Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlueLinx Holdings Inc. | q2earnings8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BlueLinx Holdings Inc. | q2earningsexhibit991.htm |

BlueLinx Quarterly Review 2nd Quarter 2015

2 Forward-Looking Statement Safe Harbor - This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All of these forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. These risks and uncertainties may include, among other things: changes in the prices, supply, and/or demand for products which we distribute; general economic and business conditions in the United States; the activities of competitors; changes in significant operating expenses; changes in the availability of capital and interest rates; adverse weather patterns or conditions; acts of cyber intrusion; variations in the performance of the financial markets, including the credit markets; and other factors described in the "Risk Factors" section in our Annual Report on Form 10-K for the fiscal year ended January 3, 2015, and in our other periodic reports filed with the SEC, including the update to the Risk Factors described in Item 1A. in the 10-Q for the quarter ended July 4, 2015. In addition, the statements in this presentation are made as of August 13, 2015. We undertake no obligation to update any of the forward-looking statements made herein, whether as a result of new information, future events, changes in expectation or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to August 13, 2015. Use of Non-GAAP and Adjusted Financial Information - To supplement GAAP financial information, we use adjusted measures of operating results which are non-GAAP measures. This non-GAAP adjusted financial information is provided as additional information for investors. These adjusted results exclude certain costs, expenses, gains and losses, and we believe their exclusion can enhance an overall understanding of our past financial performance and also our prospects for the future. These adjustments to our GAAP results are made with the intent of providing both management and investors a more complete understanding of our operating performance by excluding non-recurring, infrequent or other non-cash charges that are not believed to be material to the ongoing performance of our business. The presentation of this additional information is not meant to be considered in isolation or as a substitute for GAAP measures of net earnings, diluted earnings per share or net cash provided by (used in) operating activities prepared in accordance with generally accepted accounting principles in the United States. BlueLinx Holdings Inc.

3 Mitch Lewis Chief Executive Officer

4 Executive Summary – Second Quarter 2015 • Net income of $2.9 million; $0.03 basic and diluted earnings per share • Adjusted EBITDA of $9.8 million • Revenue of $516 million • Selling, general and administrative expenses down $4.3 million, or 7.7% from second quarter 2014

5 Price and Volume Second Quarter 2015

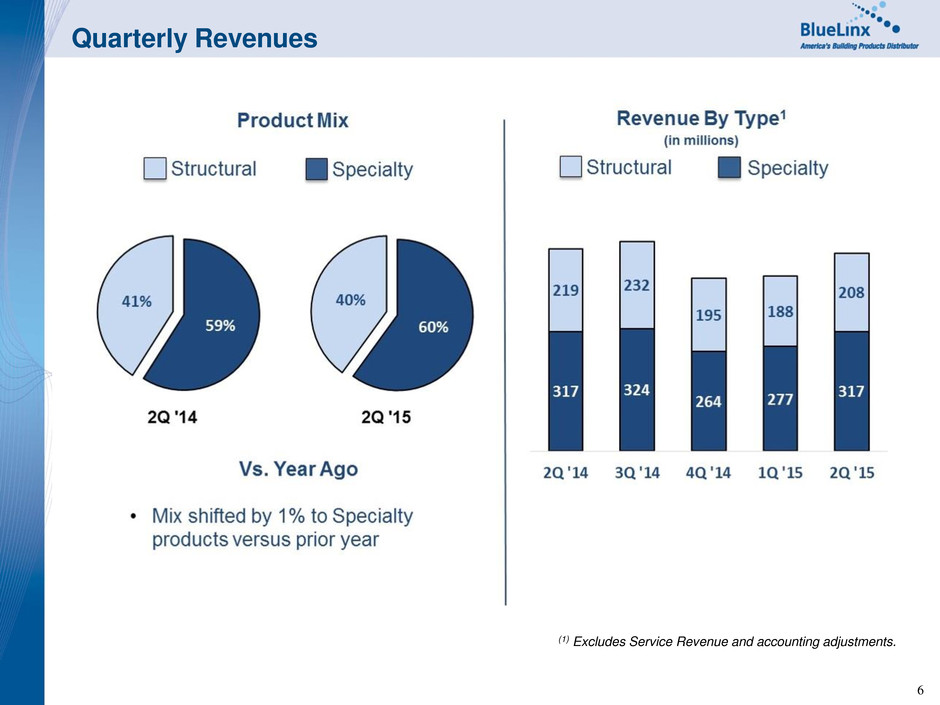

6 Quarterly Revenues (1) Excludes Service Revenue and accounting adjustments.

7 Key Emphasis • Focus on opportunities in the local markets • Inventory management and planning improvements • Supplier engagement to create mutual success • Continue margin enhancement activities • Closely manage working capital and liquidity Key Emphasis for BlueLinx

8 Susan O’Farrell Chief Financial Officer and Treasurer

9 2015 2014 2015 2014 in millions Q2 Q2 YTD YTD Net sales $ 515.7 $ 531.5 $ 970.6 $ 975.4 Gross profit $ 60.0 $ 62.0 $ 110.2 $ 114.7 Gross margin 11.63 % 11.67 % 11.35 % 11.76 % Revenue and Gross Margins • Sales ◦ Down $16.0 million, or 3.0%, compared to 2Q 2014 ◦ Impacted by structural volume increase of 0.9%, primarily in lumber, offset by structural price decreases of 6.5% • Gross margin relatively flat with low commodity prices for structural products ◦ Specialty margins negatively impacted by roofing price decline

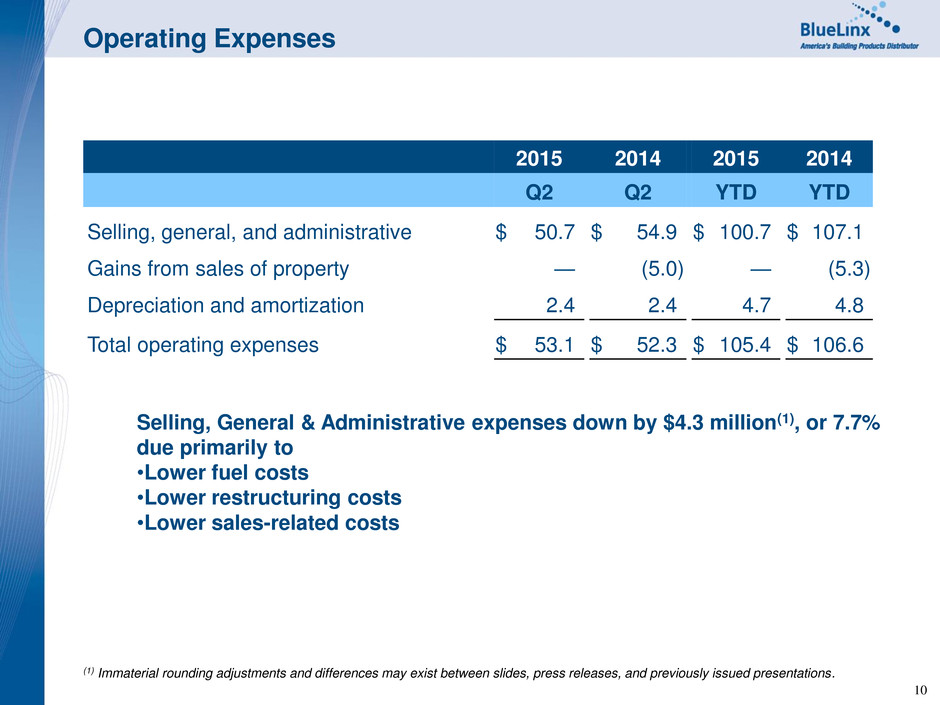

10 2015 2014 2015 2014 Q2 Q2 YTD YTD Selling, general, and administrative $ 50.7 $ 54.9 $ 100.7 $ 107.1 Gains from sales of property — (5.0 ) — (5.3 ) Depreciation and amortization 2.4 2.4 4.7 4.8 Total operating expenses $ 53.1 $ 52.3 $ 105.4 $ 106.6 Operating Expenses Selling, General & Administrative expenses down by $4.3 million(1), or 7.7% due primarily to •Lower fuel costs •Lower restructuring costs •Lower sales-related costs (1) Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations.

11 Debt Structure • Asset Based Revolving Credit Facilities • U.S. revolving credit facility $447.5 million matures April 2017 • FILO • Tranche A loan of $20.0 million final maturity of June 2016 • Mortgage • Assessing opportunities to unlock the value of our mortgage • Weighing timing with pre-payment penalty of approximately $1.0 million per month through December 2015 • Property valuation at approximately $320 million in 2006 • $169.2 million principal remaining ◦ $4.2 million cash trap also available to pay principal

12 Cash Flows Year-to-Date Operating Cash Usage Improved $22.1 million $68.3 Q2 2015 Q2 2014 YTD 2015 YTD 2014 in millions - unaudited (1) Net cash used in operating activities $ (8.7 ) $ (22.2 ) $ (46.2 ) $ (68.3 ) Net cash (used in) provided by investing activities (0.4 ) 6.4 (0.7 ) 6.0 Net cash provided by financing activities 5.9 15.9 45.3 65.0 Increase (decrease) in cash (3.2 ) 0.1 (1.7 ) 2.7 Cash balance, beginning of period 6.0 7.6 4.5 5.0 Cash balance, end of period $ 2.8 $ 7.7 $ 2.8 $ 7.7 $46.2 (1) Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations.

13 Cash Cycle Days (1) Working capital as defined by A/R plus inventory less A/P & bank overdrafts • Trailing twelve months cash cycle at 65 days • Trailing twelve months' working capital(1) was down $4 million

14 TOPIC PAGE Statements of Operations 15 Adjusted EBITDA 16 Revenue and Unit Volume 17 Gross Profit and Margin 18 Capital Structure 19 Appendix

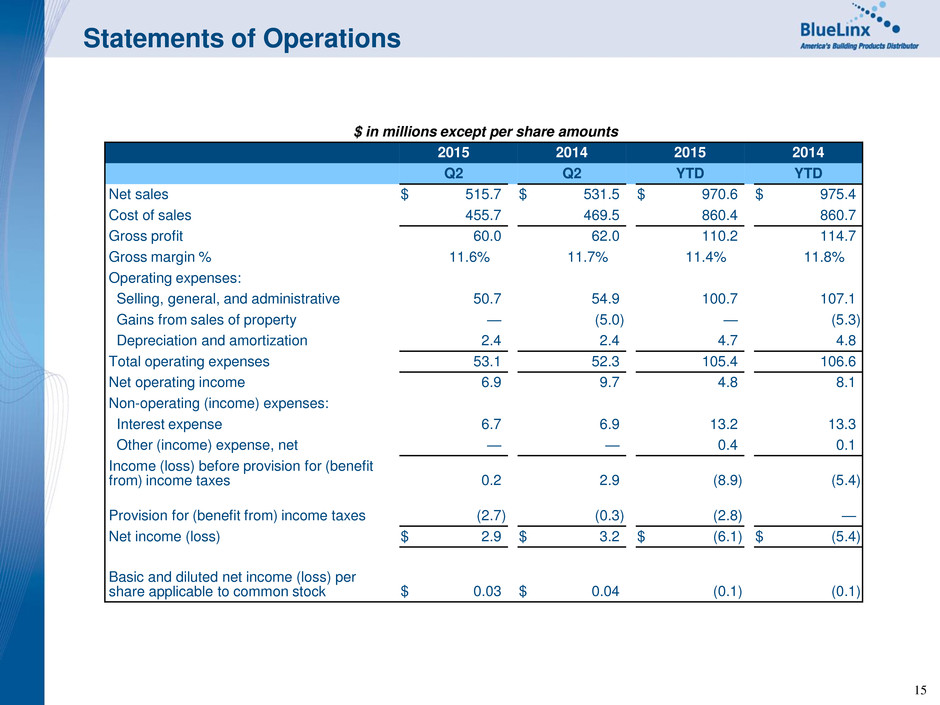

15 Statements of Operations $ in millions except per share amounts 2015 2014 2015 2014 Q2 Q2 YTD YTD Net sales $ 515.7 $ 531.5 $ 970.6 $ 975.4 Cost of sales 455.7 469.5 860.4 860.7 Gross profit 60.0 62.0 110.2 114.7 Gross margin % 11.6% 11.7% 11.4% 11.8% Operating expenses: Selling, general, and administrative 50.7 54.9 100.7 107.1 Gains from sales of property — (5.0 ) — (5.3 ) Depreciation and amortization 2.4 2.4 4.7 4.8 Total operating expenses 53.1 52.3 105.4 106.6 Net operating income 6.9 9.7 4.8 8.1 Non-operating (income) expenses: Interest expense 6.7 6.9 13.2 13.3 Other (income) expense, net — — 0.4 0.1 Income (loss) before provision for (benefit from) income taxes 0.2 2.9 (8.9 ) (5.4 ) Provision for (benefit from) income taxes (2.7 ) (0.3 ) (2.8 ) — Net income (loss) $ 2.9 $ 3.2 $ (6.1 ) $ (5.4 ) Basic and diluted net income (loss) per share applicable to common stock $ 0.03 $ 0.04 (0.1 ) (0.1 )

16 Adjusted EBITDA $ in millions 2015 2014 2015 2014 Q2 Q2 YTD YTD Net income (loss) $ 2.9 $ 3.2 $ (6.1 ) $ (5.4 ) Adjustments: Depreciation and amortization 2.4 2.4 4.7 4.8 Interest expense 6.7 6.9 13.2 13.3 Provision for (benefit from) income taxes (2.7 ) (0.3 ) (2.8 ) — Gain from the sale of properties — (5.0 ) — (5.3 ) Share-based compensation expense, excluding restructuring 0.5 0.6 1.1 1.3 Restructuring, severance, debt fees, and other — 2.8 (0.1 ) 2.8 Adjusted EBITDA $ 9.8 $ 10.6 $ 10.2 $ 11.6

17 Revenue and Unit Volume Sales $ - in millions 2015 2014 2015 2014 Q1 Q2 Q1 Q2 Q3 Q4 YTD YTD Specialty $ 273.6 $ 313.0 $ 264.0 $ 316.6 $ 324.4 $ 263.9 $ 586.6 $ 580.6 Structural 187.7 207.1 185.1 219.3 232.1 195.0 394.8 404.4 Other (1) (6.4 ) (4.4 ) (5.2 ) (4.4 ) (6.7 ) (4.8 ) (10.8 ) (9.6 ) Total $ 454.9 $ 515.7 $ 443.9 $ 531.5 $ 549.8 $ 454.1 $ 970.6 $ 975.4 Sales Mix % Specialty 59.3 % 60.2 % 58.8 % 59.1 % 58.3 % 57.5 % 59.8 % 58.9 % Structural 40.7 % 39.8 % 41.2 % 40.9 % 41.7 % 42.5 % 40.2 % 41.1 % Unit Volume Change Specialty 2.6 % (1.3 )% 1.0 % (1.2 )% 4.7 % (4.3 )% 0.5 % (0.2 )% Structural 3.2 % 0.9 % (9.5 )% (11.2 )% (7.5 )% (11.6 )% 2.0 % (10.4 )% Total 2.9 % (0.4 )% (3.8 )% (5.7 )% (0.6 )% (7.5 )% 1.1 % (4.8 )% (1) Includes cash discounts, service revenue, Canadian conversion, and accruals.

18 Gross Profit and Margin Gross Profit (in millions) 2015 2014 2015 2014 Q2 Q2 YTD YTD Structural products $ 17 $ 18 $ 30 $ 33 Specialty products 42 44 78 78 Other (1) 1 — 2 4 Total gross profit $ 60 $ 62 $ 110 $ 115 Gross Margin % Structural products 7.97 % 8.17 % 7.67 % 8.24 % Specialty products 13.57 % 13.81 % 13.29 % 13.44 % Total gross margin % 11.63 % 11.67 % 11.35 % 11.76 % (1) "Other" includes unallocated allowances and discounts.

19 Capital Structure • Asset Based Revolving Credit Facilities • Matures April 2017 • $65.0 million excess availability as of July 4, 2015 • $447.5 million U.S. facility with additional $75.0 million uncommitted accordion facility • LIBOR + 3.5% • $20 million Tranche A loan – final maturity June 2016 • LIBOR + 5.25% • $10 million Canadian facility with additional $5.0 million uncommitted accordion facility • LIBOR or Banker's Acceptance + 2.50% • Mortgage • Due July 2016 • Currently evaluating refinancing options • Book value of real estate $80.2 million as of July 4, 2015 • Appraisal value as of June 2006 of current properties approximately $320 million • Outstanding mortgage of $169.2 million as of July 4, 2015 ◦ $4.2 million cash trap further reduces principal to $165.0 million ◦ Fixed 6.35% interest rate

www.BlueLinxco.com