Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - FRISCHS RESTAURANTS INC | v415301_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - FRISCHS RESTAURANTS INC | v415301_ex31-1.htm |

| EX-21 - EXHIBIT 21 - FRISCHS RESTAURANTS INC | v415301_ex21.htm |

| EX-32.1 - EXHIBIT 32.1 - FRISCHS RESTAURANTS INC | v415301_ex32-1.htm |

| EX-23 - EXHIBIT 23 - FRISCHS RESTAURANTS INC | v415301_ex23.htm |

| EX-31.2 - EXHIBIT 31.2 - FRISCHS RESTAURANTS INC | v415301_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended June 2, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-07323

FRISCH’S RESTAURANTS, INC.

(Exact name of registrant as specified in its charter)

| State of Ohio | 31-0523213 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

2800 Gilbert Avenue

Cincinnati, Ohio 45206

(Address of principal executive offices)

513-961-2660

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each Exchange on which registered | |

| Common Stock of No Par Value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of voting common stock held by non-affiliates of the registrant on December 16, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $106,744,052, based upon the closing sales price of the registrant’s common stock as reported on NYSE MKT on that date. The registrant does not have any non-voting common equity.

As of July 28, 2015, there were 5,131,579 shares of registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Information

Forward-looking statements are contained throughout this Annual Report on Form 10-K. Such statements may generally express management’s expectations with respect to its plans, goals and projections, or its current assumptions and beliefs concerning future developments and their potential effect on the Company. There can be no assurances that such expectations will be met or that future developments will not conflict with management’s current beliefs and assumptions, which are inherently subject to numerous risks and the development of other uncertainties. Factors that could cause actual results and performance to differ materially from anticipated results that may be expressed or implied in forward-looking statements are included in, but not limited to, the discussion in this Form 10-K under Part I, Item 1A. “Risk Factors,” Risk factors and other uncertainties may also be discussed from time to time in the Company’s news releases, public statements or in other reports that the Company files with the Securities and Exchange Commission.

Sentences that contain words such as “should,” “would,” “could,” “may,” “plan(s),” “anticipate(s),” “project(s),” “believe(s),” “will,” “expect(s),” “estimate(s),” “intend(s),” “continue(s),” “assumption(s),” “goal(s),” “target” and similar words (or derivatives thereof) are generally used to distinguish forward-looking statements from statements pertaining to historical or present facts.

All forward looking statements in this Form 10-K are provided by the Company pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995. Such forward looking information should be evaluated in the context of all of the Company's risk factors, which readers should review carefully and not place undue reliance on management's forward looking statements. Except as may be required by law, the Company disclaims any obligation to update any of the forward-looking statements that may be contained throughout this Form 10-K.

References to fiscal years used in this Form 10-K

In this Annual Report on Form 10-K, the Company’s fiscal year that ended June 2, 2015 may be referred to as Fiscal Year 2015. The Company’s fiscal year is the 52 week (364 days) or 53 week (371 days) period ending on the Tuesday nearest to the last day of the month of May. Fiscal Year 2015 consists of 52 weeks which began on June 4, 2014 and ended on Tuesday, June 2, 2015.

Also in this Annual Report on Form 10-K, the Company’s fiscal years that ended June 3, 2014, May 28, 2013, May 29, 2012, and May 31, 2011 may be referred to as Fiscal Years 2014, 2013, 2012 and 2011, respectively. All of these, except for Fiscal Year 2014, years consisted of 52 weeks. Fiscal Year 2014 consisted of 53 weeks which began on May 29, 2013 and ended on Tuesday, June 3, 2014. References to Fiscal Year 2016 refer to the 52 week year that began on June 3, 2015, which will end on Tuesday, May 31, 2016.

With the exception of Fiscal Year 2014, the first quarter of each fiscal year presented herein contained 16 weeks while the last three quarters contained 12 weeks. The fourth quarter of Fiscal Year 2014 contained 13 weeks, which occurs normally every six years.

1

(Items 1 through 4)

Background

Frisch’s Restaurants, Inc. (together with its wholly owned subsidiaries, referred to as the “Company” or the “Registrant”), is a regional company that operates full service family-style restaurants under the name “Frisch’s Big Boy.” Frisch’s Big Boy restaurants operated by the Company during the last five years have been located entirely in various regions of Ohio, Kentucky and Indiana.

Incorporated in the state of Ohio in 1947, the Company’s stock has been publicly traded since 1960, and currently trades on the NYSE MKT. The Company’s executive offices are located at 2800 Gilbert Avenue, Cincinnati, Ohio 45206. The telephone number is (513) 961-2660. The Company’s web site is www.frischs.com.

As of June 2, 2015, the Company operated 95 Frisch's Big Boy restaurants. Additionally, the Company licensed the rights to operate 26 Frisch's Big Boy restaurants to other operators. All of the restaurants licensed to other operators are located in various markets within the states of Ohio, Kentucky and Indiana.

The Company owns the trademark “Frisch’s.” The rights to the “Big Boy” trademark, trade name and service mark are exclusively and irrevocably owned by the Company for use in the states of Kentucky and Indiana, and in most of Ohio and Tennessee.

Recent Development – Merger Agreement

On May 21, 2015, the Company entered into an Agreement and Plan of Merger with FRI Holding Company, LLC and FRI Merger Sub, LLC. The merger agreement was unanimously approved by the Company’s board of directors (the Board) also on that date. Under the terms of the agreement, as disclosed in the Company’s Current Report on Form 8-K on May 22, 2015, if the merger is consummated, each outstanding share of Frisch’s Common Stock will be converted into the right to receive $34.00 per share, in cash, without interest. The consummation of the merger is subject to customary closing conditions, including the approval of Frisch’s stockholders. The merger is expected to close in the first quarter of Fiscal Year 2016, at which time, the Company will cease being an Independent Public Company and no longer be traded on the NYSE MKT or required to file periodic reports with the Securities and Exchange Commission (SEC). Both FRI Holding Company, LLC and FRI Merger Sub, LLC. are wholly owned subsidiaries of NRD Partners I, L.P.

Frisch's Big Boy Restaurants

Frisch's Big Boy restaurants are full service family-style restaurants that offer quick service in an inviting atmosphere with genuine Midwestern hospitality. All of the restaurants offer “drive-thru” service. The restaurants are generally open seven days a week, typically from 7:00 a.m. to 11:00 p.m. with extended weekend evening hours. Standardized menus offer a wide variety of items at moderate prices, featuring well-known signature items such as the original “Big Boy” double-deck hamburger sandwich, freshly made onion rings and hot fudge cake for dessert. Burgers, such as the original “Big Boy”, the Swiss Miss or Brawny Lad are made with fresh, never frozen 100 percent ground beef. Other menu selections include many sandwiches, pasta, roast beef, chicken and seafood dinners, complemented by salads topped with homemade dressings, popular side dishes and a variety of well-liked desserts, non-alcoholic beverages and many other items. The Company works continually to develop new products. In Fiscal Year 2015, the Company introduced three new “Big Dinner” meals available after 4 p.m. Customers may choose from Hand Breaded Chicken Breast Fillets, Boston Scrod or Grilled Chicken Alfredo dinners. In addition, a full breakfast menu is offered, and all of the restaurants utilize breakfast bars that are converted easily to soup and salad bars for lunch and dinner hours.

2

Drive-thru and carryout menus emphasize combo meals that consist of a popular sandwich packaged with either French fries or onion rings and a beverage and are sold at lower prices than if purchased separately. In late Fiscal Year 2013, breakfast combo meals were added to the drive-thru menu. Breakfast combo meals offer breakfast sandwiches, breakfast burritos and other offerings paired with spicy spuds and customer’s choice of coffee or a soft drink. In Fiscal Year 2015, the Breakfast Combo Meal program was expanded to include a new crispy chicken breakfast biscuit.

The menu also has quality offerings for the health conscious customer, such as the soup and salad bar, a selection of wraps, seasonal fresh fruit smoothies and a section of the menu features smaller portions. All fried foods are fried only in trans fat-free shortening. In addition, customers may order customized servings to meet their dietary concerns. For example, the company offers gluten-free alternatives and sandwiches can be ordered without the usual dressing of cheese and tartar sauce.

The operations of the Company are vertically integrated. A commissary and food manufacturing plant manufactures and prepares foods, and stocks food and beverages, paper products and other supplies for distribution to all of the Company's restaurants. Raw materials, consisting principally of food items, are generally plentiful and may be obtained from any number of reliable suppliers. Quality and price are the principal determinants of source. Most companies in the restaurant industry do not operate commissaries or food manufacturing plants, choosing instead to purchase directly from outside sources. Management believes that restaurant operations benefit from centralized purchasing and food preparation through the commissary operation, which ensures uniform product quality, timeliness of distribution (two to three deliveries per week) to restaurants and ultimately results in lower food and supply costs.

Substantially all licensed Frisch's Big Boy restaurants regularly purchase products from the commissary. Sales of commissary products to restaurants licensed to other operators were $10.8 million in Fiscal Year 2015 (5.1 percent of consolidated sales), $9.9 million in Fiscal Year 2014 (4.7 percent of consolidated sales) and $9.5 million in Fiscal Year 2013 (4.7 percent of consolidated sales).

Television and radio are the primary media to carry and promote Frisch's Big Boy’s key messages. Television conveys the visual message with food photography, while radio provides a cost effective means to promote limited time offered menu items. Outdoor billboards and targeted on-line advertising are used to complement the media plan, primarily to introduce and promote new menu items. The Company also utilizes social media as a means to develop two-way communication directly with the customer. Targeted social media communities are a cost effective way to reach a wide range of customers, but are a particularly important means to promote limited time offerings and to engage younger audiences. The marketing strategy does not include discounting to increase customer traffic.

In recent years, the Frisch's Big Boy marketing strategy has evolved from “What's Your Favorite Thing?” to a tag free advertising message. This evolution has refocused marketing campaigns away from a primary emphasis on signature menu items toward other offerings to bring awareness to Frisch's Big Boy's broad menu, along with limited time offerings. However, signature menu items continue to be promoted through television commercials that are broadcast on local network affiliates and local cable programming. Television is also used to promote drive thru availability and speed, as well as dining experience with service.

The Company currently expends for advertising an amount equal to 2.5 percent of gross sales from its restaurant operations, plus fees paid into an advertising fund by restaurants licensed to other operators.

Designed with longevity in mind while also appealing to younger customers, newly constructed Frisch's Big Boy restaurants are marked with bold colors and bright environments, featuring sleek lines, cherry colored paneling and wood trim, customized glass wall partitions, accented with abundant natural light and company memorabilia covering much of the wall space. The cost to build and equip a full service Frisch's Big Boy restaurant has ranged from $2,250,000 to $3,825,000. The cost depends greatly on the costs of land and land improvements, both of which can vary widely from location to location, and whether the land is purchased or leased. Costs also depend on whether the new restaurant is constructed using basic plans for the original 2001 building prototype (5,700 square feet with seating for 172 guests) or its smaller adaptation, the 2010 building prototype (5,000 square feet with seating for 148 guests), which is used in smaller trade areas.

3

As part of the Company’s continuing commitment to serve customers in clean, pleasant surroundings, the Company renovates approximately one-fifth of its Frisch's Big Boy restaurants each year. The renovations are designed to not only refresh and upgrade the interior finishes, but also to synchronize the interiors and exteriors of older restaurants with that of newly constructed restaurants. Depending on age and a variety of other factors, the current cost to renovate a restaurant ranges from $90,000 to $235,000. The restaurants are not closed for business when being remodeled; all work is completed after normal operating hours.

In addition, certain high-volume restaurants are regularly evaluated to determine a) whether their kitchens should be redesigned for increased efficiencies (which may cost up to $150,000) and b) if an expansion of the dining room (which may cost $800,000 or more) is warranted.

The following tabulation recaps owned and operated Frisch's Big Boy restaurant openings and closings over the five most recent fiscal years:

| Fiscal Year | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Restaurants Owned and Operated by the Company | ||||||||||||||||||||

| Beginning of Year | 96 | 95 | 93 | 95 | 91 | |||||||||||||||

| Opened | — | 1 | 2 | 1 | 4 | |||||||||||||||

| Opened Replacement building | — | — | — | 1 | — | |||||||||||||||

| Closed to make way for new building | — | — | — | (1 | ) | — | ||||||||||||||

| Closed | (1 | ) | — | — | (3 | ) | — | |||||||||||||

| End of Year | 95 | 96 | 95 | 93 | 95 | |||||||||||||||

No new Frisch’s Big Boy restaurants were opened in Fiscal Year 2015 and no new location construction was in progress as of June 2, 2015. One older restaurant in Columbus, Ohio was closed in early July 2014 (the first quarter of Fiscal Year 2015).

The following tabulation recaps openings and closings for Frisch's Big Boy restaurants that are licensed to other operators over the five most recent fiscal years:

| Fiscal Year | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Frisch's Big Boy Restaurants Licensed to Others | ||||||||||||||||||||

| Beginning of Year - Licensed to Others | 25 | 25 | 25 | 25 | 25 | |||||||||||||||

| Opened | 1 | — | — | — | — | |||||||||||||||

| Closed | — | — | — | — | — | |||||||||||||||

| End of Year - Licensed to Others | 26 | 25 | 25 | 25 | 25 | |||||||||||||||

In August 2014 (the first quarter of Fiscal Year 2015), one new Franchisee location was opened in Ironton, Ohio. No Franchisee locations were closed during Fiscal Year 2015.

4

Franchise fees are charged to licensees for use of trademarks and trade names, and licensees are required to make contributions to the Company’s general advertising account. These fees and contributions are calculated principally on percentages of sales. Total franchise and other service fee revenue earned by the Company from licensees was $1.3 million in Fiscal Year 2015 and Fiscal Year 2014 and $1.2 million in Fiscal Year 2013. Other service fees from licensees include revenue from accounting and payroll services that four of the licensed restaurants purchased from the Company in each of the last three fiscal years.

The license agreements with licensees are not uniform, but most of the licenses for individually licensed restaurants that were in effect as of June 2, 2015 are covered by agreements containing the following provisions:

| 1. | The Company grants to the Licensee the right to use the name “Frisch” and/or “Frisch’s,” “Big Boy” and related trademarks and trade names in connection with the operation of a food and restaurant business, in return for which the Licensee pays a monthly license fee equal to 3.75 percent of its gross sales. In addition, an initial license fee of $30,000 is generally required in exchange for the granting of a license for a new Frisch's Big Boy restaurant. |

| 2. | The Company provides local and regional advertising through publications, radio, television, etc., in return for which the Licensee pays a monthly fee equal to 2.5 percent of its gross sales. |

In addition, Licensees are required to conduct business on a high scale, in an efficient manner, with cleanliness and good service, all to the complete satisfaction of the Company. Licensees are required to serve only quality foods and must comply with all food, sanitation and other regulations.

Long standing area license agreements granted to other operators in northern Indiana and northwestern Ohio differ in various ways from license agreements covering individual restaurants. The most notable differences are significantly lower license and advertising fee percentages and lower initial fees paid by the area operators. Provisions for these lower fees have been perpetually in place since the 1950s.

Human Resources

The Company provides equal opportunity employment without regard to age, race, religion, color, sex, national origin, disability, veteran status or any other legally protected class. The Company’s equal opportunity employment policy provides and maintains a work environment that is free from all forms of illegal discrimination including sexual harassment. The philosophy of the policy stresses the need to train and to promote the person who becomes the most qualified individual to do a particular job. The Company is committed to promoting “Diversity” in the workplace in order to enhance its equal opportunity employment policy.

The Company remains committed to providing employees with the best training possible, as management believes that investing in people is a strategic advantage. Comprehensive recruiting and training programs are designed to maintain the food and service quality necessary to achieve the Company’s goals for operating results. A management recruiting staff is maintained at the Company’s headquarters. Corporate training centers for new restaurant managers are operated in Cincinnati, Ohio and Covington, Kentucky. The training includes both classroom instruction and on-the-job training. A full time recruiter is on staff to attract high quality hourly-paid restaurant workers.

The Company’s incentive-based compensation program for restaurant managers, area supervisors and regional directors (collectively, members of the operations management team) ties compensation of the members of the operations management team directly to the cash flows of their restaurant(s), which allows incentive compensation to be earned consistently. The incentive compensation that the members of the operations management team can earn under the program is at a level the Company believes is above the average for competing restaurant concepts. The Company believes the program maintains turnover in operations management at the lowest possible level, and has resulted in a strong operations management team that focuses on building same store sales and margins.

Employee selection software helps lower hourly employee turnover rates; an employee validation website is in place that measures employee job satisfaction; and an interactive employee training program utilizes training videos and quizzes. These digital videos are loaded directly onto the hard drive of a computer located at each restaurant that is networked to the point-of-sale system, allowing headquarters to access the interactive results.

5

Information Technology

Each of the Company’s restaurants is managed through standardized operating and control systems anchored by a point-of-sale (POS) system that allows management to instantly accumulate and utilize data for more effective decision making, while allowing restaurant managers to spend more time in the dining room focusing on the needs of customers. The system generates the guest check and provides functionality for settling the customer’s check using cash, credit or debit card, or gift card. The system provides a record of all items sold, the service time, and the server responsible for the customer. Employee time keeping is also kept on the POS system. Back office functionality provides employee scheduling, inventory control, sales forecasting, product ordering and many other management reports. Security measures include biometric sign-on devices to access the POS system. The system meets the latest security requirements of the Payment Card Industry (PCI). In Fiscal Year 2015, the Company purchased and implemented new credit card signature capture devices at a cost of $316,000 that are Europay, Mastercard, and Visa (EMV) capable and meet the revised PCI 3.0 compliance levels. In addition, the Company is in the process of installing state-of-the-art firewall/routers equipped with intelligent switches at both the corporate and store level at an expected cost of $211,000. The Company has received its attestations of PCI compliance in each of the last three years. A finding of non-compliance could restrict the Company’s privileges to accept credit cards as a form of payment. A $2,000,000 four year plan to replace POS register equipment in all Frisch's Big Boy restaurants began in August 2012. As of June 2, 2015, new POS equipment had been installed in 75 Frisch's Big Boy restaurants, including 35 in Fiscal Year 2015. Twenty three more are currently scheduled for installation in Fiscal Year 2016 (the fourth and final year of the plan).

In addition to electronic signature capture devices that process debit and credit card transactions, other paperless systems in Frisch's Big Boy restaurants include a) employee payroll advices that can be either emailed directly to the employee or provided electronically to each restaurant where the employees may print them on demand if desired, b) signatures have been captured on key employment documents such as I-9s, Forms W-4 and acknowledgments regarding employee handbooks, c) an on-line employment application is on the Company’s corporate web site (www.frischs.com) that provides direct feeds into the POS system and the enterprise reporting system at headquarters, and d) a portal/dashboard, accessed centrally on corporate information systems, provides "actionable" information to restaurant operations, with "critical" information presented graphically.

Standardized operating and control systems also include an automated drive-thru timer system in all Frisch's Big Boy restaurants that measures the time from when a customer’s car first enters the drive-thru station until the order is received and the customer exits the drive-thru. This information is provided to the restaurant manager in a real time environment, which reduces the amount of time required to serve customers. To replenish restaurant inventories, a “suggested order” automated system analyzes current inventory balances and sales patterns and then “suggests” a replenishment order from the commissary operation. This process optimizes in-store inventory levels, which results in better control over food costs, identifies waste and improves food quality.

To enhance the customer's experience while visiting the drive-thru, a program was launched in Fiscal Year 2014 to fit each restaurant with an order confirmation board, replete with a sleek, custom built canopy to protect the customer from the elements of the weather, The order confirmation boards ensure that all drive-thru orders are filled accurately with the speed of service the customer expects. The project was completed during Fiscal Year 2015.

An enterprise reporting system supports the Company’s information needs including accounting, inventory control, procurement, processing of payroll and accounts payable, human resources records and other record keeping. A secondary data storage appliance with supporting hardware and a virtual server are in place as part of an off-site storage area network (SAN). The SAN performs near real time replication of all data in the production environment, which allows for quick start-up of the disaster recovery environment should it be necessary to call it into service.

6

Raw Materials

The sources and availability of food and supplies are discussed above under the caption "Frisch's Big Boy Restaurants". Other significant components used in food processing include equipment for cooking and preparing food, refrigeration and storage equipment and various other fixtures. The Company currently purchases the majority of its restaurant equipment from a single vendor. Other reliable restaurant equipment suppliers are available should the Company choose to replace this vendor, and in fact, a variety of other vendors are used to supply the balance of equipment purchased. In addition, the Company has not experienced any significant disruptions in the supply of raw materials, equipment components used in food processing and there have been no shortages in electricity and natural gas used in restaurant operations in recent years.

Trademarks and Service Marks

The Company has registered certain trademarks and service marks on the Principal Register of the United States Patent and Trademark Office, including “Frisch’s” and the tag line “What’s Your Favorite Thing?” Other registrations include, but are not limited to, “Brawny Lad,” “Buddie Boy,” “Just Right Favorites,” “Pie Baby,” “Fire & Ice,” “Frisch-ly Made,” “Bundle of Joy,” and “Tiers of Joy.” All of these registrations are considered important to the operations of Frisch's Big Boy restaurants, especially the primary mark “Frisch’s”. The duration of each registration varies, depending upon when registration was first obtained. The Company currently intends to renew all of its trademarks and service marks when each comes up for renewal.

Pursuant to a 2001 agreement with Big Boy Restaurants International, LLC, the Company acquired limited ownership rights and a right to use the “Big Boy” trademarks and service marks within the states of Indiana and Kentucky and in most of Ohio and Tennessee. A concurrent use registration was issued October 6, 2009 on the Principal Register of the United States Patent and Trademark Office, confirming these exclusive “Big Boy” rights.

The Company is not aware of any infringements on its federally registered trademarks and service marks or its other trademarks, nor is the Company aware of any infringement on any of its territorial rights to use the proprietary marks that are owned by or licensed to the Company.

Seasonality

The Company’s business is moderately seasonal, with the third quarter of the fiscal year (mid-December through early March) normally accounting for a smaller share of annual revenues. Additionally, severe winter weather can have a marked negative impact upon revenue during the third quarter. Occupancy and other fixed operating costs have a greater negative impact on operating results during any quarter that may experience lower sales. Results for any quarter should not be regarded as indicative of the year as a whole, especially the first quarter, which contains 16 weeks. Each of the last three quarters normally contains 12 weeks. The fourth quarter of Fiscal Year 2014 contained a 13th week that was necessary to complete the 53 week accounting year.

Working Capital

Restaurant sales provide the Company’s principal source of cash. Funds from restaurant operations are immediately available to meet the Company’s working capital needs, as substantially all sales from restaurant operations are settled in cash or cash equivalents such as debit and credit cards. Other sources of cash may include borrowing against credit lines, proceeds from stock options exercised and occasional sales of real estate.

The Company uses its positive cash flows for debt service, capital spending (restaurant expansion and remodeling costs), capital stock repurchases and cash dividends.

As there is no need to maintain significant levels of inventories, and accounts receivable are minimal in nature, the Company has historically maintained a strategic negative working capital position, which is not uncommon in the restaurant industry. The working capital deficit was $965,000 as of June 2, 2015. As significant, predictable cash flows are provided by restaurant operations, the deployment of a negative working capital strategy has not hindered the Company’s ability to satisfactorily retire any of its obligations when due. Additionally, a working capital revolving line of credit is readily accessible if needed. However, its availability will expire with the close of the Merger transaction.

7

Customers

Because all of the Company’s retail sales are derived from food sales to the general public, there is no material dependence upon a single customer or any group of a few customers.

Competition

The restaurant industry is highly competitive and many of the Company’s competitors are substantially larger and possess greater financial resources than does the Company. The Company's restaurants have numerous competitors, including national chains, regional and local chains, as well as independent operators. None of these competitors, in the opinion of the Company's management, is dominant in the family-style sector of the restaurant industry. In addition, competition continues to increase from non-traditional competitors such as supermarkets that not only offer home meal replacement but also have in-store dining space, trends that continue to grow in popularity.

The principal methods of competition in the restaurant industry are brand name recognition and advertising; menu selection and prices; food quality and customer perceptions of value, speed and quality of service; cleanliness and fresh, attractive facilities in convenient locations. In addition to competition for customers, sharp competition exists for qualified restaurant managers, hourly restaurant workers and quality sites on which to build new restaurants.

Research and Development

The Company’s corporate staff includes a research and development chef whose responsibilities entail development of new menu items and enhancing existing products. From time to time, the Company conducts a variety of other research to identify a) emerging industry trends and changing consumer behaviors and preferences, b) where future restaurants should be built, and c) observational research of competitors is sometimes utilized for various purposes, including assistance with design concepts for new restaurant prototypes. While these activities are important to the Company, these expenditures have not been material during the Company's last three fiscal years and are not expected to be material to the Company’s future results.

Government Regulation

The Company is subject to licensing and regulation by various Federal, state and local agencies. These licenses and regulations pertain to food safety, health, sanitation, safety, vendors’ licenses and hiring and employment practices including compliance with the Fair Labor Standards Act and minimum wage statutes. All Company operations, including the commissary and food manufacturing plant, are believed to be in compliance with all applicable laws and regulations. All of the Company’s restaurants substantially meet local and state building and fire codes, and the requirements under the Americans with Disabilities Act. Although the Company has not experienced any significant obstacles to obtaining building permits, licenses or approvals from governmental bodies, increasingly rigorous requirements on the part of state, and in particular, local governments, could delay or possibly prevent expansion in desired markets.

The federal Food Safety Modernization Act (FMA) was enacted in January 2011 to standardize procedures associated with recalls of manufactured food. The Company is in compliance with the required procedures of the FMA and is currently completing its documentation of those procedures. The Company expects implementation to be completed (including documentation of procedures) in advance of the 2016 compliance deadline.

8

In March 2014, an executive order was issued by President Obama that directed the Secretary of the U.S. Department of Labor (DOL) to revamp the regulations of the Fair Labor Standards Act (FLSA) that pertain to overtime compensation, with the end goal being to greatly expand the number of workers entitled to receive overtime compensation. On May 5, 2015, the DOL submitted its proposal to the White House Office of Management and Budget (OMB) for approval. Once the OMB completes its review, the DOL’s proposal will be published in the Federal Register, following which the regulatory process will begin, which could take a year or more before the Final Rule would be issued with a likely effective date to be at least four months later. The Company is currently evaluating the changes that are likely to be imposed by the revised regulations. The evaluation entails the review of certain jobs that are classified as exempt from overtime and contemplating new compensation plans to mitigate or offset the effects of the higher costs that will likely result once the new regulations are in place.

The federal Patient Protection and Affordable Care Act (PPACA) was enacted in March 2010. On January 1, 2015, the employer portion of the PPACA went into effect. In anticipation of significant cost increases, the Company’s 2015 coverage was moved to a different insurance carrier and new policies were issued which contained reductions in certain benefits, and a higher percentage of the premium cost is now borne by the employees. In addition to being required to provide full-time employees with medical insurance that meets minimum value and affordability standards, the employer mandate requires employers to provide covered employees and the Internal Revenue Service with specific reportable benefit information. The Company’s 2015 medical plan has been offered to all full time employees and meets the minimum value and affordability requirements of the PPACA, and the Company believes that it will be able to meet the informational reporting requirements of the act when due in January 2016.

PPACA requires calorie counts and other nutritional information to be posted on the Company’s menus. In December 2014, the Food and Drug Administration (FDA) issued the Final Rules for Calorie Labeling in Retail Food Establishments. The final rules, as originally approved, require nutritional information to appear on menus no later than December 1, 2015. On July 9, 2015, the FDA delayed the effective date by one year in response to requests from constituents. Calorie counts and other nutritional information about the Company's menu offerings are available now on the Company's website (http://www.frischs.com) and the Company expects to be in full compliance with the final rules well before the December 1, 2016 deadline. Sales and profitability could be adversely affected if customers significantly alter their menu ordering habits when this information becomes available on the Company's menus.

The Company is subject to the franchising regulations of the Federal Trade Commission and the franchising laws of Ohio, Kentucky and Indiana where it has licensed Frisch's Big Boy restaurants to other operators.

Environmental Matters

The Company does not believe that various federal, state or local environmental regulations have had or will have any material effect upon the capital expenditures, earnings or competitive position of the Company's operations. However, the Company cannot predict the effect of any future environmental legislation or regulations.

Employees

As of June 2, 2015, the Company and its subsidiaries employed approximately 6,100 active employees. Approximately 3,900 of the Company’s employees are considered part-time (those who work less than 30 hours per week). Although there is no significant seasonal fluctuation in employment levels, hours worked may vary according to sales patterns in individual restaurants. None of the Company’s employees is represented by a collective bargaining agreement. Management believes that employee relations are excellent and employee compensation is comparable with or better than competing restaurants.

Geographic Areas

The Company has no operations outside of the United States of America. The Company’s revenues, consisting principally of retail sales of food and beverages to the general public and certain wholesale sales to and license fees from restaurants licensed to other operators, were substantially generated in various markets in the states of Ohio, Kentucky and Indiana during each of the three fiscal years in the period ended June 2, 2015. Substantially all of the Company’s long-lived assets were deployed in service in the same states during the same periods stated above.

9

Available Information

The Securities Exchange Act of 1934, as amended, requires the Company to file periodic reports with the SEC including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Definitive 14A Proxy Statements, and certain other information. The Company’s periodic reports (and any amendments thereto) can be viewed by visiting the website of the SEC (http://www.sec.gov). In addition, the SEC makes the Company’s periodic reports available for reading and copying in its Public Reference Room located at 100 F. Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

The Company makes available the periodic reports that it files with the SEC by visiting the "Investors" section of the Company's corporate website (http://www.frischs.com), through which a hyperlink is provided directly to the Company’s filings on the website of the SEC. New information available through the hyperlink is generally provided within a few minutes from the time a report is filed. Information contained on or available through the Company’s website is not a part of, nor is it being incorporated into, this Annual Report on Form 10-K. In addition, printed copies of the reports that the Company files with the SEC may be obtained without charge by writing to Mark R. Lanning, Chief Financial Officer, Frisch’s Restaurants, Inc., 2800 Gilbert Avenue, Cincinnati, Ohio 45206-1206. Email requests may be sent to cfo@frischs.com.

Copies of the Company’s corporate governance documents are available in the "Investors" section of the Company’s corporate website (http://www.frischs.com). The documents include the Company’s Code of Regulations, Corporate Governance Guidelines, Code of Conduct, Code of Ethics, Insider Trading Policy, Related Person Transaction Policy, the Charter of the Disclosure Controls and Risk Management Committee, and various charters of committees of the Board of Directors, including those of the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Finance Committee.

The Audit Committee has established a procedure for the confidential, anonymous submission by employees and other concerned parties regarding the Company’s accounting, internal accounting controls or auditing matters. The toll free Corporate Governance Hotline number is 800-506-6424. The Hotline is managed by an independent third party and is available 24 hours a day, seven days a week. Messages are transcribed and referred electronically to the Audit Committee

Executive Officers of the Registrant

The following table sets forth the names and certain information concerning the executive officers of the Company:

10

| Name | Age | Current Principal Occupation or Employment and Five Year Employment History | ||

| Craig F. Maier (a) | 65 | President and Chief Executive Officer of the Company (since 1989); Director of the Company (since 1984) | ||

| Mark R. Lanning | 60 | Vice President and Chief Financial Officer of the Company (since August 2011) and Vice President - Finance of the Company (since May 2011); Vice President – Investor Relations and Treasurer, Hillenbrand, Inc. (from March 2008 to May 2011); Vice President and Treasurer of Hillenbrand Industries, Inc. (from 1988 to March 2008) | ||

| Michael E. Conner, Sr. | 63 | Vice President - Human Resources of the Company (since 2000) | ||

| Michael R. Everett | 61 | Vice President - Information Services of the Company (since May 2006); Director of Information Services of the Company (from May 2005 to May 2006) | ||

| Stephen J. Hansen | 50 | Vice President - Commissary of the Company (since June 2010); Plant Manager, Klosterman Baking Company (from March 2009 to May 2010); Operations Manager, General Mills (from October 2008 to February 2009); Plant Manager, Campos Foods LLC (from 1996 to June 2008) | ||

| James I. Horwitz | 58 | Vice President – Real Estate of the Company (since March 2008); Director of Leasing and Development, Cincinnati United Contractors (from February 2007 to March 2008); Director of Real Estate, Alderwoods Group (from December 2005 to January 2007) | ||

| Karen F. Maier (a) | 63 | Vice President - Marketing of the Company (since 1983); Director of the Company (since 2005) | ||

| James M. Fettig | 47 | Regional Director of the Company (since June 4, 2014) and formerly held position within the Company of Area Supervisor (from 1995 to June 3, 2014) | ||

| Lindon C. Kelley | 60 | Regional Director of the Company (since 2000) and formerly held positions within the Company of Area Supervisor and Executive Store Manager | ||

| Todd M. Rion | 55 | Regional Director of the Company (since February 2012) and formerly held the position within the Company of Area Supervisor (July 2009 to February 2012); independent restaurant operator (from 2006 to July 2009) |

| (a) | Craig F. Maier and Karen F. Maier are siblings |

11

Operational, strategic, compliance and other risks and uncertainties that continually face the Company are identified herein. The occurrence of adverse events associated with all risks, including those risks not listed specifically or those that are unforeseen at the present time, could result in significant adverse effects on the Company’s financial position, results of operations and cash flows, which could include the permanent closure of any affected restaurant(s) with an impairment of assets charge taken against earnings, and could adversely affect the price at which shares of the Company’s common stock trade.

In addition to operating results, other factors can influence the volatility and price at which the Company’s common stock trades. The Company’s stock is thinly traded on the NYSE MKT. Thinly traded stocks can be susceptible to sudden, rapid declines in price, especially when holders of large blocks of shares seek exit positions. Rebalancing of stock indices in which the Company’s shares are placed, such as the Russell 2000 Index, can also influence the price of the Company’s stock.

The Merger

On May 21, 2015, the Company entered into an Agreement and Plan of Merger with FRI Holding Company, LLC and FRI Merger Sub, LLC. Under the terms of the agreement approved by Frisch’s Board of Directors, if the merger is effectuated, each outstanding share of Frisch’s Common Stock will be converted into a right to receive $34.00 per share in cash, without interest. The closing of the merger is subject to customary closing conditions, including approval of Frisch’s stockholders and regulatory clearance.

Although there is no financing condition, the Merger is subject to the satisfaction of a number of conditions beyond the Company’s control that may prevent, delay or otherwise materially adversely affect the completion of the transaction. These conditions include, among other things, stockholder approval. Management cannot predict with certainty whether and when any of these conditions will be satisfied.

The Merger Agreement may be terminated under certain circumstances, including in specified circumstances in connection with superior proposals. Assuming the satisfaction of the conditions to the Merger, the transaction is expected to close in the third quarter of calendar year 2015. However, there can be no assurance.

If the Agreement and Plan of Merger are terminated, the Company may be obligated to reimburse FRI Holding Company, LLC or FRI Merger Sub, LLC for certain Merger related costs and could be subject to termination fees. These amounts would be paid from available cash that would have been otherwise available for other general corporate purposes.

Finally, the risk exists that some customers, suppliers and other persons with whom the Company has a business relationship may delay or defer certain business decisions or might decide to seek to terminate, change or renegotiate their relationship with the Company as a result of the Merger, which could negatively affect revenues, earnings and cash flows, as well as the market price of the Company’s common stock, regardless of whether the Merger is completed. Similarly, current and prospective employees may experience uncertainty about their future roles with the Company following completion of the Merger, which may materially adversely affect the ability to attract and retain key employees.

Food Safety

Food safety is the most significant risk to any company that operates in the restaurant industry. It is the focus of increased government regulatory initiatives at the local, state and federal levels. Failure to protect the Company’s food supplies could result in food borne illnesses and/or injuries to customers. If any of the Company’s customers become ill from consuming the Company’s products, the affected restaurants may be forced to close. An instance of food contamination originating at the commissary operation could have far reaching effects, as the contamination would affect substantially all Frisch's Big Boy restaurants, including those licensed to other operators.

12

Economic Factors

Economic recessions can negatively influence discretionary consumer spending in restaurants and result in lower customer counts, as consumers become more price conscientious, tending to conserve their cash amid unemployment and other economic uncertainty. The effects of higher gasoline prices can also negatively affect discretionary consumer spending in restaurants. Increasing costs for energy can affect profit margins in many other ways. Petroleum based material is often used to package certain products for distribution. In addition, suppliers may add fuel surcharges to their invoices. The cost to transport products from the commissary to restaurant operations will rise with each increase in fuel prices. Higher costs for electricity and natural gas result in higher costs to a) heat and cool restaurant facilities, b) refrigerate and cook food and c) manufacture and store food at the Company’s food manufacturing plant.

Inflationary pressure, particularly on food costs, labor costs (especially associated with increases in the minimum wage) and health care benefits, can negatively affect the operation of the business. Shortages of qualified labor are sometimes experienced in certain local economies. In addition, the loss of any key executives could pose a significant adverse effect on the Company.

Future funding requirements of the defined benefit pension plan that is sponsored by the Company largely depend upon the performance of investments that are held in the trust that has been established for the plan. Equity securities comprise 70 percent of the target allocation of the plan's assets. Poor performance in equity securities markets can significantly lower the market values of the plan's investment portfolio, which, in turn, can result in a) material increases in future funding requirements, b) much higher net periodic pension costs to be recognized in future years, and c) increases in the underfunded status of the plan, which requires a reduction in the Company’s equity to be recognized.

Competition

The restaurant industry is highly competitive and many of the Company’s competitors are substantially larger and possess greater financial resources than does the Company. Frisch's Big Boy restaurants have numerous competitors, including national chains, regional and local chains, as well as independent operators. None of these competitors, in the opinion of the Company’s management, presently dominates the family-style sector of the restaurant industry in any of the Company’s operating markets. That could change at any time due to:

| · | changes in economic conditions |

| · | changes in demographics in neighborhoods where the Company operates restaurants |

| · | changes in consumer perceptions of value, food and service quality |

| · | changes in consumer preferences, particularly based on concerns with nutritional content of food on the Company’s menu |

| · | new competitors enter the Company’s market from time to time |

| · | increased competition from supermarkets and other non-traditional competitors |

| · | increased completion for quality sites on which to build restaurants |

Development Plans and Financing Arrangements

The Company’s business strategy and development plans also face risks and uncertainties. These include the inherent risk of poor quality decisions in the selection of sites on which to build restaurants, the rising cost and availability of desirable sites and increasingly rigorous requirements on the part of local governments to obtain various permits and licenses. Other factors that could impede plans to increase the number of restaurants operated by the Company include saturation in existing markets, limitations on borrowing capacity and the effects of increases in interest rates.

In addition, the Company’s loan agreements include financial and other covenants with which compliance must be met or exceeded each quarter. Failure to meet these or other restrictions could result in an event of default under which the lender may accelerate any outstanding loan balances and declare them to be immediately due and payable.

13

The Supply and Cost of Food

Food purchases can be subject to significant price fluctuations that can considerably affect results of operations from quarter to quarter and year to year. Price fluctuations can be due to seasonality or any number of factors, such as weather, foreign demand and demographic factors. The market for beef, in particular, continues to be highly volatile due in part to import and export restrictions. Beef costs can also be affected by bio-fuel initiatives and other factors that influence the cost to feed cattle. The Company depends on timely deliveries of perishable food and supplies. Any interruption in the continuing supply would harm the Company’s operations.

Litigation and Negative Publicity

Employees, customers and other parties bring various claims against the Company from time to time. Defending such claims can distract the attention of senior level management away from the operation of the business. Legal proceedings can result in significant adverse effects to the Company’s financial condition, especially if other potentially responsible parties lack the financial wherewithal to satisfy a judgment against them or the Company’s insurance coverage proves to be inadequate. Also, see “Legal Proceedings” elsewhere in Part I, Item 3 of this Form 10-K.

Negative publicity associated with legal claims against the Company, especially those related to food safety issues, could harm the Company's reputation and brand (whether or not such complaints are valid), which, in turn, could adversely affect operating results. Publicity surrounding food safety issues has caused irreparable harm to the reputations of certain operators in the restaurant industry in the past. The Company’s reputation and brand can also be harmed by food safety issues and other operational problems that may be experienced by Frisch's Big Boy restaurants that the Company licenses to other operators, as well as Big Boy restaurants (non Frisch's) that are operated by others outside of the Company's territories or in the restaurant industry at large. Other negative publicity such as that arising from rumor and innuendo spread through social internet media and other sources can create adverse effects on the Company’s results of operations.

Intellectual Property

The Company's intellectual property, which includes its food recipes, is very important to the operation of the business and its competitive position in the marketplace. The Company protects these assets through a combination of federally registered trademarks and other trademark and service mark rights, and various other means. If the Company's efforts to protect its intellectual property are inadequate, or if any third party misappropriates or infringes on the Company's intellectual property, the value of the Company's brand may be harmed, which could have a material adverse effect upon the Company.

Governmental and Other Rules and Regulations

Governmental and other rules and regulations can pose significant risks to the Company. Examples include:

| · | general exposure to penalties or other costs associated with the potential for violations of numerous governmental regulations, include |

| o | immigration (I-9) and labor regulations regarding the employment of minors |

| o | minimum wage and overtime requirements |

| o | employment discrimination and sexual harassment |

| o | health, sanitation and safety regulations |

| o | facility issues, such as meeting the requirements of the Americans with Disabilities Act of 1990 or liabilities to remedy unknown environmental conditions |

| · | changes in existing environmental regulations that would significantly add to the Company’s costs |

| · | any future imposition by OSHA of costly ergonomics regulations on workplace safety |

| · | climate legislation that adversely affects the cost of energy |

| · | compliance with the Food Modernization Act (enacted January 2011) |

14

| · | legislative or regulatory changes affecting labor law, especially the Fair Labor Standards Act, including overtime rules and increases in federal minimum wage requirements |

| · | increases in state and local minimum wage requirements |

| · | compliance with legislation enacted to reform the U.S. health care system could have a material adverse effect upon the Company’s health care costs |

| · | nutritional labeling on menus - compliance with legislation enacted to reform the U.S. health care system that requires nutritional labeling to be placed on menus and the Company’s reliance on the accuracy of certain information that may be obtained from third party suppliers. Potential adverse effect on sales and profitability if customer menu ordering choices should change. |

| · | legislation or court rulings that result in changes to tax codes that are adverse to the Company |

| · | changes in accounting standards imposed by governmental regulators or private governing bodies could adversely affect the Company’s financial position |

| · | estimates used in preparing financial statements and the inherent risk that future events affecting them may cause actual results to differ markedly |

Catastrophic Events

Unforeseen catastrophic events could disrupt the Company’s operations, the operations of the Company’s suppliers and the lives of the Company’s employees and customers. In particular, the dependency of the Company's restaurants on the commissary operation could present an extensive disruption of products to restaurants should a catastrophe impair its ability to operate. Examples of catastrophic events include but are not limited to:

| · | adverse winter weather conditions |

| · | natural disasters such as earthquakes or tornadoes |

| · | fires or explosions |

| · | widespread power outages |

| · | criminal acts, including bomb threats, robberies, hostage taking, kidnapping and other violent crimes |

| · | acts of terrorists or acts of war |

| · | civil disturbances and boycotts |

| · | disease transmitted across borders that may enter the food supply chain |

Technology, Information Systems and Cyber Risks

Technology and information systems are of vital importance to the strategic operation of the Company. Security violations such as unauthorized access to information systems, including breaches on third party servers, could result in the loss of proprietary data. Should consumer privacy be compromised, consumer confidence may be lost, which could adversely affect sales and profitability. To prevent credit card fraud, the Payment Card Security Standards Council requires an annual audit to certify the Company's compliance with the required internal controls of processing and storing of credit card data. A finding of non-compliance could restrict the Company's authorization to accept credit cards as a form of payment, which could adversely affect sales and profitability.

Other events that could pose threats to the operation of the business include:

| · | catastrophic failure of certain information systems |

| · | failures of the Company’s disaster recovery plan |

| · | difficulties that may arise in maintaining existing systems |

| · | difficulties that may occur in the implementation of and transition to new systems |

| · | financial stability of vendors to support software over the long term |

15

Item 1B. Unresolved Staff Comments

None

All of the Company’s Frisch's Big Boy restaurants are freestanding, well-maintained facilities. In addition to full service dining rooms, all of the restaurants are fashioned with windows for drive-thru service. Older restaurants are generally located in urban or heavily populated suburban neighborhoods that cater to local trade rather than highway travel. A few of these restaurant facilities are now more than 40 years old. Restaurants that have been opened since the early 1990s have generally been located near interstate highways. A typical restaurant built before 2001 contains on average approximately 5,600 square feet with seating capacity for 156 guests. The prototype that was introduced in 2001 has generally contained 5,700 square feet with seating for 172 guests. An adaptation of the 2001 prototype was introduced in 2010 for use in smaller trade areas. Its footprint approximates 5,000 square feet and has 148 dining room seats.

Most new restaurant construction requires approximately 18 weeks to complete, depending on the time of year and weather conditions. A competitive bidding process is used to award contracts to general contractors for all new restaurant construction. The general contractor selects and schedules sub-contractors, and is responsible for procuring most building materials. A Company project coordinator is assigned to coordinate all construction projects.

The following table summarizes the number and location of Company operated restaurants and restaurants licensed to others as of June 2, 2015:

| Company | Operated by | |||||||

| Frisch's Big Boy | Operated | Licensees | ||||||

| Cincinnati, Ohio market | 51 | 4 | ||||||

| Dayton, Ohio market | 20 | — | ||||||

| Columbus, Ohio market | 9 | 1 | ||||||

| Louisville, Kentucky market | 9 | 2 | ||||||

| Lexington, Kentucky market | 6 | 3 | ||||||

| Toledo, Ohio market | — | 13 | ||||||

| Other | — | 3 | ||||||

| Total | 95 | 26 | ||||||

In July 2014, one of the Company operated restaurants in the Columbus, Ohio market was closed permanently, and in August 2014, a restaurant licensed to a third party operator was opened in Ironton, Ohio (southeast Ohio).

Sites acquired for development of new Company operated restaurants are identified and evaluated for potential long-term sales and profits. A variety of factors is analyzed including demographics, traffic patterns, competition and other relevant information. Because control of property rights is important to the Company, it is the Company’s policy to own its restaurant locations whenever possible.

In recent years, it has sometimes become necessary to enter into ground leases to obtain desirable land on which to build. In addition, many of the restaurants operated by the Company that opened prior to 1990 were financed with sale/leaseback transactions. Most of the leases have multiple renewal options. All of the leases generally require the Company to pay property taxes, insurance and maintenance. As of June 2, 2015, 15 restaurants were in operation on non-owned premises, 14 of which are classified as operating leases with one treated as a capital lease. Three of the operating leases contain options to purchase the underlying properties, which become available over time. Under the terms of the lone capital lease, the Company is required to acquire the underlying land in fee simple title at any time between the 10th (2020) and 15th (2025) years of the lease. The following table recaps the Company's restaurant operations by type of occupancy (as of June 2, 2015):

16

| Company | ||||

| Frisch's Big Boy | Operated | |||

| Owned in fee simple title | 80 | |||

| Land or land & building leased | 15 | |||

| Total | 95 | |||

The restaurant that was closed permanently in July 2014 was owned in fee simple title. It was sold to a real estate developer shortly after its closure. Six of the 15 leased locations will expire during the next five years, as detailed in the list below. One of the six expiring leases has a purchase option and four (including the one with the purchase option) have renewal options available.

| Number of | ||

| Fiscal year ending in | Leases Expiring | |

| 2016 | — | |

| 2017 | 1 | |

| 2018 | 2 | |

| 2019 | 2 | |

| 2020 | 1 |

No construction of any new Company operated Frisch's Big Boy restaurants were in progress as of June 2, 2015.

None of the real property owned by the Company is currently encumbered by mortgages or otherwise pledged as collateral. With the exception of certain delivery equipment utilized under capital leases expiring during periods through Fiscal Year 2021, the Company owns substantially all of the furnishings, fixtures and equipment used in the operation of the business.

The Company owns a 79,000 square foot building that houses its commissary in Cincinnati, Ohio. It is suitable and adequate to supply the Company's restaurant operations and the needs of restaurants licensed to others. As the facility normally operates one shift daily, additional productive capacity is readily available if needed.

The Company maintains its headquarters in Cincinnati on a well-traveled street in an up-town business district. This administrative office space approximates 49,000 square feet and is occupied under an operating lease that expires on December 31, 2022. During the term of the lease, the Company has been granted the right of first refusal in the event that the lessor receives a bona fide purchase offer from a third party. The Company has an option to purchase the property when the lease expires.

The Company owns five undeveloped pieces of land. Four of the five parcels may ultimately be developed into restaurant facilities. Two of these are in the Columbus, Ohio market and the other two in outlying areas of Indiana (south of Indianapolis). No specific plan is in place for the fifth piece of land, which is located in Northern Kentucky.

Seven surplus land locations owned by the Company were listed for sale with brokers as of June 2, 2015, four of which are located in the Columbus, Ohio area, two are in the Dayton, Ohio area and the seventh is located in Toledo, Ohio. Two former Golden Corral restaurants (which ceased operating in August 2011) are also listed for sale with brokers, one of which is in the Cincinnati area and the other one is in the Cleveland, Ohio area.

17

The Company remains contingently liable under certain ground lease agreements relating to land on which seven of the Company's former Golden Corral restaurant operations are situated. The seven restaurant operations were sold to Golden Corral Corporation (GCC) in May 2012 at which time the seven operating leases were simultaneously assigned to GCC, with the Company remaining contingently liable in the event of default by GCC. The amount remaining under contingent lease obligations totaled $5,692,000 as of June 2, 2015, for which the aggregate average annual lease payments approximate $680,000 in each of the next five years. The Company is also contingently liable for the performance of a certain ground lease (for property located in Covington, Kentucky on which a hotel once operated by the Company is situated) that was assigned to a third party in 2000; the annual obligation of the lease approximates $48,000 through April 2020. Should either of these third parties default, the Company generally has the right to re-assign the leases.

On October 16, 2012, a former employee (plaintiff) filed a complaint in Boone County Circuit Court, Burlington Kentucky, asserting various claims including negligence and intentional infliction of emotional distress, stemming from the plaintiff's employment in 1995. With the exception of the negligence claim, all claims were dismissed by the Court as a result of the Motion to Dismiss, filed by the Company on November 13, 2012. In August 2013, the plaintiff's complaint was amended to include claims of sexual harassment and a hostile work environment. Following discovery, the Company moved for summary judgment on all remaining counts. The court heard oral arguments and entertained supplemental briefings. On July 9, 2015, the Court granted the Company’s Motion for Summary Judgment in its entirety and all claims were dismissed. On July 17, 2015, the plaintiff filed a Notice of Appeal to the Kentucky Court of Appeals. The Company continues to deny all allegations and will continue to defend the matter vigorously; however, the ultimate outcome of the lawsuit remains uncertain.

As disclosed in the Company’s Current Report on Form 8-K on January 20, 2015, the Company filed a lawsuit against the Company’s former assistant treasurer (and others) alleging that he forged payroll documents and created other false documents and accounting entries to divert Company funds into his personal accounts. As part of the civil complaint filed in the Court of Common Pleas for Hamilton County, Ohio on January 20, 2015, the Company is seeking full restitution of the diverted funds, plus compensatory damages, including pre-judgment and post judgment interest, an award of punitive damages in an amount to be determined, an award of reasonable costs and expenses incurred in the action, including reasonable attorney fees and other costs, and a grant of such other relief as the Court deems just and proper. The former assistant treasurer answered the Company’s complaint on February 17, 2015 by denying all of the Company’s allegations. Similar answers have been filed by the other named defendants.

Employees, customers and other parties bring various other claims and suits against the Company from time to time in the ordinary course of business. Management continually evaluates exposure to loss contingencies from pending or threatened litigation, and presently believes that the resolution of claims currently outstanding, whether or not covered by insurance, will not result in a material effect on the Company’s earnings, cash flows or financial position.

Item 4. Mine Safety Disclosures

Not applicable.

18

(Items 5 through 9)

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock is traded on NYSE MKT under the symbol “FRS.” The closing price of the Company’s common stock as reported by NYSE MKT on July 28, 2015 was $33.36. There were approximately 1,400 shareholders of record as of July 28, 2015. The following table sets forth the high and low sales prices for the common stock and the regular cash dividend declared for each quarter within the Company’s two most recent fiscal years:

| Fiscal Year Ended June 2, 2015 | Fiscal Year Ended June 3, 2014 | |||||||||||||||||||||||

| Stock Prices | Dividends | Stock Prices | Dividends | |||||||||||||||||||||

| High | Low | per Share | High | Low | per Share | |||||||||||||||||||

| 1st Quarter | $ | 30.90 | $ | 21.57 | $ | 0.18 | $ | 22.09 | $ | 16.17 | $ | 0.16 | ||||||||||||

| 2nd Quarter | $ | 29.29 | $ | 25.05 | $ | 0.20 | $ | 25.42 | $ | 21.60 | $ | 0.18 | ||||||||||||

| 3rd Quarter | $ | 29.00 | $ | 24.80 | $ | 0.20 | $ | 27.75 | $ | 23.19 | $ | 0.18 | ||||||||||||

| 4th Quarter | $ | 35.14 | $ | 26.80 | $ | 0.20 | $ | 24.95 | $ | 22.45 | $ | 0.18 | ||||||||||||

The closing sales price of Frisch’s common stock on the NYSE MKT on May 21, 2015, the last full day of trading and the day prior to the first media report after market close that Frisch’s had entered into the Agreement and Plan of Merger with FRI Holding Company, LLC and FRI Merger Sub, LLC, was $ 28.12 per share.

Dividend Policy

Through July 10, 2015, the Company has paid 218 consecutive regular quarterly cash dividends during its 55 year history as a public company. Until the closing of the transaction contemplated under the Agreement and Plan of Merger, the Company is permitted to continue paying its regular quarterly cash dividend in an amount not to exceed $0.20 per share.

Equity Compensation Plan Information

Information regarding equity compensation plans under which common stock of the Company is authorized for issuance is incorporated by reference to Item 12 of this Form 10-K.

Issuer Purchases of Equity Securities

On July 25, 2012, the Board of Directors authorized the Company to purchase, on the open market and in transactions negotiated privately, up to 450,000 shares of its common stock. The authorization allowed for purchases to begin immediately and to occur from time to time over a three year period. When the program expired on July 25, 2015, 237,071 shares remained available to be purchased. No shares were repurchased during the fourth quarter that ended June 2, 2015, nor through July 25, 2015.

Performance Graph

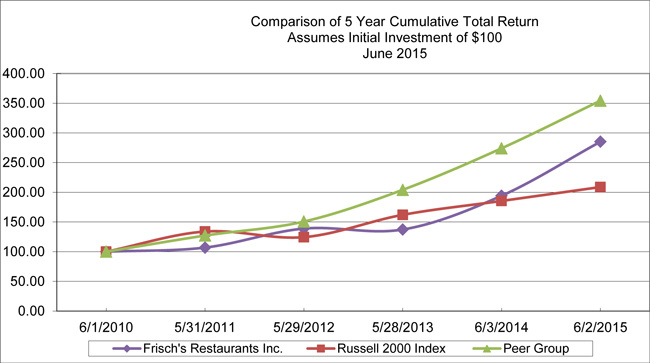

The following graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its common stock over the five year period ended June 2, 2015 with the Russell 2000 Index (Index) and a group of the Company’s peer issuers, selected by the Company in good faith. The graph assumes an investment of $100 in the Company’s common stock, in the Index and in the common stock of each member of the peer group on June 2, 2010 and reinvestment of all dividends.

19

The Company’s Peer Group consists of the following issuers: CBRL Group, Inc. (Cracker Barrel Old Country Store), Denny’s, Inc., Popeye's Louisiana Kitchen, Inc., Cosi Inc., Sonic Corp., Buffalo Wild Wings Inc., and Famous Dave's of America Inc.

20

Item 6. Selected Financial Data

FRISCH’S RESTAURANTS, INC. AND SUBSIDIARIES

SUMMARY OF OPERATIONS

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Sales | $ | 211,893 | $ | 209,173 | $ | 203,712 | $ | 205,083 | $ | 201,717 | ||||||||||

| Cost of sales | ||||||||||||||||||||

| Food and paper | 70,536 | 70,088 | 68,268 | 69,042 | 66,349 | |||||||||||||||

| Payroll and related | 72,986 | 74,236 | 71,523 | 72,721 | 71,820 | |||||||||||||||

| Other operating costs | 42,091 | 42,973 | 41,368 | 41,805 | 40,912 | |||||||||||||||

| Total cost of Sales | 185,613 | 187,297 | 181,159 | 183,568 | 179,081 | |||||||||||||||

| Restaurant operating income | 26,280 | 21,876 | 22,553 | 21,515 | 22,636 | |||||||||||||||

| Administrative and advertising | 16,725 | 12,539 | 13,424 | 13,660 | 13,087 | |||||||||||||||

| Franchise fees and other revenue, net | (1,471 | ) | (1,439 | ) | (1,376 | ) | (1,322 | ) | (1,324 | ) | ||||||||||

| (Gain) loss on sale of real property | (2,999 | ) | (135 | ) | 14 | (200 | ) | 40 | ||||||||||||

| Impairment of long-lived assets | 653 | — | 390 | 1,229 | — | |||||||||||||||

| Operating income | 13,372 | 10,911 | 10,101 | 8,148 | 10,833 | |||||||||||||||

| Interest expense | 370 | 586 | 964 | 1,414 | 1,582 | |||||||||||||||

| Earnings from continuing operations before income taxes | 13,002 | 10,325 | 9,137 | 6,734 | 9,251 | |||||||||||||||

| Income taxes | 3,047 | 853 | 2,388 | 1,114 | 2,512 | |||||||||||||||

| Earnings from continuing operations | 9,955 | 9,472 | 6,749 | 5,620 | 6,739 | |||||||||||||||

| (Loss) earnings from discontinued operations, net of tax | — | — | (158 | ) | (3,653 | ) | 2,368 | |||||||||||||

| NET EARNINGS | $ | 9,955 | $ | 9,472 | $ | 6,591 | $ | 1,967 | $ | 9,107 | ||||||||||

| Basic net earnings per share: | ||||||||||||||||||||

| Earnings from continuing operations | $ | 1.94 | $ | 1.86 | $ | 1.34 | $ | 1.14 | $ | 1.34 | ||||||||||

| (Loss) earnings from discontinued operations | — | — | (0.03 | ) | (0.74 | ) | 0.47 | |||||||||||||

| Basic net earnings per share | $ | 1.94 | $ | 1.86 | $ | 1.31 | $ | 0.40 | $ | 1.81 | ||||||||||

| Diluted net earnings per share: | ||||||||||||||||||||

| Earnings from continuing operations | $ | 1.94 | $ | 1.86 | $ | 1.34 | $ | 1.14 | $ | 1.33 | ||||||||||

| (Loss) earnings from discontinued operations | — | — | (0.03 | ) | (0.74 | ) | 0.47 | |||||||||||||

| Diluted net earnings per share | $ | 1.94 | $ | 1.86 | $ | 1.31 | $ | 0.40 | $ | 1.80 | ||||||||||

21

Item 6. Selected Financial Data (continued)

| Fiscal Year | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Other financial statistics | ||||||||||||||||||||

| Cash dividends per share | $ | 0.78 | $ | 0.70 | $ | 0.64 | $ | 0.63 | $ | 0.58 | ||||||||||

| Special cash dividend per share | — | — | 9.50 | — | — | |||||||||||||||

| Working capital (deficit) | $ | (965 | ) | $ | (5,595 | ) | $ | (5,970 | ) | $ | 36,848 | $ | (14,963 | ) | ||||||

| Total capital expenditures | 8,270 | 13,160 | 9,837 | 13,365 | 19,703 | |||||||||||||||

| Total assets | 129,011 | 128,954 | 128,018 | 179,369 | 195,499 | |||||||||||||||