Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - AYTU BIOPHARMA, INC | d947870dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 30, 2015

Registration No. 333-205414

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AYTU BIOSCIENCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 47-0883144 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

373 Inverness Parkway

Suite 200

Englewood, Colorado 80112

(720) 437-6580

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Joshua R. Disbrow

Chief Executive Officer

373 Inverness Parkway

Suite 200

Englewood, Colorado 80112

Telephone: (720) 437-6580

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

W. David Mannheim, Esq.

Alexander M. Donaldson, Esq.

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607

(919) 781-4000

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Table of Contents

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated July 30, 2015

PROSPECTUS

2,564,872 Shares

Common Stock

This prospectus relates to the sale or other disposition from time to time of up to 2,564,872 shares of our common stock by the selling stockholders named in this prospectus. We are not selling any shares of common stock under this prospectus and will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders.

The selling stockholders may sell or otherwise dispose of the shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell or otherwise dispose of their shares of common stock in the section entitled “Plan of Distribution” on page 105. The selling shareholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the shares with the Securities and Exchange Commission.

Our common stock is listed on the OTCQB Market operated by OTC Markets Group, Inc. (or OTCQB) under the ticker symbol “AYTU.” On July 29, 2015, the last reported sale price of our common stock on the OTCQB was $4.63.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 11 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2015.

Table of Contents

| Page | ||||

| 2 | ||||

| 10 | ||||

| 11 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 | |||

| 50 | ||||

| 52 | ||||

| 92 | ||||

| 99 | ||||

| 102 | ||||

| 107 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

109 | |||

| 110 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not, and the selling stockholders have not, authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the common stock being offered.

Unless the context indicates otherwise, as used in this prospectus, the terms “Aytu,” “we,” “us,” “our,” “our company” and “our business” refer to Aytu BioScience, Inc.

We own various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including Zertane, Vyrix, RedoxSYS and Luoxis. All other trade names, trademarks and service marks appearing in this prospectus are the property of their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such terms, when first mentioned in this prospectus, appear with the trade name, trademark or service mark notice and then throughout the remainder of this prospectus without trade name, trademark or service mark notices for convenience only and should not be construed as being used in a descriptive or generic sense.

i

Table of Contents

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 10, and the financial statements and related notes included in this prospectus.

Company Overview

We are a specialty healthcare company concentrating on developing and commercializing products with an initial focus on urological related conditions. We are focused primarily on the urological disorders market and specifically sexual dysfunction, urological cancers and male infertility. We are currently focused on commercializing our ProstaScint® product, which we plan to launch through a focused commercial infrastructure in the U.S. while developing corporate relationships outside the U.S. to launch ProstaScint in major healthcare markets around the world. We acquired ProstaScint in May 2015 from Jazz Pharmaceuticals. ProstaScint, which is approved by the U.S. Food and Drug Administration, or FDA, is a marketed biologic imaging agent specifically indicated for the diagnostic staging of prostate cancer patients. We plan to launch the RedoxSYS® oxidation-reduction potential system, or the RedoxSYS System, into the global research market while developing numerous clinical applications for this potential first-in-class diagnostic device, including an application for the detection of infertility in semen. Further, we are entering late-stage development of our lead therapeutic candidate, Zertane, which is being studied in premature ejaculation.

Our product candidate Zertane is in clinical development for the treatment of premature ejaculation. The premature ejaculation market in the U.S. and Europe is expected to reach over $1.3 billion in annual sales by 2017, representing a projected increase of 10.3% from 2010. According to recent published analyses, premature ejaculation, or PE, is a highly prevalent male sexual dysfunction affecting 20-30% of men worldwide. Based on internal market research and published reports, we believe that PE is up to 1.5-times more prevalent than erectile dysfunction, or ED. Currently, there are no FDA-approved prescription products in the United States to treat PE, and to our knowledge, only two other prescription products have been approved elsewhere in the world. Treatment options for PE have traditionally included antidepressant drugs prescribed “off label,” topical numbing medications, and cognitive behavior therapy or counseling, all of which have had limited effectiveness in treating the disorder. PE therefore represents an area of significant unmet medical need.

By virtue of our recent acquisition of ProstaScint, we are now commercial stage and generating sales for this FDA-approved prostate cancer imaging agent. As prostate cancer is a condition commonly diagnosed and treated by urologists, ProstaScint complements our urology-focused product pipeline. Prostate cancer is the most common cancer among men in the United States, with an estimated 218,000 annual cases (as of 2010). Further, more than 2,200,000 men were alive with some history of prostate cancer in 2006, and over 30,000 U.S. men die each year from the disease. The effect of prostate cancer on healthcare economics is substantial, which makes the need for accurate disease staging critical for treatment and management strategies. The U.S. market for the diagnosis and screening of prostate cancer is expected to total $17.4 billion in 2017, a CAGR of 7.5%.

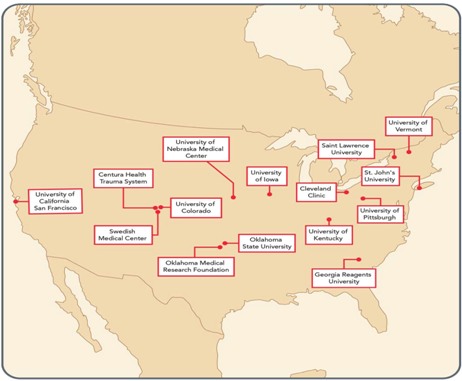

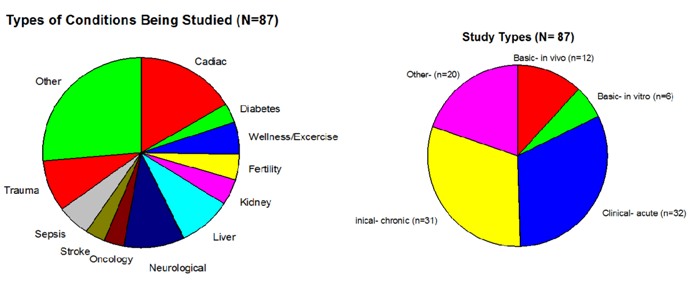

We are actively developing the global market for the RedoxSYS System across a range of applications. Specifically, we have begun commercializing RedoxSYS System for research use through direct selling, distribution partners, and academic collaborators. Over the past 18 months, we have engaged in over 60 trials around the world whereby prominent researchers are implementing oxidation-reduction potential as a marker in both chronic and acute illnesses and disorders in both clinical research as well as basic science research.

2

Table of Contents

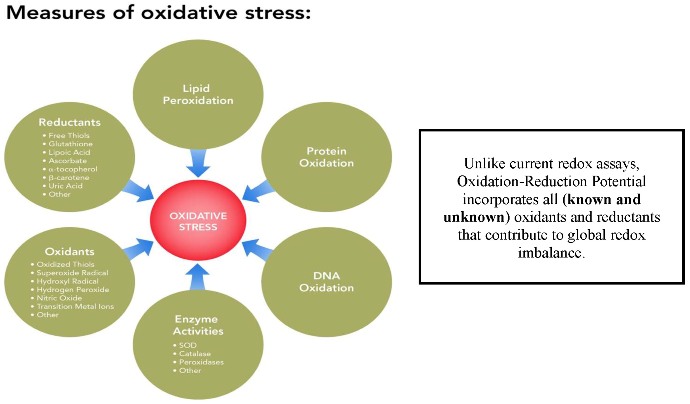

Through our extensive network of researchers, the RedoxSYS System has demonstrated the potential to have broad clinical applications. Studies are now underway at a major U.S. university in the area of male infertility. This condition is prevalent, underserved, and oxidative stress is widely implicated in its pathophysiology. As such, we expect to bolster our research focus in this area with the RedoxSYS System to complement our focus on urologic conditions. The male infertility market is expected to grow to over $300 million by 2020 with a CAGR of nearly 5% from 2013 to 2020. Oxidative stress is broadly implicated in the pathophysiology of oxidative stress, yet very few diagnostic tools exist to effectively measure oxidative stress levels in men. However, antioxidants are widely available and recommended to infertile men. With the introduction of the RedoxSYS System, we believe for the first time there will be an easy and effective diagnostic tool to assess degree of oxidative stress and monitor patients’ responses to antioxidant therapy as a treatment regimen for infertility.

The RedoxSYS System was developed by Luoxis Diagnostics, Inc. in the two years immediately preceding the merger between Luoxis, Vyrix Pharmaceuticals, Inc., and us (under our former name of Rosewind Corporation) in April 2015. Upon the consummation of the merger, the RedoxSYS System became our asset. Prior to the incorporation of Luoxis, the predecessor technologies that are now incorporated into the RedoxSYS System were developed by the research team of Dr. David Bar-Or when he was at DMI BioSciences, Inc. and subsequently at Ampio Pharmaceuticals, Inc.

Products

Zertane for Premature Ejaculation

Our premature ejaculation product candidate, Zertane, is a specifically formulated orally disintegrating tablet, or ODT, of tramadol hydrochloride patented for the on-demand treatment of PE. Zertane is being developed utilizing a regulatory pathway pursuant to Section 505(b)(2) of the Food, Drug and Cosmetic Act, as amended, or the FDCA, as the active ingredient is already well characterized for the treatment of pain, and we are relying on the FDA’s finding of safety of tramadol hydrochloride to support its use in a new indication, PE, at a lower dose. If we receive marketing approval for Zertane, we believe it will be the first commercial product approved by the FDA for PE.

Effective August 18, 2014 the Drug Enforcement Administration, or DEA, began classifying tramadol as a Schedule IV substance, including its salts, isomers, and salts of isomers. Tramadol has a low potential for abuse relative to the drugs or substances in Schedule III and has a currently accepted medical use in treatment in the U.S. for moderate to moderately severe pain. We expect the same classification for Zertane regardless of the indication, including premature ejaculation. As a result of this classification, manufacturers are required to print “C-IV” on the labeling of commercial containers of tramadol. It is unclear as to what extent the FDA and/or the DEA would expect manufacturers of tramadol-containing products to further control its distribution or monitor its use. However, we do not expect this classification to adversely affect the commercial potential for Zertane considering that tramadol has a long history of use and a low potential for abuse.

The method of use patents covering the use of tramadol for premature ejaculation were originally developed and held by Ampio Pharmaceuticals (our parent predecessor company). However, these patents and all related intellectual property were assigned to Vyrix Pharmaceuticals when it was established as an Ampio subsidiary. Following the Merger of Vyrix, Luoxis and us, the patents were transferred and are now solely owned by us.

ProstaScint for Prostate Cancer Imaging

A key part of our strategy is to identify, acquire, license, or otherwise promote marketed, complementary urology assets in order to establish a commercial footprint and generate revenues for already-approved or near-term medical products. To that end we acquired ProstaScint from Jazz Pharmaceuticals shortly after the Merger. ProstaScint received FDA approval on October 28, 1996 and was initially marketed by Cytogen Corporation.

ProstaScint (capromab pendetide) is a radio-labeled monoclonal antibody, which is a biologic product that targets a specific antigen. ProstaScint targets Prostate Specific Membrane Antigen (PSMA), a protein uniquely expressed by prostate tissue. Indium (In 111) is attached to the proprietary, mouse-derived antibody. The radiolabeled antibody is infused into the patient and is taken up by prostate cancer cells which can be detected and visualized with single-photon emission tomography (SPECT). ProstaScint has been shown to be clinically effective in determining the course of treatment for a patient who has had a prostatectomy and/or has suspected metastasis (spread of the cancer cells beyond the prostate). Further, ProstaScint has demonstrated efficacy in newly diagnosed patients classified as high-risk or with recurrent prostate cancer.

Multiple clinical studies have been conducted in the United States and published in peer-reviewed publications. These studies consistently demonstrate substantial clinical efficacy of ProstaScint in staging prostate cancer patients and specifically identifying whether the cancer is confined to the prostate or has metastasized to other parts of the body. Through more accurate clinical staging and identification of metastatic prostate cancer, clinicians are able to better direct therapeutic interventions and improve outcomes.

3

Table of Contents

RedoxSYS System for Research Use

We completed the development of the RedoxSYS System during the two years preceding the Merger. In 2014, we received ISO 13485 certification, demonstrating our compliance with global quality standards in medical device manufacturing. This enables the launch of the RedoxSYS System into the research market around the world. We also received a CE marking in Europe and Health Canada clearance to begin the market development of the RedoxSYS System as a clinical diagnostic in Europe, Canada, and elsewhere around the world where CE marking is recognized. We launched sales efforts into the research market in late 2014 and since that time have already placed the RedoxSYS System at a number of prominent research centers in the United States, Europe, Israel, Japan, Taiwan, Singapore and Korea.

RedoxSYS System for Reproductive Health

As part of our strategy to develop future clinical applications of the RedoxSYS System, we have conducted initial studies in male reproductive health. Male infertility is a significant medical condition in which oxidative stress is well known to play a substantial role. As such, we believe developing a clinical application to assess oxidative stress levels with the RedoxSYS System represents a significant commercial opportunity. Oxidative stress is well established as a leading contributing factor to male infertility. Further, a significant proportion of male infertility remains unexplained in part because of the lack of standardized tests available to clinicians and researchers to assess oxidative stress in semen and plasma. This lack of standardization has resulted in poor implementation of semen and plasma analysis around the world. Further, currently available tests are cumbersome, time consuming to perform, and costly.

We have conducted proof-of-concept studies in male infertility with a leading research center in the United States, which demonstrates that oxidation-reduction potential effectively measures oxidative stress levels in semen and seminal plasma – and that these levels strongly correlate with established markers of infertility. Semen analysis studies are routinely conducted to assess causes of infertility, so we expect clinicians and oxidative stress researchers to readily integrate the RedoxSYS System into routine use upon the completion of more extensive studies and regulatory clearance for this use. Additional studies are now in the late planning stages that will evaluate the RedoxSYS System’s performance in the detection of oxidative stress levels in healthy and infertile males. The RedoxSYS System must receive 510(k) approval from the FDA before we can market it for clinical use in the United States. Of the $300 million male infertility market projected for 2020, the North American, Middle Eastern, and Asia Pacific markets dominate due to prevalence, awareness of treatment, and availability of treatment resources. Thus, it is important that we have already established distribution relationships and direct access to major oxidative stress researchers in many of these important markets.

An attractive aspect of the reproductive health market relates to reimbursement, as infertility treatments and the associated diagnostic tests are generally paid directly by patients. The current infertility treatments and associated diagnostics typically cost in excess of $10,000 per treatment cycle, so the addition of a moderately priced oxidative stress test would consume nominal relative costs while providing specific, actionable information needed to improve the oxidative status of infertile patients. The current infertility treatments include antioxidant supplements and lifestyle modifications that lower oxidative stress (e.g., smoking cessation, exercise, dietary changes, etc.), so the measurements reported by the RedoxSYS System could effectively guide treatment in the infertile patients.

We have an extensive range of intellectual property across our two primary assets, Zertane and RedoxSYS. We have patent protection in the United States and several other large markets worldwide. Specifically, we have numerous patents issued and pending for the RedoxSYS System and its use in the U.S., Europe, Israel, and major markets in Asia inclusive of Japan, Korea, China, and the Middle East. Further, we have patent protection in the United States and several other large markets worldwide for the use of tramadol hydrochloride to treat PE. We also have intellectual property specifically covering Zertane-ED, our product candidate to treat erectile dysfunction, or ED, and methods of using Zertane-ED to treat comorbid PE and erectile dysfunction, or ED, that has issued patents in several large markets worldwide and is pending in the United States. However, we are not actively developing Zertane-ED at this time.

Strategy

Key elements of our strategy include:

| • | Develop a pipeline of therapeutics and diagnostics focused on urological conditions, with a focus on the initiation and completion of two Phase 3 clinical trials for Zertane in the United States and the development of worldwide commercialization and marketing partnerships. |

| • | Commercialize FDA-approved ProstaScint for the staging of both newly diagnosed high-risk and recurrent prostate cancer patients. We plan to commercialize ProstaScint in the U.S. and in key markets around the world. |

4

Table of Contents

| • | Establish the RedoxSYS System initially as a research tool and expand its application to other indications with a focus on male infertility and adjacent applications. |

| • | Acquire established marketed products and late-stage development assets within our core urology focus. |

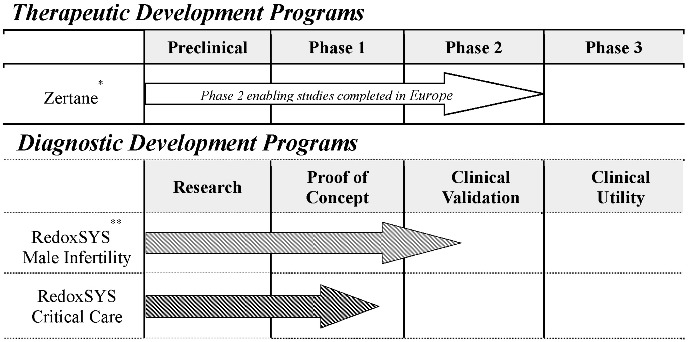

Product Pipeline

Our Lead Therapeutic Product Candidate – Zertane

Our lead therapeutic product candidate, Zertane, is a specifically formulated orally disintegrating tablet, or ODT, of tramadol hydrochloride patented for the on-demand treatment of PE. Zertane is being developed utilizing a regulatory pathway pursuant to Section 505(b)(2) of the Food, Drug and Cosmetic Act, as amended, or the FDCA, as the active ingredient is already well characterized for the treatment of pain, and we are relying on the FDA’s finding of safety of tramadol hydrochloride to support its use in a new indication, PE, at a lower dose. If we receive marketing approval for Zertane, we believe it will be the first commercial product approved by the FDA for PE.

There are three main types of NDAs, which are covered by Section 505 of the FDCA: (1) an application that contains full reports of investigations of safety and efficacy (Section 505(b)(1)); (2) an application that contains full reports of investigations of safety and effectiveness but where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the application has not obtained a right of reference (Section 505(b)(2)); and (3) an application that contains information to show that the proposed product is identical in active ingredient, dosage form, strength, route of administration, labeling, quality, performance characteristics, and intended use, among other things, to a previously approved product (Section 505(j)). Section 505(b)(2) expressly permits the FDA to rely, for approval of an NDA, on data not developed by the applicant. In the pre-IND briefing meeting with Ampio and in June 2012, the FDA agreed that our NDA may be submitted under Section 505(b)(2). As such, we intend to rely on studies published in the scientific literature and reference FDA-approved NDAs for tramadol-containing products (NDAs 21-693, 20-281 and 21-692) to support the safety and efficacy demonstrated in our clinical program. Relying on Section 505(b)(2) is advantageous because we or our collaborators may not be required (i) to perform the full range of safety and efficacy trials that is otherwise required to secure approval of a new drug, and (ii) obtain a “right of reference” from the applicant that obtained approval of the previously approved drug. However, a Section 505(b)(2) application must support the proposed change of the previously approved drug by including necessary and adequate information, as determined by the FDA, and the FDA may still require us to perform a portion or the full range of safety and efficacy trials. There can be no assurance that we would be successful under any Section 505(b)(2) application.

According to recent published analyses, PE is a highly prevalent male sexual dysfunction affecting 20-30% of men worldwide. Based on internal market research and published reports, we believe that PE is up to 1.5-times more prevalent than erectile dysfunction. Currently, there are no FDA-approved prescription products in the United States to treat PE, and to our knowledge, only one oral prescription product has been approved elsewhere in the world. Treatment options for PE have traditionally included antidepressant drugs prescribed “off label,” topical numbing medications, and cognitive behavior therapy or counseling, all of which have had limited effectiveness in treating the disorder. PE therefore represents an area of significant unmet medical need.

By virtue of significant development work performed by a previous corporate partner, Zertane has already been evaluated outside the United States in two Phase 1 clinical trials, two Phase 2 clinical trials and two Phase 3 clinical trials. This development work has demonstrated a favorable safety and efficacy profile of Zertane in men with PE and helped inform the design and endpoints of the Phase 3 clinical trials we will need to obtain FDA approval. Furthermore, the safety and pharmacology of the drug substance in Zertane, tramadol hydrochloride, is well characterized, which we believe will eliminate the need for us to conduct additional pre-clinical studies and safety trials. We believe we are well positioned to initiate Phase 3 clinical trials with Zertane in the United States. Upon completion of the trials, if successful, we plan to submit a New Drug Application, or NDA, and subsequently market Zertane in the United States, if approved.

Our strategy for Zertane is focused on the initiation and completion of the Phase 3 clinical program in the United States and the development of worldwide commercialization and marketing partnerships. We expect to finalize clinical development of Zertane, seek FDA marketing approval and – if approved—commercialize the product candidate in the United States either directly or via partnerships. While we have not yet submitted and IND for Zertane to the FDA that would allow us to initiate the planned Phase 3 trial, we expect to submit the IND in the second half of 2015. We will seek partnerships to commercialize Zertane in rest of world, or ROW,

5

Table of Contents

markets. We already have partnerships in place to market Zertane in South Korea (Daewoong Pharmaceutical Co., Ltd.) and Brazil (FBM Farma Industria Farmaceutica), which could provide near-term revenue for us if, working with our partners, we are able to successfully obtain regulatory approval in those countries. In addition, we recently entered into an agreement with Endo Ventures Limited, which recently acquired Paladin Labs Inc., or Paladin, a leading Canadian specialty pharmaceutical company, to provide exclusive rights to market, sell and distribute Zertane in Canada, the Republic of South Africa, certain countries in Sub-Saharan Africa, Colombia and Latin America.

Market Opportunity

PE Market

PE is a significant unmet medical need in the United States and worldwide as it causes significant emotional distress for affected men and their partners. According to an article published in European Urology in 2010 and a survey published in the Journal of the American Medical Association (JAMA) in 1999, PE is a highly prevalent male sexual dysfunction affecting 20-30% of men worldwide. However, most prevalence data on PE is based on patient surveys, which are inherently subjective, and therefore some of the men surveyed may not have PE as it is defined by major medical societies. In a 2007 study published in European Urology, the incidence of PE was assessed via a web-based survey of 12,133 men ages 18-70 in the United States, Germany and Italy. In this survey, 2,754 or 22.7% of the men reported that they suffer from PE. The vast majority (87.9%) of men with PE wished that they had more control over time to climax. Additionally, a majority (57.6%) of the men surveyed reported that they would seek medical treatment if they knew that a pill to control ejaculation were available. We believe men would also ask their doctor about treatment options if their partner suggested it. Additional primary company market research indicated that over 66% of patients that see a urologist for PE were self-referred, which we believe further demonstrates that PE is a condition for which patients are actively seeking treatment.

Presently, there are no approved prescription pharmaceuticals in the United States to treat PE and only two pharmaceuticals known to be approved elsewhere in the world. Current “off label” or unapproved therapies used to treat PE carry with them unwanted side effects and inconsistent or limited effectiveness. Topical over-the-counter, or OTC, options are not preferred due to route of administration and may also have an impact on partner satisfaction. Oral therapeutics, specifically selective serotonin reuptake inhibitors, or SSRIs, carry potentially significant side effects; the most notable of which is diminished libido. PDE-5 inhibitors have been prescribed “off label” for PE but have not demonstrated efficacy. Outside of oral or topical therapeutics, non-medical options include behavioral therapy and relationship counseling, both of which can be time consuming and stressful and frequently ineffective for men and their partners.

We believe patients and their partners are generally dissatisfied with existing pharmacologic and non-pharmacologic treatments for PE. Based on primary market research commissioned by us, which included discussions with a cross section of clinicians that treat patients with PE, we believe that there are significant issues with existing PE treatments demonstrating a real need for a safe and effective, FDA-approved product to treat PE that does not have a ramp-up period.

Our lead product candidate, Zertane for premature ejaculation, contains 89 mg tramadol hydrochloride in an orally dissolving tablet, or ODT. Tramadol hydrochloride is a well-established, centrally acting synthetic analgesic and has been used for more than 30 years as a treatment for moderate to severe pain. The drug and its active metabolite (M1, O-desmethyltramadol) act as an opiate agonist, apparently by selective activity at the µ-receptor. Although the mechanism by which tramadol hydrochloride delays ejaculation has not been identified, numerous laboratory studies have shown that tramadol hydrochloride also acts as an N-methyl-D-aspartate receptor antagonist, 5-hydroxytryptamine type 2C receptor antagonist, 5 nicotinic acetylcholine receptor antagonist, M1 and M3 muscarinic acetylcholine receptor antagonist, and a serotonin and norepinephrine modulator. It is possible that one or a combination of these effects leads to a delay in ejaculation. The relative contribution of tramadol hydrochloride versus its M1 metabolite to delay ejaculation is unknown. However, the metabolite is six times more potent than the parent drug in producing analgesia in animal models and 200 times more potent in µ-receptor binding. As a pain medication, tramadol hydrochloride has been associated with certain adverse effects including dizziness, nausea, constipation, vertigo, headache, vomiting and drowsiness. However, we intend that our labeling for Zertane, if regulatory approval is obtained, will suggest “as required” dosing before sexual intercourse and not to exceed one tablet per day. Based on previous clinical studies, we believe that limiting the dosing to no more than once per day will minimize any side effects.

6

Table of Contents

Our Marketed, FDA-Approved Prostate Imaging Product – ProstaScint

On May 20, 2015, we acquired ProstaScint from Jazz Pharmaceuticals. ProstaScint is already approved by the FDA and is generating revenues. As such, we expect to launch a commercial infrastructure in order to support increased sales and distribution of ProstaScint in the U.S. ProstaScint, or capromab pendetide, is a radio-labeled monoclonal antibody, which is a biologic product that targets a specific antigen. ProstaScint targets Prostate Specific Membrane Antigen (PSMA), a protein uniquely expressed by prostate tissue. A radioactive substance called Indium In 111 is attached to the proprietary, mouse-derived antibody. The radiolabeled antibody is infused into the patient and is taken up by prostate cancer cells which can be detected and visualized with a special nuclear medicine scan (single-photon emission tomography, or SPECT). ProstaScint has been shown to be clinically effective in determining the course of treatment for a patient who has had a prostatectomy and/or has suspected metastasis (spread of the cancer cells beyond the prostate). Further, ProstaScint has demonstrated efficacy in newly diagnosed patients classified as High Risk or with recurrent prostate cancer. In addition to U.S. approval ProstaScint has also been approved by Health Canada.

ProstaScint fills an important medical need in the detection of a common illness facing a significant number of men in the U.S. and around the world. Prostate cancer is the most common cancer among men in the United States, with an estimated 218,000 annual cases (as of 2010). Further, more than 1,800,000 men are alive with some history of prostate cancer, and over 30,000 U.S. men die each year from the disease. The effect of prostate cancer on healthcare economics is substantial, which makes the need for accurate disease staging critical for treatment and management strategies. The U.S. market for the diagnosis and screening of prostate cancer is expected to total $17.4 billion in 2017, a CAGR of 7.5%.

ProstaScint has several unique selling features that we believe will enable significant sales growth and regular use by healthcare providers diagnosing and treating prostate cancer. ProstaScint is the only imaging agent that specifically targets prostate cancer cells and demonstrates high sensitivity, specificity, and accuracy. In multiple clinical studies researchers have shown that when SPECT/CT scans were used in patients pre-treated with ProstaScint, ProstaScint imaging was highly sensitive in detecting prostate cancer and significantly predictive of 10-year biochemical disease free survival in prostate cancer patients (86.6% vs. 65.5%; p=0.0014). Importantly, ProstaScint is already approved by the FDA with a history of sales in the U.S. Additionally, the American Cancer Society specifically recognizes ProstaScint by name in current prostate cancer diagnosis guidelines.

Summary of Select ProstaScint Clinical Studies

Multiple clinical studies have been conducted in the United States and published in peer-reviewed publications. These studies consistently demonstrate substantial clinical efficacy of ProstaScint in staging prostate cancer patients and specifically identifying whether the cancer is confined to the prostate or has metastasized to other parts of the body. Through more accurate clinical staging and identification of metastatic prostate cancer, clinicians are able to better direct therapeutic interventions and improve outcomes. A brief summary of key clinical findings for ProstaScint from select studies are summarized below.

| Principal Investigator(s)/ Primary Authors |

Publication |

Patient Population |

Conclusion/Results | |||

| Ellis RJ et al. |

Int. J. Radiation Oncology Biol. Phy. (2010) | Patients presenting for primary radiotherapy having a clinical diagnosis of localized primary prostate cancer; Patients evaluated for tumor stage using conventional staging and SPECT/CT (N=239) | SPECT/CT imaging with ProstaScint pre-treatment was significantly predictive of 10-year biochemical disease-free survival (86.6% vs. 65.5%; p=0.0014) | |||

| Haseman MK et al. |

Urology (2007) | Men with prostate cancer who underwent imaging with ProstaScint pretreatment; Patients were divided according to the presence or absence of central abdominal uptake(CAU) (N=341) | SPECT/CT imaging with ProstaScint pretreatment effectively predicted death rates among patients with central abdominal uptake (CAU), and demonstrated that prostate cancer-specific death rates were 10 times higher in patients identified with ProstaScint as having central abdominal uptake (p=0.005). | |||

7

Table of Contents

| Principal Investigator(s)/ Primary Authors |

Publication |

Patient Population |

Conclusion/Results | |||

| Ellis RJ et al. |

Brachytherapy (2005) | Men with prostate cancer of all risk categories who underwent imaging with ProstaScint pretreatment; patients were divided into low, intermediate, and high risk and underwent brachytherapy (N=239) | SPECT/CT imaging with ProstaScint pretreatment effectively predicted biochemical disease recurrence regardless of the patient’s risk category; 7-year outcomes data from brachytherapy patients with treatment based on the ProstaScint scan showed a significant difference in biochemical disease-free survival. | |||

Radiation oncology experts have published numerous papers expressing the potential for expanded use of ProstaScint in prostate cancer imaging due to advances in imaging technologies since its FDA approval in 1996. Since the early 2000s significantly greater image resolution has been enabled due to the advent of dual head cameras (and improved imaging in general) along with the use of co-registered images where radiologists now combine the images of SPECT and computerized tomography (CT) or magnetic resonance imaging (MRI).

Our Lead Diagnostic Product Candidate – The RedoxSYS System

Our leading diagnostic product candidate, the RedoxSYS System, is now fully developed for research use. RedoxSYS is a novel, portable device that measures oxidation-reduction potential, or ORP, a global measure of oxidative stress. This system is the first and only system that measures ORP in biologic specimens to provide a complete measure of redox balance, which is broadly implicated across a wide range of both acute and chronic conditions. To date, Canadian and European regulators have characterized RedoxSYS System as Class II medical device and regulated them accordingly. Classification of a medical device as Class II in Europe and Canada indicates that the device is generally regarded as posing medium risk, and non-invasive medical devices that come into contact with injured skin are generally classified as Class II. As we have conducted initial validation studies with the RedoxSYS System across a range of conditions and obtained a CE marking in Europe and Health Canada clearance to begin the market development of the RedoxSYS System as a clinical diagnostic in Europe, Canada, and elsewhere around the world where CE marking is recognized, we are now initiating commercialization for use of the RedoxSYS System as a research tool. By employing a focused commercial infrastructure and a focused network of distributors around the world, we believe we can efficiently penetrate the academic and industry-based research centers who study oxidative stress. With this growth in the research market, we intend to develop clinical applications for the RedoxSYS System.

A significant potential opportunity that has presented promise through our research is the application of ORP in the study of male infertility. ORP represents a unique approach to assessing oxidative stress in male infertility as it relates to semen analysis, and early clinical studies have been conducted. We are now beginning larger-scale clinical studies with a globally recognized U.S. university in male infertility. Oxidative stress is widely assessed in male infertility semen analysis laboratories, and we believe the RedoxSYS System, if proven effective, will provide a simple, comprehensive solution to oxidative stress detection and management of antioxidant and lifestyle intervention in this underserved market.

Our strategy for the RedoxSYS System is to continue deployment of this system at leading academic centers around the world, develop research collaborations with key opinion leaders in oxidative stress research, identify clinical applications for the platform, and aggressively pursue infertility studies to establish efficacy of the system in this setting of care. Our plans include introduction of the RedoxSYS System to infertility specialists following FDA approval in the United States through a direct commercial effort while engaging with distributors in major markets around the world, including Canada, Europe, and Asia (with a focus on Japan, Korea, Taiwan, Singapore, and Malaysia).

In 2013 and 2014, we deployed the RedoxSYS System around the world in the development of numerous future clinical applications. While many areas of study have been undertaken, we have focused research resources on high-value areas where significant medical needs remain unmet. Given our initial orientation around trauma, the studies completed thus far have focused on large conditions related to critical care. These initial studies demonstrated the initial clinical validation for the RedoxSYS System and represent substantial opportunities as growth applications and markets following initial entry into the research and infertility markets. As our direct commercial efforts will focus on male infertility, we expect that other areas of clinical use would be pursued through partnerships with corporate partners established in these non-urological clinical channels.

8

Table of Contents

Future Products

We plan to augment our core development and commercial assets through efficient identification of complementary therapeutics, devices, and diagnostics related to urological disorders. We intend to seek assets that are near commercial stage or already generating revenues. Further, we intend to seek to acquire products through asset purchases, licensing, co-development, or collaborative commercial arrangements (co-promotions, co-marketing, etc.).

Our management team has extensive experience across a wide range of business development activities and have in-licensed or acquired products from large, mid-sized, and small enterprises in the United States and abroad. Through an assertive product and business development approach, we expect that we will rapidly advance our internal products as well as externally sourced assets.

Recent Developments

On July 22, 2015, we closed on note purchase agreements with institutional and high net worth individual investors for the purchase and sale of convertible promissory notes with an aggregate principal amount of $2.0 million. The sale of the notes is part of a private placement that we expect to continue to undertake to raise up to a maximum of $6.0 million although there can be no assurance that we will be able to raise any more capital from the sale of notes. We intend to use the net proceeds of the offering to conduct clinical studies for both Zertane® and RedoxSYS™ and for working capital to begin commercializing FDA-approved ProstaScint®, as well as general corporate purposes.

The notes are our unsecured obligation. Unless earlier converted, the notes will mature on January 22, 2017, with an option to extend up to six months at our discretion (provided that in the event we exercise such extension option, the then applicable interest rate shall increase by 2% for such extension period). We do not have the right to prepay the notes prior to the maturity date. Interest will accrue on the notes in the following amounts: (i) 8% simple interest per annum for the first six months and (ii) 12% simple interest per annum thereafter if not converted during the first six months. If there has not been a registration statement on Form S-1 filed with the SEC for the registration of the shares of common stock underlying the notes by the expiration of the first six-month period then (a) the interest rate will increase to 14% for the remainder of the period in which the notes remain outstanding and (b) any notes held by officers and directors of our company will be subordinated to the remaining notes. Interest will accrue, is payable with the principal upon maturity, conversion or acceleration of the notes and may be paid in kind or in cash, in our sole discretion.

The notes are convertible at any time in a noteholder’s discretion into that number of shares of our common stock equal in an amount equal to 120% of the number of shares of common stock calculated by diving the then outstanding principal and accrued interest by $4.63. A holder of notes will be obligated to convert on the terms of our next public offering of our stock resulting in proceeds to us of at least $5,000,000 in gross proceeds (excluding indebtedness converted in such financing) prior to the maturity date of the notes, referred to as a Qualified Financing. The principal and accrued interest under the notes will automatically convert into a number of shares of such equity securities of our company sold in such financing equal to 120% of the principal and accrued interest under such note divided by the lesser of (i) the lowest price paid by an investor in such financing or (ii) $4.63. In the event that we sell equity securities to investors at any time while the notes are outstanding in a financing transaction that is not a Qualified Financing, then the noteholders will have the option to convert in whole the outstanding principal and accrued interest as of the closing of such financing into a number of shares of our capital stock in an amount equal to 120% of the number of such shares calculated by dividing the outstanding principal and accrued interest by the lesser of (a) the lowest cash price per share paid by purchasers of shares in such financing, or (b) $4.63.

Newbridge Securities Corporation, Member FINRA/SIPC, through LifeTech Capital, acted as sole placement agent for the institutional portion of the offering. We sold the balance of the notes to individuals and entities with whom we have an established relationship. For notes sold by the placement agent, we paid the placement agent 8% of the gross proceeds of notes sold by the placement agent and a warrant to purchase shares of our common stock equal to 8% of the gross proceeds of the notes sold by the placement agent divided by the price per share at which equity securities are sold in our next equity financing, in addition to a previously paid non-refundable retainer fee of $20,000. The placement agent warrant has a term of five years, will have an exercise price equal to 100% of the price per share at which equity securities are sold in our next equity financing, and provides for cashless exercise.

Corporate Information

Aytu was incorporated as Rosewind Corporation on August 9, 2002 in the State of Colorado.

Vyrix was incorporated under the laws of the State of Delaware on November 18, 2013 and was wholly owned by Ampio Pharmaceuticals, Inc. (NYSE MKT: AMPE), or Ampio, immediately prior to the completion of the Merger (defined below). Vyrix was previously a carve-out of the sexual dysfunction therapeutics business, including the late-stage men’s health product candidates, Zertane and Zertane-ED, from Ampio, which carve out was announced in December 2012. Luoxis was incorporated under the laws of the State of Delaware on January 24, 2013 and was majority owned by Ampio immediately prior to the completion of the Merger. Luoxis was focused on developing and advancing the RedoxSYS System.

On March 20, 2015, Rosewind formed Rosewind Merger Sub V, Inc. and Rosewind Merger Sub L, Inc., each a wholly-owned subsidiary formed for the purpose of the Merger, and on April 16, 2015, Rosewind Merger Sub V, Inc. merged with and into Vyrix and Rosewind Merger Sub L, Inc. merged with and into Luoxis, and Vyrix and Luoxis became subsidiaries of Rosewind. Immediately thereafter, Vyrix and Luoxis merged with and into Rosewind with Rosewind as the surviving corporation (herein referred to as the Merger).

Concurrent with the closing of the Merger, Rosewind abandoned its pre-merger business plans to develop a sailing school, and we now solely pursue the specialty healthcare market, focusing on urological related conditions, including the business of Vyrix and Luoxis.

On June 8, 2015, we (i) reincorporated as a domestic Delaware corporation under Delaware General Corporate Law and changed our name from Rosewind Corporation to Aytu BioScience, Inc., and (ii) effected a reverse stock split in which each common stock holder received one share of common stock for each every 12.174 shares currently outstanding (herein referred to as the Reverse Stock Split). All share and per share amounts in this prospectus have been adjusted to reflect the effect of the Reverse Stock Split.

9

Table of Contents

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 2,564,872 shares of our common stock, as follows:

| • | 1,037,147 shares of common stock issued in the Merger to the stockholders of Luoxis; |

| • | 1,425,933 shares held by certain Rosewind shareholders issued prior to the merger; and |

| • | 102,613 shares of common stock issuable at a price of $4.53 per share upon the exercise of warrants issued to the placement agent for a private placement conducted by Luoxis. |

| Common stock offered by the selling stockholders |

2,564,872 shares | |

| Common stock outstanding before the offering (1) |

14,259,681 shares | |

| Common stock to be outstanding after the offering |

14,259,681 shares | |

| Common stock OTCCQB Symbol |

AYTU |

| (1) | Based on the number of shares outstanding as of June 30, 2015. |

Use of Proceeds

We will not receive any of the proceeds from the sale of shares in this offering. The selling stockholders will receive all net proceeds from the sale of shares of our common stock in this offering.

Dividend Policy

We have never paid dividends on our capital stock and do not anticipate paying any dividends for the foreseeable future. See “Dividend Policy.”

10

Table of Contents

Investing in our common stock includes a high degree of risk. Prior to making a decision about investing in our common stock, you should consider carefully the specific factors discussed below, together with all of the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our common stock to decline and could cause you to lose all or part of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have limited operating history, have incurred losses, and can give no assurance of profitability.

We are a clinical-stage healthcare company with a limited operating history. We have not generated material revenue to date and are not profitable, and have incurred losses in each year since our inception. Our net loss for the years ended June 30, 2014 and 2013 was $5.6 million and $2.8 million, respectively, and our net loss for the nine months ended March 31, 2015 was $5.6 million. We have not demonstrated the ability to be a profit-generating enterprise, and without significant financing, there is substantial doubt about our ability to continue as a going concern. We expect to incur substantial losses for the foreseeable future. Our ability to generate revenue is uncertain, and we may never achieve profitability. We have a very limited operating history on which investors can evaluate our potential for future success. Potential investors should evaluate us in light of the expenses, delays, uncertainties, and complications typically encountered by early-stage healthcare businesses, many of which will be beyond our control. These risks include the following:

| • | U.S. regulatory approval of our product candidates; |

| • | foreign regulatory approval of our products and product candidates; |

| • | lack of sufficient capital; |

| • | uncertain market acceptance of our products and product candidates; |

| • | unanticipated problems, delays, and expense relating to product development and implementation; |

| • | lack of intellectual property; |

| • | competition; and |

| • | technological changes. |

As a result of our limited operating history, and the increasingly competitive nature of the markets in which we compete, our historical financial data, which, prior to April 16, 2015, consists of allocations of expenses from Ampio, is of limited value in anticipating future operating expenses. Our planned expense levels will be based in part on our expectations concerning future operations, which is difficult to forecast accurately based on our stage of development. We may be unable to adjust spending in a timely manner to compensate for any unexpected budgetary shortfall.

We have not received any material revenues from the commercialization of our products or product candidates and might not receive significant revenues from the commercialization of products and our product candidates in the near term. Even though ProstaScint is an approved drug that we are marketing, we only acquired it in May 2015 and have limited experience on which to base the revenue we could expect to receive. To obtain revenues from our products and product candidates, we must succeed, either alone or with others, in a range of challenging activities, including expanding markets for our existing products and completing clinical trials of our product candidates, obtaining positive results from the clinical trials, achieving marketing approval for these product candidates, manufacturing, marketing and selling our existing products and those products for which we, or our collaborators, may obtain marketing approval, satisfying any post-marketing requirements and obtaining reimbursement for our products from private insurance or government payors. We, and our collaborators, if any, may never succeed in these activities and, even if we do, or one of our collaborators does, we may never generate revenues that are sufficient enough for us to achieve profitability.

11

Table of Contents

We may need to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain necessary capital when needed may force us to delay, limit or terminate our product expansion and development efforts or other operations.

We are currently advancing our product candidates through clinical development. Developing product candidates is expensive, lengthy and risky, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance Zertane into two planned Phase 3 clinical trials in the United States and develop the RedoxSYS System for additional applications. In addition, we are expending resources to expand the market for ProstaScint, which might not be successful or might take longer and be more expensive than anticipated.

As of March 31, 2015, our cash and cash equivalents were $1.5 million. Our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or a combination of these approaches. In any event, we will require additional capital to obtain regulatory approval for, and to commercialize, our product candidates. Raising funds in the current economic environment, as well our lack of operating history, may present additional challenges. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to expand any existing product or develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares to decline. The sale of additional equity or convertible securities would dilute all of our stockholders. The incurrence of indebtedness would result in increased fixed payment obligations and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any product candidate or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

If we do not obtain the capital necessary to fund our operations, we will be unable to successfully expand, develop, obtain regulatory approval of, and commercialize, our products and product candidates.

The development of pharmaceutical products, medical diagnostics and medical devices is capital-intensive. We anticipate we may require additional financing to continue to fund our operations. Our future capital requirements will depend on, and could increase significantly as a result of, many factors including:

| • | progress in, and the costs of, our pre-clinical studies and clinical trials and other research and development programs; |

| • | the scope, prioritization and number of our research and development programs; |

| • | the achievement of milestones or occurrence of other developments that trigger payments under any collaboration agreements we obtain; |

| • | the costs of securing manufacturing arrangements for commercial production; |

| • | the costs of establishing or contracting for sales and marketing capabilities for any existing products and if we obtain regulatory clearances to market our product candidates; |

| • | the extent to which we are obligated to reimburse, or entitled to reimbursement of, clinical trial costs under future collaboration agreements, if any; and |

| • | the costs involved in filing, prosecuting, enforcing and defending patent claims and other intellectual property rights. |

12

Table of Contents

Until we can generate significant continuing revenues, we expect to satisfy our future cash needs through collaboration arrangements, sales of our securities, debt financings, or by out-licensing one or more of our product candidates. Dislocations in the financial markets have generally made equity and debt financing more difficult to obtain, and may have a material adverse effect on our ability to meet our fundraising needs. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate one or more of our technologies, research or development programs or our commercialization efforts. Additional funding, if obtained, may significantly dilute existing shareholders if that financing is obtained through issuing equity or instruments convertible into equity.

We will incur increased costs associated with, and our management will need to devote substantial time and effort to, compliance with public company reporting and other requirements.

As a public company, we will incur significant legal, accounting and other expenses that Vyrix and Luoxis did not incur as private companies. In addition, the rules and regulations of the SEC and any national securities exchange to which we may be subject in the future impose numerous requirements on public companies, including requirements relating to our corporate governance practices, with which we will need to comply. Further, we will be required to, among other things, file annual, quarterly and current reports with respect to our business and operating results. Based on currently available information and assumptions, we estimate that we will incur approximately $500,000 in expenses on an annual basis as a direct result of the requirements of being a publicly traded company. Our management and other personnel will need to devote substantial time to gaining expertise regarding operations as a public company and compliance with applicable laws and regulations, and our efforts and initiatives to comply with those requirements could be expensive.

Risks Related to Product Development, Regulatory Approval and Commercialization

We cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, any of our product candidates.

We may not be able to develop our current or any future product candidates. Our product candidates will require substantial additional clinical development, testing, and regulatory approval before we are permitted to commence commercialization. The clinical trials of our product candidates are, and the manufacturing and marketing of our product candidates will be, subject to extensive and rigorous review and regulation by numerous government authorities in the United States and in other countries where we intend to test and, if approved, market any product candidate. Before obtaining regulatory approvals for the commercial sale of any product candidate, we must demonstrate through pre-clinical testing and clinical trials that the product candidate is safe and effective for use in each target indication. This process can take many years and may include post-marketing studies and surveillance, which will require the expenditure of substantial resources. Of the large number of drugs in development in the U.S., only a small percentage successfully completes the FDA regulatory approval process and is commercialized. Accordingly, even if we are able to obtain the requisite financing to continue to fund our development and clinical programs, we cannot assure you that any of our product candidates will be successfully developed or commercialized.

We are not permitted to market a product in the U.S. until we receive approval of a New Drug Application, or an NDA, for that product from the FDA, or in any foreign countries until we receive the requisite approval from such countries. Obtaining approval of an NDA is a complex, lengthy, expensive and uncertain process, and the FDA may delay, limit or deny approval of any product candidate for many reasons, including, among others:

| • | we may not be able to demonstrate that a product candidate is safe and effective to the satisfaction of the FDA; |

| • | the results of our clinical trials may not meet the level of statistical or clinical significance required by the FDA for marketing approval; |

| • | the results of our clinical trials may not meet the level of statistical or clinical significance required by the FDA for marketing approval; |

| • | the FDA may disagree with the number, design, size, conduct or implementation of our clinical trials; |

| • | the FDA may require that we conduct additional clinical trials; |

| • | the FDA may not approve the formulation, labeling or specifications of any product candidate; |

| • | the clinical research organizations, or CROs, that we retain to conduct our clinical trials may take actions outside of our control that materially adversely impact our clinical trials; |

13

Table of Contents

| • | the FDA may find the data from pre-clinical studies and clinical trials insufficient to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks, such as the risk of drug abuse by patients or the public in general; |

| • | the FDA may disagree with our interpretation of data from our pre-clinical studies and clinical trials; |

| • | the FDA may not accept data generated at our clinical trial sites; |

| • | if an NDA, if and when submitted, is reviewed by an advisory committee, the FDA may have difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of our application or may recommend that the FDA require, as a condition of approval, additional pre-clinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions; |

| • | the FDA may require development of a Risk Evaluation and Mitigation Strategy, or REMS, as a condition of approval or post-approval; |

| • | the FDA may not approve the manufacturing processes or facilities of third-party manufacturers with which we contract; or |

| • | the FDA may change its approval policies or adopt new regulations. |

These same risks apply to applicable foreign regulatory agencies from whom we may seek approval for any of our product candidates.

Any of these factors, many of which are beyond our control, could jeopardize our ability to obtain regulatory approval for and successfully market any product candidate. Moreover, because a substantial portion of our business is dependent upon our existing product candidates, any such setback in our pursuit of regulatory approval would have a material adverse effect on our business, prospects and financial condition.

Favorable results in the prior clinical trials of Zertane outside of the United States may not be predictive of the results in our planned Phase 3 clinical trials of Zertane in the United States or the designs of our Phase 3 clinical trials may be inadequate for FDA approval.

A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in earlier-stage development. The prior clinical trials of Zertane showed favorable safety and efficacy data; however, we will have different enrollment criteria in our planned Phase 3 clinical trials. In the Phase 2 clinical trials, we were able to enroll patients utilizing a broader definition of PE.

Ejaculation latency, most commonly quantified using intravaginal ejaculation latency time, or IELT, is a dominant component of PE assessment in clinical trials. IELT is defined as the time between vaginal intromission and intravaginal ejaculation. Although a standard cut-off for ejaculatory latency does not exist, it has been suggested that an IELT of two minutes or less may serve as an adequately sensitive criterion for defining PE and some studies have used IELT values from one to two minutes for defining PE. In a pre-IND meeting with FDA, we agreed to use an IELT of less than or equal to 1 minute as one of the enrollment criteria for our planned Phase 3 clinical trials. The previous European Phase 3 trials allowed for an IELT of less than two minutes however a significant proportion of enrollees had an IELT of one minute or less. In our planned Phase 3 clinical trials, we will be utilizing the definition of lifelong PE adopted by the International Society for Sexual Medicine, or the ISSM: “premature ejaculation is a male sexual dysfunction characterized by ejaculation which always or nearly always occurs prior to or within a minute of vaginal penetration; and inability to delay ejaculation on all or nearly all vaginal penetrations; and negative personal consequences, such as distress, bother, frustration and/or the avoidance of sexual intimacy.” As a result, we may encounter difficulty enrolling a sufficient number of patients in a timely fashion and we may not observe a similarly favorable safety and efficacy profile as our prior clinical trials.

In addition, Ampio obtained guidance from the FDA on our planned Phase 3 trials at a pre-IND meeting held in June 2012, including information to help us define the target patient population, select co-primary endpoints and design an acceptable patient-reported outcome measure. As a result of direction provided at the meeting, along with the existing data from six clinical trials of Zertane conducted outside the U.S. to date, we believe we are positioned to advance Zertane into Phase 3 clinical trials in the United States. However, we can provide no assurance that the FDA will not change its guidance about our planned Phase 3 clinical trials and require us to significantly modify the design of, or endpoints for, our planned clinical trials. Any change in the guidance we have received could delay and/or render more expensive our planned Phase 3 trial for Zertane.

We were not involved in any of the prior clinical studies for Zertane and are relying on the data collected from those prior clinical trials by various third parties, including a previous partner of our majority stockholder, Ampio Pharmaceuticals. Dr. David Bar-Or (now the Chief Scientific Officer of Ampio Pharmaceuticals) discovered the utility of tramadol hydrochloride for the treatment of PE in June 1999, and this discovery and accompanying intellectual property were at that time the property of DMI BioSciences, Inc., or DMI BioSciences. DMI BioSciences conducted various clinical trials, prior to licensing the worldwide rights to tramadol hydrochloride for PE to Biovail Laboratories International, or Biovail. Biovail also conducted several clinical trials and began two Phase 3 clinical trials, which trials were completed by Ampio upon its acquisition of

14

Table of Contents

DMI Biosciences, to whom the rights had reverted. This lack of prior involvement may have a negative impact on our understanding of these prior clinical trials and the design of our planned Phase 3 trial.

If we do not secure collaborations with strategic partners to test, commercialize and manufacture product candidates, we may not be able to successfully develop products and generate meaningful revenues.

A key aspect of our current strategy is to selectively enter into collaborations with third parties to conduct clinical testing, as well as to commercialize and manufacture product candidates. If we are able to identify and reach an agreement with one or more collaborators, our ability to generate revenues from these arrangements will depend on our collaborators’ abilities to successfully perform the functions assigned to them in these arrangements. Collaboration agreements typically call for milestone payments that depend on successful demonstration of efficacy and safety, obtaining regulatory approvals, and clinical trial results. Collaboration revenues are not guaranteed, even when efficacy and safety are demonstrated. The current economic environment may result in potential collaborators electing to reduce their external spending, which may prevent us from developing our product candidates.

Even if we succeed in securing collaborators, the collaborators may fail to develop or effectively commercialize products using our product candidates. Collaborations involving our product candidates pose a number of risks, including the following:

| • | collaborators may not have sufficient resources or may decide not to devote the necessary resources due to internal constraints such as budget limitations, lack of human resources, or a change in strategic focus; |

| • | collaborators may believe our intellectual property is not valid or is unenforceable or the product candidate infringes on the intellectual property rights of others; |

| • | collaborators may dispute their responsibility to conduct development and commercialization activities pursuant to the applicable collaboration, including the payment of related costs or the division of any revenues; |

| • | collaborators may decide to pursue a competitive product developed outside of the collaboration arrangement; |

| • | collaborators may not be able to obtain, or believe they cannot obtain, the necessary regulatory approvals; |

| • | collaborators may delay the development or commercialization of our product candidates in favor of developing or commercializing their own or another party’s product candidate; or |

| • | collaborators may decide to terminate or not to renew the collaboration for these or other reasons. |

As a result, collaboration agreements may not lead to development or commercialization of our product candidates in the most efficient manner or at all. For example, our former collaborator that licensed Zertane conducted clinical trials which we believe demonstrated efficacy in treating PE, but the collaborator undertook a merger that we believe altered its strategic focus and thereafter terminated the collaboration agreement. The Merger also created a potential conflict with a principal customer of the acquired company, which sells a product to treat premature ejaculation in certain European markets.

Collaboration agreements are generally terminable without cause on short notice. Once a collaboration agreement is signed, it may not lead to commercialization of a product candidate. We also face competition in seeking out collaborators. If we are unable to secure collaborations that achieve the collaborator’s objectives and meet our expectations, we may be unable to advance our product candidates and may not generate meaningful revenues.

Our product candidates are expected to undergo clinical trials that are time-consuming and expensive, the outcomes of which are unpredictable, and for which there is a high risk of failure. If clinical trials of our product candidates fail to satisfactorily demonstrate safety and efficacy to the FDA and other regulators, we or our collaborators may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of these product candidates.

Pre-clinical testing and clinical trials are long, expensive and unpredictable processes that can be subject to extensive delays. We cannot guarantee that any clinical studies will be conducted as planned or completed on schedule, if at all. It may take several years to complete the pre-clinical testing and clinical development necessary to commercialize a drug or biologic, and delays or failure can occur at any stage. Interim results of clinical trials do

15

Table of Contents

not necessarily predict final results, and success in pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials even after promising results in earlier trials and we cannot be certain that we will not face similar setbacks. The design of a clinical trial can determine whether its results will support approval of a product and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced. An unfavorable outcome in one or more trials would be a major set-back for that product candidate and for us. Due to our limited financial resources, an unfavorable outcome in one or more trials may require us to delay, reduce the scope of, or eliminate one or more product development programs, which could have a material adverse effect on our business, prospects and financial condition and on the value of our common stock.

In connection with clinical testing and trials, we face a number of risks, including:

| • | a product candidate is ineffective, inferior to existing approved medicines, unacceptably toxic, or has unacceptable side effects; |