Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CPI AEROSTRUCTURES INC | v417367_8-k.htm |

Exhibit 99.1

A Premier Supplier of Aircraft Structures and Systems NYSE MKT: CVU Q2’2015 Results Presentation August 6, 2015 Speakers: Douglas McCrosson , President & Chief Executive Officer Vincent Palazzolo, Chief Financial Officer

Forward Looking Statements 2 This presentation contains forward - looking statements that involve risks and uncertainties . All statements, other than statements of historical fact, included in this presentation, including without limitation, statements regarding projections, future financing needs, and statements regarding future plans and objectives of the Company, are forward - looking statements . Words such as "believes," "expects," "anticipates," "intends," "plans," "estimates" and similar expressions are intended to identify forward - looking statements . These forward - looking statements are based upon the current expectations of management and certain assumptions that are subject to risks and uncertainties . Accordingly, there can be no assurance that such risks and uncertainties will not affect the accuracy of the forward - looking statements contained herein or that our actual results will not differ materially from the results anticipated in such forward - looking statements . Such factors include, but are not limited to, the following : the cyclicality of the aerospace market, the level of U . S . defense spending, production rates for commercial and military aircraft programs, competitive pricing pressures, start - up costs for new programs, technology and product development risks and uncertainties, product performance, increasing consolidation of customers and suppliers in the aerospace industry and costs resulting from changes to and compliance with applicable regulatory requirements . The information contained in this presentation is qualified in its entirety by cautionary statements and risk factors disclosed in the Company's Securities and Exchange Commission filings, including its Annual Report on Form 10 - K filed on March 6 , 2015 and Form 10 - Q filed on May 8 , 2015 available at http : //www . sec . gov . We caution readers not to place undue reliance on any forward - looking statements, which speak only as of the date hereof and for which the Company assumes no obligation to update or revise the forward - looking statements herein . CPI AERO is a registered trademark of CPI Aerostructures, Inc . All other trademarks referenced herein are the property of their respective owners .

Speaker Recent Highlights Douglas McCrosson President & Chief Executive Officer 3

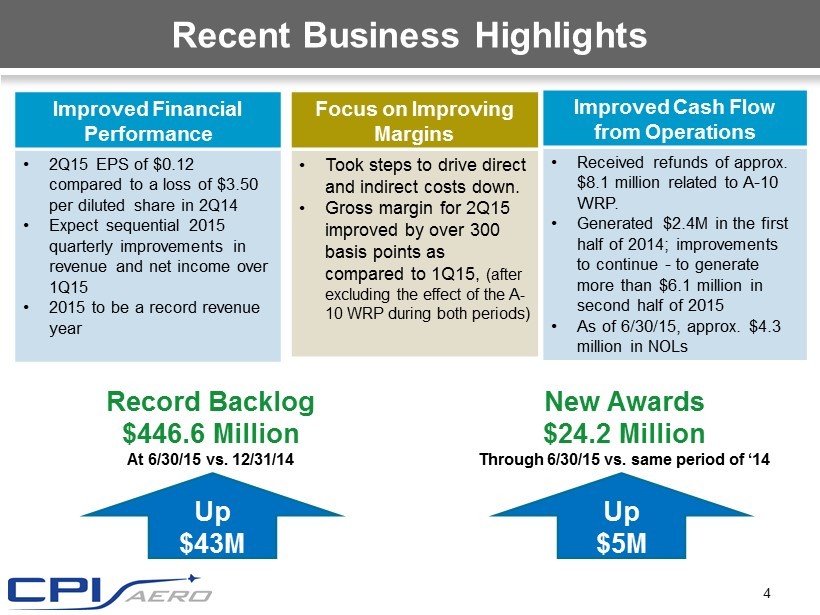

Recent Business Highlights 4 Up $43M Up $5M Record Backlog $446.6 Million At 6/30/15 vs. 12/31/14 New Awards $24.2 Million Through 6 /30/15 vs. same period of ‘14 Improved Financial Performance • 2Q15 EPS of $0.12 compared to a loss of $3.50 per diluted share in 2Q14 • Expect s equential 2015 quarterly improvements in revenue and net income over 1Q15 • 2015 to be a record revenue year Focus on Improving Margins • Took steps to drive direct and indirect costs down. • Gross margin for 2Q15 improved by over 300 basis points as compared to 1Q15, (after excluding the effect of the A - 10 WRP during both periods) Improved Cash Flow from Operations • Received refunds of approx. $8.1 million related to A - 10 WRP. • Generated $2.4M in the first half of 2014; improvements to continue - to generate more than $6.1 million in second half of 2015 • As of 6/30/15, approx. $4.3 million in NOLs

Speaker Financial Highlights Vincent Palazzolo Chief Financial Officer 5

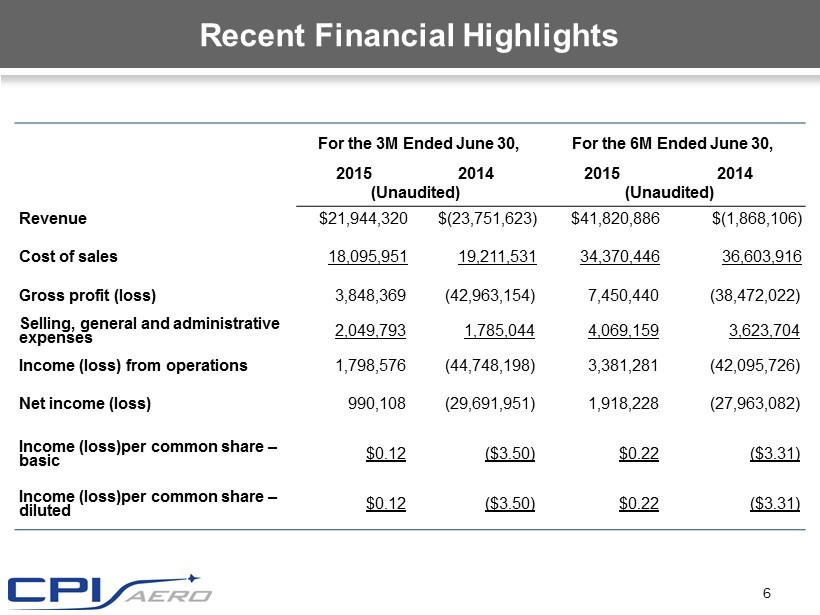

Recent Financial Highlights 6 For the 3M Ended June 30, For the 6M Ended June 30, 2015 2014 2015 2014 (Unaudited) (Unaudited) Revenue $21,944,320 $(23,751,623) $41,820,886 $(1,868,106) Cost of sales 18,095,951 19,211,531 34,370,446 36,603,916 Gross profit (loss) 3,848,369 (42,963,154) 7,450,440 (38,472,022) Selling, general and administrative expenses 2,049,793 1,785,044 4,069,159 3,623,704 Income (loss ) from operations 1,798,576 (44,748,198) 3,381,281 (42,095,726) Net income ( loss) 990,108 (29,691,951) 1,918,228 (27,963,082) Income (loss)per common share – basic $ 0.12 ($3.50) $ 0.22 ($3.31) Income (loss)per common share – diluted $0.12 ($3.50) $ 0.22 ($3.31)

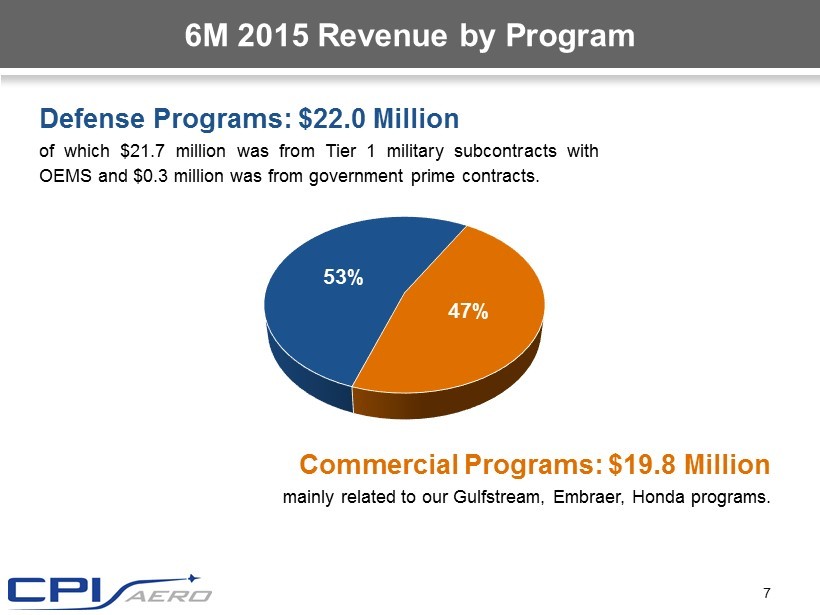

6M 2015 Revenue by Program 7 Defense Programs : $ 22 . 0 Million of which $ 21 . 7 million was from Tier 1 military subcontracts with OEMS and $ 0 . 3 million was from government prime contracts . 47% 53% Commercial Programs : $19.8 Million mainly related to our Gulfstream, Embraer, Honda programs.

6M 2015 Gross Margin 8 17 . 8 % in 6 M 2015 vs . negative margin in 6 M 2014 Affected by the change in estimate to the A - 10 program as we continued to record revenue on the A - 10 with zero gross margin Excluding the effect of the A - 10 Program 23.4% in 6M 2015 vs. 20.3% in 6M 2014 Over 300 basis points improvement This increase is primarily the result of higher gross margin on certain commercial programs as production rates have increased

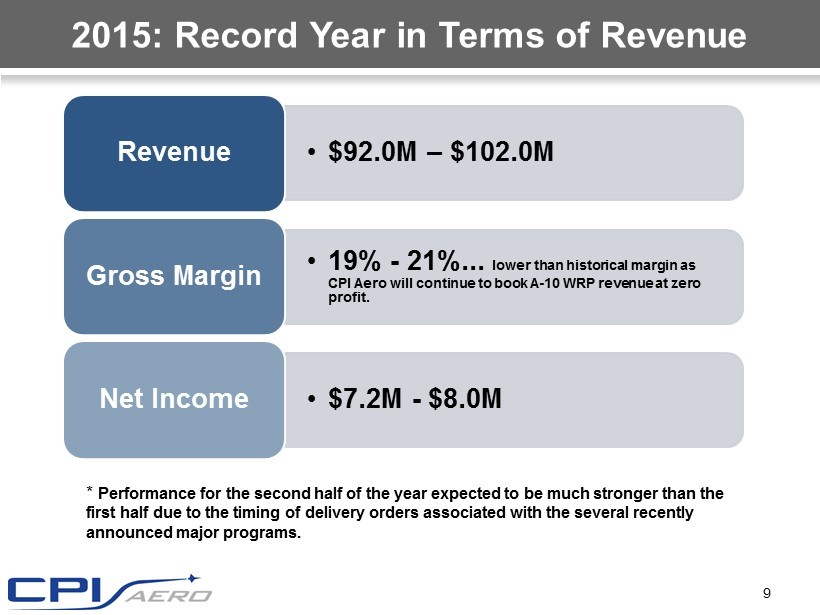

2015: Record Year in Terms of Revenue 9 * Performance for the second half of the year expected to be much stronger than the first half due to the timing of delivery orders associated with the several recently announced major programs. • $92.0M – $102.0M Revenue • 19% - 21%... lower than historical margin as CPI Aero will continue to book A - 10 WRP revenue at zero profit. Gross Margin • $7.2M - $8.0M Net Income

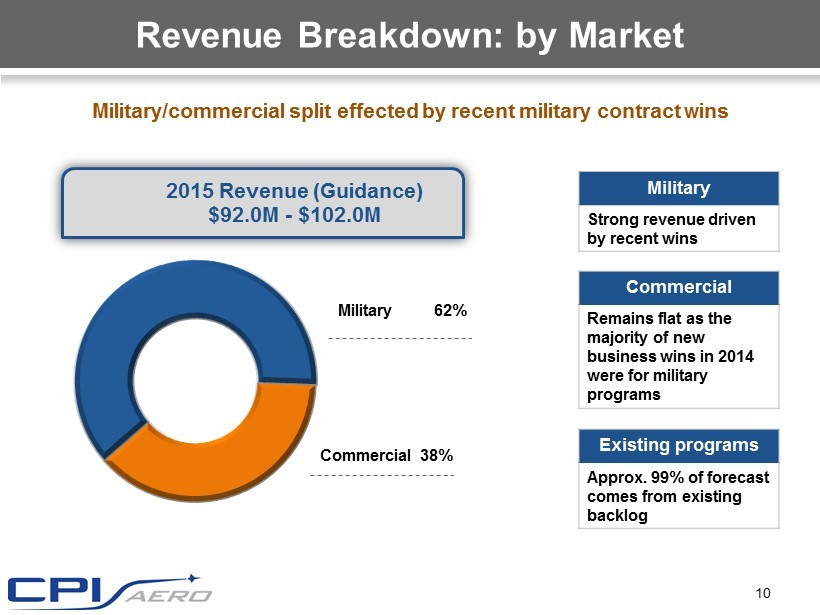

Revenue Breakdown: by Market Commercial 38% Military 62% 2015 Revenue (Guidance) $92.0M - $102.0M Military/commercial split effected by recent military contract wins 10 Military Strong revenue driven by recent wins Commercial Remains flat as the majority of new business wins in 2014 were for military programs Existing programs Approx. 99% of forecast comes from existing backlog

Revenue Breakdown: by Subcontractor Role Tier 1 82% Tier 2 15% Prime 3% 2015 Revenue (Guidance) $92.0M - $102.0M 11 Prime More than doubles due to recent wins Tier 1 Double digit growth Tier 2 Slight decline due to G650

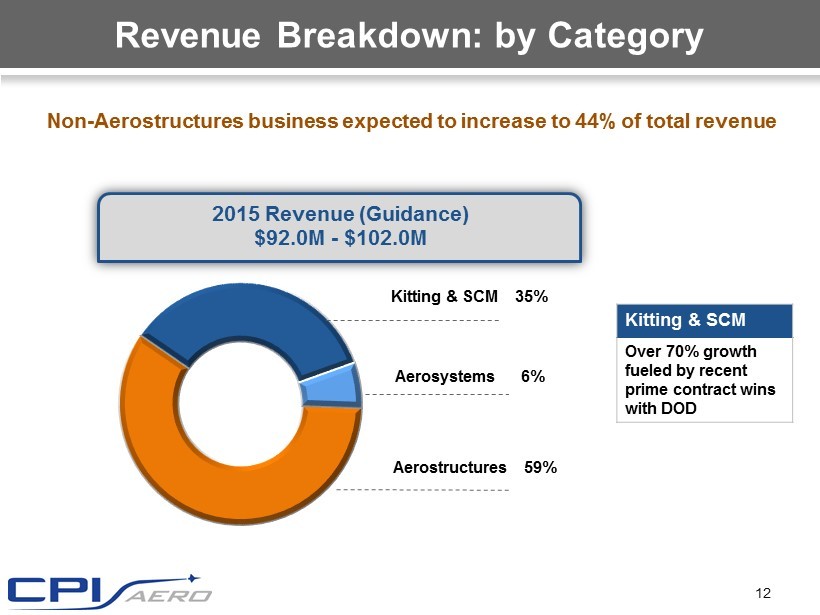

Revenue Breakdown: by Category 2015 Revenue (Guidance) $92.0M - $102.0M Non - Aerostructures business expected to increase to 44% of total revenue 12 Kitting & SCM Over 70% growth fueled by recent prime contract wins with DOD Aerostructures 59% Aerosystems 6% Kitting & SCM 35%

2015 Financial Initiatives Strengthen Financial Position Invest in Automation & Robotics Generate Positive Cash Flow from Operations Further Reduce Overhead & SG&A Expenses Expect to continue to pay down debt and reduce interest expense Investments anticipated to favorably impact operating efficiencies Currently at historical low rates Generated $2.4 M in cash from operations for the first six months of 2015, compared to negative $ 9.5M during the same period in 2014. 13

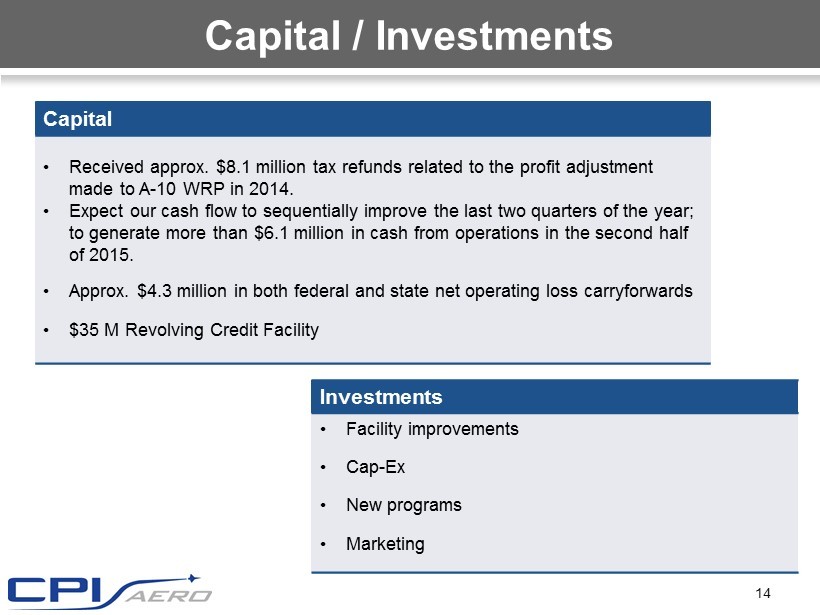

Capital / Investments Capital • Received approx. $8.1 million tax refunds related to the profit adjustment made to A - 10 WRP in 2014. • Expect our cash flow to sequentially improve the last two quarters of the year; to generate more than $6.1 million in cash from operations in the second half of 2015. • Approx. $4.3 million in both federal and state net operating loss carryforwards • $35 M Revolving Credit Facility Investments • Facility improvements • Cap - Ex • New programs • Marketing 14

Speaker Backlog, Recent Programs, Bids and Market Update Douglas McCrosson President & Chief Executive Officer 15

Funded 29% / Unfunded 71% $130.6M $316.0M Funded Unfunded Unfunded backlog represents remaining potential value of long term agreements Defense 70% / Commercial 30% $314.0M $132.6M Military Aerospace Commercial Record Backlog Consolidated Backlog at 6/30/2015 – $446.6 Million 16

Long - Term Visibility - Contracts (as of 6/30/15) Firm, Funded Contracts Provide Long - Term Revenue Visibility and Operating Leverage NORTHROP GRUMMAN - for the E - 2D and C - 2A aircraft TRIUMPH GROUP - for the Gulfstream G650 business jet SIKORSKY - for the S - 92® helicopter HONDA AIRCRAFT - for the HondaJet business jet BELL HELICOPTER - for the AH - 1Z ZULU attack helicopter UTC AEROSPACE SYSTEMS – for the DB - 110 ISR Pod EMBRAER - for the Embraer Phenom 300 business jet SIKORSKY - for the UH - 60 BLACK HAWK TEXTRON - for the Cessna Citation X+ civilian jet ‘08 ‘09 ’10 ’11 ’12 ’13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ‘25 US GOVERNMENT - for the F16 aircraft Potential to collectively generate revenue of $446.6M during their remaining periods of performance US GOVERNMENT - for the T - 38C aircraft 17 LOCKHEED - for the F - 35 aircraft

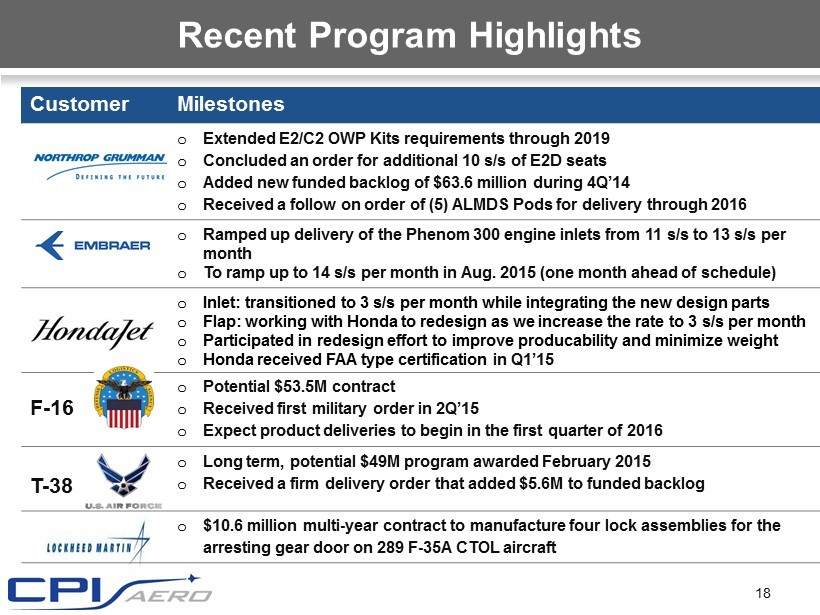

Recent Program Highlights Customer Milestones o Extended E2/C2 OWP Kits requirements through 2019 o Concluded an order for additional 10 s/s of E2D seats o Added new funded backlog of $63.6 million during 4Q’14 o Received a follow on order of (5) ALMDS Pods for delivery through 2016 o Ramped up delivery of the Phenom 300 engine inlets from 11 s/s to 13 s/s per month o To ramp up to 14 s/s per month in Aug. 2015 (one month ahead of schedule) o Inlet: transitioned to 3 s/s per month while integrating the new design parts o Flap: working with Honda to redesign as we increase the rate to 3 s/s per month o Participated in redesign effort to improve producability and minimize weight o Honda received FAA type certification in Q1’15 F - 16 o Potential $53.5M contract o Received first military order in 2Q’15 o Expect product deliveries to begin in the first quarter of 2016 T - 38 o Long term, potential $49M program awarded February 2015 o Received a firm delivery order that added $5.6M to funded backlog o $10.6 million m ulti - year contract to manufacture four lock assemblies for the arresting gear door on 289 F - 35A CTOL aircraft 18

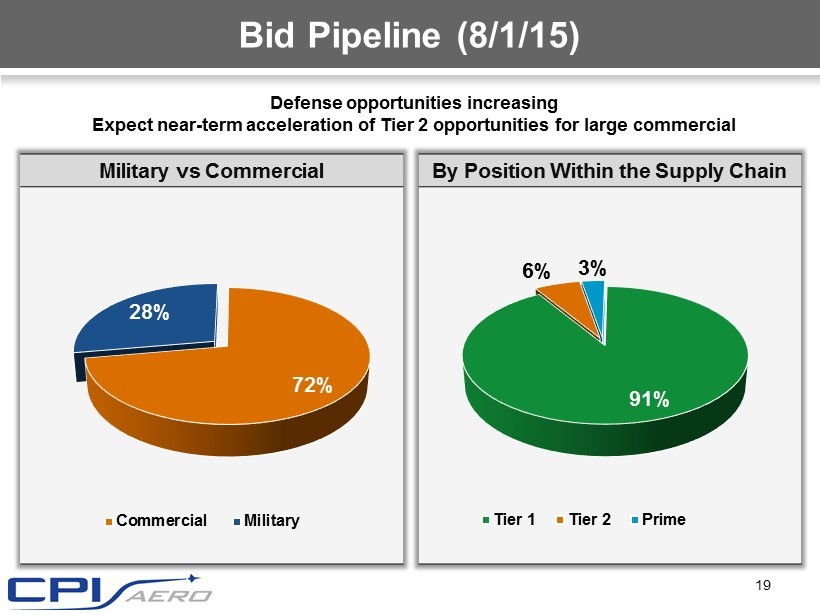

Bid Pipeline (8/1/15) Military vs Commercial 72% 28% Commercial Military By Position Within the Supply Chain Defense opportunities increasing Expect near - term acceleration of Tier 2 opportunities for large c ommercial 91% 6% 3% Tier 1 Tier 2 Prime 19

Bid Landscape Boeing 787 Dreamliner Bombardier C - series Boeing 767 Embraer E2 20

Focus Areas: 2015 and 2016 EXECUTE Maintain and grow Tier 1 status Continuously improve delivery , quality and performance Improve margins Improve cash flow GROW Continued investment in automation and productivity Replace retired program revenues with additional new long - term programs Focus on organic growth May consider acquisitions to gain scale, enter new markets EVOLVE Deploy capital to create shareholder value Expand global supply chain services and MRO Continued improvement of design and manufacturing capabilities Drive balance across segments and diversify customer base 21

Conclusion CPI is well positioned to continue to grow its business due to: • Large, diversified and growing backlog • Growing bid pipeline – new opportunities for both the defense and commercial markets • Ability to perform on larger and more complex programs due to investments in advanced technologies • Vast growth opportunities arising from developments in both commercial aerospace and military/defense sector • Opportunities in North America and internationally 22

Q&A Q&A Session Douglas McCrosson President & Chief Executive Officer Vincent Palazzolo Chief Financial Officer 23

Contact us CPI Aerostructures Vincent Palazzolo, CFO (631) 586 - 5200 www.cpiaero.com Investor Relations Lena Cati (212) 836 - 9611 www.theequitygroup.com lcati@equityny.com 24