on the Second Adjustment Date (the “Standard Second Adjustment”). Additionally, if on the Second Adjustment Date, the closing price of the Common Stock is (i) between $0.06 and $0.08, the Company shall issue to FirstFire an additional 10% of the number of shares of Common Stock issued as the Standard Second Adjustment or (ii) below $0.06, the Company shall issue to FirstFire an additional 15% of the number of shares of Common Stock issued as the Standard Second Adjustment.

During the term of the Warrant if the Company issues or sells Common Stock (subject to certain exclusions) from $0.10 to $0.20 per share, the exercise price of the Warrant shall be reduced to such price. The Warrant shall not be subject to cashless exercise unless there is not an effective Registration Statement with respect to the shares of Common Stock underlying the Warrant at the expiration of the then applicable holding period of Rule 144 under the Securities Act. At no time will FirstFire be entitled exercise any portion of the Warrant to the extent that after such conversion or exercise, FirstFire (together with its affiliates) would beneficially own more than 4.99% of the outstanding shares of Common Stock as of such date (the “Maximum Percentage”). The Maximum Percentage may be raised to any other percentage not in excess of 9.99% at the option of FirstFire upon at least 61 days’ prior notice to the Company, or lowered to any other percentage, at the option of FirstFire, at any time.

The Company agreed to pay $6,500 of reasonable attorneys’ fees and expenses incurred by FirstFire in connection with the transaction.

The Purchase Agreement contains customary representations, warranties and covenants by, among and for the benefit of the parties. The Purchase Agreement also provides for indemnification of FirstFire and its affiliates in the event that FirstFire incurs losses, liabilities, obligations, claims, contingencies, damages, costs and expenses related to a breach by the Company of any of its representations, warranties or covenants under the Purchase Agreement.

Registration Rights Agreement

In connection with the execution of the Purchase Agreement, on the Closing Date, the Company and FirstFire also entered into a registration rights agreement dated as of the Closing Date (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company has agreed to file an initial registration statement (“Registration Statement”) with the SEC to register the resale of the Common Stock under the First and Second Tranche and for which the Warrant may be exercised, on or prior to forty-five days from the Closing Date (the “Filing Deadline”) and have it declared effective at the earlier of (i) the 150th calendar day after the Closing Date and (ii) the fifth business day after the date the Company is notified by the SEC that such Registration Statement will not be reviewed or will not be subject to further review (the “Effectiveness Deadline”).

If at any time all of the shares of Common Stock under the Purchase Agreement and Warrant are not covered by the initial Registration Statement, the Company has agreed to file with the SEC one or more additional Registration Statements so as to cover all of the shares of Common Stock under the Purchase Agreement and Warrant not covered by such initial Registration Statement, in each case, as soon as practicable, but in no event later than the applicable filing deadline for such additional Registration Statements as provided in the Registration Rights Agreement.

The Company also agreed, among other things, to indemnify FirstFire from certain liabilities and fees and expenses of FirstFire incident to the Company’s obligations under the Registration Rights Agreement, including certain liabilities under the Securities. FirstFire has agreed to indemnify and hold harmless the Company and each of its directors, officers and persons who control the Company against certain liabilities that may be based upon written information furnished by FirstFire to the Company for inclusion in a registration statement pursuant to the Registration Rights Agreement, including certain liabilities under the Securities Act.

The Offering

As of August 13, 2015, there were 354,320,482 shares of our common stock outstanding, of which 174,672,384 shares were held by non-affiliates. Pursuant to the Purchase Agreement, we issued 4,000,000 shares of our common stock to FirstFire and a Warrant under which we may issue to FirstFire an additional 4,000,000 shares of our common stock. Additionally, we are registering 8,000,000 shares of our common stock which may be issued under the terms of the Purchase Agreement and an additional 4,000,000 shares of common stock which may be issuable under the Warrant. We are offering up to 20,000,000 shares of our common stock under this prospectus. If all of the 20,000,000 shares offered under this prospectus were issued and outstanding as of August 13, 2015, such shares would represent approximately 5.64% of the total number of shares of our common stock outstanding and 11.13% of the total number of outstanding shares of our common stock held by non-affiliates, in each case as of August 13, 2015.

|

Common stock offered by Selling Stockholder

|

20,000,000 shares of common stock that we have either issued to or may issue to FirstFire:

|

|

|

Common stock outstanding before the offering

|

354,320,482 shares of common stock including 4,000,000 shares already issued to First Fire per the Purchase Agreement.

|

|

|

Common stock outstanding after the offering

|

370,320,452 shares of common stock.

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we have received gross proceeds of $240,000 pursuant to the Purchase Agreement.

|

|

|

OTCBB Trading Symbol

|

BVAP

|

|

|

Risk Factors

|

The shares of common stock offered by this prospectus involve a number of significant risk factors. See “Risk Factors” beginning on page 10 of this prospectus.

|

|

SUMMARY OF FINANCIAL INFORMATION

The following selected financial information is derived from the Company’s Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus.

It should be noted that during the year ended December 31, 2014, we were an exploratory stage-mining corporation. As such, you should not view our operating results for 2014 as indicative of, or as a basis for, our operations in 2015 as our future operations will solely be related to our eCigarette business.

Statement of Operations Data:

|

Years Ended December 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Revenues

|

$

|

-

|

$

|

-

|

||||

|

Cost of good sold

|

-

|

-

|

||||||

|

Gross profit

|

-

|

-

|

||||||

|

Operating expenses

|

2,772,549

|

2,992,167

|

||||||

|

Other Expense

|

287,266

|

15,308

|

||||||

|

Net income (loss) before taxes

|

(3,059,815

|

)

|

(2,937,475)

|

|||||

|

Income tax benefit (expense)

|

-

|

-

|

||||||

|

Net loss

|

$

|

(3,059,815)

|

$

|

(2,937,475)

|

||||

|

Net loss per share

|

$

|

(0.03)

|

$

|

(0.03)

|

||||

|

Weighted average common shares outstanding

|

96,010,164

|

90,057,890

|

||||||

|

Six Month Period Ended June 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Revenues

|

$

|

6,000

|

$

|

-

|

||||

|

Cost of goods sold

|

7,057

|

-

|

||||||

|

Gross loss

|

(1,057)

|

-

|

||||||

|

Operating expenses

|

6,436,856

|

534,038

|

||||||

|

Interest expense, net

|

(177,674

|

)

|

(35,911

|

)

|

||||

|

Net income (loss) before taxes

|

(6,675,780)

|

(569,949)

|

||||||

|

Income tax benefit (expense)

|

-

|

-

|

||||||

| Loss from discontinued operations | (20,553 | ) | (508,587 | ) | ||||

|

Net loss

|

$

|

(6,696,333)

|

$

|

(1,078,536

|

)

|

|||

|

Net loss per share

|

$

|

(0.01)

|

$

|

(0.01

|

)

|

|||

|

Weighted average common shares outstanding

|

275,215,749

|

95,051,967

|

||||||

Balance Sheet Data

|

As of

June 30,

|

As of December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Cash

|

$

|

62,415

|

$

|

28,299

|

||||

|

Total Assets

|

$

|

10,340,568

|

$

|

1,457,592

|

||||

|

Total liabilities

|

1,632,055

|

649,819

|

||||||

|

Total stockholders' equity

|

8,708,513

|

807,773

|

||||||

|

Total liabilities and stockholders equity

|

$

|

10,340,568

|

$

|

1,457,592

|

||||

Cash Flow Information

|

Years Ended December 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Cash flows used in operating activities

|

$

|

(1,163,760)

|

$

|

(1,346,370)

|

||||

|

Cash flows used in investing activities

|

(71,000

|

)

|

(68,684

|

)

|

||||

|

Cash flows provided by financing activities

|

$

|

855,523

|

$

|

1,345,874

|

||||

|

Six Month Period Ended

June 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Cash flows used in operating activities

|

$

|

(1,434,736)

|

$

|

(653,580)

|

||||

|

Cash flows used in investing activities

|

-

|

(71,000

|

)

|

|||||

|

Cash flows provided by financing activities

|

$

|

1,449,447

|

$

|

235,000

|

||||

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Except for statements of historical facts, this Prospectus contains forward-looking statements involving risks and uncertainties. The words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions or variations thereof are intended to forward looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this registration statement on Form S-1 entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and the related notes included in this registration statement on Form S-1.

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this registration statement on Form S-1 that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. While the risks described below are the ones we believe are most important for you to consider, these risks are not the only ones that we face. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks related to our business

E-cigarettes are likely to become subject to increasing government regulation. Compliance with these government regulations may result in increased costs. If E-cigarettes become subject to taxes similar to regular cigarettes, or restriction on where individuals can smoke e-cigarettes, demand may decrease.

The FDA has concluded that electronic cigarettes may contain ingredients that are known to be toxic to humans and may contain other ingredients that may not be safe.

The FDA conducted a preliminary analysis on some samples of electronic cigarettes and components from two leading brands. These samples included 18 of the various flavored, nicotine, and no-nicotine cartridges offered for use with these products. These cartridges were obtained in order to test some of the ingredients contained in them and inhaled by users of electronic cigarettes. The FDA's Center for Drug Evaluation, Division of Pharmaceutical Analysis (DPA) analyzed the cartridges from these electronic cigarettes for nicotine content and for the presence of other tobacco constituents, some of which are known to be harmful to humans, including those that are potentially carcinogenic or mutagenic. The DPA's analysis of the electronic cigarette samples showed that the product contained detectable levels of known carcinogens and toxic chemicals to which users could potentially be exposed. DPA's testing also suggested that quality control processes used to manufacture these products are inconsistent or non-existent. Specifically, the DPA's analysis of the electronic cigarette cartridges from the two leading brands revealed the following:

|

|

●

|

Diethylene glycol was detected in one cartridge at approximately 1%. Diethylene glycol, an ingredient used in antifreeze, is toxic to humans;

|

|

●

|

Certain tobacco-specific nitrosamines which are human carcinogens were detected in half of the samples tested;

|

|

|

●

|

Tobacco-specific impurities suspected of being harmful to humans-anabasine, myosmine, and-nicotyrine-were detected in a majority of the samples tested;

|

|

|

●

|

The electronic cigarette cartridges that were labeled as containing no nicotine had low levels of nicotine present in all cartridges tested, except one;

|

|

|

●

|

Three different electronic cigarette cartridges with the same label were tested and each cartridge emitted a markedly different amount of nicotine with each puff. The nicotine levels per puff rangedfrom 26.8 to 43.2 mcg nicotine/100 mL puff; and

|

|

|

●

|

One high-nicotine cartridge delivered twice as much nicotine to users when the vapor from that electronic cigarette brand was inhaled than was delivered by a sample of the nicotine inhalation product (used as a control) approved by FDA for use as a smoking cessation aid.

|

Because our products may contain ingredients that are known to be toxic to humans, any decreases in tobacco product sales in the United States, including sales of our electronic cigarettes, could have a material adverse effect on our business, results of operations and financial condition.

The FDA has received voluntary reports of adverse events involving e-cigarettes from consumers, health professionals and concerned members of the public.

The FDA regularly receives voluntary reports of adverse events involving e-cigarettes from consumers, health professionals and concerned members of the public. The adverse events described in these reports have included hospitalization for illnesses such as:

|

|

●

|

Pneumonia;

|

|

●

|

Congestive heart failure;

|

|

|

●

|

Disorientation;

|

|

|

●

|

Seizure;

|

|

|

●

|

Hypotension; and

|

|

|

●

|

Other health problems.

|

Whether e-cigarettes caused these reported adverse events is unknown. Some of the adverse events could be related to a pre-existing medical condition or to other causes that were not reported to the FDA. Because our products may contribute to adverse events requiring hospitalization, any decreases in tobacco product sales in the United States as a result, including sales of our electronic cigarettes could have a material adverse effect on our business, results of operations and financial condition.

There have been publicized incidents of electronic cigarettes exploding if improperly used.

There have been several news reports publicizing incidents in which electronic cigarettes have exploded. According to such news reports, the cause of such electronic cigarettes exploding was due to improper use by users of such electronic cigarettes that charged the devices with equipment that was not intended for such devices. Although we notify users of our products with regard to how to properly use our products, we may be unable to prevent improper use that may result in explosions of our products similar to that publicized in recent news reports, which could have a material adverse effect on our business, results of operations and financial condition.

The recent development of electronic cigarettes has not allowed the medical profession to study the long-term health effects of electronic cigarette use.

Because electronic cigarettes were recently developed the medical profession has not had a sufficient period of time to study the long-term health effects of electronic cigarette use. Currently, therefore, there is no way of knowing whether or not electronic cigarettes are safe for their intended use. If the medical profession were to determine conclusively that electronic cigarette usage poses long-term health risks, electronic cigarette usage could decline, which could have a material adverse effect on our business, results of operations and financial condition.

Our business, results of operations and financial condition could be adversely affected if we are taxed like other tobacco products or if we are required to collect and remit sales tax on certain of our internet sales.

Presently the sale of electronic cigarettes is not subject to federal excise taxes, and most state and local excise taxes, like the sale of conventional cigarettes or other tobacco products, all of which have faced significant increases in the amount of taxes collected on their sales. At present, the sale of electronic cigarettes is subject to state excise taxes in only a small number of states, Minnesota and North Carolina. However, should federal, state and local governments and or other taxing authorities impose excise taxes similar to those levied by Minnesota and North Carolina, it may have a material adverse effect on the demand for our products, as consumers may be unwilling to pay the increased costs for our products.

We may be unable to establish the systems and processes needed to track and submit the excise and sales taxes we collect through Internet sales, which would limit our ability to market our products through our websites which would have a material adverse effect on our business, results of operations and financial condition. States such as New York, Hawaii, Rhode Island and North Carolina have begun collecting sales taxes on Internet sales where companies have used independent contractors in those states to solicit sales from residents of that state. The requirement to collect, track and remit sales taxes based on independent affiliate sales may require us to increase our prices, which may affect demand for our products or conversely reduce our net profit margin, either of which would have a material adverse effect on our business, results of operations and financial condition.

The market for electronic cigarettes is a niche market, subject to a great deal of uncertainty and is still evolving.

Electronic cigarettes, having recently been introduced to market, are at an early stage of development, represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future profits are substantially dependent upon the widespread acceptance and use of electronic cigarettes. Rapid growth in the use of, and interest in, electronic cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance of electronic cigarettes, in general or, specifically our products, failure to establish business relationships and competitive disadvantages as against larger and more established competitors.

We face intense competition and our failure to compete effectively could have a material adverse effect on our business, results of operations and financial condition.

We are a developmental stage company with limited capital. We will face intense competition from larger, well established e-cigarette manufacturers including big tobacco companies which are increasingly entering into the e-cigarette market. There can be no assurance that we will be able to compete based on the superior quality of our product and niche marketing opportunities.

Third parties may sue us for intellectual property infringement, which, if successful, may disrupt its business and could require it to pay significant damage awards.

Third parties may sue for intellectual property infringement, or initiate proceedings to invalidate its intellectual property, which, if successful, could disrupt the conduct of our business, cause us to pay significant damage awards or require us to cease using such infringing intellectual property. We might also incur substantial expenses in defending against third-party disputes, litigation or infringement claims, regardless of their merit. Successful claims against us might result in substantial monetary liabilities, an injunction against it and might materially disrupt the conduct of its business and harm its financial results.

Specifically, on August 5, 2015, we received a notice from Breathe, LLC, a Florida limited liability company (“Breathe LLC”), that we are violating Breathe LLC’s trademark rights under U.S. Trademark Registration No. 4,633,887 for the name “Breathe Intelligent Cigarette & Design” and a demand for us to immediately cease and desist from such use. We believe that we have rights of prior use to the name “Breathe” under the federal trademark laws. As such, on August 10, 2015, we filed (i) a Petition for Cancellation with the United States Patent and Trademark Office regarding U.S. Trademark Registration No. 4,633,887 and (ii) a Complaint against Breathe LLC in the United States District Court of Eastern District of Tennessee, Civil Action No. 3:15-cv-00345, requesting a declaratory judgment regarding our rights to use the trademark. On August 16, 2015, the Company was notified that on August 12, 2015 Breathe LLC filed a Complaint in the United States Southern District Court of New York, Civil Action N. 1:15-cv-06403, against the Company and its Chief Executive Officer, Joshua Kimmel, demanding, among other things, damages of $5,000,000 and an injunction restraining the Company from using the name “Breathe”. Although we believe we will prevail on the merits, there can be no guaranty that we will do so. If we are unable to prevail, we may be required to market our products under a different name and be subject to potential monetary damages.

Sales of conventional tobacco cigarettes have been declining, which could have a material adverse effect on our business.

The overall U.S. market for conventional tobacco cigarettes has generally been declining in terms of volume of sales, as a result of restrictions on advertising and promotions, funding of smoking prevention campaigns, increases in regulation and excise taxes, a decline in the social acceptability of smoking, and other factors, and such sales are expected to continue to decline. Recently, a national drug store chain announced that it would cease selling tobacco products. If other national drug store chains also decide to cease selling tobacco products, cigarette sales could decline further. While the sales of electronic cigarettes have been increasing over the last several years, the electronic cigarette market is only developing and is a fraction of the size of the conventional tobacco cigarette market. A continual decline in cigarette sales may adversely affect the growth of the electronic cigarette market, which could have a material adverse effect on our business, results of operations and financial condition.

Electronic cigarettes face intense media attention and public pressure.

Electronic cigarettes are new to the marketplace and since their introduction certain members of the media, politicians, government regulators and advocate groups, including independent medical physicians have called for an outright ban of all electronic cigarettes, pending regulatory review and a demonstration of safety. A partial or outright ban would have a material adverse effect on our business, results of operations and financial condition.

We may experience product liability claims in our business, which could adversely affect our business.

The tobacco industry in general has historically been subject to frequent product liability claims. As a result, we may experience product liability claims from the marketing and sale of electronic cigarettes. Any product liability claim brought against us, with or without merit, could result in:

|

●

|

Liabilities that substantially exceed our product liability insurance, which we would then be required to pay from other sources, if available;

|

|

|

●

|

An increase of our product liability insurance rates or the inability to maintain insurance coverage in the future on acceptable terms, or at all;

|

|

|

●

|

Damage to our reputation and the reputation of our products, resulting in lower sales;

|

|

|

●

|

Regulatory investigations that could require costly recalls or product modifications;

|

|

|

●

|

Litigation costs; and

|

|

|

●

|

The diversion of management’s attention from managing our business.

|

Any one or more of the foregoing could have a material adverse effect on our business, results of operations and financial condition.

If we experience product recalls, we may incur significant and unexpected costs and our business reputation could be adversely affected.

We may be exposed to product recalls and adverse public relations if our products are alleged to cause illness or injury, or if we are alleged to have violated governmental regulations. A product recall could result in substantial and unexpected expenditures that could exceed our product recall insurance coverage limits and harm to our reputation, which could have a material adverse effect on our business, results of operations and financial condition. In addition, a product recall may require significant management time and attention and may adversely impact on the value of our brands. Product recalls may lead to greater scrutiny by federal or state regulatory agencies and increased litigation, which could have a material adverse effect on our business, results of operations and financial condition.

Product exchanges, returns and warranty claims may adversely affect our business.

If we are unable to maintain an acceptable degree of quality control of our products we will incur costs associated with the exchange and return of our products as well as servicing our customers for warranty claims. Any of the foregoing on a significant scale may have a material adverse effect on our business, results of operations and financial condition.

Adverse economic conditions may adversely affect the demand for our products.

Electronic cigarettes are new to market and may be regarded by users as a novelty item and expendable as such demand for our products may be extra sensitive to economic conditions. When economic conditions are prosperous, discretionary spending typically increases; conversely, when economic conditions are unfavorable, discretionary spending often declines. Any significant decline in economic conditions that affects consumer spending could have a material adverse effect on our business, results of operations and financial condition.

Our success is dependent upon our marketing efforts.

We intend to undertake extensive marketing activities to promote brand awareness and our portfolio of products. If we are unable to generate significant market awareness for our products and our brands at the consumer level or unable to capitalize on significant marketing, advertising or promotional campaigns we undertake, our business, financial condition and results of operations could be adversely affected.

We depend on third party manufacturers for our products.

We depend on third party manufacturers for our electronic cigarettes. Our customers associate certain characteristics of our products including the weight, feel, draw, unique flavor, packaging and other attributes of our products to the brands we market, distribute and sell. Any interruption in supply and/or consistency of our products may adversely impact our ability to deliver our products to our wholesalers, distributors and customers and otherwise harm our relationships and reputation with customers, and have a materially adverse effect on our business, results of operations and financial condition.

Although we believe that several alternative sources for the components, chemical constituents and manufacturing services necessary for the production of our products are available, any failure to obtain any of the foregoing would have a material adverse effect on our business, results of operations and financial condition. Additionally, currently our manufacturers are internationally based. As such, they will be subject to instabilities in their own countries, which might directly impact the production of our products.

We may be unable to promote and maintain our brands.

We believe that establishing and maintaining the brand identities of our products is a critical aspect of attracting and expanding a large customer base. Promotion and enhancement of our brands will depend largely on our success in continuing to provide high quality products. If our customers and end users do not perceive our products to be of high quality, or if we introduce new products or enter into new business ventures that are not favorably received by our customers and end users, we will risk diluting our brand identities and decreasing their attractiveness to existing and potential customers.

Moreover, in order to attract and retain customers and to promote and maintain our brand equity in response to competitive pressures, we may have to increase substantially our financial commitment to creating and maintaining a distinct brand loyalty among our customers. If we incur significant expenses in an attempt to promote and maintain our brands, our business, results of operations and financial condition could be adversely affected.

We expect that new products and/or brands we develop will expose us to risks that may be difficult to identify until such products and/or brands are commercially available.

We are currently developing, and in the future will continue to develop, new products and brands, the risks of which will be difficult to ascertain until these products and/or brands are commercially available. For example, we are developing new formulations, packaging and distribution channels. Any negative events or results that may arise as we develop new products or brands may adversely affect our business, financial condition and results of operations.

The market for e-cigarettes is a niche market, subject to a great deal of uncertainty, and is still evolving.

E-cigarettes, having recently been introduced to market, are at an early stage of development, represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future profits are substantially dependent upon the widespread acceptance and use of e-cigarettes. Rapid growth in the use of, and interest in, e-cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance of e-cigarettes, in general or, specifically our products, failure to establish business relationships and competitive disadvantages as against larger and more established competitors.

Our business is in a relatively new consumer product segment, which is difficult to forecast.

Our industry segment is relatively new, and is constantly evolving. As a result, there is a dearth of available information with which to forecast industry trends or patterns. For instance, after several quarters of rapid growth within the segment, there was a decrease in industry growth in the second quarter of 2014 as retailers grappled with high inventory levels from 2013, coupled with changes in preferences and attitudes among users of e-cigarettes and related products. There is no assurance that sustainable industry trends or preferences will develop that will lead to predictable growth or earnings forecasts for individual companies or the industry segment as a whole. We are also unable to determine what impact future governmental regulation may have on trends and preferences or patterns within our industry segment. See “Risks Related to Government Regulation” for a discussion of the risks associated with governmental regulation.

The recent development of e-cigarettes has not allowed the medical profession to study the long-term health effects of e-cigarette use.

Because e-cigarettes were recently developed the medical profession has not had a sufficient period of time to study the long-term health effects of e-cigarette use. Currently, therefore, there is no way of knowing whether or not e-cigarettes are safe for their intended use. If the medical profession were to determine conclusively that e-cigarette usage poses long-term health risks, e-cigarette usage could decline, which could have a material adverse effect on our business, results of operations and financial condition.

The use of e-cigarettes may pose health risks as great as, or greater than, regular tobacco products.

According to the FDA, e-cigarettes may contain ingredients that are known to be toxic to humans and may contain other ingredients that may not be safe. In addition, other publicized recent studies contain assertions that additional carcinogens, including formaldehyde, may be produced through the use of tank systems. Additionally, e-cigarettes may be attractive to young people and may lead them to try other tobacco products, including conventional cigarettes that are known to cause disease. Because clinical studies about the safety and efficacy of e-cigarettes have not been submitted to the FDA, consumers currently have no way of knowing whether e-cigarettes are safe before their intended use; what types or concentrations of potentially harmful chemicals are found in these products; or how much nicotine is being inhaled.

Our products contain nicotine, which is considered to be a highly addictive substance.

Certain of our products contain nicotine, a chemical found in cigarettes and other tobacco products which is considered to be highly addictive. The Family Smoking Prevention and Tobacco Control Act, empowers the FDA to regulate the amount of nicotine found in tobacco products, but may not require the reduction of nicotine yields of a tobacco product to zero. Any FDA regulation may require us to reformulate, recall and or discontinue certain of the products we may sell from time to time, which may have a material adverse effect on us.

We need to maintain state of the art software and websites.

Website and Internet technologies are constantly changing. In order for us to remain competitive we must continue to develop and or utilize state of the art software. We must also continue to upgrade our websites to make visitors to our websites an educational and rewarding experience. If the software and technologies used in our websites should fall behind, we success of our business could be materially adversely affected.

If Internet search engines’ methodologies are modified or our search result page rankings decline for other reasons, our user engagement could decline.

We will depend in part on various Internet search engines, such as Google, Bing and Yahoo!, to direct a significant amount of traffic to our website. Our ability to maintain the number of visitors directed to our website is not entirely within our control. Our competitors’ search engine optimization, or “SEO,” efforts may result in their websites receiving a higher search result page ranking than ours, or Internet search engines could revise their methodologies in an attempt to improve their search results, which could adversely affect the placement of our search result page ranking. If search engine companies modify their search algorithms in ways that are detrimental to our new user growth or in ways that make it harder for our users to use our website, or if our competitors’ SEO efforts are more successful than ours, overall growth in our user base could slow, user engagement could decrease, and we could lose existing users. These modifications may be prompted by search engine companies entering the online professional networking market or aligning with competitors. Any reduction in the number of users directed to our website would harm our business and operating results.

Risks Related to Government Regulation

Changes in laws, regulations and other requirements could adversely affect our business, results of operations or financial condition.

In addition to the anticipated regulation of our business by the FDA, our business, results of operations or financial condition could be adversely affected by new or future legal requirements imposed by legislative or regulatory initiatives, including, but not limited to, those relating to health care, public health and welfare and environmental matters. For example, in recent years, states and many local and municipal governments and agencies, as well as private businesses, have adopted legislation, regulations or policies which prohibit, restrict, or discourage smoking; smoking in public buildings and facilities, stores, restaurants and bars; and smoking on airline flights and in the workplace. Furthermore, some states prohibit and others are considering prohibiting the sales of electronic cigarettes to minors. Other similar laws and regulations are currently under consideration and may be enacted by state and local governments in the future. At present, it is not clear if electronic cigarettes, which omit no smoke or noxious odors, are subject to such restrictions. If electronic cigarettes are subject to restrictions on smoking in public and other places, our business, operating results and financial condition could be materially and adversely affected. New legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase the prices of goods and services because of increased costs or reduced availability. We cannot predict whether such legislative or regulatory initiatives will result in significant changes to existing laws and regulations and/or whether any changes in such laws or regulations will have a material adverse effect on our business, results of operations or financial condition.

We may face the same governmental actions aimed at conventional cigarettes and other tobacco products.

Tobacco industry expects significant regulatory developments to take place over the next few years, driven principally by the World Health Organization’s Framework Convention on Tobacco Control (“FCTC”). The FCTC is the first international public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of reducing initiation of tobacco use and encouraging cessation. Regulatory initiatives that have been proposed, introduced or enacted include

|

|

●

|

The levying of substantial and increasing tax and duty charges;

|

|

●

|

Restrictions or bans on advertising, marketing and sponsorship;

|

|

|

●

|

The display of larger health warnings, graphic health warnings and other labeling requirements;

|

|

|

●

|

Restrictions or bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines;

|

|

|

●

|

Requirements regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituents levels;

|

|

|

●

|

Requirements regarding testing, disclosure and use of tobacco product ingredients;

|

|

|

●

|

Increased restrictions on smoking in public and work places and, in some instances, in private places and outdoors;

|

|

|

●

|

Elimination of duty free allowances for travelers; and

|

|

|

●

|

Encouraging litigation against tobacco companies.

|

If electronic cigarettes are subject to one or more significant regulatory initiates enacted under the FCTC, our business, results of operations and financial condition could be materially and adversely affected.

Limitation by states and cities on sales of e-cigarettes may have a material adverse effect on our ability to sell our products in the United States.

Certain states and cities have enacted laws which preclude the use of e-cigarettes where traditional tobacco-burning cigarettes cannot be used and others have proposed legislation that would categorize e-cigarettes as tobacco products, which if enacted, would be regulated in a manner equivalent to their tobacco burning counterparts. For example, San Francisco, California has passed legislation that includes e-cigarettes under its anti-smoking laws, including only allowing the use of e-cigarettes in areas where traditional cigarettes may be smoked and requiring a tobacco permit to sell e-cigarettes. Chicago, Illinois has passed legislation prohibiting the use of e-cigarettes in most public indoor places and requires that e-cigarettes may only be sold from “behind the counter.” New York City has amended its Smoke Free Air Act to ban the use of e-cigarettes anywhere that traditional cigarettes may not be used, such as bars, parks, restaurants and beaches. Similarly, Boston, Massachusetts has banned the use of e-cigarettes in the workplace and restricted the use of e-cigarettes to adults. Additionally, New Jersey, North Dakota and Utah have included bans on the use of e-cigarettes in designated smoke-free areas such as restaurants and bars, and New York has proposed law that will prohibit the sale or provision of any quantity of e-liquid used to fill e-cigarettes or cartridges. Several states and cities are currently considering similar initiatives and if such states and cities pass or further legislate to ban the use of e-cigarettes anywhere the use of traditional tobacco burning cigarettes are banned, e-cigarettes may lose their appeal as an alternative to traditional cigarettes; which may have the effect of reducing the demand for our products and as a result have a material adverse effect on our business, results of operations and financial condition.

Restrictions on the public use of e-cigarettes may reduce the attractiveness and demand for our e-cigarettes.

Certain states, cities, businesses, providers of transportation and public venues in the U.S. have already banned the use of e-cigarettes, while others are considering banning the use of e-cigarettes. If the use of e-cigarettes is banned anywhere the use of traditional tobacco burning cigarettes is banned, e-cigarettes may lose their appeal as an alternative to traditional tobacco burning cigarettes, which may reduce the demand for our products and, thus, have a material adverse effect on our business, results of operations and financial condition.

We may not be able to establish sustainable relationships with large retailers or national chains.

We believe the best way to develop brand and product recognition and increase sales volume is to establish relationships with large retailers and national chains. We currently do not have established relationships with any retailers or national chains Any agreement that we reach, we may have to pay “slotting fees”, to carry and offer our products for sale based on the number of stores our products will be carried in.

We face a risk of product liability claims and may not be able to obtain adequate insurance, and any such claims could materially and adversely affect our reputation and brand image.

Our business exposes us to potential liability risks that may arise from the clinical testing, manufacture, and sale of our products. Substantial damage awards have been issued in certain jurisdictions against pharmaceutical and tobacco companies based on claims for injuries allegedly caused by the use of pharmaceutical and tobacco products, and similar claims may be brought against manufacturers and distributors of e-cigarette products. Liability claims may be expensive to defend and result in large judgments against us. We currently carry liability insurance, however there is no assurance that it will continue to be available to us at an affordable price if at all. Our insurance may not reimburse us, or the coverage may not be sufficient to cover claims made against us. We cannot predict any or all of the possible harms or side effects that may result from the use of our current products or any future products and, therefore, the amount of insurance coverage we currently hold may not be adequate to cover all liabilities we might incur. If we are sued for any injury allegedly caused by our products, our liability could exceed our ability to pay the liability. Whether or not we are ultimately successful in any adverse litigation, such litigation could consume substantial amounts of our financial and managerial resources, all of which could have a material adverse effect on our business, financial condition, results of operations, prospects and stock price. In addition, even if a product liability claim is found to be without merit or is otherwise unsuccessful, the negative publicity surrounding such assertions regarding our products or processes could materially and adversely affect our reputation and brand image. Any loss of consumer confidence in the safety and quality of our products would be difficult and costly to overcome.

If we have improperly marketed and distributed certain of our products in violation of governmental regulations we may be subject to fines, sanctions, administrative actions, penalties and other liability, either civil and or criminal.

We may be subject to disciplinary, administrative, regulatory and or legal actions if the FDA, or any regulatory agencies in either the United Sates or any foreign jurisdiction in which our products are sold determines that our products or the means by which we marketed and sold our products was effected without the proper regulatory approvals. As a distributor and marketer of a product that a government or regulatory agency may assert is a smoking cessation device and or a tobacco product, the Company faces potential fines, sanctions, administrative actions, penalties, and other liability for: improper sales, labeling, making improper claims, referencing or publishing to its websites, marketing materials, advertisements, testimonials or representations that certain of our products have the ability or potential to treat, cure or otherwise improve a medical condition, and or provide a healthier alternative to other more traditional tobacco products.