Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WILLIS TOWERS WATSON PLC | d29170d8k.htm |

| EX-99.1 - EX-99.1 - WILLIS TOWERS WATSON PLC | d29170dex991.htm |

SECOND QUARTER 2015 RESULTS Willis Group Holdings July, 2015 Exhibit 99.2 |

Important disclosures regarding forward-looking statements

1 This presentation contains certain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future

results of our operations. All statements, other than statements of

historical facts, included in this document that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, potential cost savings and accelerated adjusted operating margin and adjusted earnings per share growth, future capital expenditures, growth in commissions and fees, business strategies, competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, plans, and references to future successes are

forward-looking statements. Also, when we use the words such as ‘anticipate’, ‘believe’

,

‘estimate’,

‘expect’,

‘intend’,

‘plan’,

‘probably’,

or similar expressions, we are making forward-looking statements. There are important uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including the following: the impact of any regional, national or global political, economic, business, competitive, market, environmental or regulatory

conditions on our global business operations; the impact of current global

economic conditions on our results of operations and financial condition, including as a

result of those associated with the Eurozone, any insolvencies of or other difficulties experienced by our clients, insurance companies or financial institutions; our ability to implement and fully realize anticipated benefits of our growth strategy and revenue generating

initiatives; our ability to implement and realize anticipated benefits of any cost-savings or operational improvement initiative, including our ability to achieve expected savings and other benefits from the multi-year Operational Improvement Program as a result of unexpected costs or delays and demand on managerial, operational and administrative resources and/or macroeconomic factors affecting the program as well as the impact of the program on business processes and competitive dynamics; our ability to consummate transactions, including the proposed Towers Watson merger and the Gras Savoye acquisition; our ability to obtain requisite approvals and satisfy other conditions to the consummation of proposed transactions, including obtaining regulatory and shareholder approvals for the proposed Towers Watson transaction and regulatory approval for the Gras Savoye acquisition; our ability to successfully integrate our operations and employees with those of Towers Watson and any acquired business, including Gras Savoye and Miller Insurance Services LLP; our ability to realize any anticipated benefit of any acquisition or other transaction in which we may engage, including any revenue growth, operational efficiencies, synergies or cost savings; the potential impact of the consummation of the proposed Towers Watson transaction on relationships, including with employees, suppliers, customers and competitors; the diversion of management’s time and attention while the Towers Watson transaction or Gras Savoye acquisition is pending; the federal income tax consequences of the Towers Watson transaction and the enactment of additional state, federal, and/or foreign regulatory and tax laws and regulations; volatility or declines in insurance markets and premiums on which our commissions are based, but which we do not control; our ability to compete in our industry; material changes in commercial property and casualty markets generally or the availability of insurance products or changes in premiums resulting from a catastrophic event, such as a hurricane; our ability to retain key

employees and clients and attract new business, including at a time when

the Company is pursuing various strategic initiatives; our ability to develop new

products and services; the practical challenges and costs of complying with a wide variety of foreign laws and regulations and any related changes, given the global scope of our operations and those of any acquired business and the associated risks of non-compliance and

regulatory enforcement action; our ability to develop and implement

technology solutions and invest in innovative product offerings in an efficient and

effective manner; fluctuations in our earnings as a result of potential changes to our valuation allowance(s) on our deferred tax assets; changes in the tax or accounting treatment of our operations and fluctuations in our tax rate; rating agency actions, including a downgrade to our

credit rating, that could inhibit our ability to borrow funds or the pricing

thereof and in certain circumstances cause us to offer to buy back some of our debt; our

inability to exercise full management control over our associates; our ability to continue to manage our significant indebtedness; the timing or ability to carry out share repurchases and redemptions which is based on many factors, including market conditions,

the Company’s financial position, earnings, share price, capital

requirements, and other investment opportunities (including mergers and acquisitions and

related financings); the timing or ability to carry out refinancing or take other steps to manage our capital and the limitations in our long-term debt agreements that may restrict our ability to take these actions; any material fluctuations in exchange and interest rates

that could adversely affect expenses and revenue; a significant decline in the value of investments that fund our pension plans or changes in our pension plan liabilities or funding obligations; our ability to receive

dividends or other distributions in needed amounts from our subsidiaries; our involvement in and the results of any regulatory investigations, legal proceedings and other contingencies; our exposure to potential liabilities

arising from errors and omissions and other potential claims against us;

underwriting, advisory or reputational risks associated with our business; the

interruption or loss of our information processing systems, data security breaches or failure to maintain secure information systems; and impairment of the goodwill in one of our reporting units, in which case we may be required to record significant charges to earnings.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. In light of the significant uncertainties inherent in the forward-looking statements included in this presentation, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless the securities laws require us to do so. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation may not occur, and we caution you against unduly relying on these forward-looking statements. The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and

results. For additional information see also Part I, Item 1A “Risk Factors” included in Willis’ Form 10-K for the year ended December 31, 2014, and our subsequent filings with the Securities and Exchange

Commission. Copies are available online at http://www.sec.gov or on request from the Company. |

Important disclosures regarding non-GAAP measures

2 This presentation contains references to "non-GAAP financial measures" as defined in Regulation G of SEC rules. We

present these measures because we believe they are of interest to the

investment community and they provide additional meaningful methods of evaluating certain aspects of the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a generally accepted accounting principles (GAAP) basis. These financial

measures should be viewed in addition to, not in lieu of, the

Company’s condensed consolidated income statements and balance sheet as of the relevant date. Consistent with Regulation G, a description of such information is provided below and a reconciliation of certain of such items to GAAP information can be found in our periodic

filings with the SEC. Our method of calculating these non-GAAP

financial measures may differ from other companies and therefore comparability may be limited. Definitions of non-GAAP financial measures We believe that investors’ understanding of the Company’s performance is enhanced by our disclosure of the following non-GAAP

financial measures. Our method of calculating these measures may differ

from those used by other companies and therefore comparability may be limited. Organic commissions and fees growth

Organic commissions and fees growth excludes: (i) the impact of foreign currency movements; (ii) the first twelve months of net commission and

fee revenues generated from acquisitions; and (iii) the net commission

and fee revenues related to operations disposed of in each period presented, from reported commissions and fees growth. We believe organic growth in commissions and fees provides a measure that the investment community may find helpful

in assessing the performance of operations that were part of our

business in both the current and prior periods, and provides a measure against which our businesses may be assessed in the future. Underlying commissions and fees, underlying revenues, underlying total expenses, underlying salaries and benefits,

underlying other operating expenses, underlying operating income,

underlying operating margin, underlying EBITDA, underlying net income and underlying earnings per diluted share (“Underlying measures”). Underlying measures are calculated by excluding restructuring costs related to the Operational Improvement Program, impact from the devaluation

of the Venezuelan Bolivar, gains and losses on disposal of operations,

and deferred tax valuation allowances, from the most directly comparable GAAP measures and from second quarter 2015 underlying measures also exclude M&A transaction related costs. Additionally, prior year GAAP measures have been rebased to current

period exchange rates to eliminate the year over year impact of foreign

currency movements. We believe that excluding such items provides a more complete and consistent comparative analysis of our results of operations. Organic revenues, organic total expenses, organic salaries and benefits, organic other operating expenses, organic operating income, organic

operating margin and organic EBITDA (“Organic measures”). Organic measures are calculated by excluding the twelve month impact from acquisitions and disposals (together with the impact of certain items,

including foreign currency movements noted above), from the most directly

comparable GAAP measures. We believe that excluding these items provides a more complete and consistent comparative analysis of our results of operations. |

2Q

2015 Reported EPS

Adjusting Items 2Q 2015 Underlying EPS Taxes and Other Total Operating Expenses Total Revenues 2Q 2014 Underlying EPS Foreign Currency Movements Adjusting Items 2Q 2014 Reported EPS 2Q 2015 EPS growth 3 See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14

Underlying EPS grew 21% driven by a combination of top-line growth coupled with

expense management initiatives and lower taxes

Adjusting items: Operational Improvement Program = ($0.15) Gain on Disposal = $0.02 Devaluation of Venezuelan Bolivar = ($0.01) M&A transaction-related costs = ($0.06) +21% $0.26 $0.20 $0.02 $0.48 $0.20 ($0.16) $0.06 $0.58 $0.38 $0.20 Adjusting items: Operational Improvement Program = $0.01 Devaluation of Venezuelan Bolivar = $0.07 Deferred tax valuation allowance = $0.12 |

2Q 2015

Commissions and fees growth 4

• Low-single digit declines in Willis Re more than offset strong growth in WCMA and Wholesale business • Underlying growth reflects contributions from recent acquisitions, primarily Miller Insurance Services • Positive organic growth driven by strong growth in Willis International, modest growth in Willis North America; partially offset by CW&R & GB declines • Organic growth across a number of practices including Human Capital, Transportation and Healthcare • Underlying decline reflects recent divestitures of small, non- core books of business • Declines in Retail & P&C offset growth in Financial Lines • Reported growth impacted by unfavorable F/X: (5.8)% • Biggest driver: GBP: 2Q14 = 1.705; 2Q15 = 1.573 Diff (8)% 1.6% 5.3% (1.3)% Group Willis GB Willis Capital, Wholesale and Reinsurance Willis North America Reported Organic Underlying Commentary Willis International • Strong organic growth from LatAm, Asia & W. Europe • Underlying growth reflects strong contribution from M&A • Reported growth impacted by unfavorable F/X: (21.3)% • Biggest driver: EUR: 2Q14 = 1.365; 2Q15 = 1.110 Diff (19)% (2.3)% (3.3)% (9.1)% (2.3)% 3.6% (1.0)% 2.5% (2.8)% (2.3)% 7.1% 27.9% 6.6% See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14 |

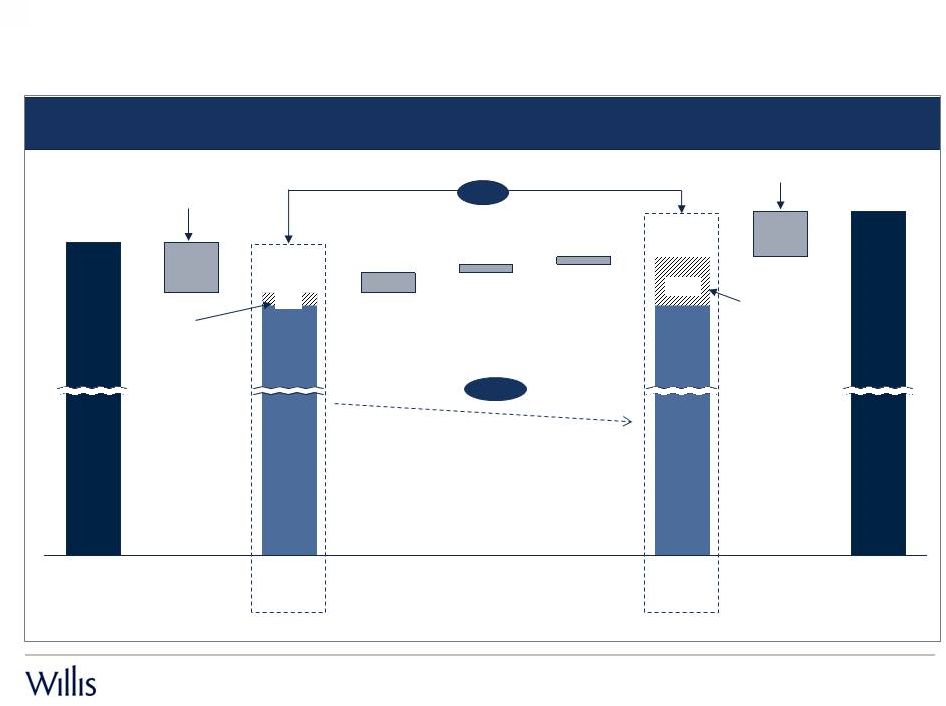

($59) $787 2Q 2014 Reported $728 $9 2Q 2014 Underlying Depreciation and Amortization 5.1% $719 F/X & Adjusting Items 2Q 2015 Reported Other Operating Expenses $817 OIP and M&A Related Expenses $765 Salaries and Benefits 2Q 2015 Underlying $49 $716 $6 Achieved 200 bps of positive organic spread (20 bps of positive underlying spread ) driven by

ongoing cost management initiatives; Organic expenses reduced versus 2Q 2014

2Q 2015 Total operating expenses

5 $ millions Acquisition & Disposals Acquisitions & Disposals Note: Some percentage changes may differ due to rounding See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14

Organic Decline $27 $4 $52 Oper. Improvement Program = $38m M&A Related Expenses = $14m F/X = ($56)m Restructuring Charges = ($3)m (0.4)% |

Organic

S&B nearly flat driven by FTE management initiatives and lower pension costs; Underlying S&B growth driven by acquisitions and disposals

2Q 2015 Salaries and benefits

6 $575 $561 5.1% 2Q 2015 Underlying 2Q 2015 Reported $560 2Q 2014 Underlying $533 Salaries and Benefits $528 $32 $526 $7 Foreign Currency Movement ($42) 2Q 2014 Reported Acquisitions & Disposals Acquisitions & Disposals $ millions 0.4% Organic growth M&A Transaction Related Expense $1 Onshore/offshore FTE trends helping to optimize cost structure 2,600 4Q14 17,700 15,700 2,000 2Q14 17,800 1,800 2Q15 18,100 +1.7% Onshore Offshore Total Organic FTEs Total FTEs (includes

acquisitions) 18,300

18,400 19,400 Note: Some percentage changes may differ due to rounding See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14

15,500 16,000 $27 |

2Q 2015

organic metrics Good revenue growth and organic expense management driving

improved organic metrics 7

$ millions 2Q 2015 2Q 2014 17.8% Organic Operating Margin 16.2% 2Q15 2Q14 Note: Some percentage changes may differ due to rounding See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14

Organic Spread Organic EBITDA -200 -100 0 100 200 -160 -160 90 170 200 2Q14 3Q14 4Q14 1Q15 2Q15 $173 $186 8.0% |

Spend $36 $130 $240 $410 Savings $11 >$60 $135 $235 >$420 $300 Operational Improvement Program update 8 Original Forecast 2014A 2015E 2016E 2017E Cumulative 2014-2017E Annualized 2018+E $ millions Spend $36 $140 $140 $125 $440 Savings $11 $80 $150 $250 $490 $325 Updated Forecast 2014A 2015E 2016E 2017E Cumulative 2014-2017E Annualized 2018+E $ millions Annualized savings increased from $300 million to $325 million; FY2015 savings increased to $80

million from $60 million |

Operational Improvement Program Update

9 Key metrics : At Inception 2Q15 Target at Completion

• Ratio of full time employees (FTEs) in higher cost vs. lower cost near-shore and off-shore centers • Ratio of square footage of real estate per FTE (indexed to 100) • Ratio of desks per FTE (indexed to 100) 80:20 100 100 (1) 75:25 (1) 96 98 60:40 85 86 Workforce Location Relocation of approximately 2,500 support roles to lower cost locations 161 Operational Excellence Reduction of support roles 81 Real Estate Lease consolidation in real estate 35 Information Technology IT applications simplification and rationalization, and IT workforce, supplier and service optimization 35 Procurement Reduction in certain expense items through renegotiation with suppliers 13 325 Annualized savings target driven by well defined initiatives in all major workstream segments;

Improving progress shown by all three key accountability metrics Excludes the impact from acquisitions which were largely in higher cost geographies |

APPENDICES |

2Q 2015

Other operating expenses 11

Ongoing expense management reflected in 1.6% organic decline;

Underlying growth driven by acquisitions and disposals Other Operating Expenses 2Q 2015 Reported $179 3.7% 2Q 2015 Underlying $166 $157 $9 2Q 2014 Underlying $160 $159 $1 Foreign Currency Movement ($13) 2Q 2014 Reported $173 Acquisitions & Disposals Acquisitions & Disposals $ millions Organic decline $13 M&A Transaction Related Expense $6 Note: Some percentage changes may differ due to rounding See important disclosures regarding non-GAAP measures on page 2 and reconciliations starting on page 14

(1.6)% |

Segment

Structure 12

Willis Re Willis Capital Markets & Advisory Wholesale businesses (e.g., Miller) Willis Portfolio and Underwriting Services Segment structure from January 1, 2015 Willis GB Willis North America Willis International Willis Capital, Wholesale and Reinsurance Comprises Willis’s Great Britain-based Specialty and Retail businesses Focused on serving corporate clients, delivering full range of Willis expertise across Great Britain Focused on serving corporate clients, delivering full range of Willis expertise across the United States and Canada Focused on serving corporate clients, delivering full range of Willis expertise across Asia, CEMEA, Latin America and Western Europe Upon closing of transaction, 100% of Gras Savoye operations will be included |

Important disclosures regarding non-GAAP measures

13 Reported commissions and fees growth to underlying and organic measures (1) Percentages may differ due to rounding. 2015 2014 Change (1) Foreign currency translation Underlying commissions and fees growth Acquisitions and disposals Organic commissions and fees growth ($ millions) % % % % % Three months ended June 30, 2015 Willis GB $170 $187 (9.1) (5.8) (3.3) (1.0) (2.3) Willis Capital, Wholesale and Reinsurance 190 192 (1.0) (4.6) 3.6 5.9 (2.3) Willis North America 314 323 (2.8) (0.5) (2.3) (4.8) 2.5 Willis International 243 228 6.6 (21.3) 27.9 20.8 7.1 Total $917 $930 (1.3) (6.6) 5.3 3.7 1.6 |

Important disclosures regarding non-GAAP measures

14 Operating income to underlying and organic operating income Note: For prior periods, underlying measures have been rebased to current period exchange rates to remove the impact of foreign currency

movements when comparing periods. In the second quarter 2015, the

definition of underlying measures was modified to exclude the impact from M&A transaction-related costs. Prior period results, which include $7 million of such expenses in the first quarter of 2015 and a de minimis amount (approximately $1 million) of such expenses in the second quarter of 2014, have not been restated. Full year results will be presented in line with the updated definition.

2014 2015 (In millions) 2Q 2Q Total revenue $935 $922 excluding: Foreign currency movements (59) - Underlying revenue $876 $922 Net revenue from acquisitions and disposals (18) (51) Organic revenue $858 $871 Operating income $148 $105 excluding: Restructuring costs 3 38 M&A transaction related costs - 14 Foreign currency movements (3) - Underlying operating income $148 $157 Net operating income from acquisitions and disposals (9) (2) Organic operating income $139 $155 Operating margin (operating income as a percentage of total revenue) 15.8% 11.4% Underlying operating margin (underlying operating income as a percentage of underlying total revenue) 16.9% 17.0% Organic operating margin (organic operating income as a percentage of organic total revenue) 16.2% 17.8% |

Important disclosures regarding non-GAAP measures

15 Net income (loss) to underlying net income Note: For prior periods, underlying measures have been rebased to current period exchange rates to remove the impact of foreign currency

movements when comparing periods. In the second quarter 2015, the

definition of underlying measures was modified to exclude the impact from M&A transaction-related costs. Prior period results, which include $7 million of such expenses in the first quarter of 2015 and a de minimis amount (approximately $1 million) of such expenses in the second

quarter of 2014, have not been restated. Full year results will be

presented in line with the updated definition. 2014

2015 (In millions, except per share data) 2Q 2Q Net income $47 $70 Excluding the following, net of tax: Operational improvement program 2 27 M&A transaction related expenses - 11 Loss (Gain) on disposal of operations - (4) Venezuelan currency devaluation 13 1 Deferred tax valuation allowance 21 - Foreign currency movements 4 - Underlying net income $87 $105 Diluted shares outstanding 182 182 Net income per diluted share $0.26 $0.38 Underlying net income per diluted share $0.48 $0.58 |

Important disclosures regarding non-GAAP measures

16 Net income to underlying and organic EBITDA 2014 2015 2Q 2Q Net income attributable to Willis Group Holdings $47 $70 Excluding: Net income attributable to noncontrolling interests 1 2 Interest in earnings (losses) of associates, net of tax 3 2 Income taxes 59 19 Interest expense 35 35 Other expense (income), net 3 (23) Depreciation 24 23 Amortization 12 16 EBITDA $184 $144 Excluding: Restructuring costs 3 38 M&A transaction related costs - 14 Foreign currency movements (4) - Underlying EBITDA $183 $196 Net EBITDA from acquisitions and disposals (10) (10) Organic EBITDA $173 $186 Note: For prior periods, underlying measures have been rebased to current period exchange rates to remove the impact of foreign currency

movements when comparing periods. In the second quarter 2015, the

definition of underlying measures was modified to exclude the impact from M&A transaction-related costs. Prior period results, which include $7 million of such expenses in the first quarter of 2015 and a de minimis amount (approximately $1 million) of such expenses in the second quarter of 2014,

have not been restated. Full year results will be presented in line with

the updated definition. |

Important disclosures regarding non-GAAP measures

17 Reported total expenses, salaries and benefits and other operating expenses to underlying and

organic measures 2014 2015 (In millions) 2Q 2Q Reported total expenses $787 $817 Excluding: Restructuring costs (3) (38) M&A transaction related expenses - (14) Foreign currency movements (56) - Underlying total expenses $728 $765 Net expenses from acquisitions and disposals (9) (49) Organic total expenses $719 $716 Reported salaries and benefits $575 $561 Excluding: M&A transaction related expenses - (1) Foreign currency movements (42) - Underlying salaries and benefits $533 $560 Net expenses from acquisitions and disposals (7) (32) Organic Salaries and benefits $526 $528 Reported other operating expenses $173 $179 Excluding: M&A transaction related expenses - (13) Foreign currency movements (13) - Underlying other operating expenses $160 $166 Net expenses from acquisitions and disposals (1) (9) Organic other operating expenses $159 $157 Note: For prior periods, underlying measures have been rebased to current period exchange rates to remove the impact of foreign currency

movements when comparing periods. In the second quarter 2015, the

definition of underlying measures was modified to exclude the impact from M&A transaction-related costs. Prior period results, which include $7 million of such expenses in the first quarter of 2015 and a de minimis amount (approximately $1 million) of such expenses in the second quarter of 2014,

have not been restated. Full year results will be presented in line with

the updated definition. |

IR

Contacts

Media Contact Peter Poillon

Tel: +1 212 915-8084

Email: peter.poillon@willis.com 18 Juliet Massey Tel: +44 7984 156 739 Email: juliet.massey@willis.com |