Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JONES LANG LASALLE INC | form8-kpineacquisition.htm |

| EX-99.2 - EXHIBIT 99.2 - JONES LANG LASALLE INC | jlloakgroveacquisitionau.htm |

August 2015 Investor Presentation JLL to acquire Oak Grove Capital Working together to create value in the world of real estate 58,000 employees, 230 offices, 80 countries, 1 global brand

Statements in this presentation regarding, among other things, future financial results and performance, achievements, plans and objectives may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2014, in each of the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, and in other reports filed with the Securities and Exchange Commission. Any forward- looking statements speak only as of the date of this presentation, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events. © 2015 Jones Lang LaSalle IP, Inc. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of Jones Lang LaSalle IP, Inc. Cautionary note regarding forward-looking statements 2

Driving to Strategy 2020 JLL’s strategy for continued success • Balance top-line growth, platform investments and productivity to maximize profit and total shareholder return • Leverage global position and industry consolidation to invest strategically and grow market share • Continue improving operating capabilities today and for our future • Maintain financial strength and flexibility to respond to opportunities and challenges • Strategy 2020 o Pursue business and operational strategies to sustain long-term performance o Invest in work streams to accelerate G5 strategies Build our local and regional Markets business Strengthen our winning positions in Corporate Solutions Capture the leading share of global capital flows for real estate investments Grow LaSalle Investment Management’s leadership position G1 G2 G3 G4 G5 Connections: Differentiate and Sustain 3

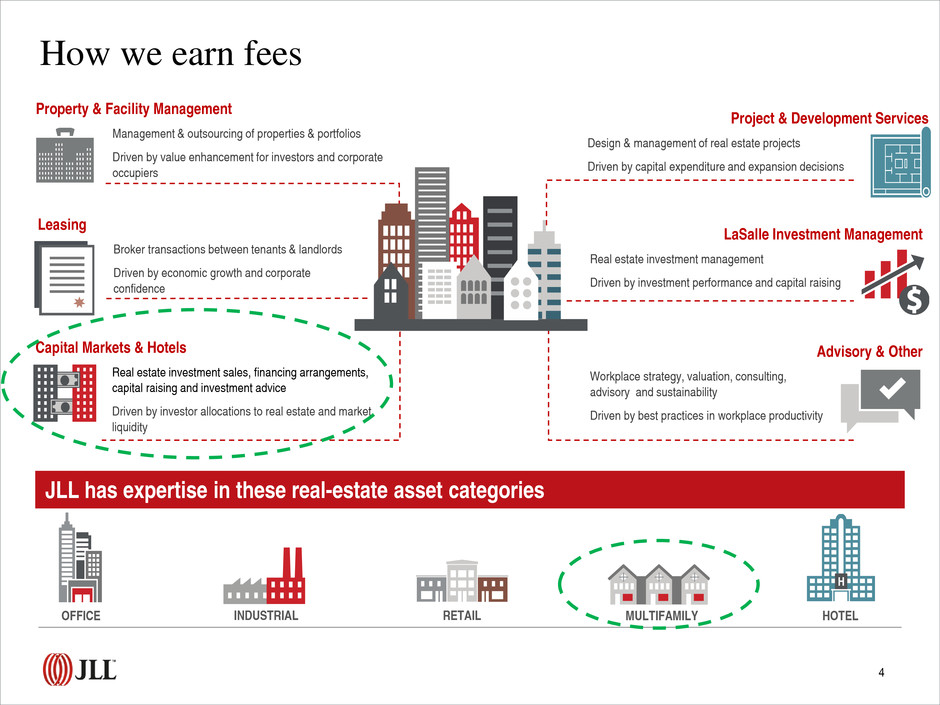

How we earn fees Leasing Broker transactions between tenants & landlords Driven by economic growth and corporate confidence Capital Markets & Hotels Real estate investment sales, financing arrangements, capital raising and investment advice Driven by investor allocations to real estate and market liquidity Property & Facility Management Management & outsourcing of properties & portfolios Driven by value enhancement for investors and corporate occupiers Project & Development Services Design & management of real estate projects Driven by capital expenditure and expansion decisions Advisory & Other Workplace strategy, valuation, consulting, advisory and sustainability Driven by best practices in workplace productivity LaSalle Investment Management Real estate investment management Driven by investment performance and capital raising MULTIFAMILY RETAIL HOTEL JLL has expertise in these real-estate asset categories INDUSTRIAL OFFICE 4

Oak Grove Capital • Leading provider of debt financing for market-rate, affordable and healthcare-related multifamily housing • Full-service platform for Fannie Mae, Freddie Mac & HUD/GNMA JLL Capital Markets • Full-service global provider of capital solutions for real estate investors and occupiers • Global access to thousands of foreign and domestic investors • Freddie Mac Program Plus® Seller/Servicer Companies today: $775M Loans in 2014 as a Freddie Mac Program Plus® Seller/Servicer $4.5B Total U.S. multifamily financing in 2014 $4B U.S. multifamily sales transactions in 2014 30+ Geographies covered throughout U.S. $1.4B 2014 Agency volume Top 3 Debt financing providers for affordable housing by both Fannie Mae and Freddie Mac in each of last 4 years 120 Employees 2014 Excellence in Asset Management Winner ~ Fannie Mae 5

A powerful combination Strategic Fit Cultural Fit • Consistent with JLL’s 2020 strategic plan • Disciplined around strategic fit, culture, financial alignment and returns • Expands JLL’s Capital Markets platform; moves JLL toward being a U.S. multifamily market leader • Adds full service Fannie Mae, Freddie Mac and HUD/GNMA platform, while expanding JLL’s expertise in the affordable, seniors housing and healthcare sectors • Combined platform provides ability to scale and expand in lending segments while maintaining discipline and credit quality • Cultural fit characterized by client focus and collaboration • Well respected firm with shared values to join JLL Combined U.S. presence Existing JLL Location New/Expanded JLL multifamily presence through merger • Our goals: 1. Maintain a strong culture of credit, risk and operational excellence 2. Become the multifamily provider of choice for our clients 3. Be one of the best partners for the U.S. multifamily finance agencies with an aligned mission 6

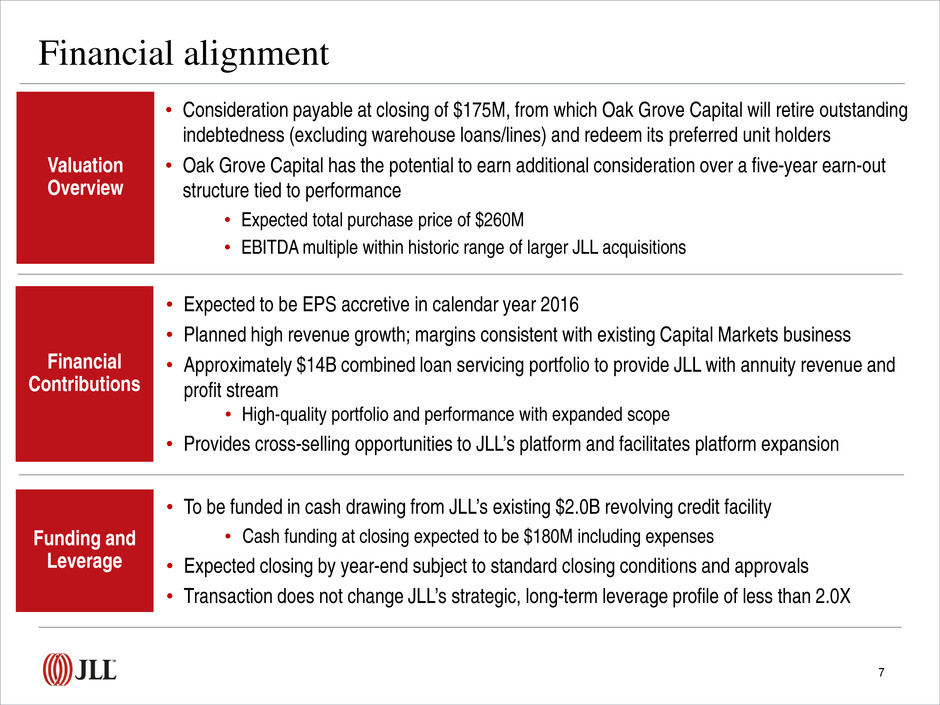

Financial alignment Valuation Overview • Consideration payable at closing of $175M, from which Oak Grove Capital will retire outstanding indebtedness (excluding warehouse loans/lines) and redeem its preferred unit holders • Oak Grove Capital has the potential to earn additional consideration over a five-year earn-out structure tied to performance • Expected total purchase price of $260M • EBITDA multiple within historic range of larger JLL acquisitions Financial Contributions • Expected to be EPS accretive in calendar year 2016 • Planned high revenue growth; margins consistent with existing Capital Markets business • Approximately $14B combined loan servicing portfolio to provide JLL with annuity revenue and profit stream • High-quality portfolio and performance with expanded scope • Provides cross-selling opportunities to JLL’s platform and facilitates platform expansion Funding and Leverage • To be funded in cash drawing from JLL’s existing $2.0B revolving credit facility • Cash funding at closing expected to be $180M including expenses • Expected closing by year-end subject to standard closing conditions and approvals • Transaction does not change JLL’s strategic, long-term leverage profile of less than 2.0X 7