Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PINNACLE WEST CAPITAL CORP | exhibit992for63015.htm |

| EX-99.1 - EXHIBIT 99.1 - PINNACLE WEST CAPITAL CORP | exhibit9916-30x15.htm |

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | a8-kfor6x30x15earnings.htm |

Second Quarter 2015 SECOND QUARTER 2015 RESULTS July 30, 2015

Second Quarter 20152 FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation or regulation, including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, particularly in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2014 which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. We present “gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power expenses. Gross margin is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this non-GAAP financial measure to the referenced revenue and expense line items on our Consolidated Statements of Income, which are the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States of America (GAAP). We view gross margin as an important performance measure of the core profitability of our operations. We refer to “on-going earnings” in this presentation, which is also a non-GAAP financial measure. We also provide a reconciliation to show impacts of our noncontrolling interests for the Palo Verde lease extensions. We believe on-going earnings and the information provided in the reconciliation provide investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis. Investors should note that these non-GAAP financial measures may involve judgments by management, including whether an item is classified as an unusual item. These measures are key components of our internal financial reporting and are used by our management in analyzing the operations of our business. We believe that investors benefit from having access to the same financial measures that management uses.

Second Quarter 20153 CONSOLIDATED EPS COMPARISON 2015 VS. 2014 $1.10 $1.19 2015 2014 2nd Quarter GAAP Net Income $1.10 $1.19 2nd Quarter On-Going Earnings $1.25 $1.34 2015 2014 Year-to-Date GAAP Net Income $1.25 $1.34 Year-to-Date On-Going Earnings

Second Quarter 20154 Gross Margin(1) $(0.02) ON-GOING EPS VARIANCES 2ND QUARTER 2015 VS. 2ND QUARTER 2014 Other, net $(0.04) Interest, Net of AFUDC $0.04 (1) Excludes costs, and offsetting operating revenues, associated with renewable energy (excluding AZ Sun), demand side management and similar regulatory programs. (2) Adjusted for the impacts of our noncontrolling interests for the Palo Verde lease extensions. See non-GAAP reconciliation in appendix. D&A(2) $(0.07) Net Decrease $(0.09) =

Second Quarter 20155 GROSS MARGIN EPS DRIVERS 2ND QUARTER 2015 VS. 2ND QUARTER 2014 Lost Fixed Cost Recovery Mechanism $0.02 = Net Decrease $(0.02) Transmission Revenue $(0.04) See non-GAAP reconciliation for gross margin in appendix. Weather $(0.06)Four Corners Rate Change $0.08 Wholesale Contract $(0.02)

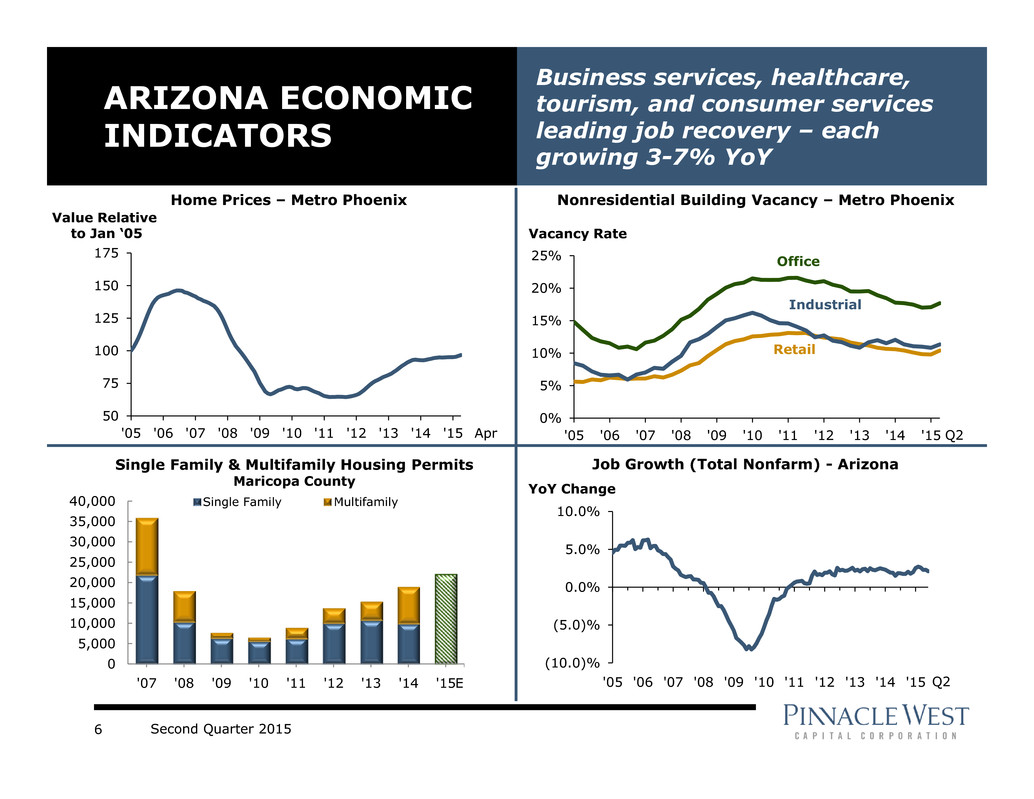

Second Quarter 20156 ARIZONA ECONOMIC INDICATORS Business services, healthcare, tourism, and consumer services leading job recovery – each growing 3-7% YoY 0% 5% 10% 15% 20% 25% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Industrial Nonresidential Building Vacancy – Metro Phoenix Single Family & Multifamily Housing Permits Maricopa County Home Prices – Metro Phoenix Value Relative to Jan ‘05 50 75 100 125 150 175 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Vacancy Rate Office Retail Job Growth (Total Nonfarm) - Arizona (10.0)% (5.0)% 0.0% 5.0% 10.0% '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 YoY Change E Q2Apr 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 Single Family Multifamily Q2

Second Quarter 20157 BALANCE SHEET STRENGTH $250 $50 $500 $250 $125 $- $100 $200 $300 $400 $500 2016 2017 2018 2019 2020 APS PNW ($Millions) Debt Maturity Schedule Credit Ratings • A- rating or better at S&P, Moody’s and Fitch • Moody’s and Fitch upgraded APS and PNW in Q2 2015 Major Financing Activities • $250 million 5-year 2.20% APS senior unsecured notes issued in January 2015 • $300 million 10-year 3.15% APS senior unsecured notes issued in May 2015 - proceeds used to refinance $300 million of 4.65% notes that matured May 15, 2015 • Currently expect up to an additional $300 million of new long-term debt

Second Quarter 20158 2015 ON-GOING EPS GUIDANCE Key Factors & Assumptions as of July 30, 2015 2015 Electricity gross margin* (operating revenues, net of fuel and purchased power expenses) $2.27 – $2.32 billion • Retail customer growth about 1.5-2.5% • Weather-normalized retail electricity sales volume about 0-1.0% to prior year taking into account effects of customer conservation, energy efficiency and distributed renewable generation initiatives • Assumes normal weather Operating and maintenance* $775 - $795 million Other operating expenses (depreciation and amortization, and taxes other than income taxes) $650 - $670 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC $45 million) $150 - $160 million Net income attributable to noncontrolling interests ~$20 million Effective tax rate 35% Average diluted common shares outstanding ~111.0 million On-Going EPS Guidance $3.75 - $3.95 * Excludes O&M of $109 million, and offsetting revenues, associated with renewable energy and demand side management programs.

Second Quarter 2015 APPENDIX

Second Quarter 201510 2015 KEY DATES ACC Key Dates Docket # Q1 Q2 Q3 Q4 Key Recurring Regulatory Filings Lost Fixed Cost Recovery E-01345A-11-0224 Jan 15 Net Metering – Quarterly Installation Filings E-01345A-13-0248 Jan 15 Apr 15 Jul 15 Oct 15 Transmission Cost Adjustor E-01345A-11-0224 May 15 Renewable Energy Surcharge E-01345A-15-0241 Jul 1 2014 Integrated Resource Plan (Biennial) and Cholla Unit 2 Retirement Proposal E-00000V-13-0070 Apr 14: ACC Review Resource Planning and Procurement in 2015 and 2016 E-00000V-15-0094 Comments due on proposed process change Grid Access Charge Filing E-01345A-13-0248 Apr 2 ALJ Recommended Opinion and Order ACC Open Meetings - ACC Open Meetings Held Monthly Other Key Dockets Docket # Ocotillo Modernization Project L-00000D-14-0292-00169 Inquiry into Solar DG business models and practices (Generic Docket) E-00000J-14-0415

Second Quarter 201511 CREDIT RATINGS APS Parent Corporate Credit Ratings Moody’s A2 A3 S&P A- A- Fitch A- A- Senior Unsecured Moody’s A2 - S&P A- - Fitch A - Outlook Moody’s Stable Stable S&P Stable Stable Fitch Stable Stable We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Investment Grade Credit Ratings

Second Quarter 201512 2015 2016 2017 RETAIL SALES IMPACT FROM ENERGY EFFICIENCY AND DISTRIBUTED GENERATION YoY Retail Sales Before Customer Programs Energy Efficiency & Customer Conservation Distributed Generation Distributed Generation (DG) Impact • DG makes up 0.5% or less of the negative impact to retail sales growth as shown in the chart • Average residential rooftop solar system produces 10,000 – 12,000 KWh per year (average metro-Phoenix customer’s usage is nearly 15,000 KWh) The difference between customer growth and weather-normalized retail sales, mostly driven by EE and DG, has ranged from (1)-(2)%, in line with guidance, despite some larger quarterly variances. • 2015 YTD: (1.4)% • 2014: (1.4)% • 2013: (1.8)% • 2012: (1.0)% Annual Retail Sales Growth

Second Quarter 201513 250 364 346 450 637 728 654 803 878 969 545 863 527 735 874 782 1,228 1,249 0 28 33 83 41 45 62 64 84 63 94 34 69 102 90 48 71 77 53 0 200 400 600 800 1,000 1,200 1,400 RESIDENTIAL PV APPLICATIONS As of June 30, 2015, nearly 34,000 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, equivalent to 239 MW. *Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the above chart. 2014 Applications* 2014 Canceled Apps 2015 Applications* 2015 Canceled Apps Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 15 19 23 44 51 57 2009 2010 2011 2012 2013 2014 Residential DG (MW) Annual Additions

Second Quarter 201514 FINANCIAL OUTLOOK Key Factors & Assumptions as of July 30, 2015 Assumption Impact Retail customer growth • Expected to average about 2-3% annually • Modestly improving Arizona and U.S. economic conditions Weather-normalized retail electricity sales volume growth • About 0.5-1.5% after customer conservation and energy efficiency and distributed renewable generation initiatives Assumption Impact AZ Sun Program • Additions to flow through RES until next base rate case • First 50 MW of AZ Sun is recovered through base rates Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge (EIS) • Assumed to recover up to $5 million annually of carrying costs for government- mandated environmental capital expenditures Power Supply Adjustor (PSA) • 100% recovery as of July 1, 2012 Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Beginning July 1, 2012 following conclusion of the regulatory settlement, transmission revenue is accrued each month as it is earned. Four Corners Acquisition • Four Corners rate increase effective January 1, 2015 Potential Property Tax Deferrals (2012 retail rate settlement): Assume 60% of property tax increases relate to tax rates, therefore, will be eligible for deferrals (Deferral rates: 50% in 2013; 75% in 2014 and thereafter) Gross Margin – Customer Growth and Weather (2015-2017) Gross Margin – Related to 2012 Retail Rate Settlement Outlook Through 2016: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized)

Second Quarter 201515 OPERATIONS & MAINTENANCE OUTLOOK Targeting to be top quartile in peer benchmarking for staffing $749 $754 $761 $788 $805 $121 $150 $124 $137 $103 $109 2010 2011 2012 2013 2014 2015E PNW Consolidated RES/DSM* *Renewable energy and demand side management expenses are offset by adjustor mechanisms. $775 - $795 ($ Millions) 2015+ Outlook • Goal is to keep O&M per kWh flat • Complete documentation of over 1,800 policies, processes and procedures, including more than 275 process improvements to drive additional efficiencies • Execute targeted initiatives to address specific gaps and inefficiencies

Second Quarter 201516 $289 $316 $352 $547$24 $43 $178 $180 $63 $80 $1 $2 $192 $192 $113 $146 $242 $325 $375 $331 $73 $100 $92 $79 2014 2015 2016 2017 CAPITAL EXPENDITURES 70% of capital expenditures are recovered through rate adjustors (30%) and depreciation cash flow (40%) ($ Millions) $883 $1,056 $1,111 Other Distribution Transmission Renewable Generation Environmental Traditional Generation Projected $1,285 • The table does not include capital expenditures related to El Paso's 7% interest in Four Corners Units 4 and 5 of $3 million in 2015, $21 million in 2016 and $26 million in 2017. • 2015 – 2017 as disclosed in Second Quarter 2015 Form 10-Q.

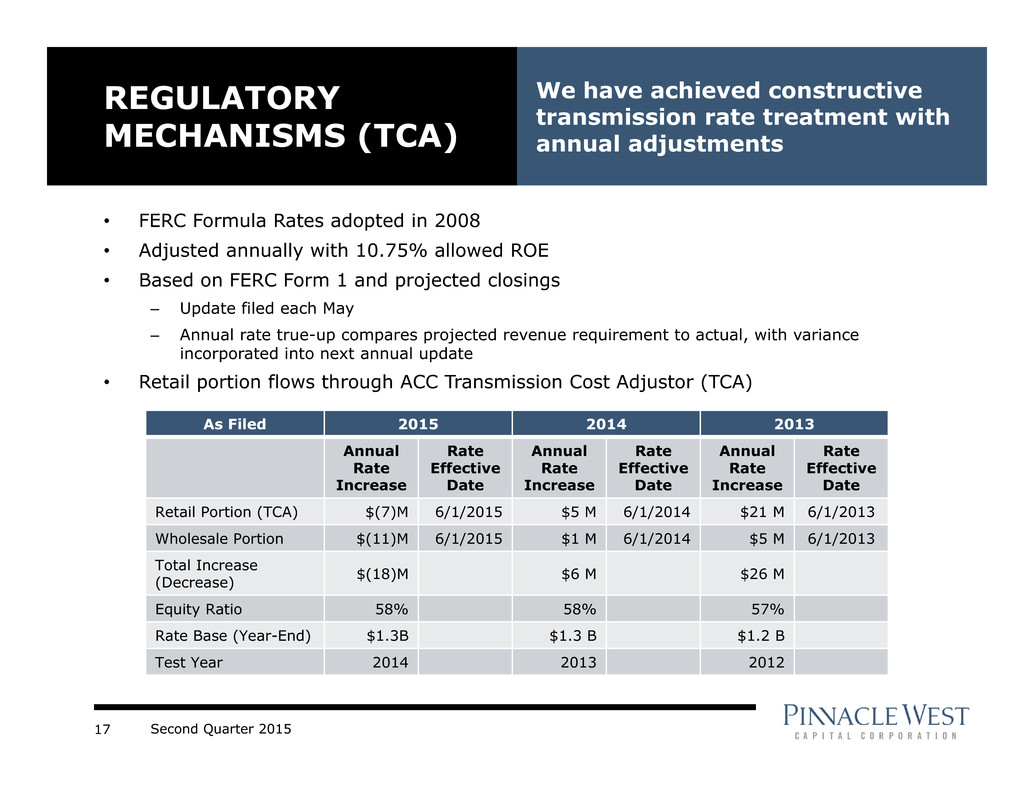

Second Quarter 201517 • FERC Formula Rates adopted in 2008 • Adjusted annually with 10.75% allowed ROE • Based on FERC Form 1 and projected closings – Update filed each May – Annual rate true-up compares projected revenue requirement to actual, with variance incorporated into next annual update • Retail portion flows through ACC Transmission Cost Adjustor (TCA) REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments As Filed 2015 2014 2013 Annual Rate Increase Rate Effective Date Annual Rate Increase Rate Effective Date Annual Rate Increase Rate Effective Date Retail Portion (TCA) $(7)M 6/1/2015 $5 M 6/1/2014 $21 M 6/1/2013 Wholesale Portion $(11)M 6/1/2015 $1 M 6/1/2014 $5 M 6/1/2013 Total Increase (Decrease) $(18)M $6 M $26 M Equity Ratio 58% 58% 57% Rate Base (Year-End) $1.3B $1.3 B $1.2 B Test Year 2014 2013 2012

Second Quarter 201518 6/1 Rate Goes Into Effect REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments 2014 2015 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 6/1 Rate Goes Into Effect ~5/15 File/Post FERC Rate ~5/1 File FERC Form 1 ~5/15 File/Post FERC Rate ~5/1 File FERC Form 1 • New accounting treatment began July 1, 2012, effective with 2012 Settlement Agreement • Quarterly true-ups can occur throughout the year (2015 included adjustments of 2014 revenue) 2014 Revenue 2014 Rates (Including True-Up) 2015 Rates (Including True-Up) 2015 Revenue Quarterly True-Ups Quarterly True-Ups

Second Quarter 201519 (17) 5 (4) (7) (10) (6) $(20) $(10) $0 $10 Q1 Q2 Q3 Q4 Q1 Q2 GROSS MARGIN EFFECTS OF WEATHER VARIANCES VS. NORMAL Pretax Millions 2014 $(23) Million All periods recalculated to current 10-year rolling average (2004-2013). 2015 $(16) Million

Second Quarter 201520 10 8 15 11 12 7 16 14 17 12 11 14 $0 $10 $20 $30 $40 $50 Q1 Q2 Q3 Q4 Q1 Q2 Renewable Energy Demand Side Management RENEWABLE ENERGY AND DEMAND SIDE MANAGEMENT EXPENSES* * O&M expenses related to renewable energy, demand side management and similar regulatory programs are offset by comparable revenue amounts. Pretax Millions 2014 $103 Million 2015 $44 Million

Second Quarter 201521 NON-GAAP MEASURE RECONCILIATION GROSS MARGIN $ millions pretax, except per share amounts 2015 2014 Operating revenues* 890$ 906$ Fuel and purchased power expenses* (281) (291) Gross margin 609 615 (0.03)$ Adjustments: Renewable energy (excluding AZ Sun), demand side management and similar regulatory programs (17) (19) 0.01 Gross margin - adjusted 592$ 596$ (0.02)$ * Line items from Consolidated Statements of Income Three Months Ended June 30, EPS Impact

Second Quarter 201522 NON-GAAP MEASURE RECONCILIATION OTHER NON-GAAP $ millions pretax, except per share amounts 2015 Palo Verde Lease Extensions2 2015 Adjusted 2014 Depreciation and amortization1 123 (5) 118 105 (0.07)$ 4 5 9 9 N/A 1 Line items from Consolidated Statements of Income 2 Not tax effected EPS Impact Three Months Ended June 30, Net income attributable to noncontrolling interests1