Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Global 2.0 | ex322.htm |

| EX-31.1 - EXHIBIT 31.1 - Global 2.0 | ex311.htm |

| EX-31.2 - EXHIBIT 31.2 - Global 2.0 | ex312.htm |

| EX-32.1 - EXHIBIT 32.1 - Global 2.0 | ex321.htm |

U.S. Securities and Exchange Commission

Washington, D.C. 20549

____________________

FORM 10-Q

____________________

(Mark One)

x Quarterly Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2015

o Transition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act

For the transition period from N/A to N/A

____________________

Commission File No. 000-51697

____________________

Global Seafood Holdings Corporation

(Name of small business issuer as specified in its charter)

|

Delaware

|

21-1992090

|

|

State of Incorporation

|

IRS Employer Identification No.

|

2705 Garnet Avenue, Suite 2A, San Diego, CA 92109

(Address of principal executive offices)

(858) 847-9090

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value per share

(Title of Class)

Indicate by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [_] No [X]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non–accelerated filer. See definition of “accelerated filer large accelerated filer” and “Smaller reporting company” in Rule 12b–2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non–Accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b–2 of the Exchange Act). Yes ¨ No x

As of August 10, 2015 there were 3,576,888 shares of the Registrant's common stock issued and outstanding.

Transitional Small Business Disclosure Format Yes o No [X]

1

GLOBAL SEAFOOD HOLDINGS CORPORATION

INDEX TO FORM 10-Q FILING

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2015 AND 2014

|

Page

Numbers

|

||

|

PART I - FINANCIAL INFORMATION

|

||

|

PART II - OTHER INFORMATION

|

||

|

CERTIFICATIONS

Exhibit 31 – Management certification

Exhibit 32 – Sarbanes-Oxley Act

|

||

As used in the footnotes to these financial statements, “we”, “us”, “our”, “Global Seafood International Holdings, Inc.”, “Bridgetech”, “Company” or “our company” refers to Global Seafood International Holdings, Inc. and all of its subsidiaries.

General

The accompanying interim consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q. Therefore, they do not include all information and footnotes necessary for a complete presentation of financial position, results of operations and cash flows in conformity with generally accepted accounting principles. Except as disclosed herein, there has been no material change in the information disclosed in the notes to the consolidated financial statements included in the Company's annual report on Form 10-K for the year ended December 31, 2014. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the six months ended June 30, 2015 are not necessarily indicative of the results that can be expected for the year ending December 31, 2015.

|

GLOBAL SEAFOOD HOLDINGS CORPORATION

|

||||||||

|

(Unaudited)

|

||||||||

|

June 30,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Cash

|

$ | 10,679 | $ | 30,004 | ||||

|

TOTAL ASSETS

|

$ | 10,679 | $ | 30,004 | ||||

|

LIABILITES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts Payable

|

$ | 284,037 | $ | - | ||||

|

Accrued interest

|

27,778 | 25,198 | ||||||

|

Accrued interest - related party

|

51,722 | 36,578 | ||||||

|

Notes payable - related party

|

60,000 | 50,000 | ||||||

|

Convertible notes payable

|

53,000 | 53,000 | ||||||

|

Revolving line of credit - related party

|

409,468 | 344,932 | ||||||

|

Total liabilities

|

886,005 | 509,708 | ||||||

|

COMMITMENTS AND CONTINGENCIES

|

- | - | ||||||

|

STOCKHOLDERS' DEFICIT:

|

||||||||

|

Series A 8% cumulative convertible preferred stock, $.002 par value

|

||||||||

|

10,000,000 shares authorized, 200 issued and outstanding

|

- | - | ||||||

|

Common stock, $.001 par value, 100,000,000 shares authorized;

|

||||||||

|

266,261 shares issued and outstanding

|

266 | 266 | ||||||

|

Additional paid-in capital

|

51,649,472 | 51,649,472 | ||||||

|

Accumulated deficit

|

(52,525,064 | ) | (52,129,442 | ) | ||||

|

Total stockholders' deficit

|

(875,326 | ) | (479,704 | ) | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$ | 10,679 | $ | 30,004 | ||||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

|

||||||||

|

GLOBAL SEAFOOD HOLDINGS CORPORATION

|

||||||||||||||||

|

FOR THE THREE AND SIX MONTHS ENDED June 30, 2015 AND 2014

|

||||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

For the Three Months Ended

|

For the Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2015

|

2014

|

2015

|

2014

|

|||||||||||||

|

OPERATING EXPENSES:

|

||||||||||||||||

|

General and administrative expenses

|

$ | 101,362 | $ | 32,267 | 377,899 | $ | 64,535 | |||||||||

|

Total operating expenses

|

101,362 | 32,267 | 377,899 | 64,535 | ||||||||||||

|

OPERATING LOSS

|

(101,362 | ) | (32,267 | ) | (377,899 | ) | (64,535 | ) | ||||||||

|

OTHER INCOME (EXPENSE):

|

||||||||||||||||

|

Interest expense

|

(9,863 | ) | (5,265 | ) | (17,723 | ) | (30,307 | ) | ||||||||

|

Gain on extinguishment of debt

|

- | 881,927 | - | 1,600,303 | ||||||||||||

|

TOTAL OTHER INCOME (EXPENSES)

|

(9,863 | ) | 876,662 | (17,723 | ) | 1,569,996 | ||||||||||

|

NET INCOME (LOSS)

|

$ | (111,225 | ) | $ | 844,395 | $ | (395,622 | ) | $ | 1,505,461 | ||||||

|

NET INCOME (LOSS) PER COMMON SHARE:

|

||||||||||||||||

|

Basic and Diluted

|

$ | (0.42 | ) | $ | 3.17 | $ | (1.49 | ) | $ | 5.65 | ||||||

|

WEIGHTED AVERAGE OF COMMON SHARES OUTSTANDING:

|

||||||||||||||||

|

Basic and Diluted

|

266,261 | 266,261 | 266,261 | 266,261 | ||||||||||||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

|

||||||||||||||||

|

GLOBAL SEAFOOD HOLDINGS CORPORATION

|

||||||||

|

FOR THE SIX MONTHS ENDED JUNE 30, 2015 AND 2014

|

||||||||

|

(Unaudited)

|

||||||||

|

For the Six Months Ended

|

||||||||

|

June 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net income (loss)

|

$ | (395,622 | ) | $ | 1,505,461 | |||

|

Adjustments to reconcile net income (loss) to net cash

|

||||||||

|

from operating activities:

|

||||||||

|

Gain on extinguishment of debt

|

- | (1,600,303 | ) | |||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts payable

|

284,037 | - | ||||||

|

Accrued interest - related party

|

15,144 | 8,368 | ||||||

|

Accrued interest

|

2,580 | 21,938 | ||||||

|

Net cash used in operating activities

|

(93,861 | ) | (64,536 | ) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Proceeds from a note payable - related party

|

10,000 | - | ||||||

|

Proceeds from line of credit - related party

|

64,536 | 64,500 | ||||||

|

Net cash provided by financing activities

|

74,536 | 64,500 | ||||||

|

NET CHANGE IN CASH

|

(19,325 | ) | (36 | ) | ||||

|

CASH, BEGINNING OF PERIOD

|

30,004 | 116 | ||||||

|

CASH, END OF PERIOD

|

$ | 10,679 | $ | 80 | ||||

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

||||||||

|

Income taxes paid

|

$ | - | $ | - | ||||

|

Interest paid

|

$ | - | $ | - | ||||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

|

||||||||

GLOBAL SEAFOOD HOLDINGS CORPORATION

JUNE 30, 2015

(Unaudited)

NOTE 1 – BUSINESS AND NATURE OF OPERATIONS AND GOING CONCERN

Global Seafood Holdings Corporation (the “Company”) was a company previously focused primarily on the business of facilitating the transfer of medical drugs, devices and diagnostics from the United States to China and other international locations. We are no longer in this business. The entity that is the original predecessor of the Company was originally incorporated in Delaware on June 4, 1991. As of January 1, 2009, the Company ceased operations of its medical imaging business and discontinued operations of all of the its business activity including those of its wholly-owned subsidiaries, Parentech, Inc., Retail Pilot, Inc., International MedLink, Inc., and Clarity Imaging International, Inc. as well Amcare (67% held by the Company).

The Company name was changed from Bridgetech Holdings International, Inc. to Global Seafood Holdings Corporation, effective on May 18, 2015.

On August 1, 2014, the Company formed Global Seafood AC Corporation which has commenced operations.

Global Seafood A.C. was established as a wholly owned subsidiary to develop and pursue a Strategy to participate in the International Seafood Industry, taking advantage of the current ongoing consolidation in the overall food industry. We intend to enter the industry through the acquisition of a recognized industry player that brings with it, the ‘industry infrastructure’ to establish an immediate presence in the market. There is no guarantee that the financing to accomplish this can be procured. There have been no operations from inception to June 30, 2015. On July 1st, 2015, the Company placed its first order for product under Global Seafood. The order exceeded 60,000 lbs. and was immediately sold at a profit.

On February 18, 2015, the Company executed an agreement with John Keeler & Co., Inc. and the Company (the "Merger Agreement"), whereby pursuant to the terms and conditions of that Merger Agreement, shareholders of John Keeler & Co., Inc. would acquire shares of our common stock in exchange for all the shares of common stock of John Keeler & Co., Inc., such that whereby John Keeler & Co., Inc. would become a wholly owned subsidiary of the Company. The shares, when issued, shall bear a restrictive transfer legend in accordance with Rule 144 under the Securities Act of 1933. The closing of the transactions in the Merger Agreement is contingent upon satisfaction of closing conditions listed in the Merger Agreement. No assurances can be provided as to the closing of the transaction or as to the Closing Date. The Merger Agreement was filed as Exhibit 2.1 on the Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 20, 2015.

On July 24, 2015, the Merger Agreement was subsequently amended to reflect the purchase of nineteen percent (19%) of John Keeler & Co., Inc. as of July 24, 2015 for consideration of Ninety Five Thousand (95,000) shares of our Series B Convertible Preferred Shares, and a no shop clause permitting the Company to retain the option to purchase the remaining eighty one percent (81%) on or before December 31, 2016 for the consideration as per the terms and conditions of the Merger Agreement. Series B Convertible Preferred Shares convert to shares of common stock on a ten for one basis and has voting rights in matters presented to the shareholders of one hundred votes for each shares of common stock voted, except that, pursuant to the amendment to the Merger Agreement, John Keeler & Co., Inc. has waived all voting rights until the Effective Date of the Merger. The Company, pursuant to the amendment to the Merger Agreement, has waived its voting rights in John Keeler & Co., Inc. until the Effective Date of the Merger. The amendment to the Merger Agreement was filed as Exhibit 2.1 on the Current Report on Form 8-K, filed with the Securities and Exchange Commission on July 27, 2015.

Global Seafood AC Corporation

On August 1, 2014, Global Seafood AC Corporation was established as a wholly owned subsidiary to develop and pursue a strategy to participate in the International Seafood Industry, taking advantage of the current consolidation going on in the overall food industry.

During a consolidation market, (which management contends began in the Seafood Industry several years ago and continues to get stronger) (“Consolidation”); the size of the potential buyers group does shrink, but the supply of inventory at the small and medium size business categories for sale actually grows, creating a very inefficient ‘Buyer’s Market’. Management’s vision is to utilize the Company’s status as a public entity to attract those smaller and medium entities, who are coming to grips with their rapidly diminishing ability to compete in light of the current Seafood Industry consolidation, necessitating pursuit of some kind of alliance or merger opportunity just to survive. Effecting this model, the Company anticipates becoming one of the limited number of remaining ‘buyers’ among the growing number of motivated sellers in the small-middle tier operators.

John Keeler & Co., Inc.

John Keeler & Co., Inc. has been processing, packaging and selling pasteurized Blue Crab meat in the United States since 1995. Their products are currently sold in the United States, Mexico, Canada, the Caribbean, UK, France, Singapore & Hong Kong. John Keeler & Co., Inc. does business under the name Blue Star Foods.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America which contemplates continuation of the Company as a going concern. However, the Company has a working capital deficit, has limited cash on hand, is in default of its outstanding debt agreements, and has not generated revenues for years. During the six months ended June 30, 2015 and 2014, the Company incurred a net loss of ($395,622) and net income of $1,505,461 (primarily through the extinguishment of debt), respectively, and at June 30, 2015 had an accumulated deficit of $52,525,064. There were no revenues during the six-month period (although revenues were realized subsequent to June 30, 2015 – See “Subsequent Events”). These factors raise substantial doubt about the ability of the Company to continue as a going concern.

NOTE 2 – NOTES PAYABLE AND RELATED PARTIES DEBT

Notes payable consist of the following as of June 30, 2015 and December 31, 2014:

|

June 30,

2015

|

December 31,

2014

|

|||||||

|

Unsecured convertible notes payable ( promissory notes from unrelated third parties bearing interest at 8%; all are in default)

|

$ | 53,000 | $ | 53,000 | ||||

|

Secured notes payable from related party at 8% interest rate due December 31, 2015

|

60,000 | 50,000 | ||||||

|

Secured line of credit – related party at 8% interest rate due December 31, 2015

|

409,468 | 344,932 | ||||||

|

Total of Notes Payable

|

$ | 522,468 | $ | 447,932 |

Line of Credit Related Party

On August 10, 2012, the Company converted an advance from shareholders to a promissory note agreement with a related note holder at 8% interest rate. The promissory note is due on December 31, 2013, extended to March 30, 2015 and then extended to December 31, 2015. The Company analyzed the modification of the term under ASC 470-60 “Trouble Debt Restructurings” and ASC 470-50 “Extinguishment of Debt”. The Company determined the modification is not substantial and did not result in an extinguishment.

The line of credit is secured by all of the assets of the Company such as intellectual property, trademarks, formulations, and all equipment. During the six months ended June 30, 2015, the Company received proceeds of $64,536. The balance of this note as of June 30, 2015 and December 31, 2014 were $409,468, and $344,932, respectively.

Notes Payable Related Party

On December 15, 2014, the Company issued a $50,000 note to a related party, bearing interest rate at 8% per annum, and due on March 15, 2015. The note was increased to $60,000 and the due date was extended to December 31, 2015. The note has a secured lien on all of the assets held by the Company, subordinated only to the secured line of credit as described above. The Company analyzed the modification of the term under ASC 470-60 “Trouble Debt Restructurings” and ASC 470-50 “Extinguishment of Debt”. The Company determined the modification is not substantial and did not result in an extinguishment.

Convertible Notes Payable

As of June 30, 2015 and December 31, 2014, the Company had convertible notes payable in the amount of $53,000 at 8% interest rate. The notes are convertible at conversion prices ranging from $125 to $750 per share. These notes are currently in default.

NOTE 3 – EQUITY

Warrants

The Company has the following warrants outstanding and exercisable as of June 30, 2015:

|

Warrants

|

Exercise

|

Expiration

|

|||||||

|

Date issued

|

Issued

|

Price

|

Date

|

||||||

|

December 23, 2006

|

480

|

$

|

750

|

None

|

|||||

The outstanding warrants at June 30, 2015 have no intrinsic value and no expiration date.

Stock Option Plans

The Company has two stock option plans: the 2001 Stock Option Plan (the “2001 Plan”) and the 2005 Stock Option Plan (the “2005 Plan”). There are currently no options outstanding under the 2001 Plan or the 2005 Plan, and 5,000,000 and 5,000,000 options remain available for future issuance under the 2001 Plan and 2005 Plan, respectively. The Company does not intend to grant any more options under the 2001 Plan. The Company’s 2005 Plan provides for the grant of options to purchase up to 5,000,000 shares of the Company’s common stock at consideration to be determined from time-to-time by the Company’s Board of Directors.

Reverse Stock Split

On February 22, 2015, the Company amended its Certificate of Incorporation to implement a reverse stock split in the ratio of 1 share for every 500 shares of common stock and Series A preferred stock (the “Reverse Stock Split”). This amendment was approved and filed of record by the Delaware Secretary of State, effective May 18, 2015. To avoid the issuance of fractional shares of Common Stock, the Company issued an additional share to all holders of fractional shares. In addition, the Company rounded up any holdings that, as a result of the Reverse Stock Split, fall below 100 shares, to the total of 100 shares.

All share and per share amounts have been retroactively restated to reflect the split as if it had occurred on the first day of the first period presented.

NOTE 4 – SUBSEQUENT EVENTS

On July 21, 2105, the Company designated 2,000,000 shares of Series B Convertible Preferred Stock, $0.02 par value. The Series B Convertible Preferred Stock may convert to shares of common stock on a ten for one basis and has voting rights in matters presented to the shareholders of one hundred votes for each shares of common stock voted.

On July 24, 2015, the Merger Agreement was subsequently amended to reflect the purchase of nineteen percent (19%) of John Keeler & Co., Inc. as of July 24, 2015 for consideration of Ninety Five Thousand (95,000) shares of our Series B Convertible Preferred Shares.

On July 29, 2015, the Company agreed to convert certain secured debt for common shares, specifically the Revolving Line of Credit (Principle and Interest) totaling $461,190 was converted for 2,804,127 shares, post-split, of Company common stock.

On August 3, 2015, the Company completed an offering in which the Company offered and sold 506,500 in Units (the “Units”) consisting of an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) shares of common stock, $0.001 par value per share (the “Common Stock”) and an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) three year common stock purchase warrants with an exercise price of $1.50 per share.

* * * * * *

The following discussion and analysis by our management of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated interim financial statements and the accompanying related notes included in this quarterly report and our audited consolidated financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission.

Forward Looking Statements — Cautionary Language

Certain statements made in these documents and in other written or oral statements made by or on Global Seafood Holdings Corporation’s behalf are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like: "believe", "anticipate", "expect", "estimate", "project", "will", "shall" and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in our businesses, prospective products, future performance or financial results. Global Seafood Holdings Corporation claims the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary materially, some of which are described in this filing. The risks included herein are not exhaustive. This annual report on Form 10-K, as quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC include additional factors which could impact Global Seafood Holdings Corporation's business and financial performance. Moreover, Global Seafood Holdings Corporation operates in a rapidly changing and competitive environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the impact of all risk factors on Global Seafood Holdings Corporation's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, Global Seafood Holdings Corporation disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of the report.

PART I

As used in this annual report, “we”, “us”, “our”, “Global”, “Global Seafood” or “our company” refers to Global Seafood Holdings Corporation and all of its subsidiaries.

ITEM 1. BUSINESS.

Except for historical information contained herein, the following discussion contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements include, but are not limited to, statements regarding future events and the Company’s plans and expectations. Actual results could differ materially from those discussed herein. Factors that could cause or contribute to such differences include, but are not limited to, those discussed elsewhere in this Form 10-Q or incorporated herein by reference, including those set forth in Management's Discussion and Analysis of Financial Condition and Results of Operations.

Overview

Our company, Global Seafood Holdings Corporation was a company focused primarily on the business of facilitating the transfer of medical drugs, devices and diagnostics from the United States to China and other international locations. We are no longer in this business.

Other than as set out in this quarterly report and any prior reports, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Corporate History

The entity that is the original predecessor of our company, originally named “Huggie Heart, Inc.,” was incorporated in Delaware on June 4, 1991. In November 2002, this entity acquired Parentech, Inc., a Delaware corporation, and changed our name to “Parentech, Inc.”. Effective May 18, 2015, we changed our name to “Global Seafood Holdings Corporation”.

As of January 1, 2009, we discontinued operations of all the following subsidiaries; Retail Pilot, Inc., MedLink International, Inc. and Clarity Imaging International, Inc.

Global Seafood A.C. was established as a wholly owned subsidiary to develop and pursue a Strategy to participate in the International Seafood Industry, taking advantage of the current ongoing consolidation in the overall food industry. We intend to enter the industry through the acquisition of a recognized industry player that brings with it, the ‘industry infrastructure’ to establish an immediate presence in the market. There is no guarantee that the financing to accomplish this can be procured

On February 18, 2015, we executed an agreement with John Keeler & Co., Inc. and our company (the "Merger Agreement"), whereby pursuant to the terms and conditions of that Merger Agreement, shareholders of John Keeler & Co., Inc. would acquire shares of our common stock in exchange for all the shares of common stock of John Keeler & Co., Inc., such that whereby John Keeler & Co., Inc. would become a wholly owned subsidiary of the Company. The shares, when issued, shall bear a restrictive transfer legend in accordance with Rule 144 under the Securities Act of 1933. No assurances can be provided as to the closing of the transaction or as to the Closing Date.

On July 24, 2015, the Merger Agreement was subsequently amended to reflect the purchase of nineteen percent (19%) of John Keeler & Co., Inc. as of July 24, 2015 for consideration of Ninety Five Thousand (95,000) shares of our Series B Convertible Preferred Shares, and a no shop clause permitting the Company to retain the option to purchase the remaining eighty one percent (81%) on or before December 31, 2016 for the consideration as per the terms and conditions of the Merger Agreement. Series B Convertible Preferred Shares convert to shares of common stock on a ten for one basis and has voting rights in matters presented to the shareholders of one hundred votes for each shares of common stock voted, except that, pursuant to the amendment to the Merger Agreement, John Keeler & Co., Inc. has waived all voting rights until the Effective Date of the Merger. The Company, pursuant to the amendment to the Merger Agreement, has waived its voting rights in John Keeler & Co., Inc. until the Effective Date of the Merger. The amendment to the Merger Agreement is attached hereto Exhibit 2.1.

The issuance of the securities above were effected in reliance on the exemptions for sales of securities not involving a public offering, as set forth in Rule 506 promulgated under the Securities Act of 1933, as amended (the "Securities Act") and in Section 4(2) and Section 4(6) of the Securities Act and/or Rule 506 of Regulation D.

On July 29, 2015, the Company agreed to convert certain secured debt for common shares, specifically the Revolving Line of Credit (Principle and Interest) totaling $461,190 was converted for 2,804,127 shares of Company common stock. The effects of these changes will be reflected on the September 30, 2015 10Q.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Global Seafood AC Corporation

On August 1, 2014, Global Seafood AC Corporation was established as a wholly owned subsidiary to develop and pursue a strategy to participate in the International Seafood Industry, taking advantage of the current consolidation going on in the overall food industry.

During a consolidation market, (which management contends began in the Seafood Industry several years ago and continues to get stronger) (“Consolidation”); the size of the potential buyers group does shrink, but the supply of inventory at the small and medium size business categories for sale actually grows, creating a very inefficient ‘Buyer’s Market’. Management’s vision is to utilize the Company’s status as a public entity to attract those smaller and medium entities, who are coming to grips with their rapidly diminishing ability to compete in light of the current Seafood Industry consolidation, necessitating pursuit of some kind of alliance or merger opportunity just to survive. Effecting this model, the Company anticipates becoming one of the limited number of remaining ‘buyers’ among the growing number of motivated sellers in the small-middle tier operators.

The Seafood Industry: Background and the important role of Vertical Integration.

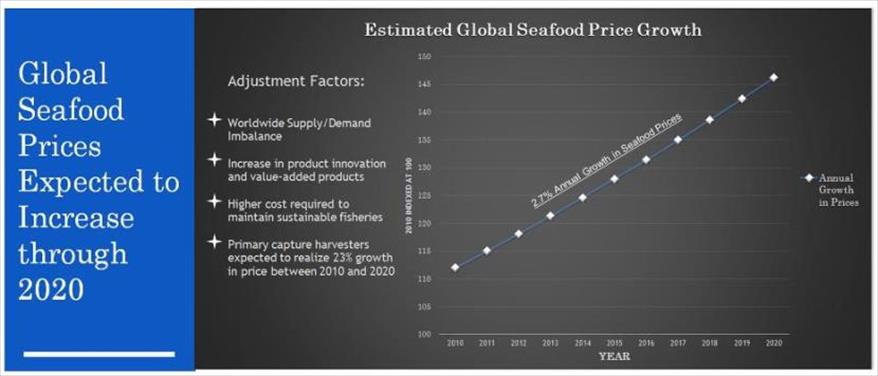

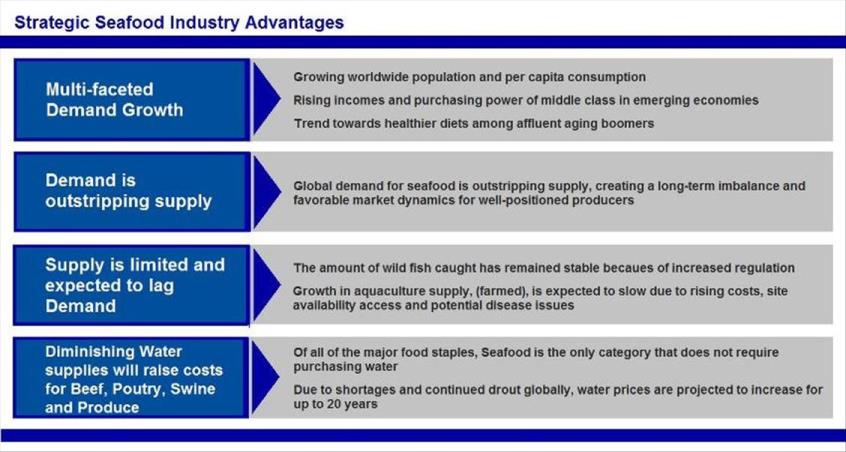

The Seafood Industry is diverse and fragmented with an estimated 154 Million tons production in 2010 projected to grow to 194.8 Million tons by 2022 globally. [FAO (Food Outlook Global Market Analysis) 2014. The State of World Fisheries and Aquaculture 2014.]

Historically, companies have specialized in a single seafood species segments within the value chain. The Industry is broken down into three main segments with a fourth rapidly emerging:

|

|

·

|

Harvesting

|

|

|

·

|

Commercial Fishing

|

|

|

·

|

Aquaculture Production (Farming vs. Wild Catch)

|

|

|

·

|

Processing

|

|

|

·

|

Primary – cleaning; sorting; freezing; filleting and packaging

|

|

|

·

|

Secondary – creation of processed products for ready meals or meal components

|

|

|

·

|

Distribution

|

|

|

·

|

Wholesale – U.S. Foods/Sysco Distributors

|

|

|

·

|

Retail – Supermarkets; Specialty Seafood Stores

|

|

|

·

|

In-Trade – Hotels; Restaurants & Institutional

|

|

|

·

|

Emerging Fourth Segment - Fish Feed – as Aquaculture continues to grow, the Fish Feed sub-category is expected to produce annual growth of 11.7%. [OECD (The Organization for Economic Co-operation and Development) and FAO Secretariats.]

|

[FAO Seafood Outlook 2011.]

Acquisition Model Objectives and Exit Strategy; In an Industry Consolidation market; the size of the potential buyers group does shrink, but the supply of inventory at the Small and Medium size business categories for sale actually grows, creating a very inefficient ‘Buyer’s Market’.

This occurs because of three irreversible changes that take effect as a result of Consolidation:

Size: Initially, a few key large target companies will be purchased at a substantial premium in order to create size quickly. The new combined entity will continue to make acquisitions but the target size requirement will get larger as smaller ‘bites’ can no longer have any significant effect on economies of scale; revenues and profits. Immediately after the initial purchases, it stops being feasible for the new large companies to pursue small and middle market acquisition opportunities. They cannot justify the allocation of the resources for acquisitions that will not have a discernable effect on revenues and their bottom line.

Margins: Since Consolidation is often the result of markets maturing experiencing fewer growth opportunities, additional profits are now pursued by taking advantage of economies of scale by expanding a company’s footprint:

|

|

·

|

By acquiring competitors, (effectively reducing supply choices for their customers), they minimize discounting; stabilize the market; and can slowly begin to increase prices.

|

|

|

·

|

As the major sources continue to grow in size, so does their purchasing power, putting pressure on component suppliers to reduce their prices, lured by the attraction of higher volumes or simply staying viable.

|

Dynamics: To achieve the expected cost savings and economies of scale, the new combined entity will eliminate infrastructure duplications. This can be accomplished by reducing the number of resources they purchase from, per category; which will enable a reduction in the buying staff and their support system. To stay viable, suppliers will be expected to grow in both size and vertical integration. Those suppliers that survive the cuts, will be expected to handle larger volumes; additional categories; covering more territories; at lower price points. (Example: four resources for product X might require oversight by a staff of eight, but encouraging one source to grow in capacity and selection could reduce that staff number to four.)

Ability to be Active on the Buy and Sell sides of the Market: Keeping the acquisition window limited to the Small and Medium size target companies gives Global Seafood the unique flexibility to be a strategic buyer and Seller… at the same time.

With each additional acquisition, the company grows closer to the size of a “Top Tier” entity. At some level of revenues, the company becomes an attractive target. Having grown without getting saddled with expensive long term debt, the company will be easier to finance for a buyer. If purchase premiums rise to a high enough level, we believe, selling becomes a very positive exit strategy.

Buy Low/Sell High, but always be in the Market: In almost every market, opportunity moves from the buy side to the sell side and back again. By positioning Global Seafood as one of the only remaining ‘Ready Buyers’ to vulnerable and displaced small and medium size entities, we believe the Company will maintain its ‘Buy Low’ strategy. At the same time, each acquisition dramatically increases revenues, gradually attracting the attention of the remaining large entities. At some level, we contend, the Company will move from ‘acquirer’ to ‘potential target’, potentially attracting bidding wars and premium offers that the few available targets in the size range enjoy.

On the Buy Side: Under normal circumstances, to gain control of a target, acquirers must pay its shareholders a premium over the current market value. Although premiums can vary widely, the average ones for corporate control have been fairly stable: almost 30 percent of the pre-offer price of the target’s equity. For targets pursued by multiple acquirers, the premium rises dramatically, creating the so-called winner’s curse. If several companies evaluate a given target and all identify roughly the same potential synergies, the pursuer that overestimates them most will offer the highest price. Since it is based on an overestimation of the value to be created, the winner pays too much—and is ultimately a loser.

Instead of competing for the largest acquisition targets attracting premium prices, Global Seafood will focus its purchases among the remaining entities that are now too small to be of interest to the largest buyers and no longer viable as a stand-alone entity competing in the overall market.

|

|

·

|

These are the historically solid businesses that in all likelihood will not able to continue to complete and survive with what is left in the marketplace. With owners in their 60’s and 70’s with either no family members wanting to, or capable of, taking over the business, they now discover there are few buyers looking to cash out their lifetime of work.

|

|

|

·

|

The challenge for smaller companies is that retailers only want to stock a certain number of brands on their shelves. Access to retail shelf space and management succession issues are all making it more difficult for small independent companies to complete with the bigger players.

|

|

|

·

|

With few if any alternatives, these pieces will sell at discounts to historical values before the consolidation began and be very flexible with regards to terms and accepting the majority of the price in paper.

|

Management believes that acquisitions made in the small to medium size of a category can be completed at smaller premiums. Private companies get valued substantially lower because there is no public market where, which adds value because of the liquidity factor. Private acquisitions often stem from the seller’s motivation to get out rather than the buyer’s desire for a purchase.

Increase the Company’s Market Value: Growth by rolling up middle tier companies, enables the acquisition company to consistently deliver increased EBITDA, even if growth slows in the overall market.

Vertical Integration: Moving forward, a successful roll-up strategy in the seafood industry must include vertical integration as a core element to effectively drive revenues and profits. Building a business that incorporates ownership and control from harvesting to processing and distribution can enable the Company to:

|

|

·

|

Achieve operational synergies, cost reductions and higher margins

|

|

|

·

|

Maintain quality control as traceability of the end product has become a major emphasis for food safety

|

|

|

·

|

Establish faster distribution to customers and have the built in ability to adapt quickly to the changing demands of customers

|

Improve the acquired company’s performance: Improving the performance of the target company is one of the most common value-creating acquisition strategies. Put simply, you buy a company and radically reduce costs to improve margins and cash flows. In some cases, the acquirer may also take steps to accelerate revenue growth.

Size: The increase in size will, we believe, also enable the Company to meet the expectations of the top customers who are looking for vendors who can deliver product in larger enough volumes to accommodate their growth and market coverage.

Margins: The aim of these deals is to take advantage of greater size, bring on more sophisticated management and reduce costs. Additional profits are now achieved by taking advantage of economies of scale from expanding a company’s footprint. Larger companies have stronger negotiating clout; (example: more buying power to purchase goods in bulk). Fewer vendor choices can reduce discounting; stabilize margins and create the opportunity to and increase pricing.

Dynamics: To achieve the expected cost savings and economies of scale, the new combined entity will eliminate infrastructure duplications.

Ability to be more aggressive with key acquisition targets by minimizing overall debt: The best way to create value from an acquisition is to buy cheap—in other words, at a price below a company’s intrinsic value. Such opportunities can be brief moments when markets, for example, sometimes overreact to negative news, such as a unavoidable worldwide event, (weather, nature, political change) or the failure of a single product in a portfolio with many strong ones.

Successfully implementing an acquisition model heavily weighted towards equity vs. cash, the Company can make superior offers to a potential acquisition because they are not reliant on finding additional capital for a higher offer.

Less debt than competing companies of similar size, not only delivers stronger earnings with less constraints due to a heavy debt load. It also keeps ‘dry powder’ available when time is limited and flexibility is needed to take advantage of market dynamics, which may cause a short term drop in the cost of raw materials or speed up a sense of urgency to a potential target due to cash flow issues.

Accelerate market access for the new and existing companies’ products; often relatively small companies with innovative products have difficulty reaching the entire potential market for their products. By adding access to the existing customer base of the core company itself, new products can reach cost effective production levels and profitability sooner.

Management and Operations

The core strategy for Global Seafood Holdings Corp. is growth through acquisition. It is anticipated that there will be aspects of operations that one entity might be capable of affecting/overseeing better than others with an eye towards the future when the majority of administrative responsibilities can be combined directly under the Holding Company.

There will be opportunities for economies of scale by centralizing some aspects of operations, but to achieve projected growth and profitability, each entity must stand on its own merits. In either case, (one entity subcontracting services to another or services being subcontracted from the holding company to an operating entity), intercompany services must be conducted under a structure of financial viability to the providing and the receiving entity.

Global Seafood Holdings Corporation has established and maintains its own operating account since inception. This account was initially capitalized with funds raised prior to establishing operations.

John Keeler & Co. Inc.

On February 18, 2015, we executed an agreement with John Keeler & Co., Inc. and our company (the "Merger Agreement"), whereby pursuant to the terms and conditions of that Merger Agreement, shareholders of John Keeler & Co., Inc. would acquire shares of our common stock in exchange for all the shares of common stock of John Keeler & Co., Inc., such that whereby John Keeler & Co., Inc. would become a wholly owned subsidiary of the Company. The shares, when issued, shall bear a restrictive transfer legend in accordance with Rule 144 under the Securities Act of 1933. No assurances can be provided as to the closing of the transaction or as to the Closing Date.

On July 24, 2015, the Merger Agreement was subsequently amended to reflect the purchase of nineteen percent (19%) of John Keeler & Co., Inc. as of July 24, 2015 for consideration of Ninety Five Thousand (95,000) shares of our Series B Convertible Preferred Shares, and a no shop clause permitting the Company to retain the option to purchase the remaining eighty one percent (81%) on or before December 31, 2016 for the consideration as per the terms and conditions of the Merger Agreement. Series B Convertible Preferred Shares convert to shares of common stock on a ten for one basis and has voting rights in matters presented to the shareholders of one hundred votes for each shares of common stock voted, except that, pursuant to the amendment to the Merger Agreement, John Keeler & Co., Inc. has waived all voting rights until the Effective Date of the Merger. The Company, pursuant to the amendment to the Merger Agreement, has waived its voting rights in John Keeler & Co., Inc. until the Effective Date of the Merger. The amendment to the Merger Agreement is attached hereto Exhibit 2.1.

Located in Miami, Florida, John Keeler & Co., Inc. (“Blue Star”) d/b/a Blue Star Foods has been in business for approximately twenty years. Blue Star was formed under the laws of the State of Florida on May 15, 1995. The primary focus of Blue Star and current source of revenue is importing blue and red swimming crab meat primarily from Indonesia, Philippines and China and distributing it in the United States of America, Canada and Europe under several brand names such as Blue Star, Seassentials, Oceanica, Pacifika and Harbor Banks. Specialty Crab is part of a US$600 million market niche growing an estimated 20% a year (Company estimates).

Blue Star’s products are currently sold in the United States, Mexico, Canada, Central America, The Caribbean, EU, UAE, Singapore and Hong Kong. Crab meat is processed in 12 plants throughout Southeast Asia, directly and indirectly employing several thousand. Average annual production for the past several years has grown to over four million pounds of premium quality crab meat, with capacity for another three million pounds. Blue Star’s facilities and co-packers are FDA approved and receive third party inspection at their plants every year, ensuring that the safety and quality of our product. More important and of significant consideration is that Blue Star has taken great efforts to become BRC, (British Retail Council), Certified. There is no other Blue Crab meat importer in the US with this status.

Blue Star imports packaged meat from the blue swimming crabs (a large crab, bright blue in color with white spots delivering a full bodied flavor) and red swimming crabs (red in color with a mild sweet flavor). Typically, products are pasteurized to have a shelf life of fourteen to eighteen months. Crabs can be caught almost all year long, but do have seasonality. Blue Star’s supply chain is country diverse which limits the effect of this seasonality. Blue Star distributes its crab meat in different grades:

Imperial (or Colossal) and Jumbo Lump; Imperial and Jumbo Lump are prized for their impressive size, bright white color and exquisite taste. Imperial and Jumbo lump consist of the two large muscles connected to the swimming fins of the crab; colossal simply comes from larger crabs than jumbo lump. Colossal and jumbo lump should never be broken up for a recipe; they are best used in upscale cocktail presentations or in sautés, where the size of the lumps can really shine.

Super Lump; Perfect for making dishes where crab is the star. Super lump crab meat’s sweet flavor and large pieces give any crab dish a dash of panache. Super lump is a combination of broken jumbo lumps and whole body meat extracted from the shell. The grade allows for even distribution of crab meat throughout the recipe, with large enough pieces of meat to shine through the rest of the ingredients. Super lump crab meat is used in crab cakes, as a pasta topping, scampi or a ceviche.

Backfin; Backfin is a blend of broken pieces of jumbo lump and special grade crab meat. It is perfect for use in crab cakes, dips, salads, and casseroles.

Special; Often considered the most versatile grade for the widest range of recipes, Special crab meat consists of the smaller pieces of white meat from the body of the crab, perfect for crab cakes, salads, quesadillas, wraps, soups, and crab balls.

Claw Meat; Picked from the swimming fins of the crab, claw meat is a brown meat with a stronger flavor profile, making claw meat ideal for dishes with heavy sauces or in dips and soups.

Trademarks and Patents; Blue Star holds multiple process patents for pasteurizing crab meat in retort pouches. These processes have not only allowed Blue Star to differentiate itself in the market place, but has also allowed Blue Star to cut back on carbon emissions and waste due to the size and type of packaging that is standard in the Industry. These patents are held in the US, EU, Great Britain and all of the countries that their goods are produced.

Blue Star has also trademarked all of its brands, as well as its Trade name Blue Star Foods. In addition its brands and trade name, Blue Star has also trademarked the phrase “America's Favorite Crabmeat”.

Competition; In general, the aquaculture industry is intensely competitive and highly fragmented. The aquaculture industry is further open to competition from local and overseas operators engaged in aquaculture and from other captured fish producers. Blue Star competes with various companies, many of which are developing or can be expected to develop products similar to the Company products.

Many of Blue Star competitors are more established than Blue Star, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of Blue Star’s competitors have greater name recognition and a larger customer base. Competitors include, but are not limited to, Chicken of the Sea Frozen Foods, Phillips Foods, Inc., Harbor Seafood, Bonamar Seafood or Twin Tails. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Consequently, Blue Star will be at a competitive disadvantage in identifying possible business opportunities and successfully completing a business combination.

Blue Star Management

John Keeler – President/CEO/CSO

In 1995, Mr. Keeler started this seafood import company that has grown to become a competitive marketer of Imported Blue Swimming Crabmeat in the United States. He has successfully built sales over the past 20 years to $49 million annually through 2014, without ever pursuing outside investment capital. Mr. Keeler is recognized as a leader and innovator in the seafood industry, including overseeing operating facilities in the Philippines and Indonesia with production potential of close to 10 million lbs. annually.

Christopher H. Constable – Chief Financial Officer

Since 2003, Mr. Constable has directed all areas of finance, accounting and corporate level general administration for a multinational consumer seafood manufacturer and importer. During his tenure, he has formalized and structured both the accounting and finance departments as well as structuring the teams coordinating affiliate companies in Asia. Mr. Constable has also directed all of the tax, legal and accounting strategies for these related entities. Additionally, he engaged and restructured the banking relationships for the Company to ensure consistent and adequate cash to fund operations in an industry that traditionally has long cash cycles. Prior to his current executive role, he spent 14 years in commercial banking specializing in deal structure and loan workouts.

Government Regulation; Blue Star complies with various national, state and local environmental protection laws and regulations, as well as certifications and inspections relating to the quality control of our production and the environmental and social impact of our operations. In addition to statutory and regulatory compliance, Blue Star actively ensures the environmental sustainability of Blue Star‘s operations. Blue Star costs of compliance with applicable environmental laws are minimal. Such failure has not occurred in the past, and Blue Star generally does not anticipate that it may occur in the future, although no assurance can be given in this regard.

HACCP Standards; Blue Star facilities are certified in accordance with the Hazard Analysis Critical Control Points, or HACCP, standards for exporting aquatic products to the United States. The HACCP standards are developed by the FDA pursuant to the FDA’s HACCP regulation, Title 21, Code of Federal Regulations, part 123, and are used by the FDA to help ensure food safety and control sanitary standards.

These standards focus on monitoring the quality of production and sanitation measures in processing plants for food products, and also take into account the environmental and social impact of the operations of the certified company. Compliance with the HACCP procedures is mandatory, and the successful implementation of these procedures depends on the design and performance of facilities and equipment, and excellent quality control and hygiene practices. HACCP conducts sample laboratory testing on our processed aquatic products to ensure no forbidden substances are present in them. Laboratory testing of our processed aquatic products was initiated by the HACCP in compliance with strict quarantine guidelines imposed by domestic export control government agencies and foreign import control government agencies.

In addition, Blue Star facilities continuously pass USDA inspection.

Product Liability Insurance; Blue Star has purchased general commercial liability insurance, which provides adequate aggregate product liability insurance based on industry standards. However, there is a possibility that Blue Star customers, or the ultimate buyers of Blue Star products, may have adverse reactions to the crab meat and other aquatic products that Blue Star will process and sell. Any such adverse reaction may result in actual or potential product liability claims against Blue Star, which may not be covered by Blue Star insurance or, if covered, may be significantly higher than the insurance amount. Such actual or potential product liability claims may have an adverse effect on Blue Star reputation and profitability.

Employees; Blue Star has approximately 25 employees including 7 executive and administrative staff and 1 independent contractor.

Development of Internally Generated Operating Revenues:

In January, we began to develop a new seafood business opportunity in Chile.

Chilean Aquaculture

Chilean Aquaculture began in experimentation in the early 1970’s. Industrial level production began in the late 70’s, grew through the 80’s & 90’s until it represented 34% of the world’s production by 2003. In 2005, Chile expected to export $1.5 billion worth of fresh-packed salmon, with 40 percent of it coming to the United States.

In 2007, Chile's Salmon Industry faced the worst crisis in its history the virus, infectious salmon anemia, or I.S.A., was first reported at a Chilean salmon farm owned by a Norwegian company. It quickly spread through southern Chile, wracking a fishing business that had become one of the country’s biggest exporters during the past 15 years. The Chilean industry suffered more than $2 billion in losses and saw its production of Atlantic salmon fall by half and subsequently laid off 26,000 workers. In 2007, Salmon reached its highest point, exporting about 76,500,000 tons. Following the outbreak, in 2010 the figures dropped substantially to 30,317,339 tons.

The solution was a massive Antibiotic/Anti-parasitic program initiated by the largest farms and producers in 2009. Mortality rates dropped from a high of 25% to an average to 15.2% in 2014. Chilean salmon farms use on average 700 grams of antibiotics per metric ton of harvested salmon vs. less than 10 grams in Norway.

In mid-2014, the negative impact of Chilean salmon industry’s use of the antibiotic oxytetracycline, (put into the feed to the fight against the persistent and widespread disease) began surfacing when agencies started to report increasing evidence that resistance had built up in salmon, with the result that the antibiotic was no working effectively. Of equal concern, the resistance buildup to oxytetracycline is particularly problematic since the World Health Organization lists the antibiotic as being “highly important” to use for human health, to fight infections due to chlamydia and brucella. Algal Scientific called it the ‘Biggest example of egregious use in aquaculture’.

In May, Walmart said it was transitioning to 100% ‘antibiotic free’ Salmon immediately. Chilean Salmon has disappeared from Costco stores as they have started selling Norwegian salmon labeled ‘raised without antibiotics’. It will inevitably take several 5-10 years to reverse the damage to the industry. [Undercurrent News June 11, 2015].

Some of the best investment opportunities come after the ‘Bubble’ bursts. I believe that is what differentiates our vision and skill set: The strength to begin looking for opportunity when indicators turn bleak and the ability to recognize the viable collateral damage worth pursuing when the ‘burst’ happens.

Collateral damage is defined as unexpected harm to things that are incidental to the damaging event, having not been the cause of/nor the intended target of the results.

In the Chilean Salmon business the Collateral damage is found in the area south of the Strait of Magellan, known for being prime conditions for salmon farming due to the frigid temperatures. This area is considered Antarctic waters isolated from the warmer productive areas further north that have been heavily hit by the ISA virus and now having to deal with business fall out due to extensive use of antibiotics. This region does not require antibiotics, but has been seriously caught up in the severe reduction in global sales, because they are a salmon product from Chile.

Having not participated in the original wave of investments developing the Chilean salmon industry and fortunately missing the billion dollar losses resulting from the ISA virus and subsequent second round of losses from the Antibiotic quagmire, this opportunity, ideally tailored to the Global Seafood Holding Corp, was presented to us in February.

Management believes that Chilean Salmon represents a tremendous opportunity for our company to expand horizontally.

On July 1st, 2015, we placed our first order for product under Global Seafood. The order exceeded 60,000 lbs. and was immediately sold at a profit.

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations is based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. While our critical accounting policies are described in Note 2 to our financial statements appearing elsewhere in this report, we believe the following policies are important to understanding and evaluating our reported financial results:

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) the disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published, and (iii) the reported amount of net sales and expenses recognized during the periods presented. Adjustments made with respect to the use of estimates often relate to improved information not previously available. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of financial statements; accordingly, actual results could differ from these estimates.

These estimates and assumptions also affect the reported amounts of revenues, costs and expenses during the reporting period. Management evaluates these estimates and assumptions on a regular basis. Actual results could differ from those estimates.

RESULTS OF OPERATIONS

We presently have no operations but our plan of operation is to identify and merge with a potential merger candidate/candidates to create new shareholder value and reestablish the Company going forward.

Three Months Ended June 30, 2015, Compared to Three Months Ended June 30, 2014.

General and administrative expenses (“SG&A”) totaled $101,362 for the three months ended June 30, 2015, compared to $32,267 for the three months ended June 30, 2014. SG&A costs in 2015 and 2014 include the accrued salary of our sole officer and director, and rent.

Interest expense was $9,863 for the three months ended June 30, 2015, compared to $5,265 for the three months ended June 30, 2014.

Six Months Ended June 30, 2015, Compared to Six Months Ended June 30, 2014.

General and administrative expenses (“SG&A”) totaled $377,899 for the six months ended June 30, 2015, compared to $64,535 for the six months ended June 30, 2014. SG&A costs in 2015 and 2014 include the accrued salary of our sole officer and director, and rent.

Interest expense was $17,723 for the six months ended June 30, 2015, compared to $30,307 for the six months ended June 30, 2014.

LIQUIDITY AND CAPITAL RESOURCES

We currently have a total accumulated deficit of $52,525,064 as of June 30, 2015, current assets of $10,679, and current liabilities of $866,005 as of June 30, 2015. As of June 30, 2015, we were in default on two convertible notes in the amount of $80,778, including principal and accrued interest. We also had a line of credit with $409,468 principal outstanding as of June 30, 2015. On August 3, 2015, the line of credit outstanding balance was converted into equity. (see “Subsequent Events” below).

Subsequent Events

On July 1st, 2015, the Company placed their first order for product under Global Seafood. The order exceeded 60,000 lbs. and was immediately sold at a profit.

On July 29, 2015, the Company agreed to convert certain secured debt for common shares, specifically the

Revolving Line of Credit (Principle and Interest) totaling $461,190 was converted for 2,804,127 shares, post-split, of Company common stock.

On August 3, 2015, the Company completed an offering in which the Company offered and sold 506,500 in Units (the “Units”) consisting of an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) shares of common stock, $0.001 par value per share (the “Common Stock”) and an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) three year common stock purchase warrants with an exercise price of $1.50 per share.

Patents and Trademarks

We do not own any patents or trademarks.

Employees

We currently have no employees other than our sole officer and director. We expect to use consultants, attorneys and accountants as necessary, and do not anticipate a need to engage any full-time employees.

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months.

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-Q in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

We do not hold any derivative instruments and do not engage in any hedging activities. We have no business activity as of the six-month period ended June 30, 2015.

a) Evaluation of Disclosure Controls and Procedures.

Under the supervision and with the participation of our Chief Executive Officer and Principal Accounting Officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as of the end of the period covered by this quarterly report. Based on this evaluation, our Chief Executive Officer and Principal Accounting Officer concluded as of June 30, 2015, that our disclosure controls and procedures were not effective such that the information required to be disclosed in our Securities and Exchange Commission (“SEC”) reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) is accumulated and communicated to our management, including our Chief Executive Officer and Principal Accounting Officer, as appropriate to allow timely decisions regarding required disclosure. Our Chief Executive Officer concluded, based on the evaluation of the effectiveness of the disclosure controls and procedures by our management, that as of June 30, 2015, our disclosure controls and procedures were not effective due to the material weaknesses described in Management's Report on Internal Control over Financial Reporting as reported in our Form 10-K for the year ended December 31, 2014.

b) Changes in Internal Control over Financial Reporting.

During the quarter ended June 30, 2015, there was no change in our internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries' officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Not required under Regulation S-K for “smaller reporting companies.”

None.

There were continuing defaults upon senior securities during the quarter ended June 30, 2015.

Not applicable.

On July 29, 2015, the Company agreed to convert certain secured debt for common shares, specifically the

Revolving Line of Credit (Principle and Interest) totaling $461,190 was converted for 2,804,127 shares, post-split, of Company common stock.

On August 3, 2015, the Company completed an offering in which the Company offered and sold 506,500 in Units (the “Units”) consisting of an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) shares of common stock, $0.001 par value per share (the “Common Stock”) and an aggregate of Five Hundred and Six Thousand, Five Hundred (506,500) three year common stock purchase warrants with an exercise price of $1.50 per share.

Apart from the above, there is no information with respect to which information is not otherwise called for by this form.

| 2.1 | Agreement and Plan of Merger and Reorganization by and among Global Seafood International Holdings, Inc., a Delaware Corporation, and Global Seafood AC Corporation, a Florida Corporation, and John Keeler & Co., Inc., a Florida Corporation, dated February 20, 2015.(2) | |

| 2.2 | Amendment to Agreement and Plan of Merger and Reorganization by and among Global Seafood International Holdings, Inc., a Delaware Corporation, and Global Seafood AC Corporation, a Florida Corporation, and John Keeler & Co., Inc., a Florida Corporation, dated July 24, 2015 (3) | |

|

3.1

|

Articles of Incorporation (1)

|

|

|

3.2

3.3

|

Amendments to Articles of Incorporation(3)

Certificate of Designation of Preferences, Rights And Limitations of Series B Convertible Preferred Stock (3)

|

|

|

3.4

|

Bylaws of the Corporation (1)

|

|

|

31.1

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act(4)

|

|

|

31.2

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act.(4)

|

|

|

32.1

|

Certification of Chief Executive Officer Pursuant to Section 906 of the Sarbanes-Oxley Act.(4)

|

|

|

32.2

|

Certification of Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act.(4)

|

|

|

(1) Incorporated by reference to the Company's Form 10-SB/12g filed on February 13, 2008.

|

|

(2) Incorporated by reference to the Company Current Report on Form 8-K, filed February 20, 2015.

(3) Incorporated by reference to the Company Current Report on Form 8-K, filed July 27, 2015

(4) Filed herein

|

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant

Date: August 13, 2015

|

Global Seafood Holdings Corporation

By: /s/ Scott Landow

|

|

|

Scott Landow

|

||

|

Chairman, Chief Executive Officer, Principal Executive Officer, Principal Financial Officer

|

26