Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BIODELIVERY SCIENCES INTERNATIONAL INC | d84232d8k.htm |

Exhibit 99.1

BioDelivery Sciences Provides Corporate Update and

Reports Second Quarter 2015 Financial Results

BUNAVAIL® (buprenorphine and naloxone) buccal film prescriptions grow 27% over first

quarter; addition of over 680 new prescribers

BUNAVAIL added to preferred drug list on 6 state Medicaid fee-for-service programs in

second quarter, bringing total to 19

Ongoing FDA review of NDA for BELBUCA™ with October 23rd PDUFA date and

associated $50 million milestone to BDSI from Endo upon approval

BUNAVAIL patent upheld and all challenged claims of an RB Pharmaceuticals Limited

patent found unpatentable in two U.S. Patent and Trademark Office Inter Partes Reviews

Secured an additional $20.7 million in gross debt funding

Second quarter ended with a strong cash position of $67.7 million

Company to host conference call today at 8:00 AM ET

RALEIGH, N.C. — August 10, 2015 — BioDelivery Sciences International, Inc. (BDSI) today reported financial results for the second quarter ended June 30, 2015, and reviewed its most significant recent accomplishments and upcoming milestones.

Net revenue for the second quarter ended June 30, 2015, was $1.7 million compared to $13.9 million in the corresponding period of 2014. Revenue for the second quarter versus 2014 is less due to 2014 containing the database lock for one of the BELBUCA Phase 3 trials. Net revenue for BUNAVAIL increased 23% versus first quarter while operating expenses decreased by 10% over the same time period.

Net revenue for the six months ended June 30, 2015, was $14.8 million, compared to $34.6 million in the corresponding period of 2014. While six month revenue for 2015 includes the milestone payment for the FDA acceptance of the NDA for BELBUCA in the first quarter, 2014 revenue includes two milestone payments, one each quarter, totaling $20 million for database locks for the two BELBUCA Phase 3 studies and $10.8 million of R&D reimbursable expenses for BELBUCA.

“We are on target with both operating expenses and cash burn both for the quarter and year to date. In addition, we have further strengthened our balance sheet as our cash balance reflects the addition of $20 million in debt financing,” said Ernest DePaolantonio, Chief Financial Officer for BDSI. “This additional cash will give us runway into mid-2016 to fund operations as currently planned.”

Financial Highlights

Second Quarter 2015 Financial Results Overview

| • | Net revenue for the second quarter ended June 30, 2015, was $1.7 million, compared to $13.9 million in the corresponding period of 2014 |

| • | Total operating expenses for the second quarter ended June 30, 2015, were $17.8 million, compared to $15.2 million in the corresponding period of 2014 |

| • | Net loss for the second quarter ended June 30, 2015, was $19.2 million, or $0.37 per diluted share, compared to $6.7 million, or $0.14 per diluted share, in the corresponding period of 2014 |

Six Months Ended June 30, 2015 Financial Results Overview

| • | Net revenue for the six months ended June 30, 2015, was $14.8 million, compared to $34.6 million in the corresponding period of 2014 |

| • | Total operating expenses for the six months ended June 30, 2015, were $37.5 million, compared to $34.5 million in the corresponding period of 2014 |

| • | Net loss for the six months ended June 30, 2015, was $27.4 million, or $0.53 per diluted share, compared to $11.3 million, or $0.24 per diluted share, in the corresponding period of 2014 |

| • | As of June 30, 2015, BDSI had $67.7 million in cash and cash equivalents, as compared to $70.5 million as of December 31, 2014 |

Corporate Update and Recent Accomplishments

BUNAVAIL (buprenorphine and naloxone) buccal film for the maintenance treatment of opioid dependence:

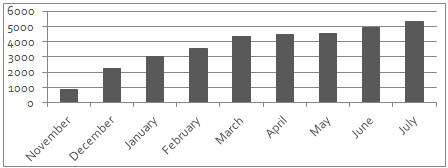

| • | Nearly 14,000 prescriptions dispensed for BUNAVAIL during second quarter 2015; 27% increase over first quarter |

Source: Symphony Health; July estimated based on weekly sales

| • | BUNAVAIL prescriber base expanded to 1,728 physicians, with 684 new prescribers added during the second quarter |

| • | Market access continues to improve with multiple managed care wins in the second quarter and through July. During the second quarter, 6 additional state Medicaid fee-for-service programs added BUNAVAIL to their preferred drug list. In total, BUNAVAIL now has parity access to other branded products in the category in 19 states |

| • | BUNAVAIL available with 3rd tier, unrestricted access in >75% of commercial managed care lives; multiple additional contracts in process |

| • | Resources aligned to areas with good managed care access including Tennessee and Massachusetts resulted in prescription growth from first quarter to second quarter of 125% and 57% respectively |

BELBUCA (buprenorphine HCl) buccal film for treatment of chronic pain:

| • | PDUFA date of October 23rd |

| • | Upon FDA approval, eligible to receive up to a $50 million milestone payment from partner Endo Pharmaceuticals |

| • | Phase 3 pivotal trial data presented during second quarter at the American Pain Society 2015 Annual Scientific Conference and the International Conference on Opioids |

Clonidine Topical Gel for treatment of painful diabetic neuropathy:

| • | Data analysis completed, resulting in identification of opportunities to strengthen patient screening criteria that will be employed in a smaller scale pivotal study |

| • | New study planned to commence in the fourth quarter of this year with a budget of $3-5 million |

Buprenorphine Depot Injection for the maintenance treatment of opioid dependence and chronic pain:

| • | Preclinical study yields favorable results supporting development of a formulation capable of providing 30 days of continuous therapy for pain and opioid dependence |

| • | On track for year-end 2015 IND filing and first human trial first quarter of 2016 |

Patent Litigation Update:

| • | On June 30th, in an Inter Partes Review (IPR) proceeding filed by BDSI, the U.S. Patent and Trademark Office rejected and rendered unpatentable all challenged claims of RB Pharmaceuticals Limited’s United States Patent No. 8,475,832 (‘832 patent) |

| • | In another IPR proceeding, on August 5th the U.S. Patent and Trademark Office again ruled in favor of BDSI and issued a decision upholding all claims of U.S. Patent No. 7,579,019 (’019 patent), which is Orange Book listed for BUNAVAIL |

“We made substantial progress in the last quarter behind the BUNAVAIL launch relating to improved managed care access, particularly Medicaid, expanded pharmacy stocking and enhanced physician targeting. Progress was also made through shifting our sales force resources to areas where physicians have the best access to BUNAVAIL and strengthening of the sales management team with some key hires, all of which are all helping us to move beyond some of the greater than anticipated challenges we faced during the early launch phase,” said Dr. Mark A. Sirgo, President and Chief Executive Officer. “We continue to expect that improved managed care and pharmacy access behind a strengthened sales and managed markets team will lead to more substantial and sustained incremental prescription growth in the second half of the year. Our sales and managed markets leadership team strengthening came with the hiring of four very experienced and successful former Salix® Pharmaceuticals individuals who complement our existing team in advancing the launch of BUNAVAIL.”

Dr. Sirgo continued, “Beyond BUNAVAIL, we have multiple important near-term value-creating opportunities including an October 23rd PDUFA date for BELBUCA, our buprenorphine product for chronic pain, which BDSI believes has peak sales potential exceeding $500 million, and initiation of a defining clinical trial of Clonidine Topical Gel likely to begin in the fourth quarter of this year. We also plan to file an IND by year-end for Buprenorphine Depot Injection now that we have defined an optimal formulation. In addition to our exciting pipeline, we are actively looking at other late stage and marketed assets that would be complimentary to our current commercial focus.”

Key Anticipated 2015 Milestones

| • | Anticipated approval of BELBUCA (October 23 PDUFA date) and an associated milestone payment from Endo of up to $50 million |

| • | Filing of an Investigational New Drug (IND) application for Buprenorphine Depot by end of year |

Conference Call & Webcast

Monday, August 10, 2015 @ 8:00 am Eastern time

| Domestic: | 888-438-5524 | |

| International: | 719-325-2435 | |

| Conference ID: | 1010257 | |

| Webcast: | http://public.viavid.com/player/index.php?id=115388 | |

| Replays available until August 24, 2015 | ||

| Domestic: | 877-870-5176 | |

| International: | 858-384-5517 | |

| Conference ID: | 1010257 | |

About BioDelivery Sciences International

BioDelivery Sciences International, Inc., headquartered in Raleigh, North Carolina, is a specialty pharmaceutical company with a focus in the areas of pain management and addiction medicine. BDSI is utilizing its novel and proprietary BioErodible MucoAdhesive (BEMA®) technology and other drug delivery technologies to develop and commercialize, either on its own or in partnership with third parties, new applications of proven therapies aimed at addressing important unmet medical needs.

BDSI’s development strategy focuses on utilization of the FDA’s 505(b)(2) approval process. This regulatory pathway creates the potential for more timely and efficient approval of new formulations of previously approved therapeutics.

BDSI’s particular area of focus is the development and commercialization of products in the areas of pain management and addiction. These are areas where BDSI believes its drug delivery technologies and products can best be applied to address critical unmet medical needs. BDSI’s marketed products and those in development address serious and debilitating conditions such as breakthrough cancer pain, chronic pain, painful diabetic neuropathy and opioid dependence.

For more information, please visit or follow us:

| Internet: | www.bdsi.com | |

| Facebook: | Facebook.com/BioDeliverySI | |

| Twitter: | @BioDeliverySI |

Cautionary Note on Forward-Looking Statements

This press release, the conference call described herein, and any statements of employees, representatives and partners of BioDelivery Sciences International, Inc. (the “Company”) related thereto (including, without limitation, at the presentations described herein) contain, or may contain, among other things, certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve

significant risks and uncertainties. Such statements may include, without limitation, statements with respect to the Company’s plans, objectives, projections, expectations and intentions and other statements identified by words such as “projects,” “may,” “will,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “potential” or similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties, including those detailed in the Company’s filings with the Securities and Exchange Commission. Actual results (including, without limitation, the results of the commercial launch of BUNAVAIL and the Company’s clinical trials for, and FDA review of, the Company’s products in development) may differ significantly from those set forth in the forward-looking statements. These forward-looking statements involve certain risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s control). The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future presentations or otherwise, except as required by applicable law.

BDSI®, BEMA® and BUNAVAIL® are registered trademarks of BioDelivery Sciences International, Inc. The BioDelivery

Sciences and BUNAVAIL logos are trademarks owned by BioDelivery Sciences International, Inc All other trademarks and tradenames are owned by their respective owners.

© 2015 BioDelivery Sciences International, Inc. All rights reserved.

CONTACTS

Investors:

Matthew P. Duffy

Managing Director

LifeSci Advisors, LLC

212-915-0685

matthew@lifesciadvisors.com

Al Medwar

Vice President, Marketing and Corporate Development

BioDelivery Sciences International, Inc.

919-582-9050

amedwar@bdsi.com

Media:

Susan Forman/Laura Radocaj

Dian Griesel Int’l.

212-825-3210

sforman@dgicomm.com

lradocaj@dgicomm.com

| BioDelivery Sciences International Condensed Consolidated Statements of Operations (in thousands, except share data) |

||||||||||||||||

| Statement of Profits and Losses | Three Months Ended | Six Months Ended | ||||||||||||||

| 6/30/2015 | 6/30/2014 | 6/30/2015 | 6/30/2014 | |||||||||||||

| Revenues: |

||||||||||||||||

| Net Revenues |

$ | 1,733 | $ | 13,885 | $ | 14,787 | $ | 34,575 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Costs and Expenses: |

||||||||||||||||

| Cost of Goods Sold |

2,621 | 687 | 3,745 | 1,413 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Research & Development |

4,506 | 7,983 | 11,054 | 22,606 | ||||||||||||

| Selling, General and Administrative |

13,287 | 7,256 | 26,468 | 11,884 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Expenses |

17,793 | 15,239 | 37,522 | 34,490 | ||||||||||||

| (Loss) / Income From Operations |

(18,681 | ) | (2,041 | ) | (26,480 | ) | (1,328 | ) | ||||||||

| Interest (expense) income net |

(527 | ) | (519 | ) | (947 | ) | (1,074 | ) | ||||||||

| Derivitive (loss) gain |

— | (4,120 | ) | — | (8,946 | ) | ||||||||||

| Other (expenses) income, net |

(3 | ) | 9 | 23 | 32 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) / Income before taxes |

(19,211 | ) | (6,671 | ) | (27,404 | ) | (11,316 | ) | ||||||||

| Income tax expense |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss)/ income |

$ | (19,211 | ) | $ | (6,671 | ) | $ | (27,404 | ) | $ | (11,316 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss)/ income per share, basic |

$ | (0.37 | ) | $ | (0.14 | ) | $ | (0.53 | ) | $ | (0.24 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss)/ income per share, diluted |

$ | (0.37 | ) | $ | (0.14 | ) | $ | (0.53 | ) | $ | (0.24 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing net income/(loss) per share, basic |

52,401,747 | 48,521,351 | 52,156,657 | 46,290,712 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing net income/(loss) per share, diluted |

52,401,747 | 48,521,351 | 52,156,657 | 46,290,712 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| BioDelivery Sciences International Condensed Consolidated Statements of Operations |

||||||||

| Balance Sheet | 6/30/2015 | 12/31/2014 | ||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 67,655 | $ | 70,472 | ||||

| Accounts receivable, net |

1,526 | 3,141 | ||||||

| Inventory |

1,533 | 1,828 | ||||||

| other assets |

14,194 | 13,870 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 84,908 | $ | 89,311 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity: |

||||||||

| Accounts Payable and other liabilities |

$ | 20,335 | $ | 22,742 | ||||

| Notes payable short and long term |

29,653 | 12,173 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Notes Payable |

49,988 | 34,915 | ||||||

| Preferred Stock |

2 | 2 | ||||||

| Common Stock |

53 | 52 | ||||||

| Additional paid-in capital |

267,847 | 259,920 | ||||||

| Treasury Stock at cost |

(47 | ) | (47 | ) | ||||

| Accumulated Deficit |

(232,935 | ) | (205,531 | ) | ||||

|

|

|

|

|

|||||

| Total stockholder’ equity |

34,920 | 54,396 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stckholders’ equity (deficit) |

$ | 84,908 | $ | 89,311 | ||||

|

|

|

|

|

|||||

| 84,908 | $ | 89,311 | ||||||

|

|

|

|

|

|||||