Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Boot Barn Holdings, Inc. | a2225541zex-21_1.htm |

| EX-23.2 - EX-23.2 - Boot Barn Holdings, Inc. | a2225541zex-23_2.htm |

Use these links to rapidly review the document

Table of contents

As filed with the Securities and Exchange Commission on July 31, 2015.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BOOT BARN HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5600 (Primary Standard Industrial Classification Code Number) |

90-0776290 (I.R.S. Employer Identification Number) |

15776 Laguna Canyon Road

Irvine, California 92618

(949) 453-4400

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

James G. Conroy

President and Chief Executive Officer

Boot Barn Holdings, Inc.

15776 Laguna Canyon Road

Irvine, California 92618

(949) 453-4400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Howard A. Kenny Morgan, Lewis & Bockius LLP 101 Park Avenue New York, New York 10178 (212) 309-6000 |

Johnny G. Skumpija Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per share(2) |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee(1)(2) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.0001 |

6,325,000 | $30.99 | $196,011,750 | $22,776.57 | ||||

|

||||||||

(1) Includes the 825,000 additional shares of common stock that the underwriters have the option to purchase from the selling stockholders.

(2) Estimated pursuant to Rule 457(c) under the Securities Act of 1933 (based on the average high and low prices of the registrant's common stock on the New York Stock Exchange on July 27, 2015) solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated July 31, 2015

The information in this preliminary prospectus is not complete and may be changed. These shares may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these shares and the selling stockholders are not soliciting offers to buy these shares in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

5,500,000 shares

Common stock

This is a public offering of common stock of Boot Barn Holdings, Inc. The selling stockholders named in this prospectus, who are certain of our directors, officers and other affiliates, are selling 5,500,000 shares of our common stock, and we will not receive any proceeds from the sale of the shares by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol "BOOT." On July 29, 2015, the last reported sale price of our common stock on the New York Stock Exchange was $31.55 per share.

The selling stockholders have granted the underwriters an option to purchase up to 825,000 additional shares of our common stock at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus. We will not receive any proceeds from the exercise of the underwriters' option to purchase additional shares.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, and therefore have elected to comply with certain reduced public company reporting requirements. See "Prospectus summary—Implications of being an emerging growth company."

Investing in our common stock involves risks. See "Risk factors" beginning on page 14 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Public offering price |

$ | $ | |||||

Underwriting discount* |

$ |

$ |

|||||

Proceeds to the selling stockholders, before expenses |

$ |

$ |

|||||

| | | | | | | | |

* We refer you to "Underwriting" beginning on page 54 of this prospectus for additional information regarding underwriting compensation.

The underwriters expect to deliver the shares to purchasers on or about , 2015 through the book entry facilities of The Depository Trust Company.

| |

|

|

||

|---|---|---|---|---|

| J.P. Morgan | Piper Jaffray | Jefferies |

Prospectus dated , 2015

You should rely only on the information contained or incorporated by reference in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission (which we refer to as the "SEC"). Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained or incorporated by reference in this prospectus or in any free writing prospectus filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. The selling stockholders are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus or as of the date of the document incorporated by reference, as applicable, regardless of the time of delivery of this prospectus or any free writing prospectus, or of any sale of our common stock.

For investors outside of the U.S.: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the U.S.

i

We operate on a fiscal calendar that results in a 52- or 53-week fiscal year ending on the last Saturday of March, unless April 1 is a Saturday, in which case the fiscal year ends April 1. For ease of reference, we identify our fiscal year in this prospectus by reference to the calendar year in which the fiscal year ends. This prospectus contains references to fiscal 2013, fiscal 2014 and fiscal 2015, which represent our fiscal years ended March 30, 2013, March 29, 2014 and March 28, 2015, respectively, all of which were 52-week periods. In a 52-week fiscal year, each quarter includes 13 weeks of operations; in a 53-week fiscal year, the first, second and third quarters each include 13 weeks of operations and the fourth quarter includes 14 weeks of operations. Each quarter ends on the last Saturday of the 13-week period (or the 14-week period in a 53-week fiscal year).

As used in this prospectus "GAAP" means U.S. generally accepted accounting principles.

Amounts presented in this prospectus in millions are approximations of the actual amounts in that they have been rounded to the nearest one decimal place.

Unless the context requires otherwise, references in this prospectus to "Boot Barn," the "Company," "we," "us" and "our" refer to Boot Barn Holdings, Inc. and its consolidated subsidiaries. Except as the context otherwise requires, all information included in this prospectus is presented after giving effect to the June 2014 transaction, which we refer to as the "Reorganization," that is described in the section entitled "Business—Recent Acquisitions and Corporate Transactions—Reorganization" of our Annual Report on Form 10-K for the fiscal year ended March 28, 2015, as filed with the SEC on May 29, 2015 and incorporated by reference herein (which we refer to as our "Form 10-K").

References in this prospectus to "RCC" refer to RCC Western Stores, Inc., which we acquired in August 2012, references in this prospectus to "Baskins" refer to Baskins Acquisition Holdings, LLC, which we acquired in May 2013, and references in this prospectus to "Sheplers" refer to Sheplers Holding Corporation, which we acquired in June 2015.

We completed the acquisition of Sheplers, which we refer to as the "Sheplers Acquisition," on June 29, 2015, after the completion of the first quarter of our fiscal year 2016. See "Prospectus Summary—Recent Developments" for a description of Sheplers and the Sheplers Acquisition. We are in the process of integrating Sheplers' business with ours. Except as indicated or the context otherwise requires, information included in this prospectus is presented without giving effect to the integration of Sheplers.

This prospectus includes our trademarks and trade names, such as "Boot Barn" and the names of our private brands, which are protected under applicable intellectual property laws and are our property. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of any applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

ii

Unless otherwise indicated, statements contained or incorporated by reference in this prospectus concerning our industry and the markets in which we operate, including our general expectations and competitive position, business opportunity and market size, growth and share, are based on information from independent industry organizations and other third-party sources (including industry publications, surveys and forecasts), data from our internal research and management estimates. Management estimates are derived from publicly available information and the information and data referred to above, and are based on assumptions and calculations made by us based upon our interpretation of such information and data, and on our knowledge of our industry and the categories in which we operate, which we believe to be reasonable. Furthermore, the information and data referred to above are imprecise and may prove to be inaccurate because the information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. However, we are responsible for all of the disclosure in this prospectus and believe it to be reasonable. Projections, assumptions, expectations, beliefs and estimates regarding our industry and the categories in which we operate and our future performance are also necessarily subject to risk and change based on various factors, including those discussed in the sections entitled "Risk factors" of this prospectus and our Form 10-K.

Statements contained or incorporated by reference in this prospectus regarding our competitive position, business opportunity and market size, growth and share in the U.S. are based on data that may not account for certain retailers. However, we believe that this data is a reasonable approximation of all relevant retailers, and we have no reason to believe that the inclusion of additional retailers in the data collection process would materially change the conclusions that we have drawn from this data. In addition, statements contained or incorporated by reference in this prospectus regarding the characteristics and preferences of our customers are based on internal analyses of our customers that have not been independently verified. A broader sampling of our customers and different methodologies, among other variables, could lead to different results; however, we know of no better methodology for estimation, nor do we have any reason to believe that our consideration of additional or different survey data would materially change the conclusions that we have drawn from these surveys.

We use the term "same store sales" to refer to net sales from stores that have been open at least 13 full fiscal months as of the end of the current reporting period, although we include or exclude stores from our calculation of same store sales in accordance with the following additional criteria:

- •

- stores that are closed for five or fewer days in any fiscal month are included in same store sales;

- •

- stores that are closed temporarily, but for more than five days in any fiscal month, are excluded from same store sales beginning in

the fiscal month in which the temporary closure begins until the first full month of operation once the store re-opens;

- •

- stores that are closed temporarily and relocated within their respective trade areas are included in same store sales;

- •

- stores that are permanently closed are excluded from same store sales beginning in the month preceding closure; and

iii

- •

- acquired stores are added to same store sales beginning on the later of (a) the first day of the first fiscal month following its applicable acquisition date and (b) the first day of the first fiscal month after the store has been open for at least 13 full fiscal months regardless of whether the store has been operated under our management or predecessor management.

If the criteria described above are met, then all net sales of an acquired store, excluding those net sales before our acquisition of that store, are included for the period presented. However, when an acquired store is included for the period presented, the net sales of such acquired store for periods before its acquisition are included (to the extent relevant) for purposes of calculating "same stores sales growth" and illustrating the comparison between the applicable periods. Pre-acquisition net sales numbers are derived from the books and records of the acquired company, as prepared prior to the acquisition, and have not been independently verified by us.

In addition to retail store sales, same store sales also includes e-commerce sales, e-commerce shipping and handling revenue and actual retail store or e-commerce sales returns. We exclude gift card escheatment, provision for sales returns and future loyalty award redemptions from sales in our calculation of net sales per store.

Measuring the change in year-over-year same store sales allows us to evaluate how our store base is performing. Numerous factors affect our same store sales, including:

- •

- national and regional economic trends;

- •

- our ability to identify and respond effectively to regional consumer preferences;

- •

- changes in our product mix;

- •

- changes in pricing;

- •

- competition;

- •

- changes in the timing of promotional and advertising efforts;

- •

- holidays or seasonal periods; and

- •

- weather.

We use the term "same store sales growth" to refer to the percentage change in our same store sales as compared to the prior comparable period.

Opening new stores is an important part of our growth strategy and we anticipate that a significant percentage of our net sales in the near future will come from stores not included in our same store sales calculation. Accordingly, same store sales are only one measure we use to assess the success of our business and growth strategy. Some of our competitors and other retailers may calculate "same" or "comparable" store sales differently than we do. As a result, data contained or incorporated by reference in this prospectus regarding our same store sales may not be comparable to similar data made available by other retailers.

EBITDA and Adjusted EBITDA are financial measures that are not calculated in accordance with GAAP. We define EBITDA as net income (loss) adjusted to exclude income tax expense (benefit), net interest expense and depreciation and intangible asset amortization. We define Adjusted EBITDA as EBITDA adjusted to exclude non-cash stock-based compensation, the non-cash accrual for future award redemptions, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets, secondary offering costs and other unusual or non-recurring expenses. In this prospectus, we present these non-GAAP measures together with a reconciliation of

iv

EBITDA and Adjusted EBITDA to our net income, the most directly comparable financial measure calculated and presented in accordance with GAAP. See "Prospectus summary—Summary consolidated financial and other data."

We include EBITDA and Adjusted EBITDA in this prospectus because they are important financial measures that our management, board of directors and lenders use to assess our operating performance. We use EBITDA and Adjusted EBITDA as key performance measures because we believe that they facilitate operating performance comparisons from period to period by excluding potential differences primarily caused by the impact of variations from period to period in tax positions, interest expense and depreciation and amortization, as well as, in the case of Adjusted EBITDA, excluding non-cash expenses, such as non-cash stock-based compensation and the non-cash accrual for future award redemptions, and unusual or non-recurring costs and expenses that are not directly related to our operations, including acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets, secondary offering costs and other unusual or non-recurring expenses. Because EBITDA and Adjusted EBITDA facilitate internal comparisons of our historical operating performance on a more consistent basis, we also use EBITDA and Adjusted EBITDA (or some variations thereof) for business planning purposes, in calculating covenant compliance for our credit facilities, in determining incentive compensation for members of our management and in evaluating acquisition opportunities. In addition, we believe that EBITDA and Adjusted EBITDA and similar measures are widely used by investors, securities analysts, ratings agencies and other parties in evaluating companies in our industry as a measure of financial performance and debt-service capabilities.

Our use of EBITDA and Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are:

- •

- neither EBITDA nor Adjusted EBITDA reflects income tax expense or the cash requirements to pay our taxes;

- •

- neither EBITDA nor Adjusted EBITDA reflects our cash expenditures for capital equipment, leasehold improvements or other contractual

commitments;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the

future, and neither EBITDA nor Adjusted EBITDA reflects capital expenditure requirements for such replacements;

- •

- neither EBITDA nor Adjusted EBITDA reflects the interest expense or the cash requirements necessary to service interest or principal

payments under our credit facilities; and

- •

- neither EBITDA nor Adjusted EBITDA reflects changes in, or cash requirements for, our working capital needs.

EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Given that EBITDA and Adjusted EBITDA are measures not deemed to be in accordance with GAAP and are susceptible to varying calculations, our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including companies in our industry, because other companies may calculate EBITDA and Adjusted EBITDA in a different manner than we calculate these measures.

In evaluating EBITDA and Adjusted EBITDA, you should be aware that in the future we may or may not incur expenses similar to some of the adjustments in this presentation. Our presentation of EBITDA and Adjusted EBITDA does not imply that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider EBITDA and Adjusted EBITDA alongside other financial performance measures, including our net income and other GAAP results, and not rely on any single financial measure.

v

This summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus from our Form 10-K and our other filings with the SEC listed in the section entitled "Incorporation of documents by reference" of this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this prospectus and the documents incorporated by reference herein, including the sections entitled "Risk factors" of this prospectus and our Form 10-K and our consolidated financial statements and related notes included in our Form 10-K and incorporated by reference herein.

We are the largest and fastest-growing lifestyle retail chain devoted to western and work-related footwear, apparel and accessories in the U.S. With 176 stores in 28 states as of June 27, 2015, we have over twice as many stores as our nearest direct competitor that sells primarily western and work wear, and believe we have the potential to grow our store base to at least 500 domestic locations. Our stores, which are typically freestanding or located in strip centers, average 10,731 square feet and feature a comprehensive assortment of approximately 200 brands and more than 1,500 styles on average, coupled with attentive, knowledgeable store associates. We target a broad and growing demographic, ranging from passionate western and country enthusiasts to workers seeking dependable, high-quality footwear and clothing. We strive to offer an authentic, one-stop shopping experience that fulfills the everyday lifestyle needs of our customers and, as a result, many of our customers make purchases in both the western and work wear sections of our stores. Our store environment, product offering and marketing materials represent the aesthetics of the true American West, country music and rugged, outdoor work. These threads are woven together in our motto, "Be True," which communicates the genuine and enduring spirit of the Boot Barn brand.

Our product offering is anchored by an extensive selection of western and work boots and is complemented by a wide assortment of coordinating apparel and accessories. Many of the items that we offer are basics or necessities for our customers' daily lives and typically represent enduring styles that are not impacted by changing fashion trends. Accordingly, approximately 70% of our inventory is kept in stock through automated replenishment programs. The majority of our merchandise is sold at full price and is not subject to typical inventory markdowns. Our boot selection, which comprises approximately one-third of each store's selling square footage space, is merchandised on self-service fixtures with western boots arranged by size and work boots arranged by brand. This allows us to display the full breadth of our inventory and deliver a convenient shopping experience. We also carry market-leading assortments of denim, western shirts, cowboy hats, belts and belt buckles, western-style jewelry and accessories. Our western assortment includes many of the industry's most sought-after brands, such as Ariat, Dan Post, Justin, Levi Strauss, Lucchese, Miss Me, Montana Silversmiths, Resistol and Wrangler. Our work assortment includes rugged footwear, outerwear, overalls, denim and shirts for the most physically demanding jobs where durability, performance and protection matter, including safety-toe boots and flame-resistant and high-visibility clothing. Among the top work brands sold in our stores are Carhartt, Dickies, Timberland Pro and Wolverine. Our merchandise is also available on our e-commerce website, www.bootbarn.com.

Boot Barn was founded in 1978 and, over the past 37 years, has grown both organically and through successful strategic acquisitions of competing chains. We have rebranded and remerchandised the acquired chains under the Boot Barn banner, resulting in sales and profit increases over their original concepts. We are currently in the process of rebranding stores acquired in the Sheplers Acquisition. We believe that our

1

business model and scale provide us with competitive advantages that have contributed to our consistent and strong financial performance, generating sufficient cash flow to support national growth, as evidenced by:

- •

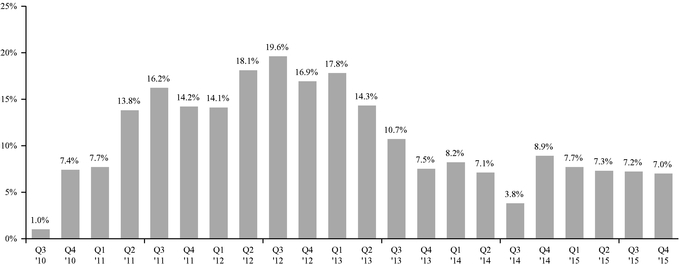

- 22 consecutive quarters of positive same store sales growth, through March 28, 2015, averaging 10.8% per quarter (see the

diagram below) and same store sales growth of 7.3% in fiscal 2015;

- •

- store base expansion to 176 stores as of June 27, 2015, with 30 new stores resulting from organic growth and 60 new stores

resulting from strategic acquisitions since March 31, 2012;

- •

- net sales of $402.7 million in fiscal 2015, an increase of $169.5 million since fiscal 2013, representing a compound

annual growth rate, or CAGR, of 31.4%; and

- •

- Adjusted EBITDA of $48.2 million in fiscal 2015, an increase of $19.3 million since fiscal 2013, representing a 29.1% CAGR (see "—Summary consolidated financial and other data" for a discussion and reconciliation of Adjusted EBITDA to net income).

Quarterly same store sales growth

22 consecutive quarters of growth

For a description of the manner in which we calculate same store sales, see "Same store sales" at the beginning of this prospectus.

We believe the following strengths differentiate us from our competitors and provide a solid foundation for future growth:

Powerful lifestyle brand. The Boot Barn brand is built on western lifestyle values that are core to American culture. Our deep understanding of this lifestyle enables us to create long-lasting relationships with our customers who embody these ideals. Our brand is highly visible through our sponsorship of rodeos, stock shows, concerts and country music artists. We sponsor local community rodeos, national rodeos and other country and western events. We sell our products through pop-up shops at several of the largest events that we sponsor. We believe these grassroots marketing efforts make our brand synonymous with the western lifestyle, validate our brand's authenticity and establish Boot Barn as the trusted specialty retailer for all of our customers' everyday needs.

2

Fast-growing specialty retailer of western and work wear in the U.S. Our broad geographic footprint, which currently spans 28 states and provides us with significant economies of scale, enhanced supplier relationships, the ability to recruit and retain high quality store associates and the ability to reinvest in our business at levels that we believe exceed those of our competition.

Attractive, loyal customer base. Our customers come to us for many aspects of their everyday footwear and clothing needs because of the breadth and availability of our product offering. In fiscal 2011, we implemented our customer loyalty program, B Rewarded, to enhance our connection and relationship with our customers. Our loyalty program has grown rapidly since its inception and includes approximately 2.8 million members who have purchased merchandise from us. A vast majority of our sales are made to these customers. We leverage this database, which provides useful information about our customers, to enhance our marketing activities across our channels, refine our merchandising and planning efforts and assist in our selection of sites for new stores.

Differentiated shopping experience. We deliver a one-stop shopping experience that engages our customers and, we believe, fulfills their lifestyle needs. Our stores are designed to create an inviting and engaging experience and include prominent storefront signage, a simple and easy-to-shop layout and a large and conveniently arranged self-service selection of boots. We offer significant inventory breadth and depth across a range of boots, apparel and accessories. We believe that our strong, long-lasting supplier relationships enhance our ability to provide a compelling merchandise assortment with a strong in-stock position both in-store and online. Our knowledgeable store associates are passionate about our merchandise and deliver a high level of service to our customers. These elements help promote customer loyalty and drive repeat visits.

Compelling merchandise assortment and strategy. We believe we offer a diverse merchandise assortment that features the most sought-after western and work wear brands, well-regarded niche brands and exclusive private brands across a range of boots, apparel and accessories. We have a core assortment of styles that serves as a foundation for our merchandising strategy and we augment and tailor that assortment by region to cater to local preferences. In fiscal 2015, the vast majority of our merchandise sales were at full price, which, we believe, demonstrates the strength of our brand and the less discretionary nature of our product offering.

Portfolio of exclusive private brands. We have leveraged our scale, merchandising experience and customer knowledge to launch a portfolio of private brands exclusive to us, including Shyanne, Cody James, Moonshine Spirit by Brad Paisley, American Worker, El Dorado and BB Ranch. Our private brands offer high-quality western and work boots as well as apparel and accessories for men, ladies and kids. Each of our private brands, which address product and price segments that we believe are underserved by third-party brands, offers exclusive products to our customers and achieves better merchandise margins. Customer receptivity and demand for our private brands has been strong, demonstrated by the private brands' increasing penetration and significant sales momentum across our store base and online.

Versatile store model with compelling unit economics. We have successfully opened and currently operate stores that generate strong cash flow, consistent store-level financial results and an attractive return on investment across a variety of geographies, markets, store sizes and location types. We successfully operate stores in markets characterized as agribusiness centers, ranch regions, oil and gas markets, as well as in various geographies in the U.S., such as California, the Southwest, the Midwest and the South. Our stores are successful in small, rural towns as well as major metropolitan areas, such as Houston, Los Angeles, Nashville and Phoenix.

3

Our new store model requires an average net cash investment of approximately $0.8 million and targets an average payback period of less than three years. We use the term "net cash investment" to refer to the cost of a store's initial inventory (net of accounts payable), pre-opening costs and capital investment (net of tenant improvement allowances). Our lean operating structure, coupled with our strong supplier relationships, has allowed us to grow with minimal supply chain investments as most of our products ship directly from our suppliers to our stores. We believe that our proven retail model and attractive unit economics support our ability to grow our store footprint in both new and existing markets across the U.S.

Highly experienced management team and passionate organization. Our senior management team has extensive experience across all key retail disciplines. With an average of approximately 25 years of experience in their respective functional areas, our senior management team has been instrumental in developing a robust and scalable infrastructure to support our growth. In addition to playing an important role in developing our long-term growth initiatives, our senior management team embraces the genuine and enduring qualities of the western lifestyle and has created a positive culture of enthusiasm and entrepreneurial spirit which is shared by team members throughout our entire organization. Our strong company culture is exemplified by the long tenure of our employees at all levels. For example, our district and regional managers have an average of eight years of service with us and our store managers have an average of more than five years of service with us, including the companies acquired by us.

We are pursuing several strategies to continue our profitable growth, including:

Expanding our store base. Driven by our compelling store economics, we believe that there is a significant opportunity to expand our store base in the U.S. Based on an extensive internal analysis, we believe that we have the potential to grow our domestic store base from 176 stores as of June 27, 2015 to at least 500 domestic locations. We currently plan to target new store openings in both existing markets and new, adjacent and underserved markets that we believe will be receptive to our concept. Over the past several years, we have made significant investments in personnel, information technology, warehouse infrastructure and an e-commerce platform to support the expansion of our operations.

Driving same store sales growth. We have delivered 22 consecutive quarters of positive same store sales growth and averaged same store sales growth of 6.6% during the last 13 full fiscal years. We believe that we can continue to grow our same store sales by increasing our brand awareness, driving additional traffic to our stores and increasing the amount of merchandise purchased by customers while visiting our stores. Our management team has launched several initiatives to accelerate growth, enhance our store associates' selling skills, drive store-level productivity and increase customer engagement through our loyalty program.

Enhancing brand awareness. We intend to enhance our brand awareness and customer loyalty in a number of ways, such as continuing to grow our store base and our online and social media initiatives. We use broadcast media such as radio, television and outdoor advertisements to reach customers in new and existing markets. We also maintain our strong market position through our grassroots marketing efforts, including sponsorship of rodeos, stock shows and other western industry events as well as our association with country music and partnerships with Brad Paisley as well as up-and-coming country musicians. We have an effective social media strategy with high customer engagement, as evidenced by our Facebook fan base, which is approximately 2.3 million fans.

Growing our e-commerce business. Our growing national footprint, expansive Facebook following and broader marketing efforts drive traffic to our e-commerce website. We continue to make investments

4

aimed at increasing traffic to our e-commerce website, which reached over 8.3 million visits in fiscal 2015, and increasing the amount of merchandise purchased by customers who visit our website, while improving the shopping experience for our customers. We recently added an e-commerce portal to each of our store locations, offering our in-store customers an "endless aisle" with additional styles, colors and sizes not carried in stores or not currently in stock. In addition, as a result of the Sheplers Acquisition, we believe our e-commerce sales as a percentage of total net sales will increase.

Leveraging our economies of scale. We believe that we have a variety of opportunities to increase the profitability of our business over time. Our ability to leverage our infrastructure and drive store-level productivity due to economies of scale is expected to be a primary driver of our improvement in profitability. We intend to continually refine our merchandise mix and increase the penetration of our private brands to help differentiate us from our competitors and achieve higher merchandise margins. We also expect to capitalize on additional economies of scale in purchasing and sourcing as we grow our geographic footprint and online presence.

We participate in the large, growing and highly fragmented western and work wear markets of the broader apparel and footwear industry. We offer a variety of boots, apparel and accessories that are basics or necessities for our customers' daily lives. Many of our customers are employed in the agriculture, oil and gas, manufacturing and construction industries, and are often country and western enthusiasts. We believe that growth in the western wear market has been and will continue to be driven by the growth of western events, such as rodeos, the popularity of country music and the continued strength and endurance of the western lifestyle. We believe that growth in the work wear market has been and will continue to be driven by increasing activity in the construction sector and the return of domestic manufacturing. Additionally, government regulations for workplace safety have driven and, we believe, will continue to drive, sales in specific categories, such as safety-toe boots and flame-resistant and high-visibility clothing for various industrial and outdoor occupations.

On June 29, 2015, we completed our acquisition of Sheplers, a 116-year old western lifestyle company with 25 retail locations across the United States and what we believe to be an industry-leading e-commerce business, for a purchase price of $147.0 million (which included our assumption of certain indebtedness). We financed the Sheplers Acquisition and refinanced approximately $172.0 million of our and Sheplers' existing indebtedness with an initial borrowing of $57.0 million under a new $125.0 million syndicated senior secured asset-based revolving credit facility for which Wells Fargo Bank, National Association, is the administrative agent (which we refer to as the "New ABL Credit Facility"), and a $200.0 million syndicated senior secured term loan for which GCI Capital Markets LLC is the administrative agent (which we refer to as the "New Term Loan" and, together with the New ABL Credit Facility, as the "New Credit Facilities").

Sheplers was founded in 1899 with its first storefront in Wichita, Kansas under the name J.W. Gibson Harness Shop, which was later purchased by Harry L. Shepler and subsequently renamed Sheplers. The business developed into a major direct-to-customer catalog business that grew for decades before adding stores in 1961 and launching an e-commerce site in 1999. With a 116-year history, Sheplers has a proven commitment to customer service and to providing a wide selection of footwear, apparel and accessories for the western lifestyle.

5

We believe that the Sheplers Acquisition represents a significant step forward in our omni-channel strategy. The addition of Sheplers' e-commerce platform provides opportunities to create a dual brand online offering, leverage Sheplers' domestic and international customer traffic and create operating efficiencies across the combined online businesses. By rebranding the Sheplers stores to the Boot Barn banner, consistent with the strategies of our prior acquisitions of RCC and Baskins, we enhance our store footprint by adding eight new retail markets and building our position in Texas and Colorado. Our businesses are highly complementary, with a similar western lifestyle focus, customer base and store experience, which will allow us to extend key merchandise categories and brands across the chain and access a combined database of more than five million customers.

Set forth below are certain key historical financial measures of Sheplers for the twelve months ended July 27, 2014, Sheplers' last completed fiscal year prior to the Sheplers Acquisition:

• Net sales |

$ | 149.5 million | ||

• E-commerce sales |

$ | 58.9 million | ||

• Operating income |

$ | 5.7 million |

See "Risk factors—Risks related to the Sheplers Acquisition" for a discussion of certain risks and uncertainties associated with the Sheplers Acquisition.

Risks associated with our business

We believe that our business strategy will continue to offer significant opportunities, but it also presents risks and challenges. These risks and challenges include, but are not limited to, the following:

- •

- there may be a decline in consumer spending or changes in consumer preferences;

- •

- we may not be able to effectively execute on our growth strategy, including our store growth plan;

- •

- we may not be able to maintain and enhance our strong brand image;

- •

- we may not compete effectively;

- •

- we may not be able to maintain good relationships with our key suppliers;

- •

- we may not be able to improve and expand our exclusive product offerings;

- •

- we may not be able to successfully integrate Sheplers' business and realize the anticipated benefits of the Sheplers Acquisition; and

- •

- there may be a substantial increase in product costs or general inflation.

See "Risk factors" for other important factors that could adversely impact our results of operations.

Our principal executive offices are located at 15776 Laguna Canyon Road, Irvine, California, 92618 and our telephone number is (949) 453-4400. Our website address is www.bootbarn.com. Except as expressly stated herein, the information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. See "Incorporation of documents by reference."

6

Implications of being an emerging growth company

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the "JOBS Act." We will remain an emerging growth company until the earlier of (1) the last day of our fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

- •

- the option to report only two years of audited financial statements and to present management's discussion and analysis of financial

condition and results of operations for only those two years;

- •

- exemption from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002, which we refer to as the "Sarbanes-Oxley

Act," requiring that an independent registered public accounting firm provide an attestation report on the effectiveness of our internal controls over financial reporting;

- •

- exemption from the "say on pay" and "say on golden parachute" advisory vote requirements of the Dodd-Frank Wall Street Reform and

Customer Protection Act, which we refer to as the "Dodd-Frank Act";

- •

- exemption from certain disclosure requirements of the Dodd-Frank Act relating to compensation of our executive officers and permission

to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended, which we refer to as the "Exchange Act"; and

- •

- permission to provide a reduced level of disclosure concerning executive compensation and exemption from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotations or a supplement to the auditor's report on the financial statements.

We have not taken advantage of certain of these reduced reporting burdens in this prospectus, although we may choose to do so in future filings. If we do take advantage of any of these exemptions, we cannot predict if investors will find our common stock less attractive, or if taking advantage of these exemptions would result in less active trading or more volatility in the price of our common stock.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, which we refer to as the "Securities Act," for complying with new or revised accounting standards. However, we have chosen to "opt out" of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

7

| Common stock offered by the selling stockholders | 5,500,000 shares (or 6,325,000 shares if the underwriters exercise in full their option to purchase additional shares) | |

Common stock outstanding before this offering |

26,138,350 shares |

|

Common stock to be outstanding immediately after this offering (giving effect to the exercise of stock options by certain selling stockholders) |

shares |

|

Use of proceeds |

The selling stockholders will receive all of the proceeds, after deducting underwriting discounts, from this offering. We will not receive any proceeds from this offering. Certain of the selling stockholders will exercise stock options to purchase all or a portion of the shares they are offering hereby. The proceeds we receive from these stock option exercises will be used by us for general corporate purposes. |

|

Risk factors |

See "Risk factors" on page 14 and the other information contained or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before you decide to invest in our common stock. |

|

Dividend policy |

We anticipate that we will retain all of our available funds to repay existing indebtedness and for use in the operation and expansion of our business for the foreseeable future. Any future determination as to the payment of cash dividends on our common stock will be at the discretion of our board of directors and will depend on our financial condition, operating results, current and anticipated cash needs, plans for expansion, legal requirements and other factors that our board of directors considers to be relevant. In addition, financial and other covenants in our New Credit Facilities restrict our ability to pay cash dividends on our common stock. See "Dividend policy." |

|

Listing and symbol |

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol "BOOT." |

Unless otherwise indicated, information in this prospectus:

- •

- assumes the underwriters have not exercised their option to purchase additional shares in this offering; and

- •

- gives effect to the 25-for-1 stock split of our common stock effected on October 27, 2014.

8

In connection with this offering, certain of the selling stockholders will exercise stock options to acquire newly-issued shares of common stock to be sold in this offering. If the underwriters exercise their option to purchase additional shares in full, an additional shares of common stock will be issued upon the exercise of stock options and sold in this offering.

The number of shares outstanding immediately after this offering is based on 26,138,350 shares of common stock outstanding as of July 13, 2015 and the shares of common stock to be issued and outstanding upon the exercise of the stock options referred to above, and excludes:

- •

- shares of our common stock issuable upon the exercise of options outstanding under our 2014 Equity Incentive Plan

at a

weighted average exercise price of $ ; and

- •

- shares of our common stock issuable upon the exercise of options outstanding under our 2011 Equity Incentive Plan at a weighted average exercise price of $ .

9

Summary consolidated financial and other data

The following tables summarize our consolidated financial and other data as of and for the periods indicated. We have derived the summary consolidated statement of operations data for the years ended March 28, 2015, March 29, 2014 and March 30, 2013, and the consolidated balance sheet data as of March 28, 2015 and March 29, 2014 from the audited consolidated financial statements included in our Form 10-K and incorporated by reference herein.

The consolidated statement of operations data and consolidated balance sheet data include the financial position, results of operations and cash flows of RCC from August 2012 and Baskins from May 2013, their respective dates of acquisition. The Sheplers Acquisition was completed on June 29, 2015 and accordingly, our consolidated financial statements do not reflect the financial position, results of operations and cash flows of Sheplers.

You should read the following summary consolidated financial and other data together with the section entitled "Capitalization" of this prospectus and the section entitled "Management's discussion and analysis of financial condition and results of operations" and the consolidated financial statements, condensed consolidated financial statements and related notes included in our Form 10-K and incorporated by reference herein.

10

| | | | | | | | | | | |

| |

Fiscal year ended(1) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) |

March 28, 2015 |

March 29, 2014 |

March 30, 2013 |

|||||||

| | | | | | | | | | | |

Consolidated statement of operations data: |

||||||||||

Net sales |

$ | 402,684 | $ | 345,868 | $ | 233,203 | ||||

Cost of goods sold |

267,907 | 231,796 | 151,357 | |||||||

Amortization of inventory fair value adjustment |

— | 867 | 9,199 | |||||||

| | | | | | | | | | | |

Total cost of goods sold |

267,907 | 232,663 | 160,556 | |||||||

| | | | | | | | | | | |

Gross profit |

134,777 | 113,205 | 72,647 | |||||||

Operating expenses: |

||||||||||

Selling, general and administrative expenses |

99,341 | 91,998 | 62,609 | |||||||

Acquisition-related expenses(2) |

— | 671 | 1,138 | |||||||

| | | | | | | | | | | |

Total operating expenses |

99,341 | 92,669 | 63,747 | |||||||

| | | | | | | | | | | |

Income from operations |

35,436 | 20,536 | 8,900 | |||||||

Interest expense, net |

13,291 | 11,594 | 7,415 | |||||||

Other income, net |

51 | 39 | 21 | |||||||

| | | | | | | | | | | |

Income before income taxes |

22,196 | 8,981 | 1,506 | |||||||

Income tax expense |

8,466 | 3,321 | 826 | |||||||

| | | | | | | | | | | |

Net income |

13,730 | 5,660 | 680 | |||||||

| | | | | | | | | | | |

Net income attributed to non-controlling interest |

4 | 283 | 34 | |||||||

| | | | | | | | | | | |

Net income attributed to Boot Barn Holdings, Inc. |

$ | 13,726 | $ | 5,377 | $ | 646 | ||||

| | | | | | | | | | | |

Net income per share:(3)(4) |

||||||||||

Basic shares |

$ | 0.56 | $ | 0.28 | $ | 0.03 | ||||

Diluted shares |

$ | 0.54 | $ | 0.28 | $ | 0.03 | ||||

Weighted average shares outstanding:(4) |

||||||||||

Basic shares |

22,126 | 18,929 | 18,757 | |||||||

Diluted shares |

22,888 | 19,175 | 18,757 | |||||||

Other financial data (unaudited): |

||||||||||

EBITDA(5) |

$ | 44,694 | $ | 28,704 | $ | 14,509 | ||||

Adjusted EBITDA(5) |

$ | 48,232 | $ | 40,271 | $ | 28,933 | ||||

Capital expenditures |

$ | 14,074 | $ | 11,400 | $ | 3,848 | ||||

Selected store data (unaudited): |

||||||||||

Same store sales growth |

7.3% | 6.7% | 11.9% | |||||||

Stores operating at end of period |

169 | 152 | 117 | |||||||

Total retail store square footage, end of period (in thousands) |

1,816 | 1,642 | 1,082 | |||||||

Average store square footage, end of period |

10,748 | 10,801 | 9,251 | |||||||

Average net sales per store (in thousands)(6) |

$ | 2,259 | $ | 2,162 | $ | 1,861 | ||||

| | | | | | | | | | | |

11

| | | | | | | | |

| (in thousands) |

March 28, 2015 |

March 29, 2014 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Consolidated balance sheet data: |

|||||||

Cash and cash equivalents |

$ | 1,448 | $ | 1,118 | |||

Working capital(7) |

75,251 | 56,786 | |||||

Total assets |

326,704 | 291,863 | |||||

Total debt |

90,402 | 128,124 | |||||

Stockholders' equity |

142,422 | 84,575 | |||||

| | | | | | | | |

(1) We operate on a fiscal calendar that results in a 52- or 53-week fiscal year ending on the last Saturday of March, unless April 1 is a Saturday, in which case the fiscal year ends on April 1. In a 52-week fiscal year, each quarter includes 13 weeks of operations; in a 53-week fiscal year, the first, second and third quarters each include 13 weeks of operations and the fourth quarter includes 14 weeks of operations. The data presented contains references to fiscal 2015, fiscal 2014 and fiscal 2013, which represent our fiscal years ended March 28, 2015, March 29, 2014 and March 30, 2013. Fiscal 2015, 2014 and 2013 were each 52-week periods.

(2) Represents costs incurred in connection with the acquisitions of RCC and Baskins.

(3) Net income per share for fiscal 2015 reflects the deduction from net income, for purposes of determining the net income available to common stockholders, of the cash payment of $1.4 million made in April 2014 to holders of vested stock options. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources—Financing activities" included in our Form 10-K and incorporated by reference herein.

(4) The indicated data gives effect to the 25-for-1 stock split of our common stock effected October 27, 2014.

(5) EBITDA and Adjusted EBITDA are financial measures that are not calculated in accordance with GAAP. We define EBITDA as net income (loss) adjusted to exclude income tax expense (benefit), net interest expense and depreciation and intangible asset amortization. We define Adjusted EBITDA as EBITDA adjusted to exclude non-cash stock-based compensation, the non-cash accrual for future award redemptions, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets, secondary offering costs and other unusual or non-recurring expenses. We include EBITDA and Adjusted EBITDA in this prospectus because they are important financial measures which our management, board of directors and lenders use to assess our operating performance. EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Given that EBITDA and Adjusted EBITDA are measures not deemed to be in accordance with GAAP and are susceptible to varying calculations, our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including companies in our industry, because other companies may calculate EBITDA and Adjusted EBITDA in a different manner than we calculate these measures. See "Non-GAAP financial measures" at the beginning of this prospectus. The following table presents a reconciliation of EBITDA and Adjusted EBITDA to our net income, the most directly comparable financial measure calculated and presented in accordance with GAAP, for each of the periods indicated:

| | | | | | | | | | | |

| |

Fiscal year ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

March 28, 2015 |

March 29, 2014 |

March 30, 2013 |

|||||||

| | | | | | | | | | | |

EBITDA reconciliation: |

||||||||||

Net income |

$ | 13,730 | $ | 5,660 | $ | 680 | ||||

Income tax expense |

8,466 | 3,321 | 826 | |||||||

Interest expense, net |

13,291 | 11,594 | 7,415 | |||||||

Depreciation and intangible asset amortization |

9,207 | 8,129 | 5,588 | |||||||

| | | | | | | | | | | |

EBITDA |

44,694 | 28,704 | 14,509 | |||||||

Non-cash stock-based compensation(a) |

2,048 | 1,291 | 787 | |||||||

Non-cash accrual for future award redemptions(b) |

(49 | ) | 591 | 219 | ||||||

Acquisition expenses(c) |

— | 671 | 1,138 | |||||||

Acquisition-related integration and reorganization costs(d) |

— | 6,167 | 2,061 | |||||||

Amortization of inventory fair value adjustment(e) |

— | 867 | 9,199 | |||||||

Loss on disposal of assets(f) |

134 | 1,980 | 322 | |||||||

Secondary offering costs(g) |

541 | — | — | |||||||

Other unusual or non-recurring expenses(h) |

864 | — | 698 | |||||||

| | | | | | | | | | | |

Adjusted EBITDA |

$ | 48,232 | $ | 40,271 | $ | 28,933 | ||||

| | | | | | | | | | | |

(a) Represents non-cash compensation expenses related to stock options and restricted stock awards granted to certain of our employees and directors.

(b) Represents non-cash accrual for future award redemptions in connection with our customer loyalty program.

(c) Represents direct costs and fees related to the acquisitions of RCC and Baskins, which we acquired in August 2012 and May 2013, respectively.

12

(d) Represents certain store integration, remerchandising and corporate consolidation costs incurred in connection with the integrations of RCC and Baskins, which we acquired in August 2012 and May 2013, respectively.

(e) Represents the amortization of purchase-accounting adjustments that increased the value of inventory acquired to its fair value.

(f) Represents loss on disposal of assets in connection with the rebranding of RCC and Baskins acquired stores and store closures, as well as other costs.

(g) Represents professional fees and expenses incurred in connection with the secondary offering held in February 2015.

(h) Represents professional fees and expenses incurred in connection with other acquisition activity.

(6) Average net sales per store is calculated by dividing net sales for the applicable period by the number of stores operating at the end of the period. For the purpose of calculating net sales per store, e-commerce sales and certain other revenues are excluded from net sales.

(7) "Working capital" means current assets, excluding cash and cash equivalents, minus current liabilities, excluding the current portion of debt under our credit facilities, as determined in accordance with GAAP.

13

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained or incorporated by reference in this prospectus, including our consolidated financial statements, condensed consolidated financial statements and related notes included elsewhere in this prospectus or incorporated by reference herein, before deciding whether to purchase shares of our common stock. If any of the following risks are realized, our business, operating results and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Our sales could be severely impacted by declines in consumer confidence and decreases in consumer spending or by changes in consumer preferences.

We depend upon consumers feeling confident about spending discretionary income on our products to drive our sales. Consumer spending may be adversely impacted by economic conditions, such as consumer confidence in future economic conditions, interest and tax rates, employment levels, salary and wage levels, general business conditions, the availability of consumer credit and the level of housing, energy and food costs. These risks may be exacerbated for retailers like us who focus on specialty footwear, apparel and accessories. Our financial performance is particularly susceptible to economic and other conditions in California and other western states where we have a significant number of stores. Our financial performance may also be susceptible to economic and other conditions relating to output and employment in the oil and gas industries, the construction sector, domestic manufacturing and the transportation and warehouse sectors because we believe that growth in these industries and sectors have driven the growth of our work wear business. In addition, our financial performance may be negatively affected if the popularity of the western and country lifestyle subsides, or if there is a general trend in consumer preferences away from boots and other western or country products in favor of another general category of footwear or attire. If this were to occur or if periods of decreased consumer spending persist, our sales could decrease, which could have a material adverse effect on our financial condition and results of operations.

Our continued growth depends upon successfully opening a significant number of new stores as well as integrating any acquired stores, and our failure to successfully open new stores or integrate acquired stores could negatively affect our business and stock price.

We have grown our store count rapidly in recent years, both organically and through strategic acquisitions of competing chains. However, we must continue to open and operate new stores to help maintain our revenue and profit growth. Our ability to successfully open and operate new stores is subject to a variety of risks and uncertainties, such as:

- •

- identifying suitable store locations, the availability of which is beyond our control;

- •

- obtaining acceptable lease terms;

- •

- sourcing sufficient levels of inventory;

- •

- selecting the appropriate merchandise to appeal to our customers;

- •

- hiring, training and retaining store employees;

14

- •

- assimilating new store employees into our corporate culture;

- •

- rebranding acquired stores under the Boot Barn banner;

- •

- marketing the new stores' locations and product offerings effectively;

- •

- avoiding construction delays and cost overruns in connection with the buildout of new stores;

- •

- avoiding other costs in opening new stores, such as rebranding acquired locations and environmental liabilities;

- •

- managing and expanding our infrastructure to accommodate growth; and

- •

- integrating the new stores with our existing buying, distribution and other support operations.

Our failure to successfully address these challenges could have a material adverse effect on our financial condition and results of operations. We opened or acquired 33 stores in fiscal 2013, 39 stores in fiscal 2014, 18 stores in fiscal 2015 and 7 stores in the first quarter of fiscal 2016. We plan to open at least 15 additional new stores in fiscal 2016 (in addition to the 25 Sheplers stores we acquired as part of the Sheplers Acquisition). However, there can be no assurance that we will open the planned number of new stores in fiscal 2016 or thereafter, or that any such stores will be profitable. This expansion will place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our existing business less effectively, which in turn could cause the financial performance of our existing stores to deteriorate. In addition, we currently plan to open some new stores within existing markets. Some of these new stores may open close enough to our existing stores that a segment of customers will stop shopping at our existing stores and instead shop at the new stores, causing sales and profitability at those existing stores to decline. If this were to occur with a number of our stores, it could have a material adverse effect on our financial condition and results of operations.

In addition to opening new stores, we may acquire stores. Acquiring and integrating stores involves additional risks that could adversely affect our growth and results of operation. Newly acquired stores may be unprofitable and we may incur significant costs and expenses in connection with any acquisition, including in remerchandising and rebranding the acquired stores. Integrating newly acquired stores may divert our senior management's attention from our core business. Our ability to integrate newly acquired stores will depend on the successful expansion of our existing financial controls, distribution model, information systems, management and human resources and on attracting, training and retaining qualified employees.

Our business largely depends on a strong brand image, and if we are unable to maintain and enhance our brand image, particularly in new markets where we have limited brand recognition, we may be unable to increase or maintain our level of sales.

We believe that our brand image and brand awareness has contributed significantly to the success of our business. We also believe that maintaining and enhancing our brand image, particularly in new markets where we have limited brand recognition, is important to maintaining and expanding our customer base. Our ability to successfully integrate new stores into their surrounding communities, to expand into new markets or to maintain the strength and distinctiveness of our brand image in our existing markets will be adversely impacted if we fail to connect with our target customers. Maintaining and enhancing our brand image may require us to make substantial investments in areas such as merchandising, marketing, store operations, community relations, store graphics and employee training, which could adversely affect our cash flow and which may ultimately be unsuccessful. Furthermore, our brand image could be jeopardized if

15

we fail to maintain high standards for merchandise quality, if we fail to comply with local laws and regulations or if we experience negative publicity or other negative events that affect our image and reputation. Some of these risks may be beyond our ability to control, such as the effects of negative publicity regarding our suppliers. Failure to successfully market and maintain our brand image in new and existing markets could harm our business, results of operations and financial condition.

Our failure to adapt to new challenges that arise when expanding into new geographic markets could adversely affect our ability to profitably operate those stores and maintain our brand image.

Our expansion into new geographic markets could result in competitive, merchandising, distribution and other challenges that are different from those we encounter in the geographic markets in which we currently operate. In addition, as the number of our stores increases, we may face risks associated with market saturation of our product offerings and locations. Our suppliers may also restrict their sales to us in new markets to the extent they are already saturating that market with their products through other retailers or their own stores. There can be no assurance that any newly opened stores will be received as well as, or achieve net sales or profitability levels comparable to those of, our existing stores in the time periods estimated by us, or at all. If our stores fail to achieve, or are unable to sustain, acceptable net sales and profitability levels, our business may be materially harmed, we may incur significant costs associated with closing those stores and our brand image may be negatively impacted.

We face intense competition in our industry and we may be unable to compete effectively.

The retail industry for western and work wear is highly fragmented and characterized by primarily regional competitors. We estimate that there are thousands of independent specialty stores scattered across the country. We believe that we compete primarily with smaller regional chains and independents on the basis of product quality, brand recognition, price, customer service and the ability to identify and satisfy consumer demand. However, we also compete with farm supply stores, online retailers and, to a lesser degree, mass merchants. Competition with some or all of these retailers could require us to lower our prices or risk losing customers. In addition, significant or unusual promotional activities by our competitors may force us to respond in-kind and adversely impact our operating cash flow. As a result of these factors, current and future competition could have a material adverse effect on our financial condition and results of operations.

Many of the mass merchants that sell some western or work wear products have greater financial, marketing and other resources than we currently do, and therefore may be able to devote greater resources to the marketing and sale of these products, generate national brand recognition or adopt more aggressive pricing policies than we can, which would put us at a competitive disadvantage if they decide to expand their offerings of these product lines. Moreover, we do not possess exclusive rights to many of the elements that comprise our in-store experience and product offerings. Our competitors may seek to emulate facets of our business strategy and in-store experience, which could result in a reduction of some competitive advantages or special appeal that we might possess. In addition, most of our suppliers sell products to us on a non-exclusive basis. As a result, our current and future competitors may be able to duplicate or improve on some or all of the product offerings that we believe are important in differentiating our stores and our customers' shopping experience. If our competitors were to duplicate or improve on some or all of our in-store experience or product offerings, our competitive position and our business could suffer.

16

We depend on cash generated from our existing store operations to support our growth, which could strain our cash flow.

We primarily rely on cash flow generated from existing stores to fund our current operations and our growth. It typically takes several months and a significant amount of cash to open a new store. For example, our new store model requires an average net cash investment of approximately $0.8 million. If we continue to open a large number of stores relatively close in time, the cost of these store openings and the cost of continuing operations could reduce our cash position. An increase in our net cash outflow for new stores could adversely affect our operations by reducing the amount of cash available to address other aspects of our business.

In addition, as we expand our business, we will need significant amounts of cash from operations to pay our existing and future lease obligations, build out new store space, purchase inventory, pay personnel, pay for the increased costs associated with operating as a public company and, if necessary, further invest in our infrastructure and facilities. If our business does not generate sufficient cash flow from operations to fund these activities, and sufficient funds are not otherwise available from our New Credit Facilities or future credit facilities, we may need additional equity or debt financing. If such financing is not available to us on satisfactory terms, our ability to operate and expand our business or to respond to competitive pressures would be limited and we could be required to delay, curtail or eliminate planned store openings. Moreover, if we raise additional capital by issuing equity securities or securities convertible into equity securities, your ownership may be diluted. Any debt financing we may incur may impose covenants that restrict our operations, and will require interest payments that would create additional cash demands and financial risk for us.

We have expanded rapidly in recent years and have limited operating experience at our current size.

We have significantly expanded our operations in the last three years, increasing our locations from 85 stores in eight states as of March 31, 2012 to 176 stores in 28 states as of June 27, 2015. If our operations continue to grow, we will be required to expand our sales, marketing and support services and our administrative personnel, and we may decide to change our distribution model. This expansion could increase the strain on our existing resources, causing operational difficulties such as difficulties in hiring, obtaining adequate levels of merchandise, delayed shipments and decreased levels of customer service. These difficulties could cause our brand image to deteriorate and lead to a decrease in our revenues and income and the price of our common stock.

Any significant change in our distribution model could initially have an adverse impact on our cash flows and results of operations.

During fiscal 2015, our suppliers shipped approximately 91% of our in-store merchandise units directly to our stores and approximately 46% of our e-commerce merchandise units directly to our e-commerce customers. In the future, as part of our long-term strategic planning, we may change our distribution model to increase the amount of merchandise that we self-distribute through a centralized distribution center. We recently hired a leading supply chain consulting firm to study our current network, supplier structure and likely sources of growth and to recommend an optimal distribution model for our future operations. Changing our distribution model to increase distributions from a centralized distribution center to our stores and customers would initially involve significant capital expenditures, which would increase our borrowings and interest expense or temporarily reduce the rate at which we open new stores. In addition, if we are unable to successfully integrate a new distribution model into our operations in a timely manner, our supply chain could experience significant disruptions, which could reduce our sales and adversely impact our results of operations.

17

If we fail to maintain good relationships with our suppliers or if our suppliers are unable or unwilling to provide us with sufficient quantities of merchandise at acceptable prices, our business and operations may be adversely affected.