Attached files

| file | filename |

|---|---|

| 8-K - 8-K - A10 Networks, Inc. | atenq22015pressrelease8k.htm |

| EX-99.1 - EXHIBIT 99.1 - A10 Networks, Inc. | july302015pressreleasebya1.htm |

A10 Networks – Q2 2015 Earnings 7/30/2015 1 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 2 | P a g e Thank you all for joining us today. I am pleased to welcome you to A10 Networks second quarter 2015 financial results conference call. This call is being recorded and webcast live and may be accessed for 90 days via the A10 Networks website, www.a10networks.com. Joining me today are A10’s Founder & CEO, Lee Chen; A10’s CFO, Greg Straughn; and our VP of Global Sales, Ray Smets. Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its second quarter 2015 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com.

A10 Networks – Q1 2015 Earnings 7/30/2015 3 | P a g e During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our third quarter operating results, our expectations for future revenue growth, profitability and operating margin, expectations of customer buying patterns and the growth of our business generally. These statements are based on current expectations and beliefs as of today, July 30, 2015. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially. We disclaim any obligation to update these forward-looking statements as a result of future events or otherwise. For a more detailed description of these risks and uncertainties, please refer to our most recent 10-Q filed on May 6th.

A10 Networks – Q2 2015 Earnings 7/30/2015 4 | P a g e Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. A reconciliation between GAAP and non-GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the third quarter of 2015 on a non-GAAP basis. However, we will not make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward- looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Before I turn the call over to Lee, I’d like to announce that management will attend the Pacific Crest Annual Global Technology Leadership Forum in Vail on August 10th, the Oppenheimer Annual Technology, Internet, & Communications Conference in Boston on August 12th, and the Jefferies Semiconductors, Hardware & Communications Infrastructure Summit on August 25th. We hope to see many of you there. Now I would like to turn the call over to Lee for opening remarks.

A10 Networks – Q2 2015 Earnings 7/30/2015 5 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 6 | P a g e We delivered a strong second quarter with good execution and growing momentum as the investments we made last year in our channel, field activities and product development are taking hold. We achieved record revenue of 47.5 million dollars, above our guidance of 44 million to 47 million dollars and up 5% year-over-year and 8% from Q1. We also continued to drive leverage through our operating structure, resulting in a 42% sequential improvement in our bottom line. From a demand perspective, we added 200 new customers, delivered record enterprise revenue, grew product revenue 9% over Q1 and won a multi-million dollar order from a current service provider customer in North America as they continued to enhance their CGN infrastructure. We also saw continued strength for our security- focused solutions including our Thunder TPS DDoS mitigation solution and our ADC with advanced security features. Our pipeline of channel initiated deals continues to grow and we are encouraged by the continued progress we see from the channel investments we made last year. In addition, we have started to roll out our Affinity channel program globally and we believe we are on track to have it launched in our key international markets by year-end. Bookings in the quarter were strong and we ended the quarter with a backlog of approximately 5 million dollars, which is more than 50% above our 2014 average.

A10 Networks – Q2 2015 Earnings 7/30/2015 7 | P a g e Cybersecurity, network resources and services management are growing priorities for our customers and for A10. Customers at the high-end of the market want products that are rich in features, fast performing and in a small form factor, which are key attributes of our Thunder products that are based on our flexible and scalable ACOS platform. This is why some of the most demanding enterprise and service provider customers already trust A10 with their networking and security needs. We believe that with our strong product portfolio and the strategic value we bring with our continued innovations and superior technical support, we are well positioned to grow within the high-end of the market, especially as the security threat to business is on the rise.

A10 Networks – Q2 2015 Earnings 7/30/2015 8 | P a g e As we mentioned last quarter, we are seeing growing demand for ADC with advanced security features such as web application firewall and SSL insight. Gartner estimates that less than 20% of organizations with a security device are currently inspecting encrypted traffic. This creates a security blind spot where malware and hackers can enter a network through uninspected encrypted traffic. While firewalls and dedicated security devices provide in-depth inspection and analysis of network traffic, they are not designed to decrypt SSL traffic at high speeds. Our Thunder ADC equipped with SSL security hardware offers a powerful and scalable decryption solution to enable policy enforcement and redundancy as well as load balance security devices. The initial launch of our Thunder ADC with SSL Insight solution has been very successful, is attracting attention among both customers and partners and is helping drive growth in our pipeline. In particular, we are gaining traction within the government, higher education, and financial services verticals with our SSL Insight capabilities. Additionally, our Thunder TPS DDoS mitigation security solution continues to build momentum. Our Q2 TPS growth was driven by both new customers and follow-on orders from existing customers as they look to A10 to protect more of their network from high-volume and sophisticated DDoS attacks. For the first six-months of 2015, TPS product revenue has contributed approximately 10% of total product revenue.

A10 Networks – Q2 2015 Earnings 7/30/2015 9 | P a g e We continue to strengthen our product portfolio and bring added flexibility and functionality to our customers. In the second quarter: We enhanced our Thunder TPS and ADC platforms with the release of aGalaxy centralized management system that leverages the fully programmable policy engine in ACOS. Our aGalaxy provides strong configuration management, reporting and real-time traffic analysis. We launched new mid-range and high-end Thunder ADC models with dedicated hardware for SSL performance and DDoS protection, providing up to 2 to 3 times better performance than the prior generation. We partnered with ThreatStop to create the A10 Threat Intelligence Service. This add-on subscription service is now available on both our Thunder ADC and TPS products. And we added our virtual ADC to the Microsoft Azure marketplace, enabling enterprises to outsource their data center operations with A10 Networks. Additionally, as we announced yesterday, our vThunder ADC was selected by KDDI as the preferred ADC for its corporate cloud infrastructure, KDDI Cloud Platform Service. Customer driven innovation has been a cornerstone of the A10 vision from our inception and we intend to continue to invest responsibly to bring new functionality, features, products and superior technical support to market including a hardware refresh throughout 2016. Overall, I’m pleased with our business momentum. We delivered a solid second quarter and are seeing the benefits from the significant investments we made last year in our channel, field activities and product development, which are all driving our growing pipeline.

A10 Networks – Q2 2015 Earnings 7/30/2015 10 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 11 | P a g e Second quarter revenue grew to 47.5 million dollars, up 5% compared with 45.1 million dollars in the prior year. In general, our deferred revenue primarily consists of customer maintenance and support contracts, but this quarter it included a larger than usual product element and increased 43% year-over-year and 10% sequentially to reach a record 65.8 million dollars.

A10 Networks – Q2 2015 Earnings 7/30/2015 12 | P a g e Second quarter product revenue totaled 33.3 million dollars, representing 70% of total revenue, compared with 34.1 million dollars or 76% of total revenue in the prior year second quarter. Service revenue was 14.2 million dollars, accounting for 30% of total revenue, compared with 11.0 million dollars or 24% in the second quarter of 2014. Second quarter revenue from the United States grew 20% sequentially and 5% year-over-year to reach 27.4 million dollars, representing approximately 58% of total revenue. Second quarter revenue from Japan was 6.6 million dollars, or 14% of total revenue, compared with 8.5 million dollars or 19% of total revenue in the same quarter of the prior year. EMEA generated record revenue of 6.8 million dollars, a 74% year-over-year increase versus 2Q of 2014 and representing 14% of total revenue. Revenue from APAC (excluding Japan) was 5.5 million dollars, up 27% year-over-year, when compared with 4.4 million dollars in the same quarter of the prior year. Our enterprise and service provider revenue split this quarter was 58% and 42% of total revenue, respectively. We generated record enterprise revenue of $27.5 million dollars, representing a 10% increase from the prior quarter. Service provider revenue came in at 20.0 million dollars, compared with 19.0 million dollars in the prior quarter and 17.7 million dollars in the second quarter of 2014. As Lee mentioned, we secured a large win with an existing service provider customer, helping this customer to become our single “greater than 10% customer” in the quarter, contributing a total of 14% of Q2 revenue.

A10 Networks – Q2 2015 Earnings 7/30/2015 13 | P a g e Moving beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless expressly stated otherwise. We delivered a second quarter total gross margin of 76.3%, within our expected guidance range of 76% to 78%. On a constant currency basis versus Q2 of 2014, gross margin was impacted by a 40 basis point decrease year-over- year due to changes in the Yen-to-dollar conversion rate. Product gross margin was 76.4% in Q2 of 2015, compared with 77.0% in the prior quarter and 78.3% in the second quarter of 2014, with the major portion of this decrease related to shifts in our geographic mix. Our services gross margin came in at 76.1%, up 63 basis points over Q1’15 and represents a 98 basis point improvement over Q2 of 2014.

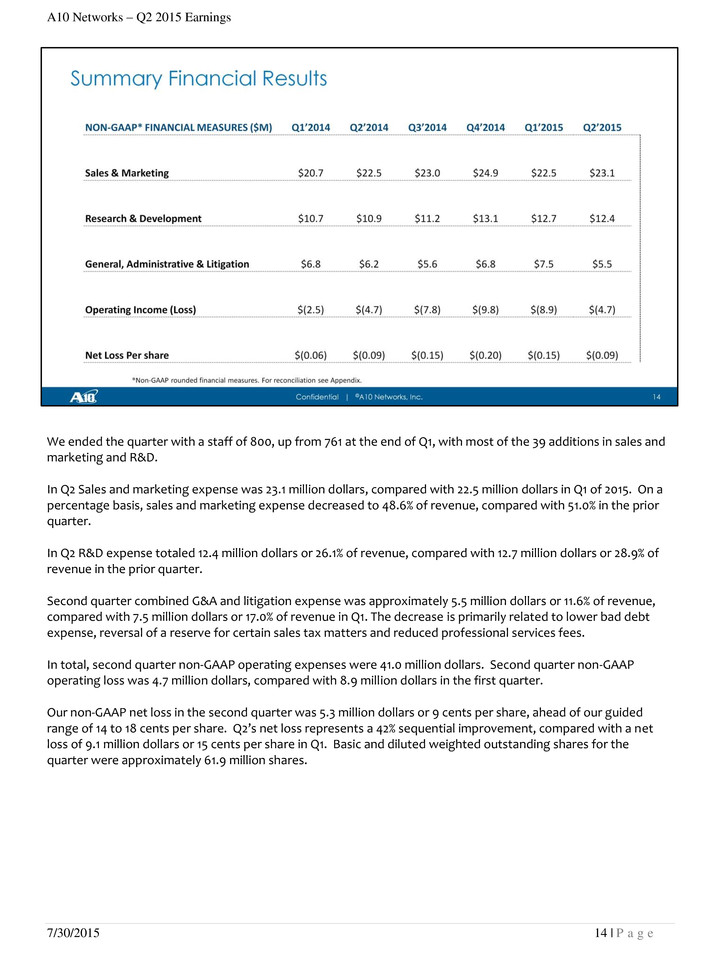

A10 Networks – Q2 2015 Earnings 7/30/2015 14 | P a g e We ended the quarter with a staff of 800, up from 761 at the end of Q1, with most of the 39 additions in sales and marketing and R&D. In Q2 Sales and marketing expense was 23.1 million dollars, compared with 22.5 million dollars in Q1 of 2015. On a percentage basis, sales and marketing expense decreased to 48.6% of revenue, compared with 51.0% in the prior quarter. In Q2 R&D expense totaled 12.4 million dollars or 26.1% of revenue, compared with 12.7 million dollars or 28.9% of revenue in the prior quarter. Second quarter combined G&A and litigation expense was approximately 5.5 million dollars or 11.6% of revenue, compared with 7.5 million dollars or 17.0% of revenue in Q1. The decrease is primarily related to lower bad debt expense, reversal of a reserve for certain sales tax matters and reduced professional services fees. In total, second quarter non-GAAP operating expenses were 41.0 million dollars. Second quarter non-GAAP operating loss was 4.7 million dollars, compared with 8.9 million dollars in the first quarter. Our non-GAAP net loss in the second quarter was 5.3 million dollars or 9 cents per share, ahead of our guided range of 14 to 18 cents per share. Q2’s net loss represents a 42% sequential improvement, compared with a net loss of 9.1 million dollars or 15 cents per share in Q1. Basic and diluted weighted outstanding shares for the quarter were approximately 61.9 million shares.

A10 Networks – Q2 2015 Earnings 7/30/2015 15 | P a g e Moving to the balance sheet, at June 30, 2015 we had 96.2 million dollars in total cash and equivalents. During the quarter, cash generated from operations was $9.0 million dollars, reflecting strong billings and collections activities and expense management. Although cash flow was strong in Q2 we do not necessarily expect to remain cash flow positive in the near-term. Looking into Q3, we expect to use up to $3 million dollars in cash for operations. Additionally, inventory levels were reduced for the second consecutive quarter as we continue to refine our supply chain operations. We ended Q2 with 46.2 million dollars of net accounts receivable, compared with the Q1’15 balance of 52.8 million dollars. Average days sales outstanding declined to 95 days compared with 110 days in the prior quarter.

A10 Networks – Q2 2015 Earnings 7/30/2015 16 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 17 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 18 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 19 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 20 | P a g e

A10 Networks – Q2 2015 Earnings 7/30/2015 21 | P a g e