Attached files

| file | filename |

|---|---|

| 10-Q/A - FORM 10-Q AMENDMENT - ASPIRITY HOLDINGS LLC | aspirity_10qa-063015.htm |

| EX-10..4 - ADMINISTRATIVE SERVICES AGREEMENT - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex1004.htm |

| EX-31.1 - CERTIFICATION - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex3101.htm |

| EX-31.2 - CERTIFICATION - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex3102.htm |

| EX-32.1 - CERTIFICATION - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex3201.htm |

| EX-10.5 - DATALIVE SOFTWARE LICENSE - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex1005.htm |

| EX-10.3 - SECURITY AND GUARANTEE AGREEMENT - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex1003.htm |

| EX-10.1 - EQUITY INTEREST PURCHASE AGREEMENT - ASPIRITY HOLDINGS LLC | aspirity_10qa-ex1001.htm |

Exhibit 10.2

SECURED PROMISSORY NOTE

| $20,240,704.00 | Minneapolis, MN |

| June 1, 2015 |

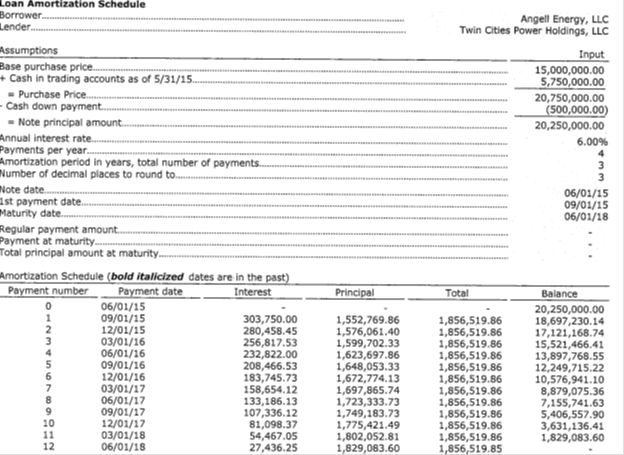

FOR VALUE RECEIVED, Angell Energy, LLC, a Texas limited liability company (the “Maker” or the “Company”), hereby promises to pay to the order of Twin Cities Power Holdings, LLC or its successors or assigns, as the case may be (“Payee”), at Payee’s principal place of business, or such other place as may be specified in writing by Payee, the principal sum of Twenty Million Two Hundred Forty Thousand Seven Hundred and Four Dollars ($20,240,704.00), together with simple interest on the unpaid principal balance from the date of this Note until May 31, 2018 (the “Maturity Date”) at the rate of six percent (6%) per annum.

1. Payments. The Maker shall make quarterly payments of interest and principal as set forth in the amortization schedule attached hereto as Exhibit A and made a part of this Note by this reference thereto. On the Maturity Date, all unpaid principal and accrued interest shall be due and payable.

2. Events of Default. The Maker will be in default under this Agreement upon the happening after the effective date of this Agreement of any of the following events:

(a). Filing by the Maker of a petition for relief under the United States Bankruptcy Code, or any other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect, or seeking the appointment of a trustee, receiver, liquidation, custodian, or other similar official of it or any substantial part of its property, or consenting to any such relief or to the appointment of or taking possession by any such official in an involuntary case or other proceeding commenced against it, or making a general assignment for the benefit of creditors.

(b). The failure by the Maker to pay any principal and accrued interest on the Note when due.

3. Remedies Upon Default. In the event of a default described above, and provided that the Maker has not cured the default within 45 days of such default, the Payee will have the right, at Payee’s option and without demand or notice: (a) to declare all or any part of the Note immediately due and payable; and (b) to exercise, in addition to the rights and remedies granted hereby, all of the rights and remedies of the Payee under the Uniform Commercial Code, or any other applicable law. In addition, the interest rate hereunder shall increase to an annual rate of 15%.

4. Security. The repayment of this Note is secured by a Security and Guarantee Agreement, of even date herewith, among Angell Energy, LLC, Twin Cities Power, LLC, Summit Energy, LLC, Michael Angell (individually) and Twin Cities Power Holdings, LLC.

| 1 |

5. Notices. All notices, requests, demands, claims and other communications pursuant to this Note will be in writing and will be deemed duly given two business days after such notice is sent by registered or certified mail, return receipt requested, postage prepaid and addressed to the intended recipient as set forth below:

(a). If to Maker:

Angell Energy Services, LLC

Attn: Michael Angell

5613 Ridgepass Lane

McKinney, TX 75071-6221

Email:

(b). If to Payee:

Twin Cities Power Holdings, LLC

16233 Kenyon Avenue

Lakeville, MN 55044

Email: tkrieger@twincitiespower.com

(c). Any Party may send any notice, request, demand, claim or other communication to the intended recipient at the address set forth above using any other means (including personal delivery, overnight courier, messenger service, telecopy, telex, ordinary mail or electronic mail). Such notice, request, demand, claim or other communication will be deemed to have been duly given on the day of personal delivery or the day after sent via reputable overnight courier. Otherwise, notice will only be deemed to have been received when it actually is received by the intended recipient. Any Party may change the address to which notices, requests, demands, claims and other communications hereunder are to be delivered by giving the other Parties notice in the manner set forth in this Agreement.

6. Invalidity of Particular Provisions. Maker and Payee agree that the unenforceability or invalidity of any provision or provisions of this Note will not render any other provision or provisions herein contained unenforceable or invalid.

7. Successors or Assigns. Maker and Payee agree that all of the terms of this Note will be binding on their respective successors and assigns, and that the term “Maker” and the term “Payee” as used herein will be deemed to include, for all purposes, their respective designees, successors, assigns, heirs, executors and administrators.

8. Governing Law; Choice of Venue, Waiver of Jury Trial. This Note will be interpreted and governed under the laws of the State of Minnesota, without regard to conflict of laws principles. Any action or proceeding against any of the Parties relating in any way to this Note or the subject matter of this Note will be brought and enforced exclusively in the competent state or federal courts of Minnesota, and the parties to this Agreement consent to the exclusive jurisdiction of such courts in respect of such action or proceeding. The Parties waive their right to a trial by jury for any action or proceeding seeking to enforce any provision of, or based on any right arising out of, this Agreement, whether grounded in tort, contract or otherwise.

| 2 |

9. Waiver. Waiver of any default hereunder by Payee will not be a waiver of any other default or of a same default on a later occasion. No delay or failure by Payee to exercise any right or remedy will be a waiver of such right or remedy and no single or partial exercise by Payee of any right or remedy will preclude other or further exercise thereof or the exercise of any other right or remedy at any other time.

10. Waiver of Presentment. Maker waives presentment, dishonor, protest, demand, diligence, notice of protest, notice of demand, notice of dishonor, notice of nonpayment, and any other notice of any kind otherwise required by law in connection with the delivery, acceptance, performance, default, enforcement or collection of this Note and expressly agrees that this Note, or any payment hereunder, may be extended or subordinated (by forbearance or otherwise) at any time, without in any way affecting the liability of Maker.

11. Collection Costs. Maker agrees to pay on demand all costs of collecting or enforcing payment under this Note, including reasonable attorneys’ fees and legal expenses, whether suit be brought or not, and whether through courts of original jurisdiction, courts of appellate jurisdiction, or bankruptcy courts, or through other legal proceedings.

12. Amendment. This Note may not be amended, converted, or modified, nor will any waiver of any provision hereof be effective, except by an instrument in writing signed by the party against whom enforcement of any amendment, conversion, modification, or waiver is sought.

IN WITNESS WHEREOF, Maker has executed this promissory note as of the date first above written.

MAKER:

ANGELL ENERGY SERVICES, LLC

_/s/ Michael C. Angell, CEO_________________

Michael Angell, Chief Executive Officer

| 3 |

Exhibit A

Amortization Schedule