Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATTERSON UTI ENERGY INC | d72103d8k.htm |

Patterson-UTI Energy, Inc. Meetings with Investors July 30-31, 2015 Exhibit 99.1 |

Forward Looking Statements 2 This material and any oral statements made in connection with this material

include "forward-looking statements" within the

meaning of the Securities Act of 1933 and the

Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for

the future are forward-looking statements and are inherently

uncertain. The opinions, forecasts, projections or

other statements other than statements of

historical fact, including, without limitation, plans and

objectives of management of the Company are

forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking

statements. Important factors that could cause actual

results to differ materially include the risk

factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the

Company or the SEC. These filings are also available through the

Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no

obligation to publicly update or revise any

forward-looking statement. Statements

made in this presentation include non-GAAP financial

measures. The required reconciliation to

GAAP financial measures are included on our website and at the end of this presentation. |

Patterson-UTI Energy is a leading provider of contract drilling and pressure pumping services 3 |

Contract Drilling • High quality fleet of land drilling rigs including 159 APEX ® rigs • Leader in walking rig technology for pad drilling applications • Large footprint across North American drilling markets Pressure Pumping 38% Oil & Natural Gas 1% Contract Drilling 61% Components of Revenue Patterson-UTI reported results for the six months ended June 30, 2015

4 |

Pressure Pumping • High quality fleet of modern pressure pumping equipment • A leader in natural gas bi-fuel technology • Strong reputation for regional knowledge and efficient operations Patterson-UTI reported results for the six months ended June 30, 2015

5

Pressure

Pumping

38%

Oil &

Natural

Gas

1%

Contract

Drilling

61%

Components of Revenue |

Contract Drilling |

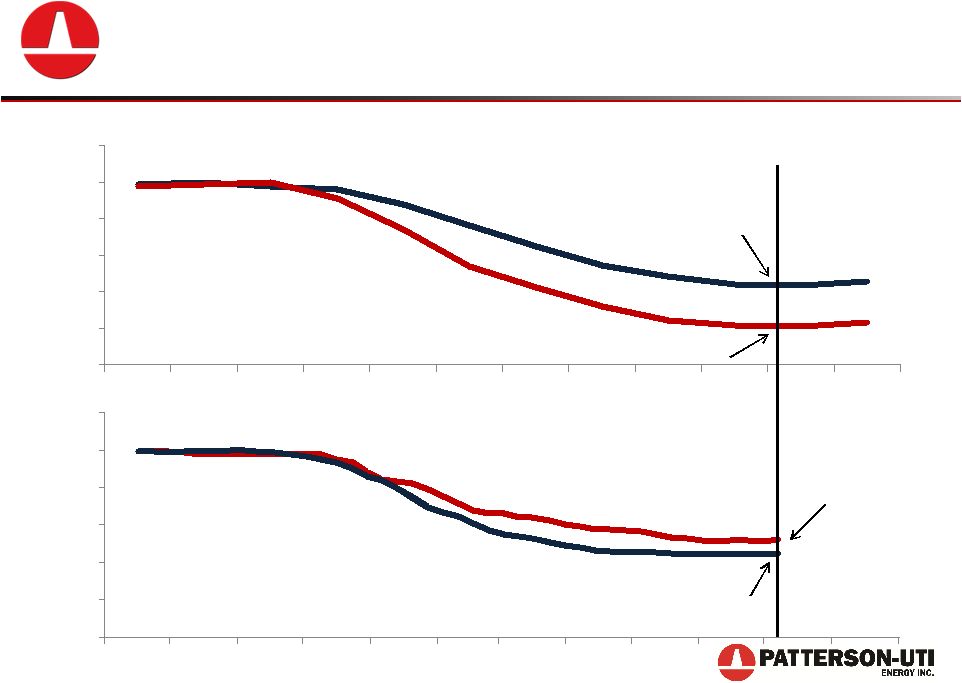

Improved Performance 0% 20% 40% 60% 80% 100% 120% U.S. Rig Count Downturn 0% 20% 40% 60% 80% 100% 120% 2008 - 2009 Total Baker Hughes U.S. Land Rig Count: -56% Total PTEN U.S. Rig Count: -77% 2014 - 2015 Total PTEN U.S. Rig Count: -48% Total Baker Hughes U.S. Land Rig Count: -55% Baker Hughes and Patterson-UTI U.S. Land Rig Counts as of July 24, 2015

7 |

A Rig Fleet Transformation 8 Other Electric APEX® Mechanical Patterson-UTI Energy Total Rig Fleet Other Electric APEX® Mechanical December 2009 Projected December 2015 |

…and Expected as of December 31, 2015 APEX-XK 1500 ® APEX-XK 1000™

APEX WALKING

®

APEX 1500

®

APEX 1000

®

Total APEX

®

Rigs

Class

APEX

®

Rigs as of July 30, 2015

53

4

49

44

11

161

12/31/2015

A leader in high specification drilling rigs

51

4

49

44

11

159

7/30/2015

APEX

®

Rig Fleet

9 |

West Texas 27 Rigs Large Geographic Footprint 10 PTEN’s Active U.S. Land Drilling Rigs as of July 24, 2015 Appalachia 21 Rigs East Texas 15 Rigs Mid-Continent 9 Rigs Mid-Continent 9 Rigs Rockies 8 Rigs South Texas 19 Rigs North Dakota 13 Rigs |

Patterson-UTI Energy …the impact of APEX ® rigs has been transformative! |

Increasing APEX ® Drilling Activity 12 0 20 40 60 80 100 120 140 160 Active APEX ® Rig Count |

PTEN Relative Active Rig Count by Rig Class 13 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% APEX® Other Electric Mechanical |

Greater Stability of Utilization 14 0% 20% 40% 60% 80% 100% 120% APEX ® Rig Utilization |

Improving Average Rig Revenue Per Day 15 Patterson-UTI Total Average Rig Revenue Per Day Excludes early-termination revenues during the third and fourth quarters of 2013 of $3,600 per day and $130

per day, respectively, and early-termination

revenues during the first and second quarters of 2015 of $1,020 per day and $1,390 per day, respectively. |

Adjusted EBITDA Contribution from High Specification Rigs 16 2010 2011 2012 2013 2014 2015 APEX® & Other Electric Mechanical Preferred rigs account for approximately 96% of Adjusted EBITDA in Contract Drilling Excludes early-termination revenues during the third and fourth quarters of 2013 of $62.8 million and $2.4 million,

respectively, and early-termination revenue

during the first and second quarters of 2015 of $15.8 million and $15.6 million, respectively. |

Patterson-UTI Energy …the APEX ® rig outlook remains strong! |

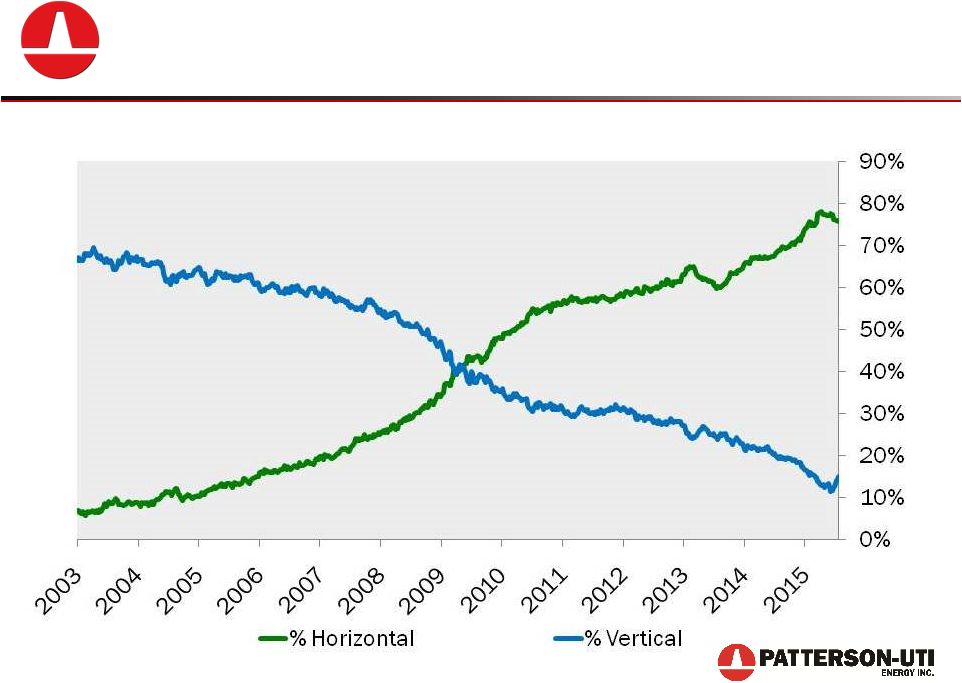

18 U.S. Rig Count % by Drilling Type Continued Demand for APEX ® Rigs Source: Baker Hughes North America Rotary Rig Count |

SCR AC Mechanical AC-powered rigs have increased as a percentage of the horizontal rig count Total U.S. Horizontal Rig Count by Power Type Continued Demand for APEX ® Rigs Analysis from Patterson-UTI Energy based on data from RigData and company filings. 19 |

Patterson-UTI Energy …Patterson-UTI is a technology leader! |

APEX WALKING ® Rigs 21 • Capable of walking with drill pipe and collars racked in the mast • Full multi-directional walking capability • Walking times average 45 minutes for 10’ – 15’ well spacing http://patenergy.com/drilling/technology/apexwalk 21 |

Strong Demand for Pad Drilling 22 • Pad drilling is contributing to increasing rig efficiency • Pad drilling capable rigs are highly utilized • Most new APEX ® rigs are expected to have walking systems http://patenergy.com/drilling/technology 22 |

The APEX-XK ® 23 • Enhanced mobility including more efficient rig up and rig down • Greater clearance under rig floor for optional walking system • Advanced environmental spill control integrated into drilling floor • Minimized number of truck loads for rig moves • Available in both 1500 HP and 1000 HP http://patenergy.com/drilling/technology 23 |

Enhancing our Position in Pad Drilling 24 Walking Systems Can be Added to Any Rig in Our Fleet…

…Allowing for True Multi-Directional Pad Drilling

Capabilities 24

|

Enhancing our Position in Pad Drilling 25 http://patenergy.com/drilling/technology 25 |

Early Adopter of Natural Gas Engines 26 http://patenergy.com/drilling/technology 26 |

Pressure Pumping |

Growing Pressure Pumping Business 28 0 200 400 600 800 1000 1200 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Period End Fracturing Horsepower Other Horsepower Investments in Pressure Pumping… …Have Increased Fleet Size and Quality 65 1,100 |

Southwest Region: Northeast Region: 34% 66% Fracturing Horsepower Fracturing horsepower: 663,800 Other horsepower: 32,165 Fracturing horsepower: 343,800 Other horsepower: 55,400 A Significant Player in Regional Markets Pressure Pumping Areas 29 Horsepower distribution as of June 30, 2015 |

A Leader in Bi-Fuel Technology • Engines can burn a fuel mix comprised of up to 70% natural gas • Comparable torque and horsepower to an all diesel engine • Reduces operating costs by lowering fuel costs • Good for environmental sustainability http://patenergy.com/pressurepumping/services 30 |

A Leader in Bi-Fuel Technology 31 http://patenergy.com/pressurepumping/services 31 |

Comprehensive Lab Services http://patenergy.com/pressurepumping/services 32 |

Financial Flexibility |

Investing in Our Company 34 $598 $637 $445 $453 $976 $1,012 $974 $662 $1,229 $710 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015E Year End Capital Expenditures and Acquisitions ($ in millions) 2015 Capital expenditure forecast as of July 23, 2015 |

Strong Financial Position 35 • History of returning capital to investors – Cash Dividend • Initiated cash dividend in 2004 • Doubled quarterly cash dividend to $0.10 per share in February 2014 – Stock Buyback • Total of $857 million repurchased since 2005 • Approximately $187 million remaining authorization as of

June 30, 2015

• Returned more than $1.3 billion to shareholders since 2005 |

Strong Financial Position 36 2006 2007 2008 2009 2010 2011 2012 2013 2014 2Q15 Period End Line of Credit Availability Cash Total Liquidity ($ in millions) Liquidity defined as end of period cash plus availability under revolving line of credit

|

Strong Financial Position 37 6% 2% -4% -2% 15% 13% 18% 14% 24% 22% -10% 0% 10% 20% 30% 40% 50% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2Q15 Period End Net Debt to Capital Ratio Includes $600 million of debt not due until at least 2020 |

Why Invest in Patterson-UTI Energy? • Continuing Transformation – Committed to high-spec land rigs where demand remains strong – Creating value through focus on well site execution • Technology leader – Leader in walking rigs for pad drilling – Innovator in use of natural gas as a fuel source for both drilling and pressure pumping • Financially flexible – Strong balance sheet – History of share buybacks – Dividends 38 |

Patterson-UTI Energy, Inc. Meetings with Investors July 30-31, 2015 |

Additional References |

41 Contract Drilling Capital Expenditures and Acquisitions

($ in millions)

Investing in Our Drilling Rig Fleet

More than $5 billion invested since 2005

2015 Capital expenditure forecast as of July 23, 2015

|

Investing in Pressure Pumping 42 $41 $48 $61 $43 $289 $198 $194 $123 $418 $165 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015E Pressure Pumping Capital Expenditures and Acquisitions

($ in millions)

More Than $1.5 billion invested since 2005

2015 Capital expenditure forecast as of July 23, 2015

|

Strong Financial Position • Total liquidity of approximately $577 million – $76.5 million of cash at June 30, 2015 – $500 million revolver availability at June 30, 2015 • $796 million net debt at June 30, 2015 – 21.7% Net Debt/Total Capitalization – $300 million of 4.97% Series A notes due October 5, 2020 – $300 million of 4.27% Series B notes due June 14, 2022 – $273 million of term loans maturing September 27, 2017 • No equity sales in last 14 years • Reduced share count by 25.2 million shares since 2005 43 |

Term Contract Coverage • Based on term contracts in place as of July 23, 2015 – An average of 85 rigs expected under term contract in the

third quarter of 2015

– An average of 77 rigs expected under term contract during

the second half of 2015

•

Drilling term contract revenue backlog of $1.0 billion at

June 30, 2015

44 |

Three Months Ended June 30, Six Months Ended June 30, 2015 2014 2015 2014 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

(Adjusted EBITDA)(1):

Net income (loss)

$

(18,975)

$

54,283

$

(9,850)

$

89,105

Income tax expense (benefit)

(14,720)

25,905

(8,000)

42,847

Net interest expense

8,931

7,041

17,189

14,053

Depreciation, depletion, amortization and

impairment 181,924

153,426

357,306

300,748

Adjusted EBITDA

$

157,160

$

240,655

$

356,645

$

446,753

Total revenue

$

472,761

$

757,276

$1,130,460

$1,435,444

Adjusted EBITDA margin

33.2%

31.8%

31.5%

31.1%

Adjusted EBITDA by operating segment:

Contract drilling

$

133,053

$

181,674

$

308,023

$

354,870

Pressure pumping

29,517

59,533

61,420

95,118

Oil and natural gas

5,037

9,244

8,739

17,974

Corporate and other

(10,447)

(9,796)

(21,537)

(21,209)

Consolidated Adjusted EBITDA

$

157,160

$

240,655

$

356,645

$

446,753

(1)

The company makes use of financial measures that are not

calculated in accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the assessment of ongoing operating performance. These non-GAAP financial measures are reconciled to their most directly

comparable GAAP measures in the tables above. We

define Adjusted EBITDA as net income plus net interest expense, income tax expense and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of

our fundamental business activities and our

ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA is not defined by GAAP and, as such, should not be construed as an

alternative to net income (loss) or operating cash flow. We

define margin as revenues less direct operating costs. We present margin because we believe it to be the component of our earnings most impacted by the variability in our contract drilling and pressure pumping operations.

Margin is not defined by GAAP and, as such, should

not be construed as an alternative to net income (loss). PATTERSON-UTI

ENERGY, INC. Non-GAAP Financial Measures (Unaudited)

(dollars in thousands)

Non-GAAP Financial Measures

45 |

Non-GAAP Financial Measures 46 2014 2013 2012 2011 2010 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

(Adjusted EBITDA)(1):

Net income (loss)

$

162,664

$

188,009

$

299,477

$

322,413

$

116,942

Income tax expense (benefit)

91,619

108,432

176,196

187,938

72,856

Net interest expense (income)

28,846

27,441

22,196

15,465

11,098

Depreciation, depletion, amortization and

impairment 718,730

597,469

526,614

437,279

333,493

Net

impact of discontinued operations

-

-

-

(209)

1,778

Adjusted EBITDA

$

1,001,859

$

921,351

$

1,024,483

$

962,886

$

536,167

Total revenue

$

3,182,291

$

2,716,034

$

2,723,414

$

2,565,943

$

1,462,931

Adjusted EBITDA margin

31.5%

33.9%

37.6%

37.5%

36.7%

(1) The company makes use of

financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the assessment of

ongoing operating performance. These

non-GAAP financial measures are reconciled to their most directly comparable GAAP measures in the tables above. We define Adjusted EBITDA as net income plus net interest expense, income tax expense and depreciation, depletion, amortization and

impairment expense. We present Adjusted EBITDA because we believe it provides additional information with respect to both the performance of our fundamental business activities

and our ability to meet our capital expenditures

and working capital requirements.

Adjusted EBITDA is not defined by GAAP and, as such, should not

be construed as an alternative to net income

(loss) or operating cash flow. We define margin as

revenues less direct operating costs. We present

margin because we believe it to be the component of our earnings most impacted by the variability in our contract drilling and pressure pumping operations. Margin is not defined by GAAP and, as such, should not be construed as

an alternative to net income (loss). PATTERSON-UTI ENERGY,

INC. Non-GAAP Financial Measures (Unaudited)

(dollars in thousands) |