Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RAYONIER INC | rayonierrefinancingjvrecap.htm |

Rayonier Refinancing & JV Recapitalization: Supplemental Materials August 2015

Safe Harbor Statement Certain statements in this presentation regarding anticipated financial outcomes including Rayonier’s earnings guidance, if any, business and market conditions, outlook, expected dividend rate, Rayonier’s business strategies, including expected harvest schedules, timberland acquisitions and sales of non-strategic timberlands, the anticipated benefits of Rayonier’s business strategies, and other similar statements relating to Rayonier’s future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,” “anticipate” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. The following important factors, among others, could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical and competitive nature of the industries in which we operate; fluctuations in demand for, or supply of, our forest products and real estate offerings; entry of new competitors into our markets; changes in global economic conditions and world events, including political changes in particular regions or countries; fluctuations in demand for our products in Asia, and especially China; various lawsuits relating to matters arising out of our previously announced internal review and the restatement of our consolidated financial statements; the uncertainties of potential impacts of climate-related initiatives; the cost and availability of third party logging and trucking services; the geographic concentration of a significant portion of our timberland; our ability to identify, finance and complete timberland acquisitions; changes in environmental laws and regulations, timber harvesting, delineation of wetlands, and endangered species, that may restrict or adversely impact our ability to conduct our business, or increase the cost of doing so; adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires, which can adversely affect our timberlands and the production, distribution and availability of our products; interest rate and currency movements; our capacity to incur additional debt, and any decision we may make to do so; changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors; changes in key management and personnel; our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect tax treatment of our specific businesses or reduce the benefits associated with REIT status. Specifically with respect to our Real Estate business, the following important factors, among others, could cause actual results to differ materially from those expressed in forward-looking statements that may have been made in this document: the cyclical nature of the real estate business generally, including fluctuations in demand for both entitled and unentitled property; a delayed or weak recovery in the housing market; the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida, which also may be affected by changes in law, policy and political factors beyond our control; the potential for legal challenges to entitlements and permits in connection with our properties; unexpected delays in the entry into or closing of real estate transactions; the existence of competing developers and communities in the markets in which we own property; the pace of development and the rate and timing of absorption of existing entitled property in the markets in which we own property; changes in the demographics affecting projected population growth and migration to the Southeastern U.S.; changes in environmental laws and regulations, including laws regarding water withdrawal and management and delineation of wetlands, that may restrict or adversely impact our ability to sell or develop properties; the cost of the development of property generally, including the cost of property taxes, labor and construction materials; the timing of construction and availability of public infrastructure; and the availability of financing for real estate development and mortgage loans. For additional factors that could impact future results, please see Item 1A – Risk Factors in the company’s most recent Annual Report on Form 10-K and similar discussions included in other reports that we subsequently file with the Securities and Exchange Commission (the “SEC”). The credit agreement containing the complete terms of Rayonier’s new credit facilities, which credit agreement is referenced in the analysis included herewith, is available by review of the company’s Current Report filed on Form 8-K on August, 5, 2015. Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward- looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent reports filed with the SEC.

(US$ in millions) Actual Refinancing Pro Forma 6/30/2015 Transaction (1) 6/30/2015 Rates Revolving Credit Facility $45.0 ($45.0) – L + 1.25% New Zealand JV Credit Facility (2) 160.0 (160.0) – 6.50% Senior Exchangeable Notes due 2015 130.7 (130.7) – 4.50% New Term Loan Facility – 350.0 350.0 3.30% Senior Notes due 2022 325.0 325.0 3.75% Other Debt 68.5 68.5 3.68% New Zealand JV Noncontrolling Interest Loan 23.1 23.1 0.00% Total Debt $752.4 $766.6 3.43% (–) Cash & Equivalents 91.6 12.3 103.9 NA Net Debt (3) $660.8 $662.8 Credit Data LTM Adjusted EBITDA $215.9 $215.9 Implied Annual Interest Expense 31.6 26.3 Weighted Average Interest Cost 4.21% 3.43% Credit Ratios Net Debt / Adjusted EBITDA 3.1x 3.1x Adjusted EBITDA / Implied Interest 6.8x 8.2x Net Debt / Enterprise Value (at 6/30/2015) (4) 17.0% 17.0% Note: Reflects consolidated balance sheet and credit data. (1) Reflects repayment of NZ$235mm / US$155mm of JV debt assuming FX rate of US$0.66 per NZ$1.00, plus NZ$7mm / US$5mm of other transaction expenses. (2) Actual amount as of 6/30/15 based on NZ$235mm / US$160mm of debt at FX rate of US$0.68 per NZ$1.00. (3) Net debt increases approximately $2mm due to transaction fees and expenses. (4) Based on equity market capitalization as of 6/30/2015 plus net debt. Rayonier Refinancing Overview / Pro Forma Capitalization 1 On August 5, 2015, Rayonier announced that it had closed $550 million of new credit facilities (including a $200 million undrawn revolver), the proceeds of which will be used to: (1) refinance existing debt, and (2) recapitalize its New Zealand joint venture The following table highlights Rayonier’s capitalization at 6/30/15 and pro forma for the announced transactions ~$5mm reduction in interest expense ~0.8% reduction in average interest rate Leverage neutral post-refinancing Improved interest coverage

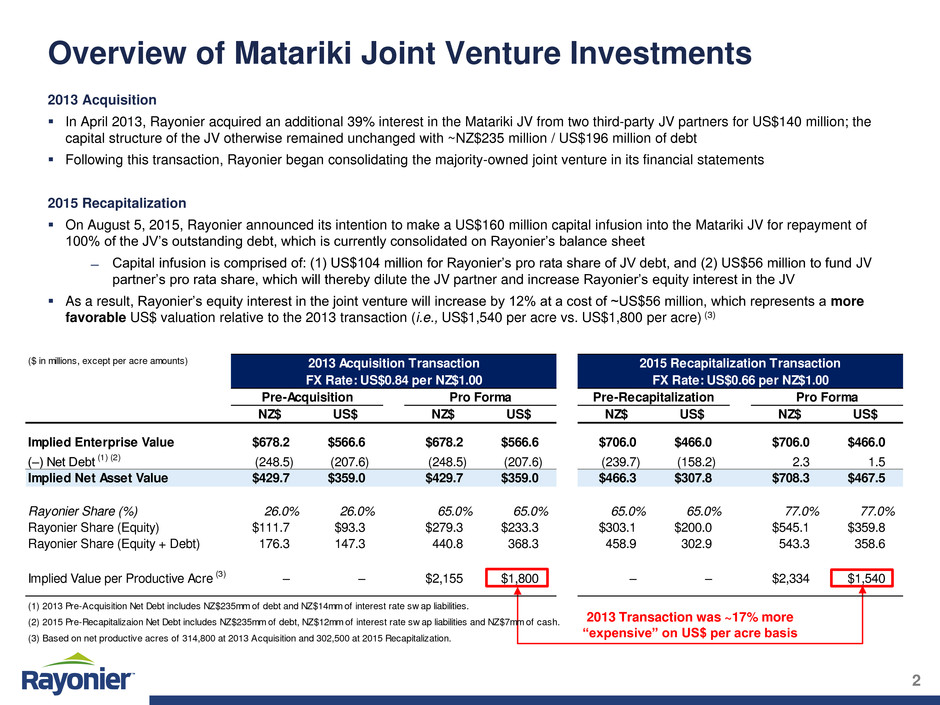

Overview of Matariki Joint Venture Investments 2 2013 Acquisition In April 2013, Rayonier acquired an additional 39% interest in the Matariki JV from two third-party JV partners for US$140 million; the capital structure of the JV otherwise remained unchanged with ~NZ$235 million / US$196 million of debt Following this transaction, Rayonier began consolidating the majority-owned joint venture in its financial statements 2015 Recapitalization On August 5, 2015, Rayonier announced its intention to make a US$160 million capital infusion into the Matariki JV for repayment of 100% of the JV’s outstanding debt, which is currently consolidated on Rayonier’s balance sheet ̶ Capital infusion is comprised of: (1) US$104 million for Rayonier’s pro rata share of JV debt, and (2) US$56 million to fund JV partner’s pro rata share, which will thereby dilute the JV partner and increase Rayonier’s equity interest in the JV As a result, Rayonier’s equity interest in the joint venture will increase by 12% at a cost of ~US$56 million, which represents a more favorable US$ valuation relative to the 2013 transaction (i.e., US$1,540 per acre vs. US$1,800 per acre) (3) 2013 Transaction was ~17% more “expensive” on US$ per acre basis ($ in millions, except per acre amounts) 2013 Acquisition Transaction 2015 Recapitalization Transaction FX Rate: US$0.84 per NZ$1.00 FX Rate: US$0.66 per NZ$1.00 Pre-Acquisition Pro Forma Pre-Recapitalization Pro Forma NZ$ US$ NZ$ US$ NZ$ US$ NZ$ US$ Implied Enterprise Value $678.2 $566.6 $678.2 $566.6 $706.0 $466.0 $706.0 $466.0 (–) Net Debt (1) (2) (248.5) (207.6) (248.5) (207.6) (239.7) (158.2) 2.3 1.5 Implied Ne Asset Value $429.7 $359.0 $429.7 $359.0 $466.3 $307.8 $708.3 $467.5 a o ier Share (%) 26.0% 26.0% 65.0% 65.0% 65.0% 65.0% 77.0% 77.0% a nier Sh re (Equity) $111.7 $93.3 $279.3 $233.3 $303.1 $200.0 $545.1 $359.8 R yo i r Share (Equity + Debt) 176.3 147.3 440.8 368.3 458.9 302.9 543.3 358.6 Implied Value per Productive Acre (3) – – $2,155 $1,800 – – $2,334 $1,540 (1) 2013 Pre-Acquisition Net Debt includes NZ$235mm of debt and NZ$14mm of interest rate sw ap liabilities. (2) 2015 Pre-Recapitalizaion Net Debt includes NZ$235mm of debt, NZ$12mm of interest rate sw ap liabilities and NZ$7mm of cash. (3) Based on net productive acres of 314,800 at 2013 Acquisition and 302,500 at 2015 Recapitalization.

Backdrop New Zealand JV debt has been fully consolidated in Rayonier’s balance sheet since 2013 JV debt is very high-cost (~6.5%) relative to Rayonier’s cost of financing High leverage at JV (~33% loan to value) limits operational flexibility due to debt covenant constraints JV debt adds complexity to Rayonier’s capital structure (i.e., NZ$ denominated, secured debt) Strategic Rationale for Recapitalization Significant annual interest expense savings – NZ$15 million at JV level – US$5 million at consolidated Rayonier level Improves operational flexibility by allowing the JV to flex harvest based on market conditions without debt covenant constraints Capitalizes on favorable exchange rate environment in refinancing NZ$ denominated debt – NZ$ at lowest level against the US$ in five years with exchange rate of US$0.66 per NZ$1.00 Potential to capture valuation upside in the future – New Zealand is experiencing discount rate compression linked to net inflow of capital to buy timberlands – Trend expected to continue, which should translate to higher valuations Greater New Zealand ownership share provides increased market diversification – Radiata pine from New Zealand uniquely positioned in growing export markets in China, South Korea and India – Strong domestic New Zealand market 3 Strategic Rationale for Joint Venture Recapitalization