Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Starwood Waypoint Homes | sway-8k_20150731.htm |

| EX-99.1 - EX-99.1 - Starwood Waypoint Homes | sway-ex991_6.htm |

SECOND QUARTER 2015 Supplemental Operating & Financial Data Exhibit 99.2

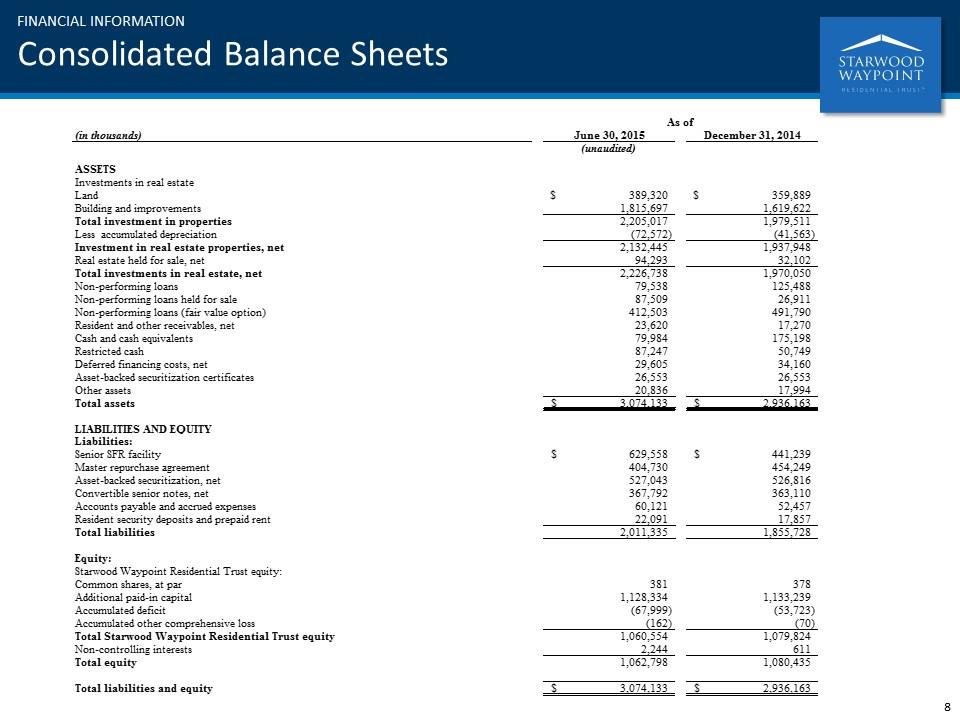

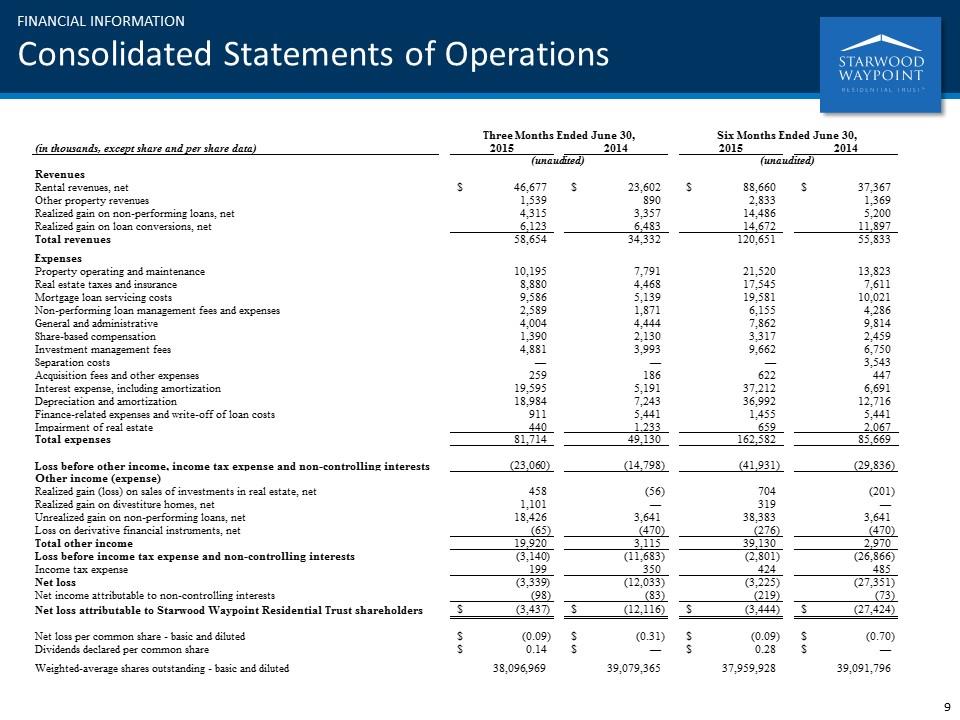

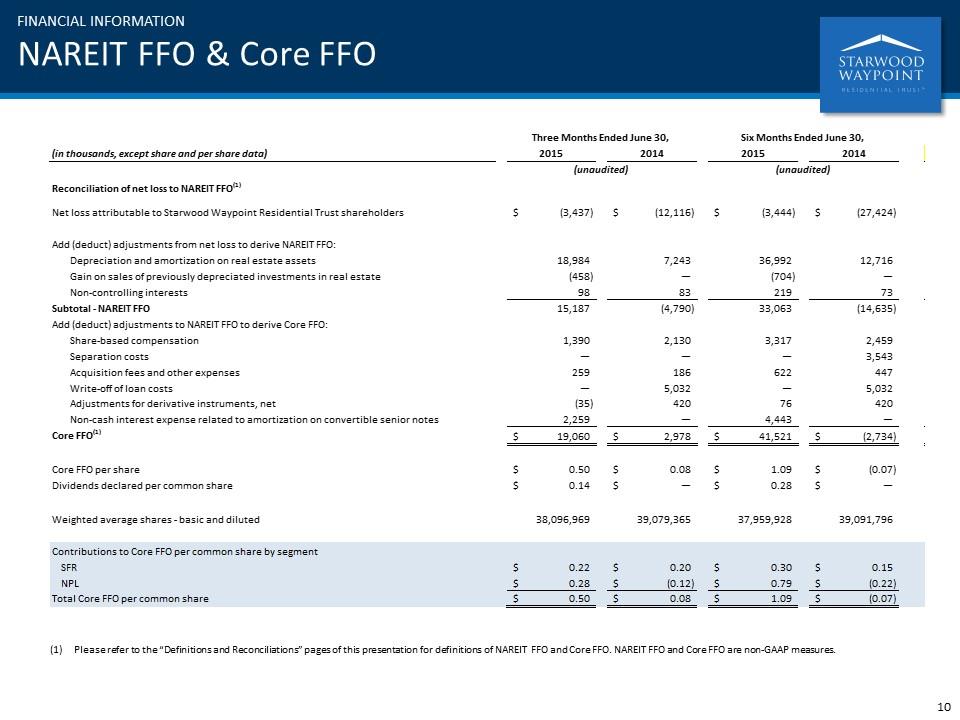

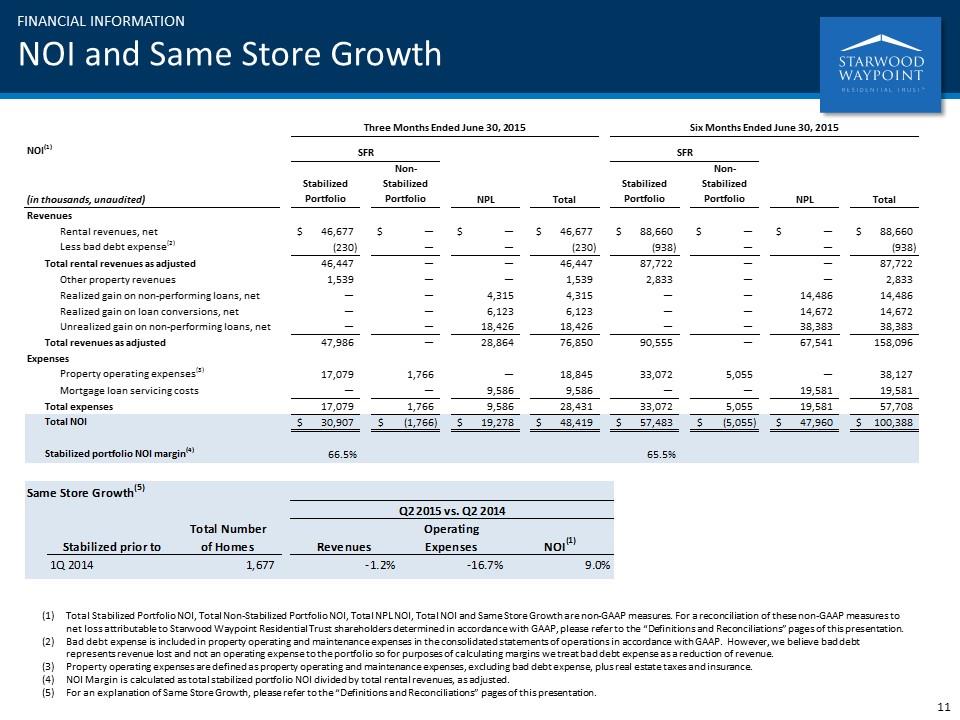

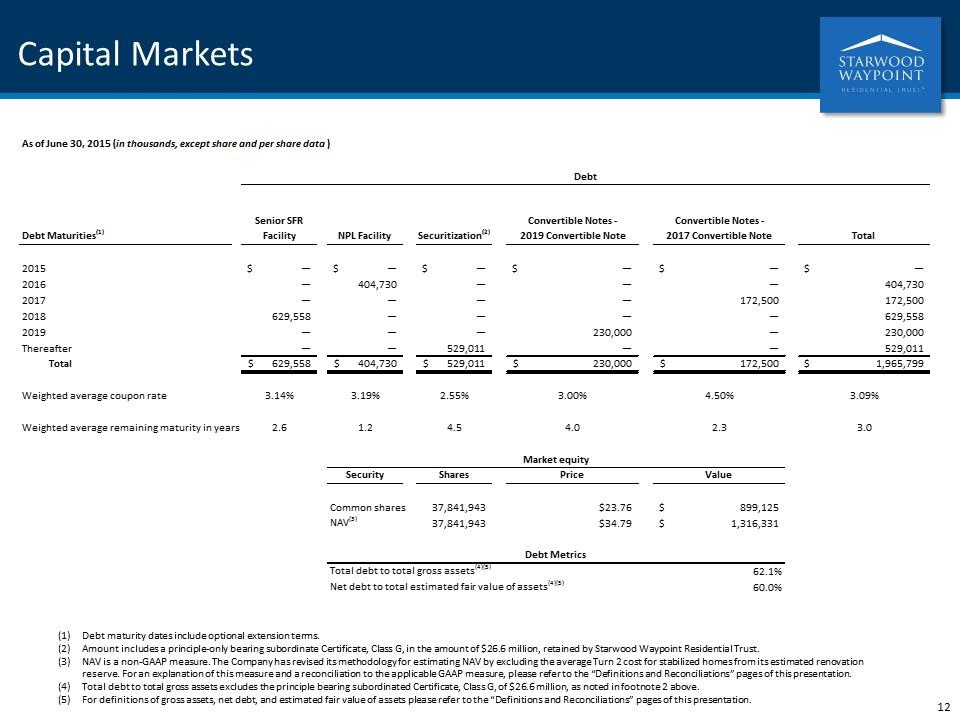

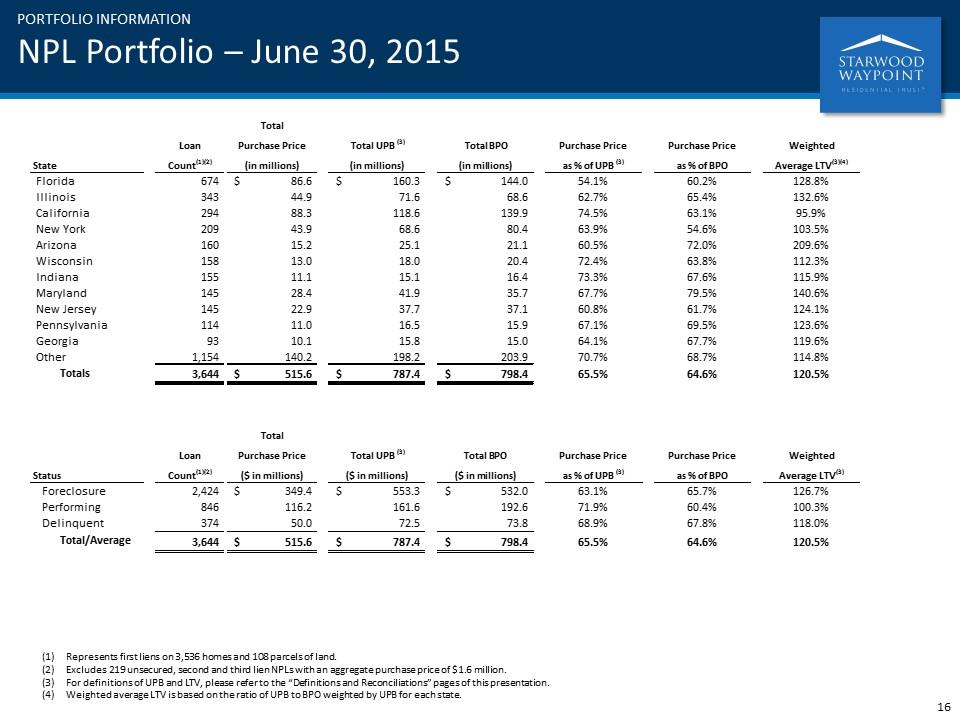

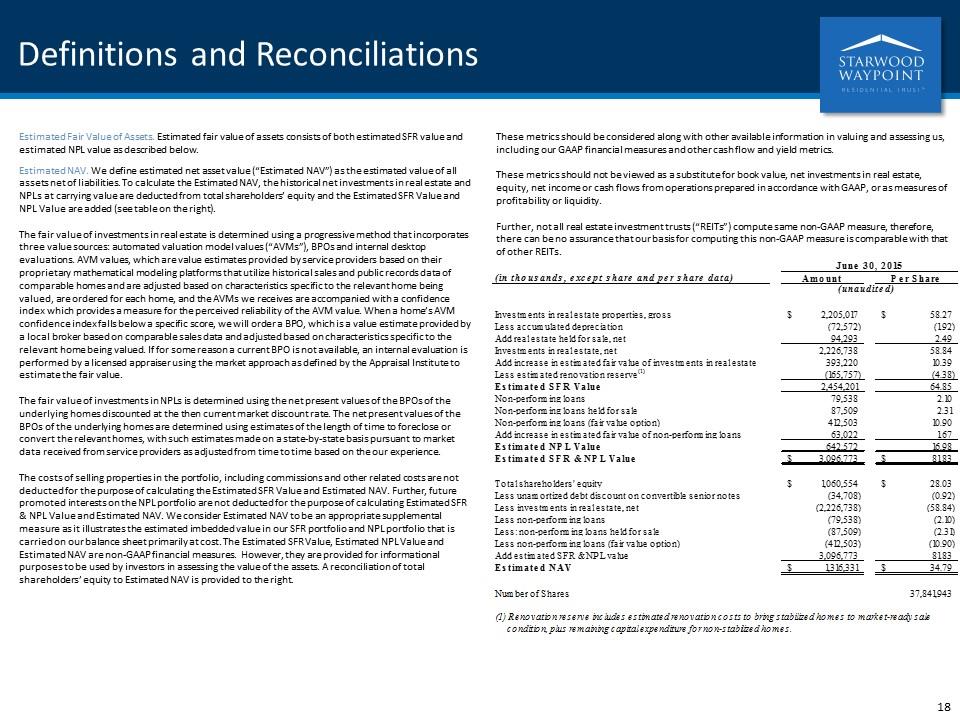

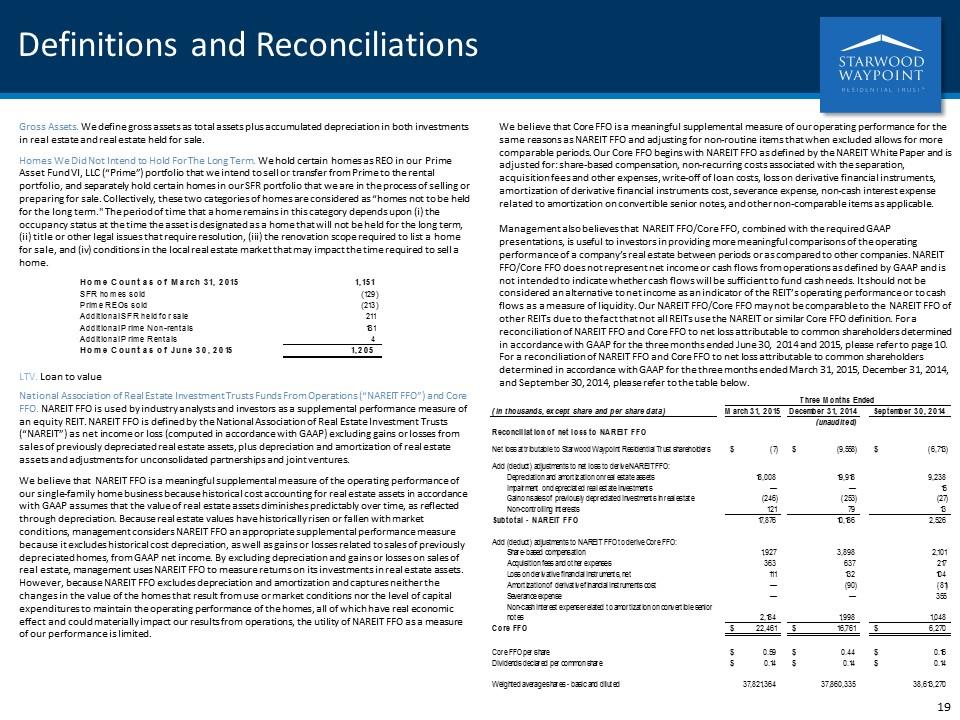

Table of Contents Pages ABOUT SWAY 1-6 FINANCIAL AND OPERATING INFORMATION Selected Financial & Operating Information 7 FINANCIAL INFORMATION Selected Financial & Other Information 7 Consolidated Balance Sheets 8 Consolidated Statements of Operations 9 NAREIT FFO & Core FFO 10 NOI and Same Store Growth 11 Same Store Growth CAPITAL MARKETS 12 PORTFOLIO INFORMATION Total Rental Homes Portfolio 13 Rent Growth by Lease Category 14 Leasing Statistics 15 NPL Portfolio 16 TRANSACTION ACTIVITY Acquisitions 17 Dispositions DEFINITIONS AND RECONCILIATIONS 18-21 Pages ABOUT SWAY 1-6 FINANCIAL AND OPERATING INFORMATION Selected Financial & Operating Information 7 FINANCIAL INFORMATION Selected Financial & Other Information 7 Consolidated Balance Sheets 8 Consolidated Statements of Operations 9 NAREIT FFO & Core FFO 10 NOI and Same Store Growth 11 Same Store Growth CAPITAL MARKETS 12 PORTFOLIO INFORMATION Total Rental Homes Portfolio 13 Rent Growth by Lease Category 14 Leasing Statistics 15 NPL Portfolio 16 TRANSACTION ACTIVITY Acquisitions 17 Dispositions DEFINITIONS AND RECONCILIATIONS 18-21

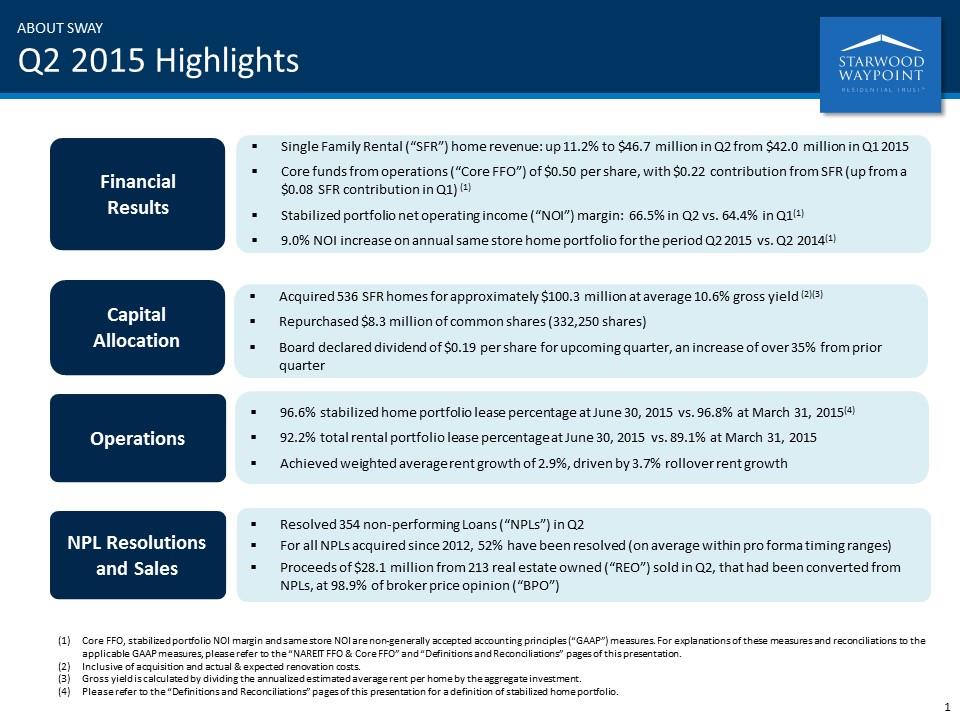

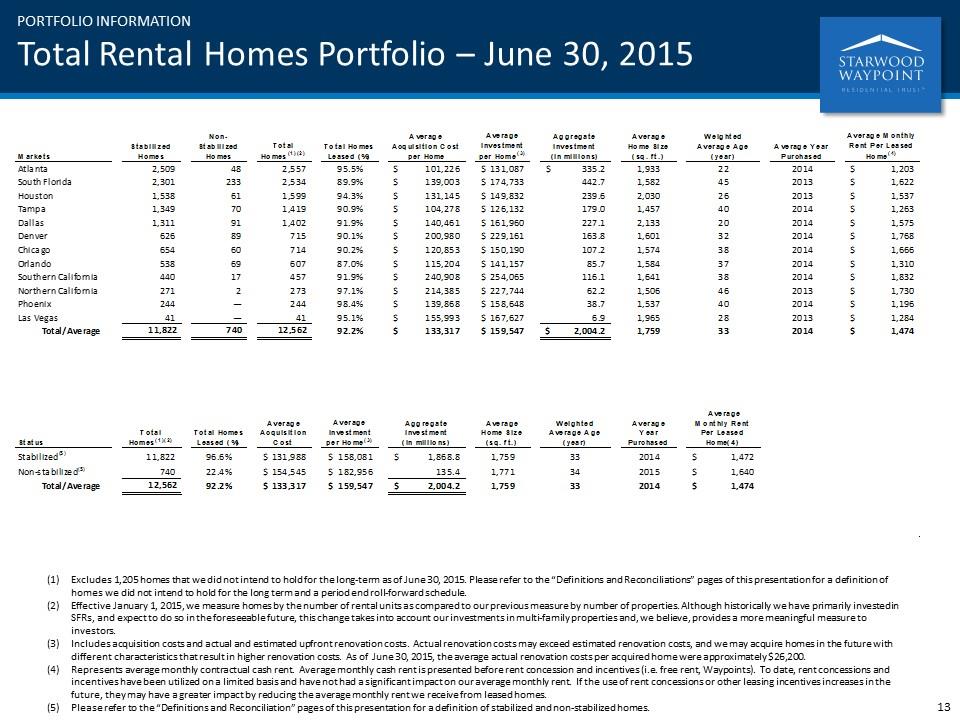

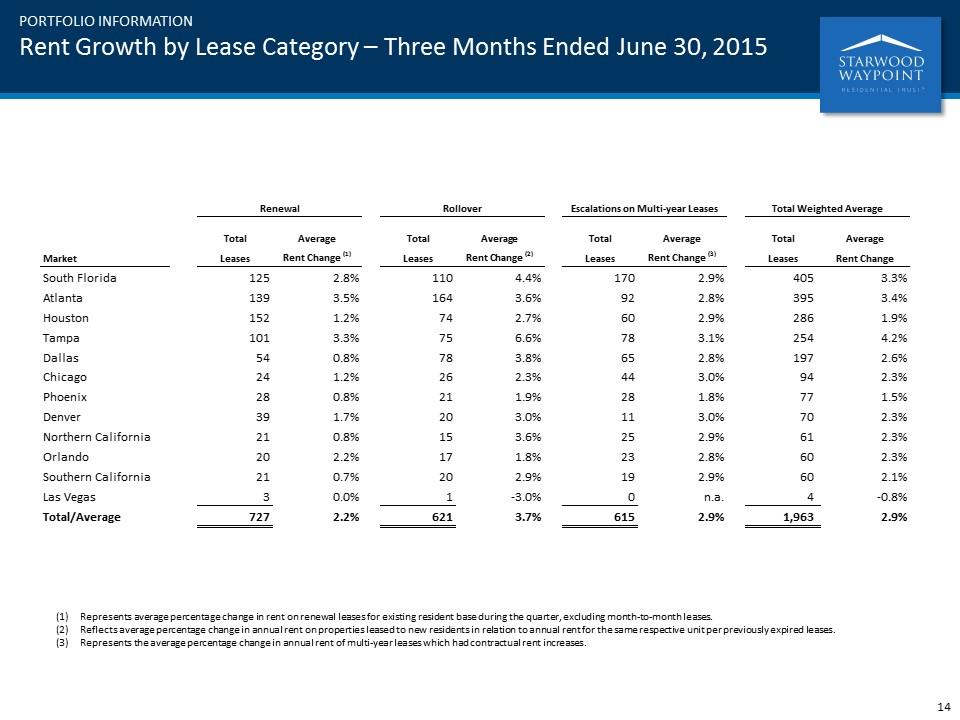

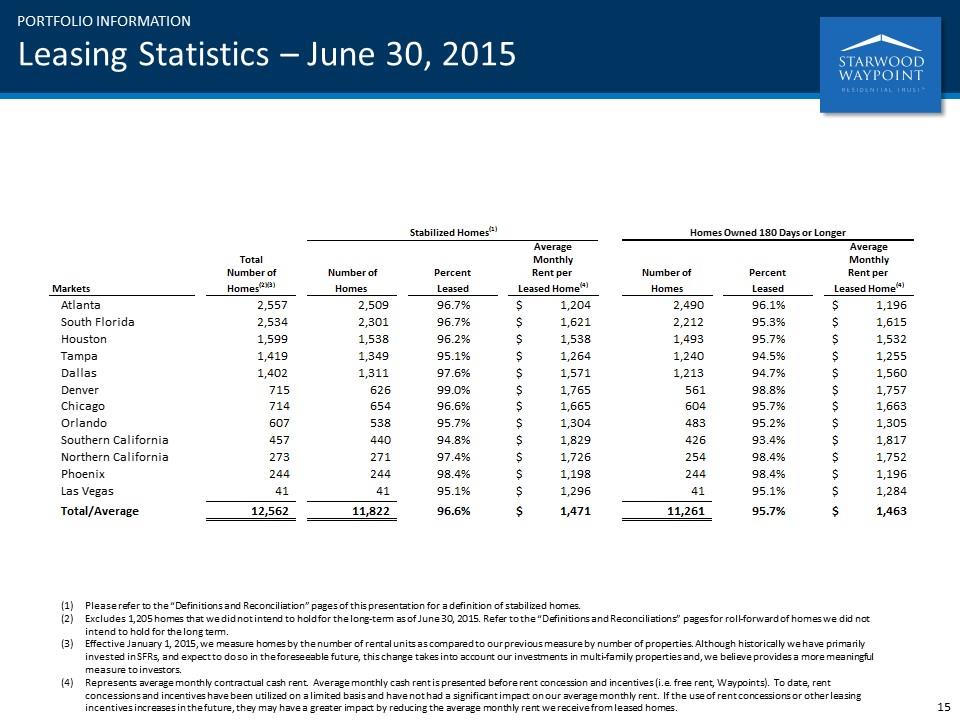

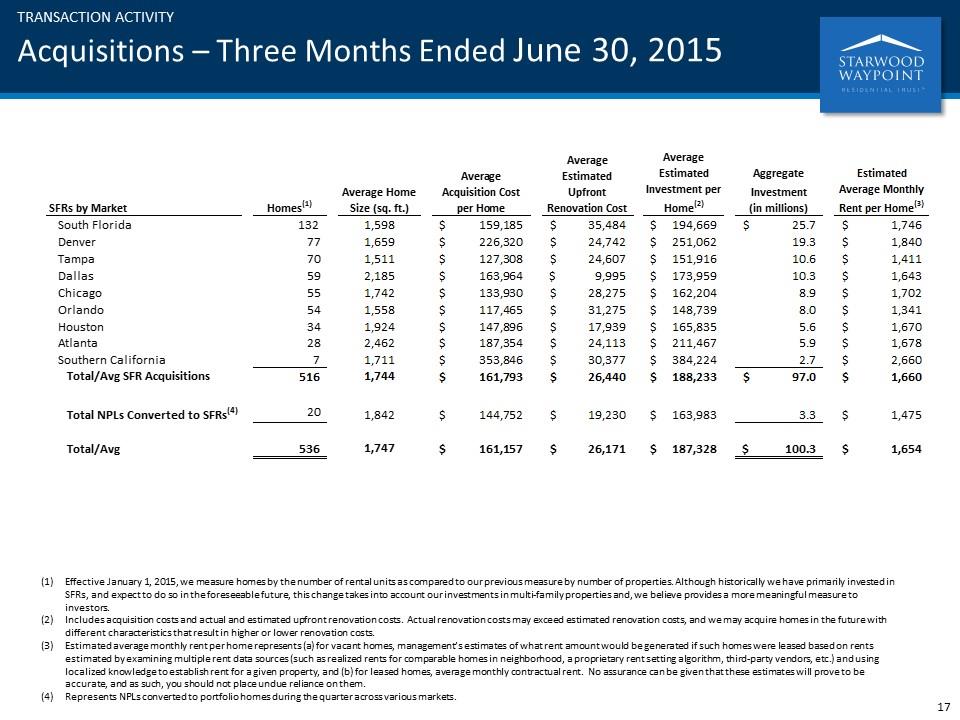

NPL Resolutions and Sales Resolved 354 non-performing Loans (“NPLs”) in Q2 For all NPLs acquired since 2012, 52% have been resolved (on average within pro forma timing ranges) Proceeds of $28.1 million from 213 real estate owned (“REO”) sold in Q2, that had been converted from NPLs, at 98.9% of broker price opinion (“BPO”) Capital Allocation Acquired 536 SFR homes for approximately $100.3 million at average 10.6% gross yield (2)(3) Repurchased $8.3 million of common shares (332,250 shares) Board declared dividend of $0.19 per share for upcoming quarter, an increase of over 35% from prior quarter Financial Results Single Family Rental (“SFR”) home revenue: up 11.2% to $46.7 million in Q2 from $42.0 million in Q1 2015 Core funds from operations (“Core FFO”) of $0.50 per share, with $0.22 contribution from SFR (up from a $0.08 SFR contribution in Q1) (1) Stabilized portfolio net operating income (“NOI”) margin: 66.5% in Q2 vs. 64.4% in Q1(1) 9.0% NOI increase on annual same store home portfolio for the period Q2 2015 vs. Q2 2014(1) Core FFO, stabilized portfolio NOI margin and same store NOI are non-generally accepted accounting principles (“GAAP”) measures. For explanations of these measures and reconciliations to the applicable GAAP measures, please refer to the “NAREIT FFO & Core FFO” and “Definitions and Reconciliations” pages of this presentation. Inclusive of acquisition and actual & expected renovation costs. Gross yield is calculated by dividing the annualized estimated average rent per home by the aggregate investment. Please refer to the “Definitions and Reconciliations” pages of this presentation for a definition of stabilized home portfolio. 1 Operations 96.6% stabilized home portfolio lease percentage at June 30, 2015 vs. 96.8% at March 31, 2015(4) 92.2% total rental portfolio lease percentage at June 30, 2015 vs. 89.1% at March 31, 2015 Achieved weighted average rent growth of 2.9%, driven by 3.7% rollover rent growth ABOUT SWAY Q2 2015 Highlights

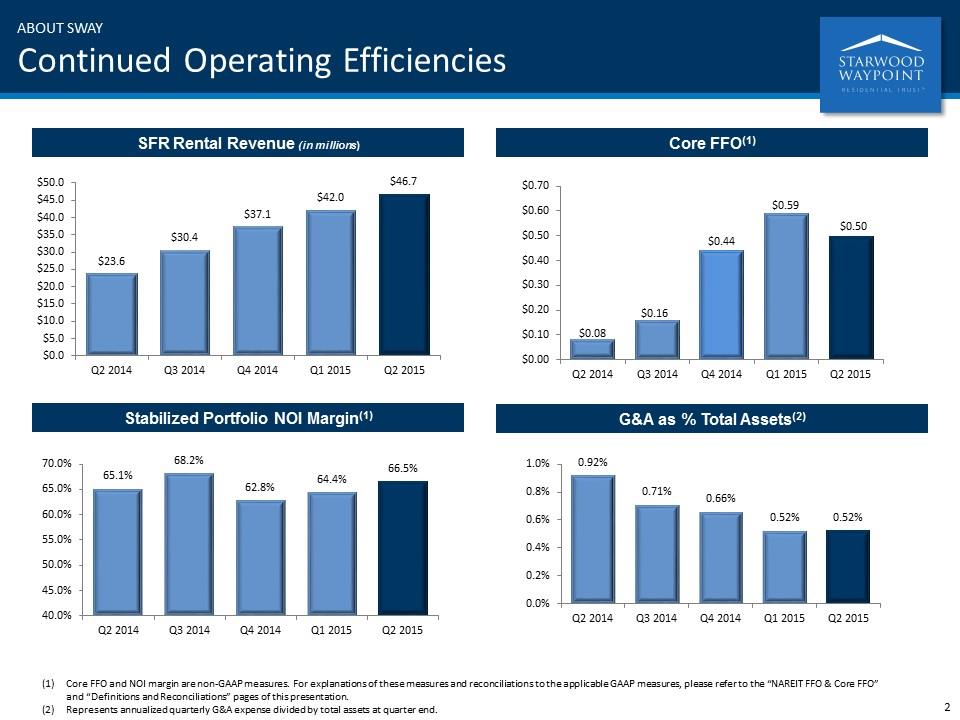

SFR Rental Revenue (in millions) Core FFO(1) ABOUT SWAY Continued Operating Efficiencies Core FFO and NOI margin are non-GAAP measures. For explanations of these measures and reconciliations to the applicable GAAP measures, please refer to the “NAREIT FFO & Core FFO” and “Definitions and Reconciliations” pages of this presentation. Represents annualized quarterly G&A expense divided by total assets at quarter end. Stabilized Portfolio NOI Margin(1) G&A as % Total Assets(2) 2

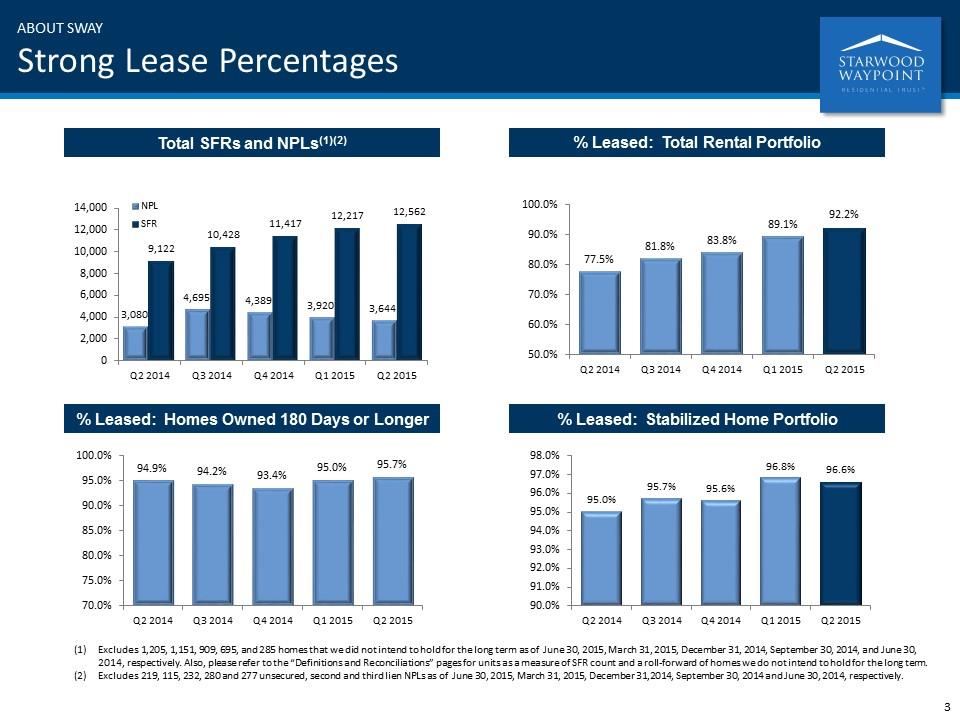

Total SFRs and NPLs(1)(2) % Leased: Total Rental Portfolio ABOUT SWAY Strong Lease Percentages % Leased: Homes Owned 180 Days or Longer % Leased: Stabilized Home Portfolio 3 Excludes 1,205, 1,151, 909, 695, and 285 homes that we did not intend to hold for the long term as of June 30, 2015, March 31, 2015, December 31, 2014, September 30, 2014, and June 30, 2014, respectively. Also, please refer to the “Definitions and Reconciliations” pages for units as a measure of SFR count and a roll-forward of homes we do not intend to hold for the long term. Excludes 219, 115, 232, 280 and 277 unsecured, second and third lien NPLs as of June 30, 2015, March 31, 2015, December 31,2014, September 30, 2014 and June 30, 2014, respectively.

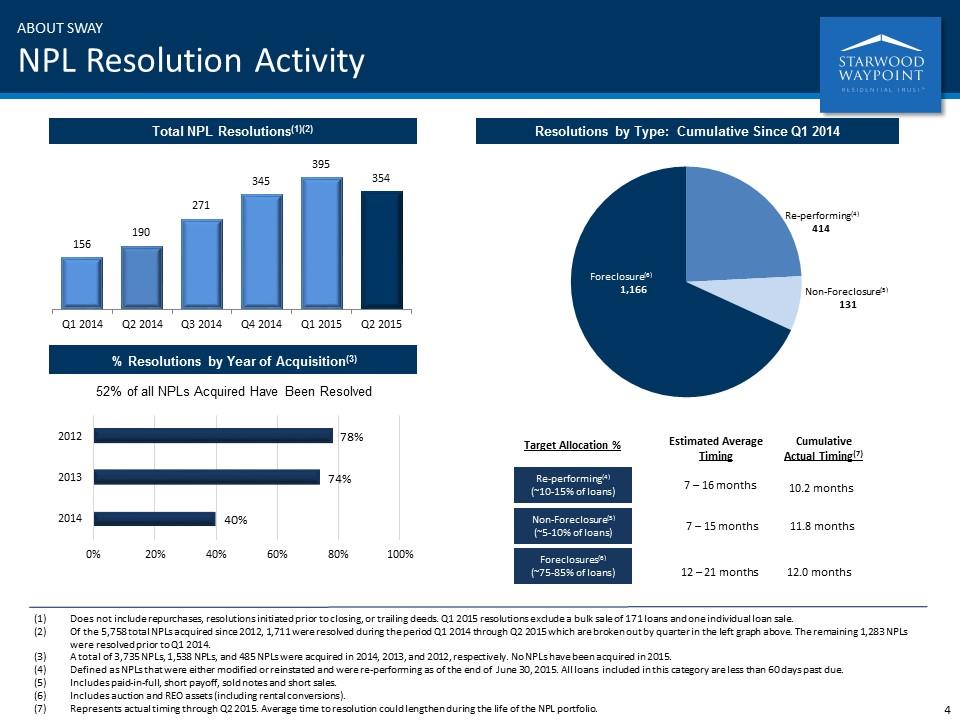

ABOUT SWAY NPL Resolution Activity Total NPL Resolutions(1)(2) 4 Does not include repurchases, resolutions initiated prior to closing, or trailing deeds. Q1 2015 resolutions exclude a bulk sale of 171 loans and one individual loan sale. Of the 5,758 total NPLs acquired since 2012, 1,711 were resolved during the period Q1 2014 through Q2 2015 which are broken out by quarter in the left graph above. The remaining 1,283 NPLs were resolved prior to Q1 2014. A total of 3,735 NPLs, 1,538 NPLs, and 485 NPLs were acquired in 2014, 2013, and 2012, respectively. No NPLs have been acquired in 2015. Defined as NPLs that were either modified or reinstated and were re-performing as of the end of June 30, 2015. All loans included in this category are less than 60 days past due. Includes paid-in-full, short payoff, sold notes and short sales. Includes auction and REO assets (including rental conversions). Represents actual timing through Q2 2015. Average time to resolution could lengthen during the life of the NPL portfolio. Resolutions by Type: Cumulative Since Q1 2014 Re-performing(4) (~10-15% of loans) Non-Foreclosure(5) (~5-10% of loans) Foreclosures(6) (~75-85% of loans) Estimated Average Timing Cumulative Actual Timing(7) 7 – 16 months 7 – 15 months 12 – 21 months 10.2 months 11.8 months 12.0 months Re-performing(4) 414 Non-Foreclosure(5) 131 Target Allocation % % Resolutions by Year of Acquisition(3) 52% of all NPLs Acquired Have Been Resolved

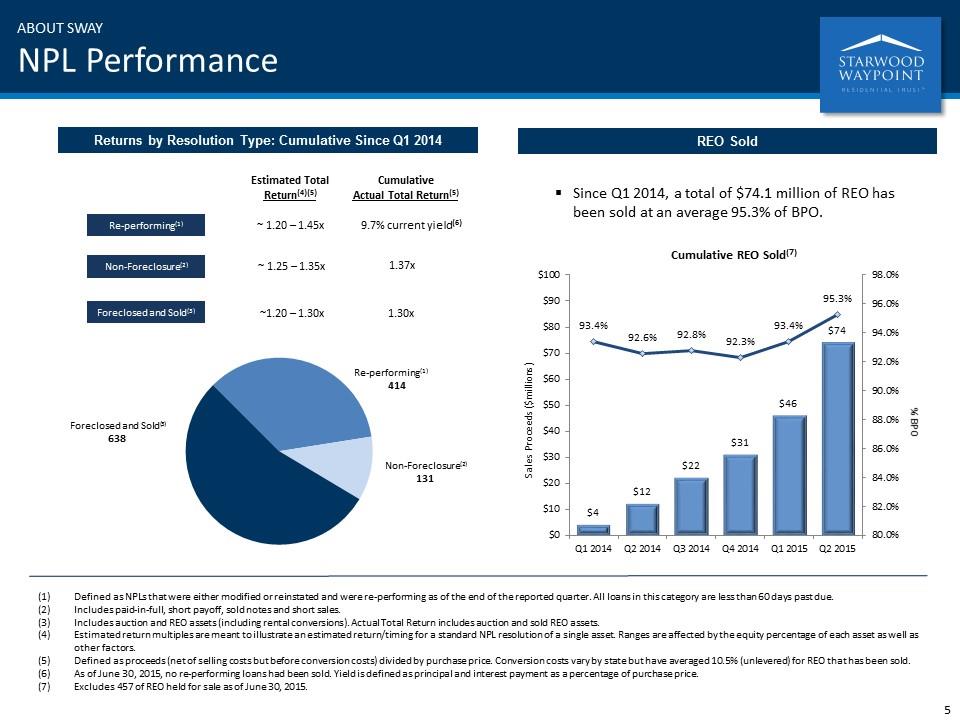

ABOUT SWAY NPL Performance Defined as NPLs that were either modified or reinstated and were re-performing as of the end of the reported quarter. All loans in this category are less than 60 days past due. Includes paid-in-full, short payoff, sold notes and short sales. Includes auction and REO assets (including rental conversions). Actual Total Return includes auction and sold REO assets. Estimated return multiples are meant to illustrate an estimated return/timing for a standard NPL resolution of a single asset. Ranges are affected by the equity percentage of each asset as well as other factors. Defined as proceeds (net of selling costs but before conversion costs) divided by purchase price. Conversion costs vary by state but have averaged 10.5% (unlevered) for REO that has been sold. As of June 30, 2015, no re-performing loans had been sold. Yield is defined as principal and interest payment as a percentage of purchase price. Excludes 457 of REO held for sale as of June 30, 2015. 5 Sales Proceeds ($millions) Since Q1 2014, a total of $74.1 million of REO has been sold at an average 95.3% of BPO. % BPO Cumulative REO Sold(7) REO Sold Re-performing(1) Non-Foreclosure(2) Foreclosed and Sold(3) Estimated Total Return(4)(5) Cumulative Actual Total Return(5) ~ 1.20 – 1.45x ~ 1.25 – 1.35x ~1.20 – 1.30x 9.7% current yield(6) 1.37x 1.30x Re-performing(1) 414 Non-Foreclosure(2) 131 Returns by Resolution Type: Cumulative Since Q1 2014 Foreclosed and Sold(3) 638

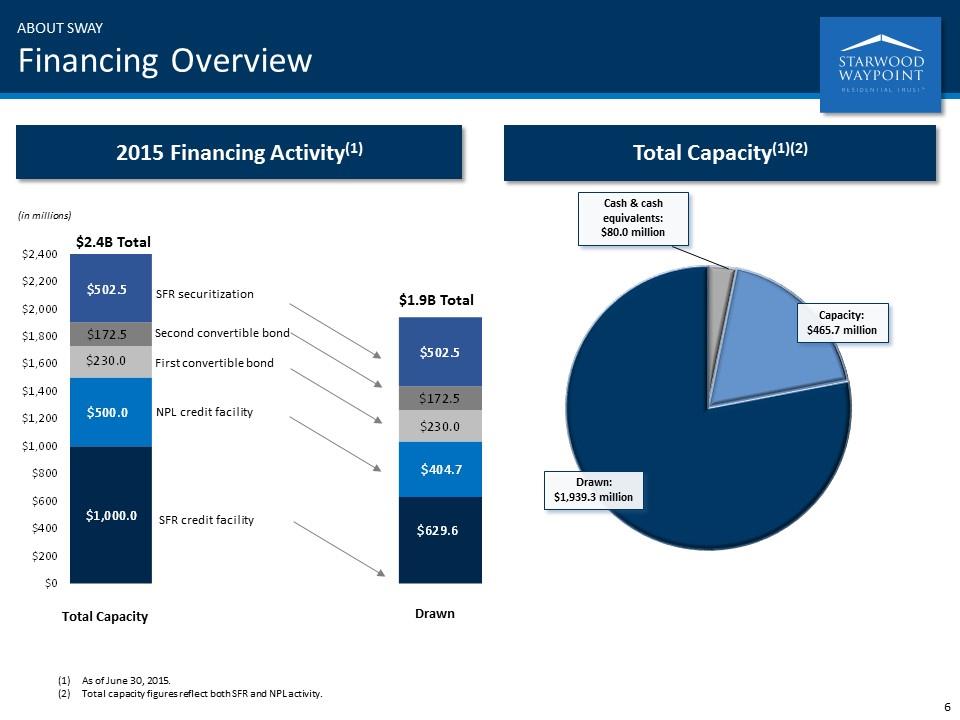

ABOUT SWAY Financing Overview 2015 Financing Activity(1) Total Capacity(1)(2) Drawn: $1,939.3 million Capacity: $465.7 million As of June 30, 2015. Total capacity figures reflect both SFR and NPL activity. (in millions) Total Capacity First convertible bond 6 Cash & cash equivalents: $80.0 million Second convertible bond SFR securitization $2.4B Total $1.9B Total Drawn NPL credit facility SFR credit facility

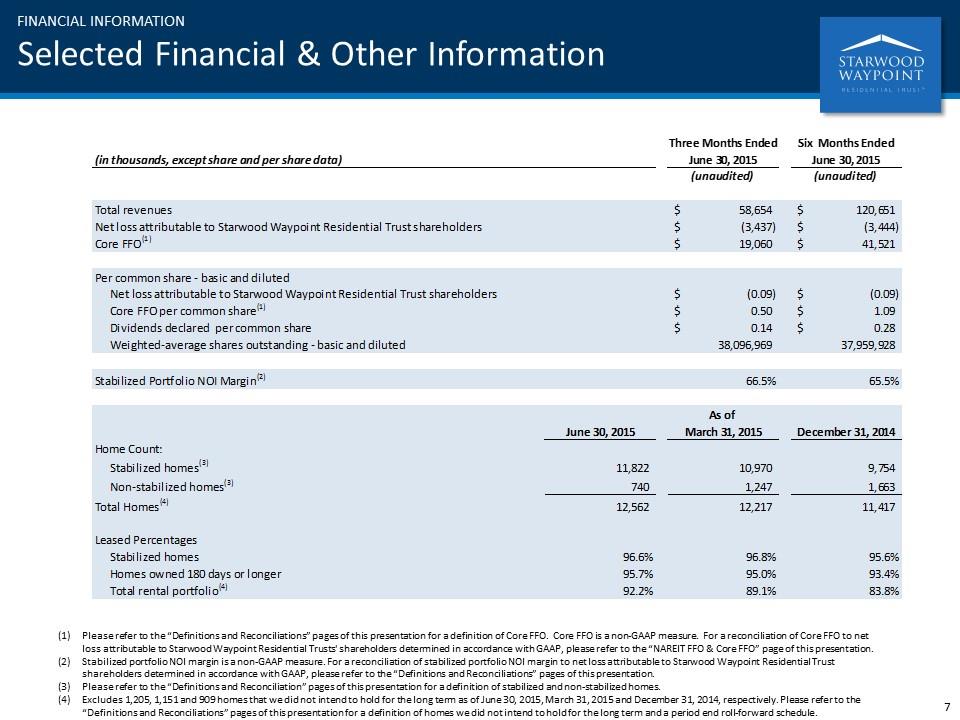

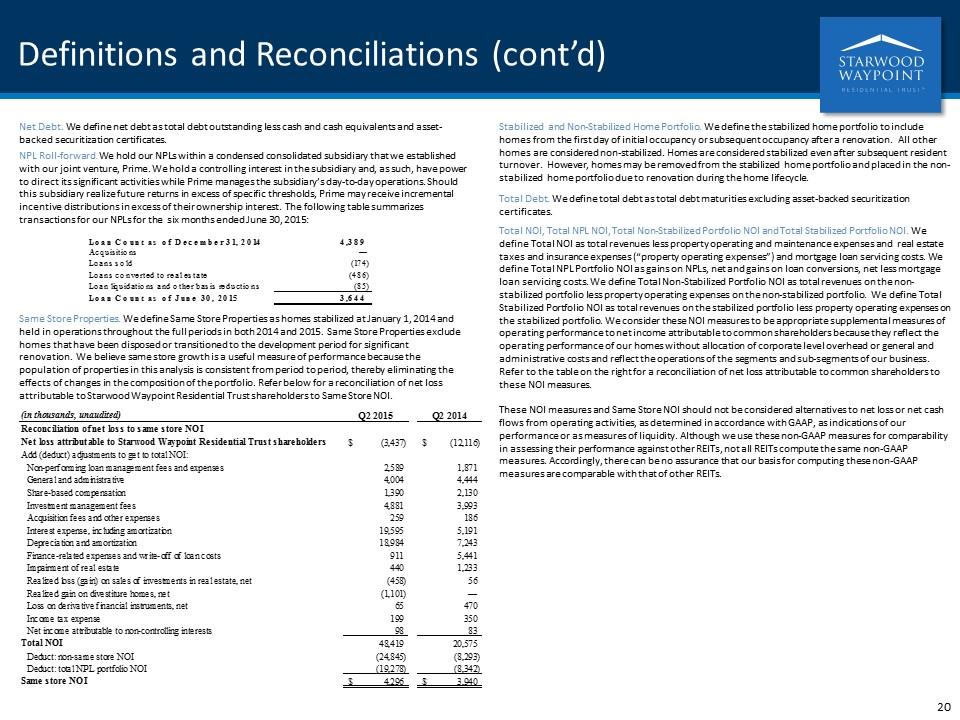

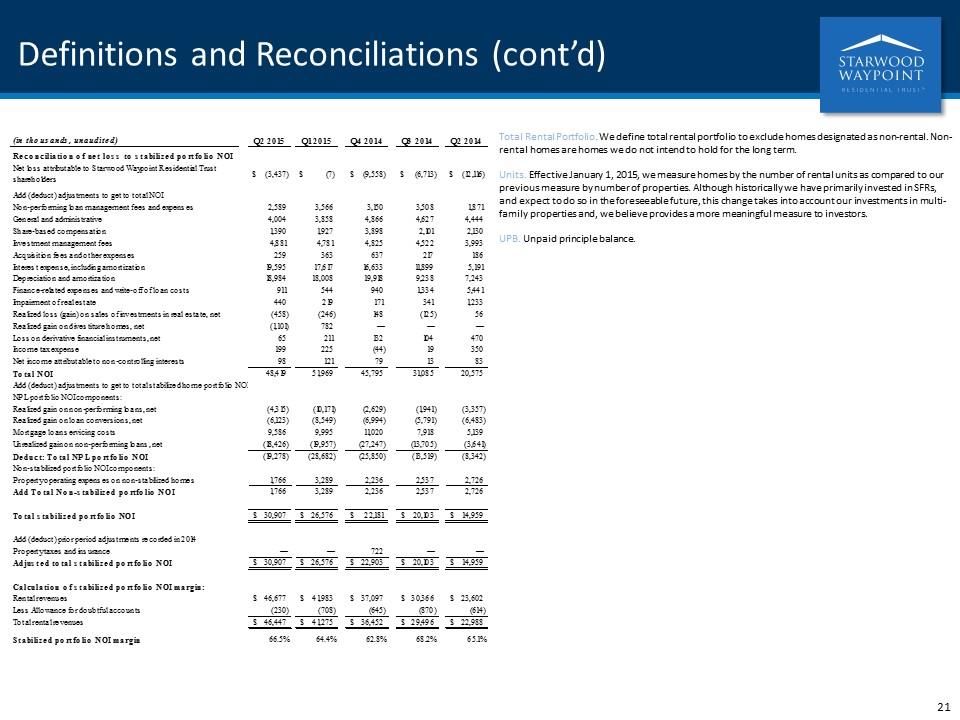

7 FINANCIAL INFORMATION Selected Financial & Other Information Please refer to the “Definitions and Reconciliations” pages of this presentation for a definition of Core FFO. Core FFO is a non-GAAP measure. For a reconciliation of Core FFO to net loss attributable to Starwood Waypoint Residential Trusts' shareholders determined in accordance with GAAP, please refer to the “NAREIT FFO & Core FFO” page of this presentation. Stabilized portfolio NOI margin is a non-GAAP measure. For a reconciliation of stabilized portfolio NOI margin to net loss attributable to Starwood Waypoint Residential Trust shareholders determined in accordance with GAAP, please refer to the “Definitions and Reconciliations” pages of this presentation. Please refer to the “Definitions and Reconciliation” pages of this presentation for a definition of stabilized and non-stabilized homes. Excludes 1,205, 1,151 and 909 homes that we did not intend to hold for the long term as of June 30, 2015, March 31, 2015 and December 31, 2014, respectively. Please refer to the “Definitions and Reconciliations” pages of this presentation for a definition of homes we did not intend to hold for the long term and a period end roll-forward schedule. Three Months Ended Six Months Ended (in thousands, except share and per share data) $42,185 $42,185 (unaudited) (unaudited) Total revenues $58,654 $,120,651 Net loss attributable to Starwood Waypoint Residential Trust shareholders $-3,437 $-3,444 Core FFO(1) $19,060 $41,521 AFFO, as defined by Waypoint Homes Per common share - basic and diluted Net loss attributable to Starwood Waypoint Residential Trust shareholders $-9.021715087097873E-2 $-9.0727253223451848E-2 Core FFO per common share(1) $0.50030226814106915 $1.0938113475873821 Dividends declared per common share $0.14000000000000001 $0.28000000000000003 Weighted-average shares outstanding - basic and diluted 38,096,969 37,959,928 Weighted Average Shares Outstanding, Diluted 38,142,566.40271125 38,004,196.12960732 Stabilized Portfolio NOI Margin(2) 0.66541939070189138 0.65528601719067048 Leased Home Portfolio NOI Margin(2) As of $42,185 $42,094 December 31, 2014 Home Count: Stabilized homes(3) 11822 10970 9754 Non-stabilized homes(3) 740 1247 1663 Total Homes(4) 12562 12217 11417 Leased Percentages Stabilized homes 0.96608018947724583 0.9684594348222425 0.95571047775271678 Homes owned 180 days or longer 0.95657579255838732 0.95011921793037668 0.93448047650562538 Total rental portfolio(4) 0.92238497054609137 0.89121715642138 0.83793173921929276 Three Months Ended Six Months Ended (in thousands, except share and per share data) $42,185 $42,185 (unaudited) (unaudited) Total revenues $58,654 $,120,651 Net loss attributable to Starwood Waypoint Residential Trust shareholders $-3,437 $-3,444 Core FFO(1) $19,060 $41,521 AFFO, as defined by Waypoint Homes Per common share - basic and diluted Net loss attributable to Starwood Waypoint Residential Trust shareholders $-9.021715087097873E-2 $-9.0727253223451848E-2 Core FFO per common share(1) $0.50030226814106915 $1.0938113475873821 Dividends declared per common share $0.14000000000000001 $0.28000000000000003 Weighted-average shares outstanding - basic and diluted 38,096,969 37,959,928 Weighted Average Shares Outstanding, Diluted 38,142,566.40271125 38,004,196.12960732 Stabilized Portfolio NOI Margin(2) 0.66541939070189138 0.65528601719067048 Leased Home Portfolio NOI Margin(2) As of $42,185 $42,094 December 31, 2014 Home Count: Stabilized homes(3) 11822 10970 9754 Non-stabilized homes(3) 740 1247 1663 Total Homes(4) 12562 12217 11417 Leased Percentages Stabilized homes 0.96608018947724583 0.9684594348222425 0.95571047775271678 Homes owned 180 days or longer 0.95657579255838732 0.95011921793037668 0.93448047650562538 Total rental portfolio(4) 0.92238497054609137 0.89121715642138 0.83793173921929276