Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LDR HOLDING CORP | d21139d8k.htm |

Exhibit 99.1

In this filing, unless the context otherwise requires, references to “LDR Holding Corporation,” “LDR”, “we”, “our,” “us,” and the “company” refer to LDR Holding Corporation together with its subsidiaries.

BUSINESS

Overview

We are a global medical device company focused on designing and commercializing novel and proprietary surgical technologies for the treatment of patients suffering from spine disorders. Our primary products are based on our VerteBRIDGE fusion and Mobi non-fusion platforms, both of which are designed for applications in the cervical and lumbar spine. We believe our VerteBRIDGE and Mobi platforms enable products that are less invasive, provide greater intraoperative flexibility, offer simplified surgical techniques and promote improved clinical outcomes for patients as compared to existing alternatives. As one example, in August 2013 we received approval from the U.S. Food and Drug Administration, or FDA, for the Mobi-C cervical disc replacement device, the first and only cervical disc replacement device to receive FDA approval to treat both one-level and two-level cervical disc disease and the only disc device technology to demonstrate overall clinical superiority (as compared to traditional fusion for two cervical vertebral levels) in an FDA pivotal clinical trial. Industry sources expect that the cervical disc replacement market, which is currently relatively small, will be one of the fastest growing segments of the U.S. spine implant market.

For the years ended December 31, 2014, 2013 and 2012, our total revenues were $141.3 million, $111.6 million and $90.9 million, respectively, of which approximately 22%, 26% and 29%, respectively, was from outside the United States. For the years ended December 31, 2014, 2013 and 2012, we had net losses of $11.0 million, $27.9 million and $9.7 million, respectively. For the six months ended June 30, 2015, our total revenues were $80.6 million and net losses were $9.0 million. We expect to continue to incur losses in the near term. Through June 30, 2015, we had an accumulated deficit of $103.7 million.

Revenue from our VerteBRIDGE and Mobi platform products represented approximately 89% of our revenue in 2014 and 92% for the first six months of 2015. For the past three calendar years, total revenue has grown at a compounded annual growth rate, or CAGR, of 22%. Since 2011, revenue for our exclusive technology products has grown at a CAGR of approximately 30%.

Our VerteBRIDGE and Mobi platform products incorporate design advancements that provide us with competitive advantages, discussed in detail below. The U.S. cervical disc replacement market is one of the fastest growing segments of the U.S. spine implant market. We believe several factors will influence growth in the spine implant market segments in which we compete, including patients’ and surgeons’ demand for technologies that allow for less invasive treatment options, the availability of clinical safety and efficacy data demonstrating improved patient outcomes provided by new technologies and an aging global population leading to continued growth in the number of spinal procedures performed.

Our highly differentiated VerteBRIDGE fusion platform targets the cervical and lumbar spine fusion markets. Our VerteBRIDGE products are designed around our proprietary, less invasive plating technology that enables surgeons to implant VerteBRIDGE devices with direct visualization of the disc and to affix the devices to the vertebrae from inside the spinal disc space. VerteBRIDGE is the first platform of interbody devices with integrated fixation to market that may be implanted without screws, resulting in a zero-profile construct without hardware protruding outside of the vertebral body. We believe these differentiated features offer distinct advantages over other interbody devices, including simplified and less invasive surgical techniques for both cervical and lumbar fusion procedures. While these products only address a specific segment of the overall spine implant market, our VerteBRIDGE products have been used in more than 80,000 device implantations globally since the introduction of the VerteBRIDGE platform in 2007.

Our Mobi non-fusion platform is highlighted by Mobi-C, a cervical disc replacement device with a patented mobile bearing core that is designed to replicate the natural anatomical movement of the spine by facilitating independent bending and twisting. Mobi-C is the first and only cervical disc replacement device to have received FDA approval

for both one-level and two-level cervical disc replacement procedures. In addition, Mobi-C is the only cervical disc replacement device that has demonstrated overall clinical superiority in an FDA pivotal clinical trial as compared to two-level traditional fusion. Mobi-C is implanted without the use of keels or screws, allowing for what we believe is a simplified, less invasive and bone sparing surgical approach that we believe will result in fewer complications and allow for faster surgical procedures as compared to other existing cervical disc replacement devices. We estimate that 30% of U.S. patients indicated for anterior surgery with symptomatic cervical disc disease may be candidates for one-level disc replacement procedures, and 42% of such candidates may be candidates for two-level disc replacement procedures. As a result, we believe the FDA approval of Mobi-C, the overall clinical superiority demonstrated by Mobi-C as compared to two-level traditional fusion procedures and the innovative product features will allow us to penetrate and drive growth in the U.S. cervical disc replacement market. We believe this market has the potential to grow relative to the total U.S. spine market. Mobi-C is the first-to-market cervical disc device approved for both one-level and two-level cervical disc procedures in the United States. The FDA approval of Mobi-C established the on-label two-level cervical disc market potential. Development of this market will require continued investment of time and capital. To support the ongoing launch of Mobi-C, we intend to continue to leverage our extensive international experience with Mobi-C going back to 2004 in addition to our growing experience in the United States.

While the cervical disc market in the United States is still developing, we believe that clinical data from second generation products, such as Mobi-C, and longer term evidence from all products, will continue to drive the growth of the market. Industry sources estimate that the number of anterior cervical fusion and non-fusion procedures in the United States will be approximately 267,700 in 2015, 277,800 in 2016, 288,400 in 2017, 299,600 in 2018, 311,400 in 2019 and 324,000 in 2020. Industry sources estimate that the number of posterior cervical fusion procedures in the United States will be approximately 46,700 in 2015, 49,200, in 2016, 51,900 in 2017, 54,900 in 2018, 58,000 in 2019 and 61,300 in 2020.

Our Products

VerteBRIDGE Fusion Platform Products

Our VerteBRIDGE platform is designed to provide fusion without screws or external plates, thereby providing a zero-profile construct. The integrated titanium plates that comprise the integrated fixation solution in our VerteBRIDGE fusion products are distinct in their ability to be implanted directly in the plane of the surgical exposure, with a minimally invasive surgical technique, and provide screwless fixation intra-discally through the interbody device. VerteBRIDGE plating increases segmental stability, and multiple sizing options provide significant intra-operative flexibility. VerteBRIDGE is applicable for one-level cervical and lumbar fusion with or without supplemental fixation.

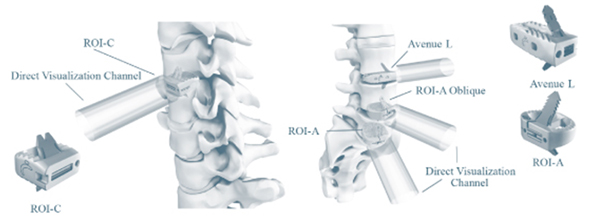

The figure below demonstrates the VerteBRIDGE technology:

VerteBRIDGE Products – Cervical VerteBRIDGE Products – Lumbar Spine

Our VerteBRIDGE platform products and their launch dates are presented in the table below:

| Selected Product |

Description |

Region |

Launch | |||

| ROI-C | Anterior cervical fusion Poly-ether-ether-ketone, or PEEK, interbody device. Provided in anatomic and lordotic options. | United States International |

2009 2008 | |||

| ROI-A | Anterior lumbar fusion PEEK interbody device. | United States International |

2008 2007 | |||

| ROI-A Oblique | Oblique lumbar fusion PEEK interbody device. | United States International |

2011 2009 | |||

| Avenue L | Lateral lumbar fusion PEEK interbody device. | United States International |

2012 2010 |

We believe that our VerteBRIDGE fusion platform addresses many of the limitations of traditional fusion and existing stand-alone implants by offering the following benefits:

| • | Less Invasive Access. The surgical incision and retraction required to insert a VerteBRIDGE device and secure it to the vertebral body is no larger than that required to complete the initial discectomy. As a result, the procedure requires less retraction than traditional fusion procedures and many existing stand-alone implants. This can lead to decreased disruption of soft tissue and support structures. |

| • | Simplified Surgical Procedure. Once the VerteBRIDGE device is in place, the surgeon can quickly affix it to vertebral bodies by inserting the plates through the implant holder. We believe this results in a simplified surgical procedure with fewer steps as compared to existing stand-alone devices, which can result in shorter operating times. |

| • | Zero-profile Design. The design of VerteBRIDGE devices does not require external screws or plates on the anterior surfaces of the spine, which enables self-stabilizing implant products with zero profile on the exterior of the vertebral body. We believe that this distinct feature can help avoid the risks associated with hardware protruding beyond the vertebral body into the major blood vessels and soft tissue, thereby reducing surgical morbidity. |

| • | Integrated, Screwless, Self-Locking Plating System with Extensive Implant Selection. VerteBRIDGE devices have a differentiated self-locking design and extension implant selection enabling them to be closely matched to the patient’s anatomy and securely implanted in multiple footprints and heights, thereby ensuring appropriate sizing and reducing the risk of implant migration. |

Not all spine patients may be suitable candidates for using our VerteBRIDGE products, and some may be more appropriately treated by other existing procedures or by new procedures that are developed in the future. For example, certain patients with severe instability of the spine may be better candidates for treatment with an anterior plate and/or pedicle screws than with our VerteBRIDGE fusion platform products when used on a stand-alone basis. In addition, some surgeons may not prefer our products when treating patients with poor bone quality.

Mobi Non-fusion Platform Products

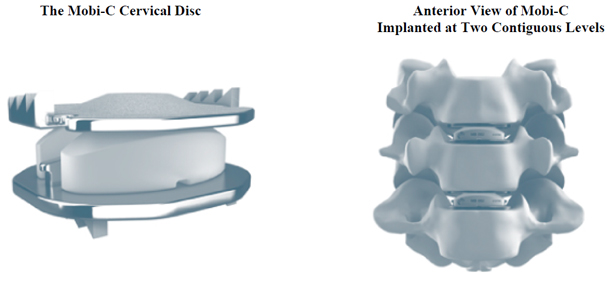

Our Mobi non-fusion platform utilizes an ultra-high molecular weight polyethylene core and cobalt chromium alloy superior and inferior endplates. The Mobi platform can be used in cervical and lumbar procedures, although the highlight of our Mobi platform is our Mobi-C cervical disc replacement device. Mobi-C endplates incorporate short, lateral, inclined teeth that provide initial stability and fixation. The endplates are titanium plasma sprayed and coated with hydroxyapatite, an essential ingredient of normal bone, that helps promote bone ongrowth and long-term fixation. The mobile bearing core is designed to move within the prosthesis as the neck bends and twists, thereby simulating the movement of a healthy disc. The mobile core feature is also designed to minimize stresses in the implant-to-bone interface. The surgical technique to implant Mobi-C avoids the need to cut into the vertebral bone above and below the implant or to perform significant endplate preparation. Mobi-C is indicated in the United States for the treatment of symptomatic cervical disc disease with radiculopathy or myelopathy at one or two contiguous levels.

The figure below demonstrates our Mobi-C cervical disc replacement device:

Our Mobi platform products and their launch dates are presented in the table below:

| Selected Product |

Description |

Region |

Launch | |||

| Mobi-C | Cobalt Chromium alloy and ultra-high molecular weight polyethylene, mobile-bearing cervical disc replacement device. | United States International |

2013 2004 | |||

| Mobidisc | Cobalt Chromium alloy and ultra-high molecular weight polyethylene, mobile-bearing lumbar disc replacement device. | International | 2004 |

We believe that our Mobi-C cervical disc replacement device addresses many of the limitations of traditional ACDF procedures and offers the following benefits:

| • | Overall Clinical Superiority as Compared to Two-level ACDF. In its FDA pivotal clinical trial at two-year follow up, Mobi-C demonstrated overall clinical superiority as compared to two-level ACDF with an overall success factor of 70% at two years as compared to an overall success factor of 37% with ACDF. In the FDA pivotal clinical trial, overall success was defined as improvement in Neck Disability Index, or NDI, no subsequent surgeries, no adverse event considered a major complication, no deterioration from pre-operative neurological states and radiographic success. |

| • | Preservation of Motion. Mobi-C incorporates an advanced mobile bearing core that is designed to provide more normal physiologic motion in one- and two-level cervical disc treatment, allowing patients, on average, to maintain or improve their range of motion at two years for the treated levels. |

| • | Reduced Rate of Adjacent Level Disc Degeneration. Mobi-C has demonstrated significantly lower rates of adjacent level disc degeneration as compared to ACDF in one- and two-level cervical disc treatment. In the FDA pivotal clinical trial, patients treated with Mobi-C at two-levels were statistically significantly less likely to demonstrate radiographic evidence of the advancement of disc disease to vertebral levels above or below the treated segments as compared to ACDF. |

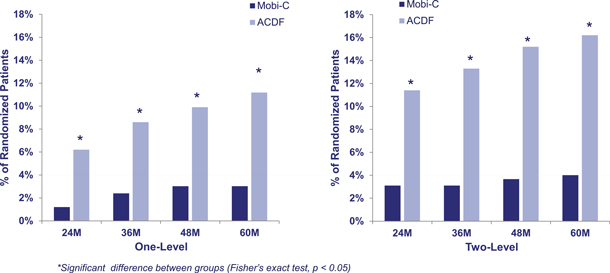

| • | Lower Rates of Subsequent Surgery. Mobi-C has demonstrated statistically significantly lower rates of subsequent surgery as compared to ACDF in one- and two-level cervical disc treatment. The likelihood of subsequent surgery for the two-level Mobi-C patients was approximately one-third that of the two-level ACDF patients. Two-level rates of subsequent surgery at two years were 3.1% with Mobi-C as compared to 11.4% with ACDF. |

| • | Simplified, Less Invasive Surgical Procedure. Mobi-C simplifies surgery with innovative instrumentation that, we believe, allows the implantation to be performed in fewer steps, less retraction resulting in reduced disruption to bone and soft tissue as compared to other cervical discs and in a manner substantially consistent with proven surgical techniques. |

In addition to addressing many of the limitations associated with ACDF, we believe that our Mobi-C cervical disc replacement device also addresses many of the limitations associated with existing cervical disc replacement devices and offers the following benefits:

| • | First-to-market in the United States with FDA Approval for Both a One- and Two-Level Cervical Disc Replacement. Mobi-C is the only cervical disc replacement device to have FDA approval for both one-level and two-level cervical disc replacement procedures. In addition, Mobi-C is the only cervical disc replacement device that has demonstrated overall clinical superiority as compared to two-level ACDF. |

| • | Simplified, Less Invasive and Bone Sparing Surgical Approach. Mobi-C has a minimally invasive design, resulting in less disruption to bone and soft tissue. Mobi-C does not require invasive fixation into the vertebral bone, which results in a bone sparing implant procedure. Mobi-C is also available in a wide range of implant sizes, which is intended to enable a more accurate anatomical fit. |

| • | Advanced Mobile Bearing Technology. Mobi-C uses an advanced mobile bearing core technology, which facilitates independent bending and twisting similar to a healthy disc. The mobile bearing core technology is designed to replicate the natural anatomical movement of the spine, which can minimize the stress placed on the implant-bone interface. |

| • | Clinical Data Demonstrating Overall Clinical Superiority as Compared to Two-level ACDF. Mobi-C has extensive clinical data from two arms of its 575 patients randomized in the FDA pivotal clinical trials that demonstrated overall clinical superiority over ACDF for two-level cervical disc replacement, although the clinical trials were not powered to demonstrate one-level superiority with respect to one-level disc replacement. We believe that this superiority claim will drive adoption of the technology and overall market growth of non-fusion devices. |

Not all cervical spine patients may be suitable candidates for using our Mobi-C products. In addition, some cervical discs on the market may have a more constrained articulation that could be more suitable for some patients, some surgeons may prefer cervical discs with greater fixation features than Mobi-C, and some cervical discs have been studied for use adjacent to a prior fusion whereas this was not part of the Mobi-C clinical study.

The following table identifies the characteristics of our Mobi-C cervical disc replacement device and, to the best of our knowledge, the characteristics of the other cervical disc replacement devices currently approved for sale in the United States:

| Company/Product |

LDR |

DePuy |

Medtronic |

Medtronic |

Globus |

NuVasive |

Medtronic | |||||||

| One-Level Indication | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |||||||

| Two-Level Indication | Yes | No | No | No | No | No | No | |||||||

| Primary Fixation | Inclined Lateral Teeth |

Central Keels |

Anterior Screws |

Press Fit |

Central Keels |

Serrations | Lateral “Rails” | |||||||

| Superiority | Yes (Two- Level Only) |

No | No | No | Yes (One- |

No | No | |||||||

| Heights | 5-7mm | 5-7mm | 6-7mm | 6mm | 7-12mm | 6.5-8mm | 6-8mm | |||||||

| FDA Approval Dates | 2013 | 2007 | 2007 | 2009 | 2012 | 2012 | 2014 | |||||||

Minimal Implant Volume Surgery Solutions

We recently introduced a new way of characterizing our philosophy for treatment of spine conditions. The Minimal Implant Volume Surgery approach, or MIVo, is the result of development programs initiated and pursued by us over the past several years. MIVo is a combination of minimally invasive surgery using a minimum amount of implant material. This philosophy applies to our existing cervical products. For example, the ROI-C cervical stand-alone cage achieves cervical fusion via a minimally invasive, direct access approach to the disc while avoiding the need for the traditional cervical plate with four screws. Mobi-C offers a stable, motion-preserving disc replacement solution without the use of keels or screws. We expect that the recent introduction of the MIVo philosophy will be a focus for us as we work to penetrate the lumbar spine market by offering a suite of current and new, novel interbody cages along with non-pedicle screw posterior fixation options. We believe LDR is uniquely able to position its products to support our MIVo philosophy because of the inherent stability of our VerteBRIDGE plating technology, which is a key element of our lumbar interbody implants. MIVo combines our VerteBRIDGE interbody implant portfolio with our new InterBRIDGE and FacetBRIDGE posterior fixation devices. With our existing VerteBRIDGE products, ROI-A, ROI-A Oblique, Avenue L, and our new product, Avenue T posterior transforaminal interbody fusion cage, for which we received 510(k) clearance from the FDA in June 2015, we believe we are the first spine company to offer lumbar interbody solutions with integrated fixation for all lumbar surgical approaches — anterior, anterior oblique, oblique lateral, lateral and posterior. We believe the benefits of the MIVo approach include reduced surgical trauma and reduced soft tissue disruption. We believe our solutions result in a 45% to 60% reduction in the volume of implant material used to stabilize one level of the lumbar spine, while still providing sufficient stability to both the anterior and posterior spinal columns, avoiding the use of the vertebral pedicles and preserving surgical revision options if necessary in the future. We launched new products for the lumbar MIVo surgical technique in the fourth quarter of 2014 in Europe and plan to conduct a limited beta-launch in the United States in the fourth quarter of 2015.

Traditional Fusion Products

We also have a broad portfolio of traditional fusion products. Our traditional fusion products include Easyspine, MC+, ROI, ROI-T, SpineTune and C-Plate. Unlike the products in our VerteBRIDGE platform or Mobi-C non-fusion platform, which offer highly differentiated features and benefits not found in competitive devices, our traditional fusion products are those devices that we offer for sale, but which cannot be significantly differentiated from competitive devices from a feature or clinical benefit perspective. Some industry experts may describe such traditional fusion products as spine commodity products. Examples include pedicle screw systems, anterior cervical plates and interbody cages absent integrated fixation. Our traditional fusion products are presented in the table below:

| Selected Product |

Description |

Region |

Launch | |||

| Easyspine | Titanium alloy pedicle screw system incorporating a flattened rod offering variable stiffness with a constant diameter and a pre-assembled closure mechanism enhancing simplicity. | United States International |

2005 2002 | |||

| MC+ | PEEK cervical interbody device with a single, straight titanium plate to provide fixation to the vertebral bone inferior to the interbody device. MC+ was our first product to offer intra-discal fixation. | United States International |

2005 2003 | |||

| ROI | PEEK interbody device designed to be implanted bilaterally from a posterior lumbar surgical approach. Open design provides stability of similar closed interbody devices but with larger graft area. | United States International |

2005 2002 | |||

| ROI-T | Curved PEEK interbody device designed to be implanted unilaterally from a posterior lumbar approach. Tapered tip eases insertion. | United States International |

2007 2007 | |||

| SpineTune TL | Pedicle screw fixation system for the thoracic and lumbar spine comprised of a titanium, in-line, open, polyaxial screws. | United States International |

2010 2010 | |||

| C-Plate | Anterior cervical plate with a narrow, low-profile that incorporates an integrated, zero-step flexible locking ring and variable and semi-fixed screw options. | International | 2010 |

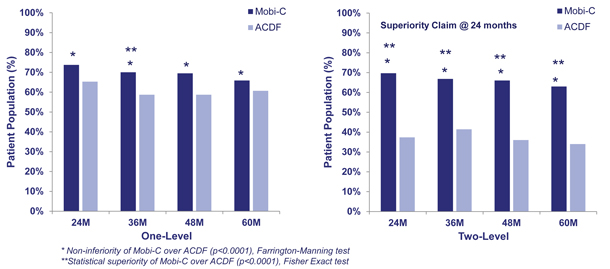

Mobi-C Clinical Data Summary

We have established a significant body of clinical evidence demonstrating the safety and efficacy of Mobi-C. We conducted two concurrent FDA pivotal clinical trials studying Mobi-C for treatment of one-level and two-level cervical disc disease. Data from these trials was submitted to the FDA to support PMA approval of Mobi-C for use in the treatment of one-level and two-level cervical disc disease. Mobi-C is the only device to have FDA approval for treatment of two-level cervical disc disease. The data from these trials demonstrated that Mobi-C results in clinically superior outcomes as compared to ACDF for treatment of two-level cervical disc disease.

Mobi-C FDA Pivotal Clinical Trials and Post-Approval Study (Mobi-C vs. ACDF)

To support our Mobi-C PMA application, we conducted two concurrent, randomized, prospective, multi-center, non-inferiority studies, with preplanned tests for superiority that were designed to establish the safety and effectiveness of Mobi-C as a treatment for patients with symptomatic cervical disc disease with radiculopathy or myeloradiculopathy at one or two contiguous levels. The FDA pivotal clinical trial concluded that Mobi-C is safe and effective for treatment of patients with symptomatic cervical disc disease in one or two contiguous levels.

Additionally, Mobi-C demonstrated overall clinical superiority to traditional fusion in two-level applications. Mobi-C is the first and only cervical disc replacement device to demonstrate overall clinical superiority as compared to traditional fusion for treatment at two-levels. Based on the data from the FDA pivotal clinical trials and the post-approval follow-up, Mobi-C demonstrated advantages as compared to ACDF in several areas, including:

| • | statistically significant superiority of two-level overall success at all time points of data measurement through five years; |

| • | decreased incidence of continued adjacent level degeneration for both one- and two-levels; and |

| • | lower rates of subsequent surgery. |

Patients enrolled in the trials presented without prior cervical fusion and either were unresponsive to non-operative conservative treatment for six weeks after symptom onset, or had the presence of progressive symptoms or had signs of nerve or spinal cord compression. Patients were followed post-operatively at six weeks, and three, six, 12, 18, 24 and 60 months. The one-level trial included 245 patients and the two-level trial included 330 patients, each enrolled with 2:1 randomization against ACDF across 24 sites with 24 months of follow-up, and encompassed the ability to test for superiority as compared to ACDF if non-inferiority was achieved. Subsequent to the required 24 month follow-up in the FDA pivotal clinical trials, patients were followed at 36, 48 and 60 months.

The primary objective of both trials was to evaluate the overall success rate of Mobi-C as compared to ACDF. The studies evaluated multiple criteria in order to determine overall success over a two year period. All control and Mobi-C patients had to satisfy each of the following criteria to be considered an overall success:

| • | improvement in Neck Disability Index, or NDI; |

| • | no subsequent surgery; |

| • | no adverse events that were considered major complications; |

| • | no deterioration from pre-operative neurologic status; and |

| • | radiographic success. |

The NDI is a standard metric for measuring patient disability due to neck pain. It is derived from a patient reported questionnaire and is based on a 50 point scale, which is sometimes reported as point or percentage. In our trial, patients had to have at least a 15 point improvement in the raw NDI score to be considered an NDI success.

The results from the primary endpoint are summarized in the graphs below.

Overall success is reported as the percentage of patients that met all pre-defined criteria for success. In the one-level trial, Mobi-C patients achieved a higher level of overall success at early time points, including six months, and maintained a higher level of overall success as compared to ACDF at all time points. The data was sufficient to demonstrate that treatment with Mobi-C was not inferior to ACDF. In the two-level trial, Mobi-C patients on average achieved a statistically superior level of overall success as compared to ACDF at all time points.

Mobi-C Overall Success as compared to ACDF

The charts below demonstrate subsequent surgery rates for patients in the one and two-level trial. In these trials, patients had to be free from any trial-defined subsequent surgeries in order to be considered a clinical success. A subsequent surgery is defined as any reoperation, removal, revision or supplemental fixation at the treated spine level. In the two-level trial, patients were nearly three and half times more likely to have a subsequent surgery when treated with ACDF as compared to those treated with Mobi-C.

Mobi-C Subsequent Surgery Rates as Compared to ACDF

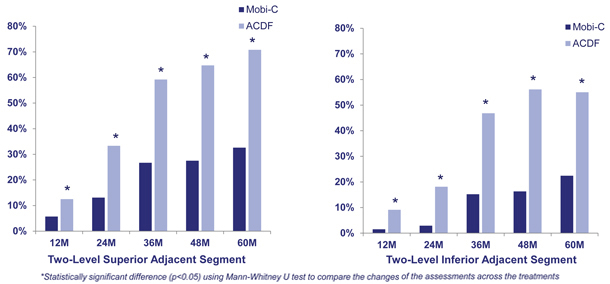

In addition to the primary endpoints that were components of the overall success, the FDA pivotal clinical trials analyzed other secondary endpoints, including adjacent segment degeneration. Adjacent segment degeneration, which is an indicator of disease

progression, was measured radiographically, utilizing the standardized Kellgren-Lawrence scale. A patient’s pre-operative level of degeneration was compared to the level of degeneration at annual time points at both the superior and inferior vertebral segments to the treated levels. In the two-level trial, patients treated with Mobi-C demonstrated statistically significantly lower rates of adjacent segment degeneration at 12, 24, 36, 48 and 60 months as compared to patients treated with ACDF.

Mobi-C Adjacent Segment Degeneration as compared to ACDF (Two-Level)

Other Ongoing Clinical Trials

As a condition of approval of the Mobi-C cervical disc replacement device by the FDA, we are required to follow all patients who received Mobi-C prior to FDA premarket approval for a period of seven years from treatment. We are also conducting research regarding the cost effectiveness and cost utility of outcomes for patients treated with Mobi-C to support our reimbursement coverage efforts. In addition, we continue to conduct clinical studies on a smaller scale to evaluate clinical efficacy of our portfolio of VerteBRIDGE and Mobi platform products and support respective global marketing efforts and product clearance, approval, CE mark and registrations.

Coverage and Reimbursement Overview

Private insurance coverage for one-level and/or two-level cervical disc replacement has been steadily improving for the last several years with positive coverage policies issued by several national and regional payors. As of June 2015, Cigna, United Healthcare, Aetna, Blue Cross Blue Shield Louisiana and other third-party payors, which collectively have approximately 162 million U.S. covered lives, have issued coverage policies and decisions for one-level and/or two-level cervical disc replacement for certain patients. We are actively engaged in activities to support increasingly broad, positive coverage. Peer-reviewed publications of the clinical data from the Mobi-C FDA pivotal clinical trial by the surgeon investigators will be an important, supportive component of our effort, as will support from the relevant physician specialty societies.

For payors who currently cover one-level and/or two-level cervical disc replacement, we are currently communicating our FDA approval of Mobi-C for both one- and two-level cervical disc replacement and approved indications and providing our published peer-reviewed evidence in our request to have Mobi-C added to existing coverage policies. In addition, effective January 1, 2015, surgeons are now able to use a new, Category I CPT code as an add-on code to the current one-level CPT code to report the performance of total disc arthroplasty at a second level. Although we anticipate that the trend toward broader coverage for one-level and two-level disc replacement will continue as payors have the opportunity to review the most recently available clinical evidence, including the data from the Mobi-C FDA pivotal clinical trial, we can provide no assurances that payors will continue to broaden coverage for such procedures.

Because Mobi-C is the only device to be approved by the FDA for both one- and two-level cervical disc replacement, payors may be concerned about expanding coverage to, or adopting formal coverage policies and decisions for, two-level cervical disc replacement. To prevent the use of one-level discs being used in a two-level cervical disc replacement, payors may limit their coverage policies to discs that are labeled for contiguous two-level degenerative disc disease. For example, an United Healthcare Total Artificial Disc Replacement for the Spine medical policy dated April 1, 2015 has limited coverage for two-level cervical disc replacement to: “cervical artificial discs FDA labeled for contiguous two level disease are proven and medically necessary for [a two level] indication.” Further, some payors may cover and reimburse two-level replacement procedures on a claim-by-claim basis before adopting a formal coverage policy, if at all. We are using our published, peer-reviewed evidence from the two-level Mobi-C FDA pivotal clinical trial, including the conclusion of overall clinical superiority to ACDF and further longer-term evidence, to petition in support of positive coverage for Mobi-C for two-level cervical disc replacement. We believe that the demonstration of overall clinical superiority of Mobi-C as compared to traditional fusion is an important and compelling component of our activities supporting positive coverage. In addition, we feel that the substantial and growing library of evidence for one-level cervical disc replacement, including long term evidence, further supports one-level cervical disc replacement as a safe and effective procedure. Also, we believe that physician specialty society support will help improve coverage. For example, in April 2014, the International Society for the Advancement of Spine Surgery, or ISASS, issued a policy statement on cervical artificial discs stating that ISASS no longer considers cervical disc replacement investigational and that cervical disc replacement is a viable alternative to cervical fusion in certain patients with symptomatic one and two-level cervical radiculopathy or myelopathy. Finally, we are continuing to conduct clinical trials evaluating the cost effectiveness and cost utility of two-level cervical disc replacement. We believe that this research will further support increasingly broad coverage for one and two-level cervical disc replacement as safe, effective and cost-effective treatments for patients suffering from cervical disc disease. We can provide no assurances that these efforts will be successful and result in expanded coverage for one-level and/or two-level cervical disc replacement.

Intellectual Property

Our success depends upon our ability to protect our intellectual property. For protection of our intellectual property, we rely on a combination of intellectual property rights, including patents, trade secrets, copyrights and trademarks, as well as customary confidentiality and other contractual protections. As of June 30, 2015, we owned over 400 issued patents globally, of which 44 were issued U.S. patents. As of June 30, 2015, we owned over 100 patent applications pending globally, of which 33 were patent applications pending in the United States. Our issued U.S. patents expire between 2020 and 2033, subject to payment of required maintenance fees, annuities and other charges. As of June 30, 2015, we also owned 14 U.S. trademark registrations and 74 foreign trademark registrations, as well as 6 pending U.S. trademark applications and 4 pending foreign trademark applications.

We also rely upon trade secrets, know-how, continuing technological innovation, and may in the future rely upon licensing opportunities, to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to proprietary information.

Marketing and Sales Strategy Overview

We market and sell our products globally through a highly adaptable worldwide sales organization that allows us to continually expand our sales channels and rapidly penetrate new geographic markets. Our U.S. sales organization consists of sales managers that recruit, develop and lead direct sales representatives and a broad network of over 220 independent sales agencies. We estimate that non-captive independent sales agencies drive approximately 30% of total U.S. spine implant market revenue, and Mobi-C is the only cervical disc replacement device currently available to this large independent sales agency network. We believe this market position will facilitate the recruitment of high-quality direct sales representatives and independent sales agencies, allowing for direct end-user pricing and sales channel control. We currently generate revenue in more than 25 countries globally, and revenue from outside of the United States represented approximately 22% of our total revenue in 2014, with France representing 9% of our revenue during 2014. In the first half of 2015, approximately 20% of our total revenue was generated outside of the United States, with France representing 8% of our revenue in the first half of 2015. Our international sales organization includes sales managers and direct sales representatives located in various countries, including France, Germany, Belgium, Spain, South Korea, China, Hong Kong and Brazil. We also sell to independent stocking distributors in certain international markets. A majority of our U.S. and international independent sales agencies and distributors have agreed to offer one or more of our VerteBRIDGE and/or Mobi products on an exclusive basis. We expect to continue to make investments in our sales organization by broadening our relationships with independent sales agencies, expanding exclusivity commitments among these agencies and international distributors and increasing our number of direct sales representatives.

We were founded in 2000 in France, one of the world’s leading regions for spine surgery advancements. We believe our product development capabilities are differentiated by our extensive spine industry experience and our ability to leverage close collaboration with thought leaders in spine surgery. Our capabilities allow us to gain significant design feedback and clinical experience, which facilitates our ability to affix a CE mark to our products or gain regulatory clearances and market registrations globally. Our product development experience, incorporating input from both European and U.S. thought leaders in spine surgery, is a key component of our ability to design highly differentiated and clinically beneficial technologies. In addition, we have a robust product pipeline that we expect will enhance our product platforms and enable us to continue to penetrate the fastest growing segments of the global spine implant market.

The “LDR Holding” name, the “LDR” name, the “Mobi,” “Mobi-C,” “Mobidisc,” “Avenue,” “C-Plate,” “VerteBRIDGE,” “InterBRIDGE,” “FacetBRIDGE,” “ROI,” “Spinetune,” “Easyspine,” “MC+,” “ROI-A,” “ROI-C,” “ROI-A Oblique” and “ROI-T” names and related images, logos and symbols appearing in this filing are our properties, trademarks and service marks. Other marks appearing in this filing are the property of their respective owners.

NON-GAAP FINANCIAL MEASURES

We define EBITDA as net income (loss) plus interest (income) expense, net, income tax expense and depreciation and amortization. We define Adjusted EBITDA as EBITDA plus stock-based compensation expense, other interest (expense), net, beneficial conversion of promissory notes and change in fair value of common stock warrants. We present Adjusted EBITDA because we believe it is a useful indicator of our operating performance. Our management uses Adjusted EBITDA principally as a measure of our operating performance and believes that Adjusted EBITDA is useful to our investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. Our management also uses Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections.

Adjusted EBITDA should not be considered in isolation or as a substitute for a measure of our liquidity or operating performance prepared in accordance with U.S. generally accepted accounting principles, or GAAP, and is not indicative of net income (loss) from operations as determined under GAAP. Adjusted EBITDA and other non-GAAP financial measures have limitations that should be considered before using these measures to evaluate our liquidity or financial performance. Adjusted EBITDA does not include certain expenses that may be necessary to review our operating results and liquidity requirements. Our definition and calculation of Adjusted EBITDA may differ from that or other companies.

The following table presents a reconciliation of net loss to Adjusted EBITDA (in thousands) for the fiscal years ended December 31, 2012, December 31, 2013 and December 31, 2014, and the quarters ended March 31, 2014, June 30, 2014, March 31, 2015, and June 30, 2015:

| Year Ended December 31, 2012 |

Year Ended December 31, 2013 |

Year Ended December 31, 2014 |

Quarter Ended March 31, 2014 |

Quarter Ended March 31, 2015 |

Quarter Ended June 30, 2014 |

Quarter Ended June 30, 2015 |

||||||||||||||||||||||

| Net loss |

$ | (9,701 | ) | $ | (27,935 | ) | $ | (10,977 | ) | $ | (3,499 | ) | $ | (3,184 | ) | $ | (2,328 | ) | $ | (5,825 | ) | |||||||

| Interest (income) expense, net |

4,618 | 10,163 | 871 | 282 | 184 | 207 | 182 | |||||||||||||||||||||

| Income tax expense (benefit) |

1,179 | 1,671 | 1,430 | 157 | 583 | 404 | (324 | ) | ||||||||||||||||||||

| Depreciation and amortization |

3,133 | 4,024 | 4,682 | 959 | 1,442 | 1,164 | 1,565 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| EBITDA |

(771 | ) | (12,077 | ) | (3,994 | ) | (2,101 | ) | (975 | ) | (553 | ) | (4,402 | ) | ||||||||||||||

| Stock-based compensation |

295 | 1,269 | 5,225 | 1,040 | 2,391 | 1,343 | 2,807 | |||||||||||||||||||||

| Other (interest) expense, net |

987 | 771 | (2,037 | ) | 41 | (2,844 | ) | (78 | ) | 889 | ||||||||||||||||||

| Beneficial conversion of promissory notes |

— | 7,413 | — | — | — | — | — | |||||||||||||||||||||

| Change in fair value of common stock warrants |

1,643 | 5,593 | — | — | — | — | — | |||||||||||||||||||||

| Adjusted EBITDA |

$ | 2,154 | $ | 2,969 | $ | (806 | ) | $ | (1,020 | ) | $ | (1,428 | ) | $ | 712 | $ | (706 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

OTHER FINANCIAL INFORMATION

We classify our products into two categories: exclusive technology and traditional fusion products. The following table represents total sales by product category (in thousands) for the periods presented:

| Six Months Ended | ||||||||||||

| June 30, 2013 | June 30, 2014 | June 30, 2015 | ||||||||||

| Exclusive technology products |

$ | 42,449 | $ | 57,067 | $ | 74,133 | ||||||

| Traditional fusion products |

9,972 | 8,753 | 6,491 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 52,421 | $ | 65,820 | $ | 80,624 | ||||||

|

|

|

|

|

|

|

|||||||