Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RAYMOND JAMES FINANCIAL INC | a8-k_3q15shareholdersletter.htm |

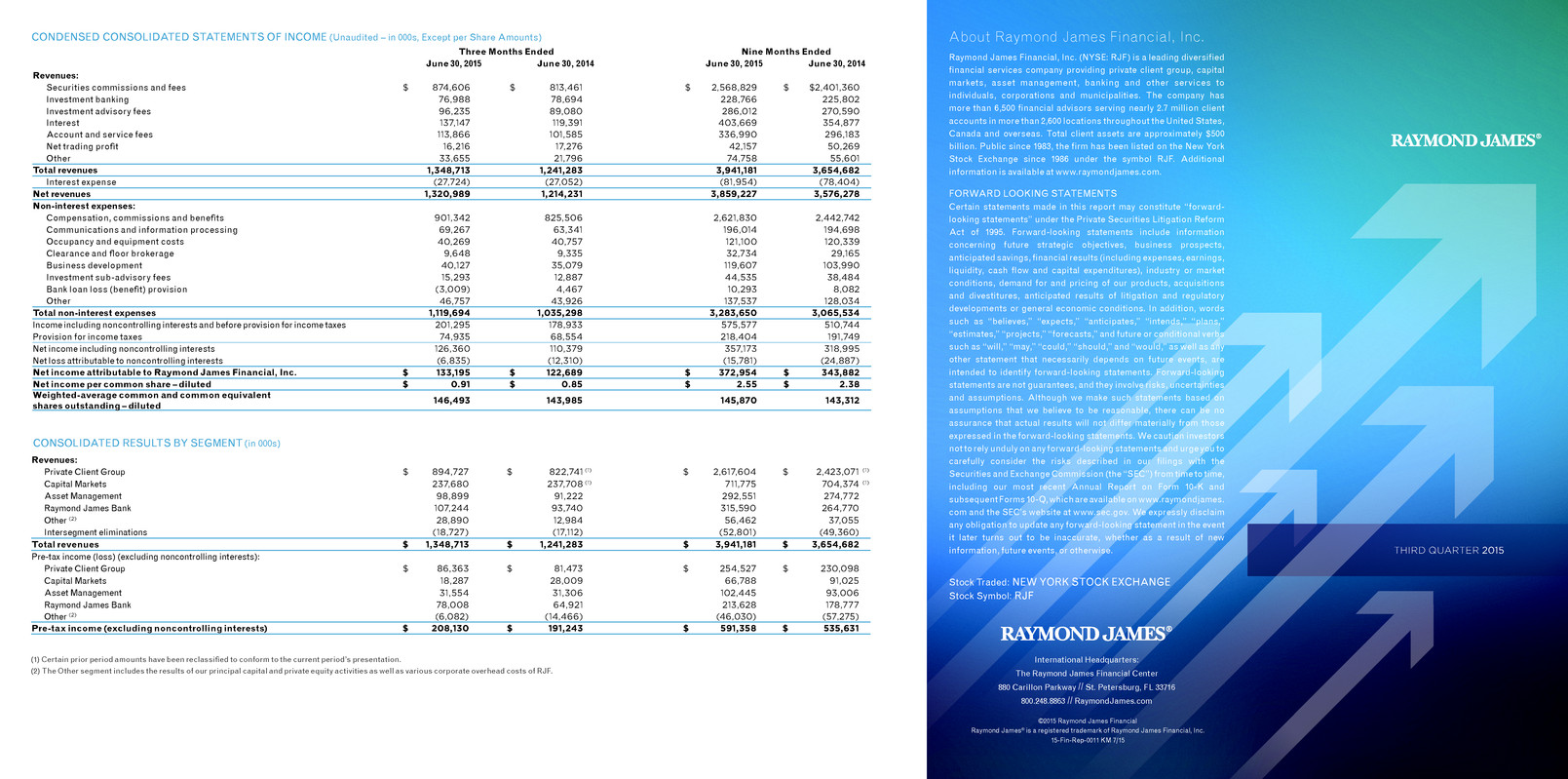

Revenues: Private Client Group $ 894,727 $ 822,741 $ 2,617,604 $ 2,423,071 Capital Markets 237,680 237,708 711,775 704,374 Asset Management 98,899 91,222 292,551 274,772 Raymond James Bank 107,244 93,740 315,590 264,770 Other (2) 28,890 12,984 56,462 37,055 Intersegment eliminations (18,727) (17,112) (52,801) (49,360) Total revenues $ 1,348,713 $ 1,241,283 $ 3,941,181 $ 3,654,682 Pre-tax income (loss) (excluding noncontrolling interests): Private Client Group $ 86,363 $ 81,473 $ 254,527 $ 230,098 Capital Markets 18,287 28,009 66,788 91,025 Asset Management 31,554 31,306 102,445 93,006 Raymond James Bank 78,008 64,921 213,628 178,777 Other (2) (6,082) (14,466) (46,030) (57,275) Pre-tax income (excluding noncontrolling interests) $ 208,130 $ 191,243 $ 591,358 $ 535,631 (1) Certain prior period amounts have been reclassified to conform to the current period’s presentation. (2) The Other segment includes the results of our principal capital and private equity activities as well as various corporate overhead costs of RJF. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts) CONSOLIDATED RESULTS BY SEGMENT (in 000s) (1) (1) Three Months Ended Nine Months Ended June 30, 2015 June 30, 2014 June 30, 2015 June 30, 2014 Revenues: Securities commissions and fees $ 874,606 $ 813,461 $ 2,568,829 $ $2,401,360 Investment banking 76,988 78,694 228,766 225,802 Investment advisory fees 96,235 89,080 286,012 270,590 Interest 137,147 119,391 403,669 354,877 Account and service fees 113,866 101,585 336,990 296,183 Net trading profit 16,216 17,276 42,157 50,269 Other 33,655 21,796 74,758 55,601 Total revenues 1,348,713 1,241,283 3,941,181 3,654,682 Interest expense (27,724) (27,052) (81,954) (78,404) Net revenues 1,320,989 1,214,231 3,859,227 3,576,278 Non-interest expenses: Compensation, commissions and benefits 901,342 825,506 2,621,830 2,442,742 Communications and information processing 69,267 63,341 196,014 194,698 Occupancy and equipment costs 40,269 40,757 121,100 120,339 Clearance and floor brokerage 9,648 9,335 32,734 29,165 Business development 40,127 35,079 119,607 103,990 Investment sub-advisory fees 15,293 12,887 44,535 38,484 Bank loan loss (benefit) provision (3,009) 4,467 10,293 8,082 Other 46,757 43,926 137,537 128,034 Total non-interest expenses 1,119,694 1,035,298 3,283,650 3,065,534 Income including noncontrolling interests and before provision for income taxes 201,295 178,933 575,577 510,744 Provision for income taxes 74,935 68,554 218,404 191,749 Net income including noncontrolling interests 126,360 110,379 357,173 318,995 Net loss attributable to noncontrolling interests (6,835) (12,310) (15,781) (24,887) Net income attributable to Raymond James Financial, Inc. $ 133,195 $ 122,689 $ 372,954 $ 343,882 Net income per common share – diluted $ 0.91 $ 0.85 $ 2.55 $ 2.38 Weighted-average common and common equivalent shares outstanding – diluted 146,493 143,985 145,870 143,312 International Headquarters: The Raymond James Financial Center 880 Carillon Parkway // St. Petersburg, FL 33716 800.248.8863 // RaymondJames.com ©2015 Raymond James Financial Raymond James® is a registered trademark of Raymond James Financial, Inc. 15-Fin-Rep-0011 KM 7/15 Stock Traded: NEW YORK STOCK EXCHANGE Stock Symbol: RJF Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has more than 6,500 financial advisors serving nearly 2.7 million client accounts in more than 2,600 locations throughout the United States, Canada and overseas. Total client assets are approximately $500 billion. Public since 1983, the firm has been listed on the New York Stock Exchange since 1986 under the symbol RJF. Additional information is available at www.raymondjames.com. FORWARD LOOKING STATEMENTS Certain statements made in this report may constitute “forward- looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions, demand for and pricing of our products, acquisitions and divestitures, anticipated results of litigation and regulatory developments or general economic conditions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K and subsequent Forms 10-Q, which are available on www.raymondjames. com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise. About Raymond James Financial, Inc. THIRD QUARTER 2015 (1) (1)

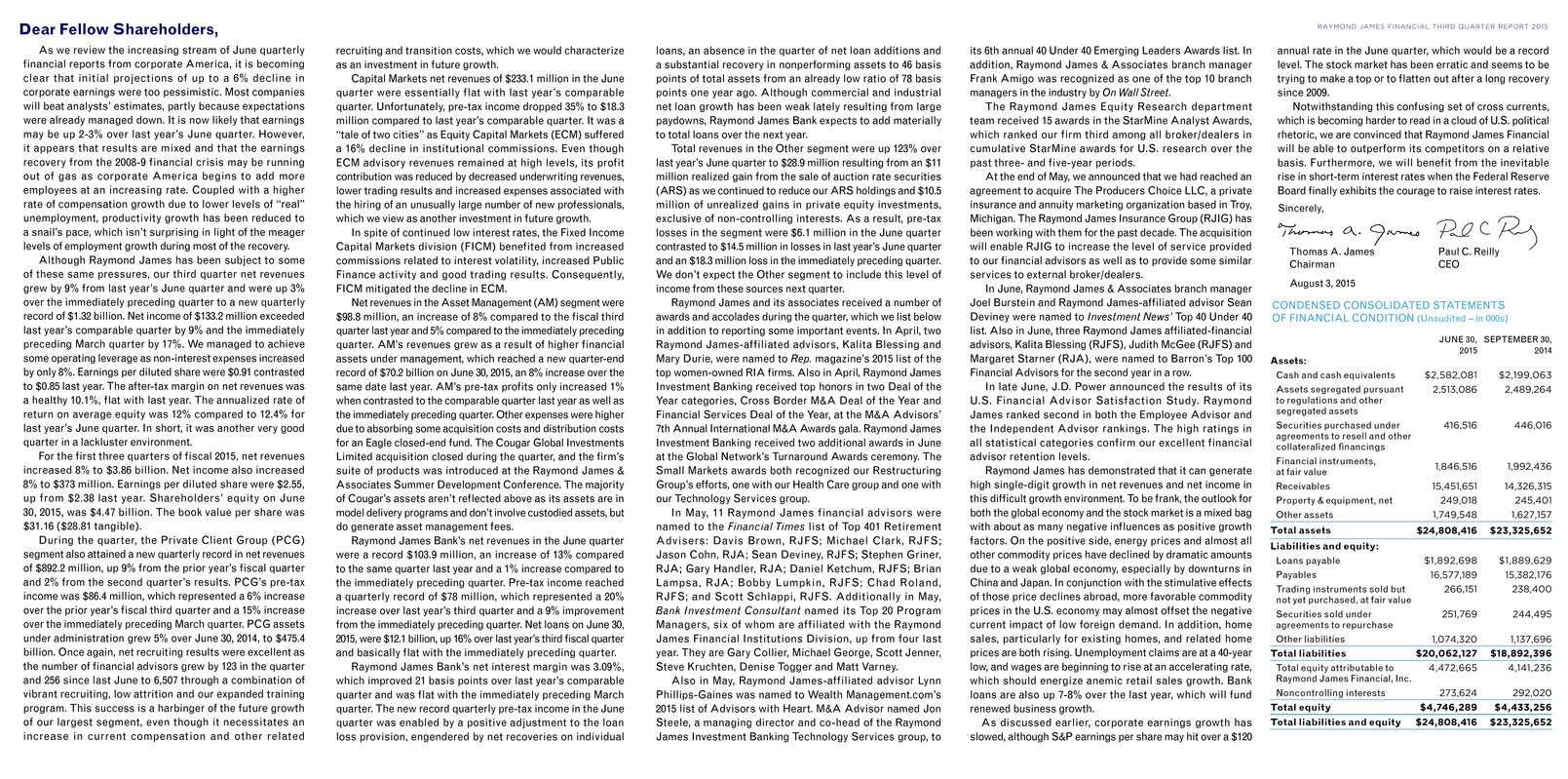

Dear Fellow Shareholders, As we review the increasing stream of June quarterly financial reports from corporate America, it is becoming clear that initial projections of up to a 6% decline in corporate earnings were too pessimistic. Most companies will beat analysts’ estimates, partly because expectations were already managed down. It is now likely that earnings may be up 2-3% over last year’s June quarter. However, it appears that results are mixed and that the earnings recovery from the 2008-9 financial crisis may be running out of gas as corporate America begins to add more employees at an increasing rate. Coupled with a higher rate of compensation growth due to lower levels of “real” unemployment, productivity growth has been reduced to a snail’s pace, which isn’t surprising in light of the meager levels of employment growth during most of the recovery. Although Raymond James has been subject to some of these same pressures, our third quarter net revenues grew by 9% from last year’s June quarter and were up 3% over the immediately preceding quarter to a new quarterly record of $1.32 billion. Net income of $133.2 million exceeded last year’s comparable quarter by 9% and the immediately preceding March quarter by 17%. We managed to achieve some operating leverage as non-interest expenses increased by only 8%. Earnings per diluted share were $0.91 contrasted to $0.85 last year. The after-tax margin on net revenues was a healthy 10.1%, flat with last year. The annualized rate of return on average equity was 12% compared to 12.4% for last year’s June quarter. In short, it was another very good quarter in a lackluster environment. For the first three quarters of fiscal 2015, net revenues increased 8% to $3.86 billion. Net income also increased 8% to $373 million. Earnings per diluted share were $2.55, up from $2.38 last year. Shareholders’ equity on June 30, 2015, was $4.47 billion. The book value per share was $31.16 ($28.81 tangible). During the quarter, the Private Client Group (PCG) segment also attained a new quarterly record in net revenues of $892.2 million, up 9% from the prior year’s fiscal quarter and 2% from the second quarter’s results. PCG’s pre-tax income was $86.4 million, which represented a 6% increase over the prior year’s fiscal third quarter and a 15% increase over the immediately preceding March quarter. PCG assets under administration grew 5% over June 30, 2014, to $475.4 billion. Once again, net recruiting results were excellent as the number of financial advisors grew by 123 in the quarter and 256 since last June to 6,507 through a combination of vibrant recruiting, low attrition and our expanded training program. This success is a harbinger of the future growth of our largest segment, even though it necessitates an increase in current compensation and other related recruiting and transition costs, which we would characterize as an investment in future growth. Capital Markets net revenues of $233.1 million in the June quarter were essentially flat with last year’s comparable quarter. Unfortunately, pre-tax income dropped 35% to $18.3 million compared to last year’s comparable quarter. It was a “tale of two cities” as Equity Capital Markets (ECM) suffered a 16% decline in institutional commissions. Even though ECM advisory revenues remained at high levels, its profit contribution was reduced by decreased underwriting revenues, lower trading results and increased expenses associated with the hiring of an unusually large number of new professionals, which we view as another investment in future growth. In spite of continued low interest rates, the Fixed Income Capital Markets division (FICM) benefited from increased commissions related to interest volatility, increased Public Finance activity and good trading results. Consequently, FICM mitigated the decline in ECM. Net revenues in the Asset Management (AM) segment were $98.8 million, an increase of 8% compared to the fiscal third quarter last year and 5% compared to the immediately preceding quarter. AM’s revenues grew as a result of higher financial assets under management, which reached a new quarter-end record of $70.2 billion on June 30, 2015, an 8% increase over the same date last year. AM’s pre-tax profits only increased 1% when contrasted to the comparable quarter last year as well as the immediately preceding quarter. Other expenses were higher due to absorbing some acquisition costs and distribution costs for an Eagle closed-end fund. The Cougar Global Investments Limited acquisition closed during the quarter, and the firm’s suite of products was introduced at the Raymond James & Associates Summer Development Conference. The majority of Cougar’s assets aren’t reflected above as its assets are in model delivery programs and don’t involve custodied assets, but do generate asset management fees. Raymond James Bank’s net revenues in the June quarter were a record $103.9 million, an increase of 13% compared to the same quarter last year and a 1% increase compared to the immediately preceding quarter. Pre-tax income reached a quarterly record of $78 million, which represented a 20% increase over last year’s third quarter and a 9% improvement from the immediately preceding quarter. Net loans on June 30, 2015, were $12.1 billion, up 16% over last year’s third fiscal quarter and basically flat with the immediately preceding quarter. Raymond James Bank’s net interest margin was 3.09%, which improved 21 basis points over last year’s comparable quarter and was flat with the immediately preceding March quarter. The new record quarterly pre-tax income in the June quarter was enabled by a positive adjustment to the loan loss provision, engendered by net recoveries on individual JUNE 30, 2015 SEPTEMBER 30, 2014 Assets: Cash and cash equivalents $2,582,081 $2,199,063 Assets segregated pursuant to regulations and other segregated assets 2,513,086 2,489,264 Securities purchased under agreements to resell and other collateralized financings 416,516 446,016 Financial instruments, at fair value 1,846,516 1,992,436 Receivables 15,451,651 14,326,315 Property & equipment, net 249,018 245,401 Other assets 1,749,548 1,627,157 Total assets $24,808,416 $23,325,652 Liabilities and equity: Loans payable $1,892,698 $1,889,629 Payables 16,577,189 15,382,176 Trading instruments sold but not yet purchased, at fair value 266,151 238,400 Securities sold under agreements to repurchase 251,769 244,495 Other liabilities 1,074,320 1,137,696 Total liabilities $20,062,127 $18,892,396 Total equity attributable to Raymond James Financial, Inc. 4,472,665 4,141,236 Noncontrolling interests 273,624 292,020 Total equity $4,746,289 $4,433,256 Total liabilities and equity $24,808,416 $23,325,652 CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited – in 000s) RAYMOND JAMES FINANCIAL THIRD QUARTER REPORT 2015 Sincerely, Thomas A. James Paul C. Reilly Chairman CEO August 3, 2015 loans, an absence in the quarter of net loan additions and a substantial recovery in nonperforming assets to 46 basis points of total assets from an already low ratio of 78 basis points one year ago. Although commercial and industrial net loan growth has been weak lately resulting from large paydowns, Raymond James Bank expects to add materially to total loans over the next year. Total revenues in the Other segment were up 123% over last year’s June quarter to $28.9 million resulting from an $11 million realized gain from the sale of auction rate securities (ARS) as we continued to reduce our ARS holdings and $10.5 million of unrealized gains in private equity investments, exclusive of non-controlling interests. As a result, pre-tax losses in the segment were $6.1 million in the June quarter contrasted to $14.5 million in losses in last year’s June quarter and an $18.3 million loss in the immediately preceding quarter. We don’t expect the Other segment to include this level of income from these sources next quarter. Raymond James and its associates received a number of awards and accolades during the quarter, which we list below in addition to reporting some important events. In April, two Raymond James-affiliated advisors, Kalita Blessing and Mary Durie, were named to Rep. magazine’s 2015 list of the top women-owned RIA firms. Also in April, Raymond James Investment Banking received top honors in two Deal of the Year categories, Cross Border M&A Deal of the Year and Financial Services Deal of the Year, at the M&A Advisors’ 7th Annual International M&A Awards gala. Raymond James Investment Banking received two additional awards in June at the Global Network’s Turnaround Awards ceremony. The Small Markets awards both recognized our Restructuring Group’s efforts, one with our Health Care group and one with our Technology Services group. In May, 11 Raymond James financial advisors were named to the Financial Times list of Top 401 Retirement Advisers: Davis Brown, RJFS; Michael Clark, RJFS; Jason Cohn, RJA; Sean Deviney, RJFS; Stephen Griner, RJA; Gary Handler, RJA; Daniel Ketchum, RJFS; Brian Lampsa, RJA; Bobby Lumpkin, RJFS; Chad Roland, RJFS; and Scott Schlappi, RJFS. Additionally in May, Bank Investment Consultant named its Top 20 Program Managers, six of whom are affiliated with the Raymond James Financial Institutions Division, up from four last year. They are Gary Collier, Michael George, Scott Jenner, Steve Kruchten, Denise Togger and Matt Varney. Also in May, Raymond James-affiliated advisor Lynn Phillips-Gaines was named to Wealth Management.com’s 2015 list of Advisors with Heart. M&A Advisor named Jon Steele, a managing director and co-head of the Raymond James Investment Banking Technology Services group, to its 6th annual 40 Under 40 Emerging Leaders Awards list. In addition, Raymond James & Associates branch manager Frank Amigo was recognized as one of the top 10 branch managers in the industry by On Wall Street. The Raymond James Equity Research department team received 15 awards in the StarMine Analyst Awards, which ranked our firm third among all broker/dealers in cumulative StarMine awards for U.S. research over the past three- and five-year periods. At the end of May, we announced that we had reached an agreement to acquire The Producers Choice LLC, a private insurance and annuity marketing organization based in Troy, Michigan. The Raymond James Insurance Group (RJIG) has been working with them for the past decade. The acquisition will enable RJIG to increase the level of service provided to our financial advisors as well as to provide some similar services to external broker/dealers. In June, Raymond James & Associates branch manager Joel Burstein and Raymond James-affiliated advisor Sean Deviney were named to Investment News’ Top 40 Under 40 list. Also in June, three Raymond James affiliated-financial advisors, Kalita Blessing (RJFS), Judith McGee (RJFS) and Margaret Starner (RJA), were named to Barron’s Top 100 Financial Advisors for the second year in a row. In late June, J.D. Power announced the results of its U.S. Financial Advisor Satisfaction Study. Raymond James ranked second in both the Employee Advisor and the Independent Advisor rankings. The high ratings in all statistical categories confirm our excellent financial advisor retention levels. Raymond James has demonstrated that it can generate high single-digit growth in net revenues and net income in this difficult growth environment. To be frank, the outlook for both the global economy and the stock market is a mixed bag with about as many negative influences as positive growth factors. On the positive side, energy prices and almost all other commodity prices have declined by dramatic amounts due to a weak global economy, especially by downturns in China and Japan. In conjunction with the stimulative effects of those price declines abroad, more favorable commodity prices in the U.S. economy may almost offset the negative current impact of low foreign demand. In addition, home sales, particularly for existing homes, and related home prices are both rising. Unemployment claims are at a 40-year low, and wages are beginning to rise at an accelerating rate, which should energize anemic retail sales growth. Bank loans are also up 7-8% over the last year, which will fund renewed business growth. As discussed earlier, corporate earnings growth has slowed, although S&P earnings per share may hit over a $120 annual rate in the June quarter, which would be a record level. The stock market has been erratic and seems to be trying to make a top or to flatten out after a long recovery since 2009. Notwithstanding this confusing set of cross currents, which is becoming harder to read in a cloud of U.S. political rhetoric, we are convinced that Raymond James Financial will be able to outperform its competitors on a relative basis. Furthermore, we will benefit from the inevitable rise in short-term interest rates when the Federal Reserve Board finally exhibits the courage to raise interest rates.